Canadian Institute of Quantity Surveyors

Chief Executive Officer

Sheila Lennon, CAE

Managing

Arif Ghaffur, PQS(F)

Editor Chris Court, PQS(F) editor@ciqs.org

Assistants to Editor

Ajibola Soboyejo, PQS

Shane McKernan, PQS

Send Change of Address to: Canadian Institute of Quantity Surveyors

90 Nolan Court, Unit 19, Markham, Ontario L3R

CIQS Board

Chair: Erin Brownlow, PQS

Vice-Chair: Arif Ghaffur, PQS(F)

Past Chair: David Dooks, PQS(F)

Education Director: Adam Ding, PQS

Director: Tammy Stockley, PQS

Director: Hiran Dassoruth, PQS

Director: Jack Chen, PQS

Director: Antoine Aurelis, PQS

Director: Dominic Leadsom, PQS

Advisor: Roy Lewis, PQS(F)

Managing

Woychyshyn

Design/Production Kellee

Thetime has come. This is my last message.

The last two years have been awesome. I have spent most of my term as Chair at home. I started shortly after the beginning of the pandemic in 2020 and we had no choice but to pivot to a virtual board and a virtual world. Our two years of adapting, all while implementing the aggressive strategic plan put in place in 2019, have been amazingly successful. I can honestly say that I am proud of what we have accomplished together.

Some of the highlights from past two years:

1. Reorganized committees to directly align with strategic plan and organizational goals.

• Member Engagement

• External Relations

• Chapter Relations

• Education

2. Launched new insurance program for our members.

3. Strengthened strategic relationships with external stakeholder organizations and engaged a public relations firm to aid with government relations to increase awareness and enhance professionals in various industries.

4. Mentorship pilot program developed to engage with our developing members.

5. Board of Directors started to transition from a managing board to a strategic board, building on the trust of our relationship with the CEO.

6. YQS program established, and will continue to be enhanced.

7. Accreditation program for secondary schools implemented.

8. Major update to the syllabus and the TPE process underway.

9. New membership management system and website developed and launched.

10. Marketing plan for external stakeholders developed and implemented.

11. Ambassador program implemented.

All I can say is: “Wow!”

Thank you to all who have been involved in our many achievements over the past couple of years. This is an amazing list of accomplishments and we all need to recognize that. This could not have been done without the dedicated team we have.

It’s now 2022 and we will again be in person for Congress. While there is heightened anxiety around attending in person events again, I hope there will also be a sense of normalcy.

As Past Chair, I will continue to provide advice and guidance to our dedicated team of directors and will focus my time on our governance policies, procedures, and documents. I am honoured to continue to work for the CIQS.

I thank all our members, volunteers, staff, and directors with whom I have had the pleasure of working. Your work is appreciated and required. Our industry is growing, the programs and tools we have been putting in place will continue to enhance our professionalism and education.

In my time as Chair, I have grown both personally and professionally. I would not trade this experience for anything.

Erin Brownlow, PQSI will be handing the gavel to Arif Ghaffur, PQS(F) as Chair this summer. You will be in good hands; I am confident he will be a fantastic Chair.

Stay happy, healthy, and safe.

Erin Brownlow, PQS Chair, CIQS

The Professional Quantity Surveyor (PQS) is an individual who is certified and licenced by the CIQS to provide quantity surveying services both in Canada and internationally.

The term Professional Quantity Surveyor and PQS are licensed trademarks owned by the CIQS and can only be used by a current member certified by the CIQS.

I thank all our members, volunteers, staff, and directors with whom I have had the pleasure of working. Your work is appreciated and required.

Lemoment est venu. C’est mon dernier message.

Les deux dernières années ont été géniales. J’ai passé la majeure partie de mon mandat de présidente à la maison. J’ai commencé peu après le début de la pandémie en 2020 et nous n’avons eu d’autre choix que de nous tourner vers un conseil virtuel et un monde virtuel. Nos deux années d’adaptation, tout en mettant en œuvre le plan stratégique robuste mis en place en 2019, ont connu un succès étonnant. Je peux honnêtement dire que je suis fière de ce que nous avons accompli ensemble.

Voici quelques-uns des faits marquants de ces deux dernières années :

1. Réorganisation des comités pour les aligner directement sur le plan stratégique et les objectifs organisationnels :

• Engagement des membres, • Relations extérieures, • Relations avec les chapitres, • Éducation;

2. Lancement d’un nouveau programme d’assurance pour nos membres;

3. Renforcement des relations stratégiques avec les organisations de parties prenantes externes et embauche d’une société de relations publiques pour soutenir la relation avec le gouvernement afin d’accroître la sensibilisation et d’améliorer le statut des professionnels dans divers secteurs;

4. Développement d’un programme pilote de mentorat pour impliquer nos membres en devenir

5. Transition du conseil d’administration qui commence à passer d’un conseil de gestion à un conseil stratégique, en s’appuyant sur notre relation de confiance avec la directrice générale;

6. Mise en place du programme YQS, qui continue d’être amélioré;

7. Mise en place d’un programme d’accréditation pour les écoles secondaires;

8. Mise à jour importante des plans de cours et du processus de TEP en cours;

9. Développement et lancement d’un nouveau système de gestion des membres et d’un nouveau site web; 10. Élaboration et mise en œuvre d’un plan de commercialisation pour les parties prenantes externes; 11. Mise en place d’un programme d’ambassadeurs.

C’est épatant !

Merci à tous ceux et celles qui ont participé à nos nombreuses réalisations au cours des deux dernières années. C’est une liste incroyable d’accomplissements, et nous devons tous le reconnaître. Cela n’aurait pas pu se faire sans l’équipe dévouée que nous avons.

Nous sommes maintenant en 2022 et nous nous réunirons de nouveau en personne pour le Congrès. Bien que l’anxiété soit grande à l’idée de participer à nouveau à des événements en personne, j’espère qu’il y aura également un sentiment de normalité.

En tant que présidente sortante, je continuerai à fournir des conseils et des orientations à notre équipe dévouée

d’administrateurs et je consacrerai mon temps à nos politiques, nos procédures et nos documents de gouvernance. C’est un honneur pour moi de continuer à travailler pour l’ICÉC.

Merci à tous les membres, les bénévoles, le personnel et les directeurs avec lesquels j’ai eu le plaisir de travailler. Votre travail est apprécié et nécessaire. Notre secteur est en pleine croissance. Les programmes et les outils que nous avons mis en place continueront à renforcer notre professionnalisme et notre formation.

Au cours de mon mandat de présidente, j’ai grandi tant sur le plan personnel que professionnel. Je n’échangerais cette expérience pour rien au monde.

Je vais passer le relais à Arif Ghaffur, PQS(F) en tant que président cet été. Vous serez entre de bonnes mains; je suis sûre qu’il sera un président fantastique.

Au revoir pour le moment! Restez heureux, en bonne santé et en sécurité!

Erin Brownlow, PQS Présidente, ICÉC

Merci à tous les membres, les bénévoles, le personnel et les directeurs avec lesquels j’ai eu le plaisir de travailler. Votre travail est apprécié et nécessaire.

TheCIQS introduced its Continuing Professional Development (CPD) program in 2003. The aim was to promote continual learning and professional development to keep members current with the latest knowledge and technologies and enabling them to perform as effectively as possible. Promoting CPD for CIQS members also elevates membership bar and denotes recognizes the CIQS as an organization that sets the highest standards for construction economists in Canada and abroad.

Formal training can be a small part of Continuing Professional Development. There is also a vast number of informal, independent, learning opportunities that count towards the 50 annual CPD points CIQS members are required to earn to maintain their designations. To name a few examples, members can:

• Volunteer for the CIQS board of directors, committees, or a taskforce

• Write an article for the Construction Economist or CIQS newsletter

• Take an approved course

• Attend CIQS events (Congress, webinars, chapter chats and seminars, workshops, etc.)

• Present at an industry event Continuing Professional Development can open career doors while offering opportunities to learn something new, get inspired, and sharpen your knowledge to keep your skills current in an increasingly competitive market.

Participation in the CIQS CPD program is mandatory for the following CIQS Members:

• Professional Quantity Surveyor, PQS

• Professional Quantity Surveyor Fellow, PQS(F)

Sheila Lennon, CAE• Construction Estimator Certified, CEC

• Construction Estimator Certified Fellow, CEC(F)

New members are exempt from the CPD program from the time they register and pay their initial membership dues until their first annual membership renewal is due. Each member must earn a minimum of 50 CPD points each calendar year and is currently required to complete a CPD declaration when they renew their annual membership. Failure to acquire 50 CPD points in a calendar year, or failure to submit proof of their CPD declaration, may result in dismissal. There is currently an audit process where members are randomly selected for audit. Participation in these audits is mandatory. Retired and Honorary Life members are not required to participate in the CPD program.

As with the CIQS requirement for its designated members to remain current, so shall the CIQS. The CPD program will therefore undergo a thorough review this year as the Institute seeks to update the program categories and

reporting requirements. When the new CPD module within the Institute’s new member management system is launched, it will allow PQS, PQS(F), CEC, and CEC(F) Members to upload their CPD activities directly into their database profile as they are earned. This information then links to the renewal process to prove each Member’s CPD activity as they renew annual membership dues.

Various events, webinars, virtual chapter chats, and volunteer opportunities available through the CIQS, offer the perfect way for all members to meet their annual CPD requirement while supporting their Institute. As an example, the annual CIQS Congress currently offers 12 CPD points to its attendees – one-quarter of the annual requirement earned in just two days!

Further information about the CPD program updates and procedures will be released as it becomes available. In the meantime, always strive for personal excellence through continuous learning!

canadien des économistes en construction a lancé son programme de DPC (développement professionnel continu) en 2003. Le but était de promouvoir l’apprentissage continu et le développement professionnel pour maintenir les membres à jour des dernières connaissances et technologies et leur permettre d’agir de manière aussi efficace que possible. La promotion du DPC pour les membres de l’ICÉC permet aussi d’élever la barre d’adhésion et reconnaît l’ICÉC en tant qu’organisation qui établit les normes les plus prestigieuses pour les économistes en construction au Canada et à l’étranger.

La formation formelle peut ne représenter qu’une petite partie du développement du projet professionnel. Il y a également un large nombre d’opportunités de formations indépendantes et informelles qui font partie des 50 points DPC annuels que les membres de l’ICÉC doivent recevoir pour maintenir leur titre. Par exemple, les membres peuvent

• se porter volontaires au conseil d’administration, aux comités ou à un groupe de travail de l’ICÉC ;

• écrire un article pour la lettre d’information Économiste en construction ou ICÉC ;

• suivre un cours approuvé ;

• assister aux évènements de l’ICÉC (congrès, webinaires, séminaires et discussions des sections locales, ateliers, etc.) ; et

• assister à un évènement de l’industrie, et bien plus encore

Le développement professionnel continu peut ouvrir des portes professionnelles tout en offrant des opportunités d’apprendre de nouvelles choses, de trouver des sources d’inspiration et d’aiguiser vos connaissances et de maintenir vos compétences à jour sur un marché de plus en plus compétitif.

La participation au programme DPC de

l’ICÉC est obligatoire pour les membres suivants de l’ICÉC :

• Économiste en construction agréé, ÉCA

• Économiste en construction agréé, catégorie camarade, ÉCA(C)

• Estimateur en construction certifié, ECC

• Estimateur en construction certifié, catégorie camarade, ECC(C)

Les nouveaux membres sont dispensés du programme DPC à partir de leur inscription et du paiement de leurs frais d’adhésion initiaux jusqu’à leur premier renouvellement annuel. Chaque membre doit recevoir un minimum de 50 points DPC par année calendaire et doit actuellement remplir une déclaration lors du renouvellement annuel de leur adhésion. Faute d’avoir reçu les 50 points DPC en une année calendaire, ou faute d’apporter la preuve de leur déclaration DPC, la conséquence peut être le rejet. Il y a actuellement un processus d’audit lors duquel les membres sont sélectionnés au hasard pour être audités. La participation aux audits est obligatoire. (Les membres retraités et honoraires à vie ne sont pas tenus de participer au programme DPC.)

Comme l’ICÉC exige de ses membres désignés de rester à jour, l’ICÉC se le doit également. Le programme DPC va, par conséquent, subir un examen complet

cette année, alors que l’Institut cherche à mettre à niveau les catégories du programme et les exigences de rapport. Lorsque le nouveau module DPC au sein du nouveau système de gestion des membres de l’Institut sera lancé, il permettra aux membres ÉCA, ÉCA(C), ECC et ECC(C) de charger leurs activités DPC directement sur leur profil de la base de données au fur et à mesure. Cette information est ensuite associée au processus de renouvellement pour justifier de l’activité DPC de chaque membre au moment de leur renouvellement annuel d’adhésion.

Il y a différents évènements, webinaires, discussions virtuelles des sections locales et opportunités de volontariat disponibles grâce à l’ICÉC qui permettent à tous les membres de respecter l’exigence DPC annuelle tout en soutenant leur Institut. Par exemple, le Congrès annuel de l’ICÉC apporte actuellement 12 points DPC à ses participants : un quart du quota annuel rempli en seulement deux jours !

Plus d’informations sur les mises à jour et les procédures du programme DPC seront publiées au fur et à mesure de leur disponibilité. En attendant, visez toujours l’excellence personnelle grâce à l’apprentissage continu !

In my first Editor’s Message, I focused on the housing affordability crisis we are currently facing across Canada. Since the article was published, the Bank of Canada did what most bank analysts predicted it would do and raised the interest rate by 0.25% followed by another 0.50% in April. The Bank of Canada has signaled that inflation is not under control and another increase of at least 0.50% is expected in June. It seems that the interest rate hikes have taken some steam out of the market, with average selling prices in March and April already dropping.

In this article, I focus on the recommendations that the Ontario Housing Affordability Task Force (the Task Force) put forward and the measures that the current Ontario and Federal governments have just announced to address the housing crisis in the country.

The Task Force report highlighted a few major solutions1:

• Increase housing density across the province

• Eliminate municipal rules that block or delay new housing

• Depoliticize the housing approval process

• Prevent abuse of the housing appeals system

• Financially support municipalities that build more housing

On March 30, 2022, the Ontario government released the More Homes for Everyone Act, 2022 (also known as Bill 109). This bill will be implementing some of the recommendations of the Task Force such as:

Zoning By-Law Amendment 90 Days 150 Days 210 Days

Zoning By-Law, and concurrent Official Plan Amendment

Site Plan Approval

• Site Plan Approval

• Application Processing Times

• Ontario Housing Accelerator

• Parkland Dedication

Days

Days

Days

Days 90 Days Not Applicable

• Give cities the tools to speed up housing construction

• Build and repair more affordable housing

• Minister Approval of Official Plans/ Official Plan Amendments

I can attest to the application processing times being egregiously too long since I work with developers on a daily basis, and I see how long it takes from the proforma budgeting stage to actual construction start. Bill 109 sets timelines for the three major approvals: Zoning By-Law Amendment, Zoning By-Law, and concurrent Official Plan Amendment, and Site Plan Approval. If the timelines are delayed, the municipalities will have to refund the application funds based on the length of the delay, as follows2:

The Federal government’s “A Home for Everyone” plan which is proposed by the Liberal party, focuses on the following commitments3:

• Help renters become owners

• Help first time buyers afford a down payment faster

• Offer flexible first-time home buyer incentives

• Minimize on the closing costs of home purchases

• Reduce monthly mortgage costs when necessary

• Convert empty office space into housing

• Help different generations of a family live together

• Support Indigenous housing

• End chronic homelessness

• Curb unproductive foreign ownership

• Stop excessive profits in the financialization of housing

• Strengthen federal oversight of the housing market

• Reduce returns on speculation and house flipping

• Introduce a Home Buyer’s Bill of Rights

Colleagues and other industry professionals with whom I have been speaking all agree that more solutions are needed to fix the current housing issues. One of my industry contacts had an interesting idea on how to reduce quick flipping of residential units, suggesting that new condominium owners be prohibited from selling their unit for a period of three years – essentially a prohibition on flipping the unit for a period of three years, forcing some investors to think twice about having their money tied up for three years.

If investors did purchase units and were prohibited from flipping for three years, no doubt they would put their units into the rental pool. Based on the Federal Liberal party, this ‘Reduce incentives for speculation and house flipping’ listed above proposes to require properties to be held for at least 12 months before selling.

The Federal and Provincial government and the Task Force have some great ideas to fix the housing crisis. That said, they will need to work cohesively to achieve these goals, which will likely take time before we notice any improvement. The changing world markets, labour shortages, and supply chain issues will make these changes more difficult and will have to be addressed.

If you have feedback, suggestions, and of course any articles that you would like to have considered for publication, please email editor@ciqs.org or ceo@ciqs.org.

1 Report of the Ontario Housing Affordability Task Force – Letter to Minister Clark. (February 8, 2022),

2 Canada: More Homes for Everyone Act, 2022: A First Step to Address Housing Affordability by Robert Howe, David Bronskill, Max Laskin and Matthew Lakatos-Hayward. Goodmans LLP, dated April 6, 2022.

3 A Home for Everyone. The Liberal Housing Plan. www.liberal.ca/housing

The Construction Estimator Certified (CEC) is an individual who is certified and licenced by the CIQS to provide construction estimating services both in Canada and internationally.

The term Construction Estimator Certified and CEC are licensed trademarks owned by the CIQS* and can only be used by a current member certified by the CIQS.

*The French equivalent terms Estimateur en Construction Certifié are also licensed trademarks of the CIQS.

The Federal and Provincial government and the Task Force have some great ideas to fix the housing crisis.

you ever considered becoming a PQS or CEC specializing in mechanical and electrical disciplines?

Our education committee has been diligently updating and developing M/E syllabi for the past two years. Now we are pleased to announce the work has achieved “substantial completion,” thanks to the hard work by our dedicated volunteer committee members! (Check the CIQS website for the new subject contents).

Why M/E (or ME, possibly punintended), you might ask? Well, almost everyone agrees that mechanical and electrical systems are important components of building construction; however, the reality is more like “good to know but nobody knows it enough.” Of course, there are ample employment opportunities with M/E specialty contractors, requiring hands-on familiarities with pipes, ducts, conduits, wires, fittings, and insulations. Cost consultants are either outsourcing or having dedicated quantity surveyors

Adam Ding, PQS

in-office preparing M/E cost plans. While general contractors usually rely on subcontractors to execute M/E work, a thorough understanding of building M/E systems would better define the scope of work in subcontract agreements and improve trade coordination on jobsite. Experience shows a building project with well-managed M/E work has far better chances of meeting budget, time, and quality goals. Did we also mention the interconnection of M/E work with land development and site servicing? Things get even more interesting when sustainability context is introduced. For example,

stormwater control, green roofs, light pollution, daylighting, solar panels,

I encourage everyone to look at our new M/E education offerings.

sponsoring employees to adopt our

who possesses specialty knowledge.

designations, additional training on M/E disciplines might offer a future cutting edge. So what do you think?

Feel free to let us know by emailing

. By the way, if you would like to join our education committee on many current/future exciting adventures, you are always more than welcome to drop us a line

Theimportance of compliance with the prompt payment and adjudication provisions of the Construction Act , R.S.O. 1990, c. C.30 has been highlighted with the Ontario Divisional Court’s recent decision in SOTA Dental Studio Inc. v. Andrid Group Ltd., 2022 ONSC 2254 (SOTA). In the SOTA case, the Court dismissed an application for judicial review of an adjudicator’s determination under the prompt payment provisions of the Construction Act, without any consideration of its underlying merits, because the applicant failed to pay the amount ordered or obtain a stay of the adjudicator’s determination.

The applicant, SOTA, retained the respondent, Andrid Group, to perform work on the construction of a dental clinic in Vaughan. Andrid Group invoiced SOTA for its work. SOTA did not dispute the invoices within the prescribed time, making them due and payable pursuant to section 6.4 of the Construction Act . However, SOTA did not pay. An adjudication was held, and the adjudicator ordered SOTA to pay Andrid Group $38,454.55 for work performed. SOTA did not make payment in accordance with section 13.19(2) of the Construction Act , causing Andrid Group to pursue enforcement efforts, in which it obtained a nominal amount of the payment owed.

SOTA was granted leave to bring an application for judicial review of the adjudicator’s determination. On September 24, 2021, three days

after leave to bring the application was granted, a case conference was held before the Court to address the scheduling of steps required for the application. At this case conference, the issue of SOTA’s failure to bring a motion to stay the determination of the adjudicator’s decision was raised.

On April 14, 2022, the Court dismissed SOTA’s application for judicial review.

The Court recognized that prompt payment is integral to the scheme of the Construction Act , which is further reinforced by the provisions related to appeals and reviews. There are no appeals from prompt payment adjudication determinations, but there may be judicial review of the decisions, only with leave of the Divisional Court.

SOTA argued that “there was no money” to make payment of the adjudicator’s determination. In the Court’s opinion, this admission reinforced its view that if an owner is insolvent, it should not be allowed to “run up costs and delays through recourse to litigation”. In the SOTA decision, the Court determined that when leave is granted, the applicant is faced with two options: (1) obtain a motion to stay or (2) adhere to the prompt payment provisions of the Construction Act , failing which the court may dismiss the application on a motion to quash or at the hearing of the application.

The SOTA case illustrates the importance of understanding the processes surrounding adjudications

in Ontario, as well as recognizing the required steps after receiving an adjudication determination. A party looking to set aside the determination of an adjudicator through an application for judicial review must adhere to the timelines set out under the Construction Act. Under section 13.18(2), a motion for leave to bring an application for judicial review of a determination of an adjudicator must be filed no later than 30 days after the determination is communicated to the parties.

Further, the SOTA decision has confirmed that a failure to pay in accordance with the prompt payment requirement of the Construction Act may lead the Court to refuse an application for leave. Alternatively, where leave is granted, an applicant must either obtain a stay of the adjudicator’s determination, or make payment, failing which the Court may dismiss the application for judicial review altogether.

Recognized as “Top 40 under 40” in Canadian Construction in 2021 by On-Site and SitePartners and the “Next Generation Partner” by Legal 500 Canada 2022, Sahil Shoor, is a Partner with Gowling WLG (Canada) LLP. He is called to the Bar in both Ontario and BC. His national practice is focused on complex litigation and dispute resolution in the sectors that drive Canada’s economic development, including commercial construction, real estate development, infrastructure and civil works, power, and energy (nuclear, hydro-electric and power generating stations), and transit/transportation (P3). He also provides advice on COVID-19 excusable and delay claims and force majeure events.

Sahil focuses on practical and commercial solutions to complex issues that arise throughout the lifecycle of major projects, where he has advised all the key participants in the supply chain: developers, owners, contractors, subcontractors, consultants, and manufacturers. While he is a firm believer in proactive project management to avoid disputes, he always has an eye on positioning clients to best achieve their objectives and is as comfortable managing large trials on highly technical disputes in litigation and arbitration as he is in performing early case assessments, and conducting mediations, adjudications, and other forms of alternative dispute resolution.

Sahil is intimate with the industry changes effected by Ontario’s new Construction Act and has a record of effective advocacy as counsel before courts in Ontario, Saskatchewan, and British Columbia and arbitration panels (international and domestic disputes).

As we enter a new year, I am pleased to issue our annual profile edition of YQS Corner. No two paths are the same and I find, not unlike myself, some members fall into it unexpectedly. As part of our YQS corner, we are thrilled to feature three YQS members with inspiring stories and showcase their work.

When I learn more about the members who will continue to shape the CIQS, I get very excited, and I encourage YQS members interested in attending future CIQS webinars, events, etc. to check out our networking and information portal: www.qscareer.org.

I got into the industry the old-fashioned way: Following in Dad’s footsteps. Too conventional for some, no doubt, but to me, whatever I was going to do, I wanted to be among the best. So construction, a career where I would have the benefit of an in-house mentor, was an obvious decision. I wanted to go to BCIT right out of high school and figured their two-year diploma would get me well on my way to a career in construction project management. But a poor Physics 11 mark meant that BCIT wouldn’t have me, and I would spend a gap year working for a close friend, who happened to be a QS. BCIT did take me the following year, at which stage I still knew I wanted to go into construction but was less certain about the specific outcome. Two diplomas, two degrees, and various positions later, I am now the Estimating Manager at Scott Construction, where I’ve been for the past six years. I’ve had the good fortune over the last 14 years or so of working on projects in an operations capacity, in an estimating capacity, and in a QS consulting capacity and have been exposed to the wide variety of careers that might be pursued by new entrants to the industry.

When people ask – in a personal context, not professional! –what I do, I often just say I’m in construction. Really, that doesn’t say anything at all about what I do, but I let the person posing the question come to their own conclusions, and more often than not, that’s the end of the subject. The reality is that within construction and the QS field, there are so many different roles. Even within the construction industry, there seems to be a perception that quantity surveying is a narrow field, but my own experience suggests anything that it is but. So, I always encourage students and new graduates to keep an open mind to trying different career paths. For example, try working as a project coordinator, an estimator, or try

loan monitoring and cost planning. The different roles require different skillsets and suit different personalities. Taking a few years to figure out how best to spend the next 40 years will bring far more joy and enthusiasm for work in the long run.

I was born and raised in Ukraine; throughout my youth, I observed the aftermath left behind the Soviet collapse in the early 90s. Corruption suffocated the country's economy, and many have chosen to leave in pursuit of a new, safe life. My family and I landed in Toronto, ON, in February 2002.

At that time, I already had completed the 3rd semester of studying mechanical engineering at my hometown university and was trying to figure out what to do with my new life in Canada. My English was nowhere good enough, and I ended up with a job on a construction site working for a Ukrainian plumber. Soon after I realized that I needed to advance and set a goal to complete my higher education. Around the summertime of 2002, I signed up for the English as a Second Language (ESL) evening class while working my construction job daytime. Time flew by and in 2004 I was admitted to George Brown College to study Construction Engineering Technology.

In my second year, we got introduced to a construction cost estimation class led by Clint Kissoon, who was actively promoting the institution to the students. I became inspired and joined CIQS as a student in 2006 since then I have been a member and achieved my PQS designation in 2014.

Upon graduation from George Brown College, I began my professional career as a Junior Estimator in 2006 with a local family-owned Design-Builder firm in Barrie, ON. Through dedication, hard work, and often leaving my comfort zone, I progressed many roles on complex projects since then, and worked for multinational firms like AECOM, AMEC, Turner & Townsend, Faithful + Gould, and now EllisDon – companies that shaped who I am today. The Toronto York Spadina Subway Extension, Maple Leaf Foods processing facility, and Darlington Nuclear Power Plant Refurbishment are amongst the most notable projects with which I can associate myself. My career shifted from estimating to project management to commercial management, switching hats multiple times. Through the lens of consultant, owner, and contractor I gained extensive experience in team building, project management, commercial and cost management, in defense, environmental, nuclear, and private

and public health sector assignments. Working for both public and private clients in major projects has resulted in increased knowledge and versatility with projects of various sizes.

Fast Forward to 2022, where I am currently a preconstruction manager at EllisDon in Ottawa and running with over $1 billion worth of precon in major infrastructure projects.

I always followed high profile projects and wanted to be associated with landmarks that will remain on the Canadian landscape for generations. By undertaking roles that made me work late nights to get myself to the level of the job expectations I have professionally grown, and I never regretted taking the hard path, this enabled me to become a well-rounded PQS.

As an Associate Partner at LEC Group, a Vancouver-based Cost Consulting Firm, I specialize in cost management for sectors including gaming and entertainment, K-12 education, post-secondary education, health care, and institutional.

I am currently Chair of the CIQS – BC Chapter and a CIQS Ambassador. I sit on the British Columbia Institute of Technologies Program Advisory Committee as Chair for the

Construction Management Degree Program and as an Advisor for the Architecture and Building Technology Diploma Program.

I graduated from BCIT’s Architectural and Building Engineering Diploma program in 2010 and from BCIT’s Construction Management Bachelor of Technology in 2018.

I first heard of CIQS in 2008 when CIQS gave a student presentation on quantity surveying. Like any student looking for a career in estimating, I quickly realized that quantity surveying was in line with my career goals and aspirations.

I had the opportunity to complete my student work practicum in 2010 where I was able to see many aspects of quantity surveying including takeoff and pricing for cost planning, budget reviews, and loan monitoring. Seeing that quantity surveying was more than just takeoff became more and more appealing.

After entering the construction industry in 2010 as an estimator, I had the opportunity to join LEC as a junior quantity surveyor in 2012.

Early in my career I was able to attend CIQS dinners and social events which allowed me to connect with other members. Being able to connect with an industry-specific social network allowed me to grow as a young professional. The ability to connect with mentors within the Vancouver market is invaluable for a young quantity surveyor.

A.W. Hooker Associates Ltd., offers leading edge Cost Consulting with a comprehensive portfolio of services from a team of Professional Quantity Surveyors; including, Architectural, Structural, Civil, Mechanical, Electrical, Independent Certification, Loan Monitoring, Expert Witness, Adjudication and Client Representation roles. Our team provides full services to our Clients in both the private and public sectors of the construction industry.

In 2017, I was the recipient of the CIQS Young QS Award and began volunteering for CIQS – BC on the Board of Directors. Being on the board at a local level gave me the opportunity to stand in the same lecture hall I was in many years ago and deliver a presentation to students on quantity surveying.To come full circle from student to presenter is one of the most rewarding feelings I have experienced in my career.

Anyone starting off in this great industry as a young quantity surveyor or thinking of becoming a member should know that CIQS was built and maintained by many member volunteers over the years. This in turn provides a solid foundation for young professionals to grow and have a successful career.

About the author

Shane McKernan, PQS, GSC, B.Tech is a Project Manager & Estimator for Landa Global Properties, based in Vancouver, BC. With over fifteen years of experience in the construction sector, Shane’s experience includes estimating, cost consulting, project loan monitoring, and project & construction management. Shane is the current Past-President of the CIQS – BC Chapter, where he joined as the board’s first-ever student member in 2013. Shane also previously sat on the CIQS National Council as the YQS Observer for two terms and is an Assistant to the Construction Economist editor.

Congratulations to the following ‘Designation Holders’ who have qualified as a PQS or CEC (Including reinstatements):

CIQS – British Columbia

Chan Kin Lok Matthew, PQS

Chan Long Ching, CEC

Daniel Robbins, CEC

Edgaras Virvicius, CEC

Esmaeli Boustani, CEC

Frank Inkoom, PQS

Gareth Benjamin David Miller, PQS

John Walker, CEC

Sahar Sarvari, CEC Sukh Purewal, PQS

CIQS – Newfoundland and Labrador Michael W. Freeman, PQS

CIQS – Members at Large

Aadith Anna Somnath, PQS

Andrei Vodolagin, CEC

Hamzath Arakkal Parakkat, CEC

Kumarage Nilosha Sandya Kumari Pathirana, PQS

Madusanka Godamuna Vithanage, PQS Milinda Madava Perera, PQS

Poon Yuk Kwan, PQS

Ranuka Upendranath Nissanka, PQS

Sathish Kumar Prabhakar, CEC

Saud Bin Sadique, CEC

Tyrone Borja Arguelles, CEC

CIQS – Ontario

Ahmed M. Bahgat Elsayed, CEC

Amir Mehrabian, CEC

Behshad Dadgostar, CEC

Changiz Mokhtari, CEC

Damilare Oluwasegun Allison, PQS

Devang Pandya, CEC

Haidar Al-Maroof, PQS

Hongjie Wang, CEC

James Baah, CEC

Jillian Du Ulopani, CEC

Joel Weerdenburg, CEC

Mackenzie Bowcott, CEC

Maria Isabel Bercasio, PQS

Maziar Mazloomi, CEC

Mehrdad Fakhrjahani, PQS

Michael Amirthanathan, CEC

Michael Wiebe, CEC

Mohamed Moustafa Arafa, PQS

Omid Jokar, PQS

Oyindamola Titilayo Akinola, PQS

Prathamesh Sanjay Raut, CEC

Priyal Kapade, CEC

Richard Daniel Johns, CEC

Richard Ian Tyms, CEC

Usman Saeed, PQS

CIQS – Prairies and NWT

Adetunji Enoch Oluwaleke, PQS

David Hicks, CEC

Devorah Parrera Dizon, CEC

Eric Sapiano, CEC

Judy Mao, CEC

Kaleb L. Dickson, CEC

Kunkun Li, CEC

Marc Brown, CEC

Nicholas Wanat, CEC Ryan Dusselier, CEC

Wendell Hauck, CEC

CIQS – Quebec

Haili Tian, CEC

Hemaduth Jhugroo, CEC

Mohamed (Max) Mm Mahi, PQS

I am the Member Services Coordinator for CIQS. I am the first point of contact for members and the public for membership inquiries. My role assists and provides administrative support to the Membership Manager, and I act as a staff resource for the CIQS Education Committee. I am also responsible for the management of the student and member welcome package and participate as a member of the Student Outreach Committee. Regarding membership, I maintain member profiles and reports in the Institute’s database, assist members with any issues logging into our new system, process membership invoices, renewals, reinstatements, and new applications. For new applicants, I follow up with any additional documentation CIQS requires. Exams also fall under my portfolio including the coordination of the three CIQS exams sessions, and the TPE Part C exam coordination and scheduling. I am responsible for handling front office reception, office administrative duties, fulfilling e-store orders, textbook inventory, and producing reports and files for the bookkeeper.

My days always include assisting members and potential members with their membership questions. Other than that, there is not really a typical day. Depending on what point we are at in the membership cycle, I could be working on renewals, reinstatements, TPEs, exam registration and coordination, diploma processing, and publication orders.

I think what I enjoy most are the many different aspects within my job’s role. Almost every day is different based on what is needed by our members and/or the Institute itself and it keeps me busy and motivated. I have learned a lot in the past six months, and I am still learning; I know there is much more ahead.

I feel that the knowledge and experience I have gained through my previous roles, as a Training Coordinator and Customer Experience Manager, will provide a high standard of member service, through the development of customer service policies and procedures, and formal processes for exam coordination and scheduling.

I am a creative individual who loves to sing, dance, and hand-knit blankets, which I learned in the early stages of the pandemic. I enjoy staying active by skiing, cycling, and my recent interest in yoga. I also recently adopted a one-year-old rescue dog from Tennessee, and we love to go for walks together.

Kelsey Wright is the Member Services Coordinator for CIQS and has nine years of customer service experience, gaining that experience in the retail sector, from working with one of Canada’s top high-end sporting goods companies. She has most recently obtained her Business diploma at Seneca College.

On May 11, 2022, the Managing Editor of Construction Economist, Arif Ghaffur, PQS(F), engaged in a webinar hosted by the Canadian business law firm Osler, Hoskin & Harcourt on the topic of resource cost fluctuations alongside moderator Andrew Wong (Partner) and co-panelist Richard Wong (Partner).

The thematic surrounded supply issues across the global economy, the effect of cost fluctuations among several resources, which are causing significant challenges as well as reducing disruptions to construction projects.

The audience consisted of professionals working across the supply chain, including owners, developers, general contractors, trade contractors, suppliers, and other professionals from across Canada.

Andrew Wong posed questions to the panelists, sharing his own thoughts as Richard Wong also provided insightful perspectives from a legal perspective, including the concept and use of price fluctuation clauses.

During a short but impactful session, an engaging conversation took place, and abstracted below are some of the questions and answers by Arif Ghaffur, PQS(F).

Andrew Wong (AW): Arif, could you give the audience your perspective of the key forces behind the Resource Cost Fluctuations that we are currently seeing? What impact are they having on the planning and development of capital projects?

Arif Ghaffur (AG): Thanks Andrew and thanks to Osler for inviting me to share my thoughts on this very important topic, a topic that I have been closely tracking via my editorials for Construction Economist – particularly over the last two years.

Every aspect of construction –including labour, materials and equipment – is experiencing price increases. For some materials, the increases are dramatic and causing disruption to project development. I don’t believe that this price volatility is temporary. In the background, we now have inflation at the highest level since 1991 as it is edging towards 7%.

Higher logistics costs and the rising price of fuel seems to gets much attention; however, the INDUSTRIAL PRODUCT PRICE INDEX or IPPI, which covers over 2,300 products (published by Statistics Canada), is showing significant spikes, particularly over the last few months. This IPPI type of variance reporting started over 100 years ago, yet March 2022 saw the highest month on month increase of the IPPI since 1956 – around 4%.

To give you an example, triggered by the war in Ukraine, Nickel (found in stainless steel rebar) has gone from a tonnage US$ price of 10k, to $48k, to $100k and back down to around $30k. Prices are shifting and is changing almost daily.

I recently looked at major types of construction materials and found High Volatility in the prices of Steel, Copper and Lumber. If you have tried to build a wooden fence or deck recently, you will know how prices have swung. Other impacted materials include Aluminum, Concrete, Gypsum, as well as Plastics. Irrespective of volatility levels, all materials have been impacted to some extent.

Economic price graphs typically show steady increases, consistent periods and steady decreases. Sometimes, triggered by identifiable events, there are sharp peaks and sharp troughs.

Arif Ghaffur, PQS(F)The current reality is that pricing data indicates greater volatility across most material classes – there are certainly more bumps and more spikes, and less of those consistent periods.

Andrew, you also asked about key forces behind these cost increases – I believe that it boils down to three aspects:

1. The fall out and bounce back from the pandemic

2. A greater demand from a strong project pipeline

3. Political events, such as the war in Ukraine

The impact is that the outcome of projects, irrespective of size, complexity or schedule, is requiring extraordinary effort to approach cost certainty. On that theme of cost certainty, the variance between project budgets, bids and project outcome costs is greater than ever. Lots of time is being spent trying to explain variances.

This cocktail of increasing prices, labour shortages and supply chain disruption is a new norm, creating potential to become what I would term as a perpetual disruptor.

AW: Arif, the issue is not just in Canada – it’s a global issue. How are other countries dealing with these issues, and are there any lessons learned that Canada should consider implementing?

AG: The prevalence of trade across borders internationally, combined with rising prices and market volatility, absolutely makes this a global issue. Professional associations, such as the Canadian Institute of Quantity Surveyors, has been engaging with international bodies to set up standards for common tracking and reporting platforms on cost. This is something that institutions such as the World Bank are understandably keen on.

In my research, I have found that some international jurisdictions have mechanisms built into contracts that are used to address Resource Cost Fluctuations. For example, the International Federation of Consulting Engineers (or FIDIC forms of Contract) are often used for large-scale construction projects across the globe. These FIDIC forms allow for price change adjustments, and I use the term adjustments intentionally. Prices can of course go up and come down –it’s very much intended to be a two way street.

Those attendees that have experience in the United Kingdom will know that there are options available under the NEC forms of Contract - published by the Institute of Civil Engineers.

The general commercial concept of the price fluctuation provision used globally is that there is a mechanism for dealing with construction price inflation.

Whilst my co-panellist Richard Wong can better explain the legal concept of these clauses, the idea is that the Contractor is reimbursed for price changes to specified items. In the global arena, price fluctuations clauses have been around for many years.

However, I do recall from my time working on international projects that they were traditionally used for the higher value, longer-term projects. Due to market conditions, that seems to have changed, and these clauses are also being used on smaller projects. Of course, this also protects the emerging supply chain.

From a commercial viewpoint – for materials and equipment that are at risk of price fluctuation or short in supply – we are seeing some trends globally:

• Owners are purchasing directly from suppliers, often storing and then providing free issue to Contractors.

• Contractors are being told to advance purchase and being paid a pre-agreed amount for OH&P.

• Designers and Procurers are increasingly looking at alternative materials, equipment and methods

In parallel, there is of course internationally – as in Canada –the increased use of collaborative forms of contract, such as alliancing and progressive design build. These seek to buffer and de-risk particularly large multi-year projects.

Back to Resource Cost Fluctuation Clauses, I believe that Canada is well positioned to learn from the global experience. The aim is to pivot back towards cost certainty and reduce the constraints to economic recovery. It may be a long journey, but we will have to get there.

AW: Arif, what are the price indexes available? How are you seeing price fluctuation adjustments being made and resolved during the implementation of projects?

AG: Where there are Resource Cost Fluctuation Clauses, then of course the formula included in contracts are being used to address price changes. For example, as Richard mentioned, the Ministry of Transportation in Ontario has a provision to address price changes for asphalt cement. In terms of other indices that are used to track price changes, the common goto is Statistics Canada, which holds substantial data on prices and indexes.

There are other commercial sources that carry price indices and usage guidelines, with a number of these being from the United States. The challenge with indices, however, is that data collection takes time and there is often a time lag to actual publication, so current relevance becomes an issue.

For instances where there is no indexed price formula clause in contracts, then one reverts to making what I would term as a “CIP” or change in price submission. Typically, these details include a contractual basis, causation, quantification and, of course, evaluation of the relief and substantiation – akin to a change or a claim. My experience is that owners and the supply chain mostly, and I intentionally say mostly, switch to addressing such requests in an efficient manner

Andrew, as usual, owners continue to seek justification, while contractors and suppliers pursue what they believe to be a contractual right to additional compensation flowing from price increases.

Note: The above interview notes are an abstract from the Webinar, may not be complete in nature (subject to addition or omission) and constitute the views of those being interviewed anddoesnotreflectthepolicyorpositionoftheCIQS

Prepared by Magdalaina Fogarasi Coordinator, Commercial & Contract Lakeland Consulting Inc.On the path to decarbonization, Canada’s building and construction owners will require guidance from construction economists about the economics of carbon pricing.

In 2019, federal carbon pricing, largely implemented through a carbon tax program took effect across Canada. It began as a minimum fee of $20 imposed on every carbon dioxide equivalent tonne (CO2e) of emissions from fossil fuels: gasoline, diesel, natural gas, propane, or even electricity generated from burning coal. That $20/tonne price in 2019 has increased to $50 in 2022, and scheduled to increase each year by $15, to reach $170/tonne by 2030 (Figure 1). The increasing costs of carbon emissions make it expensive to burn fossil fuel and act as financial incentive for organizations to pursue non-emitting energy alternatives such as renewables: solar, wind, etc. Carbon pricing, according to the 2021 judicial decision that cemented the program, “is integral to reducing greenhouse gas emission.” Canada has committed to promoting the carbon pricing policy globally.

Canada provides flexibility on how its jurisdiction implements carbon pricing and there is now one in place across all jurisdictions (Table 1). Provinces and territories can develop their own carbon pricing framework but must comply with a federal minimum standard or may elect to apply the federal plan directly. Where a jurisdiction has not provided a framework for carbon pricing or has a

Federal fuel charge

Figure 1: Canada carbon pricing, currentlyat $50/tonne in 2022, will increase to $170/tonneby2030

plan that doesn’t meet the federal benchmark, the federal system kicks in, wholly or partially. This is known as the federal backdrop. The federal backdrop currently applies in Manitoba, Nunavut, and Yukon. Organizations across Canada would therefore be prudent to understand the carbon pricing mechanisms in their localities and seek strategic guidance on how to mitigate their impacts.

Alberta, Saskatchewan

Provincial Output Based Pricing System (OBPS) Alberta, Newfoundland and Labrador, New Brunswick, Ontario, Saskatchewan

Provincial/Territorial carbon tax

Federal Backdrop

British Columbia, Northwest Territories

Manitoba, Nunavut, Yukon

Newfoundland and Labrador Cap and trade

Provincial carbon tax

Provincial fuel charge

Federal OBPS

Table 1: Carbon pricing as applied across Canadian jurisdictions

Nova Scotia, Quebec

Prince Edward Island

Prince Edward Island, Saskatchewan

There are two parts to the carbon pricing system: one is a regulatory charge on emitting fuels, known as the fuel charge, and the other is the Output-Based Pricing System (OBPS) for industries to trade emissions. Provincial OBPS systems such as the new Emissions Performance Standard in Ontario are designed to meet the minimum federal standard. The annual increase in the federal minimum standard for 2023-2030 offers an incentive for organizations to move away from emitting fuel sources and practices across their value chains.

Cap and trade is another form of carbon pricing, and it is currently operational in Nova Scotia and Quebec. Nova Scotia is currently reviewing its cap and trade program, and may shift to a straight carbon tax system in 2023. Unlike a carbon tax, the cap and trade system is subjective to the market forces of demand and supply, which could cause prices to fall when there is an oversupply of carbon units in the market, such as during the 2008 financial crisis. The carbon tax system avoids this limitation, since government can always set the amount to appropriate values that incentivize decarbonization. Measures, such as the European market stability reserves can, however, help to check the effectiveness of cap and trade by giving authorities the ability to tighten or loosen supply of available carbon units.

Implication for buildings and the construction sector Buildings and infrastructure are a top contributor to Canada’s greenhouse gas emissions. The true quota of this sector’s contribution to emission is unknown since the available data from 2019 only considered operational emissions and does not account for embodied carbon. Natural Resources Canada, (NRCAN) is developing a guideline based on European and International standards for quantifying embodied carbon through whole building Life Cycle Assessments. It is expected that the NRCAN guideline will evolve into a Canadian standard for quantifying embodied carbon.

The carbon pricing policy carries several implications for buildings, infrastructure, and heavy industry, as well as energy costs across provinces. To avoid or mitigate the burden of increasing carbon pricing, building owners would need to make significant investments in retrofit measures to bring their existing buildings to a net-zero state. As embodied carbon quantification matures, owners would need to offset the locked-in emissions in their buildings and infrastructure through additional zero-carbon or even carbon-negative investments. Also, high emissions during the construction process are increasingly coming under scrutiny. Competitiveness in a low carbon economy would require heavy industry, including those that serve the construction sector, to utilize energy more efficiently, rely on clean fuels, and develop new technology. These are expensive measures that would require investments from public and private sources, despite the availability of several government grants. Carbon pricing in the transportation sector raises fuel prices, thus encouraging use of cleaner vehicles, and promotes the use of alternative modes of transportation, such as public transit.

To reduce greenhouse gas emissions, per the carbon pricing initiative, unabated fossil fuel-fired power plants would need to be replaced with non-emitting sources of electricity like solar, wind, and hydro. This would ultimately drive up energy costs, as additional investments in energy storage and grid stability will be required to ensure affordability and reliability.

Carbon Pricing as a factor influencing cost Carbon pricing provides a strong paradigm shift on the factors influencing the costs of construction and operation for owners and businesses. It is imperative that careful consideration is undertaken to determine carbon pricing exposures that projects have, and suitable ways to mitigate their impacts.

Environment and Climate Change Canada, (2022). 2030 Emissions Reduction Plan: Canada’s Next Steps for Clean Air and a Strong Economy. Gatineau, QC: Her Majesty the Queen in Right of Canada, represented by the Minister of Environment and Climate Change, 2022.

Author’s acknowledgement

The author wishes to acknowledge Anjola Olufowobi, 3rd Year Biomedical and Mechanical Engineering student at Carleton University, Ottawa, and Energy and Sustainability Services intern at Black and McDonald Ltd. Anjola provided research assistance from the ‘2030 Emission Reduction Plan,’ for this article.

Ayo Daniel Abiola, P.Eng, PQS is the Engineering Manager for the Energy and Sustainability Services (ESS) at Black and McDonald Limited. He has experience delivering mechanical services and sustainability solutions for buildings and infrastructure development. He has also contributed to the development of resilient renewable energy infrastructure for the Canadian climate and environment.

Ayo is a licensed professional engineer in Ontario, Alberta, and BC, and a Certified Energy Manager. He has provided services for construction projects and developments located across Canada, the US, and the Middle East.

Figure2:SolarPanelsforelectricityatamulti-unitresidentialbuilding. PhotobyJubbarJ.onUnsplash

In late March, the Supply and Confidence Agreement struck between the Liberal and New Democratic Party paved a smooth road for business conducted in the House of Commons over the next few years. This agreement essentially ensures the NDP will help the Liberal minority government pass bills and motions in the House of Commons as if it were a majority government, the only caveat being that they need to have the NDP’s blessing. While we haven’t seen a supply and confidence agreement at the federal level in Canada, we’ve seen some dramatic cases of them used at the provincial level. In 2017 in British Columbia, we saw the BC NDP and Green Party immediately strike a supply and confidence agreement after the election to defeat the BC Liberal Party by two votes, similar to what occurred in New

Brunswick in 2018, where the Progressive Conservatives and Green Party joined forces to overthrow the Liberal government by two votes.

Reporting on whether this supply and confidence agreement can last until June of 2025 seems to indicate that this agreement is solid, despite three years being an eternity in politics. Like most relationships, however, there is some compromise. The NDP will make it conditional that the Liberals put forward policies to achieve key asks, including housing and healthcare commitments – centre pieces of the 2022 Budget.

The Supply and Confidence Agreement gives the liberals two significant governing advantages that impact our industry. The first is that it provides relative stability for the government to pass bills in the House of Commons. The second is that it allows the government to maintain control of the Cabinet and executive decision-making powers. Essentially, this gives the government the ability to get things done with less political obstruction from opposition parties. For the NDP, they have the opportunity to achieve key objectives without forming government, thus avoiding another costly election.

In April, the government tabled its Budget titled A Plan to Grow Our Economy and Make Life More Affordable. While the budget focused more on policy than projects, the theme of the budget was geared more toward affordability as the government prepositions itself for the cost-of-living issues ahead. Overall, the budget theme was centered around investments in housing, dental care, climate change, and security. Contextualizing the past two years of the pandemic, the government made mention of the supply chain 45 times and dedicated Chapter 2.2 to address the issue, titled Supporting Economic Growth and Stable Supply Chains.

The government’s intent to spend its way out of the threat of recession is clearly tied to building homes and spending on green infrastructure projects to build net-zero projects and achieve emission reduction targets. While this budget is more cautious in its approach to taking on additional debt to finance these projects, rising inflation rates have contributed to higher tax revenues that will likely stabilize the books in the short term, while inflation rises higher than interest rates. This indicates that the government foresees a trough in the business cycle ahead, as signaled in the Budget

foreword, and as evidenced by reports that interest rates are projected to climb throughout the year,1 triggering a wait-andsee approach as it relates to new economic stimulus through infrastructure spends.

Evidence of the former can be seen in the Canada Growth Fund, which acknowledged the annual investment in climate transition would need to rise from between $15 billion and $25 billion per year to $125 billion to $140 billion of investment per year. However, details will be announced in the Fall Economic Statement; so we’ll have to see. The key here was the government’s admission they cannot do this alone, without private domestic and foreign investment. Regardless, this total falls short of the Investing in Canada Plan, which committed $180 billion over 12 years, which is from where the funding for the Investing in Canada Infrastructure Plan is stemmed. The CIQS has been pushing government for more upfront and transparent infrastructure investment.

The CIQS has been pushing the government to involve quantity surveyors on all major infrastructure projects to ensure accountability and timely delivery. The budget announced minor changes to the Investing in Canada Infrastructure Program (ICIP), the $33.5 billion dollar over 10-year program delivered through five sub-streams, including the public transit, green infrastructure, community, culture and recreation infrastructure, rural and northern communities’ infrastructure, and COVID-19 resiliency. The 2022 Budget changes to the program include:

• An intention to accelerate the deadline for provinces to fully commit their remaining funding under the ICIP to priority projects to March 31, 2023, with any uncommitted funds by this date to be reallocated to other priorities.

• An extension of the ICIP’s construction deadline from October 2027 to October 2033. To support this extension, the budget proposes to adjust the program’s funding profile so that funding is available when needed.

The former program funding profile adjustments to make funding available when needed is closely aligned with the CIQS pre-budget recommendation to the Ministry of Finance, urging the government to bring forward funding to earlier years of the program. While it’s still too early to know precisely how this will roll out, it’s a good sign that government is trying to get infrastructure spending out the door to stimulate the economy post-COVID-19.

To date, the ICIP has approved more than $20 billion for 4,500 projects in communities across the country. As projects roll out, the CIQS is well-positioned to push the government on accountability and to provide cost assurance to deliver value for taxpayers. Historically, major infrastructure projects have been the target of federal, provincial, and municipal Auditor Generals, as evidenced by the 2020 Audit of the ICIP. 2 A 2021 report tabled by the auditor general was equally scathing, as the Investing in Canada Plan, through which ICIP is funded, could not demonstrate that ICIP was on track to meet objectives. 3 The CIQS can advocate for members to be a partner in this space by being involved in all federal projects, to provide cost assurance and value-for-money to taxpayers. The audit of the ICP could very well lead to a follow-up audit in the future or generate more inquiries by Members of Parliament to the Parliamentary Budget Officer. In addition, provincial, territorial, and municipal Auditor General’s may also audit the major infrastructure projects that received seed funding from the ICP.

It’s clear that accountability and value-for-money are an issue for the government in this space. Here at the CIQS, we will continue to engage the federal government as an ally to help achieve on-time, on-budget, and transparent infrastructure projects as they roll out across the country.

References

1 https://www.reuters.com/business/bank-canada-turnsinterest-rate-guidance-it-battles-inflation-2022-05-10/

2 https://www.infrastructure.gc.ca/pd-dp/ia-vi/icip-pidc-eng.html

3 https://www.oag-bvg.gc.ca/internet/English/ mr_20210325_e_43794.html

As the Senior Consultant at Impact Public Affairs, Ben Howe works with a variety of associations at the federal level. This includes working with the Canadian Institute of Quantity Surveyors, advocating that the federal government accelerate infrastructure investments and implement broad involvement of quantity surveyors in infrastructure projects.

Overall, the budget theme was centered around investments in housing, dental care, climate change, and security.

Construction industry GDP and investment

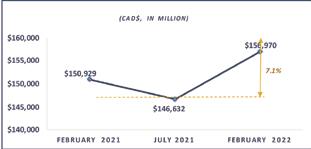

The industry GDP appears to have grown by approximately 4% over the past year and 7% compared to mid-2021. Does this necessarily mean more investments?

Over the past two years, data show investment in residential construction tends to slow down towards the last quarter and the next year’s first quarter before activity increases again. While this explains the decrease in investment between November 2021 and February 2022, the percentage increase in investment in residential construction in February 2022 was not as significant as that of 2021. Nonetheless, non-residential construction appears to be gaining more momentum with an increase of 24% compared to the 11% decrease recorded in February 2021. According to Statistics Canada, “Institutional investment posted its ninth consecutive increase (+2.2% to $1.3 billion), with most provinces and territories reporting gains in July.”

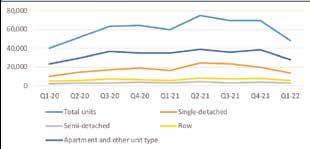

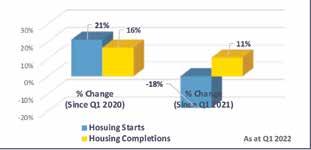

There has been a significant drop in housing starts and completions, especially between Q4 2021 and Q1 2022. The housing starts in Q1 2022, compared to Q1 2021, dropped by 18%, while housing completions recorded an increase in both quarters. Going by data on housing starts for the past two years, this decrease appears to be one of the most significant since Q1 2020, suggesting many projects are not proceeding as planned. Is inflation to be blamed for this, or is the permit approval process not favourable?

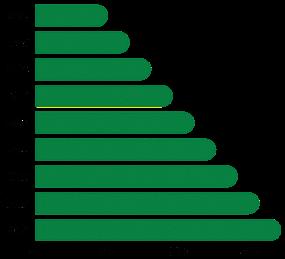

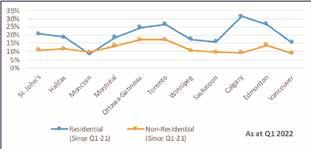

Another indicator of inflation in the industry is the observed change in the building construction price indices in metropolitan areas. The average construction price index increased by 20% and 12% for residential and non-residential projects, respectively, in the past year, suggesting double-digit inflation in the industry in just one year. Calgary, Edmonton, Toronto, Ottawa, and St John’s experienced above 20% increases in construction prices in Q1 2022 from the previous year. It is no doubt that residential projects now cost more.

Employment in the Canadian construction industry Employment in the construction industry appears to be unaffected by inflation. The unemployment rate declined from 8.1% to 6.2 %. Also, the wide gender gap in the sector remains evident, with a composition currently estimated at 87% male and 13% female, compared to the total industry composition of approximately 48% female.

*Based on available data from Statistics Canada as on May 7, 2022, as follows:

1. Growth in Construction Industry Gross Domestic Product (GDP), as of February 2022: Statistics Canada. Table 36-10-0434-01 Gross domestic product (GDP) at basic prices, by industry, monthly (x 1,000,000)

2. Composition & Changes in Investments in Construction, as of February 2022: Statistics Canada. Table 34-10-0175-01 Investment in Building Construction

3. Changes in Construction Price Index Across Metropolises, as of Q1 2022 : Statistics Canada. Table 18-10-0135-01 Building construction price indexes, by type of building

4. Housing Starts Trend - Q1 2020 to Q1 2022 (Residential Construction): Statistics Canada. Table 34-10-0135-01 Canada Mortgage and Housing Corporation, housing starts, under construction and completions, all areas, quarterly

5. Changes in Housing Starts and Housing Completions, as of Q1 2022: Statistics Canada. Table 34-10-0135-01|Canada Mortgage and Housing Corporation, housing starts, under construction and completions, all areas, quarterly

6. Composition of Employment in All Industries Vs Construction, as of April 2022: Statistics Canada. Table 14-10-0022-01 Labour force characteristics by industry, monthly, unadjusted for seasonality (x 1,000)

Recent data on the Canadian Construction Industry performance indicators say a lot about the inflation plaguing the construction industry and the global economy.

1. Growth in Construction Industry

Domestic Product

Changes in Construction Price Index

Metropolises

Housing

-

Investments

Construction

2020 to Q1 2022

Changes in Housing Starts and Housing

6. Composition of Employment in All Industries Vs Construction

About the authors

Ajibola Soboyejo, MSc, MRICS, PQS is a Senior Consultant at Altus Group. Ajibola is a professional quantity surveyor specializing in BIM estimating, cost planning, cost control, and project management. Ajibola possesses both Master’s and Bachelor’s degrees in Quantity Surveying and has worked on series of commercial real estate projects in Nigeria and Canada.

Udayan Chatterjee, B.Tech, PMP, MRICS, PMI-SP is Associate Director of Contracts and Commercial at Lakeland Consulting Inc. Udayan is a commercial and project management professional with expertise in quantum assessment, schedule forensics, contract and claims management. He holds a Bachelor’s degree in Electrical Engineering and has worked on various large-scale transportation, mining and commercial construction projects across Canada and India.

With online classes starting throughout the year, we make it simple to fit learning into your schedule. Select individual courses best suited to your interests, or register for those courses that make up a certificate or designation requirement. You can work toward a program at your own pace – you register (and pay) on a course-bycourse basis.

Discover our courses and programs in construction, estimating, quantity surveying and Ontario’s Building Code. Taught by industry professionals using the latest tools and standards, our courses provide you with the skills to succeed. Develop your knowledge with our series of Canadian Institute of Quantity Surveyors (CIQS) accredited courses. Expand your career potential by completing a program and achieving a credential from George Brown College. Learn from home with our online courses.

Programs

Building Officials Fundamentals Program

Construction Estimating Program

Construction Project Management Program

Construction Superintendent Program

Electrical Estimating Program

Mechanical Estimating Program

We also offer Canadian Construction Association (CCA) Gold Seal credit courses that you can apply towards your Gold Seal Certified (GSC) designation.

coned.georgebrown.ca/construction Register now!

The CIQS official company page on LinkedIn has over 4,100 followers and it is growing every day. The platform offers an efficient and effective channel for CIQS to promote events, share Institute and industry news, and to celebrate its members, volunteers, and partners.

For example, CIQS ran a targeted campaign during National Volunteer Week this year, with one post each day to highlight volunteers who have donated their time and expertise to various Institute projects, committees, and taskforces. The outpouring of accolades from the industry was beyond anyone’s expectations, generating over 16,000 impressions combined with an average engagement rate of 6.47%!

We appreciate everyone who is engaging with the CIQS posts through likes, comments, and shares, as well as everyone who is receiving CIQS news first by following our page. If you are not yet following the page, or not yet active on LinkedIn, below are three strong reasons to start.

According to an article on Hootsuite, “37 LinkedIn statistics you need to know in 2022,” 49 million people use LinkedIn to search and apply for jobs every single week and six people are hired from LinkedIn every minute. Employers and recruiters often search out the social media profiles of potential hires to learn more about them. Creating a strong LinkedIn profile by uploading a strong resume and highlighting awards, degrees, designations (such as your PQS or CEC), volunteer work, and accolades will help build a personal brand to make you stand out amongst the crowd.

EXPAND YOUR MIND LinkedIn allows its users to publish articles on the platform on a variety of subjects. Learn about new technologies, upcoming project launches, how to grow your net worth, the best way to grow your career network, and top ten lists for pretty much everything under the sun. Follow LinkedIn influencers, celebrities, companies and groups of interest, industry experts, and of course, the official CIQS company page, – to grow your knowledge and your connections.

With 810 million members worldwide,1 LinkedIn is a strong platform on which to showcase your knowledge and expertise by commenting on relevant articles and posts. Interacting on people’s posts gives you an opportunity to connect with people whom you may not otherwise have a chance to meet, such as the president of a company to which you are pitching a project, or the journalist you have tried to contact for a story idea, or the recruiter who specializes in your field to discuss a job that interests you.

Following company pages is an easy way to learn about a company and its movers and shakers. Be first in the know of upcoming CIQS events, advocacy news, marketing campaigns and events, while connecting with fellow industry professionals from across the globe. Scan the QR code to follow the CIQS company LinkedIn page today.

Alexandra Parliament is the Director, Marketing & Communications at CIQS. She has over 25 years of experience in her field and owned a boutique marketing agency for over 15 years. She has a formal education in print journalism and has worked in the marketing and communications departments of a PR Agency, a major Marketing Agency, a national magazine, an annual three-day festival, provincial and national non-profit organizations and one of the largest loyalty programs in Canada. She has been published in a variety of magazines and online real estate, construction, and business publications.

On March 24, 2022, Vernon Ian Banks of Bedford, NS passed away following a battle with cancer at the Halifax Infirmary at the age of 73.

Vernon (Vern) was born on April 12, 1948, in Chester, England, UK to parents Ian Dowie Banks and Irene Banks (Hirst), (pre-deceased). As part of a British military family, Vern spent some of his earliest childhood years living overseas, along with his older sister, Suzanne Kirkpatrick (nee Banks, predeceased), while their father was deployed to India, before moving back to England where he completed his primary and secondary schooling. Vern obtained a Bachelor of Arts (Hons) degree from the University of East Anglia followed by a diploma from the Polytechnic of Central London. Vern began his career in construction estimation in London, UK and eventually moved briefly to Trinidad and Tobago, where he met and eventually married his loving wife Wendy (née Morreau) of Ottawa, ON, Canada. Vern and Wendy finally settled in Bedford, NS, Canada where

granddaughter Clara.

Vern worked for 35 years as an accomplished PQS member of the CIQS. Vern adored the sport of Alpine Skiing, kindled during his early ages skiing in the European Alps, and he served for many years on the volunteer boards of the Martock Ski Race Club and Alpine Ski Nova Scotia. Vern also loved golf, was a keen participant in local and national politics, and held great interest in computers, gardening, international cuisine, and world music. His wit and keen sense of humour will be dearly missed by all those who knew and loved him.

In keeping with Vern’s wishes, cremation will take place and there will be no visitation or memorial service. In lieu of flowers, donations in Vern’s memory can be made to the Canadian Cancer Society by visiting www.cancer.ca/en/waysto-give/personal-donation.

Construction Economist is made possible by the companies below who convey their important messages on our pages. We thank them for their support of the Canadian Institute of Quantity Surveyors and its publication and encourage you to contact them when making your purchasing decisions. To make it easier to contact these companies, we have included the page number of their advertisement, their phone number, and, where applicable, their website.

Company Page Phone # Website

A. W. Hooker Associates Ltd. 14 905-823-8111 www.awhooker.com

Altus Group 32 416-641-9703 www.altusgroup.com

Arbitech Inc. 29 800-838-8183 www.arbitech.ca