MEMO

Date: November 2021

To: Audit Finance Committee

From: Finance

OCTOBER CITY‐WIDE TAX REVENUE

Real Estate Tax

The city collects property tax in the General Fund and the Health, Parks and Recreation Funds. The city receives property taxes in November and therefore the City has no property tax in October.

Sales Tax

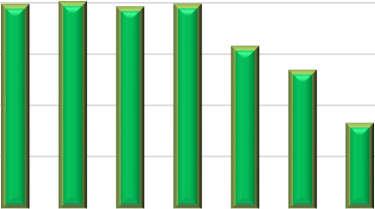

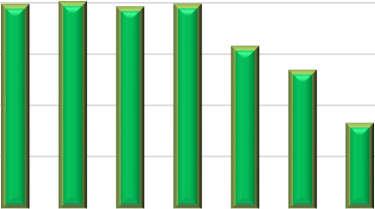

As shown with the red dot on the Sales Tax revenue graph below, October sales tax collections are in line with last year’ collections.

‐ GENERAL FUND 002

002 October 31, 2021

500,000.00 1,000,000.00 1,500,000.00 2,000,000.00 2,500,000.00

2019-20 2020-21 2021-22 15,000,000 16,000,000 17,533,711 17,745,438 18,295,167 6,499,957 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 16,000,000 18,000,000 20,000,000 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22

General Fund

SALES TAX REVENUE

Annual Sales Tax Revenue

Use Tax

The cap for Animal Shelter (Fund 010) is $762,750.

The cap for Police Use Tax (Fund 018) is $3,032,000.

The funds received after the caps have been met are then prorated based on the sales tax rate for each of the funds receiving sales tax. Distribution for the amount is as follows:

Use Tax Monthly for 2021‐2022

Use Tax Annual Comprison For Years Ending 2020-2022

Fund Oct 21 Collections Year to Date Collections Animal Services Use $ 24,008 $ 762,750 Police Use $ 398,995 $ 1,137,738 General $ - $Street Sales $ - $Parks Sales $ - $Stormwater Sales $ - $Police Sales $ - $Fire Sales $ - $$ 423,003 $ 1,900,488 217,198 258,488 263,056 24,008 - - - - - -217,198 258,488 263,056 398,995100,000 200,000 300,000 400,000 500,000 600,000

010 Animal 018 Police 0 100000 200000 300000 400000 500000 600000

2020 2021 2022

TRANSIENT GUEST TAX

The City receives taxes from the gross daily rent due from or paid by transient guests of all hotels and motels, bed and breakfast inns and campgrounds. Each operator will, on or before the twentieth day of the month following the close of each month, make a return of taxes collected for transient occupancy.

Use of funds are used for Historic site maintenance and Tourism sales and services.

The October collections are trending higher than collections for October in 2019 and 2020.

Guest Tax By Month

Fiscal Years 2019, 2020 & YTD 2021

Guest Tax Annual Receipts

Fiscal Years 2016 - YTD 2022

FUND BALANCE

The City’s policy for minimum fund balances are:

o General Fund – 16% of annual operating revenues.

o Special Revenue Funds designated for capital purposes – 5% of annual operating revenues.

o Special Revenue Funds supporting personnel and ongoing operations – 16% of annual operating revenues.

The following page show the fund balance calculation for October 31, 2021

o The General Fund, Street Sales Tax, Parks and Rec Property Tax and Power and Light fund are below their targets.

o City Policy is that a plan needs to be developed to replenish the fund balance to target within five-years.

Some funds show surplus over the target. These surpluses need to be balanced with capital spending plans showing the use of those surpluses.

The page after includes the adopted six-year CIP showing capital expenditures for each fund.

$0 $50,000 $100,000 $150,000 $200,000 $250,000

2019-2020 2020-2021 2021-2022 1,963,550 1,991,864 1,938,962 1,967,003 1,554,582 1,321,757 800,659 $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 2016 2017 2018 2019 2020 2021 2022

Fund October 31, Balance Policy Basis of Calculation Actual % 5% Policy 16% Policy Over (Under) General 3,943,901 16% of operating expenditures 78,017,743 5% - 12,482,839 (8,538,938) $ Street Sales Tax 465,851 Between 5% and 16% of Revenues 9,035,391 5% - 1,445,663 (979,812) Park Improvement 2,609,740 Between 5% and 16% of Revenues 5,037,657 52% - 806,025 1,803,715 Storm Water 8,690,894 Between 5% and 16% of Revenues 4,637,032 187% - 741,925 7,948,969 Police Public Safety Sales 1,460,797 5% of Annual Revenues 2,459,201 59% 122,960 - 1,337,837 Fire Protection Sales Tax 1,027,884 Between 5% and 16% of Revenues 2,271,486 45% - 363,438 664,446 Animal Shelter Use 702,627 Between 5% and 16% of Revenues 762,750 92% - 122,040 580,587 Police Use 4,298,487 Between 5% and 16% of Revenues 3,039,000 141% - 486,240.00 3,812,247 Health Property Tax (129,077) Between 5% and 16% of Revenues 1,386,432 -9% - 221,829.12 (350,906) Parks and Rec Property Tax (131,693) Between 5% and 16% of Revenues 2,146,831 -6% - 343,493 (475,186) Tourism 1,013,369 Between 5% and 16% of Revenues 1,683,926 60% - 269,428.16 743,941 Power and Light 54,386,861 Risk Based Calculation 67,000,000 - - - (12,613,139) Water 43,940,016 Risk Based Calculation 15,300,000 0% - - 28,640,016 Water Pollution Control 30,207,251 Risk Based Calculation 16,550,000 - - - 13,657,251

OF

Reserve Balance per Policy For the period ended October 31, 2021

CITY

INDEPENDENCE, MISSOURI

Capital Improvement Program 2022‐2027

Total 6‐year Fund 2022 2023 2024 2025 2026 2027 CIP General - - - - - -Street Sales 6,499,336 6,473,836 6,415,899 6,176,579 6,395,871 7,250,256 39,211,777 Park Improvement - - - - - -Storm Water 1,772,500 2,822,500 2,892,500 1,720,000 1,780,000 1,760,000 12,747,500 Police Public Safety Sales 2,573,508 1,834,663 1,898,917 550,000 - - 6,857,088 Fire Protection Sales Tax - - - - - -Animal Shelter Use - - - - - -Police Use Health Property Tax------Parks and Rec Property Tax - - - - - -Tourism 275,000 75,000 75,000 75,000 75,000 75,000 650,000 Power and Light 6,003,956 4,560,000 3,540,000 2,000,000 950,000 960,000 18,013,956 Water 6,420,000 7,200,000 3,025,000 9,600,000 9,325,000 1,275,000 36,845,000 Water Pollution Control 3,937,500 3,878,900 3,978,750 4,008,000 3,977,000 4,000,000 23,780,150 27,483,822 26,846,922 21,828,090 24,131,604 22,504,897 15,322,283 138,105,471

ITEMS OF NOTE for OCTOBER 2021

GENERAL FUND NOTES

The actual year-to-date General Fund revenues and other financing sources, through October 31st, compared to the amended budget are 34.32%, and actual expenditures and other financing uses are 35.08%. These percentages are in line with the cumulative total trend of 33.33% (October is month 4 and divided by 12 = 33.33%). The attached summary reports reflect the October year-to-date actual revenues and expenditures compared to total budget.

There are a couple of revenue streams that are trending significantly below the 33.33%.

Franchise Taxes are at 24.54%.

Fines and Forfeitures are at 17.03%.

The American Rescue Plan (ARP) funds of $3,122,000 have been transferred to the General Fund for loss of revenue. Without the ARP funds the revenues and other financing sources would be at 30.14%.

There are a couple of departments where expenditures are trending slightly above the 33.33%.

City Clerk is at 59.37% - this is due to a payment for election costs in October that utilized 100% of the budget for this line item.

Municipal Court is at 35.34% - this is due to encumbrances being entered at the start of the year that cover the entire fiscal year.

Fire is at 38.10% - this is mainly due to over-time and minimum staffing and encumbrances being entered at the start of the year that cover the entire fiscal year or multiple future months.

Law is at 39.03% - this is due to a purchase being made in October that utilized 100% of the budget for this line item (land purchase).

UTILITY FUND NOTES

Power and Light

The actual year-to-date Power and Light operating revenues, through October 31, 2021, compared to the amended budget are 40.29%. Operating expenditures are 32.88%. This percentage is compared to the cumulative total trend of 33.33% (October is month 4 and 4 divided by 12 = 33.33%). Total Transfers and Special Items are at 41.32% which includes Payments in Lieu of taxes for the month of October. The attached summary reports reflect the October 2021 year-to-date actual revenues and expenditures compared to total budget.

Water

The actual year-to-date Water operating revenues, through October 31, 2021, compared to the amended budget are 38.77%. Operating expenditures are 22.11%. This percentage is compared to the cumulative total trend of 33.33% (October is month 4 and 4 divided by 12 = 33.33%). Total Transfers are at 36.73% which includes Payments in Lieu of taxes for the month of October. The attached summary reports reflect the October 2021 year-to-date actual revenues and expenditures compared to total budget.

Sanitary Sewer

The actual year-to-date Sanitary Sewer operating revenues, through October 31, 2021, compared to the amended budget are 35.63%. Operating expenditures are 17.35%. This percentage is compared to the cumulative total trend of 33.33% (October is month 4 and 4 divided by 12 = 33.33%). Total Transfers are at 24.08% which includes Payments in Lieu of taxes for the month of October The attached summary reports reflect the October 2021 year-to-date actual revenues and expenditures compared to total budget.

Monthly Financial and Operating Report October 2021

Table of Contents General Fund 1 Sales Tax Funds Street Improvements Sales Tax Fund 2 Park Improvements Sales Tax Fund 3 Storm Water Sales Tax Fund 4 Police Public Safety Sales Tax Fund 5 Fire Protection Sales Tax Fund 6 Use Tax Funds Animal Shelter 7 Police 8 Property Tax Levy Funds Health Property Tax Levy 9 Parks and Recreation Property Tax Levy 10 Special Revenue Funds Tourism Fund 11 Independence Square Benefit District 12 Community Development Block Grant Fund 13 Rental Rehabilitation 14 License Surcharge 15 Grants 16 American Rescue Plan (ARP) 17 Enterprise Funds Power and Light 18 - 19 Water 20 - 21 Water Pollution Control 22 - 23 Events Center Debt Service 24 Internal Service Funds Central Garage 25 Staywell Health Care 26 Worker's Compensation 27 Risk Management 28 Enterprise Resource Planning 29 Debt Service Fund Debt Service - Neighborhood Improvement Districts 30 Capital Improvement Funds Street Improvements Capital Project Fund 31 Revolving Public Improvements Capital Project Fund 32 Building and Other Improvements Capital Project Fund 33 Storm Drainage Capital Project Fund 34 Park Improvements Capital Project Fund 35 Private Purpose Expendable Trust Fund - Vaile Mansion 36 Independence Events Center CID 37 Crackerneck Creek TDD 38 Tax Increment Financing Summary 39 Mid-Town Truman Rd TIF 40 Santa Fe TIF 41 Hartman Heritage TIF 42 Drumm Farm TIF 43 Eastland TIF 44 North Independence TIF 45 Mt Washington TIF 46 Crackerneck Creek TIF 47 Old Landfill TIF 48 Trinity TIF 49 HCA TIF 50 Cinema East TIF 51 23rd & Noland Project 1 TIF 52 23rd & Noland Project 2 TIF 53 23rd & Noland Project 3 TIF 54 23th & Noland Project 4 TIF 55 Independence Square TIF 56 I-70 & Little Blue Parkway Project 1 TIF 57 I-70 & Little Blue Parkway Project 3 TIF 58 Marketplace Project 1 TIF 59 Marketplace Project 2 TIF 60 TIF Application Fees 61 TIF Economic Development Sinking Fund 62

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule General Fund

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Real Estate Tax $ 5,732,000 5,732,000 (7,203) (5,739,203) -0.13% -33.46% Sales Tax 18,617,431 18,617,431 6,499,957 (12,117,474) 34.91% 1.58% Use Tax 448,000 448,000 (448,000) 0.00% -33.33% Cigarette Tax 420,000 420,000 134,664 (285,336) 32.06% -1.27% Franchise Tax 8,171,990 8,171,990 2,005,365 (6,166,625) 24.54% -8.79% Licenses and Permits 4,043,350 3,991,500 1,354,894 (2,636,606) 33.94% 0.61% Intergovernmental 5,330,000 5,330,000 1,715,499 (3,614,501) 32.19% -1.14% Charges for Current Services 1,915,000 1,908,000 612,367 (1,295,633) 32.09% -1.24% Interfund Charges for Support Services 5,035,500 5,035,500 1,678,500 (3,357,000) 33.33% 0.00% Fines and Forfeitures 3,710,000 3,710,000 631,981 (3,078,019) 17.03% -16.30% Investment Income (Loss) 194,000 194,000 53,290 (140,710) 27.47% -5.86% Other Revenue 541,894 541,894 140,210 (401,684) 25.87% -7.46% Total Revenues 54,159,165 54,100,315 14,819,524 (39,280,791) 27.39% -5.94% Other Financing Sources: Payments In Lieu of Taxes 20,696,578 20,696,578 7,727,779 (12,968,799) 37.34% 4.01% Operating Transfers In - American Rescue Plan 3,122,000 3,122,000 0.00% -33.33% Total Other Financing Sources 20,696,578 20,696,578 10,849,779 (9,846,799) 52.42% 19.09% Total Revenues and Other Financing Sources 74,855,743 74,796,893 25,669,303 (49,127,590) 34.32% 0.99% Expenditures: City Council 711,350 711,350 224,492 486,858 31.56% -1.77% City Clerk 325,744 376,244 223,364 152,880 59.37% 26.04% City Manager 1,185,232 1,185,232 370,616 814,616 31.27% -2.06% Municipal Court 1,264,139 1,225,139 432,911 792,228 35.34% 2.01% Law 611,371 771,371 301,063 470,308 39.03% 5.70% Finance 6,264,935 6,303,935 2,129,270 4,174,665 33.78% 0.45% Community Development 4,576,184 4,576,184 1,555,163 3,021,021 33.98% 0.65% Police 33,155,226 33,155,226 11,206,334 21,948,892 33.80% 0.47% Fire 23,852,022 23,852,022 9,087,134 14,764,888 38.10% 4.77% Health 2,941 (2,941) 0.00% -33.33% Municipal Services (Public Works) 5,995,281 5,828,028 1,867,088 3,960,940 32.04% -1.29% Parks and Recreation 165,363 32,675 132,688 19.76% -13.57% Contingencies 17,028 17,028 17,028 0.00% -33.33% Debt service 59,231 59,231 59,231 0.00% -33.33% Total Expenditures 78,017,743 78,226,353 27,433,051 50,793,302 35.07% 1.74% Other Financing Uses: Transfers Out 10,000 10,000 10,000 100.00% 66.67% Total Expenditures and Other Financing Uses 78,027,743 78,236,353 27,443,051 50,793,302 35.08% 1.75% Excess of Revenue and Other Financing Sources Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (3,172,000) (3,439,460) (1,773,748) 1,665,712 Unassigned Fund Balance at Beginning of Year 5,708,549 Cancellation of prior year encumbrances 11,206 Change in other fund balance components during the year (2,106) Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 3,943,901 Restricted 118,750 Committed 18,479 Assigned 1,836,254 Total Fund Balance $ 5,917,384

1

CITY OF INDEPENDENCE, MISSOURI Budgetary

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Sales Taxes $ 8,770,391 8,770,391 3,071,883 (5,698,508) 35.03% 1.70% Use Tax 224,000 224,000 (224,000) 0.00% -33.33% Charges for Services 0.00% -33.33% Intergovernmental Revenue 0.00% -33.33% Investment Income (Loss) 41,000 41,000 30,905 (10,095) 75.38% 42.05% Other Revenue 0.00% -33.33% Total Revenues 9,035,391 9,035,391 3,102,788 (5,932,603) 34.34% 1.01% Other Financing Sources: Transfers in 0.00% -33.33% Total other financing sources 0.00% -33.33% Total revenues and other financing sources 9,035,391 9,035,391 3,102,788 (5,932,603) 34.34% 1.01% Expenditures: General Government 0.00% -33.33% Street Maintenance 1,166,177 1,166,177 646,384 519,793 55.43% 22.10% Capital Outlay 6,486,836 22,952,225 4,067,092 18,885,133 17.72% -15.61% Debt Service 474,576 474,576 217,074 257,502 45.74% 12.41% Total Expenditures 8,127,589 24,592,978 4,930,550 19,662,428 20.05% -13.28% Other Financing Uses: Transfers Out 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 8,127,589 24,592,978 4,930,550 19,662,428 20.05% -13.28% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 907,802 (15,557,587) (1,827,762) 13,729,825 Unassigned Fund Balance at Beginning of Year 1,885,478 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year 408,135 Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 465,851 Fund Balance Components: Restricted - Current Year Encumbrances 4,470,040 Restricted - Prior Year Encumbrances 2,715,336 Restricted - Debt Reserve Project Accounts - Capital Projects 13,431,457 Total Fund Balance $ 21,082,684

Comparison

Improvements Sales Tax Fund For the period ended October 31, 2021 2

Schedule Street

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Park Improvements Sales Tax Fund For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Sales Taxes $ 4,385,212 4,385,212 1,535,943 (2,849,269) 35.03% 1.70% Use Tax 112,000 112,000 (112,000) 0.00% -33.33% Charges for services 519,752 519,752 165,871 (353,881) 31.91% -1.42% Intergovernmental 0.00% -33.33% Investment Income (Loss) 18,180 18,180 15,867 (2,313) 87.28% 53.95% Other Revenue 2,513 2,513 6,107 3,594 243.02% 209.69% Total Revenues 5,037,657 5,037,657 1,723,788 (3,313,869) 34.22% 0.89% Other Financing Sources: Transfers In 240,092 240,092 (240,092) 0.00% -33.33% Transfers In - American Rescue Plan 2,134,500 2,134,500 0.00% -33.33% Proceeds from Bond Issuance/Capital Lease 0.00% -33.33% Total Other Financing Sources 240,092 240,092 2,134,500 1,894,408 889.03% 855.70% Total Revenues and Other Financing Sources 5,277,749 5,277,749 3,858,288 (1,419,461) 73.10% 39.77% Expenditures: Culture and Recreation 4,373,935 4,373,935 1,780,709 2,593,226 40.71% 7.38% Capital Outlay 506,000 1,394,608 67,086 1,327,522 4.81% -28.52% Debt Service 207,215 207,215 207,215 0.00% -33.33% Total Expenditures 5,087,150 5,975,758 1,847,795 4,127,963 30.92% -2.41% Other Financing Uses: Transfers Out 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 5,087,150 5,975,758 1,847,795 4,127,963 30.92% -2.41% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 190,599 (698,009) 2,010,493 2,708,502 Unassigned Fund Balance at Beginning of Year 599,247 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 2,609,740 Other Fund Balance Components: Restricted - Current Year Encumbrances 458,431 Restricted - Prior Year Encumbrances 75,344 Total Fund Balance $ 3,143,515

3

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison

For

Storm

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Sales Taxes $ 4,385,212 4,385,212 1,535,943 (2,849,269) 35.03% 1.70% Use Tax 112,000 112,000 (112,000) -33.33% Investment Income (loss) 132,000 132,000 66,543 (65,457) 50.41% 17.08% Other Revenue 7,820 7,820 7,876 56 100.72% 67.39% Total revenues 4,637,032 4,637,032 1,610,362 (3,026,670) 34.73% 1.40% Expenditures: Storm water Administration 272,856 272,856 117,077 155,779 42.91% 9.58% Maintenance 2,381,657 2,381,657 1,242,056 1,139,601 52.15% 18.82% Permit completion 318,000 318,000 318,000 0.00% -33.33% Capital outlay 1,760,000 4,999,175 1,036,842 3,962,333 20.74% -12.59% Total Expenditures 4,732,513 7,971,688 2,395,975 5,575,713 30.06% -3.27% Total Ependitures and Other Financing Uses 4,732,513 7,971,688 2,395,975 5,575,713 Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (95,481) (3,334,656) (785,613) 2,549,043 Unassigned Fund Balance at Beginning of Year 9,476,507 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 8,690,894 Other Fund Balance Components: Restricted - Current Year Encumbrances 1,216,627 Restricted - Prior Year Encumbrances 453,932 Restricted - Regional Detention Construction 18,759 Restricted - Regional Detention Maintenance 40,311 Restricted - Emergency Response Relief 500,000 Total Fund Balance $ 10,920,523

Schedule

Water Sales Tax Fund

the period

October

4

ended

31, 2021

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Police Public Safety Sales Tax Fund

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Sales Taxes $ 2,358,694 2,358,694 819,267 (1,539,427) 34.73% 1.40% Use Tax 56,000 56,000 (56,000) 0.00% -33.33% Investment Income (Loss) 37,000 37,000 14,217 (22,783) 38.42% 5.09% Other Revenue 7,507 7,507 10,729 3,222 142.92% 109.59% Total Revenues 2,459,201 2,459,201 844,213 (1,614,988) 34.33% 1.00% Expenditures: Public Safety Communications 675,922 675,922 453,977 221,945 67.16% 33.83% Facilities 104,500 104,500 51,911 52,589 49.68% 16.35% Equipment 1,924,697 1,924,697 1,155,001 769,696 60.01% 26.68% Debt Service 0.00% -33.33% Total Expenditures 2,705,119 2,705,119 1,660,889 1,044,230 61.40% 28.07% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 2,705,119 2,705,119 1,660,889 1,044,230 61.40% 28.07% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (245,918) (245,918) (816,676) (570,758) Unassigned Fund Balance at Beginning of Year 2,277,473 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 1,460,797 Other Fund Balance Components: Restricted - Current Year Encumbrances 943,110 Restricted - Prior Year Encumbrances 75,192 Total Fund Balance $ 2,479,099

5

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Fire Protection Sales Tax Fund For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Sales Taxes $ 2,192,486 2,192,486 767,973 (1,424,513) 35.03% 1.70% Use Tax 56,000 56,000 (56,000) 0.00% -33.33% Investment Income (Loss) 17,000 17,000 11,506 (5,494) 67.68% 34.35% Other Revenue 6,000 6,000 (6,000) 0.00% -33.33% Total Revenues 2,271,486 2,271,486 779,479 (1,492,007) 34.32% 0.99% Expenditures: Public Safety 2,763,693 2,763,693 432,793 2,330,900 15.66% -17.67% Debt Service 73,236 73,236 73,236 0.00% -33.33% Total Expenditures 2,836,929 2,836,929 432,793 2,404,136 15.26% -18.07% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 2,836,929 2,836,929 432,793 2,404,136 15.26% -18.07% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (565,443) (565,443) 346,686 912,129 Unassigned Fund Balance at Beginning of Year 678,965 Cancellation of Prior Year Encumbrances 2,233 Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 1,027,884 Other Fund Balance Components: Restricted - Current Year Encumbrances 154,264 Restricted - Prior Year Encumbrances 1,416,626 Total Fund Balance $ 2,598,774

6

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

Animal Shelter Use Tax

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Use Tax $ 762,750 762,750 762,750 100.00% 66.67% Intergovernmental Revenue 0.00% -33.33% Investment Income (Loss) 1,117 1,117 0.00% -33.33% Other Revenue 0.00% -33.33% Total Revenues 762,750 762,750 763,867 1,117 100.15% 66.82% Expenditures: General Government -33.33% Animal Services 728,545 728,545 214,363 514,182 29.42% -3.91% Capital Outlay 0.00% -33.33% Debt Service 0.00% -33.33% Total Expenditures 728,545 728,545 214,363 514,182 29.42% -3.91% Other Financing Uses: Transfers In 0.00% -33.33% Transfers Out 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 728,545 728,545 214,363 514,182 29.42% -3.91% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 34,205 34,205 549,504 515,299 Unassigned Fund Balance at Beginning of Year 153,123 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 702,627 Fund Balance Components: Restricted - Current Year Encumbrances Restricted - Prior Year Encumbrances 1,437 Total Fund Balance $ 704,064

7

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

Police Use Tax

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Use Tax $ 3,032,000 3,032,000 1,137,737 (1,894,263) 37.52% 4.19% Investment Income (Loss) 7,000 7,000 23,859 16,859 340.84% 307.51% Other Revenue 0.00% -33.33% Total Revenues 3,039,000 3,039,000 1,161,596 (1,877,404) 38.22% 4.89% Expenditures: Public Safety 2,258,155 2,258,155 409,601 1,848,554 18.14% -15.19% Debt Service 0.00% -33.33% Total Expenditures 2,258,155 2,258,155 409,601 1,848,554 18.14% -15.19% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 2,258,155 2,258,155 409,601 1,848,554 18.14% -15.19% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 780,845 780,845 751,995 (28,850) Unassigned Fund Balance at Beginning of Year 3,546,492 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 4,298,487 Other Fund Balance Components: Restricted - Current Year Encumbrances Restricted - Prior Year Encumbrances Total Fund Balance $ 4,298,487

8

CITY OF INDEPENDENCE, MISSOURI

Budgetary Comparison Schedule Health Property Tax Levy For the period ended October 31, 2021 Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Taxes $ 870,000 870,000 (673) (870,673) -0.08% -33.41% Charges for Services 150,000 157,000 36,779 (120,221) 23.43% -9.90% Licenses & Permits 366,432 418,282 39,728 (378,554) 9.50% -23.83% Investment Income (Loss) 1,257 1,257 0.00% -33.33% Other Revenue 2,115 2,115 0.00% -33.33% Total Revenues 1,386,432 1,445,282 79,206 (1,366,076) 5.48% -27.85% Other Financing Sources: Transfers In - American Rescue Plan 300,000 300,000 0.00% -33.33% Total Other Financing Uses 300,000 300,000 0.00% -33.33% Total Revenues and Other Sources 1,386,432 1,445,282 379,206 (1,066,076) 26.24% -7.09% Expenditures: Animal Services 884,518 884,518 322,966 561,552 36.51% 3.18% Health Services 778,674 778,674 238,158 540,516 30.59% -2.74% Total Expenditures 1,663,192 1,663,192 561,124 1,102,068 33.74% 0.41% Other Financing Uses: Transfers Out 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Uses 1,663,192 1,663,192 561,124 1,102,068 33.74% 0.41% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (276,760) (217,910) (181,918) 35,992 Unassigned Fund Balance at Beginning of Year 52,841 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 (129,077) Other Fund Balance Components: Restricted - Current Year Encumbrances 27,826 Restricted - Prior Year Encumbrances 2,947 Total Fund Balance $ (98,304)

9

CITY OF INDEPENDENCE, MISSOURI

Budgetary Comparison Schedule Parks and Recreation Property Tax Levy For the period ended October 31, 2021 Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Taxes $ 1,850,000 1,850,000 (1,431) (1,851,431) -0.08% -33.41% Intergovernmental 65,985 65,985 16,390 (49,595) 24.84% -8.49% Charges for Services 230,746 230,746 64,871 (165,875) 28.11% -5.22% Investment Income (Loss) 100 100 4,857 4,757 4857.00% 4823.67% Other Revenue 4,080 4,080 0.00% -33.33% Total Revenues 2,146,831 2,146,831 88,767 (2,058,064) 4.13% -29.20% Expenditures: Parks and Recreation 2,099,104 2,099,104 631,048 1,468,056 30.06% -3.27% Total Expenditures 2,099,104 2,099,104 631,048 1,468,056 30.06% -3.27% Other Financing Uses – Transfers Out 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Uses 2,099,104 2,099,104 631,048 1,468,056 30.06% -3.27% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 47,727 47,727 (542,281) (590,008) Unassigned Fund Balance at Beginning of Year 410,588 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 (131,693) Other Fund Balance Components: Restricted - Current Year Encumbrances 20,427 Restricted - Prior Year Encumbrances 6,156 Total Fund Balance $ (105,110) 10

CITY OF INDEPENDENCE, MISSOURI

Budgetary Comparison Schedule Tourism Fund For the period ended October 31, 2021 Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Transient Guest Taxes $ 1,652,283 1,652,283 800,659 (851,624) 48.46% 15.13% Charges for Services 30,000 4,039 (25,961) 13.46% -19.87% Investment Income (Loss) 26,593 26,593 8,654 (17,939) 32.54% -0.79% Other Revenue 5,050 5,050 2,635 (2,415) 52.18% 18.85% Total Revenues 1,683,926 1,713,926 815,987 (897,939) 47.61% 14.28% Other Financing Sources: Transfers In - American Resuce Plan 150,000 150,000 0.00% -33.33% Total Other Financing Uses 150,000 150,000 0.00% -33.33% Total Revenues and Other Sources 1,683,926 1,713,926 965,987 (747,939) 56.36% 23.03% Expenditures: Tourism 2,550,789 2,617,529 816,217 1,801,312 31.18% -2.15% Total Expenditures 2,550,789 2,617,529 816,217 1,801,312 31.18% -2.15% Other Financing Uses – Transfers Out 240,092 240,092 240,092 0.00% -33.33% Total Other Financing Uses 240,092 240,092 240,092 0.00% -33.33% Total Expenditures and Other Uses 2,790,881 2,857,621 816,217 2,041,404 28.56% -4.77% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (1,106,955) (1,143,695) 149,770 1,293,465 Unassigned Fund Balance at Beginning of Year 863,599 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 1,013,369 Other Fund Balance Components: Restricted - Current Year Encumbrances 375,851 Restricted - Prior Year Encumbrances 35,258 Restricted - Operating Reserve 376,368 Total Fund Balance $ 1,800,846

11

Independence Square Benefit District For the period ended October 31, 2021 Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Taxes $ 0.00% -33.33% Investment Income (Loss) 23 23 0.00% -33.33% Other Revenue 0.00% -33.33% Total Revenues 23 23 0.00% -33.33% Expenditures: Capital Outlay 0.00% -33.33% Total Expenditures 0.00% -33.33% Other Financing Uses – Transfers Out 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Uses 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 23 23 Unassigned Fund Balance at Beginning of Year 7,663 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 7,686 Other Fund Balance Components: Restricted - Current Year Encumbrances Restricted - Prior Year Encumbrances Total Fund Balance $ 7,686 12

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

INDEPENDENCE, MISSOURI

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Federal Grant - CDBG $ 1,605,692 1,605,692 340,129 (1,265,563) 21.18% -12.15% Other Revenue -33.33% Total Revenues 1,605,692 1,605,692 340,129 (1,265,563) 21.18% -12.15% Expenditures: CDBG Administration 166,173 166,173 58,781 107,392 35.37% 2.04% CDBG Expenditures 1,455,527 1,455,527 791,407 664,120 54.37% 21.04% Total Expenditures 1,621,700 1,621,700 850,188 771,512 52.43% 19.10% Other Financing Uses: Transfers Out 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Uses 1,621,700 1,621,700 850,188 771,512 52.43% 19.10% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (16,008) (16,008) (510,059) (494,051) Unassigned Fund Balance at Beginning of Year (96,680) Cancellation of Prior Year Encumbrances 28,467 Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 (578,272) Other Fund Balance Components: Restricted - Current Year Encumbrances 529,536 Restricted - Prior Year Encumbrances 48,023 Total Fund Balance $ (713)

Schedule Community Development Block Grant Fund For the period ended October 31, 2021 13

CITY OF

Budgetary Comparison

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Rental Rehabilitation For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: HOME Program Grant $ 482,477 482,477 76,293 (406,184) 15.81% -17.52% Total Revenues 482,477 482,477 76,293 (406,184) 15.81% -17.52% Expenditures: HOME Administration 63,607 63,607 24,089 39,518 37.87% 4.54% Multi Family Housing 359,759 359,759 359,759 0.00% -33.33% Community Housing Development 102,788 102,788 102,788 0.00% -33.33% Total Expenditures 526,154 526,154 24,089 502,065 4.58% -28.75% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (43,677) (43,677) 52,204 95,881 Unassigned Fund Balance at Beginning of Year (401,485) Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 (349,281) Other Fund Balance Components: Restricted - Current Year Encumbrances Restricted - Prior Year Encumbrances 349,287 Total Fund Balance $ 6

14

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

License Surcharge For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Licenses and Permits $ (3,218) (3,218) 0.00% -33.33% Investment Income (Loss) 17,000 17,000 8,212 (8,788) 48.31% 14.98% Other Revenue 0.00% -33.33% Total Revenues 17,000 17,000 4,994 (12,006) 29.38% -3.95% Expenditures: General Government 0.00% -33.33% Total expenditures 0.00% -33.33% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 17,000 17,000 4,994 (12,006) Unassigned Fund Balance at Beginning of Year 1,251,500 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance, 10/31/21 1,256,494 Other Fund Balance Components: Restricted - Current Year Encumbrances Restricted - Prior Year Encumbrances Total Fund Balance $ 1,256,494

15

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Grants

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Intergovernmental $ 1,343,409 3,824,593 366,081 (3,458,512) 9.57% -23.76% Charges for Services 105,103 105,103 66,183 (38,920) 62.97% 29.64% Other Revenue 63,885 102 (63,783) 0.16% -33.17% Total Revenues 1,448,512 3,993,581 432,366 (3,561,215) 10.83% -22.50% Other financing sources: Transfers In 0.00% -33.33% Total other financing sources 0.00% -33.33% Total revenues and other financing sources 1,448,512 3,993,581 432,366 (3,561,215) 10.83% -22.50% Expenditures: Public Safety 422,758 1,535,760 613,689 922,071 39.96% 6.63% General Government 138,063 247,282 8,934 238,348 3.61% -29.72% Culture and Recreation 18,750 24,450 (5,700) 130.40% 97.07% Community Development 500,000 1,356,103 2,299,103 (943,000) 169.54% 136.21% Animal Services 7,256 7,256 0.00% -33.33% Health Services 375,721 619,786 96,754 523,032 15.61% -17.72% Total Expenditures 1,436,542 3,784,937 3,042,930 742,007 80.40% 47.07% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 1,436,542 3,784,937 3,042,930 742,007 80.40% 47.07% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ 11,970 208,644 (2,610,564) (2,819,208) Unassigned Fund Balance at Beginning of Year (338,049) Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 (2,948,613) Other Fund Balance Components: Restricted - Current Year Encumbrances 2,111,719 Restricted - Prior Year Encumbrances 269,507 Total Fund Balance $ (567,387)

16

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule American

For

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Intergovernmental $ 9,595,332 9,595,332 0.00% -33.33% Charges for Services 0.00% -33.33% Other Revenue 0.00% -33.33% Total Revenues 9,595,332 9,595,332 0.00% -33.33% Other financing sources: Transfers in 0.00% -33.33% Total other financing sources 0.00% -33.33% Total revenues and other financing sources 9,595,332 9,595,332 0.00% -33.33% Expenditures: CARES Act 1,654,297 (1,654,297) 0.00% -33.33% Total Expenditures 1,654,297 (1,654,297) 0.00% -33.33% Other Financing Uses: Transfers Out - American Rescue Plan 8,056,500 (8,056,500) 0.00% -33.33% Total Other Financing Uses 8,056,500 (8,056,500) 0.00% -33.33% Total Expenditures and Other Financing Uses 9,710,797 (9,710,797) 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses $ (115,465) (115,465) Unassigned Fund Balance at Beginning of Year Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 (115,465) Other Fund Balance Components: Restricted - Current Year Encumbrances 115,465 Restricted - Prior Year Encumbrances Total Fund Balance $

Rescue Plan (ARP)

the period ended October 31, 2021 17

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

Power and Light

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating Revenues: Charges for Services $ 130,609,070 130,609,070 5,130,226 (125,478,844) 3.93% -29.40% Penalties 1,106,786 1,106,786 500,145 (606,641) 45.19% 11.86% Connection Charges 280,151 280,151 48,010,800 47,730,649 17137.47% 17104.14% Miscellaneous 18,293 18,293 0.00% -33.33% Temporary Service 1,300 1,300 0.00% -33.33% Rental Income 340,239 340,239 13,662 (326,577) 4.02% -29.31% Transmission Wheeling 5,000,000 5,000,000 1,663,457 (3,336,543) 33.27% -0.06% Total Operating Revenues 137,336,246 137,336,246 55,337,883 (81,998,363) 40.29% 6.96% Operating Expenses: Personnel Services 29,687,152 29,693,152 10,740,382 18,952,770 36.17% 2.84% Other Services 27,329,604 27,323,604 9,376,816 17,946,788 34.32% 0.99% Supplies 60,402,130 60,402,130 18,542,745 41,859,385 30.70% -2.63% Capital Projects 6,003,956 11,609,690 4,331,084 7,278,606 37.31% 3.98% Capital Operating 1,617,600 1,619,600 7,346 1,612,254 0.45% -32.88% Debt Service 9,992,712 9,992,712 3,331,907 6,660,805 33.34% 0.01% Other Expenses 275,000 275,000 275,000 0.00% -33.33% Total Operating Expenses 135,308,154 140,915,888 46,330,280 94,585,608 32.88% -0.45% Nonoperating Revenues (Expenses): Investment Income 202,902 202,902 46,715 (156,187) 23.02% -10.31% Interfund Charges for Support Services 1,828,147 1,828,147 584,426 (1,243,721) 31.97% -1.36% Miscellaneous Revenue (Expense) 715,639 715,639 270,848 (444,791) 37.85% 4.52% Total Nonoperating Revenue (Expenses) 2,746,688 2,746,688 901,989 (1,844,699) 32.84% -0.49% 4,774,780 (832,954) 9,909,592 10,742,546 -1189.69% -1223.02% Capital Contributions 0.00% -33.33% Transfers Out – Utility Payments In Lieu of Taxes (13,000,000) (13,000,000) (5,371,994) (7,628,006) 41.32% 7.99% Transfers In 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers and Special Items (13,000,000) (13,000,000) (5,371,994) (7,628,006) 41.32% 7.99% Excess of Revenue and Other Financing Sources Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (8,225,220) (13,832,954) 4,537,598 18,370,552 Beginning Available Resources 49,849,263 Ending Available Resources 54,386,861 Revenue Risk 10,900,000 Capital Reserve 12,600,000 Expense Risk 12,900,000 Working Capital 30,600,000 Targeted Reserve Level 67,000,000 Total Non-Restricted Resources Available $ (12,613,139) Income (Loss) Before Transfers

18

Power and Light - Open Capital Projects

PROJECT PROJECT TITLE ORIGINAL BUDGET NET BUDGET AMENDMENTS REVISED BUDGET ENCUMBRANCES ACTUALS AVAILABLE BUDGET 200815 T&D Sys IMPROVEMENTS $ 250,000.00 641,486.08 891,486.08 84,444.46 223,920.00 583,121.62 200824 Prod Plt MISC PROJECTS - 68,257.76 68,257.76 - - 68,257.76 200828 FIBER OPTIC PROGRAM 105,956.00 93,394.03 199,350.03 21,561.46 48,577.02 129,211.55 201106 69 KV SUBSTATION FACILITIES 300,000.00 138,222.55 438,222.55 1,435.00 - 436,787.55 201405 SUBSTATION SECURITY PROJECT - 259,644.39 259,644.39 - 24,494.75 235,149.64 201509 NEW BILLING Sys - 22,047.36 22,047.36 - - 22,047.36 201510 Sys OpS / DISPATCH - 44,634.77 44,634.77 35,122.10 - 9,512.67 201603 69 KV Trans LINE REBUIL 800,000.00 1,348,663.48 2,148,663.48 2,474,977.09 5,777.80 (332,091.41) 201604 Sys OpS / UPS UPGRAD - 45,493.59 45,493.59 - - 45,493.59 201605 Sys OpS WORK AREA - 619,842.18 619,842.18 - - 619,842.18 201606 NEW FINANCIAL MANAGEMENT SYS - 200,000.00 200,000.00 - - 200,000.00 201702 Prod FACILITIES IMPROVE - 586,830.00 586,830.00 - - 586,830.00 201703 BV GROUND WATER - 445,491.07 445,491.07 143,975.30 13,930.75 287,585.02 201706 SUBSTATION K SWITCHGEAR & - 4,006,011.31 4,006,011.31 4,013,554.57 17,922.23 (25,465.49) 201707 MASTER PLAN-FUTURE GENERATIO - 32,500.00 32,500.00 - - 32,500.00 201710 Mo CITY DIVESTITURE - 530,640.70 530,640.70 501,564.04 29,076.16 0.50 201804 SUBSTATION E SWITCHGEAR REPLACEMENT 950,000.00 2,543,308.28 3,493,308.28 1,580,894.05 239,861.23 1,672,553.00 202004 Above Ground Fuel Storage Tanks - 41,800.00 41,800.00 - - 41,800.00 202005 Blue Valley - Eckles Rd 161kV Trans - (41,604.90) (41,604.90) - - (41,604.90) 202101 Substation Fiber Optic Network 750,000.00 125,000.00 875,000.00 - 36,736.38 838,263.62 202102 Traffic Controller Upgrades 60,000.00 (4,000.00) 56,000.00 - - 56,000.00 202103 Traffic Camera System Upgrades 20,000.00 11,837.00 31,837.00 - - 31,837.00 202107 Motorola APX Radio Purchase Phase 2 70,000.00 1,706.82 71,706.82 - 3,989.93 67,716.89 202109 Substation Modeling 100,000.00 150,000.00 250,000.00 - - 250,000.00 202110 20MVAR Capacitor Bank Sub A - 800,000.00 800,000.00 175,536.25 70,919.77 553,543.98 202111 Transmission Pole Replacement Prog 300,000.00 100,000.00 400,000.00 31,252.30 - 368,747.70 202201 Substation A Transformer T-9 Mtce 180,000.00 - 180,000.00 - - 180,000.00 202204 Relay Test Set 80,000.00 - 80,000.00 - - 80,000.00 202205 Desert Storm Switchgear Cabinets 250,000.00 - 250,000.00 - - 250,000.00 202208 Traffic Signal Detection Systems 50,000.00 - 50,000.00 - - 50,000.00 202210 IPL Service Center PBX Upgrade to I 70,000.00 - 70,000.00 - - 70,000.00 202211 H-5 Hot Gas Path Inspection 1,518,000.00 - 1,518,000.00 1,909,344.00 - (391,344.00) 9669 SERVICE CTR FACILITY IMPROVE. 150,000.00 220,084.17 370,084.17 7,174.50 - 362,909.67 $ 6,003,956.00 13,031,290.64 19,035,246.64 10,980,835.12 715,206.02 7,339,205.50 Current Year Prior Year Budget Budget (Enc Roll) Total Budget 11,609,689.70 $ 7,425,556.94 19,035,246.64 Less Expenditures 22,856.06 692,349.96 715,206.02 Less Encumbrances 4,308,228.14 6,672,606.98 10,980,835.12 Total Available 7,278,605.50 $ 60,600.00 7,339,205.50

19

As of October 31, 2021

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

Water

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating Revenues: Charges for Services $ 32,720,000 32,720,000 12,636,582 (20,083,418) 38.62% 5.29% Penalties 120,000 120,000 84,267 (35,733) 70.22% 36.89% Connection/Disconnection Charges 12,000 12,000 8,035 (3,965) 66.96% 33.63% Miscellaneous 1,000 1,000 3,535 2,535 353.50% 320.17% Returned Check Charges 23,000 23,000 10,035 (12,965) 43.63% 10.30% Rental Income 85,000 85,000 28,242 (56,758) 33.23% -0.10% Meter Repairs 0.00% -33.33% Merchandising Jobbing 6,715 6,715 0.00% -33.33% Total Operating Revenues 32,961,000 32,961,000 12,777,411 (20,183,589) 38.77% 5.44% Operating expenses: Personnel Services 9,507,888 9,561,542 3,019,226 6,542,316 31.58% -1.75% Other Services 13,356,698 13,356,698 3,261,846 10,094,852 24.42% -8.91% Supplies 2,466,330 2,466,330 1,759,814 706,516 71.35% 38.02% Capital Projects 6,420,000 19,286,025 370,500 18,915,525 1.92% -31.41% Capital Operating 1,072,318 1,072,318 306,620 765,698 28.59% -4.74% Debt Service 2,523,363 2,523,363 1,982,579 540,784 78.57% 45.24% Other Expenses 125,000 125,000 125,000 0.00% -33.33% Total Operating Expenses 35,471,597 48,391,276 10,700,585 37,690,691 22.11% -11.22% Nonoperating Revenues (Expenses): Investment Income 539,138 539,138 244,485 (294,653) 45.35% 12.02% Interfund Charges for Support Services 1,392,092 1,392,092 464,031 (928,061) 33.33% 0.00% Miscellaneous Revenue (Expense) 1,000 1,000 16,409 15,409 1640.90% 1607.57% Total Nonoperating Revenue (Expenses) 1,932,230 1,932,230 724,925 (1,207,305) 37.52% 4.19% (578,367) (13,498,046) 2,801,751 16,299,797 -20.76% -54.09% Transfers Out – Utility Payments In Lieu of Taxes (3,200,000) (3,200,000) (1,175,247) (2,024,753) 36.73% 3.40% Transfers In 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers (3,200,000) (3,200,000) (1,175,247) (2,024,753) 36.73% 3.40% Excess of Revenue and Other Financing Sources Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (3,778,367) (16,698,046) 1,626,504 18,324,550 Beginning Available Resources 42,313,512 Ending Available Resources 43,940,016 Revenue Risk 3,800,000 Capital Reserve 4,300,000 Expense Risk 400,000 Working Capital 6,800,000 Targeted Reserve Level 15,300,000 Total Non-Restricted Resources Available $ 28,640,016 Income (Loss) Before Transfers

20

Water - Open Capital Projects

As of October 31, 2021

PROJECT PROJECT TITLE ORIGINAL BUDGET NET BUDGET AMENDMENTS REVISED BUDGET ENCUMBRANCES ACTUALS AVAILABLE BUDGET 400708 TREATMENT Plt DISCHARGE $ - 300,000.00 300,000.00 - - 300,000.00 400904 EAST INDEPENDENCE INDUST PARK - 674,000.00 674,000.00 - - 674,000.00 401003 FUTURE Prod WELLS - 965,326.00 965,326.00 - - 965,326.00 401301 23RD ST MAIN REPLACEMENT 150,000.00 177,230.57 327,230.57 - - 327,230.57 401402 LAGOON CLEANOUT - 302,560.00 302,560.00 327,060.00 - (24,500.00) 401505 Dist Sys IMPROVE - 258,054.00 258,054.00 13,273.00 - 244,781.00 401506 TRUMAN ROAD BOOSTER STATION - 106,569.52 106,569.52 34,658.85 - 71,910.67 401601 FILTER BACKWASH OUTFALL - 190,325.00 190,325.00 - - 190,325.00 401602 Plt DISCHARGE OUTFALL - 459,824.48 459,824.48 - - 459,824.48 401605 COURTNEY BEND BASIN CATWALK - 10,020.00 10,020.00 - - 10,020.00 401608 LIME SILO 1,300,000.00 291,070.12 1,591,070.12 209,101.22 255,046.50 1,126,922.40 401703 Maint BUILDING AT CBP - 200,000.00 200,000.00 - - 200,000.00 401704 VAN HORN RESERVOIR IMPROVE - 500,204.23 500,204.23 293,929.00 199,459.23 6,816.00 401706 Main Replacement Ellison Way - 483,814.35 483,814.35 - - 483,814.35 401802 6" Main Replacement James Downey Rd - 250,087.60 250,087.60 - - 250,087.60 401804 Filter Valve House Roof Improvement 75,000.00 22,292.00 97,292.00 - - 97,292.00 401808 VFD Drive Replacements HSP 2 & 4 - 227,728.00 227,728.00 12,060.00 (15,299.00) 230,967.00 401818 30" Steel Transmission Main Assess - 156,300.00 156,300.00 - - 156,300.00 401821 Main Replacement-32nd/Hunter/Bird - 91,000.00 91,000.00 - - 91,000.00 401822 Main Replacement-24Hwy/Northern/RR - 240,166.00 240,166.00 - - 240,166.00 402002 39th Street Reservoir - 1,200,000.00 1,200,000.00 29,800.00 - 1,170,200.00 402004 Main Replace Walnut/Leslie/LeesSumm - 143,152.66 143,152.66 12,022.53 49,911.40 81,218.73 402007 Courtney Bend Emergency Generator 1,000,000.00 150,000.00 1,150,000.00 - - 1,150,000.00 402008 Wellfield Overhead Electrical Imp 800,000.00 200,000.00 1,000,000.00 - - 1,000,000.00 402009 Main Replace Sheley/Claremont/Norw - 191,032.00 191,032.00 2,242.00 - 188,790.00 402010 Main Replace Gudgell/Dodgion/KingsH - 1,008,365.00 1,008,365.00 - - 1,008,365.00 402011 Main Replace Salisbury/Peck/Geospac - 551,900.00 551,900.00 - - 551,900.00 402012 College Avenue Improvements - 250,000.00 250,000.00 - - 250,000.00 402101 Main Replacement Ralston 31st/29th - 350,000.00 350,000.00 - - 350,000.00 402102 Main Replacement 3rd St & Jennings - 460,000.00 460,000.00 - - 460,000.00 402103 Main Replacement Truman Road 50,000.00 490,502.00 540,502.00 6,332.00 - 534,170.00 402104 Lime Slaker No 5 - 350,000.00 350,000.00 - - 350,000.00 402105 Main Replacement Sheley - 100,000.00 100,000.00 4,100.00 - 95,900.00 402106 Main Replacement Sheley & Northern - 1,035,000.00 1,035,000.00 12,300.00 - 1,022,700.00 402107 Facility Improvements/Const/Maint - 250,000.00 250,000.00 - - 250,000.00 402108 Basin Drive Improvements 250,000.00 250,000.00 500,000.00 - - 500,000.00 402201 Roof Improvements 250,000.00 - 250,000.00 - - 250,000.00 402203 Lime Slaker No 1 350,000.00 - 350,000.00 - - 350,000.00 402207 CB Electrical Switchgear Improvemen 200,000.00 - 200,000.00 - - 200,000.00 9749 MAIN REPLACEMENT PROGRAM 1,745,000.00 793,907.19 2,538,907.19 - - 2,538,907.19 9952 SECURITY UPGRADES 250,000.00 267,590.82 517,590.82 - - 517,590.82 $ 6,420,000.00 13,948,021.54 20,368,021.54 956,878.60 489,118.13 18,922,024.81 Current Year Prior Year Budget Budget (Enc Roll) Total Budget 19,286,024.81 $ 1,081,996.73 20,368,021.54 Less Expenditures - 489,118.13 489,118.13 Less Encumbrances 370,500.00 586,378.60 956,878.60 Total Available 18,915,524.81 $ 6,500.00 18,922,024.81

21

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Sanitary Sewer

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating revenues: Charges for Services $ 35,151,285 35,151,285 12,465,280 (22,686,005) 35.46% 2.13% Penalties 200,000 200,000 129,185 (70,815) 64.59% 31.26% Total operating revenues 35,351,285 35,351,285 12,594,465 (22,756,820) 35.63% 2.30% Operating expenses: Personnel Services 6,672,780 6,672,780 1,972,745 4,700,035 29.56% -3.77% Other Services 13,843,955 13,718,955 3,519,443 10,199,512 25.65% -7.68% Supplies 1,222,200 1,349,808 338,193 1,011,615 25.05% -8.28% Capital Projects 3,925,000 15,487,758 659,359 14,828,399 4.26% -29.07% Capital Operating 424,500 421,892 321,697 100,195 76.25% 42.92% Debt Service 6,288,332 6,288,332 812,944 5,475,388 12.93% -20.40% Other Expenses 0.00% -33.33% Total Operating Expenses 32,376,767 43,939,525 7,624,381 36,315,144 17.35% -15.98% Nonoperating Revenues (Expenses): Investment Income 104,000 104,000 131,391 27,391 126.34% 93.01% Miscellaneous Revenue (Expense) 7,820 7,820 10,676 2,856 136.52% 103.19% Total Nonoperating Revenue (Expenses) 111,820 111,820 142,067 30,247 127.05% 93.72% 3,086,338 (8,476,420) 5,112,151 13,588,571 -60.31% -93.64% Transfers Out – Utility Payments In Lieu of Taxes (3,596,612) (3,596,612) (1,180,539) (2,416,073) 32.82% -0.51% Transfers In 10,000 10,000 10,000 100.00% 66.67% Transfers Out 0.00% -33.33% Total Transfers (3,586,612) (3,586,612) (1,170,539) (2,416,073) 32.64% -0.69% Excess of Revenue and Other Financing Sources Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (500,274) (12,063,032) 3,941,612 16,004,644 Beginning Available Resources 26,265,639 Ending Available Resources 30,207,251 Revenue Risk 2,750,000 Capital Reserve 6,000,000 Expense Risk 400,000 Working Capital 7,400,000 Targeted Reserve Level 16,550,000 Total Non-Restricted Resources Available $ 13,657,251 Income (Loss) Before Transfers

22

Sanitary Sewer - Open Capital Projects

As of October 31, 2021

PROJECT PROJECT TITLE ORIGINAL BUDGET NET BUDGET AMENDMENTS REVISED BUDGET ENCUMBRANCES ACTUALS AVAILABLE BUDGET 300801 NEIGHBORHOOD PROJECTS $ - 574,405.94 574,405.94 452,267.71 86,755.18 35,383.05 301108 HOLDING BASINS AND PMP STATION - 694,045.55 694,045.55 - - 694,045.55 301201 BURR OAK EAST - 1,035,327.15 1,035,327.15 - - 1,035,327.15 301202 CRACKERNECK-VAN HOOK SEWER - 529,163.59 529,163.59 - - 529,163.59 301505 SEWAGE SLUDGE INCINERATOR IMP - 605,823.97 605,823.97 - - 605,823.97 301603 RCTP FACILITIES ROOF, CEILING - 170,925.00 170,925.00 - - 170,925.00 301604 PRIMARY SLUDGE GRINDERS & - 6,989.69 6,989.69 - - 6,989.69 301701 SCADA UPGRADE - 1,006,730.00 1,006,730.00 73,487.00 6,343.15 926,899.85 301703 ARROWHEAD CENTER - 551,675.62 551,675.62 110,591.89 310,521.81 130,561.92 301705 16TH/SCOTT - 357,780.55 357,780.55 5,390.10 - 352,390.45 301706 TREATMENT FACILITY IMPROVEMENT - 593,007.00 593,007.00 260,400.00 - 332,607.00 301707 NEIGHBORHOOD IMPROVE 17-18 - 82,650.24 82,650.24 7,606.50 - 75,043.74 301804 ROCK CREEK EFFLUENT STRUCTURE - 361,673.21 361,673.21 23,805.27 12,847.44 325,020.50 301806 Neighborhood Improvements 2018-19 - 442,262.68 442,262.68 4,381.81 - 437,880.87 302001 Fairmount Highlands - 170,000.00 170,000.00 - - 170,000.00 302002 Arlington Improvements - 100,000.00 100,000.00 - - 100,000.00 302003 Bison Park - 424,907.85 424,907.85 92.00 2,644.00 422,171.85 302004 Neighborhood Projects 2019-20 - 580,000.00 580,000.00 - - 580,000.00 302005 Biosolids Handling - 2,919,676.59 2,919,676.59 1,782,194.59 245,725.00 891,757.00 302006 Raw Pumps & Screening - 900,000.00 900,000.00 - - 900,000.00 302007 Electrical Substation Rehab - 158,690.00 158,690.00 - - 158,690.00 302008 RCTP Fence - 450,000.00 450,000.00 377,798.00 - 72,202.00 302009 Truman & Harris - 50,000.00 50,000.00 - - 50,000.00 302101 Sanitation Sewer Evaluation Survey - 199,303.60 199,303.60 70,230.50 4,628.25 124,444.85 302102 Raymond Harkless Mills San Imp - 200,000.00 200,000.00 - - 200,000.00 302103 Pump Station Imp & Maintenance 100,000.00 200,000.00 300,000.00 67,148.00 - 232,852.00 302104 Polymer System Relocation - 100,000.00 100,000.00 - - 100,000.00 302105 Piping Rehabilitation 200,000.00 200,000.00 400,000.00 19,947.50 - 380,052.50 302201 Upper Adair Interceptor 800,000.00 - 800,000.00 - - 800,000.00 302202 Crackerneck Creek Slope Rehab 1,100,000.00 - 1,100,000.00 5,600.00 - 1,094,400.00 302203 Sanitary Sewer Main Reloc from Stre 300,000.00 - 300,000.00 - - 300,000.00 302204 RCTP - Septic Pumper 300,000.00 - 300,000.00 - - 300,000.00 302205 Clarifier Rehabilitation 800,000.00 - 800,000.00 - - 800,000.00 302206 Railing Safety RCPS & SCPS 325,000.00 - 325,000.00 - - 325,000.00 9757 TRENCHLESS TECHNOLOGY - 1,555,740.96 1,555,740.96 245,223.10 141,751.50 1,168,766.36 $ 3,925,000.00 15,220,779.19 19,145,779.19 3,506,163.97 811,216.33 14,828,398.89 Current Year Prior Year Budget Budget (Enc Roll) Total Budget 15,487,758.04 $ 3,658,021.15 19,145,779.19 Less Expenditures 15,561.15 795,655.18 811,216.33 Less Encumbrances 643,798.00 2,862,365.97 3,506,163.97 Total Available 14,828,398.89 $ - 14,828,398.89

23

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Events Center Debt Service For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating revenues: Charges for Services $ 0.00% -33.33% Miscellaneous 0.00% -33.33% Total operating revenues 0.00% -33.33% Operating Expenses: Personnel Services 0.00% -33.33% Other Services 1,000 1,000 333 667 33.30% -0.03% Supplies 0.00% -33.33% Capital Outlay 3,120,150 4,525,245 1,337,618 3,187,627 29.56% -3.77% Debt Service 5,292,906 5,292,906 1,212,719 4,080,187 22.91% -10.42% Other Expenses 0.00% -33.33% Total Operating Expenses 8,414,056 9,819,151 2,550,670 7,268,481 25.98% -7.35% Nonoperating Revenues (Expenses): Investment Income 71,000 71,000 2,915 (68,085) 4.11% -29.22% Miscellaneous Revenue (Expense) 0.00% -33.33% Sales Tax 5,173,844 5,173,844 1,429,810 (3,744,034) 27.64% -5.69% Total Nonoperating Revenue (Expenses) 5,244,844 5,244,844 1,432,725 (3,812,119) 27.32% -6.01% (3,169,212) (4,574,307) (1,117,945) 3,456,362 24.44% -8.89% Transfers Out – Utility Payments In Lieu of Taxes 0.00% -33.33% Transfers In 75,000 75,000 75,000 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers 75,000 75,000 75,000 0.00% -33.33% Excess of Revenue and Other Financing Sources Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (3,094,212) (4,499,307) (1,117,945) 3,381,362 Unassigned Fund Balance at Beginning of Year (25,273,358) Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year (1,617,573) Ending Unassigned Fund Balance, 10/31/21 (28,008,876) Restricted: Bond Reserve Project Accounts 6,841,093 Total restricted 6,841,093 Committed: Capital Projects In Process 3,187,627 Total Committed 3,187,627 Assigned: Prior Year Open Encumbrances - Excluding Capital Projects Current Year Open Encumbrances - Excluding Capital Projects Total Assigned Total Fund Balance $ (17,980,156) Income (Loss) Before Transfers

24

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

Central Garage

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating revenues: Charges for Services $ 2,206,668 2,306,668 781,101 (1,525,567) 33.86% 0.53% Miscellaneous 2,171 2,171 0.00% -33.33% Total Operating Revenues 2,206,668 2,306,668 783,272 (1,523,396) 33.96% 0.63% Operating Expenses: Personnel Services 852,345 852,345 262,293 590,052 30.77% -2.56% Other Services 538,628 538,628 616,214 (77,586) 114.40% 81.07% Supplies 787,055 787,055 773,686 13,369 98.30% 64.97% Capital Outlay 39,000 39,000 29,131 9,869 74.69% 41.36% Other Expenses 0.00% -33.33% Total Operating Expenses 2,217,028 2,217,028 1,681,324 535,704 75.84% 42.51% Nonoperating Revenues (Expenses): Investment Income 8,000 8,000 2,625 (5,375) 32.81% -0.52% Miscellaneous Revenue (Expense) 1,009 1,009 0.00% -33.33% Total Nonoperating Revenue (Expenses) 8,000 8,000 3,634 (4,366) 45.43% 12.10% (2,360) 97,640 (894,418) (992,058) -916.04% -949.37% Transfers Out – Utility Payments In Lieu of Taxes 0.00% -33.33% Transfers In 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers 0.00% -33.33% Change In Net Position (Budget Basis) $ (2,360) 97,640 (894,418) (992,058) Unassigned Fund Balance at Beginning of Year (1,536,610) Cancellation of Prior Year Encumbrances 81,491 Change in Other Fund Balance Components During the Year (1,617) Year-end investment market value adjustment Ending Unassigned Fund Balance GAAP Basis, 10/31/21 (2,351,154) Other Net Position Components: Assigned - Current Year Encumbrances 909,294 Assigned - Prior Year Encumbrances 11,916 Total Fund Balance $ (1,429,944) Income (Loss) Before Transfers

25

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Staywell Health Care

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating revenues: Charges for Services $ 15,500,000 15,500,000 6,345,720 (9,154,280) 40.94% 7.61% Miscellaneous 0.00% -33.33% Total Operating Revenues 15,500,000 15,500,000 6,345,720 (9,154,280) 40.94% 7.61% Operating Expenses: Personnel Services 187,200 187,200 3,840 183,360 2.05% -31.28% Other Services 19,166,120 19,166,120 7,735,378 11,430,742 40.36% 7.03% Supplies 0.00% -33.33% Capital Outlay 0.00% -33.33% Other Expenses 0.00% -33.33% Total Operating Expenses 19,353,320 19,353,320 7,739,218 11,614,102 39.99% 6.66% Nonoperating Revenues (Expenses): Investment Income 4,000 4,000 1,569 (2,431) 39.23% 5.90% Miscellaneous Revenue (Expense) 775,667 775,667 0.00% -33.33% Total Nonoperating Revenue (Expenses) 4,000 4,000 777,236 773,236 19430.90% 19397.57% (3,849,320) (3,849,320) (616,262) 3,233,058 16.01% -17.32% Transfers In - American Rescue Plan 2,350,000 (2,350,000) 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers 2,350,000 (2,350,000) 0.00% -33.33% Change In Net Position (Budget Basis) $ (3,849,320) (3,849,320) 1,733,738 5,583,058 Unassigned Fund Balance at Beginning of Year 289,505 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year 135,720 Ending Unassigned Fund Balance GAAP Basis, 10/31/21 2,158,963 Other Net Position Components: Assigned - Current Year Encumbrances 80,000 Assigned - Prior Year Encumbrances Total Fund Balance $ 2,238,963 Income (Loss) Before Transfers

26

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

Workers' Compensation

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating revenues: Charges for Services $ 4,625,000 4,625,000 1,541,664 (3,083,336) 33.33% 0.00% Miscellaneous 0.00% -33.33% Total Operating Revenues 4,625,000 4,625,000 1,541,664 (3,083,336) 33.33% 0.00% Operating Expenses: Personnel Services 13,778 13,778 4,341 9,437 31.51% -1.82% Other Services 4,599,000 4,599,000 1,986,914 2,612,086 43.20% 9.87% Supplies 3,000 3,000 3,000 0.00% -33.33% Capital Outlay 2,000 2,000 2,000 0.00% -33.33% Other Expenses 0.00% -33.33% Total Operating Expenses 4,617,778 4,617,778 1,991,255 2,626,523 43.12% 9.79% Nonoperating Revenues (Expenses): Investment Income 2,001 2,001 0.00% -33.33% Miscellaneous Revenue (Expense) 1,063 1,063 0.00% -33.33% Total Nonoperating Revenue (Expenses) 3,064 3,064 0.00% -33.33% 7,222 7,222 (446,527) (453,749) -6182.87% -6216.20% Transfers In 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers 0.00% -33.33% Change In Net Position (Budget Basis) $ 7,222 7,222 (446,527) (453,749) Unassigned Fund Balance at Beginning of Year (8,482,526) Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year (198,698) Year-end investment market value adjustment Ending Unassigned Fund Balance GAAP Basis, 10/31/21 (9,127,751) Other Net Position Components: Restricted - Work Comp Escrow Assigned - Current Year Encumbrances 129,727 Assigned - Prior Year Encumbrances 10,675 Total Fund Balance $ (8,987,349) Income (Loss) Before Transfers

27

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Risk Management

For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating revenues: Charges for Services $ 2,995,000 2,995,000 991,700 (2,003,300) 33.11% -0.22% Miscellaneous 0.00% -33.33% Total Operating Revenues 2,995,000 2,995,000 991,700 (2,003,300) 33.11% -0.22% Operating Expenses: Personnel Services 13,778 13,778 4,341 9,437 31.51% -1.82% Other Services 2,977,000 2,977,000 1,245,037 1,731,963 41.82% 8.49% Supplies 3,000 3,000 3,000 0.00% -33.33% Capital Outlay 0.00% -33.33% Other Expenses 0.00% -33.33% Total Operating Expenses 2,993,778 2,993,778 1,249,378 1,744,400 41.73% 8.40% Nonoperating Revenues (Expenses): Investment Income 9,056 9,056 0.00% -33.33% Miscellaneous Revenue (Expense) 0.00% -33.33% Total Nonoperating Revenue (Expenses) 9,056 9,056 0.00% -33.33% 1,222 1,222 (248,622) (249,844) -20345.50% -20378.83% Transfers Out – Utility Payments In Lieu of Taxes 0.00% -33.33% Transfers In 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers 0.00% -33.33% Change In Net Position (Budget Basis) $ 1,222 1,222 (248,622) (249,844) Unassigned Fund Balance at Beginning of Year 1,345,764 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-end investment market value adjustment Ending Unassigned Fund Balance GAAP Basis, 10/31/21 1,097,142 Other Net Position Components: Assigned - Current Year Encumbrances 56,258 Assigned - Prior Year Encumbrances 7,382 Total Fund Balance $ 1,160,782 Income (Loss) Before Transfers

28

CITY OF INDEPENDENCE, MISSOURI

Actual Variance Percent Percent Budgeted Amounts Amounts with Amended Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Operating revenues: Charges for Services $ 2,200,000 2,200,000 733,333 (1,466,667) 33.33% 0.00% Miscellaneous 0.00% -33.33% Total Operating Revenues 2,200,000 2,200,000 733,333 (1,466,667) 33.33% 0.00% Operating Expenses: Personnel Services 655,218 655,218 186,419 468,799 28.45% -4.88% Other Services 1,147,200 1,147,200 59,159 1,088,041 5.16% -28.17% Supplies 0.00% -33.33% Capital Outlay 50,000 50,000 5,946 44,054 11.89% -21.44% Other Expenses 0.00% -33.33% Total Operating Expenses 1,852,418 1,852,418 251,524 1,600,894 13.58% -19.75% Nonoperating Revenues (Expenses): Investment Income 0.00% -33.33% Miscellaneous Revenue (Expense) 0.00% -33.33% Total Nonoperating Revenue (Expenses) 0.00% -33.33% 347,582 347,582 481,809 134,227 138.62% 105.29% Transfers Out – Utility Payments In Lieu of Taxes 0.00% -33.33% Transfers In – CARES Act 0.00% -33.33% Transfers Out 0.00% -33.33% Total Transfers 0.00% -33.33% Change In Net Position (Budget Basis) $ 347,582 347,582 481,809 134,227 Unassigned Fund Balance at Beginning of Year 1,233,146 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance GAAP Basis, 10/31/21 1,714,955 Other Net Position Components: Assigned - Current Year Encumbrances 39,019 Assigned - Prior Year Encumbrances 109,024 Total Fund Balance $ 1,862,998 Income (Loss) Before Transfers

Budgetary Comparison Schedule Enterprise Resource Planning

the

29

For

period ended October 31, 2021

CITY OF INDEPENDENCE, MISSOURI Budgetary

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Charges for Services $ 9,289 9,289 (9,289) 0.00% -33.33% Investment Income (Loss) 200 200 98 (102) 49.00% 15.67% Other Revenue 0.00% -33.33% Total Revenues 9,489 9,489 98 (9,391) 1.03% -32.30% Expenditures: General Government 0.00% -33.33% Debt Service 9,586 9,586 1,085 8,501 11.32% -22.01% Total Expenditures 9,586 9,586 1,085 8,501 11.32% -22.01% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total expenditures and other financing uses 9,586 9,586 1,085 8,501 11.32% -22.01% Excess of Revenues Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (97) (97) (987) (890) Unassigned Fund Balance at Beginning of Year 106,985 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-End Investment Market Value Adjustment Ending Unassigned Fund Balance, 10/31/21 105,998 Other Fund Balance Components: Restricted - Current Year Encumbrances Restricted - Prior Year Encumbrances Total Fund Balance $ 105,998

Comparison Schedule Debt Service - Neighborhood Improvement Districts For the period ended October 31, 2021 30

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Charges for Services $ 1,153 1,153 0.00% -33.33% Investment Income 2,000 2,000 292 (1,708) 14.60% -18.73% Intergovernmental 0.00% -33.33% Other Revenue 0.00% -33.33% Total Revenues 2,000 2,000 1,445 (555) 72.25% 38.92% Other Financing Sources: Transfers In 0.00% -33.33% Total Other Financing Sources 0.00% -33.33% Total Revenues and Other Financing Sources 2,000 2,000 1,445 (555) 72.25% 38.92% Expenditures: Public Works 0.00% -33.33% Culture and Recreation 0.00% -33.33% Capital Outlay 124,236 124,236 0.00% -33.33% Total Expenditures 124,236 124,236 0.00% -33.33% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 124,236 124,236 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses, Budget Basis $ 2,000 (122,236) 1,445 123,681 Unassigned Fund Balance at Beginning of Year (137,026) Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-End Investment Market Value Adjustment Ending Unassigned Fund Balance, 10/31/21 (135,581) Other Fund Balance Components: Committed - Current Year Encumbrances Committed - Prior Year Encumbrances 147,103 Total Fund Balance $ 11,522 Budgetary Comparison Schedule

OF INDEPENDENCE, MISSOURI Street Improvements Capital Project Fund For the period ended October 31, 2021 31

CITY

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Revolving Public Improvements Capital Project Fund For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Charges for Services $ 0.00% -33.33% Investment Income (Loss) 144 144 0.00% -33.33% Other Revenue 0.00% -33.33% Total Revenues 144 144 0.00% -33.33% Expenditures: Public Works 0.00% -33.33% Culture and Recreation 0.00% -33.33% Capital Outlay 0.00% -33.33% Total Expenditures 0.00% -33.33% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses, Budget Basis $ 144 144 Unassigned Fund Balance at Beginning of Year 21,613 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-End Investment Market Value Adjustment Ending Unassigned Fund Balance, 10/31/21 21,757 Other Fund Balance Components: Committed - Current Year Encumbrances Committed - Prior Year Encumbrances Total Fund Balance $ 21,757

32

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Charges for Services $ 0.00% -33.33% Investment Income 1,647 1,647 0.00% -33.33% Other Revenue 100,800 100,800 100,800 100.00% 66.67% Total revenues 100,800 100,800 102,447 1,647 101.63% 68.30% Other Financing Sources: Transfers In 0.00% -33.33% Total Other Financing Sources 0.00% -33.33% Total Revenues and Other Financing Sources 100,800 100,800 102,447 1,647 101.63% 68.30% Expenditures: Public Works 0.00% -33.33% Culture and Recreation 0.00% -33.33% Capital Outlay 506,900 783,998 783,998 0.00% -33.33% Total Expenditures 506,900 783,998 783,998 0.00% -33.33% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total expenditures and other financing uses 506,900 783,998 783,998 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (406,100) (683,198) 102,447 785,645 Unassigned Fund Balance at Beginning of Year (701,084) Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-End Investment Market Value Adjustment Ending Unassigned Fund Balance, 10/31/21 (598,637) Other Fund Balance Components: Committed - Current Year Encumbrances Committed - Prior Year Encumbrances 572,663 Total Fund Balance $ (25,974)

Buildings and Other Improvements Capital Project Fund For the period ended October 31, 2021 33

Schedule

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Charges for Services $ 0.00% -33.33% Investment Income 0.00% -33.33% Other Revenue 0.00% -33.33% Total revenues 0.00% -33.33% Expenditures: Public Works 0.00% -33.33% Culture and Recreation 0.00% -33.33% Capital Outlay 0.00% -33.33% Total Expenditures 0.00% -33.33% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total expenditures and other financing uses 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses, Budget Basis $ Unassigned Fund Balance at Beginning of Year (16,155) Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Ending Unassigned Fund Balance, 10/31/21 (16,155) Fund Balance Components: Committed - Current Year Encumbrances Committed - Prior Year Encumbrances Total Fund Balance $ (16,155) CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Storm Drainage Capital Project Fund For the period ended October 31, 2021 34

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Park Improvements Capital Project Fund For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Charges for Services $ 0.00% -33.33% Investment Income (Loss) 215 215 0.00% -33.33% Other Revenue 0.00% -33.33% Total revenues 215 215 0.00% -33.33% Expenditures: Public Works 0.00% -33.33% Culture and Recreation 0.00% -33.33% Capital Outlay 0.00% -33.33% Total Expenditures 0.00% -33.33% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total expenditures and other financing uses 0.00% -33.33% Excess of Revenues Over (Under) Expenditures and Other Financing Uses, Budget Basis $ 215 215 Unassigned Fund Balance at Beginning of Year 31,479 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-End Investment Market Value Adjustment Ending Unassigned Fund Balance, 10/31/21 31,694 Fund Balance Components: Committed - Current Year Encumbrances Committed - Prior Year Encumbrances Total Fund Balance $ 31,694

35

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Charges for Services $ 10,500 10,500 (10,500) 0.00% -33.33% Investment Income 32 32 0.00% -33.33% Other Revenue 0.00% -33.33% Total Revenues 10,500 10,500 32 (10,468) 0.30% -33.03% Expenditures: Public Works 0.00% -33.33% Culture and Recreation 10,310 10,310 2,602 7,708 25.24% -8.09% Capital Outlay 0.00% -33.33% Total Expenditures 10,310 10,310 2,602 7,708 25.24% -8.09% Other Financing Uses: Transfers Out/Capital Outlay 0.00% -33.33% Total Other Financing Uses 0.00% -33.33% Total Expenditures and Other Financing Uses 10,310 10,310 2,602 7,708 25.24% -8.09% Excess of revenues over (under) expenditures and Other Financing Uses, Budget Basis $ 190 190 (2,570) (2,760) Unassigned Net Position at Beginning of Year 903 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Year-End Investment Market Value Adjustment Unassigned Net Position, 10/31/21 (1,667) Other Net Position Components: Committed - Current Year Encumbrances Committed - Prior Year Encumbrances Total Net Position $ (1,667)

Private Purpose Expendable Trust Fund - Vaile Mansion For the period ended October 31, 2021 36

CITY OF INDEPENDENCE, MISSOURI Budgetary Comparison Schedule Independence Events Center CID For the period ended October 31, 2021

Actual Variance Percent Percent Budgeted Amounts Amounts with Final Actual From Original Amended (Budget Basis) Budget 33.33% of Year Budget Revenues: Sales Taxes $ 8,106,070 8,106,070 2,134,818 (5,971,252) 26.34% -6.99% Investment Income 75,000 75,000 6,356 (68,644) 8.47% -24.86% Total Revenues 8,181,070 8,181,070 2,141,174 (6,039,896) 26.17% -7.16% Expenditures: Administrative Fee 162,121 162,121 42,696 119,425 26.34% -6.99% Insurance 2,150 2,150 717 1,433 33.35% 0.02% Legal 55,300 55,300 55,300 0.00% -33.33% Audit 5,500 5,500 5,300 200 96.36% 63.03% Banking 6,500 6,500 3,133 3,367 48.20% 14.87% Contract Services 0.00% -33.33% Capital Outlay 0.00% -33.33% Other 0.00% -33.33% Total Expenditures 231,571 231,571 51,846 179,725 22.39% -10.94% Other Financing Uses: Transfers Out - EATS (1,175,000) (1,175,000) (227,411) (947,589) 19.35% -13.98% Transfers Out - Debt Service (City) (4,205,456) (4,205,456) (1,202,398) (3,003,058) 28.59% -4.74% Transfers Out - Captial Projects (3,120,150) (3,120,150) (3,120,150) 0.00% -33.33% Total Other Financing Uses (8,500,606) (8,500,606) (1,429,809) (7,070,797) 16.82% -16.51% Excess of Revenue and Other Financing Sources Over (Under) Expenditures and Other Financing Uses, Budget Basis $ (551,107) (551,107) 659,519 1,210,626 Unassigned Fund Balance at Beginning of Year 9,171,998 Cancellation of Prior Year Encumbrances Change in Other Fund Balance Components During the Year Unassigned Ending Fund Balance, 10/31/21 9,831,517 Other Fund Balance Components: Restricted - current year encumbrances 5,300 Restricted - prior year encumbrances 300,000 Total Fund Balance $ 10,136,817

37