CITY OF IRVING, TEXAS

ACKNOWLEDGMENTS

TIP Strategies , Inc., would like to thank the following participants who contributed to the planning process.

MAYOR AND CITY COUNCIL

• Rick Stopfer, Mayor

• John Bloch, Deputy Mayor Pro Tem, District 1

• Brad M. LaMorgese, District 2

• Abdul Khabeer, District 3

• Luis Canosa, District 4

• Mark Cronenwett, District 5

• Al Zapanta, District 6

• Kyle Taylor, District 7

• Dennis Webb, Mayor Pro Tem, District 8

CONSULTING TEAM

TIP Strategies, Inc., is a privately held Austin-based firm providing consulting and advisory services to public and private sector clients. Established in 1995, the firm’s core competencies are strategic planning for economic development, talent strategies, organizational development, resiliency planning, and equity initiatives.

CITY OF IRVING

• Chris Hillman, City Manager

• Philip Sanders, Assistant City Manager

• Bryan Haywood , EDFP; Senior Economic Development Manager

GREATER IRVING-LAS COLINAS CHAMBER OF COMMERCE

• Beth A. Bowman, IOM, CCE; President/CEO

• Diana Velazquez, EDFP, PCED; VP of Economic Development

IRVING CONVENTION & VISITORS BUREAU

• Maura Gast, FCDME; Executive Director

Contact TIP Strategies 13492 N Hwy 183, Suite 120-254, Austin, TX 78750

PH: +1 512 3439113 www.tipstrategies.com

Project Contributors

Tracye McDaniel, President John Karras, VP, Business Development Alexis Angelo, Consultan t Erica Colston, Associate Consultant

Image credit: Cover images courtesy of the Greater Irving-Las Colinas Chamber of Commerce and the City of Irving.

SUMMARY

The City of Irving, Texas, (the City) was incorporated more than a century ago in 1914. Development was slow for the City’s first several decades, but over the past 50 years Irving has transformed from a bedroom community into a thriving global business hub. In 2023, one of the country’s first master-planned communities Irving’s Las Colinas marked its 50th anniversary During this period, the area has amassed an amount of commercial office space comparable to, and total employment higher than, that of downtown Dallas (including Uptown and the Dallas Central Business District). This year, 2024, marks the 50th anniversary of Dallas Fort Worth International Airport (DFW Airport) , now the second busiest airport in the world. With the major assets that have fueled Irving’s growth reaching the mid-century mark, now is the time to look ahead to the next 50 years, starting with a new roadmap for Irving’s economic development efforts over the next five years.

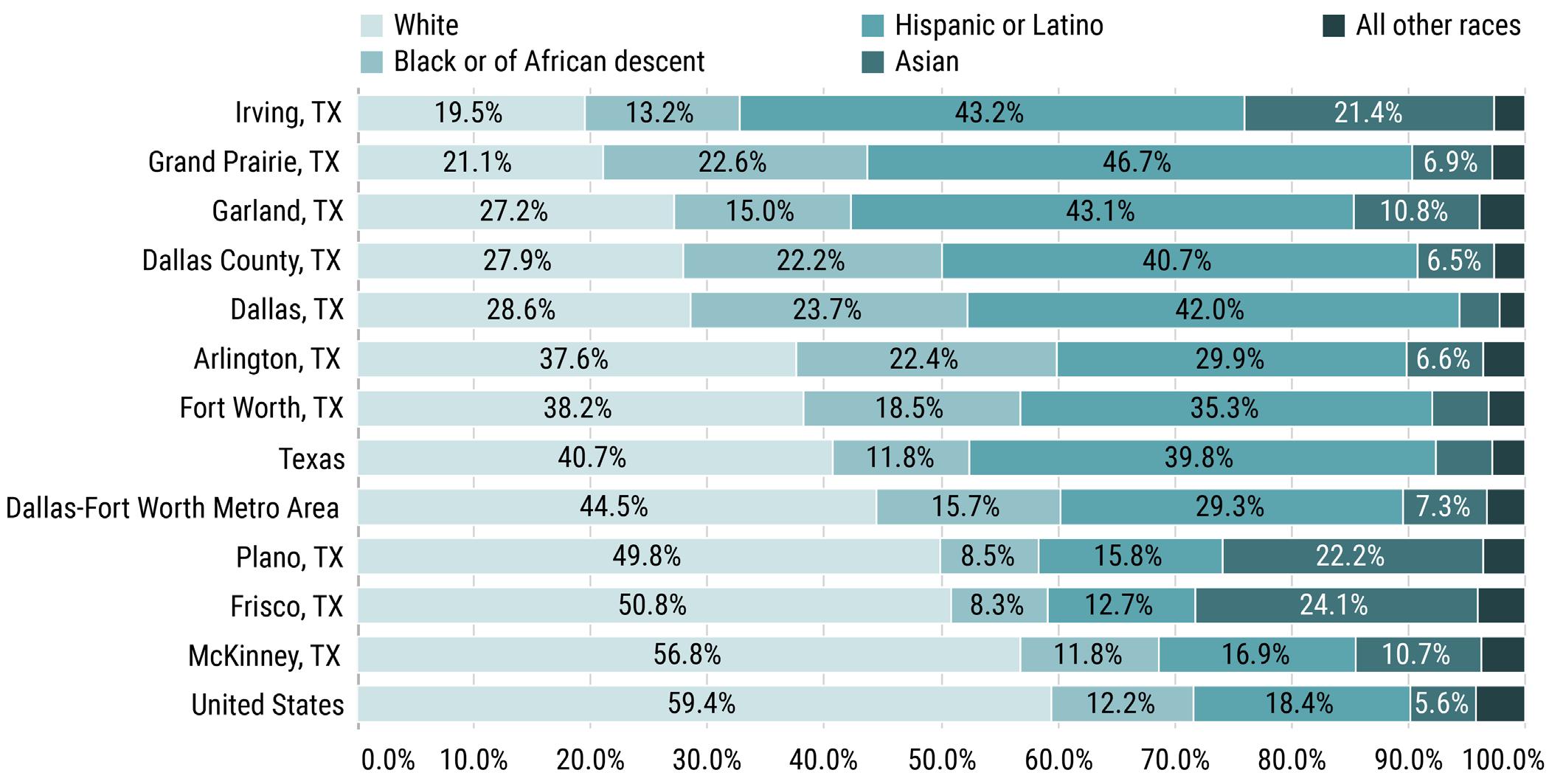

Thanks to decades of visionary leadership, forward- thinking real estate development, and focused planning efforts, Irving has become the center of gravity for the North Texas economy. Irving’s success in attracting global companies has earned it the nickname “Headquarters of Headquarters ” However, that status is not guaranteed. Irving’s economic drivers are under constant threat. The risk to Irving’s economic vitality comes from communities and economic development leaders across the country looking to lure the City’s existing businesses. The threat also comes from nearby cities ranging from Arlington and Grand Prairie to Dallas and Frisco (and dozens of others) looking to outcompete Irving for new jobs and investment.

Leaning into the community’s reputation as the Headquarters of Headquarters, a new vision emerges for Irving to become a leading hub for innovation, reinvention , and placemaking by 2030 This updated vision for Irving is an aspirational one. It draws from existing strengths and builds on the Irving Economic Development Partnership’s (IEDP) future economic development program for the creation of sustainable, modern work, live, and play spaces that integrate cutting-edge technology; the promotion of global engagement; and the enhancement of Irving’s overall quality of life for employers, employees, visitors, residents, and corporate tenants.

PLANNING APPROACH

To help leverage these opportunities, the City of Irving engaged TIP Strategies (TIP) to prepare a five-year economic development strategic plan (EDSP). This effort builds on other TIP-led planning initiatives, beginning with the January 2017 EDSP prepared for the IEDP. The plan set forth a vision of Irving as “the leading international business center in America a destination for investment and high-wage jobs and a vibrant urban community.” It laid out eight priority initiatives for each of the partners of the IEDP, comprising the City, the Greater Irving-Las Colinas Chamber of Commerce (GILCCC), and the Irving Convention & Visitors Bureau (ICVB), designed to translate the vision to reality. TIP was reengaged in 2020 to evaluate progress on the 2017 plan and to assist the GILCCC with a business-focused response to the COVID-19 pandemic, including an update to the organization’s business retention and expansion (BRE) efforts.

STAKEHOLDER ENGAGEMENT

Like the prior planning efforts, this EDSP was prepared using TIP’s three-phase planning model: discovery, opportunity, and implementation. During the discovery phase, TIP conducted an extensive outreach to local stakeholders. This effort, illustrated in Figure 1 (page 2), included a series of more than 25 roundtables encompassing more than 150 participants across a range of institutions. Several prominent themes emerged from the stakeholder input that helped shape the plan framework.

• SUCCESSES. The IEDP has the best in the business in key leadership roles, which has helped Irving achieve success in its economic development efforts, especially over the past decade with numerous major economic development wins. Irving maintains a welcoming business environment but faces competition from other North Texas communities and cities across the country regularly trying to recruit companies away from Irving.

• INNOVATION . The innovation and research and development (R&D) ecosystem across North Texas has grown at an accelerated pace over the past decade, with major momentum in life sciences innovation, a rising set of research universities, numerous place-based innovation districts, and a growing network of corporate R&D, startup ventures, and investment capital. Much of this innovation activity has taken place around Irving, but the community has not strategically positioned itself to capitalize on the region’s innovation and R&D efforts.

• REINVENTION Irving is no longer shiny and new in comparison to some of the rapidly growing cities outside the urban core of the North Texas region. Greenfield development projects are a thing of the past for Irving The City’s future is increasingly tied to its success in facilitating redevelopment projects and reinvestment.

• PLACEMAKING. Irving has benefitted historically from assets like its central location and access to DFW Airport but will need to keep evolving to remain competitive. The need to embrace change is especially important regarding lifestyle amenities and entertainment destinations. People are drawn to quality places Irving’s ability to maintain its competitive edge for attracting the next generation of talent, companies, residents, and visitors will require it to leverage existing amenities and create new attractors.

Insights gained from these discussions and from personal interviews were supplemented by a comprehensive quantitative analysis. The analysis was presented to the City as an interactive data visualization to allow for indepth exploration. More information on these discovery phase tasks, including highlights from the quantitative analysis, is presented in the Planning Context section (page 36).

joint

and ICVB to discuss next steps and collaboratively make decisions

Source(s): TIP Strategies, Inc.

FIGURE 1. STAKEHOLDER ENGAGEMENT OVERVIEW

TARGET INDUSTRIES AND DEVELOPMENT OPPORTUNITY SITES

The quantitative and qualitative findings from the discovery phase helped to validate and refine Irving’s development opportunity sites and districts and its target industry sectors. The recommended target areas for Irving’s business development efforts, outlined here, leverage Irving’s assets (including its existing companies, workforce, sites, and infrastructure) and align with City priorities. Twelve development opportunity sites and districts that represent Irving’s focus areas for development and redevelopment are shown in Figure 2 (page 4).

• HEADQUARTERS. This target includes Fortune 1000 headquarters (HQs), other corporate HQs, regional and divisional HQs of large corporations, and North American HQs of foreign-based multinational corporations. A new addition to this target is the recruitment of corporate R&D centers, innovation hubs, technology centers, and venture capital arms of major corporations.

• FINANCIAL SERVICES. Large commercial banks, insurance firms, and other financial institutions represent a logical target for Irving given the long-term success of this sector in the region This target is centered on finance and insurance firms with on-site C-suite executives and is not intended to include back-of-house operations, such as call centers.

• LIFE SCIENCES AND HEALTHCARE. Local and regional growth of life sciences, pharmaceutical, and biotechnology companies, as well as major healthcare providers positions Irving for success in this target Substantial investments from R1 universities are bringing increased research and innovation activity to the Dallas-Fort Worth metro area, providing further support for this target.

• RETAIL, RESTAURANTS, AND HOSPITALITY. Irving’s central location makes the attraction of additional retail, restaurant, and hospitality firms an opportunity to serve travelers and residents alike. This target includes destination retail, grocery stores, restaurants, and local retail establishments, as well as full-service hotels, entertainment venues, events/festivals, and nightlife.

• TECHNOLOGY AND PROFESSIONAL SERVICES. This target builds on the Dallas-Fort Worth metro area’s rising stature as a hub for innovation , technology, and professional services. It includes software and technology firms and professional services companies ranging from architecture, engineering, and design firms to legal, marketing, and accounting firms.

• HIGH-VALUE INDUSTRIAL. Advanced manufacturing facilities, aerospace/aviation-related companies, data centers, and modern distribution/warehousing/showroom facilities are desirable, high-value industrial targets By focus ing on industrial employers that are responsible neighbors and are viable over the long-term, this target seeks to avoid generating a demand for public resources that is not sustainable.

FIGURE 2. SELECTED DEVELOPMENT OPPORTUNITY SITES IN IRVING, TEXAS

Irving’s focus areas for development and redevelopment

Source(s): City of Irving; TIP Strategies, Inc.

Note(s): TIRZ = tax increment reinvestment zone

PLAN FRAMEWORK

The opportunity phase of the planning process focuses on identifying the ideas and strategies with the greatest potential to affect change. With findings from the discovery phase in hand, leaders were brought together to build consensus on framework for the plan. The results from other tasks, including an evaluation of Irving’s promotional efforts, an assessment of economic development roles and responsibilities , and a review of similarly situated cities , helped shape the discussion, which resulted in the selection of three goal areas. Within each goal, the project team identified three bold projects with potential for transformational change along with priority initiatives that encompass the overall work program for the IEDP (see Figure 3). Strategies and action items for accomplishing these goals, along with additional details about the associated bold projects and considerations for the plan’s implementation are outlined in the Action Plan section

BOLD PROJECTS

• Support the creation of a life sciences complex with 25,000 SF of lab/R&D space and 125,000 SF of office space

• Foster higher education and industry partnerships in Irving.

• Recruit five new corporate R&D, technology, and innovation centers with a total of 500 net new jobs

STRATEGIC INITIATIVES

1.1. Target industry recruitment

1.2. Life sciences innovation

1.3. Higher education and industry partnerships

1.4. Business retention and expansion (BRE) and corporate engagement

1.5. International business development

1.6. High-growth startups and entrepreneurial support

1.7. Small business and M/WBE support

BOLD PROJECTS

• Facilitate public-private partnerships (P3s) to create 500,000 SF of new and upgraded Class A office space in Irving-Las Colinas.

• Support the revival of the Freeport area through the creation of a master plan for the district.

• Engage in P3s to create a total of 250,000 SF of new vertical mixed-use space in South Irving.

STRATEGIC INITIATIVES

2.1 High-profile sites and districts

2.2. Commercial office development and reinvestment

2.3. Targeted retail recruitment, development, and reinvestment

2.4. High-value industrial developments

2.5. Redevelopment of aging multifamily properties

2.6. Reinvestment in neighborhood housing stock

2.7. Land banking and site prep for future development

2.8. Infrastructure investment

BOLD PROJECTS

• Attract a global destination in the PUD 6 area.

• Create an international culinary destination, anchored by a food hall or food test kitchen incubator

• Pursue one or more freeway deck park caps at high-visibility locations linking major development sites in Irving.

STRATEGIC INITIATIVES

3.1 New destination development

3.2. Greater attraction capacity for existing amenities

3.3. Upscale hotel development and reinvestment

3.4. Irving brand unity

3.5. Targeted events and conferences

3.6. Gateway enhancement

3.7 Leadership Irving talent program

3.8. Workforce readiness and K–12 engagement

M = million; M/WBE = minority and women owned business enterprises; PUD = planned unit development; R&D = research and development; SF = square feet

FIGURE 3. STRATEGIC FRAMEWORK

GOAL 1. INNOVATION

GOAL 2. REINVENTION GOAL 3. PLACEMAKING

ACTION PLAN

The Action Plan lays out the bold projects and initiatives required to bring the three goals to fruition. It sets out bold projects under each goal that will enable Irving to leverage the region’s innovation successes, position its redevelopment opportunities in the competitive North Texas market, and create quality amenities that will draw investment and talent to the City. It concludes with a consideration of the resources that will be required to support the plan’s full implementation and, ultimately, its success

GOAL 1. INNOVATION

By 2030, Irving will be recognized as a leading hub for innovation by creating a life sciences innovation complex, fostering higher education and industry partnerships, and recruiting new corporate R&D, technology, innovation, and venture capital centers.

The strategies in this goal have the potential to transform Irving’s economic future over the next 5 to 10 years. The entire Dallas-Fort Worth metro area is experiencing a surge of momentum in academic R&D, entrepreneurial activity, corporate technology growth, and life sciences innovation As the region grows to become the third largest metro area in the US over the next decade (surpassing Chicago in population, employment, and economic activity), innovation will create opportunities for Irving. In addition to the three bold projects listed below (life sciences innovation, intentional higher education partnerships, and corporate innovation), strategies encompassed in this goal include business engagement, business retention and expansion (BRE), high-growth startup support, and efforts to align City activities toward innovation.

BOLD PROJECTS

Support the creation of a life sciences complex in Irving with lab, R&D, and office space as part of a larger Citywide goal.

The life sciences complex would feature 25,000 square feet (SF) of lab/R&D space and 125,000 SF of office space for innovative life sciences companies and related firms in the life sciences ecosystem in a dynamic mixed-use district. The project would be part of a larger Citywide goal to develop 50,000 SF of lab/R&D space and 250,000 SF of office space for life sciences companies and related firms in the ecosystem.

The Dallas-Fort Worth metro area is poised to become one of the most important hubs in North America for life sciences innovation over the next decade, thanks in part to the recent selection of Dallas as the national HQ of Advanced Research Projects Agency for Health (ARPA- H) at Pegasus Park and the continued strength of University of Texas Southwestern (UTSW). UTSW accounts for roughly 1 percent of the region’s enrolled higher education students but represents more than one-half of the total academic R&D investments (with $700 million annually) Dallas is poised to benefit from the center of gravity that has intentionally been developed at Pegasus Park. Other communities around the region are starting to pay attention. The city of Plano is partnering with developers and life sciences companies (Reata Pharmaceuticals, in particular) to reimagine the former Electronic Data Systems (EDS) campus into a life sciences cluster. Fort Worth has focused investments on its Near Southside Medical Innovation District. With a focused effort to develop a life sciences complex in Irving, the City can capitalize on its existing strengths (including the presence of major life sciences companies ranging from McKesson to Caris Life Sciences) to play an essential part in the region’s ambitious goal of becoming a top-tier life sciences market.

Foster higher education and industry partnerships in Irving, better connecting the City with the regional and statewide innovation ecosystem.

There is tremendous momentum in research and innovation tied to research universities across North Texas. A decade ago, when Irving was first contemplating the creation of an economic development strategic plan, there were no R1 research institutions in North Texas 1 Now, the region has three: the University of North Texas (UNT in Denton), the University of Texas-Arlington (UT-Arlington) , and the University of Texas- Dallas (UTD) and all three are expanding rapidly. UNT is building a major new campus in Frisco UT-Arlington is investing heavily in Arlington (and Fort Worth) UTD is growing its presence in Richardson and in Dallas. UTD’s collaboration with UTSW Medical Center is a unique joint venture that will amplify the research strengths of both institutions in Dallas. And perhaps the most transformational higher education expansion project in the region is Texas A&M University’s (TAMU) new downtown Fort Worth campus that will bring multiple innovation assets from the TAMU system into the region, along with an expansion of the TAMU School of Law.

Irving would benefit from partnerships that link its businesses to the region’s growing research university ecosystem. An equally important opportunity for Irving is to expand higher education and industry partnerships among its existing institutions University of Dallas and Dallas College and the many corporations that call Irving home. Some university-industry collaborations already exist in Irving, but more can be done through efforts such as internships, career fairs, and capstone projects for students (such as the University of Dallas Satish & Yasmin Gupta College of Business Capstone Consulting Experience for MBA students)

Position Irving as the location of choice for global corporations to develop and implement new ideas, technologies, and business models, adding five new corporate R&D, technology, innovation, and venture capital centers with a total of 500 net new jobs through new marketing efforts and incentives to facilitate this goal.

The Dallas-Fort Worth metro area has more Fortune 1000 HQs than any region except New York And Irving is known as the Headquarters of Headquarters, with a higher concentration of HQs than any other city in the region (second only to Dallas in absolute number of HQs). Beyond HQs themselves, there is an equal and perhaps even more significant opportunity for expansion and recruitment of corporate innovation centers. This includes corporate R&D facilities, innovation hubs, technology centers, and venture capital/startup acquisition centers. In addition to attracting new corporate innovation facilities, Irving can position itself through business partnerships and innovation efforts as a location of choice for testing new technologies.

STRATEGIC INITIATIVES

1.1. Target industry recruitment. Continue recruiting companies to Irving, focusing on target industry sectors.

1.1.1. Concentrate the IEDP’s business recruitment efforts on six target industries representing a mix of established and emerging sectors for new investment and employment growth. (See Appendix B. Target Industry Intelligence for details about resources to support this effort )

1.1.2. Become a driver of corporate innovation by expanding beyond the attraction of headquarters to include corporate R&D centers, innovation hubs, and venture capital/startup investment centers.

1.1.3. Maintain and enhance Irving’s incentives for target industry recruitment.

1 The Carnegie Classification of Higher Education Institutions categorizes institutions in the US based on a uniform set of criteria, including their level of research activity. The R1 designation is awarded to doctoral universities exhibiting “very high research activity,” based on measures such as research spending, staff levels, and the number of doctorates awarded The Carnegie framework is currently under review. The American Council on Education, which helps manage the classifications, is developing significant revisions that will be made effective in 2025.

• Modernize economic impact tools to better estimate capital investment and tax base impacts from business expansion and recruitment projects.

• Prioritize City incentives for economic development projects based on capital investment and reinvesting in existing space.

1.2. Life sciences innovation. Support the creation of a life sciences complex in Irving with 25,000 SF of lab/R&D space and 125,000 SF of office space for innovative life sciences companies and related firms in the life sciences ecosystem in a dynamic mixed-use district, as part of a larger Citywide goal to develop 50,000 SF of lab/R&D space and 250,000 SF of office space for life sciences companies and related firms in the ecosystem.

1.2.1. Work with existing partners in Irving and the surrounding region to identify unmet needs in the region’s life sciences ecosystem and match those gaps with opportunities in Irving to meet them.

1.2.2. Form a task force of Irving life sciences companies that can serve as ambassadors to nurture growth in the target sector.

1.2.3. Visit other robust life sciences clusters (such as Boston, San Francisco, San Diego, Seattle, and Philadelphia) to learn lessons from successes and challenges in the development of their innovation ecosystems.

1.2.4. Actively participate in life sciences industry initiatives at the regional and state levels with partners , including the ARPA- H facility at Pegasus Park, UTSW, Bio North Texas (BioNTX), and the Texas Healthcare and Bioscience Institute.

1.2.5. Conduct a study of demand for real estate space in Irving and the surrounding area specific to the life science industry needs, including new lab/R&D space (including wet lab space) and other property types (including conversions of existing space and new construction)

• Review existing zoning and consider potential zoning changes as part of the study that may be necessary to satisfy demand for life science industry real estate space in Irving.

1.3. Higher education and industry partnerships. Lead an intentional effort to build on recent momentum in academic research, innovation, and technology development.

1.3.1. Support higher education and industry partnerships in Irving.

• Encourage partnerships among existing institutions, including the University of Dallas, Dallas College, the University of Texas (UT) System, the Texas Tech University (TTU) System, Medical City Las Colinas, Baylor Scott & White Medical Center, and others to advance R&D in Irving.

DETAILS: Texas A&M University’s expansion into downtown Fort Worth, the long-term vision for UNT’s Frisco campus, and UT MD Anderson Cancer Center’s $2 billion+ expansion into Austin in partnership with UT-Austin are some of the most ambitious ongoing university expansion projects in Texas. The guiding principle behind these and similar higher education expansions is a commitment to university-industry partnerships. These are case studies of major higher education expansions that Irving should review and apply lessons learned to pursue its own efforts to expand higher education and industry partnerships.

1.3.2. Support the alignment of academic programs with employer needs.

• Evaluate where gaps and opportunities exist within degree offerings at regional higher education institutions that align with industry needs (e.g., engineering, life sciences, artificial intelligence/ machine learning) and use this intelligence to inform campus expansion opportunities in Irving.

1.4. Business retention and expansion and corporate engagement Fuel the engine of Irving’s economy with continued and expanded emphasis on retaining and engaging existing companies.

1.4.1. Create a GILCCC committee to assist with BRE efforts.

1.4.2. Increase the current BRE program visitation target by 10 percent each year (the current target is 75 companies per year) by using both on-site visits and virtual engagement. This effort should be structured using guidelines such as the following

• Make a concerted BRE effort to engage the City’s top taxpaying entities and largest employers with regular visits.

• Prioritize BRE visits on companies in target sectors. Use intelligence gained from these sessions to inform recruitment activities.

1.4.3. Identify companies that are currently working with partners to address specific challenges, like workforce and permitting, and ensure they are on the visitation schedule Revisit the current incentives package to ensure they are tailored to the retention of existing companies.

• Emphasize incentives that support the retention of headquarters and international firms, establishments that are highly desirable and frequently targeted by competitors

• Prioritize incentives tied to the use of the Irving name by the company in press releases, letterhead, and other traditional and online communications channels.

• Continue and enhance business retention incentives for companies that make long-term commitments to remain in Irving

1.4.4. Empower corporate leadership through business engagement activities that help to build connections and expand communications channels. Potential initiatives include the following

• Reestablish CEO breakfasts and expand other existing communications channels among Irving business and community leaders.

• Create and maintain networking opportunities among corporate employers and small businesses to help them exchange knowledge and work together.

• Continue the GILCCC’s system of celebrating any new or expanding business in Irving that file a sales tax license with the Texas Comptroller of Public Accounts, so that a celebratory “thank you” package and message is sent to the business owner/manager. Extend the system so that whenever the City issues a certificate of occupancy, the GILCCC is notified and sends a similar celebratory package and message.

1.5. International business development Shine a bright light on existing international firms in Irving and leverage new opportunities for international business attraction and investment

1.5.1. Aim international business efforts toward three distinct yet overlapping audiences: (1) existing international companies in Irving and primary markets, such as North America (Canada and Mexico), Asia (Japan, China, India, and other Asian countries), Europe, and Australia; (2) existing international population of foreign-born residents primarily from Latin America, South Asia, and the Middle East; and (3) existing and new nonstop flight connections to major global business hubs through DFW Airport

1.5.2. Scale up the capacity of Irving’s international affairs efforts on three separate functional areas: (1) travel and global engagement: trade missions and travel to targeted foreign destinations and appropriate US-based international trade shows, with commitments to long-term relationship development with annual visits for multiple years; (2) hosting international business delegations from

geographic markets where target industry sectors are concentrated; and (3) research and intelligence to facilitate increased foreign direct investment (FDI) in Irving, international business attraction, and training/support for existing Irving companies doing business in foreign markets.

1.5.3. Engage the diverse landscape of ethnic, cultural, and international chambers of commerce and international business and cultural associations throughout North Texas and the state of Texas.

• Encourage the GILCCC to continue participation and collaboration with these organizations supporting Irving’s diverse domestic and international business community.

1.5.4. Strengthen existing relationships and cultivate new relationships between the IEDP and DFW Airport at all levels, including the airport’s executive team, its infrastructure and development team, and other executive team members.

• Partner with DFW Airport to pursue international business opportunities, promoting new and existing international nonstop flight destinations and major international cargo routes to expand relationships that lead to FDI.

DETAILS: The recently launched new nonstop flight to Sydney, Australia, has already been critical in Irving landing multiple Australian-based company expansion projects, such as Acquire BPO.

1.5.5. Evaluate the potential for establishing an international soft- landing center in Irving that could provide assistance (such as real estate, financial, and workforce support) for highgrowth international businesses new to the Dallas - Fort Worth metro area, Texas, and the US (See text box )

1.6. High-growth startups and entrepreneurial support. Create a fertile environment in Irving for the formation, attraction, and growth of startups and entrepreneurial firms.

1.6.1. Participate in Dallas-Fort Worth metro area entrepreneurship networks, angel and venture capital networks, startup incubators/accelerators, and technology workforce networks to identify business development opportunities for Irving

1.6.2. Launch a pitch competition inviting existing Irving startups and other high-growth potential startups from across the region, state, and internationally.

• Consider two tracks for the competition: (1) a traditional pitch event in which entrepreneurs present their companies, products, and technologies to a group of investors; and (2) a reverse pitch event that addresses corporate innovation needs

INTERNATIONAL SOFT-LANDING PROGRAMS

International soft- landing programs have been successful across the country. Examples include the following

• International Accelerator, a 12-month program based in Austin, Texas, aimed at foreign-born entrepreneurs, with an emphasis on early-stage technologydriven ventures

• OU INC, a SmartZone business accelerator representing a collaboration among Oakland University, the city of Rochester Hills, and the Michigan Economic Development Corporation

• Q-Branch , a global accelerator offering assistance to foreign entrepreneurs through its Texas Soft Landing Program and a network of economic development organizations and chambers of commerce

• Strong international offices in organizations like the Kentucky Cabinet for Economic Development and the Charlotte Regional Business Alliance

Source(s): TIP Strategies, Inc.

• Engage Irving’s major companies to explore reverse pitch approaches that present challenges facing existing companies and invite entrepreneurs to develop solutions.

• Start with a small pilot project that invites a group of major employers to present their most urgent unsolved problems in need of innovative solutions to a group of Irving entrepreneurs and investors.

1.6.3. Recruit venture capital, private equity firms, and other investors and financial services firms that pursue entrepreneurial companies and innovative technologies within Irving’s target industries.

1.6.4. Work with the ICVB and the Irving Convention Center to recruit conferences and events to Irving that can serve as deal-making and investment summits that bring together investor networks, startup founders, and other entrepreneurial ecosystem stakeholders to explore business development and collaboration opportunities.

1.6.5. Engage private sector partners through pilot projects for testing new technologies in Irving.

• Work with innovative companies, infrastructure providers, property owners, and other stakeholders to pilot new technologies that enhance mobility, physical infrastructure, and quality of life for residents, businesses, and visitors.

• Research technologies for potential pilot projects , including automation of systems, intelligent transportation (parking, transit, passenger vehicles, freight), energy efficiency, building systems (water, lighting, heating, ventilation, and air conditioning), and other needs.

1.7. Small business and M/WBE support. Cultivate Irving’s local business scene with expanded support for small businesses and minority/women-owned business enterprises (M/WBE).

1.7.1. Develop a clearinghouse of support systems for small businesses and entrepreneurs, including a more robust database of existing companies in Irving to be shared and updated across the IEDP and in collaboration with the Irving Hispanic Chamber (IHC)

• Formalize and institutionalize partnerships with small businesses and the City’s M/WBE programs.

• Work with the GILCCC, the IHC, and other partners to regularly showcase small businesses and tell stories of their success in Irving.

• Work with the GILCCC, the IHC, and other partners to continue and expand small business training and networking opportunities, including the potential creation of a small business bootcamp.

1.7.2. Promote the City’s small business resources (including the Small Business Resource Guide and the Minority and Women-Owned Business Enterprises Program Guide) in collaboration with partners , including the GILCCC, the IHC, and the ICVB.

• Conduct an annual review of the City’s small business resources, with input from partner organizations and small business owners, to ensure information is accurate, relevant, and effective.

• Study other city M/WBE programs to learn best practices and apply relevant approaches

1.7.3. Work with developers to be inclusive of small businesses in Irving as part of any new developments or redevelopment projects supported by the City.

1.7.4. Conduct regular reviews of permitting, development, and other relevant regulations with Irving’s economic development partners and relevant business leaders to ensure Citywide and districtspecific regulations are appropriately balanced with City and business interests.

• Pay close attention, as part of the reviews, to specific ordinances, such as alcohol and food sales that impact specific businesses.

GOAL 2. REINVENTION

By 2030, Irving will be recognized as a center for economic reinvention by advancing publicprivate partnerships to develop and upgrade Class A office space in Irving-Las Colinas, drive high-value industrial development in the Freeport area and Citywide, and revitalize legacy business districts across South Irving with new mixed-use development.

Real estate development is perhaps the best way to tell the story of the Dallas-Fort Worth metro area’s growth The development of sites and buildings in Irving is a central part of the region’s story over the past 50 years. Greenfield development, new master-planned subdivisions, and far-flung suburbs will continue to be an important part of the region’s future growth. But the next 50 years will depend increasingly on redevelopment and economic reinvention across the region’s mature cities. And Irving is, once again, poised to play a lead role in the next phase of growth as the North Texas region matures from a Sunbelt growth center to a leading international metropolis.

BOLD PROJECTS

Facilitate public-private partnerships (P3s) to upgrade existing offices and develop new space for a total of 500,000 SF of Class A office space in Irving.

The competition is fierce for major development and redevelopment projects in North Texas. From Panther Island in Fort Worth to Hall Park in Frisco, cities across the region are pursuing long-term public-private developments to attract the next generation of companies and talent. The uncertainties facing the future of commercial office space in the wake of the pandemic recovery are a challenge, complicating development projects , especially in established business districts that have a high concentration of office space and corporate employers. However, the future clearly favors modern, trophy Class A properties with amenities and walkability over aging Class B and C properties. The opportunity for Irving is to balance reinvestment and upgrades to existing office space (to maintain or upgrade its Class A features) and to continue developing new sites for major corporations.

Support the revival of the Freeport area through the creation of a master plan for the district as part of a larger Citywide goal for attracting new investment into existing industrial areas.

Industrial development projects in the Freeport area would feature a minimum of $125 million of new capital investment by 2030. Reinvestment in the Freeport area would be part of a larger Citywide goal to attract $250 million of capital investment from industrial development across all of Irving’s existing industrial districts.

Irving’s central location is not only a strength for accessing the region’s labor force for major corporate and professional services firms but it’s also a strength for high-value industrial employers. Irving sits at the nexus of the region’s transportation network and is equidistant to the region’s most significant industrial/freight hubs, including AllianceTexas in far north Fort Worth and southern Denton County and the International Inland Port of Dallas in southern Dallas County. Irving’s central location, access to highway transportation, and location adjacent to DFW Airport make it an ideal option for advanced manufacturing and innovative industrial companies. The Freeport area, with its immediate access to DFW Airport, is well-situated to attract high-value industrial projects. The district already is home to dozens of major employers in the advanced manufacturing, aerospace, and logistics industries. However, the roads and other public infrastructure and common areas (landscaping and green space) are in dire need of improvement to retain existing companies and attract a new wave of industrial investment projects.

Engage in P3s to create a total of 250,000 SF of new vertical mixed-use space in South Irving, especially at key sites, including the Heritage District, Plymouth Park, and the Irving Mall.

Revitalization efforts across South Irving have achieved mixed results over the past couple of decades. Similar urban revitalization efforts and Main Street development projects across North Texas have led to the creation of vibrant mixed-use districts. While the development drivers in every walkable urban district vary based on nearby assets and market dynamics, the common themes include a long-term focus, P3s to kickstart private development, and a commitment to density, walkability, and vertical mixed-use projects. Three major districts Heritage District, Plymouth Park, and the Irving Mall provide opportunities for broader revitalization of South Irving. With a focused program of City- led mixed-use development projects, these areas are poised to catalyze a sustainable wave of revitalization

STRATEGIC INITIATIVES

2.1. High-profile sites and districts. Position Irving’s high-profile sites and major redevelopment areas for new commercial and mixed-use development.

2.1.1. Planned Unit Development (PUD) 6 area. Attract a global destination in the PUD 6 area (including the former Texas Stadium site), setting the stage for a 50-year vision of the district with a greater amount of investment, jobs, and tax base than the Las Colinas Urban Center. (See Initiative 3.1.1 under Goal 3. Placemaking for more detail.)

2.1.2. Former ExxonMobil HQ site. Set an ambitious long-term vision for the former ExxonMobil HQ site to become a high-density, mixed-use destination with Class A space for major corporations, life sciences innovation space, hotels, entertainment and visitor attractions, mixed-use residential highrise development, and other uses.

• Work with new owners of the property to position the site for corporate HQs and other uses.

• Support efforts to create a master plan for the property that incorporates a rich mixture of uses not just another corporate office surrounded by multifamily complexes to develop true walkability, including enhanced connectivity to other key sites, including the Las Colinas Urban Center and the Verizon site

2.1.3. Las Colinas Urban Center. Position the Las Colinas Urban Center as a premier mixed-use business and entertainment district. (See Initiatives 2.2 and 2.5 under Goal 2. Reinvention and Initiative 3.2 under Goal 3. Placemaking for more detail )

• Incentivize development of true high-rise (10–20+ stories) Class A residential in and around the Las Colinas Urban Center to jump-start the high-rise residential market in the area.

• Encourage high-rise construction projects in and around the Las Colinas Urban Center that incorporate structured parking to design parking components in a manner that they can be converted in the future to a non-parking use (such as residential, hotel, or office space).

DETAILS: Real estate development projects are often financed over a 20–30-year period, a timeframe that is likely to include the widespread deployment of autonomous vehicles With this convergence in mind, forward-looking developers are questioning the financial feasibility of continuing to build parking garages based on historical usage patterns. Rather than treating resilience and adaptive reuse as an afterthought, a growing number of high-rise developments are incorporating innovative parking garage designs that can be easily converted into office space, residential, or other uses in the future.

2.1.4. Freeport area Position the Freeport area in Irving as the premier high-value industrial district in North Texas. (See Initiatives 2.4 and 2.8.2 under Goal 2. Reinvention for more detail.)

2.1.5. Verizon site. Work with developers, investors, major companies, and other stakeholders to advance the vision of the Verizon site as a premier corporate office and mixed-use district similar to the original plans unveiled several years ago by Verizon.

• Continue to advance opportunities in the district for high-density, walkable, mixed -use development, including new high-rise urban residential development in the district.

• Explore options for greater connectivity such as a pedestrian/bicycle bridge between the Verizon site and the Las Colinas Urban Center, especially the Irving Convention Center and the Toyota Music Factory.

• Work to position the roughly 25-acre site adjacent to the Verizon site, Green Park Drive, the Dallas Area Rapid Transit (DART) Orange Line, and the State Highway (SH) 114 access road as an ideal site for new development that can serve as a connector and complement to surrounding districts.

2.1.6. Heritage District. Advance efforts to transition the Heritage District from a quaint, low-density historic district into a higher density, more walkable urban district with a diverse and growing mix of creative businesses and residents.

• Establish a downtown public improvement district or a business improvement district.

DETAILS: Evaluate existing models of downtown organizations , such as the Downtown Arlington Management Corporation, the Garland Downtown Business Association, McKinney Main Street, Historic Downtown Grapevine, Historic Downtown Carrollton, and others.

• Encourage Dallas County, the North Central Texas Council of Governments (NCTCOG), and the Texas Department of Transportation (TXDOT) to cost share for a redesign and reconstruction of 2nd Street through downtown Irving so that it matches the new Complete Streets quality design of Irving Boulevard.

• Work with property owners in the Heritage District, especially along Irving Boulevard and 2nd Street, to redevelop and revitalize properties with higher-value, more dense development, including mixed-use projects.

• Use City redevelopment efforts to acquire and land bank properties along East Irving Boulevard and East 2nd Street between Britain Road and Loop 12 with the long-term goal of redeveloping properties along the corridor with more dense, walkable, mixed-use development.

• Launch a real estate working group hosted by the IEDP for developers, property owners, and real estate professionals to work collaboratively and share information regarding redevelopment opportunities that increase the value of sites and buildings.

DETAILS: This initiative should not be limited to the Heritage District It should be a Citywide group that meets regularly (quarterly or a similar interval).

2.1.7. Plymouth Park Work to redevelop the Plymouth Park area, with the cooperation of ownership, as a lively mixed-use business district, including new mixed-income housing, employment, retail/restaurant space, and other amenities to serve South Irving and jump-start broader revitalization efforts across the area

• Support redevelopment efforts of the Plymouth Park area with the roughly 35-acre site at the northwest corner of West Irving Boulevard and North Story Road.

• Identify multiple anchor employment uses that would provide hundreds of daytime jobs and up to 50,000–100,000 SF of Class A office space as part of a new mixed-use development project.

DETAILS: Ideally, a single large employer or mix of midsize and smaller private employers would occupy office space in these new mixed-use projects. H owever, the Plymouth Park area in particular and South Irving in general is an unproven commercial office market as compared to Las Colinas. In order to create a vibrant mix of uses in the district, it may be necessary to pursue public or quasipublic anchor employers to fill the office space, including Irving Independent School District (ISD), Dallas County, administrative offices for healthcare organizations, nonprofit organizations, and similar entities.

2.1.8. Irving Mall. Reimagine the Irving Mall area as a vibrant international shopping and entertainment district, with more walkable development, including mixed-use housing components. (See Initiative 3.2.3 under Goal 3 Placemaking for more detail.)

• Pilot a buy local program in partnership with the GILCCC, the IHC, and the City to support small retail/restaurant businesses and other M/WBEs in Irving and work with the Irving Mall as a potential partner to showcase small businesses in Irving.

DETAILS: Pasadena Loves Local is a good example of a Texas city with a buy local program supporting small businesses through a collaboration between the Pasadena Economic Development Corporation, the Pasadena Chamber of Commerce, and the city of Pasadena.

• Partner with Irving Mall and surrounding property owners to redevelop portions of large surface parking lots with mixed-use development, including retail/restaurant space , housing, and other amenities.

• Invest in new transportation connectivity and green spaces (bicycle paths, trails, pocket parks) to better connect the site to surrounding neighborhoods and commercial areas.

• Work with TXDOT and other partners to redevelop the interchange of SH 356 and SH 183 and Belt Line Road to remove space from the highway footprint and create new land for development in the Irving Mall area on all corners of the current interchange. Explore the potential for a deck park spanning across SH 183 to provide greater connectivity.

2.2. Commercial office development and reinvestment. Create new Class A commercial office space by collaborating with private landowners to upgrade existing commercial office space.

2.2.1. Encourage and support office redevelopment opportunities across Irving.

• Review the Williams Square revitalization project and Vistra’s new HQ as examples of successful P3 office reinvestment projects. Use similar approaches to upgrade other office properties.

2.2.2. Continue using Chapter 380 agreements to reinvest in existing vacant and underutilized major commercial office buildings in partnership with private landowners.

• Use lessons learned from the successful application of City rebates for the redevelopment of the 400,000 SF former EDS building to retain the Vistra HQ, including a new parking garage, to inspire similar P3 reinvestment projects across Irving.

2.2.3. Create new incentives to renovate aging commercial office space.

• Create incentives for reinvestment in existing mid-rise and high-rise office structures. On a caseby-case basis, consider incentivizing conversion of aging commercial office space into other uses, such as high-rise residential.

• Create incentives for teardown and reconstruction with higher-value and higher-density development for existing lower-density, low- rise, and lower-quality office space (Class B or C properties). Similar incentives should be used for redevelopment of aging limited-purpose hotels, aging low-rise multifamily sites, aging retail centers, and similar properties. (See Initiatives 2.3, 2.4, 2.5, and 3.3 )

2.3. Targeted retail recruitment, development, and reinvestment. Recruit new retailers into the Irving market, develop new retail space, and reinvest in existing retail space, using P3 approaches throughout Irving

2.3.1. Recruit high-value anchor tenants (e.g., top-tier retailers like Costco and Apple Stores that have a loyal following) into major retail/entertainment complexes to help revitalize struggling shopping centers and/or amplify the success of more dynamic retail destinations.

2.3.2. Regularly attend and actively participate in the International Council of Shopping Centers (ICSC) trade shows in North Texas and Las Vegas to cultivate relationships with retailers, restaurant management groups, and retail developers

• Partner with local landowners to showcase Irving at ICSC and similar retail trade shows.

2.3.3. Evaluate data subscriptions that assist with retail/restaurant recruitment. (See Implementation and Resources section for more detail.)

2.4. High-value industrial developments Encourage high-value development, redevelopment, and major renovations of industrial buildings in Irving’s existing industrial areas.

2.4.1. Position the Freeport area in Irving as the premier high-value industrial district in North Texas.

• Support the revival of the Freeport area, including the potential reconstitution of the Freeport Property Owners Association to invest in common area maintenance and landscaping

• Support the creation of a master plan (or a small area development plan) for the Freeport area to guide infrastructure, redevelopment, placemaking, and other investments.

2.4.2. Capitalize on Irving’s proximity to DFW Airport with industrial development and related business development opportunities.

• Identify and pursue industrial development opportunities to house companies that would benefit from an airport-adjacent location but might not be able to (or would prefer not to) lease space directly from the airport.

• Work with DFW Airport and other partners to make enhancements to major transportation corridors leading to/from the airport.

2.4.3. Identify sites for potential redevelopment as multistory warehouse buildings to create the most advanced, modern industrial logistics/distribution space in the Dallas-Fort Worth metro area, while minimizing sprawl and land consumption and maximizing the valuable real estate footprint and existing infrastructure in the Freeport area.

2.5. Redevelopment of aging multifamily properties. Accelerate redevelopment efforts across Irving to phase out older apartment complexes dominated by low-rise and low-value structures and replace them with modern mid-rise and high-rise structures with a diverse housing stock and a vibrant mix of commercial uses.

2.5.1. Prioritize demolition and higher-density redevelopment of the oldest and lowest- quality apartment complexes, starting with aging properties constructed in the 1960s and 1970s (and possibly 1980s) throughout much of the City

• Create new incentives to encourage landowners to redevelop properties with newer housing and a mix of commercial uses and employment space

• Actively enforce existing code restrictions and public health/safety regulations to force absentee landlords to provide fair and safe housing.

2.5.2. Conduct planning and design workshops with area real estate professionals, architects, and design professionals to come up with long-range redevelopment scenarios for the large number of multifamily properties constructed across Irving in the past few decades

• Conduct design scenarios based on two broad categories of multifamily properties: (1) the largely two- and three-story garden apartments built across much of Las Colinas primarily in the 1980s, 1990s, and into the early 2000s; and (2) the more recently built four- and five-story apartment buildings constructed primarily in the Las Colinas Urban Center since the mid-2000s, including the properties surrounding Lake Carolyn.

• Consider redevelopment options for the largely residential areas dominated by low-rise apartments, with a variety of mid-rise structures and a diverse set of housing options and space for commercial uses

• Explore ambitious redevelopment options for the most well-located properties (those along major arterial roads and surrounding Lake Carolyn) currently occupied with four- and five-story apartments, including complete demolition of existing space for construction of high-rise and possibly even skyscrapers. New development could include a wider mix of uses beyond more rental housing and should consider condominiums, Class A office, and upscale hotels, along with flexible ground-floor space suitable for retailers and restaurants

DETAILS: Now that the final lakefront property adjacent to Lake Carolyn has been developed (The Mustang apartment building scheduled for completion in 2024 adjacent to the Levy Event Plaza), the time to plan for the long-term future of the Las Colinas Urban Center has arrived. With no new vacant properties available in the district, any future growth will come in the form of reinvestment, redevelopment, teardowns, and higher-density new construction.

2.6. Reinvestment in neighborhood housing stock. Encourage reinvestment in existing single-family housing stock throughout Irving’s neighborhoods.

2.6.1. Increase the number of owner-occupied housing units in existing neighborhoods, providing incentives that increase opportunities for existing renters to become homeowners

2.6.2. Incorporate the recommendations from the City of Irving Housing Plan 2021 into the City’s economic development efforts and other planning and real estate development initiatives.

2.6.3. Work with landowners and real estate developers to create missing middle housing units that provide families with ownership options for moderately sized homes that are more affordable than a standalone single-family home on a large lot.

2.6.4. Create a neighborhood empowerment zone (NEZ) program to incentivize redevelopment in targeted areas of Irving.

• Review the NEZ policies for the cities of Dallas and Fort Worth as models.

• Use the NEZ to incentivize housing reinvestment in existing single-family housing stock across South Irving.

2.6.5. Identify sites for executive housing development to build large, luxury homes desired by CEOs and corporate management team members to encourage them to live in Irving.

2.7. Land banking and site prep for future development. Identify and acquire properties for future development and work with private landowners to support higher-value redevelopment across South Irving and Citywide.

2.7.1. Tap into mixed-use redevelopment opportunities by utilizing City- owned and land banked properties and P3 projects for key sites

2.7.2. Work with property owners and relevant City departments to identify sites for flood mitigation and new commercial/industrial development.

• Conduct site analysis and civil engineering work to identify opportunities for removing land from the floodplain in South Irving along Hunter Ferrell Road and Loop 12 to create new sites for industrial flex, manufacturing, and warehouse/distribution space.

• Invest in the Hunter Ferrell Road corridor to make that the primary east/west truck route in South Irving, as opposed to the currently used Shady Grove Road, and to increase its appeal for adjacent industrial development.

2.7.3. Work with landowners and the real estate community to create mixed-use development opportunities along Shady Grove Road near the Irving Golf Club that take advantage of upland views of the Dallas skyline above the West Fork and the Elm Fork of the Trinity River.

• Use the Trinity Groves and Bishop Arts areas in Dallas overlooking the Trinity River and the areas near downtown Fort Worth along the West Fork of the Trinity River as comparable areas with similar viewshed opportunities and development constraints.

2.7.4. Conduct regular engagement with neighborhood groups and local organizations in South Irving to provide a forum for discussing economic development needs in South Irving, including redevelopment opportunities that provide more amenities for residents and grow the customer base for businesses.

2.7.5. Maintain the City’s competitive advantage of speed, a customer-centric service, efficiency, and quick turnaround time for permitting, inspections, and other development review functions.

• Promote Irving’s superior permitting/inspections/development review processes to the area real estate community.

2.7.6. Conduct a Citywide review of ordinances that impact redevelopment.

• Streamline development review process where appropriate. For example, variances currently require special zoning cases approved by the City Council. Make variances more consistent, predictable, and efficient by running the process through the Zoning Board of Adjustment, only sending complex or special cases to Council.

• Review City ordinances in specific districts targeted for new development/redevelopment, including areas that have not seen significant new private sector driven development to identify and remove barriers to construction and redevelopment.

• Consider a Citywide regulatory change to move away from mandatory minimum parking requirements and allow developers to decide how much parking is necessary based on specific uses, market conditions, and shared parking agreements with adjacent properties.

DETAILS: The city of Austin recently removed all citywide mandatory minimum parking requirements after a successful multiyear pilot program of a removal of minimum parking requirements in the downtown area. Other cities around the US are pursuing similar overhauls of their parking regulations to reduce the overbuilding of parking that has resulted in an inefficient use of land across many cities over the past several decades. Irving should consider a similar change, perhaps starting with a pilot project for new parking regulations in one or more specific districts, such as the Las Colinas Urban Center, the Heritage District, near rail stations, or another high-profile development area.

2.8. Infrastructure investment. Work across City departments to support ongoing efforts to maintain and enhance Irving’s economic competitiveness through sound investments in essential infrastructure and amenities desired by residents and businesses.

2.8.1. Work with City departments to highlight and promote Irving’s superior City infrastructure (especially the City’s current and future water supply) and its efforts to improve existing infrastructure (such as the Road to the Future efforts to reinvest in transportation infrastructure).

• Support City efforts to maintain and promote Irving’s cost advantage as having one of the lowest water and wastewater rates for commercial and residential customers in the entire Dallas-Fort Worth metro area.

• Continue efforts to improve broadband internet infrastructure and access across the entire City.

• Continue and expand Irving’s Drainage Solutions for a Better Tomorrow initiative to improve stormwater management throughout the City.

• Leverage Irving’s status as one of the largest DART member cities to improve transit service across Irving.

2.8.2. Continue and expand Irving’s Road to the Future effort to reconstruct heavily used roads throughout the City.

• Focus near- term expansion of the Road to the Future investments in the Freeport area where many roads have deteriorated to the point where current conditions drive existing and potential business investment away from Irving and into surrounding cities.

• Work with economic development partners to ensure major roads serving key commercial and industrial areas receive proper attention for reconstruction, repaving, and repair.

2.8.3. Prepare for the SH 114 $1 billion+, seven-mile reconstruction and expansion project between International Parkway and Riverside Drive through the heart of Las Colinas in Irving.

• Advocate to TXDOT for gateway signage, landscaping at integral interchanges, bridges, and overpasses.

• Work with property owners and businesses along the corridor to minimize disruptions from the project.

2.8.4. Work with relevant City departments, external partners, landowners, business owners, and real estate developers to provide clear, consistent messaging regarding any changes, additions, or new/revised policies affecting development and redevelopment in Irving.

2.8.5. Plan and implement a network of vertiports (transit hubs for electric vertical take- off and landing eVTOL vehicles) across Irving to advance the connectivity among high-profile districts with a new mode of innovative mobility solutions.

• Evaluate options for a central vertiport adjacent to the Irving Convention Center and the Toyota Music Factory as the initial and central vertiport hub in Irving.

• Evaluate additional vertiport sites across the Las Colinas Urban Center, the Verizon site, the former ExxonMobil HQ site, the PUD 6 area, and other sites across Irving-Las Colinas and South Irving.

2.8.6. Work with transportation innovation companies and transportation infrastructure partners (including DART, NCTCOG, TXDOT, and DFW Airport) to evaluate the potential for new innovative mobility solutions in Irving, such as drone delivery systems and vertiports.

DETAILS: In early 2023, Ferrovial Vertiports announced Irving as the location for its global headquarters. Later that year, the city of Arlington and DFW Airport announced a partnership with an urban air mobility (UAM) company to advance vertiport development. Arlington plans to offer air taxi service by the 2026 FIFA World Cup. Other companies in the region, such as Boeing and Bell (in Fort Worth and Arlington) are investing in UAM solutions and eVTOL vehicle development. Walmart has launched drone delivery of retail products to homes in Frisco and Lewisville. With the growing interest across North Texas in UAM and eVTOL vehicles, Irving can leverage its central location and high-profile sites for greater connectivity within the community and to the surrounding region.

GOAL 3. PLACEMAKING

By 2030, Irving will be recognized as a center for placemaking by targeting a global destination and unique attractors that drive growth for the entire region.

Irving needs to upgrade its amenities to better serve all existing residents, workers, and visitors. However, the two demographics requiring special attention are families and young professionals Other cities in the area feature a much more robust set of entertainment offerings, retail options, and other amenities for young adults and for families with children.

BOLD PROJECTS

Attract a global destination in the PUD 6 area, setting the stage for a 50 -year vision of the district generating a greater amount of investment, jobs, and tax base than the Las Colinas Urban Center.

Cities across North Texas are creating vibrant entertainment offerings that draw business and leisure visitors away from Irving. Dallas and Fort Worth are investing heavily in their downtown convention centers and nearby urban districts. Arlington, Frisco, and Grand Prairie are adding major new sports and entertainment destinations. Irving has also invested in new entertainment offerings, most notably the Toyota Music Factory and Entertainment Center. Continued investment in existing amenities will be important, but Irving has a chance to create a one-of-a-kind destination in the PUD 6 area. The district, including the former Texas Stadium site (the 80-acre Parcel D site owned by the City), represents one of the most exciting redevelopment opportunities in the US The district will take decades to redevelop, but the next five years are critical for determining the future of the district and its impact on the future growth for the entire City Patience and strategic intention will be necessary for Irving to attract a global destination that can compete with attractions in New York, Dubai, Singapore, and Macau

Create an international culinary destination leveraging Irving’s diverse population with a major initiative that showcases the City’s global diversity and multitude of cultures.

Food halls and culinary destinations have opened in recent years from The Collective Kitchens + Cocktails in Oklahoma City to the Assembly Food Hall in Nash ville. These new destinations complement dozens of established culinary meccas from Grand Central Market in Los Angeles to Reading Terminal Market in Philadelphia that have experienced a resurgence as central gathering places .

Irving should celebrate its international population with a new culinary initiative that highlights its cultural diversity, or that capitalizes on its cultural diversity where it lives with distinctive positioning that touts that diversity This could be a bricks - and - mortar food hall development, should an appropriate location be available, but there may also be an opportunity to work with retail center property owners to create a literal intersection where a world of vendors can coexist. Patel Brothers , a South Asian grocer with a national presence, has two locations in Irving , and there are a number of other similar specialty markets throughout the City, including the northwest corner of O’Connor Road and SH 183 , which features South Asian and Latin American markets. More opportunities exist for internationally inspired culinary attraction s across Irving.

Pursue one or more freeway deck park caps at high-visibility locations linking major development sites in Irving. Texas communities have increasingly turned to deck parks as a strategy for connecting neighborhoods divided by interstate highways constructed decades ago. Spanning three blocks above the Woodall Rodgers Freeway, Klyde Warren Park links downtown Dallas to Uptown. The proposed Southern Gateway Park will span I-35E in Dallas between Ewing and Marsalis Avenues. McKinney has approved plans for up to $45 million in funding from the city, NCTCOG, and TXDOT for a deck park along SH 5 to connect its historic downtown with the new City Hall complex, part of a mixed-use development area to the east. Austin has been exploring several options for deck parks reconnecting downtown to East Austin as part of the I-35 expansion. Outside of Texas, highway deck parks are an increasingly attractive response to the urban design and development challenges facing cities with major highways running through dense development districts. Several non-Texas examples include Margaret T. Hance Park and the Japanese Friendship Garden of Phoenix spanning I-10 linking downtown Phoenix to Midtown; Teralta Park spanning I-15 in San Diego; the Kansas City Convention Center that spans I-670 in downtown Kansas City; and the Washington State Convention Center and Freeway Park spanning I-5 in downtown Seattle, linking it with the Capital Hill neighborhood. Irving should explore opportunities along its major highway corridors especially in the PUD 6 area to pursue long-term plans for deck park caps that stitch together major development districts otherwise separated by highway traffic. Potential funding sources for deck parks include state and federal transportation dollars along with private and philanthropic funds. In addition, depending on the ultimate use of a freeway cap, the newly available space itself could serve as a significant funding source if the cap includes space for commercial real estate, such as commercial offices, hotels, retail, restaurants, or entertainment venues

STRATEGIC INITIATIVES

3.1. New destination development. Attract a global destination in the PUD 6 area that draws in visitors and workers, serves as an economic engine for the Dallas- Fort Worth metro area, and develops new attractors across Irving

3.1.1. Work with the new and current landowners in the PUD 6 area to create a new vision and new standards for the area to be a true destination-based redevelopment district anchored by one or more national and international attractions.

• Pursue global entertainment venues and visitor destinations that would put Irving (and the surrounding region) in the same league as New York, Dubai, and other great business and leisure destinations of the world.

• Work with landowners to create high-density urban mixed-use development as a supporting use, not the primary use on the City- owned 80 acres (Parcel D) and the adjacent larger site across from SH 114 (Parcel A). The supporting uses should be comparable to the newest Class A mixed-use development projects across the region, such as the recent additions to the Las Colinas Urban Center, Uptown Dallas, Cypress Waters, Frisco Station, and Legacy West in Plano.

• Pursue major new retail destination anchored development as another supporting use once a global visitor attraction is recruited.

• Engage a professional real estate services firm to market a request for expressions of interest or a request for proposals for the City-owned Parcel D site in the PUD 6 area.

• Pursue a deck park cap between sites D and A in PUD 6 area connecting the former stadium site to the larger site across SH 114 (John W. Carpenter Freeway).

• Partner with TXDOT to serve as an ally around these ideas

• Rebrand the PUD 6 area over time based on the anchor development projects that give the area a distinctive identity to ensure the district and its various components amplify Irving’s brand and raise the City’s profile as a premier economic driver within the Dallas-Fort Worth metro area and the central US.

3.1.2. Create an international culinary destination , leveraging Irving’s diverse population with a major initiative that showcases the City’s global diversity and multitude of cultures.

• Consider in corporating a food test kitchen incubator as part of the culinary destination , similar to the early phases of the Trinity Groves development in Dallas that has evolved into a diverse culinary/entertainment district.

DETAILS: An example of a successful food incubator is the Louisiana State University (LSU) AgCenter Food Innovation Institute in Baton Rouge, a resource center where entrepreneurs can start a food business, process foods, receive technical and marketing assistance, and benefit from expert advice and research on food safety and food sustainability.

3.1.3. Evaluate strategically and appropriately located sites to develop or incentivize a unique amenity, such as a brewery/distillery with food trucks, live music space, and family-friendly recreational space.

• Identify sites in South Irving and in Las Colinas for developments anchored by a brewery/distillery.

• Identify and recruit craft breweries or distilleries looking for an expansion or relocation, particularly any that are based outside of North America to build on Irving’s diverse international appeal

3.1.4. Identify and recruit distinctive experiential attractors that are not saturating the US marketplace and that Irving can provide with appropriate appeal and sites.

3.2. Greater attraction capacity for existing amenities. Build attraction capacity in Irving-Las Colinas and leverage existing assets (Mandalay Canal, Trinity River, Lake Carolyn, Toyota Music Factory, Area Personal Transit System, Water Street).

3.2.1. Capitalize on the City’s $30 million investment, in collaboration with Brookfield, to reposition the Toyota Music Factory and Entertainment Center as a premier mixed-use event space

• Encourage a much higher level of active programming at the reimagined Toyota Music Factory and Entertainment Center.

DETAILS: Examples of entertainment districts with superb programming with events and activities for a diverse range of visitors (families, kids, young adults) include the Star in Frisco; Klyde Warren Park in Dallas ; and the Titletown District in Green Bay, Wisconsin, adjacent to Lambeau Field and owned by the Green Bay Packers football team.

3.2.2. Reactivate the Mandalay Canal area to encourage walkability and accessibility both day and night.

3.2.3. Establish one or more international districts in Irving and promote these new amenities, along with existing areas that function in this capacity (See text box )

DETAILS: If New York City can claim nine Chinatowns, the Dallas-Fort Worth metro area can sustain multiple international districts. The city of Dallas is advancing a vision for the redevelopment of the Valley View Mall as the new Dallas International District, a site that is equidistant between the Dallas-Fort Worth Chinatown in Richardson and the Dallas Koreatown. Irving already has two districts that function as international districts: Las Colinas with its large concentration of international companies and an unofficial international food mile along Belt Line Road with an impressive array of ethnic food offerings. By continuing the corridor westward into Irving and to DFW Airport, this area could become known as the premier international district corridor of North Texas spanning multiple cities.

3.2.4. Work with the Dallas County Utility & Reclamation District (DCURD) and NCTCOG to repurpose the Area Personal Transit (APT ) System in the Las Colinas Urban Center. (NCTCOG has authorized a $1 million grant for engineering a modern relaunched system )

• Incorporate new autonomous vehicle technologies in the relaunch.

INTERNATIONAL DISTRICT PLANNING

Irving already has two areas that effectively function as international districts : Las Colinas with its concentration of international companies and the array of ethnic food offerings along Belt Line Road. Efforts to expand on these de facto districts should consider the following.

• Mix of uses. Future districts could include space for food, entertainment, cultural attractions, major companies (such as North American HQs of foreignbased firms), and an international softlanding center for high-growth startups and small tech firms expanding into the US. (See text box, page 9.)

• Potential sites. Areas in Irving that could be rebranded and developed as international districts include the area around Irving Mall, portions of the PUD 6 area, and portions of Las Colinas.

• Branding As part of its recently concluded brand studies, the ICVB has evaluated the concept of a unifying graphics campaign that would potentially include elements such as signage, window stickers, street sign toppers, and a literal or figurative trail that showcases the “Irving Flavorhood ”

Source(s): TIP Strategies, Inc.

• Create smart city innovation challenges associated with the APT relaunch.

• Work with DCURD, NCTCOG, and other partners to identify other funding sources to sustain the APT System after the engineering work is completed.

• Consider alternative uses such as a green roof overhead park and trail network similar to the High Line in New York of the APT System as part of long-term plans for its use

3.2.5. Work with the City’s Parks and Recreation Department and ICVB to attract more non-local youth sports tournaments to soccer, baseball, softball, and other ballfields in Irving.

DETAILS: The Rockford, Illinois, Park District has created a model where local youth sports organizations have priority usage rights for ballfields and other sports facilities Monday through Thursday, while weekends (Friday through Sunday) are prioritized for out-of-town visitors coming into the region for tournaments. They have also repurposed dilapidated warehouses and decaying real estate in partnership with community investors to convert these facilities into year- round tournament venues. Irving should evaluate models like this to balance the needs of residents while generating additional operating revenues through tournament rentals, which will in turn drive greater weekend economic activity at Irving hotels, restaurants, and retailers.

• Conduct a study for untapped niche sports markets nationally, in Texas, and in the Dallas-Fort Worth metro area. For example, there may be an unmet need for inclusive sports programs for children who are differently abled or children with neurodivergent needs.