Ended September 30, 2023

Ended September 30, 2023

One of the most impressive things about the City of Irving is the people who work on behalf of the city and their passion for excellence. From the elected officials and city employees to the Irving Convention Center and Visitors Bureau, Irving Arts Center and the city's two Chambers of Commerce, everyone works hard to make Irving an outstanding community to live, work and play.

Building relationships with businesses that invest in Irving is also key to our success. Companies like Christus Health and Wells Fargo spend years planning and working with various city teams to make sure the development of their corporate office complexes suit both the city and organization’s needs. These partnerships are another example of the commitment people make to better our community.

Maintaining infrastructure and amenities are key to Irving’s quality of life. The city continues to make investments in drainage, roads and recreational opportunities to meet the needs of our community. Over the past five years, the city has improved over 72 miles of roadways and has entered phase two of the Road to the Future program that invests $200 million on road improvements in 10 years. In Fiscal Year 2022-23, the city also committed to elevating aquatics and recreation in Irving by making improvements to several facilities, including building a new outdoor pool at Lee Park, a new indoor pool at Senter Park and a Multi-Generational Community, Recreation and Aquatic Center at Mustang Park.

The city’s Annual Report is full of great information about Irving, and I hope you enjoy learning more about our fantastic city!

Richard H. Stopfer Mayor

Richard H. Stopfer Mayor

The City of Irving is governed by a council-manager form of government where the City Council sets city policy and the City Manager is responsible for implementing that policy and managing city operations.

The council consists of a mayor and eight council members who are elected for three-year terms. Elected officials are under a mixed system, which includes three at-large districts (Mayor, place 2 and 8), and six singlemember districts (places 1, 3, 4, 5, 6 and 7).

Email Mayor and City Council Members CCouncil@cityofirving.org

Irving City Council meetings are typically held on designated Thursdays at 7 p.m. in the Council Chambers at Irving City Hall, 825 W. Irving Blvd.

Work Sessions are held prior to council meetings and begin at various times depending on the agenda. Work Sessions are open to the public in the first floor Council Conference Room at Irving City Hall, 825 W. Irving Blvd. Check specific meeting agendas to confirm start times.

Meetings are streamed live at ICTN.tv and on local cable channels. On-demand meeting archives are available at CityofIrving.org/ICTN-on-Demand or ICTN.tv.

Founded in 1903 and Incorporated in 1914

2,499 Full-Time-Equivalent City Employees

21 Appointed Boards, Commissions and Committees with Almost 200 Irving Residents Serving Various Volunteer Functions Irving is located in the Heart of North Texas & Home to One of the Most Diverse ZIP Codes in the Nation – 75038

SCAN ME

SCAN ME

The financial data highlighted in the Popular Annual Financial Report (PAFR) is designed to provide a summary view of the city’s financial activities for Fiscal Year 2022-23 (FY23). Information included in this report can be found in greater detail in the FY23 Annual Comprehensive Financial Report (ACFR) located at

CityofIrving.org/ACFR

or by contacting Financial Services by mail at 825 W. Irving Blvd., Irving, TX 75060 or by phone at (972) 721-2401. The financial report was prepared in accordance with Generally Accepted Accounting Principles (GAAP) and was audited by the independent certified public accounting firm Weaver and Tidwell, L.L.P.

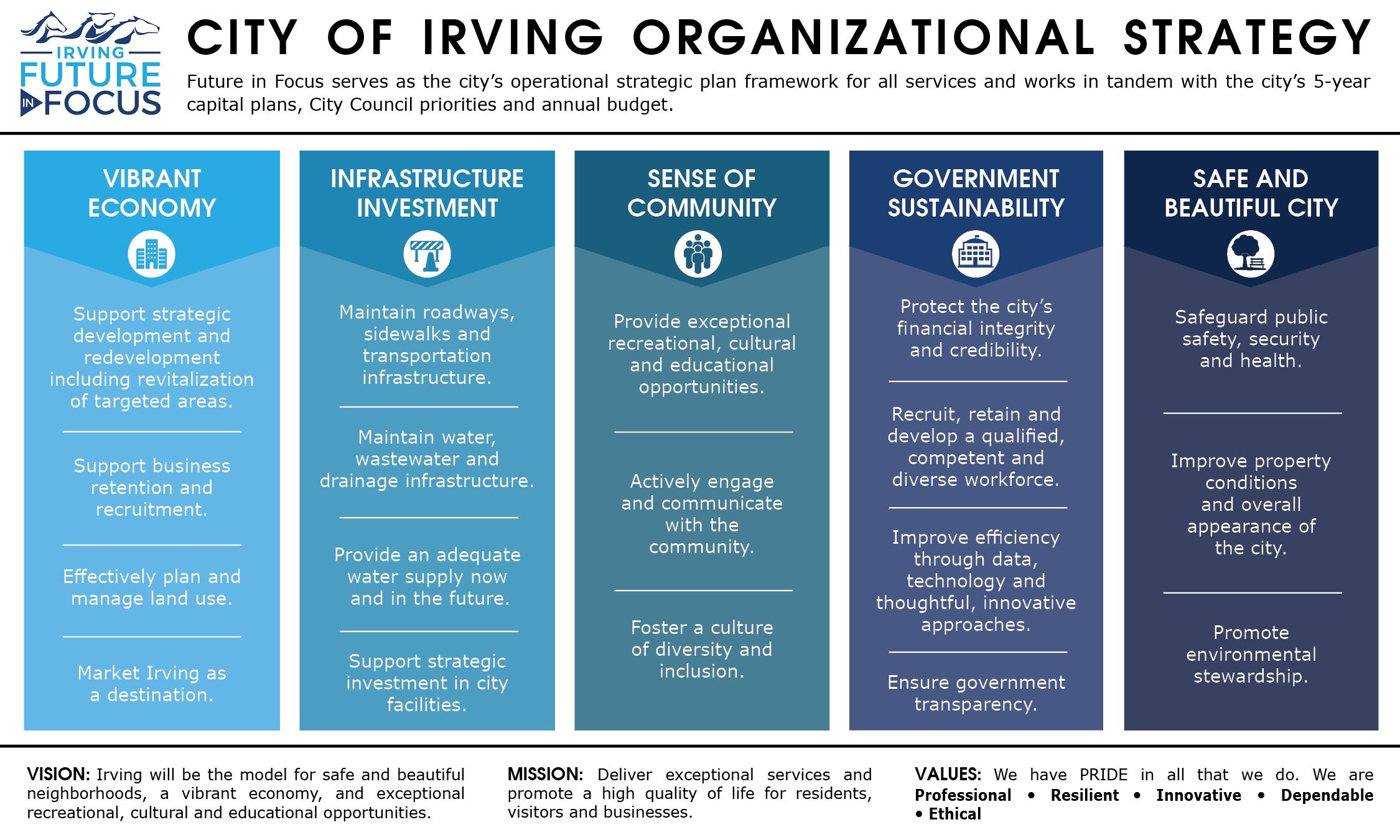

Strategic thinking, planning and management play a strong role in the City of Irving’s organizational culture. The city’s organizational strategy, Future in Focus, consists of five focus areas and 18 operating strategies. Based on input from city leadership and key stakeholders, the plan works in tandem with the city’s five-year capital plans, City Council priorities and annual budgets.

Future in Focus encompasses key initiatives that allow the city to stay focused on what matters most, which is to deliver exceptional services and promote a high quality of life for residents, businesses and visitors.

S

ettlers came to the area that is now Irving in the 1850s, and communities such as Sowers, Kit, Shady Grove, Union Bower, Finley, Estelle and Bear Creek sprang up in the last half of the 19th century. The new town of Irving, founded in 1903 by J.O. Schulze and Otis Brown, eventually included most of these settlements. Irving was officially incorporated April 14, 1914.

Visit the Irving Archives and Museum, located at the Jack D. Huffman Community Building, 801 W. Irving Blvd., to learn more about Irving's history.

IrvingArchivesandMuseum.com

Home of DFW International Airport and Adjacent to Dallas Love Field Airport

Trinity Railway Express (TRE) with Two Stations in Irving Connecting Passengers to Destinations Throughout Dallas and Tarrant Counties

DART Orange Line Light Rail with Five Stops and Local Buses

Four 18-hole Championship Golf Courses

More than 92 Parks, 33+ Miles of Trails, Three Libraries and a Municipal Golf Course

Smithsonian-Affiliated Arts Center, Four Museums, Three Symphonies and Award-Winning Theater Productions

Home of Toyota Music Factory, an Entertainment and Restaurant Complex featuring the 8,000-person capacity The Pavilion at Toyota Music Factory and Texas Lottery® Plaza

Implemented ‘Let’s Play Irving – Elevating Aquatics and Recreation’ Plan to rebuild Lee Park and Senter Park pools, re-envision Lively Park Pool area with teen input and build Irving’s first multi-generational mixeduse recreation and aquatics community center.

Lee Park Recreation Center

Demolish & Replace Pool Opening Spring/ Summer 2025

Senter Park Recreation Center

Rebuild New Pool & Enclose for Natatorium Opening Spring/ Summer 2026

Mustang Park Recreation Center

Build New Multi-Generational Facility & Aquatics Center Opening Fall 2026

City Council authorized a funding strategy that will not impact the tax rate and has earmarked $92 million for the projects while still fully funding existing capital improvement projects. The $92 million is primarily comprised of voter-approved recreation and senior center bond funds and non-bond capital improvement program allocations.

Started construction on the $6.9 million Central Fire Station

Continued operation of 20 subtenant leases at the Toyota Music Factory, including 11 full-service restaurants. Using sales tax revenue from the Toyota Music Factory development, Irving City Council approved an estimated $6.3 million in improvements to the plaza, outdoor stage, new signage, architectural graphics, storefront/patio remodels and more. The agreement also included potential reimbursements for up to $25 million for improvements to key tenant lease spaces.

Texas Department of Transportation's (TxDOT) $301 million project to reconstruct the State Highway 183/SH 114/Loop 12/Spur 482 interchange is anticipated to be complete in spring 2024.

(Metker Street to Byron Nelson Way)

The $27.9 million project includes water, wastewater, storm system, sidewalks and roadway pavement. Construction began February 2023 and estimated completion is February 2025.

FY23 GENERAL FUND

$256 Million Budget

$248.2 Million Actual Expenditure

The General Fund is the city’s main operating fund used to account for day-to-day operations except those required to be reported in other funds. The majority of city departments and personnel are budgeted in this fund. References to General Fund budget include funds aggregated with the General Fund as reported in the Annual Comprehensive Financial Report.

The majority of General Fund revenues are generated from tax revenues. These are primarily comprised of property taxes and sales taxes at city rates of $.05891 per $100 valuation and 1% of taxable sales, respectively.

Irving City Council Adopted a Balanced $867.7 Million Operating Budget, which Includes the General Fund and Several Dedicated Funds.

The General Fund accounts for 30% of all funds combined.

70% Dedicated Funds

30%

14% Water and Sewer System Funds

12% Debt Service Funds

10% Special Revenue Funds

34% Other Funds include Internal Services, Grants, Solid Waste Services, Hotel/Motel Tax and Municipal Drainage Utility

*Expenditures increased in 2022 primarily due to one-time contributions made to pension plans from pension obligation bonds issued in the same year. The 2022 pension obligation bond proceeds of $167 million are not included in the 2022 revenues outlined here but classified as an other financing source in the ACFR.

Property tax and sales tax collections represent the largest sources of revenue for the General Fund. When combined with Franchise Fee revenue, tax collections comprise 86% of total General Fund revenues.

The increase in tax revenue from FY22 to FY23 is primarily from $6.5 Million property tax Increase and $8.9 Million increase in sales tax in General Fund.

Expenditures decrease from $382.2 Million in FY22 to $248.2 Million in FY23 primarily due to the one-time contributions made to the pension plans from bonds issued in FY22.

Sales tax revenues are the second largest source of funding for both the General Fund and Economic Development Incentive Fund. For the prior three years the city collected in total:

Out of every dollar spent on taxable goods and services in Irving, 8.25% in sales tax is generated and allocated to the State of Texas, Dallas Area Rapid Transit (DART) and the City of Irving.

According to the Dallas Central Appraisal District (DCAD), the Total Estimated Taxable Value for the 2023 Tax Year is $35.8 Billion an Increase of $3.8 Billion over the Prior Year.

New Construction Added 1, 192 New Properties with $395 Million in Taxable Value.

The largest share of property tax collected goes to one of three Independent School Districts (ISDs) serving Irving residents: Irving ISD, Carrollton-Farmers Branch ISD or Coppell ISD. Other taxing authorities include the city, Dallas County, School Equalizations, Parkland Hospital and the Dallas County Community College.

Based

*Average taxable value based on tax rate/$100 valuation. Homeowners age 65+ or with proof of disability qualify for a $50,000 exemption off their residence’s taxable value.

The City’s Debt Service Reserve Balance was $16.4 Million in FY23

The city has a Fund Balance Policy to target a minimum General Fund balance for operations that is 30% of annual revenues. This financial policy ensures an adequate fund balance in operating funds to maintain liquidity, as well as provide the city with capital in the event of unexpected financial impacts, such as economic downturns and natural disasters. As of Sept. 30, 2023, the city has a general fund reserve rate of 39% 39%

(Changes in Net Position)

Irving’s fiscal year runs Oct. 1 to Sept. 30. The city’s statement of activities for fiscal years ending Sept. 30, 2021-2023 are shown in the chart below. ACTIVITIES/CHANGES

Over time, increases or decreases in the city’s net position may be an indication of whether the financial situation of the city is improving or deteriorating.

The City of Irving’s Overall Net Position

Increased 13% or $157Million from the Prior Fiscal Year

The most significant portion of net position ($1.1 Billion) is invested in capital assets. Irving uses these capital assets to provide a variety of public goods and services to its residents. For that reason, these assets are not available for future spending. Irving’s investment in capital assets is reported net of related debt.

General Fund balance represents city reserves and amounts nonspendable, committed (assigned or unassigned) for special purposes. These are shown for the fiscal years ending Sept. 30, 2021-2023 in the chart below.

This portion of net position ($120.2 Million) is restricted, representing funds that are limited to construction activities, payment of debt or specific programs by law.

The remaining portion of net position ($167.8 Million) is unrestricted, representing resources that are available for services including $42.6 Million allocated for non-bond onetime capital projects. 79% Capital Assets

*In FY22, $1.595 M was restricted for the amount held in escrow for pension contributions to be paid from pension obligation bond proceeds.

Capital assets represent a significant portion of the city’s financial position used to deliver services and community needs.

Long-term debt represents borrowings used to finance the construction and purchase of capital assets used by the city. In FY23, the city issued $111.1Million in new debt to fund a variety of planned capital projects ranging from building and park renovations to water main replacements and drainage improvements.

Aaa/AAA are the highest ratings assigned to an issuer's bonds by the major credit rating agencies. The city's strong credit worthiness allows Irving to borrow at reduced interest rates and reduced overall cost.

Assigned funds: Amounts set aside by the city for specific purposes that are not restricted or committed.

Committed fund balance: Amounts that can only be used for a specific purpose by formal action from City Council.

Dedicated funds: Amounts set aside for a specific purpose.

Deferred outflows of resources: Amounts pending recognition as expenses in future periods.

Deferred inflows of resources: Amounts pending recognition as revenues in future periods.

Franchise fees: Charges to utility companies for the use of public rights-of-way.

General fund: The main operating fund for the city.

Intergovernmental: Revenue recognized from grant awards and reimbursement of operating costs by other funds.

Net investment in capital assets: Capital assets, net of accumulated depreciation, reduced by outstanding capital related debt.

Net position: The net position of the city is equal to city assets and deferred outflows reduced by liabilities and deferred inflows.

Nonspendable funds: Fund balance representing assets not in a spendable form (i.e. inventory).

Reserves: Amounts of fund balance that are not available for appropriation or are set aside for a specific future use.

Restricted fund balance: Amounts that can only be used for a specific purpose set by external entities.

Restricted net position: Restricted assets reduced by liabilities and deferred inflows of resources related to those assets.

Unassigned fund balance: Remaining amount that has not been assigned to other funds or been restricted, committed or assigned to specific purposes.

Unrestricted net position: Remaining net position not included in net investment in capital assets or restricted net position.

Each year, the city releases the Year in Review document to provide residents with an overview of the achievements, highlights and accomplishments from that year.

Allocated $1,084,706 in grant funds for public improvements at King Square, West Park, East Branch Library, Georgia Farrow Recreation Center and Lively Pointe Youth Center

Received $45 million in grant dollars with zero percent financing from the Texas Water Development Board, which is expected to save the city $26.3 million in interest

Homeless Outreach Team responded to 561 calls, made 900 contacts and connected 110 individuals to resources/services, including 10 who were permanently housed

Implemented the Short-term Rental Registration program with over 160 short-term rentals registered in year one

Funded all employee positions at the 70th percentile of the market, and approved moving to the 80th percentile in 2024, as part of the city’s recruitment and retention strategy

Irving Convention Center & Visitors Bureau received three Bronze Adrian Awards – Hospitality Sales & Marketing Association International

Irving Convention Center & Visitors Bureau is a Platinum Choice Award winner – Smart Meetings

Irving Archives and Museum and the Irving Black Arts Council received the Award for Excellence for “A Local Green Book” exhibition – American Association for State and Local History

Irving Archives and Museum was awarded the John L. Nau III Award for Excellence in Museums for its exhibit “The Irving Story” – Texas Historical Commission

Public Safety Wellness Unit won the Destination Zero Award in the Comprehensive Wellness Program category – National Law Enforcement Officers Memorial Fund

Received certification as a Mother Friendly Workplace –Texas Department of State Health Services

Fleet received the Clean Cities Silver Award for six consecutive years – Dallas-Fort Worth Clean Cities Coalition

Received Certificate of Achievement for Excellence in Financial Reporting for 39 consecutive years – Government Finance Officers Association

Received the Distinguished Budget Presentation Award for 36 consecutive years – Government Finance Officers Association

Heritage Park received President’s Award for Best Public Improvement – Texas Downtown

Irving Community Television Network won 9 awards – National Association of Telecommunications Officers and Advisors

Irving Community Television Network won 17 awards – Texas Association of Telecommunications Officers and Advisors

Communications won 3 Awards of Excellence – Texas Association of Municipal Information Officers

Keep Irving Beautiful won the President’s Circle Award and First Place National Affiliate Innovation Award – Keep America Beautiful

Water Utilities received the Gold Award for Exceptional Utility Performance – Association of Metropolitan Water Agencies

SCAN MEANNUAL VISITS

2.1Million

PAGE VIEWS

4.6Million

CityofIrving.org

Sign up for website updates delivered via email at CityofIrving.org/Join

DIGITAL NEWSLETTERS

City information is distributed weekly through email newsletters.

Sign up at CityofIrving.org/Newsletters

IRVING CITY SPECTRUM

Award-Winning Monthly Newspaper Delivered to Over 104,000 Households

IRVING CITY SPECTRUM BRIEFS

Delivered to more than 40,000 Residents in Monthly Utility Bills in English and Spanish CityofIrving.org/Publications

Watch a variety of Irving news and public meeting broadcasts on the web or cable television. On-Demand and Live Streaming at ICTN.tv

Subscribe to Irving's video content

YouTube.com/TheCityofIrving

More than 124,654 People Follow Irving Across Social Media, an increase of 7,823 over 2022.

Views

Irving’s Heritage Park won the 2023 Texas Downtown Association President’s Award in the category of Best Public Improvement for a city with a population of over 50,000 people. For more information visit TexasDowntown.org

In 2021, the City of Irving completed the Irving Heritage Park renovation project that turned a 1-acre lot into a 2-acre open space in the heart of downtown Irving. Improvements include new lighting, walking paths, restored historical buildings and a state-of-the-art entertainment stage with an enormous 15x20-foot LED screen.