City of Suffolk, Virginia

For Fiscal Year Ended June 30, 2024

City of Suffolk, Virginia

For Fiscal Year Ended June 30, 2024

The 2024 Popular Annual Financial Report (PAFR) is a report for our citizens. It provides you and other interested parties with an overview of the City’s financial standings. This report is prepared to increase awareness throughout the community of the City’s financial operations; therefore, it is written in a user-friendly manner. The information is derived from the audited financial statements in the City’s 2024 Annual Comprehensive Financial Report (ACFR), our formal annual report, which can be viewed using the QR code provided.

To conform to generally accepted accounting principles (GAAP), the ACFR must include the City’s component units and the presentation of individual funds in much more detail, as well as a full disclosure of all material events, financial and non-financial. The 2024 ACFR was audited by Cherry Bekaert LLP and has received an unmodified or “clean” audit opinion.

Unlike the ACFR, the PAFR is not an audited document and it does not include details by fund nor does it include the other disclosures required by GAAP. The PAFR is not required to present the same level of detail as the ACFR and, therefore, does not fully conform to GAAP.

This report, in a summarized version, highlights the overall financial condition and trends of the City. For more in-depth information, you may obtain a copy of the ACFR online or by contacting the Finance Department at (757) 514-7500.

Dear Citizens of Suffolk,

I am delighted to present the City of Suffolk’s Popular Annual Financial Report for the fiscal year ending June 30, 2024. As your City Manager, it is a privilege to provide this comprehensive overview of our city’s financial health and accomplishments.

This year, we are particularly proud to share that the City of Suffolk has been honored with the Government Finance Officers Association’s (GFOA) Award for Outstanding Achievement in Popular Annual Financial Reporting for the fiscal year ended June 30, 2023. This prestigious recognition reflects our commitment to transparency, creativity, and excellence in financial reporting. The award is a significant achievement and underscores our dedication to providing an engaging and accessible financial report that resonates with our citizens.

As Suffolk continues to grow and prosper, we have made impactful investments in infrastructure, public safety, education, and economic development while maintaining fiscal responsibility. This commitment has allowed us to reaffirm our AAA bond rating, ensuring cost-effective funding for essential projects and services.

Our accomplishments would not be possible without the active support and engagement of our community. Your contributions and feedback help shape the policies and initiatives that drive our city forward.

This report stands as a testament to our collective efforts and serves as an invitation for you to explore the many ways your tax dollars are enhancing Suffolk’s quality of life. Thank you for being an integral part of our city’s success.

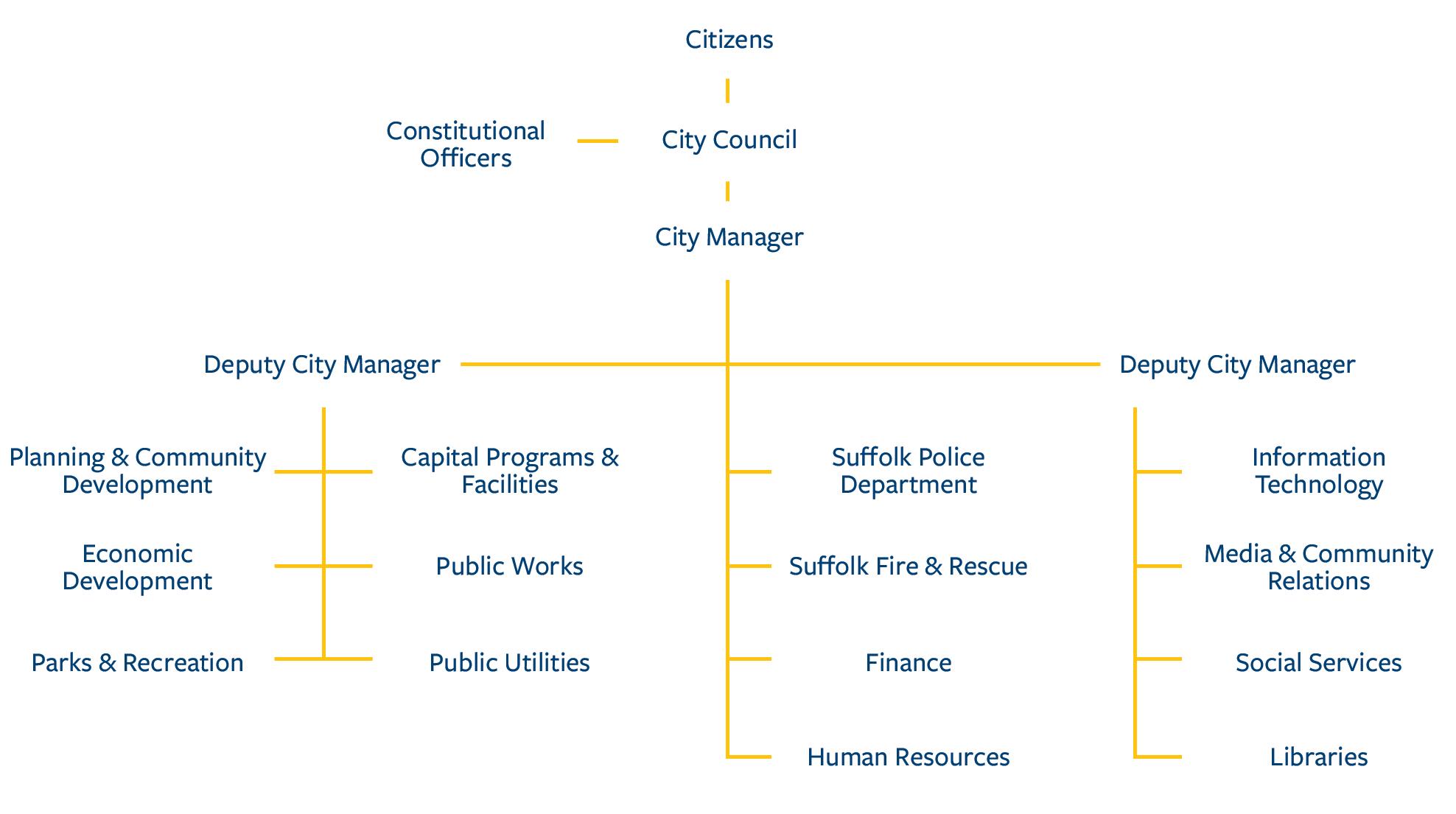

The City’s government is organized under the Council-Manager form of government. The governing body, the City Council, is composed of seven members and a Mayor who develop policies for the administration of the City. The Mayor is elected at large and the Council Members are elected by borough in a city-wide election every other year with terms of office being four years. The City Council appoints a City Manager to act as administrative head of the City. The City Manager serves at the pleasure of City Council and carries out the City Council’s policies and directs business procedures. The City Manager also appoints the directors of all departments. Council meetings are streamed at https://www.youtube.com/@CityofSuffolkVA and on local cable network channels.

The School Board is elected by borough. Under Virginia law, all operations of the School Board are completely independent of the City Council and City Administration. City Council is required to make an annual appropriation to the School Board based upon an approved budget, but has no authority to direct how such appropriation is expended.

As a full-service city, Suffolk provides a broad range of municipal services authorized by statute or charter. Those services include education, public safety, highways and streets, parks and recreation, sanitation, health and social services, public improvements, planning and zoning, public utilities, storm water management and general administrative services.

All Suffolk City Council meeting dates, agendas, and instructions for speaking at a council meeting can be found online at suffolkva.us/ CouncilMeetingInformation. Both live streamed meetings, as well as archived meetings, can be viewed at www.suffolkva.us/tv and on the local Charter Spectrum cable channel 190.

The City of Suffolk, established on January 1, 1974, through the merger of Suffolk and Nansemond County, is Virginia’s largest city by land area, covering over 400 square miles with 30 square miles of waterways. Located in the western Hampton Roads region, Suffolk blends rural, suburban, and urban landscapes. It borders the James River to the north, Chesapeake and Portsmouth to the east, North Carolina to the south, and Southampton and Isle of Wight counties to the west. Part of the Norfolk-Virginia Beach-Newport News metropolitan area, Suffolk contributes to the 1.7 million-population Hampton Roads region.

Known as the “Peanut Capital of the World,” Suffolk hosted its first peanut festival in 1941. Planters Peanuts, founded here in 1912, created Mr. Peanut, its iconic mascot. Today, the Suffolk Peanut Fest, held annually in October, attracts 125,000 visitors with parades, concerts, and more, earning national acclaim.

The City of Suffolk thrives year after year as businesses and residents embrace its unique opportunities and exceptional quality of life. With sound financial management, strategic growth planning, and a diverse mix of urban, suburban, and rural landscapes, Suffolk remains a premier community in the Hampton Roads region.

The Comprehensive Plan serves as a guide for City staff, officials, the public, and developers in making decisions about growth, redevelopment, preservation, and public services. It provides policies for managing growth, housing, transportation, public facilities, and the conservation of natural and cultural resources. The Code of Virginia mandates the plan be reviewed every five years to ensure it remains relevant.

Suffolk boasts diverse community types, including urban neighborhoods, riverside developments, and rural villages. The plan seeks to preserve the City’s unique character while encouraging quality new development.

With Suffolk’s population projected to grow by 30% by 2040, the comprehensive planning process is critical to managing this expansion effectively, ensuring sustainable development, and maintaining the City’s quality of life.

1. Maintain an efficient transportation network with effective choices for mobility.

2. Define and enhance the various unique character types and development patterns within the City.

3. Promote a diverse housing stock, providing options in terms of type, location, and affordability.

4. Protect the natural, cultural, and historical assets of the City.

5. Maintain high-quality services and facilities as growth occurs.

6. Preserve the agricultural heritage and character of the City.

7. Keep jobs and schools near population centers.

To view the full 2035 Comprehensive Plan visit suffolkva.us.

The City experienced another strong year of economic growth in 2024 with 795 new jobs created and over $300 million in capital investment from both domestic and international companies across various business sectors including logistics, healthcare, food and beverage, retail, and technology.

• Several warehousing projects are underway across the City including Coastal Logistics Center II, Virginia Port Logistics Park, Northgate Commerce Center, and Port 460 Logistics Center. The Port of Virginia provides direct access to efficient movement of goods for businesses throughout the City. The Port also reached a significant milestone to become the first major port on the East Coast to fully operate on clean energy.

• Solenis, a leading global producer of specialty chemicals for water intensive industries, announced they will invest $193 million to expand their operation in the City. The company will build a new 80,000 square foot production facility, packaging facility, and tank farm, and add a new rail spur to accommodate production of polyvinylamine (PVAm) products, which are used in paper and cardboard manufacturing. The project is expected to create 34 new jobs

• ESKA USA, a 140 year old manufacturer headquartered in the Netherlands is expanding to the City. The move will bring existing machinery for the manufacture of solid board used in packaging for cosmetics, perfume, and other luxury goods, hardcover books, and games. The company expects an initial creation of 39 new jobs with anticipated future expansion.

• Nansemond Pre-Cast Concrete Inc. (NPCC) is expanding their existing concrete pipe manufacturing site to increase production of reinforced concrete pipe that is manufactured on-site. NPCC is only one of two manufacturers of reinforced pipe in the Commonwealth, producing sanitary sewer and storm drainage products for infrastructure development.

• In December 2023, Bon Secours celebrated the “topping out” of its new Harbour View Hospital. This new stateof-the-art facility costing nearly $80 million to construct, joins the Bon Secours Health Center at Harbour View campus. The facility will provide 98,000 square feet of space to extend the hospital’s offering including the addition of 18 medical/surgical beds and four operating rooms.

Advanced Manufacturing

$62.3 M

Square Footage: 31 K

New Jobs: 149

$35.7 M

Square Footage: 155 K

New Jobs: 408

&

$106 M Square Footage: 1.8 M New Jobs: 160

& Administration

$1.1 M Square Footage: 3 K New Jobs: 12

• Massimo Zanetti Beverage USA (MZB-USA) invested more than $29 million to simultaneously consolidate its local roasting and production operations, while also creating a new distribution center. The project created 79 new jobs

• Birdsong Peanuts completed a $25.1 million project to modernize and automate its production lines at its Suffolk peanut shelling facility. With this innovation, the Suffolk facility is now one of the most modern and efficient of the company’s five shelling plants that stretch from Virginia to Texas.

• The City Council and City Management places a high priority on education and continues to be one of the City’s highest priorities. The City financially supported Suffolk Public Schools in the amount of $71.7 million for fiscal year 2024 which represents 22.49% of the total governmental expenses in Suffolk.

Suffolk Public Schools Maintains:

11 Elementary Schools

4 Middle Schools

3 High Schools

1 Alternative School

2,300 Employees

13,450 Students

16,918 Capacity

$91 M Square Footage: 115 K New Jobs: 46

& Other

$9.6 M

Square Footage: 79 K

New Jobs: 20

• Successfully hosted Public Works Academy – providing citizens with an opportunity to learn firsthand about the inner workings of the department.

• Completed Downtown Drainage Improvements to reduce flooding that occurs during normal rain events.

• Implemented automated traffic enforcement cameras to enhance roadway safety.

• Maintained approximately 1,681 lane miles in the City.

• Inspected 75 bridges and ancillary structures.

• Initiated several capital projects including the replacement of the bridge on Longstreet Lane, bridge replacements at Freeman Mill Road over Spivey Swamp and Pittmantown Road over Mill Swamp.

• Completed stormwater drainage improvements at Halifax St. from East Washington St. to Bank St. extension and South 4th St. from East Washington to the end of cul-de-sac.

• Paved approximately 60 centerline miles. Awarded State of Good Repair (SGR) funds for asphalt resurfacing for a total of six additional centerlines on road segments on Whaleyville Blvd., Route 17, Route 189 and Great Mill Highway.

• Maintained reaccreditation for the police department from the Commission on Accreditation for Law Enforcement Agencies (CALEA) and Forensics from the ANSI National Accreditation Board.

• Implemented license plate readers and gunshot technology to assist in the reduction of crime and in criminal investigations.

• Completed first annual compliance report for the Department of Fire and Rescue’s International Accredited Agency status through the Commission on Fire Accreditation International (CFAI).

• Began construction on the new Fire Station 11 in Northern Suffolk.

Provided extensive marketing and promotional assistance for a variety of Suffolk events, as well as citywide, non-municipal events. Support provided for the Suffolk Plein Air Festival; 35th Annual Nansemond Pow Wow; 45th Annual Suffolk Peanut Fest; 30th Annual Driver Days Fall Festival; 5th Annual Holland Ruritan Club’s Custom Car, Truck & Motorcycle Show; Suffolk Peanut Fest Golf Tournament; Suffolk Leadership Prayer Breakfast; Suffolk Ruritan Club Shrimp Feast; Suffolk Sister Cities events; Nansemond River Garden Club events; Suffolk Nansemond Historical Society events; Suffolk Center for Cultural Arts events; and Suffolk Art League events and exhibits. Sponsored three thematic film series, plus one stand-alone family film at the Suffolk Center for Cultural Arts.

Scan here for citywide programs

Extended Suffolk Tourism’s outreach by participating in “Thank the Visitor Day” at the Norfolk International Airport in celebration of U.S. Travel Association’s “National Travel and Tourism Week;” Coastal Virginia Tourism Alliance’s “Thankful for the Traveler” (during Thanksgiving travel time period); and setting up a Suffolk Tourism Information Table at Bracey Welcome Center for Coastal Virginia Tourism Alliance’s October Blitz.

• Commemoration efforts instituted for celebrating Suffolk’s 50th Anniversary (2024), included a custom logo, city vehicle magnets, lapel pins, and displays. Established Suffolk VA 250 Committee as part of the VA 250 American Revolution: Commemorating the 250th anniversary of the American Revolution, the Revolutionary War, and US Independence in the Commonwealth of Virginia.

• Received Virginia Telecommunication Initiative (VATI) Grant Award and Federally administered Federal Communications (FCC) funding.

• Processed 9,427 applications for SNAP, TANF, Medical Assistance, Child Care and Energy Assistance, and met or exceeded the 97% application timeliness processing standards for TANF and Child Care applications.

• Provided workforce development services to 9,407 citizens. Suffolk Workforce Development Center has continued to grow partnerships with area businesses and community partners and holds weekly onsite classes such as Beginning Spanish, Beginning Literacy, Basic Computer Classes, Microsoft Office Suite, Job Readiness Class and GED classes. Provided opportunities for clients to receive credentialing classes such as Personal Care Aid Certificates, Driver Improvement Classes, Work Zone, CPR, AED, and First Aid. Collaborated with city departments to provide a wide array of training opportunities such as Basic and Advanced Excel classes, Business Writing, Customer Service Training, and Police Department Boot Camp to City of Suffolk employees.

Suffolk’s fiscal year (FY) runs July 1 to June 30. The City’s statement of activities for fiscal years ending June 30, 2022, 2023 & 2024 are shown in the chart below.

The statement of Net position presents information on all city assets and deferred outflows of resources and liabilities and deferred inflows of resources, with the difference reported as net position. This data is inclusive of all the activities of the city but does not include city component units. Net position is one way to measure the city’s financial health, or financial position.

$884.2 Million on all City assets and deferred outflows of resources and liabilities and deferred inflows of resources, with the difference reported as net position. This data is inclusive of all the activities of the City but does not include City component units. Net position is one way to measure the City’s financial health and this represents an increase of 18% from the previous year.

The City of Suffolk’s overall net position increased $135.3 million from the prior fiscal year. The three components of net position are net investment in capital assets, restricted net position, and unrestricted net position.

The most significant portion of net position ($591.3 million) is invested in capital assets to provide a variety of public goods and services to its citizens. For that reason, these assets are not available for future spending. Suffolk’s investment in capital assets is reported net of related debt. Net investment funds are 66.87% of the net position.

This portion of net position ($42.7 Million) is restricted, representing funds that are limited to construction activities, payment of debt, or specific programs by law. Restricted funds are 4.8% of the Net Position.

The remaining portions of net position ($250.2 Million) is unrestricted, representing resources that are available for services. Unrestricted funds are 28.30% of the Net Position.

Long-term debt represents the borrowings used to finance the construction and purchase of capital assets used by the city. These comprise items for governmental and business-type activities.

At the end of Fiscal Year 2024, the city had a total outstanding debt of $696.5 million, including general government, school construction, and utility fund debt.

The City has financial policies that are vital for maintaining consistency and focus. One of the financial policies continually reviewed is that of fund balance levels. The ratio of unassigned General Fund balance as a percentage of budgeted governmental funds expenditures (net of the general fund contribution to the Schools, transfers to other governmental funds, and Capital Projects fund expenditures), plus the budgeted expenditures in the School Operating and Food Service Funds, indicates the ability of the City to cope with unexpected financial challenges or emergencies. The policy also states that any surplus amounts over 20% will be put into a budget stabilization fund until it reaches 2.5% based on the same ratio and the remaining will go to a capital reserve fund. The City has set the unassigned fund balance percentage at 20%. At June 30, 2024, the

the target. The City was also able to establish the budget

In 2024, the City’s Capital Reserve

fund at 2.5%

was $60.7 million. In 2023, the City’s

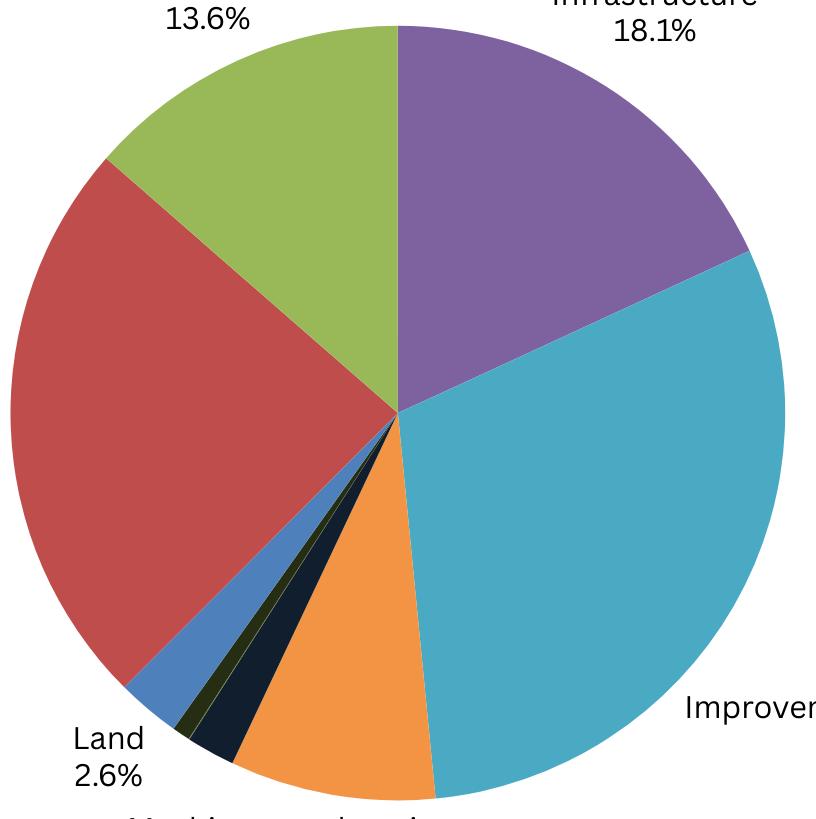

The term capital assets is used to describe assets that are used in operations and that have initial useful lives extending beyond a single reporting period. Capital assets include major government facilities, infrastructure, equipment, and networks that enable the delivery of public sector services.

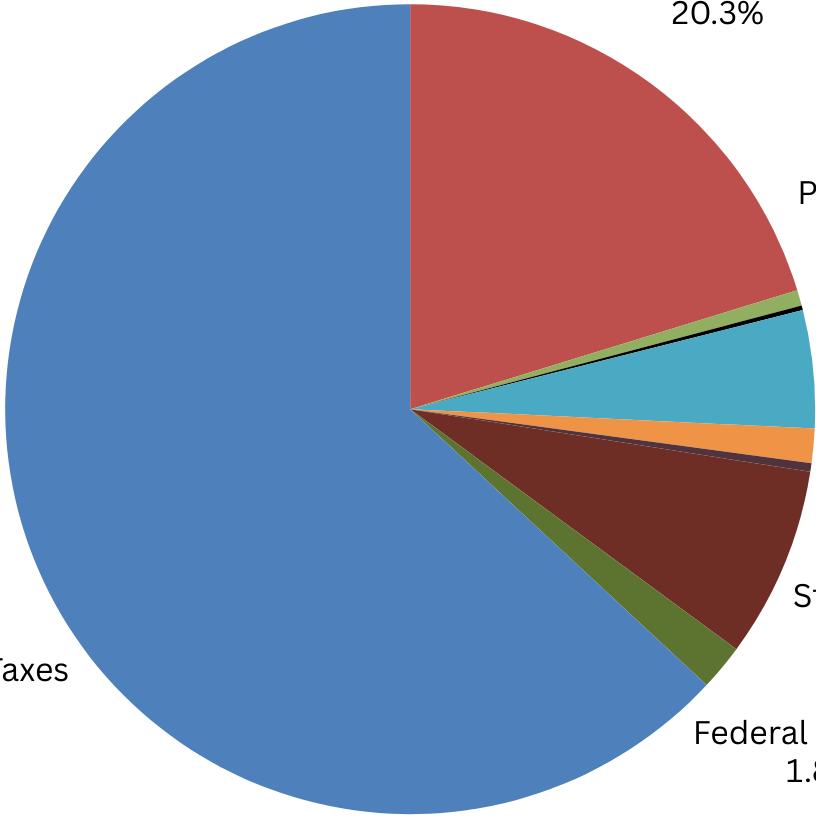

The chart following indicates the growth in the General Property Taxes revenue over the past ten years.

$250

$200

$150

$100

$0 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24

Source: Annual Comprehensive Financial Reports 2014-2024

Real Estate and personal tax revenues represent the City’s largest source of revenue, and totaled $205.6 million in fiscal year 2024. In 2023 the total revenue was $176.3 million. This growth is due in part to increased property values and and a substantial increase in new commercial and residential construction. In fiscal year 2024, a two cent tax relief credit was provided bringing the rate $1.09 to $1.07.

Other Local Taxes, comprised of revenue from local sales tax, meals, lodging, and utilities increased from fiscal year 2023 to fiscal year 2024. The City experienced growth in sales, meals, business license, and lodging tax revenue, new businesses, and an increase in population.

The General Fund is the chief operating fund of the City. As of June 30, 2024, the fund balance of the General Fund was $202.9 million. $106.7 million represents the unassigned fund balance. The General Fund has increased from 2023. This increase is attributable to better than anticipated collections of local taxes such as sales tax and business license taxes as well as rising interest rates, which resulted in an increase of interest revenue, earned on the City’s cash balances.

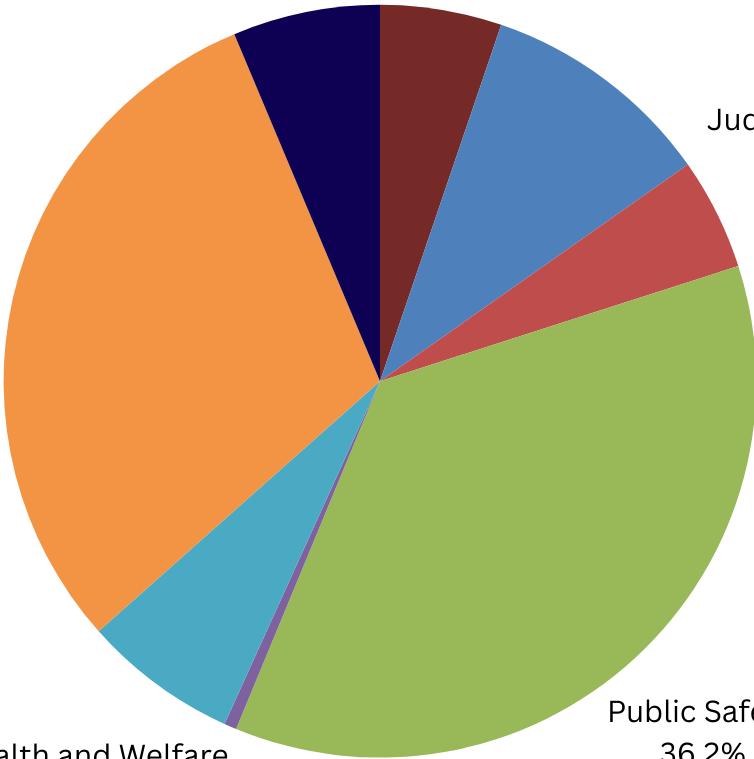

by Function

• For fiscal year 2024, the City’s tax rate was $1.09 per $100 and remained the third lowest tax rate in the region.

• The City’s economic development initiatives created over 795 new jobs and over $306 million in new and expanding capital investment in the City during the calendar year 2023.

• Population in the City has increased 12.4% in the last ten years.

• The City has achieved Triple A (Aaa/AAA) from Moody’s, Fitch and Standard & Poor’s Rating Agencies. These ratings reflect the City’s continued commitment to strong financial management.

Financial policies are essential for maintaining consistency and focus. The City’s ten-year Capital Improvements Plan (CIP) outlines $1.5 billion in expenditures for physical improvements from fiscal year 2025 through fiscal year 2034. Key priorities include utilities, stormwater, fleet, and information technology projects, estimated at $213.3 million, while general government projects total approximately $1.3 billion. Some improvements will be funded through bonds. Suffolk has earned top-tier bond ratings: Aaa from Moody’s Investor Service and AAA from both Fitch Ratings and Standard & Poor’s. These ratings reflect the City’s strong creditworthiness, sound financial management, and solid fiscal health, contributing significantly to Suffolk’s overall economic stability.

Certificate in Achievement for Excellence in Financial Reporting

For the 39th consecutive year.

Award for Outstanding Achievement in Popular Annual Financial Reporting

For the 8th consecutive year.

Distinguished Budget Presentation Award

For the 14th consecutive year.

Assessed Value: The dollar value assigned to a home or other piece of real estate for property tax purposes.

Capital Assets: These include all land, buildings, equipment, and other elements of the City’s infrastructure having a cost of more than $5,000 and having been funded by the Capital Budget.

Debt Service Funds: Funds to finance and account for the annual payment of principal and interest on bonds.

Deferred Inflow of Resources: An acquisition of net assets by the City that is applicable in a future reporting period.

Deferred Outflow of Resources: A consumption of net assets by the City that is applicable to a future reporting period.

General Fund: The main operating fund of the City, which is used to finance the City’s operations.

General Fund Revenues: Revenues which the City raises through taxation and other means. General Revenues are available to be used for any authorized program or function.

General Fund Expenditures: The primary fund from which the City pays ongoing expenses.

General Obligation Debt: Debt secured by the full faith and credit of the local government issuing the debt. The City pledges its tax revenues unconditionally to pay the interest and principal on the debt as it matures.

Governmental Fund: Governmental funds is money, assets, or property of a local government, including any branch, subdivision, department, agency, or other component of any such government.

Operating Budget: A plan for the acquisition and allocation of resources to accomplish specific purposes. The term may be used to describe special purpose fiscal plans or parts of a fiscal plan, such as “the budget of the Police Department or Capital Budget” or may relate to a fiscal plan for an entire jurisdiction, such as “the budget of the City of Suffolk.”

Trend: A general direction in which something is developing or changing.

Do you like this report? Let us know! Contact the Finance Department at FinanceEmail@suffolkva.us or 757-514-7500. You can also visit at 442 West Washington Street, Suffolk, Virginia 23434.

For more information, including the City of Suffolk Annual Comprehensive Financial Report, visit www.suffolkva.us or scan the QR code below.