CITY OF SUFFOLK

PROPOSED OPERATING & CAPITAL BUDGET

FY 2024-2025

www.suffolkva.us

Table of Contents: Page City Manager's Message 7 Executive Summary by Fund 11 Proposed Organizational Structure 39 General Operating Fund Revenue and Expense Summary 43 General Government 49 Judicial 71 Public Safety 87 Public Works 99 Health & Welfare 103 Education 111 Parks & Recreation and Cultural 113 Community Development 119 Other Public Services 129 Non Departmental 131 Capital Projects Fund 135 Special Revenue Funds Aviation Fund 141 Transit Fund 145 Downtown Business Overlay Taxing District 149 RT. 17 Taxing District 153 Road Maintenance Fund 157 Grants Fund 161 Law Library Fund 165 Debt Service Fund 171 Enterprise Funds Public Utilities Fund 177 Stormwater Management Fund 187 Refuse Services Fund 191 Internal Service Funds Fleet Management Fund 197 Information Technology Fund 201 Risk Management Fund 205 Component Unit School Fund 211 Appendix Appendix A - Personnel Summary By Fund 217 Appendix B - Statistical Information, Charts, & Graphs 221 Appendix C - Summary of Reserve Funds 229 Appendix D - Financial Policy Compliance Report 231 Appendix E - Proposed Budget Ordinances and Resolutions 255 City of Suffolk Proposed FY 24-25 Operating and Capital Budget 3

THIS PAGE INTENTIONALLY BLANK

4

City Manager’s Message

5

THIS PAGE INTENTIONALLY BLANK

6

April 3,2024

The Honorable Council City of Suffolk, Virginia

Dear Council Members:

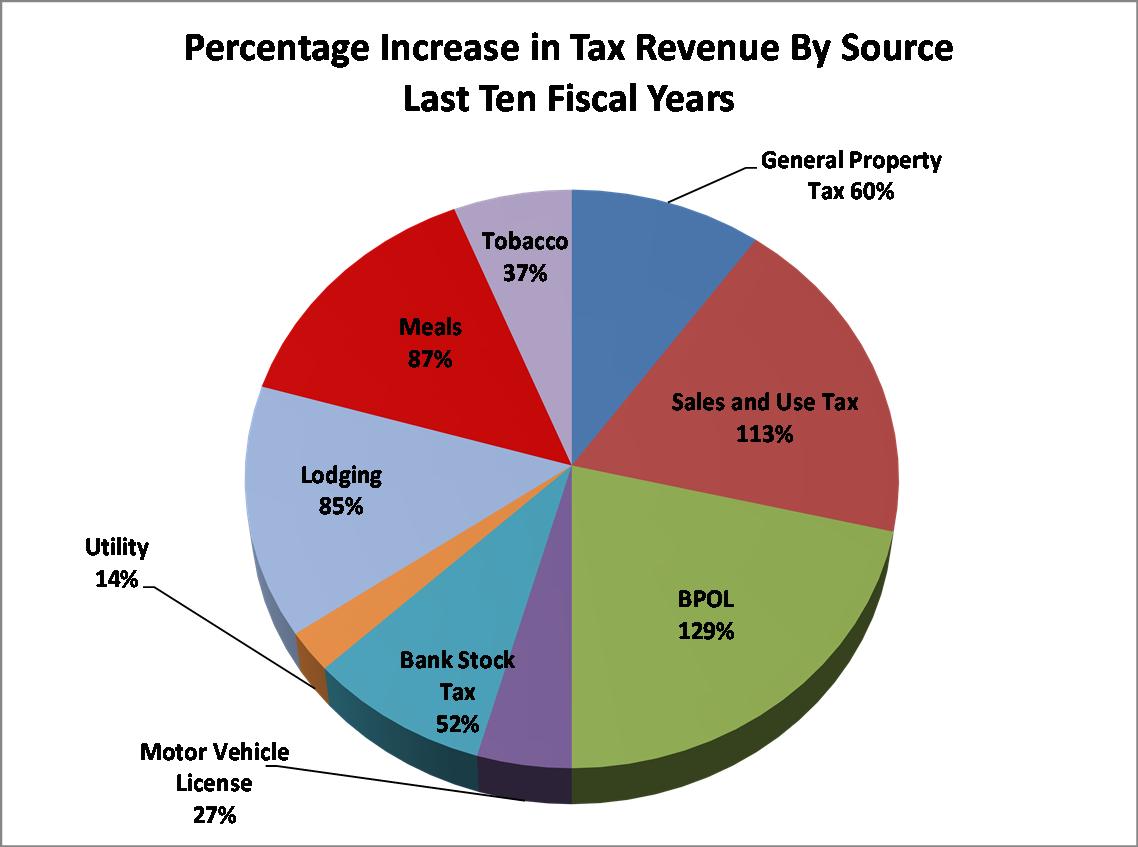

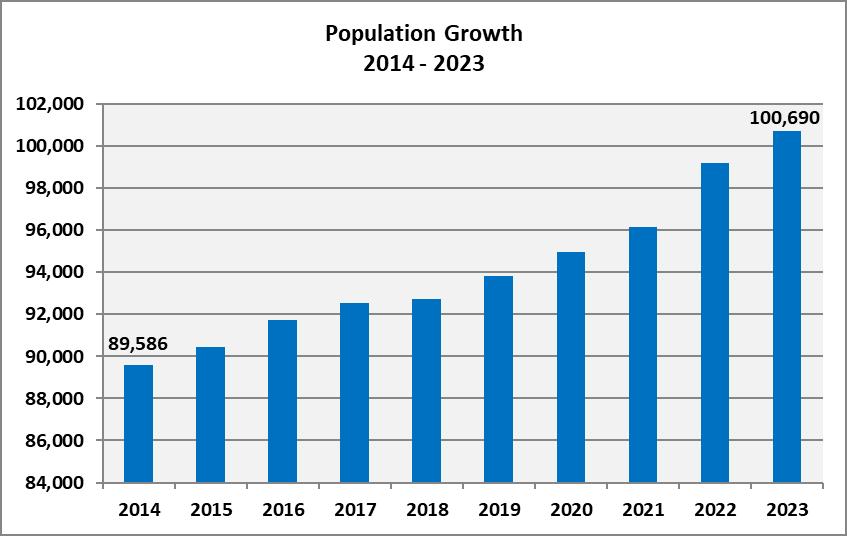

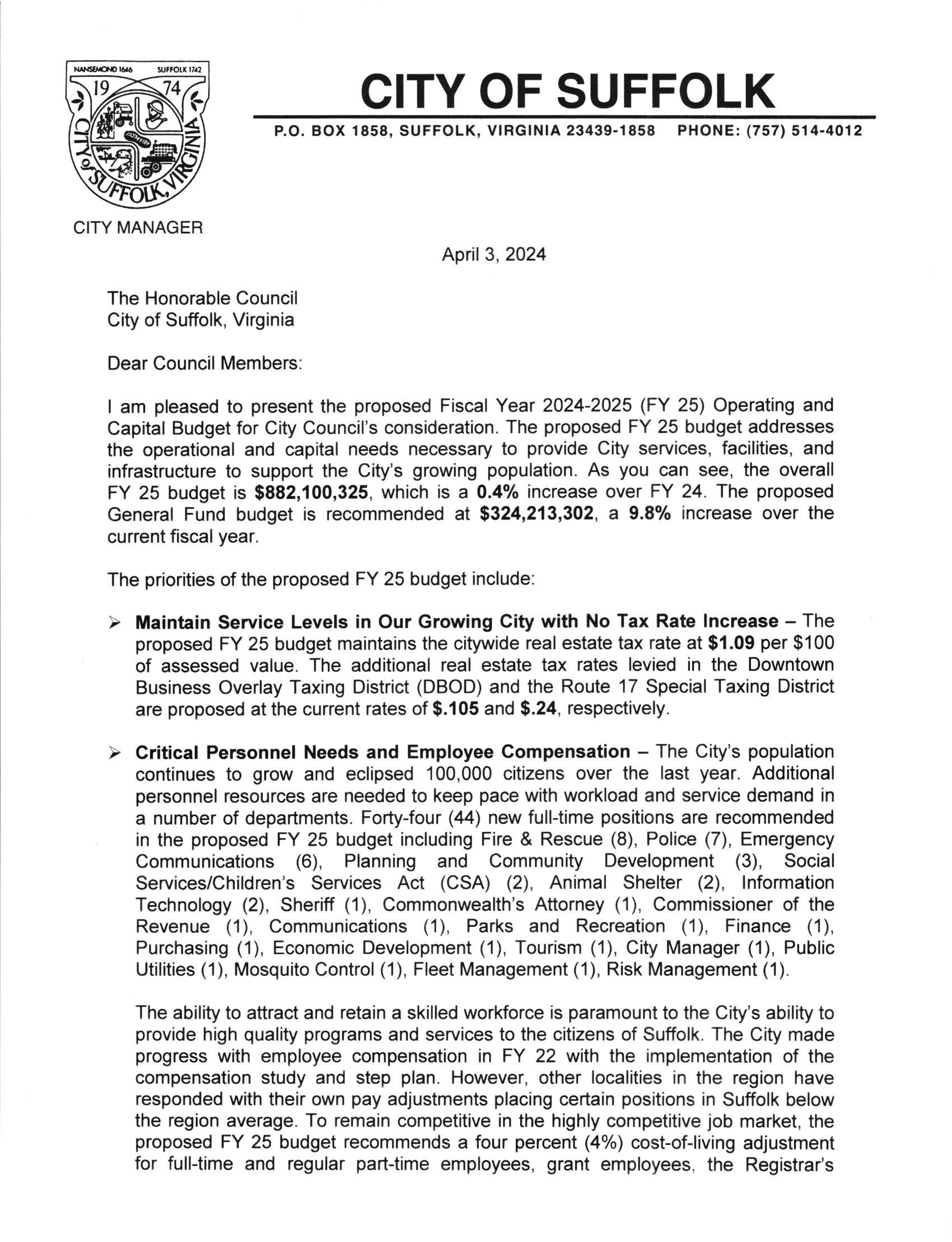

I am pleased to present the proposed Fiscal Year 2024-2025 (FY 25) Operating and Capital Budget for City Council's consideration. The proposed FY 25 budget addresses the operational and capital needs necessary to provide City services, facilities, and infrastructure to support the City's growing population. As you can see, the overall FY 25 budget is $882,100,325, which is a 0.4o/o increase over FY 24. The proposed General Fund budget is recommended at $324,213,302, a 9.87o increase over the current fiscal year.

The priorities of the proposed FY 25 budget include:

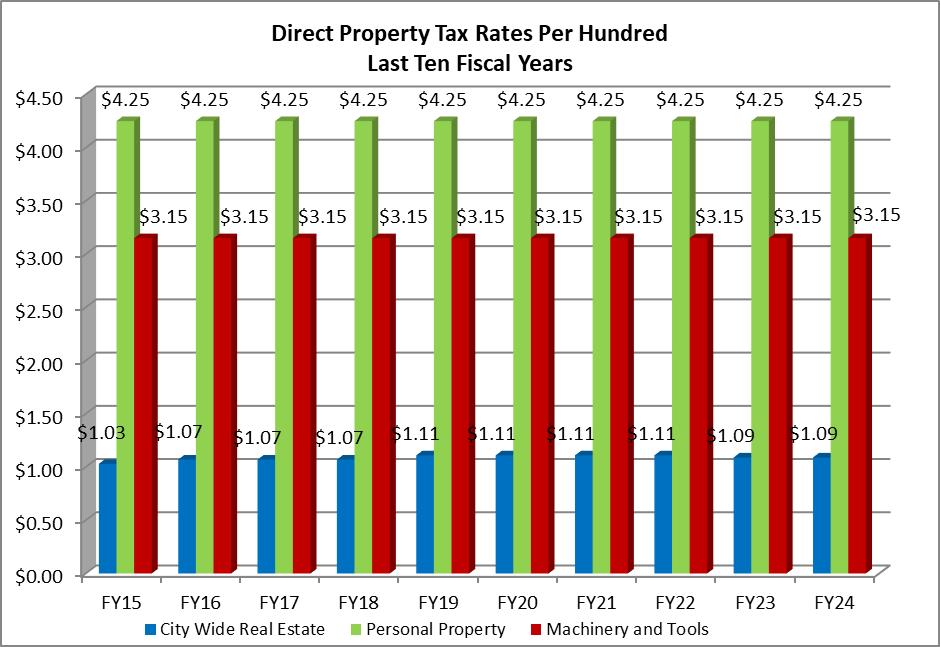

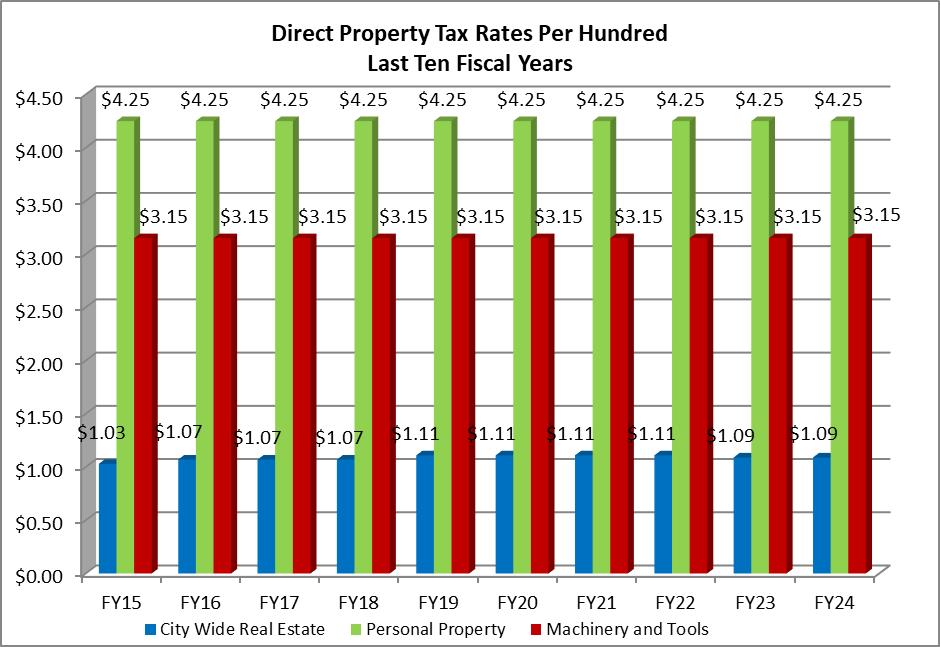

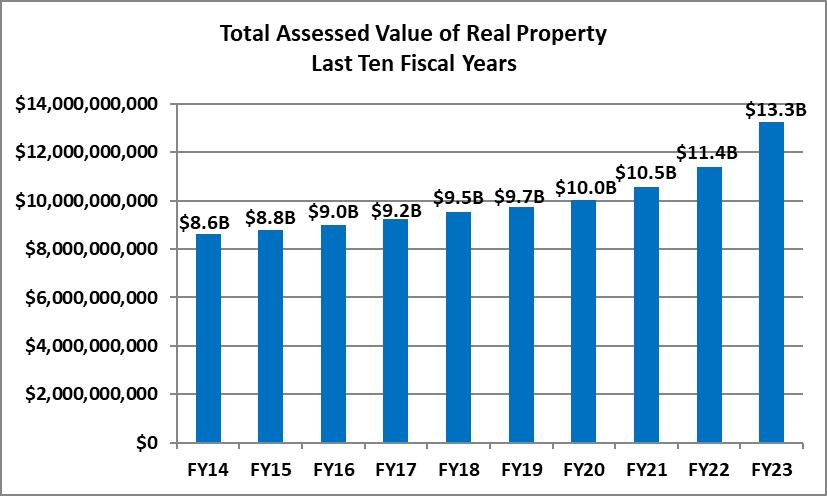

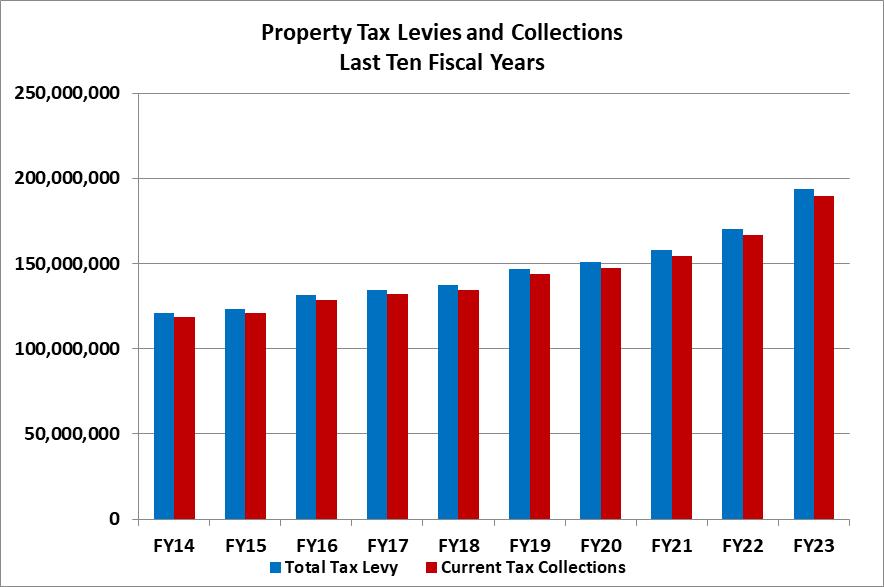

> Maintain Service Levels in Our Growing City with No Tax Rate lncrease - The proposed FY 25 budget maintains the citywide real estate tax rate at $1.09 per $100 of assessed value. The additional real estate tax rates levied in the Downtown Business Overlay Taxing District (DBOD) and the Route 17 Special Taxing District are proposed at the current rates of $.105 and $.24, respectively.

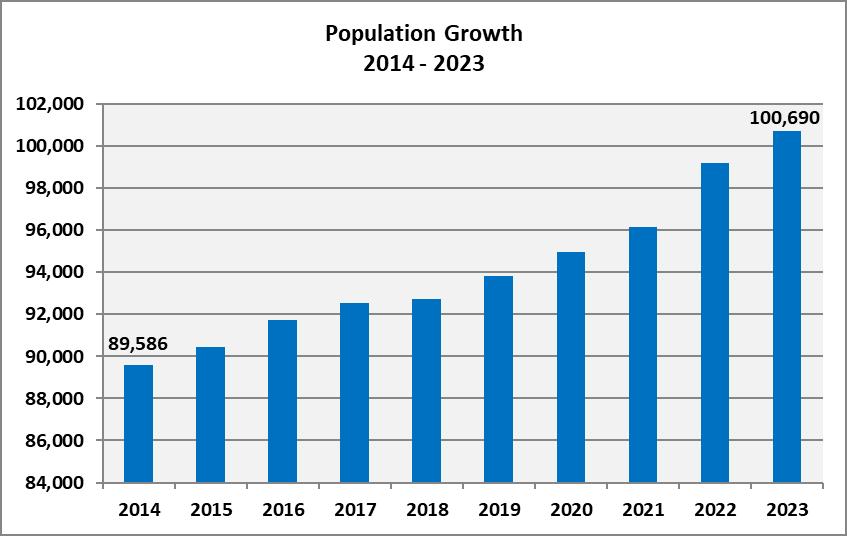

F Critical Personnel Needs and Employee Compensation - The City's population continues to grow and eclipsed 100,000 citizens over the last year. Additional personnel resources are needed to keep pace with workload and service demand in a number of departments. Forty-four (44) new full-time positions are recommended in the proposed FY 25 budget including Fire & Rescue (8), Police (7), Emergency Communications (6), Planning and Community Development (3), Social Services/Children's Services Act (CSA) (2), Animal Shelter (2), lnformation Technology (2), Sheriff (1), Commonwealth's Attorney (1), Commissioner of the Revenue (1), Communications (1), Parks and Recreation (1 ), Finance (1 ), Purchasing (1), Economic Development (1), Tourism (1), City Manager (1), Public Utilities (1), Mosquito Control (1), Fleet Management (1), Risk Management (1).

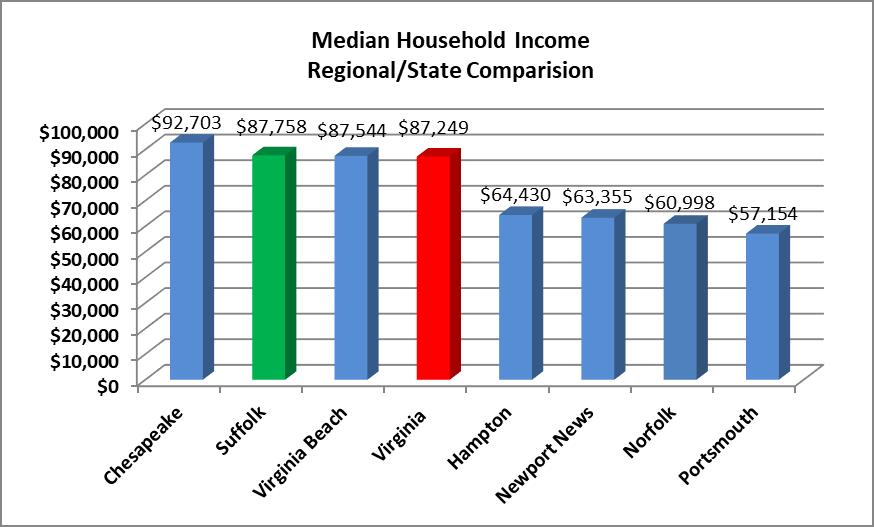

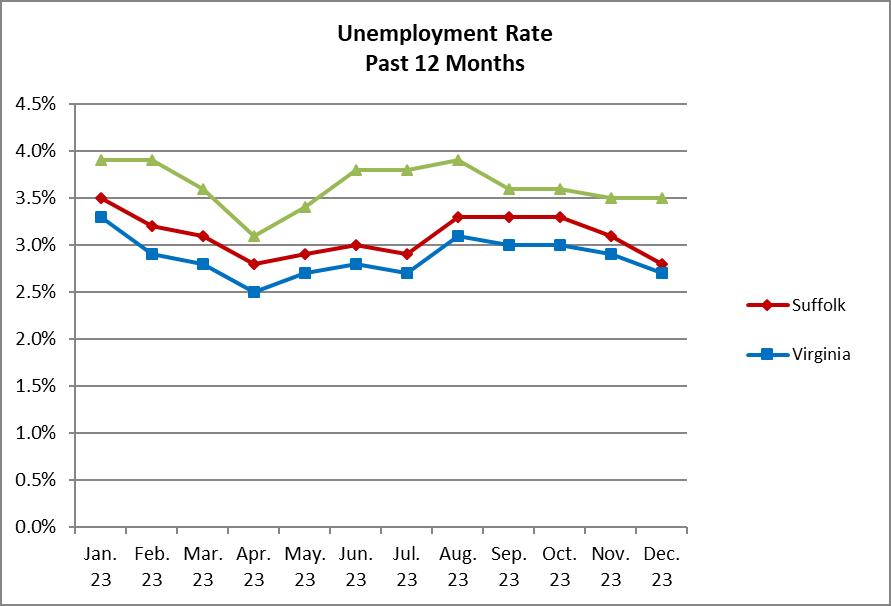

The ability to attract and retain a skilled workforce is paramount to the City's ability to provide high quality programs and services to the citizens of Suffolk. The City made progress with employee compensation in FY 22 with the implementation of the compensation study and step plan. However, other localities in the region have responded with their own pay adjustments placing certain positions in Suffolk below the region average. To remain competitive in the highly competitive job market, the proposed FY 25 budget recommends a four percent (4%) cost-of-living adjustment for full-time and regular part-time employees, grant employees, the Registrar's

P.O. BOX 1858, SUFFOLK, VIRGINIA 23439-1858 PHONE: (757) 514-4012

CITY OF SUFFOLK

7

CITY MANAGER

employees, and Constitutional Offlcers' employees; a one-step increase for sworn police personnel; step increases for qualifying employees in accordance with the adopted step plan; and regrades and reclassifications of positions below market averages or that have experienced changes in job duties. Constitutional Officers, the Registrar, Council appointees, Deputy City Managers, and Department Directors are recommended to receive a market adjustment in lieu of a cost-of-living adjustment.

Community Health and Safety - The proposed FY 25 budget recommends increased funding support for community health and safety. Additional public safety positions have been added in the police department, emergency communications (E-9'11), fire and rescue, and the Sheriffs Office. The proposed budget also provides increased funding for a number of local agencies and nonprofit organizations that provide public health, mental health, legal, emergency housing, food, and legal assistance to citizens in need of services. The City is also continuing efforts to develop an emergency shelter and has set aside funding in the budget for shelter operations.

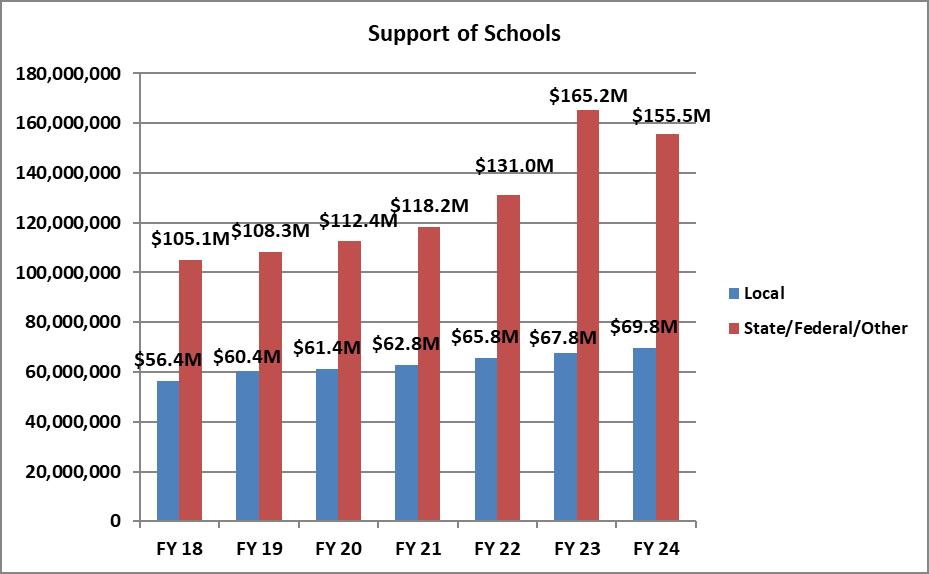

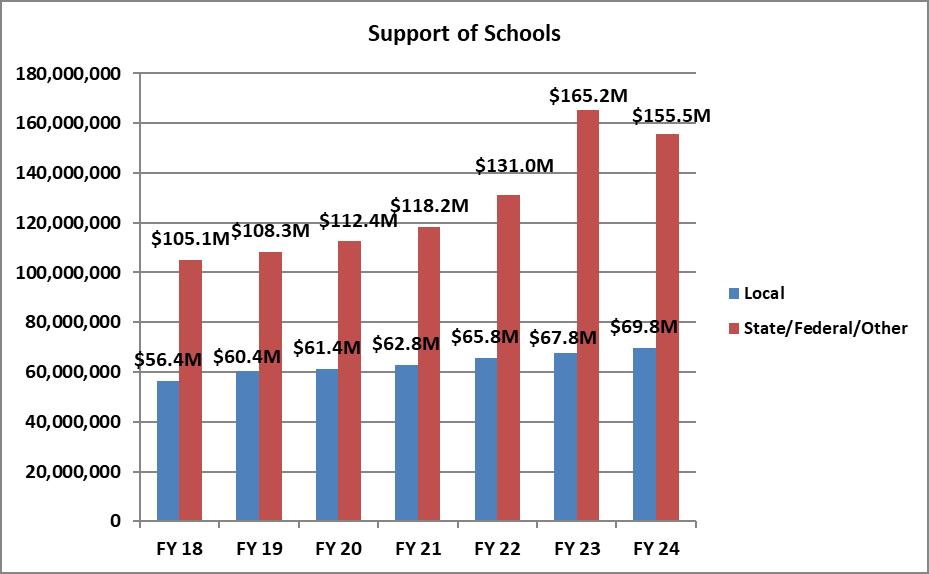

Public Education - The proposed FY 25 budget provides significant funding for public school operations and capital projects. The proposed budget includes t75.3M for Schools operational needs, a $4M increase over the amended FY 24 budget. ln addition, $28.6M is budgeted for the John F. Kennedy Middle School Replacement and Northern Shores Elementary School Addition projects. The proposed budget also includes $11.5M for schools debl service and $739,702 for the school administration and operations facility leases.

Quality of Life - Capital Projects - A total of $83.5M is budgeted for capital project improvements in FY 25. This significant investment in our City will enhance quality of life by improving parks and recreation facilities, public buildings, public safety equipment and training facilities, schools, roadways and intersections, neighborhoods, the downtown area, stormwater drainage, and water and sewer infrastructure.

Numerous major capital projects are undeMay or about to get started across the City including the new downtown library, the College Drive (Station '11) Fire Station, and various road and intersection improvements. Given the scope and complexity of these projects and the continued volatility in construction and equipment prices, it is important to maintain capital contingency funds to ensure projects continue moving foMard for the benefit of City residents. The proposed FY 25 budget provides $8M in General Fund cash to address unforeseen construction challenges without delaying the implementation of these much needed capital improvements

Financial Policy Compliance - AAA Status - The City has made a strong commitment to fiscal responsibility for more than a decade leading to the highest credit ratings that can be achieved. As a Triple AArq rated community, the City is able to secure the lowest possible interest rates available for municipal bonds issued to finance capital proJects. This saves the City millions of dollars in principal and interest expenses. A major factor in maintaining the City's Triple AAA status is compliance with financial policies. The proposed FY 25 budget achieves compliance

8

with all of the City's adopted financial policies including capital pay-go, debt to assessed value and general government operations, and fund balance reserves.

Public Utilities

The Utility Fund is a self-sustaining enterprise fund, which provides safe drinking water and sewage collection services to customers in the City of Suffolk. The proposed FY 25 Utility Fund budget is recommended at $71.8M and includes $7.5M to cash fund utility capital projects in FY 25. Cash funding utility capital projects helps to mitigate future water and sewer rate impacts by preventing the need for additional debt issuance which must be paid back over 20 years through principal and interest payments.

The Utility Fund faces several challenges in FY 25 including:

. Equivalent Residential Units (ERUS) are projected to Iemain flat at 550 ERUS resulting in no anticipated revenue growth from water and sewer connections.

. Bulk water contracts with the City of Norfolk and Portsmouth are projected to increase $441,'195. The Norfolk water contract includes a consumer price index increase next year, and Portsmouth is increasing its water rate 6% which will result in additional costs for bulk water purchase. The City's surface water lakes and groundwater permit do not provide enough water supply to serve our growing community. The City has entered inlo bulk water contracts with Norfolk and Portsmoulh to ensure adequate water supply for citizens and businesses.

. The cost of chemicals and lab supplies continue to increase adding $180,000 in expenses to the Public Utilities budget.

Adjustments to the water and sewer rates are necessary in FY 25 including $.47 monthly per cubic feet to the water rate and S.12 monthly per cubic feet to the sewer rate. The fixed monthly meter service charge will remain at $15.25 per month. The average customer with a 5 ccf combined water and sewer bill will see an increase of approximately $2.95 per month ot 2.8o/o not including any rate adjustments adopted by the Hampton Roads Sanitation District (HRSD).

Stormwater Manaqement Fund

The Stormwater Management Fund is a self-sustaining enterprise fund that oversees the City's state and federal stormwater regulatory permits, development plan review and inspections, stormwater drainage improvements, and mosquito control operations. The Stormwater Management Fund is supported by stormwater fees paid by residential and commercial property owners, permit and inspection fees, and the sale of services to other City funds.

The Stormwater Management Fund budget is recommended at $9.6M in FY 25. The monthly stormwater fee is proposed to remain $7.50 per month, per ERU. Approximately $5.9M in stormwater projects are included in the FY 25 Capital budget to address drainage improvements needed throughout the City. Fy 25 marks the third

9

consecutive year of debt issuance in support of stormwater capital projects. Stormwater debt service will increase by $804,299 in FY 25.

Refuse Fund

The Refuse Fund budget is proposed at $13.6M in FY 25. The proposed budget maintains current service levels for trash collection, disposal, and recycling. The proposed FY 25 Refuse Fund budget utilizes approximately $2.4M from the Refuse Fund unrestricted fund balance to replace multiple aging refuse trucks and to stabilize the refuse rate at the current monthly fee of $25.25 per month.

Closino Remarks

The proposed FY 25 budget is fiscally sound and addresses the operating and capital needs of our growing City of '100,690 residents. The proposed budget maintains the real estate tax rate at its current level, addresses personnel resources to address workload and service demands, compensates our hard working and dedicated employees to ensure the City remains competitive in the region, increases funding for community health and safety and public education, enhances quality of life through capital improvement projects, and complies with all City financial policies to help maintain our AAA status.

The proposed FY 25 budget will be presented to City Council at the work session on April 3, 2024. As you review the proposed budget, please feel free to contact me should you have any questions. WrW-*

Albert S. Moor ll, P.E. City Manager

10

Attachment

CITY OF SUFFOLK, VIRGINIA

PROPOSED FY 2024-25 OPERATING AND CAPITAL BUDGET

Annual Operating and Capital Budget by Fund Recommended Prior Yr. Budget Budget Budget Budget % Fund 2021-2022 2022-2023 2023-2024 2024-2025 Change General Fund $ 237,816,531 $ 263,051,194 $ 295,250,072 $ 324,213,302 10% Capital Projects Fund 60,673,312 62,142,627 131,757,223 83,514,269 -37% Debt Service Fund 29,396,660 30,973,668 33,444,121 34,228,465 2% Downtown Business Overlay District 174,091 190,421 230,842 228,443 -1% Route 17 Special Taxing District 1,989,160 4,526,712 2,565,433 2,675,020 4% Grants Fund 660,129 660,129 800,000 800,000 0% Transit System Fund 2,431,160 1,682,962 2,435,624 3,189,830 31% Aviation Facilities Fund 1,078,197 1,082,899 1,127,319 1,136,650 1% Law Library Fund 48,847 50,460 50,719 0 -100% Road Maintenance Fund 29,722,740 32,307,128 32,119,837 36,732,494 14% Fleet Management Fund 13,949,849 15,154,998 14,956,873 17,347,316 16% Information Technology Fund 13,844,606 14,233,559 15,493,577 17,118,453 10% Risk Management Fund 19,627,218 21,931,001 22,291,801 23,191,500 4% Utility Fund 71,384,777 67,106,896 81,156,518 71,778,919 -12% Stormwater Fund 7,937,478 8,331,177 8,553,039 9,633,418 13% Refuse Services Fund 10,681,077 11,168,391 11,516,086 13,582,526 18% School Fund 196,784,863 232,977,616 224,836,452 242,729,720 8% Total Funds Budget $ 698,200,695 $ 767,571,838 $ 878,585,536 $ 882,100,325 11

Local Tax Dollar for City Services

General Fund

Public Safety 30¢ Education and Related Debt 27¢ Capital Pay-Go 7¢ Debt Service 7¢ Health & Welfare 6¢ General Government 6¢ Parks, Recreation, & Cultural 5¢ Judicial 4¢ Community Development 4¢ Public Works 2¢ Non-Departmental 1¢ Local & Regional Organizations 1¢ $1.00 12

Notes:

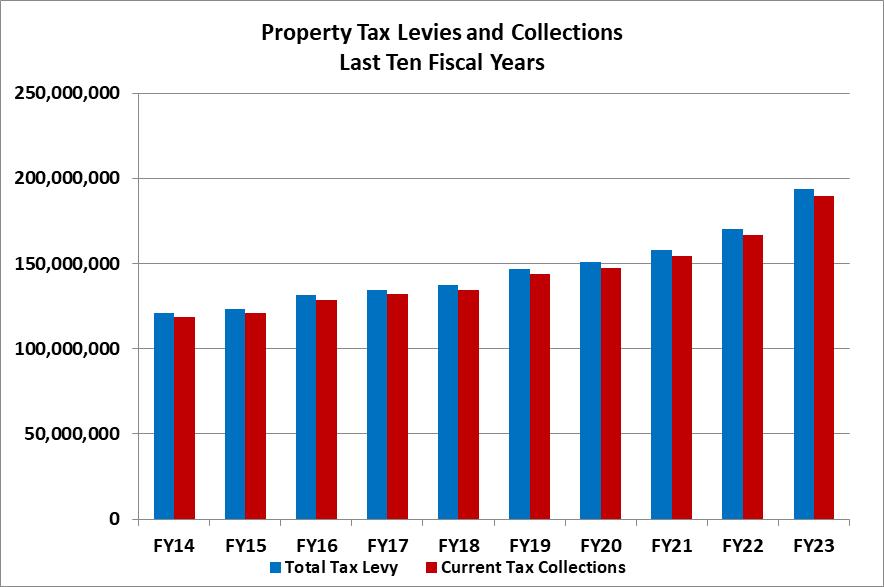

FY 2023 Actual amounts are tied to the City's Annual Comprehensive Financial Report (ACFR) and do not reflect receipts carried forward from prior years or unexpended funds for future years.

Fund Balances are shown in total to include nonspendable, restricted, unrestricted, committed, assigned, and unassigned fund balance classifications.

FY 2023 FY 2024 FY 2025 Actual Budget Budget REVENUES General Property Taxes $ 178,451,277 $ 198,185,884 $ 214,079,668 Other Local Taxes 61,187,205 57,606,203 59,668,872 Permits, Fees, and Regulatory Licenses 3,198,075 2,566,000 2,680,800 Fines and Forfeitures 847,987 945,000 925,000 Use of Money and Property 13,461,299 2,803,627 4,963,940 Charges for Services 123,995,857 135,541,945 144,350,380 Miscellaneous Revenue 8,405,671 3,179,556 3,147,100 Recovered Costs 1,906,518 1,102,050 1,405,568 Revenue from the Commonwealth 199,669,672 221,990,535 220,890,731 Revenue from the Federal Government 53,083,598 37,967,974 39,318,613 Fund Transfers In 123,997,423 150,314,325 149,642,184 Long Term Debt Issuance 31,484,877 38,467,994 15,219,609 Fund Balance - 27,914,443 25,807,862 TOTAL REVENUES $ 799,689,456 $ 878,585,536 $ 882,100,325

Summary of Revenues and Expenditures for All Funds FY 2023 - FY 2025

- by Function General Government $ 45,934,878 $ 61,063,956 $ 61,314,736 Judicial 11,501,040 11,782,698 12,768,222 Public Safety 84,285,405 88,009,647 99,498,364 Public Works 96,394,609 124,174,623 102,635,435 Public Utilities 25,455,240 53,709,622 39,007,193 Health & Welfare 15,061,449 18,108,027 19,112,866 Education 226,611,636 248,036,452 271,304,720 Parks, Recreation & Cultural 16,537,735 20,811,067 21,470,782 Community Development 9,705,409 14,524,992 17,534,565 Other Public Services 7,477,320 6,708,655 6,134,356 Non-Departmental 26,798,569 20,769,334 19,596,010 Debt 41,956,020 59,385,105 60,931,586 Fund Transfers Out 124,685,090 151,501,359 150,791,490 TOTAL EXPENDITURES $ 732,404,401 $ 878,585,536 $ 882,100,325 Projected Fund Balances - June 30, 2024 $ 323,227,103 Projected Fund Balances - June 30, 2025 $ 302,773,347

EXPENDITURES

13

THIS PAGE INTENTIONALLY BLANK

14

City of Suffolk All Funds Revenues and Expenditures Summary FY 2024 - 2025 Proposed Operating and Capital Budget Downtown Business Overlay Taxing General Fund Aviation Fund District Fund REVENUES General Property Taxes $ 211,176,205 $ - $ 228,443 Other Local Taxes 59,668,872 -Permits, Fees, and Regulatory Licenses 1,459,800 -Fines and Forfeitures 675,000 -Use of Money and Property 4,384,132 261,804Charges for Services 4,470,269 -Miscellaneous Revenue 529,000 695,000Recovered Costs 1,140,568 -Revenue from Commonwealth 24,452,979 -Revenue from Federal Government 5,830,319 -Fund Transfers In 3,115,171 179,846Long Term Debt Issuance - -Fund Balance 7,310,987 -TOTAL REVENUES $ 324,213,302 $ 1,136,650 $ 228,443 EXPENDITURES - by Function General Government $ 17,496,137 $ - $Judicial 12,768,222 -Public Safety 95,313,364 -Public Works 7,652,961 - 228,443 Public Utilities - -Health & Welfare 19,112,866 -Education - -Parks, Recreation & Cultural 17,542,693 -Community Development 12,785,397 -Other Public Services 2,070,979 1,035,731Non-departmental 2,799,450 -Debt - -Fund Transfers Out 136,671,232 100,919TOTAL EXPENDITURES $ 324,213,302 $ 1,136,650 $ 228,443 Fund Balances - June 30, 2023 $ 98,014,544 $ 838,167 $ 308,933 Restatement of Beginning Fund Balance: - -Estimated Operating Surplus/(Deficit) FY24: 25,472,116 -Appropriations to/from Fund Balances during the year - FY24 (1,665,550) -Projected Fund Balances - June 30, 2024 121,821,110 838,167 308,933 Appropriations to/from Fund Balances during the year - FY25 (7,310,987) -Projected Fund Balances - June 30, 2025 $ 114,510,123 $ 838,167 $ 308,933 15

General Property Taxes

Other Local Taxes

Permits, Fees, and Regulatory Licenses

Fines and Forfeitures

Use of Money and Property

Charges for Services

Miscellaneous Revenue

Recovered Costs

Revenue from Commonwealth

Revenue from Federal Government

Fund Transfers In Long Term Debt Issuance

Fund Balance

City of Suffolk

Funds Revenues and Expenditures Summary FY 2024 - 2025 Proposed Operating and Capital Budget

All

REVENUES

TOTAL

- by Function General Government Judicial Public Safety Public Works Public Utilities Health & Welfare Education Parks, Recreation & Cultural Community Development Other Public Services Non-departmental Debt Fund Transfers Out TOTAL EXPENDITURES Fund Balances - June 30, 2023 Restatement of Beginning Fund Balance: Estimated Operating Surplus/(Deficit) FY24: Appropriations to/from Fund Balances during the year - FY24 Projected Fund Balances - June 30, 2024 Appropriations to/from Fund Balances during the year - FY25 Projected Fund Balances - June 30, 2025 Law Library Debt Service Transit Fund Fund Fund - $ - $- -- -- -- -62,000 -428,604 -- -664,032 -1,576,194 -9,000 - 34,228,465 - -450,000 -3,189,830 $ - $ 34,228,465 - $ - $- -- -- -- -- -- -- -- -2,973,146 -- -- - 34,228,465 216,684 -3,189,830 $ - $ 34,228,465 3,456,103 $ 232,414 $ 643,011 - -- -- (22,719)3,456,103 209,695 643,011 (450,000) -3,006,103 $ 209,695 $ 643,011 16

REVENUES EXPENDITURES

General Property Taxes

Other Local Taxes Permits, Fees, and Regulatory Licenses Fines and Forfeitures

Use of Money and Property Charges for Services Miscellaneous Revenue Recovered Costs Revenue from Commonwealth Revenue from Federal Government Fund Transfers In Long Term Debt Issuance Fund Balance

City of Suffolk All Funds Revenues and Expenditures Summary FY 2024 - 2025 Proposed Operating and Capital Budget

REVENUES

TOTAL REVENUES

- by Function General Government Judicial Public Safety Public Works Public Utilities Health & Welfare Education Parks, Recreation & Cultural Community Development Other Public Services Non-departmental Debt Fund Transfers Out TOTAL EXPENDITURES Fund Balances - June 30, 2023 Restatement of Beginning Fund Balance: Estimated Operating Surplus/(Deficit) FY24: Appropriations to/from Fund Balances during the year - FY24 Projected Fund Balances - June 30, 2024 Appropriations to/from Fund Balances during the year - FY25 Projected Fund Balances - June 30, 2025 Utility Fleet Mgmt. Information Technology Fund Fund Fund $ - $ - $ - $ - -- -- -298,004 -63,919,227 13,791,816 17,118,453 21,996 -- -- -- -- -- -7,539,692 3,555,500$ 71,778,919 $ 17,347,316 $ 17,118,453 $ $ - $ - $ 16,485,888 $ - -- -- 17,024,16431,467,501 -- -- -- -- -54,500 -6,491,095 86,491 179,683 25,378,410 - 148,500 8,387,413 236,661 304,382 $ 71,778,919 $ 17,347,316 $ 17,118,453 $ $ 37,489,823 $ 18,144,402 $ 999,391 - -172,863 - 43,725 (16,440,362) (3,175,000)21,222,324 14,969,402 1,043,116 (2,185,586) (3,555,500)$ 19,036,738 $ 11,413,902 $ 1,043,116 17

EXPENDITURES

REVENUES General Property Taxes

Other Local Taxes

Permits, Fees, and Regulatory Licenses

Fines and Forfeitures

Use of Money and Property

Charges for Services

Miscellaneous Revenue

Recovered Costs

Revenue from Commonwealth

Revenue from Federal Government

Fund Transfers In Long Term Debt Issuance Fund Balance

City of Suffolk

Funds Revenues and Expenditures Summary FY 2024 - 2025 Proposed Operating and Capital Budget

All

TOTAL REVENUES

- by Function General Government Judicial Public Safety Public Works Public Utilities Health & Welfare Education Parks, Recreation & Cultural Community Development Other Public Services Non-departmental Debt Fund Transfers Out TOTAL EXPENDITURES Fund Balances - June 30, 2023 Restatement of Beginning Fund Balance: Estimated Operating Surplus/(Deficit) FY24: Appropriations to/from Fund Balances during the year - FY24 Projected Fund Balances - June 30, 2024 Appropriations to/from Fund Balances during the year - FY25 Projected Fund Balances - June 30, 2025 Risk Mgmt. Route 17 Taxing Refuse Fund District Fund Fund - $ 2,675,020 $- -- - 801,000 - -- -22,341,501 - 10,036,526 - -- - 265,000 - -- -- -- -850,000 - 2,480,000 23,191,500 $ 2,675,020 $ 13,582,526 22,877,710 $ - $- -- -- - 13,313,526 - -- -- -- -- -- -214,772 1,604,434- -99,018 1,070,586 269,000 23,191,500 $ 2,675,020 $ 13,582,526 10,538,437 $ 4,592,640 $ 5,358,823 - -545,813 122,893 81,726 (850,000) (436,196) (634,722) 10,234,250 4,279,337 4,805,827 (850,000) - (2,480,000) 9,384,250 $ 4,279,337 $ 2,325,827 18

EXPENDITURES

General Property Taxes

Other Local Taxes Permits, Fees, and Regulatory Licenses

Fines and Forfeitures

Use of Money and Property Charges for Services Miscellaneous Revenue

Recovered Costs

Revenue from Commonwealth Revenue from Federal Government

Fund Transfers In Long Term Debt Issuance Fund Balance

City of Suffolk

Revenues and Expenditures Summary FY 2024 - 2025 Proposed Operating and Capital Budget

All Funds

REVENUES

TOTAL REVENUES

- by Function General Government Judicial Public Safety Public Works Public Utilities Health & Welfare Education Parks, Recreation & Cultural Community Development Other Public Services Non-departmental Debt Fund Transfers Out TOTAL EXPENDITURES Fund Balances - June 30, 2023 Restatement of Beginning Fund Balance: Estimated Operating Surplus/(Deficit) FY24: Appropriations to/from Fund Balances during the year - FY24 Projected Fund Balances - June 30, 2024 Appropriations to/from Fund Balances during the year - FY25 Projected Fund Balances - June 30, 2025 Road Maintenance Stormwater Capital Projects Fund Mgmt. Fund Fund $ - $ - $- -420,000 -250,000 -20,000 -1,265,605 8,507,64922,500 - 300,000 - -32,258,475 - 32,017,159 -- - 35,977,501 - - 15,219,609 2,495,914 1,125,769$ 36,732,494 $ 9,633,418 $ 83,514,269 $ - $ - $ 3,655,000 - -- - 4,185,000 34,730,629 6,803,392 22,882,320 - - 7,539,692 - -- - 28,575,000 - - 3,928,089 - - 4,749,168 - -- 220,085 8,000,000 - 1,176,2112,001,865 1,433,730$ 36,732,494 $ 9,633,418 $ 83,514,269 $ 15,897,066 11,809,706 $ 97,537,134 - -10,024,464 334,230(2,741,166) (163,836)23,180,364 11,980,100 97,537,134 (2,495,914) (1,125,769)$ 20,684,450 $ 10,854,331 $ 97,537,134 19

EXPENDITURES

REVENUES

General Property Taxes

Other Local Taxes

Permits, Fees, and Regulatory Licenses

Fines and Forfeitures

Use of Money and Property

Charges for Services

Miscellaneous Revenue

Recovered Costs

Revenue from Commonwealth

Revenue from Federal Government

Fund Transfers In Long Term Debt Issuance

Fund Balance

TOTAL REVENUES

EXPENDITURES - by Function General Government Judicial Public Safety Public Works Public Utilities Health & Welfare Education Parks, Recreation & Cultural Community Development

Other Public Services Non-departmental Debt Fund Transfers Out

Fund Balances - June 30, 2023 Restatement of Beginning Fund Balance:

FY24:

All Funds Revenues and Expenditures Summary

Proposed Operating and Capital Budget

City of Suffolk

FY 2024 - 2025

TOTAL EXPENDITURES

Estimated Operating Surplus/(Deficit)

Appropriations to/from

Balances

Projected

Balances

Appropriations to/from Fund Balances during the year - FY25 Projected Fund Balances - June 30, 2025 Grants Schools Fund Fund Grand Total $ - $ - $ 214,079,668 - - 59,668,872 - - 2,680,800 - - 925,000 - - 4,963,940 - 2,837,334 144,350,380 - 1,150,000 3,147,100 - - 1,405,568 - 131,498,086 220,890,731 - 31,912,100 39,318,613 800,000 75,332,201 149,642,184 - - 15,219,609 - - 25,807,862 $ 800,000 $ 242,729,720 $ 882,100,325 $ 800,000 $ - $ 61,314,736 - - 12,768,222 - - 99,498,364 - - 102,635,435 - - 39,007,193 - - 19,112,866 - 242,729,720 271,304,720 - - 21,470,782 - - 17,534,565 - - 6,134,356 - - 19,596,010 - - 60,931,586 - - 150,791,490 $ 800,000 $ 242,729,720 $ 882,100,325 $ 3,705,605 $ 11,317,028 $ 320,883,227 - -- - 36,797,830 - (8,324,403) (34,453,954) 3,705,605 2,992,625 323,227,103 - - (20,453,756) $ 3,705,605 $ 2,992,625 $ 302,773,347 20

Fund

during the year - FY24

Fund

- June 30, 2024

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

General Fund - Executive Summary

BUDGET PRIORITIES:

•

•

•

•

• Assistant Director of Downtown Development - City Manager's Office

• Assistant Fire Chief (2) - Fire & Rescue

• Benefits Program Manager - Social Services

• Buyer - Purchasing

• Call Taker (2) - Police - Emergency Communications

• Communications Operator (4) - Police - Emergency Communications

• CSA Management Specialist - Social Services

• DEI-B Analyst and Training Consultant - Human Resources

• Deputy Sheriff II - Sheriff

• Family Services Program Manager - Social Services

• Fire Captain - Fire & Rescue

• Fire Recruit (5) - Fire & Rescue

• Grants Manager - Finance

• Police Captain - Police

• Police Recruit (5)/Canine Officer (1) - Police

• Recreation Specialist - Parks and Recreation

• Senior Deputy Commissioner of the Revenue - Commissioner of the Revenue

• Service Support Manager - Planning and Community Development

• Visitor Center Advisor (converted from part-time) - Tourism

• Webmaster - Communications

• Zoning Official - Planning and Community Development

• Zoning Technician - Planning and Community Development FINANCIAL POLICY COMPLIANCE STATUS:

Current R.E. Tax Rate: 1.09 $ % Proposed R.E. Tax Rate: 1.09 $ General Fund Change Proposed Tax Rate Adjustment: - $ Reassessment Tax Rate Impact to Citizens: 0.02 $ Proposed Revenues: 324,213,302 $ 9.8% Proposed Expenditures: 324,213,302 $ 9.8% Unfunded Gap: 0 $

1 Maintain Service Levels in Our Growing City with No Tax Rate Increase 2 Critical Personnel Needs and Employee Compensation 3 Community Health and Safety 4 Public Education 5 Quality of Life - Capital Improvements 6 Financial Policy Compliance - AAA Status OTHER IMPORTANT BUDGET ITEMS TO NOTE: $4M new + $2M FY 24 mid-year funding for Suffolk Public Schools.

Net 38 new full-time positions to address increasing service demand and workload.

Administrative Assistant - Commonwealth's Attorney's Office

Agricultural Specialist

Economic

-

Development

Animal

Caretaker - Animal Shelter

Animal Control Officer - Animal Shelter

Unassigned Fund Balance as % of Governmental Funds - 20% minimum 20.0% Projected Capital Cash "Pay-Go" - 3% min. of General Fund Expenses 11.5% Projected

Debt as % of Assessed Value - 4% maximum 1.4% Projected

Debt as % of General Govt. Expense - 10% maximum 6.2% Projected

21

SUMMARY OF BUDGETED REVENUE CHANGES FROM PRIOR YEAR: 28,963,230 $ 10% Revenue Gains / (Losses) : - Local Tax 17,849,265 $ - Miscellaneous/Fees 2,617,750 - State Revenue & Aid 490,357 - Federal Revenue & Aid 484,200 - Other 7,521,658 SUMMARY OF BUDGETED EXPENDITURE CHANGES FROM PRIOR YEAR: 28,963,230 $ 10% Expenditure Increases / (Decreases): - Personnel & Benefits 10,764,682 $ - Purchased Services 36,865 - Professional Services 741,796 - Repairs and Maintenance 107,293 - Maintenance Service Contracts 168,000 - Printing and Binding 30,540 - Advertising 158,300 - Juvenile Detention Services 480,275 - Information Technology 1,514,353 - Fleet 1,498,260 - Risk 798,113 - Utilities 91,000 - Postage 14,435 - Telecommunications 9,222 - Lease of Equipment 158,297 - Lease of Buildings (62,870) - Travel & Training 157,372 - EDIP- Dues and Memberships 21,303 - Codes (3,000) - Rewards 15,000 - Marketing- Office Supplies 43,256 - Uniforms 187,854 - Books & Subscriptions 105,973 - Other Operating Supplies 93,970 - Merchandise for Resale- Copier 5,443 - Special Programs 155,818 - Capital Outlay (63,974) - Regional Jail Detention Costs (280,623) - Health & Welfare - Social Services 51,111 - Local Organization Contributions 164,327 - Regional Organization Memberships 15,698 - Local Contribution to Schools 6,296,723 - Debt Payments 788,743 - Contingency (60,000) - Transfer to Other Funds (Aviation, Capital, Debt, Fleet, Grants, Public Utilities, Transit) 4,759,677 TOTAL INCREASED SERVICE REQUIREMENTS: 28,963,230 $ 22

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Capital Projects Fund - Executive Summary

Includes:

$7,539,692 in Public Utility cash funding for essential water/sewer projects.

$4,982,750 in Stormwater Bonds for stormwater drainage capital projects.

Cash Pay-Go Funding to leverage significant grant support of the following projects:

$32M or 38% of proposed capital project expenses funded by State/Federal dollars including Virginia Literary Loans.

$26.6M for Capital Pay-Go and contingency to safeguard projects against escalating construction and equipment costs.

FINANCIAL POLICY COMPLIANCE STATUS:

% Capital Projects Change Proposed Revenues: 83,514,269 $ -37% Proposed Expenditures: 83,514,269 $ -37% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: (48,242,954) $

Includes

of the

% Education: 2025 Bond $ Grant $ Grant Northern Shores Elementary Addition 3,575,000 $ Transportation: Pitchkettle Road Realignment 6,037,000 RT58 Improvements - Longstreet Land to Holland Bypass 624,859 10,236,859 $ - $

$25M in Literay

for John F. Kennedy Middle School

GO Bonded Projects

following:

Loan

replacement.

Aviation: Cash Pay-Go Grant $ T Hanger G 120,000 $ 480,000 $ 80% 120,000 $ 480,000 $

Capital Cash "Pay-Go" - 3% min. of General Fund Expenses 11.5% Projected

23

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Aviation Facilities Fund- Executive Summary

Includes:

Administrative and operational services and facilities to the general aviation community. Division maintains and operates the Suffolk Executive Airport to include runways, taxiways, hangar facilities, apron and tie down facilities, fueling facilities, required navigational equipment, and the airport café.

A transfer of $179,846 to support Airport operations from the General Fund to a Special Revenue Fund under the management of the Department of Economic Development.

% Aviation Change Proposed Revenues: 1,136,650 $ 1% Proposed Expenditures: 1,136,650 $ 1% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: 9,331 $

24

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Downtown Business Overlay Tax District Fund - Executive Summary

Includes:

Funding to foster economic development in Downtown Suffolk. Revenues provide for beautification enhancements to the downtown business district, sidewalk and street sweeping, and refuse services.

% Current Tax Rate: 0.105 $ DBOD Change Proposed Tax Rate: 0.105 $ Proposed Tax Rate Adjustment: - $ Proposed Revenues: 228,443 $ -1% Proposed Expenditures: 228,443 $ -1% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: (2,399) $

25

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Law Library Fund - Executive Summary

Includes:

Funding to provide the general public and legal community access to current legal and consumer protection information at no cost. A special fee of $4.00 is levied on civil court cases in the General District and Circuit Courts. This fee is held in a separate fund for the purpose of providing the public and Officers of the Court with a reliable network of legal information and educational support. This fund also supports community outreach efforts, legal publications, the salaries of support staff, and operating costs of the library.

Temporarily closed for courthouse renovations. No funding budgeted in FY 25.

% Law Library Change Proposed Revenues: - $ -100% Proposed Expenditures: - $ -100% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: (50,719) $

26

Includes:

Funding to promote infrastructure improvements to facilitate economic development and business attraction in the taxing district located in North Suffolk.

Transfer of debt service for payment of financed infrastructure improvements in the taxing district. Proposed FY 2024-25 Operating and Capital Budget RT17 Tax District Fund - Executive Summary

% Current Tax Rate: 0.24 $ RT. 17 Tax District Change Proposed R.E. Tax Rate: 0.24 $ Proposed Tax Rate Adjustment: - $ Proposed Revenues: 2,675,020 $ 4% Proposed Expenditures: 2,675,020 $ 4% Unfunded Gap: 0 $ Increase / (Decrease) from Prior Fiscal Year: 109,587 $

27

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

% Road Maintenance Change Proposed Revenues: 36,732,494 $ 14% Proposed Expenditures: 36,732,494 $ 14% Unfunded Gap: 0 $ Increase / (Decrease) from Prior Fiscal Year: 4,612,657 $

Includes:

Funding provides for road maintenance, traffic engineering and signals, signage, paving and street improvements, bridge repairs, and street light utilities.

State Road Maintenance revenue based on City lane miles of: 1,291.46 secondary and 380.26 primary.

28

Road Maintenance Fund - Executive Summary City of Suffolk

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Debt Fund - Executive Summary

% Debt Change Proposed Revenues: 34,228,465 $ 2% Proposed Expenditures: 34,228,465 $ 2% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: 784,345 $ Includes: Annual

service for General

Includes GO Bond

Education: Northern Shores Elementary Addition 3,575,000 $ Transportation: Pitchkettle Road Realignment 6,037,000 RT58 Improvements - Longstreet Land to Holland Bypass 624,859 10,236,859 $ FINANCIAL POLICY COMPLIANCE STATUS: Debt as % of Assessed Value - 4% maximum 1.4% Projected Debt as % of General Govt. Expense - 10% maximum 6.2% Projected

debt

Government Projects.

Revenue for the following projects:

29

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Public Utilities - Executive Summary

Includes:

New customer revenue projection of 550 ERUs (Equivalent Residential Units)

The following rate structure adjustments are proposed effective July 1:

Transfer of $7.5M to cash fund Public Utilities Capital Projects.

Provides for 1 new full-time position:

• Programmer Analyst

% Public Utilities Change Proposed Revenues: 71,778,919 $ -12% Proposed Expenditures: 71,778,919 $ -12% Unfunded Gap: (0) $ Increase / (Decrease) from Prior Fiscal Year: (9,377,599) $

FY 24 FY 25 % Change Water per 100 cubic feet 10.63 $ 11.10 $ 4% Sewer per 100 cubic feet 7.56 $ 7.68 $ 2% Meter Service Charge 5/8 inch & 3/4 inch meter 15.25 $ 15.25 $ 0% Water Availability Charge - Single Family 5,520 $ 5,520 $ 0% Sewer Availability Charge - Single Family 6,000 $ 6,000 $ 0%

FINANCIAL POLICY COMPLIANCE STATUS: Utility Fund Financial Independence of the General Fund Yes Unrestricted Cash and Long Term Investments Balance at 25% of operations 36% Bond amortization not to exceed useful life of projects financed Yes Debt Service Coverage Ratio of 1.15 or greater 1.16

30

Includes:

State/Federal mandated stormwater management services citywide to include mosquito control services.

Debt service for stormwater capital projects.

Provides for 1 new full-time position:

• Mosquito Technician (converted from part-time)

% Current Monthly Fee per ERU: 7.50 $ Stormwater Change Proposed Monthly Fee per ERU: 7.50 $ Proposed Revenues: 9,633,418 $ 13% Proposed Expenditures: 9,633,418 $ 13% Unfunded Gap: 0 $ Increase / (Decrease) from Prior Fiscal Year: 1,080,379 $

31

City of Suffolk Proposed FY 2024-25 Operating and Capital Budget Stormwater Fund - Executive Summary

Proposed FY 2024-25 Operating and Capital Budget City of Suffolk Transit Fund - Executive Summary

Includes:

Operation of six bus routes and ADA service.

A transfer of $418,604 from the General Fund to support Transit operations.

$450,000 from Transit Fund balance previously provided from General Fund transfers to support operational needs.

Increase in state and federal funding of $637,658 for Transit operations.

% Transit Change Proposed Revenues: 3,189,830 $ 31% Proposed Expenditures: 3,189,830 $ 31% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: 754,206 $

32

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Refuse Fund - Executive Summary

Includes:

Provides for refuse, recycling, bulk refuse pick up and disposal costs at the Southeastern Public Service Authority (SPSA) regional landfill.

Provides for Citywide residential refuse and recycling pick-up to an estimated 32,600 households.

Compliance with state mandated citywide recycling requirement.

$2M provided for replacement of refuse trucks.

$480,000 from Refuse Fund unrestricted fund balance provided for rate stabilization.

% Current Monthly Fee per Household: 25.25 $ Refuse Change Proposed Monthly Fee per Household: 25.25 $ Proposed Revenues: 13,582,526 $ 18% Proposed Expenditures: 13,582,526 $ 18% Unfunded Gap: 0 $ Increase / (Decrease) from Prior Fiscal Year: 2,066,440 $

33

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Grants Fund - Executive Summary

Includes:

$800,000 in local cash match funds to leverage state and federal grant opportunities for the City.

% Grants Change Proposed Revenues: 800,000 $ 0% Proposed Expenditures: 800,000 $ 0% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: - $

34

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Fleet Fund - Executive Summary

Includes:

Cost estimate for fuel of $3.33 per gallon.

$3.5M cash funding for fleet equipment additions and replacements due to cost and safety factors.

Provides for 1 new full-time position:

• Fleet Support Associate

% Fleet Change Proposed Revenues: 17,347,316 $ 16% Proposed Expenditures: 17,347,316 $ 16% Unfunded Gap: 0 $ Increase / (Decrease) from Prior Fiscal Year: 2,390,443 $

35

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Information Technology Fund - Executive Summary

Includes:

Funding for citywide technology support services including:

- information technology disaster recovery

- website maintenance

- telecommunications, radio and tower services

- network infrastructure

- internet services

- hardware and software program support

Provides for 2 new full-time positions:

• Business Analyst

• Project Manager

% Information Technology Change Proposed Revenues: 17,118,453 $ 10% Proposed Expenditures: 17,118,453 $ 10% Unfunded Gap: (0) $ Increase / (Decrease) from Prior Fiscal Year: 1,624,876 $

36

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

Risk Fund - Executive Summary

Includes:

Mandated coverage of workers compensation, public safety "line of duty" benefits, employee drug and alcohol screenings, and property/liability insurance.

Mandated provision of health insurance benefits to employees with employer/employee cost sharing formula.

Net 1 new full-time position:

% Risk Change Proposed Revenues: 23,191,500 $ 4% Proposed Expenditures: 23,191,500 $ 4% Unfunded Gap: 0 $ Increase / (Decrease) from Prior Fiscal Year: 899,699 $

Risk Management Specialist retitled from Administrative

of Human Resources Benefits Consultant retitled from Employee Relations Consultant transferred from Department of Human Resources Human Resources Manager retitled Training Manager transferred to Department of Human Resources

Projected compliance for Risk Stabilization Reserve of 20% of anticipated claims. 45%

Analyst transferred from Department

FINANCIAL POLICY COMPLIANCE STATUS:

37

City of Suffolk

Proposed FY 2024-25 Operating and Capital Budget

School Operating Fund - Executive Summary

Year to Year Comparative Data

% Schools Change Proposed Revenues: 242,729,720 $ 8% Proposed Expenditures: 242,729,720 $ 8% Unfunded Gap: - $ Increase / (Decrease) from Prior Fiscal Year: 17,893,268 $ Includes: Request: Recommended: $4M increase + $2M mid-year FY 24 funding in local support for Suffolk Public Schools operations 6,000,000 $ 6,000,000 $ Adopted FY 24 Requested FY 25 Recommended FY 25 % Change Operating Fund 185.4 $ 198.0 $ 198.0 $ 6.80% Lease of Building 0.4 $ 0.7 $ 0.7 $ 75.00% Grant Fund 29.8 $ 34.0 $ 34.0 $ 14.09% Food Services Fund 9.6 $ 10.0 $ 10.0 $ 4.17% Operating Request: 225.2 $ 242.7 $ 242.7 $ 7.77% School Debt Service: 11.9 $ 11.5 $ 11.5 $ -3.36% Total School Funding: 237.1 $ 254.2 $ 254.2 $ 7.21% Student Population: September Enrollment: 14,490 14,518 14,518 0% Average Daily Membership: 14,000 14,000 14,000 0%

38

Citizens City Attorney Clerk of the Circuit Court Sheriff Assessor City of Suffolk FY 20242025 Operating and Capital Budget Organizational Chart Director of Human Resources Chief of Police Fire Chief City Manager Other Authorities, Boards, and Commissions Planning Commission Director of Finance City Clerk School Board Treasurer Commissioner of the Revenue Commonwealth’s Attorney Deputy City Manager Director of Public Works Director of Economic Development Director of Planning & Community Development Director of Public Utilities Director of Parks & Recreation Director of Capital Programs & Facilities Deputy City Manager Director of Social Services Director of Libraries City Council Director of Information Technology Director of Media & Community Relations Elected Officials Appointed Officials

SUFFOLK FOR VISION

SUFFOLK CITY COUNCIL

Suffolk is a vibrant and fiscally strong community leading the region in advancements in education, comprehensive transportation, public safety and diverse economic growth while continuing to preserve its rural heritage and enhancing its neighborhoods and urban centers.

Throughout 430 square miles of rich land and pristine waterways, citizens and tourists treasure the beautiful trails, rivers and open spaces. Residents, visitors and merchants delight in the revitalized downtown featuring cultural, educational and recreational opportunities.

Diverse shopping, businesses and entertainment venues abound. A sense of harmony and pride permeates this rare community, where crime is low; where schools are cutting edge; where people and goods move safely and efficiently throughout the city; and where citizens receive valuable services and have opportunities to be engaged.

Suffolk is the desired destination of the Hampton Roads Region. The City achieves this by focusing on the following:

TARGETED AREAS

PUBLIC SAFETY

Preserve, promote, and continue to invest in public safety.

FINANCIAL STABILITY

Continue practices that ensure strong financial management and fiscal responsibility.

GROWTH MANAGEMENT AND COMPREHENSIVE PLANNING

Use the Comprehensive Plan and Unified Development Ordinance to enable and facilitate private investment in strategic target areas and preserve, conserve, and protect the City's unique natural and agricultural heritage.

CIVIC ENGAGEMENT AND RESPONSIVE CITY SERVICES

Ensure that all citizens have pertinent information in a timely manner and provide convenient and diverse means for citizen input; provide responsive, effective and efficient programs and services to citizens.

EXPANDED ECONOMIC DEVELOPMENT

Implement strategies that add new businesses and provide jobs for a skilled and diverse workforce, retain and enhance existing businesses, promote entrepreneurship, create a vibrant downtown, and build an economy that expands our tax base.

PUBLIC EDUCATION

Create a structure of shared accountability between the City and Schools to build an educational environment known for excellence.

LEISURE, HEALTH, AND WELLNESS

Implement programs and services designed to improve the health, economic and social wellbeing of citizens.

TRANSPORTATION

Increase capacity and connectivity of our roadways and public transportation system.

AAA RATED STANDARD & POOR’S AND FITCH RATINGS.

NERD WALLET - BEST PLACES FOR YOUNG FAMILIES/BEST CITIES FOR VETERANS IN AMERICA - 2015.

9TH BEST COMMUNITY ON BEST PLACES TO LIVE TOP 25

LIST OF “WHERE THE JOBS ARE” – CNN MONEY MAGAZINE – 2012.

ONE OF AMERICA’S BEST SMALL CITIES TO LIVE - CNN MONEY MAGAZINE 2010.

FAST GROWING

CITY,

COMPANIES. 40

HOME TO FAST GROWING

General Operating Fund

41

THIS PAGE INTENTIONALLY BLANK

42

SUFFOLK, VIRGINIA PROPOSED FY 2024-25 OPERATING

Budget 2021-2022 2022-2023 2023-2024 2023-2024 2024-2025 % Revenue Type Actual Actual Budget Projected Recommended Change GENERAL PROPERTY TAXES Real Property $ 117,584,079 $ 137,128,382 $ 156,989,609 $ 160,257,540 $ 168,376,205 7% Public Service Corporation Taxes 4,842,247 4,901,989 4,800,000 5,338,750 5,000,000 4% Personal Property 32,009,431 31,685,199 32,000,000 35,693,855 36,000,000 13% Penalties and Interest on Taxes 1,833,288 2,162,422 1,600,000 2,127,379 1,800,000 13% Total General Property Taxes $ 156,269,045 $ 175,877,992 $ 195,389,609 $ 203,417,524 $ 211,176,205 8% OTHER LOCAL TAXES Sales and Use Tax 16,370,460 18,035,988 16,500,000 18,575,550 17,500,000 6% Communications Sales Tax 2,499,745 2,434,071 2,000,000 2,306,089 2,000,000 0% Utility Taxes ( Electric / Gas) 5,024,008 5,034,466 4,700,000 4,904,249 4,800,000 2% Business License Tax 10,964,624 11,819,247 11,000,000 11,819,247 11,500,000 5% Motor Vehicle License Tax / Fee 2,709,174 2,837,185 2,500,000 2,837,185 2,700,000 8% Bank Stock Tax 747,889 768,872 706,203 706,203 768,872 9% Recordation & Probate Tax 3,279,397 1,851,695 2,200,000 1,708,524 1,800,000 -18% Tobacco Tax 1,831,481 1,849,863 1,600,000 1,474,492 1,600,000 0% Admissions Tax 177,788 227,453 100,000 273,309 200,000 100% Lodging Tax 2,206,627 2,067,131 1,800,000 2,067,131 1,800,000 0% Meals Tax 15,592,762 14,261,234 14,500,000 16,075,344 15,000,000 3% Total Other Local Taxes $ 61,403,956 $ 61,187,205 $ 57,606,203 $ 62,747,323 $ 59,668,872 4% TOTAL LOCAL TAX REVENUE $ 217,673,001 $ 237,065,197 $ 252,995,812 $ 266,164,847 $ 270,845,077 7% PERMITS, PRIVILEGE FEES, AND REGULATORY LICENSES Animal License 29,414 25,298 25,000 20,463 25,000 0% Land Use Application Fee 29,070 14,940 15,000 15,000 15,000 0% Land Transfer Fee 4,871 3,430 3,000 3,000 3,000 0% Zoning, Use and Ordinance Fee 469,283 339,460 300,000 300,000 300,000 0% Building Permits 1,608,485 1,297,186 1,000,000 1,475,227 1,000,000 0% Weapons Permits 65,104 74,032 70,000 59,002 50,000 -29% Borrow Pit Fees 176,078 129,046 65,000 65,000 65,000 0% Fishing Permits 1,377 380 1,300 1,300 1,300 0% Miscellaneous Permits 593 695 500 500 500 0% Total Permits, Privilege Fees, and Regulatory Licenses $ 2,384,274 $ 1,884,467 $ 1,479,800 $ 1,939,492 $ 1,459,800 -1% FINES & FORFEITURES General District Court Fines 383,726 363,076 375,000 375,000 375,000 0% Parking Fines and Violation Fees 133,678 135,652 120,000 109,385 100,000 -17% False Alarm Violation Fees 199,853 175,737 200,000 200,000 200,000 0% Total Fines & Forfeitures $ 717,257 $ 674,465 $ 695,000 $ 684,385 $ 675,000 -3% REVENUE FROM USE OF MONEY AND PROPERTY Interest on Investments 307,011 4,306,672 1,000,000 16,029,138 2,000,000 100% Interest on Bond Proceeds 208,917 3,634,415 1,000,000 5,349,533 2,000,000 100% Municipal Center Building Rent 191,870 203,248 203,248 203,248 209,545 3% Park Facility Use Fees 32,050 21,590 25,000 25,000 25,000 0% Recreational Building Rental 123,700 142,044 100,000 123,455 100,000 0% Antenna Space Rental 34,560 34,560 34,560 34,560 41,472 20% Vending Machine Commission 15,771 19,152 - 14,300 -Other Rentals 8,115 8,115 6,615 8,215 8,115 23% Total Revenue from Use of Money and Property $ 921,994 $ 8,369,796 $ 2,369,423 $ 21,787,449 $ 4,384,132 85% GENERAL FUND Revenue Summary 43

CITY OF

AND CAPITAL BUDGET

OF SUFFOLK, VIRGINIA PROPOSED FY 2024-25 OPERATING AND CAPITAL BUDGET Budget 2021-2022 2022-2023 2023-2024 2023-2024 2024-2025 % Revenue Type Actual Actual Budget Projected Recommended Change GENERAL FUND Revenue Summary

Excess Fees - Circuit Court Clerk 213,134 88,734 100,000 100,000 100,000 0% Sheriff's Fees (Serving Court Papers) 7,099 4,474 5,787 5,787 5,787 0% Court Appointed Attorney Fees 15,848 25,022 18,000 18,000 18,000 0% Court Security Fee 67,715 72,368 80,000 80,000 80,000 0% Commonwealth Attorney's Fees 7,824 8,356 8,000 8,000 8,000 0% Police 36,056 36,778 35,000 35,000 35,000 0% Fire & Rescue 14,620 5,022 15,000 15,000 15,000 0% EMS Fee 2,644,364 3,195,157 2,868,408 2,868,408 3,182,932 11% Animal Control Fees 21,940 31,154 50,000 50,000 50,000 0% Recreation & Special Event Fees 632,410 799,863 600,000 600,000 600,000 0% Library Fines and Charges 10,572 13,557 15,000 11,099 15,000 0% Tourism Special Event Fees 8,569 22,509 23,000 8,093 28,000 22% Charges for Planning & Community Development - - 50 50 50 0% Sale of Service - Capital Projects Administration 33,853 49,540 55,000 55,000 50,000 -9% Sale of Service - Road Maintenance (Police Weights & Measures) 151,971 240,436 115,000 182,196 200,000 74% Sale of Service - Road Maintenance Fund (Landscape by P&R) 800 - 7,500 7,500 7,500 0% Grave Openings 108,000 85,085 90,000 87,754 75,000 -17% Total Charges for Services $ 3,974,775 $ 4,678,055 $ 4,085,745 $ 4,131,887 $ 4,470,269 9% MISCELLANEOUS REVENUE SRHA - Payment in Lieu of Taxes - - 3,000 - 3,000 0% Sale of Salvage/Surplus Property 3,959 704 1,000 2,338 1,000 0% Sale of Real Estate 21,065 11,199 15,000 6,933 15,000 0% Delinquent Tax Collection Fee 614,723 783,172 500,000 639,641 500,000 0% Miscellaneous Revenue (401,206) (484,638) - (389,501) -Sales - Tourism 14,961 15,947 10,000 10,000 10,000 0% Total Miscellaneous Revenue $ 253,502 $ 326,384 $ 529,000 $ 269,411 $ 529,000 0% RECOVERED COSTS Reimbursement - Other Localities 55,651 58,108 100,000 100,000 100,000 0% Reimbursement - School Board 488,589 641,604 631,550 631,550 890,068 41% Reimbursement - Community Service Board 199,977 188,582 150,000 150,000 150,000 0% Reimbursement - Jury Duty Compensation 1,038 930 500 920 500 0% Reimbursement - Extradition of Prisoners 35,483 26,429 - 45,819 -Total Recovered Costs $ 780,738 $ 915,652 $ 882,050 $ 928,289 $ 1,140,568 29% TOTAL REVENUE FROM FEES / CHARGES $ 9,032,540 $ 16,848,821 $ 10,041,018 $ 29,740,913 $ 12,658,769 26% REVENUE FROM THE COMMONWEALTH - NON CATEGORICAL AID Mobile Home Titling Tax 37,724 32,755 25,000 32,755 25,000 0% Tax on Deeds - Grantors Tax 746,545 542,418 450,000 450,000 450,000 0% Rolling Stock Tax 130,114 138,544 125,000 138,544 125,000 0% Police House Bill 599 3,075,124 3,380,654 3,380,652 3,522,634 3,522,634 4% Personal Property Tax Relief 10,169,730 10,169,730 10,169,730 10,169,730 10,169,730 0% Vehicle Rental Tax 245,212 250,946 200,000 250,946 200,000 0% Games of Skill 18,000 - - - -Total Non-Categorical Aid $ 14,422,449 $ 14,515,047 $ 14,350,382 $ 14,564,609 $ 14,492,364 1% 44

CITY

CHARGES FOR SERVICES

SUFFOLK, VIRGINIA PROPOSED FY 2024-25 OPERATING

CAPITAL

Budget 2021-2022 2022-2023 2023-2024 2023-2024 2024-2025 % Revenue Type Actual Actual Budget Projected Recommended Change GENERAL FUND Revenue Summary SHARED EXPENSES Commonwealth Attorney 1,118,106 1,134,463 1,225,673 1,225,673 1,225,673 0% Sheriff 1,102,701 1,141,792 1,209,916 1,209,916 1,209,916 0% Commissioner of the Revenue 229,973 240,374 253,810 253,810 253,810 0% Treasurer 270,348 288,525 306,662 306,662 306,662 0% Registrar 101,660 92,380 106,071 106,071 106,071 0% Circuit Court Clerk 576,610 626,834 628,220 635,220 635,220 1% Total Shared Expenses $ 3,399,399 $ 3,524,368 $ 3,730,352 $ 3,737,352 $ 3,737,352 0% CATEGORICAL AID Asset Forfeiture Funds 4,713 2,775 - 11,782 -Jurors' Fees 5,820 24,630 10,000 42,890 40,000 300% Courthouse Maintenance Fees 24,514 30,367 30,000 30,367 30,000 0% Public Assistance Grants 2,359,231 2,661,991 2,938,158 2,938,158 3,128,633 6% Comprehensive Services Act 1,518,461 1,731,741 1,820,468 1,820,468 1,864,132 2% Property Seizure Program - Police 11,459 5,081 - 35,345 -Wireless E911 Grant 492,679 437,642 400,000 437,642 400,000 0% Miscellaneous Grants 377 224 - 2,391 -Four for Life Grant - EMS 93,893 93,435 93,893 93,893 93,435 0% Fire Programs Fund 342,357 378,438 378,438 424,690 424,690 12% Library Aid 237,572 157,586 210,931 247,524 242,374 15% Total Categorical Aid $ 5,091,075 $ 5,523,912 $ 5,881,888 $ 6,085,150 $ 6,223,264 6% TOTAL STATE REVENUE $ 22,912,923 $ 23,563,327 $ 23,962,622 $ 24,387,111 $ 24,452,979 2% REVENUE FROM THE FEDERAL GOVERNMENT - NON CATEGORICAL AID Property Seizure Program - Police 5,748 3,042 - 838 -Public Safety DEA Overtime 14,170 - - - -Public Assistance Grants 5,259,003 5,643,557 5,326,119 5,326,119 5,810,319 9% Refuge Revenue Sharing (Dismal Swamp) 21,100 23,504 20,000 20,000 20,000 0% TOTAL FEDERAL REVENUE $ 5,300,021 $ 5,670,103 $ 5,346,119 $ 5,346,957 $ 5,830,319 9% FUND TRANSFERS Transfer from Fund Balance - - - - 7,310,987Indirect Cost Return: Transfer from Road Maintenance Fund 714,960 563,241 578,590 578,590 667,056 15% Transfer from Transit 95,589 219,659 167,731 167,731 156,684 -7% Transfer from Aviation Fund 89,329 100,135 95,562 95,562 100,919 6% Transfer from Utility Fund 808,685 737,020 788,941 788,941 847,721 7% Transfer from Stormwater Fund 279,372 335,756 341,634 341,634 433,730 27% Transfer from Refuse Fund 302,897 244,397 268,971 268,971 269,000 0% Transfer from Fleet Management Fund 280,676 263,842 239,199 239,199 236,661 -1% Transfer from Information Technology Fund 290,789 351,128 337,321 337,321 304,382 -10% Transfer from Risk Management Fund 68,350 99,896 86,551 86,551 99,018 14% TOTAL OTHER REVENUE $ 2,930,647 $ 2,915,074 $ 2,904,500 $ 2,904,500 $ 10,426,158 259% TOTAL REVENUES $ 257,849,132 $ 286,062,521 $ 295,250,072 $ 328,544,328 $ 324,213,302 9.8% 45

CITY OF

AND

BUDGET

GENERAL GOVERNMENT

Budget 2021-2022 2022-2023 2023-2024 2023-2024 % 2024-2025 % 2024-2025 % Actual Actual Budget Exp To Dec Exp Request Incr Recommended Change

CITY OF SUFFOLK, VIRGINIA PROPOSED FY 2024-25 OPERATING AND CAPITAL BUDGET

City Council $ 444,475 $ 516,151 $ 765,187 $ 315,483 41% $ 768,668 0% $ 797,594 4% City Manager 1,162,914 1,213,640 1,371,650 613,360 45% 1,381,649 1% 1,654,125 21% Budget & Strategic Planning 374,556 391,951 420,789 197,855 47% 522,051 24% 467,366 11% City Attorney 1,290,388 1,286,717 1,507,740 663,398 44% 1,507,866 0% 1,564,288 4% Human Resources 1,555,246 1,689,892 2,053,811 931,481 45% 2,082,964 1% 2,147,774 5% Commissioner of the Revenue 1,159,466 1,316,428 1,355,066 608,739 45% 1,448,264 7% 1,569,389 16% Assessor 1,907,744 2,178,399 2,562,643 1,144,803 45% 2,571,643 0% 2,814,605 10% Treasurer 1,761,661 1,903,806 2,053,705 994,599 48% 2,076,681 1% 2,216,471 8% Finance 1,714,759 1,950,187 2,162,778 975,625 45% 2,334,365 8% 2,439,930 13% Purchasing 359,339 386,439 412,155 191,263 46% 471,731 14% 510,768 24% Registrar 828,826 940,224 1,263,980 699,039 55% 1,244,333 -2% 1,313,828 4% Total General Government $ 12,559,373 $ 13,773,835 $ 15,929,503 $ 7,335,644 46% $ 16,410,215 3% $ 17,496,137 10%

Circuit Court Judges 220,222 228,375 342,245 114,801 34% 334,245 -2% 361,641 6% General District Court 60,901 87,053 87,246 15,917 18% 107,246 23% 107,246 23% Magistrate's Office 13,725 14,463 17,975 5,824 32% 15,075 -16% 15,075 -16% Juvenile & Domestic Relations Court 13,347 13,261 17,939 5,910 33% 19,653 10% 19,039 6% Court Services Unit 847,633 793,516 973,885 657,027 67% 1,454,160 49% 1,454,160 49% Clerk of the Circuit Court 1,679,449 1,818,378 2,015,766 880,258 44% 2,072,174 3% 2,158,034 7% Sheriff 3,563,618 3,836,164 4,032,012 1,887,172 47% 4,205,916 4% 4,494,237 11% Commonwealth's Attorney 3,509,711 3,715,581 4,244,911 1,823,885 43% 4,416,147 4% 4,158,791 -2% Total Judicial $ 9,908,606 $ 10,506,792 $ 11,731,978 $ 5,390,794 46% $ 12,624,616 8% $ 12,768,222 9% PUBLIC SAFETY Police 26,459,081 29,397,864 32,190,510 15,259,966 47% 34,703,801 8% 37,182,807 16% Police - Emergency Communications 1,670,661 2,094,824 2,606,831 1,190,666 46% 3,301,079 27% 3,463,797 33% Animal Shelter Management 758,966 982,915 1,145,391 510,039 45% 1,326,553 16% 1,401,329 22% Fire and Rescue 35,991,963 41,171,428 45,156,596 22,130,171 49% 46,969,548 4% 48,962,727 8% Fire and Rescue - Emergency Management 9,376 11,452 15,617 2,523 16% 22,627 45% 22,627 45% Western Tidewater Regional Jail 4,492,631 4,560,701 4,560,701 2,280,351 50% 4,280,078 -6% 4,280,078 -6% Total Public Safety $ 69,382,678 $ 78,219,185 $ 85,675,647 $ 41,373,716 48% $ 90,603,686 6% $ 95,313,364 11% PUBLIC WORKS Public Works - Administration 1,013,405 1,210,369 1,378,627 549,866 40% 1,500,792 9% 1,504,380 9% Capital Programs & Facilities 4,412,774 4,921,294 5,530,134 2,724,678 49% 5,795,138 5% 6,148,582 11% Total Public Works $ 5,426,179 $ 6,131,663 $ 6,908,761 $ 3,274,544 47% $ 7,295,930 6% $ 7,652,961 11%

46

JUDICIAL

GENERAL FUND Expenditure Summary

GENERAL FUND Expenditure Summary

HEALTH & WELFARE

PROPOSED

Budget 2021-2022 2022-2023 2023-2024 2023-2024 % 2024-2025 % 2024-2025 % Actual Actual Budget Exp To Dec Exp Request Incr Recommended Change

CITY OF SUFFOLK, VIRGINIA

FY 2024-25 OPERATING AND CAPITAL BUDGET

Social Services 10,862,477 10,825,545 13,451,269 5,068,421 38% 13,733,961 2% 14,290,669 6% Children's Services Act 2,184,136 2,478,687 2,811,757 940,673 33% 2,855,494 2% 2,867,511 2% Western Tidewater Health District 1,095,655 1,189,651 1,245,000 622,500 50% 1,300,000 4% 1,300,000 4% Western Tidewater Community Service Board 474,404 550,000 600,000 300,000 50% 654,686 9% 654,686 9% Total Health & Welfare $ 14,616,672 $ 15,043,883 $ 18,108,027 $ 6,931,594 38% $ 18,544,141 2% $ 19,112,866 6% EDUCATION Transfer to School Operating - Local Support 65,377,695 66,507,115 69,775,180 29,966,634 43% 76,071,903 9% 76,071,903 9% Total Education $ 65,377,695 $ 66,507,115 $ 69,775,180 $ 29,966,634 43% $ 76,071,903 9% $ 76,071,903 9% PARKS, RECREATION & CULTURAL Parks and Recreation - Administration 2,676,052 3,257,913 3,630,475 1,618,471 45% 3,891,591 7% 4,002,343 10% Parks and Recreation - Parks, Gateways & Maintenance 2,981,017 3,357,279 3,850,403 1,651,332 43% 3,955,657 3% 4,250,878 10% Parks and Recreation - Recreation 2,271,375 2,995,979 4,091,301 1,933,834 47% 5,579,022 36% 4,599,180 12% Library 3,470,088 3,933,816 4,173,547 2,140,910 51% 4,565,351 9% 4,690,293 12% Total Parks, Recreation & Cultural $ 11,398,532 $ 13,544,987 $ 15,745,726 $ 7,344,547 47% $ 17,991,621 14% $ 17,542,693 11% COMMUNITY DEVELOPMENT Planning and Community Development 4,111,620 4,699,826 6,666,015 2,464,300 37% 7,696,819 15% 7,340,865 10% Economic Development 1,786,768 968,649 2,718,906 628,538 23% 2,726,905 0% 2,918,228 7% Tourism 735,388 823,914 892,155 443,767 50% 1,039,150 16% 986,222 11% Communications 886,899 796,411 1,196,820 463,524 39% 1,489,550 24% 1,452,303 21% Virginia Cooperative Extension Service 31,084 55,703 79,117 7,604 10% 87,779 11% 87,779 11% Total Community Development $ 7,551,759 $ 7,344,504 $ 11,553,012 $ 4,007,733 35% $ 13,040,203 13% $ 12,785,397 11% OTHER PUBLIC SERVICES Local and Regional Organizations 1,215,257 2,376,244 1,885,955 1,279,995 68% 2,355,168 25% 2,070,979 10% Total Other Public Services $ 1,215,257 $ 2,376,244 $ 1,885,955 $ 1,279,995 68% $ 2,355,168 25% $ 2,070,979 10% NON-DEPARTMENTAL Non-departmental 673,338 1,356,352 2,885,372 6,973 0% 2,799,450 -3% 2,799,450 -3% Transfer to Funds (Capital, Debt, Transit, Aviation) 33,494,035 37,751,872 55,050,910 27,986,944 51% 53,024,243 -4% 60,599,329 10% Total Non-departmental $ 34,167,372 $ 39,108,224 $ 57,936,282 $ 27,993,917 48% $ 55,823,693 -4% $ 63,398,779 9% Total General Fund Expenditures $ 231,604,123 $ 252,556,432 $ 295,250,072 $ 134,899,118 46% $ 310,761,175 5% $ 324,213,302 9.8% 47

THIS PAGE INTENTIONALLY BLANK

48

City Council Description

The City Council is the legislative and policy making body of the City Government. It establishes policies, sets goals and priorities, and interprets and represents the needs of the community to ensure the economic, social, educational, and physical quality of the City. The City Council is supported by the City Clerk whose office is responsible for the preservation and maintenance of the legislative record; recording and publishing City Council minutes; serving as an information center to address inquiries from citizens, municipal departments, and agencies; the management of boards and commissions; and fulfilling research requests.

Council Target Area

Civic Engagement & Responsive City Services

Budget Highlights:

No significant changes.

FY 25 Objectives

To prepare City Council meeting minutes in accordance with State Code provisions

To comply with Freedom of Information Act (FOIA) requests within five working days as outlined in the State Code.

To disseminate all City Council resolutions and ordinances within seven days of approval.

FY 23 FY 24 FY 25 Actual Projected Estimate Number of internal and external inquiries received 2,200 2,600 3,000 Average response time to internal and external inquiries 2 days 2 days 2 days Average time to post Council actions to website 2 days 2 days 2 days Meeting minutes prepared in accordance with State Code 100% 100% 100% Percent of FOIA requests answered within five working days 100% 100% 100% Percent of ordinances/resolutions disseminated within seven days 95% 96% 97%

Key Measures

49

Department: City Council Budget Detail 2021-2022 2022-2023 2023-2024 2023-2024 % 2024-2025 % 2024-2025 % Account Number: 100-11110- Actual Actual Budget Exp to Dec Exp Requested Change Recommended Change 51100.02 Salaries and Wages $ 306,127 $ 321,258 $ 440,092 $ 186,012 42% $ 440,092 0% $ 453,897 3% 52100 FICA 23,123 24,062 33,667 13,748 41% 33,667 0% 34,723 3% 52210 VRS Retirement 5,131 27,179 35,268 14,269 40% 35,268 0% 39,033 11% 52400 Group Life 2,360 2,624 3,405 1,377 40% 3,405 0% 3,590 5% 53100 Professional Services 295 67 5,000 216 4% 5,000 0% 5,000 0% 54100 Information Technology 52,620 52,731 69,031 30,132 44% 69,031 0% 77,264 12% 54500 Risk Management 15,532 28,995 109,859 54,929 50% 100,839 -8% 112,722 3% 55210 Postal Services 121 189 1,000 121 12% 1,000 0% 1,000 0% 55230 Telecommunications 10,249 11,502 12,347 3,948 32% 12,347 0% 12,347 0% 55500 Travel and Training 11,900 20,603 20,000 3,495 17% 30,000 50% 25,000 25% 55810 Dues & Association Memberships 190 285 750 - 0% 1,000 33% 1,000 33% 55840 Code Expense 5,358 6,876 10,000 5,126 51% 7,000 -30% 7,000 -30% 56001 Office Supplies 2,549 4,285 5,500 616 11% 5,500 0% 5,500 0% 56012 Books and Subscriptions 878 840 750 496 66% 1,000 33% 1,000 33% 56017 Copier Costs 2,372 2,647 3,519 996 28% 3,519 0% 3,519 0% 56026 Special Events 5,671 12,010 15,000 - 0% 20,000 33% 15,000 0% Total Operating Expenditures $ 444,475 $ 516,151 $ 765,187 $ 315,483 41% $ 768,668 0% $ 797,594 4% 56026 - Special Events: Christmas Party, Peanut Fest City Reception and special event sponsorships Personnel Summary 2021-2022 2022-2023 2023-2024 2024-2025 2024-2025 Range Class Actual Actual Budget Requested Recommended Mayor 1 1 1 1 1 Councilman 7 7 7 7 7 City Clerk 1 1 1 1 1 221 Deputy City Clerk 1 1 1 1 1 210 Assistant City Clerk 1 1 1 1 1 Number of Full-Time Positions 11 11 11 11 11 50

City Manager

Description

Council Target Area FY 25 Objectives

Civic Engagement & Responsive City Services

To move the City forward by advancing City Council’s vision and priorities.

To ensure delivery of quality services to the citizens of Suffolk.

To attract and maintain the City’s workforce to meet citizen demand for services.

The City Manager is the Chief Executive Officer of the City of Suffolk and is responsible for the day-to-day administration of City Government. The City Manager recommends policy alternatives to the City Council and implements the policies and priorities established by the governing body in accordance with the city charter, city code and ordinances, and state and federal regulations. Other essential activities and duties include oversight of operating departments, coordination of legislative affairs with state and congressional leaders, and serving as a liaison to businesses, community organizations, and various local and regional boards and commissions. Key Measures

Budget Highlights:

Assistant Director of Downtown Development added to enhance coordination of downtown initiatives.

FY 23 FY 24 FY 25 Actual Projected Estimate Bond Rating: Moody’s Aaa Aaa Aaa Standard’s and Poor’s AAA AAA AAA Fitch AAA AAA AAA Unassigned Fund Balance 20% 20% 20% Jobs created 598 795 850 Capital Investment $369M $384M $395M

Expanded Economic Development

promote

economic growth

sustainability. Financial Stability To maintain the City’s

financial position through compliance with City financial policies. 51

To

and facilitate

and

strong

Department: City Manager Budget Detail 2021-2022 2022-2023 2023-2024 2023-2024 % 2024-2025 % 2024-2025 % Account Number: 100-12110- Actual Actual Budget Exp to Dec Exp Requested Change Recommended Change 51100.02 Salaries and Wages $ 800,545 $ 793,283 $ 872,423 $ 415,592 48% $ 872,423 0% $ 1,077,434 23% 51100.04 Salaries and Wages - Overtime 667 475 - - - - - -51100.14 Transportation Expense 17,770 22,800 22,800 10,830 48% 22,800 0% 22,800 0% 52100 FICA 55,719 53,289 66,740 24,207 36% 66,740 0% 82,424 23% 52210 VRS Retirement 95,678 108,373 121,092 58,922 49% 121,092 0% 165,098 36% 52400 Group Life 8,140 10,516 11,690 5,694 49% 11,690 0% 14,438 23% 53100 Professional Services 45,400 54,300 60,000 14,349 24% 60,000 0% 60,000 0% 53600 Advertising - 2,310 - 126 - 5,000 - 5,00054100 Information Technology 48,912 50,645 64,779 30,097 46% 64,779 0% 72,810 12% 54200 Fleet - - - - - - - -54500 Risk Management 54,545 77,287 80,052 40,026 50% 80,052 0% 82,049 2% 55210 Postal Services 50 40 100 2 2% 100 0% 100 0% 55230 Telecommunications 9,767 12,544 12,856 4,275 33% 12,856 0% 12,856 0% 55410 Lease/Rent of Equipment - - 1,000 - 0% 1,000 0% 1,000 0% 55500 Travel and Training 12,160 12,965 20,000 3,170 16% 20,000 0% 20,000 0% 55810 Dues and Association Memberships 1,845 2,327 7,200 45 1% 7,200 0% 7,200 0% 56001 Office Supplies 4,416 5,132 7,000 1,834 26% 7,000 0% 7,000 0% 56012 Books and Subscriptions 506 416 1,500 8 1% 1,500 0% 1,500 0% 56017 Copier Costs 6,796 6,937 7,417 3,148 42% 7,417 0% 7,417 0% 56026 Special Events - - 15,000 1,036 7% 20,000 33% 15,000 0% Total Operating Expenditures $ 1,162,914 $ 1,213,640 $ 1,371,650 $ 613,360 45% $ 1,381,649 1% $ 1,654,125 21% 53100 - Professional Services: Legislative Services Personnel Summary 2021-2022 2022-2023 2023-2024 2024-2025 2024-2025 Range Class Actual Actual Budget Requested Recommended City Manager 1 1 1 1 1 Deputy City Manager 1 2 2 2 2 Chief of Staff 1 - - -223 Assistant Director of Downtown Development - - - - 1 217 Senior Administrative Analyst 1 1 1 1 1 214 Administrative Analyst - - - 1 1 209 Executive Office Administrator 1 1 1 1 1 205 Executive Administrative Assistant 2 2 2 1 1 204 Staff Support Assistant 1 1 1 1 1 Number of Full-Time Positions 8 8 8 8 9 52

Description

Finance – Budget and Strategic Planning

The Division of Budget and Strategic Planning provides financial, management information, control, and guidance to the City Council, City Manager, and City departments. The primary responsibilities of the division include the development of the annual operating and capital budget and capital improvements program and plan, revenue and expenditure analysis and quarterly financial reporting, strategic financial planning, and fiscal impact analysis. Key

Financial Stability

To develop a balanced budget in accordance with local and state laws and City financial policies.

To prepare quarterly budget projection reports within 30 days of the end of each fiscal quarter.

To achieve a variance between budgeted and actual General Fund revenue of 5% or less.

Budget Highlights:

Reclassification of Budget Analyst positions to Senior Budget Analyst and Budget Manager to address increasing complexity and workload of job duties and functions.

FY 23 FY 24 FY 25 Actual Projected Estimate Projection reports submitted within 30 days of quarter end 100% 100% 100% Financial Policies: Capital Pay-Go at least 3% of General Fund budget less transfers 4.5% 10.3% 11.5% Debt as percentage of assessed value at/below 4% 1.7% 1.5% 1.4% Debt as percentage of general govt. expenditures at/below 10% 6.4% 6.6% 6.2% Variance of actual to projected General Fund revenue 8.7% 5.0% 5.0%

Measures

Council Target Area FY 25 Objectives

53

Division: Budget & Strategic Planning (Department of Finance) Budget Detail 2021-2022 2022-2023 2023-2024 2023-2024 % 2024-2025 % 2024-2025 % Account Number: 100-12440- Actual Actual Budget Exp to Dec Exp Requested Change Recommended Change 51100.02 Salaries and Wages $ 266,503 $ 273,791 $ 287,121 $ 139,199 48% $ 369,535 29% $ 320,669 12% 52100 FICA 19,726 20,119 21,965 10,219 47% 28,269 29% 24,531 12% 52210 VRS Retirement 32,644 37,955 39,852 19,926 50% 51,291 29% 46,722 17% 52400 Group Life 3,508 3,664 3,847 1,924 50% 4,952 29% 4,297 12% 53600 Advertising 6,219 5,855 6,400 - 0% 6,400 0% 6,400 0% 54100 Information Technology 17,541 15,848 20,834 9,039 43% 20,834 0% 23,179 11% 54500 Risk Management 23,313 28,995 30,129 15,065 50% 30,129 0% 30,927 3% 55210 Postal Services 28 31 100 - 0% 100 0% 100 0% 55230 Telecommunications 461 440 3,308 127 4% 3,308 0% 3,308 0% 55500 Travel and Training - 353 2,000 95 5% 2,000 0% 2,000 0% 55810 Dues and Association Memberships 575 1,215 1,200 725 60% 1,200 0% 1,200 0% 56001 Office Supplies 1,191 1,256 1,500 479 32% 1,500 0% 1,500 0% 56012 Books and Subscriptions - 21 200 - 0% 200 0% 200 0% 56017 Copier Costs 2,847 2,409 2,333 1,057 45% 2,333 0% 2,333 0% Total Operating Expenditures $ 374,556 $ 391,951 $ 420,789 $ 197,855 47% $ 522,051 24% $ 467,366 11%

2021-2022 2022-2023 2023-2024 2024-2025 2024-2025 Range Class Actual Actual Budget Requested Recommended 223 Assistant Director of Finance - Budget 1 1 1 1 1 219 Budget Manager - - - 1 1 218 Senior Budget Analyst - - - 1 1 217 Budget Analyst 2 2 2 1Number of Full-Time Positions 3 3 3 4 3 54

Personnel Summary

City Attorney

Description

The Suffolk City Attorney’s Office provides legal representation, consult, and advice to the Suffolk City Council and all City Departments. The Office represents the City and Council in Court proceedings and in grievance matters.

To strive to resolve legal disputes involving the City in a manner which is professional and fiscally responsible.

To provide accurate and reliable legal advice to City Council and to the various City departments to ensure that the actions taken by the City in furtherance of the Comprehensive Plan are lawful and promote the wellbeing of all Suffolk citizens. Civic Engagement & Responsive

Budget Highlights:

No significant changes.

To strive to provide the Council and the Departments with the most current, relevant, and proactive legal advice when requested.

Target Area FY 25 Objectives Financial Stability

Council

Growth Management & Comprehensive Planning

Services

City

Key Measures FY 23 Actual FY 24 Projected FY 25 Estimate Number of legal requests for services Number of contract reviews Number of court appearances Number of real estate matters handled 1,528 150 129 150 2,000 160 200 175 2,400 220 250 200 55

Department: City Attorney Budget Detail 2021-2022 2022-2023 2023-2024 2023-2024 % 2024-2025 % 2024-2025 % Account Number: 100-12210- Actual Actual Budget Exp to Dec Exp Requested Change Recommended Change 51100.02 Salaries and Wages $ 785,463 $ 881,782 $ 960,575 $ 447,480 47% $ 960,575 0% $ 1,017,678 6% 51100.14 Transportation Expense 6,150 6,000 - 2,850 - - - -52100 FICA 58,418 64,245 73,484 31,842 43% 73,484 0% 77,852 6% 52210 VRS Retirement 94,931 120,933 133,328 66,644 50% 133,328 0% 160,806 21% 52400 Group Life 10,188 11,735 12,872 6,455 50% 12,872 0% 13,637 6% 53100 Professional Services 159,071 10,725 50,000 5,880 12% 50,000 0% 50,000 0% 53100.11 Legal Services 3,663 4,726 4,788 1,745 36% 4,414 -8% 4,414 -8% 53600 Advertising 2,364 218 1,000 - 0% 1,000 0% 1,000 0% 54100 Information Technology 56,245 51,490 111,419 28,056 25% 111,419 0% 75,667 -32% 54500 Risk Management 70,120 87,115 100,327 50,164 50% 100,327 0% 102,786 2% 55210 Postal Services 1,696 1,722 2,000 1,143 57% 2,500 25% 2,500 25% 55230 Telecommunications 13,127 12,277 14,877 4,101 28% 14,877 0% 14,877 0% 55500 Travel and Training 8,476 11,217 17,500 6,235 36% 17,500 0% 17,500 0% 55810 Dues and Association Memberships 4,430 4,120 7,100 4,545 64% 7,100 0% 7,100 0% 56001 Office Supplies 3,379 3,912 5,000 617 12% 5,000 0% 5,000 0% 56012 Books and Subscriptions 4,764 5,898 5,000 2,057 41% 5,000 0% 5,000 0% 56017 Copier Costs 7,904 8,601 8,470 3,586 42% 8,470 0% 8,470 0% Total Operating Expenditures $ 1,290,388 $ 1,286,717 $ 1,507,740 $ 663,398 44% $ 1,507,866 0% $ 1,564,288 4% Personnel Summary 2021-2022 2022-2023 2023-2024 2024-2025 2024-2025 Range Class Actual Actual Budget Requested Recommended City Attorney 1 1 1 1 1 Deputy City Attorney 1 1 1 1 1 219/222/223 Assistant City Attorney I-III 3 4 4 4 4 214 Paralegal Administrator 1 1 1 1 1 210 Legal Services Coordinator 1 1 1 1 1 208 Paralegal 2 2 2 2 2 Number of Full-Time Positions 9 10 10 10 10 56

Human Resources

Description

The Department of Human Resources provides support to the City Manager and City departments in the recruitment, hiring, development, and retention of employees. These services are provided through data collection, needs projection, recruitment, selection, retention, general training, advice to management, and review of human resources policies and procedures. The Department oversees ongoing programs related to employee health and welfare, employee recognition, and employee relations with internal and external customers. Key

Council Target Area

Civic Engagement & Responsive City Services

FY 25 Objectives

To implement technology enhancements with a focus on data integrity and business needs.

To implement an off-boarding process with a focus of analyzing and reporting out data.

To leverage technology to assist in talent acquisition and brand recognition as a great place to work.

Budget Highlights:

Training Manager position established and transferred to Human Resources from Risk Management Fund.

Diversity Equity and Inclusion – Belonging (DEI-B) Analyst and Training Consultant position established via full-time position transfer from the Department of Social Services.

Two positions transferred from Human Resources to Risk Management Fund.

Increased funding for professional services and travel and training.

Measures FY 23 Actual FY 24 Projected FY 25 Estimate New hires Average time to hire Percent of vacant positions 422 50-80 days 12.0% 545 50-80 days 12.9% 450 50-80 days 12.0%

57