What can you find in Bermuda? Cotton candy skies. Pink sand beaches. Crystal-clear blue waters. The chance to disappear. Sway to the rhythm of island life as you discover the natural wonders, rich history and vibrant culture. Take the time to slow down and get lost in each moment, knowing that another will reveal itself all too soon. That’s the magic of Bermuda.

Indulge in the tranquility of knowing your assets are secured. We address the vulnerabilities that threaten your lifestyle, ofering customized protection for your private aircraft, residence, yacht and valuables. Experience a full service, direct path to peace of mind.

ROBERT KERDASHA DIRECTOR

CHAIRMAN

Jim McCann

CHIEF EXECUTIVE OFFICER

Josh Kampel

PRESIDENT

Paul Stamoulis

EDITORIAL DIRECTOR

EXECUTIVE EDITOR

STAFF EDITOR

ASSISTANT EDITOR

CREATIVE DIRECTOR

CONTRIBUTORS

Dan Costa

Seán Captain

Eva Crouse

Gabrielle Doré

Nicole Dudka

Christopher Allbritton, Samson R. Amore, Jason Allen Ashlock, Meehika Barua, Abigail Bassett, Cait Bazemore, James Chen, Kirsten Cluthe, Bob Diamond, Deborah Grayson, Marshall Honorof, Max Isaacman, Larry Kantor, Michael Puttré, Jonathan Russo, Adina Solomon, Tim Stevens

VP OF PARTNERSHIPS & DIRECTOR OF LEADING ADVISORS

VP OF PARTNERSHIPS

VP OF PARTNERSHIPS

VP OF LEADING ADVISORS

DIRECTOR OF ACCOUNT MANAGEMENT

JEWELRY & WATCH SALES DIRECTOR

Greg Licciardi

Dan Figura

Ron Stern

Kevin Haniffy

Kendall Wyckoff

Heather Hanson

HEAD OF MARKETING

MARKETING COORDINATOR

DIRECTOR OF HOSPITALITY

Clyde Lee III

Payton Turkeltaub

Kimberly Anderson-Marichal

Our Mission Is Building Worth Beyond Wealth

Worth helps our influential, successful community better invest their time and money. We believe business is a lever for social and economic progress. From practical financial advice to exclusive profiles of industry leaders, Worth inspires our readers to lead more purpose-driven lives. Through our conferences, digital channels, and quarterly print publication, we connect the people and companies that are building the future. We showcase products and services that are indulgent, luxurious, and sustainable.

Advisors you can count on no matter where your journey takes you. Wilmington Trust is by your side in the communities where you live, work, and thrive, creating a deep connection that you can count on to help bring your wealth plan to life.

Let's start the conversation.

BY JOSH KAMPEL

At Worth, we continue to navigate the ever-evolving landscape of wealth and economic influence, so it was imperative to examine the current generational wealth transfer and its massive impact on millennials. Our latest research underscores a significant shift in the financial paradigm, driven by a potent combination of this wealth transfer and entrepreneurial success. This rise in Millennial wealth not only reshapes our economy but also redefines the societal values and priorities that underpin it.

We were proud to collaborate with Boston Consulting Group on this project. BCG’s extensive experience conducting research for leading organizations across industries, combined with Worth’s direct access to an affluent millennial audience, creates a powerful partnership for this pioneering study.

This exclusive research is highlighted throughout this issue. It will inform our ongoing content strategy and help us better serve

our brand partners with unique insights that will assist them in refining their messaging and engaging with this influential generation.

In addition to exploring how Millennials earn, invest, and spend their money, we studied their attitudes toward philanthropy, purpose, and other interests and attitudes that influence their decisions.

Now 28-42 years of age, millennials continue to emerge as a powerful economic force. While a significant portion of their wealth is inherited, Millennials are also distinguished by their entrepreneurial spirit; many are building substantial wealth through innovative ventures and investments. This generation prefers to selfmanage their investments, with a significant focus on alternative assets like private equity and cryptocurrency. Their investment strategies are diverse and reflect a forward-thinking approach.

While wealth accumulation is a priority, Millennials are notably

more engaged in social justice initiatives and political activities, with many valuing involvement in social causes. This highlights a shift towards a more socially responsible and politically active generation. At the same time, fewer millennials donate money compared to older generations; they prefer to contribute their time and expertise to philanthropic causes.

Findings like this represent a broader narrative about the future of our economy and society. Millennials’ emphasis on sustainability, social justice, and health is driving new market trends and setting the stage for a more conscientious and dynamic economic environment.

As we look ahead, it is clear that the financial decisions and values of Millennials will play a crucial role in shaping the economic and social landscape. Their innovative approach to wealth generation and investment, coupled with their commitment to societal wellbeing, promises to foster a more inclusive and forward-thinking world.

At Worth, we are dedicated to exploring and understanding these trends to better serve our readers and the broader community. We believe that by highlighting the transformative power of Millennial wealth, we can contribute to a more informed and inspired discourse on the future of our economy and society.

For more about our Millennial research, visit Worth.com/millennial.

— Josh Kampel CEO, WORTH MEDIA josh.kampel@worth.com

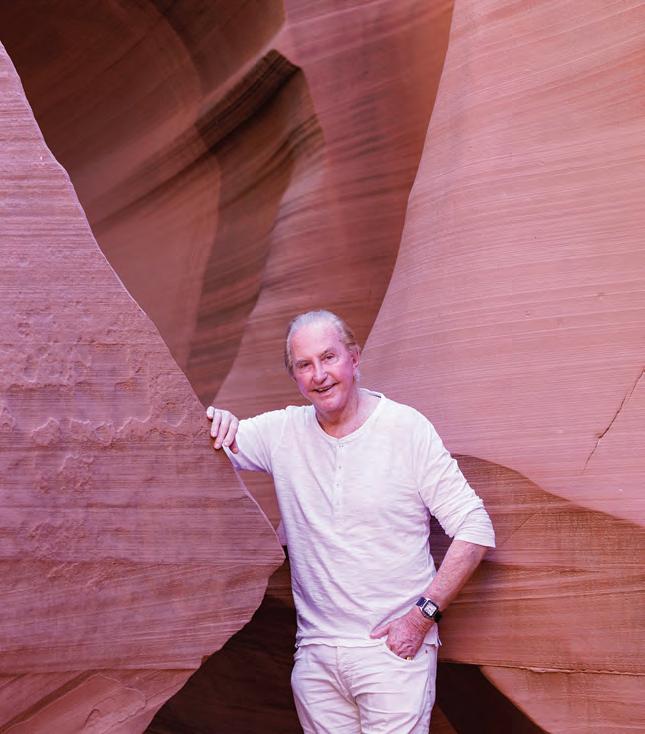

“Journeys are the midwives of thought.” –Alain de Botton, The Art of Travel

BY DAN COSTA

The best job I ever had didn’t pay me a dime.

Years ago, while running PC Magazine, I got an offer from the U.S. State Department to serve as a cultural attache. The job required giving presentations two or three times a day, organized by the local embassy. The hours would be long, and there would be no pay, but travel would be covered. Sold! Over the years, I have visited Hong Kong, Taiwan, Oman, Portugal, and Uruguay. The people I met on those trips have shaped my career and how I look at the world.

Perhaps it is no coincidence that my current job also comes with some travel benefits. On page 32, you can read about my recent trip to Rome and Crete. Americans tend to have a myopic view of history. It is almost inevitable when your country is only 250 years old. In high school, all of U.S. History was broken into two courses, pre and post 1945. We can barely think in centuries,

but in Rome, the history goes back millennia.

Spending time in Rome causes time to slip, the current and the past colliding in weird ways. An amphora decorating a hotel lobby could be a thousand years old. Or it could be from Pottery Barn. I made fresh pasta in the basement of a restaurant that was also part of the ruins of the theater where Julius Cesar was killed.

Sadly, I can’t take all of the trips myself. We also sent Worth regulars Jonthan Russo and Deborah Grayson to enjoy the serene and stunning landscapes of French Polynesia via cruise ship.This collection of islands, scattered like jewels in the vast expanse of the Pacific Ocean, attracts around 200,000 visitors annually. While tourism is a vital part of the economy, there is a strong emphasis on sustainable practices to protect the natural beauty and cultural heritage. In part, this is because unlike in, say, the Hawaiian Islands, locals still own 85% of the land in French Polynesia. Indeed, with limited tourism infrastructure, a small cruise ship is probably the best way to explore the islands.

The Copal Tree Lodge in Punta Gorda, Belize, is also

trying to combine luxury with conservation to boost the local economy. This rainforest hideaway, with its 16 suites and one villa, employs 180 locals and produces rum, chocolate, and coffee. Its sustainability initiatives include ocean and rainforest conservation, debt-for-nature agreements, and supporting local organizations. Worth’s Eva Crouse visited the Lodge and spoke with its chief sustainability officer. And while she expected to talk about the threat of climate change and overfishing, the growing pirate threat was a surprise. These stories remind us that travel is not just about the destinations we visit but the connections we make and the stories we carry with us. At Worth, we aim to inspire thoughtful and responsible travel that enriches both the traveler and the communities they explore. As we continue to uncover the world’s wonders, we remain committed to promoting sustainability and cultural appreciation, ensuring that the beauty we experience today is preserved for future generations.

— Dan Costa EDITORIAL DIRECTOR dan.costa@worth.com

Samson is a journalist based in Southern California. His reporting has been featured in outlets including The Advocate Magazine, The Boston Globe, The Los Angeles Blade, The Los Angeles and San Fernando Valley Business Journals.

In addition to his business reporting, Samson covers beats including crime, culture, and labor. He has reported on the entertainment business for TheWrap and lends his skills to the private sector as a content strategist and media trainer.

Samson was a 2023 data fellow at the University of Southern California’s Center for Health Journalism, investigating the public health impact of anti-LGBTQ+ hate crimes in Los Angeles. He is a member of Investigative Reporters and Editors and the Trans Journalists Associations.

When not on deadline, Samson can be found on the golf course, exploring his local National Parks, or entertaining his adopted kittens, Merry and Pippin. His hidden talent is wiggling his ears.

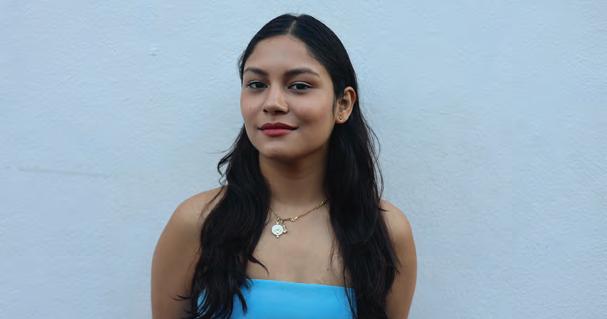

Meehika is a freelance journalist writing for Vogue magazine, The Guardian, Cosmopolitan, Business Insider, Grazia, The Washington Post, Elle, Al Jazeera, Harper’s Bazaar, Reader’s Digest, Allure, and TimeOut, among other publications.

She covers culture, lifestyle, travel, and social issues, sometimes through the lens of tech and human rights. Her coverage has ranged from the rise of accent coaches in the UK to opinion pieces on starter marriages.

Meehika won the 2018 Journalism Now competition for a fellowship with Thomson Reuters. She was also nominated for the 2022 Journalist of the Year award at the Asian Media Awards. She has appeared on many panels to talk about freelance journalism and also teaches freelance writing classes to mentor writers. Some of her workshops have also centered around career change, as Barua changed from studying architecture in university to becoming a journalist after graduation. When not chasing stories, she can be found working on her memoir. Follow her on X(Twitter) and Instagram @meehikabarua

Tim Stevens

Stevens is a freelance automotive and technology journalist with more than 25 years of experience. He is a frequent contributor to major domestic and international online, print, and broadcast news outlets including MotorTrend, TechCrunch, Wired, CBS, and AP, sharing his insights and perspectives on everything from cybersecurity to supercars.

Tim also serves as a juror for the World Car Awards and regularly acts as speaker and moderator at major industry events like CES, Web Summit, SXSW, NAIAS, and AutoMobility LA. He formerly served as editor-at-large and VP of content at CNET. Before that, he was editor-in-chief of Engadget and editorial director at AOL Tech.

A frequent traveler and avid cyclist, if he’s not on a plane he’s probably out putting in miles on his road bike.

Adopting new technology is risky when modernizing classic machines, but Icon 4X4’s Ward sees an EV future for the industry.

BY TIM STEVENS

The restomod business is booming, a burgeoning industry of makers who take vintage autos and make them drive better than new. Every day, a new boutique manufacturer seems to be entering the scene, promising some fresh take on a classic car. The idea is to deliver all the allure of the original machine with none of the vintage compromises, a “reimagining” that drives better than new.

LA-based Icon 4X4 was among the first wave of restomod companies, earning co-founder and CEO Jonathan Ward a position as one of the most respected builders in the world. Now, despite flourishing in an industry with an obsessive reverence for all things vintage, he’s embarking on a potentially disruptive business pivot that even he’s a little nervous about.

Ward and Icon 4X4 are taking on EVs, pausing development on new internal combustion vehicles to focus on battery-powered ones.

Fifty-four-year-old Ward is a former child film and television star, regularly appearing in ‘80s TV classics like “Charles in Charge,” taking a leading role in the 1988 scifi comedy “Mac and Me,” and also playing a role in the 1989 tear-fest “Steel Magnolias.” After deciding Hollywood wasn’t his thing, Ward followed a circuitous path to automotive royalty. He founded Icon 4X4 in 2007 with his wife Jamie, building off their successes at recreating FJ-series Land Cruisers. Toyota’s 1960s-era off-roader is highly prized among retro-minded

collectors, and Icon’s reimagining of that rig, plus subsequent followons, cemented the company’s reputation as a brand that creates truly special modernizations of cars without losing their inherent classic feel.

Icon’s reborn classics come with major suspension and interior refinements and big power upgrades, usually in the form of large-displacement V8s. A modernized 1960s Bronco 4X4 built by Ward’s company can cost well over $300,000, a price tag typically reserved for Ferraris, not Fords.

I spoke with Ward while he was vacationing in San Miguel, Mexico, hunting for fabrics for another of his projects, Campfire Coats. It was a delightfully rambling conversation where we covered everything from in-vehicle networks to the challenges of retrofitting steering racks. Ward was all too happy to delve into his passion for this growing movement away from internal combustion and into electrification.

“You know, when Icon started, we were kind of the first goobers in this modern restomod space, followed by Singer and all these other companies,” he said. “But up until that point, and even today, people that haven’t heard of the brand discover it and go, ‘Oh my god, I can have the best of both worlds... I can have the vintage style and character and distinction and quality, but I can have modern drivability.’”

Increasingly, modern drivability means EVs. Though electric vehicles made up only 7.6% of the U.S. car market in 2023, sales of batterypowered machines jumped 50% over the prior year. Interest in EVs is surging, and Ward’s passions are similarly progressing past V8s.

“Despite flourishing in an industry with an obsessive reverence for all things vintage, Ward is embarking on a potentially disruptive business pivot to electrification that even he’s a little nervous about.

“When you introduce EV into the mix, it’s a whole different demographic that likely would have never known about us or engaged with us whatsoever,” Ward said. He’s aware of some of the recent negative press surrounding EVs, plus the compromises they require, but that’s less of a concern in this space. “Consumers who are going to buy an Icon EV, it’s not their daily driver. It’s for specific lifestyle or locale or mood or vibe or weekend.”

Icon’s first efforts on the EV restomod front were oddities, including a 1974 Volkswagen Thing, a slab-sided convertible with Beetle underpinnings; and a 1966 Fiat Giardiniera, a stretched version of the tiny Fiat 500 supermini. But it was something much larger, a

1949 Mercury Eight, where everything came together.

The Mercury Eight is a particularly significant model on the tuner scene, a long-time object of customizer obsession. The sedan’s already prodigious length is often visually augmented by dropping the roof and stripping away much of the chrome and badging, yielding gleaming, perfectly polished machines often called “lead sleds.”

Ward’s Mercury is different, showing as much rust as paint and sporting more patina than a Roman artifact. The magic, though, lies under that corroded bodywork, a complete mechanical reinvention of the sort you’d never imagine at a casual glance. Despite the lack of internal combustion, finding a way to cool all those electrical components was one of the biggest

headaches. Since the Mercury wasn’t designed for this kind of configuration, Ward and his team needed to come up with a completely custom solution.

“We actually ended up befriending a thermal dynamics flow engineer at a local college to help us through that brain drain,” he said. They ultimately sourced a compressor from an 18-wheeler to handle cooling duties.

Ward’s team filed patents for the way the powertrain connects to the wheels, a dual-motor setup that runs inline where the transmission had been.

While a restomod is all about maintaining character amidst a flurry of modern updates, Ward believes the manual transmission experience is not worth preserving in an EV. “You’re going to use a maximum of two forward gears, if any,” he said.

Despite all the headaches and challenges faced in building “the Merc,” Ward was not deterred. He was emboldened, pausing development on

an internal combustion project to instead develop an electric vehicle platform for the next generation of Icon restomods.

In the automotive world, a platform is the fundamental internal architecture of a car, a set of common components and the requisite software to connect them, which can be shared across multiple models. Large manufacturers use platforms to simplify new vehicle development. This is particularly important as more and more manufacturers embrace electrification, a pivot requiring stratospheric levels of investment.

Hyundai Group, for example, developed the E-GMP platform to underpin its current-generation EVs across all its brands. Cars running on that platform include everything from the slippery little Hyundai Ioniq 6 sedan to the luxurious Genesis GV60 crossover and even the big, three-row Kia EV9 SUV.

The company hopes to sell millions of E-GMP EVs across all its brands,

enough to recoup that initial investment readily. For Icon 4X4, which builds just 40 cars per year, the path to platform profitability is challenging.

Ward puts it more succinctly: “Because my volume is so low, we can’t amortize anything for shit.”

For its own EV pivot, Icon is starting with its most popular products. “We intend to electrify our whole fleet of the production vehicles we build, meaning the Broncos, the FJ series, and the 47 to 53 Chevy pickup line,” Ward said. The Ford, though, will come first. “The Bronco is just so on-trend culturally these days, it won out,” he said. “So, we’re currently building an all-wheel-drive, transmission-less, firstgeneration Icon Bronco EV.”

That shift to prioritize electrification when expanding the Icon 4X4 lineup was not a decision made lightly, and even now, Ward is not without doubt. Before this shift, Ward’s team had been working on a next-generation internal combustion project. “We put that on hold because the demand for the EV has been so strong. And then now I see all this negative EV press,” he said.

Ward said some EV criticism is justifiable, particularly regarding confusion around local and federal incentives, plus the sad state of the U.S. charging infrastructure: “But I really believe in it. As a business decision, I think it could prove to be quite interesting because I’ve already seen, just in early discussions, that it really brings a whole new demographic into our space.”

While that new, likely younger demo craves electrification, Icon can’t ignore the demand for more traditional powertrains. Those V8s aren’t going away anytime soon. “At this point, I don’t see the market being interested in us doing only electric,” Ward said.

For now, at least, it makes sense for Icon to cover all its bases, but the shifting demand will be interesting to watch. Just like you didn’t have to be a kid in the ‘60s to want a first-gen Bronco today, you certainly don’t have to be an environmentalist to want your next Sunday cruise to be battery-powered.

After a pandemic-era boom, many countries are tightening the rules.

BY MEEHIKA BARUA

Lately, there has been considerable debate on social media about leaving the U.S. or other countries like the UK or Australia for a better quality of life in Europe, Asia, and other regions. The rumblings have come from podcasts such as entrepreneur Steven Bartlett’s notable “Diary of a CEO,” as well as from Instagram and TikTok influencers. Kacie Rose Burns’ most popular video on leaving the U.S. for Italy was viewed 19.8 million times. The overriding theme: The new American dream is to leave America.

Record numbers of Americans already wanted to leave the U.S. when Donald Trump won the presidency in 2016, including 40% of women younger than 30, according to a 2019 Gallup Poll. Similar sentiment is seen among British people, as recent polls suggest that most are unhappy with the UK’s direction. In a survey by pollster Omnisis, 45% of British respondents said they would take up the opportunity to leave.

The wealthy are building passport portfolios by applying for second citizenship if they need to flee their home country due to financial instability. Recent high-profile examples include tech billionaires Peter Thiel, who added citizenship in New Zealand, and former Google CEO Eric Schmidt, who has applied in Cyprus.

Countries are constantly launching new visas to attract foreign residents and their economic contributions. In April 2024, Italy launched its digital nomad visa, providing extended residency to remote workers who derive their income from outside the country. Spain, Portugal, Norway, and 50 other countries already have such visas.

British digital PR specialist Laura Burns now lives in Malaga, thanks to Spain’s “teletrabajadora” (remote worker) digital nomad residency. After lockdown, Burns went on a short trip to Ibiza with her friend and realized she wanted to move to Spain. “I had lived in a city for five years, and I was ready to move closer to a beach,” she says.

Not everything about the process seemed rosy. “I waited four months for a form from the UK government, which slowed down my process,” she says. “Also, finding a long-term rental is very difficult in Malaga.”

A long-term rental is required to be registered for the program. Yet Burns has no regrets and says she was lucky to find a great lawyer who did everything from start to finish. “I was also fortunate to be granted three years residency—which is more than I thought I would be granted,” she says.

While there are several ways to get foreign residency, buying into it through a so-called ”golden visa” seems to be the most common one among the elite. This visa allows individuals to quickly obtain residence or citizenship in return for making qualifying investments. However, due to social pressures, those programs are now being eliminated in several countries.

On April 9, the Council of Ministers in Spain voted to end granting visas in exchange for purchasing properties valued at 500,000 euros (about $545,000) or more. In February 2022, the UK government closed its long-running Tier 1 Investor visa route, its version of a golden visa. The Home Office said that the visa category had failed to deliver for the UK people and provided opportunities for corrupt elites to access the country.

“In Spain, the reason exposed by the President during a public press conference was that they were going to focus on the constitutional right of having a home.” So says Marbella Solicitors Group

Law Offices senior partner Eduardo Pérez Mazuecos, who has assisted numerous clients in purchasing properties and obtaining the golden visa. “From the point of view of our many expert agents, this explanation of the measure is not reasonable.” He says properties over 500K are out of range for the average Spaniard, anyway, calling the luxury property and average property markets completely different.

37.4% of digital nomads come from the U.S.*

46 The average age of all expats**

Mazuecos’ office specializes in advising English-speaking clients on legal and tax advice and mainly deals with real estate law. Apart from purchasing a property, foreigners could also access the golden visa by purchasing public debt or shares on Spanish properties or making bank deposits. However, Perez Mazuecos says that the investment amount must be considerably higher. “In any case, the policies of canceling the golden visa programs comes not only from the government but these decisions are also pushed by the EU Commission which is pointing in that direction.”

Patrick Mitchell, a U.S. citizen with a Spanish residence visa, says it took nine months to get the paperwork. His wife and children live in Spain, while he travels back and forth to the U.S. Patrick’s realtor in Spain (a Danish expat) was exceptionally helpful in navigating the process, he says, by introducing them to legal counsel in the country. His advice is to work with a reasonable attorney, since certain forms of residence visas are being abolished due to concerns about housing costs.

Portugal ended its golden visa last year after thousands of people took to the streets of Lisbon and other cities to protest skyrocketing rents and house prices. These come at a time when high inflation is making it even harder for people to make ends meet. “With the removal of nonhabitual residents in Portugal, and the increase of golden visa investment in Greece, our clients are starting to research other suitable countries to settle for their retirement,” says Ellie in an email. She asked that we use only her first name to protect her job at Praia Club, a company that helps people to immigrate throughout Europe. It’s used widely for destinations like Spain, Portugal, Italy, Greece, Cyprus, and Dubai. Portugal’s Non-Habitual Resident (NHR) special tax regime allows qualifying entrepreneurs, professionals, and retirees to enjoy reduced tax rates on Portuguese-source income and exemption on most foreign-source income for 10 years.

“In terms of visa options, we’re facing more difficulties. The government wants to receive qualified professionals or retired people who are willing to stay for a long time in the country,” says Giselle, who works in Praia Club’s legal team, in an email. She also asked that we use only her first name to protect her job. For example, three years ago the Portuguese consulates accepted Airbnb and Booking.com reservations as proof of accommodation.

“Today, for all the long-stay visas, which are longer than one year, it’s mandatory to have at least one year of rental accommodation or to buy your own house. Which means more investment and time before the visa application,” says Giselle. The requirements are getting more restrictive every year.

“We think the major challenge today is to face the bureaucracy and the stress involved in the visa process due to the increase in visa applications. We have changes in the law and on the directives every semester or year,” says Ellie. She adds that requirements are also common and differ by jurisdiction and consulate.

“But besides these difficulties, Portugal remains one of the most preferred countries to move abroad, and the good news is that these changes in the internal procedures means that the government is attentive to reduce these problems,” says Ellie. The immigration process for Italy, Greece, and Cyprus has its own challenges, too, especially if one manages them alone and from abroad, she says. However, Louise Carr, the founder of movetospainguide. com, a company specializing in the Spanish Digital Nomad Visa, thinks the process is getting easier. Since launching in early 2023, the program has had 10,000+ successful applications. “Until then, it was very difficult for non-EU passport

holders to come to Spain for work. There were lots of barriers,” says Carr. As Spain is a country with high unemployment and an excellent health service, it makes sense why these barriers exist. However, in the case of the digital nomad visa, the applicant’s employer or client must be located outside of Spain, which means that no jobs should be taken from Spanish citizens.

“Even though Spain has just modified (not yet abolished) the Golden Visa, that is a completely different kind of residency,” she says. “It was possible for golden visa holders to spend up to 182 days in Spain each year and avoid becoming a Spanish tax resident.” Digital nomad visa holders, on the other hand, must spend over six months in Spain each year, which means that they cannot avoid becoming tax residents.

For Burns, the Brit in Malaga, Facebook was the best resource for figuring out the ins and outs of the system. “I joined a group that was full of lawyers and people wanting to apply for the Spanish Digital Nomad Visa. There are several Facebook pages with information that simplifies all the important information you need. At first, I thought the process seemed very complicated, but it turned out to be much easier than I thought,” she says.

While Europe—especially Portugal and Spain—may be the most talked-about region in the press and social media, other continents also beckon digital nomads. South East Asia is also one of the most coveted destinations due to the low cost of living and ideal weather. People can live comfortably in Bangkok for just $1,400 monthly, including rent. Thailand’s digital nomad visa grants professionals up to 4 years of residency, but they must make at least $80,000 per year. With these stricter requirements, Thailand hopes to attract more affluent, highly skilled professionals.

Malaysia’s capital city, Kuala Lumpur, is considered one of the best destinations in Asia. The Malaysia digital nomad visa allows people to live in the country for up to two years. The Philippines also launched its digital nomad visa in June 2023, allowing applicants to live and work there for 12 months, with a possible extension for another year.

Effective April 1, Japan introduced a “Digital Nomad Visa” to qualifying foreign nationals to remotely work and stay in Japan for up to six months. It will be available to nationals of 49 countries, including the United Kingdom and the United States.

Giselle points out exceptionally favorable options in the United Arab Emirates. “Dubai offers visas for many different categories—it is also a very slick process. We can have someone’s residency permit approved and issued after just a two-week stay in Dubai.” Singapore also offers residency programs and tax benefits, as does Malaysia. “However, we do see that unless someone is relocating for professional purposes, the majority of emigrants are choosing to settle in Europe,” says Ellie.

12,718 Golden Visas issued in Portugal*

$7 billion Invested by Golden Visa holders in Portugal*

Many North Americans are also choosing to settle in Panama and South America, due to a preferential tax position in those countries, making their Social Security stretch that bit further, says Ellie

The profusion of options for living and working abroad has propelled nomadic living as an empowering alternative to traditional life. More people are choosing to live outside the norm, and the trend doesn’t seem to be slowing down anytime soon.

BY KIRSTEN CLUTHE

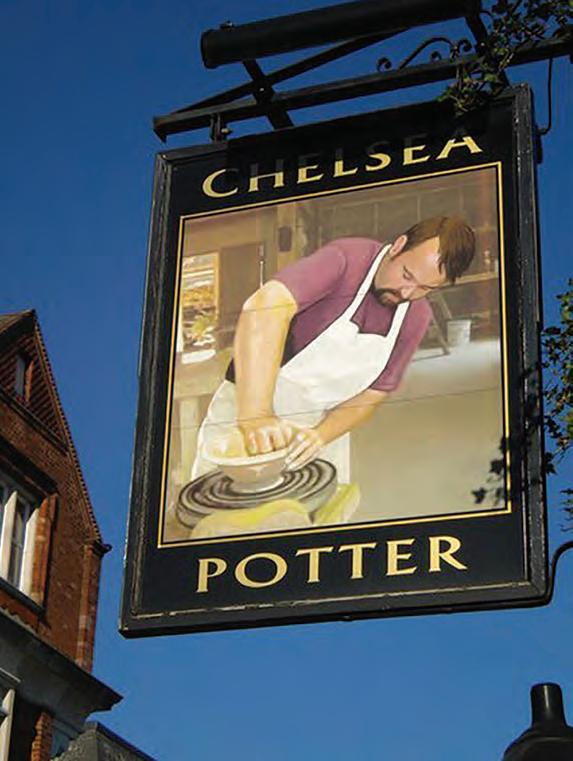

The first time I visited Kings Road in London, it was in pursuit of its counterculture reputation and the bands that embodied it. I was in high school and, with a friend, ditched my class field trip to find Kings Road, the notorious street where Malcolm McLaren and Vivienne Westwood held court among London’s punk rock elite. Hoping to run into one of the bands we loved, we found ourselves at the Chelsea Potter, a traditional pub established in 1760 that had become the epicenter of the antiestablishment movement by the time we showed up in the mid80s. We met a rockstar at the bar that evening—Mars Williams, the saxophonist for The Psychedelic Furs.

From William Blake to Damien Hirst, Banksy to The Rolling Stones, London has long been the birthplace and home of influential artistic movements and cultural revolutions. London’s richness lies in its diversity, with each neighborhood offering a unique slice of the city’s history while layering an appropriate amount of modernity into the experience. And so it was with the aforementioned friend that I recently spent a long weekend with in London in the fresh pursuit of art, culture, and great food. Kings Road may have changed since my last visit, but it’s still as interesting as ever.

A daytime flight from New York to London always seems like a good idea until you arrive exhausted and need something to eat before heading to bed. Luckily, the Chelsea Townhouse was my first destination. Though the kitchen was closed by the time I arrived, the gracious front desk manager directed me to take away options nearby—and thus, I highlighted what distinguishes Chelsea Townhouse from other hotels in the city: location. The hotel is the latest addition to the Iconic Luxury Hotels collection in a residential part of Chelsea. Formerly known as the Draycott Hotel, the building has shed its oldworld style—characterized by heavy furnishings, ornate wallpapers, and chintz—favoring a sophisticated neutral palette, elegant mid-grey walls, and chic, modern amenities. It’s so cozy and comfortable that you may do nothing more than sleep in or chill out with a good book, occasionally padding your way to the dining salon

on the first floor to enjoy a meal and a drink by the garden. Because guests have access to 11 Cadogan Gardens around the corner, you don’t have to venture far to hit the gym, a bar that stays open late, and Hans Grill, a modern all-day cafe and bar for more food and beverage offerings.

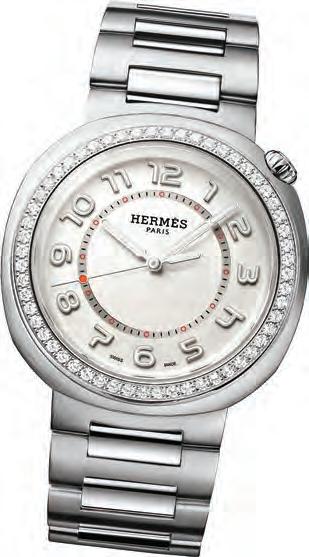

Of course, there’s too much to do, and everything London offers is practically outside your door. Kings Road, now filled with stylish boutiques, hip cafes, and pubs—yes, the Chelsea Potter is still there—is a short walk from the hotel. Bustling Sloane Square is also nearby, a hub for high-end shopping, featuring flagship stores of renowned fashion brands and luxury brands like Diptyque, Balenciaga, Cartier, Dior, Hermes, and more. Need help figuring out where to go, or just want to keep the paparazzi away? Tap into the Sloane Street Concierge for assistance with restaurant recommendations and reservations or booking an out-of-hours appointment at a Sloane Street boutique.

While I was in town, the Saatchi Gallery hosted an exhibit on Edward Burtynsky, the renowned Canadian photographer known for his captivating and thought-provoking images of industrial landscapes. It was the largest showing of his work and featured 94 of Burtynsky’s large-format photographs as well as 13-foot high-resolution murals and an augmented reality (AR) experience. It was a powerful and stunning display of his work, beautifully detailed photographs of plundered landscapes. As luck would have it, my travel companion ran into the artist himself at the Hans Grill bar on our first evening in town.

Located around the corner from the hotel in the elegant Duke of York’s Headquarters in Chelsea, the Saatchi Gallery has become a prominent showcase for contemporary art since its inception in 1985 by Charles Saatchi. The gallery’s spacious, light-filled rooms provide an ideal backdrop for the everchanging exhibition roster featuring cutting-edge works by emerging and established artists like Burtynsky from around the world.

The Victoria & Albert and the Natural History Museum are within easy walking distance or just one stop away on the District line from the Chelsea Townhouse. The V&A Museum hosts exhibits that span “5,000 years of human creativity,” it says. Pop culture, fashion, architecture, music—even wallpaper and embroidery—are all subjects you might find at an exhibit. Current shows

include one dedicated to Naomi Campbell’s career in fashion and another that showcases a collection of photographs from the Sir Elton John and David Furnish Collection. Meanwhile, across the street is the Natural History Museum. Housed in a stunning Romanesque building in South Kensington, the museum is renowned for its impressive architecture as much as its vast collections. Visitors are greeted by the awe-inspiring Hintze Hall, featuring the magnificent blue whale skeleton suspended from the ceiling. Exhibits span a range of topics, from dinosaur fossils and rare gemstones to interactive displays about climate change and biodiversity. Right now, they’re featuring several guided tours focusing on women scientists who changed the world through their work in paleontology, space, and nature. You can also participate in some of the museum’s social activities, like a Silent Disco or a sleepover with food, drinks, and morning yoga when you wake up the next day.

All of the gallery-wandering will undoubtedly make you thirsty. Luckily, you can jump in a taxi and head to The Connaught in Mayfair for cocktail hour. The Connaught Bar, a celebrated destination in its own right, is renowned for its incredible design, inspired by 1920s English and Irish Cubist art. The cocktail program reflects the era, and you might order a Vintage White Lady—a Gin, Cointreau, and lemon juice concoction that was famously included in Harry Craddock’s Savoy Cocktail Book; or you might opt for the Connaught Martini, which is the classic aperitif served from their famous trolley, tailored to your taste with a selection of vermouths and handmade bitters. If cocktails aren’t your thing or you prefer an elegant glass of wine, the Red Room is The Connaught’s cocooning wine bar, accessible only through a velvet-curtained doorway from the Champagne Room. Showcasing a collection of creative works in red, the

stunning interior features a soft-hued palette that highlights art curated over several years by four visionary female artists. Follow the hand-cut mosaic runway, crafted by Italian artisans, to the striking pink onyx bar or marvel at the red-flecked marble fireplace, dominated by Louise Bourgeois’ piece “I Am Rouge.” Bourgeois’ work is complemented by crimson and scarlet creations from Jenny Holzer, Tia- Thuy Nguyen, and a singular photographic piece by Trina McKillen. Flanking the fireplace are two dramatic glass panels in vivid reds and blues by celebrated British artist Brian Clarke, the only male artist represented in the Red Room.

It’s an ideal backdrop for enjoying a world-class wine served from a custom-crafted marble trolley alongside a capsule collection of six cocktails, each inspired by the wine selection and crafted to reflect the changing seasons. The menu features imaginative small plates such as charcuterie, veal carpaccio, and kale tempura, which is all you need with such an extensive wine list at your disposal.

To mix things up, we headed across town to Hotel Café Royal, where we would stay for the remainder of the trip. Once a vibrant hub of high society in the late 19th and early 20th centuries, Café Royal has been meticulously restored by architect David Chipperfield into a superlative hotel, while preserving its historic charm. The hotel effortlessly blends period charm with contemporary sophistication, with rooms clad in mock Portland stone or pale English oak. Each space exudes understated luxury, from the Tudor Suite boasting an original 16th-century fireplace to the Dome Penthouse, which features a private cinema and expansive terrace overlooking the city.

My room, a Regent Suite, was essentially a one-bedroom, two-bath apartment with more closet space than any home I have ever lived in. I didn’t even discover the second bathroom until my second day in the hotel. The ambiance is quietly sophisticated, lean-

ing towards minimalism, except for the unexpected touch of leather sofas in charming dusky pink and khaki green hues. However, luxury reigns supreme, evident in the fine details such as Frette linens—my initials were embroidered on the pillowcases—spacious bathtubs carved from single slabs of stone, discreetly integrated TVs within bathroom mirrors, bedside-controlled curtains, and cutting-edge Bang & Olufsen technology.

What truly astonishes is the tranquility within the rooms. Despite the building’s proximity to the vibrant Piccadilly Circus billboard, its tripleglazed windows ensure absolute silence. It’s truly an oasis amidst the lively cityscape. The main entrance is discreetly situated on Air Street, and its location in the heart of Piccadilly means you can easily move from one neighborhood to the other.

Intrigued by the description, “an Absinthe wonderland,” we opted to visit Green Bar in the hotel, where meticulously crafted cocktails are served in delicate glasses, and the lush green hues of the bar provide a serene, Alice In Wonderland-like environment. The cocktail menu reads like a storybook, and our server guided us towards three absinthe cocktails, all different, as a way to taste the variety. It was an experience you won’t find elsewhere, and even if you aren’t a fan of absinthe, the cocktail program at the Green Bar is exquisite.

Mayfair, known for its refined elegance, is home to some of London’s most prestigious addresses. Take a leisurely walk around Grosvenor Square and enjoy the beautiful architecture. Visit the Royal Academy of Arts for a dose of culture, or unwind in the tranquil Green Park, which offers a peaceful respite amidst the urban bustle.

In contrast, Soho is the beating heart of London’s entertainment scene. This area is a cultural melting pot, offering everything from vibrant nightlife to eclectic eateries and

quirky shops. Catch a show in the West End, explore the independent boutiques on Carnaby Street, and soak in the lively atmosphere of this iconic neighborhood. You’re in the center of the theater district— London’s version of Times Square, though thankfully, much smaller and less gritty. If world-class theater is your idea of the perfect evening out, look no further. The energy and creativity of London’s theatre scene are truly unparalleled.

BOB BOB RICARD

Bob Bob Ricard is a three-minute walk from Café Royal, a glamorous restaurant famous for its “Press for Champagne” button at every table. The interior resembles the fine dining car of a train, comfortable yet ornate and a lot of fun. Elevated comfort food is on the menu, a fine pairing for the champagne you will undoubtedly order. It is worth visiting despite what might seem like a lavish price for chicken pot pie. The pot pie is outstanding.

BÉBÉ BOB

Bébé Bob, Bob Bob Ricard’s scaledback rotisserie chicken, caviar, and champagne spot next door, designed in the style of a mid-century airport lounge, is also fun if you’re in the mood for something more casual.

Café Royal will provide you with a personal chauffeur and a luxury car for up to 10 hours per day for those staying in Deluxe Suites and above. It rained on the day we had a chauffeur, which isn’t surprising in London, but it made us appreciate the comfortable ride around town all the more. Our driver, Ameen, knew the city well, was a wonderful conversationalist, and waited patiently while we explored Camden Town and its iconic market.

Set along the banks of the Regent’s Canal, Camden Market is a cultural hub where music, art, and fashion collide. Live music performances echo through the narrow alleyways while street artists showcase their talents on every corner. Graffiti murals adorn the walls, adding color to the bustling atmosphere. There’s a reason why Camden is known as the best neighborhood for live music in London—it’s home to Camden Palace, the venue where bands like The Sex Pistols, The Clash, The Cure, and Madness got their start. Amy Winehouse called it home, and it’s rumored that the infamous feud between Oasis and Blur began in the Good Mixer pub.

The market’s culinary diversity mirrors its multicultural ambiance. At The Cheese Bar, a counter-only space awaits, beckoning with British and London cheeses in thoughtfully crafted

dishes. Nearby, Chin Chin Labs presents innovation in the form of ice cream— flavors like tonka bean and Valrhona chocolate are adorned with gourmet touches like fleur de sel caramel and bee pollen honeycomb, and the special offering is a brioche waffle pour-over. If you descend into the depths of Delancey Street, you’ll discover Yokoya, one of London’s rare izakayas, a subterranean sanctuary with cozy wooden booths and ample bar stools where shochu, sake, and beer lead the charge, complemented by a respectable selection of Japanese single malts. The culinary offerings are equally enticing, from delicate mackerel and sea bass sashimi to hearty servings of chicken karaage and grilled onglet with sweet yakiniku sauce.

We grabbed coffee with a Londonbased friend at Luminary Bakery, a social enterprise that empowers women facing social and economic disadvantages. Luminary helps women gain employability and entrepreneurship skills, offering courses, work experience, and paid employment in its bakery. The coffee and pastries were delicious, and the place was packed.

As I strolled through Camden Town, I was reminded that London’s magic lies in its ability to seamlessly blend history with modernity. From the rebellious spirit of Kings Road to the sophisticated charm of Mayfair, London’s artistic soul remains as captivating and diverse as ever.

The business hasn’t gone as smoothly as hoped, but new players are promising new types of rides with lower prices.

BY ABIGAIL BASSETT

For the affluent adventurer, space offers a unique allure: exorbitant prices, stringent physical prerequisites, a scarce number of seats, and the compelling “overview effect.” Getting high above the Earth changes how we see everything from our own selfhood to borders, politics, and our interconnectedness.

Space tourism provides an exceptionally rarefied experience for those who have already conquered Everest or explored Antarctica in luxury. While the sector has encountered significant financial and technical challenges, new companies are joining the fray, offering (comparatively) more affordable escapades for those willing to make a substantial investment.

The market is divided into two segments: orbital and suborbital. The former is considerably more expensive and rare. Only state-owned Roscosmos out of Russia, and Axiom Space and Elon Musk’s SpaceX out of the U.S. have been able to offer those trips, which require vehicles to reach a speed of 17,400 mph and punch out of the Earth’s atmosphere. There have been roughly ten orbital space launches with tourists on board since the early 2000s. Musk’s SpaceX successfully sent astronauts to the International Space Station for the first time in 2020. Then, in 2021, it launched its first tourist flight in collaboration with Axiom Space, with four civilians orbiting the Earth for three days during the Inspiration4 mission, without any professional astronauts on board. Two subsequent missions have taken tourists to the International Space Station. Tickets are in the $50-$70 million range.

In suborbital flight—which requires less power, speed, and money—a vehicle crosses what is known as the Kármán line, a proposed boundary that is roughly 330,000 feet above sea level. The main players have been Richard Branson’s Virgin Galactic and Jeff Bezos’s Blue Origin, at prices above $200,000 per ride, but several new providers are poised to enter this space.

According to NSR, a global satellite and space market research firm based in Europe, the suborbital space tourism sector is projected to reach $2 to $2.2 billion by 2033, and the pricier orbital sector is expected to approach nearly $20 billion. While that sounds tremendous, analysts say space tourism is still in a very nascent stage, and the industry continues to encounter challenges.

“I think we’re in a bit of a stall pattern right now,” Dallas Kasaboski, principal analyst at NSR, said, underlining that Virgin Galactic has been around for more than 20 years. It has made 11 crewed missions with tourists. “We’ve made a lot of progress in the last five years,” Kasaboski said, “but there have been a few stalls since.” Blue Origin had six crewed flights since July 2021, but a 2022 malfunction on an unmanned mission caused it to ground operations for nearly two years. Blue Origin finally resumed human flight on May 19.

Branson’s Virgin Galactic has become mired in the ongoing Boeing scandal, suing over shoddy work on its next-generation mothership that carries the space planes on the first part of their journey. And it faces serious financial troubles. However, the company is currently working on a new suborbital plane.

Kasaboski notes that there is a lot of pressure to get these space flights right. “I think we’ve moved past the period of early technological development. We’ve seen two

prominent companies [Virgin and SpaceX] flying people to space several times…but there’s a lot of caution and a lot of checks and rechecks that are being done before this market truly takes off,” Kasaboski said. “Public perception of risk is a major challenge, and I think, practically speaking, it may inhibit funding, which then slows these companies down from developing their vehicles.”

Despite these challenges, Kasaboski notes that the industry is in a unique place, as demand is currently significantly outstripping supply. “People are willing to spend several percentages of their yearly worth, or their full net worth, just for this once-in-alifetime experience,” he says, noting that NSR estimates suborbital demand at around 200,000 people, and orbital trip demand is likely less than 100 people. As space tourism becomes more accessible, those numbers will likely go up, according to Kasaboski.

There are currently a few ways to get to (or at least close to) space as a tourist: via orbital and suborbital rocket (SpaceX and Blue Origin, respectively), or suborbital plane (Virgin Galactic). Now, a slew of companies like Space Perspective, Halo Space, and WorldView are aiming to use high-altitude balloons to gently lift tourists to suborbital heights, 100,000 feet above the Earth.

Roman Chiporukha is the cofounder of SpaceVIP, a bespoke tour operator that recently announced plans to host a Michelin-star dinner aboard Space Perspective’s Spaceship Neptune for $495,000 per person. Chiporukha says that a few years ago, he was approached by a space company (which he declined to name) to help promote the first private mission to the International Space Station in 2022. Chiporukha placed

one of the tourists on that trip and has since built a successful space travel business that works alongside wealthy tourists looking to the stars for their next adventure.

Roman & Erica, Inc., the lifestyle management company he and his wife run, already had a reputation for working closely with well-heeled consumers looking for unique experiences, like coordinating exclusive access to Paris Fashion Week with the Alexander McQueen team.

Chiporukha notes that space travel on suborbital balloons can be similar to flying on an airplane. However, there are many physical and financial hoops to jump through if you want to get on the next rocket into orbit. “First, you need to show your serious intent to go to space, and that’s typically done financially,” Chiporukha said. “There are some hard costs to do a proper medical [evaluation] and training. All of those things cost tens of thousands of dollars to do in a proper setting. If you are not qualified, you don’t get that money back.” Chiporukha notes that companies will financially vet travelers to ensure that they have the liquid assets required to pay for their space flight.

As NSR analyst Kasaboski points out, even if you do invest in an orbital trip, there’s no guarantee that you’ll actually go. “There are people who bought tickets over a decade ago, who are finally getting a chance to fly now. So expect that kind of window,” he said.

Suborbital trips, like those that Virgin Galactic and Space Perspective offer, require far less physical preparation and cost less. Balloon trips are especially easy, according to Jane Poynter. The Space Perspective founder and co-CEO got her start in otherworldly adventure as part of the team that lived and worked from 1991 to 1993 in Biosphere 2, a hermetically sealed environment in the Arizona desert.

Poynter says that as long as you are physically fit enough to travel in an airplane, you can travel in their capsule, which hangs below a space balloon. That is, if you can afford the $125,000 per-person ticket. That gets you a six-hour excursion—two hours each for lift-off and landing—and two hours hovering above the Earth.

The balloons launch from boats off the coast of Florida and splash down again in the ocean upon return. The technology is the same that NASA has used for decades to launch research equipment, such as telescopes (though not astronauts), according to Poynter, who says it is a much gentler way to get the overview effect. The balloons are filled with hydrogen to lift off passengers, But the company rejects comparison to the Hindenburg. Hydrogen is the gas of choice for balloonists around the world, it says, explaining that the balloon is designed to keep the flammable gas from mixing with oxygen in the ambient air. Space Perspective is also aiming to be carbon neutral—thanks to using balloons instead of fuel-burning rockets, and through other measures, such as carbon offsets.

Space Perspective plans to take people up in a comfortable pressurized capsule, designed to provide 360-degree views through huge windows. Passengers will not experience weightlessness, however.

The trip, Poynter promises, should be breathtaking. “As the sun starts coming up, it creates these wild rainbows on a planetary scale that are just crazy,” she says, “and then eventually, you’ll have the sun in that classic black sky, and you will see that iridescent thin blue line of our atmosphere, the curved horizon that astronauts talk about.”

The gentle ride and long duration of the trip allow for plenty of luxury experiences, too, like the one that Chiporukha and his partners are putting together. In addition to that Michelin-Star dinner, there’s discussion of bringing musicians, celebrities, and more to drum up more

demand for the exceedingly expensive escapades.

Poynter says she anticipates Space Perspective flights to begin sometime in 2025, pending clearance from the FAA and the Office of Commercial Transportation. The company plans around 50 flights in its first year, and double that in the second. As of May, Space Perspective said it had booked nearly 1,800 seats.

The reality, however, as Kasaboski points out, is much more nuanced. “Theoretically, the [balloon] technology should be easier to develop and launch more often at a cheaper price than rockets or rocket planes, however, a number of factors have held this market back,” he says.

Balloon technology can be easier to deploy because the hydrogen used to lift the balloons to space is more affordable than rocket fuel, but it is far more limited thanks to short supply around the world. There are also intellectual property litigation issues, he adds. “In short, the technology is interesting and should take off, but the market remains underdeveloped, underinvested, and slower to develop than other forms of space tourism,” says Kasaboski.

Space Perspective’s Spaceship Neptune capsule

The space tourism business has passed the initial hurdle of demonstrating that these trips are possible, says Kasaboski, but it’s far from fully established. “With this market, it’s more that we know there’s demand and people are lining up to buy tickets,” he says, “but the flights are not ready yet.”

Though there’s been plenty of criticism about billionaires going to space rather than solving hunger or homelessness right here on Earth, those working in the space tourism industry claim that it can benefit society. They underline that many of our modern comforts and tools have come as a direct result of space exploration—everything from the GPS in your car to the exercise bike in your bedroom.

Providers also defend the intangible benefits of the overview effect. “It is our job to give them the most extraordinary experience,” Poynter said. “We anticipate that some fairly large percentage of those people will be deeply moved and come back and do something extraordinary with that experience.”

Teaching poker to women, Jenny Just fosters confidence and strategic thinking in traditionally male-dominated fields.

BY EVA CROUSE

Jenny Just, co-founder of Peak6 Investments and visionary behind Poker Power, has found a unique and shockingly effective way to empower women in male-dominated fields. With a career spanning over two decades in finance and technology, Just has made significant strides not only in business but also in the fight for true financial and cultural gender equality. Her distinctive approach involves teaching women and girls to play poker—a game traditionally played by men—to develop crucial skills such as risk assessment, strategic thinking, and confidence. What started as a small experiment soon evolved into an initiative that has reached over 280 companies in more than 40 countries.

Worth recently spoke with Just about her business philosophy and how she helps women and girls build their confidence. This interview has been edited for length and clarity.

When did you know you wanted to teach women and girls to play poker? Why?

I started because of my daughter, who was losing a tennis match… Her dad was watching her play, and she was losing, even though she was probably the better athlete. He was frustrated that she was losing, but he didn’t want to tell her. So he came home and let his frustration out with me. [He] said she just hadn’t realized that she was playing against someone who’s thinking and strategizing based on not only what they brought to the game but also what’s happening in the game. He said she needed to learn to play poker.

From lesson one to lesson four, literally the skies opened; it was that impactful. What those girls experienced and what I saw in [them] really was about their confidence. It grew [exponentially] from lesson one to lesson four—we’re talking about four one-hour lessons.

I always knew that if I had something tangible that could really benefit women around money and taking risks…I would do it.

When I started to learn, I realized: here it is. This silly little card game called poker was really the answer. For women to get comfortable taking risks, allocating capital, [and] strategizing, it could really change their whole approach to this idea of perfection and what it means to fail—and pick yourself back up again. Men and boys are practicing this for 10 years before they get to the workplace.

People say women are more riskaverse when it comes to investing. I’ve noticed that it’s often framed as a positive thing. What are your thoughts on that?

It’s a stat I would hope we would get away from…In poker, every hand is a risk. Which hands am I going to play? …If I never get a good hand, which is possible, I could be sitting for an hour [waiting]. Am I not going to play? If [I walk] into a meeting, and the perfect situation never happens, I never open my mouth, am I going to be asked to the next meeting? Maybe. But what about the next one? And the next one? I have to

figure out how to play even when I don’t have a good hand. And those are risks that we have to start to take over and over and over again.

What do you feel are the outside forces shaping your business the most right now?

The outside forces are always technology and people. We are constantly forcing ourselves to compete with the person who’s in the garage, who’s thinking about new ways of trying to solve problems.

The difference between good and great is amazing people. [We want] to find those people, educate those people, and have them bring us their expertise from their experiences…Since the market changed in April of 2022, there have been unique opportunities to get fabulous people because of all the layoffs. We’re fortunate at Peak6 to have a lot of people stay for a really long time, but we also don’t want to be insular, and we know we can learn a lot from great people.

How do you keep tabs on what the people in their garages are working on?

I try to become my own worst competitor—or best competitor— however you want to say that. But if I wanted to beat me, I think, “what would I do?”

How do you measure success for yourself?

It always starts with financial because we’re a for-profit company. But we’ve had the good fortune of having financial success, which has led us to be able to do some of those other non-financial, [impactful things]—like Poker Power. Poker Power is about getting a million women and girls to play poker, and ultimately, that’s not a financial metric.

What keeps you awake at night? How do you prepare for those challenges that you’re anticipating?

Definitely complacency. We’ve been around for 27 years now, and our trading business has never had a losing year, which is quite extraordinary. But it’s easy to take things for granted when you are on a winning team. We want the next generation of people to come into Peak6 to have that entrepreneurial spirit that allows us to succeed for 27 more years.

Our mantra here at Worth is “Worth Beyond Wealth.” Does that resonate with you, and if so, in what capacity?

I think what’s most interesting to me about it, at least at this time and place, is that “worth,” or I’ll call it a sort of “non-monetary value creation,” comes in all different sizes, shapes, and packages. I think it can come from top-down ideas. I think it comes from bottom-up ideas. I think it can come in unexpected ways. But we have to look for them and then acknowledge them when they come. What we’re doing through poker is a perfect example. It was completely unexpected and nontraditional, and I’m hoping your readers open their eyes to how we are making young girls and women feel about themselves. That is true worth.

If you could give our readers one piece of advice to help make the world a better place, what would it be?

Play poker. I eat my own cooking—and I know how valuable it has become to me. I say this all the time. If I had learned poker years ago, I would have saved 10 years of losses and failures in my career for sure. I would totally have thought about [everything] differently.

“This silly little card game called poker was the answer. For women to get comfortable taking risks, allocating capital, [and] strategizing, it could really change their whole approach to this idea of perfection.”

The other thing is, I will tell them to be selfish. But not in the traditional way of being selfish. You are a unique, independent, thinking human, and you have different ideas. The reason why Peak6 exists and has employed however many thousands of people over the years and accomplished what it’s accomplished is because I was there. Myself and my co-founder brought two totally different thought processes to the entity.

Do you have any advice for how people can trust that their opinions and ideas are valid and worth sharing?

If you think it’s valid, it’s valid. It actually doesn’t matter what other people think.

Whether it’s relaxation, connecting to nature, community service, or exploration, luxury travel—like everything else—follows trend cycles. This year, it was difficult to pin down exactly what we were seeing; the dots didn’t seem to connect. That is because classic values are so integrated, they become invisible. Privacy is a staple of luxury experiences (the velvet rope was created for a reason), but this year is different. It is not just about taking off on a private jet to a private island (although we walk you through how to do just that). This year, luxury travel demands true escapism. Whether you are looking to avoid the summer siege of European tourists by fleeing to the remote islands of French Polynesia (page 42), are looking for serenity while absorbing thousands of years of history and mythology in Crete (page 32), or perhaps are looking for a boozier adventure to a rainforest hideaway in Belize (page 48), we’ve got you covered. Plus, for more luxurious stays, check out our list of the Best New Hotels worldwide (page 52).

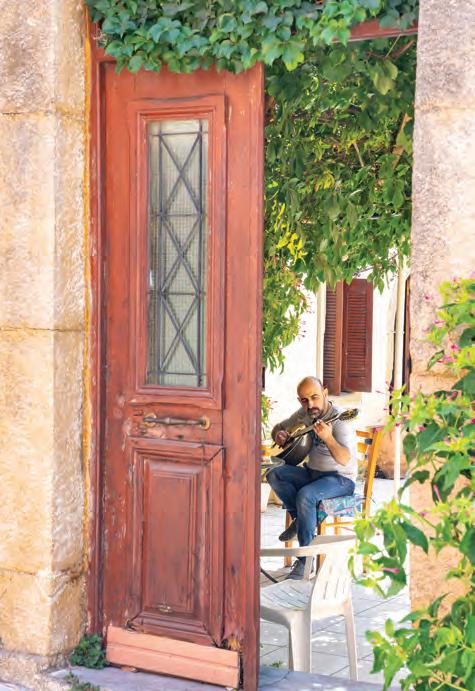

An Exploration of Rome and Crete Via Private Jet Takes You Back and Forth Through the Millennia.

BY DAN COSTA

Embarking on a journey with a group of strangers can be a challenge. This was my situation when I joined fellow travel writers for an exclusive tour of Rome and the Cretan countryside. After a delightful dinner of prawns, smoked salmon, sautéed dorado, and a generous amount of Mazzei Zisola Noto Rosso, I joked with my colleagues that the only unforgivable sin on a press trip was to make the group late for the next stop. Little did I know that I would be the one to commit this cardinal sin the next day when our guide, Kapi, called me at 8:30 am to say, “We are all waiting for you.”

Thinking our departure was at 9 a.m., not 8 a.m. I’d been awake for hours in my room checking email, oblivious to my fellow journalists waiting in the vans on the street just one floor below me. Roman traffic is never predictable; rush hour makes it worse. It was a long, uncomfortable ride to the airport. But as rude as my tardiness was, we were unlikely to miss our flight. We were flying private.

Abercrombie and Kent, our tour organizers, has a unique way of showcasing their Wings over the World Journeys. These tours utilize private jets to transport guests between destinations like London, Paris, Rome, and Athens. The convenience of private flights cannot be overstated, but what truly sets these tours apart are the local guides. They are the key to unlocking the hidden gems of each location. A good guide can transform a trip, and A&K has the best. Thanks to them, I could travel through ancient Roman and Minoan civilizations while indulging in some of the world’s best street food.

And if I did sleep in, the plane would wait.

Fortunately, I was more punctual for my commercial flight into Rome. At the airport, I was greeted by Kapi, an Abercrombie & Kent representative who stayed with us for the entire trip. The drive to Hotel de la Ville was easy, if not particularly swift. Rome has no freeways, and every street is a winding road. It’s best to sit back and enjoy the ride.

Perched atop the Spanish Steps, Hotel de la Ville blends historical grandeur and contemporary luxury. The central courtyard, which serves breakfast and lunch, and refined interiors provide a serene retreat from the bustling streets of Rome.

It is also worth stopping by the rooftop bar for great views of the Roman skyline and a playful cocktail menu. I opted for the Abbronzatissima, described by the hotel as: “Sunshine, Wild Turkey, Bourbon— and you’re already in pole position—fresh lemon juice, London Essense white peach, and jasmine soda. Libidine.” In Italian it means “very tanned,” but it could also be a reference to the 1963 single by Edoardo Vianello. Regardless, it was lovely.

Our first stop was a truly exclusive visit to San Lorenzo in Miranda, a site not open to the public. Originally constructed as the Temple of Antoninus and Faustina in 141 AD, it was a tribute to Emperor Antoninus Pius and his wife, Faustina. The temple underwent a transformation during the Middle Ages, around the 7th century when it was converted into the Church of San Lorenzo in Miranda. Over the years, it evolved into a hub for medicinal practices and the apothecary arts, reflecting the medieval and Renaissance periods’ reliance on herbal medicine. Today, it is a treasure trove of beautifully crafted glass and ceramic bottles that store essential oils, tinctures, and extracts derived from rosemary, sage, and lavender. The jar of “merucio ossido giallo” was marketed “veleno” with a skull and crossbones.

This evolution of San Lorenzo is part of a broader trend in which many ancient Roman structures were repurposed for Christian worship, turned into storehouses of natural knowledge, and are now used as tourist attractions.

San Lorenzo sits at the edge of the Forum, the epicenter of Roman public life. The forum hosted triumphal processions, elections, public speeches, criminal trials, and gladiatorial matches. The Forum dates back to around the 7th century BC and continued to be used until the 4th century AD. The area subsequently fell into disrepair, becoming a pasture known as the “Campo Vaccino” (Cow Field) during the Middle Ages.

Excavations at the Roman Forum began in earnest in the early 19th century, driven by a thriving market for relics from classical antiquity. The Italian archaeologist, Carlo Fea, led the first efforts to clear the area in 1803. However, it wasn’t until the unification of Italy and the subsequent establishment of Rome as the capital in 1870 that more systematic and state-sponsored excavations were initiated.

Excavations in the Forum have revealed layers of history; for example, the San Lorenzo on the Miranda floor sits five meters above the floor of the Roman Forum, all of which have been excavated. These archaeological efforts often spark controversy, particularly when intersecting modern infrastructure projects. The construction of the new metro line near the Forum has faced significant delays due to the discovery of ancient artifacts and structures. When I asked our local guide, Eva, when the project would be completed, she just laughed.

The quest to uncover the Roman Forum’s secrets has not been without its losses. Early excavators often removed or destroyed layers of history in their eagerness to reach the most ancient remains. Medieval and Renaissance structures that had developed on top of the ancient ruins were often demolished to get to the more ancient relics, erasing centuries of historical layers. For instance, the 16th-century church of Santa Maria Liberatrice was demolished in 1900 to reveal the ancient church of Santa Maria Antiqua beneath it.

Today, the Roman Forum is an open-air museum with ongoing excavations and restoration efforts to preserve its history. Modern archaeologists use advanced technologies such as ground-penetrating radar and 3D modeling to explore the site with minimal disturbance. These efforts are helping to uncover new insights while preserving the delicate balance of the historical layers.

The following morning began with an exclusive tour of Castel Sant’Angelo. Originally designed as Emperor Hadrian’s grand tomb, the massive stone rotunda grew to become the fortress from which popes defended the city. Although Sant’Angelo served as an escape room for popes in times of invasion, the papal apartments are quite grand, featuring the best art of every age. As one of the most secure buildings in the city, it was also used to hold the Vatican’s treasury.

Abercrombie & Kent can sometimes arrange access to the secret passages connecting the castle to the Vatican, but the gates were sealed on our trip. Nevertheless, the Castello’s roof offers some of the best views of St. Peter’s Basilica and the Tiber River in Rome. It is a great place to snap photos and get a feel for the city’s layout.

After immersing ourselves in Rome’s ancient splendors, we ventured into Trastevere, one of the city’s most charming and vibrant neighborhoods, for a culinary journey like no other. Our guides, Toni and Walter from culinary tour company Eating Europe, introduced us to the unique food culture of Rome with their extensive knowledge and passion for local cuisine. Like all the best guides, they brought us to attractions we would never have been able to find on our own.

Our first stop was at La Norcineria di Iacozzilli, a haven for meat lovers. We learned the nuanced differences between Parmigiano Reggiano and pecorino romano, two of Italy’s most beloved cheeses. But the highlight was undoubtedly the porchetta—succulent, slow-roasted pork seasoned with aromatic herbs. Roasted daily in a small town outside Rome, it was soft, fatty, salty, and perfect. It is cliché to say this dish was “the best thing I have tasted,” but my mouth waters every time I edit these words. I was reaching for a second slice when a local Nonna scolded us in Italian for taking up all the sidewalk space on the narrow street in front of the shop. One perfect bite would have to suffice.

Leaving the cozy confines of La Norcineria, we crossed the Tiber River and arrived at Campo de Fiori, Rome’s most famous open-air market. It buzzed with activity, a vibrant tapestry of colors, smells, and sounds. La Norcineria was like a farmers market anywhere in the world but loaded with Italian staples—eggplant, artichokes, and, of course, tomatoes. After the meatiness of the porchetta, a few bites of Caprese salad with local tomatoes, buffalo mozzarella, and basil was the perfect palate cleanser.

From there, we headed a few blocks to the Ristorante di Pancrazio, where we were led to the basement and handed an apron. In addition to being travel guides, Toni and Walter were chefs who helped us make homemade ravioli filled with lemon-scented ricotta and tagliatelle all’amatriciana. The best way to appreciate a place’s food is to eat it, but making it yourself gets your hands dirty.

I was so focused on kneading and rolling pasta that I almost forgot to look up and see the past. The Ristorante di Pancrazio was built on the ruins of the Theater of Pompey, a venue built entirely of marble that could hold more than 20,000 spectators. Perhaps most infamously, this was the theater where Brutus and Cassius assassinated Julius Caesar. Walking down the steps to the basement, we stepped back to 55 BC. I can’t say why, but it made our pasta taste better.

I flew from Rome to Heraklion on a private plane, and as we arrived at the executive terminal at Rome’s Ciampino Airport, it didn’t feel like we were late. The plane would leave when we were ready. We breezed through security as our luggage was loaded onto the plane. We sat, gave a thumbs-up, and rolled down the tarmac in minutes. I have heard mixed things about safety protocols on private flights, but both times I have flown private, we took off without formal safety briefings. Just get on and go.

The plane itself was everything you would expect in a private jet. The Bombardier Challenger 850 has a range of approximately 2,800 miles and seats 14 passengers in its VIP configuration. To give you a sense of size, the 850 is based on the Bombardier CRJ-200 regional jet that can seat 50. You will have room to stretch out.

Approaching Crete by plane can be bumpy, at least when the south winds are blowing, and they were blowing hard when we arrived. Known as the “Livas” or “Sirocco,” these warm winds from the Sahara Desert can raise temperatures significantly and often carry dust and sand from North Africa. The Livas typically occur in the spring and autumn, influencing the island’s climate and occasionally causing discomfort due to their dryness and heat.

Although merely curious to tourists like me, Cretan natives took the South Winds very seriously. My visit was at the first blush of spring; all the olive trees were starting to bloom. A long, harsh south wind can disrupt the bloom and damage the leaves and fruit. The results can be catastrophic. During the 2013-2014 season, for example, crop yields dropped from 100,000 tons to less than 40,000 tons. The crash crushed many local producers.

The winds died off after a day, but I had to wash the sand off my contacts that first night.

Though only three miles from the center of Heraklion, the Palace of Knossos feels like the middle of nowhere. A few homes and trinket shops in the small valley are all you see when you park. “Is the Palace really near here?” asked one member of our party. Indeed it was, but think more palace ruins than Palace. This isn’t the Renaissance or ancient Rome; we were exploring a civilization that existed two thousand years before Christ. A people more myth than memory.

It was the myth I was most interested in. I grew up on Greek mythology. Theseus used a thread to navigate the Labyrinth and slay the half-man, half-bull beast, which seemed to be the height of cleverness and heroism for my 10-year-old self. And now, a few millennia later, I would get the chance to walk those same tunnels.

Or on top of them, as it turns out. They no longer let tourists in the maze, although our guide, Kapi, has brought people there and even gotten lost. Nonetheless, the Palace is amazing. At this point, the structure combines ruins and recreations that replicate the colors and art of the time. At its peak, the palace was the home of up to 1,500 residents, with an even larger community around the building to support it.

While I did not see a Minotaur, I did see the Bull-Leaping Fresco, one of the most iconic and well-preserved pieces of Minoan art. It depicts a ceremony in which men and women leap over the back of a charging bull.

I also discovered what is undoubtedly one of many controversies about the inventor of the flushable toilet. Conventional wisdom holds that it was invented by Sir John Harington, an English courtier, and godson of Queen Elizabeth I, who devised a flushing toilet system in 1596. Indeed, this design persists today in most forms.

But maybe the Minoans got there first? They used a series of aqueducts and cisterns to channel fresh water into the more luxurious parts of the palace. The palace also included toilets that led to a gravity-driven system of terracotta pipes that would channel waste away from living quarters to a cesspit outside the residence. This knowledge was lost to time. It would be thousands of years before the English flushed their first loo.

Today, the real palace on Crete is Daios Cove, the resort. Nestled in a private bay on the northeast coast of Crete, near the town of Agios Nikolaos, Daios Cove offers breathtaking views of the Aegean Sea from nearly all of its 290 villas. In 2022, it elevated its status with the unveiling of Kēpos by Goco, a 27,00-square-foot wellness sanctuary that merges holistic healing with advanced medical technology.