What can you find in Bermuda? Cotton candy skies. Pink sand beaches. Crystal-clear blue waters. The chance to disappear. Sway to the rhythm of island life as you discover the natural wonders, rich history and vibrant culture. Take the time to slow down and get lost in each moment, knowing that another will reveal itself all too soon. That’s the magic of Bermuda.

CHAIRMAN

Jim McCann

CHIEF EXECUTIVE OFFICER

Josh Kampel

PRESIDENT

Paul Stamoulis

EDITORIAL DIRECTOR

SENIOR EDITOR

STAFF EDITOR

CREATIVE DIRECTOR

CONTRIBUTORS

Dan Costa

Eva Crouse

Gabrielle Doré

Nicole Dudka

Jason Allen Ashlock, Alec Applebaum, Cait Bazemore, Alexis Buncich, Kirsten Cluthe, Bob Diamond, Deborah Grayson, Max Isaacman, Larry

Kantor, Jonathan Russo, Tim Stevens

VP OF PARTNERSHIPS & DIRECTOR, LEADING ADVISORS

VP OF PARTNERSHIPS

VP OF LEADING ADVISORS

VP OF ACCOUNT SERVICES

JEWELRY & WATCH SALES DIRECTOR

Greg Licciardi

Ron Stern

Kevin Haniffy

Kendall Wyckoff

Heather Hanson

HEAD OF MARKETING

MARKETING COORDINATOR

DIRECTOR OF HOSPITALITY

Clyde Lee III

Payton Turkeltaub

Kimberly Anderson-Marichal

Our Mission Is Building Worth Beyond Wealth

Worth helps our influential, successful community better invest their time and money. We believe business is a lever for social and economic progress. From practical financial advice to exclusive profiles of industry leaders, Worth inspires our readers to lead more purpose-driven lives. Through our conferences, digital channels, and quarterly print publication, we connect the people and companies that are building the future. We showcase products and services that are indulgent, luxurious, and sustainable.

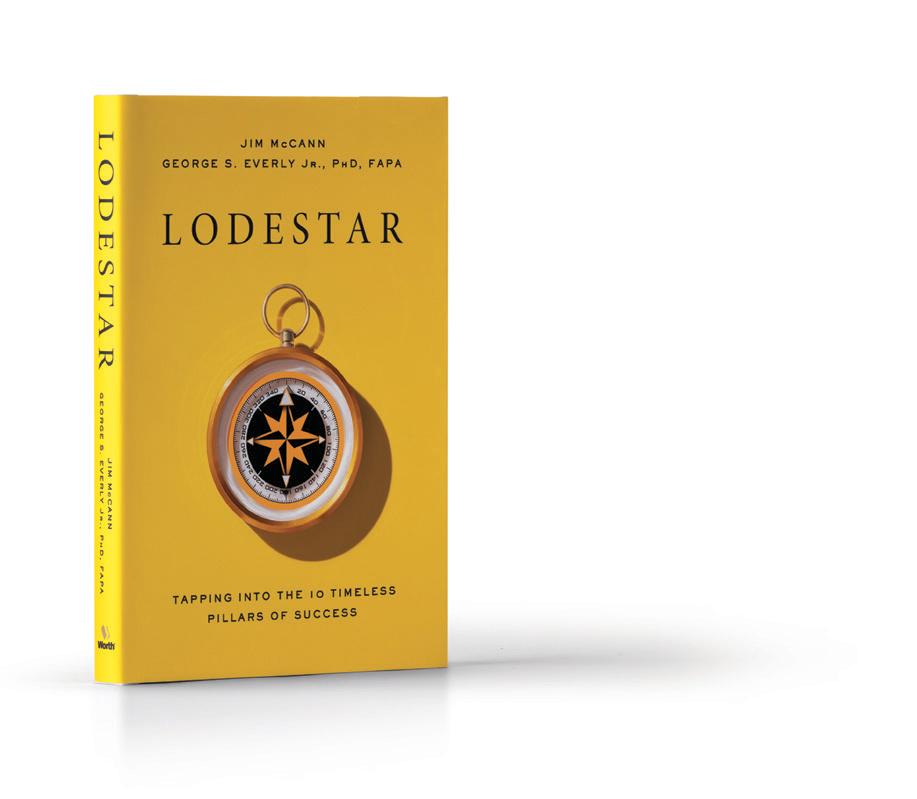

An unexpected friendship sparked a new book, transforming a weekly newsletter into a blueprint for living your best life through timeless self-help principles.

BY JIM MCCANN

What’s the key to a happy and fulfilling life? Is it money or health? Intelligence or ambition? More friends or better friends? According to thousands of years of expert advice, the secret to improving your life is a mix of all the above.

Anyone seeking self-help ideas faces an overwhelming amount of sometimes conflicting information. You could spend a lifetime exploring advice in sources ranging from the Bible and Aristotle’s scrolls to Dale Carnegie’s lectures and the millions of books and websites available today.

What’s missing is a comprehensive guide that showcases the best advice and demonstrates how to apply it to your life.

I encountered this situation during the pandemic when I started writing the Celebrations Pulse letter to stay connected with 1-800-Flowers.com’s customers and brands. The goal of the weekly letter wasn’t to sell products; rather, I aimed to foster community and offer insights on building stronger relationships.

The letter became more popular than I ever imagined, prompting me to dig deeper into the self-help library for inspiration. I began questioning how anyone could untangle and benefit from all this information.

While researching for a Celebrations Pulse letter, I found a fascinating article in Psychology Today about the pandemic’s impact on connection. It was written by Dr. George S. Everly, Jr., an esteemed clinical psychologist and public health expert who holds faculty positions at the Johns Hopkins Bloomberg School of Public Health and School of Medicine.

Impressed by the article, I wrote to him asking if he’d like to chat. Soon after our first conversation, George and I started referring to ourselves as “COVID buddies.” Our friendship grew, and we discovered that we shared the desire to be the best versions of ourselves, help others do the same, and combat the epidemic of loneliness.

I invited George to join 1-800-Flowers.com’s Connectivity Council, a panel of experts who advised on topics and provided expertise for Celebrations Pulse. He introduced me to his community of psychologists while I extended introductions to my network of academic and business friends.

When he invited me to work on a book together, I was flattered. He suggested that writing a book would help focus our thoughts and share them with a wider audience. I immediately agreed.

Two years later, we’re publishing Lodestar, a self-help book unlike any other. It draws on themes from the most influential and credible self-help books of the last century— books that have collectively sold hundreds of millions of copies—and dives into those themes with insights and anecdotes from me, George, and other notable figures.

We began by conducting a factor analysis, comparing the content of each top book to determine which topics appeared most frequently. We then filtered the list through our own experiences and those of historical figures, celebrities, and our friends.

Lodestar explores key principles such as harnessing optimism, building resilience, improving time management, embracing happiness, and strengthening relationships. Most importantly, we show you how to make these top ideas work for you.

As we wrote in the introduction: “If you close this book feeling more equipped to find success—whether you want to make it on your own terms, make the world a better place, or simply make it through the challenges ahead—and to be kind to yourself and others along the way, our job here is done.”

Lodestar has been a labor of love for George and me. Working on this project deepened our bond, turning the process of research and writing into a journey of mutual growth and discovery.

Our collaboration was driven by a shared commitment to meaningful work that has the power to change lives. Partnering with someone who shares your vision adds a profound layer of satisfaction to a project. George’s friendship has been a true gift in my life.

We hope Lodestar becomes a beacon for those seeking to navigate their paths to success, happiness, and fulfillment. May this book serve as the starting point for your incredible journey toward becoming the best version of yourself.

— Jim McCann FOUNDER, 1-800-FLOWERS CHAIRMAN, WORTH MEDIA

Nestled in the heart of the Lowcountry, Palmetto Bluffs’ 20,000 acres and 32 miles of coastline are yours to explore. Roam through centuries-old live oaks canopied over Mother Nature’s inspired creations and historical landmarks. Here, the land pulls you towards something familiar and inviting – the discovery that home isn’t just a place to live; it’s a place that makes you feel alive.

Join us in celebrating the companies prioritizing sustainability and corporate responsibility.

BY JOSH KAMPELL

As we navigate the complexities of today’s global landscape, the role of leadership has never been more challenging or critical. Today, business leaders are tasked with balancing the diverse needs of their stakeholders—customers, employees, investors, and communities— while confronting the rapid pace of technological innovation, such as the rise of transformative AI.

In recognition of the companies successfully navigating this complex landscape, we are proud to introduce our inaugural Impact 150 list—a curated selection of companies that have made significant commitments to the United Nations Sustainable Development Goals (SDGs). These companies are not just leaders in their industries; they are mastering the intricate balance between profitability and purpose. In today’s environment, managing this balance

requires making difficult decisions prioritizing long-term sustainability over short-term gains, all while remaining agile enough to respond to rapidly evolving market demands. These companies are setting new standards for corporate responsibility in a world where the pressure to deliver financial performance must be aligned with the imperative to make a positive social and environmental impact.

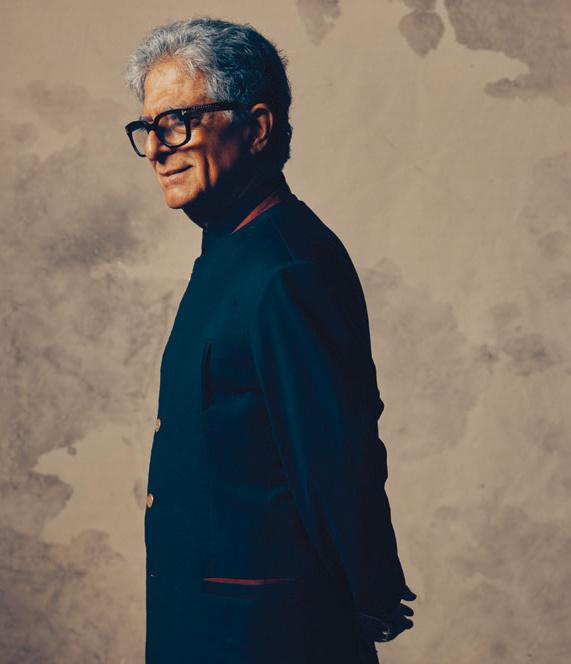

This issue also features an interview with Deepak Chopra and the CEO of the Chopra Foundation, Poonacha Machaiah. Dr. Chopra has been a trusted advisor to countless leaders across various sectors. His insights on mindfulness, holistic well-being, and the power of consciousness have guided many CEOs, entrepreneurs, and public figures in their decision-making processes. We are proud to partner with the Chopra Foundation on their Sages & Scientists conference, which will bring together some of the bright-

est minds in science, technology, and spirituality to address the critical issues facing humanity. This collaboration underscores our ongoing commitment to fostering meaningful dialogue addressing today’s leaders’ challenges.

Within this same context, the theme of our upcoming Techonomy 24 conference will be Leading with Intelligence. Over three days, we will explore how leaders can harness human and artificial intelligence to drive meaningful progress. The conversation will extend beyond AI to examine the critical balance between technological advancement and the human capacity for empathy, understanding, and connection. Our Techonomy conference has been a platform for over a decade where technologists, business executives, academics, and government officials converge to explore the intersection of technology, business, and impact.

At Worth, we believe that spotlighting these extraordinary companies and collaborations can inspire our readers to lead with intelligence in their domains, leveraging technology and human insight to navigate complexity and drive positive change. Together, we can build a more sustainable, equitable, and prosperous future for all.

— Josh Kampel CEO, WORTH MEDIA josh.kampel@worth.com

See how the leading donor-advised fund can add flexibility and ease to your family foundation.

Worth found 150 companies pushing the boundaries of corporate responsibility.

BY DAN COSTA

When the United Nations unveiled the Sustainable Development Goals (SDGs) in 2015, they were audacious, ambitious, and, to my cynical eyes, almost hopelessly idealistic. The collection’s 17 goals are a kitchensink wishlist for a dramatically better world where poverty and hunger are eradicated, good health and education are universally accessible, and climate action is not just an obligation but a priority. The SDGs are noble, inarguable, and undeniable. That is why they were adopted by a unanimous vote of all 193 member nations.

But are they truly attainable? Progress has been made, but the world still needs to achieve these ambitious goals. We have seen success in areas like renewable energy and health, but we face daunting challenges, particularly in combating hunger, reducing inequality, and preserving biodiversity.

As we approach the halfway mark of the 2030 deadline, the finish line is far from clear.

To be sure, there have been notable successes since the SDGs were launched. Take, for instance, Goal 3: Good Health and Well-being. Global efforts to combat diseases, improve maternal health, and provide vaccine access have saved millions of lives. The global under-five mortality rate has been cut by nearly half since 2000, largely thanks to these efforts. (Note,

the COVID pandemic was relatively benign for children under five.) In Goal 7: Affordable and Clean Energy, we’ve seen renewable energy capacity more than double in the last decade, with solar and wind power leading the charge in reducing reliance on fossil fuels.

But for every step forward, there are areas where progress has stalled or even reversed. Goal 2: Zero Hunger is a stark example. Despite early gains, global hunger is again rising, driven by conflict in regions like Yemen and South Sudan. As of this writing, 1.5M people are at risk for starvation in the Darfur region. The number of undernourished people in the world has increased from 624 million in 2014 to over 800 million today.

Goal 15: Life on Land also presents a sobering picture. Despite increased awareness and conservation efforts, the rate of biodiversity loss remains alarming. We are losing species at a rate unprecedented in human history, and this decline is directly linked to human activities, from deforestation to climate change.

The SDGs were not just a set of guidelines—they were a call to action for governments, businesses, and individuals alike. Although I have been skeptical from the beginning, I have been impressed by the willingness of some businesses to commit to these lofty goals.

Worth’s Impact 150 is our way of highlighting companies moving the needle. These companies are not perfect—they are still businesses—but they are committed to making a difference. They understand that in today’s world, businesses can no longer afford to operate in a vacuum. We built the list in partnership with Karma Wallet, which aggregates data from over 30 trusted third-party sources to evaluate companies’ social and environmental performance.

The Impact 150 businesses are not merely responding to market pressures or regulatory requirements—they are driven by a genuine desire to effect change. Here are just a sample:

n Apple: It is on track to become carbon neutral across its entire business by 2030, having already achieved 100% renewable energy usage across its global corporate operations.

n Bank of America: BoA has committed $1 trillion by 2030 towards sustainable investments, already achieving carbon neutrality in its operations and procuring 100% renewable electricity by 2019.

n L’Oréal: It has reduced the carbon emissions of its production sites by 81% since 2005, while production volumes have increased by 37%.

n Nike: Since 2015, Nike has reduced its carbon emissions per unit of revenue by 30%, and 100% of its North American facilities are powered by renewable energy.

By spotlighting these trailblazers, we can inspire others to follow suit.

I first saw the multi-colored wheel that is the Sustainable Development Goals pin on the lapel of David Kirkpatrick, the founder and former editor-inchief of Techonomy. I bought one shortly after that. Since then, I have seen them worn by tattooed hipsters in the East Village and captains of industry in Davos. Much as a flag pin is part of the standard politician’s uniform, the SDG pin seems to signify a particular global citizenship. This is virtue signaling, no doubt, but at least these are virtues common to 196 nations. That alone is worth celebrating.

— Dan Costa EDITORIAL DIRECTOR dan.costa@worth.com

Oliver Rist is a long-time journalist specializing in all kinds of technology. Though he lives in Connecticut, he’s traveled the world, usually astride a motorcycle. Riding like this, he’s motored up and down Route 66, negotiated an ocean of switchbacks across the Alps touching Germany, France, and Italy; whizzed through the Andalusians; traveled the length of the Pacific Coast Highway down to Cabo San Lucas in Baja; even dragged a modified Norton up the Tribhuvan Highway in Nepal back when he was younger, dumber, and didn’t yet suffer from altitude sickness. His current rides are a Ducati Diavel and an aging, but nevertheless awesome, BMW K1200S. Since seeing Curtiss Motorcycles’ electric flagship, however, he’s started dreaming about one of those and maybe figuring out how to EV restomod a ‘69 Mustang Mach 1.

Cait Bazemore is a New York City-based journalist with over a decade of experience working with content in the luxury space. In recent years, Cait has specifically honed in on her passion for luxury watches and jewelry. She’s contributed to both print and digital publications including Worth Magazine, Robb Report, The New York Times, Gear Patrol, Watchonista, HODINKEE, The Hour Glass, Revolution, Modern Luxury, and Watches & Culture Forum as well as podcasts like Beyond the Dial and The Deep Track.

In her spare time, Cait writes poetry and completed a residency in Paris working on her debut collection (forthcoming 2024). Most recently, Cait began her journey to becoming an enameller with an apprenticeship under one of the world’s few Grand Feu enamellers, Vanessa Lecci.

Alexis Buncich is a freelance writer and producer based in New York City. She graduated from Columbia University with a Bachelor of Arts in English Literature. She especially loves writing travel and coming-of-age stories. You can find her work at alexisbuncich.com.

HOST & CURATOR

DEEPAK CHOPRA Founder & Director

CHOPRA FOUNDATION

FEATURED SPEAKERS & MEMBERS INCLUDE:

Sam Altman

Diane von Furstenberg

Gary Vaynerchuk

Kenneth Cole Dava Newman, PhD

Poonacha Machaiah

Carme Artigas

Rudy Tanzi, PhD

Rachel Gerrol

WELL-BEING | HUMANITY | COSMOS

Deepak Chopra hosts global luminaries at the forefront of their fields to unite in conscious collaboration. Sages & Scientists fosters a unique and vibrant community where an unparalleled assembly of visionaries—including worldrenowned entrepreneurs, philosophers, medical experts, scientists, celebrated musicians, and influential artists—converge. Together, they collaborate and unlock innovative pathways to address the most pressing global challenges related to well-being, humanity, and the cosmos.

The Chopra Foundation invites you to join this transformative movement.

Learn more about becoming a member or sponsoring our upcoming global programs: sagesandscientists.org

But don’t worry, CEO Peter Rawlinson has a plan to fix that.

BY TIM STEVENS

Peter Rawlinson is sick of the industry not taking his company and its cars seriously.

“Back in 2020, when I said we’re going to have the best car in the world, everyone said it’s vaporware. They really did! When I said we’re going to have over 500 miles range. That was laughed at. They said it was impossible. Then, in ‘21, we brought it out. EPA range? Five hundred twenty miles for our very first model, the Air Dream,” he told me, getting increasingly animated as he recounted each successive slight.

The Air is Lucid’s first effort, and Rawlinson, the company’s CEO, certainly has plenty to be proud of. A long, low, lithe, and luxurious all-electric sedan with unmatched range and power, the Air gives an impression of what a next-generation Tesla Model S might be like. Before Lucid, Rawlinson was chief engineer of the Model S, Tesla’s top sedan.

The Lucid Air entered the market in 2021, selling just a handful that year. Its sales are still slight,

less than 9,000 annually, but the company is proud to point out that this figure bests the annual sales of luxury EV heavyweights like the Porsche Taycan or Mercedes-Benz EQS.

Of course, those manufacturers have plenty of other cars to bolster their numbers and keep them afloat. For Lucid, selling 9,000 cars a year is not sustainable. But Rawlinson has big goals: over a million cars sold per year within a decade.

A primary challenge in driving that kind of growth is retail presence. Lucid has fewer than 30 so-called Studios nationwide, but they’re not dealerships, so you can’t buy cars there in many states. You must order online. Likewise, Lucid

has fewer than 50 service locations in the U.S.

I’ve been lucky enough to drive every flavor of the Air since its inception, and every time, I’ve been impressed. It’s not only a big car; it’s a heavy one, weighing roughly 4,500 and 5,500 pounds, depending on configuration.

It’s not a car that hides its weight. When cruising down a busted and broken stretch of asphalt, which is all-too-common near my home in Upstate New York, the Air seems barely affected. It telegraphs confidence as if to say you’d need to find more aggressive terrain to threaten its poise.

That stately composure would seemingly translate into a blasé

feel on twistier stretches of road. Amazingly, the Air shines here, too. Though the Lucid’s steering is a bit muted, it is swift, resulting in a car that eagerly darts through corners. As you step up through the Air lineup, that willingness increases. On the low end is the basic Pure, the rear-wheel-drive, single-motor flavor, which makes do with 430 horsepower. From there, you can pay $8,000 more for a dual-motor Touring model with 620 horsepower and all-wheel drive or continue up to the Grand Touring model, with 819 hp plus a range-topping 516 miles of range and a $109,900 starting price.

At the pinnacle of the Air lineup is the three-motor, $249,900 Sap-

phire. It looks the same as the rest but is on another planet performance-wise. With 1,234 horsepower, it accelerates from zero to 60 mph in 1.89 seconds. Put your foot on the accelerator, and you’re immediately treated to the sort of starfielddistortion view that Disney’s effects gurus spend months rendering for the Star Wars spinoff du jour. Forget impressing your friends; experiencing a launch in the Sapphire is borderline terrifying.

Despite this, the car still delivers the calm composure and poise of the rest of the Airs. You still get the same acres of legroom inside. You still get the giant trunk and frunk for a combined 32 cubic feet of cargo space (more than twice that offered

in a Mercedes-Benz S-Class).

THE CATCH

Good as it is, the Air has one crucial flaw: It’s a sedan, a dying species of car. The market demands SUVs, and Lucid finally has one of those coming. It’s called Gravity, and it will seat seven across three rows. Thanks to its compact electric powertrain, the second and third rows quickly and easily fold flat into the floor, creating an open space with acres of room.

“I’d like to actually provide an inflatable mattress in the back as well because you actually can go camping in the thing,” Rawlinson said.

Where the Air could be seen as a passion project, an opportunity to trump Tesla’s halo car, the Gravity is a more logical volume play. “If you look at the total addressable market for Gravity, it’s six times that of Air, and we’ve guided for the manufacture of 9,000 Airs this year,” Rawlinson said. “Six times nine is 54. That should be a reasonable production number.”

Producing 54,000 cars is a big step up for the company, but far from the million vehicles per year that Rawlinson wants Lucid to make by the early 2030s. They’ll need something more affordable than Gravity, starting at around $80,000 to do that.

Cue a new series of smaller, more affordable Lucid machines meant to directly target Tesla’s Model 3 and Model Y, offering a variety of crossover SUV shapes for different purposes -- some more sporty, some more lifestyle—with a starting price of around $45,000.

The first more affordable options will not enter production until 2026. Gravity, however, will hit the road this year. Just like with Air, Rawlinson is talking big ahead of its launch, saying Gravity will be quicker than a Lamborghini Urus with the comfort of a Cadillac Escalade.

“I think it’s going to be the best SUV in the world. Nothing less will suffice,” he said. Those are some serious promises; this time, we’d be wise to take them seriously.

Discover the art of transforming heirloom stones into cherished jewelry pieces with insights from two expert designers, Anthony Robert and Jean-Paul Xavier.

BY GABRIELLE DORÉ

Every morning, I follow the same routine: brush my teeth, do my skincare, take supplements, apply makeup, and put on jewelry. But unlike adding 50 SPF, when I put on the diamond ring that ordains my left pinky, apply the back to each diamond stud post, and snap shut the miniature hoops, or “huggies” as they are often referred to, I feel a sense of comfort.

Not because of the stones themselves but rather because each one used to be my grandmother’s. When she passed, she made a point that my mother, sister, and I keep and reuse each stone we inherited. Understanding the unique experience of working with a jewelry designer to create a custom piece, Worth decided to sit down with two expert designers, Anthony Robert and Jean-Paul Xavier, who combined have over 60 years of experience. Together they outline their unique processes and how to create a piece that is promised to be cherished for generations to come.

Anthony Robert, a seasoned jewelry designer with over four decades of experience, began his journey in the jewelry industry serendipitously. “I was an engineer for General Motors for 13 years,” stated Robert. “[I] went to their college of engineering called ‘General Motors Institute’ [but] engineers weren’t paid that well back in the late 70s and early 80s due to the gas crisis [and] I needed extra money to buy Christmas

gifts for my [family], so I started doing jewelry on the side, selling to the 5,000 employees we had working at the GM. I did that for about five years before I made the decision to quit and go into a flea market,” he explained.

Marked by a dedication to creating timeless pieces using both natural and lab-grown diamonds, Robert’s approach to jewelry is deeply rooted in engineering principles, ensuring that every piece is as durable as it is beautiful.

Jean-Paul Xavier, a former industrial designer and mechanical engineer, transitioned into the jewelry industry after moving from Australia to New York. His career took a significant turn when he joined David Yurman, where he worked for a decade, ascending to the research and development director role. During his tenure, Xavier honed his skills in developing innovative jewelry materials and techniques. In 2019, he established his own brand, JPX, focusing on bespoke jewelry that intertwines personal stories with exquisite craftsmanship. His unique approach involves a deep understanding of clients’ narratives, integrating cultural and emotional elements into each custom piece.

ROBERT’S APPROACH

Robert emphasizes a balance between traditional craftsmanship

and modern technology in creating heirloom jewelry. His process begins with a thorough consultation to understand the client’s preferences regarding the type of jewelry (ring, necklace, bracelet) and their inclination towards diamonds or colored stones. “Most of my customers prefer diamonds, but we can work with a combination of colored stones and diamonds,” he explained when speaking with Worth

If a client chooses to incorporate heirloom stones, Robert explained, “We [then] take your stones and try to create from the stones you have. It’s not just about the value of [them] but the memories and the sentimental value they hold. When we work with heirloom stones, we are preserving those memories in a new piece that can be passed down for generations.”

ROBERT’S STEP-BY-STEP PROCESS:

1. Initial Consultation: Identify the type of jewelry and stone preferences.

2. Sketching: Create initial sketches based on client discussions.

3. CAD Drawing: Develop detailed computer-aided designs (CAD) for precision.

4. Stone Selection: Source and approve stones, whether natural or lab-grown, ensuring quality and matching characteristics.

5. 3D Printing and Casting: Use 3D printing to create a model, then cast the piece in the chosen metal.

6. Setting and Polishing: Set the stones and perform final polishing to complete the piece.

Robert is meticulous about uniformity and quality. “If a stone is visibly flawed, I recommend replacing it with something that matches better,” he noted.

XAVIER’S APPROACH

Xavier takes a highly personalized approach, focusing on the emotional

and narrative aspects of each piece. His process is deeply collaborative, involving clients in every step to ensure the final product resonates with their personal stories and cultural heritage.

XAVIER’S STEP-BY-STEP PROCESS:

1. Personal Narrative: Begin with an in-depth conversation about the client’s story, cultural background, and significant life events.

2. Live Sketching: Sketch initial ideas during consultations, often on napkins or paper towels for an immediate visual representation.

3. Design Integration: Integrate meaningful symbols and elements into the design, such as incorporating motifs from the couple’s favorite places or cultural heritage.

4. CAD Modeling and Prototyping: Develop detailed CAD models and prototypes, ensuring every detail is meticulously planned.

5. Custom Craftsmanship: Employ master jewelers to bring the design to life, using techniques suited to the specific materials and design intricacies.

Xavier believes in the power of symbolism and detail. Especially in his specialty—engagement rings. He often incorporates elements that reflect the client’s journey, such as specific cuts of stones that resonate with their personality, life experiences, or important relationship locations.

“We leverage our creativity to make each piece meaningful,” Xavier explained. “For example, one client had a waterfall splash incorporated into their [engagement] ring because they met at a waterfall in Puerto Rico, [Inspiration] comes from anywhere, and our job is just to listen and then provide guidance.”

When asked specifically about the use of heirloom stones in any of Xavier’s designs, he explained, “We do that a lot. We do a lot of heirloom pieces. I think it’s becoming a bit of a trend. People are thinking, ‘Okay, well let’s reuse mum’s diamonds,’ and that way [they] get a natural stone, and we also have this sentimental component.”

Designing jewelry with heirloom stones is a deeply personal and meticulous process, as evidenced by the approaches of Robert and Xavier. While Robert emphasizes precision, quality, and durability, Xavier focuses on the narrative, emotional, and symbolic aspects of jewelry design.

Both methods offer unique pathways to creating timeless pieces that not only preserve family history but also embody the wearer’s personal story and values ensuring each piece is cherished for generations to come.

Today’s tech moguls sail in the wake of yesterday’s Gilded Age robber barons.

BY JONATHAN RUSSO

If cultural historians were asked to freely associate with the prompt: “The Gilded Age” (roughly 1870-1890), they might say, ‘corpulent men, cigars, huge houses furnished with booty from European castles, lavish parties with elegantly dressed attendees, and lots of servants.’ To be historically accurate, their lists should include enormous yachts crewed by scores of mariners.

Take, for example, Kanawha, a 471-ton, 200-foot-long steam yacht built in 1899 for Baron Henry Rodgers, whose fortune was from the extractive industries of oil and coal mining. Kanawha required a 39-man crew.

Or Coronet, a 131ft sailing vessel launched in 1885 for Rufus T. Bush. The yacht had a marble staircase and a grand piano in the main salon. The New York Times covered this beauty front page when she won a trans-Atlantic crossing.

The super-rich owned hundreds of other epic steam-powered and sailing yachts. Their yachts were a socially necessary symbol of wealth, and membership in the NY Yacht Club required inclusion in the upper crust.

This love of fast, luxury yachts did not end with the demise of the Gilded Age. The Roaring Twenties saw the building of scores of commuter boats—sleek, high-speed vessels that transported tycoons in New York, Chicago, and Boston from their country homes to their downtown offices. Their upkeep required legions of mechanics, carpenters, and captains.

That legacy of fantastic wealth and unlimited budgets lives on in today’s yachting world.

There must be something compelling about having your own floating palace; it unites people across the ages, like Rodgers and Bush with Jeff Bezos and Mark Zuckerberg. The latter two recently built yachts worthy of the Gilded Age. In these endeavors, they have put aside their high-tech toys (spaceships) to engage in an ageold passion…man at one with the sea. While Bezos and Zuckerberg are not in the old extractive industries of oil, coal, and minerals, numerous

cultural observers contend they are in the new ones, i.e., by capturing attention and impressions, selling data, and fueling the hyper-consumerism machine.

Bezos’ Koru (Māori for new beginnings) is a 417ft, three-masted vessel. Built by top Dutch yard Oceanco, she is reported to have cost $550 million. Her numerous decks belong more on a mid-size cruise ship than a private craft. Estimated running costs are $25 million a year, some of which pay a crew of 40. On a recent flight to the Caribbean, I met one of her captains,

“There is something so powerful about yachting that its popularity spans centuries and cultural dimensions.”

who, due to the NDA she had signed, could only offer, “There’s nothing like Koru afloat anywhere in the world. If you can think of an amenity, she has it. There’s splendor everywhere, from the engine room to the master stateroom.”

As the largest sailboat in the world, Koru requires a support vessel to store the helicopter, water toys, extra food, relief crew, and support gear. The Albeona vessel is only 246ft and operates with just a 20-person crew. Running costs are around $10 million.

Not to be outdone, Zuckerberg’s $300 million Launchpad just came out of build. He went for power over sails. Like Bezos, a Dutch shipyard, the world-renowned Feadship was commissioned. Zuckerberg did not have to wait the usual four years as a now-sanctioned Russian oligarch began the yacht. At 387ft, she can accommodate 29 guests, who will be cared for by a crew of 49. A key feature is her helicopter landing pad near the lavish swimming pool. To relax from the journey, there is a jacuzzi and movie theater. There’s also a gym.

Her support vessel is the $30 million Wingman, which stores the submarine. Using the standard yachting rule of thumb, the estimated running costs for Launchpad will be $30-40 million, with an additional $7 million for Wingman. Both have been spotted in the usual nautical haunts—the Mediterranean and the Caribbean.

Despite the cost, these yachts will not prevent prying eyes, as, ironically, the privacy-breaching technologies that have made Bezos

and Zuckerberg rich also make them susceptible to all sorts of privacy violations. Telephoto lenses, drones, and speedboats with tracking devices enable paparazzi to supply us with endless photos of them and their mates in bathing suits and at dinner parties with boldface-named guests. Frankly, they would have more privacy on a Wyoming ranch.

There is something so powerful about yachting that its popularity spans centuries and cultural dimensions. The Gilded Age tycoons, in their suited finery, have nothing in common with the hoodie and jeans wearing Bezos and Zuckerberg. And there is little resemblance between the social register, private-club-going, ultra-snobs of the past and their everyman persona heirs of today. Save for the lure of the biggest and boldest luxury yachts afloat.

Nell Diamond discusses the challenges and triumphs of building Hill House Home and the Nap Dress phenomenon.

BY EVA CROUSE

Nell Diamond, founder of the exploding fashion, home, and lifestyle brand, Hill House Home, sat down with Worth to discuss her company’s expansion, including new collections and locations, and capitalizing on going viral. Famous for their Nap Dress, which combines comfort with elegance at a fair price-point, Hill House tapped into a coveted market—the intersection of Millennial and Gen-Z fashion. Worn by new moms and cottagecore trend lovers alike, the Nap Dress is a feminine, structured, and flattering piece that has found universal appeal. After the dress went viral during the pandemic, Diamond adjusted quickly, responding to the demand for a strong social media presence and meeting increased order volumes. The Nap Dress is now offered in 24 different styles and innumerable prints, winning Hill House an avid and loyal customer base and solidifying the brand as a new leader in the luxury space.

When did you know you wanted to be involved in fashion, design, and entrepreneurship?

I knew I loved retail from a very early age. I grew up in London, and I loved shopping. I loved seeing stores. I loved going to little flea markets. I loved seeing the big stores of the era, like Top Shop, and exploring all of the amazing small brands that they had in their space. I didn’t know how to connect the dots on that interest until much later.

I worked in finance right after undergrad, and I loved the experience, but I wanted something more. So I went to business school with the idea of pursuing a future in retail. I didn’t know whether that future in retail was going to be for somebody else or for myself. But I had an inkling that I wanted to at least try the entrepreneurship route. I only applied to Yale because I loved their entrepreneurship program…I worked for the Louis Vuitton U.S. group, and loved that experience, too. But [I] ended up realizing that if I didn’t try this entrepreneurial thing, I would never do it. So I spent the whole second year at Yale focusing on incubating the business, getting everything from our trademark to our bank account to our operations set up, and then I launched the business about six months after I graduated.

What was the biggest challenge you faced when launching Hill House Home, and how did you deal with it?

I was a solo founder and the only employee for quite a bit. I found the loneliness of launching something really challenging at the beginning. It wasn’t until I started to develop a team of people who were also really excited about the business that I began to feel a little bit more at ease. At the start, I was sitting in every role, so I had a fake name to do our customer service emails, “Charlie.” I responded to all the emails. I had a fake name to do our finance, a fake name to do our marketing, but it

was really just one person sitting in a lonely office on Canal Street. And I think even now, with this scale, entrepreneurship can still be lonely, but significantly less so now that we have a team.

How do you measure success?

I think we have a varied list of markers of success. There’s no one perfect metric. Some of the metrics that I track are extremely quantitative. We obviously track to a fiscal plan that’s related to gross revenues and net revenues. And then we have margin targets and profit targets, and those are all pretty specific and quantitative. So those are pretty clear markers of success—if we’re meeting our plan or not.

And then we have more qualitative markers of success. Those really come from things like customer feedback, from things like our retail stores’ teams’ feedback. It can come from sitting next to somebody at a restaurant who’s wearing our clothing and them coming over and sayin g, “Hey, I really love this dress, because it made me feel really confident, and I wore it to XYZ.”

We also have internal markers of success. Retention rate is a big one for our employees. We’re super proud to still have the original five employees that were at the company back in 2017, 2018.

What keeps you awake at night?

How do you prepare for those possible challenges?

I used to have some magical view that a lot of the worries that I had on day one would go away, but they don’t. They just change. Even though we’ve hit every revenue target that I could have imagined, I’m still constantly thinking about things like cash flow and inventory management and how we get to that next revenue hurdle. What keeps me motivated is probably the thing that was most difficult for me in year one, which was one of the reasons I didn’t hire many people

right at the start. It felt like a tremendous responsibility to be in charge of other people’s livelihoods. And I’m glad I took that really seriously. It’s one thing to fail for yourself. It’s another thing to fail for other people who are relying on you and whose families are relying on you. Because of that, I was very slow to hire. I couldn’t sleep at night if I didn’t feel like I could offer people true, real job security.

Now, eight years later, that idea of doing things to ensure my team has job security still keeps me motivated.

You have been commemorated for your brand’s adaptation to the nap dress’ virality. What were some of the key decisions you made to capitalize that popularity?

I always say, going viral is the easy part in this day and age. What’s difficult is actually taking a minute, and thinking about that virality, and bringing it forward into something that’s meaningful to the original mission of your brand. We’re really lucky that we went viral for a product we feel incredibly passionate about internally, and that we genuinely think deserves to go viral.

For us, it wasn’t virality by accident. We had all the pieces in place, and it was really product led. People got excited and told their friends about the Nap Dress because they loved it, and they loved to wear it. And I think the reason that happened was because it was really organic virality, right? It wasn’t like we were putting money towards something, making it go viral. I think the important steps to take in in those moments were to really think about, ‘what was it that made this product naturally create a flywheel of excitement?’ And for us, it was this combination of style, comfort and price...[And beyond that,] we have amazing, amazing partners. So, when we started suddenly selling out of shipments that we thought would last us a year in a day, we were able to call up our factories and say, ‘Hey, we’re so excited. Can you believe this?’ And because they trusted us and

knew us, they were like, ‘Oh my god, we can’t believe it either. What can we do to help?’

Can you tell me more about the creative process behind your seasonal collections? How do you stay inspired? What is your personal favorite print + style?

The business started as a home business. So, bedding and home products were our first foray into the world of retail, and that’s been a guiding inspiration for us in fashion. We’re super inspired by interiors, everything from iconic [architecture] to paintings that we love. The world of interiors continues to inspire us.

Looking ahead, what are your goals and vision for the future of Hill House Home?

I’m super excited about retail. Our stores have been performing so well. We opened a store in Charleston a couple of months ago, and that’s become one of our top-performing stores. We’re also opening in Dallas in a few months. Bringing it back to basics and back to that retail experience that I grew up loving is just really exciting for me and continues to be a primary goal for the brand.

Our motto at Worth is “worth beyond wealth.” Does that resonate with you, and if so, in what capacity?

Absolutely. I like that that can be taken in a million different ways. I’m a mom to three young kids, and I think one of the greatest parts of having kids has been the perspective it’s offered me at the end of every day. No matter how big or exciting or monumental a sales day we have, at the end of the day, I come home to my role as a mother. And that really gives me perspective and grounds me in a really beautiful way. It reminds me of my worth outside of work.

Under the conservation-minded ownership of South Street Partners, the South Carolina coastal community is adding appealing new amenities, like an 18-hole golf course coming next year. But the imperative of preserving natural beauty remains.

Palmetto Bluff, a 20,000-acre expanse of land nestled along the May River between Savannah, Georgia, and Beaufort, South Carolina, is a place of singular beauty, where live oaks, pines and palmettos dominate the landscape, while the spartina-lined river and its tributaries twist through the land, attracting a diverse assortment of coastal birds, sea creatures like dolphins and blue crabs, and countless species of fish.

It’s also a place where history is embedded in the community. Archeologists from Palmetto Bluff have found artifacts in its soil dating from the Civil War era back to 10,000 BC. Prior to the 19th century, Native Americans used to fish for redfish, trout and flounder in the May and hunt deer, fox and rabbit on the land. Inhabitants left behind records of their cultures and toils—ceramics, pipes, tools used for harvesting oysters. Sometimes painful and sometimes beautiful, sometimes surprising and always powerful, the layered stories of human history reveal themselves in the earth of Palmetto Bluff.

So, when South Street Partners, the Charleston, South Carolina- and Charlotte, North Carolina-based private equity real estate investment firm that bought the community in 2021, decided to add a new golf course at Palmetto Bluff, they knew they had to respect the land and its history. They were already working closely with the Palmetto Bluff Conservancy, a non-profit organization founded in 2003 to protect the land and wetlands throughout Palmetto Bluff. With the Conservancy’s support, South Street asked Bill Coore, co-founder of the golf course design firm Coore & Crenshaw—his partner is legendary golfer Ben Crenshaw—to design the new course.

In the golf community, Coore is renowned for designing courses that seem to emerge organically from the environment, as if they were always there, just waiting to be recognized. He was a natural to design the course—he even had a history with the land: Decades before, Coore had walked the very same acreage when a previous owner was considering

building a golf course. That project had never come to fruition. This one would.

“The site here—first of all, it’s sandy,” which is helpful for drainage, Coore, now 78, said recently. “Second of all, the vegetation—the big oak trees, the big pine trees, the understory trees and the magnolia, the hollies . . . is extremely attractive.”

South Street agreed. They assured Coore that they didn’t want the course surrounded by real estate, even though the sale of homesites around a Coore & Crenshaw course would be lucrative. The ethos of a Coore & Crenshaw golf course is that it’s a pristine experience, a world unto itself. No matter how tasteful they might be, homes around the course would dilute that magic. “South Street said, “Choose the site to

best showcase the ideal course routing,” Coore recalled. “It’s not meant to sell real estate.” That was exactly what Coore needed to hear.

The currently unnamed Coore & Crenshaw course is estimated to open winter 2025-2026. Its debut will mark a compelling new phase in the growth of Palmetto Bluff. But it also represents continuity, an appropriate and seamless evolution in a long and eventful history. To understand why, it’s helpful to know just a little about that history.

The story of Palmetto Bluff—the modern story, anyway— begins in 1902, when a New York financier named Richard T. Wilson Jr. bought 10,000 acres of land in the town of Bluffton. The land was inexpensive then, and for a New Yorker weary of cold and snow, the idea of a mild winter was allur-

ing. Over the next two decades, Wilson would acquire an additional 10,000 acres. Naming his estate Palmetto Bluff, Wilson built an enormous four-story mansion on the land. Surrounded by stables, barns, kennels, and gardens, it contained an estimated 40 bedrooms. Wilson’s wife, Marion, enjoyed the company of society, and the couple’s numerous friends from New York would come to visit and stay for weeks. For the Wilsons, the beauty of South Carolina and the sophistication of New York meant the best of both worlds.

But Wilson’s romantic tenure in South Carolina would come to a tragic end. On March 2, 1926, a fire of unknown origin consumed the house. Legend has it that, though the occupants safely evacuated, a distraught Richard Wilson twice attempted to reenter the inferno to rescue valuable art, books and other possessions, fortunately restrained by onlookers. The fire raged for three days—a mansion that big took time to burn—and reduced the grand building to ashes. An emotionally devastated Wilson, too overwhelmed to consider rebuilding, sold the land to J.E. Varn of the Varn Turpentine and Cattle Company. Wilson returned to New York and died three years later, never seeing Palmetto Bluff again. Today, the ruins of the Wilson Mansion—a few stone columns, a section of brick wall, a five-step stairway ending in mid-air—still linger in an area now aptly named “Wilson Village,” a poignant reminder of the grand dreams of a bygone era.

In 1937, Varn sold the land to the Union Bag and Paper Company, which originally planned to harvest timber there to make, as one might guess, bags and paper. But company executives came to believe that this land was too special to be turned into a tree farm. Instead, in the 1970s, Union Bag built a hunting and fishing lodge on Palmetto Bluff at which they hosted their biggest clients.

All of which meant that, for most of the 20th century, the great majority of the 20,000 acres at Palmetto Bluff had been left untouched—a stroke of good fortune. Had it been developed in the 1970s and 1980s, Palmetto Bluff might not have enjoyed the benefits of America’s evolving appreciation of its increasingly scarce coastal beauty. Not until the year 2000 did a Charlotte, North Carolina-based developer purchase the land. The tasteful homes built were designed to blend in with the landscape. Palmetto Bluff’s first community center, Wilson Village, was built, as well as the Palmetto Bluff Club and the Wilson Lawn and Racquet Club. A Montage Palmetto Bluff luxury resort opened in 2014.

The original land planners were supported in their work by the then-new Palmetto Bluff Conservancy. Intended to help build in compliance with local, state and federal guidelines, the Conservancy forged a balance between development and conservation. “We were set up to make sure that development and our natural environment can coincide in harmony,” says Conservancy director Jay Walea. Since the land of Palmetto Bluff had been privately held for centuries,

it was unlikely that it would be preserved indefinitely, left alone and untouched. The key was to steward the land with a spirit of gratitude for its beauty, reverence for its history, and concern for its future: Everyone who experienced its forests, pathways and waterways would want generations to come to be able to share that experience. Palmetto Bluff was too magical to risk it falling into the hands of another cattle farmer or paper company that might not be as wellintentioned as its prior owners.

“I fell in love with this place from day one,” says Walea, who’s been involved with Palmetto Bluff for over 30 years. “From the time my feet hit it, I knew that there was no other place like it in the world.”

The Conservancy has an expansive mission. It identifies land for conservation; ensures that developers comply with regulations; pursues ecological research; and promotes outreach, education, and community engagement such as naturalist camps for kids. The results are tangible. Palmetto Bluff’s healthy, mixed-pine hardwood forest provides shelter and food for, among others, wild turkey, white-tailed deer, rabbits, fox and quail. The deer population is surveyed and culled so that it’s healthy, and every year the Conservancy donates hundreds of pounds of venison to local charitable organizations. Its land management also includes controlled burning, to create wildlife corridors and prevent more severe fires. The burns work to boost species variation and ground cover. More than 200 varieties of birds, ranging from bald eagles to Baltimore orioles, have been documented on Palmetto Bluff.

South Street was founded in 2009 by four friends who worked in the industry. They had made a name for themselves as an innovative group of investors and planners who think about their purchases not in terms of an exit strategy, but in terms of generations. As a result, South Street has earned a reputation as a firm that believes in “designing with nature,” an approach to development that prioritizes conservation not just as a moral imperative but as a means of enhancing stakeholder value—which further incentivizes homeowners to conserve the land. It’s the most effective way, the firm believes, to ensure a balance of environmental beauty with human activity.

South Street’s first big purchase, in 2013, was Kiawah Partners, which made them the master residential developer of the 10-square-mile Kiawah Island, a barrier island south of Charleston, and owner of the Kiawah Island Club. At Kiawah, South Street demonstrated the thoughtful development strategies that it would bring to Palmetto Bluff. The firm added amenities—new restaurants, more activities, enhanced shopping—that made homeowners want to spend more time at their vacation homes, which translated into longer visits, out-of-season visits, even full-time residency. They paid attention to all the different generations of families, creating camps and classes that parents could share with children—and activities that allowed parents

to spend time with each other while their children played and learned. South Street even donated the land for a leading-edge health center, creating access to top-notch medical care for both Kiawah homeowners and local area residents. The MUSC Health Kiawah Partners Pavilion is not only a moral good—before, locals had to drive an hour to Charleston for comparable care—it’s an economic enhancement: The previous lack of medical care had meant that Kiawah property owners spent less time at their homes on the island. Now that obstacle to greater enjoyment of their homes was removed.

South Street’s stewardship has meant an active four years for Palmetto Bluff. The Covid epidemic saw current homeowners spending more time in their homes alongside increasing demand from potential buyers who wanted to change their way of life. When they purchased Palmetto Bluff, South Street first focused on the completion of Moreland Village, the community’s second vibrant center. A third, Anson Village, is in the works. “As with every Palmetto Bluff neighborhood that’s preceded it,” South Street says, “the developmental dictate remains to preserve and protect one of America’s treasured landscapes while creating a human settlement.” Crossroads, a nine-hole golf course designed by King-Collins and intended to make the sport more accessible and inclusive, opened in early 2024. There are now seven restaurants, a coffee and ice cream shop, an art gallery, a Montage hotel, and even a speakeasy. Activities include fishing, kayaking, hiking, horseback riding, biking, birdwatching, waterway tours, and a sporting and shooting club. And there’s the 18-hole Coore & Crenshaw golf course coming soon.

All of this, of course, is against the backdrop of rare and singular natural beauty—of water winding its way through land, of wildlife free to roam, plants and trees growing as they did centuries ago. Even as so many things have changed at Palmetto Bluff, the wonder of nature’s creations stays the same.

Dr. Mostafa Waziri

One of Egypt’s Heads of Antiquities

World’s Most Famous Archaeologist

Dr. Khaled El-Enany

Egypt’s First Minister of Tourism & Antiquities

VIP tour of the Grand Egyptian Museum, the largest archaeological museum in the world

Private visits to the Giza Pyramids and Luxor Temple for a crowd-free experience

A chance to stand between the paws of the Great Sphinx instead of seeing it from a distance

Private entry to the Great Pyramid of Khufu, with a visit to chambers closed to the public

Private entry to the Valley of the Kings and King Tut’s Tomb

Tours of active excavation sites, including the newly discovered Lost Golden City

Special access to Taposiris Magna Temple, the likely long-lost resting place of Cleopatra

And many more once-in-a-lifetime experiences!

Travel

START YOUR EXTRAORDINARY TOUR OF EGYPT TODAY Enjoy exclusive VIP access to Egypt’s greatest wonders

Discover the companies leading the charge in sustainability and social responsibility with Worth Magazine’s inaugural Impact 150 list.

BY OLIVER RIST

Since their inception in 2012, the United Nations Sustainable Development Goals (SDGs) have become a global blueprint for achieving a better and more sustainable future. Throughout its history, Worth has been at the forefront of recognizing and celebrating companies that embrace these goals and demonstrate leadership in sustainability and social responsibility. Our commitment to highlighting these exemplary organizations has been unwavering, and we are proud to continue this tradition with the launch of the inaugural Impact 150 list.

The Impact 150 list represents diverse companies, from innovative growth-stage businesses to some of the largest publicly traded corporations, all united by their dedication to addressing the U.N. SDGs. In partnership with Impact Karma, we have evaluated and selected companies that excel in their industries and make significant strides in creating positive societal and environmental impacts. This list is a testament to the incredible work done by businesses worldwide to drive meaningful change and set new standards for corporate responsibility.

At Worth, we believe in the power of recognizing those who are doing well and doing good. By shining a light on these trailblazing companies, we hope to inspire others to follow suit and amplify their sustainability and social impact efforts. The Impact 150 list is more than just a recognition; it celebrates the innovative and impactful initiatives shaping our future and demonstrates that business success and social responsibility can go hand in hand.

At first glance, you might think 4ocean is an environmental nonprofit rather than a for-profit corporation, but it’s a fully profitable jewelry maker. Still, part of its original mission is working towards cleaner oceans, so it’s easy to make that mistake. Over the past year, it’s done some incredible work. It removed 35 million pounds of trash from the world’s oceans, from plastic bottles to discarded toothbrushes. Much of this resulted from partnerships with several for-profit organizations like the U.S. Polo Association, which accounted for 215,000 pounds of trash removed from rivers, oceans, and coastlines over the past year.

Abbott, a medical manufacturer and research company, recently released an impressive Sustainability Report. In it, the company highlights its work to help three billion people get affordable healthcare by 2030.

Abbott also focuses on environmental sustainability (something we always welcome from big research facilities). It’s working the gamut there, looking to reduce waste, water usage, and emissions. Its Future Well Kids program educates children on healthy choices, while partnerships like the one in Tanzania build important healthcare infrastructure.

In its third annual ESG report, Adore Me detailed several adoring commitments to sustainability. For one, it launched the Adore Me Sustainability Accelerator to collaborate with startups like EverDye and Carbonfact. Its eco efforts led to a 12% drop in its product-level carbon footprint since 2021. On the social side, it’s vetting suppliers and pushing for size inclusivity. And it’s now a fully Certified B Corporation, which means it delivers stringent governance requirements. All in all, it’s a good candidate for the Worthy 150.

Accenture is known for its consulting expertise across various industry sectors. However, it’s also been recognized as a leader for its efforts in global sustainability, particularly the market impact those initiatives are having, as well as Accenture’s vision for the future.

Today, Accenture’s contributions to sustainability revolve around the consulting services it offers to companies on their journeys to protect our environment and natural resources. In particular, it has a large team of experts who have developed a solid strategy for different global regions, including EMEA and North America. They’ve also acquired companies to help them, like Green Domus and Carbon Intelligence.

For companies looking to tackle global sustainability challenges, Accenture’s Sustainability Services cover everything from strategy and performance measurement to net zero transitions and sustainable customer experiences. This has helped its clients boost their competitiveness while creating a more sustainable future for all of us.

Aday’s latest impact report describes a company quickly developing a more sustainable consciousness. Last year, it became a certified B Corp. We also like that it acknowledged a setback with its Tailored Stretch items, but picked itself up and continued its goal of using 85% sustainable materials by 2024. It’s promised to ensure fair wages and safe environments for its employees and works with 22 partners worldwide, all of whom it vets to be sure they’re responsible suppliers. Plus, 1% of all its sales go to non-profits that customers can choose at purchase time.

Allbirds describes the fashion industry as a major polluter, basing that conclusion on the 2.1 billion tons of carbon monoxide the industry spews into the world every year—a figure that, according to Allbirds, is the same as what comes out the back of more than 456 million cars. To fight this, the company launched the Allbirds Flight Plan in 2021, aiming to cut its carbon footprint in half by 2025 and reduce it to nearly zero by 2030. They’re already more than halfway to their goals. In 2022, they reduced their average product carbon footprint by 19% compared to 2021.

The company is focused on driving emissions to zero through a data-driven approach, investing in projects, systems, and tools that maximize positive impact. They measure emissions, reduce their footprint, and support carbon removal projects. Allbirds is also focusing less on competition and more on sustainability by partnering with Adidas so both companies can build shoes based on the lowest possible carbon footprint.

L’Oréal acquired hair care and cosmetic maker Aesop in August of 2023. And just like the rest of the L’Oréal Groupe, it’s working towards radical sustainability and social impact goals. By 2030, it aims to align with the Science-Based Targets, ensuring its activities respect the planet’s limits. They’re also committing € 150 million to support vulnerable women and fight environmental issues. It did so well here that it rose to ninth place in the 2024 Equileap Gender Equality Report and Ranking, an independent expert on gender equality, diversity, and inclusion metrics. It is an excellent record for just one year.

Alphabet is making sure the world knows it is walking the walk to impact the environment positively, and they’ve got a solid plan to do it. Given that its biggest subsidiary is a major player in AI and that the average AI query takes up more than 10 times the electricity of a regular Google search, we’re glad to hear it. Their sustainability strategy is built on three main pillars: economic efficiency, environmental sustainability, and social responsibility.

First up is economic efficiency. Alphabet is all about making your life easier with sustainable and cost-effective mobility solutions. It’s pushing for electric mobility, aiming to integrate electric vehicles into fleets seamlessly and support companies that use its technology by making sure they hit their cost targets.

Next is environmental sustainability. Alphabet makes no bones about its activities impacting the environment, so it’s committed to conservation and governance. The company has embedded sustainability into its corporate values and processes, which boils down to a commitment to helping its customers hit their CO2 reduction goals, too.

Lastly, social responsibility. Alphabet believes in the power of diversity and inclusion. It’s dedicated to supporting its employees’ authentic selves and driving societal change. Sure, that’s a common statement among large companies these days, but somehow, we think Alphabet is going to make the effort.

Ando launched several years ago with the unusual mission of becoming a bank with climate change as part of its core mission. Ando’s customers’ funds are invested only in green projects like clean energy and sustainable infrastructure. You might think that this approach would hurt profitability, but so far, it’s doing great. The service offers no fees, a vast ATM network, and interest rates over three times the national average. And if you want to know where your money is going, its Impact Center shows exactly where the funds are, so you can see the difference you’re making. That’s a very cool concept and certainly deserving of the Impact 150.

Lisa Jackson Vice President of Environment, Policy and Social Initiatives, Apple

Pretty soon, your iPad will be good for the environment. That’s because in 2020, Apple came out with an ambitious plan: It wants to become carbon neutral across its entire business, manufacturing supply chain, and product life cycle, and it wants to do that by 2030. A tall order, but Apple was already well on its way since it was carbon-neutral for its global corporate operations even before the announcement. The new commitment will still be a toughie, however, since it extends to all other aspects of its business.

When he announced the initiative, Tim Cook, Apple’s CEO, emphasized the importance of businesses in building a sustainable future. He highlighted that the innovations driving Apple’s environmental journey benefit the planet, make their products more energy-efficient, and bring new sources of clean energy online globally. Apple’s 2020 Environmental Progress Report outlines its plan to reduce emissions by 75% by 2030 and develop innovative carbon removal solutions for the remaining 25%.

Apple also established an Impact Accelerator to invest in minority-owned businesses that drive positive outcomes in its supply chain and communities disproportionately affected by environmental hazards. This initiative is part of Apple’s $100 million Racial Equity and Justice Initiative.

Aspire Technology is making some very excellent efforts to increase environmental sustainability in the telecom industry, specifically by making Open RAN networks more energy efficient. As detailed in a white paper on the subject, it’s using 3rd Gen Intel® Xeon® Scalable processors to slash power consumption and reduce its carbon footprint. By using features like C-States, this solution not only saves energy but also boosts network performance. Geek environmentalists—we like!

Athleta is something of a sustainability veteran. It’s been making strides in sustainability since it announced its commitment to bettering the planet back in 2019. Since becoming a certified B Corporation, the brand has increased the use of sustainable fibers to 60% of its materials. It uses recycled polyester, nylon, TENCEL Modal, TENCEL Lyocell, and organic cotton, which has diverted over 38 million plastic bottles from landfills since 2014. The company’s swimwear collection is made with 85% sustainable fabrics, including H2Eco and AquaRib, which use ECONYL, a regenerated nylon fiber sourced from abandoned fishing nets. Athleta’s target is to reach 80% use of sustainable fibers across its product line.

Autodesk is committed to advancing sustainability through its operations and products. The company aims to achieve net-zero carbon emissions by 2030, leveraging renewable energy and enhancing energy efficiency. Autodesk’s software solutions empower customers to design and build sustainably, focusing on reducing environmental impacts across various industries. The company also emphasizes waste reduction and responsible sourcing, ensuring materials are sustainably procured. Autodesk’s social initiatives include supporting education and training in sustainable design and engineering, fostering a new generation of professionals equipped to address global challenges. These comprehensive efforts highlight Autodesk’s dedication to sustainability and social impact.

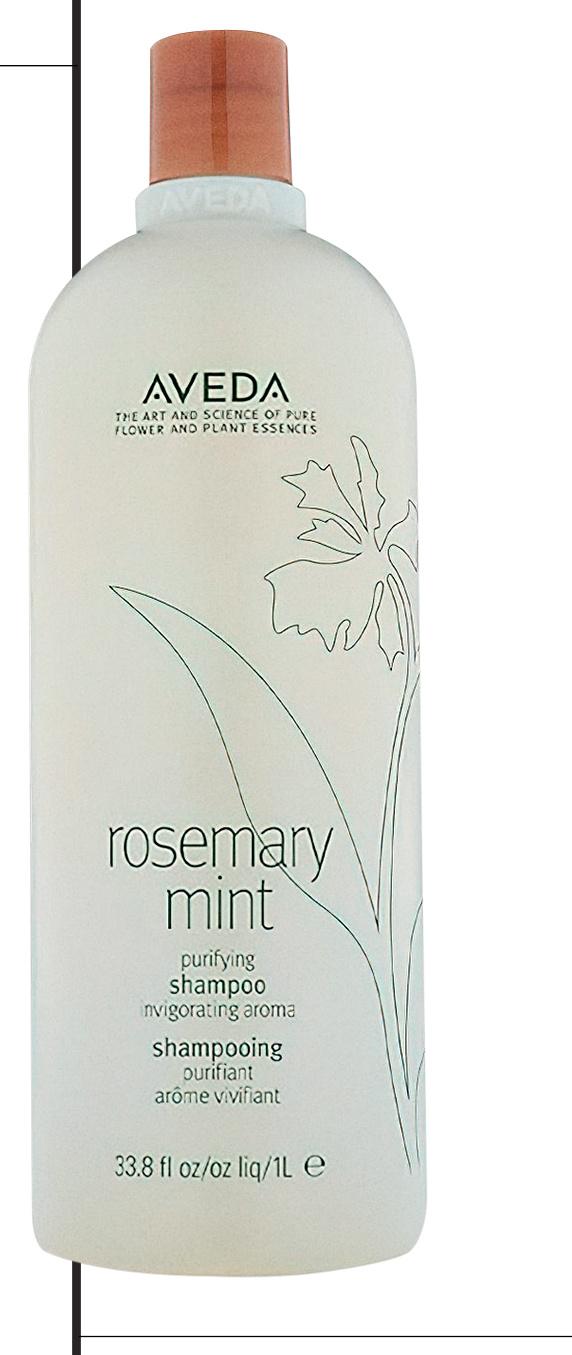

Aveda has demonstrated a deep commitment to sustainability, and we’ve seen it in every aspect of the business It uses 100% vegan ingredients and ensures its suppliers meet strict social, ethical, and environmental standards Aveda also guarantees that its products are free from harmful substances, including animal-derived ingredients, phthalates, parabens, and more If you want to dig into its ingredient list you can, since it keeps an online glossary of every ingredient used in its products

One of the standout features of Aveda’s sustainability strategy is its use of blockchain tracing This technology helps them track and ensure ingredient quality and responsible sourcing practices throughout the supply chain. Mobile phones and QR codes create a tamperproof record, tracing ingredients from farmers to processors to Aveda’s primary manufacturing facility This not only lets Aveda work with suppliers to achieve organic certification, it’s also a way to make sure workers are paid a fair wage

Finally, like many of the companies on this list, Aveda is a certified B Corp, which means it meets high standards of verified social and environmental performance, transparency, and accountability It’s been using 100% renewable electricity for over 20 years, powered by its onsite solar array and wind power credits The primary manufacturing facility has achieved Zero Industrial Waste to Landfill status

In addition, Aveda is committed to minimal packaging with maximal recyclables, challenging suppliers to innovate their packaging using a sustainability lens

According to Avocado Green Mattress’ 2023 Impact & Sustainability Report, it’s made significant progress towards being more eco-friendly in the past year. It’s always made high-quality organic mattresses and bedding, but part of its core mission is to fight climate change and promote social equity. It’s got the certs to prove it, too. Not only is it a Certified B Corporation, it’s also a Climate Neutral Certified brand and holds additional certifications from the Global Organic Textile Standard (GOTS) and Global Organic Latex Standard (GOLS). That’s a pretty high bar for transparency and sustainability and a perfect fit for the Impact 150.

BBen & Jerry’s is surprisingly vocal about protecting our planet. Then again, the company is rather dependent on dairy farmers, who probably feel the impact of climate change more than anyone. The company has publicly committed to reducing its carbon footprint. It carefully measures its greenhouse gas emissions to understand where it can make the most significant impact.

Dairy ingredients are a significant contributor, accounting for around 53% of Ben & Jerry’s carbon footprint. To tackle this, it’s exploring solutions like changing cow feed to reduce emissions and using manure digesters to generate renewable energy. It’s also working with farmers on regenerative agriculture practices to improve soil health and mitigate synthetic inputs.

Ben & Jerry’s also uses sustainable packaging. The company says it loves cones because they’re plastic-free, and you can eat them! But for those pints we all ingest so guiltily, it’s working on reducing single-use plastics and creating more sustainable packaging options.

Though I’m leery of moving away from my favorite ice creams, Ben & Jerry’s is challenging all its customers to try out new things like its new lowcarbon product options including Non-Dairy ice cream. All that work is paying off, too, since it’s nearly at its goal of 100% renewable electricity for its global manufacturing operations and Scoop Shops.

In short, Ben & Jerry’s is committed to sustainability through sciencebased targets, innovative solutions, and a focus on reducing their environmental impact at every step.

Banyan Botanicals resolves its sustainability mission by working to uplift people’s well-being through Ayurveda while also caring for the planet. In 2023, it served over 459,000 customers and boosted its certified B Corp score to 107.8. It introduced sustainable packaging and certified 38 new Fair Trade products. Though it acknowledged some supply hiccups, it still managed to donate over 39,000 products to nonprofits and supported community projects. Its farm partners even installed water systems in local schools! In the future, Banyan says it plans to certify more products and host a Sustainable Herbs Learning Lab.

The big sustainability news for 3D printer maker, Bambu Labs, in 2023 is that it achieved the Climate Neutral Certified label. That means it’s demonstrated a quantifiable commitment to reducing its greenhouse gas emissions. To get this label, companies need to measure their emissions, create action plans to cut them, and invest in verified carbon credits. For its part, Bambu is redesigning packaging, recycling more, and eliminating air freight. It is also supporting projects like sustainable forest management and wind energy.

Financial institutions may not immediately jump to mind when you think about environmental protection, but Bank of America (BoA) is making big moves in sustainability. It’s publicly committed to improving the environment through a global business strategy, partnerships, and sustainable operations. It also announced that it aims to achieve net zero greenhouse gas emissions in its financing activities, operations, and supply chain by 2050.

BoA’s Environmental Business Initiative represents a mammoth $1 trillion investment the company intends to make by 2030 to accelerate the transition to a low-carbon, sustainable economy. Its success here focuses on low-carbon energy, energy efficiency, and sustainable transportation, as well as other areas like water conservation and waste management.

Bank of America achieved carbon neutrality and procured 100% renewable electricity in 2019, which was a year ahead of schedule and beat many other folks on this list to the punch. It offers programs and benefits to help employees become better environmental stewards. One of those is its Environmental and Social Risk Policy Framework, a company-wide resource that outlines how employees can identify, measure, monitor, and control environmental risks.

Sustainability is a difficult corporate goal for any business, but BoA, especially among financial institutions, truly deserves credit for the effort.

Benevity Inc. released its 2024 State of Corporate Purpose report just in time to make the Impact 150. Part of what gets it here is that sustainability and social impact aren’t just a value for the company; it’s what they do. Benevity makes social impact software that lets customers implement and track progress on their sustainability initiatives. Its report compiles data from nearly 1,000 companies and highlights a survey of 400 CSR leaders who aren’t required to be Benevity customers, just sustainability movers and shakers. Buy the software or not, Benevity is a good way to see how your organization’s efforts match up with the rest of the corporate world.

In 2023, Bi-Rite continued on its mission to become a Zero Waste company that wants to reuse or recycle 90% of its products and materials. An example is how it repurposes ‘imperfect’ produce into treats like Balsamic Strawberry and Roasted Banana ice creams. On an annual basis, it diverts around 800,000 pounds of waste from landfills and saves over 63,000 kilowatts because it switched entirely to LEDs. Currently, it already reuses 85% of its materials, so that 90% goal is tantalizingly close. We hope they hit it in the next 12 months.

Birdies Inc. is a female-founded footwear company that aims to support women through collaborations and giving back. An example is its partnership with Angel City FC. Together they launched The Soar Internship Program, offering paid opportunities to 11 high school girls from under-resourced communities since 2021. Birdies also partnered with Step Up for the Fly Together Mentorship Program, helping over 100 girls and gender-expansive teens. Plus, its partnership with Soles4Souls has donated over 54,000 pairs of shoes, reducing its carbon emissions and textile waste while still creating business opportunities for women globally.

Blueland describes itself as and eco-friendly maker of household and beauty products. The trick is that every product it sells sends you a single bottle that you can refill when you reorder the product—for the rest of your life. That’s a great ecological strategy and its let the company keep over a billion plastic bottles out of landfills and saved more than 488 billion square feet of plastic packaging since 2019. With an ecological core mission and results like that, Blueland is definitely part of the Impact 150.

Blueair, a leading air purifier brand, made its sustainability mark in 2023 by achieving its B Corp Certification. That means it had to prove that it meets very high standards for social and environmental impact. Blueair’s selfdeclared mission is to provide clean air while minimizing environmental impact. It’s worked to ensure that its air purifiers are highly energy-efficient, using no more power than a lightbulb, and that they remove up to 99.97% of airborne particles. Plus, it instituted a “Clean Air for Children” initiative is providing better to children globally; and its Freedom to Breathe campaign, in partnership with NGO Global Action Plan, resulted in the UN acknowledging a child’s right to clean air after receiving 30,000 signatures from children worldwide.

Bombas realizes that every piece of clothing it produces has an environmental footprint, so it’s committed to making its production process as sustainable as possible.

The company focuses on creating essential clothing items like socks, underwear, and t-shirts, the most requested items in homeless shelters. As a brand, it understands the importance of these items and is very dedicated to producing them responsibly.

And to ensure it’s on the right track, Bombas has teamed up with experts to evaluate its environmental impact. It received B Corp certification in 2017, which means it meets high social and environmental performance standards. Bombas has also partnered with South Pole and Watershed to measure and reduce its greenhouse gas emissions.

Finally, like the other fashion businesses on this list, Bombas is paying particular attention to the materials used in its products. The company aims not just for more environmentally responsible options but also for products that last longer. There’s even a Take Back Bag program so customers can easily recycle their old clothing.

Bombas is on this list because it is thoughtful about its production, uses responsible materials, and works on innovative solutions that benefit the planet.