ComparativeAnalysisof UpcomingDisclosureStandards KeyStepstoRaise Ambition

and the case of deforestation

A STUDY BY CLIMATE & COMPANY

Authors

Elisabeth Hoch | elisabeth@climcom.org

Frank Schiemann | frank@climcom.org

Ingmar Juergens | ingmar@climcom.org

Laura Kaspar | laura@climcom.org

Max Tetteroo | max@climcom.org

Raphael Tietmeyer | raphael@climcom.org

Theresa Spandel | theresa@climcom.org

1 Berlin,January2023

DISCLAIMER(January,2023) This comparative analysis and the resulting recommendations are based on the three consultation drafts published by the European Financial Reporting Advisory Group (EFRAG), the International Sustainability Standards Board (ISSB) and the US Securities and Exchange Commission (SEC) in March and April 2022.

Since these drafts, there have been a number of developments, including an update in the ESRS standards, and the announcements of scope 3 emissions and the double materiality concept in upcoming versions of the IFRS standards. The development of disclosure standards is ongoing, and this paper aims to contribute towards an ambitious and effective international disclosure landscape, by providing an analytical comparative framework for disclosure standards and recommendations

2

TABLE OF CONTENTS

EXECUTIVE SUMMARY

4

INTRODUCTION 6

ZoominginonDisclosureandDeforestation 8

METHODOLOGY 9

ANALYSIS 11

Buildingblock1:Mandatoryvs.Voluntary 11

Buildingblock2:Disclosurecontent 12

Buildingblock3:Materiality 14

Buildingblock4:Scope 16

Buildingblock5:Assurance 17

Buildingblock6:Disclosurechannel 18 Buildingblock7:Linkstootherstandardsandframeworks 19

THE CASE OF DEFORESTATION 20 REMARKS BEYOND THE BUILDING BLOCKS 23

CONCLUSION 24

3

EXECUTIVE SUMMARY

An internationally harmonised disclosure landscape is crucial to enabling financial market participants to evaluate andprice-insustainabilityrisksandimpactswhenmakinginvestmentdecisions.Alack of harmonisationandambition gapsbetween internationaldisclosureregimes withvaryingcoverageofkeydisclosure criteria hamperfinancialactors’ ability to consider sustainability risks and impacts systematically on their financial decisions. This study analyses three proposals for sustainability and climate-related disclosure standards, published by the European Financial Reporting Advisory Group (EFRAG), the International Sustainability Standards Board (ISSB), and the US Securities and Exchange Commission (SEC) in March and April 2022. Understanding their most important differences is critical to steering international harmonisation efforts towards standards that work for all stakeholders, are widely applicable and future-proof.

The analysis is structured along seven building blocks for effective disclosure standards, and for each building block, we evaluate the three proposals’ design choices, identify ambition gaps and provide recommendations on how to close these gaps. We use deforestation as a case study because it is part and parcel of two of the most important sustainability challenges we face today: climate change and biodiversity loss. The analysis shows that the next steps in the development of these proposals will be pivotal for the future of sustainability reporting; to avoid ‘a race to the bottom’ it is crucially important to push for the recommended design choices (per building block) in the ISSB’s standards while mitigating the risk of the EU standards being diluted

The study’s key insights (per building block):

1. The SEC’s and EFRAG’s proposals for reporting standards are mandatory in nature. The ISSB’s proposal for a voluntary market standard aims to serve as a baseline reporting standard, which can gain mandatory status by being adopted and implemented in national legislation

2. The required disclosure content varies, but for two of the three proposals, it is currently narrowly focused on climate-related issues. Only EFRAG’s proposal provides detailed disclosure requirements along several environmental, social and corporate governance issues. Even for climate-related disclosure, more specific guidance on Scope 3 and forward-looking disclosures are necessary.

3. The SEC's and the ISSB’s current proposals only refer to financial materiality Financial materiality is largely based on associations between past financial and sustainability performance. As such, financial materiality does not (fully) reflect sustainability impacts, if they have not been financially material in the past. This is problematic, amongst others, as the link between financial and impact materiality is dynamic. Especially in consideration of the increasing reputational risk and regulatory dynamics, the link between these two materiality dimensions is increasingly blurred. Therefore, we recommend developing clear materiality definitions involving both financial and impact materiality.

4. The scope of the disclosure standards is mainly defined based on firm size and/or whether a firm is publicly listed on a stock market as its main criteria. This can create problems, as smaller or medium-sized companies may have substantial sustainability impacts or risks, especially in high-impact or high-risk sectors We urge standard-setters to use impact-based criteria to define the scope of disclosure requirements. SMEs that then qualify should be given a simplified set of disclosure requirements, tailored to the characteristics of SMEs.

5. We welcome the aim to increase assurance requirements for sustainability disclosures, mentioned by the SEC’s and EFRAG’s proposals, which target reasonable assurance in four (SEC) to six (EFRAG) years. We strongly recommend the ISSB to provide clear recommendations to jurisdictions regarding which disclosure requirements should be verified under a limited or reasonable assurance approach.

4

6. We welcome the aim to provide sustainability information in a tagged and machine-readable channel.1 Providing such information via a single access point (e.g. the European Single Access Point) would greatly increase the usability of sustainability-related information.

7. We acknowledge and welcome that the current proposals built on existing standards and recommendations, especially for climate-related reporting. We recommend continuing and deepening cooperation and interoperability, especially between the main standard setters. One crucial objective is to ensure that reporting on more ambitious standards automatically fulfils all requirements of baseline reporting standards

1 ESGdisclosurescanbepublishedviadifferentchannels,(e.g.intheannualreport,inaseparatesustainabilityreport,oronawebsite)

5

INTRODUCTION

4

Without full transparency about firms’ material sustainability impacts, risks and opportunities important information asymmetries persist and drastically reduce market efficiency Risks cannot be appropriately priced, nor can preferences be adequately expressedin financing and investment decisions. This ultimately results in welfare losses forshare- and stakeholders by increasing uncertainty, search costs and undetected risk exposures. Research has provided vast evidence that increased sustainability disclosure can reverse these effects 2

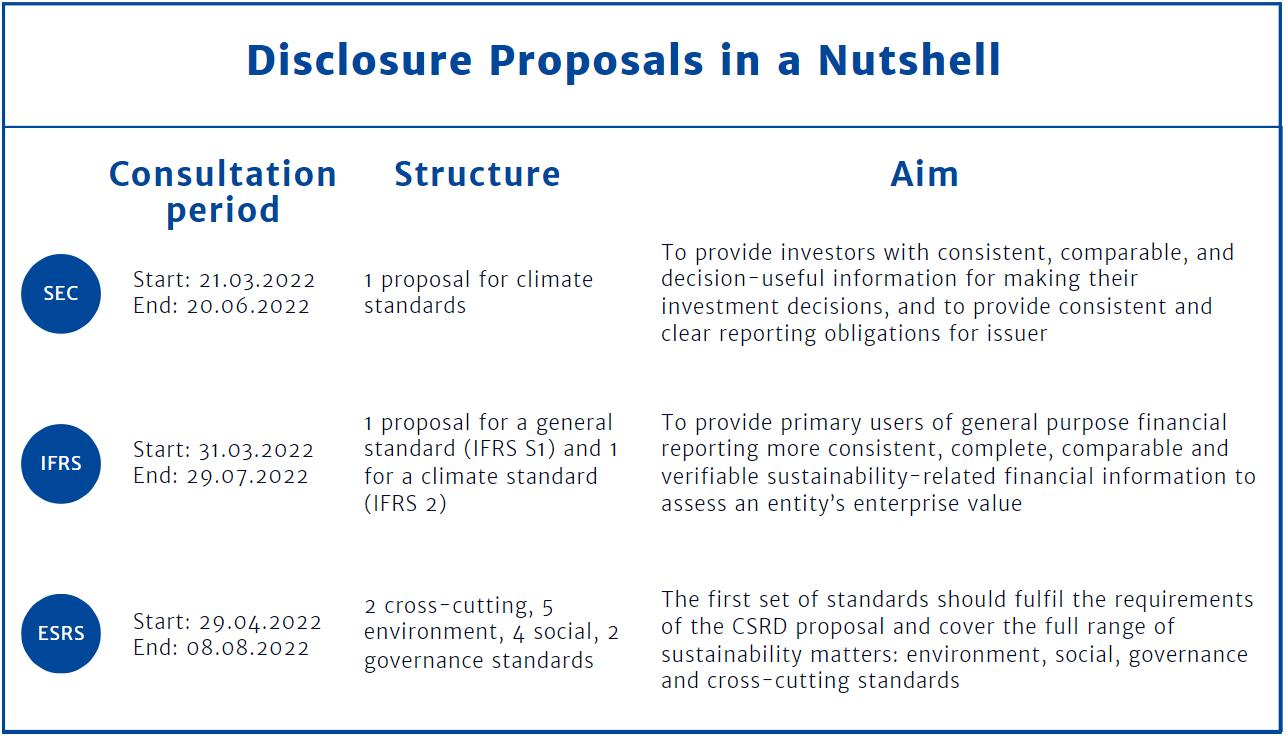

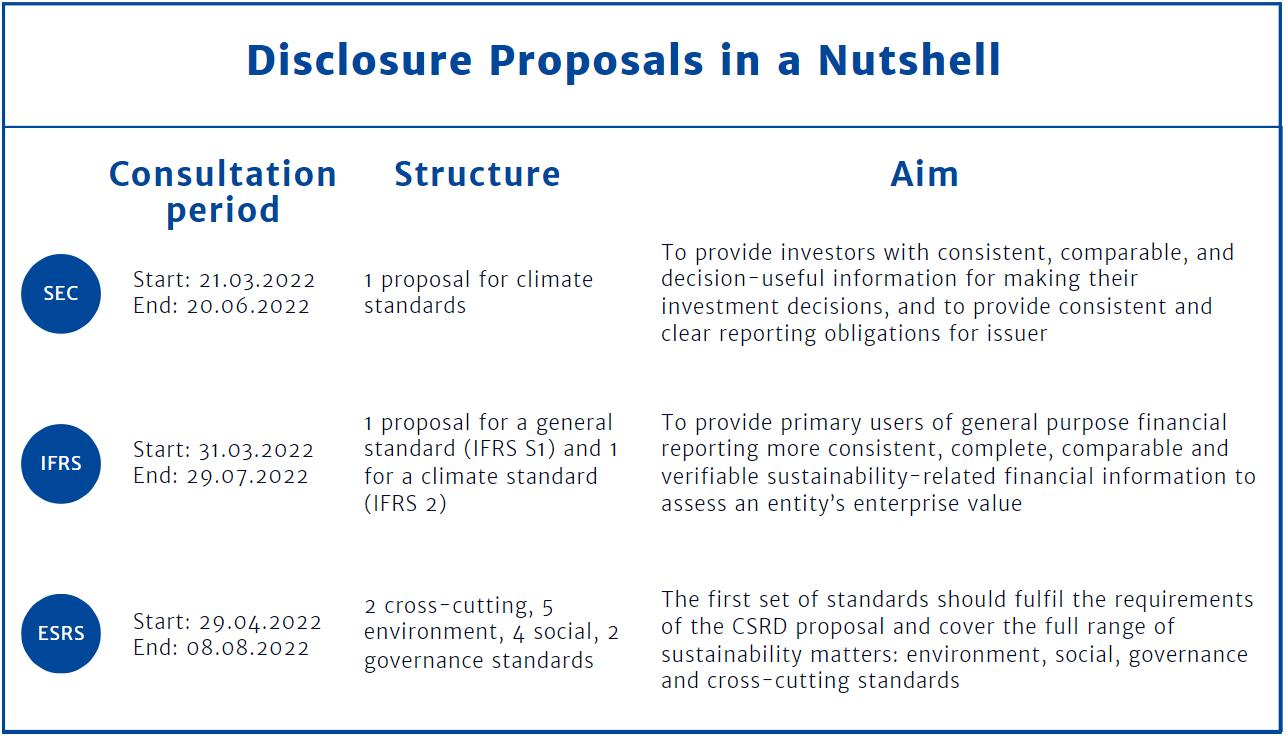

This strong case for increasing transparency around environmental, social and governance (ESG) issues was picked up by three organisations of outstanding economic relevance and international standing: in March and April 2022, three proposals for sustainability disclosure standards were submitted for public consultation by the US Securities and Exchange Commission (SEC), the EU’s European Financial Reporting Advisory Group (EFRAG), and the International Sustainability Standards Board (ISSB) (Figure 1)

The three proposals agree in principle on the pertinence of corporate environmental and other sustainability information for investment and financing decisions, but take different approaches and vary across key characteristics of disclosure. The key question going forward will be how ambitious and useful any emerging global minimum reporting standard will beandtowhichextentitwillreflecttheparadigmof astakeholdereconomy(assuggested,a/o,bytheUSBusiness Roundtable in 2019) 3

Due to their fundamental relevance for a broad range of stakeholders, especially for efficient capital allocation, these consultations received much attention, even beyond the sustainable accounting and finance community. Along with numerous other stakeholders, Climate & Company provided feedback to the consultation documents, highlighting the perceived strengths and weaknesses of the individual proposals.4

Following the consultation periods, comparisons of the three proposals 5 have been accompanied by calls for international harmonisation and coherence between the drafts. At the same time, the ongoing calls for international harmonisation of sustainability disclosures are criticised, as they “appear to be driven by a desire to remove control of sustainability reporting standard-setting away from a multi-stakeholder process […] to one led by an accounting standard-setter established with the legitimate yet very narrow purpose of serving investors’ needs (without an evidence-based examination of what that means for sustainable development)” 6 The divergent responses to the three proposals highlight how comparability and coherence between international standards could develop in the direction of two basic scenarios:

1. An international race to the bottom of the three proposals, which would result in static disclosure standards narrowlyfocused oncurrentandveryshort-term financial risks,inlinewiththe proposals oftheSECandISSB.

2. Raising the bar for disclosure standards internationally and generating positive spill-over effects via the more comprehensive and ambitious European Sustainability Reporting Standards (ESRS) published by EFRAG, which appreciate the importance of environmental impacts for future financial risk and current investors’ sustainability preferences.

2 Dhaliwaletal.(2011)link;Dhaliwaletal.(2012)link;Choetal.(2013)link;Christensenetal.(2021)link

3 USBusinessRoundtable.StatementonthePurposeofaCorporation(2022)link

1)SEC;generalcomment,in-depthcomment.2)ISSB;generalcomment,in-depthcomment.3)EFRAG:remarksonthedraftESRS

5 TheevolutionofSustainabilityDisclosure:Comparingthe2022SEC,ESRS,andISSBProposals(2022)link

6 Adams&Abhayawansa(2021)link

6

In comparison to the SEC and the ISSB, the ESRS benefits from many years of market (and regulatory) experience with the Non-Financial Reporting Directive (NFRD) and from the fact that financial and non-financial corporates as well as EU regulatory bodies have simply had moretimeto reflect on and develop standards for abroaderset ofsustainability risks and impacts. Moreover, research has already provided early evidence on the Directive’s impacts on company’s financial performance and real effects.7 Hence, the current differences above all represent a case in point for mutual regulatory learning and international co-operation.

Motivated to facilitate the second scenario, in which the more ambitious ESRS informs the other policy processes and raises the bar internationally, the team of disclosure experts at Climate & Company, together with our partners, developed several analyses developing and building on the seven building blocks for sustainability disclosure regulation.8 We use these building blocks to structure the analysis of and facilitate the comparison between the three sustainability disclosure drafts. On the basis of this comparative assessment, we propose a small set of key recommendations to “close the ambition gap”9 and to facilitate international co-operation and global convergence towards widely applicable and useful, and future-proof international sustainability disclosure standards.

Figure 1: a brief overview of the three disclosure proposals

7 Grewaletal.(2018)link;Korca&Costa(2021)link;Fiechteretal.(2022)link

8 These building blocks were developed in a report coordinated by the European Commission together with the IPSF Swiss and Japanese members, with substantial contributions received from IPSF members and observers, Climate & Company and with the support of the UniversityofHamburg.In:StateandtrendsofESGdisclosurepolicymeasuresacrossIPSFjurisdictions,Brazil,andtheUS(2021) link

9 Raising ambition is also linked to these building blocks and includes, amongst others, more comprehensive disclosure content, double materialitydefinitions,andbroaderscope

7

ZoominginonDisclosureandDeforestation

Firms’impactson deforestation causeamajorthreattobiodiversityandclimate,andhence,ultimately,tohuman survival. In other words, there is no solution to climate change without a solution to deforestation. 18% of the emissions reductions by2030canbe achievedbyprotectingandrestoringglobalforests.Logging,landandagricultureindustries are the most critical, as half of their emissions (accounting for 22% of global emissions in 2019) come from deforestation, driven by commodities providing food, fiber, feed and fuel.10 Meanwhile, there is strong evidence that there is a tremendous role for the land sector in combatting climate change, both by reducing emissions from land use practices, but also by sequestering carbon in trees, other vegetation, and soil.11

Deforestation can lead to major financial and investment risks. A significant share of terrestrial biodiversity is harbored by forests, and as these are disappearing, so is the availability of ecosystem services on which many economic activities depend. This is an investment risk: “By financing companies that depend on ecosystem services, financial institutions are exposed to physical risks. The loss of ecosystem services can threaten companies’ production processes12 and this can translate into a deterioration in their financial position. […] Financing companies with a negative impact on biodiversity and ecosystem services also exposes financial institutions to transition and reputational risks”.13

The criticality of deforestation impacts and risks substantiate the needfor disclosure standards’coverage of deforestation Empirical evidence shows that mandatory sustainability disclosure can turn into positive effects for sustainable development, such as higher mine safety,14 significant improvements in carbon performance15 and lower industrial wastewater and Sulphur Dioxide (SO2) emission levels in cities.16 In the context of deforestation, there are yet no ambitious and international mandatory disclosure regulations, or other effective sustainable finance mechanisms in place. Investors are increasingly mindful of the massive economic importance of nature and ecosystem services, but they need transparency about the impact economic activities, companies and assets have on deforestation. As the Glasgowdeclaration of33investors as well as theveryrecentdeclarationin SharmEl-Sheikhbymajorfoodcompanies shows, there is a strong corporate (financial and non-financial) commitment to halting deforestation.17 Investment professionals now critically need access to comparable, reliable and quantifiable information for their decisionmaking.18 Our exemplification of deforestation in light of the three proposals highlights in how far they respond and reflect this gap.

10 ClimateChange2022MitigationofClimateChange(2022)link

11 IPCC’s2019SpecialReportonClimateChangeandLand(2019)link;Nature-basedsolutionscanhelpcooltheplanet-ifweactnow(2021) link;Griscometal.(2017)link

12 Examples include agriculture production companies that depend on rain-fed crops, or a regularly replenished aquifer for irrigation, or naturalpollinators;trees/perennialcropsthatdependonaspecificmicroclimateprovidedbynaturalhabitats.

13 Indebtedtonature:ExploringbiodiversityrisksfortheDutchfinancialsector (2020)link

14 Christensen et al. (2017) link

15 Bauckloh et al. (2022) link

16 Chen et al. (2018) link

17 Financial Sector Commitment Letter on Eliminating Commodity-Driven Deforestation (2021) link

18 Amel-Zadeh&Serafeim(2018)link

8

METHODOLOGY

The analysis will review the three proposals 19 along the seven essential ‘building blocks’, which characterise sustainabilitydisclosureregulationsandstandards (Figure2).20 Wehave usedthesebuilding blocks tomap andcompare the three different proposals’ (SEC, IFRS S1 and S2, and ESRS) design choices. An overview of these design choices per proposal per building block can be found in Figure 3

The analysis chapter is also structured per building block: first a short definition is provided, followed by the overall recommendation, that identifies the ambition gap between the three proposals concerning the respective building block, and what could be done to close it. Then, one or more design choices are presented, which are the key insights we have derived from our deep engagement with disclosure standards and regulations and are informed by scientific insights on how sustainability disclosure standards and regulations can be implemented in an effective manner. 21 Per design choice, we provided an evaluation of each of the three standards and provided specific recommendations for each to be further developed and adjusted in the upcoming revisions.

19 Sincetheirinitialpublicationsand firstconsultationround,EFRAG haspublishedreviseddraftsoftheESRSstandards inNovember2022 Whileouranalysisbuildspredominantlyontheformerversions(MarchandApril2022),wetooktheupdatedESRSdraftsintoconsideration andviewouranalysisasstillapplicable

20 StateandtrendsofESGdisclosurepolicymeasuresacrossIPSFjurisdictions,Brazil,andtheUS(2021) link

21 Among others explained and justified in the ‘Building Blocks’ report: State and trends of ESG disclosure policy measures across IPSF jurisdictions,Brazil,andtheUS(2021)link

9

Figure 2: the seven building blocks for sustainability disclosure regulation

10

Figure 3: an overview of the three draft standards (versions published in March and April 2022) per building block

ANALYSIS

Buildingblock1:Mandatoryvs.Voluntary

Definition: Guidelines, frameworks or international standards usually represent voluntary ESG disclosure measures, while reporting regulations, laws or reporting regimes represent legally binding, mandatory ESG disclosure measures. Entities might be subject to both mandatory and voluntary disclosuremeasuressimultaneously.

Overall recommendation: Existing research provides compelling evidence that the disclosure of corporate sustainability informationimprovestheinformationenvironmentforcapitalmarketparticipants.22 Whilewewelcomethemandatorynature oftheSECandtheESRS,weseeahighdangerof lessambitiousdisclosurerequirementsthroughIFRSS1andS2,astheseare currentlylargelypromotingvoluntarydisclosure.Forthisbuildingblock,wethereforehighlightthattheISSBshouldconsider, in the design of their standards, how they could be used as a standard for mandatory disclosure. Although the ISSB does not havethelegislativepowertomandatetheirstandards,westillrecommendtheyanticipatemakingtheirstandardscompatible withother,mandatorydisclosureschemes

Design choice: Sustainability disclosures should be mandatory.

Standard Evaluation

SEC

IFRS S1 & S2 (by ISSB)

ESRS (by EFRAG)

The proposal specifies mandatory reporting obligations.

The proposal reflects a voluntary standard which could be mandated by jurisdictions.

The proposal specifies mandatory reporting obligations.

Recommendation

We welcome the mandatory nature of the proposal and thus recommend to maintain this ambition throughout further revision periods.

We recommend the ISSB to ensure that the standards are suitable to be implemented in a mandatory manner.

We welcome the mandatory nature of ESRS, especially because the CSRD will only deliver mandatory reporting effectively if the mandatory nature of reporting is consistently implemented throughout the ESRS.

See,forexample,Dhaliwaletal.(2011)link;Dhaliwaletal.(2012)link;Cho&Patten(2013)link

11

22

Buildingblock2:Disclosurecontent

Definition: The information which must be disclosed by entities. The content can target only one or several ESG sub-dimensions (e.g. climate, deforestation, biodiversity, human rights, diversity), and can be qualitative and/or quantitative, contain specific key performance indicators (KPIs) or general information.

Overall recommendation: Our comparativeanalysis reveals that thefocus ofthe SEC andISSB onclimate is currently too narrow to correctly assess, report and manage sustainability impacts and risks with comprehensive disclosure requirements. Also, the general standard of the ISSB is currently too superficial to fulfill the data needs for comprehensive analyses for investments and sustainable development. A certain level of rigour in providing information related to targets is needed to avoid greenwashing issues and to provide investors with precise data. Therefore, these standards should only mark the beginning of further complementary proposals.

Design choice: The disclosure must go beyond climate and include further sustainability issues, such as biodiversity.

Standard Evaluation Recommendation

SEC The requirements on disclosure content incorporate climate-related information.

We welcome that the proposal contains crucial climaterelated aspects but recommend expanding it to additional complementary proposals. Environmental disclosure requirements must go beyond climate. The specified disclosure content should also reflect environmental objectives such as deforestation, biodiversity, circular economy, pollution, effects on water, and also social topics including human rights and affected communities.

IFRS S1 & S2 (by ISSB)

The requirements on disclosure content incorporate general information (S1) and the detailed climate information (S2).

We recommend the ISSB to expand the disclosure requirements to go beyond climate and expand on sustainability issues to reflect environmental objectives including deforestation, circular economy, pollution, effects on water, and biodiversity, and also social topics including human rights and affected communities. We believe that the Appendix B (Industrybased disclosure requirements, derived from the Sustainability Accounting Standards Board (SASB)) can provide a suitable starting point.

ESRS (by EFRAG)

The requirements on disclosure content incorporate a set of standards with sector and topical

We welcome the holistic approach of the ESRS series. The standards specify disclosure requirements for a broad range of ESG issues, especially in comparison to the proposals by SEC and IFRS. We strongly encourage EFRAG to maintain the ambition for broader content coverage, as this is crucially needed to increase the availability of critical information for decisions in the face of today’s sustainability challenges.

12

standards,23 which are partially still under development.

Design choice: The disclosure content should be specified in a manner that ensures meaningful, precise and comparable information

Standard Evaluation

SEC The proposal requires the disclosure of metrics on greenhouse gas (GHG) emissions for scope 1 and 2, and for if applicable or material, scope 3, based on the GHG Protocol’s concept of scope and its related methodology.

IFRS S1 & S2 (by ISSB)

ESRS (by EFRAG)

S1 does not require specific metrics, while S2 provides a specific appendix, which builds on the SASB standards’ metrics.

The standards require entity specific materiality assessments (ESRS 2) and disclosures based on an extensive set of topical and sectoral disclosure requirements.

Recommendation

We welcome that the proposed rule builds on existing well-developed reporting frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and standards such as GHG Protocol and recommend increasing the (industry-)specificity of required indicators and metrics such as those indicated in the SASB standards.

We welcome that the S2 Appendix provides industryspecific metrics, but for S1 we recommend to further increase the specificity of the disclosure content, in particular through the provision of metrics that shall be disclosed.

We recommend specifying the disclosure requirements related to the materiality assessment further, and to add a list of per se material disclosure issues (meaning that [certain] firms must always disclose on specified sustainability issues). For the topical and sectoral standards, we recommend specifying quantifiable and codifiable metrics for disclosure requirements where these metrics provide meaningful information. Further, we recommend complementing those with clear instructions for their measurement to ensure comparability and validity.

Design choice: The disclosure content needs to incorporate GHG emission disclosure requirements with detailed and consistent metrics and calculations.

Standard Evaluation Recommendation

SEC Scope 1 and 2 GHG emission metrics must be separately disclosed and expressed as disaggregated and aggregated constituent GHG emissions, and in absolute and intensity terms. Scope

We welcome that the proposed rule would require a registrant to describe the methodology, significant inputs, and significant assumptions used to calculate its GHG emissions metrics and recommend to further 23 i.e. covering climate, biodiversity, circular economy (all taxonomy environmental objectives) and also include social- and governancerelatedreporting

13

IFRS S1 & S2 (by ISSB)

3 emissions must only be reported, if applicable.

S2 requires the GHG emission disclosure in gross scope 1, scope 2 and scope 3 emissions in metric tons of CO2-equivalent. For scope 1 and 2 emissions, the entity shall disclose emissions separately for: the consolidated accounting group (parent and subsidiaries) as well as associates, joint ventures, unconsolidated subsidiaries or affiliates.

follow the path of using the GHG Protocol and the TCFD for the GHG calculation metrics.

We welcome the suggestions of ISSB in the S2 to include Scope 3 emissions in the reporting process. Nonetheless, we suggest providing a stronger application guidance on scope 3 emissions.

ESRS (by EFRAG)

ESRS E1 follows the GHG Protocol and requires the disclosure of Information on transition/ physical risks, opportunities, internal carbon prices; cross-industry metrics for scope 1, 2 and 3 in GHG emissions in metric tons of CO2-equivalent, disaggregated for business units/activities and regions.

Buildingblock3:Materiality

WewelcomethecomprehensiverequirementsonGHG emissiondisclosureandrecommendmaintainingthese requirementsascurrentlydrafted.

Definition: The approach to materiality determines how and “through what lens” ESG issues are identifiedfordisclosure.Itcanbedefinedfromanoutside-inperspective(financialmateriality)orfroman inside-outperspective(stakeholdermateriality).“Doublemateriality”combinesbothperspectives.

Overall recommendation: Sustainability issues that are classified as primarily material from an inside-out perspective can quickly become material from an outside-in perspective to firms and investors. More specifically, the impacts of a company on society and the environment could possibly reverse to become external factors influencing companies. With the pressing challenges of climate change, biodiversity collapse, nature destruction and growing inequality, the development of these sustainability impacts might soon affect the economy and undertakings from a double materiality perspective, which is why the dynamic nature of materiality must be considered. As double materiality-based approaches are increasingly implemented internationally,24 we strongly recommend the ISSB and SEC to go beyond a financial materiality approach and incorporate the disclosure of sustainability-related impacts, as done by the ESRS. Also, we recommend specifying certain sustainability issues as per se material (mandatory to report, no matter the outcome of the materiality assessment) by (1) any undertaking, (2) undertakings in a specific sector, and/or (3) undertakings with certain characteristics

24 StateandtrendsofESGdisclosurepolicymeasuresacrossIPSFjurisdictions,Brazil,andtheUS (2021)link

14

Design choice: Materiality should be defined through an inside-out and outside-in perspective (double materiality)

Standard Evaluation Recommendation

SEC The proposal focuses on specific aspects of financial (outside-in) materiality.

IFRS S1 & S2 (by ISSB) The standards focus on specific aspects of financial (outside-in) materiality.

ESRS (by EFRAG)

The standards build on double materiality as a guiding principle.

We strongly recommend the SEC to go beyond a financial materiality approach and incorporate the inside-out perspective in the materiality definition.

We strongly recommend the ISSB to go beyond a financial materiality approach and incorporate the inside-out perspective in its materiality definition.

We welcome the adoption of a double materiality approach and highly recommend maintaining it.

Design choice: Materiality assessments need to be specified through clear and ambitious application guidance.

Standard Evaluation Recommendation

SEC Thefinancialmaterialityassessment(a matterismaterialifthereisa substantiallikelihoodthata reasonableinvestorwouldconsiderit importantwhendeterminingwhether tobuyorsellsecuritiesorhowtovote) istoonarrow.

IFRS S1 & S2 (by ISSB) S1 is not detailed in their guidance on the materiality assessment. S2 provides industry-based (financially material) disclosure requirements.

Considering the dynamic nature of the materiality concept and coherence with other international regulations, we recommend the SEC to go beyond a financial materiality approach and incorporate a wider range of issues, such as disclosure of climate-related impacts on the environment and society, instead of only considering the impact on current and potential investments.

We welcome the industry-specific disclosure requirements in the Appendix of IFRS S2, but we propose that the IFRS S1 provides more specific guidance about the material issues (e.g. following the pollution-related specific application guidance of ESRS E2).

ESRS (by EFRAG)

The standards include extensive guidance in ESRS 2, but also allow that entities can define most sustainability issue in ESRS topical or sectoral standards as “not material for the undertaking”, with the provision of a reason why.

We welcome the extensive guidance on materiality in ESRS 2 and also the specification of certain per se material topics (e.g. ESRS 2 disclosure requirements or ESRS E1 disclosure requirements since the November update of the ESRS standards) but argue that further sustainability issues need to be specified as always material by (i) any undertaking, (ii) undertakings in a specific sector, and/or (iii) undertakings with certain characteristics, to enhance comparability and guidance.

15

Buildingblock4:Scope

Definition: Scope defines which entities, financial products or services are subject to ESG disclosure followingaregulationorstandard.Thedefinitionofscopemightbebasedonthelegalstatus(e.g.,listed companies),size,impact,sectoraffiliation,orthetypeoffinancialproductorservice.

Overall recommendation: Transparency on sustainability impacts can only be achieved if companies that represent the substantial share of sustainability impacts fall under the scope of the disclosure regulation or standard. As such, the scope must be based on entities’ impacts, independent of their legal status or size. Hence, we encourage the SEC and ISSB to consider the scope of the firms in the development of these standards in order to enable a large coverage of sustainability data in sectors which are dominated by SMEs. Also, the current proposal for the CSRD does not yet capture a large fraction of the sustainability impacts in certain sectors (e.g., agriculture or land transportation) 25

Design choice: The scope of sustainability disclosure standards/regulations should be determined by sustainability impacts (considering firm and sector levels), risks and opportunities.

Standard Evaluation

SEC The scope only considers SEC Registrants, meaning an issuer with a class of equity securities registered under the Exchange Act.

IFRS S1 & S2 (by ISSB) The scope is not specified, as this will be legislated through the jurisdictions adopting the standards and transposing them to national regulations.

ESRS (by EFRAG)

The scope includes non-listed firms and SMEs.

Recommendation

We recommend determining the scope not only by listing status, but to also consider sustainability impacts (considering firm and sector levels), risks and opportunities.

We recommend that the ISSB provides suggestions for the scope of the regulations based on sustainability impacts (considering firm and sector levels), risks and opportunities.

We welcome the decision to target non-listed firms and SMEs. We recommend to further develop the scope based on sustainability impacts (considering firm and sector levels), risks and opportunities.

Design choice: The scope of sustainability disclosure standards/regulations should consider SMEs’ capacities.

Standard Evaluation

Recommendation

We welcome that the SEC is considering SMEs’ capacities. We recommend targeting SMEs depending on their scope and sector in order to gain a comprehensive picture of the climate impact of their 25 WhyitwouldbeimportanttoexpandthescopeoftheCorporateSustainabilityReportingDirectiveandmakeitworkforSMEs(2021)link

SEC The proposed rule would affect some issuers that are small entities (approx. 1,004 according to the

16

SEC26). The SEC is considering amendments which lower the burden on small entities.

economic activity. Furthermore, we suggest developing a set of simplified sustainability disclosure standards which are tailored to the characteristics of SMEs.

IFRS S1 & S2 (by ISSB) The standards do not provide simplified SME reporting standards. We encourage the ISSB to develop a set of simplified sustainability disclosure standards, which are tailored to the characteristics of SMEs.

ESRS (by EFRAG)

TheEUcurrentlyasksMemberStates toconsiderintroducingmeasuresto support SMEs in applying the voluntary simplified reporting standards.27 Article 19c requires the Commission to adopt sustainability reporting standards for small and medium-sized companies by 31 October 2023.28

Buildingblock5:Assurance

We welcome the development of simplified SME reporting standards. We suggest lowering the administrative burden for SMEs through reduced complexity and potentially by providing a clear list of sector-specific material sustainability issues to begin with.

Definition: Assurance refers to the external verification of financial or ESG reporting by entities. The aim of third-party assurance is to provide a higher degree of reliability and credibility to the disclosed information. Regulations and standards can demand different assurance requirements, ranging from “consistency checks” and “limited” assurance, to stronger and demanding levels, such as “reasonable” or“full”assurance.

Overall recommendation: The scientific literature provides evidence for positive effects of assurance on investors’ credibility perception of the disclosed information.29 As such, assurance requirements are likely to increase the extent to which capital market participants use ESG information in their decision-making processes, by fostering the perception of the sustainability disclosures as reliable sources of information. Although assurance obligations are scarce in currently implemented sustainability disclosure measures, it is an emerging aspect in the proposals. We argue that the ISSB needs to consider assurance more ambitiously, while we recommend the SEC to maintain its innovativecoursewiththe coherentandambitious timelineforreasonableassurance. Wealsowelcometheambitious aim of theESRStostrive forasimilarlevel ofassurancefor sustainability reportingas is inplaceforfinancial reporting.

Design choice: Assurance of sustainability disclosures should be mandated to generate reliable information.

26 TheEnhancementandStandardizationofClimate-RelatedDisclosuresforInvestors(2022)link 27 Directive of The European Parliament And Of The Council amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC andRegulation(EU)No537/2014,asregardscorporatesustainabilityreporting (2021)link

28 Ibid

29 Quick&Inwinkl(2020)link;Reimsbachetal.(2017)link

17

Standard Evaluation

SEC The assurance requirements demand large accelerated filers to include an attestation report for scopes 1 and 2 GHG emission disclosures. The assurance requirements are phased in with limited assurance in the second and third year after the initial compliance, and reasonable assurance as of year four.

IFRS S1 & S2 (by ISSB)

The ISSB provides general guidelines, which include audit and oversight of disclosures from third parties. Specific regulations on assurance will likely be regulated by the respective jurisdictions adopting the standards.

Recommendation

We recommend the SEC to stick to the proposed timeline for phased-in limited and reasonable assurance.

ESRS (by EFRAG)

The ESRS target a similar level for sustainability reporting assurance as financial reporting in the long run, but currently limited assurance is expected within three years after implementation and reasonable assurance after six years.

Buildingblock6:Disclosurechannel

WerecommendtheISSBtoprovideclear recommendationstojurisdictionsregardingwhich disclosurerequirementsshouldbeverifiedunderalimited orreasonableassuranceapproach.

We welcome the aim to achieve a similar assurance level for sustainability disclosures as for financial information. We recommend EFRAG to stick to the proposed timeline for phased-in limited and reasonable assurance.

Definition: ESGdisclosurescanbepublishedindifferentchannelsormediums,e.g.,aspartofthe annualreport,inaseparatesustainabilityreport,oronafirms’website.

Overall recommendation: Current developments in sustainability disclosure increasingly strive for disclosures through singleaccesspoints.Thesecanreduceinformationcosts,whichprovideaconsiderablecomponentofinformationasymmetry. We thus welcome the standards’ requirements for publication in publicly accessible databases instead of solely in annual or sustainabilityreports.Theseeffortscancentralizeinformationflowsandfosterdigitaltagging.

Design choice: The disclosure channel(s) need to facilitate increased data availability, traceability and accessibility.

Standard Evaluation Recommendation

18

SEC

The proposal considers tagging the climate-related disclosures of registrants, including block text tagging and detail tagging of narrative and quantitative disclosures required by Subpart 1500 of Regulation S-K and Article 14 of Regulation S-X in Inline XBRL, as proposed.

We welcome the proposal to require registrants to tag their climate-related disclosures, and the SEC should continue to integrate the climate-related data to the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) database which contains registration statements, quarterly and annual reports and other forms which are mandatory submissions for listed companies.

IFRS S1 & S2 (by ISSB)

The IFRS Foundation staff developed an XBRL representation of the (draft) IFRS Sustainability Disclosure Standards, considered as the IFRS sustainability disclosure taxonomy.

We welcome that the IFRS Foundation is considering the tagging of disclosure prepared using the IFRS’ Sustainability Disclosure Standards. We suggest that the ISSB considers how specified disclosure channels could contribute to lower information costs. We believe that the EDGAR Database of the SEC provides a suitable starting point with an example of the set-up for financial disclosure.

ESRS (by EFRAG)

ESRSE1statesthatSustainability informationshallbepresented (§106b)underastructurethat facilitatesaccesstoand understandingofthesustainability statements, both in human and machine-readable formats.

We welcome the target for machine-readable sustainability information to enable the information to feed into the European Single Access Point (ESAP)30 as envisaged under the Capital Markets Union Action Plan31

Buildingblock7:Linkstootherstandardsandframeworks

Definition: Reportingstandardsandregulationscanreferenceandrefertootherexistingstandards andframeworks,especiallyto provideguidanceandorientationtoentitiesonhowtodisclosespecific ESGinformation.Thereisarangeofavailable(international)reportingstandardsspecifying methodologies,metricsandKPIsfordisclosure.

Overall recommendation: Reporting standards are particularly helpful if they enable the disclosure of specific and meaningful KPIs and metrics for certain sustainability topics. Reporting standards which offer detailed guidance could assist entities in reporting and increase comparability, particularly if specific KPIs and calculation methods are explicitly defined in thestandards.However,differentindustriesrequirespecificindustryguidance.Therefore,wehighlyrecommendtheSECand theISSBtodevelopindustry-specificguidanceandbelievethattheESRScouldprovideablueprintforsuchefforts.

30 EUTaxonomy,CorporateSustainabilityReporting,SustainabilityPreferencesandFiduciaryDuties:DirectingfinancetowardstheEuropean GreenDeal(2021)link

31 ACapitalMarketsUnionforpeopleandbusinesses-newactionplan(2020)link

19

Design choice: New sustainability disclosure standards/regulations should build on and/or be linked to existing reporting standards

Standard Evaluation Recommendation

SEC The standard has been established based on reviews and input from the TCFD and GHG emission protocol, Global Reporting Initiative (GRI), CDP Climate Disclosure Standards Board (CDSB), the Value Reporting Foundation and the International Integrated Reporting Council (IIRC).

IFRS S1 & S2 (by ISSB)

ESRS (by EFRAG)

The standards build on the TCFD, the SASB standards and industrybased standard-setting processes.

We believe that for its current focus on climate reporting, the standard is sufficiently connected to other reporting standards and frameworks. If the disclosure content is expanded, as we recommend, further reporting standards (e.g. ESRS) and frameworks should accordingly be integrated as well (e.g. AFI).

We strongly suggest the ISSB further strengthen and make explicit the link to other sustainability reporting standards (e.g., GRI and ESRS), but also to consider more specialised, nature-related standards (e.g., CDP, AFI).

The standards include references to other existing standards and frameworks.

We urge EFRAG to keep ambition levels high by building on and even going beyond existing standards. Furthermore, we recommend EFRAG to not only aim for consistency with other standards, but to even advocate for a rise of ambition levels in other reporting standards and frameworks.

THE CASE OF DEFORESTATION

To complement our overarching analysis with the illustration of a specific case, this section provides insights on how each building block relates to the topic of deforestation. We choose deforestation as the exemplificative case because it is closely linked to the two most important sustainability challenges we face today, namely climate change and biodiversity loss. As such, it is absolutely critical that sustainability disclosure standards sufficiently address the topic of deforestation and more broadly ecosystem conversion, as we highlight in the introduction of this brief. How each building block can support the reflection of deforestation in disclosure standards is illustrated in the following.

Mandatory versus voluntary: The need for mandatory disclosure regulation also applies to the specific case of deforestation, as existing voluntary and market-based measures have failed to do so sufficiently 32 Studies conducted as part of the elaboration of the EU regulation on deforestation-free products (to be adopted around the end of 2022)

32 MinimisingtheriskofdeforestationandforestdegradationassociatedwithproductsplacedontheEUmarket (2021)link

20

have shown that mandatory measures are more effective than voluntary measures such as voluntary due diligence, labelling or private certification.33 As such, specific disclosure topics linked to deforestation should be mandated and specified precisely where possible. The lack of mandatory supply-chain-related disclosures has especially caused corporate actors to underinvest in improving traceability of their supply chains or to managing their deforestation impacts. Hence, the mandatory nature of deforestation-linked disclosure requirements must be applicable throughout firms’ supply chains.

Disclosure content: Ecosystem conversion and specifically deforestation needs to be addressed via specific disclosure requirements and specific sets of disclosure standards if the sustainability disclosure standards aim to target climaterelated disclosures comprehensively. In comparison to the ESRS standards, emission-intensive land use changes are specifically underrepresented in the SEC and the ISSB proposals.Also,as recommended in the building block 2above, we highly recommend addressing biodiversity and ecosystems in a specific set of disclosure standards of sustainability disclosure frameworks (e.g., as done in ESRS E4). This set of standards on biodiversity and ecosystems needs to especially address ecosystem conversion including deforestation through comprehensive, quantitative and comparable disclosure requirements. That includes the (1) size of areas converted, (2) type of ecosystem conversion, (3) location of production sites (georeferenced), and (4) cut-off date, or assessment period used to define ecosystem conversion linked to the undertaking or to its value chain by direct or indirect sourcing activities. 34 Furthermore, as deforestation is highly connected to social dynamics, close linkages need to be made to social standards, such as the ESRS S3 Affected Communities. While the overwhelming majority of tropical deforestation is linked to agriculture, it is a result of food (and to a smaller extent other) food commodity supply chains. As such, the issue of deforestation criticallyrequires disclosures alongfirms’supplychains,whichshouldalsobespecificallyhighlightedintherespective standards. Furthermore, at least one third of recently deforested land does not even lead to active agricultural production but is a result of speculative clearing (and related social and economic dynamics). As such, it is essential to safeguard against a disregard of deforestation related impacts, which are not (yet) directly linked to certain products or services.35

Materiality: The double-materiality principle is a key prerequisite to address deforestation effectively. The principle of doublematerialityis embeddedintheESRSstandards, whiletheSECandISSBproposalscurrentlybuildonthenarrow financial materiality approach. As such, the SEC and ISSB proposals do not address the critical deforestation impacts of firms. This is especially critical, as deforestation activities may not be identified as risks under the narrow financial materiality approach because deforestation is frequently not happening within direct operations of companies and may currently not be traceable to the firm level The traceability problems thus allow deforestation impacts to remain externalities, which cause substantial welfare losses. As double materiality approaches can increase transparency about firms’ direct and indirect links to deforestation, they might enable the internalisation of deforestation-related externalities andthereby increase thefinancial materiality of theseissues: Onceinformationasymmetries are reduced and stakeholders informed about firms’ impacts on deforestation, firms might face financial consequences, for instance due to reputational loss. This interconnectedness of financial and impact materiality is captured by the conceptofdynamic materiality,andhighlights theimportanceto cover boththeimpactandthefinancial perspectives of materiality in disclosure regulations.

Given the criticality of deforestation, we recommend specifying certain deforestation issues as per se material, meaning that they must always be reported on (by firms with certain characteristics, such as a certain size or sector

33 Proposal for a regulation of the European Parliament and of the Council on the making available on the Union market as well as export from the Union of certain commodities and products associated with deforestation and forest degradation and repealing Regulation (EU) No 995/2010 (2021) link These findings were corroborated by the outcome of the Open Public Consultation, where the overwhelming majorityofstakeholders businessassociationsandNGOs supportedamandatoryduediligenceregime

34 A clear definition of cut-off dates or assessment periods is crucial in order to address the very destructive speculative practice of forest clearance followed by production several years later. Cut-off dates should be set in line with existing sector conventions (e.g., Amazon Soy Moratorium), legal requirements (e.g., Brazilian Forest Code) and certification schemes (e.g., Round Table on Sustainable Palm Oil, Forest StewardshipCouncil).FortheBrazilianSoyMoratoriumwithcut-offdates2006/8seee.g.Heilmayretal.(2020)link;Forcertificationschemes seee.g.,RoundtableonSustainablePalmOil (RSPO),4cut-offperiodsdefined in:Annex3LUCAguidancedocument (2017)link;andForest StewardshipCouncil(FSC)link

35 Pendrilletal.(2022)link

21

affiliation).Such per se material disclosure requirementsshouldcover, (1)assessments anddisclosures offirms’direct impacts on land and natural ecosystems conversion, (2) assessments and disclosures of firms’ supply chain dependencies on key commodities linked to deforestation36 and (3) if such dependency exists, the reporting on the four disclosure requirements listed above in disclosure content.

Scope: A more comprehensive scope of disclosure standards is more effective in tackling deforestation. Deforestation is linked to commodities that are imported by firms of different sizes, and to a great extent by SMEs. As such, SMEs are key for increasing sustainable livelihoods of forest-dependent people, for managing and protecting the natural resources and biodiversity of the forests and for combating climate change 37 We recommend including SMEs in a larger scope but also recommend the current disclosure standard proposals consider and implement the proportionality principle. This means that firms of different sizes should be obliged to report on their activities with links to deforestation, but that especially smaller firms and those with smaller impacts on deforestation should be supported by either simplified disclosure standards or supportive reporting guidelines and tools. Including more companies in disclosure standards’ scope does not only improve decision making processes on the capital market, but also improves (unlisted) entities understanding and management of their deforestation impacts, which are likely to translate to financial risks in the future. Furthermore, it would prevent smaller firms from being excluded from certain markets when access depends on transparency provisions (as, for example, foreseen in the proposal for the EU regulation on deforestation-free products).

Assurance: While it is currently challenging to assure firms’ (absence of) deforestation related impacts and/or risks, assurance is essential to increase the reliability and usability of deforestation related information. The mandatory implementation of assurance could also lead to the development of new solutions for better assessment of firms’ deforestation related impacts and risks Such new assurance solutions could substantially contribute to the reliability andconsequentlyusability of deforestation relatedinformation,which is currently oftentimes perceivedas unreliable. The perceived unreliability of deforestation information is partly due to the difficulty of tracing deforestation to the productandfirmlevel,whichislinkedtothefactthatdeforestationis oftenlocatedin remoteareas upstreamnational and international supply chains. Thanks to satellite-based data and traceability tools38 satellite imagery-derived landuse cover and change data as well as supply chain tracing data is increasingly available globally. Such information can however not always be attributed to specific producers, firms and consumers, which constitutes a substantial barrier to transparency on the firm level In order to support auditors’ assessments of deforestation disclosures, we suggest to implement additional verification schemes, which may happen through cooperation with local actors, which are better equipped to verify firms’ information on deforestation 39

Mandatory disclosure and verification of firm-level deforestation disclosures have the potential to constantly increase reliable data availability, and to thereby reduce the currently prevailing uncertainty and information asymmetries about firms’ deforestation impacts.40 Verified data to be disclosed should include (i) production sites’ geo-locations, (ii)scales to which products aretraceable,and(iii)theirlanduse changeassociatedwithsourcing regions.Verification can be provided e.g. by satellite-based tools in combination with local ground-truthing. We note that there is a high but not yet explored potential to involve local institutions41 with geographical proximity to upstream activities in such ground-truthing activities. Especially in remote areas and where land tenure schemes are still weak, their knowledge can make data more reliable and less prone to wrongful reporting. Such local “ground-truthing” of disclosed

36 suchasthe “covered products” of the proposal for EU regulation on deforestation-free products (2021) link

37 SupportingSmallandMediumEnterprises(SMEs)intheForestSector:Howcanwedomore?Therationaleforamulti-sectoralapproach (2017)link

38 suchasTrase,GlobalForestWatchPro,Mapbiomas

39 Forexample:ifacompanydiscloses that thesoy sourcedin theirsupplychaincomesexclusivelyfromspecificproductionunitsinregion x, that have not been deforested after 2008, then the local institution would have to confirm that this threshold was maintained for the reporting period and that the involved suppliers do not engage in deforestation as part of land speculation in other areas close-by. The disclosing company could provide information and proof of the local verification process as part of their report and/or such cooperation withlocalentitieswouldbecomepartoftheauditors’tasks

40 Fuhrmannetal.(2017)link

41 suchasmunicipalitiesorrepresentativeorganizationsofcommunitiesandsmallholders

22

information by corporates could – as a formalised process - also offer economic development options to local institutions and increase ownership for local sustainability transformation processes.

Disclosure channel: Increasing the use of deforestation data can be enhanced through integrating deforestationrelated information in disclosure channels such as sustainability reports, or even centralised single access points, which can reduce information costs and thereby information asymmetries. Like other sustainability information, the usability of deforestation-related disclosures critically depend on its accessibility. As deforestation-related information is currently seldom available on the firm level, it is not commonly published through disclosure channels such as firms' sustainability reports or ESG data providers. The currently-drafted sustainability disclosure proposals indicate the development of publicly accessible databases and efforts towards digital tagging, which would provide convenient disclosure channels for information users. We thus recommend deforestation data to be integrated and considered in these efforts.

Links to other standards and frameworks: We recommend the SEC, ISSB and EFRAG to seek first or further exchange with the team of the Accountability Framework Initiative42 and the disclosure platform CDP Forests43 regarding their developedsetof synthesisedstandards toaccountfordeforestation.CDP Forestsand GRIhaverecentlyaddedmetrics on extent of conversion linked to operations and supply chains, in alignment with the Accountability Framework. Forthcoming guidance by the Accountability Framework, Science Based Targets initiative, and Greenhouse Gas Protocol on holistic land use change accounting and reporting will provide further clarity on best practice. Similar to other sustainability issues, it will be crucial for the standard-setters SEC, ISSB and EFRAG to consult and build on the in-depth experience, which has been built by experts in the specific topic of deforestation.

REMARKS BEYOND THE BUILDING

BLOCKS

Our analyses are built on our extensive engagement with, and observation of, the standard setting processes of the SEC, ISSB and EFRAG. Beyond the analytical comparison and recommendations based on the building blocks, we use this section to highlight areas where we see room for procedural improvement, in particular with regard to (i) diversity of experts involved, (ii) interjurisdictional cooperation, and (iii) empowerment of effected stakeholders.

In terms diversity of experts involved, we urge standard setters to actively reach out to and involve experts from different disciplinary backgrounds in the development process. Currently, the standard setting groups are mainly composed of experts with business backgrounds, specifically in the areas of finance and accounting. The effective development of sustainability disclosure standards urgently requires in depth input of experts from environmental and social studies, such as experts on biodiversity and sustainable land use. Only an interdisciplinary development process will deliver standards that enable the disclosure of risks, opportunities and impacts of firms’ activities on people and the environment. Furthermore, we observed that younger generations and marginalised groups are currently under-represented in the standard-setting boards. While we acknowledge that a certain level of experience

42 The Accountability Framework Initiative (AFI) supports companies in achieving supply chains free from deforestation, conversion, and humanrightsviolations.CompaniesandotherstakeholderscanusetheFrameworkasatooltoassesscompanypoliciesandsystemsagainst consensus-basedprinciplesandbestpractices,aswellasaresourcetosupportimprovementprocesses

43 CDP Forests defines high deforestation risk commodities and countries and provides a menu of key performance indicators that companieswithtropicalcommoditysupplychains,financierswithhighdeforestationriskinvestments,andforestryassetmanagerscanuse togeneratestandardizedandcomparabledisclosures

23

is necessary, we view it as essential to increase the (generational) diversity of the standard-setting bodies, as these actors will face the consequences of limited accountability due to unambitious disclosure standards.

Similarly, we highlight the importance of increased inter-jurisdictional cooperation, as we observed a lack of active consultation of and integration of upstream perspectives in the standards’ development process. In the context of the ESRS development process, for example, it is important for the EFRAG to cooperate with jurisdictions that are connected with the EU through close economic and commercial relations, and that are connected to many EU-based firms’ supply chains. Brazil, for instance, plays an important role in the successful implementation of the European Green Deal, as many European firms import goods from Brazilian producers. For the disclosure regulations developed in the EU to work effectively and with the regulations in place in other jurisdictions, it is necessary for public and private actors in the EU to have a good understanding of existing and proposed regulatory frameworks and initiatives in these countries. Brazil represents a very relevant example of such a country, as it is one of the most important countries in which high-deforestation risk commodities are produced. An intensive exchange of information and knowledge between the EU and Brazil on sustainable finance regulations and how it impacts the production of forestrisk commodities can lead to greater cooperation and integration between these jurisdictions and facilitate effective implementation by market actors 44

Additionally, we urge standard setters to think critically about stakeholders that will be affected by the standards,and howtoempowerthemthroughthestandards’design choices.Ratherthanimposingdifficultandunrealisticdisclosure obligations on, for example, smallholders in other countries, standard-setters could think about mechanisms that integrate local knowledge in a manner that considers the local realities of these stakeholders. We see a high and not yet explored potential to better include know-how and insights of local institutions with geographical proximity to upstream activities, as highlightedfor example through our recommendationfor the development of local verification schemes under building block “assurance” in our deforestation exemplification This could also foster structural strengthening of people and institutions in remote areas by granting them access to business opportunities arising fromtheneedforcompanies to provecompliancewithdisclosurestandards.This aspectlinks toourrecommendation regarding the importance of interdisciplinary perspectives in the development process because such approaches can only be developed through interdisciplinary exchange between disclosure and sustainable development experts

CONCLUSION

The three disclosure standards should fulfill the need for more transparency about material sustainability impacts, risks and opportunities across different sectors and actors. While they all agree on the pertinence of corporate environmental and other sustainability information for investment and financing decisions, our analysis shows that along the lines of the seven ESG building blocks, they still vary vastly across key characteristics.

By comparing the three consultations per building block, we were able to systematically identify ambition gaps. We find that among the three proposals, the ESRS standards are most ambitious for “disclosure content”, “materiality”, and “links to other standards and frameworks” Regarding “mandatory vs. voluntary” and “assurance”, the ESRS andSEC standards stand out in their level of ambition and leave room for improvement for IFRS. All three disclosure standards show efforts in developing towards a single access point (subsumed under building block “disclosure channel” , which

44 Bridgingsustainablefinanceandsustainablelanduseinitiativestoreducedeforestation:AnoverviewofEUandBrazilianlegislation(2022) link

24

we regard as beneficial and see as a potential to collaborate and proceed Regarding “scope ” , we formulate suggestions forallthree proposals,suggestingto consider thesustainabilityrelated impacts inestablishingthescope. This analysis of key characteristics of disclosure standards shows clearly that most room for improvement lies with the IFRS standards. The SEC standards, which only focus on climate so far, are more ambitious for several building blocks. The most comprehensive requirements can currently be found with the ESRS standards Nonetheless, it is important to keep the different roles and agendas of the SEC (investor protection), ISSB (establishing a global baseline) and EFRAG (reporting under the CSRD) in mind.

The results of our analyses lead us to believe that the future of sustainability reporting standards can develop in two directions: i) a race to the bottom with narrow and static disclosure standards or ii) a situation of international cooperation and global convergence towards widely applicable and future-proof sustainability standards. It is especially important to prevent a race to the bottom, by understanding and clearly communicating that the IFRS standards aim to become the global baseline of sustainability reporting standards Thereby, the IFRS standards will play an important role in communicating the minimum level of the global ambition of international disclosure standard-setting, while this leaves room for the other standards to aim for more comprehensive and useful standards The next months will be crucial in setting the international stage and for the determination which of the two scenarios becomes most dominant This will also affect the ambition of the ESRS standards. It is crucially important to push for the recommended design choicesin the IFRS standards, whilemitigatingthe risk of the ESRS standards being diluted down. Climate & Company raised these concerns during the 2022 consultation rounds and will continue to promote ambitious sustainability disclosure standard-setting in future dialogues among relevant actors, based on sciencebased arguments

25