CMBA-ACHC.CA PM No. 41297283 FALL 2022 $6.95 THE MAGAZINE FOR PROFESSIONAL MORTGAGE BROKERS BROKERING SUCCESS Putting the emphasis on transparency, coaching and values-driven achievement p.10 Special pull-out section INSIDE UNDER THE MICROSCOPE Unconscionability: how to avoid crossing the line p.24

THINK OUTSIDE THE BOX! FEELING BOXED IN? COMMERCIAL MORTGAGE LENDING CRITERIA Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rate Starting at Retail/Office/ Industrial 70% $1.5 M - $75 M 7.50% Land (urban infill) 65% $1.5 M - $75 M 8.00% Apar tments 70% $1.5 M - $75 M 7.00% Res. Condo Inventory 70% $1.5 M - $65 M 7 75% RESIDENTIAL MORTGAGE LENDING CRITERIA Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rate Starting at Single Family 70% $1.5 M - $5.0 M 7.50% Luxury Condos 65% $1.5 M - $3.5 M 7 75% Vacation 65% $1.5 M - $3.5 M 7.75% Sam Fogell - Western Canada sfogell@lanyardgroup.com 604-688-5388 x103 David Coyle - Ontario dcoyle@lanyardgroup.com 416-509-2940 Phone 604.688.5388 www.lanyardgroup.com

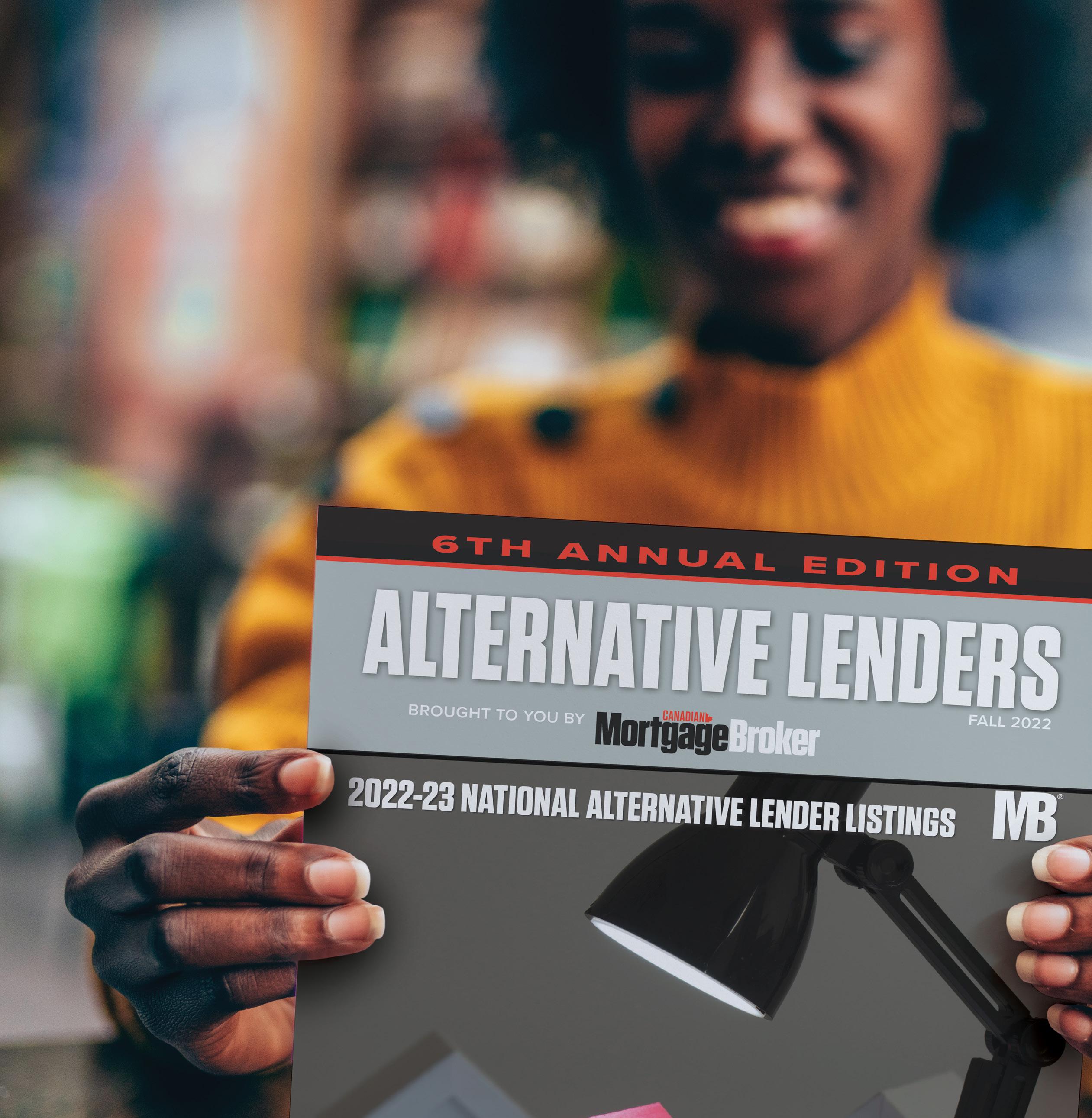

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 5 VOLUME 7 ISSUE 4 FALL 2022 departments features columns Editorial Advertisers’ Index Off the Clock: East Coast mortgage broker Jonah Wright applies lessons learned on the ball field to define his own brand of professional success BY LISA GORDON Legal Ease: When friends fall out –Sole Conduct of Sale BY RAY BASI 8 30 14 20 10 24 BROKERING SUCCESS Today’s successful mortgage brokerages put the emphasis on transparency, coaching and values-driven achievement BY LISA GORDON NEW LEGISLATION TO GOVERN B.C. MORTGAGE BROKERS BY RAY BASI UNCONSCIONABILITY UNDER THE MICROSCOPE Where is the line and how can you avoid crossing it? BY RAY BASI Comprehensive listings of alternative lenders, mortgage investors, private lenders and syndicators across Canada. 18 SPECIAL PULL-OUT SECTION

VOLUME

THE CANADIAN MORTGAGE BROKERS ASSOCIATION

DIRECTORS

Terry Kilakos (CMBA-Quebec)

Sadiq Boodoo (CMBA-Ontario)

Jim DeCoste (CMBA-Atlantic)

Sachin Varma (CMBA-BC)

EXECUTIVE DIRECTORS

Carla Giles

Petra Keller

CMBA - ATLANTIC Mortgage Brokers Association of Atlantic Canada

12 M - 7095 Chebucto Road, Halifax, NS B3L 0A1

CMBA - BC Mortgage Brokers Association of British Columbia 202 - 338 West 8th Avenue, Vancouver, BC V5Y 3X2

CMBA - ONTARIO Independent Mortgage Brokers Association of Ontario 7 - 40 Winges Road, Woodbridge, ON L4L 6B2

CMBA - QUEBEC L'Association des courtiers hypothecaires du Québec 5855 Taschereau #202, Brossard, QC J4Z 1A5

4

CANADIAN MORTGAGE BROKER magazine is produced by the Canadian Mortgage Brokers Association (CMBA)

EDITOR

Carla Giles

STAFF WRITER

Ray Basi

MANAGING EDITOR Kathleen Freimond

ART DIRECTOR

Scott Laing

BILLING AND SALES

Debra Hiller

CONTRIBUTORS

Ray Basi

Carla Giles Lisa Gordon

7 ISSUE

FALL

PUBLICATIONS MAIL AGREEMENT 41297283 Please return undeliverable Canadian addresses to 202-338

Ave,

Printed in

IMAGES Adobe iStock by

2022

West 8th

Vancouver, BC V5Y 3X2

Canada

Hemlock Printers Ltd.

The views expressed

the

RESIDENTIAL COMMERCIAL CONSTRUCTION DEVELOPMENT LAND

CANADIAN MORTGAGE BROKER © All rights reserved.

in CANADIAN MORTGAGE BROKER are those of

respective contributors and are not necessarily those of the publisher or staff.

When you need speed and agility as much as you need funding.

Ensuring our borrowers see a clear path to success is our unique specialty. We’re one of North America’s leading commercial non-bank mortgage lenders with over $3 billion under administration. We specialize in bespoke lending solutions for commercial real estate financing in amounts from $10M to $400M. We’ll share your vision, and your entrepreneurial mindset, to provide time-sensitive lending and financing solutions. Let’s talk.

Investment Corporation

800 494 0389 | romspen.com License # 10172

CYBER THREATS IN THE MORTGAGE INDUSTRY

BY CARLA GILES, EXECUTIVE DIRECTOR, CMBA-BC AND MBIBC; CO-EXECUTIVE DIRECTOR CMBA

BY CARLA GILES, EXECUTIVE DIRECTOR, CMBA-BC AND MBIBC; CO-EXECUTIVE DIRECTOR CMBA

The rate of change within the digital transformation space has accelerated in recent years, bringing opportunities for organizations to find efficiencies and close gaps in service. The pandemic accelerated this transition as businesses saw the need to adjust to the implementation of a range of stringent policies aimed at reducing levels of COVID-19 transmission, including stay-athome ‘lockdowns.’

In the mortgage brokering sector, the adoption of digital technology streamlined the mortgage application process to service an increased flow of borrowers driven by historically low interest rates. It also helped the industry rapidly adjust to remote working and virtual environments. Those companies that had already started their digital transformation journey before the pandemic began were better positioned to differentiate themselves from the competition.

However, the adoption of digital platforms and applications, particularly those that rely on cloud technologies and third-party providers, can increase exposure to cyber threats.

According to the Bank of Canada, the concentration of third-party service providers in the financial sector makes the financial system more susceptible to cyber crime. The Bank notes that many participants in the financial system are highly interconnected. This vulnerability can lead to cascading effects and compromise the provision of services to other participants in the financial system.

The ongoing digitalization of the economy and financial services creates entry points into IT systems that cyber criminals can exploit. According to a survey of organizations

across Europe and the U.S. in 2021, the most common first point of entry for a cyber attack was through a corporate-owned server (37 per cent). The second most common entry point was corporate cloud servers (31 per cent), followed by the company website (29 per cent).

Cyber crime, which includes data breaches, ransomware and phishing attacks, can have a wide range of consequences for governments, organizations and individuals. Police-reported instances of cyber crime in Canada have grown steadily from just over 15,000 in 2014

8 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE ADOBESTOCK

Be aware of regulatory frameworks to ensure data security

editorial Description: As of 2021, the number of police reported instances of cyber crime in Canada amounted to 70,288 cases. This was a significant increase compared to 2014, when there were 15,184 such cases reported to the police. Among the examined types of cyber crime, the number of fraud incidents in Canada was the highest. Note(s): Canada; 2014 to 2021 Source: StatCan Number of police-reported instances of cyber crime in Canada from 2014 to 2021 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 17,887 23,996 27,829 33,893 48,318 65,141 70,288 15,184 Number of reported instances 2014 2015 2016 2017 2018 2019 2020 2021 *Cybersecurity refers to the application of technologies, processes, and controls designed to protect systems, networks, programs, devices, and data from attack, damage, or unauthorized access. When applied, cybersecurity reduces the likelihood and impact of cyber attacks. These cyber attacks can seek unauthorized access to sensitive client information or disrupt business activities.

to more than 70,000 in 2021. The actual number is expected to be substantially more significant as many instances go unreported.

As cyber threats become more sophisticated, the federal government has become increasingly concerned with cyber attacks that can have systemic consequences. With the ongoing war in Ukraine, it has been reported that the frequency and sophistication of cyber attacks on critical infrastructure have increased.

Bill C-26 has been introduced in the House of Commons to help bolster cybersecurity* across Canada’s financial, telecommunications, energy and transportation sectors. It would impose a series of obligations related to cybersecurity on designated organizations in the aforemen tioned sectors. The bill would enact the Critical Cyber Systems Protection Act (CCSPA) to protect critical cyber systems considered integral to Canadian infrastructure and public safety.

Bill C-26, if passed, would require cybersecurity incidents to be reported to the Communications Security Establishment and their applicable regulator.

Cyber threats in the mortgage industry are elevated due to the sensitive nature of client data exchanged between various parties, in cluding mortgage brokers, lenders, investors, borrowers and third-party service providers. The Mortgage Broker Regulators’ Council of Canada (MBRCC) released guidance on cybersecurity preparedness earlier this year. This guidance proposes practices to limit cybersecurity incidents and respond when they occur. It is an effort to prevent unauthorized access to sensitive client information in the mortgage brokering sector.

The Financial Services Regulatory Authority of Ontario (FSRA) fol lowed suit by adopting MBRCC’s cybersecurity guidance. The guidance applies to individuals and entities regulated by FSRA under Ontario’s Mortgage Brokerages, Lenders and Administrators Act. This includes mortgage agents, brokers, brokerages, and administrators. The guidance requires that mortgage brokerages and administrators notify the FSRA of any cybersecurity incident that could have a material impact on client information. In addition, once an incident is communicated, the FSRA will continue to monitor the notifying party’s response to the cyber incident until it is satisfied that it meets several requirements.

Given recent trends, cybersecurity should be an integral part of risk management frameworks to prevent and mitigate more sophisticated cyber threats. Training staff and users is an essential part of that plan. According to the Hiscox Cyber Readiness Report 2022, spending on cybersecurity has increased in recent years. Companies in the United States report that 24 per cent of their IT spending in 2022 is allocated to cybersecurity.

While larger organizations are better resourced to invest in cyber security, smaller organizations often lack the internal capabilities to do so. While preparedness and preventative measures are still needed, irre spective of size, carrying data security and privacy breach insurance can provide the resources required to recover from cyber crime.

As the mortgage brokering sector continues to embrace digital transformation, the regulatory environment will mature, but not at the same pace. Consequently, decisions around adopting new technologies and innovation should consider and weigh data security and privacy concerns and err on the side of caution to ensure compliance with regulatory frameworks and cybersecurity guidance. At the same time, embedding compliance considerations and strengthening controls into new processes can enhance the value of digital solutions.

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 9

“

Be

Christine Buemann, The Collective Mortgage Group

Today’s successful mortgage brokerages put the emphasis on transparency, coaching and values-driven achievement

BY LISA GORDON

BROKERING SUCCESS

10

very clear on what success will be for your brokerage and stay on course.”

BROKERING

Magic happens when you find a safe space to earn money.”

In a nutshell, that’s Christine Buemann’s recipe for success as broker/owner of The Collective Mortgage Group in British Columbia.

After 12 years in the mortgage industry, she has no regrets about leaving a large broker house and joining forces with partner Chad Oyhenart to found a different kind of mortgage brokerage.

Today, The Collective Mortgage Group has 25 staff, including 10 primary brokers. Buemann says it’s a group of leaders who are focused on achieving their own personal definition of success.

“Our brokerage is run very differently. Our focus is not on volume. We try to help determine what success looks and feels like for each of our brokers, and our goal is to sup port them through that success. We are happy to stay small and create a safe and inclusive environment for our brokers to thrive,” says Buemann.

Buemann and Oyhenart seem to have hit the cultural nail on the head. According to Forbes, “the organizations that succeed (in 2022) will rethink employee engagement and develop an employee-centric work environment.”

That kind of culture does double duty by first attracting top talent to an organization, and then helping them keep it.

“We are fortunate that others believed in our vision,” reflects Buemann, who says she and Oyhenart have never needed to actively recruit brokers. In fact, people have always come to them.

“I think our industry is very focused on ego. As Type A competitive people, it’s easy to get lost in the wrong metrics of success. Success for some brokers will feel like more funded deals. For others, success looks like taking two months of holidays with your family. It creates a more efficient environment when your passion drives your purpose, rather than your fear pulling you to an outcome.”

She points out that “like attracts like,” and, “if you’re living your truth to your highest and best ability, others will naturally gravitate to that.”

Another key to a successful bro kerage, in her opinion, is to be open to change. Just because something has always been done a certain way, doesn’t mean that way is suitable in today’s market. In fact, as the mortgage industry slows and tightens, Buemann says many

brokers will be evaluating the relation ship they have with their brokerage.

“People have the time now to con sider change. They are looking at their costs and assessing value. For right now, attrition is to be expected.”

Going forward, she expects brokers to demand transparency.

“I think that compensation will shift,” continues Buemann. “For the last few years, bigger has had the perception of being better. But I think quality will become more important than quantity. We’ll focus on relationships more than egos. I also think that some of the behaviour that has been normalized in our industry will no longer be tolerated.”

She thinks the industry is under going a seismic shift, focusing less on bravado and turning more towards trust.

“The pandemic stripped us of a lot of facades. The ability to be fully vulnerable in a safe space will hold more value than an extra dollar in your pocket.”

When taking on a broker, Buemann and her team look for specific qualities: kindness, family values, honesty, at least 10

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 11

SUPPLIED

brokerage building

“

years’ experience and good relationships with lender partners.

As far as she’s concerned, The Collective Mortgage Group is the perfect size as it stands today, and there’s no need to expand. She’s just focused on being better tomorrow, and part of that goal is realized through professional development and industry involvement.

“I participate in various industry organizations. Our associations are a massive resource and likely our primary source of information,” said Buemann. “There is a lot of opportunity for people to be involved in the industry.”

Another thing she tries to do in her leadership role is to “speak without offending and listen without defending.”

The latter is difficult, she admitts, because “your company is a passion project. It’s hard not to feel defensive.”

SUPPORTIVE CULTURE

At Definitive Mortgage Group in Oakville, Ont., father-son team Pat Raimondo and Andrew Raimondo also take care to cultivate a supportive envi ronment for their 24 mortgage agents.

Founded in 2011 by Pat Raimondo, Definitive Mortgage Group is a member of the Verico Financial Group. Over time, the business has evolved and shifted, says Andrew Raimondo.

“My father has been in the business for 30+ years. His background is in banking management, so when we look for someone, they need to have, ideally, a bank background. We’re really big on professionalism, respect, and being transparent.”

For Andrew Raimondo, that means arriving at 1:25 for a 1:30 meeting. It means delivering on what is promised. And it means transpar ency when it comes to the brokerage’s business partners.

“We’re very selective about who we do business with.”

Pat Raimondo agrees, adding: “It shows our character as the people behind the brokerage, and it translates through our business. If you don’t hold yourself to high values and morals, the people that work for you won’t.

Our business is people-driven, and it’s about relationships. If people know they can trust you, they will have a level of comfort.”

Over the last 11 years, the Raimondos have worked hard to embed those founding principles into every broker relationship, and they feel it’s paid off. Recognizing that nothing happens overnight, they offer a supportive environment and work with mortgage agents to help them succeed. That’s especially important now that the real estate market has slowed.

“You can choose how to structure your business,” says Andrew Raimondo. “We focus on delivering extra income or resources to agents in terms of nurtur ing their database and their book of business. They are not solely dependent on realtors when purchases may have dried up.

“We can help to mitigate some of that choppiness through the value-adds we give. We’ve been doing this for seven years; for us, it works out well,” he says.

Definitive Mortgage Group provides free tools to help agents stay in touch with clients. Andrew Raimondo says it’s an investment he’s happy to make, since the mortgage business is about the big picture, not the short term.

“For us, if you maintain the client relationship, if the rates go down you can call them and save them money. They trust you and that trust goes

a long way. If someone you trust calls you, you’ll be more inclined to listen to them. Our people are not pushy, they are well-mannered professionals.”

Building a successful brokerage takes time and effort. Along the way, patience and perseverance are crucial.

“You really have to be passionate about it,” notes Pat Raimondo. “You have to be able to work with people, the agents and staff. Be open to other people’s ideas; as I’ve learned, your idea may not always be the best one. It’s also important to have a good support network.”

Part of that support network includes accessing a variety of resources, including bulletins from the regulator and industry associations, Verico round-up emails and quarterly owner calls.

“The CMBA membership is definitely valuable,” says Andrew Raimondo. “We’ve had that since day one and it’s proven itself from a networking point of view, relation ship-building, and establishing trust. It gives us a resource to go to.”

In addition, he says lenders are an important resource. He regularly associates with a key group, and he believes the relationships and shared trust lead to more business at the end of the day.

Summing up his final thoughts on building a successful brokerage, Andrew Raimondo says respect is a key component.

“I think respect for what you do, and having a lot of integ rity for the company and yourself is very important. At the end of the day, you’re always selling yourself and the company. Carry yourself in a respectful and classy manner and respect your profession.”

Christine Buemann of The Collective Mortgage Group agrees.

“I would say to be very clear on what success will be for your brokerage, and stay on course,” she concludes. “For some people, that means a $2-billion franchise. For others, it’s a few people and a succession plan. Be very clear on why that vision is so important to you – and then go get it.”

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 13

SUPPLIED brokerage building

“If you don’t hold yourself to high values and morals, the people that work for you won’t.”

Pat Raimondo, Definitive Mortgage Group

DIAMOND CAREER

you’re growing up. It makes you want to com pete harder and represent your community.”

That same drive and confidence has served him well in business, too.

In 2006, Wright completed his business degree at St. Francis Xavier University in Antigonish. He was invited to work for a friend who was opening his own mortgage broker business in late 2007.

It turned out to be a savvy career move. Now working with Mortgage Intelligence in Halifax, Wright has established himself as a multiple award-winning broker in the Atlantic region, attributing much of his professional success to the relationships he’s developed playing softball and hockey.

Traditional networking is not his style; he prefers a casual approach to developing relationships as opposed to being “a business card guy.” Wright’s involvement in sports has allowed him to pursue a more relaxed style of networking over the years.

Living in Halifax allowed him to play softball with a more competitive group of teammates. He was able to test his skill out side of Nova Scotia, playing in the Canadian Nationals starting in 2007.

Wright’s first real shot at playing against high-level competition came in 2009, when

BY LISA GORDON

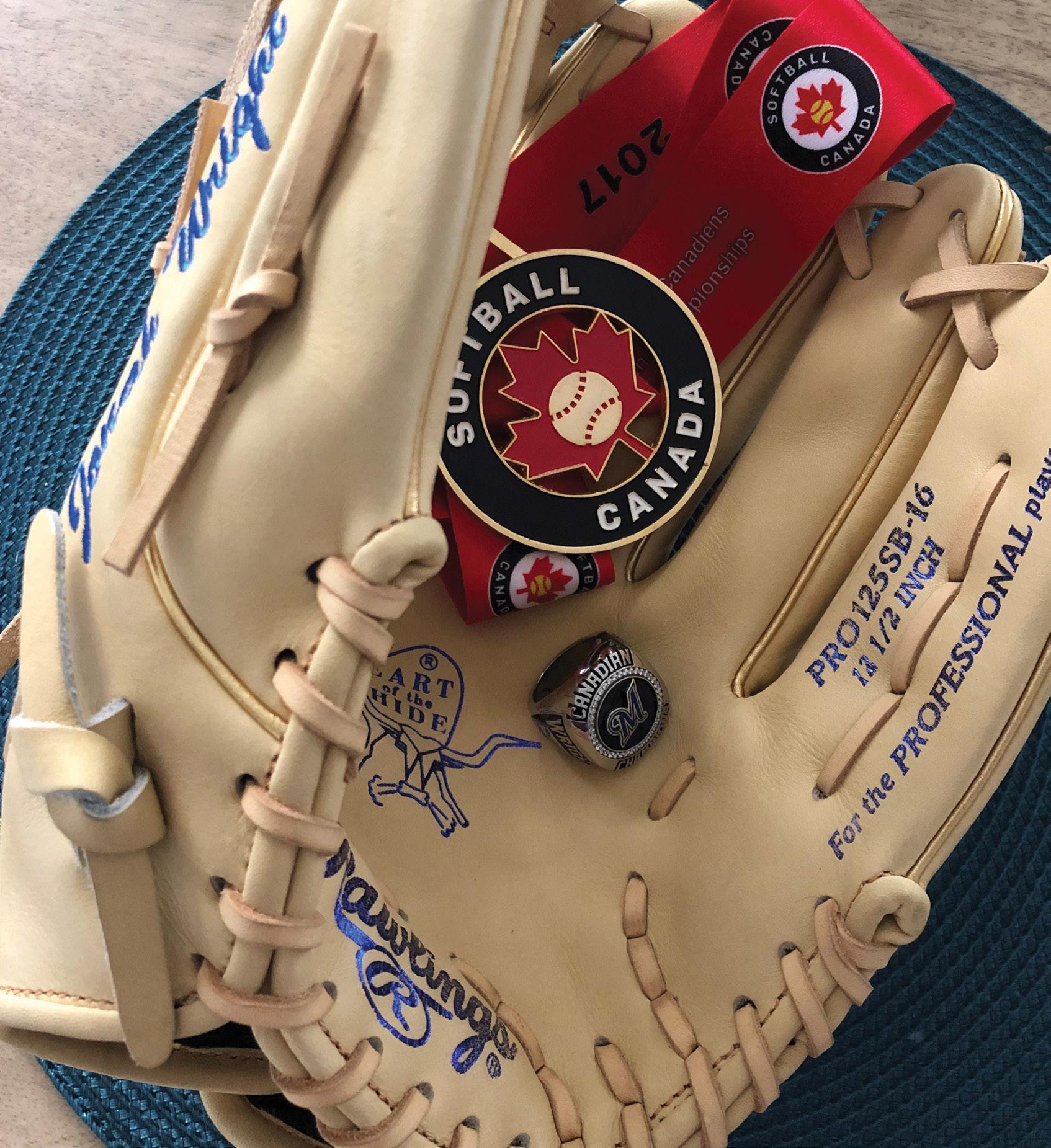

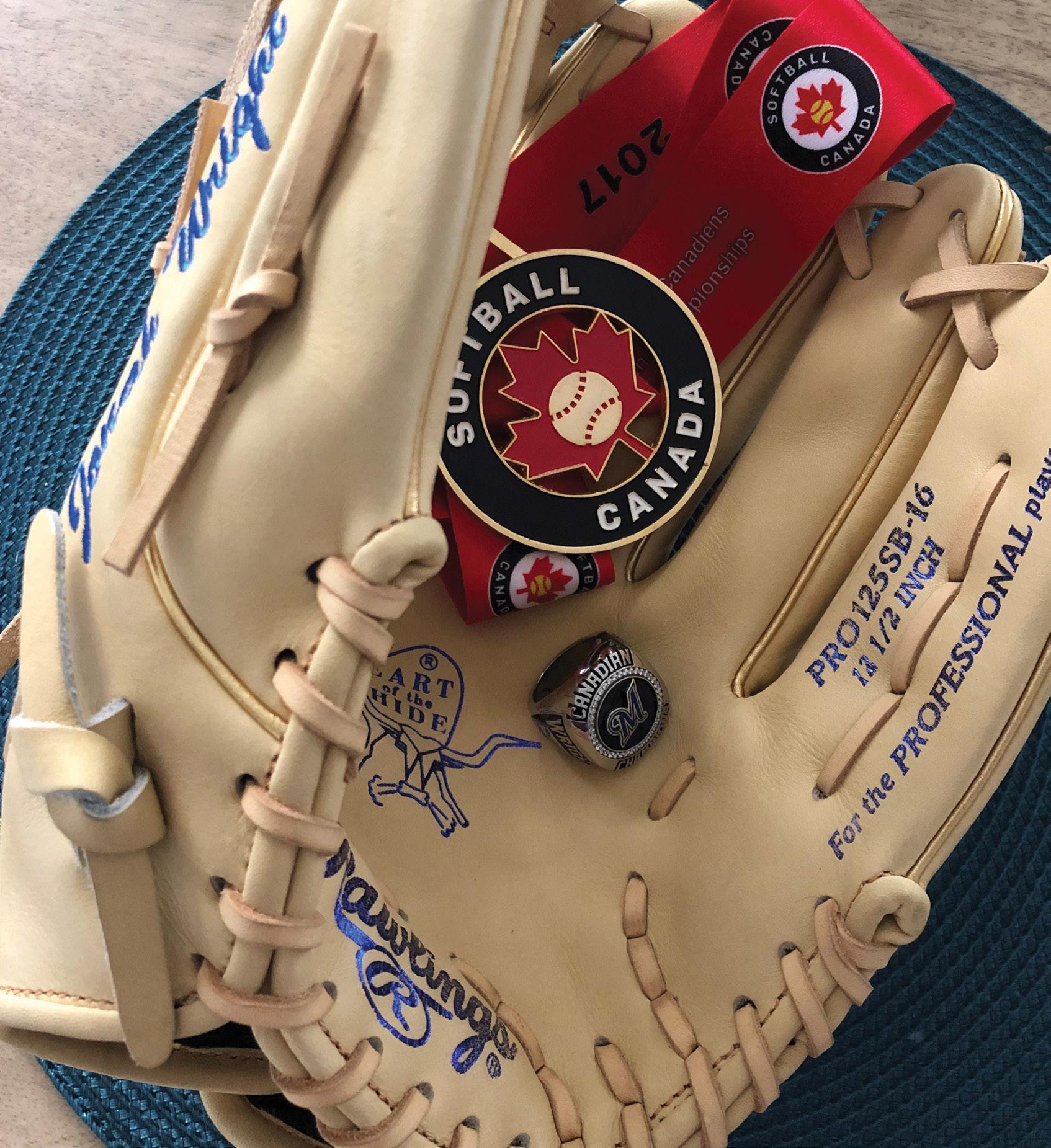

Mortgage broker Jonah Wright has a passion for sport. He and his teammates have developed a medal-winning habit in softball (fastpitch), with their Nova Scotia team taking several honours at the Canadian Nationals over recent years. Most notably, the Nova Scotia Mastodons took home the gold medal in 2017 in Saskatoon, marking the first big win for their province since the 1990s.

Raised in Guysborough, N.S., Wright was happy to join his community’s passionate pursuit of softball.

“In sports, confidence is key when you start out in a small town, and that serves you well when you move to a larger community like Halifax,” he told Canadian Mortgage Broker. “Hearing your name announced on the local radio shows and being identified as a good player is pretty cool when

Jonah Wright takes to the field in the distinctive blue Nova Scotia Mastodons shirt. The team won the gold medal at the Canadian Nationals in 2017.

14 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE

East Coast mortgage broker Jonah Wright applies lessons learned on the ball field to define his own brand of professional success

brokers off-the-clock

his local team decided to compete in Iowa at the World Fastpitch Championships. While they didn’t win anything that year, they were exposed to world-class ball, which led them to better understand what it would take to successfully compete at that level.

In 2014, the house league team Wright played with unexpectedly won it all at the North American Fastpitch Association tournament, finishing their final game at 2 a.m. before catching an early flight home that same morning.

His teams continued to compete at the Canadian Nationals, where they won silver in 2015, bronze in 2016, and finally a gold in 2017 in Saskatoon.

It’s the latter that reminds Wright of his favourite softball memory: “It was a 4-4 tie in the fifth inning, and we had runners on first and second. I decided that it was my respon sibility to bunt to move the runners over, as we had two of the best hitters coming up behind me. As the pitcher began his delivery, I noticed the second baseman moving toward first, and I was able to push the ball toward his vacated position,” he reminisced. “I ended up with a bunt double, driving in a run and putting us ahead for good.”

They would win that game 6-5, securing the gold medal.

Following two years of cancelled tournaments due to the COVID-19 pandemic, the Canadian Nationals were held again in Newfoundland in September 2022.

For Wright, this tournament was different because he had decided to compete at the Masters Level versus the Senior Division. Years of the constant training required for the highest Senior level had been draining and required a significant commitment. More

Contributing to his community is also important to Wright, and he regularly sponsors local sports teams. In fact, he is also a sponsor of the Peter Smith Memorial Field in Lantz, N.S., and people often send him pictures of the field’s banner with his logo on it.

Wright’s early years playing ball in Guys borough taught him the importance of giving back to his community – and these days, that always brings satisfaction and scores him a personal home run.

This interview with Jonah Wright continues our series Brokers off the Clock. In every issue, we ask a mortgage broker to tell us what they like to do when they’re not behind a desk. Be it playing or coaching sports, working with animals, travelling to exotic places or researching your family roots, we want to know how you unwind. Would you like to be profiled in a future edition – or suggest a fellow mortgage broker? Contact info@cmba-achc.ca

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 15

SUPPLIED BRITISH COLUMBIA Greg Kakuno Business Development Manager 604-430-1498 gkakuno@capitaldirect.ca ALBERTA Donna Hunter Business Development Manager 403-874-6348 dhunter@capitaldirect.ca ONTARIO Cheryl Smith Business Development Manager 905-299-1706 csmith@capitaldirect.ca Still waiting for Bank Approvals? Stress Test killing your deals? Your clients need you now, more than ever as the banks are tightening up! We offer 24 Hour turnaround on commitments – allowing you to present solutions for your clients sooner rather than later.

16 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE Residential 1st & 2nd Mortgages Differentiate yourself and get rewarded awcapital.ca Stand out from the crowd and stand up for your clients. Working with Alta West Capital provides flexible solutions to help your clients with unique circumstances and needs. We offer quick and responsive underwriting and an easy application process, which makes Alta West Capital the clear choice for alternative lending. Mortgage Brokerage License 12633 I Mortgage Admin License 12634 Up to 75% LTV Alberta, British Columbia, & Ontario Flexible terms & fast approvals Broker Loyalty Program - earn more with each funded deal

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 17 Incentive Program for applied insurance applications or annualized premium: Jessey Camara 604-761-1552 jessey@bmiadvisory.ca Rosy Jallad 778-893-0510 rosy@bmiadvisory.ca Better Life Insurance for Your Clients: $4000 Cash 50 applied applications or $110,000 annualized premium $2000 Cash 27 applied applications or $60,000 annualized premium $1000 Cash 16 applied applications or $36,000 annualized premium 5 x $500 Cash 6 applied applications = 1 ballot Fine Print: Applied insurance application is a referral that is converted by a life insurance agent to a submitted life, disability and/or critical illness insurance application. | Referrals coming from our partners must be their own application or their clients - no pooling | There will be no pro-rating of qualification re quirements for brokers who join BMI Advisory Services during the contest period.| Recipients of incentive must be in good standing with BMI Advisory Services at Dec 31, 2022 to receive the incentive. Incentives will be distributed January 2023.

LEGISLATION TO GOVERN B.C. MORTGAGE BROKERS

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

On October 4, 2022, the British Columbia government announced that the Mortgage Brokers Act (MBA), the legislation governing mortgage brokers since 1972, is being replaced with the Mortgage Services Act (MSA). Bill 29 – 2022: Mortgage Services Act contains the draft legislation and can be found at leg.bc.ca.*

The MSA is not expected to come into force earlier than late 2023 and is expected to take several years to implement. The intention is to allow suitable transition periods for registrants/licensees.

The MSA is essentially framework legislation, with many of the principles and provisions of the MBA having been carried over. Many of the salient details are to be determined by regulations and rules made by the provincial Cabinet and rules made by the regulator BC Financial Services Authority (BCFSA).

Cabinet is authorized to make regulations in various areas, including conferring additional powers and imposing additional duties and restrictions on the Superintendent of Mortgage Services (Superintendent). Notably, Cabinet is authorized to make regulations allowing individuals to provide mortgage services through a corporation of which the individual is the sole voting shareholder, the sole director and the president. It remains to be seen if and when Cabinet acts regarding this authority.

BCFSA, in addition to various specific rule-making authorizations, is authorized to make rules it considers necessary or advisable

18 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE mortgage services act

ADOBESTOCK.COM

full

to the

*The

link

legislation is: www.leg.bc.ca/parliamentary-business/legislation-debates-proceedings/42nd-parliament/3rd-session/bills/first-reading/gov29-1

respecting licensing or regulating licensees in relation to the provision of mortgage services. It is required to seek public comment and obtain ministerial consent before making, amending or repealing a rule.

BCFSA has committed to sharing information with, and seeking feedback from, CMBA-BC as things progress. Cabinet can, using its regulation-making power, make rules or repeal or amend BCFSA’s rules. If there is a conflict between a Cabinet regulation/rule and a BCFSA rule, Cabinet’s regulation/rule prevails.

Following are key highlights of the proposed legislation:

n The position of Registrar will be replaced by the position of Superintendent.

n The regime will be one of licensing rather than registration.

n There will be four levels of licences: mortgage brokerage, principal broker, mortgage broker, and mortgage lender.

n Licence holders will need to obtain authority from the Superintendent to have a trust account.

n Administrative penalties will be very much increased:

• Rules can designate that specific contraventions of the MSA are subject to administrative penalties of up to $100,000.

• Different contraventions can be subject to different amounts of penalties.

n Penalties concerning discipline orders will increase to not more than $500,000 in the case of a mortgage broker or former mortgage broker, and not more than $250,000 in any other case.

• The amount can be increased by up to the amount of the remuneration accepted by the licensee for the mortgage services that are the subject of the discipline.

n Errors and Omissions insurance will not be required by statute and instead will be left to be addressed by rules.

The government is required to, within five years of the MSA coming into force, initiate a review to determine what changes, if any, should be made.

CMBA-BC will strive to provide high-level education concerning compliance, practice and related matters as further details become available.

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 19 1-877-279-2116 info@pillarfinancial.ca www.pillarfinancial.ca FSRA Administration License #11209 FSRA Brokerage License #10119 RESIDENTIAL MORTGAGE SOLUTIONS ACROSS ONTARIO Flexible Mortgage Solutions 30+ Years of Lending Expertise Rural Mortgages Construction Financing Refinancing Self Employed Pillar Financial - Ad - Alternative Lender - 2209-v2.indd 1 2022-09-21 6:07 PM SUPPORTING FAMILIES ACROSS ONTARIO SINCE 2004 1st & 2nd Mortgages Urban, Small Center, Rural All Property Types Construction, Renovation Bridge Financing Up to 85% LTV No Lender Fee at Renewal Submit on Filogix or Velocity Up to 40yr AM or Interest Only Up to 2 Year Terms westboromic.com | westboromic

WHEN FRIENDS FALL

THE ISSUE

Your clients want to purchase a new property and would like you to arrange a mortgage for them. Together they own a half interest in a property; the other half is owned by a now ex-friend who does not want the property sold and is not co-operating. They will need their half share of the funds from the sale of that property to purchase a new property.

Are you going to simply direct them to a lawyer or are you able to prepare them as to the nature of the conversation they can expect at the lawyer’s office? Will you come across as a knowledgeable advisor? The recent case of Kainth v. Brar, 2022 BCSC 1552 provides you with assistance.

WHAT HAPPENED?

The Kainths, a husband and wife, and their friend (Brar) purchased an investment property. The Kainths and Brar each put in half of the deposit, made half of the amount of the payments, and held half of the interest in the property.

A month after the purchase, to the surprise of the Kainths, Brar and her family moved into the property. They were still living there at the time of the court hearing. The Kainths made several attempts at resolving the dif ference that arose, including sending numerous emails suggesting that Brar

20 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE legal ease

ADOBESTOCK.COM

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 21 We Make Easy Borrowing 1st, 2nd and 3rd Mortgages Loans Up To 10 Million No Minimum Beacon Score Purchase, Refinance, Construction Loans, Land Loans, Commercial Loans Purchase Refinance Equity take out Debt consolidation Stop power of sale/ foreclosure proceedings Bridge and interim financing Builder inventory loans ONTARIO LIC.# 12350 We only do business in Ontario BensonCapital.ca (647) 277-3950 bm@BensonCapital ca *more on an exception basis Financing Solutions to Seize Opportunities www.aarea.ca mail@aarea.ca 855.830.7452 Loan Administration Residential & Commercial Private Mortgages INVEST. LEND. GROW. threepointcapital.ca uDrive@threepointcapital.ca | 1.800.979.2911 With uDrive, you’re in control. As an alternative MIC mortgage lender, we focus on being a good business partner to our broker community. We work diligently to find creative solutions for your clients who don’t qualify for traditional financing. • uDrive: No Fee or Lower Rate • Residential 1st and 2nd mortgages • Fully open options available • Lending in BC, AB, MB and ON • Maximum LTV of 75% • Submissions can be made via Expert, Velocity or Lendesk NOW YOU’RE IN THE DRIVER’S SEAT. FSRA #13070

22 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE LAWRENSONWALKER.COM VANCOUVER · VICTORIA · OKANAGAN PEACE REGION · CALGARY · EDMONTON Elevating The Client Experience EQB-SFR-CMB-Half-Page-Ad-July2022-EN-V1.indd 1 2022-06-29 4:19 PM

buy them out, the property be rented to a third party and the rent be equally split, or Brar pay them half of the market rent for the property. They were met with silence or non-responses from Brar.

Unable to resolve the situation, the Kainths eventually stopped paying their share of the mortgage. Eventually the parties agreed that the property was to be sold, but Brar was effectively not co-operating in a sale completing. This caused the Kainths to bring an application to have the property sold by court order, which led to the parties consenting to a court order that required them to obtain an appraisal for the property, gave each the opportunity to buy the other’s share in the property, provided a process for selecting a realtor, and provided that the property would be listed for sale within 14 days of the parties receiving the appraisal.

The consent order did not resolve the issue. The Kainths wanted the property sold urgently, as they felt the housing market was in decline, but Brar was acting to delay the property being sold. Ultimately the Kainths applied to the court to give them sole conduct of the sale. Brar did not agree to be excluded from the sale process. She felt the sale process impacted her family (who resided at the British Columbia property) more than the Kainths (who resided in Alberta). She felt her presence at the property put her in a better position to make decisions about the sale.

Can a court grant sole conduct of the sale of a property to one or some of the owners of a property and exclude others who have an ownership interest in the property? If so, were these the right circumstances in which to do so?

JURISDICTION

In British Columbia, a court must order the sale of a property when requested to do so by owners who own half or more of the interest in the property. The court can decline to make the order if “it sees good reason to the contrary.” On ordering the sale, the court may give directions according to the B.C. Partition of Prop erty Act, section 6. The directions can, for example, include which owner is to have

conduct of selling the property. The court has authority to appoint the person who is to have conduct of sale under the B.C. Supreme Court Civil Rules, Rule 13-5(4)(a) as well.

THE TEST

Courts do not favour granting sole con duct of sale, as all owners have a profound interest in the terms of any sale.

In deciding whether to award a person sole conduct of sale, the court considers: n the willingness of the various owners to facilitate a sale;

n any inability of the parties to agree on routine aspects of the sale; and n any inability of the parties to co-operate.

Past cases have awarded sole conduct of sale:

n when the other party has caused unnecessary delay, n where the other party is not adversely affected;

n based on concerns that the other party may thwart the marketing and sale process on the basis that they live at the property; or

n where the other party would suffer merely financial or personal inconvenience.

THE OUTCOME

Brar had consistently delayed moving forward with the sale of the property and moved the sale process forward only when litigation was threatened or commenced. Delays were caused by numerous emails from the Kainths’ lawyer requesting that the sale move forward going unanswered. For example, Brar took 24 days to agree to the routine matter of approving the realtor suggested by the Kainths. This illustrated the lack of Brar’s willingness to facilitate the sale and the inability of the parties to agree on routine matters.

While the Kainths and Brar both have an interest in realizing gains from the sale, Brar’s desire may be less because the sale process would disrupt her family

Can a court grant sole conduct of the sale of a property to one or some of the owners of a property and exclude others who have an ownership interest in the property?

If so, were these the right circumstances in which to do so?

who reside at the property. A delay in the sale will result in a lower sale price in the declining market. Overall, delays in the sale generally prejudice the Kainths more than Brar.

The parties in this case are unable to co-operate. For example, Brar did not respond to the Kainths numerous emails seeking to resolve their differences with her concerning the property.

The court concluded that if Brar had the opportunity to further delay the sale of the property by not agreeing with the Kainths on certain aspects of the sale, she may delay it.

The Kainths were given sole conduct of sale. However: n the sale would be subject to the approval of the court unless the parties agreed otherwise in writing; n the Kainths were to make the process transparent to Brar, including providing Brar information and documents on her request and informing Brar of all offers to purchase; and n Brar was to be given 24 hours’ notice before the property was shown to prospective buyers.

The court concluded that this order balanced moving the sale process forward while giving some protection to Brar’s interests.

TAKEAWAY

Courts, in some circumstances, will grant sole conduct of the sale of property to a person who owns only part of the interest in the property. Generally speaking, where the owners do not get along enough to effect the sale, the court will step in to examine whether sole conduct of the sale is warranted.

A broker who wants to assist their client might consider alerting the client to the general approach and recommending the client discuss the matter with a lawyer in greater detail. While this would amount to an add-on service, many a senior broker has noted how such add-on services can be a valuable tool in building a solid client base.

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 23 legal ease

UNCONSCIONABILITY UNDER THE MICROSCOPE

Where is the line and how can you avoid crossing it?

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

THE ISSUE

Mortgage brokers often assist clients who are in financially difficult circumstances. A mortgage arranging broker might be asked to find a lender who is willing to lend in the difficult circumstances and a lender-broker might be asked to fund the mortgage themself.

Some clients will very much appreciate and understand the challenge the mortgage broker met in arranging a mortgage for them in the circumstances. Others might have short or selective memories and later think either that they could have made it through the circumstances without needlessly having taken on a too severe mortgage or that they failed to make it through the circumstances only because they took on a too severe mortgage.

24 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE unconscionability and mortgages

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 25 INTRODUCING Secured first position up to 75% LTV, variable rate Residential, Ontario Only Purchase, Refinance, Rentals and Condos No Minimum beacon No Income No TDS/GDS ROYALFLEX 1st LINE OF CREDIT Contact one of our BDMs for details: www.royalcanadianmortgage.com/contact-us UNCONSCIONABILITY ADOBESTOCK.COM

Certainly, these clients are worthy of assistance and, aside from the service aspect of providing such assistance, many mortgage brokers make a living from providing it. Mortgage brokers can better service their clients who are in financial distress without putting themselves at risk by understanding when a mortgage transaction is so severe as to be unconscionable and therefore perhaps unenforceable.

When is a mortgage unconscionable? Unfortunately, there is no exhaustive definition of unconscionability used by the court, but Vanguard Mortgage Investment Corporation v. Dietterle, 2022 BCSC 1512 provides some guidance.

WHAT HAPPENED?

An 85-year-old man with a grade six education (Dietterle) had operated a turkey farm for over 30 years. His company had contracts with large meat processing companies. He had, during his lifetime, owned about five different properties, all of which were financed with mortgages, and on two occasions had mortgaged properties to fund other endeavours. His only income was a monthly pension of $1,200 and occasional monthly rent of $500 from his daughter. He had RRSPs worth approximately $80,000; during the events discussed here, the RRSPs became exhausted. He owned a more than five-acre home located in the Agricultural Land Reserve in Surrey, British Columbia.

A neighbour convinced Dietterle to invest in a skin care business; Dietterle lost the entire $200,000 investment. That same neighbour later convinced Dietterle to enter into a joint venture to buy a property, tear down the existing home on it, subdivide it, build two new homes on it, and then sell those homes for profit. Dietterle took out a $1.3-million mortgage against his home and the property to fund the venture. That venture also failed. The development property was sold (in a way that left the neighbour open to claims from Dietterle), leaving Dietterle owing $650,000 to the lender. To recover the amount, the lender commenced foreclosure proceedings.

Dietterle obtained a further mortgage to repay the foreclosing lender. The new mortgage soon went into default. Shortly before the due date, the lender offered renewal terms but Dietterle could not afford them. Dietterle was property rich but cash poor. With the help of a mortgage

broker, he obtained an equity-only mortgage to replace the one in default. The new $1,020,000, 15-month, open mortgage was secured by the house appraised at $1,550,000. An interest reserve of $101,490 was established so he would not have to make the interestonly payments for the first 12 months. Mortgage payments were required for months 13 to 15, and the rate at the end of month 12 increased to 12 per cent per annum.

When the interest reserve ran out, Dietterle could not afford the monthly payments. He sued the neighbour for fraud and breach of fiduciary duty. He obtained about $35,000 from a default judgment.

The lender brought foreclosure proceedings and Dietterle defended by claiming that the mortgage transaction with the last lender was unconscionable according to prior court cases (that is, at common law) and violated B.C.’s Business Practices and Consumer Protection Act (BPCPA).

WHAT IS UNCONSCIONABILITY UNDER COMMON LAW?

The common law of unconscionability protects vulnerable people in the contracting process. It has two parts: n an inequality of bargaining power because of a weakness or vulnerability affecting the claiming party; and n an improvident transaction.

An inequality of bargaining power exists where one party cannot adequately protect their interests in the contracting process because of personal or situational circumstances. For example, there is an inequality of bargaining power where a weaker party might be so dependent on

unconscionability and mortgages

the stronger party that the weaker party would suffer serious consequences from not agreeing to the contract. Another example is where only one of the parties can understand and appreciate the full importance of the contract terms. Where there is an inequality of bargaining power, the normal assumptions we make about free bargaining are not true or cannot be fairly applied.

An improvident bargain is one that is an undue advantage for the stronger party or an undue disadvantage for the weaker party. Whether a bargain is improvident is determined by looking at the circumstances in which the bargaining took place.

Independent legal advice can help overcome a claim of unconscionability if it leads to overcoming the weaker party’s inability to understand the contract; however, independent legal advice does not undo a weaker party’s desperation or dependence on a stronger party.

It does not matter whether the stronger party meant to take advantage of the weaker party. A weaker party is as disadvantaged by unintentional exploitation as by intentional exploitation.

WHAT ARE THE FACTORS UNDER COMMON LAW?

A number of factors determine whether there was an inequality of bargaining power, including:

n the relative intelligence and sophistication of the borrower;

n whether the lender was aggressive in the negotiation;

n whether the borrower sought or was advised to seek legal advice; and

n whether the borrower was in circumstances that compelled them to enter the bargain.

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 27

unconscionability and mortgages

WAS THE MORTGAGE UNCONSCIONABLE UNDER COMMON LAW?

The mortgage was not unconscionable under common law.

There was no inequality of bargaining power. There is always an imbalance of power between a lender and a borrower; the borrower requires money for a purpose and the lender has it to lend. Dietterle had experience dealing with both banks and private lenders. The lender was not pursuing Dietterle as a customer; rather, Dietterle’s retained a licensed mortgage broker to obtain financing for him; and he received advice about the nature of the mortgage from a lawyer.

Even if there was inequality of bargaining power, the mortgage was fair, just and reasonable in the circumstances. Based on the risk profile of the home and Dietterle, and the private lending market at the time, the mortgage was at market rates. Dietterle understood that the mortgage was only a short-term solution that bought him time to find a way out of the mess he found himself in because of his relationship with the neighbour.

WAS THE MORTGAGE UNCONSCIONABLE UNDER BPCPA?

The concept of unconscionability under the BPCPA is essentially the same as under the common law; however under the common law it is up to the borrower to prove that the transaction was unconscionable but under the BPCPA it is up to the lender to prove that it was not.

Claims of unconscionability under the BPCPA are available only if the transaction was a “consumer transaction.” A consumer transaction concerns a mortgage that was for primarily personal, family, or household purposes. Dietterle used the mortgage proceeds from the last mortgage to refinance a business debt from his failed real estate venture with the neighbour. The fact this was a second refinancing of the business debt does not change the nature of the transaction. As a result, it does not matter that he was

refinancing his home for the purposes of the debt. It was, at its core, a business debt and not a consumer transaction, and so BPCPA does not apply.

Even if the BPCPA did apply, the mortgage was not unconscionable under it. The BPCPA sets out specific criteria that must be satisfied for the mortgage to be unconscionable, and that criteria are not satisfied.

n The lender had not subjected Dietterle to undue pressure; the pressure came from circumstances created by Dietterle’s dealings with the neighbour, of which the lender knew nothing. The lender had, after all, arranged the mortgage designed and requested by Dietterle’s mortgage broker to give Dietterle time to sell the home, refinance it, or, as he was hoping, arrange for the mortgage to be paid out by his business partner. Under the mortgage, Dietterle could take any of those steps without a penalty.

n The lender had not taken advantage of any inability or incapacity of Dietterle to reasonably protect his own interest because of a physical or mental infirmity, ignorance, illiteracy, age, or inability to understand the character, nature or language of the consumer transaction or any other matter related to the transaction. Dietterle appreciated the nature of the mortgage his broker had arranged for him and the options the mortgage created for him.

n The total price of the mortgage did not grossly exceed the total price at which

similar consumer transactions were readily obtainable by similar consumers. It was at market price for a similarly situated borrower.

n At the time the mortgage was entered into, there was reasonable probability that Dietterle would be able to repay the mortgage. During the term of the mortgage, he could have paid out the mortgage by mortgaging the, as expected, increased equity in the property. (It was reasonable to assume that in the then Lower Mainland market the price of the property would increase over the term of the mortgage.) He could have obtained payout from the neighbour of the money the neighbour owed him. He could have sold the property. He could have taken out a reverse mortgage.

n The terms or conditions entered into by Dietterle were not so harsh or adverse as to be inequitable. The transaction was in accordance with what the market would charge at the time.

RESULT

Dietterle’s difficult situation was not created for him by the lender. What he bargained for was what he got –12 months without having to pay any interest and the right to sell, redeem or refinance in those 12 months without penalty.

The mortgage is not unconscionable and is subject to the foreclosure process.

TAKEAWAYS

In summary, it is not unconscionable to lend money to a borrower who is in a difficult financial situation. It can be unconscionable to take advantage of that person’s circumstances, such as by imposing uncalled for harsh terms in the mortgage.

Brokers are encouraged to keep thorough file notes. The notes should include details as to the client’s difficult circumstances, needs, options, understanding of the choices, and instructions. They should also include any key explanations or advice the broker provided and any important factors concerning the same.

28 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE

CMB MAGAZINE CMBA-ACHC.CA FALL 2022 I 29 Providing our broker partners with competitive solutions, responsive service, and a commitment to helping them grow their businesses is what drives us. At Home Trust we… Driven by what matters most Commit with Classic alternative mortgages Empower with Equityline Visa HELOC alternative Grow with Accelerator prime programs Build with Spire partnership program Connect with LOFT broker portal Get started at hometrust.ca/partners

Alpha August Real Estate Advisory BC, ON

Alta West Mortgage Capital Corporation BC, AB, ON Antrim Investments Ltd. BC, AB, ON Armada Mortgage Corporation BC, AB, ON

BC Notaries BC

Benson Capital ON

BMI Advisory Services Ltd. BC, AB, SK, MB, ON, ATL

Canadian Mortgages Inc. National

Capital Direct BC, AB, ON, Atlantic Community Trust BC, ON

Equitable Bank National

First National Financial LP National

First Source Mortgage Corporation ON

Fisgard Asset Management Corporation BC, AB, SK, MB, ON Gentai Capital Corporation BC, AB, ON

Graysbrook Capital Ltd. NB, NL, NS, PEI

Haventree Bank BC, AB, SK, MB, ON

Home Trust Company National

IC Savings – Mortgage Broker Services ON Lanyard Financial Corporation BC

Lawrenson Walker Real Estate Appraisers BC

Mandate National Mortgage Corporation BC

Pillar Financial Services Inc. ON Premiere Mortgage BC, AB, MB

Romspen Investment National

Royal Canadian Mortgage Investment Corporation ON

Three Point Capital BC, AB, MB, ON

VWR Capital Corp. BC, AB, SK, MB, ON

Westboro Mortgage Investment Corp. ON, QC

30 I FALL 2022 CMBA-ACHC.CA CMB MAGAZINE *EACH ABOVE ENTITY IS SOLICITING BUSINESS ONLY IN THE LOCATIONS INDICATED FOR THAT ENTITY advertisers’ index

21 16 04 09 30 21 17 15 32 22 26 17 22 06 09 03 29 25 02 22 06 19 17 07 25 21 12 19 WITH YOU EVERY STEP OF THE WAY Real Estate Conveyancing Mortgages Refinances 604-676-8570 BCNA@bcnotaryassociation.ca www.bcnotaryassociation.ca 31

Offering custom solutions tailored to your clients’ needs: We’ve put more than $1 Billion in private mortgage funds in the hands of Canadian homeowners since 2015. Partner with Canada’s premier private mortgage lender We are proud to serve mortgage brokers with the industry’s most innovative and extensive private mortgage financing solutions. We lend across Canada on all types of owner occupied, rental and mixed-use residential properties. canadianlending.ca/brokers info@canadianlending.ca | (888) 465-7888 We can help with rush purchases, debt consolidation, working capital, arrears and more. 9 1st Mortgages 9 2nd & 3rd Mortgages 9 Bundle Mortgages 9 Bridge Financing 9 Equity Mortgages 9 Home Renovation Mortgages

BY CARLA GILES, EXECUTIVE DIRECTOR, CMBA-BC AND MBIBC; CO-EXECUTIVE DIRECTOR CMBA

BY CARLA GILES, EXECUTIVE DIRECTOR, CMBA-BC AND MBIBC; CO-EXECUTIVE DIRECTOR CMBA