3 minute read

LV RESEARCH - FOLLOW THE RENTS

LAS VEGAS RESEARCH

Follow the bouncing rent.

Advertisement

The onslaught of economic changes in 2020 have left property owners a bit confused – or at least the movement of asking rents suggests that this is the case. With new and often contradictory information appearing every day (or hour), what is an owner to do? Just how much rent should they be asking – or how much is their building worth?

Since I’m a researcher, and therefore a pseudo-academic, I’m not actually going to answer that question. Hey – if I don’t give you a straight answer, I can never be wrong, right? But in this article, I am going to talk a bit about the strange trajectory – or perhaps lack of trajectory – we are seeing in 2020 in rents, and show a bit of data that might point people in the right direction.

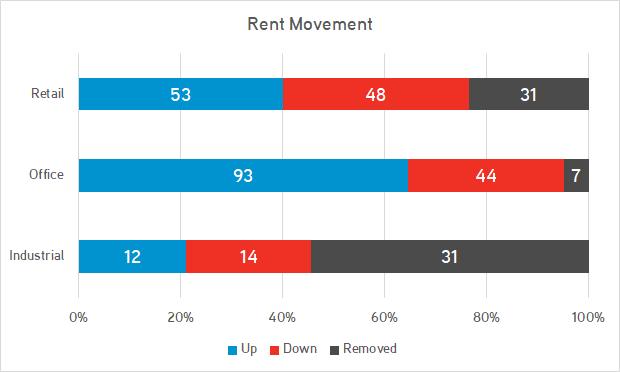

When the business closures hit in March of this year, landlords and property owners did not quite know what to do. This was not surprising, as they were lacking significant pieces of data upon which to make a sound decision, such as how long the closures would last, how badly would tenants be hurt, etc. With no solid data, the reaction was confused, to say the least. Industrial owners primarily took their asking rents off the table – ah, the allure of mystery. This was the primary action taken by landlords during the Great Recession. Approximately an equal number of industrial units had their rents raised as lowered. Office landlords were more sanguine, with more units getting an asking rent increase. Retail landlords behaved more like their industrial counterparts. The more important piece of information is not shown on the table though – roughly 93% of units saw no change at all. There is wisdom in crowds after all!

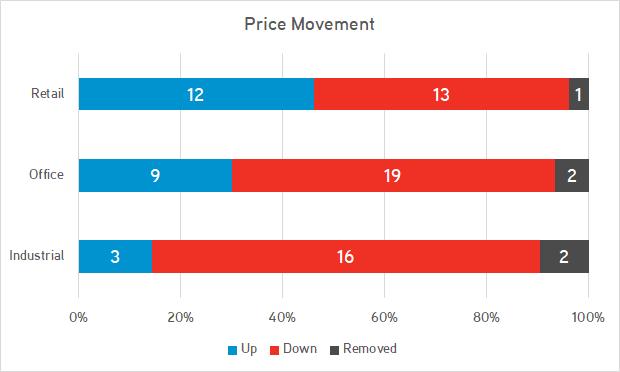

Property sellers were more realistic in my opinion. Although roughly 83 percent of properties saw no change in their asking price, of those that did, the majority saw that asking price decreased.

By the third quarter, trends were changing. First and foremost, only about 5 percent of units saw an asking rent change and only 12 percent saw a change in asking price. Clearly, owners were less worried about the future, and felt better about waiting the economic troubles out.

Of those units that did see their rent change, approximately an equal number of industrial and retail units saw rents increase versus decrease – much as in the second quarter of 2020. Office owners, on the other hand, finally got the memo, with more units seeing asking rent decrease than increase.

Sales price movement was approximately the same as in the second quarter, with most owners decreasing asking price, and retail owners splitting evenly between raising and lowering their prices. What the data doesn’t show (because it would take too long for me to compile it) is that many owners that changed their asking rent or price in the second quarter changed it back to what it had been previously in the third quarter.

The other question, of course, is who is right? Is the rents too dang high (bonus points if you get the reference) or should they go higher?

Among the bits of data I gather quarterly, I look at the difference between effective rent and asking rent on the lease comps we capture. Looking at this data, industrial and office rents appear to be in just about the right place, but effective rents are trending downward as a percent of asking rent – we will probably see asking rents decrease in these segments in the near term, though not substantially. That trend has been more exaggerated in retail rents, and thus the decreases in asking retail rents could be more substantial than in other market segments.