The Bayer family of products is powerful, especially when used together. Combined, they create an agronomic force eld around your crops, providing protection during the rst 75 days when potatoes are most susceptible to pests and diseases. Safeguard your potatoes against nature's harmful pests and diseases with the Bayer 75-Day Integrated Pest Management program. Visit BayerPotato75DayIPM.com to learn more.

PO Box 333, Roberts, Idaho 83444

Telephone: (208) 520-6461

Circulation: (503) 724-3581

PotatoCountry.com

EDITOR

Denise Keller editor@ColumbiaMediaGroup.com

OPERATIONS MANAGER, ADVERTISING

Brian Feist brian@ColumbiaMediaGroup.com

PUBLISHER, ADVERTISING

Dave Alexander dave@ColumbiaMediaGroup.com

INSECT IDENTIFICATION

Andy Jensen www.nwpotatoresearch.com

DISEASE IDENTIFICATION

Jeff Miller jeff@millerresearch.com

MARKET REPORT

Ben Eborn napmn@napmn.com

POTATO GROWERS OF WASHINGTON

Dale Lathim dale@pgw.net

EDITORIAL INFORMATION

Potato Country is interested in newsworthy material related to potato production and marketing. Contributions from all segments of the industry are welcome. Submit news releases, new product submissions, stories and photos via email to: editor@ColumbiaMediaGroup.com.

ADVERTISING SALES

For information about advertising rates, mechanics, deadlines, etc., call (208) 520-6461 or email dave@PotatoCountry.com.

SUBSCRIPTIONS

U.S. $24 per year / Canada $40 per year / Foreign $80 per year Subscriptions can be entered online at: potatocountry.com/subscribe or call (503) 724-3581. Email address changes/corrections to: brian@ColumbiaMediaGroup.com or send to

Potato Country, PO Box 333, Roberts, ID 83444.

Potato Country magazine (ISSN 0886-4780), is published eight times per year and mailed under a standard rate mailing permit at Idaho Falls, Idaho and at additional mailing offices. It is produced by:

Columbia Media Group, PO Box 333, Roberts, ID 83444

Copyright 2023. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, for any purpose without the express written permission of Columbia Media Group.

Notonly is consumer demand strong for potatoes, according to Kim Breshears, chief marketing officer with Potatoes USA, but demand for Potato Expo tickets and booths was also stout. From all accounts given by attendees and judging by the numbers, the Potato Expo, held Jan. 4-5 in Denver, was a rousing success, and maybe the best one yet.

Compared to Potato Expo 2022 in Anaheim, California, attendance was nearly double and booths sold were up by 10 percent.

Breshears, speaking at the Potato Business Summit, held right before the doors opened to Expo, reminded a standingroom-only, packed venue that potatoes are the top-selling vegetable in America and remain America’s favorite take-out dish and side dish at restaurants.

Compared to five years ago, potato sales are up 6 percent. Potato chips lead the way in sales volume, followed by fresh and then frozen spuds.

Inflation drove the price of potatoes up in the third and fourth quarters of 2022 to $2.26 per pound. In 2018-19, this price was $1.69 per pound, but Breshears stressed that potatoes remain an economical product for consumers to buy. She also said spuds are on 83 percent of restaurant menus, reinforcing and doubling-down on the “favorite” theme.

Unlike the 2022 Expo at Anaheim, every vendor we spoke with at this year’s Potato Expo was impressed. Jamie Barker with Ceres Imaging said Expo is his favorite show because decision-makers always attend.

Allen Peterson with All Star Manufacturing and Design said, “Every time I walked around, I never saw a row that didn’t have people in it.”

Jonathan Adamson with Vive Crop Protection said he had a lot of interaction with growers and customers.

“It was really fun. We had a great time,” he said.

Thomas Sitzer with Harriston-Mayo said he did quite a bit of business during Expo.

“The show was good. It was well attended by growers and vendors,” he said.

The numbers bear these comments out. A total of 1,816 people attended and 175 trade show booths were sold.

Matthew Weaver and Reinie Drygala with Intelligro said they had good traffic at their booth and made good contacts, but the second day booth traffic declined. Weaver, traveling from Mississauga, Ontario, to Denver for Expo, said a full one-day show with a reception the night before would work well for them. But Potato Expo has already been shortened, going from three days to two in 2019.

Story and photos by Dave Alexander, Publisher Potato Variety Management Institute retiring executive director Jeanne Debons (right) introduces new director Jenny Durrin to the industry.

Potato Expo opens in Denver on Jan. 4.

Reinie Drygala and Matthew Weaver, working the Intelligro booth, traveled from Ontario, Canada, for the event.

From left, Jacalynn Gumz and Rod Gumz with Gumz Farms in Endeavor, Wisc., and Amber Esmond with L&M Companies in Raleigh, N.C., visit the trade show during Potato Expo.

Chip lovers have it good at Potato Expo.

Celebrity chefs Duff Goldman (left) and Jason Morse win a boxingstyle belt for a mashed potatoes dish cooked during the “This Spud’s for You – Celebrity Chef Edition” cook-off at Potato Expo 2023.

Potato Expo opens in Denver on Jan. 4.

Reinie Drygala and Matthew Weaver, working the Intelligro booth, traveled from Ontario, Canada, for the event.

From left, Jacalynn Gumz and Rod Gumz with Gumz Farms in Endeavor, Wisc., and Amber Esmond with L&M Companies in Raleigh, N.C., visit the trade show during Potato Expo.

Chip lovers have it good at Potato Expo.

Celebrity chefs Duff Goldman (left) and Jason Morse win a boxingstyle belt for a mashed potatoes dish cooked during the “This Spud’s for You – Celebrity Chef Edition” cook-off at Potato Expo 2023.

The Expo organizing committee has always been receptive to change and to make improvements, but shortening Expo again seems unlikely, as there is just too much happening to fit it all into one day. Breakout sessions, Potato Talks and cooking demonstrations fill both days. This year, the second day featured celebrity chefs from the Food Network, and here, too, demand was strong - for seats.

Dubbed “This Spud’s for You – Celebrity Chef Edition,” spectators jammed the Potato Talks stage area, filling every seat and standing in every free spot to see celebrity chefs Duff Goldman, Jason Morse, Simon Majumdar and Potato USA’s own RJ Harvey in action. Hosted by Emmy-award winning Ted Allen from “Chopped” and “Chopped Junior,” this event found the right recipe for drawing a crowd and is likely to be repeated in some form at the next Potato Expo, Jan. 10-11, 2024, in Austin, Texas.

RJ Harvey with Potatoes USA addresses spectators at Potato Expo.

The Potato Leadership, Education, and Advancement Foundation (Potato LEAF) holds a fundraising auction at Potato Expo, assisted by Shelley Olsen, a potato grower from Othello, Wash., (above) and auctioneer Randy Mullen with the Washington Potato and Onion Association (below).

Danica Kluth (left) with Crop Vitality and Victoria Marsh with Vive Crop Protection share notes and a laugh in Denver.

RJ Harvey with Potatoes USA addresses spectators at Potato Expo.

The Potato Leadership, Education, and Advancement Foundation (Potato LEAF) holds a fundraising auction at Potato Expo, assisted by Shelley Olsen, a potato grower from Othello, Wash., (above) and auctioneer Randy Mullen with the Washington Potato and Onion Association (below).

Danica Kluth (left) with Crop Vitality and Victoria Marsh with Vive Crop Protection share notes and a laugh in Denver.

By John Klimes, Product Quality Specialist, Agri-Stor

By John Klimes, Product Quality Specialist, Agri-Stor

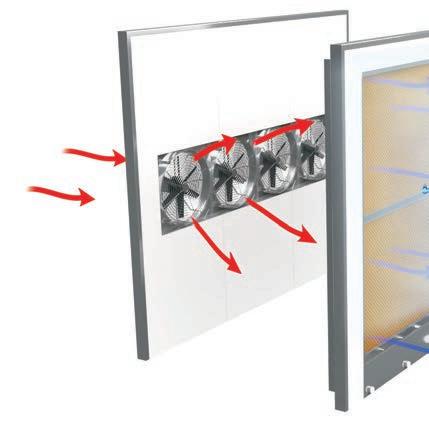

During the coldest parts of the year when high temperatures are around 20 degrees, we start to see problems with condensation over tubers in storage. This is caused by air with high humidity being pushed through the potatoes and out the top where it meets a cold surface. This cold surface causes condensation to collect.

A quick fix is to place heaters on top of the pile to warm the air, giving it the ability to hold more moisture. Also, check the thickness and quality of the insulation.

A second fix, which is more complex to understand, would be to “let the potatoes be the heater.” Slow your fan speed to allow your potatoes to heat the air 1 to 1.2 degrees as it moves through the pile. This is the delta T – the

difference in temperature between the top and bottom of the pile – we are looking for.

For example, if the set point is 48, we would want the pulp temperatures on the bottom of the pile to be 48. When the air comes out the top, we want it to be between 49 and 49.2, and the potato pulp temperature on the top would also

be 49 to 49.2. One degree increase in temperature has an enormous water holding capacity and will effectively reduce the humidity.

Do not increase fan speed or turn off the ClimaCell. If you increase the fan speed, your delta T will tighten so the

temperature at the bottom of the pile and at the top will be the same. This means that the humidity being pushed in the bottom of the pile will be equal to the humidity coming out the top. With a fraction of a degree in cooling, condensation will appear over your pile.

If you turned your ClimaCell off, turn it back on. The cell is an evaporative cooling device that maintains high humidity through evaporation. This evaporation cools the air and will maintain humidity above 95 percent. If the air enters the cell at 98 percent humidity, no additional humidity will be added. It just passes through. If you bring in fresh air that is drier, say 85 percent, water will evaporate into the air, increasing the humidity. This evaporation also causes cooling.

If your cell is turned off and fresh air enters your plenum, say 85 percent humidity, then it will find water to evaporate somewhere – the floor or the potato. Potatoes are very high in water content and the skin (in the best case) will only resist evaporation down to about 90 percent humidity. So, here’s what happens. You shut the cell off and now the air is working to increase humidity by evaporating it off of the floor and from the tubers. Because potatoes are big bags of water, the air will pull moisture out of the tubers to increase the humidity in the air so that when the air comes out the top of the pile, it will be 95 to 98 percent humidity. This will condense on your ceiling just as bad as it did before.

And it gets worse. Remember that when water evaporates, it cools. The set point was 48 and the plenum temperature is 48. Check the pulp temperatures. You will likely find that after about three days, your bottom pulp temperatures will decrease noticeably by up to a full degree, depending on the amount of evaporation. How can this be when your plenum is 48? This is due to the evaporation of the water from the tuber, also known as shrink.

Furthermore, as the air moves through the pile, evaporating water, it will continue to cool. As air cools, the water holding capacity is decreased. At some point, the air will cool to the dew point and moisture will condense out of the air, leaving water behind. Check the pulp

temperatures on the bottom and top of your pile. If the temperatures at the bottom of your pile are warmer than the temperatures at the top of your pile, you have an inverted delta T. This is all caused by the cooling effect of evaporation of water from tubers that should have taken place in the cell.

If the temperatures drop and the dew point is reached within the pile, there will be a very wet band of moisture in your pile instead of on your ceiling. Free water

in the pile is not a good thing. Adding more is worse.

If you want to dry out areas or the ceiling, allowing temperature to increase as it flows through your pile is your best bet. As air warms, its moisture holding capacity increases. A delta T of 1 to 1.2 degrees will help dramatically. Higher delta T will begin to dry out the pile. To protect product quality, we can monitor what is happening in the pile by watching the carbon dioxide (CO2) levels. If CO2 exceeds 2,000 ppm, air speed should be increased.

Dr. Jeff Miller, a plant pathologist, is the president and CEO of Miller Research, Rupert, Idaho. He can be contacted by phone: (208) 531-5124; cell: (208) 431-4420; jeff@millerresearch.com

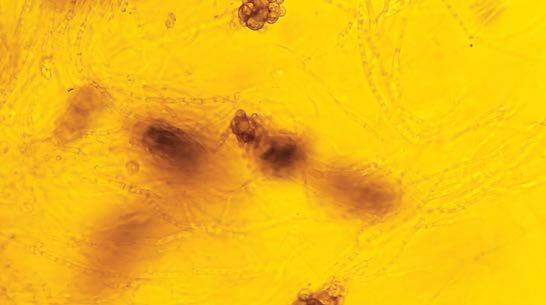

Do you know the difference between a disease and a pathogen? Below are three photos of potatoes with disease symptoms and three photos of pathogens (or at least, parts of the pathogen). Can you name the disease and match the pathogen which causes the disease?

Some hints:

Photo 1 is a picture of a structure called a sporangium. The sporangium can produce zoospores (spores which can swim in water) or germinate directly.

Photo 2 is a picture of specialized fungal cells (hyphae) which have developed dark, thick walls. These masses of cells are called microsclerotia.

Photo 3 is a picture of a cystosorus, which is a sponge-like aggregate of thick-walled resting cells. B

1 A C

2 3

By Rabecka Hendricks, Nora Olsen, Mike Thornton and Patrick Hatzenbuehler, University of Idaho

By Rabecka Hendricks, Nora Olsen, Mike Thornton and Patrick Hatzenbuehler, University of Idaho

Aprimary objective of each fresh potato packing operation is to maintain quality and minimize bruising. There are many points throughout the packing operation that could cause damage to potatoes if left unmonitored. Previous work has shown that equipment adjustments can be an effective way to lower the risk of bruise and ensure quality standards are met when potatoes reach the consumer.

To evaluate potential equipment adjustments that may be helpful to minimize bruise in a fresh pack operation, the risk of damage during several handling scenarios can be assessed using a tool called an impact recording device (IRD). This device can measure and record peak acceleration, velocity change and the number of impacts endured while it moves through various pieces of handling equipment. The IRD has been developed to mimic what a potato would experience when it travels through pieces of equipment, but one area that it hasn’t been applied is the last step potatoes take before shipping: palletization. Although IRDs are not commonly used at

this stage, researchers at the University of Idaho conducted three trials to examine how handling can influence the risk for physical damage and bruise once potatoes are packaged.

For the experiments, the IRD was used to record peak acceleration in common fresh market packaging options (boxes or bales) at four drop heights on three common warehouse surfaces: concrete, plastic slip and wooden pallet. The rule of thumb is the higher the peak acceleration sustained, the greater the risk that a potato will be bruised at that specific point on the piece of equipment. Peak acceleration is reported as g-force (1 g = 9.8 m/s2). A threshold of 100 g max force (peak acceleration) was used as an indicator of an impact that could bruise potatoes.

The experiment results showed that when boxed potatoes were dropped onto concrete or a plastic slip from heights of 6 to 30 inches, the potatoes on the bottom of the box had the highest risk of damage (greater than 100 g-force). The risk for damage was lower for potatoes in the top or middle

of the box. When drop heights were lowered, or when cushioning material was added to hard surfaces (wooden pallet), the risk for impact damage was decreased throughout the box. When stacking boxed potatoes, the risk of bruise decreased after the first layer was stacked on the pallet. High peak accelerations (over 100 g-force) were not seen in the dropped or stationary bales for any of the drop heights examined.

As fresh market potatoes are packed, there are multiple points in the packing process where potential damage can occur. Each added impact could result in a downgraded product at its destination. Even at the last step in a packing shed, boxed or baled potatoes being placed on pallets have the potential for bruise to occur.

This research clearly showed that increased cushioning for the bottom stack of potatoes during palletization in fresh pack facilities could lower the risk of bruise. Cushioned plastic slips could provide an efficient alternative to wooden pallets. Lowering drop heights to below 6 inches, especially when

University of Idaho researchers include an impact recording device (IRD) in a box of potatoes to examine how handling can influence the risk for physical damage and bruise once potatoes are packaged.

making the first layer in a palletized stack of packaged potatoes, would reduce the risk of bruise damage. These

PLANTERS

2020 Checchi Magli 4 row used, but like new

2013 Spudnik 8069 bed planter 9 units in 6 row pull Type

2010 Spudnik 8080 Pull type cup, 8 row, 36” rear steer,

2008 Spudnik 8080 Pull type cup, 8 row, 36”

2008 Lockwood 6 row pick planter 6 row 36” x 2

2004 Spudnik 8060 Cup 6 row 36”

Semi Mount

2003 Kverneland 3300 cup 6 row 34” pull hitch

PLANTER FILLER PILERS

New Logan Fill Pro Planter Filler

Telescopic 36” In Stock

2005 Double L 815 30” x 25’, 18’ swing, 3ph, Hyd.

SEED CUTTERS

Milestone 72” 230 volt 3ph

Milestone 60” 220 Volt 1ph Reconditioned

Milestone 48” 220 volt 1ph, Hyd adjust, elev. Drive, wheel drive

Better Built Model 465 3ph 60”

Better Built model 448 single phase 220 volt 48”

TREATERS

2008 Milestone 42” Barrel Duster

2008 Milestone 36” Barrel Duster

2003 Milestone 42” Barrel Duster

2005 Milestone MSLT36 36”

Liquid Treater

2002 Better Built 12” Cannon Duster

1991 Better Built CDT10- 8”

Cannon Duster

results complement ongoing education efforts for managing human and robotic handling of fresh potatoes to reduce

the risk of bruising and emphasize adjustments to ensure lower drop heights of packaged potatoes.

PILERS

New Logan Stac Pro Piler 42” In stock

2012 Spudnik model 560 36” 230 volt. 3ph remote, belt chain

2000 Wemco 36” x 49’ hydraulic variable speed, 3phase

1997 Double L 813 31” x 49’ single phase all belt w/ finger table

1994 Spudnik 550 36” BC Elev 220 volt 1ph VFD speed control, remote

1988 Double L 813 31” x 49’ 1ph belted chain

1984 Double L 813 31” x 49’ 220 Volt 1ph

SCOOPERS

New Logan Scoop Pro Hog 30” In stock

1990 Spudnik 100 24” 3ph

POTATO TRUCK

1997 Peterbilt 377 Cummins diesel, 18spd 20’ bed frame

BEDS

1999 Double L 902 bed 22’

1998 Spudnik 24’ PTO

1992 Spudnik 20’ Electric

1990 Spudnik 20’ Electric

1986 Spudik 20’ electric

1985 Logan 20B Electric 20’

CROSSOVERS/WINDROWERS

2018 Allan 6 row

2012 Lockwood 554

2010 Spudnik 6160 6 row R&L discharge

2009 Double L 951

2004 Double L 851

NOT COMPLETE LIST - CALL OR CHECK OUR NEW SITE SPUDEQUIP.COM

HARVESTERS

2018 Double L 7340 4 row

2017 Allan 3 row Electric with VFD controls

2012 Spudnik 6640 4 row

2012 Lockwood 474H 4 row

2011 Double L 973 4 row

2009 Spudnik 6400 4 row

2008 Spudnik 6200 2 row multi sep

2003 Grimme SE 75-30

2004 Double L 859 2 row 69”

2001 Spudnik 5625 2row 69”

CROP CARTS

2020 Allan AEC 35T, Scott Table

2018 Spudnik 4835

2017 Spudnik 4835

WATER DAMMERS

2019 Logan 6 row Yield Pro 36” Water Dammer

2016 AG Engineering 6 row Dammer Diker Hyd reset

2014 Logan 8 row Yield Pro 36”

folding wings Water Dammer

2004 Spudnik 9060 cultivator, bed shaper, props

1991 Age Engineering 6 row 36” Hyd reset

1985 Ag Engineering 4 row 36”

STINGERS

2015 DL 832 36” BC fingers

2014 Logan Trac Pro 30” belt

2012 Spudnik 2200 36” belt x 2

CONVEYORS TELESCOPIC

2013 Spudnik 1250 30”/36” x 60’ 3phase

Milestone 36” x 85’ 230 V 3ph Hyd steer & drive wheel

1993 STI 30” x 70’ 3ph Tel. Conv.

1989 Double L 810 Tel. conv. 30” x 50’ 3ph

CONVEYORS STRAIGHT

Double L 809’s 30” x 40’ 3ph x 6

Spudnik 1200 30” x 40’ 3ph x 4

Spudnik 1200 30” x 30’ 3ph

Spudnik 1205 30” x 30’ 3ph

Mayo 48” x 20’ side shift with 2 – Belt Stingers 30”

SIZER ONLY

2010 Milestone 60” sizing table only w/acorns quick adjust arms

1998 Spudnik Model 910 72” acorn rolls 230 volt 3phase, spring adjustable

DIRT ELIMINATOR W/ SIZER

2013 Milestone Model MSDS 96 BC Elev

Sizer clod drum split picking table

2002 Spudnik 72” DE belt elev

1997 Double 807 Dirt Elim. 62” BC 3ph Stingers 72” Sizer

1994 Milestone 72” Dirt Elim. Sizer, 2 – 24” x 12’ stingers

DIRT ELIMINATOR ONLY

2017 Milestone 96” 480 3phase

1998 Double L Model 806 BC, fingers, belt table, 2- pups 230 volt 3ph

1997 Spudnik 950 72” BC, rolls, peg belt, split picking 480 Volt

1990 Spudnik 950 72” 230 volt 3phase

ROCK/CLOD/AIR

ELIMINATORS

2013 Harriston 4240 Clod Hopper 3ph

2003 Harriston 200 Clod Hopper 3ph 480 volt Ellis table

EVEN FLOWS/ SURGE HOPPER

New Logan Surge Pro Hoppers 60” 72”

1998 Milestone 45cwt

DIRT TARE PILER

New Logan Dirt Tare Pro 30” 36”

2005 Double L Model 815 30” x 25’ Hyd swing, lift, tip

MISC.

2020 Logan Barrel Washer for little potatoes

24” x 25’ Flume with drag chain

Scooper belly dump unloader attachment

Ace 5 bottom Hyd. Reset Plow

Warehouse Evenflows: 1200 cwt, 900 cwt, 400 cwt

Greentronics Scale

Wash shed: Flumes, pumps, washer, dryer, sizer, rolling tables

After 20 years growing Montana Certified Seed Potatoes, the crew at London Hills Farm would like to thank all of their customers and vendors for their help and support over the past two decades. LHF has now decided to discontinue potato production and direct all of their efforts into growing seed grains and other crops as they continue farming in southwest Montana.

Multiple photos and video on each piece of equipment is available at

The H-2A temporary agricultural workers program may not be perfect, but it’s hard to argue that it’s not popular. The number of growers employing the program continues to grow despite its increasing costs and an ongoing push for a better system.

On Dec. 22, 2022, the U.S. Department of Labor released the Adverse Effect Wage Rate (AEWR) for 2023, which took effect on Jan. 2 (Fig. 1). The AEWR is the hourly rate for H-2A workers or those in corresponding work, defined as work done by those who are not H-2A workers but are doing the same or “like” work that is listed on an approved job order, or any agricultural work performed by H-2A workers during the period of the job order.

The average 2023 AEWR is $16.13, up from $15.56 in 2022. The top five H-2A employment states and their AEWR (nonrange occupations) increases for 2023 are:

• Florida: $14.33, up 15 percent

• California: $18.65, up 7 percent

• Georgia: $13.67, up 14 percent

• Washington: $17.97, up 3 percent

• North Carolina: $14.91, up 5 percent

The Department of Labor also recently released fiscal year 2022 certification numbers. The H-2A program saw a 17 percent increase over fiscal year 2021 in certifications.

The program continues to grow exponentially while there is still no consensus in Congress to help farmers find long-term relief from labor shortages.

The recent Farm Workforce Modernization Act did not pass the Senate, and advocates for ag labor and immigration reform had been trying to find some common ground and compromise.

Another ag labor reform bill proposed by Sen. Michael Bennett had hoped to

find bi-partisan support and did not make it in the omnibus spending bill. The Affordable and Secure Food Act would have helped year-round producers like dairy and meat processors bring in foreign workers on the H-2A program and provide a pathway to citizenship to those agricultural workers already in the U.S. Both bills have had bi-partisan support but have been unable to move forward. The failure of these bills has producers questioning if they will ever see a solution at a time when the price of inputs continues to climb and the onfarm labor shortage continues to worsen.

While many have called for reform of the current H-2A program, the program is working for an ever-increasing number of farms. Currently, there is no “cap” on H-2A visa numbers, unlike H-2B and other visa programs. The

government agencies involved in the H-2A certification and visa process have improved processing times and listened to feedback from stakeholders to make the application and certification process more user-friendly while keeping up with increasing application numbers.

Because the H-2A program is seasonal in nature, deadlines and timeliness are important. H-2A applications must be submitted to the Department of Labor 60-75 days in advance.

One of the biggest challenges is finding available and affordable housing that meets state and federal housing requirements for farmworkers, especially during the recent housing market boom. H-2A housing must pass inspection by state agencies before job order certification, which is typically 30 days before the start date of the job order or the date the employer needs the worker to begin.

Proper planning is a must to have workers arrive at the farm on time. Most farms or ag businesses that use the program use an agent or attorney to navigate the application process. According to the USDA, 21 percent use

an agriculture association, and only 15 percent of employers file their own applications (Fig. 2). The H-2A program has over 200 rules and regulations, and that number is not getting any smaller. While the program may seem daunting

and complex, having a reliable, seasonal workforce has been an important asset for U.S. farms. Finding a reliable partner and advocate to assist in the application process is a vital part of having a successful H-2A program for your farm.

agriculture.basf.us

Provysol fungicide, powered by the new Revysol fungicide active ingredient, is an isopropanol azole chemistry that provides a unique new disease management tool for potato growers.

Engineered with a flexible molecule, Provysol fungicide quickly penetrates plants for fast control. Designed specifically for low-growing plants that can be excellent hosts for diseases, Provysol fungicide can be a foundational application in a fungicide spray program, delivering early protection for long-lasting control. The isopropanol azole link in Provysol fungicide allows its active ingredient molecule to flex for better control of resistant fungal strains.

Endura fungicide features the active ingredient Boscalid, which offers growers a unique mode of action and superior control of white mold and foliar diseases, including early blight, and suppression of gray mold. It is a preventive fungicide that inhibits new growth of fungal cells while also blocking energy production in existing cells.

Benefits of Endura fungicide include long-lasting residual, resulting in less scouting, and proven and trusted chemistry.

www.bayerpotato75dayipm.com

The Bayer family of products is powerful, especially when used together. When combined, they create an agronomic force ¬field around potatoes, providing protection during the ¬first 75 days when potatoes are most susceptible to pests and diseases.

With the Bayer 75-Day Integrated Pest Management Program, growers can safeguard their potatoes against nature’s harmful pests and diseases, as well as help create a successful harvest and higher yield potential.

www.corteva.us

Bexfond is an OMRI-listed biological fungicide that allows growers to build a more well-rounded disease management program by providing root protection against many soil-borne pathogens, including Fusarium, Rhizoctonia, Verticillium and Phytophthora. Bexfond contains the active ingredient Bacillus amyloliquefaciens subspecies plantarum strain FZB42.

Once applied, Bexfond colonizes the roots, creates a “bio-barrier” and protects the roots from soil-borne diseases. As roots continue to grow following application, Bexfond will continue to colonize, helping plants stay protected throughout the growing season.

www.drexchem.com

Me-Too-Lachlor MTZ

Me-Too-Lachlor MTZ is a pre-mix of metolachlor and metribuzin that provides two effective modes of action for controlling grasses and key broadleaf weeds in potatoes, including barnyard grass, crabgrass, foxtail weeds, kochia, lambsquarters, nightshade weeds, pigweed, purslane, Russian thistle, yellow nutsedge and waterhemp.

www.jhbiotech.com/plant-products/fosphite

Fosphite is an EPA-approved, reduced-risk fungicide for year-round protection and control. A fantastic input in any integrated crop management program, Fosphite is a systematic fungicide with two modes of action. Working as a plant protectant and as a growth promoter, Fosphite prevents severe disease while supporting potato growth and yield. Fosphite protects potato production by slowing the growth of pathogens and inhibiting sporulation to prevent fungal infections. Effectively fighting off diseases while remaining gentle on crops, Fosphite has a zero-day pre-harvest interval and a four-hour re-entry interval.

www.liphatech.com

Liphatech has a long history of advancing the science of rodent management through research and product innovation. Combining advanced technology with high levels of customer service and technical support, Liphatech delivers solutions that allow growers, landowners and certified applicators to achieve cost-effective management of rodent populations. With over 50 years of combined hands-on knowledge and experience, the Liphatech ag team can provide tips and tools to manage ground squirrels, pocket gophers, rats, mice and voles.

Liphatech specializes in servicing agricultural field and animal health markets with a product line that includes FastDraw, Revolver, Rozol, Hombre, BootHill, Cannon and Renegade rodenticides, as well as Aegis tamper-resistant bait stations. Bait formulations include soft bait, treated grains, manufactured mini-blocks, bulk pellets and pellet-placepacks.

Rozol is a restricted use pesticide.

www.novasource.com/en/products/linex

Linex

Linex by NovaSource has a new presence west of the Rockies and could be growers’ solution to resistant weeds. Due to the over-use of glyphosate, triazines and other herbicides, more resistant weeds are developing. Linex, a Group 7 herbicide, provides broad-spectrum control of dozens of tough grasses and broadleaf weeds and provides a different mode of action versus ALS-inhibitor (Group 2) or triazine-based (Group 5) herbicides.

www.oroagriusa.com

ORO-RZ

ORO-RZ adjuvant improves the efficacy of soil-applied pesticides and nutrients. When tank mixed with pre-emergent herbicides, it improves soil hydraulic conductivity, even in hydroscopic soils, to move the herbicide solution into soil pore spaces to lay down a uniform barrier of herbicide protection. ORO-RZ, when applied with nutrients such as Nanocal, distributes the application uniformly throughout the soil profile, boosting efficient uptake by the root system.

www.restrain.io

Restrain is the manufacturer of a unique generator that converts ethanol into ethylene gas for the control of sprouts in potatoes and onions. Used in over 40 countries, the technology has been proven effective to control sprouts in long-term storages. The process is safe for storage managers, leaves no residue and is an effective sprout control for potatoes, onions, shallots and garlic.

Restrain also offers a seed potato treatment called Accumulator that is formulated to increase stem numbers, yield and profit. The product has recently gained an organic label in Canada, and the company is working on an organic label in the U.S.

www.syngenta.com

Potato growers will find Elatus fungicide to provide enhanced, early-season control of soil-borne diseases. The application of Elatus in-furrow at planting for the control of Rhizoctonia, black dot and silver scurf, has been shown to suppress Verticillium levels (2ee label recommendation).

Use as a management tool in combination with the use of resistant potato varieties, fertility and irrigation management (optimum phosphorus and potassium soil concentrations and avoiding water stress after flowering), crop rotation (green manure crops) and fumigation for best results.

www.vivecrop.com/products/azterknot

AZterknot

For potato growers seeking plant health benefits and proven disease control, Vive Crop Protection’s AZterknot fungicide combines a trusted strobilurin with a market-leading biological to maximize yield potential and return on investment, all while providing peace of mind. With AZterknot, potato growers are able to maximize their plant health and systemic, broad-spectrum control of key diseases with two modes of action, and the added bio-stimulant induces the plant’s natural defenses and improves stress tolerance. Plus, AZterknot contains Vive’s Allosperse Delivery technology, so it can be seamlessly mixed with liquid fertilizers, micronutrients and other crop inputs for a hassle-free infurrow or foliar application.

RUSSET VARIETIES:

Russet Norkotah S3

Russet Norkotah S8

Rocky Mountain Russet

Silverton Russet

Rio Grande Russet

Canela Russet

Mesa Russet

Mercury Russet

Fortress Russet

Crimson King

COLORED VARIETIES:

Columbine Gold

Colorado Rose

Rio Colorado

Red Luna

Purple Majesty

Masquerade

Mountain Rose

Vista Gold

Zapata Seed Company

Worley Family Farms

SLV Research Center

San Acacio Seed

Salazar Farms

Rockey Farms, LLC

Pro Seed

Price Farms Certified Seed, LLC

Palmgren Farms, LLC

Martinez Farms

La Rue Farms

H&H Farms

G&G Farms

Bothell Seed

Allied Potato

“Quality as High as our Mountains”

Researchers, extension educators and industry stakeholders are teaming up under the name Potatoes & Pests – Actionable Science Against Nematodes (PAPAS) to address industry-wide challenges in managing potato nematodes.

There are currently no russet-type varieties with resistance to potato nematodes, and the use of soil fumigants for control has become increasingly restricted, according to PAPAS.

The group will work to develop resistant commercial varieties, establish damage thresholds and decision support systems, and create new nematode control measures.

Louise-Marie Dandurand, director of the University of Idaho Potato Cyst Nematode Program, is leading the project and is joined by more than a dozen other researchers from Cornell University, Michigan State University, University of Idaho, University of Oregon, University of Wisconsin, USDA-ARS and Washington State University.

Maximizes plant health and provides systemic, broad-spectrum control of key diseases.

Added biological activates the plant’s natural defenses and improves stress tolerance.

President Joe Biden ended 2022 with the signing of the 2023 omnibus appropriations bill. The $1.65 trillion package includes funding for the National Institute of Food and Agriculture’s (NIFA) Potato Research Special Grants in the amount of $4 million, up from $2.8 million last year and the highest amount in the history of the grant program.

AZterknot trial results consistently show enhanced root and plant growth and increased disease control. 2022. Aberdeen, ID.

Better resistance management with two active ingredients (P5 + Group 11). vivecrop.com/azterknot

The Tri-State Breeding Program, comprised of Washington State University, Oregon State University and the University of Idaho, will apply for grant funding to support its efforts to develop new potato varieties in the Pacific Northwest.

Amistar® Top

AZterknot delivers long-lasting disease protection and increases crop health for maximum tuber development and ROI.

2022. Bliss, ID. Both treatments had AZteroid FC 3.3 and Viloprid FC 1.7 in-furrow.

The Idaho Potato Commission (IPC) started 2023 with two new members representing the grower and shipper industries. Daren Bitter of Bittersweet Farms and Brian Jones of Sun Valley Potatoes will each serve a three-year term. Commissioners Bryan Wada of Wada Farms and Paul Saito with McCain Foods are serving their second terms and are taking a turn as chairman and vice chairman, respectively.

The nine-member commission also includes Ron Ambrose with Four Ace Farms, Mark Darrington with Big D Farms, Mark Duncanson with Basic American, Eric Jemmett with J&S Farms and Brett Jensen with Brett Jensen Farms.

Feb. 7-9

Southern Rocky Mountain Ag Conference Ski Hi Regional Event Center Monte Vista, Colo. agconferencesrm.com

Feb. 27–March 3

2023 NPC Washington Summit Washington Marriott at Metro Center Washington D.C. nationalpotatocouncil.org

Mar. 13-15

Potatoes USA Annual Meeting

Four Seasons Hotel Denver Caitlin Roberts caitlinr@potatoesusa.com

June 6

Ag World Golf Classic Canyon Lakes Golf Course Kennewick, Wash. www.agworldgolf.com

June 8

Ag World Golf Classic

The Links at Moses Pointe Moses Lake, Wash. www.agworldgolf.com

June 27-29

NPC Summer Meeting Hyatt Regency Lake Tahoe Resort Incline Village, Nev. www.nationalpotatocouncil.org

Anew movement is happening in the potato industry: simplifying the potato genome. Growers around the country have experienced the effects of unpredictable weather, which impacts production and profitability, and consumers continually shift their wants, requiring changes from potato processors. These uncontrollable factors explain why breeding is important. The industry has a team of 11 individuals from seven institutions and USDA’s Agricultural Research Service (ARS) dedicated to increasing the likelihood of genetic improvement through a project known as Potato 2.0, along with education about diploids to increase the likelihood of grower adoption.

Genetics are largely responsible for the breeding difficulties associated with potatoes. While many crops hold two copies of chromosomes, potatoes astoundingly contain four copies, disrupting what most people know and understand about the fundamentals of genetics. The additional set of chromosomes leads to slow and meticulous breeding practices.

To simplify the breeding process, a team of researchers has been studying the genetic processes of moving from tetraploids (four chromosomes) to diploids (two chromosomes) and are making significant progress. In the first four years, the team geared up for and executed a trial with diploid potatoes to measure, evaluate and optimize the process. In the fifth and final year of the project, the team will continue to develop a breeding system that is responsive to grower and market needs while putting effort into market traits to compete with traditional tetraploid lines.

Diploid potatoes are not a novel concept. China and Europe have engaged in their own diploid potato experiments. With environmental changes, it’s universally understood that optimizing control in the breeding process must happen.

Growers will experience additional benefits from genetically simplified potatoes such as disease resistance and other quality traits. Moving from four to two chromosomes increases the probability of desired varieties and ultimately improves profitability for growers and processors. For example, genes have been identified that contribute strong, multi-strain resistance to late blight. Breeding for these genes could result in greater potential for durable late blight resistance.

While there are many reasons to be excited about the evolution of potato breeding, skepticism exists surrounding diploid potatoes. Growers have expressed fear of introducing diploids to their fields and harvesting tubers that look, feel and process strangely. However, the research team has conducted experiments with seasoned potato growers. The growers were given multiple tubers and asked to determine which tuber was the diploid variety. To the participants’ surprise, most were unable to identify the diploid. In addition to disrupting misconceptions about the appearance of diploids, the team is also interested in providing education on the consistency of growing and harvesting between tetraploids and diploids, such as not needing additional or alternative harvest equipment. Challenging misconceptions is always difficult, but this does not deter the team from making diploids a reality.

To learn more about diploids, the project and the team, scan the QR code.

We are dedicated to providing you with consistent high quality, high yielding seed that you can depend on year after year. You are always welcome to visit our farm. Let us show you what our program can do for you.

A disease is not the same thing as a pathogen. A plant disease is a malfunctioning of plant cells or tissues that result from a pathogen or environmental factor which leads to the appearance of symptoms. As a result, it is not truly correct to say that a disease spreads, but it is correct to say that pathogens spread.

Photo A is powdery scab, and it is caused by Spongospora subterranean f. sp. subterranea, the pathogen in Photo 3. This pathogen is not truly a fungus, but it is treated like a fungus for the sake of convenience. The pathogen produces cystosori (plural of cystosorus) in lesions on potato roots and tubers. It is estimated that cystosori can live in the soil for over 10 years. As a result, crop rotation is not an effective method of disease control. Chemical control is very limited and may not be cost-effective. It is best controlled by keeping the pathogen out of the field.

Photo B is pink rot caused by Phytophthora erythroseptica, the pathogen shown in Photo 1. Similar to the powdery scab pathogen, this organism is also not a true fungus. Sporangia are produced from mycelia (thread-like growth of the pathogen) or from oospores which survive in the soil. Small, swimming spores can be released from sporangia and swim toward susceptible host plant roots. The pathogen can also grow directly from this spore. Potato roots and stolons can be infected almost anytime during the growing season. Long periods of saturated soils favor the production of the sporangia and zoospores.

The plant in Photo C is showing symptoms of Verticillium wilt, caused by Verticillium dahliae. The microsclerotia of this fungus are shown in Photo 2. Microsclerotia can survive in the soil for many years. However, the longer the time between potato crops, the fewer microsclerotia will be present in the soil, thus reducing disease pressure.

U.S.and Canadian growers produced 519.9 million cwt of potatoes during 2022. That is 12 million cwt, or 2.3 percent, less than 2021 production. The U.S. potato crop accounted for all the downturn. U.S. production is estimated to be down 3.2 percent from the 2021 crop. Canada’s 2022 crop is estimated to be 0.8 percent larger than last year’s record production. Dec. 1 stocks data, for both the U.S. and Canada, highlight several challenges and opportunities for the potato industry during the remainder of the storage season. In this article, we provide a brief outline of the raw-product supply situation for the North American frozen processing industry.

USDA estimates that potato growers produced 396.89 million cwt of potatoes during 2022. That is 12.94 million cwt less than the 2021 crop, a 3.2 percent decline. It is the smallest U.S. potato crop since 2010. Growers in the 11 states that traditionally have reported potato stocks held 255 million cwt of potatoes on Dec. 1. That is 8 million cwt less than those states had in storage a year ago, a 3 percent decline. It is the smallest Dec. 1 inventory since 2013.

USDA puts Idaho’s 2022 potato crop at 120.75 million cwt. That is 11.35 million cwt less than 2021 production, an 8.6 percent downturn. Idaho’s Dec. 1 potato stocks totaled 85 million cwt. That fell 7 million cwt short of the year-earlier inventory, a 7.6 percent decline. Idaho processors used 25.80 million cwt of potatoes from the 2022 crop prior to Dec. 1. That is 1.27 million cwt less than

they used from the 2021 crop during the same period.

USDA reports that Washington growers produced 94.90 million cwt of potatoes in 2022. That is 2.98 million cwt more than the state produced in 2021, a 3.2 percent increase. Oregon’s 2022 potato crop totaled 25.31 million cwt, which is 969,000 cwt, or 3.7 percent, less than the 2021 crop. Combined OregonWashington potato stocks on Dec. 1 totaled 71.5 million cwt, according to USDA. That is 1.20 million cwt less than year-earlier holdings, a 1.7 percent decline. The Columbia Basin’s small carryover from the 2021 crop created the need for increased new-crop processing use, despite slow crop development. Processors used 36.63 million cwt of new-crop potatoes prior to Dec. 1. That is 1.71 million cwt more than they used during the same timeframe a year earlier. That may have included potatoes from outside the region.

Dec. 1 stocks in the other processing states are mixed. At 19.3 million cwt, Wisconsin’s reported Dec. 1 potato stocks fell by 500,000 cwt, 2.5 percent short of the year-earlier inventory. North Dakota had 16.5 million cwt of potatoes in storage on Dec. 1. That is 600,000 cwt less than the state held a year ago, a 3.5 percent decline. It is the second lowest inventory for this time of year since 2013. USDA reports that Maine had 15.3 million cwt of potatoes left in storage on Dec. 1. That is 1.7 million cwt more than the year-earlier inventory, a 12.5 percent increase. However, Maine’s production and stocks numbers do not seem to add up. This year’s Dec. 1 stocks are the largest reported since 1997. Minnesota had 15 million cwt of potatoes left in storage on Dec. 1. That is 2.5 million cwt more than it held a year earlier, a 20 percent increase.

U.S. processors used 64.28 million cwt of potatoes from the 2022 potato crop for purposes other than dehydration (mostly French fry production) prior to Dec. 1. That exceeded the 2021 pace by 531,000 cwt, or 0.8 percent. It followed a 23.4 percent decline reported for lateseason usage from the 2021 crop. JuneNovember disappearance in this category totaled 84.56 million cwt. That fell 5.66 million cwt, or 6.3 percent, short of June-

November 2021 usage in the category. The drop in June-November processing for uses other than dehydration suggests that French fry production got off to a slow start. If the stocks data are accurate, it will be hard for fryers to pick up the pace during the remainder of the season. French fry plants in the Pacific Northwest currently are running below capacity due to raw product constraints. Plants in other parts of the country may be running at close to capacity.

Canada’s 2022 potato crop is the largest on record. Canadian growers produced 123 million cwt of potatoes in 2022. That exceeded the 2021 crop by 956,000 cwt, or 0.8 percent. The country had 87.92 million cwt of potatoes in storage on Dec. 1. That exceeded yearearlier holdings by 462,000 cwt, a 0.5 percent increase. This year’s Dec. 1 inventory is the largest on record. All of the increase came in Alberta and Manitoba. Each of the other provinces posted reduced inventories on Dec. 1. Potatoes intended for processing saw the largest volume increase. Processing stocks rose by 1.52 million cwt, or 2.7 percent.

Alberta’s Dec. 1 potato stocks jumped 3.192 million cwt above 2021 holdings to a record 20.25 million cwt. Intended use data show that the province’s processing potato stocks rose by 2.511 million cwt to 14.769 million cwt, a 20.5 percent increase. Manitoba had 17.541 million cwt of potatoes in storage on Dec. 1. That is the largest Dec. 1 inventory since 2004. It includes 13.713 million cwt of processing potatoes. While Manitoba’s processing stocks are down 3 percent from last year, they are 10.7 percent above five-year average holdings. Ag Canada reported Quebec’s Dec. 1 inventory at 9.886 million cwt, down 846,000 cwt or 8.6 percent from last year. At 4.051 million cwt, processing stocks are down 0.7 percent from last year. New Brunswick had 11.59 million cwt of potatoes left in storage on Dec. 1. That is 1.042 million cwt less than the yearearlier inventory, an 8.3 percent decline. The province experienced a 710,000 cwt decline in its Dec. 1 processing potato inventory to 7.498 million cwt. The 8.7

percent decline leaves the province with its second lowest processing potato inventory since 2015. PEI held 22.25 million cwt of potatoes in storage on Dec. 1. That is 753,000 cwt less than yearearlier holdings, a 3.3 percent decline. PEI’s processing potato stocks exceeded the year-earlier inventory by 341,000, at 13.315 million cwt, a 2.6 percent increase. That is the island’s largest Dec. 1 processing potato inventory on record. Though total production is up in both Alberta and Manitoba, those provinces do not have sufficient raw product to keep plants running at capacity.

Processors in the Maritime Provinces and Quebec should have enough raw product to keep plants running at capacity. PEI and New Brunswick may have a surplus available for processors in other areas.

Fryers in the Pacific Northwest have been purchasing potatoes from Canada’s Atlantic Provinces to cover this year’s supply gap. Raw-product supplies available to Canadian processing plants may be limited due to grower sales to processors in the Pacific Northwest.

The raw-product supply situation for the frozen processing sector has improved slightly, relative to last year, in some areas of the U.S. and Canada. However, production fell significantly below expectations in Idaho and the Columbia Basin. Given strong domestic and export demand for French fries and other frozen products, the raw-product supplies available are inadequate for local processing plant needs. Fryers have been purchasing open-market fry-quality potatoes in Idaho and the Columbia Basin. Given the tight supply of table potatoes this year, processors are unlikely to secure enough potatoes to meet their needs. Maine and the Canadian Atlantic Provinces have some extra supplies. Processors are moving those potatoes to plants in the Pacific Northwest to cover their raw-product supply gap. The quality of this year’s potato crop appears to be much better than it was in 2021, which should improve finished product recovery rates. However, demand for finished product is outstripping the industry’s ability to cover it due to raw-product supply constraints.

By Ben Eborn, Publisher, North American Potato Market News

• North America’s 2022 potato crop is the smallest since 2013.

• U.S. Dec. 1 potato stocks totaled 255 million cwt, the smallest inventory since 2013.

• Canada’s Dec. 1 potato stocks were the largest on record at 87.9 million cwt.

• The raw-product supply situation has improved somewhat in parts of the U.S. and Canada.

• Processors in the Pacific Northwest have been supplementing local raw-product supplies with potatoes from Maine and the Canadian Atlantic Provinces.

• Demand for finished product will likely exceed the industry’s ability to cover it for at least the next eight months.

or to subscribe to North American Potato Market News (published 48 times per year), write or call: P.O. Box 176, Paris, ID 83261; (208) 525-8397; or email napmn@napmn.com.

Editor’s note:

ometimes breaking down scenarios to their simplest form seems ridiculous and silly, yet it can be very important in reminding everyone of why and how things are done.

The past year has been very trying for us at Potato Growers of Washington (PGW). We have gone out of our way to try to serve and meet the needs of growers economically by negotiating a reasonable contract price that works for both growers and processors. As I have mentioned in previous columns, both sides must remain economically viable for our industry to succeed due to the symbiotic relationship between growers and processors.

SIn simple terms, processors have hundreds of millions of dollars invested in each manufacturing plant that can essentially only be used to make frozen potato products. Thus, without potatoes and the growers that grow them, the investment in those manufacturing facilities is worthless. Conversely, major growers have tens of millions of dollars invested in specialized potato equipment and storages that can essentially only be used to grow potatoes. Since there are no other major markets to replace the approximately 150,000 acres of process potatoes grown in the Columbia Basin, contract potato growers need the processors to buy their potatoes, or their investment in specialized potato equipment and storages is also worthless.

With that in mind, we start out each year with the idea that both sides need to reach a reasonable agreement on the contract price and terms. This gets rather tricky because “reasonable” is a relative term and means different things to different people. Right or wrong, our definition of this standard is that it is a reasonable price if a normal yield and normal quality both are average, more than 75 percent of the volume of potatoes grown return the growers more than our targeted rate of return above the cost to grow. Over the past 30 years, I feel very strongly that we have done an excellent job of meeting that standard.

are able to parlay their buying power and other aspects of their business model into lower costs that for some potato varieties and delivery types are approaching $2,000/acre less than some other growers are experiencing.

As an industry, we cannot price our contracts to the point that every grower exceeds our targeted profit levels. If we did, we would price our processors out of their markets, and sales would be declining instead of increasing, which is allowing us to keep up with the rising costs.

As I mentioned earlier in this column, we target the contract price to meet profit levels when a grower receives an average yield and quality. So, what happens when we have years like the last two that are off on both yield and quality? We would expect that far fewer growers would be hitting our profit targets but hope that most can still eke out a profit of some size. What this does for growers is that those years get added into the quality average. We use a five-year rolling average for yield and quality on a weighted average basis for each variety and delivery type. Having two high yielding and quality years coming off the five-year average to be replaced by the past two will bring down the averages for at least the next four years.

Nutri-Cal ..................................19

Oro-Agri ..................................32

Rivers

Schutter

Skone Irrigation .......................28

SpudEquip.com .......................15

Stukenholtz .............................29

Teton West ..............................31

The Potato Podcast

Sponsored by Vive ..................31

Titan ........................................23

TKI .............................................5

Verbruggen..............................25

Vive

It gets even trickier when we try to balance different size operations and consider the different dynamics of each farm. There has been an immense amount of scrutiny on the cost of production these past two years as growers have been experiencing hyperinflation on nearly all fronts. Part of that scrutiny has led us to dig deeper than ever on cost and get information from more growers than ever, as the disparity between the most efficient grower and the least efficient grower has grown exponentially over these two years. Consequently, some growers feel the approximately 20 percent increase in contract price we have received each of the past two years is not nearly enough, as they believe their costs are up another 15-20 percent above what the contracts have increased. Are they wrong in how they are looking at costs? Not at all, but neither are the ones who

As the averages reflect these two crops, the average quality and yield needed to hit the profit targets should be far more achievable for all growers going forward, and those growers at the top end of the yield and quality charts should be doing even better going forward. Is this immediate makeup for the reduced revenue from the 2021 and 2022 crops? No, but over the next four years, it should more than make up for it if we return to our normal growing conditions.

Hopefully, you can see a little more clearly how we approach contract negotiations. I encourage anyone who thinks that more could or should have been achieved in the negotiations the past two years to step up and be part of next year’s contract negotiations. Taking the needs of all growers and the industry to heart when making decisions is a lot more complicated than most people think. We would welcome your input as the year unfolds, and everyone at PGW hopes 2023 is a far better year for all potato growers.