n Potato psyllid

n Colorado potato beetle

n Worms (loopers, armyworms)

n Thrips

Insecticide applications may target a single pest, but other pests likely reside in your elds. With Delegate® WG insecticide with Jemvelva™ active, you can control multiple pests at once, including Colorado potato beetle, potato psyllid, worms (loopers, armyworms) and thrips.

As a member of the spinosyn class of chemistry (IRAC Group 5), Delegate WG controls pests like no other class of chemistry used in potatoes. Yet, Delegate has low impact on populations of key bene cial insects and will not lead to secondary pest outbreaks.

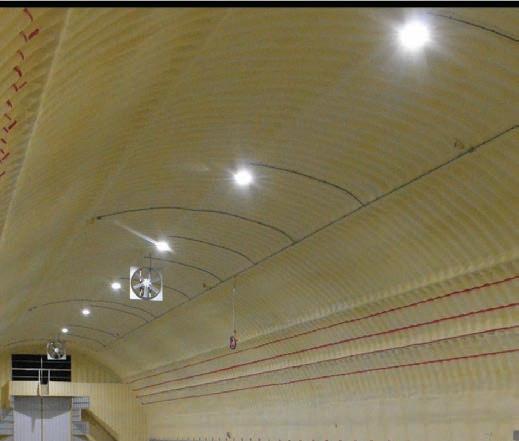

The Potato Decision Aid System (Potato DAS) is an innovative online platform designed to help Columbia Basin growers manage insect pests and related pathogens. The system features tools to facilitate risk assessment, time pest monitoring and management activities, and select effective insecticide products. Setting up an account on the Potato DAS is easy and free of cost. All that is required is your name, email address and zip code.

Users of the Potato DAS should link at least one weather station to their account. This step unlocks the functionality of weather-dependent models for site-specific pest development prediction. To do this, simply navigate to the “Add Stations” option on the sidebar,

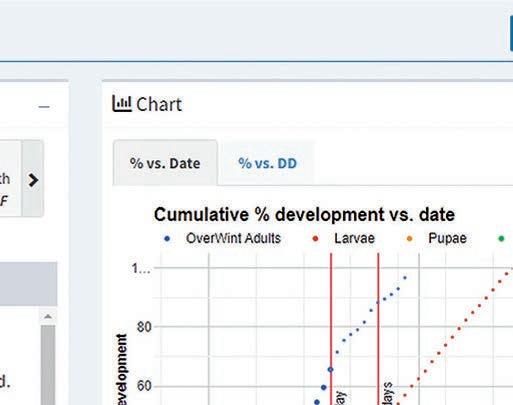

In this phenology model, 50 percent of the larvae are expected to hatch by June 5. This is the recommended stage to treat Colorado potato beetles. where there are lots of weather stations to choose from.

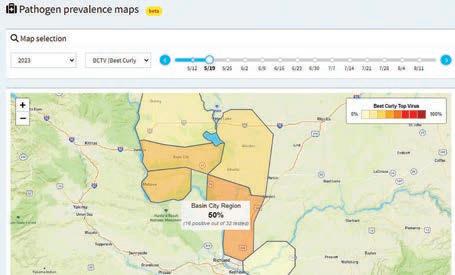

disease. This data is spatially exhibited on the Potato DAS as pathogen prevalence maps.

The Potato DAS features contour maps, commonly known as “heat maps,” that visually represent the pest population data that is gathered weekly from WSU Extension’s areawide pest monitoring network. These maps serve as an aid in risk assessment and determining the necessity of pest management measures, particularly for pests that can be difficult to scout. Maps are provided for aphid, beet leafhopper, lygus bug, potato psyllid and potato tuberworm.

A subset of the beet leafhoppers collected from the monitoring network is tested for pathogens, including the BLTVA phytoplasma that causes purple top

The Potato DAS also features temperature-based phenology models that forecast and track the emergence of different insect life stages, using data from your selected weather stations. These phenology models are useful in identifying the time to begin scouting for a pest, and they can help you schedule insecticide applications by predicting when the most susceptible life stages will be present in the field. Currently, the Potato DAS includes phenology models for Colorado potato beetle and potato psyllid, and more models will be added soon.

Text or email alerts can be set up to

notify you when a pest life stage reaches a management threshold. You can choose which pests are most relevant to you and how many days in advance of the peak you would like to receive an alert.

A “time machine” feature included with the phenology models allows you to view pest development charts from the past; the clock can be rolled back up to five years. You can also rewind the pest contour maps and pathogen prevalence maps. This functionality helps you follow the trajectory of pest development in the current season. Or it can be used for a historical perspective on pest development in your part of the region. It’s useful for identifying patterns and preparing for future pest management.

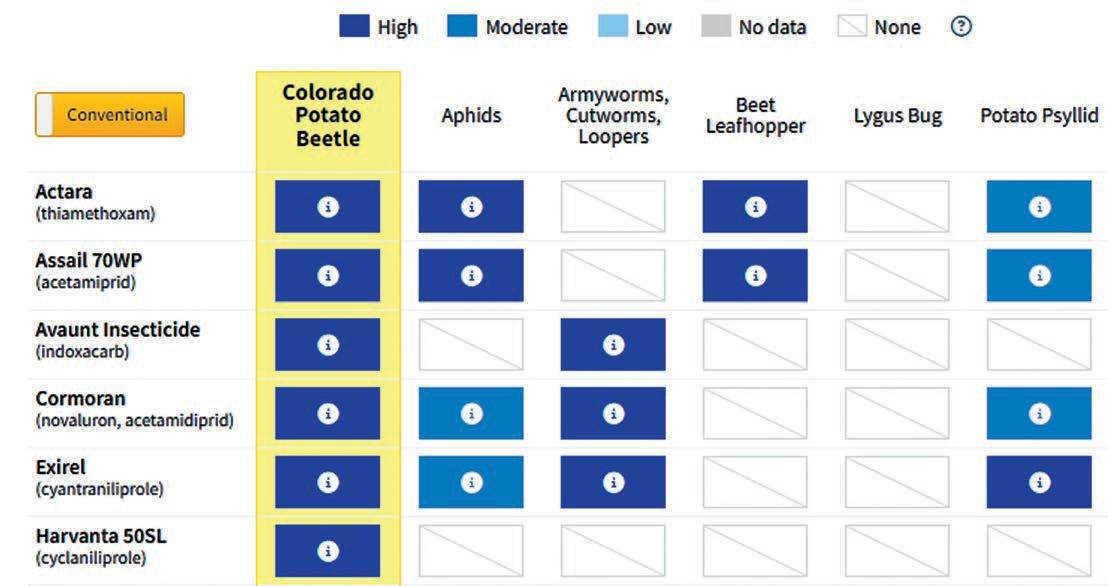

The spray selection tool provides a comprehensive list of approved pesticide products for a chosen pest, ranked by efficacy, along with other pests that may be affected by the same application. This tool is particularly useful when you want to target more than one pest with a single application. There are 10 pests in the selector. By toggling the Conventional/Organic switch, you can filter products by type of management. Information about each product and its recommended usage for each pest can be accessed by clicking on the blue boxes in the spray selector output.

The spray selection tool includes links to our new Potato Crop Protection

Guide, which is the pesticide database that operates behind the tool. The Potato Crop Protection Guide offers three ways to explore pesticide products. First, you can review them by crop stage to understand the appropriate application timing for each product. Alternatively, you can select a pesticide for information about product usage and the pests it targets. Lastly, you can choose a pest for information about the pest and the products that will control it.

Potato Decision Aid System: potatoes.decisionaid.systems

Potato Crop Protection Guide: cpg.potatoes.wsu.edu

Questions or suggestions: Email the Potato DAS team at potatoes.das@wsu.edu

will be a very challenging year for potato growers in Colorado’s San Luis Valley. Besides the normal risks of producing a potato crop, there are three daunting challenges facing them this season: market prices, Potato virus Y and irrigation water supplies.

What a difference a year makes! Last year, potato growers experienced some of the best potato prices ever. Today, prices are down 57 percent with growers barely breaking even. U.S. growers planted an additional 48,000 acres in 2023 – 35,000 acres in Idaho alone – and most regions had good yields for the

first time in three years. This resulted in approximately a 10 percent increase in potato supplies for 2024 and crashed prices. On Feb. 1, national fresh potato stocks were up 12 percent compared to 2022. This was the largest February supply inventory since 2001. This is bad news for prices, and this large inventory will carry over into the 2024 new crop harvest.

It is particularly difficult for San Luis Valley potato growers because our production is primarily for the fresh market, where there is less contract pricing than process growers have. One of our inherent advantages has traditionally been our lower cost of production compared to most of the country. This advantage is eroding because of increasing irrigation water costs as we adapt to a drier and warmer climate and work to maintain our irrigation water supplies. The 2024 outlook is tough at best unless growers plant fewer acres to balance supply and demand this season.

Keeping the potato crop healthy is the top priority for growers. A critical input, maybe the most important input, is the seed that grows the plant. In the San Luis Valley, potato growers have traditionally purchased high quality certified seed to plant and retained a portion of their crop at harvest to plant the following year. Historically, because the local growing environment did not have high levels of disease pressure, this worked well and saved growers money compared to other areas where planting certified seed every year is the standard practice.

But now San Luis Valley potato growers are facing an epidemic of Potato virus Y. PVY is important because it causes economic damage to the crop by reducing yields, affecting the size profile of tubers and may cause necrotic blemishes to tubers, preventing them from being marketable. PVY is seed borne, making it particularly hard to control unless you can plant certified

seed with very low levels of PVY. Over the last decade, PVY levels within the San Luis Valley have escalated out of control. Producing high quality certified seed has become very difficult and has resulted in a very tight seed supply for growers.

PVY is a problem worldwide. A 2014 research study in Idaho determined that PVY was costing growers $19.5 million annually, and this spring Wisconsin potato growers are struggling to purchase crop insurance for a portion of their potential crop due to a shortage of certified seed caused by high levels of PVY. Colorado State University research has confirmed that PVY is costing our growers economically by reducing yields and quality, but we do not know the total value being lost by valley growers. Valley growers are debating how to address this problem. Attempting to solve the issue with the least economic and regulatory impact possible is very challenging. It will require creative ideas and cooperation as we continue to work on potential solutions.

Today, the Rio Grande Basin snowpack is hovering in the 100 percent of average range because of recent snowstorms. Our unconfined irrigation aquifer level is nearly 600,000 acre-feet below the minimum sustainability target set by the Colorado state water engineer. There is a threat that if this target is not met, irrigation pumping will be curtailed in some manner. The clock is ticking toward the deadline to meet this sustainability target. Very hard decisions are coming fast for our growers who have already reduced pumping by 30 percent from pre-2002 levels.

I am confident that these challenges will be met. Farmers are some of the most resilient and toughest people on Earth, and the San Luis Valley has some of the best and most progressive farmers you will ever meet. No one ever said farming is easy.

Dr. Jeff Miller, a plant pathologist, is the president and CEO of Miller Research, Rupert, Idaho. He can be contacted by phone: (208) 531-5124; cell: (208) 431-4420; jeff@millerresearch.com

Some bacteria are called “pectolytic” bacteria. These bacteria are able to break down pectin, which is present in potato cells. For those that attack potatoes, these types of bacteria used to be known as Erwinia species. Now they are called Pectobacterium and Dickeya species. Three diseases caused by these bacteria are blackleg, aerial stem rot and tuber soft rot.

Can you identify which symptoms are typical of blackleg and which are typical of aerial stem rot? A B D C

agri-stor.com/crop-protection/

Agri-Stor Company’s storage disinfecting and crop protection solutions address seed, process and fresh market growers’ needs for superior product quality. Multiple modes of application are available, including cold and thermal fogging, AANE and misting. Solutions include peracetic acid (PAA), chlorine dioxide and other effective options to protect storage and crops against various diseases and micro-organisms.

greentronics.com

Greentronics offers an easy and accurate method for tracking loads and weights by date, field, variety, temperature and cellar. New features added to Greentronics’ RiteWeight in-line conveyor scale are designed to automate harvest and storage data recording. Data are uploaded via an Android phone or tablet to the Greentronics cloud server for processing and reporting in near real-time. Maps and reports can be viewed, downloaded, shared or printed from anywhere. A range of reports detail how much crop is stored and where it was grown. 2-D maps show where crop is stored by date, field and variety. By including a crop temperature sensor with the scale, maps will provide a temperature profile for each cellar. Maps allow growers to easily complete traceability reports. Harvest and storage progress can be monitored remotely. Reports show inventory levels.

lockwoodmfg.com

Lockwood’s new 774 Harvester is designed with today’s higher-level harvesting capacities in mind. The Lockwood 774 Harvester handles more volume by incorporating a wider rear cross and side elevator with numerous cleaning table options. Plus, the higher capacity full swing boom makes truck loading more efficient. The dual Lockwood high-efficiency fans increase airflow using less power. Lockwood’s 774 Harvester boasts excellent visibility for the operator along with a 10-inch touchscreen control system with joystick control. Optional wheel drive and vine choppers can be added to complete the system. Take harvesting to the next level and save time and money with the Lockwood 774 Harvester.

loganpotato.com

The 2024 Logan Evenflow Tub offers a number of new upgrades with innovative designs for metering a consistent, continuous flow to downstream planting or post-harvest equipment.

The 54-inch elevating conveyor and 36-inch to 72-inch discharge belt sizes offer a large range of throughputs while utilizing new features like efficient electric drives for conveyors and externally mounted carry-up and carryback rollers for easy replacement. The machine has many options for customizing to each operation and is designed heavy for long-lasting use; Logan didn’t spare the iron on this one. For growers looking for a high quality machine priced very competitively, the Logan Evenflow Tub is the answer.

Listen on:

ThePotatoPodcast.com

Sponsored by:

Telescoping Surge Hopper

The Mayo Telescoping Surge Hopper is ideal for harvest trucks to unload quickly and return to the field. The feature that stands out is the telescoping section. With sensor control, this keeps the loading and discharge operating continuously without any downtime between trucks. The wide live bottom belt provides even flow with no dirt buildup and full-width discharge. This is a gentle, steady unloading system for potatoes. Options include standard or telescoping feed stingers.

Trinity Trailer Mfg.

trinitytrailer.com

Eagle Bridge

When it comes to transportation from the field to the freeway, growers need a belt trailer that can haul and unload products gently. For 50 years, the long-lasting Eagle Bridge has delivered agricultural commodities safely and efficiently.

Western Trailers

westerntrailer.com

Since 1969, Western Trailers’ guiding philosophy of “lightweight pays” has been enhancing the company’s reputation, built on quality, innovation and service. With a focus on versatility, durability and strength, the company’s trailer models help to tackle any job. The trailers are built and improved through ongoing product specifications, performance data and, most importantly, input from valued customers. Let Western Trailers show you how lightweight pays.

This material is provided courtesy of Andy Jensen, Ph.D., Manager of the Northwest Potato Research Consortium. For more information, visit www.nwpotatoresearch.com.

Spring is an important time to get out in the field and see what insects are present, both pest and beneficial. Some insects commonly rest on tops of leaves and can be easily detected and assessed by simply walking slowly and carefully through the crop. Below are two such insects.

1. What is each insect?

Answers Page 25

2. What is it about their biology that makes them important to potato production? B A

U.S.potato growers and allied partners from across the country recently united as an industry to fulfill the National Potato Council’s (NPC) mission of “Standing Up for Potatoes on Capitol Hill.” The 2024 Washington Summit, held Feb. 26 – March 1, provided a forum for potato industry members to discuss, define and advocate for the policy priorities impacting their businesses and protecting their ability to farm.

Agenda items included a discussion on nutrition policy, including the ongoing efforts to craft the 2025 Dietary Guidelines for Americans. A keynote speaker provided analysis of the issues, trends and events that are shaping today’s political environment with special emphasis on the 2024 general election.

And a representative from the EPA Office of Pesticide Programs gave a briefing on the implementation of the agency’s Endangered Species Act work plan.

Several members of Congress joined the group to address their priorities and hear from attendees on their policy concerns.

The meeting also included a presentation of the NPC’s new economic report, “The Current and Potential Impact of Expanded Potato Exports.” The report assessed the economic contribution of U.S. potato and potato product exports and analyzed the impact of expanded trade opportunities.

The report, authored by economists at Michigan State University, found that U.S. potato and potato product exports generate around $4.78 billion

in economic activity and support nearly 34,000 U.S. jobs. In addition, moderate and achievable expansions in trade access to new and existing trade partners, including Canada, Japan, Mexico, South Korea, and other East Asian and Middle Eastern countries, would generate an additional $1 billion in economic activity and support 5,600 more U.S. jobs.

The Washington Summit marked the end of RJ Andrus’ term as NPC president, as he passed the gavel to Bob Mattive, who will serve as the 2024 NPC president. Mattive has been part of Worley Family Farms, a five-generation family farm in Monte Vista, Colorado, since 1982. The farm grows 1,800-1,900 acres of potatoes and 2,000 acres of other crops.

Alexis Taylor, USDA’s undersecretary for trade and foreign agricultural affairs, explains

NPC CEO Kam Quarles how her team is working to promote U.S. agricultural exports and increase market access.

For 50 years, the self-unloading EAGLEBRIDGE® has delivered potatoes and other agricultural commodities safely and efficiently. From custom belt trailers, to Service and Parts, Pre-Owned Equipment, Rentals, and top-tier financing* on all equipment types, Trinity provides the complete solution.

While you may still be planting or tending to new plants, harvest will be here before you know it. That’s why we put Harvest Essentials in this late spring issue (see page 10), and it’s also why we gathered harvest photos from the photo archives of Potato Country for this issue’s 40th anniversary celebration.

None of the harvest equipment pictured here is GPS-enabled, nor does it operate on its own or provide yield data, but it did the work it was meant to do. These machines are probably all retired now, many set out to an unused corner, reminding us of a simpler time. We’re hoping this nostalgic look at equipment, working in its prime, brings you fond memories, or possibly relief that you have better technology today.

If you have an old photo that you think would make a good addition to an upcoming 40th anniversary issue of Potato Country, please email it to editor@columbiamediagroup.com.

June 4

Ag World Golf Classic

Canyon Lakes Golf Course

Kennewick, Wash.

www.agworldgolf.com

June 6

Ag World Golf Classic

The Links at Moses Pointe

Moses Lake, Wash.

www.agworldgolf.com

June 9-11

Washington Potato and Onion Association

Summer Convention

Icicle Village Resort

Leavenworth, Wash.

www.wapotatoonion.com

June 23-26

World Potato Congress

Adelaide Convention Centre

Adelaide, Australia

www.potatocongress.org

June 24-28

NPC Summer Meeting

The Elizabeth Hotel

Fort Collins, Colo.

www.nationalpotatocouncil.org

June 26

OSU Potato Field Day

OSU HAREC

Hermiston, Ore.

Sagar Sathuvalli, (541) 223-1699

June 27

WSU Potato Field Day

WSU Othello Research Unit

Othello, Wash.

Mark Pavek, (509) 335-6861 or mjpavek@wsu.edu

July 21-25

Potato Association of America Annual Meeting

Portland, Ore.

www.potatoassociation.org

Aug. 5-7

Potatoes USA Summer Meeting

Westin Bayshore

Vancouver, BC, Canada

Caitlin Roberts

caitlinr@potatoesusa.com

Last fall, Potatoes USA hosted our inaugural culinary medicine immersion for health professionals. We invited doctors, nurse practitioners, dietitians and chefs to the Spud Lab (test kitchen) in Denver to explore potato nutrition and scientific research – all through the lens of culinary medicine.

You may be thinking: that sounds great, but what’s culinary medicine? Culinary medicine is an exciting field, blending the art of food and cooking with the science of medicine. Its objective is to help people reach good personal health decisions about accessing and eating high quality meals that help prevent and treat disease and restore wellbeing. Culinary medicine is a cornerstone of the burgeoning “Food as Medicine” movement, which aligns healthcare with food, nutrition and cooking.

Culinary medicine matters because what we eat is critical to our overall health. Evidence consistently shows that a healthy dietary pattern is associated with beneficial health outcomes in conditions including cardiovascular disease, diabetes and certain types of cancer. According to the 2020 Dietary Guidelines for Americans, core components of a healthy dietary pattern include fruits and vegetables of all types.

Unfortunately, we don’t eat enough of them. And it’s killing us.

In the United States, only one in 10 adults gets the recommended amount of vegetables and fruits. On a global scale, an estimated 3.9 million deaths were attributable to inadequate vegetable and fruit consumption in 2017 alone.

The solution to this massive challenge is to get more people to eat more vegetables, fruits and other nutritious foods – and that’s where culinary medicine comes in.

Culinary medicine comes to life in many ways. Medically tailored meals and groceries are designed to meet the needs of people with specific health conditions like heart disease and diabetes. Produce prescription programs allow healthcare providers to prescribe fruits and vegetables directly to patients. Medical nutrition education helps give healthcare providers the knowledge and tools they need to engage patients on nutrition and eating effectively. This is particularly important because doctors are on the front lines with patients, but they only receive about an hour per year of nutrition instruction in medical school, leaving them underprepared to give appropriate guidance.

Culinary medicine has the significant potential to improve health outcomes and economics for Americans. For example, preliminary research suggests that implementing medically tailored meals nationwide for patients with diet-sensitive conditions could be associated with 1.6 million averted hospitalizations each year and annual savings of $13.6 billion.

With the scale of these potential impacts, it’s no surprise that there’s a growing public interest in this topic. The government and other private, public and nonprofit institutions have committed more than $8 billion to fund initiatives that aim to end hunger and reduce diet-related diseases like diabetes, obesity and hypertension by 2030. Food as Medicine and culinary medicine are a significant focus of these efforts.

At Potatoes USA, we’re using this opportunity to position potatoes as an affordable, versatile and familiar vegetable in healthy eating patterns that can help achieve the goals of culinary medicine.

For example, at a fall culinary medicine immersion hosted

at Potatoes USA, we helped health professionals learn about potato nutrition, potatoes’ place in the vegetable group, and how potatoes fit into conversations with patients of diverse backgrounds and various health conditions. Participants also got into the kitchen with Potatoes USA chefs who shared practical ways to include potato preparation discussions in their healthcare practices, empowering them to guide their patients toward healthier choices.

Potatoes USA is planning another culinary medicine immersion in the spring and several other tactics to ensure potatoes have a prominent place in this exciting movement. To boost these efforts, Potatoes USA’s nutrition and culinary team is studying to be Certified Culinary Medicine Specialists, meaning we can lead training for other health professionals. We’re also building culinary medicine website content that will provide resources for health professionals to provide to their patients. We’re proud to be part of the culinary medicine movement helping Americans achieve good health by eating good food – including the wholesome potato.

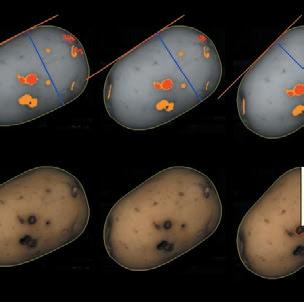

You want the best of both worlds. Speed to deliver maximum capacity and accurate defect detection to maintain consistent quality. Inspect the entire surface and look inside each potato to get the best out of every batch.

As someone with a master’s degree in nutrition and 25 years in food policy, I’ve participated in the Dietary Guidelines for Americans (DGA) process since it began and now work with the potato industry as a food policy advisor. Over those two and a half decades, the process by which the national nutrition recommendations are developed has evolved – and rightfully so. Every year, we gain more knowledge into how diet impacts overall health, which is why the DGAs are updated. However, what is of particular interest to some of us longtime participants is how this committee will thread the needle of addressing

PILERS

1998 Double L 831 36” x 49’ belted chain 3ph

2004 Milestone 36”x 49’ 3ph All belt

2000 Wemco 36”

more subjective issues such as cultural preferences with scientifically based research on nutrients needs and healthy eating patterns.

The DGAs have long served as the cornerstone of federal nutrition recommendations, mandated by Congress “based on the preponderance of the scientific and medical knowledge which is current at the time the report is prepared.” However, the current process is seemingly injecting more ambiguous metrics into the decision making. For example, because some cultures may prefer rice with their dinner meal and

COLLECTORS & STINGERS/PUPS

bed

1998 Volvo 13spd cummins 400hp Tri Drive, Spudnik 22’ Bed

BULK BEDS/BOXES/ SELF UNLOADING

1996 Spudnik 2100 Combo 20’

1982 Logan 20B Electric 20’

1983 Logan 20B Electric 20’

1990 Spudnik 2100 26’

CROSSOVERS/WINDROWERS

2023 Double L 6540 34” bed 4 row

2014 Double L 6560 36” 6 row

2009 Double L 951 34” bed 4row

1996 Double L 851 36” bed 4 row

2019 Spudnik 6140 32” rows R&L discharge

HARVESTERS

2023 Double L 7040 Legend 34” bed 4 row

2020 Double L 973 36” bed 4 row

2019 Double L 953 Std Bed 4 row

2018 Double L 7340 36” bed 4 row

2002 Double L 873 36” bed 4 row

2012 Lockwood 474H 4 row

2001 Spudnik 5625 36” bed 2 row

other groups prefer potatoes, there is a question as to whether those should be interchangeable.

The origin of the definition of Staple Carbohydrate is unclear.

Specific to potatoes, this move toward more subjective goals raises many questions. The government’s panel of experts, the Dietary Guidelines Advisory Committee (DGAC), is proposing a new approach by introducing a grouping of foods known as the Staple Carbohydrate Group, which encompasses only certain carbohydrates. The stated purpose for combining this limited group of carbohydrates (grains, starchy red and orange vegetables, starchy vegetables,

DIRT ELIMINATOR W/SIZER

PLANTERS

2019 Spudnik 1600 Collector 60” belt, 1-42”, 2-36” stinger/pups

2015 Logan Collect Pro Cart 48” belted chain, dirt belts, 2 -30” Logan belt stinger/pups

2012 Logan LTS 30/36/5’ Tel Stinger 230 V 3ph

2007 Double L 833 30” Belt Chain only

2015 Double L 832 36” BC with fingers

2013 Logan STGT 36” Telescopic 230 V 3ph

CONVEYORS TELESCOPIC

1998 Double L 820 30” x 60’ 480 Volt 3ph

1998 Double L 820 30” x 60’ 480 Volt 3ph

2013 Milestone 42”/48” x 100’ 480 Volt 3ph

Milestone 30”/36” x 60’ Tel. Conv. 480 volt 3ph

Tri Steel Mfg 30”/36” x 60’ 220 Volt 1ph

1996 STI 30” x 70’ 480 volt 3ph

CONVEYORS STRAIGHT

10- 1998 Double L 809 30” x 38’ 480 Volt 3ph

Spudnik Model 1200 30” x 12’ 230 Volt 3ph

Spudnik Model 1205 30” x 40’ 3ph x 5

SIZER ONLY

2017 Milestone 48” 480 Volt 3ph

2014 Milestone 96” 480 Volt 3ph

1998 Spudnik 925 72” 230 volt 3ph

1998 Spudnik 925 72” 220 Volt 1ph

1997 Double L 807 Dirt Elim. 62” BC 3ph Stingers 72” Sizer

2010 Milestone 60” sizing table only w/acorns quick adjust arms

1994 Milestone 72” Dirt Elim. Sizer, 2 – 24” x 12’ stingers

2011 Spudnik 96” 990 BC Elev. Reverse roll table, sizing table, split picking, cross out conv.

2004 Spudnik 995 DES 72” Q A dirt & Size roll tables, split picking 230 volt 3ph.

2002 Spudnik 72” DE belt elev

DIRT ELIMINATOR ONLY

2000 Double L Model 878 80” BC hopper, fingers, BC picking table 3ph.

2017 Milestone 96” 480 3phase

2006 Spudnik 925 72” 3phase

2006 Spudnik 995 72”Finger rollers, ellis table, Belt Chain table 230 Volt 3phase

1990 Spudnik 950 72” 230 volt 3phase

ROCK/CLOD/AIR ELIMINATORS

2013 Harriston 3240 Clod Hopper 3ph

2001 Harriston 200 Clod Hopper Ellis table 1ph

EVEN FLOWS/SURGE HOPPER

1998 Mayo 4236 600cwt

New Logan 2024 Surge Hopper

New Logan 2024 Even Flow

PLANTER FILLER DIRT TARE

Double L Model 815 24” x 26’

Spudnik model 1100 Tube loader 20’

2002 Kverneland 3300 Cup 6 row 36” Pull type, Hyd. Drive

2007 Harriston 6 row Cup semi mount 36”

2006 Harriston 6 row Cup semi Mount 36’

2011 Lockwood 6 row Air Cup 34” semi mount hyd drive

2013 Spudnik 8069 bed planter 9 units in 6 row pull Type

2008 Spudnik 8080 Pull type cup, 8 row, 36”

2007 Spudnik 8060 hyd. Drive, 34”

SEED CUTTERS

2002 Better Built 72”

1994 Milestone 60” Reconditioned 230 Volt 3ph

1989 Milestone 48” 220 Volt 1ph

TREATERS

2018 Better Built 12” Liquid/Dry treater

1994 Better Built CDT10- 8” Cannon Duster

WATER DAMMERS/ POWER HILLER

2013 Ag Engineering 4 row Dammer diker HYD Reset

Milestone 6 row Water Saver 36” spacing

TOTE BAG FILLERS

2019 Tri Steel single auto fill

2005 Tri Steel single auto fill

MISC.

Lockwood Even flow 24” belt 3ph 600cwt

Shop built Tire roller w/ water tank, 6 row and 4 row

Ace Roll over Hyd. Reset Plow 5 bottom

2020 Logan Barrel Washer for little potatoes

Belly Dump unloader attachment for Scooper

Warehouse Evenflows: 1200 cwt, 900 cwt, 400 cwt

Greentronics Scale

Kerian 60” sizer

and beans/peas/lentils) is because these foods are “important to many cultural food ways.”

While laudable in its goal to address cultural sensitivities, the origin of the definition of Staple Carbohydrate is unclear. According to the Staple Carbohydrate protocol, staple carbohydrate foods are foods eaten often, usually daily, or multiple times a day, that supply a large proportion of energy and nutrients in a dietary pattern.

However, the metrics around this classification rapidly lack specificity from a scientific perspective. This is clear given three facts: 1) The Staple Carbohydrate group contains some but not all carbohydrates that could be considered critical (“staple”) to good health; 2) Dairy products could be classified as “foods eaten often that supply a large portion of energy and nutrients in a dietary pattern,” but are not considered a staple carbohydrate; and 3) The foods included do not provide the same nutrients. (All are sources of carbohydrates and can be sources of fiber, but grains are sources of B vitamins, while starchy and other vegetables provide vitamin C and potassium, and beans, peas and lentils provide more protein, iron and magnesium, among others.)

The potential reclassification or interchangeability of foods like potatoes under this new category that departs from empirical definitions has sparked confusion. While USDA spokesperson Joellen Leavelle maintains through communications with the press that there is no intention to reclassify potatoes, the grouping of grains and starchy vegetables under the umbrella of “staple carbohydrates” suggests otherwise.

It is imperative that we seek clarity in the Dietary Guidelines, ensuring that scientific principles, built on a foundation of empirical metrics, guide the classification of foods. Potatoes are, scientifically speaking, vegetables. Grains are grains. The two categories are neither the same nor interchangeable.

Let us ensure that the Dietary Guidelines accurately reflect the preponderance of scientific evidence, empowering dietitians to merge this knowledge with their expertise to guide individuals and cultural groups toward healthy dietary patterns.

2. Beet leafhopper is a pest of potato because it can transmit the phytoplasma that causes purple top in the Northwest. Bigeyed bugs are important predators of aphids and other small insects in potato and other crops. KNOW

1. Photo A is a beet leafhopper. Photo B is a big-eyed bug (a.k.a. “Geocoris”).

Do you need the ability to accumulate boxes with multiple SKUs?

Scan the QR to watch our flagship machine VPM-VHV stack pallets at blistering speeds or visit verbruggen-palletizing.com

The University of Idaho’s College of Agricultural and Life Sciences (CALS) has opened a new laboratory at its Parma Research and Extension Center. The 9,600-square-foot Idaho Center for Plant and Soil Health contains laboratory space for research in nematology, pomology, plant pathology and microbiology.

CALS launched a campaign to construct the $12.1 million facility in 2019. Construction was funded by $3 million in donations from agricultural stakeholders, in addition to investments from the university and the state of Idaho.

Potatoes USA has elected Shelley Olsen from Othello, Washington, to serve as chairwoman for the upcoming year. This is Olsen’s seventh year on the Potatoes USA board. Over the last year, she has traveled to Vietnam to promote U.S. potatoes and has been active in representing the industry in Washington, D.C.

In addition to her involvement with Potatoes USA, Olsen is a founding board member and former chair of the Potato Leadership, Education & Advancement Foundation (LEAF) and a 2015 Potato Industry Leadership Institute graduate. Olsen also serves on the Washington State Potato Commission’s Marketing and Industry Affairs Committee.

Olsen and her husband farm with his parents and their two sons.

Colorado Certified Potato Growers Association

“Quality as High as our Mountains”

RUSSET VARIETIES:

Russet Norkotah S3

Russet Norkotah S8

Rocky Mountain Russet

Silverton Russet

Rio Grande Russet

Canela Russet

Mesa Russet

Mercury Russet

Fortress Russet

Crimson King

COLORED VARIETIES:

Columbine Gold

Colorado Rose

Rio Colorado

Red Luna

Purple Majesty

Masquerade

Mountain Rose

Vista Gold

Sorts Potatoes By Size Quickly And Accurately

Proven for use in: Reds, Russets, Round Whites, Gold Rush and more

Potato Sizing Video Now Available: www.kerian.com

GENTLE: Grades by size without damaging potatoes

ACCURATE: Precisely grades potatoes of all shapes and varieties

FAST: Thirteen standard models custom-designed to meet your needs sort from 1000 lb/hr to 150,000 lb/hr

SIMPLE: Effective but simple design provides a rugged, low cost, low maintenance machine at a high value to our customers. It can even be used in the field! KERIAN

Zapata Seed Company

Worley Family Farms

SLV Research Center

San Acacio Seed

Salazar Farms

Rockey Farms, LLC

Pro Seed

Price Farms Certified Seed, LLC

Palmgren Farms, LLC

Martinez Farms

La Rue Farms

H&H Farms

G&G Farms

Bothell Seed

Allied Potato

Majorexporting countries shipped a record 9.433 billion pounds of French fries and other frozen potato products to countries outside of their local trading zones during the year ending Jan. 31, 2024. That is 450 million pounds less than year-earlier shipments, a 4.6 percent decline. Limited rawproduct supplies held back sales from the EU; offshore exports fell 1.2 percent short of the year-earlier sales volume. Offshore sales from U.S. fryers dropped 13.6 percent below 2022-23 levels despite this year’s large raw product oversupply situation.

In addition, sales from smaller exporters such as Canada, Argentina, New Zealand and Turkey dropped off during the period. Their combined external frozen product sales were down 14.5 percent during the year ending Jan. 31. On the other hand, frozen product exports from China increased 36.5 percent.

In this article, we explore global French fry trade by major exporter as well as the trade outlook for the next 12 months.

European fryers exported 6.351 billion pounds of French fries and other frozen potato products to customers outside the EU during the year ending Jan. 31. Exports to external customers fell 79 million pounds short of year-earlier

sales, a 1.2 percent decline. Six of the EU’s top 10 external customers reduced their purchases of French fries and other frozen product during the year ending Jan. 31. The largest volume reductions came in sales to Brazil (-86 million pounds), Columbia (-30 million pounds) and Saudi Arabia (-24 million pounds). In addition, the United Kingdom, Jordan, Malaysia, South Korea, the Philippines and Russia each reduced purchases by 20-23 million pounds during the period.

The United States, the third largest importer of EU French fries, increased its purchases by 35 million pounds, or 7.4 percent, relative to a year earlier. Australia increased its imports by 103 million pounds, or 55.3 percent, during that timeframe. EU processors captured 67.3 percent of the global market. That is up from 65.1 percent in 2022-23 and 64.5 percent in 2021-22.

Down 12 Percent

North American fryers shipped 2.14 billion pounds of frozen potato products to offshore markets during the year ending Jan. 31. That is 291 million pounds less than year-earlier shipments, a 12 percent downturn. Frozen product export volumes fell short of year-earlier sales to eight of the top 10 customers. U.S. frozen product exports dropped by 13.6 percent, while Canadian offshore exports fell by 3.3 percent during the period.

Japan, the largest customer, took 590 million pounds of product, 59 million pounds or 9.1 percent less than yearearlier purchases. Mexico reduced its imports by 7.4 percent, to 503 million pounds. Exports to South Korea dropped by 20.6 percent, to 170 million pounds. Sales to Taiwan rose by 0.4 percent, while exports to the Philippines fell 8 percent short of year-earlier shipments. Frozen product exports to the remaining 82 customers dropped 18.2 percent below

year-earlier levels.

Raw-product supplies are abundant in both the U.S. and Canada. Nevertheless, exports during the year ending Jan. 31 were the second smallest since 201213 (behind 2020-21). North American fryers captured 22.7 percent of the global market, which is down from 24.6 percent in 2022-23 and 24.8 percent in 2021-22.

From Argentina, China, Turkey, New Zealand

Argentina exported 385 million pounds of French fries during the year ending Jan. 31. That is 103 million pounds less than year-earlier sales, a 21.2 percent decline. Argentina’s global market share was 4.1 percent, down from 4.9 percent a year earlier. Brazil is Argentina’s main customer.

China continued to ramp up French fry exports during the year ending Jan. 31, to 296 million pounds. That is 79 million pounds more than year-earlier sales, a 36.5 percent increase. Exports have nearly tripled during the past two years. China is becoming a major player in the global French fry export trade. China has a 3.1 percent share of the global French fry market, up from 2.2 percent in 202223 and 1.1 percent in 2021-22. China’s major customers include the Philippines, Japan, Indonesia, Thailand and South Korea.

Turkey also has become a major French fry exporter during the past several years. The country exported 145 million pounds of frozen potato products during the year ending Jan. 31. That is 51 million pounds, or 26.2 percent, less than year-earlier sales. Turkey captured 1.5 percent of the global French fry business during the period, down from 2 percent a year earlier. Turkey’s major customers include Russia, Iraq and China.

New Zealand exported 117 million pounds of French fries during the year ending Jan. 31. That is 5 million pounds less than year-earlier sales, a 3.9 percent

reduction. New Zealand captured 1.2 percent of the global market during the period, unchanged from a year earlier. Most of New Zealand’s French fry exports go to Australia and Thailand.

Global offshore French fry exports have grown by an average of 5.1 percent per year during the previous 10 years. However, global sales dropped by 4.6 percent during the year ending Jan. 31, 2024. Global French fry exports, during the year ending Jan. 31, only declined one other time during the past 20 years. During 2020-21, the year of the pandemic, external exports dropped by 12 percent. Frozen product exports reached a record 9.884 billion pounds during 2022-23, despite raw-product supply constraints in the European Union and in the United States. The North American raw-product supply situation has reversed with the harvest of the 2023 crop.

Nevertheless, exports continue to decline, and North American fryers continue to lose their market share. Several factors may be contributing to the downturn. Domestic demand appears to be relatively strong both in North America and in the European countries. Overall economic growth may be slowing in some of the key importing countries. In addition, one fryer’s marketing strategy change may have impacted North America’s export sales.

Trends suggest that long-term global French fry demand growth is likely to continue. Raw-product supplies are abundant for North American fryers and probably won’t be a limiting factor during at least the first part of the 202425 processing season. Sales from North America could pick up. EU French fry processors are likely planning to resume export growth when the new crop becomes available.

• Major exporting countries shipped 4.6 percent less French fries and other frozen potato products to countries outside of their local trading zones during the year ending Jan. 31.

• Raw-product supply constraints may have held back European external sales during the year ending Jan. 31.

• Offshore frozen product exports from the U.S. during the year ending Jan. 31 were the smallest since 2011-12. Though sales were down from last year, Canada’s offshore exports were the second largest since 2011-12.

• China has ramped up export sales during the period, while sales from Argentina, Turkey and New Zealand fell short of year-earlier volumes.

• North American fryers’ share of the global French fry market continues to decline, even though the U.S. and Canada both have an abundant supply of frozen processing potatoes.

This spring has been full of surprises for growers of most crops in the Columbia Basin. Prices for most crops are down substantially from where they were last year, and many crops that contract their volume are also greatly reduced. However, one thing that is not a surprise is how stable the potato contract prices are for 2024.

This point was driven home to me recently in two different ways. First, I was preparing for an upcoming presentation, and I used a graph depicting the annual contract returns at all three major

Ag World ..............................3

Colorado Seed ....................27

Corteva Delegate ..................2

Corteva Vydate ...................32

Ellips ..................................23

Greentronics.......................18

JH Biotech ............................5

Kerian.................................27

Lockwood ...........................15

Milestone ...........................31

Montana Seed ....................19

Skone Irrigation ..................28

SpudEquip.com ..................24

Stukenholtz ........................29

The Potato Podcast

Sponsored by Vive ..............11

Titan Steel ..........................11

Trinity Trailer ......................16

Verbruggen.........................25

Western Trailer ...................31

processors in the Basin compared to the fresh price received each year by local growers. The line for contract pricing was very steadily increasing as the contract price kept up with the rate of inflation in the growing economic environment. Of course, there was a bump in price for the 2022 crop year as growers experienced hyperinflation. Even with the bump in the line for 2022, the graph looked very stable.

The fresh price during the 10 years I was looking at, however, was all over the place – from being well below the price we received on our contracts to more than triple the contract price in 2022. However, the sad part is that the price was lower than the contract price for more years than it was above the line. Further, as we all know, price is a product of supply and demand. The higher prices get, the shorter the supply and fewer growers/shippers get to experience those prices or only get to ship a limited volume. Conversely, when prices are low, that usually means there is an oversupply and everyone in the fresh market feels the pain on a larger portion of their crop.

The second time I was reminded of the stability of contract pricing was when I received a call from one of my favorite growers. He called to tell me that when we first reached our agreement for a low single-digit decrease in contract price for 2024, he was “really pissed off” because he believed we should have gotten at least a rollover in price. However, since then, he has found out the prices on the rest of the crops he plans to grow for 2024, and they are all down well more in both price and volume than he is on his potato contracts. His exact words were, now the potato contracts that I thought were bad are the “shining star” on my farm.

This is a perfect year for everyone to see exactly what we are trying to do with your contract prices. We are trying to keep them as stable as possible and in line with your cost of production. By keeping them at a stable rate of return, we allow you to plan for your future while making a very solid return most years. This also allows for your processors to make long-term business decisions knowing they can count on the price of potatoes, which is still their single biggest cost factor, to remain steady in line with inflation. This is one of the reasons why in the past 20 years, more than 80 percent of the new processing capacity in North America has been in the Columbia Basin. This appears to be continuing as there is a very large expansion under construction in Moses Lake, Washington, right now, and other processing companies are “kicking the tires” on locating additional capacity in the area.

Stable contract pricing may be boring coffee shop talk, but it is the financial engine that runs many of the big farms in the Basin. This only comes about with a very strong grower organization. As you noticed this year, other crops that are contracted certainly didn’t have stable pricing; in fact, sweet corn is not much higher in price this year than it was 20 years ago. Yet it is covered by the same bargaining laws in the state of Washington as frozen potato processors. Potato Growers of Washington has been here for you for many years, and we plan to be here for you for many more. To all of you who are members, we thank you for your support. To all that are not members, we must ask, “why aren’t you?” We welcome all who would like to be part of making each year better for all potato growers.

Blackleg is shown in Photos B and C. Blackleg starts from the seed piece and moves up the potato stem. Most of the time, the outer portion of the stem becomes black and slimy, as shown in Photo B. Sometimes, however, the infection will move up the inside of the stem first before the symptoms develop on the outer stem surface. Infected plants often appear weak with reduced growth and dying leaves, as seen in Photo C.

There are no control measures that can be used in-season to manage blackleg. It is best controlled by planting disease-free seed and avoiding water-logged conditions after planting if possible.

For aerial stem rot (shown in Photos A and D), infection starts on petioles and stems and usually stays above ground. With susceptible varieties like Dakota Russet, the infection can occur at the soil surface, as is shown in Photo A. Symptoms first appear water-soaked and light green to brown, as seen in Photo D. When aerial stem rot lesions dry out, they can be confused with white mold.

Aerial stem rot often develops under hot, wet conditions after the canopy has been damaged (such as from wind). Application of copper-based sprays has been recommended to reduce symptom severity, but this is not always effective. Best efficacy has been obtained with weekly applications, and this may not be cost effective.

When you invest in a Western Spud Express® you can rest assured your new trailer has been built to stand up to the rigors the potato industry can dish out. The backbone of the Express is our high tensile steel main frame, treated with our level 4 paint system. Year after year the Spud Express delivers quickly and gently the biggest payloads, along with the highest resale value of any potato trailer on the market! Learn

It’s easy to see all the bene ts that Vydate® C-LV insecticide/nematicide offers. In the soil, Vydate C-LV provides protection against damaging nematodes. Above ground, its foliar activity protects plants against numerous insects, such as aphids, lygus, Colorado potato beetle, potato psyllid and leafhoppers. Plus, Vydate C-LV delivers the “carbamate kick”, something you’ll observe as “green up” of plants, improved plant vigor/growth, reduced senescence and improved yields. To learn more about the eye-catching bene ts of Vydate C-LV, contact your crop consultant.