BROUGHT TO YOU BY:

BROUGHT TO YOU BY:

JANUARY 9-10, 2025

PO Box 333, Roberts, Idaho 83444

Telephone: (208) 520-6461

Circulation: (503) 724-3581

editOr

denise Keller editor@ColumbiaMediaGroup.com

OPerAtiOns MAnAGer, AdvertisinG Brian Feist brian@ColumbiaMediaGroup.com

PUBLisher, AdvertisinG dave Alexander dave@ColumbiaMediaGroup.com

inseCt identiFiCAtiOn Josephine Antwi josephine.antwi@oregonstate.edu

diseAse identiFiCAtiOn Jeff Miller jeff@millerresearch.com

MArKet rePOrt Ben eborn napmn@napmn.com

POtAtO GrOwers OF wAshinGtOn dale Lathim

editOriAL inFOrMAtiOn

Potato Country is interested in newsworthy material related to potato production and marketing. Contributions from all segments of the industry are welcome. Submit news releases, new product submissions, stories and photos via email to: editor@ColumbiaMediaGroup.com.

For information about advertising rates, mechanics, deadlines, etc., call (208) 520-6461 or email dave@PotatoCountry.com.

sUBsCriPtiOns

U.S. $24 per year / Canada $40 per year / Foreign $80 per year Subscriptions can be entered online at: potatocountry.com/subscribe or call (503) 724-3581.

Email address changes/corrections to: brian@ColumbiaMediaGroup.com or send to Potato Country, PO Box 333, Roberts, ID 83444. Potato Country magazine (ISSN 0886-4780), is published eight times per year and mailed under a standard rate mailing permit at Idaho Falls, Idaho and at additional mailing offices. It is produced by: Columbia Media Group, PO Box 333, Roberts, ID 83444 Copyright 2024. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, for any purpose without the express written permission of Columbia Media Group.

The Idaho Potato Commission cautions people not to be duped by knock-off potatoes.

In its latest TV commercial, the Idaho Potato Commission humorously highlights the growing problem of knock-off potatoes by showcasing imposters peddling imposter spuds – urging viewers to look for the “Grown In Idaho® ” seal. The ad is running nationally on popular networks including TBS, TNT, Food Network, Discovery, HGTV, ID, Animal Planet, and TLC. Additionally, it can be seen on streaming platforms like Discovery+, Hulu Live, and Sling.

View the spot anytime at IdahoPotato.com

Story by John O’Connell, University of Idaho

Photos by Dave Alexander, Publisher

Astudy underway at University of Idaho’s Aberdeen Research and Extension Center seeks to help potato farmers identify nitrogen application rates to optimize the efficiency of fertilizer uptake by plants and tuber performance in storage.

Rodrick Mwatuwa, a doctoral student in the Department of Plant Sciences, is finishing the second growing season of a three-year dissertation project working under advisor Rhett Spear, an assistant professor of plant sciences specializing in agronomic and economic evaluations of new potato varieties through cultural management trials and new variety selection. Mwatuwa spoke to attendees at the extension’s field day in August.

Rates of nitrogen applied to potato fields can strongly influence how well potatoes withstand storage, including when they break dormancy, susceptibility to bruising, weight loss and conversion of starch to reducing sugars that result in darker fry color. Mwatuwa suspects many area growers are erring on the side of over-applying nitrogen to ensure they meet their yield, quality and storability expectations.

“I expect to find growers are applying more nitrogen and we can still reduce the rates to less and less,” Mwatuwa said. “Can we find a midpoint?”

Mwatuwa’s trial includes four replications of each treatment, using small plots in a field with a Declo loam soil. Over the course of the season, he applied a total of either 0, 160, 200 or 240 pounds per acre of nitrogen, with some plots receiving applications weekly and others receiving them every other week. Plots received 25 percent of nitrogen before tuber initiation, 50 percent at tuber initiation and 25 percent at tuber bulking.

Mwatuwa took soil and plant-tissue samples throughout the growing season to evaluate nitrogen concentrations in soil compared with plant uptake. In many of his 64 plots, Mwatuwa used the form of nitrogen commonly used by farmers, UAN 32.0.0 (32%N). In four plots, however, he applied urea 46-0-0 enriched with stable isotope 15N, which is an extremely expensive isotope of nitrogen that isn’t found in abundance in nature and can be easily distinguished from commonly used fertilizer with isotope 14N. By tracking 15N in soil and plant tissue, Mwatuwa will know exactly how much of the fertilizer he applied was taken up by the plants without his results being skewed by residual 14N fertilizer in the soil or 14N fertilizer fixed from the atmosphere by soil-borne microorganisms.

Most potato storage research focuses on late-maturing varieties. Mwatuwa chose two early-maturing varieties, Russet Norkotah 278 and Teton Russet, for his study, seeking to cover new ground with his data.

After harvesting his crop in September, he placed the tubers in storage for eight to nine months. The literature suggests

Olsen shows off a new publication on which she and several other university researchers have collaborated. The publication, “Potato Virus Initiative: Developing Solutions,” can be found at uidaho.edu/cals/potato-virus-initiative/newsletter.

Potato breeder Jonathan Whitworth tells field day attendees that 22 percent of 2023 U.S. seed acres were grown with seed originating from Aberdeen, Idaho. Use of Mountain Gem Russet was up 73 percent from the year before, and LaBelle Russet was up 117 percent.

that higher rates of nitrogen can lead to an increase in total soluble sugars in the leaves, while the conversion of starch to sugar in tubers may not occur as efficiently, potentially leading to thinner skin set. Additionally, high nitrogen may result in tubers with higher water weight, increasing the risk of shrinkage during storage and promoting earlier sprouting, known as breaking dormancy.

“Some of these things we’re going to find out with this trial. While I think there is some literature, it’s not variety specific,” Spear said. “Ultimately, with potato production, it all comes down to the money. If we can help growers to keep a little more money in their pockets, if we can show them through research the nitrogen rates are a little too high, if they can reduce those and get the same or a little bit better yield and quality, it will help their margins be a little better.”

Dr. Jeff Miller, a plant pathologist, is the president and CEO of Miller Research, Rupert, Idaho. He can be contacted by phone: (208) 531-5124; cell: (208) 431-4420; jeff@millerresearch.com

Powdery scab is not new. Bulletins published decades ago presented pictures of potato roots with ugly looking galls and tubers with unsightly lesions. Recently, however, powdery scab has become a more prevalent worry in the potato world. As if the galls and scab weren’t enough of a problem, the organism that causes powdery scab can also carry the potato mop top virus (PMTV). While scientists debate whether the galls and scabs reduce yield in the field, there is no doubt that the virus can make tubers unmarketable. Additionally, recent research shows that potatoes affected by powdery scab may be more susceptible to damage caused by other diseases. However, common scab can also look similar to powdery scab.

Can you tell which tubers are affected by powdery scab and which are common scab?

1 2 3 4 5 6

This material is provided courtesy of Josephine Antwi, Ph.D., Assistant Professor of Irrigated Crop Entomology at the Oregon State University Hermiston Agricultural Research & Extension Center. She can be reached at josephine.antwi@oregonstate.edu.

The potato leaves shown here have signs of insect damage. The insect that caused this damage has a piercing-sucking type of mouth that sucks up plant sap. Which insect is responsible for this type of damage?

Our isolated northern location along with our group of 10 experienced growers have been producing exceptional seed potatoes with increased energy and the lowest possible disease levels for over 60 years.

Our longevity and historical performance have made us a valued resource and seed potato supplier to growers across North America and the world. With over 100 varieties including main crop and specialty selections, we invite you to give us a call to discuss how we can help you make this growing season the best one yet.

Contact us to discuss how we can help make this year’s crop the best it can be.

Toll Free: 1 (800) 362–9791

(780) 447-1860 • darcyo@epg.ab.ca Edmonton Potato Growers 12220 – 170 Street, Edmonton, AB T5V 1L7

By Roger McKinley III and Trey Reid, RegenAg Nation

Imagine laboring through an entire growing season, investing in fertilizers, crop protection and irrigation, meticulously caring for your crop, and then storing your potatoes for months, only to find yourself facing a harsh reality: the market is flooded with spuds, and you might have no choice but to feed them to cattle or dump them. It’s a painful situation that many potato growers know all too well.

Input costs are rising, profit margins are dwindling, and the reliance on synthetic chemicals doesn’t solve the problem. Add in increasing pressure from regulators and consumer demand for sustainable farming, and it’s clear that the status quo may no longer be sustainable.

For decades, synthetic fertilizers, fungicides, insecticides and herbicides have delivered impressive yields and high-quality crops. But as their costs continue to climb and their long-term impacts on soil health and sustainability become clearer, farmers are realizing that these tools may no longer offer the reliability they once did.

A typical potato farming program uses 3.1 pounds of pesticides and 10.4 pounds of nitrogen fertilizer per ton of crop. These inputs contribute to greenhouse gas (GHG) emissions and environmental degradation, with over 683,550 pounds of pesticides used annually for potato production in the U.S. The situation is becoming increasingly untenable for farmers trying to balance short-term profits with long-term viability.

Conventional inputs are not just expensive; they can also pose significant environmental risks. Synthetic fertilizers are major contributors to GHG emissions, and they can leach into water systems, leading to pollution and algal blooms. Additionally, the overuse of pesticides has created resistant pests and depleted soil quality, making it harder to maintain high yields without even more chemicals. Farmers face a dilemma: continue using synthetic inputs and risk environmental and economic disaster, or switch to alternatives and risk short-term financial losses. The costs of maintaining the status quo are rising, but the shift

to more sustainable practices is often daunting.

The solution to this conundrum lies in a comprehensive approach – what progressive agronomists call the “threeheaded monster.” This strategy blends healthy plants, disease-suppressive soils and effective stress management to reduce the reliance on harsh chemicals. These techniques, which are already being employed by companies like RegenAg Nation, have led to pesticide reductions of up to 90 percent while maintaining yield and quality standards.

This shift involves inputs that improve plant function, reduce oxidative stress and fight soil pathogens biologically through antagonism, competition for resources and antibiosis. Combined with fundamental practices like cover cropping, composting and reduced tillage, growers can build more diseasesuppressive soils and plants that are better equipped to fend off pests and diseases. Adding precision irrigation, optimized mineral nutrition and biostimulants helps plants thrive under stress, lessening the necessity for some synthetic chemicals.

The future of potato farming doesn’t have to mean choosing between conventional and regenerative methods; it’s about blending the two – at least initially. By integrating sustainable practices like disease testing, microbial inoculants and “soft chemistry” sprays, growers can reduce pesticide use without sacrificing crop protection. Likewise, optimizing plant nutrition with cleaner, low-salt fertilizers and carbon-based products helps reduce dependence on synthetic nitrogen.

This hybrid approach offers a common sense alternative: healthier soils, fewer chemical inputs, and sustained or improved yields.

The biggest hurdle for many farmers is the fear of reduced profitability during the transition to sustainable methods. If done correctly, adopting these changes should lead to stable output in terms of yield and quality without increasing input expenses. However, studies have shown

that in the long term, sustainable farming can lead to significant cost savings.

The lever that might be required for the producer to adopt change is either incentivization of what’s being produced, or less risk in the form of reduced input costs or stability of outcome. Farming operations that push forward individually will find rewards in the future, albeit shouldering some of the risk in the short term. The best outcome for all entities in the supply chain is to create brand new value-added markets in the supply chain that demand a premium because of the way potatoes are grown. Consumers are clear that they prefer to consume products that avoid conventional pesticides and are environmentally friendly and will make that choice with their pocketbooks, but standards must be in place.

A new driver in the push for sustainability is consumer demand. While organic potatoes command a 51 percent price premium, a middle ground exists for growers who adopt low-chemical, environmentally friendly farming methods. Potatoes marketed as “sustainably grown” or “low-chemical” could capture consumers looking for alternatives without the steep price tag of organic products.

This isn’t just about consumer preference; it’s also about meeting the sustainability goals set by food companies and processors that are increasingly committed to reducing their GHG emissions. There’s a real opportunity here to create value-added markets for potatoes grown with fewer chemicals, providing growers with a premium for their efforts.

Progressive farmers must have the opportunity to highlight their achievements. By breaking away from traditional farming practices and adapting to market demands, they can create value in new markets. As industry pressures push farmers toward restrictive practices, it’s crucial for farmers to take the initiative and demonstrate their ability to surpass these imposed standards. In an intensely competitive market, progressive farmers need a unique selling point because these potatoes are different from the rest.

Crop Size: 3000 Ton

Variety: Russett Burbank

Plant Date: 15th Apr, 2023

Harvest Date: 18th Sep, 2023

I.Q./Acre: 191.85

I./Ton: .214

Crop: 1.104

of Crop: 14.98

EIQ stands for Environmental Impact Quotient. It was developed by Cornell university and is a method to measure the environmental impact of pesticides commonly used in agricultural production.

Growing high value crops while meeting sustainability metrics, impact on the environment, water usage and fertilizer application are the largest challenges farmers will have to face in the next decade. These benchmarks provide farmers, food processors and consumers with a black and white grade that demonstrates the quality of what is being grown. We did the impossible and guarantee we can do

All Star Manufacturing and Design offers potato seed cutters designed to cut both long and round potato varieties. The company is always striving to make improvements in its equipment and has a new optional electronic control system for 2024 that allows users to save settings that can be recalled later for even quicker setup. This feature will be particularly useful when cutting different varieties and sizes in a season.

Potato seed treating involves setting a chemical application rate. It’s set for an estimated average flow rate of seed potatoes through the treater. In practice, potato flow rate will vary, leaving potential for poorly treated seed to reach the field. To avoid this, some operators will err on the side of caution and set the rate a little higher than necessary. While this reduces risks in the field, it also leads to waste and higher costs.

To solve this problem, growers can install a scale from Greentronics in the conveyor ahead of the treater. The scale can be equipped to output a signal proportional to the flow rate over the scale. This output becomes the input for the chemical application pump. With this connected, the pump will apply chemical according to the flow rate measured by the scale. This offers greater uniformity in chemical application and reduced waste and cost.

With the 2024 growing season in the rearview mirror, it is time to think about planting the 2025 crop. Lockwood Manufacturing is known for offering accurate, efficient planters. The Air Cup and Belted Cup planters are the company’s best options. New for 2025 is a redesigned seed hopper. Lockwood has reduced the number of cross supports. This is extremely beneficial for growers as they look to clean out the hopper when changing potato varieties. This new feature will be available on Lockwood’s Air Cup models immediately and Belted Cup planters in the near future.

One of the many planting and seed handling machines from Mayo, the Telescoping Loader is a high-capacity planter filler that also has many other uses such as transfer and truck loading.

Mayo seed handling equipment includes sorting, sizing and storage equipment with design and layout service.

Milestone potato seed cutters are designed and built to be the ultimate example of capacity, technology and raw performance. Designed and proven to produce a uniform and blocky seed piece, new Milestone seed cutters incorporate several improvements and enhancements over older generations, such as smart coulter/ sizer adjust, full-width one drop belt, quick adjust trim section and reinforced cutting table support. All Milestone potato seed cutters are backed by knowledgeable and responsive support that customers can rely on when they need it the most.

SS destoner

Tri Steel .5 Polisher/Washer

Stainless Steel

Tri Steel 6” Flume pump

Kwik Locs

Ag Pack weigher bagger

Grain Treater USC LP2000 with seed wheel

seed cutters

3- 2014 Better Built 72” 400 3ph

2002 Better Built 72”

treaters

2018 Better Built 12” Liquid/Dry treater

2006 Milestone Liquid Treater 36”

2005 Milestone 36” Barret duster

1994 Better Built CDT10- 8” Cannon Duster

Planter filler dirt tare

Double L 815 24” x 25’

Planters

2008 Grimme GL34T 36” SS Fert bins rear hiller hanks guidance

2002 Kverneland 3300 Cup 6 row 36” Pull type, Hyd. Drive

2- 2007 Harriston 6 row Cup semi mount 36”

2011 Lockwood 6 row Air Cup 34” semi mount hyd drive

2008 Spudnik 8080 Pull type cup, 8 row, 36”

2007 Spudnik 8060 hyd. Drive, 34”

water dammers/ Power hiller

2013 Ag Engineering 4 row Dammer Diker Hyd. Reset

1996 Ag Engineering 6 row Dammer Diker Hyd. Reset

Ag Engineering 4 row Tillage Master

Pilers

2005 Spudnik 780 42” BC Elev./50’ Boom 3ph Remote

1998 Double L 831 36” BC Elev./49’ boom 3ph Elec remote

1991 Double L 813 30” BC Elev./ 49’ boom 3ph

1985 Double L 811 30” BC Elev./ 49’Boom 3ph

2004 Milestone 36” All belt Arcing / 48’ boom 3ph remote

2000 Wemco 36” All belt Arcing / 49’boom 3ph All HYD remote

scooPers

2013 Logan Scoop Pro SC 30”

Spudnik 100 24” 3ph

Spudnik 1000 Scoop trailer

Bulk Beds/BoXes/ self unloading

2001 Double L 801 20’ Electric drives both ends

1989 Double L 802 22’ PTO only Rear wrap drive

2000 Spudnik 2100 20’ Electric drives both ends

1999 Spudnik 2100 20’ Electric drives both ends

1996 Spudnik 2100 20’ Electric drives both ends

1982 Logan 20B Electric 20’ live belt drive

1983 Logan 20B Electric 20’ live belt drive

crossovers/windrowers

2023 Double L 6540 34” bed 4 row

1996 Double L 851 36” bed 4 row

2005 Lockwood 5000 4 row RH

2008 Spudnik 6140 4 row LH

2019 Spudnik 6140 32” rows

R&L discharge

harvesters

2023 Double L 7040 Legend 34” bed 4 row

2019 Double L 953 Std Bed 4 row

2018 Double L 7340 36” bed 4 row

2002 Double L 873 36” bed 4 row

2012 Lockwood 474H 4 row

2005 Lockwood 474H 4 row

2001 Spudnik 5625 36” bed 2 row collectors & stingers/PuPs

2001 Mayo 250 Side shift Conveyor

36”x20’w/ 2- 30” Belt Stingers

2015 Double L 832 36” BC with fingers

2014 Spudnik 2200 All belt 30”x10’ 3ph

1993 Spudnik 2200 All belt 30 x10’RH 3ph

1993 Spunik 2200 All belt 30”x10’ LH 3ph

telescoPic conveyors

2015 Double L 1336 36”x 85’ 3ph

2000 Double L 836 36” x 85’ 3ph

2002 Milestone 30” x 65’ 3ph

2- 2001 Spudnik 1255 30/36/85 3ph drive wheel & steer

1996 STI 30” x 70’ 480 volt 3ph

straight conveyors

3- 2000 DL 877 36”/ 40’ 3ph

5- 1998 DL 809 30”/38’ 3ph 4- 1991 DL 809 30” /38’ 3ph

5- Milestone 30” x 30’ 3ph

siZer only

2004 Spudnik 925 84” Acorns 480 volt 3ph

Kerian 60”W x 6’ L, 3- adjustable lanes 1” to 5”, smooth rolls

Kerian 60”W x 10’ L, 4 adjustable lanes 1” to 4.5”, rib rolls

dirt eliminator w/siZer

2005 Milestone MSDSE84 belt Elev. Finger rolls dirt & sizing, split picking Cross out conv.

2011 Spudnik 96” 990 BC Elev. Reverse roll table sizing table split picking cross out conv.

2004 Spudnik 995 DES 72” Q A dirt & Size roll tables, split picking, 230V 3ph

2002 Spudnik 72” DE belt elev

dirt eliminator only

2017 Milestone 96” 480 3phase

2005 Double L 878 72” 3phase

2006 Spudnik 995 72”Finger rollers, ellis table, Belt Chain table, 230V 3ph rock/clod/air eliminators

2012 Harriston 3240 CH fingers peg belt blower sizing fingers 480 V 3ph

2002 Harriston 240 CH Ellis table peg belt blower 230 V 3ph

1995 Harriston 200 Clod Hopper finger Table 3ph

even flows/surge hoPPer

1996 Double L 860 600cwt 42” Elevator 36” discharge 3ph

2013 Mayo 455 Surge Hopper 300cwt 3ph, 2 belt stingers

1992 Spudnik 1800 600cwt 48” Elevator 36” discharge 3ph

1994 Spudnik 1800 600cwt 48” Elevator 36’ discharge 3ph

1988 Spudnik 1800 525cwt 30” Elevator 30” discharge 3ph

By Matt Harris, Director of Government Affairs, Washington State Potato Commission

Asconsumers, we rarely think about simple expressions we use every day. For example, as I was enjoying lunch, I asked my wife to “pass the ketchup, please” – a great accompaniment for French fries. That phrase is part of the food fabric of so many generations and flows off the tongue.

Interestingly, the United States Department of Agriculture, National Agricultural Statistics Service stated that in 2023, California’s tomato processors reported contracts estimated at 12.4 million tons. That’s 24.8 billion – with a “b” – pounds of tomatoes to be turned into so many of our favorite tomato staples including ketchup almost every year, grown on 248,000 acres of land, exclusively in the Golden State.

Now that you’re hungry for fries with California ketchup, start to ponder what happens when weather patterns change and those great “salad bowl” regions in the U.S. become too hot and dry to

produce food we all enjoy.

Nick Bond, the emeritus state climatologist at the Office of the Washington State Climatologist, is busy working on climate drought persistence across parts of Washington and the Pacific Northwest. The collaboration of water managers and scientists helps to

adapt to seasonal variations to best use water we have today and food we’ll need to consume tomorrow.

Now think about how the U.S. salad bowl may need to be grown in new locations across the country. In Eastern

Washington, the agricultural sector plays a crucial role not only in the local economy but also in the national food supply. However, the ability to meet the growing demand for food with an ever-changing climate is limited by the U.S. not fully accessing consistent and available water.

Authorized in 1945, the Columbia Basin Project is still incomplete 80 years later. Advancing a critical piece of water infrastructure is building the East High Canal which will feed an additional 300,000 acres of agricultural production.

Within the East High region, farmers are scrambling to meet the current drought demands on water availability by shutting down pumping from an aquifer and drawing water from the Columbia River through laterals such as EL 22.1, EL 80.6, EL 84.7 and EL 86.4, with a few other laterals providing surface water to roughly 65,000 acres of land. These lands are critically important but only represent a fraction of needed food production. If climate modeling is correct, we’ll need more acres for food production if the U.S. wants to keep supplying ketchup for our fries.

Experience the vigour of the north. With colder winters and long summer days, Alberta Seed Potatoes are the best choice for a higher yielding potato crop.

Ideal climate, profitable results.

Check out the seed directory at albertapotatoes.ca

The potato leaves were damaged by lygus bugs. Lygus bugs are emerging pests of potato. Adults are about one-fourth inch long. They move into potato fields from their overwintering hosts in early to mid-spring, or when potatoes are just beginning their vegetative stage. Lygus feeding damage on potato leaves does not often show up until several days after feeding. Leaf damage starts with wilting (Photo 1), then eventually results in leaf deformation (Photo 2). There is evidence of reduced tuber quality due to lygus bug damage.

A good management tip is to base control measures on insect scouting. There is no established threshold for lygus on potato. However, on alfalfa seed, spraying is recommended when there are three to five lygus bugs per insect net sweep before seed hardening or 15 lygus bugs per insect net sweep after seed hardening. Lygus bugs become abundant on potatoes soon after mowing alfalfa fields. Chemical products such as Vydate C-LV, Transform, Athena, Leverage 360, Endigo ZC and most products containing permethrin are recommended for controlling lygus on potatoes. For more recommendations on managing lygus bugs, check out the PNW Insect Management Handbook.

Restrain has developed new technology for use in potato storages. The company’s new Precision Ethylene Treatment (PET) technology is designed to provide precise ethylene application and control. Ethylene, a natural plant hormone, plays a role in various physiological processes such as ripening, aging and stress responses. Restrain uses ethylene gas to suppress sprouts in storage.

The PET technology includes a newly designed sensor to ensure precise, continuous ethylene sensing and also measure carbon dioxide, temperature and relative humidity. In addition, an ultra-low dosing pulse system delivers controlled ethylene at parts per billion, below sensor detection levels. This prepares potatoes for higher ethylene levels, suppressing sprouting while minimizing respiration to protect fry color and reduce weight loss, according to Restrain. Visit www.restrain.io.

RUSSET VARIETIES:

Russet Norkotah S3

Russet Norkotah S8

Rocky Mountain Russet

Silverton Russet

Rio Grande Russet

Canela Russet

Mesa Russet

Mercury Russet

Fortress Russet

Crimson King

COLORED VARIETIES:

Columbine Gold

Colorado Rose

Rio Colorado

Red Luna

Purple Majesty

Masquerade

Mountain Rose

Vista Gold

diseAse Answers

Tubers in Photos 1, 4 and 5 have symptoms of powdery scab. In Photo 1, the lesions are raised and erumpent, looking like small volcanoes. Photo 4 shows powdery scab lesions on Shepody. These lesions are relatively flat, but have a raised margin. The powdery scab lesions in Photo 5 (Russet Burbank) are the small, black lesions on the left side of the photo. Some russet varieties like Burbank may not express large lesions like smootherskinned cultivars.

Photos 2, 3 and 6 are all examples of common scab. The lesions in Photo 2 look like cuts in the tuber surface that have healed. The white-skinned cultivar in Photo 3 has an erumpent appearance, showing the similarities between common and powdery scab lesions. Photo 6 shows deep pitted scab (a type of common scab) on Dark Red Norland.

Zapata Seed Company

Worley Family Farms

SLV Research Center

San Acacio Seed

Salazar Farms

Rockey Farms, LLC

Pro Seed

Price Farms Certified Seed, LLC

Palmgren Farms, LLC

Martinez Farms

La Rue Farms

H&H Farms

G&G Farms

Bothell Seed

Allied Potato

nov. 13-14

Montana seed Potato seminar

Holiday Inn Missoula, Mont. www.mtseedpotatoseminar.com

nov. 13-14

Pacific northwest vegetable Association Conference and trade show

Three Rivers Convention Center Kennewick, Wash.

Sheri Nolan, (509) 585-5460 or www.pnva.org

Jan. 9-10

Potato expo

World Center Marriot Orlando, Florida www.potato-expo.com

Jan. 22-23

idaho Potato Conference and Ag expo

Pond Student Union Building and Holt Arena

Pocatello, Idaho

Kristy Mayer, kristym@uidaho.edu

Jan. 28-30

washington-Oregon Potato Conference

Three Rivers Convention Center Kennewick, Wash. www.potatoconference.com

Feb. 24-28

nPC washington summit Hilton Washington DC National Mall the Wharf Washington D.C. www.nationalpotatocouncil.org

Editor’s note: To have your event listed, please email Denise Keller at editor@ columbiamediagroup.com. Please send your information 90 days in advance.

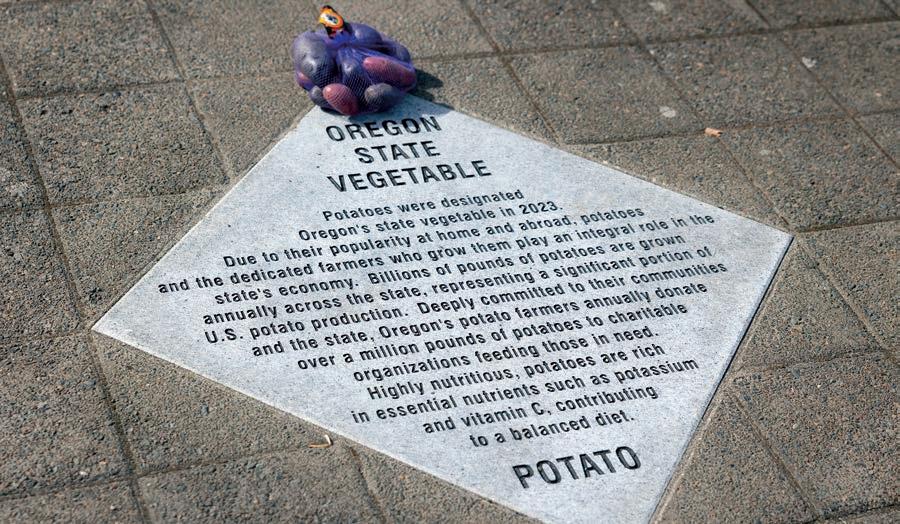

Oregon has named the potato as the state vegetable. This comes after Oregon Potato Commissioner and chef Leif Benson discovered six years ago that Oregon didn’t have a registered state vegetable. The Oregon Potato Commission began working with lawmakers to create a bill to adopt the potato. The Oregon potato industry celebrated the new state vegetable with a plaque dedication at the Oregon State Capitol this fall.

With over 43,000 acres of spuds grown in Oregon, potatoes are the number one vegetable produced in the state.

Mart Frozen Foods has opened a $65 million facility in Rupert, Idaho, where it will produce and package frozen, fully baked Idaho potatoes known as OH!Tatoes. Although the product has been marketed in Asia, this is the first time it is being sold to consumers through North American grocery stores including Publix and Associated Foods. Created by Idaho’s grower-owned Mart Group, the potatoes can be microwaved and ready to serve in four minutes and are good in the freezer for up to 18 months.

The new 100,000-square-foot facility will create 80 full-time jobs and have an estimated annual economic impact of $11.15 million, according to the company.

U.S. potato export values grew 4 percent to a record $2.3 billion in the 12-month period from July 2023 through June 2024. Export volume decreased slightly (-1.6 percent) to 3.3 million metric tons (fresh weight equivalent) during that time.

U.S. potato export values increased across all categories: fresh (4.9 percent), frozen (4.2 percent), chips (2.7 percent), dehydrated (2.2 percent) and seed (19 percent). For export volumes, fresh (7.5 percent), dehydrated (0.7 percent) and seed (12.4 percent) saw increases, while frozen (-6.1 percent) and chips (-3.3 percent) decreased.

Mexico was the United States’ largest export market for the second year in a row, followed by Canada and Japan.

Vive Crop Protection has made several key leadership changes, bringing on board two new employees and promoting a pair from within.

The company has hired Lana Green as national account manager. Green has a background in agricultural sales and distribution at companies including FMC and Syngenta. She will lead Vive’s distribution network in the United States and develop and execute distribution strategies and large account management plans.

Steve Eskelsen has joined the company as northern technical sales agronomist, bringing a Ph.D. in horticulture crop science and pest management, as well as agronomic expertise and technical support experience. He will lead field trials and oversee agronomic recommendations, data generation and training.

In addition, Jonathan Adamson has been promoted to regional account manager, while Greg Esco, previously the eastern U.S. sales manager, has been promoted to U.S. sales leader.

when these photos from the Potato Country archives were taken, things didn’t change too much from day to day or even year to year. A new tractor probably had more horsepower and capability than a farm’s old one, but it was basically the same machine. New harvesters undoubtedly had improved features or upgrades from previous models, but nothing drastic.

Today, things change so significantly we can barely keep up. Colorado State University and Boise State University still play football in the Mountain West Conference, but they will be in the PAC-12 next year. Or is it the year after?

Speaking of the PAC-12, Cal Berkeley and Stanford, previously in the Pacific Athletic Conference, are now in the Atlantic Coast Conference (ACC). So yes, Pacific coast teams now have road games along the Atlantic coast. Confusing, if you’re not keeping close track.

Luckily, the current generations of Gen X, millennial and Gen Z farmers adapt easily to change. They are adept at learning new skills and technology in order to compete in a changing world. And that’s a good thing because these growers will have to feed over 10 billion people by 2065.

We’re confident they are up to this daunting task, helped along by ever-increasing technology. But we’re not confident college conferences won’t continue to change. Maybe one day we’ll watch the University of Mars playing Moon State – no doubt in the ACC.

By Kayla Vogel, Senior Global Marketing Manager, Potatoes USA

For the eighth consecutive year, potatoes are America’s favorite vegetable, according to the 2024 Consumer Attitudes and Usage study commissioned by Potatoes USA. This research is conducted annually to help the industry understand the challenges and opportunities in marketing potatoes to Americans and to track trends over time.

This year’s results showed that consumers love potatoes because they’re real, natural and can be eaten in a variety of ways. Confidence in the health and performance benefits of potatoes also continues to grow.

Consumer beliefs in the health benefits of potatoes are strong. Since 2018, a growing number of Americans believe that potatoes provide nutrients, are healthy, provide underconsumed vitamins and minerals, are low in calories and are

good for weight management. Since 2019, more Americans believe that potatoes contain fiber and are an excellent source of vitamin C. A large majority of consumers (77 percent) believe potatoes are a vegetable. (Based on this survey, consumers believe potatoes are low in calories. However, they do not meet the U.S. Food and Drug Administration (FDA) definition of “low in calories,” as they have 110 in a 5.3 oz serving. Consumers also believe potatoes contain fiber. “Contain” is defined by the FDA as 10 percent DV, and potatoes have 2 grams for 7 percent DV.)

Additionally, consumer confidence in using potatoes as fuel for athletic performance is high:

• 68 percent believe potatoes help fuel everyday activities and provide sustained energy.

• 66 percent believe potatoes deliver fuel for the body and brain.

• 58 percent believe potatoes are a nutrient-dense, energypacked vegetable.

• 51 percent believe potatoes are good for athletic performance and aid recovery with high-quality protein.

More than four out of five Americans report eating potatoes at least once a week, and one-third eat them three or more times weekly. At home, consumers are more likely to eat their potatoes baked or mashed, while they prefer fries, mashed potatoes or chips when dining out. The majority of consumers most recently ate potatoes at dinner (51 percent), followed by lunch (26 percent), breakfast (15 percent) and snack (7 percent).

Beyond potatoes, nearly half of those surveyed eat three meals a day, including snacks. About half also follow a specific dietary pattern, with the three most common being low sugar, carb restrictive and low sodium. However, the number of consumers who say they follow carb-restrictive diets fell from the previous year.

When choosing food, Americans rank the most important attributes as flavor, freshness and value, which potatoes consistently deliver. When thinking about spuds specifically, consumers love them because they’re real food, can be eaten in many ways, and are filling and satisfying.

Over 80 percent of those surveyed say they like or even love cooking, and most describe their style as traditional yet creative. They also prefer to prepare basic meals from scratch, as opposed to complex, gourmet food. The stovetop and indoor oven still reign supreme as Americans’ preferred cooking appliances, although toaster ovens and air fryers are also popular, with 45 percent of respondents using them at least twice per week.

Recipes are critical to connect with consumers. The vast majority (83 percent) likes to follow a recipe when cooking and most often find new recipes through a search engine. Visiting specific websites (e.g., allrecipes.com) and YouTube are also popular ways of discovering recipes. These findings complement Path to Purchase research Potatoes USA conducted last year, which found that recipe inspiration can motivate consumers’ purchases both before going grocery shopping and in-store.

The Consumer Attitudes and Usage online study is conducted annually to gather insights on U.S. consumers. It evaluates their attitudes toward foods – potatoes, in particular – and their dietary choices. This year’s study was fielded in January 2024 and included results from 2,000 respondents that were balanced to current census data on gender, income and age.

Please contact Potatoes USA at media@potatoesusa.com for more information.

Each Potato Seed Cutter built by Milestone is the product of constant refinement, nonstop innovation and hard earned experience. Milestone has over 50 years experience designing, building and operating potato seed cutters. Let that experience go to work for you!

Toll Free: 800-574-1852

Fax: 208-785-1060

info@milestone-equipment.com www.milestone-equipment.com

At422.2 million cwt, U.S. potato production in the reporting states is expected to fall 17.9 million cwt short of the 2023 crop. That is according to a North American Potato Market News (NAPMN) estimate as of early October. A large portion of the 4.1 percent reduction was intended for the frozen processing industry, but the downturn will affect the table potato and dehydrated product sectors.

Table 1 outlines our current usage projections for the 2024 crop, along with a three-year history of usage, as reported by USDA. Please note that relative demand between the industry sectors and market forces could alter the distribution of the 2024 potato crop relative to our current outlook. In the remainder of this article, we lay out our projections for the various industry sectors in greater detail.

Program states shipped 88.2 million cwt of table potatoes from the 2023 crop. That is 7.9 million cwt more than they shipped a year earlier. We believe that supply conditions and market forces will allow for a 3.7 million cwt reduction in 2024 crop-year shipments, to 84.5 million cwt, a 4.2 percent decline.

In addition, the product mix could be different. Low prices and increased promotion by retailers have supported strong russet table potato movement, which has offset red and yellow potato sales. Early-season red potato shipments are down 16.5 percent. Red potato shipments are likely to fall short of the 2023-24 pace throughout the storage season. Early-season yellow potato shipments are running 5.9 percent behind last year’s pace. Yellow potato shipments from the storage states could be relatively flat this year.

The russet potato supply situation is complicated by its intersection with the processing industry. Early russet table potato shipments have been running 13.7 percent ahead of the 2023 pace. Shipments have continued to pick up recently. Packers shipped 1.4 million cwt of russet table potatoes during the week ending Sept. 28. That is 288,000 cwt more than the previous year’s shipments, a 25.9 percent increase. We expect relatively strong russet table potato movement during at least the first half of the marketing year.

Processors in the eight reporting states used 176.1 million cwt of potatoes from the 2023 crop for frozen processing. That is 7.2 million cwt more than year-earlier usage, a 4.3 percent increase. NAPMN expects fryers to use 177 million cwt of potatoes from the 2024 crop. That is 950,000 cwt more than last year’s reported usage, a 0.5 percent increase.

The expected increase is due to strong domestic and export demand for French fries and other frozen potato products.

North American fryers shipped 3.7 percent less frozen potato products to offshore markets during the year ending June 30 than they did a year earlier. However, global French fry exports have grown by an average of 4.3 percent per year during the past 10 years.

Raw product supplies should be sufficient for local processor demand again this year in each of the major processing regions. North American fryers have expanded their processing capacity during the past several years. They may be able to re-capture some

of their lost market share during the 2024-25 processing season. However, market constraints and global economic uncertainty may hold processing use for the 2024 crop below our estimate.

Dehydrators in the reporting states used 42.7 million cwt of potatoes from the 2023 crop. That exceeded the yearearlier volume by 12.7 percent. We expect dehydrators in the eight reporting states to use 40 million cwt of potatoes from the 2024 crop. That is 2.7 million cwt less than they used from the 2023 crop, a 6.2 percent decline. It nearly matches the three-year average pace. Despite the downturn in offshore sales, demand for dehydrated products appears to be relatively strong. U.S. potato flake exports during the April-June quarter fell 7.5 percent below last year’s nearrecord sales volume. At 88.9 million pounds, second-quarter U.S. dehydrated product exports were the third largest on record. Raw product supplies should be sufficient to keep dehydrators running near capacity.

This is the difference between total processing use reported for the eight states and usage reported for dehydration and frozen products. It may include usage at chip plants in the reporting states, as well as other miscellaneous uses. At 13 million cwt, use in the category would fall 5.5 percent. Usage has been relatively stable at 12-14 million cwt each year.

This is the difference between total processing use reported for the program states and usage reported for the eight processing states. This is where most of the program states’ chip potato usage would show up. Total 2023-crop processing use in this category increased by 12.3 percent to 51.2 million cwt. At 48 million cwt, we are projecting a 3.2 million cwt reduction in 2024-crop processing use outside of the eight reporting states. Despite the 6.3 percent decline, projected usage in this category exceeds 2021 and 2022 levels. Chip

potato use could exceed our estimate if storage supplies are sufficient to offset the need for early new-crop potatoes.

Reported seed potato shipments from the 2023 crop totaled 21.4 million cwt, up 16.6 percent from the previous year. Two years of poor prices, due to excess supplies of table and processing potatoes, should encourage acreage reductions in 2025. At 20 million cwt, NAPMN expects seed movement from the program states to decline by 6.5 percent relative to the 2023 crop.

By Ben Eborn, Publisher, North American Potato Market News

• NAPMN currently forecasts a 17.9 million cwt reduction for the 2024 potato crop, down 4.1 percent from the 2023 crop.

• NAPMN expects 2024-crop table potato shipments from the program states to fall 4.2 percent short of yearearlier movement.

• Fryers could use 177 million cwt of raw product, 950,000 cwt more than they used from the 2023 crop.

per year), write or call: P.O. Box 176, Paris, ID 83261; (208) 525-8397; or email napmn@napmn.com.

By Dale Lathim, Potato Growers of Washington

Ihope everyone had a great summer and is finishing up a productive crop year. Over the past few years, I have written about a variety of subjects relating to rising costs of production, seed selection and overall industry trends. However, one very important topic I haven’t covered for a while is why you should be a member of the Potato Growers of Washington, Inc.

For those of you who are already members, we thank you and hope you recognize that we are doing all that we can to make this a better and more profitable industry for all growers. Your support helps us tremendously.

At a recent meeting, however, someone asked me why they should become a member. Before I could answer, another grower answered for me by replying, “Why would you not be a member?” When it was my turn to speak again in that conversation, these are the points I shared.

First, as a member, you not only have a say in voting on whether to accept a contract proposal, but you also get input into the topics discussed at the bargaining table. Often, it takes a few years of battling the same issues to make any significant changes to the contract. If your concerns are not addressed, they potentially can be put off for years unless there are other members who experience the same issue.

Second, we are your voice in dealing with any questions or concerns regarding either the contract implementation by your processor or the grading of your potatoes by the third-party inspection service. Many growers have questions throughout the year but are hesitant to ask their processor or the graders. PGW members can ask me the question and I can either answer it outright based on my experience or I can ask the question in a way that neither the processor nor the inspectors would ever know who is asking and why. This completely protects

your relationship with each party while getting you the answers you seek.

Third, as a member, you have access to the most up-to-date information about the industry. We have contacts within all the major processing companies, restaurant chains, exporters, growers in other regions and all of the grower groups around the country. As a result, we can be a one-stop source of information, whereas others have to pull together information from multiple other sources to form an opinion. We deal with this daily and have it at the ready; all you need to do is ask and we can provide you with the answer to most any question.

While there are many other reasons to be a PGW member, for the sake of space, I will stop at those for now and address a few of the common reasons growers give for not being a member.

The most frequent one is that since we changed the voting structure to weigh every vote by the volume each grower produced in the prior year, the organization is totally controlled by the large operations and other votes don’t carry any weight. While the facts in that statement appear to be correct, they are being taken somewhat out of context.

We changed the voting structure to volume rather than one person, one vote to protect the smaller grower. Prior to this change, smaller growers were being pressured by at least one processor into voting for the contract proposals in fear of losing their contract volume should the offer not be approved. This change immediately took the weight of the industry off several growers and they have thanked us multiple times for doing so. The targets are now on the backs of the large growers, who have a much better chance of standing up and protecting all growers than growers of any size would have had under the oneperson-one-vote system.

Along this same line, growers need to remember, the big growers have similar wants and needs as the small growers, just on a bigger scale. During my years in the industry, I have found that the large growers often ask how things will

impact the smaller growers before they ever vote on a contract proposal. Most of our large members are focused on the long-term health of the potato industry as they look not only to this year, but to generations to come.

Another reason I hear for not belonging is to avoid paying member dues when growers will get the contract price without paying a dime. It is correct that processors buy most of their potatoes on the contract that is negotiated with us for all of their growers, not just members. However, when you look at the cost of membership, if forgoing 13 cents per ton is going to make or break your operation, then by all means we understand and want you to protect your bottom line. But have you ever really considered how small the dues really are?

Back in 1988 and prior years, the dues were set at ½ of 1 percent of your gross dollars received. Growers would bring in copies of their settlement sheets and checks. The staff would then calculate the dues owed and the grower would write a check for the annual dues.

Then in 1989, with the passage of the Agricultural Fair Practices Act, which required first handlers to withhold dues for the accredited bargaining association, ½ of 1 percent was calculated to be 35 cents per ton. That was the rate from 1989 through 2016. In 2017, we lowered the rate to the current 13 cents per ton, which now represents less than 0.00065 percent of the average contract price. Or another way of looking at it is 42 pounds of potatoes out of the 66,000 pounds produced on average.

While I know I am biased, I feel that being a PGW member is the best bang for the buck in the entire potato industry. Further, we have the most complete information available and have the most direct impact on your pricing of anyone industry wide. For a few pennies per ton, you can be an active part in shaping our industry not only for today but for the future.