Definition:

A Donor Advised Fund (DAF) allows fundholders to make grant recommendations from their funds to benefit qualified nonprofit organizations.

Calculating the Dollar Amount Available for Grantmaking

Endowed Funds: Every October, the Community Foundation determines the dollar amount available for grantmaking from your fund by calculating 5% of the 12-quarter rolling average of your fund balance.

For example, if your average fund balance for the 12 quarters between July 2020 and June 2023 is $26,500, then 5% - $1,325 - would be available for grantmaking beginning October 2023.

Non-Endowed Funds: The total amount of the non-endowed fund is always available for distribution, less $5,000 – the minimum Fund balance required to maintain an active fund.

How to Submit a Grant Recommendation

The Foundation encourages you to support the organizations or causes that matter to you by making at least one grant annually. There are two ways to submit a grant recommendation:

1)Via the Donor Portal

2)Via email to your Donor Services Team Representative. Grant advisements processed via email include the following statement: “I acknowledge that grant recommendations must receive approval by the Foundation. In accordance with IRS regulations, no goods or services or non-tax deductible benefits will be received by payment of this grant”.

3) Form: Complete the Donor Advised Fund Grant Recommendation Form (a copy is provided upon request) and email it to your Donor Services Team Representative, or mail it to:

• All options allow you to specify the purpose of a grant as well as preferences about

• fundholder contact information and anonymous grantmaking.

• Once submitted, please allow five business days for review and the due diligence process. There is no limit to the number of grants authorized each year. The minimum grant amount for an advisement is $250.

Grant Advisements That Do NOT Meet IRS Regulations

Grants to charities which result in a direct benefit to you or your family.

Memberships that could result in a membership benefit to you.

Charity events that result in a benefit to you.

Grants to private foundations.

The Due Diligence Process

Upon receipt of your grant advisement, the Foundation will perform due diligence:

o Confirm 501(c)3 status using GuideStar or request the organization’s IRS tax exemption letter.

o Confirm current nonprofit contact information and address.

Grant Awards

Grant checks are issued weekly.

Unless you choose to remain anonymous, the grant checks are accompanied by a letter notifying the nonprofit that the donation should be recognized as a gift from your fund of the Community Foundation of Broward.

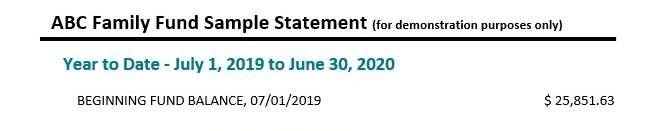

Fund Statements

You receive fund statements detailing information about your fund:

o Grant distributions made within the statement period.

o Donations to your fund made within the statement period.

o Current fund balance

o Current dollars available for grantmaking

• This information can also be viewed online via the Donor Portal.