1 minute read

2. PSD2 puts change and opportunity in the hands of PSPs

The payments industry has needed updating for a long time, and PSD2 makes change a reality.

Open banking, perhaps the directive’s most revolutionary initiative, enables third party access to account information and paves the way for greater innovation and competition in the market through open APIs.

PSD2 and the open banking initiative move the payments industry forward in two very large strides:

CREATING A LEVEL PLAYING FIELD

All PSPs active in the EU will be regulated and answerable to relevant rules set out by PSD2. This creates a level playing field that makes it possible for new entrants to make their mark in the payments market and a new environment for consumers using payment services.

Consumers will be able to use Payment Initiation Service Providers (PISPs) and Account information Service Providers (AISPs) to manage multiple accounts, data and make comparisons.

SECURING THE PLAYING FIELD

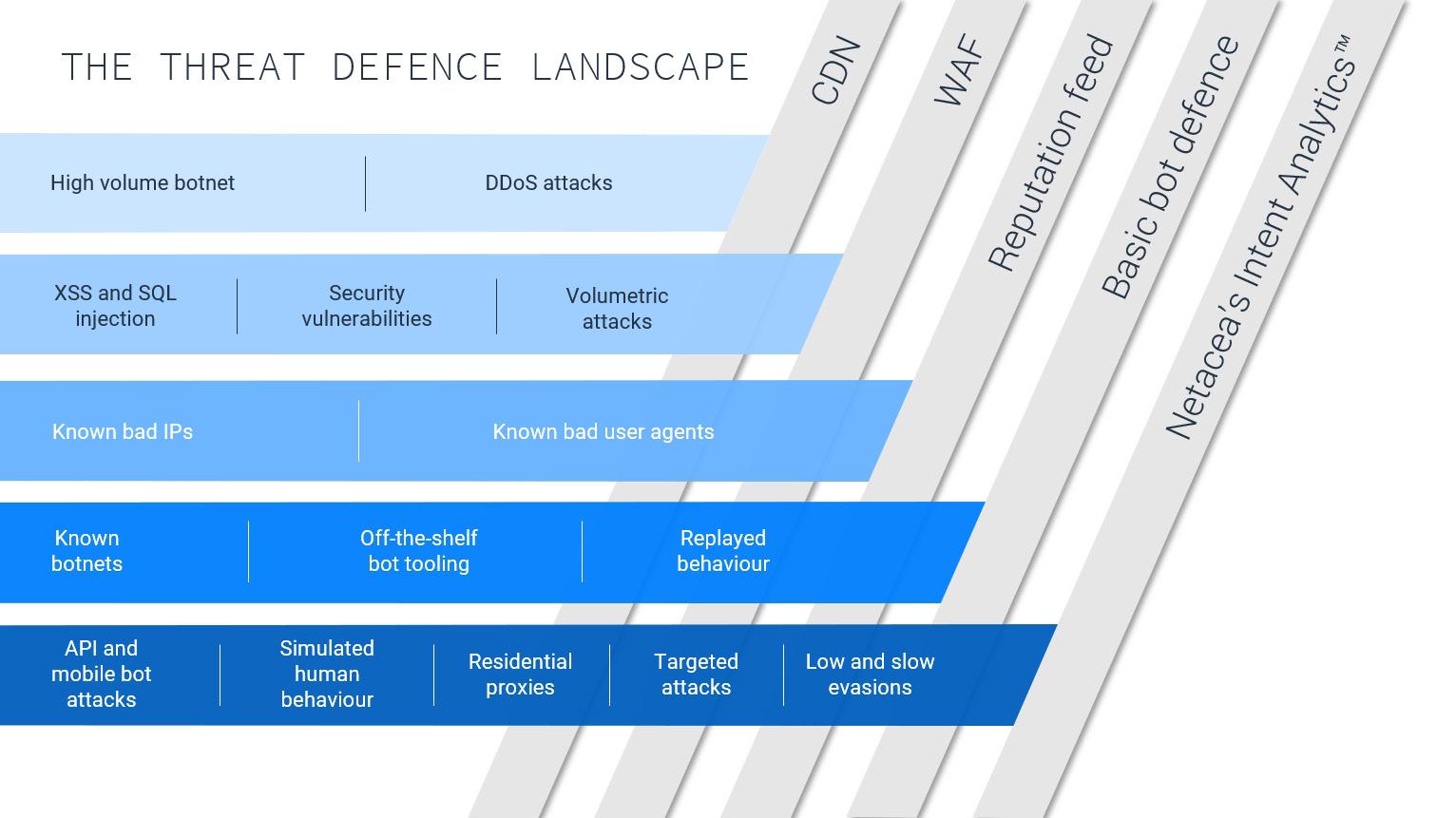

The introduction of open banking is a big red flag for PSPs to ensure their houses are in order. Systems and infrastructure must be up to date and open APIs in place to facilitate third party access requests; the ability to initiate online payments directly from a customer’s account.

APIs put control in the hands of TPPs. They can use a bank’s API to deploy their own solutions for businesses and customers, which can be integrated with data held by the bank.

Securing customer data is vital. According to the FCA, reports of cyber incidents at financial services firms increased 1000% in 2018. This figure is expected to rise with the growth in mobile payments.¹

¹Experian - New case of financial fraud reported every 15 seconds in 2018.