1 minute read

How Netacea supports PSD2 compliance

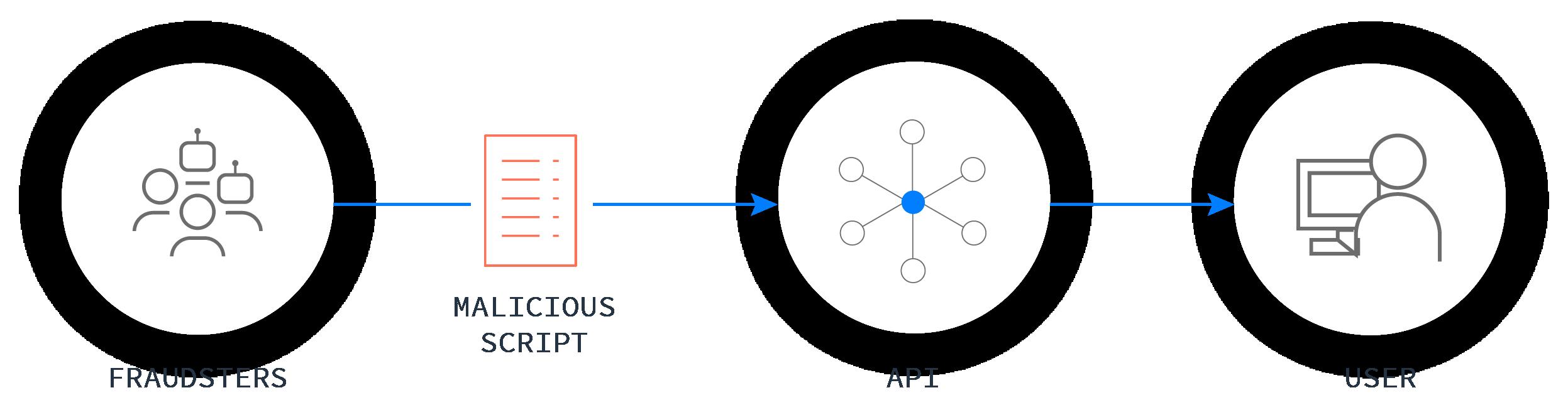

To comply with PSD2, your financial services organisation must implement APIs to facilitate open banking, and you must also recognise the associated security risks.

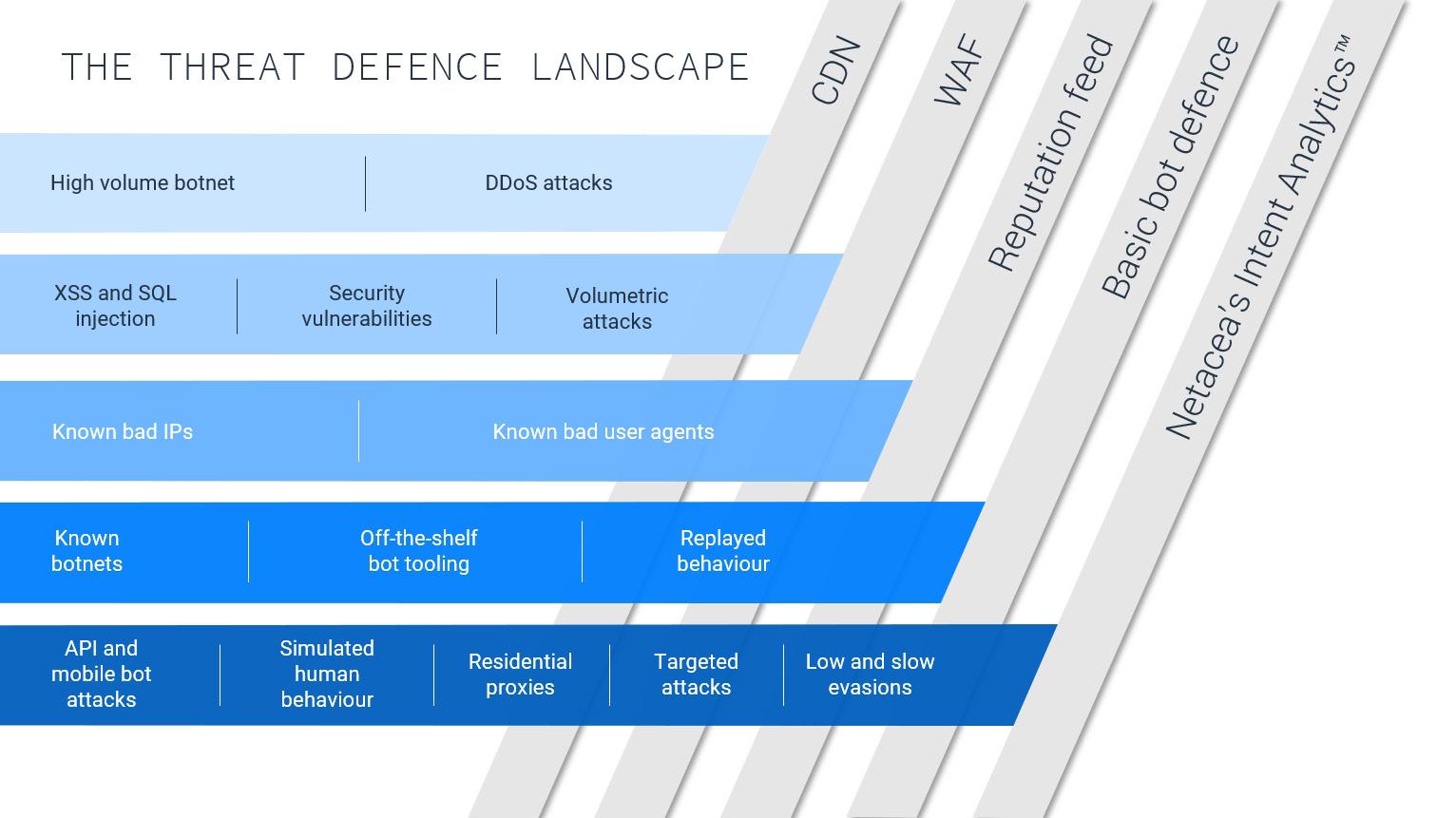

At Netacea, we take a revolutionary approach to bot management, applying a single solution with innovative coverage across all API points of vulnerability – browser, mobile app and API server – without the need for multiple products or complex mobile SDKs.

We monitor all site visits to a specified path and analyse them in context relative to each of the visitors to the enterprise estate. The technology then automatically learns from the business’s web estate according to the threats identified and your specified business priorities. This in-depth insight is then fed back to your business so that you can make informed decisions about your traffic.

We look at the behaviour of all website visitors, and in our multi-dimensional data, we look for identifying clusters of behaviour, including fingerprint markers. The machine learning intelligence dynamically assesses what constitutes “normal” behaviour over time, by path or location.

By its very nature, this machine learning approach becomes more efficient over time while traditional approaches become less effective as the bots evolve and work around the scripts.

Talk to our team today at hello@netacea.com or https://www.netacea.com/contact, to find out how we can protect your API layer and secure your customer data where it matters most.

Netacea provides a revolutionary bot management solution that protects websites, mobile apps and APIs from malicious bots such as scraping, credential stuffing and account takeover. Visit Netacea.com to find out more.