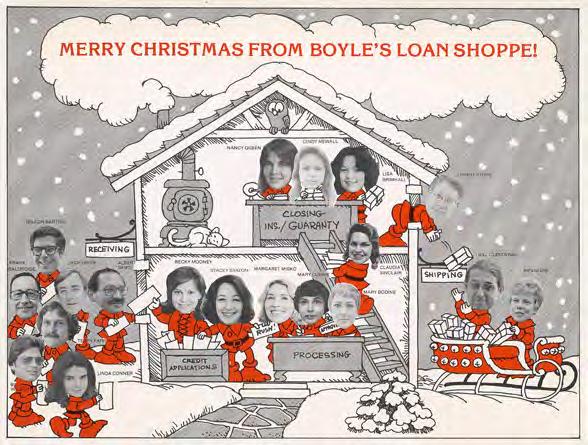

Dedicated to the employees, partners, and customers of Boyle Investment Company and Boyle Insurance Agency in Memphis and Nashville.

published by 2023

Vision and o t her Boyle Pro P e rties

Dedicated to the employees, partners, and customers of Boyle Investment Company and Boyle Insurance Agency in Memphis and Nashville.

published by 2023

Vision and o t her Boyle Pro P e rties

These are the traits that make up vision. They are the traits that can transform a landscape, and they are the traits that deliver lasting value and sustainability. And they are the traits on which Boyle Investment Company was founded in 1933 and has built a legacy of visionary development and lasting impact.

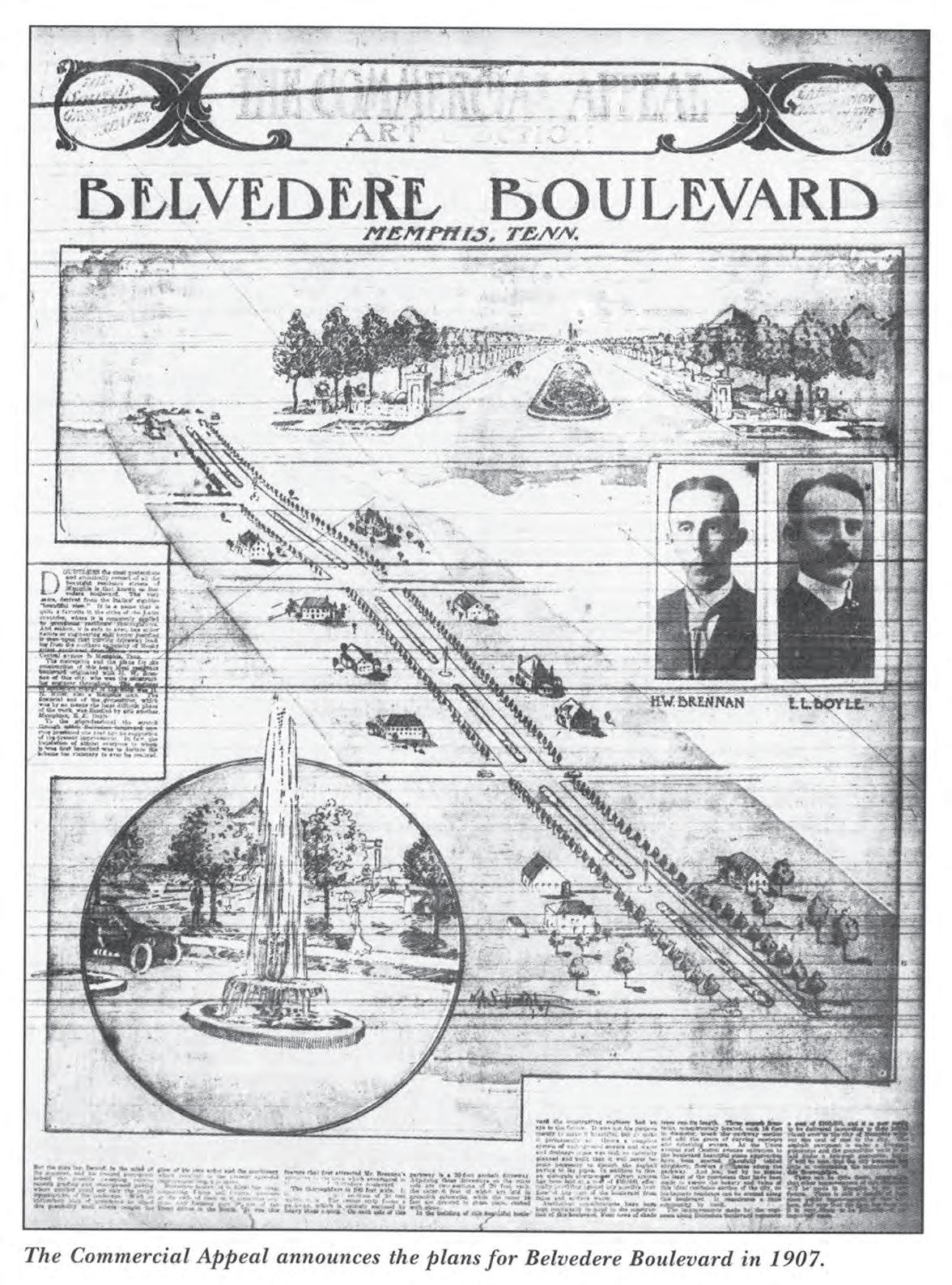

The Boyle family and their ancestors have been building community since the early days of the founding of Memphis. Boyle family ancestor John Overton founded the city of Memphis in 1819 in partnership with Andrew Jackson and James Winchester. In 1907, Overton’s great-great-grandson, Edward Boyle, began development of the stately Belvedere Boulevard in Midtown Memphis, which remains today one of the city’s most prestigious addresses. In 1933, Edward’s three sons — J. Bayard Boyle, Sr., B. Snowden Boyle, and Charles Boyle — founded a company based on their father’s dedication to building community with long-term vision.

Bayard Boyle, Sr., president of the growing firm, had a remarkable ability to predict the paths of growth. With an eye for the future, he acquired large parcels in key corridors that would be developed decades later.

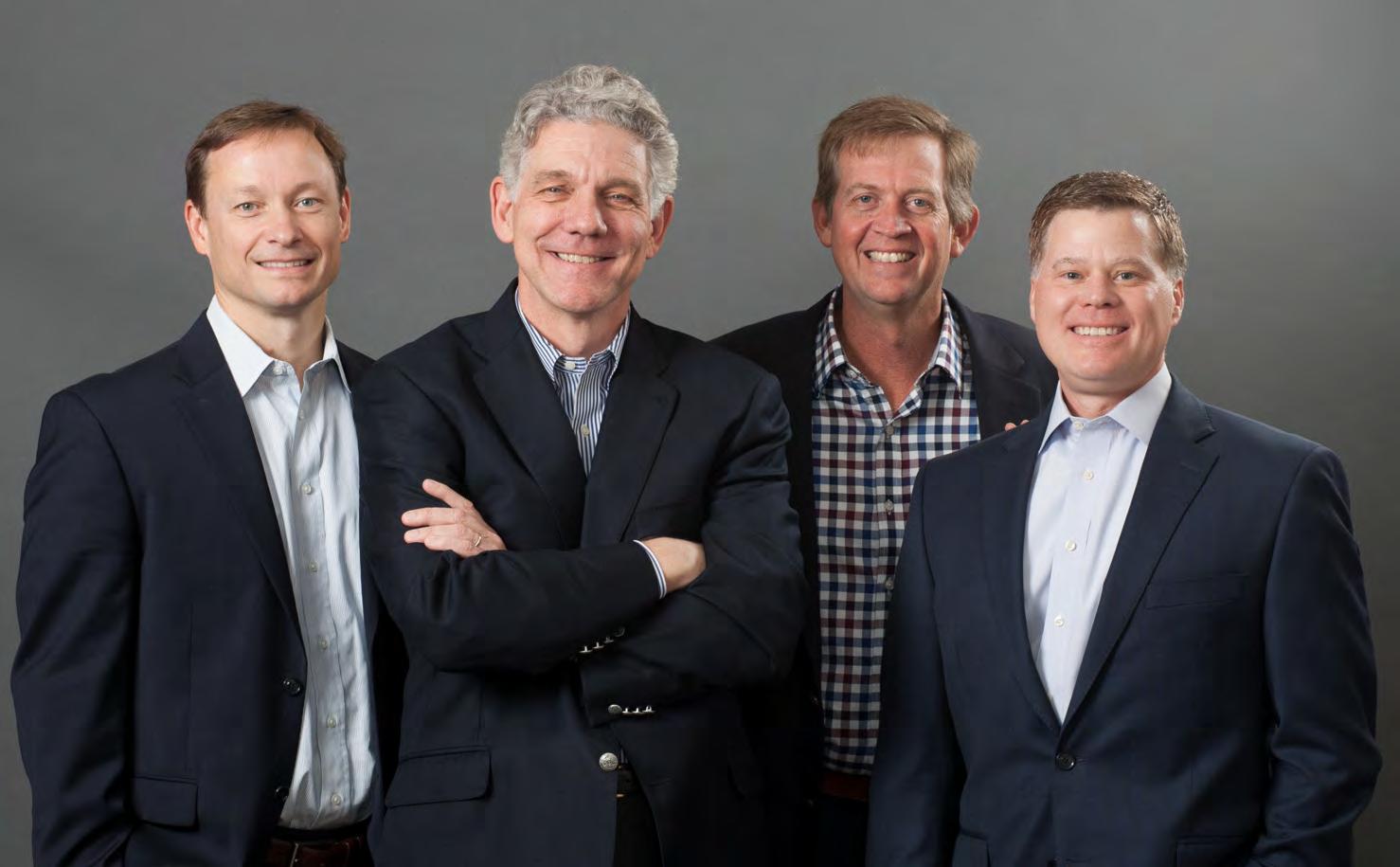

Boyle Investment Company’s commitment to building community with visionary projects and long-term ownership has not changed. In fact, the large parcels of land have now been transformed into some of the region’s premier communities — known for their high quality, strict standards, and attention to detail. Today, the company has a strong portfolio of commercial, residential, and mixed-use projects in Memphis and Nashville that have endured the test of time.

In Memphis, Boyle is known for its planning, development, management, and leasing of major projects such as Farmington, Ridgeway Center, Humphreys Center, River Oaks, The Regalia, Schilling Farms, and Spring Creek Ranch. Boyle Nashville was launched in 2001 and has grown to become one of the largest private developers in the greater Nashville market. The firm is recognized for its complex, mixed-use projects such as Meridian Cool Springs, Berry Farms, Capitol View, and McEwen Northside.

We could not have achieved this without the hard work, talent, and dedication of our employees, many of whom have been with the company for more than 50 years. Our depth of expertise is indeed a key ingredient to the high quality of our real estate projects.

Year after year, the news on the street changes and fads come and go. But generation after generation, Boyle remains dedicated to building community with the same value-oriented principles established at its founding.

On the following pages we outline the rich history of Boyle Investment Company.

Matt Hayden President and CEO Boyle Investment Company

Follow the course of the mighty Mississippi River, from its broad mouth at the Gulf of Mexico, as it twists and turns past low-lying land to the west and high bluffs to the east, and eventually explorers will discover its source — a lake in Minnesota called Itasca. Now, trace the origins of the Boyle family of Memphis, and going back through five generations, historians will encounter one of the most noteworthy men in Tennessee: Judge John Overton of Nashville.

Joining with two influential friends, also from the capital of the newly established state of Tennessee — Generals James Winchester and Andrew Jackson — Overton founded the city of Memphis on the highest of those riverside embankments, the southwest bluff of the Chickasaw nation. Over the years, his descendants would eventually marry and form strong ties with some of the most industrious and farsighted families in the Bluff City — Brinkley, Snowden, Ragland, Morgan, Boyle — to this day, prominent bankers, lawyers, developers, and civic leaders.

OPPOSITE: An illustration from Harper’s Weekly shows the section of Madison Avenue that was known as “Banker’s Row” since so many banks were located there in the mid1800s. At the end of this view, the Customs House stands on Front Street. That building has survived; today it’s the University of Memphis Cecil C. Humphreys School of Law.

As a result of these connections, we come to the present day, 90 years after Boyle Investment Company opened its doors in 1933, and everything has come full circle. Those three men from Middle Tennessee purchased land to build a brand-new city to the west, calling it Memphis, after the ancient Egyptian capital along the Nile. The Boyle family, which traces its ancestry back to Judge John Overton, has helped transform this city into one the founders wouldn’t have recognized, with its major property acquisitions and exciting developments. Meanwhile, they have turned their vision back to Middle Tennessee, reshaping the urban and suburban landscape of our state’s capital.

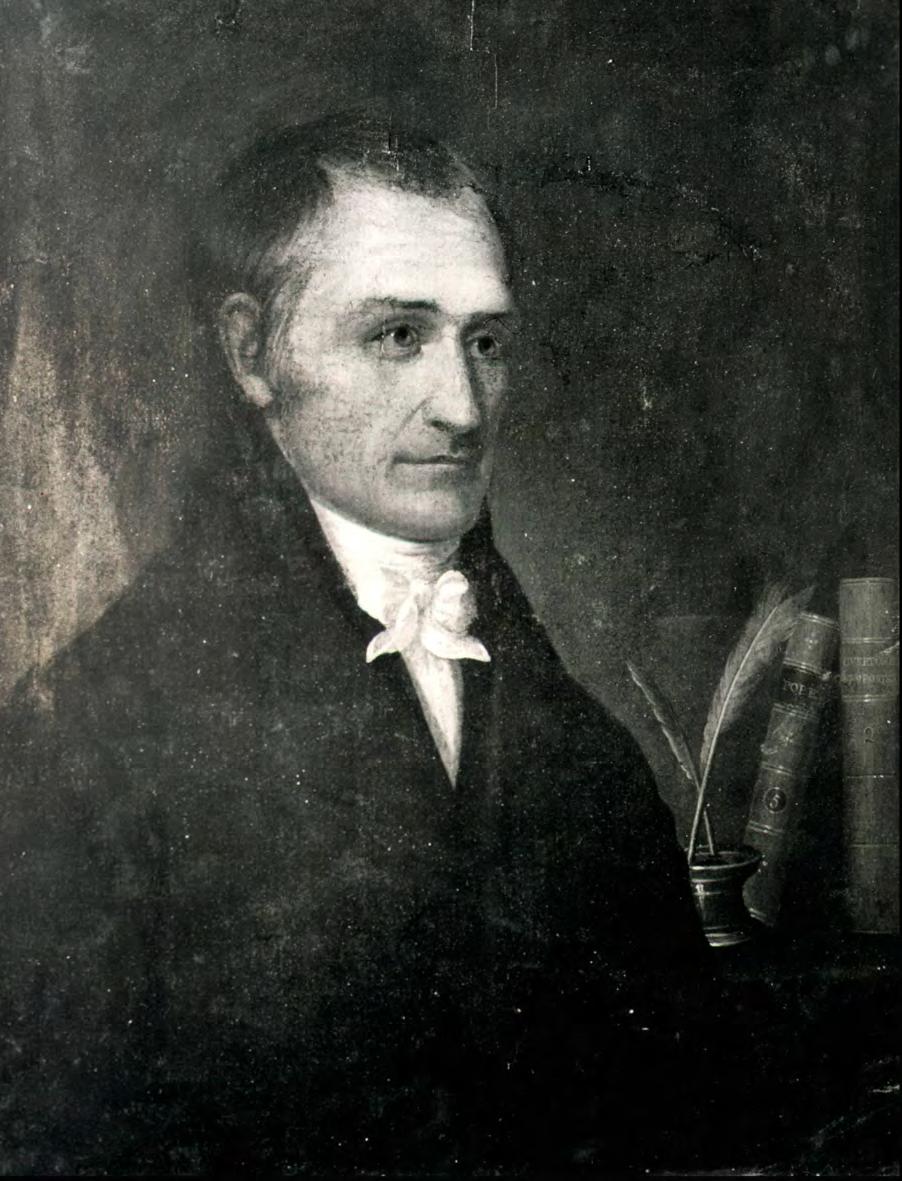

RIGHT: Judge John Overton, one of the state’s most influential citizens, joined with two of his friends — G eneral Andrew Jackson and General James Winchester — to purchase and lay out the new city of Memphis.

Born October 26, 1869, in Hardeman County, for many years Edward Boyle, the son of Thomas Boyle, helped run the family’s operations there. He enrolled at Princeton University, and after graduation, earned a law degree from the University of Virginia.

Returning to Memphis, he began practicing law while also developing an interest in property sales and development. In 1894, he formed the real estate firm, Boyle & Boyle, with his brother, Charles. Edward married Imogene Snowden, the daughter of Colo -

nel Robert Bogardus Snowden, described by The Commercial Appeal as “a leader in Memphis affairs … and praiseworthy and admirable in all relations in life.”

The company’s offices were located on the second floor of 16 Madison Avenue. They remained

“Three hundred and sixty lots were surveyed, with wide streets running towards the cardinal points of the compass and four public squares. Provision was also made for a spacious promenade along the summit of the bluff for the entire length of the riverfront.”

— GERALD CAPERS

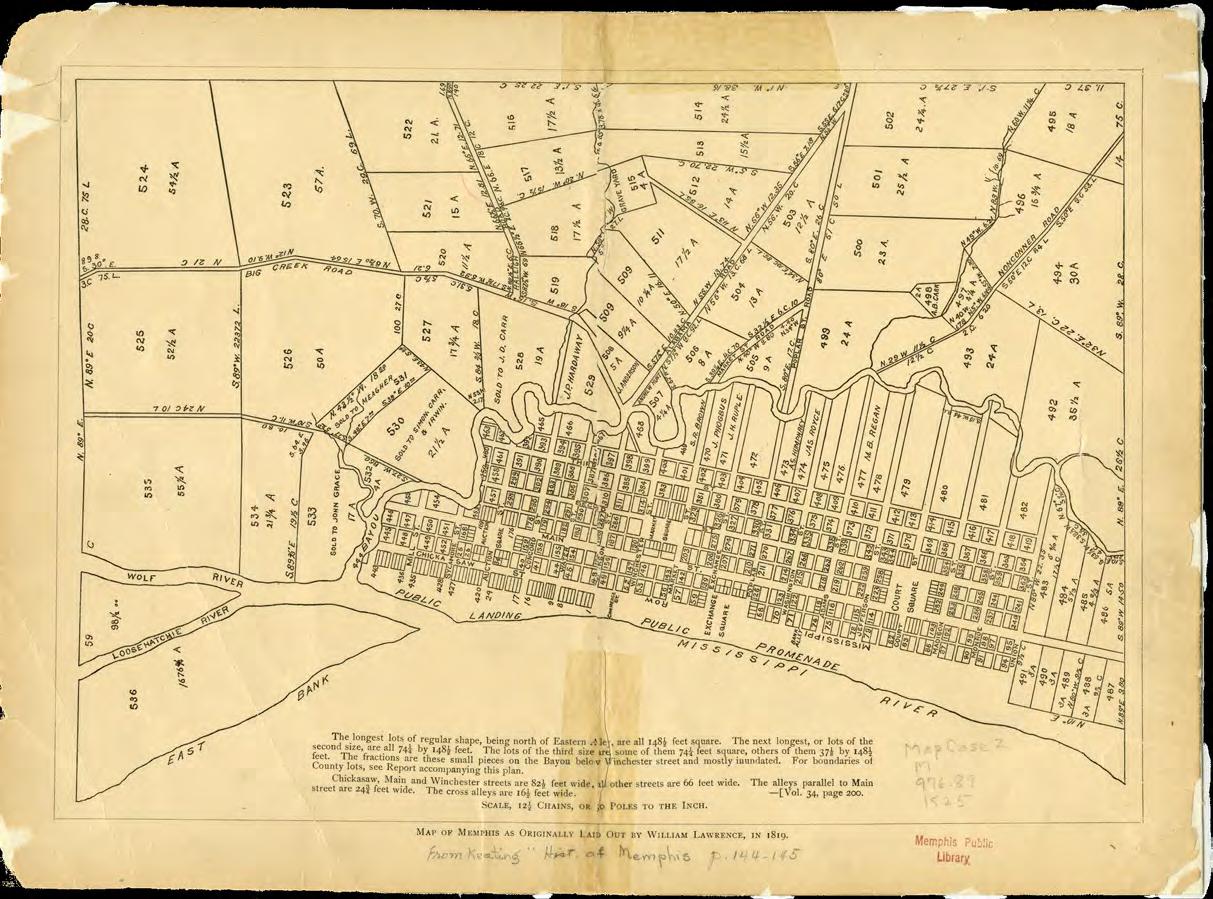

BELOW: The original plan for the new city of Memphis shows a grid of streets arranged along the riverbluff, with four public squares and a promenade.

in the law business for only a few years, until 1906, when they embarked on one of the most memorable real estate ventures in this city’s history — the development of Belvedere Boulevard.

Memphis had been steadily expanding eastward during the late 1800s and early 1900s, with other developers laying out grids of streets lined with handsome residences, from four-squares to low-slung bungalows, in the Annesdale-Snowden and Central Gardens neighborhoods. The two principals of Boyle & Boyle took a

look at a vacant stretch of land between Union and Central, with its distinctive ridge along the western side of the property, and had a grand idea. Selecting the best architects of the city — among them Mahan and Broadwell, Hanker and Cairns, Charles Oscar Pfeil,

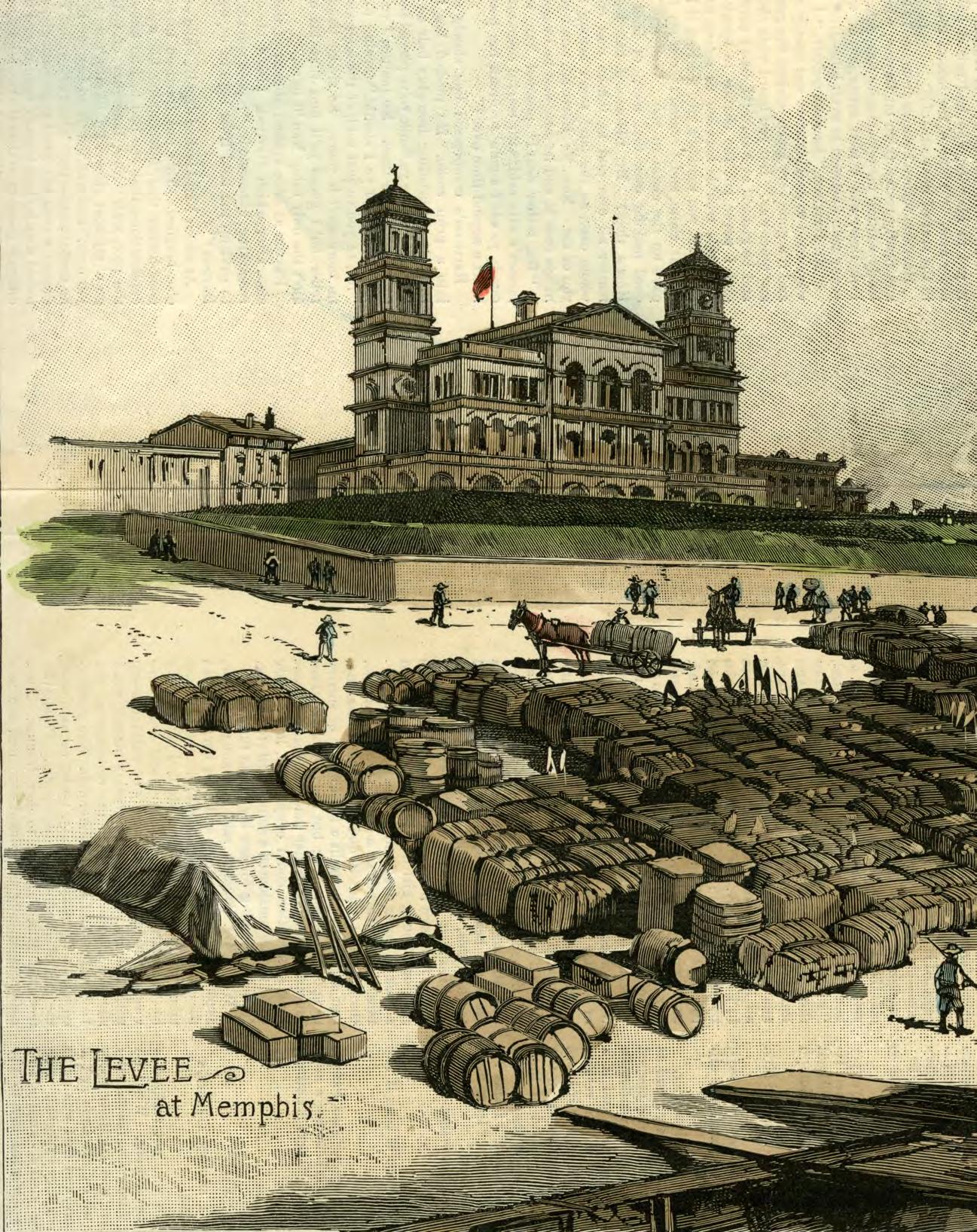

BELOW: Harper’s Weekly published this illustration showing how the growing city of Memphis looked from across the river.

and others — they created what the authors of Memphis: An Architectural Guide considered “one of the most impressive residential streets in the city,” in spite of the fact that The Commercial Appeal initially had deemed the project “too visionary to ever be realized.”

Mary Keyes, author of the history/guidebook Belvedere and Other Places, described the new development as “marvelous, wonderful

Belvedere, where lives have been lived out, and history and families have been made, and all in this glorious setting.”

Due to health problems, Charles left the family business, and in 1920 Edward briefly teamed up with another real estate professional in Memphis, Oscar Polk. Their new firm of Polk and Boyle handled smaller residential transactions throughout the city, though noth-

ing on the scale of Belvedere.

As the Depression deepened, three of Edward’s sons – Bogardus Snowden Boyle, John Bayard Boyle, and Charles H. Boyle, Jr. — opened offices in a red-brick building at 148 Monroe, sharing the ground floor with the Western Union telegraph offices. On April 5, 1933, they chartered a new firm that would endure for decades, calling their new venture Boyle Investment Company.

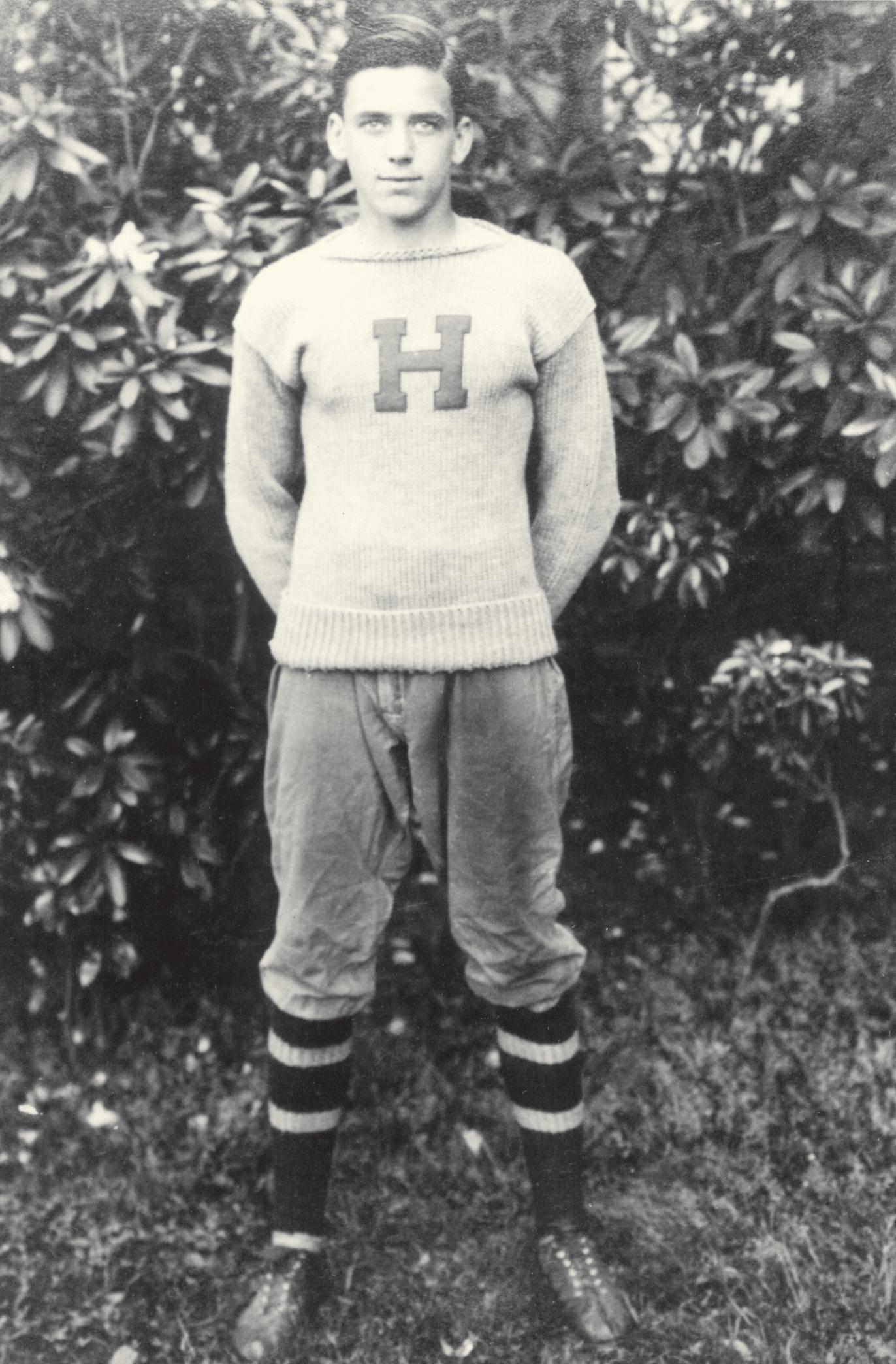

This 1913

shows the Boyle family children. in

in

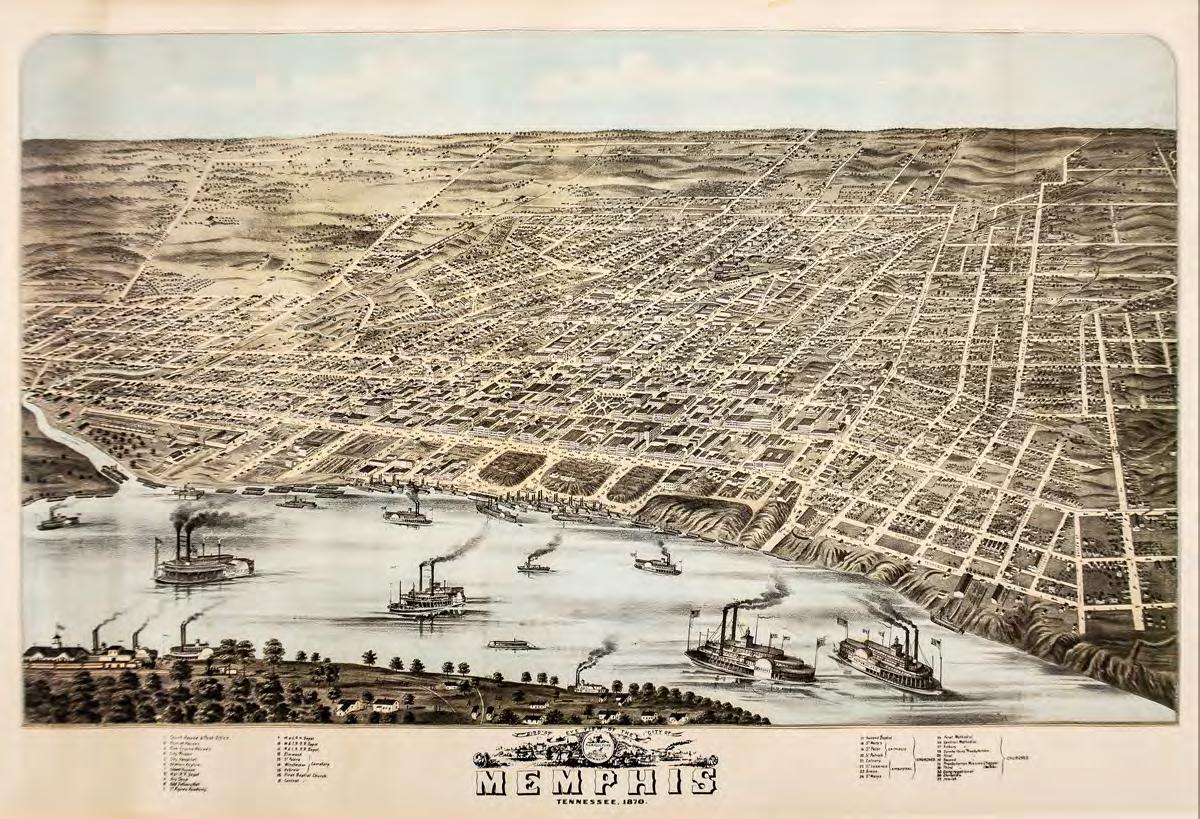

ABOVE: An aerial view shows Memphis spreading eastward in the mid-1800s. Note the river traffic along the Mississippi.

Selecting the best architects of the city — among them Mahan and Broadwell, Hanker and Cairns, Charles Oscar Pfeil, and others — they created what the authors of Memphis: An Architectural Guide considered “one of the most impressive residential streets in the city.”

OPPOSITE: The Commercial Appeal included this illustration of the proposed Belvedere Boulevard development, a project they deemed “too visionary to ever be realized.”

ABOVE: With its stately homes and mature trees, Belvedere Boulevard today, which stretches south from Union to Central, is considered one of the most beautiful streets in Memphis.

In April 1933, three of Edward Boyle’s sons — J. Bayard Boyle, Sr., B. Snowden Boyle, and Charles H. Boyle — followed their father’s lead and established Boyle Investment Company. It seems appropriate that the new firm was located at 148 Monroe Avenue, one of the first streets laid out by the original founders of Memphis.

The end of the Great Depression would not seem an ideal time to embark on a new business venture. The stock market had crashed, factories across America were shuttered, and farmers lost their crops when a relentless drought struck at the same time. Memphis, however, seemed to escape the full brunt of these economic forces. A history of the city’s largest bank (now known as First Horizon) noted, “Despite the unstable economic conditions prevailing after 1929, First National showed a remarkable growth record, and its deposits tripled during the 13-year period 1926 and 1939.”

Boyle Investment Company, starting out with only five employees, served as agents and mortgage loan specialists for a number of high-profile insurance companies, almost all of them based outside of Memphis. Their first client was New York Life, and that was soon followed by associations with Nashville Life & Accident Insurance Company in Nashville and the Provident Life & Accident Insurance Company in Chattanooga. These companies had foreclosed on a number of houses throughout the state, including Memphis. They asked Boyle Investment Company to manage the properties — renting them out, or financing their sales to new owners — while also managing the advertising and promotions necessary. Boyle Investment Company would later open a residential sales department to handle these smaller properties.

It seems appropriate that the new firm was located at 148 Monroe Avenue, one of the first streets laid out by the city’s founders.

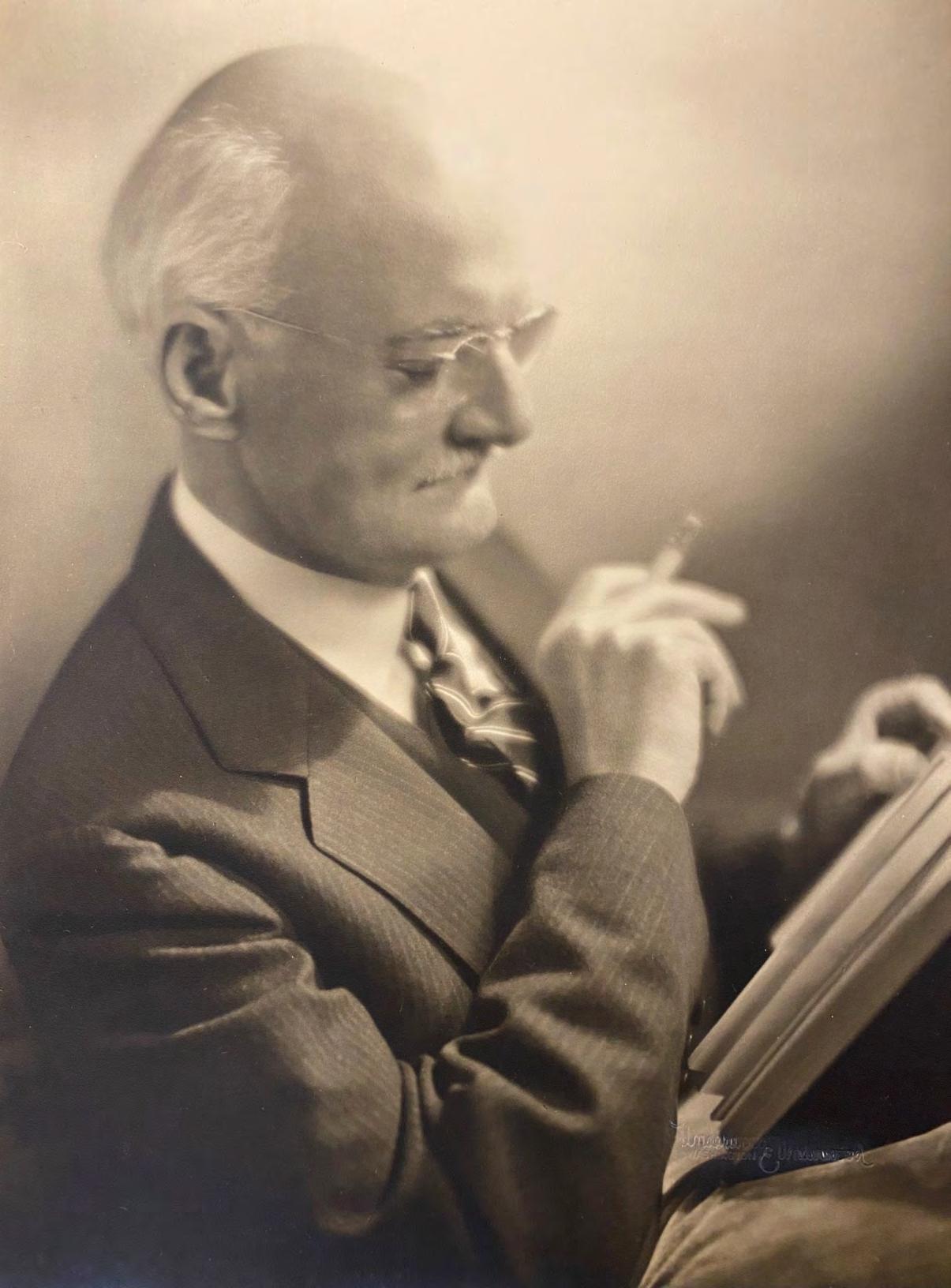

ABOVE: Portrait of young Bayard Boyle, Sr.

The company suffered a setback in 1935, when Charles Boyle, Jr. passed away. Cancer had restricted his involvement in the business for several years, and he had essentially retired at about the same time the new company was getting off the ground. In his role as secretary-treasurer, he was replaced by James B. Chism — the first person outside the immediate Boyle family to work in a leadership role.

During this early period, through their connection with New York Life, Boyle also established a strategic relationship with A&P groceries. Established in New York City in 1859, the full name was the Great Atlantic & Pacific Tea Company, but these stores sold much more than tea; in the early 1900s, they became the largest grocery chain in America. The company erected stores throughout Memphis and also constructed warehouses in other cities, such as New Orleans, for their merchandise.

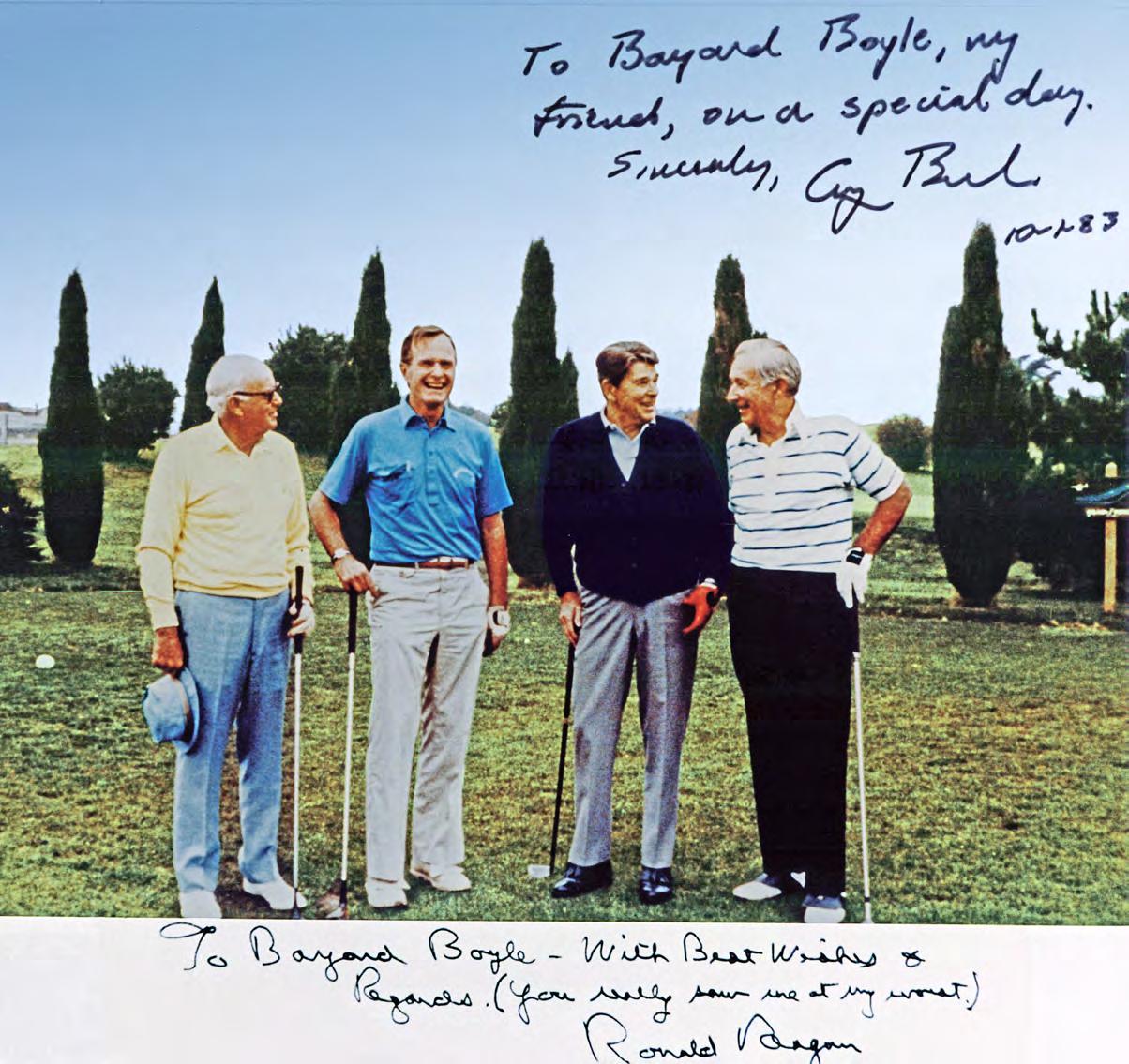

“My father worked out a deal where New York Life would finance the A&P warehouses in New Orleans and different places,” said Bayard Boyle, Jr., who would later become president and chairman of the firm. “There weren’t that many of them, but it was a lot of money for those days. The financing arrangement required no equity, but New York Life got all the income for the first 20 years, after which we owned the property free and clear. Basically it was a 100 percent loan, fully amortized over a 20-year period.”

In 1933, Bayard Boyle, Sr. achieved what he always said was his greatest accomplishment — marrying Margaret Elizabeth Ragland, the daughter of Samuel and Cary Ragland. Memphians knew her father well, the longtime president of Central State National Bank, and when that firm was acquired by First National Bank in 1926, he was named president of First National (later called First Tennessee, and now First

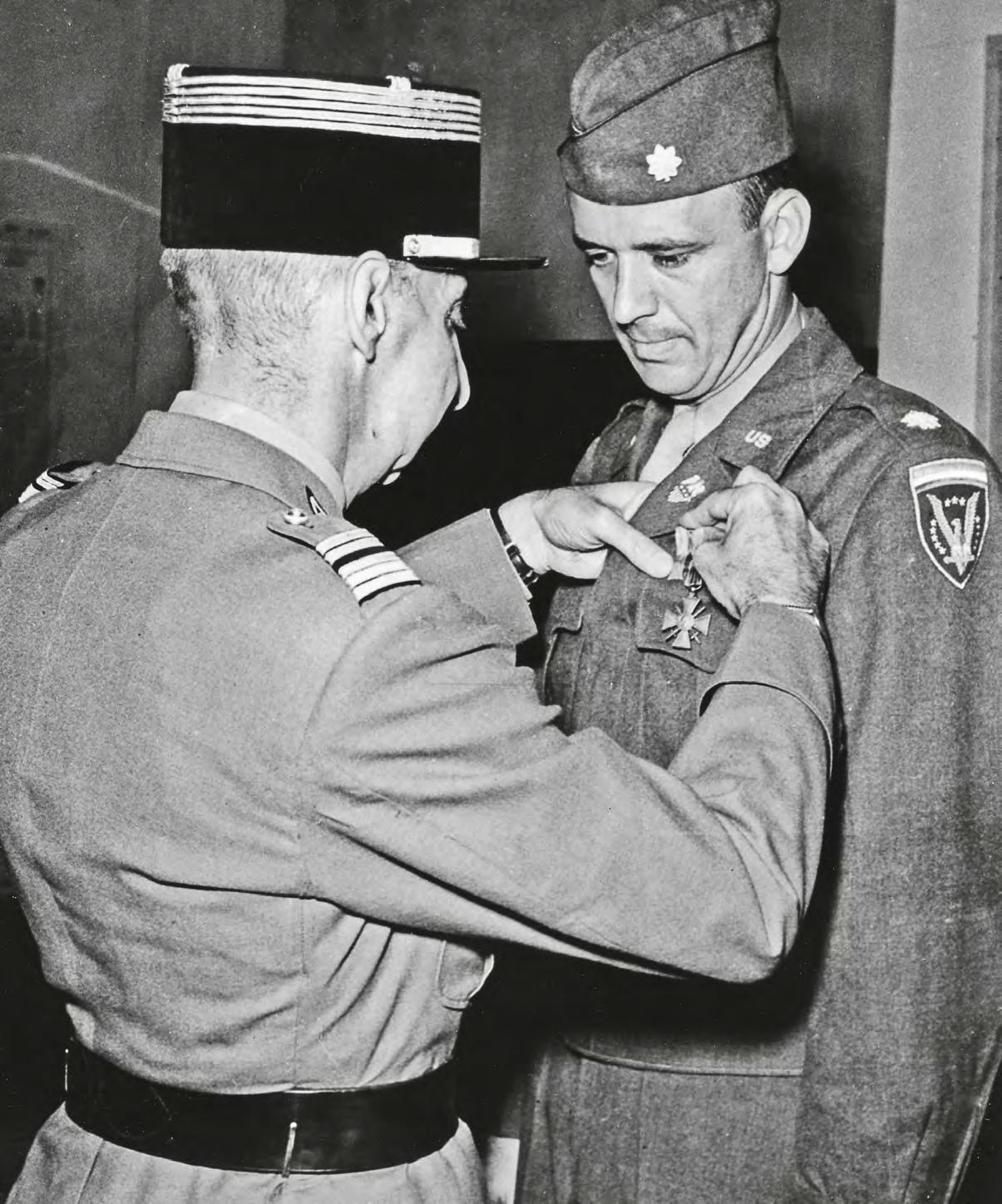

When the war began, Bayard Boyle, Sr., at age 33, joined the Army, rising through the ranks to the position of Lieutenant Colonel by war’s end.

ABOVE: The attack on Pearl Harbor. On Battleship Row, dense smoke rises from the forward and midships portion of the USS Arizona BB-39. Just ahead of her (L-R) is the sinking USS West Virginia BB-48 outboard with the slightly damaged USS Tennessee BB-43 inboard.

OPPOSITE: For bravery in action, Lieutenant Colonel Bayard Boyle, Sr. was awarded the French Croix de Guerre, among other military honors.

BELOW: Portrait of Elizabeth Boyle.

Horizon), a position he would hold until his retirement in 1943.

The wedding also forged ties with another prominent Memphis banker, Norfleet Turner, who had married Elizabeth’s sister, Eleanor. Turner would follow Ragland as the next president of First National, a position he held from 1943 to 1960, with The Commercial Appeal describing him as “one of the most widely known bankers in the South.”

The 1941 attack on Pearl Harbor and this country’s entry into World War II affected everyone in America. In Memphis, as in other communities, companies immediately adapted their products and workforce to support the war effort. Construction firms and other companies involved in the home-building industry found themselves pivoting to produce equipment for the armed forces, with supplies — especially essentials such as gasoline, rubber, steel, tin, copper, and lead —

strictly rationed.

In Shelby County, the U.S. Army took over a chemical plant operated by DuPont and transformed it into one of the country’s largest manufacturers of gunpowder. Buildings at the Fairgrounds were converted into offices and barracks for the Second Army, and the massive Defense Depot opened on Airways.

On a personal level, hundreds of men and women enlisted in the Armed Forces, including employees of Boyle, among them the company’s co-founder. When the war began, Bayard Boyle, Sr., at age 33, joined the Army, rising through the ranks to Lieutenant Colonel before the end of the war. He served as the personal aidede-camp to General Benjamin Lear, who was in charge of training for the Second Army. In fact, that connection came about when Lear approached Boyle Investment Company about acquiring and developing office properties for the Army around Memphis.

“I don’t know how he did it, but Dad got it done in an amazingly short time,” said Bayard Boyle, Jr. “General Lear was so impressed that he asked him to be his personal aide-de-camp.”

Bayard Boyle, Sr. saw considerable action in Europe, where he served in battle. He was at the Battle of the Bulge and witnessed the famous capture of the Remagen Bridge over the Rhine. During the last few months of 1944, as Allied forces were approaching the German border, he reported battle situations to headquarters. Boyle witnessed the first use of massed searchlights illuminating the battlefield by bouncing light off a low fixed cloud cover. Allied intelligence was predicting a massive German night counterattack across a valley, so they were able to position searchlights ahead of the attack. When the German forces were fully committed, the searchlights were turned on, and American artillery and machine gun fire decimated the attacking forces.

During another German counterattack a battalion commander was killed or otherwise incapacitated and Boyle was made acting battalion commander for several days until a replacement could be found. For his action in this engagement he received the French Croix de Guerre with Bronze Star. Because he worked so closely with General Lear, Lieutenant Colonel Boyle also interacted with many of the war’s military leaders, including Generals Marshall, Eisenhower, Patton, Bradley, Simpson, Hodges, and others.

After the war ended, the Boyles embarked on a major residential development — something the company, in its earlier incarnation as Boyle & Boyle, had not attempted since the Belvedere Boulevard project some 40 years

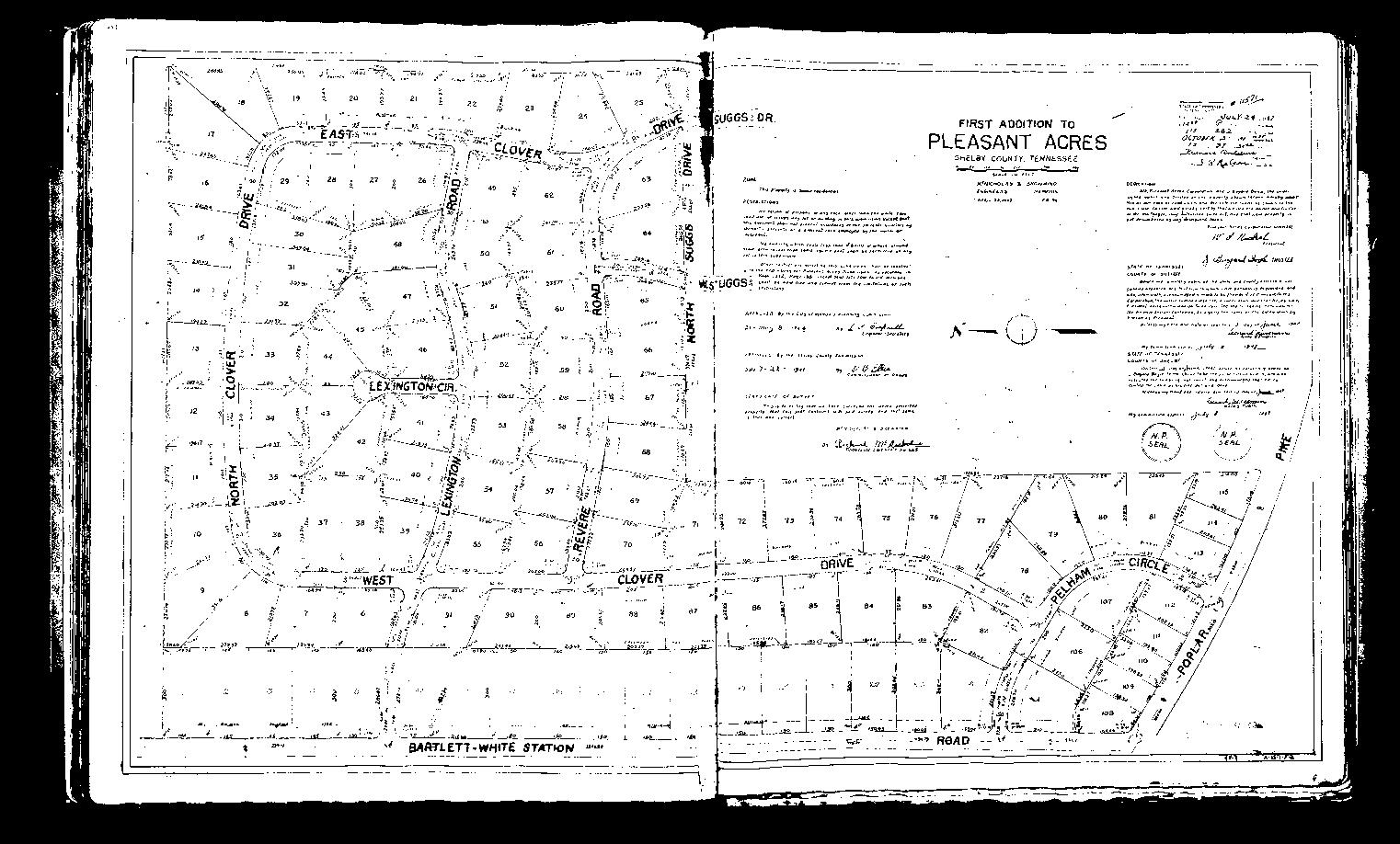

ABOVE: One of the homes in Pleasant Acres, developed by Boyle Investment Company in the 1950s.

OPPOSITE : The original plan for the neighborhood in East Memphis.

earlier. They would call their new subdivision Pleasant Acres, noted for its winding roads and half-acre (and larger) lots.

Located just northeast of present-day Poplar Avenue and White Station Road, when this project began, in 1947, the area was considered out in the country. There was, in fact, no White Station

Road. The Bartlett Road, as it was then called, stretched south from Macon Road and came to a deadend at Poplar Avenue. Developers in the 1940s saw no need to extend it farther; Eastgate Shopping Center was still an empty field, and the present-day subdivision of Colonial Acres, with hundreds of homes built by Jacobson-Lovitt

and other developers, was still a pipe dream. On Poplar itself, about the only commercial enterprise in that area was a popular restaurant called Davis White Spot, just east of present-day Estate Drive.

So Boyle Investment Company, after acquiring acres of fields and farmland, shielded by clumps of oaks, pines, and hickory, basically

worked with a blank slate. What they produced was a scenic neighborhood, accurately named. These were indeed pleasant acres for the new residents who would call the area home. Curving roads — Clover, Suggs, Pelham Circle, Lexington — ex tended north from Poplar, and the lack of sidewalks allowed builders to work around the existing trees to erect handsome ranchstyle residences on more than 100 lots. It was never meant to be a high-end development, but a quiet, secluded place to live and raise a family.

Beginning in the late 1940s, Boyle got involved with another venture across town, in a similar — but considerably larger — development called Sherwood Forest, located southwest of Park and Getwell. This neighborhood also incorporated winding roads, sheltered by large oaks and tall pines, this time naming them after characters from the legend of Robin Hood. Different local contractors, all of them following several basic plans, constructed two- and three-bedroom houses along Friar Tuck, Maid Marian, Nottingham, and other roadways. Boyle handled promotions, sales, and financing.

Elementary schools that would serve more than 600 families in the development (which included additions until 1962) followed the Robin Hood theme; their mascot

financing and management of these retail centers. “Since they were a grocery wholesaler, they worked with stores like Big Star and other chains,” said Bayard

These were indeed pleasant acres for the new residents who would call the area home. Curving roads extended north from Poplar, and the lack of sidewalks allowed builders

to work around the existing trees to erect handsome ranchstyle residences on

more than 100 lots.

Bayard, Jr. recalled one time when Boyle Investment Company had developed lots along the south side of Poplar Avenue, and sold a few of them to Wilson. After two months, Wilson called Bayard, Sr. and said there had been a terrible mistake. It seems Wilson had built a new home on one of the Boyle lots — but not one that he had purchased.

“Dad said, ‘Oh, that’s all right. I’ll just swap lots with you.”

For commercial loans, Bayard, Jr. remembered that Belz was probably their biggest client for many years. “They were tough on the deals, so we didn’t make a lot of money from them,” he remembered, “but we did an awful lot of business with them.”

As with Pleasant Acres, the homes weren’t spacious — approximately 700 to 940 square feet — but they were situated on unusually large lots. Prices were affordable, ranging from $7,600 to $10,500, with discounts for veterans, and the absence of sidewalks gave the older parts of the area a pleasing, “village” feel. The new Sherwood Junior High and

was (and still is) the Archer. By this time, Boyle Investment Company also had become involved with the Memphis-based grocery wholesaler Malone & Hyde, which operated its own stores and provided inventory for other chains. The Malone & Hyde stores often served as anchors for smaller shopping centers in the area, and Boyle Investment Company took over the

Boyle, Jr., “and with their lease in hand, we were able to borrow to construct the small retail centers in this region.”

These were busy times for the growing company. They also worked with other investment firms and developers, such as Kemmons Wilson, founder of the worldwide Holiday Inns, and Belz Enterprises, perhaps best-known for reviving the Peabody Hotel.

Snowden and Bayard — two men who had established a reputation for their honesty, integrity, and high-quality projects — carried on, and the firm prospered. One reason for their enduring success was the strong partnerships they formed with other companies. They established mortgage-loan associations with the New England Life Insurance Company of Boston and The Bowery Savings Bank of New York. One of the most important and long-lasting of these was with Northwestern Mutual, based in Milwaukee.

“Over the years, Northwestern Mutual has been wonderful; we mainly worked with them on mortgage loans,” said Bayard, Jr. “We’ve been with them for decades. They are great partners — people with good judgment who know what they are doing.”

OPPOSITE: Bayard Boyle, Sr.

The success of Pleasant Acres and Sherwood Forest played a role in the next phase of Boyle Investment Company. When the firm opened in 1933, it had a staff of five; by the early 1950s, Boyle had grown to more than 40 employees. The owners realized that their growing company had simply run out of office space. Western Union, which shared the building at 148 Monroe, also needed more room. There was only one option — to move to another location. As it turned out, the solution was right across the street.

In the 1920s, Marx & Bensdorf, a mortgage loan company founded in 1848, erected an impressive classical-style stone façade building at the southeast corner of Second and Monroe. In the late 1940s they relocated several blocks away to Court Square. In September 1955, Boyle leased the former Marx & Bensdorf building.

Bayard Boyle, Sr., now president of the company (Snowden had been named chairman), told reporters, “With confidence in the future of Memphis, and in the growth of our business, we have taken a long-term lease for a new location.” They hired the architectural firm of Windrom, Hagland and Venable to change the interior to their own needs, and the move began in May of 1955. At first, the company occupied only the ground floor of 42 South Second, but it quickly expanded to fill the entire building, including the basement. For the first time, the company would have a place all its own: The Boyle Building.

ABOVE: The impressive new Boyle Building opened in 1955 at 42 South Second Street.

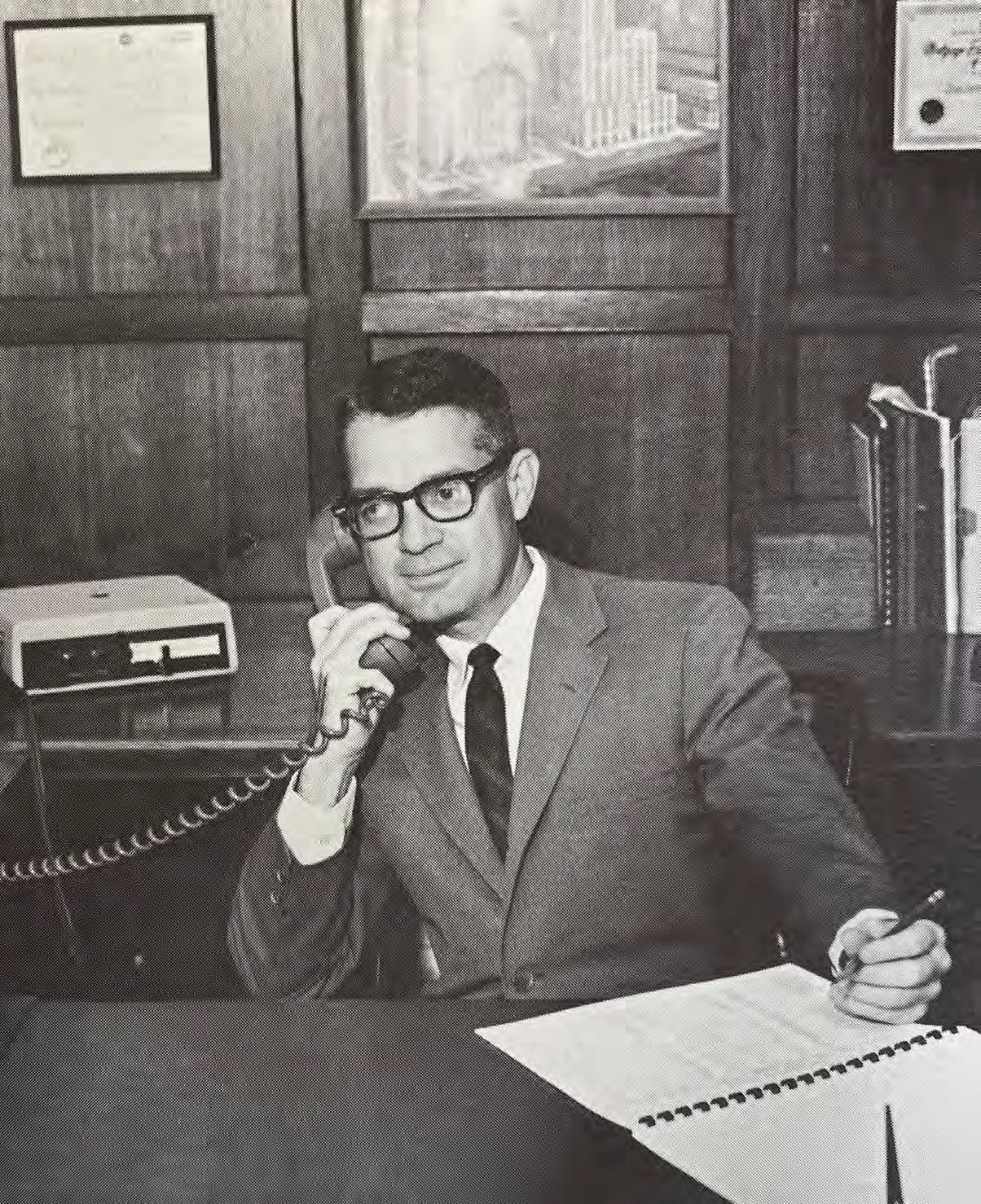

OPPOSITE: John Stone was in charge of the company’s residential loan department for years.

More than two decades old now, the company was thriving. The Commercial Appeal reported, “Boyle is now the mortgage loan correspondent for four life insurance companies which have a combined insurance-in-force of more than twenty-three billion dollars. In addition, Boyle serves as contractor for The Bowery Savings Bank of New York City, the largest mutual savings bank in the world.” Representatives from these agencies came all the way from New York, Chicago, Chattanooga, Nashville, Louisville,

and other cities to enjoy the Boyle Building open house.

Speakers throughout the day praised the company, along with the city it called home. Edwin Craig, chairman of the board of the National Life and Accident Company, based in Nashville, declared, “We take pride in connection with this fine company, through whom we have loaned vast sums for investments. We know of no other city in which we would prefer to invest company funds than Memphis.”

New departments handled

commercial and industrial properties, and The Commercial Appeal assured Boyle’s customers that the commercial loan department, especially, “can furnish loan commitments promptly on all types of income property.”

Meanwhile, the newspaper noted that, managed by W.S. Strehl, “a recently organized residential sales force has an expansion underway, and has acquired additional salesmen for this department.”

Mentioning the “well-trained staff” of the loan department un-

“With confidence in the future of Memphis, and in the growth of our business, we have taken a long-term lease for a new location.”

— BAYARD BOYLE, SR.

der the direction of Arnold Prather, the newspaper reported, “The company’s facilities enable him to approve and close loans in 48 hours. He specializes in furnishing builders with commitments for new subdivisions.” The company also expanded its general insurance department, as well as its land department, which handled both sales and loans on properties of all sizes.

got on a ship!” Stationed first at the Great Lakes Training Center, and later at a base outside New York City, he was preparing for overseas duty when the war came to an end in 1945.

“His forte was also acquiring the best people and not micromanaging them.”

In short, as The Commercial Appeal told readers, “Every phase of the real estate business is covered by this organization.” Snowden Boyle responded, “This company, during its entire history, has not made a loan that has been foreclosed, which is a record all members of the Boyle firm are proud of.”

Moving to the new building allowed Boyle Investment Company to hire new staff and expand many departments. Among those was the residential mortgage loan division, for years under the direction of John Stone.

Born in Tupelo, Stone attended the University of Mississippi, but entered the Navy when World War II started. “I always had a fascination with ships,” he said, “so I joined the Navy — and never

— JOHN STONE

Stone returned to Ole Miss, where he earned a degree in finance and banking. After a few years working as a clerk at a Firestone retail store in Memphis, Stone entered the mortgage business.

In 1955, Bayard Boyle, Sr., gave him a call. “It seems they had a small residential mortgage business in place, and they wanted to expand it,” said Stone, “so Bayard hired me. They had been doing it for a while, of course, but it was like starting a whole new deal.”

Soon Stone took charge and was promoted to vice president of the residential loan department.

Stone and his department serviced home mortgages, but Boyle wasn’t a typical mortgage company. “We were mortgage

bankers,” he explained. “We made the loans and we sold them, but we also serviced them here in Memphis. Everybody knew everybody, and it was just a great business to be in, because we were so close to our customers. They’d make a loan with Boyle, they’d make payments to Boyle, and if there were any problems, they’d come to Boyle and we’d handle it.”

That level of customer loyalty was partly because of his boss, Bayard, Sr. “He was just one of the finest gentlemen I have ever known,” he said. “I mean a truly fine person — big-time.”

He recalled that Bayard, Sr., an avid golfer, was one of the few Memphians to be a member of the prestigious Augusta National, home of the Masters. “Do you know, he took me to the Masters with him a couple of years? To me, that was worth a year’s salary, to go there and play golf.”

In the 1980s, the residential mortgage department was “spun off” to Union Planters. Stone recalled, “They took all the mortgage employees except Al Austin, who was in charge of commercial mortgages, and me. We were supposed to act as consultants while the bank got its mortgage

department running, but they didn’t need us very much.”

Stone stayed on, but in a different role, helping to develop lots for some of Boyle’s new residential projects — Blue Heron, Hunter’s Hollow, River Edge, and others. It was highly enjoyable work. “The greatest thing about working with people in the building business is that you know all of them,”

he said, “and they know you. So they are your friends as well as your customers.”

After more than 50 years, he “quietly retired,” and he and his wife, Tootsie, who had lived in Midtown for many of his years at Boyle, moved into one of the company’s new subdivisions in East Memphis. Looking back at a lifetime of work with Boyle In-

vestment Company, he gave a lot of credit for the company’s enduring success to Bayard, Sr.

“Bayard had a knack for finding the best land,” Stone said, “but his forte was also acquiring the best people and not micromanaging them. In my case, I felt like I was running my own business. He just let you do what you needed to do, and never interfered.”

Throughout the 1950s, Boyle Investment Company embarked on a wide range of other commercial, industrial, and retail projects throughout Shelby County. They oversaw the construction and management of a warehouse for Sears and a commercial building for Vann’s Baking Corporation, both on South Third. During this period Boyle also built, owned, and/or managed shopping centers around the city: Kimbrough Shopping Center at Poplar and Perkins; the Harbin Center on U.S. Highway 51 South in Whitehaven; Barron Shopping Center on Barron Avenue; Winchester Square Shopping Center; and the Point Shopping Center on U.S. Highway 51 North.

Albert Fulmer deserves a good deal of credit for Boyle’s growing land department. Born in Houston, Mississippi, he moved to Memphis at an early age, where he attended Miss Lee’s School and Central High School, and later Columbia Military Academy. His stud-

“When Albert Fulmer joined us, he already knew all the farmers, and he had a vision for profitable opportunities and a gift for negotiations, so he was able to get a lot of valuable land for us.”

ies at West Tennessee State Normal School (now the University of Memphis) were interrupted by the United States’ entry into World War II. He enlisted and saw action in Europe as a B-24 squadron leader and navigator for the U.S. Army Air Corps.

By 1944, Fulmer had flown his final mission, but when another bomber needed a last-minute replacement, he volunteered for one last bombing run over Romania. Enemy fire crippled his plane. He and the rest of the crew were able to bail out, but then were captured. Second Lieutenant Fulmer spent 11 months as a prisoner-of-war at various stalags in southern Europe before his camp

was liberated by General George Patton’s troops. For gallantry in action, his entire B-24 crew was awarded the Silver Star.

After the war, Fulmer returned to Memphis, where he opened stores selling feed to local farmers. Bayard Boyle, Jr. remembered, “One of his products was Curly Tail Hog Feed. He sold it all over the country, and that’s how he knew all the farmers.”

When Fulmer joined Boyle Investment Company in 1961, he was a perfect fit to take charge of the newly formed Land Development and Acquisition Department. “When Albert joined us, he already knew all the farmers,” said Bayard, Jr., “and he had a vision for

profitable opportunities and a gift for negotiations, so he was able to get a lot of valuable land for us.”

Fulmer remained with the company for more than 40 years, retiring in December 2000 as senior vice president of commercial sales and leasing. He passed away in 2006.

Some of the pastures, fields, and farmland Fulmer and his team acquired during those early years later became the site of Hickory Ridge Mall (which included more than 100 stores, with national retailers Sears and Goldsmith’s serving as anchors), South Perkins Industrial Park, Farmington (later Germantown) Country Club, and major subdivisions such as Hickory Hills and Kensington Gardens.

By the 1960s, Boyle Investment Company had evolved into a major full-service real estate operation, involved with residential, commercial, and industrial properties throughout Shelby County. Working out of the Boyle Building downtown at Second and Monroe, Boyle and its sister companies offered a complete range of services: sales, leasing, management, development, construction, mortgages, loans, and insurance. Major clients by this time included such well-known corporations as Shell, General Motors, Sears, Malone & Hyde, Exxon, General Mills, and countless others.

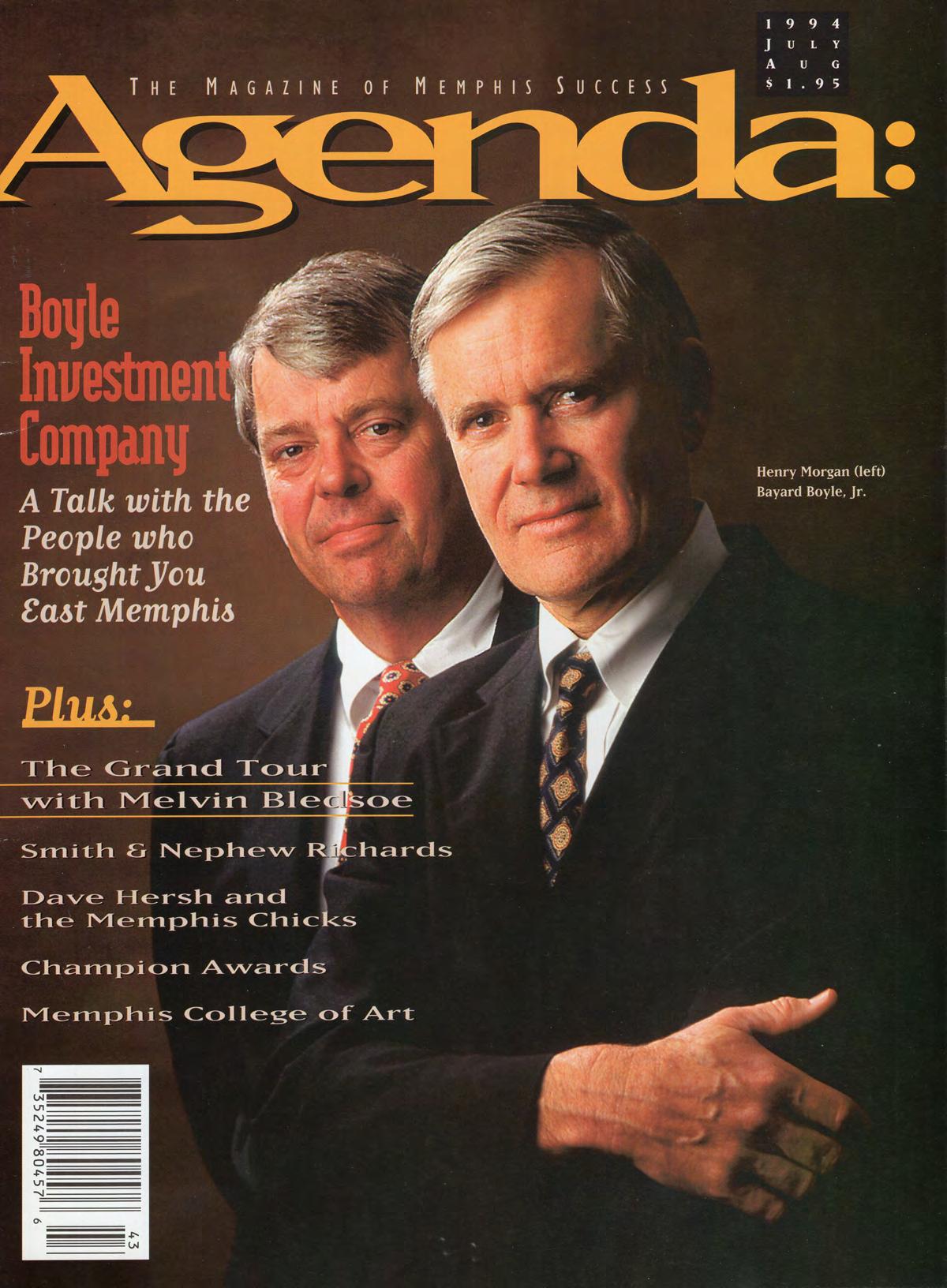

As their operations expanded, so did the Boyle team, as a new generation came aboard. Bayard Boyle, Jr. graduated from Washington and Lee University, went to the University of Virginia for one year of law school, and served as an ROTC graduate at the Ft. Sill Artillery School in Oklahoma. He returned to Memphis and joined the company in 1960, rising through the ranks to be named the company’s president in 1971, CEO in 1978, and chairman in 1986. Today he is chairman emeritus.

“To what can we attribute our success? It is the contributions of our employees that have made the company what it is today,” he said. “To echo the words of my father, we make a practice of hiring good people, and we provide them with the resources and freedom to do their jobs. Our employees all adhere to the same standards of integrity for which Boyle has become known.”

His father’s sister, Margaret, introduced him to his future wife, Ann Hudson Jones, known as “Huddy.” Aunt Margaret, he said, was so impressed with Huddy after meeting her at a May Day festival at the Hutchison School in Memphis, that she urged Bayard, Jr. to ask her out on a date.

Huddy and Bayard, Jr. married in 1963. Her father, Dr. Paul Tudor Jones, was the beloved, longtime rector of Idlewild Presbyterian Church on Union Avenue in the heart of Memphis. His 21-year ministry at Idlewild extended far beyond the walls of the gothic “flagship” congregation. An active presbyter, he soon became a part of the progressive vanguard of leaders that helped move the “Southern Presbyterian Church” away from its theological and ecclesiastical isolationism toward a greater sense of social responsibility and ecumenical involvement.

Dr. Jones was a gracious, courtly “son of the South” who combined in a remarkable way a pastor’s heart with a prophet’s voice. His passion for improved relations between the races led him not only to address these issues in preaching, but to assume a position of leadership in chairing the Memphis Committee on Community Relations during the racial tensions of

the 1960s. During the Sanitation Workers Strike, Dr. Jones and other faith leaders had been crafting a resolution to deliver to Mayor Henry Loeb. In the wake of the 1968 assassination of Dr. Martin Luther King, Jr., their resolution took on new importance, becoming a timely and essential “tribute to the peaceful ideals of Dr. King, a statement of support for the black clergy, [and] a plea for justice.”

The morning after the assassination, Dr. Jones went with other faith leaders, both black and white, to deliver their statement to Mayor Loeb. He also was a lifetime member of the boards of both Rhodes College and Louisville Seminary and a PCUS representative to the National Council of Churches. Dr. Jones was an accomplished artist, and many of his watercolors enhance the Boyle corporate offices.

When he first started at Boyle, Bayard, Jr. said, “Things were slow going at first. I had taken an ac-

counting correspondence course, and they put me in the mortgage loan department. Meanwhile, I tried to figure out what everybody else was doing in the various other departments.”

The workload increased when the company brought in aggressive new sales people. “We got Eddie Sappinsley and Albert Fulmer, and they were really good at working together — finding and buying property and getting it rezoned,” said Bayard, Jr. “The mortgage banking business picked up, so it got really interesting. And then when we got the Ridgeway Country Club property, we really had a lot to do.”

At Boyle Investment Company, the focus is always on quality and designing communities for the long term. The high standards that were established by Edward and Charles Boyle in creating Belvedere Boulevard are still prevalent today in every Boyle community.

Henry Morgan came from two of this area’s most prominent families. On his mother’s side, the Wetters had owned the Wetter Manufacturing Company, whose products included cast-iron stoves — a common feature in almost every home in America. The Wetters also owned large tracts of land between Poplar Avenue and the Wolf River, most of it sparsely populated farmland and fields, bisected by Shady Grove Road, as late as the mid-1900s a narrow gravel lane.

Henry’s father was Allen Morgan, Sr. Hailed by The Commercial Appeal as “the father of the municipal bond business in Memphis,” he had joined the bond department of First National Bank in 1929, became an executive vice president in 1946, and was named president in 1960. During his 44-year career, First National grew from a single institution in Memphis to a holding company with some 150 branches across the state. Under his leadership, the bank moved

into its gleaming new building, still a landmark on the city skyline today, and changed its name to First Tennessee to reflect its prominence in the state.

Henry’s older brother, Allen Morgan, Jr., also began his career in the investment business. He would eventually form Morgan-Keegan, one of this area’s largest brokerage firms and one of the few companies in Memphis to hold a seat on the New York Stock Exchange.

Henry attended Memphis University School and then enrolled at the University of North Carolina, majoring in economics. Friends assumed he would take a job with First National, but he had other ideas. “I never wanted to work for the bank,” he said, “because it would have been too hard to follow in the shadow of my dad.”

downtown. “I spent the whole time in the old vault downstairs, just throwing out old files,” he remembered. “This was certainly not an exciting time, but I was lucky to have a summer job.”

It also gave him a chance to meet other members of the company, so he made plans to return after college. After college, he took a job at Boyle in the commercial mortgage loan department.

“Hoshall Davis ran that division, which was a great place to learn about the real estate business, especially the financing aspect,”

The high standards that were established by Edward and Charles Boyle in creating Belvedere Boulevard are still prevalent today in every Boyle community.

said Morgan. “We had good connections with major life insurance companies, and we did a lot of work for the Belz family. It was a good experience. I learned a lot about development and what was going on in the world, and I really enjoyed it.”

One summer, before he graduated from college, he came home and took a job at Boyle Investment Company at 42 S. Second Street

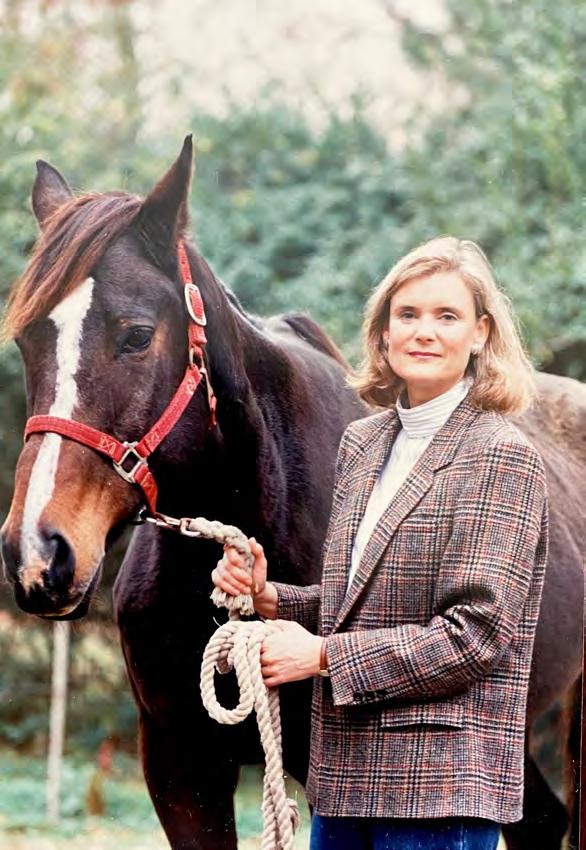

Soon after joining Boyle, he married Imogene Snowden Boyle, the daughter of Bayard and Elizabeth Boyle. Known to everyone as

“Snow,” she and Henry met when they were 12 years old, since their families owned adjacent properties, and she would see the young boy when she was out riding her horses. Snow attended the Hutchison School, went away to Bennett College in Millbrook, New York (the same school her mother attended), then returned to Memphis to attend Southwestern at Memphis (now Rhodes College). Snow remembered how she first learned about Henry. “One day, my father wanted me to ride with him to see an old log house on the Wetter property,” she said. “When we got there, he said, ‘You know, Mrs. Wetter has two grandsons, and they’re about your age. If you marry one of them, you might get to live in this old house.’”

As it turned out, that’s exactly what happened. “That’s where we lived the first two years after we married in 1968,” Henry said. “It was an ancient house, from the 1840s, built entirely of cypress logs.”

Henry was impressed with his new father-in-law. “Bayard Boyle, Sr. had remarkable vision about outlying property and raw land,” he said, “He was very wise in un-

and he helped Boyle acquire the Ridgeway Country Club property [see next chapter]. And then Bob Horrell was handling lots of our Malone & Hyde shopping centers.”

Very soon, however, he assumed even more important duties. He formed the Office Development Team, along with Russell “Rusty” Bloodworth, Mark Halperin, Dick Nichol, John Doherty, and Bill

derstanding how the city would grow, and he was very patient. He bought land way ahead of its time.”

Snow also thought Henry and Bayard, Jr. made a good team.

“My brother and Henry did really well together,” she said. “They complemented each other. With any project, Henry did one part and my brother did another, and that’s been a great blessing.”

Henry also thought the Boyle company had assembled a fine group of people. “Albert Fulmer was involved with commercial land sales, and he was very wise and capable, helping us acquire big properties that became very important.” Another of his colleagues was Eddie Sappinsley, one of the company’s sales agents. “Eddie was an aggressive, smart guy,

Werhum. He also established the Mid-America Construction Company, which enabled Boyle to have more control over their growing number of projects, instead of relying on outside contractors.

In short, “It’s been a great place to work,” Henry said, “and I’ve been lucky to be here.”

Russell Bloodworth — better known as Rusty — earned a degree in architecture from the University of Virginia, studied environmental design at Yale, was an American Scandinavian Fellow in Sweden, and followed that up with a Knight Fellowship at the University of Miami. After graduating from Virginia, he decided he didn’t really want to be an architect.

In a Commercial Appeal story, he

explained how he came to make that decision. At a young age, he was fascinated with architecture, he told the reporter, but “during college I realized there were other people involved in the building process [who] hired the architect, and that inspired me to think a little more about being more in control.”

The story continued, “A trip to Reston, Virginia, one of the nation’s most well-known planned communities that focused on mixed-use areas, fanned Bloodworth’s creative flame. ‘I was just stunned with the thought of building complete communities,’” he said.

On a return home in 1968, he noticed all the Boyle signs on various developments around town, so one day, without making an appointment with anybody in particular, he dropped by the company’s downtown offices, seeking a job.

Bayard Boyle, Jr. was in the office that day. “Bayard, Jr. glanced over my resume,” Bloodworth recalled, “and noticed that I had won the outstanding boxing award at Virginia. His father [Bayard Boyle, Sr.] was a famous boxer at Yale, so he introduced us, accentuating my boxing exploits. Bayard’s father was a tall, handsome man, then 60 years old. He exuded strength and energy. Mr. Boyle grinned, asked about my college activities, and said he was glad to have me on board. I thought I had died and gone to heaven!”

Bloodworth’s first duties had nothing to do with architectural design. Instead, he was given the task of running projections of population data, which would help Boyle decide where to build future projects. One day, during lunch downtown at the Bon-Ton Café, Boyle, Sr. asked Bloodworth to estimate the cost of a particular piece of property. “I knew absolutely nothing about land values,” he remembered, “but I came up with a figure that, as it turned out, was extremely low. Mr. Boyle

never chided or corrected me, but I had given him good reason to be cautious with my opinions!

“Mr. Boyle had a special quality for treating people as important,” he continued. “He remembered what had been occurring in their lives, and what they had been accomplishing. In all the years I knew him, he never focused on mistakes. He was always congrat-

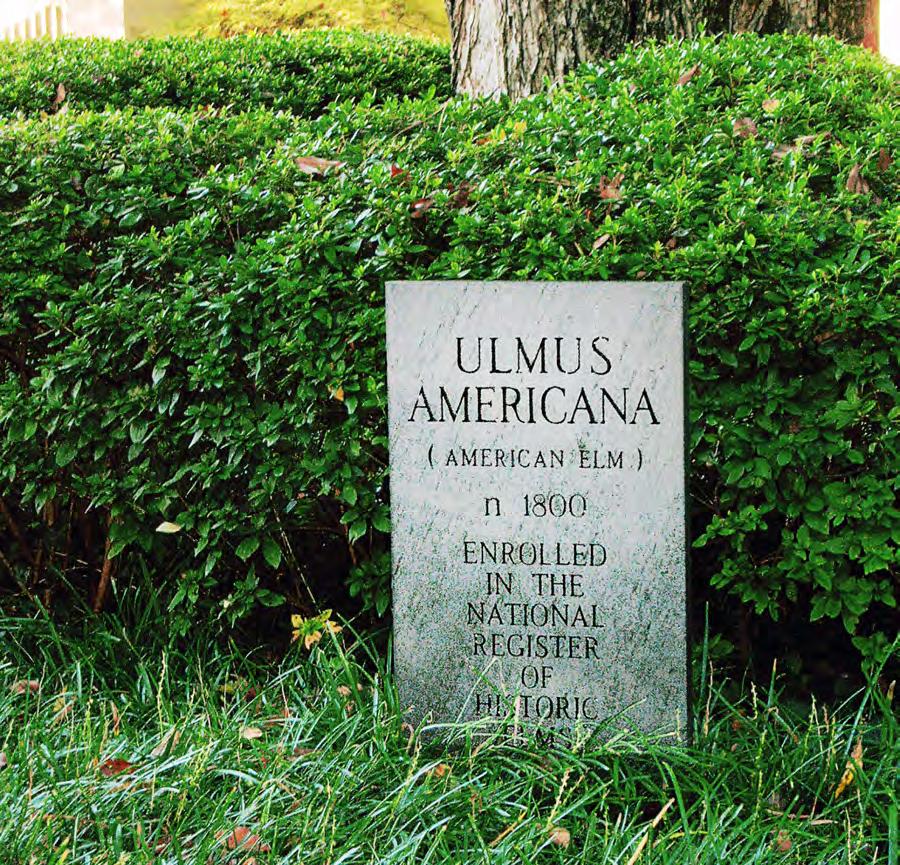

of River Oaks, an elm shades the entrance gate, and is marked with a plaque noting that it stands as the only tree in Tennessee on the National Register of Elms.

As late as the 1960s, few families called the Shady Grove / Sweetbrier area home. Dr. John Shea, one of the world’s leading authorities on hearing disorders,

purchased significant acreage for their future homeplace in the heart of what is now River Oaks. At the time, the area was rolling countryside and covered with mature hardwoods. Their home was designed by Everett Woods. One of this city’s noted architects, Woods had designed fine homes in Central Gardens, Chickasaw Gardens, and East Memphis, and

ulating people on the good they were doing — building them up and praising them.”

Bloodworth had a special interest in preserving the natural environment. In 1974, Southern Living featured him in a story called “A Tree Fanatic in Memphis.” The article noted that “he spends a great deal of time planning ways to save the trees at the company’s new development sites — at one point even standing in front of a bulldozer.”

“It was getting all set for a run at this beautiful old oak,” said Bloodworth, “so I put myself between the machine and the tree.” When a site was selected, the company would order a map with each major tree identified by species and size. Bloodworth was known to change plans to save particularly fine trees, and in The Gardens

erected a striking Japanese-style home just north of Poplar. Not far away, the Briar Patch estate, home to Robert and Eugenia Whitnel, complete with a separate studio for Eugenia, a nationally acclaimed photographer, stood on a hill (the site today of Briarcrest School). A half mile up Shady Grove Road stood Bayard and

had also designed the imposing East High School campus.

Shady Grove Road East at that point stopped its easternmost extension and turned abruptly south toward Poplar. The emerging Boyle homeplace made a wonderful spot for their three young children to grow and mature. Bayard Boyle, Sr. sold a large tract to the north to his elementary school classmate, Herbert Humphreys. Altogether, the potentially developable acreage exceeded 300 acres.

“[Bayard, Sr.] was very wise about how the city would grow. He bought land way ahead of its time.”

— HENRY MORGAN, SR.

Elizabeth Boyle’s home. Much of the area was undeveloped.

Boyle Investment Company had a broader vision. During the mid1930s, Bayard Boyle, Sr. with his wife, Elizabeth Ragland Boyle,

In the 1950s, three strategic events occurred that would forever change the rural character of this area, while creating a residential haven for some of the most noteworthy business leaders in Memphis. First, the Federal Aid Highway Act of 1956 provided for a national network of high-

ABOVE: Longtime Boyle employee Bob Lofton served from 1963 to 2011 and eventually became Chief Administrative Officer.

speed expressways criss-crossing the country, which included the construction of the Memphis I-240 loop immediately west of the assembled acreage.

Second, three respected private schools moved to within a mile of the Boyle homestead: Memphis University School, Lausanne School, and the Hutchison School. Within a few years, two others, Briarcrest School and Christian Brothers High School, would join them.

Third, the Memphis Hunt and Polo Club, located in the 1950s on Cherry Road, south of what is now The Dixon Gallery and Gardens, burned to the ground. Bayard Boyle, Sr. acquired land for its reincarnation on Shady Grove Road immediately south of his homeplace. Noted architect Walk C. Jones, Jr. did the classic design for the club, while Sam Stevenson

served as contractor. In addition to the beautiful setting and significant acreage, these occurrences made the area ripe for a very high-end residential community the likes of which Memphis had never seen.

A “River Oaks” development already existed on the edge of Houston, Texas, and was well

River Oaks became known as Boyle Investment Company’s signature development.

known nationally as a haven for executives of large corporations. Those facts, combined with the existence of real “river” oaks along the adjoining Wolf River, made the name a natural. Like its Texas namesake, architectural control restrictions assured an initial level of quality.

The first section began in the mid-sixties, and immediately became the neighborhood of choice for those who could afford it. Narrow, meandering streets were laid out with particular care for the natural terrain and vegetation. Memphis Light, Gas, and Water approved a plan for all utilities to be placed underground, making River Oaks the city’s first subdivision to do so. Boyle Investment Company received permission to use special “pea-gravel” curbs without sidewalks. Homes rose and the initial neighborhood of only 48 lots grew over the decades to encompass eight additions. Over the years, new forms of architectural control were introduced in the newer sections as well as different housing types.

In 2011, the original Boyle homeplace that lay in the last section developed was sold to

Bill and Carole West, whose niece would marry Guy Pelham of England. The wedding ceremonies took place next door at the Memphis Hunt and Polo Club. Remarkably, Pelham’s close friends, Prince William and Prince Harry, attended — one staying in the original Boyle homeplace and one across the street.

River Oaks became known as Boyle Investment Company’s signature residential development, serving as the basic pattern for other upscale communities in the decades to follow.

Throughout the 1960s, Boyle remained involved with different lines of business — servicing residential and commercial mortgages, buying land, and planning new subdivisions or expanding the ones they had already developed. Starting out relatively small, some of these grew into large single-family subdivisions. These included Woodland Hills

(36 lots) north of James Road, Golden Acres (54 lots) off Stage Road, Winchester Park (100 lots) and Cromwell Park (149 lots) both off Winchester, Kirby Woods (341 lots) south of Park Avenue, and Blue Ridge (363 lots) south of Raleigh-LaGrange Road.

Multi-family complexes developed during the 1960s included the 100-unit Sherwood Apartments on Rhodes, and the 96u nit Hickory Hills Apartments on Graceland Drive.

The company had already developed some small shopping centers, and expanded that operation. New retail centers included the Mid-Town Shopping Center on Poplar, Millbranch Shopping Center in Whitehaven, and City Center Shopping Center in Collierville.

The Cloverleaf Shopping Center, at Summer Avenue and White Station Road, was a particular favorite with Memphians since it was home

to a Sears outlet store, and also Café St. Clair, one of the city’s most popular finedining establishments. On South Mendenhall Road, just south of Poplar, Williamsburg Village was an attractive row of small shops, all designed in a Colonial Revival style.

Boyle Investment Company also reached beyond the city — and state — limits for several commercial projects: Five Points Shopping Center in Birmingham, Alabama; Gateway Shopping Center in Osceola, Arkansas; and Westgate Shopping Center in Effingham, Illinois. For all of these, Boyle either built, owned, or managed them — sometimes a combination of all three. “It just depended on the client,” explained Henry Morgan. “Every project had different needs.”

All these smaller developments, however, would pale in comparison to what Boyle had in mind for East Memphis in the 1970s.

LEFT: River Oaks was designed with particular care for the neighborhood’s vegetation and natural terrain.

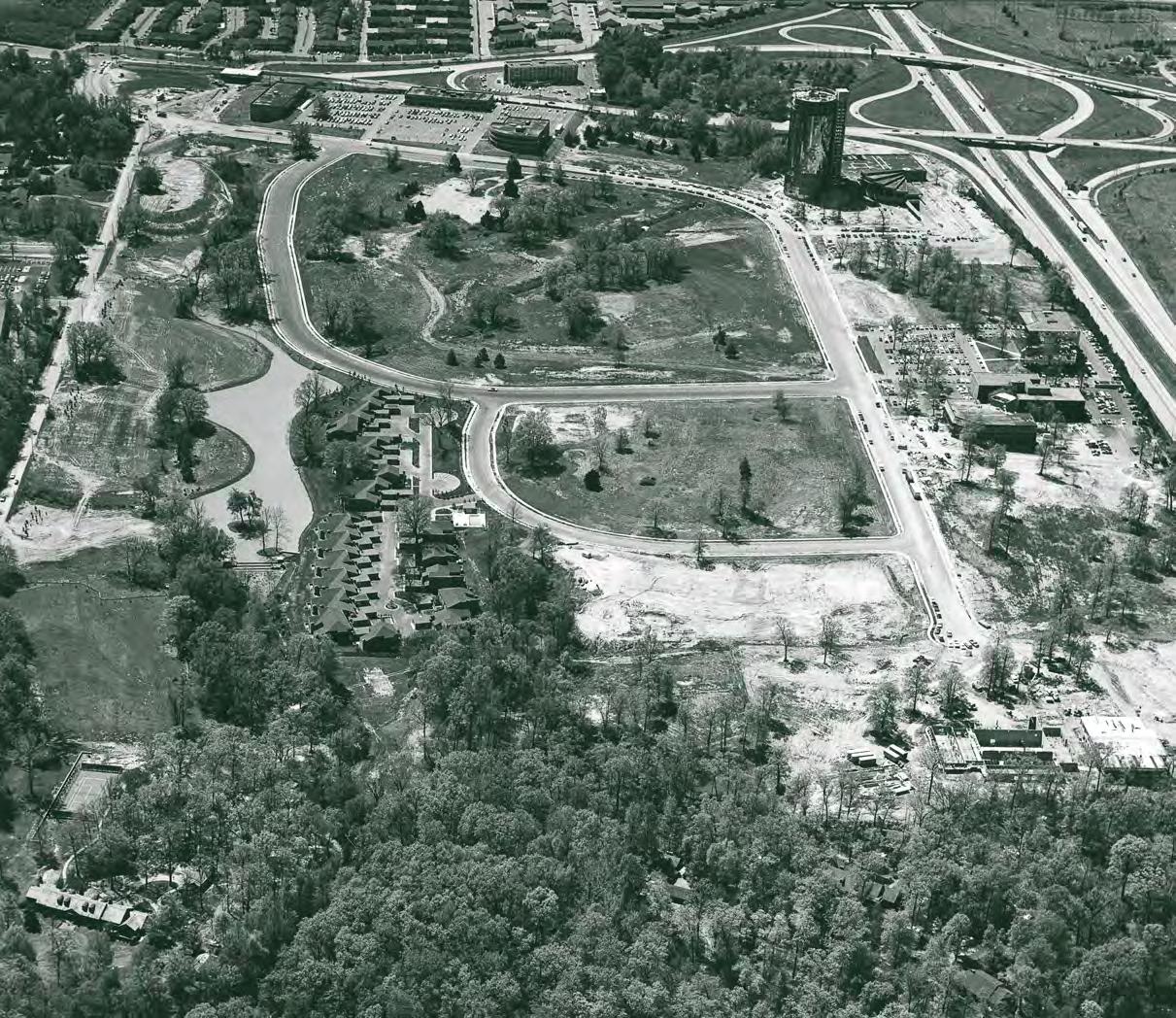

OPPOSITE: Boyle would transform the grounds of the former Ridgeway Country Club into one of the most important mixed-use developments in Memphis.

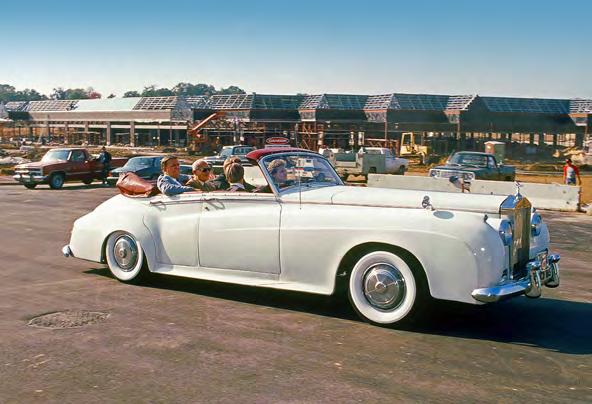

The Boyle family liked to tell the story about Bayard, Sr. piling his wife and kids in their car and going on Sunday drives. While these outings beyond the city limits may have been pleasant, they were actually work days for the father, who was scouting the landscape for new properties his company could acquire and develop.

The family didn’t have far to drive, however, to notice Ridgeway Country Club, which was only a mile south of their home on Shady Grove Road. Bayard Boyle, Sr. was an avid golfer, after all, but he had more ambitious plans in mind than a sunny day on the links. In fact, he and his team would create what might arguably be the most important commercial development in this area’s recent history — a project that would be called “a city on the edge of the city” and the first mixed-use development (commercial, retail, residential) in the Mid-South.

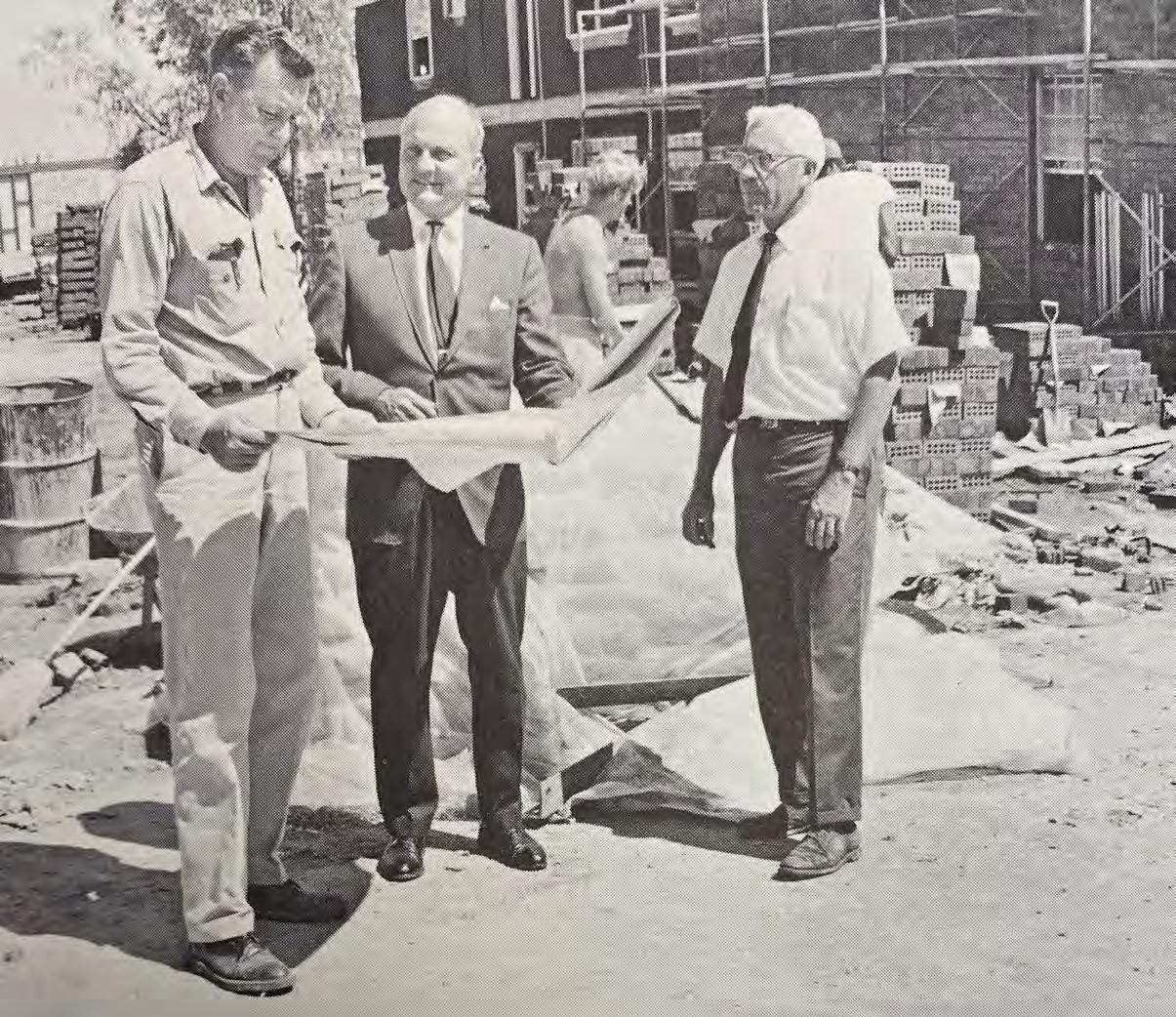

In 1966, some of the Ridgeway Country Club members began to consider a move eastward, while Bayard Boyle, Jr. and Eddie Sappinsley started negotiations for the possible purchase of the 154-acre golf course property. After a challenging rezoning process, Boyle Investment Company acquired the property.

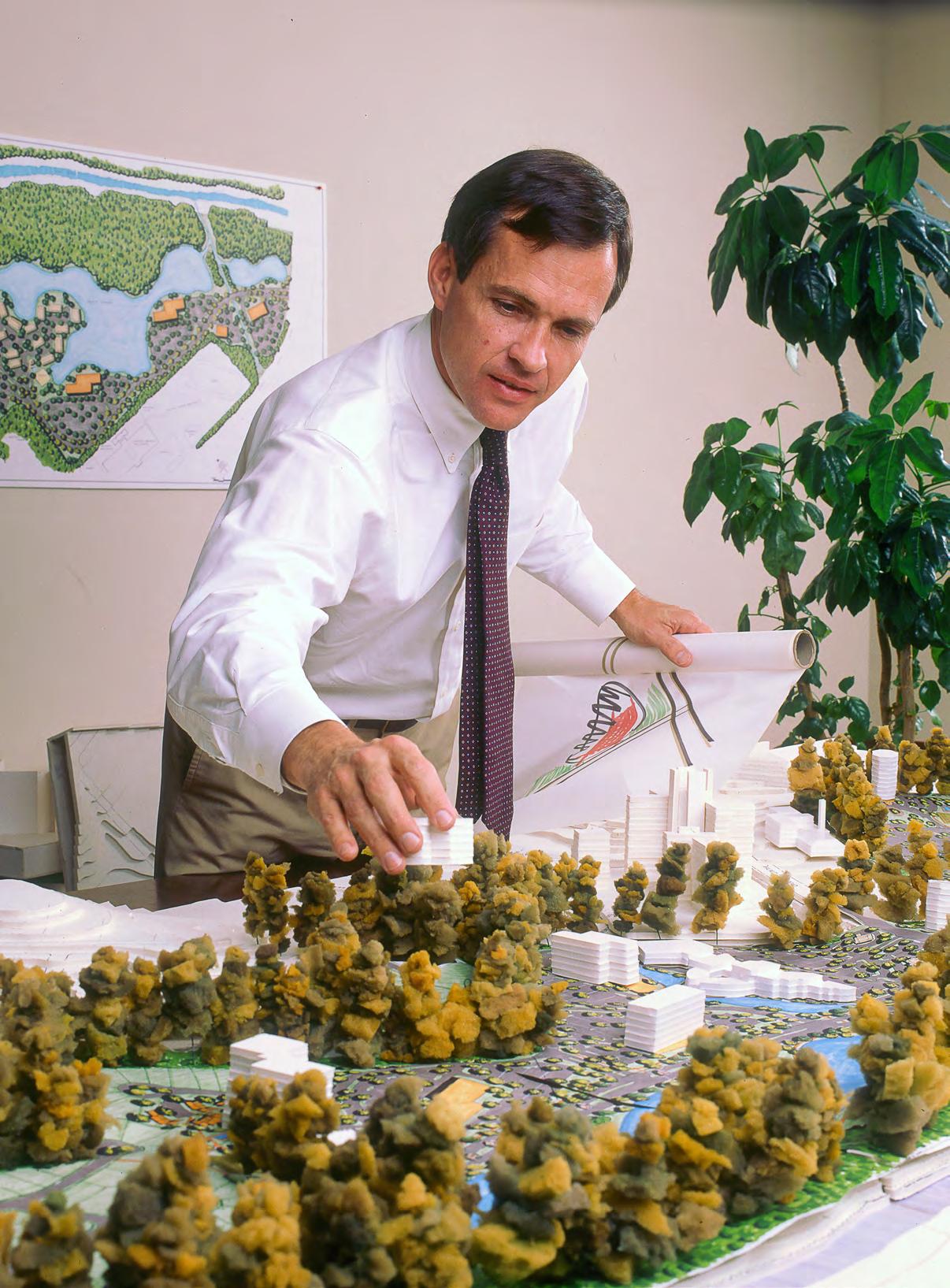

As head of the newly formed Office Development Team, Henry Morgan recalled, “Ridgeway Center was really the beginning of my career. I enjoyed getting into that, and it was a fun, exciting time. It was an opportunity to get in a lot of development, and we had the best suburban office site in East Memphis, with a nice blank canvas to work with.” Developing the new project would involve almost every member of the Boyle company, and some new faces, as well.

Born in Chicago, a young Mark Halperin and his family moved to Memphis in 1959. He attended Memphis University School and graduated from the University of Tennessee in Knoxville, with a degree in accounting. He met Henry Morgan when Morgan helped Halperin with a college real estate course project.

“After that, Mark wanted some advice about what he was going to do,” said Morgan, “and I persuaded him to come work for us.” Morgan introduced Halperin to

Bayard Boyle, Sr., and they offered him a job in 1973. Halperin soon became part of the newly formed Office Development Team, and was mentored by Bob Lofton, the company’s longtime chief administrative officer, as well as Morgan. He joined the firm just as Ridgeway Center was being developed, and took primary responsibility for leasing almost all of the initial buildings — some 130,000 square feet of office space — which grew to more than 2,000,000 square feet, not including other

Boyle developments.

A key part of that job had always been keeping the tenants happy. “We really motivate ourselves to think like owners,” Halperin said, “and I think our customers really respond to that and appreciate that.” Apparently, they do. “In all these years, we have never lost a transaction over lease language,” he said. “We’re just not going to let that happen.”

Halperin shared the opinion of so many others about the genius of Bayard Boyle, Sr. “He could just see way down the road,” he

said. “A lot of investments that the company is benefitting from today, he made maybe 40, 50, or 60 years ago.”

After earning a degree in political science from Washington and Lee University, Joel Fulmer also joined Boyle in 1972. He was the son of Albert Fulmer, who had played a major role in acquiring much of the farmland that later became Boyle’s most high-profile developments.

Joel Fulmer eventually became involved in the company’s industrial properties, developing

factories and warehouses for international clients such as Cargill and Hunter Fan, and taking charge of leasing and managing Century Center and the South Perkins Business Center, among others.

Speaking about Bayard Boyle, Sr., he shared the same respect of his colleagues who joined the company in the early 1970s. “His business acumen was remarkable,” he said, “and his ability to relate to people, encourage them, and inspire their loyalty was unmatched.”

Russell Bloodworth was tasked with developing an overall scheme for the Ridgeway land. Not satisfied after climbing the club’s water tower, he took a helicopter flight for a bird’s-eye view of the entire property. “My sense,” Bloodworth shared, “was that the existing terrain and vegetation, carved originally for a golf course, offered us a rare opportunity to preserve ancient oaks while enhancing environmental processes. We worked around the trees and introduced a series of lakes to en-

“Bayard Boyle, Sr.’s business acumen was remarkable, and his ability to relate to people, encourage them, and inspire their loyalty was unmatched.”

hance both water quality and slow downstream flows.”

The first task was to design a traffic plan for the development, and Boyle planners came up with three main streets to circle the development, with only a few cross streets. Despite the eventual large number of tenants, the general effect was an uncongested, and quite beautiful, office park.

The first phase began in 1973, with the construction of a three-story building close to the Poplar Avenue entrance to Ridgeway Center. Boyle Investment Company moved their entire op -

— JOEL FULMER

eration into this building, leaving behind their downtown office.

Other buildings quickly followed, many of the early ones designed by noted Memphis architect Francis Mah. For the most part, they were two- or three-story structures, featuring buff brick exteriors and tinted glass windows. Wherever possible, the oldest and largest trees on the property were preserved, creating an office park with plenty of mature greenery.

Mark Halperin worked with clients to move their offices into Ridgeway Center. Among the ear-

liest tenants were UMIC, Buick Motor Division, National Bank of Commerce, New England Life, and Rhea & Ivy. Established in Midtown in 1939, First Evangelical Church erected a new sanctuary, hard to miss with its soaring white steeple, at the northern terminus of Ridge Lake Blvd. in the early 1970s. The Malco chain, operating movie theaters in Memphis for decades, opened its Ridgeway Four cinema in 1976, with a distinctive hand-painted lobby mural depicting movie stars, past and present. An essential component of the new development was the re -

vamped intersection at Poplar Avenue. Boyle estimated that some 4,000 cars would enter and leave Ridgeway Center on a daily basis, so traffic planners, civil engineers, and the Boyle team conceived the Poplar Avenue overpass, to allow easy entrance and exit, and quick access to the adjacent interstate.

“From a driver’s point of view,” said Halperin, “it remains the only unencumbered left turn the entire length of Poplar.” It was a remarkable feat considering that Poplar is this city’s longest and one of its busiest streets, stretching from the riverfront all the way (as Highway 57) to Collierville and beyond.

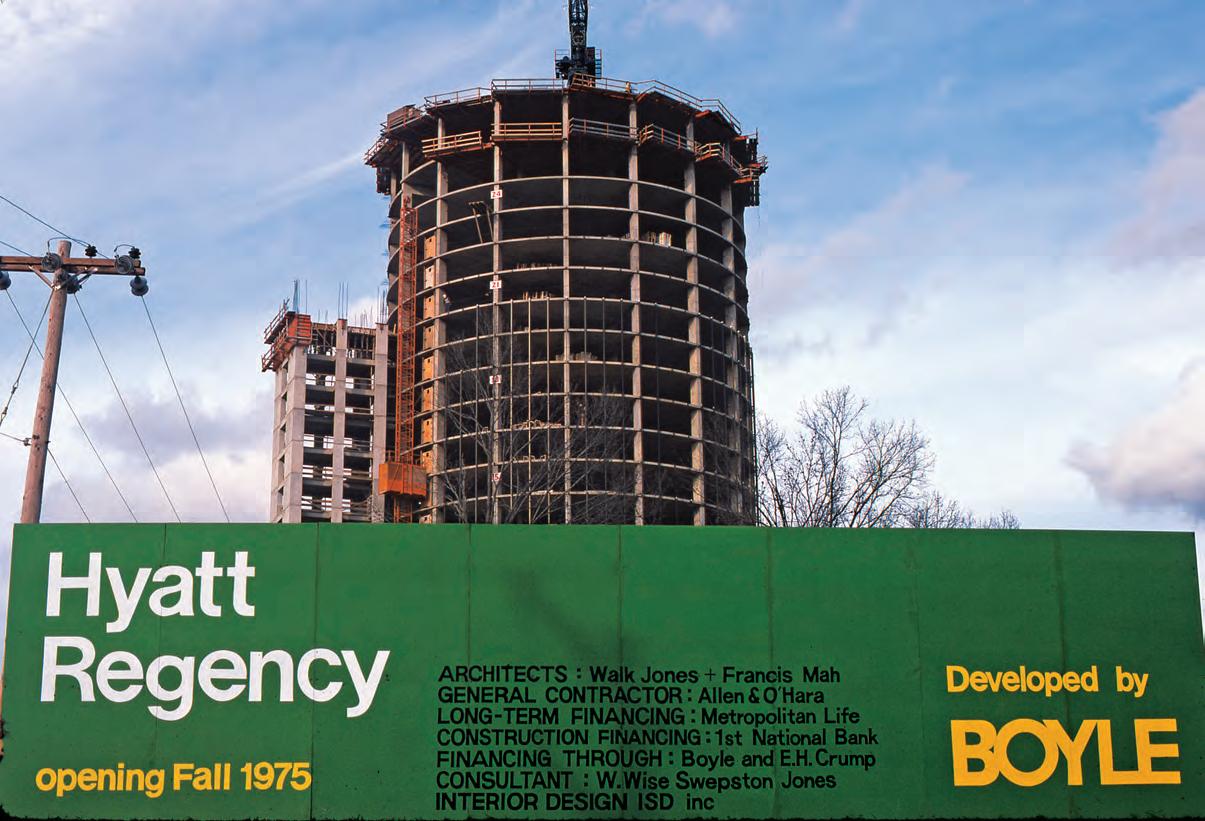

The most eye-catching element of Ridgeway Center, of course, was the Hyatt Regency

Hotel, developed in a joint venture with Boyle. The Commercial Appeal colorfully but correctly described the 26-story mirror-glass tower as “the maypole around which East Memphis will revolve.” Designed by Walk Jones and Francis Mah, the distinctive hotel opened in 1975. More than 400 guest rooms occupied the round tower, all of them reached by a feature that was, at the time, unique to Memphis: glass-walled elevators mounted outside of the tower. These would whisk guests and visitors to their rooms or to the top-floor restaurant, Hugo’s.

The hotel interior was a complex design. After praising the “pure mirror-glass cylinder that rises from a reflecting pool,” the authors of Memphis: An Architectural Guide described

it in this way: “Inside, the space is shaped like a fan, each blade raised above the other to allow daylight to pour into the interior.” They noted the spacious lobby, the formal Regency Court cocktail lounge, a more casual entertainment area called the Joint Venture, mirrored escalators to lower levels, and even a bridge that carried guests and visitors to the elevator tower. Those elevators “open your view to the surrounding landscape as you go up to your room, thus providing the final panorama in this clever promenade of changing space and perceptions.”

On the lower levels, The Commercial Appeal praised the “large, convex windows in the Garden Café, [which] give a picturesque view of the man-made lake which nearly surrounds the hotel tower.” The

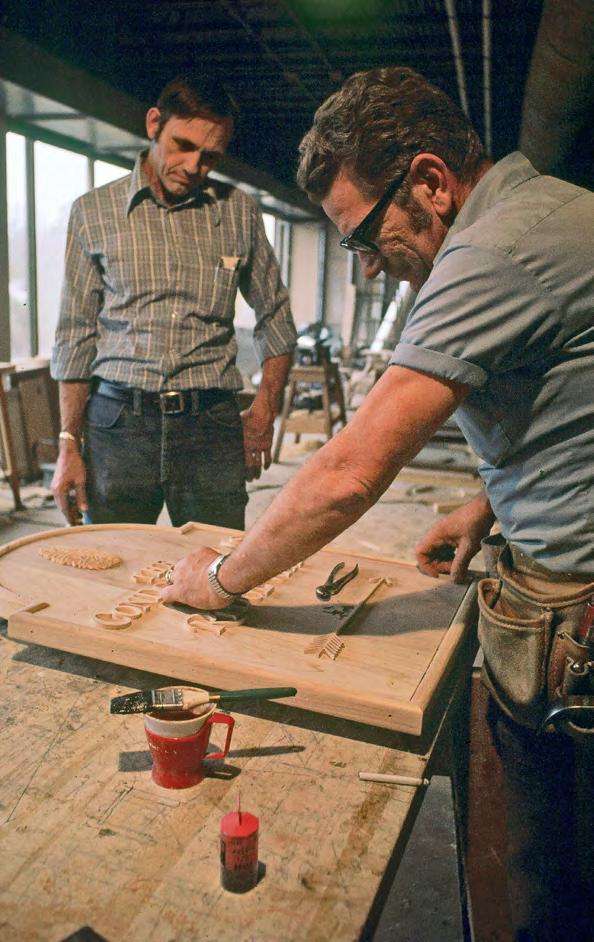

ABOVE LEFT: A handcrafted sign graced the entrance.

ABOVE RIGHT: A “Who’s Who” of American businesses would call Ridgeway Center home, shown here in the mid-1980s.

ABOVE: The Commercial Appeal described the circular Hyatt Regency, shown here under construction in 1974, as “the maypole around which East Memphis will revolve.“

reporter concluded his appraisal of the new building: “Overall, the new Hyatt Regency reflects an eye for detail. When the lake was finished, the management knew exactly what was needed — some graceful swans. But locating them proved to be difficult. For the hotel’s grand opening, two white swans had to be flown in from Boston.”

The grand opening took place on September 15, 1975. Over the years, Boyle sold the hotel to other owners, first becoming the Omni Memphis (1989), then Adam’s Mark (1992). Since 2004, it’s been part of the Hilton chain. “The hotel business is complicated,” reflected Morgan.

Even as Ridgeway Center filled with tenants, and Boyle Investment Company seemed to be working on impressive projects

all over town, behind the scenes, “The 1970s were extraordinarily tough times for the real estate industry,” said Bloodworth. “It was a difficult time. We’d had a great burst of investment activity through the 1960s and into the early 1970s, but in the years of Jimmy Carter’s presidency, just when we were getting started with the Ridgeway project, interest rates soared to 18, 19 percent.”

On top of that, inflation was climbing, and the Arab oil embargo pushed gas prices higher than Americans had ever seen. So while Boyle was reshaping the face of Memphis, discretionary spending hit an all-time low. “It was certainly one of the worst times we’ve ever experienced in our industry,” said Bloodworth. “I thought the world was coming to an end, but tough times are when character and deep pockets mat-

ter the most.”

When Ronald Reagan took office in 1981, Bloodworth said, “The interest rates went down, and things really brightened.”

Even before that happened, though, Boyle was able to expand River Oaks and other developments around town. The company was also at work on major subdivisions such as Raleigh Heights and River Birch Farms. Ron Hickman joined the firm to head up the residential development division, both building subdivisions as well as homes. O.T. Whitehead was his righthand man in the field. When Ron left to join the Kemmons Wilson firm, Trey Hayden took over.

Akey project in Germantown during the 1970s was the beginning of Farmington. Embracing more than 1,000 acres, this

development — a joint venture with Lloyd Lovitt and the Willey family — would contain 800 single-family homes, 322 multi-family apartment units, 88 condominiums, retail shopping, and even a country club (with golf course and tennis courts) for 400 members. Al Austin and Lewis Weeks played an important part in this project.

After the debacle of the 1973 Arab Oil Embargo, the economy was faced with roaring inflation and high interest rates. Many real estate developments suffered, including a golf course development by others east of Memphis on I-40 called Stonebridge. Connecticut Mutual was the lender. Reminiscent of the 1930s, after the original developer defaulted, it turned to Boyle for assistance. The project was situated on 700 acres and included more than 500 single-family lots, condos, an 18-hole golf

course, eight tennis courts, and a clubhouse for 400 members.

In spite of the national economy, the 1970s also saw more than a dozen apartment communities built, owned, or managed

Within just a few years, Ridgeway Center had become “the city on the edge of the city.”

by Boyle. These smaller projects ranged from the 41-unit Eventide Condominiums in East Memphis, the 90-unit Lexington Apartments in Raleigh, the 105-unit Birches in Whitehaven, to much

larger communities such as the Raleigh Forest Apartments (200 units) in Raleigh, the Continental Village Apartments (260 units) in Southeast Memphis, and the Hickory Ridge Apartments (378 units) off Winchester Road.

Shopping center developments remained a large segment of the company’s portfolio. During the 1970s, Boyle was directly involved in such retail developments as the Park Center Shopping Center at Park and Getwell, Balmoral Shopping Center at Quince and Ridgeway, and Glen Haven Shopping Center at Perkins and Knight-Arnold.

As Ridgeway Center began to gain significant traction, Boyle Investment Company acquired more land to the east, for the decades to follow. Ridgeway Center was becoming “the city on the edge of the city.”

would later be purchased by Baptist Hospital and converted to medical uses.

OPPOSITE: Russell Bloodworth considering alternative massing options north of Walnut Grove Road in the Humphreys Center development.

In the early 1980s, Boyle Investment Company’s Office Development Team had grown significantly and continued to bring a variety of new tenants to Ridgeway Center. The 16 buildings in the complex became home to the corporate offices or headquarters for IBM, Provident Life Insurance, Allegheny Airlines, Memorex, the Bogatin Law Firm, FedEx, AT&T, Tru-Temper Sports, Sparks Commodities, Promus Hotels, Kroger, and others.

Bechtel, Inc., at the time the world’s largest engineering and construction firm, with international headquarters in San Francisco, decided to open a new office in Memphis that would focus solely on the construction of nuclear power plants. After evaluating other office parks in the city, they chose Ridgeway Center, moving engineers, planners, and other professionals to the ground floor of 889 Ridge Lake Blvd.

“The tenants we’ve brought to Ridgeway Center have been a who’s who of American business,” said Mark Halperin, then Boyle vice president, and later chief operating officer. “And I don’t think people truly understood at the time what a huge project this was for Memphis.” He gives well-deserved credit to the team at Boyle for making the project a reality — transforming a former golf course into this city’s first true mixed-use development, with a special nod to Bayard Boyle, Sr. and Jr. for seeing the potential of the land, and to his colleague Russell Bloodworth, executive vice president, for his keen attention to detail.

“Rusty is another of our company’s true visionaries,” said Halperin. “He sees things that other people simply cannot see — color and scale and mass. He can take a blueprint that’s just a one-dimensional drawing, and has a gift for seeing it as a fully formed three-dimensional building, or in this case, an entire office complex.”

Even as Ridgeway Center filled with businesses, two hotels (the Hyatt Regency and a smaller hotel originally called Hawthorne Suites), a church, and the 41-unit Eventide Condominiums, Boyle was looking to expand to the east. The company purchased a 22-acre parcel north of Poplar Road, between Shady Grove and Sweetbrier Roads, which would allow for the construction of several major office buildings between Ridgeway Center and Shady Grove Road by 2020.

As the population increased in Germantown and Collierville, traffic congestion became a problem, as more and more commuters headed to Memphis on a road network that had remained relatively unchanged since the 1930s. The main east-west arter-

between Memphis and Ger-

mantown were Walnut Grove Road and Poplar Avenue. By the 1970s, during rush hour it was not uncommon to see both lanes of Walnut Grove Road backed up with traffic, so city officials, planners, and sometimes regular citizens offered solutions to im-

prove traffic flow.

None of these proposals seemed suitable, because many of them involved running another road through Shelby Farms, the 4,500acre public park just east of the Memphis city limits. After years of debate, in 1986 the Poplar Corridor

Task Force came up with a solution — a brand-new boulevard linking Memphis and Germantown that would run parallel to the Wolf River. Along its one-and-a-half-mile length, other major streets in the area, such as Shady Grove, Kirby Parkway, and Ridgeway would tie into the new road, funneling traffic away from Poplar Avenue.

The Memphis portion of this six-lane divided road would be named Humphreys Boulevard, after the family of Herbert Humphreys, the former president of

the Humko Products Company. His widow, Wilda Humphreys, in partnership with Boyle, donated most of the land, with the rest of the property donated by Boyle Investment Company (64 acres) and other families, including those of Jack Erb, John B. Thompson, and Billy Clark to facilitate timing of the boulevard’s development.

Humphreys Boulevard wouldn’t just be a six-lane superhighway. Under a special agreement with the city, the roadway would be transformed into one of the most

Humphreys Boulevard

beautiful in the county, lined on both sides with Red Sunset Maples, and the wide median filled with other plantings. Along the north side, between the right-ofway and the Wolf River, Boyle created an easement encompassing 90 acres for the Wolf River Conservancy, to allow for the construction of walking and hiking trails, along with a series of ponds to make the drive as scenic as possible while preserving the natural beauty of the area. Bloodworth told reporters that “the plan was

wouldn’t just be a six-lane superhighway.

Under a special agreement with the city, the roadway would be transformed into one of the most beautiful in the county, lined on both sides with Red Sunset Maples, and the wide median filled with other plantings.

“The

tenants we’ve brought to Ridgeway Center have been a who’s who of American business. And I don’t think people truly understood at the time what a huge project this was for Memphis.”

— MARK HALPERIN

Humphreys Boulevard stopped just past Kirby Parkway. The city of Germantown soon approved an extension of the road, to be called Wolf River Parkway, that would link it with Germantown Road, and eventually stretch to Collierville.

Amajor component of this new development would take advantage of the future interchange of Humphreys Boulevard and Walnut Grove Road. In 1986, as work continued on the roadway itself, which would be completed by 1988, the Memphis City Council approved Boyle’s $150

million commercial and residential development just east of the Baptist Memorial Hospital complex. Humphreys Center would be similar to Ridgeway Center, a multi-use site that would include office buildings, a hotel, townhouses and other multi-family residences, retail spaces, a gas station, a fast-food franchise, and even a climbing wall.

Boyle began construction in 1989 on a retail complex of 62,000 square feet, which would occupy a single-story building, with easy access to the new boulevard.

The Shops of Humphreys Center quickly filled with upscale tenants, eager to join the new development. Original tenants included the Sekisui restaurant, Elite Travel, T. Joseph Clifton Art Gallery, Guy’s Tuxedos, Eston Styling Salon, and River Oaks Wine and

Spirits. Advertisements for Humphreys Center touted its unique features: “Everything you need is right here, including some things you don’t expect. Like outside benches and a beautiful lake and fountain. Classical music in the air. Striking architecture and a feeling of elegance.”

ABOVE: Ridgeway Center, 2022. patterned after a development along the Potomac River. Only the south side of the [Wolf] River will be development, leaving extraordinary river vistas that can never be disturbed.”

A three-story, 110,000-squarefoot medical office building was next, along with other buildings carefully situated around the site — eventually totaling 550,000 square feet of office space.

Humphreys Boulevard extended north of Walnut Grove Road. On this short section, just east of the Christian Brothers High School campus, Boyle Investment Company developed several major projects, including the headquarters building for

Baptist Memorial Health Care, the West Clinic (now Le Bonheur Outpatient Center), and the Southeastern Regional Headquarters for the U.S. Postal Service.

In 1983, Boyle Investment Company began an addition to River Oaks, which now had some 200 homes completed and others under construction along Shady Grove and the adjacent streets. River Oaks would eventually comprise more than 500 single-family homes. The new 73-lot project would be called The Gardens of River Oaks, and it would follow the same general design of upscale, beautifully designed homes sheltered by many old-growth trees, but with a secure entry off Sweetbrier Road.

“The concept is to leave the land heavily wooded with rolling hills,” reported The Commercial Appeal, “and enhance the natural terrain as much as can be when it is disturbed by building roads, sewers, utilities, and houses.”

Despite the increasing development along the Poplar Corridor, the northeast corner of Poplar Avenue and Shady Grove Road remained little more than an open field. That land had been owned by the Erb family of Memphis for decades, who had personal connections with the Boyle family: Mrs. Imogene Erb was Bayard Boyle, Sr.’s niece.

In 1987, Boyle Investment Company reached a joint agreement with the Erb family to purchase 15 acres of the 20-acre site and began to transform this property into a specialty retail center.

“No detail was left to chance. Gates and walls were closely studied.”

“What we have done is to lace a ribbon of asphalt through the terrain in the valleys. What we have is narrow streets, no sidewalks, washed pea-gravel curbs, large lot sizes, and an entry with electronic access,” added David Gribble.

No detail was left to chance. Gates and walls were closely studied from European estates and Virginia, so the brick walls and entrances emulate the best. Even such a seemingly minor element as the brick caps atop the walls at the entry precisely match those at the Governor’s Palace in Williamsburg, Virginia.

“We thought the time was right for this area to have an upscale shopping center,” said Steve Bowie, who managed the development, “so we began planning The Regalia Center.” The design by Cooper Carry Architects was eye-catching: a long brick and granite crescent of some 20 retail shops, with a decorative stucco façade topped with a copper roof. A smaller building closer to the street would hold two or three larger retailers. Adjacent to The Regalia, just to the north, construction also began on the Embassy Suites Hotel, with 212 rooms. To the west would be what was then the headquarters of Union Planters Bank (now Regions).

The new 90,000-square-foot center filled quickly. Among the first tenants were Johnston & Murphy shoes, Graham & Gunn clothiers, an importer and retailer of Asian antiques called Design International, and The Cooker Bar and Grille.

“If we wanted to, we could have

filled up the whole center with restaurants,” said Robert Lofton, senior vice president of Boyle. He noted that the company still preferred to offer customers a variety of shopping and dining options, but as far as places for them to eat, “it’s been great for us because we’ve had the luxury of picking the right one.”

The “right one” turned out to be Owen Brennan’s, an upscale New Orleans-style restaurant, patterned after the original Brennan’s in that city. A group of American and European investors backed this new venture, which included nationally syndicated food writer Burt Wolf. When the

restaurant opened in March 1990, The Commercial Appeal ’s food critic wrote that it “offers the flavor and atmosphere of a Crescent City restaurant.” She praised the food and concluded, “For an outstanding meal from the start, it’s hard to beat Owen Brennan’s.”

Boyle now had a pair of upscale retail centers north and south of their new River Oaks developments — The Regalia and The Shops of Humphreys Center. “We will be flanking the highest income area of the city with these two developments of upscale specialty retailing,” Mark Halperin told reporters. “We think they will complement each other nicely.”

From inception, Boyle Investment Company has depended on a legal counsel. Initially, Thomas Farnsworth provided in-house counsel. As projects grew more complex, the company used outside counsel to structure ventures, lease agreements with commercial tenants, and legal agreements with builders at its residential developments. Charles Cobb with Evans, Petree, Cobb & Edwards handled the company’s legal needs for many years, and in the early eighties Cobb handed those duties off to his protégés, Lytle Nichol and Woods Weathersby.

“I don’t know what we would have done without Woods,” said

Bayard Boyle, Jr. “For over 40 years, Woods has worked relentlessly with our partners, lenders, and staff to see that every project is well structured. He has been a great friend as well as a major corporate asset. He has been invaluable in advising on business decisions and personnel relationships outside of purely legal matters.”