C NTENT

Formats Outlook: The 2024 Update

Production: Taiwan’s GrX redraws boundaries

Plus Tech & storytelling in the era of spectacle films

Formats Outlook: The 2024 Update

Production: Taiwan’s GrX redraws boundaries

Plus Tech & storytelling in the era of spectacle films

When Bitsmedia ventured into streamed entertainment, the idea was to expand engagement with Muslim Pro’s millions of users around the world. Adding an AVOD layer is another step towards the ultimate goal of providing a digital home for all things Muslim. Qalbox head of content, Junaidah Said Khan, speaks about the new initiative.

Banijay Rights, the global distribution arm of content powerhouse Banijay Entertainment, is one of the leading distributors of format sales in Asia. With a breadth of format genres and iconic brands including Big Brother, Fear Factor, Deal or No Deal and MasterChef in its burgeoning catalogue, the business has built a strong foundation across the territory. Rashmi Bajpai, EVP sales Asia, who sits under the ex-EMEA team, headed by Matt Creasey, EVP sales, acquisitions and coproductions, discusses the key to the distributor’s success in the region, while breaking down its focus on scripted formats, and broader plans.

to you

Game shows, drama series and reality singing-based formats made up 65% of format adaptations on-air or commissioned in the first half of 2024. Vietnam, Mongolia and Thailand were Asia’s top markets with a combined share of 43%, ContentAsia’s Formats Outlook for 1H 2024 shows.

Creatively and technologically, Namit Malhotra is part of a movement [re]moving fi lmmaking barriers between East and West.

Four Asian titles hit #1 on Netflix’s global non-English-language TV top 10 since the end of April 2024, well behind Spanish drama series, which took nine of the top spots in the 15 weeks. Total global viewership of the top 10 non-English TV programmes hit 2 billion hours in May, June and July 2024. Asia made up 53%

Editorial Director Janine Stein janine@contentasia.tv Events Manager CJ Yong cj@contentasia.tv

Upsized Taiwanese producer, GrX Studio, is building upon the success of The Victim’s Game and Copycat Killer to roll out a studio/hub model it says will enable producers to expand and find new stories, markets and audiences across the region and –hopefully – beyond.

ContentAsia Marketing & Awards Heather Berger heather@contentasia.tv Production Rae Yong Research Rhealyn Rigodon iyah@contentasia.tv

Associate Publisher (Americas, Europe) and VP, International Business Development Leah Gordon leah@contentasia.tv

Assistant Publisher (Asia/Middle East) Malena Amzah malena@contentasia.tv

What is ContentAsia?

ContentAsia is an Asia-based multi-platform information resource that refines today’s infodeluge into usable, digestible and reliable intelligence about video content creation, funding, financing, licensing, & distribution across the Asia-Pacific region.

To receive your regular free copy of ContentAsia, please email contentasia@contentasia.tv

Copyright 2024 Pencil Media Pte Ltd. All Rights Reserved.

When Muslim Pro owner, Bitsmedia, ventured into streamed entertainment, the idea was to expand engagement with its millions of users around the world. Adding an AVOD layer is another step forward in the ultimate goal of providing a digital home for all things Muslim. Malena Amzah spoke to Qalbox head of content, Junaidah Said Khan, about the new initiative.

Faith-based streaming programming expanded in August this year when Qalbox unveiled its first AVOD platform. The move marks a major milestone in parent company Bitsmedia’s mission to expand global access to its content suite.

Qalbox AVOD is available worldwide to all users of the Muslim Pro app, and runs alongside the platform’s ongoing SVOD subscription, priced by location. In Singapore, the annual SVOD price is SG$34.99/US$26.

The inspiration behind Qalbox AVOD is to celebrate and share the global Muslim identity, and to highlight “the diverse narratives of Muslims around the world,” says Junaidah Said Khan, head of content for Muslim Pro and Qalbox.

Inclusivity and diversity are central to Qalbox’s approach; the platform acquires content from around the world and has enhanced its localisation efforts, offering languages such as French, Bahasa Melayu and Bahasa Indonesia.

“Our goal is to further these efforts to create a comfortable and enriching user experience for everyone, regardless of their background,” Khan says.

The AVOD content focus is morals-driven movies, historical AI productions and Quran readings, catering to all ages.

Special attention is being given to raising the profile of women.

Khan speaks about curating special content rails, producing and acquiring titles that champion women in Islam. “Recognising that most clerics in the industry are male, we take positive action to collaborate with and feature female scholars and experts,” she says.

Qalbox also addresses mental health from an Islamic perspective to help remove social stigmas.

“We believe this approach will benefit our users greatly, providing con-

Recognising that most clerics in the industry are male, we take positive action to collaborate with and feature female scholars and experts.”

The series is 2018 Turkish action/war drama, Mehmed the Conqueror season one (18x45/48 mins), about a man who, after his father’s death, faces fierce obstacles to conquer Constantinople. The platform will include approximately 30% original content, produced in collaboration with global content suppliers from Turkey, the U.S., Egypt, the U.K. and Malaysia, among others.

Junaidah Said Khan, Head of Content, Muslim Pro and Qalbox

sumers with a deeper understanding of mental well-being,” Khan says. At launch on 1 August, the Qalbox AVOD line up was led by two movies and a drama series from Turkey, with aims to add five new highlights every month by the end of the year. These will include features, series and children’s programming.

One of the two AVOD movies kicking off the ad-supported initiative is Turkish animated feature Tay 2 (2024) from Istanbul-based Siyahmarti Animation Studios. The film is about a colt, Riyah, as he journeys from Quds to Mecca, inspired by his mother’s legacy, to become a messenger horse.

The second is 2021 Turkish film Suveyda, written and directed by Mesut Uçakan, about an 11-year-old boy who dreams of becoming a hafiz of the Quran and learning the language of birds as he navigates adolescence amid social and political turmoil of the 1930s.

“Through AVOD, we aim to penetrate new markets and increase user engagement within the app. Additionally, the ad-based service provides more options for our customers, balancing cost and content variety,” she adds.

User feedback plays a critical role in shaping the content on Qalbox AVOD. The platform relies on data analytics and direct user input from surveys and polls to refine its offerings. This feedback has been instrumental in curating a large selection of trusted children’s content and deeper faith-based programming, particularly during free promotional weekends, where the full platform is opened to all users, and seasonal campaigns.

“Parents’ feedback on educational content is valuable, leading us to offer a large selection of safe and trusted kids’ content on AVOD, allowing parents to trust the content their children consume on Qalbox,” Khan says.

Qalbox plans to expand its reach within the global Muslim community through partnerships and by leveraging technology. Khan says the introduction of features like “Livestream” underscores the platform’s commitment to growth and engagement.

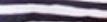

Banijay Rights, the global distribution arm of content powerhouse Banijay Entertainment, is one of the leading distributors of format sales in Asia. With a breadth of format genres and iconic brands including Big Brother, Fear Factor, Deal or No Deal and MasterChef in its burgeoning catalogue, the business has built a strong foundation across the territory. Rashmi Bajpai, EVP Sales Asia, who sits under the ex-EMEA team, headed by Matt Creasey, EVP Sales, Acquisitions and Coproductions, discusses the key to the distributor’s success in the region, while breaking down its focus on scripted formats, and broader plans.

Over the past five years, Banijay Rights has worked with more than 50 broadcasters across 16 Asian countries to produce more than 110 seasons of 33 different formats, an even stronger number when you consider territories such as Vietnam and China experienced extensive covid delays with the return of production. This is in addition to Banijay Asia and Endemol Shine India, who collectively produce 85-90 scripted and unscripted shows in India every year. To achieve these numbers is no small feat, and recent successes, such as competition reality format LEGO® Masters, which launched in Japan on TBS last year; celebrated talent show Your Face Sounds Familiar on Edutainment TV in Mongolia; Puzzle Masters in China; and MasterChef in Thailand, continue to drive this pipeline of enviable deals. The company has also seen real success in exploiting catalogue formats such as First and Last Thailand, and Minute to Win It Philippines. “These are just some examples of how we mine the markets and catalogue to offer a variety of entertainment and reality formats,” says Bajpai, adding: “We not only pitch an idea but also ensure we work closely with all stakeholders to produce top quality, engaging content that meets the clients’ programming and budgetary requirements.”

Banijay Rights has an extensive catalogue of over 5,000 formats, which includes superbrands MasterChef, Big Brother, Survivor, and LEGO Masters, as well as scripted titles like Younger. The comedydrama based on the hit Darren Star (Sex and the City) US series is

being developed in China and South Korea. “We have formats to offer every client and territory, and being a well-established, reputable player, the added experience from our production companies and consultants is invaluable,” explains Bajpai. “In 2024 we further increased our regional production presence via the launch of CreAsia Studio by Banijay Asia, led by Jessica Kam. Bolstering Banijay Entertainment’s regional stronghold, we now benefit by having additional production counterparts, and cross-territory creative strength. In both sales and production Banijay Entertainment is persistent in its approach, along with a “can do” attitude which is crucial in localising ideas and offering flexibility within the brands’ guardrails,” she adds. “We are specialised in working with our partners to respectfully customise formats to serve local needs, maintaining the strong cultural identity of each territory in which we operate. From an emerging territory like Sri Lanka to an evolved market like Thailand, we leave no stone unturned to service our clients’ needs, while maintaining the strong pillars on which our formats were built.”

Banijay Entertainment has long had a significant presence in India. Banijay Asia and Endemol Shine India, both led by Deepak Dhar, work with nearly every partner to produce originals, and Banijay Entertainment-owned or represented IP. “India is a dynamic TV market, multi-lingual and presents a lot of opportunities,” Bajpai says. “The business has seen a lot of success in scripted format adaptations such

as crime-thriller drama Aarya (Disney+ Hotstar), which has been adapted from Penoza, and unscripted formats like Big Brother (Asianet, Disney+ Hotstar), Fear Factor (Viacom), Temptation Island (JioCinema), Survivor (Zee5), MasterChef (SonyLIV), Deal or No Deal (&TV), Wipeout (Imagine TV), and Minute to Win It (Colours TV) in India. And, despite commissioning shifts and economic challenges, demand here remains high.”

To date, Thailand has been one of the company’s most successful territories in terms of the number of formats adapted. This is partially due to support from Thai producers who acquire formats rather than only relying on local broadcasters to do so. “Producers underwrite the costs and monetise the project by blocking a timeslot from the free-to-air broadcasters,” Bajpai says. “This business model puts more revenue in the hands of independent producers, and in doing so, strengthens their affinity with the IP, and heightens their inclination to deliver on quality and creativity to hook local audiences.”

Banijay Rights is also seeing a lot of brands land well in Thailand and MasterChef and its various adaptations have always resonated via its partnership with Heliconia. Other successful commissions include The Face with Kantana, and studio-based gameshow First and Last, a recurring property that does well for Workpoint TV.

“Indonesia is a territory that historically has not been well-associated with formats,” explains Bajpai. “Classic superbrands tend to perform with extended slots, but primarily, it is a region which enjoys long formcontent, so episodes tend to run longer than 60 minutes. Naturally,

We not only pitch an idea but also ensure we work closely with all stakeholders to produce top quality, engaging content that meets the clients’ programming and budgetary requirements.”

Rashmi Bajpai EVP Sales Asia, Banijay Rights

this means we are mindful in our approach with international format structures, suggesting upwards of one-hour run-times. MasterChef has been going strong for 11 seasons and we will have another iteration coming next year. We consider Indonesia to be a key growing market, and you will soon see more Banijay Entertainment adaptations, inclusive of scripted formats.”

“Across the region, Philippines has always been an important market for us with Pinoy Big Brother being a grand success, and currently on-air with its 11th season. The Filipino audience is an early adopter of good formats no matter the genre, which is how we have delivered six seasons of Deal or No Deal, and four seasons of Minute to Win It, with both making much-anticipated comebacks next year,“ Bajpai says.

In discussing Asia at-large, it would be an oversight not to mention South Korea. “We are always looking to strengthen our ties in the territory, simply because it offers so much opportunity. Not only have we licensed our scripted format Younger to SLL studios and are eagerly

waiting for the production to begin, but we have also licensed one of our fastest-moving, family entertainment formats, LEGO Masters, to JTBC. At Banijay Entertainment, we are always keen to explore new and innovative ideas and collaborations, that are complementary to our in-house creations, so we have multi-territory format acquisitions from our Korean partners like CJ and JTBC. Most recently we acquired the UK format rights from CJ for Genius Game, and the local adaptation will be produced by Remarkable Entertainment (part of Banijay UK) for ITV. Interestingly, our scripted formats are also gaining a lot of traction there, so we continue to explore suitable partners with whom we can expand our moves further, given South Korea’s leading position in the scripted charts both locally and on the global stage,” Bajpai says.

And it doesn’t stop here… Banijay Rights has seen real ambition from other South Asian territories. “Bangladesh is a fast-growing market, and we are confident it will become an adaptor of international formats in the near future. The signing of MasterChef, set to be produced next year, is an early indication of this.” Bajpai says. “We had licensed MasterChef in Pakistan many years ago and are trying against all odds to revive our format business there, and with Sri Lanka, while also an important territory, its production costs have been a significant roadblock. In order to open up these territories, our current tactic is to get some of our sponsor-friendly brands adapted there. Money Drop is already popular in Sri Lanka; and Cambodia has done a remarkable job with its return season of MasterChef this year, so hopefully we will see more to come from there as well. In Myanmar, despite the civil unrest, the broadcasters have done a great job in ensuring TV audiences do not lose hope and are continually served with uplifting entertainment. Don’t Forget the Lyrics for instance has been produced and broadcast in the territory, and we hope the situation returns to normality soon.”

Banijay Rights’ strategy has always been to forge close partnerships with clients - not just on the creative adaptation - but also in ideating

Our focus remains on developing our key titles for markets that are receptive to scripted formats across Asia, while keeping a close eye on format renewal opportunities.”

Rashmi Bajpai EVP Sales Asia, Banijay Rights

and helping them with creative solutions to finding sponsors and brand associations. “An idea will open a dialogue with the client but to sign on the dotted line, must find financial solutions to convince the client on the feasibility,” explains Bajpai, who adds: “the company is focusing on building our scripted formats business by finding suitable stories for each country.” Indeed, different stories resonate with different audiences, so a sensitive, tailor-led approach is key. For instance, some territories prefer women-led protagonists, whilst others prefer action and male-skewing stories. The key is in developing deep-rooted client partnerships, listening to our own producers, and remaining adaptable to market and societal shifts. “Our focus remains on developing our key titles for markets that are receptive to scripted formats across Asia, while keeping a close eye on format renewal opportunities.” In addition, as production budgets seem prohibitive with marketers tightening their budgets, Bajpai says “we are open to co-production and co-financing opportunities, where they make sense in the sharing of costs and rights.”

Bajpai concludes: “Like most territories, Asia comes with its challenges and opportunities. We are now seeing incredible growth in certain markets but also a proliferation of South Korean, Chinese and Thai content gaining traction. It is important to stay relevant, ahead of the curve, and above all, have operational flexibility to provide complete solutions to our clients.”

Dune: Part Two

Creatively and technologically, Namit Malhotra is part of a movement [re]moving filmmaking barriers between East and West.

Namit Malhotra is part of a movement that will, if it succeeds, create Indian films with global aesthetics and narrative forms. “Whether we succeed or fail, the jury is out. But we are leaving no stone unturned to reach there,” says the Prime Focus founder and CEO of DNEG, which Awards for, among others, Vanita Kohli-Khandekar spoke to him about the relationship between technology and storytelling in the era of spectacle films, and India’s filmmaking evolution as budgets rise with consumers’ growing appetites.

Where in the global film/ media ecosystem does DNEG/Prime Focus sit? For the last 25-30 years, our focus has been the building of the largest and most integrated company

in the world, which is what Prime Focus/DNEG is today. It is in terms of revenue (US$508 million), headcount (10,000), number of Oscar awards (7) in the last 10 years, global locations (London, India, Canada, etc) the most diversified.

What part did DNEG play in the success of say Interstellar, the director’s (Christopher Nolan) vision is that we show the world what happens when you travel through time and space through the wormhole or blackhole. There is no evidence of what that means in the real world, no imagery. We worked with Nobel prize winning theoretical physicist, Kip Thorne, and used his scientific formulae to render something that scientific journals said was ‘as accurate as it gets’. A filmmaker of the ilk of Chris Nolan, his vision has always been about doing something unique. It cannot just be great, snazzy images. He wants to make the audience experience that reality on the big screen. We work closely with these filmmakers (like Denis

Villeneuve of or Nolan) to make that impact. That is where our technology and creative skill set comes into action.

Does it ever stop becoming about the story and more about the visual effects? Does VFX overpower the story at times? No technology, no tool, no superstar means anything. What people care about ultimately is the story they are being told. That is the crux of what we do. If the director wants to tell you a story about going into time and space through the blackhole and wormhole, he cannot tell that story if he does not use the tool to show you that. It is servicing the need of the story and not the other way round. There are instances in world of filmmaking where people think it is cool, that young people will love it, let us style it, design it so that people get the wow impact. That happens. At that point we put on that hat to deliver that part of the storytell-

No technology, no tool, no superstar means anything. What people care about ultimately is the story they are being told.”

Namit Malhotra

ing they want to achieve. You have to think of us as designers, we are custom creative creators. Ultimately even if I think it too much, if that is what they want, then that is what they will get.

If Dune and Interstellar are the pinnacle of the high-end work, is there middle and lower end, bread and butter stuff that is different? We don’t call it bread and butter. Just because we win an Oscar, doesn’t make it everything. We have done films like First Man or Ex Machina, which are very small budget but Oscar-worthy movies. But these are not big enough to keep a company of our size fed. So we will still do some of the biggest visual effects extravaganzas that are made. Ultimately, an Oscar is a qualitative call by the Academy. But whether we are doing Fast and Furious or Dark Knight, for us sometimes the other work is harder, more complex. Ex Machina is the lowest budget Oscar-winning (for visual effects) movie in the history of the business.

You are getting into production now with Garfield and Ramayana. Does it create conflict with clients? We have produced films but in a more

fragmented manner. We started an animation division seven to eight years ago and made Garfield (released in 2024) and Angry Birds 3 (in production). We co-produced Brahmastra – part one, Shiva (the first of an Indian trilogy, 2022). The idea now is do it in a more structured manner. How do we become a source where filmmakers can say ‘hey let me go to Prime Focus, they can help me bring my project to life’. Ramayana is funded and created by us, it will be directed by Nitesh Tiwari (the director of Dangal, the biggest Indian blockbuster of all time). The vision, scale and ambition of making it happen comes from me. I believe that the world should sit up and watch it. It is the biggest production currently in the world with two parts going back-to-back.

revenue outcome for a Brahmastra, which gets the bulk of its revenue from India, versus Oppenheimer, which gets roughly half its revenues from the U.S., are different…. It is a bit of a chicken and egg. Unless you make that breakthrough the world can consume, you will never get there. It is time for Indian filmmakers and filmmaking to get to a place we present something aesthetically and at a scale and in a narrative form that the world can consume. Whether we succeed or fail, the jury is out. But we are leaving no stone unturned to reach there.

How did Brahmastra happen? Ayan (Mukherji, the director) was clear ‘I want you not just as a VFX company telling me how to do it but take some responsibility in delivering that’. I came on board more as a creative producer to fit the director’s vision. Then, we also take a financial position because we were going beyond the scope of just being a vendor. That is why the idea of becoming more invested is interesting. With Ramayana, which we are producing, we are trying to tell an Indian subject but for the world. Why would this be anything less than say Lord of the Rings or Avatar. Am also trying to build parity – different films perform differently, audiences have different tastes. But creatively and technologically we are removing the barriers between East and West.

Isn’t that imperative given the audience is homogenised. We are all exposed to the same level of storytelling thanks to streaming. But the

Indian cinema is a wonderful space. But does it offer enough opportunities to do the kind of work you do in Hollywood? Everything that we price is based on how much time and effort is going to be applied to doing the work. So Brahmastra or Kalki will be priced based on the complexity of what is being asked. And how much use of the talent needs to be made internationally; we do know talent in the West is going to be more expensive than talent in East. We are upfront with the filmmaker on how much time and resources are going to be applied based on the budget they have. The world of filmmaking in India or the West is becoming similar. The reason to go to a cinema today is for to a big event – like Kalki. Munjya (a horror comedy), which is doing so well is also a Prime Focus delivery. You can see the transition; budgets in India are growing as the appetite of our consumers becomes similar to the rest of the world. Kids today consume a Marvel movie or a Western movie in the same way that they consume an Indian movie. The games they play, the clothes they wear, everything is becoming much more homogenised. That is the customer we are servicing.

Taipei|11.05 TUE - 11.08 FRI

A major annual event in the Asian creative content industry featuring three main sections: PITCHING, MARKET, and FORUM

A platform to showcase promising content proposals

Connect buyers and investors with exciting new audiovisual projects and original story IPs that have strong potential for screen-adaptation

Select 40 projects and 20 story IPs from 50 countries

A hub for rights transactions of international audiovisual content and promising IPs

Access the industry chain for developing business opportunities, which encompasses content development, filming resources, and visual technologies all in one place

A platform where global industry leaders and professionals gather to share the most up-to-date information

Discover global strategies, industrial partnerships, and emerging market trends 250+ buyers and professionals from over 29 countries

TCCF Professional Badge Sales Will Be Available In Mid-September. Stay Tuned! For more information, please visit www.tccf.tw/en, or scan QR Code

Game shows, drama series and reality singingbased formats made up 65% of format adaptations on-air or commissioned in the fi rst half of 2024. Vietnam, Mongolia and Thailand were Asia’s top markets with a combined share of 43%, ContentAsia’s Formats Outlook for 1H 2024 shows.

Asia’s formats business continued to contract in the first half of this year as broadcasters and platforms region-wide battled with shrinking advertising revenues and, with some high-profile exceptions, lower production output.

Overall, volume was down 32% to 91 adaptations on-air/newly commissioned in 16 markets from January to June 2024, compared to a total of 133 titles in the same period in 2023.

The decline continues the downward trend tracked over seven years from a high of 285 in the first half of 2017.

The ongoing ContentAsia’s Formats Outlook research tracks formats adaptations commissioned/on air in 18 countries and territories across the region, including Hong Kong, which reported no new adaptations in the first half of this year.

For the first time since 2020, Vietnam topped Asia’s volume charts, beating frequent formats leader, India.

Vietnam took 18% of the region’s share, followed by Mongolia at 13% and Thailand at 12%. India and the Philippines tied at fourth spot with 10% each.

FORMATS BY GENRE....

Reality formats were the dominant category, representing 47% (43 titles) of the total 91 titles.

Delving deeper into the subcategories within reality formats, singingbased titles lead with the highest count, totaling 18 out of the 43 titles.

ITV Studios was the key distributor of reality-singing based formats, accounting for 10 of the 18 titles.

These were multiple versions/seasons of The Voice format in five coun-

tries: Mongolia (The Voice Kids Mongolia S1), Nepal (The Voice Kids Nepal S3, The Voice of Nepal S5), Philippines (The Voice Kids Philippines S6/S7, The Voice Teens Philippines S3), Sri Lanka (The Voice Generations Sri Lanka S2, The Voice Kids Sri Lanka S1, The Voice of Sri Lanka S3) and Vietnam (The Voice Kids Vietnam S8).

Reality sub-genres in the first half of the year involved six cooking shows, four social experiment titles and three dating formats.

Banijay Rights was responsible for three of the six cooking shows, featuring adaptations of the MasterChef format in Cambodia (MasterChef Cambodia season 3), Thailand (MasterChef Junior Thailand season 3), and Myanmar (MasterChef Myanmar season 4).

Game shows were the second-largest genre by volume, making up 30% of the total titles, with 27 entries.

Fremantle played a significant role in this category, driving game show formats across six countries.

These consisted of various versions of classic favourite, Family Feud, with adaptations in Malaysia (Family Feud Malaysia in both Chinese and Malay), Mongolia (Family Feud Mongolia), the Philippines (Family Feud Philippines season 8), Indonesia (Family 100 aka Super Family 100), and Thailand (Family Feud Thailand). By country, game show formats are most prevalent in Mon-

golia, Thailand and Vietnam, each of which featured four titles

This included three titles from All3Media International: Cash At Your Door Mongolia season 4, Cash Cab Mongolia, and Beat The Internet Vietnam

Drama formats ranked third by volume, comprising 15% of the total 91 titles, highlighting a sustained interest in scripted content. This demand is particularly strong in India, the Philippines, and Thailand, each of which reported three scripted titles.

Korea’s KBS Media led the scripted format segment with three titles, including two versions of medical drama series, Good Doctor, for the Philippines and Thailand: Good Doctor Philippines, commissioned by CreaZion Studios, and Good

by Thai/Korean joint venture, True CJ Creations.

1H 2024 FORMATS IN VIETNAM For the first half of 2024, Vietnam surpassed its volume from the previous three years (1H 2021: 22, 1H 2022: 31, 1H 2023: 22) to lead this year’s 1H chart with 16 titles, accounting for 18% of the total 91.

Vietnam previously ranked #1 twice: with 16 titles in 1H 2017 and 22 titles in 1H 2020, according to ContentAsia’s Formats Outlook reports.

Reality formats dominated Vietnam’s format landscape during the six months, with eight titles.

Half of these were singing-based reality formats, including The Voice Kids Vietnam season 8 from ITV Studios, Beautiful Sisters Riding Waves (Chị đẹp đạp gió rẽ sóng) from China’s Mango TV, and two versions of NBC Universal’s Singer Auction, known locally as Sàn Chiến Giọng Hát Mùa 5/6. All four were commissioned by government-backed national broadcaster, Vietnam Television (VTV).

Game shows ranked second in volume, with four titles.

These included My Boyfriend is Better, a CJ ENM Korea format where girlfriends showcase their boyfriends’ singing talents, commissioned by FPT Play; Beat the Internet Vietnam from All3Media International, commissioned by VTV; Who Wants To Be A Millionaire? season 12 from Sony Pictures Television, also commissioned by VTV; and Lightning Quiz season 4 from Thailand’s Workpoint TV, commissioned by Ho Chi Minh City Television (HTV).

FORMATS IN MONGOLIA Mongolia was a rising formats market in the first half of the year. Traditionally ranked 4th-9th with an average of 12 formats over the past seven years, Mongolia secured second spot in the 1H 2024 rankings, albeit with the same number of titles.

Much like Vietnam, reality-singing formats are thriving in Mongolia, with six titles in the first half of this year. These included two formats from Banijay Rights: Killer Karaoke Mongolia season 1, commissioned by Central TV, and Your Face Sounds Familiar Mongolia season 7 (Яг түүн шиг), commissioned by Edu TV.

Mongolia also featured four game shows. Two of these were from All3Media International –Cash At Your Door Mongolia season 4 (commissioned by Edu TV) and Cash Cab Mongolia (commissioned by NTV).

Other game shows were Family Feud Mongolia from Fremantle (commissioned by Star TV) and That’s My Jam Mongolia from NBCUniversal Format (commissioned by Central TV).

The other two titles were drama series – Suits Mongolia, commissioned by Mongol TV, and the Japanese format, Mother Mongolia (Ээж), commissioned by Green Show Production for Mongol TV.

FORMATS IN THAILAND In the first half of this year, Thailand ranked third, following Vietnam and Mongolia, with 11 titles, representing 12% of the total 91 titles. This position is consistent with previous years: third in 1H 2023 with 16 titles, third in 1H 2022 with 18 titles, and also third in 1H 2021 with 15 titles.

Of Thailand’s 18 titles in the first half of this year, eight were split evenly between reality and game shows.

Game shows included two seasons of Banijay Rights’ First And Last Thailand (seasons 7 & 8), where contestants must avoid finishing first or last to stay in the game, commissioned by free-TV station BBTV Channel 7.

Reality-cooking formats included MasterChef Junior Thailand season 3, commissioned by Heliconia from Banijay Rights for BBTV Channel 7; and Hell’s Kitchen Thailand season 1, also commissioned by Heliconia from ITV Studios for BBTV Channel 7.

The remaining Thai format was dating show, Take Me Out Thailand season 18, commissioned by Creatist Media for BEC World’s free-TV Channel 3.

FORMATS BY DISTRIBUTOR Banijay Rights was a clear formats leader in the first half of this year, with 16 of the total 91 titles, representing 18% of the total. Fremantle followed with 13 titles, accounting for 14%.

India was Banijay’s strongest market, featuring five titles commissioned or on air, including several versions of the reality-social experiment format Big Brother for Viacom 18/Colors, Star Vijay, and JioCinema. Thailand also emerged as a key market for Banijay, with three titles, including cooking format MasterChef Junior Thailand season 3 for BBTV Channel 7.

Fremantle’s strongest market was Indonesia, with six titles commissioned or on air in the first half of 2024. This included big-budget reality singing format Indonesian Idol season 13 for RCTI, game show Family Feud for MNCTV, and improvised comedy format, Thank God You’re Here, known locally as Akhirnya Datang Juga for GTV.

ITV Studios and NBCUniversal Formats tied for third place by volume, each with 11 titles. ITV Studios’ strongest markets were the Philippines and Sri Lanka, with three titles each.

These included multiple versions/seasons of The Voice, such as The Voice Kids Philippines seasons 6 and 7 for GMA Network and The Voice Generations Sri Lanka season 2 for Maharaj TV.

Source: Distributors/rights holders, titles/seasons either on air or commissioned in Jan-June 2024 by broadcasters/platforms/companies in 18 countries in Asia, as of August 2024, ContentAsia’s Formats Outlook 1H 2024

LOOKING TO THE REST OF 2024 The second half of 2024 started well. In Japan, TV Asahi premiered in July a local remake of Korean 2018 blockbuster, Sky Castle (JTBC/SLL) directed by Naomi Tamura, Yuji Nakamae and Kazunari Hoshino.

In August, Malaysia’s Astro premiered its first local adaptation of Japanese scripted format, Daun Hijau Di Angin Lalu, a coming-of-age romcom based on a manga about social minorities. This is one of two Nippon TV formats acquired by Astro; the second, Kelas Tahanan Cikgu Hiragi (a remake of Homeroom), premieres on 25 September on Astro Ria/sooka.

In India, Disney+ renewed Paramount Global’s legal drama, The Good Wife (The Trial: Pyaar, Kanoon, Dhoka), for a second season. The eight-episode first season aired in July 2023.

Four Asian titles made #1 spot on Netflix’s global non-English-language TV top 10 since the end of April 2024, well behind Spanish drama series, which took nine of the top spots in the 15 weeks. Total global viewership of the top 10 TV programmes hit 2 billion hours in May, June and July 2024. Asian programming, led by Korea and Japan, made up 53% of the combined hours.

Total non-Eng hours viewed Total Asia hours viewed

Upsized Taiwanese producer, GrX Studio, is building upon the success of The Victim’s Game and Copycat Killer to roll out a studio/hub model it says will enable producers to expand and find new stories, markets and audiences across the region and – if all goes according to plan – beyond.

The Victim’s Game was a turning point for Taiwan’s GrX Studio – in more ways than one.

The series, about a forensic detective with Asperger’s syndrome and a bloodthirsty reporter turned public relations rep, was Netflix’s first Chinese-language renewal. Season two, which premiered in June four years after season one ended, drew the original 2020 season back into the top 10 in the show’s top four markets – Taiwan, Hong Kong, Singapore and Vietnam. The series return didn’t expand its footprint beyond those four markets, according to Netflix’s published data. But fans nevertheless say the season two ending paves the way for a third season (no confirmation as of mid-August) to follow other stand-out made-inTaiwan shows, like GrX’s Copycat Killer, which hit Netflix’s global nonEnglish top 10 for two weeks, and, soon, The Outlaw Doctor.

While The Victim’s Game and Copycat Killer drove eyes on Taiwan, the shows have also paved the way for GrX’s pro-active outreach across the region.

Now, founder Hank Tseng and CEO Phil Tang are positioning GrX, which incorporates Greener Grass Productions, for bigger things, led by a studio structure and a “hub” model that connects creators, investors, distributors across languages and geography.

To this end, the two have expanded the leadership team, forged regional alliances, and are building on initiatives such as the biennial Wild Grass Project, where feature film Marry My Dead Body was pitched.

As they move from production house to studio, Tseng and Tang also speak about broadening the stories they tell, a focus on mainstream drama and narratives, taking note of global trends, and building out

regional as well as international distribution networks. Countries on GrX’s radar are Vietnam, Japan, New Zealand, Singapore and Indonesia.

In July this year, GrX appointed veteran entertainment execs Dennis Wu as strategy and chief investment officer and writer Shing Ming Ho as chief creative director. Ho talks about the “new industrial revolution” of AI, and finding solutions to this challenge in developing creative talent, “crossing borders and breaking boundaries”.

This was already evident in The Victim’s Game season two, which, along with returning cast members, starred Japanese actor Dean Fujioka and Hong Kong’s Lau Chun-him Terrance.

Whatever its current shifts and cutbacks, streaming has irrevocably changed viewing habits and tastes. Tang talks about cross-regional strategic co-operation, injecting different cultural elements, and using multiple languages in series such as upcoming medical crime drama,

The Outlaw Doctor (化外之醫), starring Taiwan’s Janine Chang (The Psychologist) and Vietnam’s Lien Binh Pha (Running Man Vietnam).

The Outlaw Doctor in an alliance with Taiwanese public broadcaster, Public Television Service (PTS), with investment from Taiwan’s Chunghwa Telecom. The 10-episode drama was filmed in Vietnam with a cast drawn from the Philippines, Malaysia, Thailand and India.

Tang says 60% of the series is in English. “In future, we will produce all English works. It’ll be starting from Taiwan and forward to challenging the international market,” he says. “Everyone wants something new,” Tang says. “We know that.”

The full interview is at www.contentasia.tv

Connecting your brand and products with 12,800 + verified executives in the Asia-Pacific content space, across all platforms in 22 APAC markets. ContentAsia’s clear editorial focus on Asia delivers all the latest trends, market developments, influences, information & analysis that make a difference.

Contact

Leah@contentasia.tv (Americas/Europe)

Malena@contentasia.tv (Asia Pacific/Middle East) CJ@contentasia.tv (China/Taiwan)

The ContentAsia Summit is made possible with the generous support of:

CONTENTASIA X GAGAOOLALA:

FOCUS ON LGBTQ+ PROGRAMMING & PRODUCTION

Organised with

Intelligence Partner

Organised with