Welcome to the 2025 edition of Malta Invest, the global investment guide showcasing Malta as an attractive international investment destination. This is the largest and most comprehensive edition to date, supported by an expanded global distribution network. Malta Invest is now available in key strategic locations across London, Paris, Geneva, Frankfurt, Zurich, Dubai, Abu Dhabi, Brussels, and Malta. Distribution points include leading business centres, investment banks, corporate firms, luxury hotels, private members’ clubs, embassies, firstand business-class airline lounges, and private jet terminals –making it a first for Malta.

Produced, published and owned by Content House Group –one of Malta’s largest media organisations in the online and print sectors – Malta Invest is the only international investment guide focused exclusively on Malta as a destination. It offers extensive content, actionable insights and detailed information across various sectors for investors considering Malta as a jurisdiction of choice.

This one-stop guide provides invaluable details on Malta’s schemes and incentives designed to foster private enterprise. The 2025 edition also features in-depth analysis and custom content, spotlighting the key public and private stakeholders

poised to assist investors on their journey. Readers will also find timely updates on current and forthcoming policy and economic developments.

The publication delves into Malta’s dynamic economic transformation, highlighting a country that thrives on innovation and progress. From iGaming and fintech to renewable energy and artificial intelligence, Malta is establishing itself as a hub for industries shaping the future. Meanwhile, established sectors like financial services and tourism remain robust, offering refreshed opportunities aligned with Malta’s ambitious vision. The country is also breaking new ground in superyacht services and fostering a vibrant startup ecosystem to drive innovation.

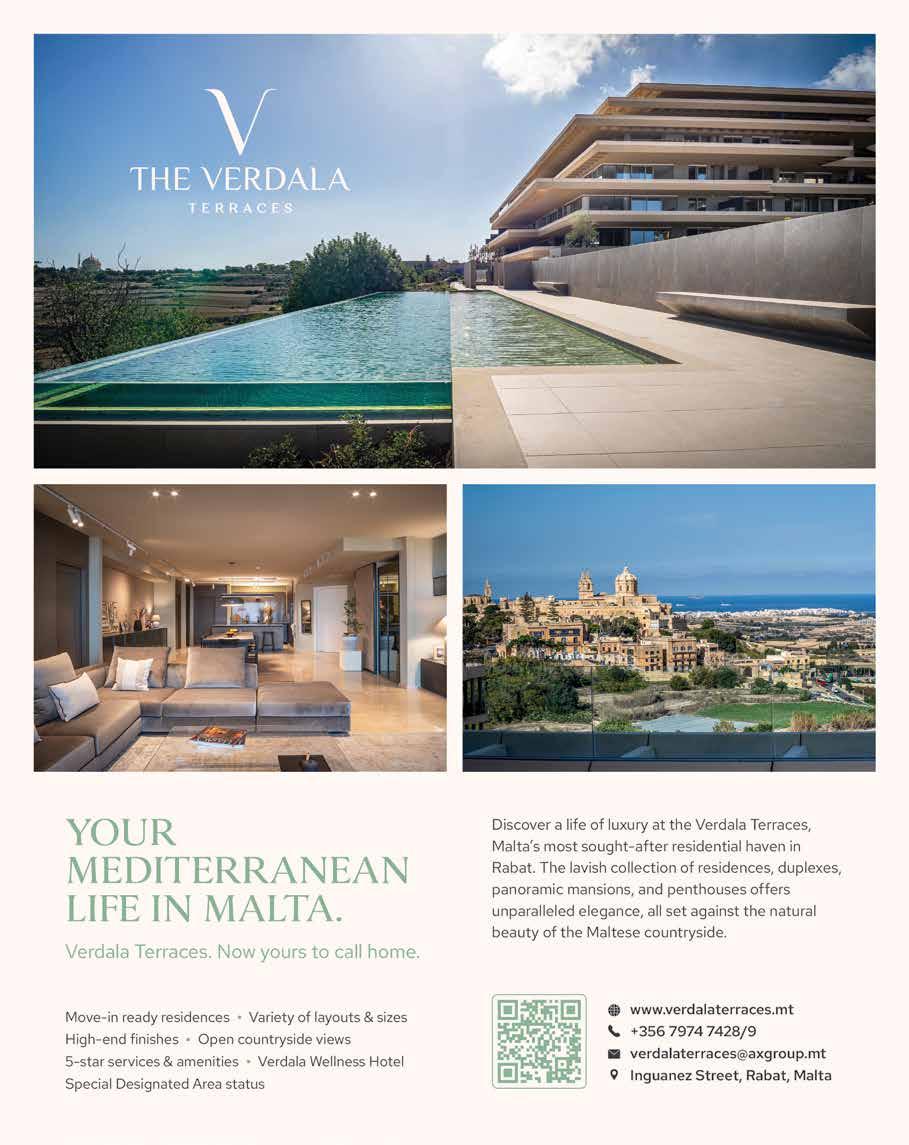

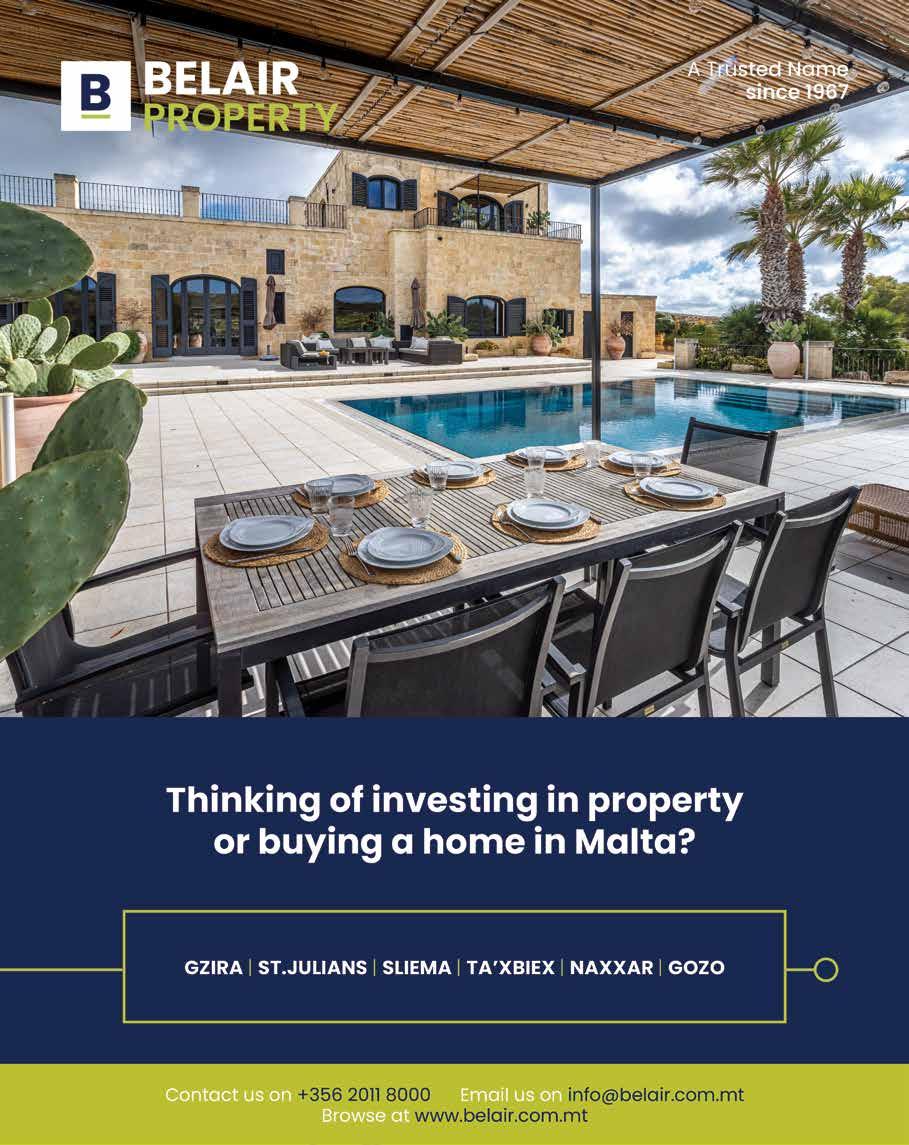

Malta’s allure goes beyond its business environment. The islands attract high-net-worth individuals with a compelling mix of Mediterranean charm, rich history and contemporary luxury. Whether investing in premium properties within Special Designated Areas or restoring historic townhouses, these investors are shaping Malta into a cosmopolitan hub of global significance.

This edition of Malta Invest serves as a comprehensive resource, guiding potential investors at every stage of their journey. Inside, you’ll find detailed industry overviews, expert insights from

sector leaders and practical information on support schemes, tax regulations, residency requirements, and real estate opportunities. Contributions from industry experts and stakeholders further enrich the guide, equipping readers with the tools needed to make informed and strategic decisions.

When we say comprehensive, we mean it. By presenting a holistic view of Malta’s evolving economic landscape, this publication highlights the myriad opportunities available for both foreign and local investors in an economy that consistently exceeds expectations.

Finally, we’re excited to announce the launch of MaltaInvest.mt in early 2025 – the first online, AI-enabled investment guide dedicated to Malta. This innovative platform will offer investors, business professionals and entrepreneurs a centralised hub for accessing all the information they need to invest in Malta, powered by cuttingedge search tools and technology.

We hope you find this edition of Malta Invest invaluable. Your feedback is always appreciated and helps us continue to refine and improve this essential resource.

PUBLISHER

Content House

Quad Central, Q2, Level 2, Central Business District, CBD 1040, Malta

Tel: +356 2132 0713 info@contenthouse.mt www.contenthouse.mt

Malta Invest 2025 is published, produced and owned by Content House Group Ltd and its relevant subsidiary companies.

Visit MaltaInvest.mt, our new digital investment platform, for the latest business and investment news and updates.

EDITOR

Robert Louis Fenech

HEAD OF SALES & BUSINESS DEVELOPMENT

Marie Claire Camilleri

DEPUTY HEAD OF SALES & BUSINESS DEVELOPMENT

Godwin Buttigieg

CREATIVE DIRECTOR & DESIGN

Nicholas Cutajar

HEAD OF DIGITAL & MARKETING

Raisa Mazzola

ADMINISTRATION & CLIENT RELATIONSHIP EXECUTIVE

Rodianne Sammut

Content House Group Ltd would like to thank all the protagonists, sponsors, partners, advertisers, and all relevant private companies and public companies that have embraced this project and assisted the project team in the collation of information. The publisher would also like to thank all participants and interviewees who accepted to feature in this publication. Moreover, the publisher extends its gratitude to the entire project team who have made this project a success, and to the local and international distributors.

Malta Invest is strategically distributed for free in Dubai, Abu Dhabi, London, Paris, Frankfurt, Geneva, Zurich, Brussels, and Valletta. Our global reach includes distribution to top corporate firms, business centres, investment banks, airline lounges, and leading embassies. In the UK, the publication is also distributed in select luxury hotels, private members’ clubs, airline gate services, private jet centres, and at the Eurostar Lounge at London St Pancras. In Malta, Malta Invest is distributed to leading businesses, companies and corporate firms, as well as to prominent business leaders and CEOs, business centres, financial institutions, Government agencies and ministries, as well as yacht marinas.

The publisher cannot be held liable for any information that is published in this publication. Every effort has been made to ensure accuracy of information. The publisher cannot be held responsible for any decision based on the content published in Malta Invest, which is solely aimed as an informative guide.

The content appearing in this publication does not necessarily reflect the views of Content House Group Ltd, or of its subsidiary companies, as the publisher. All rights reserved. Reproduction in whole or in part without written permission of the publisher is strictly prohibited.

Why do so many individuals choose to live, work and invest in the smallest member state of the European Union?

If you find yourself pondering this, you’re in good company. Malta, a de facto pair of small islands in the heart of the Mediterranean, continually intrigues with its remarkable success story. As the EU’s tiniest nation, Malta punches well above its weight, boasting one of the Union’s strongest and most diverse economies. Currently, it is registering the highest economic growth in the EU. The European Commission’s official forecast highlights Malta’s achievements, noting that the Maltese economy continues to grow robustly,

driven by strong exports and domestic demand. Tourism flows have bounced back to well above pre-pandemic levels, and a strong inflow of workers is boosting domestic demand. After reaching 5.6 per cent GDP growth in 2023, the Maltese economy is expected to achieve a growth rate of 5 per cent in 2024 and 4.3 per cent in 2025.

Malta’s appeal is multifaceted. Its adoption of the euro in 2008 has provided stability and ease of business within the European market. An agile, highly skilled local workforce, proficient in English – an official language and the primary language of business – adds to its competitive edge. The island nation offers abundant opportunities

for investment and employment across various sectors, from finance and iGaming to shipping, aviation, pharmaceuticals, aquaculture, ICT, and chemical manufacturing.

Strategically located at the crossroads of north and south, east and west, Malta’s geographical significance has been recognised for millennia, shaping its rich cultural heritage. The island enjoys excellent year-round weather conditions, further enhancing its appeal as a desirable place to live and work. This makes it a popular destination for investors, global companies seeking a European presence, digital nomads, and thousands of expats. Additionally, Malta has made significant investments in education, cultivating a workforce capable of driving economic progress and innovation, which strengthens its position as an attractive hub for business and living.

Connectivity is another of Malta’s assets. Malta International Airport links the islands to around 100 destinations, ensuring easy access to major European cities. This robust connectivity is complemented by a solid digital infrastructure, facilitating seamless business operations. Moreover, Malta is experiencing a boom in tourism, a strategic industry that has attracted substantial investment to its shores. With over 3.5 million visitors, 2024 is expected to be crowned the record year in tourism, surpassing the previous year, which was the record holder until then.

Foreign investment flows have increased significantly over the years, with both Government and private entities doing their utmost to warmly welcome and facilitate such investment, and with service providers offering tailored, cost-effective solutions. The overall cost base, from human resources to real estate, remains competitive, rendering Malta an attractive destination for investors. Beyond the practical advantages, Malta offers excellent healthcare, a culture of innovation and a vibrant community that attracts individuals, families, startups, and multinationals. Moreover, safety is a hallmark of life in Malta, providing a secure environment for residents and businesses alike.

In summary, Malta’s unique blend of economic strength, strategic location, skilled workforce, and high quality of life makes it an exceptional place to invest and thrive. Explore the intricate tapestry of opportunities that Malta weaves and discover why this small island nation stands out on the global stage. Malta is proving its versatility through the diverse range of investment ventures it attracts to its shores. The country hosts an impressive array of industries, from aquaculture and film production to software engineering, education, gaming, financial services, and manufacturing. The 2025 edition of Malta Invest provides a comprehensive overview of Malta’s economy and delves into each of these economic sectors. Before diving in, it is worth outlining three broad pillars that underpin the country’s economic success: the stability it presents, the support it offers, and the access it grants to regional and global markets.

Gender Distribution in Malta 47%

563,443 as at end 2023 Total Population +4% Annual Population Growth

Population Density

1,783/km2

Malta ranks among the most stable and safest countries in the world, making it an attractive destination for foreign investment. It is governed by a parliamentary democracy led by two major parties that share a common understanding on economic matters, each building on the successes of previous administrations. The domestic political stability, combined with the safety net of Malta forming an integral part of the EU and the euro area, provides peace of mind for investors who continue to see the benefits of choosing Malta as a strong base in Europe.

That is not to say that Malta is immune from the challenges posed by global developments or local political issues at the domestic level. One of the toughest challenges Malta faced in recent years was high inflation, a phenomenon affecting the continent and beyond in the aftermath of Russia’s invasion of Ukraine. This delicate situation led to a cost-of-living crisis for many households and a significant increase in the cost base for businesses. Malta responded decisively by subsidising the cost of energy and fuel for investors, businesses and the population at large. Despite the EU labelling Malta’s approach as unsustainable, the decision contributed to a period of prolonged economic growth and stability, when other EU member states were facing economic woes and significant instability.

In Europe, inflation prompted central banks to raise interest rates after years of low rates. However, Malta’s highly liquid banks managed to maintain their long-term rates, providing enhanced stability for thousands of businesses, economic operators and investors in Malta. Consequently, local banks have continued to offer stable and competitive interest rates on commercial and business loans.

These examples highlight Malta’s ability to navigate through the current global situation while placing significant importance on the stability it offers to its population, investors and businesses operating in the country.

One of the important factors foreign investors consider when choosing their investment destination is the level of support they will find. This includes support from the workforce, Government agencies, the private sector, as well as access to domestic and EU grants. Therefore, the initial contact and experience can make all the difference.

Since Malta joined the EU in 2004, Government agencies and the private sector have upped their game and continue to evolve, demonstrating agility in assisting and welcoming foreign investment. Foreign investors and companies that have chosen to invest in Malta often praise the support provided by both private and public entities, as well as the consistent assistance from their local partners, who stand ready to provide guidance on a daily basis.

Malta’s extensive history as a destination for foreign investment has made private and public service providers adept at meeting the needs of incoming operators, ensuring that establishing a presence in the country is straightforward and transparent.

There are numerous initiatives and schemes available for investors to tap, ranging from grants and guarantees to tax credits and

free services. The primary support hub is Malta’s economic development agency, Malta Enterprise, which will be discussed in more detail in the next chapter (seep.60). At a macro level, the entire system is geared towards welcoming foreign investment. Due to the country’s small size, leveraging strong private consultants and corporate providers, along with utilising the information and assistance provided by public agencies, can create an effective hybrid approach to achieving your goals quickly and sustainably. This strategy ensures that even small and medium-sized businesses receive treatment comparable to that offered to much larger firms in other jurisdictions, including tailored assistance aimed at giving your company a competitive edge.

The support available extends beyond financial assistance, such as access to land in state-owned industrial zones. In terms of employment, employers will find that the local workforce is highly

skilled, dedicated, loyal, and capable of thinking outside the box. Companies unable to find the necessary talent locally can leverage the EU’s workforce of 200 million and potentially benefit from incentives to attract needed workers from abroad. Local educational and training institutes also prioritise understanding industry needs, allowing investors to have their say in the development of future human capital today.

Foreign investors will find a wealth of corporate service providers ready to assist with company registration, access to banking facilities, legal aid, recruitment, and all other requirements to set up a business. These professional services come at a much lower cost than in other major European cities. The same applies to technical services, human resources, rental costs, and support services, which remain significantly below the continental standard from a cost perspective, without compromising on quality.

Underpinning Malta’s strong economy are corporate, legal and judicial systems familiar to those accustomed to common law frameworks. These systems, essential for the smooth functioning of business, have been further strengthened through the implementation of EU regulations and directives. Moreover, the establishment of a commercial section within the Civil Court has been successful, and its jurisdiction over legal matters is expected to expand in the coming years. This extension will provide those with commercial interests in Malta the assurance of a specialised court dedicated to resolving disputes promptly and effectively.

Make no mistake. Although Malta is often too small to be physically visible on world maps, its strategic location in Europe and the Mediterranean provides crucial access to the European bloc and its expansive Single Market. Malta’s proximity to Africa has also been pivotal in facilitating the expansion of local companies across various sectors, from manufacturing in the food and drink industries to software development, into North Africa and other parts of the central Mediterranean region.

Malta lies at a crossroads of civilisation, a strategically advantageous position that, combined with its membership of the EU’s Single Market, makes it an ideal location for companies seeking a base for international business operations.

Savvy investors have long recognised this potential. The textile factories that initially spurred foreign direct investment in Malta have since given way to more sophisticated production facilities

and import/export businesses, particularly those engaged in trade with European and North African markets.

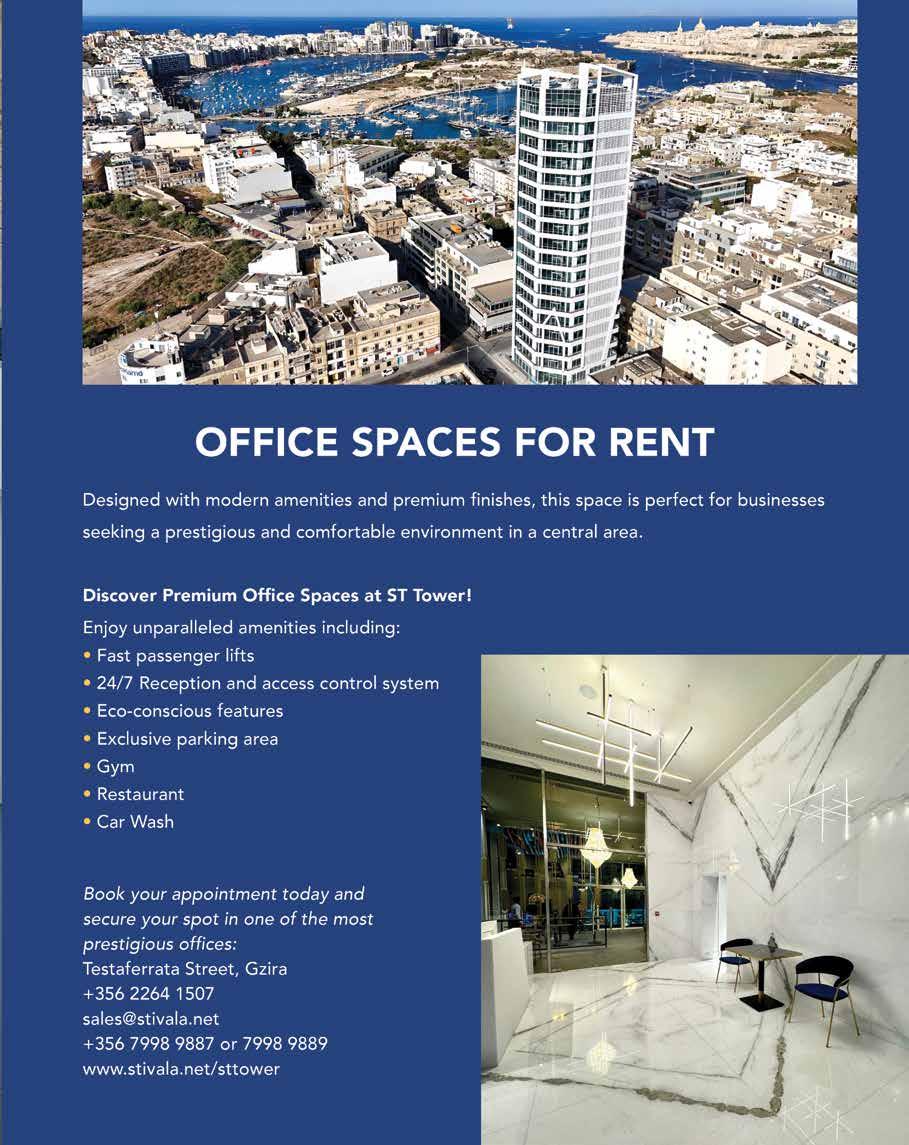

One major artery for the flow of goods is Malta’s world-class port infrastructure. The Port of Valletta, also known as the Grand Harbour, serves as the primary entry point for people and goods arriving by sea. It stretches approximately 3.6km inland and offers a wide array of services, including ship repair and building yards, ship chandelling, bunkering facilities, and specialised silos. On the southern end of the main island lies the Malta Freeport, one of the Mediterranean’s largest transshipment hubs with over 120 global connections.

Another crucial artery is Malta International Airport, the first and last destination for over 95 per cent of all visitors to Malta. The airport connects Malta to over 100 destinations, including most regional capitals and major cities, many of which are less than three hours away. Annually, over 18,000 tonnes of cargo

Over decades, Malta has offered foreign investors and companies an attractive tax regime that enables foreign-owned firms to save money. In a nutshell, these are key elements of Malta’s tax structure for foreigners:

No withholding taxes on dividends, interest, royalties, or proceeds from liquidation distributed to non-residents

No separate capital gains tax

No wealth taxes

No inheritance taxes

No stamp duty on asset transfers by companies carrying out international activities

pass through the airport, making it the primary hub for Maltese operations of global companies such as DHL and Servisair. Additionally, the airport hosts several maintenance facilities, including those operated by Lufthansa Technik, Ryanair, and most recently, EasyJet.

The digital revolution and robust infrastructure supporting it have ushered in a new generation of export-oriented service firms. Continued investment in Malta’s digital connectivity has yielded significant returns, facilitating the growth of two pivotal sectors over the past 25 years: financial services and remote gambling. The success of these industries, reliant on fast and stable network connections, underscores the quality of Malta’s communications infrastructure. Building on this foundation, Malta has established itself as a hub for emerging technologies. Companies in dynamic fields such as fintech, edtech, artificial intelligence (AI), blockchain, Internet of Things (IoT), software development, and esports are increasingly choosing Malta as their base of operations.

That leaves income tax as the main instrument of corporate taxation. The standard rate is 35 per cent, but foreign-owned companies are eligible for refunds that can bring the effective rate down to as low as 5 per cent.

Crucially, foreign firms whose business is controlled or managed in Malta are subject to the Maltese regime, to the extent that income from abroad is remitted to Malta.

The bottom line is that Malta’s taxation framework can be highly advantageous for foreign companies and investors. More details can be found in the next chapter (seep.68)

Is Malta in the European Union? What about Schengen?

Malta has successfully been a European Union member state since 2004 and joined the Schengen Area in 2007.

What currency does Malta use?

Euro. Malta joined the euro area in 2008.

Is Malta a rich country?

Malta has been the fastest-growing EU economy for three years running, with the latest statistics showing that Malta’s GDP per capita is 5 per cent higher than the Eurozone average.

What are Malta’s top exports?

Malta’s top material exports include petroleum products, pharmaceuticals, electronics, and fish, while its main services exports are related to the tourism and travel, remote gaming, financial services, and professional and technical consulting sectors.

Is finance readily accessible?

Since the main commercial banks have high liquidity, interest rates in Malta have remained stable and competitive. The Malta Stock Exchange is also a popular avenue for companies looking to tap the local capital market, while a recent push to encourage venture capital and private equity activity has started to yield results. However, bank finance remains the most popular way of financing corporate projects. There are around 25 banks active in the country, ranging from midsized local banks to branches of foreign institutions and specialised operations. Most have competitive fees while providing tailor-made banking solutions, including trade and project finance, custodian banking and specialist wealth management services.

Does everyone speak English?

Yes. Practically the entire workforce is proficient in English. Italian is also widely spoken, and the local population’s knowledge of French, German and Spanish has grown since joining the EU. A boom in the foreign-born population has also increased the number of people who speak other languages, ranging from Swedish and Polish to Arabic, Mandarin and Hindi.

Is Malta safe?

Malta is considered a very safe country where theft and violence are isolated incidents.

How’s the weather?

Malta enjoys over 300 days of sunshine every year, with mild winters and hot summers.

What’s the healthcare like?

Malta boasts excellent public healthcare. A thriving ecosystem of private healthcare providers is similarly recognised for the high quality of care it provides, and the country has in recent years been taking tentative steps toward promoting itself as a destination for medical tourism.

What are the residency options available?

Foreign investors have several residency options available to them. These range from full citizenship through naturalisation to retirement schemes and special residency options for digital nomads. You can find out more on the subject in the relevant chapter (seep.92)

Can I buy property on the Maltese Islands?

Yes, although holders of foreign passports are limited to only one residential property unless it is in one of several Special Designated Areas around the islands. For more information, see the chapter on real estate (p.120)

How many expats live in Malta?

There are around 100,000 people born abroad who now live in Malta. Many of these live in the cosmopolitan North Harbour region, surrounded by luxury residences, high-end shopping and excellent leisure opportunities.

Speaking of leisure, what is there to do in Malta?

Malta’s cosmopolitan lifestyle, coupled with its traditional charm, offers a unique blend that few places can match. The country has retained its island culture, with the relaxed Mediterranean way of life being a major selling point for those considering relocating. There is a wide

The Private Equity Venture Capital Association of Malta (PEVCA Malta) is at the forefront of strengthening and expanding the private equity and venture capital ecosystem on the island. As the gateway to new investment opportunities, PEVCA Malta is dedicated to fostering a dynamic environment for investors, fund managers, family offices, and service providers alike.

As we look ahead to 2025, PEVCA Malta is poised to deliver a series of impactful events and initiatives that will solidify Malta’s position as a destination for private equity and venture capital in the Mediterranean.

Research and Industry Recommendations

In 2025, PEVCA Malta will publish new research focused on the current state of private equity and venture capital activity in Malta, with a detailed examination of the funds market.

This report will serve as a key resource for industry stakeholders, offering critical insights and actionable recommendations aimed at policymakers to encourage growth and stability in the sector.

The research initiative underscores PEVCA Malta’s commitment to evidence-based advocacy and fostering a regulatory environment conducive to investment and economic development.

Professional Training Programmes: Advancing Industry Expertise To build a robust pipeline of skilled professionals and enhance the industry’s capabilities, PEVCA Malta is pleased to announce the launch of a comprehensive professional training programme.

Scheduled for May 2025, this first in a series of programmes will be led by Gavin Ryan, a highly respected private equity fund manager with over two decades of experience managing funds valued at hundreds of millions of euro. Ryan’s extensive background also includes advisory work with the World Bank. He has specialised in emerging and small markets – a perfect fit for Malta’s unique investment landscape.

PEVCA Malta’s first training initiative is designed for industry professionals seeking to elevate their expertise, as well as those aiming to transition into the field of private equity and venture capital. Participants will gain a deep

understanding of best practices, strategic fund management and innovative investment techniques, positioning them at the cutting edge of the sector.

PEVCA Malta is more than an industry association; it is a thriving network of professionals dedicated to mutual growth. Throughout 2025, members can look forward to exclusive networking events featuring distinguished international speakers and thought leaders in their space. These member meet-ups will provide invaluable opportunities for exchanging ideas, forming strategic partnerships, and discussing the latest trends impacting global and local markets.

PEVCA Malta gatherings serve as a platform where deals are brokered, partnerships are formed and innovation is sparked. With an agenda packed with world-class speakers and interactive panels, PEVCA Malta’s events promise to be highlights of the investment calendar for members and participants alike.

The PEVCA Podcast: Amplifying Malta’s Voice

One of the most exciting new initiatives for 2025 is the launch of the PEVCA Podcast. This series will spotlight key players in Malta’s private equity and venture capital landscape, featuring in-depth interviews with local stakeholders, regulators and international investors.

By offering a platform for candid conversations, the podcast aims to enhance visibility, inspire confidence among foreign investors and shine a light on the opportunities Malta presents. The podcast will serve as a strategic communication tool, helping to place Malta firmly on the map for venture capital and private equity innovation.

The board of directors at PEVCA Malta is spearheading ambitious outreach efforts aimed at attracting foreign asset managers to Malta. These initiatives will be executed in collaboration with national bodies to create a seamless investment experience and underline Malta’s appeal as an investmentfriendly jurisdiction. The outreach plan includes showcasing Malta’s strategic advantages, such as its favourable regulatory framework, skilled workforce, and connectivity to European and global markets.

PEVCA Malta continues to collaborate with key stakeholders, including the Malta Financial Services Authority (MFSA), to develop and offer advanced learning opportunities for members. This partnership ensures that the training and resources provided are in line with the latest regulatory standards and

industry best practices. By equipping its members with superior knowledge and expertise, PEVCA Malta is laying the groundwork for a more competitive and vibrant private equity and venture capital ecosystem.

Malta’s advantageous position as a bridge between Europe and North Africa, combined with its business-friendly climate and robust legal framework, makes it an attractive destination for private equity and venture capital investments. With PEVCA Malta actively supporting these strengths through its initiatives and advocacy, there has never been a better time for investors to explore the opportunities this island offers.

Join PEVCA Malta in 2025 to be part of a transformative year filled with research breakthroughs, world-class training, high-impact networking events, and strategic outreach. Whether you are a seasoned investor, an ambitious professional or a new entrant to the field, PEVCA Malta is your gateway to leveraging the full potential of the Maltese private equity and venture capital landscape.

Learn more at pevca.mt

As DIZZ Group approaches its milestone 25th anniversary in 2025, Sarah Muscat Azzopardi discovers the story behind the company’s entrepreneurial vision and strategic growth within Malta’s retail landscape.

From its humble beginnings with a single Terranova franchise in 2000, DIZZ Group has evolved over 25 years into a powerhouse of international fashion and food brands, reshaping Malta’s retail and dining sectors in the process.

Diane Izzo, its CEO and Founder, reflects on the company’s remarkable journey, affirming, “over the years we have successfully embarked on numerous exciting projects that have become significant milestones, forming part of the extended DIZZ Group today.”

Indeed, while the group began its journey with Terranova, over the years, it has experienced continuous growth across both the fashion and catering sectors. Today, as the CEO maintains, its portfolio boasts around 20 distinct brands, reflecting a diverse range of styles and culinary experiences.

The company’s growth has also been marked by significant financial achievements. “In 2016, we approached the Malta Stock Exchange

and listed our first bond on the main market, which was successfully oversubscribed,” Ms Izzo notes, adding, “then, in 2018 and 2020, we successfully listed another two bonds on the Prospects and IFSM markets, and this financing enabled us to achieve a remarkable level of growth as we reap its rewards.”

This financial strategy has enabled substantial growth, with the group now employing around 350 people, cementing its position as “a highly respected entity within the Maltese business community.”

The evolution from fast fashion to a diverse portfolio of brands has been strategic and measured, the CEO continues, noting that “in the initial years of our business, our main focus was solely on fast fashion brands, which remains an important and considerable portion of our retail business.”

However, the team soon identified significant opportunities elsewhere. “Over the years, as the market evolved, we saw opportunities in the mid and luxury retail segments, which we felt were important additions to our

portfolio. These brands complement our offering, providing clients with a wider range of products while helping us diversify our risk profile.”

Regarding the food offering, the CEO maintains, “cautious experimentation over the years has led to this pillar becoming a very important component of the group, and having the right people within the operation has always been vital for the success of this part of the business, which we continue to pursue. Today, we are proud to be a considerable player in the market, evidenced by prestigious brands approaching us to form part of the DIZZ Group offering.”

Despite its success, the company’s journey has not been without challenges, particularly during the global Covid-19 pandemic. “Top and middle management rallied around, along with all members of staff, to find better and leaner ways of operating to ensure that we steered through this extremely difficult period with the least impact possible,” Ms Izzo recalls proudly. “Despite the immensity of this challenge, not one of the DIZZ family lost his or her job, which in turn has created a deep sense of loyalty among our employees, helping us achieve more successes together.”

“In 2018 and 2020, we successfully listed another two bonds on the Prospects and IFSM markets, and this financing enabled us to achieve a remarkable level of growth.”

“By successfully introducing international brands to the local market, DIZZ not only enlivens the retail scene but also creates jobs and boosts the economy. Their presence shows that Malta can be a great place for business, which could encourage even more foreign investment.”

Edwin Pisani, Group General Manager, elaborates on how the company has structured itself to manage its diverse portfolio. “DIZZ Group has really adjusted its management style to support growth across different sectors by adopting a decentralised approach. This means each division – such as fashion, food and retail – can operate independently while still fitting into the bigger picture. Each sector has its own specialised teams that focus on what works best in their markets, which helps them stay agile and responsive to trends,” he says.

Highlighting that collaboration is key to their success, the General Manager continues, “we also encourage collaboration between the divisions, sharing ideas and innovations that can benefit everyone. This teamwork helps them find ways to streamline processes, such as using similar marketing strategies or optimising their supply chains.”

Denise Bonello, COO of Retail Fashion, provides insight into the group’s approach to managing different market segments, emphasising the importance of market understanding, product differentiation and marketing strategy, together with customer experience and sustainability, in successfully navigating the fashion spectrum.

The introduction of mid-range designer brands has been transformative for the group, she explains. “Introducing mid-range brands has broadened our customer base, allowing us to cater to a larger segment of customers who seek quality products at affordable prices,” Ms Bonello says, adding, “the introduction of these brands

has diversified our product assortment. We now offer more versatile and classic pieces alongside trend-driven items, appealing to both everyday wearers and style-conscious shoppers looking for fashion that suits a range of occasions and price points.”

Looking to the future, the COO highlights the importance of sustainability and digital transformation: “As consumers in Malta and globally become more environmentally conscious, there will be increased demand for sustainable fashion. All our partners have already introduced collections focused on sustainability and ecofriendly products.”

The group is also investing in digital transformation, she notes, through user-friendly websites, apps and CRM systems, while focusing on building long-term relationships through personalised service. Meanwhile, in-store events and community building are also crucial, Ms Bonello adds, as they “allow customers to engage with the brand in a more relaxed and social environment, helping to foster deeper connections.”

Finally, the group’s food division has experienced remarkable growth under the leadership of Nicolai Cachia, Operations Manager for Food. “We recognised a growing interest in quality dining experiences, particularly in the casual and fast-casual sectors, which align well with the evolving lifestyle of consumers,” he explains. “Our strategy centres on curating unique brands and fostering local talent while maintaining high standards of food quality and service. We also pay close attention

to operational efficiency, integrating modern technologies to streamline our supply chain and enhance customer experience.”

Indeed, with the launches of Ladurée and Paul, DIZZ Group is set to further enhance Malta’s culinary landscape.

For Ladurée, known for its luxurious Parisian charm and world-renowned macarons, Mr Cachia affirms, “we will position the brand as a high-end destination for those seeking elegance, indulgence and refinement. Our goal is to make Ladurée the go-to choice for those celebrating special moments or looking for a premium café experience.” Meanwhile, Paul, with its rich history of artisanal baking, will be positioned as “an approachable, everyday experience that brings authentic French bakery culture to Malta. Our focus will be on offering high-quality, freshly baked goods and light meals in a relaxed, inviting environment.”

Meanwhile, the acquisition and revitalisation of the Michelin-recommended Marea restaurant represents another strategic move for the group. “Marea adds a new dimension to our offerings, particularly in the upscale dining category, allowing us to diversify our reach and appeal to a more premium market segment,” the Operations Manager notes. “By revitalising Marea, we aim to create a destination that combines exceptional cuisine with an outstanding atmosphere, catering to both locals and tourists seeking a refined yet approachable dining experience.”

As a major player in Malta’s retail sector, DIZZ Group’s impact extends beyond its business success. The company emphasises both employment and skill development – as one of the island’s leading retailers, the group provides a diverse range of job opportunities, employing a considerable number of individuals. “This not only helps to reduce unemployment rates but also supports local communities by offering stable jobs,” they state.

The company is also committed to fostering talent and enhancing skills within Malta’s workforce. “Through workshops, team-building and comprehensive training programmes conducted both locally and abroad, we equip our team members with the skills that not only benefit their personal career growth but also contribute to the overall improvement of the retail sector in Malta.”

Emphasising the group’s significant role in Malta’s economic landscape, General Manager Edwin Pisani notes that, “by successfully introducing

international brands to the local market, DIZZ not only enlivens the retail scene but also creates jobs and boosts the economy. Their presence shows that Malta can be a great place for business, which could encourage even more foreign investment.”

Overall, the team behind DIZZ Group is dedicated to creating a positive impact on the Maltese economy by promoting sustainable employment practices and investing in the future of the island’s workforce.

And as DIZZ Group looks towards international expansion, leveraging its territorial rights across Europe, the focus remains on maintaining quality and consistency across all brands. Their approach involves “setting clear standards for quality, training the team to deliver excellent service and gathering feedback to identify areas for improvement. Regular quality checks will help us stay on track, while sharing ideas and best practices among brands will ensure everyone benefits from each other’s successes.”

With its diverse portfolio of fashion and food brands, strong commitment to employee development and strategic vision for growth, DIZZ Group is poised to retain its position as a leading force in Malta’s retail and hospitality sectors as it celebrates its 25th anniversary and looks towards future expansion.

Foreign investors looking to establish a base in Malta will find no shortage of support. The country’s public and private service providers know what newcomers need, from the initial exploratory phase through to business set-up and beyond. Nurturing relationships with local partners is essential, ensuring that establishing a presence in Malta is relatively straightforward, inexpensive and fast, whether you are a startup or an established multinational. Expert guidance, typically provided by highly skilled and experienced advisory and corporate services firms, can help you navigate and maximise the potential gains offered by Malta’s legal, corporate and tax frameworks.

Several Government agencies are also dedicated to streamlining the bureaucratic process, and the country’s small size means that many authorities are just a phone call away. The relational nature of business in Malta means face-to-face meetings, where possible, are highly recommended, as they are crucial to cultivating genuine contacts.

Anyone seriously considering Malta as a destination for their investment, whether it is a branch of an established company, a back-office department, a startup, or an innovative business model, would do well to engage a local advisory firm and visit the islands to meet with the relevant authorities, agencies and private associates. Malta is more than the sum of its parts, and that intangible magic is best experienced in person, where the whole system geared toward attracting legitimate foreign investment can be seen and felt first-hand.

Malta’s corporate services providers (CSPs) have earned a stellar reputation for their unwavering commitment to safeguarding and advancing their clients’ interests. Their indepth understanding of the country’s dynamic and evolving economic and regulatory landscape makes them essential partners for anyone contemplating investing in Malta. Wellversed in the various incentives and support mechanisms available to foreign investors, these local partners can assist with everything from securing grants and tax benefits to finding the perfect industrial space, unlocking the full potential of Malta’s business environment. Other assistance provided includes obtaining work permits for employees, securing residency, applying for licences, opening bank accounts, and handling other requirements a prospective investor may face.

Clients often commend CSPs for their dedication to understanding their unique needs and for taking the time to listen, analyse and develop bespoke solutions that align with investors’ specific goals and objectives. Moreover, their tenacity and proactive approach ensure they are always looking out for your best interests, navigating challenges and seizing opportunities on your behalf. Just as importantly, by partnering with a local corporate services provider, you gain access to their network. Entering a new business environment with the right introductions and guidance can make all the difference, significantly facilitating the entire process.

Foreign investors would do well to engage with local stakeholders in the specific sector in which they operate. For example, those venturing into manufacturing, research and innovation projects will find critical support and resources at Malta Enterprise. In fact, the national economic development agency should be involved in any investment, since it can provide invaluable backing through its many support schemes – more on Malta Enterprise on the next page.

For those in the financial services sector, the Malta Financial Services Authority is a key contact, offering detailed counsel on the regulatory framework governing financial services in Malta. Finance Malta, meanwhile, is a public-private partnership providing critical insights into market-related matters and supporting the sector’s growth. Engaging with these organisations will help financial services firms navigate the complex regulatory landscape and identify opportunities for growth.

Investors interested in the iGaming industry should prioritise establishing a relationship with the Malta Gaming Authority (MGA). One of the preeminent global authorities on online gambling, the MGA offers comprehensive guidance on the legal and regulatory aspects of the sector, ensuring that businesses comply with local laws and regulations. Additionally, Gaming Malta serves as a valuable resource for those involved in the broader gaming industry, encompassing video game development, esports, and related fields such as augmented and virtual reality.

Beyond these specific sectors, investors can access information and support from a variety of public and private entities within the Maltese business community. Chapter 10 of this publication provides a comprehensive list of these organisations, offering a useful starting point for any investor looking to establish or expand their business in Malta.

Meeting with these stakeholders not only provides practical support but also helps investors build essential networks within the local business community. These connections can prove invaluable as businesses navigate the challenges and opportunities of operating in Malta. By leveraging the expertise and resources of these entities, investors can maximise their chances of success and fully capitalise on all that Malta has to offer.

The ideal first port of call for any prospective investor, whether local or foreign, is surely Malta Enterprise, the country’s economic development agency. Its services include pre-investment fact finding to acquaint potential investors with the realities of operating in Malta, allocation of industrial space, access to finance, investment credits, and bespoke schemes to assist in export activities, research and development, and more, giving beneficiaries a competitive edge.

The agency also operates Business1st, a one-stop-shop platform that serves as a single point of contact to Government business information and services. The recently revamped

digital service, launched in 2024, has made setting up a company easier than ever, eliminating the need to fill out similar forms for different agencies and significantly streamlining the entire registration process. More digital services will be added as part of a multi-year plan to reduce bureaucracy and fully leverage digital systems – efforts that are set to make incorporation in Malta smoother and more efficient.

To extract the utmost value from these services, companies and individuals looking to start operations in Malta should engage with Malta Enterprise at the earliest stage possible, and be frank about their investment goals and needs. The team has extensive experience in lending an ear and extending a hand – use it!

The incentives offered by Malta Enterprise can be pivotal in helping investors decide to establish operations in Malta. Below is a small sample of the agency’s offering, which are regularly updated in line with changing economic realities. For the full, current list, visit its website www.maltaenterprise.com

Accelerate

This incentive provides a grant of up to €100,000 to cover accelerator participation fees and startup expenses (such as travel, rent and corporate services provider fees) for ventures with potential for growth, that have a viable business concept based on sound technical and scientific knowhow, and that are in the process of developing the technology into a market-ready offering.

Research and Development

The aim of this incentive is to assist industrial research and experimental development activities required by industry. By way of example, it can be used to provide support for pilot studies or to undertake experimental development, such as for the creation of commercially usable prototypes. The incentive can also facilitate collaboration between industry and academia by funding the secondment of university experts to enterprise.

Start-up Finance

Through this measure, Malta Enterprise can provide startups with an advance of up to €1.5 million, provided they operate from a (long) list of Maltese localities and qualify as innovative enterprises.

Business START

Business START offers seed and growth funding, with an initial grant of up to €10,000 to help startups develop their business proposal and assess the feasibility of their idea, prior to seeking third-party equity.

Invest aims to sustain regional industrial and economic development in Malta by supporting initial investments in new establishments,

the expansion of existing facilities and the diversification of existing businesses engaged in strategic sectors. Support may be granted through loan guarantees, interest rate subsidies, cash grants, and tax credits.

This measure supports new business initiatives, expansions and transformation activities that lead to new opportunities, additional employment, increased competitiveness, or broader market reach, by providing up to €300,000 over three years, awarded as a tax credit or cash grant.

Micro Invest encourages undertakings to innovate, expand and develop their operations through a tax credit equivalent to 45 per cent (65 per cent for Gozo-based businesses) of eligible expenditure.

In collaboration with INDIS, the entity responsible for managing Malta’s state-owned industrial zones, Malta Enterprise helps companies to set up or expand operations in Malta by allocating developable land or space in existing buildings for various uses.

In line with the European Union’s goal to achieve climate-neutrality by 2050, Malta is incentivising the twin digital and green transitions by funding businesses that develop more sustainable processes. Beneficiaries can receive a cash grant of up to €100,000, capped at 50 per cent of the eligible costs in machinery and equipment, with a further tax credit of €40,000 awarded under certain criteria.

While each scheme has its own eligibility criteria, investments aligned with Malta’s strategic economic development objectives will be best placed to receive the most generous support. These priority areas include:

manufacturing management of waste and environmental solutions research and development activities

provision of industrial services and solutions to manufacturing operations

digitisation of processes

software development (including video games and entertainment systems)

health, biotechnology, pharmaceuticals, and life sciences

projects related to the green and blue economies maintenance, repair and overhaul of aircraft and other electromechanical equipment

artisanal works

services that are scalable internationally and not limited by geographic scope

projects aimed at improving business performance and fostering innovation

Paul Mifsud is CEO at Sparkasse Bank Malta plc, where he oversees company strategy and the bank’s overall business management. He was instrumental in expanding the bank’s presence in Malta, developing its investment services and wealth management division, and steering the bank to become a major player in fund custody within the Maltese market.

As a leading financial institution in Malta, how does your bank support foreign investors looking to establish or expand their businesses here?

Our banking services are specifically tailored to support entities investing in Malta, particularly those requiring licensing by a regulator in Malta. The country offers several opportunities to international investors to set up their operations here, and we aim to support this growth as effectively as possible.

In your experience, what are the most common financial challenges that foreign investors face when setting up in Malta, and how does your bank help address these issues?

Rather than facing financial challenges per se, I would say that it is more about obtaining the correct advice and understanding the correct processes to follow. Effective guidance, thorough knowledge of local regulations and managed expectations are key to successful partnerships. Our team has in-depth knowledge and expertise in our specialist sectors, allowing us to guide potential investors effectively and manage expectations from the outset.

Malta has been working to position itself as a fintech hub. From a banking perspective, how is the country’s financial infrastructure evolving to accommodate innovative businesses and new technologies?

Malta is well-positioned in this respect, remaining at the forefront with a suite of regulations that support this sector and that several

other jurisdictions seem to struggle to implement, such as the Markets in Crypto Assets (MiCA) Regulation.

How would you assess Malta’s current economic climate for foreign investment?

Malta is well-positioned for foreign investment, offering an EU jurisdiction with a robust framework and a network of service providers that enable businesses to establish operations effectively and quickly.

Given the global emphasis on anti-money laundering (AML) and know-your-customer (KYC) regulations, how does your bank balance the need for stringent compliance with providing efficient services to foreign investors? What should new investors be prepared for in this regard?

There is no compromise in this space – the laws and regulations are clear, and strict adherence is non-negotiable. These regulations are harmonised across the European Union, making it not just a Malta-specific issue. Savvy and experienced investors understand and welcome (and expect) stringent levels of compliance, as they support product integrity and instil confidence in the professional standards upheld by local practitioners.

Effective guidance, thorough knowledge of local regulations and managed expectations are key to successful partnerships.

George Gregory is the recently appointed CEO at Malta Enterprise, the country’s economic development agency tasked with attracting new foreign direct investment and facilitating the growth of existing operations. He has held partner positions at RSM Malta and other top tier firms, leading several high-profile projects, including acquisitions and restructuring plans.

As the new CEO at Malta Enterprise, can you outline the key incentives and support programmes that Malta Enterprise offers to attract foreign investors to the country?

Incentive schemes are crucial to proactively foster investment in key industries and therefore have to be relevant to the economic needs today, whilst also being forward-thinking to stimulate future growth. These schemes are aimed at assisting the establishment of new businesses, whether through greenfield investments by FDI companies, startups choosing to launch their business in Malta, local entrepreneurs developing a new venture, or established businesses looking to diversify into a new industry or become more sustainable ecologically.

Can you share some success stories of foreign companies that have established themselves in Malta with the assistance of Malta Enterprise?

Recent companies that Malta Enterprise has managed to attract to Malta include Torrent Pharma, a major Indian pharmaceuticals firm; R3Vox, an avant-garde sonar marine imaging firm; and GIMAS, a key player in green/clean technology from Turkey, which specialises in wind turbine manufacturing.

Over the last years, Malta Enterprise has also supported the growing startup and scale-up ecosystem by simplifying processes and enhancing incentives. This includes a mix of local and international innovators like Smart Materials, Tristatus, Hope Fertility, OpenIIOT, Axon Park, and edtech accelerator Supercharge Ventures.

We do not stop at the point of attraction but are now focusing even more diligently on our kick-off and retention processes. We have introduced an implementation unit to guide foreign direct investment (FDI) when setting up operations in Malta, ensuring businesses can hit the ground running. We also, of course, work with firms that have been established here for decades and have chosen to expand in size and operations, including internationally renowned companies like De La Rue, Trelleborg, Baxter, and Seifert. Our strategic foresight has also led us to focus on the semiconductor industry, securing Malta’s largest R&D project through the IPCEI2 application for STMicroelectronics Malta.

Looking ahead, how is Malta Enterprise adapting its strategies to address global economic challenges and maintain Malta’s competitiveness as an investment destination?

Over the past four years we have seen the global geopolitical environment becoming significantly more volatile, impacting Malta’s attractiveness as a business destination both directly and indirectly. While our size as a country can be seen as a limiting factor, it is in these situations that we can capitalise on our smallness. Being nimble in such market conditions brings significant advantages.

While our size can be seen as a limiting factor, we can capitalise on our smallness by being nimble in volatile market conditions.

As a country, we have consistently ensured business stability. On various occasions, the Government has absorbed shocks that businesses might otherwise have felt due to market developments. Having a sound and coherent Government policy for businesses has contributed positively to our appeal as an attractive FDI location.

ME’s overall strategy will remain focused on attracting high valueadding companies across different economic niches. From an FDI perspective, we are targeting a number of sectors; however, we will also be looking out for new opportunities arising from current market conditions. Our small size and agility can give us a valuable head start over our competitors.

Many business activities require industry-specific licensing to ensure standards are met and regulations are enforced. The authorities have in-depth expertise in their respective sectors and can often provide help in getting your business up and running in compliance with local regulations. For companies involved in the below-listed sectors, it is advisable to establish early contact with the relevant authority. Their assistance can make all the difference.

Regulatory Authority

Malta Tourism Authority

Transport Malta

Malta Digital Innovation Authority

Malta Further and Higher Education Authority

Malta Financial Services Authority

Malta Gaming Authority

Malta Medicines Authority

Regulated Activity

Accommodation and catering

Aviation and maritime

Blockchain

Education

Financial services

iGaming

Pharmaceutical and life sciences

Malta Communications Authority Telecommunications

Foreign investors may also join trade bodies and associations active in Malta, both sectoral and general. Notable general associations include The Malta Chamber, the Malta Chamber of SMEs, the Malta Employers Association, and the Gozo Business Chamber. All four work tirelessly to represent the interests of Malta-based businesses and are highly active in publishing research, providing guidance and proposing improvements to the country’s business landscape, while serving as a platform for communication and knowledge-sharing among Malta’s key economic stakeholders. Many find that membership in such associations can be highly rewarding, facilitating their entry into the Maltese business community and generating new opportunities.

Gozo, Malta’s smaller sister island, is renowned for its tranquil ambience and breath-taking landscapes, offering an escape from the busy life of its larger counterpart – making it a favourite destination for expat retirees and digital nomads. However, Gozo’s allures go beyond the lifestyle it offers. Since being designated as the vanguard of the country’s twin green and digital revolutions, new opportunities have arisen in the development of high-tech solutions to the challenges facing Malta, Europe and the world.

In 2024, the Ministry for Gozo launched a new online portal to facilitate investment in the region (www.investgozo.gov.mt). The portal provides information on the different incentives available to investors in Gozo and highlights its comparative advantage in certain sectors. Many business support schemes offer more advantageous terms for Gozo-based companies, while other incentives are specific to Gozo, like reduced inter-island transport costs for manufacturing enterprises and several wage support measures, with the most generous reserved for firms engaged in knowledge-based activities.

Housed in a campus-style layout with two main buildings, the Gozo Innovation Hub is the home of the island’s knowledgebased industries. Managed by INDIS, the larger building is a 9,000sqm business centre split into units of various sizes, while the smaller building contains shared ancillary facilities like a conference hall and meeting rooms. Space in the Gozo Innovation Hub may be used by operations involved in, among others, back office and financial management, market research, media and audio-visual services, and new technologies like AI and machine learning, bioinformatics, cybersecurity, and the Internet of Things (IoT).

In recent years, Malta’s startup ecosystem has seen significant improvement as the country positions itself as a platform for international growth. Acknowledging that the domestic market alone does not offer the necessary economies of scales, the focus is on supporting young companies capable of selling their products and services across Europe and beyond.

Startups with a base in Malta can now benefit from a generous package of state support that includes grants and tax credits (Malta Enterprise), loan guarantees (Malta Development Bank) and seed guarantees (MIMCOL). This support was further enhanced in early 2024 when Malta Government Investments launched a €10 million venture capital fund aimed at helping startups set up operations in Malta.

However, a thriving ecosystem extends beyond financial support. The Startup Festival Malta is now a regular fixture on the calendar, while the prestigious EU-Startups Summit 2024 was also held in Malta, testament to the country’s growing cachet in the space. These events have proven invaluable in establishing Malta as an increasingly important player, backed by unwavering Government support.

Startup accelerators form an integral part of the ecosystem. The University of Malta’s TAKEOFF business incubator has been joined over the last couple of years by the world’s top edtech-focused accelerator (SuperCharger Ventures) and another which targets climate tech (Malta ClimAccelerator). These programmes attract a steady stream of foreign firms enticed to take their first steps in Malta – helped along by the Startup Visa extended to non-EU nationals, which creates an efficient route to residency for entrepreneurs as well as their teams.

Private sector interest has been slow to pick up, but is finally gathering steam after years of relative lethargy. Initiatives like the startup competition Pitchora and the TV show Shark Tank have played a crucial role in raising public interest, while JA Malta’s startup programme continues to attune youths to the huge potential that may await those willing to take calculated risks. Most promisingly, the final piece of the puzzle is now being addressed, with the establishment of a Private Equity and Venture Capital Association (PEVCA) in 2024, bringing together many of the country’s top financial institutions, investors and family offices.

The sector is growing rapidly as new initiatives and entities coalesce around the national effort to establish Malta as a startup hub, making this a hugely intriguing space to watch. As the country looks to its future, the investment in startups is already showing great promise, though the nature of the sector means that any optimism should be tempered with caution. Nonetheless, money is pouring in, and with it comes a new wave of hope for what could become another significant pillar of Malta’s economy.

Malta offers foreign investors a highly attractive tax rate that is effectively the lowest in the European Union. This has served to attract companies from around the world, allowing them to mitigate their tax burden and maximise profits. Coupled with the lack of withholding taxes on dividends, interest, royalties, and proceeds from liquidation distributed to non-residents, as well as the absence of a separate capital gains tax, wealth or inheritance taxes, Malta makes for an interesting proposition for those seeking tax efficiency. Meanwhile, the country’s extensive network of taxation treaties and the provision of unilateral tax relief protects investors and entrepreneurs from incurring double taxation.

The numerous foreign firms present on the islands can attest to the substantial savings afforded by this unique tax framework, at the centre of which is an acclaimed refund system, bolstered by an extensive network of double taxation treaties and tax relief measures. It is essential for investors to engage local tax advisors that can navigate the system to identify the optimal structure to fully capitalise on the opportunities offered by Malta’s status as a fully onshore tax-efficient jurisdiction.

In Malta, a corporate income tax of 35 per cent is levied on the profits of all business concerns, calculated after adjusting for depreciation, unrealised losses and profits, and all expenses incurred in the production of income, as well as the interest expense on capital invested. Once the profits are distributed to shareholders as dividends, foreign shareholders are entitled to claim a tax refund on the taxes paid by the company. The refund rates depend on the kind of income declared by the company, and vary from 2/3rds to 100 per cent, although the portion most companies qualify to obtain as a refund is 6/7ths, generating an effective tax rate of 5 per cent.

Malta has committed to implementing a Minimum Tax Directive that would see the introduction of a minimum corporate tax rate of 15 per cent for companies generating combined revenues over €750 million. However, the Government has clarified that it will be delaying the implementation of the rules until 2030. Additionally, it has indicated that the new regime will be supplemented by a system of conditional tax credits linked to sustainability targets, allowing proactive firms to continue benefitting from some of the most competitive rates anywhere, thus maintaining Malta’s edge.

Malta’s tax code exempts dividends and capital gains related to income derived from subsidiaries from taxation in Malta. These provisions draw particular interest from multinational conglomerates looking for an efficient holding structure, as well as from investment portfolios involved in the ownership, management and administration of equity holdings in other companies. Eligibility hinges on a number of factors. Notably, less than half the entity’s income can be derived from passive interest, although other conditions may be applied. Once again, the services of a local tax professional familiar with the nuances and potential benefits of the Maltese tax system is crucial.

Malta levies a tax on consumption in line with most other European Union countries. Under EU rules, the Value Added Tax (VAT) is paid in only one country, and Malta’s standard rate is set at 18 per cent. Certain economic activities benefit from reduced rates, with accommodation, for example, subject to a 7 per cent VAT rate. Medical accessories and domestic help services, among others, fall under the 5 per cent rate, while food, pharmaceuticals and all exports are taxed at 0 per cent. Certain sectors may benefit from competitive VAT calculation, including ship and aircraft registration (see p. 209), so be sure to consult a financial advisor to determine whether your investment is eligible.

It only takes a few days to register a company with the Malta Business Registry and make it operational. This can be done remotely and relatively inexpensively. Companies registered in Malta require a Maltese address – often the office of the corporate services provider handling the registration. Accountancy, management consultancy and legal firms also provide such a service.

New private limited liability companies – the preferred vehicle for foreign investment – must also submit bylaws, the authorised and issued share capital, details of the shareholders, directors and other key persons, and a deposit slip showing the paid-up share capital credited to the company’s (not necessarily local) bank account. Once all that has been submitted, the Malta Business Registry will issue a certificate authorising the company to commence business. Depending on the sector, additional licensing may be required (seep.64)

Shares may be held directly, by nominee, or in trust, and there are no restrictions on the nationality or residency of Maltese company shareholders. Additionally, foreign companies can transfer their domicile to Malta without dissolution and the establishment of a new entity, reducing associated time and costs.

Accounting and Audit Requirements

Company accounting in Malta follows the EU Single Accounting Directive, transposed into Maltese law through the introduction of the General Accounting Principles for Small and Medium-Sized Entities (GAPSME). Public companies must however conform to the International Accounting Standards Board’s (IASB) Financial Reporting Standards (IFRS). Either way, investors are assured that financial statements are in line with prevailing European and global standards of clarity, accuracy and usefulness, generally including a balance sheet, a profit and loss account, notes to the accounts, a directors’ report, and an auditors’ report (with certain allowances for small companies).

Other Requirements

Upon receiving official confirmation of the company’s registration from the Malta Business Registry, the next steps include registration for VAT and income tax with the Commissioner for Revenue. If the company will engage employees, it must also register with the national employment agency, JobsPlus. Altogether, these registrations can be expected to take up to one week to complete, after which the company is fully set up and ready to operate.

The Malta Stock Exchange, situated in Valletta, provides access to Malta’s capital market. Today, it is a fully-fledged platform for the admission and trading of financial instruments, namely bonds and equities, once these would have been granted admissibility to listing by the Malta Financial Services Authority or any other competent authority in recognised jurisdictions. The MSE operates a main market, a market specifically for institutional investors, and a multilateral trading facility, which provides a more cost-effective opportunity for startups and SMEs to raise up to €8 million in capital.

The MSE’s in-house Central Securities Depository (CSD) is linked with Clearstream Banking, offering a comprehensive range of services, including maintenance of registers, clearing and

settlement, securities administration, as well as custody services. It is also worth mentioning that, as part of its Corporate Social Responsibility, the MSE runs an educational institute (the MSE Institute) aimed at increasing financial literacy among investors and market participants alike.

Over the past few years, the MSE witnessed a surge in primary market activity as more enterprises have turned to the Maltese investor community to finance their projects, including some companies whose major operations are outside Malta. They are attracted by the enthusiasm shown by local investors for securities, with most corporate bond issues being fully subscribed. Indeed, this is evident from the fact that, since 2019, companies have raised over €1.4 billion through 64 separate bond issues on the Malta Stock Exchange.

Kenneth Farrugia is the Chief Executive Officer of the Bank of Valletta Group and also sits on the bank’s Board of Directors as an Executive Director, chairs the Executive Committee and is a member of several management committees. Additionally, he sits on the Board of Directors of BOV Fund Services Ltd, BOV Asset Management Ltd and MAPFRE MSV Life plc.

In your experience, what are the most common financial challenges that foreign investors face when setting up in Malta, and how does your bank help address these issues?

Establishing an operation in a new country involves various challenges. Pre-investment research is an essential part of this process, where potential investors evaluate the economic and business climate to assess the viability of expanding operations internationally. Key financial considerations include ease of payments and access to financing.

Bank of Valletta employs a tailored approach, recognising that each customer’s requirements are unique and necessitate customised solutions. The bank collaborates closely with potential investors, offering guidance and developing solutions for their banking and financing needs based on the specific requirements of each client and the sector in which they intend to operate.

Malta has been working to position itself as a fintech hub. From a banking perspective, how is the country’s financial infrastructure evolving to accommodate innovative businesses and new technologies?

Over the past two decades, Malta has launched various initiatives aimed at strengthening its value proposition as a fintech hub. Significant investments have been made in both the financial infrastructure and the telecoms sector, all aimed at attracting innovative businesses and supporting new technologies.

How would you assess Malta’s current economic climate for foreign investment? Are there particular sectors that you believe offer the most promising opportunities for investors?

Malta’s economy excels compared to other European countries, with strong GDP growth and low unemployment making it attractive to investors. Key sectors for international investment include hospitality, advanced manufacturing, aviation, maritime, gaming, ICT, and financial and fintech services.

Given the global emphasis on anti-money laundering (AML) and know-your-customer (KYC) regulations, how does your bank balance the need for stringent compliance with providing efficient services to foreign investors? What should new investors be prepared for in this regard?

The bank’s anti-money laundering and know-your-customer regulations apply equally to all customers, regardless of whether they are local or foreign investors. The bank employs a risk-based approach that is influenced by the nature of the business activity and the corresponding risk profile of the customer.

Banks generally follow a detailed process to ensure that customer profiles are current, relevant, and up-to-date. Efforts are made to balance efficiency with compliance obligations. Customers recognise that KYC and due diligence requirements are standard practice worldwide and understand that accurate, relevant data enhances their banking experience while protecting their financial integrity.

Malta’s economy excels compared to other European countries, with strong GDP growth and low unemployment making it attractive to investors.

PEVCA Malta’s Secretary General Herald Bonnici uses his wealth of experience in the public and private sectors to help companies navigate the worlds of finance, sustainability and energy. Previously CEO of Malta Government Investments, where he was responsible for the establishment of a sovereign wealth fund network across the EMENA region, he now occupies a variety of roles.

PEVCA is a new organisation with familiar faces, with many of Malta’s largest financial and corporate stakeholders involved. Why was it set up?

The Private Equity and Venture Capital Association Malta, known as PEVCA Malta, brings together a diverse array of stakeholders, including fund managers, direct investors, institutional investors, family offices, financial institutions, accelerators, and professional services firms. It is committed to driving private investment, serving as a central hub where industry players can convene, learn and network, championing regulatory reforms to fortify and expand the private capital ecosystem, and cultivate cultural change within the business community.

What does Malta offer private equity and venture capital firms and funds?

Malta presents an array of compelling attributes for private equity and venture capital firms and funds. Among these is the stable and pro-business environment, a skilled and multilingual workforce, and a strategic location in close proximity to Europe, Africa and

the Middle East. The robust regulatory framework overseen by the Malta Financial Services Authority (MFSA) upholds stringent governance, transparency and investor protection standards crucial to private equity and venture capital undertakings. The favourable fiscal regime positions Malta as a competitive financial jurisdiction, while Government policies cultivate an environment that is supportive of entrepreneurship and innovation.

What kind of opportunities are there for venture capital in Malta?

The country has solidified its position as a dynamic startup hub, particularly in sectors such as fintech, gaming, healthcare, and biotech, in addition to AI. Meanwhile, the Maltese Government has implemented policies and incentives aimed at attracting foreign investment and fortifying local startups, encompassing tax incentives, grants, and specialised support through entities like Malta Enterprise, Malta Venture Capital and Gaming Malta.

Are there any gaps in Malta’s private equity and venture capital ecosystem that foreign investors should be attuned to?

Malta’s private equity and venture capital landscape has experienced notable growth; however, it presents opportunities for foreign investors due to several discernible gaps.

Malta’s private equity and venture capital landscape has experienced notable growth; however, it presents opportunities for foreign investors due to several discernible gaps.

Despite the presence of some local funds, the overall pool of capital available for private equity and venture capital remains relatively modest. There is also a distinct disparity in funding for early-stage startups, as local investors exhibit a preference for later-stage investments. This presents an opportunity for foreign investors to provide crucial support to these startups and potentially benefit from their high growth potential.

Malta’s burgeoning tech and fintech sectors are currently underserved by investors with extensive sector-specific knowledge. Therefore, foreign investors possessing experience in these areas can not only provide financial backing but also impart valuable mentorship and strategic guidance.