Paradigm Shift

How Olé is Re-Inventing Life Insurance in Latin America

Plus Cargo’s Future at MIA

Interport’s Gary Goldfarb

Dominica Opens Up

RISK IS THE REWARD

The first watch brand to embrace the world of sailing, the Corum Admiral collection celebrates its nautical origins. With its unique 12-sided case and nautical pennants as hour markers, it is instantly recognized the world over.

ADMIRAL 45 CHRONOGRAPH • ADMIRAL 38

©2022 Coldwell Banker Realty (FLA License No. 2027016). All Rights Reserved. Coldwell Banker Realty fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Operated by a subsidiary of NRT LLC. Coldwell Banker, the Coldwell Banker Logo, Coldwell Banker Global Luxury, the Coldwell Banker Global Luxury logo are registered and unregistered service marks owned by Coldwell Banker Real Estate LLC. The property information herein is derived from various sources that may include, but not be limited to, government records and the MLS. Although the information is believed to be accurate, it is not warranted and you should not rely upon it without personal verification.

13000-13001 LEWIN LN | SOUTHWEST RANCHES | $54M

325 LEUCADENDRA DR | GABLES ESTATES | $37.5M

8955 COLLINS AVE #LPH | ARTE - SURFSIDE | $19.9M

30 PALM AVE | PALM ISLAND | MIAMI BEACH | $43M

9530 W BROADVIEW DR | BAY HARBOR ISLANDS | $25M

5275 HAMMOCK DR | CORAL GABLES | $10.9M

13000-13001 LEWIN LN | SOUTHWEST RANCHES | $54M

325 LEUCADENDRA DR | GABLES ESTATES | $37.5M

8955 COLLINS AVE #LPH | ARTE - SURFSIDE | $19.9M

30 PALM AVE | PALM ISLAND | MIAMI BEACH | $43M

9530 W BROADVIEW DR | BAY HARBOR ISLANDS | $25M

5275 HAMMOCK DR | CORAL GABLES | $10.9M

You don’t just want a house. You want the right house.

Experience Matters

Audrey opened her own real estate firm in Miami in 1984 and has established herself as one of the city’s preeminent purveyors of luxury homes. Audrey Ross is the go-to broker to bring your real estate transaction to the most satisfying conclusion. Call Audrey to unlock exclusive properties with our list of off market properties. You have the dream. We have the tools to find what you’re looking for.

Vol 1/Issue 2 FEATURES

58

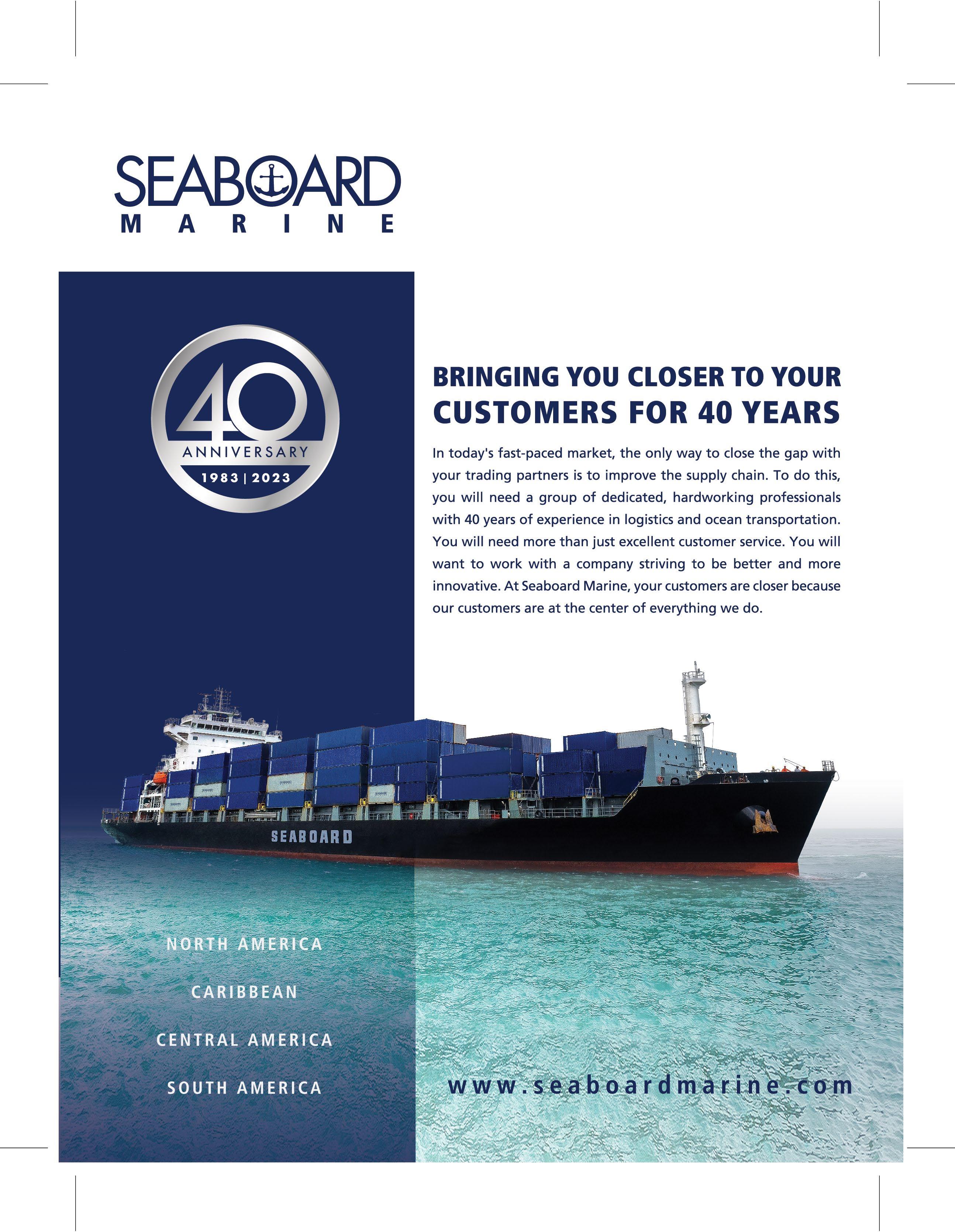

Cruise traffic returns to PortMiami as cruise lines and Miami-Dade invest in future growth. The port – including both cruise and cargo sides – has an economic impact of $45 billion on the state’s economy, according to a PortMiami report from fiscal year 2021.

66

BACK TO GLOBAL SEAS INSURANCE

With its AI digital platform, Olé is upending the life insurance market in Latin America. Having spent close to a decade understanding how life insurance was sold in Latin America, the Carricarte brothers have a whole new approach.

72

SUPPLY CHAIN MASTERS

Walking into the warehouses at Interport Logistics’s headquarters just west of Miami International Airport is like stepping into a giant beehive. Industrial storage racks stretch up to the 36-foot ceilings like massive slats of honeycomb. But instead of storing honey, they house air conditioning units, pallets of whiskey, and cotton t-shirts.

78

GOING VERTICAL

Miami International Airport’s new $2 billion Vertically Integrated Cargo Community (VICC) is a state-ofthe-art facility that will double the airport’s cargo capacity and cement its position on the global stage.

THE MOST TRUSTED LOGISTICS PAYMENT PLATFORM

With the largest multi-modal logistics network in the industry, PayCargo allows for faster release of cargo and improved daily cash flow for all types of freight payments and invoices.

A Template for Miami’s Success

Our cover story this month is about a company that is both unique and emblematic of what makes Miami such a superb place to base a global business. Olé defines what so many other cities have, for decades, tried to figure out: what we have – and what they lack.

Why is it that cities such as Houston, Dallas, New Orleans, and even Atlanta have fallen short of the success that Miami (a relatively small city compared to others) has had in attracting domestic and foreign companies to relocate here and serve the region? After all, other cities have thriving ports and airports, large workforce populations, and all the requisites of finance, legal, and accounting services. Yet, they haven’t become the center for pan-hemispheric trade, nor have they garnered the enormous influx of capital and corporations that Miami is now witnessing. Why? What’s the “magic?”

Not complicated for a Miamian to answer. Miami (and South Florida as an extension) has been a hemispheric trade interchange for decades: the right geographic location north and south and now east/ west; a thriving multi-lingual, multicultural population that grows yearly; a world-class education and healthcare system; and the unique desire to imagine, create, and develop in an environment that encourages new startups and innovative ideas. People come here on planes, trains, boats, and yes, rafts, with a burning desire to succeed in a city where the new holds sway as much as the old. They will risk it all for the chance to be

part of the American Dream.

Why us and not Houston, Dallas, New Orleans, or Atlanta? We’re at the right place at the right time with the right population, along with the stroke of luck of having political leadership that is unabashedly pro-business and pro-innovation, helping lure a new talent pool with a focused vision. As the late Representative Dante Fascell once said, “The unique thing about Miami is that we’re in the Caribbean but close to the United States.” He understood that Miami is a special global trade city, buffeted from the economic domestic downturns that affect those other mainland cities. His vision is now unfolding in a most dramatic way.

The Carricarte family, creators of Olé (and Amedex, decades ago) clearly is a case study of why Miami has thrived. The first-generation family came here to have a better life (in this case from Cuba). They embraced all the benefits that a global city can provide. They raised a family with strong moral values, giving them a great education and a strong work ethic. They saw opportunity, envisioned what could be done to bring their idea to market, and worked hard to make it happen. Fortunately for them, and for us, they chose Miami as the fulcrum for their success.

RICHARD ROFFMAN PUBLISHER GLOBAL MIAMI MAGAZINE

PUBLISHER

Richard Roffman

EDITOR-IN-CHIEF

J.P. Faber

SENIOR VP INTERNATIONAL

Manny Mencia

DIRECTOR OF OPERATIONS

Monica Raucci

ASSOCIATE PUBLISHER

Gail Feldman

NEW BUSINESS DEVELOPMENT

Sherry Adams

Amy Donner

Gail Scott

MANAGING EDITOR

Kylie Wang

ASSOCIATE EDITOR

Yousra Benkirane

DIRECTOR, STYLE & ART

Harriet Mays Powell

WRITERS

Doreen Hemlock

Joe Mann

Katelin Stecz

ART DIRECTOR

Jon Braeley

PHOTOGRAPHERS

Rodolfo Benitez

Tiege Dolly

Emily Fakhoury

PRODUCTION DIRECTOR

Toni Kirkland

CIRCULATION & DISTRIBUTION

CircIntel

BOARD OF ADVISORS

Ivan Barrios, World Trade Center Miami

Ralph Coutié, Miami International Airport

Gary Goldfarb, Interport

Bill Johnson, Strategic Economic Forum

David Schwartz, FIBA

Bill Talbot, Beacon Council

EDITORIAL BOARD

Alice Ancona, World Trade Center Miami

Greg Chin, Miami International Airport

Paul Griebel, World Strategic Forum

Jerry Haar, Florida International University

James Kohnstamm, Beacon Council

John Price, Americas Market Intelligence

TJ Villamil, Enterprise Florida

COVER PHOTO by Rodolfo Benitez

Global Miami Magazine is published monthly by Global Cities Media, LLC. 1200 Anastasia Ave., Suite 217, Coral Gables, FL 33134. Telephone: (305) 452-0501. Copyright 2023 by Global Cities Media. All rights reserved. Reproduction in whole or part of any text, photograph, or illustration without o\prior written permission from the publisher is strictly prohibited. Send address changes to subscriptions@ globalmiamimagazine.com. General mailbox email and letters to editor@globalmiamimagazine.com

Crypto as an Alternative National Currency? A Fool’s Bet

BY JERRY HAARWith the collapse of cryptocurrency exchange FTX, those three letters will be removed from the arena that serves as home to the Miami Heat basketball team and a popular venue for musical events. While many local politicians and business leaders have been promoting Miami as a hub for fintech, including cryptocurrency, their unbridled enthusiasm can impede due diligence on firms like FTX that seek to promote branding.

In this instance it is not just about FTX, which new CEO John Ray asserts is really “just old-fashioned embezzlement,” but a case of the financial instrument itself –cryptocurrency.

The verdict is still out on cryptocurrency, a digital currency that exists only electronically. The advantages of crypto are compelling: protection from inflation; secure and private; self-governed; and cost-effective for transactions. The negatives are significant, however: crypto can be used for illegal transactions such as drug trafficking and money laundering; adverse effects of coin mining on the environment (enormous amounts of energy required); susceptibility to hacks; and no refund or cancellation policy.

Recent times have not been good to crypto. Digital currencies have lost over $2 trillion during the past year. In the second week of November alone, crypto fell 21 percent. Big companies are not bullish on cryptocurrency, cases in point being Tesla (will no longer accept it for payment) and Facebook/Meta (sold its crypto intellectual property and assets).

While individuals should be free to invest in any financial instrument they choose, entire nations should not. Yet that is precisely what El Salvador has done, becoming the first country in the world to use Bitcoin as legal tender in 2021.

A careful examination of El Salvador’s experiment with cryptocurrency should give one reason to pause. President Bukele launched a virtual wallet named “Chivo” (meaning “awesome” in Spanish) and paid

people $30 to download the app and use it. But so far only 20 percent have – no surprise, since one in three Salvadorans lacks access to a mobile phone with internet. As for businesses, only 20 percent accept the digital currency.

El Salvador’s experiment with cryptocurrency has cost the country $375 million so far, a sizeable loss for a GDP of $60 billion. Not to be deterred, President Bukele is keen on building a “Bitcoin City” near the country’s Conchagua volcano.

Those who champion cryptocurrency as legal national tender regard it as a tool to reform financial services, making them more inclusive and accessible. The IMF, World Bank, and central banks, on the other hand, argue that crypto can facilitate money laundering, undermine capital controls, and expose citizens to major price volatility. Besides crypto’s negative impact on macroeconomic stability, financial integrity, and consumer protection, the adoption of crypto as a national currency would make it impossible to estimate tax revenue.

To quote Harvard economist Jeffrey Frankel: “Cryptocurrencies are backed neither by reserves nor by the reputation of a well-established institution such as a government, private bank, or trusted corporation.” Todd Baker, a financial services executive and Columbia Business School fellow is more concise and harsher, asserting: “Crypto is money without a purpose.”

Miami has been masterful in promoting the city as a global business and finance hub, not just a tourism and leisure destination. Within the financial realm, crypto is “hot” at the moment, joining derivatives (such as options and warrants, forwards, and futures) in the portfolio of financial instruments. But entire nations such as El Salvador that speculate on crypto, substituting it or placing it alongside their national currencies, can create collateral damage. Impacts can include distress sales of real estate, shuttered businesses, defaults on bank loans, and repatriation of capital to meet obligations in their home countries.

The Latin warning “caveat emptor” (buyer beware) is meant for consumers. Nations that consider banking their treasuries on speculative instruments should heed the warning, as well. l

Recent global transactions affecting trade & investment

international business advisor in its Government Solutions Practice Group. Ambassador Rocha, who previously served as a special advisor on international business at Foley from 2009 to 2012, will help clients with immigration issues and international business opportunities.

EC1 PARTNERS LAUNCHES FOURTH GLOBAL HUB IN MIAMI

International fintech recruiter EC1 Partners added a fourth global hub in Miami alongside its three existing hubs in New York, Singapore, and London.

DISNEY CRUISE LINE SELECTS PORT EVERGLADES AS HOMEPORT FOR SECOND YEAR

A new agreement has named Port Everglades as Disney Cruise Line’s second year-round homeport. The 15-year partnership includes a minimum of 10.6 million passenger movements and three five-year extension options that could add another 11.25 million movements. The agreement provides for one ship to be homeported in Port Everglades year-round beginning in Fall 2023, joined by a second, seasonal ship in 2025.

MIAMI-DADE, ROYAL CARIBBEAN SIGN $2.8B PORTMIAMI DEAL

Miami-Dade County commissioners have approved a development and lease agreement with Royal Caribbean Cruises projected to net the county $2.8 billion over the next 50 years. The deal is expected to create 12,000 permanent cruise-related jobs, including 1,000 new positions at Royal Caribbean’s Miami headquarters. It also includes the construction of a new terminal at PortMiami for exclusive use by Royal Caribbean and its subsidiary companies.

BTIG OPENS REGIONAL OFFICE IN MIAMI BEACH

BTIG’s newest location opened in Miami Beach in late November. The global financial services firm’s new location in the Starwood capital group headquarters building is its third largest in the U.S., accommodating all of its business divisions, including investment banking, research, and institutional trading. BTIG, LLC and its affiliates operate out of 20 cities in the U.S., Europe, Asia, and Australia.

ALDI EXPANDS IN MIAMI

The German supermarket chain Aldi has secured a 20-year ground lease at Midway Crossings shopping mall near Miami International Airport. The deal provides Aldi with four five-year renewal options.

HOLLAND & KNIGHT LOOKS TO STRENGTHEN GLOBAL ENERGY PRACTICE

Law firm Holland & Knight has recruited a new nine-partner transactional and regulatory team from Eversheds Sutherland, a global multinational law practice, all members of which have experience in the energy industry. The team is led by energy and renewables partner Ram Sunkara in Houston and tax partner Amish Shah in Washington, D.C.

AMERICAN AIRLINES TO ADD OVER 700 MIAMI JOBS

American Airlines is looking to fill around 600 roles in its reservations department and 100 in customer service roles at Miami International Airport this year. The company hired more than 2,000 team members in Miami in 2022 and continues to expand.

U.S. AMBASSADOR REJOINS FOLEY & LARDNER LLP

Foley & Lardner LLP announced that former U.S. ambassador to Bolivia, Manuel Rocha, has rejoined the firm’s Miami office as a senior

FLIGHT UPDATES

American Airlines and Spirit have resumed flights from Miami International Airport (MIA) to Managua, Nicaragua after a 2.5-year pause due to the pandemic. American is also now offering a third daily flight from Miami to Sao Paulo (GRU) and Buenos Aires (EZE), while suspending its nonstop flights to Paramaribo, Suriname, effective March 1. Meanwhile, Delta Airlines is planning to resume its service to Havana, Cuba in April 2023 with two daily nonstop flights from MIA. Eastern Airlines has also launched a new monthly route connecting MIA to Santo Domingo, and low-cost carrier French Bee is now offering nonstop service from MIA to Paris Orly Airport (ORY).

MIAMI-DADE COUNTY WINS GLOBAL BUSINESS AWARD

The county received the Global Business Relationship Management (BRM) Community Excellence Award in December, recognizing its IT department’s BRM capabilities and its impact on business. The county’s BRM program was created to promote collaboration across Miami-Dade County’s departments and make them more efficient and effective. At-

lanta-based BRM Institute is a non-profit corporation established to help organizations grow business relationship management capabilities.

as flower importers) that require time-sensitive, temperature-controlled segments of the supply chain. Mogul, an international oil and gas exploration company, will use the FLORA companies to help grow revenues from approximately $70 million in 2022 to $185 million by 2025.

WORLD TRADE CENTER MIAMI SIGNS MOU WITH CARIBBEAN EXPORT AND CANNING HOUSE

A memorandum of understanding between Caribbean Export, World Trade Center Miami, and UK-based Canning House is designed to increase trade relations between Latin America and the Caribbean. Canning House is the United Kingdom’s leading forum on Latin America.

TOGAL.AI WINS WORLD’S LARGEST CONSTRUCTION TECH COMPETITION

After winning Miami’s eMerge Americas Startup competition, Miami-based Togal.AI’s team traveled to Dubai to compete in The Big 5 – the world’s largest construction event with more than 38,000 companies from 60 countries. After several rounds of pitching, Togal.AI won first place in the Start-Up City Pitch Competition. The company’s AI-powered construction software can process site designs and building requirements in less than a minute.

NORTHMARQ OPENS NEW MIAMI OFFICE

Northmarq is expanding its debt and equity platform in South Florida with plans to open a debt/equity office located in Miami’s Brickell financial district. The Miami team will be responsible for originating, underwriting, and closing debt and equity financing for commercial and multifamily properties in the Miami metropolitan area and Southwestern Florida.

U.S. SENATE CONFIRMS FIU PROFESSOR AS U.S. AMBASSADOR TO THE OAS

Professor Frank O. Mora, who previously led Florida International University’s Kimberly Green Latin American and Caribbean Center and teaches politics and international relations, was confirmed by the U.S. Senate as the permanent U.S. representative to the Organization of American States (OAS). The appointment carries the rank of ambassador. The OAS is a leading multilateral organization that works to strengthen peace and security in the Western Hemisphere. Mora was nominated to the diplomatic role by President Biden.

AIR CARGO FORUM TO BE PERMANENTLY HOSTED IN MIAMI

In 2024, Miami will become the permanent host of the Air Cargo Forum, which was held at the Miami Beach Convention Center last November. Almost 4,000 people attended the trade show with more than 220 companies exhibiting from the global air cargo, transportation, and logistics industry.

SANCTUARY WEALTH LAUNCHES MIAMI-BASED FIRM FOR INTERNATIONAL CLIENTS

Sanctuary Wealth’s Sanctuary Global subsidiary has launched a new Miami-based partner firm, Diagonal Investment Office, to oversee $200 million in assets for international clients. The boutique family firm serves wealthy Latin American clients who want to invest in the U.S.

MOGUL ENERGY INTERNATIONAL, INC. ACQUIRES “FLORA” GROUP

The group includes Florida Beauty Flora, Florida Beauty Express, Floral Logistics of California, and Tempest Transportation, all of which provide refrigerated trucking and logistics services to companies (such

GENERAL ATLANTIC OPENS MIAMI OFFICE

Global growth equity firm General Atlantic has opened a new office in Miami Beach, its fourth U.S. office and its 16th worldwide. “With the establishment of our Miami office, we are well-positioned to play a larger role in advancing the city’s growing and dynamic tech sector,” said Chairman and CEO Bill Ford.

SAUDI ARABIA ACQUIRES MAJORITY STAKE IN MAGIC LEAP

The South Florida-based augmented reality company completed a deal reportedly worth $450 million to make Saudi Arabia its majority stakeholder. The Public Investment Fund (PIF), which acquired the interest in Magic Leap, is controlled by Crown Prince Mohammed bin Salman and invests in projects deemed worthy of diversifying the country’s national economy. Through PIF, the country also owns minority stakes in American companies like Disney, Uber, Boeing, and Meta, among others. l

Recent Miami Trade Stats: The Big Picture

OVERALL TRADE IS ON THE RISE, IF ONLY CONSERVATIVELY

BY YOUSRA BENKIRANEIn the Miami Customs District, which encompasses all of South Florida’s ports and airports, cargo volume has been steadily growing after COVID-19 slowdowns and is projecting a conservative increase in the coming year. As trade through South Florida leverages the growth of nearby offshore manufacturing – and avoids some of the worst slowdowns in the global supply chain – demand for imported products and commodities is on the rise. From August 2021 to August 2022, imports increased by approximately 12 percent. Exports rose as well, by approximately 4 percent, led by shipments to South America.

On the import side, China is still Greater Miami’s top import source as of August 2022 ($611 million that month), despite the decrease in trade flows amid Chinese COVID shutdowns. Colombia follows next ($345 million in August), as gold imports regained demand.

The overall increase in year-to-year imports was explained primarily by an increase of product from Vietnam (a jump of 83.9 percent to $77.9 million), led by a surge in shipments of integrated circuits. Imports from Colombia also grew sharply, up 29.2 percent, led by not only gold (up 76.9 percent to $99 million) but by telephones (up 27.2 percent to $55.4 million) and integrated circuits (up 107 percent to $41 million).

On the export side, Brazil remains the leading destination from the Miami Customs District ($1.19 billion in August). The overall increase in year-to-year numbers can be attributed to increased shipments to Argentina (up $84 million, or 61 percent), Chile (up $69.8 million, or 19.7 percent to), and Brazil (up $42.8 million, or 4.86

percent). In terms of products, the growth in exports was led by increases in computer shipments (up $66.9 million, or 25.5 percent); medical products such as vaccines, blood, antisera, toxins, and cultures (up $53.6 million, or 92.2 percent); and telephones (up $41.8 million, or 12.3 percent). Additionally, while the export of aircraft parts decreased overall compared to the previous year (down 21.6 percent), year-byyear aircraft parts shipments to the United Arab Emirates (UAE) increased a breathtaking 634 percent to $146 million, thanks

to the UAE’s demand for air travel following the easing of the pandemic.

On the sea side, PortMiami recorded cargo growth of 8.88 percent from August 2021 to August 2022. Reflecting that cargo increase, Florida East Coast (FEC) Railway now runs two trains daily into and out of PortMiami, with each train carrying 50 to 80 containers (aka TEU’s or 20-foot equivalent units). Inbound containers came primarily from the interior of the U.S., while outbound containers were destined primarily for Central and North Florida and the

FLORIDA EAST COAST RAILWAY, OWNED BY GRUPO MÉXICO, RUNS TWO TRAINS DAILY INTO PORTMIAMI

FLORIDA EAST COAST RAILWAY, OWNED BY GRUPO MÉXICO, RUNS TWO TRAINS DAILY INTO PORTMIAMI

Our thoughts turn gratefully to those who have made our success possible. It is in this spirit that we say Thank You and send our best wishes for The New Year!

THE LUXURY PROPERTY PROFESSIONALS

THE LUXURY PROPERTY PROFESSIONALS

Southeast U.S.

Indeed, data from PortMiami shows an increase in rail cargo volumes over the past several years. During the 2021 fiscal year, FEC trains moved 37,938 containers by rail in and out of PortMiami, 52 percent more than in the 2020 fiscal year, when FEC trains moved 24,908 TEUs. As of June 2022, volume was up 44 percent from the pre-pandemic level in June 2019. New trends and disruptions in the global supply chain are giving East Coast seaports like PortMiami, which has an economic impact of $43 billion and generates about 334,500 jobs, the ability to receive more cargo shifting from the West Coast to the East Coast.

MIAMI CUSTOMS DISTRICT TOP EXPORT DESTINATIONS 2022

MIAMI CUSTOMS DISTRICT TOP IMPORT ORIGINS 2022

Miami International Airport, meanwhile, experienced a slight decrease in the year-to-year dollar value of overall freight carried (down 6.41 percent) despite substantial increases in freight volume. This can be attributed to export decreases in high-ticket categories like aircraft parts (down $168 million or 22.6 percent), gold (down $36.7 million or 47.6 percent), and fine art paintings (down $32.7 million or 78.2 percent), and import decreases in vaccines, blood, antisera, toxins, and cultures (down $81.6 million or 98.8 percent), and gas turbines (down $50.3 million or 51.5 percent).

Overall, while Latin America and China remain the top sources for imports to the

Miami Customs District, Europe showed the fastest growth, with France increasing by 82 percent to $126 million, and Italy increasing by 27.7 percent to $65.3 million. The fastest growing export destinations between August 2021 and August 2022 were the United Arab Emirates (up 264 percent to $124 million), China (up 155 percent to $61.7 million), and Peru (up 39.9 percent to $73.8 million). l

Sources: The Observatory of Economic Complexity, United States Census Bureau USA Trade® Online, PortMiami, Miami International Airport

FLORIDA ROOTS. GLOBAL REACH.

The Hemisphere’s Next Vacation Hotspot

WITH NEW AIR ROUTES FROM MIAMI, THE ISLAND NATION OF DOMINICA POSITIONS ITSELF FOR SUSTAINABLE TOURISM

BY YOUSRA BENKIRANEFloating along the scenic Indian River, our expert boatman Aza points out places where the second “Pirates of the Caribbean” movie was filmed. Also hidden amongst the mangroves is a secluded local hangout, the Bush Bar, where “Time Stands Still.” The motto is fitting – tucked among majestic Bwa Mang trees, and offering homemade coconut and rum cocktails, time really does seem to stop at this jungle gem. Here, as elsewhere, locals are happy to proffer advice on where to visit on this tiny island nation in the Caribbean’s farthest reaches.

No matter where you go in Dominica – and no, the country has nothing to do with the Dominican Republic, so don’t let the locals hear you say that – people will offer up lessons on the island’s flora and fauna: which fruits you can eat, what teas you can make, and which leaves are used as medicine. Throughout the picturesque island you can find coffee, bananas, cocoa, nutmeg, cinnamon, ginger, papaya, guava, and pineapple, amongst other plants. As you might expect, agriculture is Dominica’s main export. The country trades mostly with other neighboring Caribbean islands, but even Miami receives a portion of its ginger imports from here.

In recent years, however, Dominica has sought to increase their services exports – in particular to position the island as a destination for sustainable eco-tourism, attracting new types of visitors looking for a rustic tropical vacation that treats the environment responsibly.

As it is, the island offers stunning natural habitats that align with its Ministry of Tourism’s goals to promote agra-tourism, aqua-tourism, and adventure-tourism, among others – like tubing through the famous Titou Gorge, where I tried to stay dry in my tube despite Mother Nature’s opposite agenda.

To further Dominica’s eco-tourism agenda, the government has put extraordinary efforts into protecting the island’s natural habitats and wildlife. In its promotion of sustainable tourism, it encourages visitors to preserve the nation’s unspoiled natural beauty and requires new developments to use renewable sources for things like power and water.

These initiatives go hand in hand with Dominica’s efforts to protect itself from natural disasters, since the island nation, like much of the Caribbean, is susceptible to climate-related increases in tropical storms. In 2017, Hurricane Maria wreaked havoc on the island, much of which is still recovering. Shortly after the crisis, Prime

Minister Hon. Roosevelt Skerrit promised to rebuild the country as the “world’s first climate-resilient nation” at the 72nd United Nations General Assembly. To follow up on his vow, Dominica began pursuing initiatives to become a leader in the development of renewable energy sources.

Currently, wind and hydropower account for 28 percent of Dominica’s electricity production, and the nation hopes to achieve energy independence by 2030. The government offers incentives for the importation of solar-related equipment and is working on several sustainability projects, including the installation of solar streetlights and, most notably, geothermal plants that will convert heat from the earth’s core to electricity.

In March 2019, the World Bank approved a $27 million investment for the first of these geothermal projects, a 7-megawatt geothermal power plant which aims to increase the share of renewables and diversify the country’s energy matrix. “This is an extraordinary opportunity for Dominica to reach its energy and climate goals by investing in geothermal, and to build a greener and more resilient future,” says Tahseen Sayed, World Bank Country Director for the Caribbean. “The country has huge potential to provide reliable, low-cost, renewable, and high-quality energy in support of climate resilient growth.”

That effort is now expanding with the island’s Geothermal Risk Mitigation Project to further lower electricity costs and increase the share of renewable energy in the country’s energy grid from 25 to 51 percent, reducing greenhouse gas emissions by 38,223 tons of

THE CARIBBEAN REBOUND

The Caribbean has always been a hotspot for vacationers, derailed by the pandemic in 2020 and 2021. Now, many of the islands are recovering and gearing toward growth. The number of foreign tourists is expected to rise in Caribbean countries this year, including Dominica. So far, the Dominican Republic has lead the recovery, with foreign arrivals up 40 percent from 2019 levels, followed by the U.S. Virgin Islands (up 33%), Bonaire (up 30%), and Martinique (up 26%). “Caribbean tourism is seeing a strong recovery,” says Carolin Lusby, Ph.D., Assistant Professor in Tourism at Florida International University’s Chaplin School of Hospitality & Tourism Management. “COVID-19 has put an increased emphasis on the resilience of the tourism-dependent economies of many Caribbean islands and nations. The focus on sustainability served many islands well and will continue to be important, as well as creating experiences centered on well-being for both locals and travelers and protecting natural resources through the creation of protected areas, both land and marine. Economically, the Caribbean, which has seen much leakage, is focusing on keeping more money in the local economy.”

carbon per year.

The project is truly international in scope: The Dominica Geothermal Development Company Ltd is implementing the project with a $17.2 million credit from the International Development Association, $9.95 million from the World Bank’s Clean Technology Fund, and $10 million in grants from the UK’s Department for International Development. Technical assistance is being provided by the governments of New Zealand and France, while proceeds from the country’s Citizenship by Investment Program are also providing part of the funding (see sidebar). Already, a $12.5 million contract with Iceland Drilling Company is producing two wells for another geothermal plant expected to be operational by 2024. It will also generate foreign exchange by providing electricity to the neighboring French islands of Guadeloupe and Martinique.

SUSTAINABLE VISITING

The island’s “sustainable” resorts are one of Dominica’s major tourism appeals. Jungle Bay, Coulibri Ridge, Secret Bay, and Cabrits Resort & Spa Kempinski are all eco-resorts on the island, with Hilton and Marriott both planning to join them. All use sustainable practices to maintain Dominica’s land and community while providing a luxury experience. Discover Dominica CEO Colin Piper says these projects “let people value nature, then return to a place where they can comfortably lay their heads.” They also combine sustainability with a “high-end lifestyle” experience.

Take Coulibri Ridge, a 14-suite off-grid luxury resort atop a mountain ridge in southern Dominica, just minutes from Soufrière Bay, where the Atlantic Ocean meets the Caribbean Sea. The brainchild of Canadian-born entrepreneur Daniel Langlois, Coulibri Ridge was originally designed as a long-term research project on creating and running a cutting-edge, self-sufficient eco-resort tightly entwined with the local community. As we walked through the villas, built from stone sourced from the property, Langlois explained how solar panels fuel all the resort’s power needs, how all its water is filtered rainwater, and how much of the restaurant’s produce is grown on-site.

The project took more than 20 years of research on environmental testing, infrastructure building, and community engagement to ensure the highest level of sustainable development and collaboration. Celebrating its official grand opening in October of 2022, Coulibri Ridge is now a model for self-sustainability. “This was to push the limit of what can be done,” Langlois says. It’s also self-consciously high-end, with a 1,000-square-foot Sky Penthouse that comes with a private pool and terraces that overlook the sea, Martinique, Morne Fou summit, and Sulphur Spring Valley.

Part of what is sustaining the growth of eco-tourism in Dominica is new accessibility. Prior to 2021, most people who visited Dominica had to go through neighboring islands. But in December 2021, American Airlines launched direct flights from Miami. It started with two flights per week, grew to three flights per week in early 2022, and now offers daily flights. Partly as a consequence, North American tourists have grown from 17 percent of total visitors to 30 percent. Samuel Johnson, CEO of Dominica’s International Airport Development Company, explained how prior to AA’s direct flight, most visitors were experienced divers or nature enthusiasts coming to see Dominica’s coral reefs. “Now, we have seen more and more casual visitors just come to explore. If it was not for the direct flight, Dominica would never make their radar.” Johnson’s company plans to open a new international airport in 2026 to handle the growing demand.

The Dominica Citizenship by Investment Program (CBI) is one of the world’s longest-running economic citizenship programs. Operating since 1993, the program invites investors to make an economic contribution to the country. In return, if they meet strict legal and other requirements, the applicant and their family are granted full citizenship of the Commonwealth of Dominica. To qualify for the CBI Program, the government requires either a $100,000 contribution made into the Government Fund or an investment in government-approved real estate with a value of at least $200,000. The most common real estate options available are shares in high-end tourist accommodations. Additional payments are required for any dependents included in an application, as well as due diligence and government fees. Applications are processed by the Ministry of Finance’s Citizenship by Investment Unit; approval takes about three months from the submission of a fully completed application.

(Shown above: Titou Gorge)

The new international airport will also allow for long-haul flights complete with a cargo facility that has refrigeration capabilities. Since Dominica grows one of the largest varieties of flowers in the Caribbean, the new airport will allow it to become a flower exporter at an international level. According to Miami International Airport, 90 percent of fresh-cut flower imports to the U.S. enter through MIA, so a Dominican flower source could join the floral flights into Miami once the air cargo facilities expand. “The airport is more than just tourism, but also our ability to trade,” emphasized Johnson. “By 2026… the existing [airport will] be bursting at the seams.”

While floral exports will boost the nation’s income, however, Dominica is betting that sustainable tourism will be the driving force for economic development. In competition with the sun, sea, and white sand beaches that other Caribbean islands also provide, Dominica is offering a new way to travel. With the latest eco-projects and the development of the international airport, the island is positioning itself to become a recognized global tourist destination. From the food to the waterfalls, it’s all about the adventure. Taking sulfur mud baths in a tub hidden by trees, exploring the rainforest, or eating meals made from locally sourced food items, all provided a whole new experience for me. Sustainability isn’t just a trend for the island – it’s becoming way of life.

By my fourth day in Dominica, I had discovered a hidden adrenaline junkie in myself, deciding I would take the plunge –literally – and go cliff diving. Unbeknownst to me, that meant climbing up a small mountain in my bare feet behind a half-naked man dripping water all over the slippery rocks. After hurling myself off of Mount Everest 2.0, I crashed into the waters below with a newfound appreciation for the country’s natural playground. l

Now, we have seen more and more casual visitors just come to explore. If it was not for the direct flight, Dominica would never make their radar.

World Trade Center Miami is Here for You!

World Trade Center Miami, the largest and oldest trade association in Miami, is part of the World Trade Center Association global business network of 315 World Trade Centers in 92 countries with over two million members.

Whether your business is looking to find your next customer, expand to international markets or make global connections we have the resources, services and decades of expertise to successfully grow your bottom line.

WE PRODUCE WORLD CLASS TRADE SHOWS

• The annual Americas Food and Beverage Show now in its 27th year – the ideal meeting place for decision makers and buyers from all sectors of the global food and beverage industry.

• The Air Cargo Americas Show, now in its 17th year, held bi-annually, brings together top executives from all sectors of the aviation and logistics industry.

• The Supply Chain Americas Conference is held annually and in conjunction with the Air Cargo Americas Show is one of the leading events focused on innovation and resiliency in the global supply chain.

SCHEDULE OF EVENTS:

• International Women’s Day Luncheon: March 8, 2023

• Miami World Trade Month: May 2023

• Americas Food & Beverage Show: September 18-20, 2023 Miami Beach Convention Center

• Air Cargo Americas/Supply Chain Americas Show & Conference: October 31-November 2, 2023

• State of the Ports: November 2023

The Roar of the Isthmus

PANAMA’S ENVIOUS GDP GROWTH IS PREDICATED, IN PART, ON TRADE WITH MIAMI

BY DOREEN HEMLOCKWhen COVID-19 hit, no world region suffered more economically than Latin America and no regional nation more than Panama. In 2020, the economy of the services-dependent country shrunk by nearly 19 percent, and unemployment spiked to double digits. Passenger flights to the main airport stopped for months.

Now Panama is roaring back, with an assist from Miami. Economic growth topped 15 percent in 2021 and was poised to top 6 percent in 2022, surpassing preCOVID levels. No Latin American nation has rebounded as strongly, with growth forecasted to continue in 2023.

Key to the surge: increased foreign investment and greater exports, with South Florida as a leading partner and with growth extending far beyond Panama’s famed Canal and banking sector.

Millicom, the telecom company that runs operations from Miami suburb Coral Gables, shows the trend. In June, Millicom completed its purchase of Panama’s biggest mobile, cable, and internet service provider, known as Tigo Panama. Since 2018, the Europe-based firm has invested more than $2.5 billion in Panama, even setting up headquarters for its new mobile payments unit called Tigo Money. “The government of Panama was really helpful” in providing spectrum for communications and facilitating internet services during the pandemic, says Esteban Iriarte, Millicom’s chief operating officer.

PANAMA DELEGATIONS VISIT MIAMI

To spur greater investment and trade, a delegation of two-dozen Panamanian leaders visited Miami in November and met with South Florida business and government counterparts. The group even hosted a

PANAMA AND THE WORLD: A Comparison of GDP Growth

seminar on “Doing Business with Panama” that was attended by more than 75 people at a Hilton Hotel west of Miami International Airport.

“During the pandemic, we had to rethink everything – our role in the world, and what we wanted to bring to Panama,” Carmen Gisela Vergara, general administrator of business promotion authority ProPanama, told the audience. Government and business leaders decided on a plan to facilitate foreign direct investment in various areas, including multinational office space, near-shore manufacturing, and renewable energy. “We want to be the hub for sustainable investment in Latin America and the Caribbean,” Vergara said.

More than 180 multinationals now keep regional offices in Panama, with at least 30 of them setting up since the pandemic began – including Tigo Money – delegates told the Hilton group. The Central American nation of roughly 4 million residents offers incentives, from tax breaks to training grants, in order to lure investments.

During COVID, Panama also decided to ramp up local exports, identifying South Florida as a prime market. This September, the country participated for the first time in the Americas Food and Beverage Show

We want to be the hub for sustainable investment in Latin America and the Caribbean.

CARMEN GISELA VERGARA, PROPANAMA, SPEAKING AT THE “DOING BUSINESS WITH PANAMA” SEMINAR IN MIAMI

in Miami Beach, organized by the World Trade Center Miami. Sixteen Panamanian companies showcased their wares, offering items from hot sauce and tropical honey to craft beer and liqueur made from Panama’s prized geisha coffee.

Panama’s leaders say the new growth strategy is working because their country is so business-friendly. Among its advantages: using the U.S. dollar as its currency; registering new businesses online in as little as 20 minutes; and steering clear of the leftist, populist drift in some Latin American nations.

“Panama can be considered a beacon of liberty, prosperity, and democracy in Latin America,” says Jose Alejandro Rojas Pardini, advising minister for the facilitation of private investment. A Purdue graduate, he worked for General Electric in the U.S. before returning to work in his homeland. “Social, economic and political stability in our country has been key to a solid and sustainable recovery.”

STRONG GROWTH, HIGH-INCOME STATUS PRE-COVID

Before COVID, Panama’s economy was already surging. Between 2014 and 2019, economic growth averaged more than four times the rate across Latin America and the Caribbean: 4.6 percent yearly vs. 0.8 percent yearly regionwide. That speedy advance had propelled Panama into the ranks of “high-income” nations, joining such powerhouses as the United States, Germany, and Japan, according to the World Bank. Growth back then came largely from services – especially transport and communications – as well as construction, including the $5 billion-plus widening of Panama’s Canal in the 2010s, the bank says.

During the pandemic, the expanded Panama Canal never shut down – “not for one day,” says minister Rojas Pardini – and trade through it now exceeds pre-COVID levels. Cruises through the Canal are also increasing, many by top lines that call Miami home, such as Carnival, Norwegian, and Royal Caribbean.

With so many business links, Florida is targeting Panama for its own growth. The state’s economic development agency, Enterprise Florida, sent a delegation to Panama in September, led by Florida Transportation Secretary Jared W. Perdue. The group included executives from some 20 transport and logistics firms and key Florida seaports, including Port Everglades and PortMiami.

Miami-Dade County’s leaders see potential for joint business promotion with

Panama, so both locales can fill different links in the broader supply chain. For example, Panama could serve as a base for “nearshore” manufacturing of electric-vehicle batteries or other high-value goods that are made in Asia. Those goods could then be sent to Florida for distribution across the U.S.

“We share so much with Panama –business, culture, and similar economic sectors,” says Maria Dreyfus-Ulvert, executive director of Miami-Dade’s International Trade Consortium, which promotes the county as a global business gateway. “Even our skylines are similar,” she says, referring to the dense cluster of skyscrapers in Downtown Miami and in Panama’s fast-growing capital, Panama City. Indeed, some now call Panama City “the Miami of Central America.” Stephanie Pragnell, ProPanama’s investment coordinator and a graduate of two Florida universities, summed up business opportunities this way to the Hilton audience: “There are so many synergies and ways we can collaborate in this brave new world after the pandemic.” l

TOP: THE PANAMA SKYLINE CAN BE MISTAKEN FOR MIAMI, THEY ARE SO SIMILAR.

MIDDLE: THE PANAMA CANAL STAYED OPEN DURING THE PANDEMIC AND TODAY, TRADE IS EXCEEDING PRE-COVID LEVELS.

BOTTOM: JOSE ALEJANDRO ROJAS PARDINI, MINISTER FOR THE FACILITATION OF PRIVATE INVESTMENT, SPEAKING IN MIAMI

THE NEW GENERATION OF LUXURY

Taking Audio Books Global

HOW ONE NONPROFIT IS PUSHING THE ENVELOPE

During the pandemic, the audiobook industry exploded. With people forced to stay at home, the earbuds went in. According to the Audio Publishers Association, its 28 member companies saw a revenue increase of 12 percent in 2020 and an additional 25 percent in 2021, topping out at $1.6 billion that year. Large companies have also bought in, with Amazon, Apple, and Google developing their own digital book platforms; annual double-digit growth is expected for the next decade.

Now comes Miami-based Audiobook World Awards Academy (AWAA). Founded in 2021, AWAA is a nonprofit organization that promotes audiobooks as an educational tool, looking to increase their availability in disabled and disadvantaged communities worldwide. Co-founder and president Marzia Lavinia Di Pietro gives the example of a nursing home. Many elderly don’t have easy access to physical books or have conditions that limit their ability to read. Audiobooks provide them with a way to enjoy literature. “These individuals can just lay down in bed and let the story flow through their mind,” Di Pietro says.

AWAA is taking their mission overseas to provide educational tools to disadvantaged communities. Currently, they’re partnering with Lions Club International, an organization that builds schools in Africa, by providing students with access to audiobooks. “Paper books are susceptible to a lot of damage,” says AWAA co-founder and CEO

Massimiliano Biasiol. “But even in Africa, it’s pretty easy to find a Wi-Fi center to download audiobooks. So, essentially, we can create a paperless school for these kids who live in remote villages.”

AWAA opened a European branch in Monaco last March and plans to extend its influence with a YouTube channel, podcast, and TV channel on CIBORTV. “If we can increase access to information through audio, then we’re putting together an effort for a brighter future,” says Biasiol. l - by Katelin Stecz

LOCA TED IN THE HEA RT OF CO RAL GABLES, MIAMI FL

Recognized as one of the top travel agencies in the nation. American Society of Travel Advisors agency of the year.

Recognitions received from the South Florida Business Journal, Miami Today, Greater Miami Chamber of Commerce, Coral Gables Chamber of Commerce, among many others.

Paying it Forward

HOW A MIAMI COMPANY IS REVOLUTIONIZING THE WAY THAT COMPANIES PAY FOR FREIGHT

BY DOREEN HEMLOCKPaper payments for freight? Not if you’re a customer of PayCargo, which offers an online platform that lets shippers pay electronically, speeding up the payments and reducing the time for cargo to be released from seaports, airports, and other facilities. The platform also provides easy-to-use electronic data not available when paying for freight through traditional means such as vouchers, checks, or cash.

In June, PayCargo secured $130 million in investment from Blackstone Growth, part of the behemoth global investment firm Blackstone. That infusion – coming on top of $160 million raised in 2020 and 2021 from Insight Partners – is accelerating overseas expansion beyond Europe and the Middle East. PayCargo is now setting up offices in Japan, Vietnam, Australia, and New Zealand, and it plans to open in Chile, Panama, and Mexico in 2023, says CEO Eduardo Del Riego.

“By the end of 2024, we hope to be on both coasts of Latin America – east and west – and in the Caribbean,” Del Riego told Global Miami in a wide-ranging interview.

CHALLENGING TIMES, AS TRADE SLOWS

PayCargo was launched in 2007 by a group of South Florida shipping executives who saw the need to modernize freight payments. By 2019, the venture had matured its business model and grown substantially, processing a record $2 billion in payments that year. Business then doubled each year to $4 billion in payments processed in 2020 and $10 billion in 2021. This year, it’s on pace to reach $20 billion, according to Del Riego.

Today, PayCargo serves more than

40,000 customers, including heavyweights DHL, UPS, and Kuehne & Nagel. They pay some 5,000 vendors from shipping lines to airlines, train operators to warehouses.

PayCargo’s business has soared recently, partly because of overseas expansion. It first grew across Europe and earlier this year opened in the Middle East in Dubai (United Arab Emirates) and in Asia in Hong Kong and Taiwan. Adding to revenue, freight rates had risen sharply due to

COVID-19 up-ending supply chains and crimping the availability of metal shipping containers and other supplies.

But PayCargo’s growth is set to slow in 2023, Del Riego says, as the world economy also slows. Many analysts predict a global recession in 2023, though earlier predictions of a recession in the U.S. never materialized. Regardless, world trade is already slowing, slashing the rates to ship goods. In early 2022, U.S. importers paid about $18,000

By the end of 2024, we hope to be on both coasts of Latin America –east and west – and in the Caribbean.

EDUARDO DEL RIEGO, CEO OF PAYCARGO

Think ahead and others will follow.

To be at the forefront takes vision and sometimes guts. However, the reward is worth the risk. At Pacific National Bank, we believe in those always striving to break the mold. It’s part of your DNA to be a leader. We admire you for doing things differently. We’ve been doing it for years in our own industry, creating unique solutions to fit our clients’ distinct needs. Drop by and experience banking like you never have before.

to transport a metal container by sea from Shanghai to Los Angeles. Now, they pay roughly $1,800 to ship that same container, down 90 percent, because of shrinking demand in the U.S.

“For PayCargo, we’re forecasting to grow about 50 percent next year,” Del Riego said. “That’s still pretty impressive, if you consider that global trade – if it grows at all – is expected to rise only by 1 percent.”

PayCargo charges a fee for each payment it processes, currently about $6 to $12.50 per transaction. In 2021, its revenue topped $40 million, and for 2022, it expects to reach at least $100 million. The tally also includes revenue from a tech company that PayCargo is now buying.

That acquisition and strong growth should boost PayCargo’s global employment to top 300 at year-end, including some 50 at their Coral Gables headquarters adjacent to Miami and 25 at a tech hub in Downtown Miami. Hiring is easier now that the tech boom has increased the number of programmers locally, he says. “We also have a partnership with Florida International University, which helps us to get programmers, developers, and logistics specialists,” Del Riego said.

MORE CREDIT FOR TRADE IN EUROPE

Of course, doing business globally presents diverse challenges. For example, to start an office some countries require more paperwork than others, while other administrations move more quickly. Setting up in Dubai and the United Kingdom went “relatively fast,” but took longer in Hong Kong, Taiwan, and Vietnam, Del Riego said.

Operations also differ. “There tends to be more credit offered in Europe than in the rest of the world,” Del Riego explained. Companies in Europe often get 30 to 180 days to pay for freight shipments, whereas importers in the U.S. typically get no credit and U.S. exporters tend to offer 15 to 30 days. “In Europe, it’s part of the sales presentation for freight to include credit.”

For PayCargo, the new investment from financial giant Blackstone offers more than cash. Blackstone owns or has interest in some 200 seaports and more than 1.1 billion-square-feet of warehouse space worldwide. It’s keen on three trends, says Vini Letteri, senior managing director at Blackstone Growth: “the proliferation of electronic payments, the digitization of the

supply chain, and the modernization of business-to-business payments.” PayCargo fits perfectly in that mix and ranks as “a category leader,” according to Letteri.

Blackstone is starting to introduce PayCargo to some of its portfolio companies, which could become customers, Del Riego says. With quicker release of cargo and better data, “ports and warehouses can operate more efficiently, so working together makes all the sense in the world.”

The potential for growth remains enormous. Less than 10 percent of U.S. cargo payments – and less than 1 percent of freight payments globally – are now handled electronically, with most still relying on paper, from vouchers to checks to cash. Says PayCargo’s CEO: “There’s a lot of upside.” l

Reaping the LatAm Winds

HOW A NICHE FOCUS ON LATIN AMERICAN CLIENTS HAS PROPELLED IFB

BY J.P. FABERWhen Roberto Gatica joined IFB as their senior VP for international banking in 2015, he came with a perfect resume. He’d just finished a stint with Spanish private banking group Sabadell, managing a portfolio of 250 Latin American clients. Before that, he’d spent 10 years with Chile’s Banco de Crédito e Inversiones as head of their Corporate Banking Group. And before that, he’d spent a decade in Mexico working for Grupo Santander, First Union, and Citibank.

Like his current employer, International Finance Bank, “the advantage is that we have done this for 30 years,” says Gatica. That experience with Latin American culture, he says, has been critical. “Any bank can offer banking solutions, but not with the same closeness. We are a niche bank with a human touch.”

That sense of contact and interaction gives IFB its competitive edge, especially with Latin Americans who are more comfortable with personal relationships. The other advantage is that large U.S. banks have backed away from international clients because of the increased cost of regulatory compliance for foreign depositors. “In the banking community, the international client has become less important than it was in the past for the big players,” Gatica says. “They have become a [greater] risk.” He says large U.S. banks have shed most of their foreign clients, except for the most important ones.

IFB, meanwhile, specializes in taking on foreigners for loans and deposits. “The regulators know us, they know our portfolio, they know our clients. They have been reviewing us for 30 years. So, for us it’s easier,” says Gatica. It also helps that many of the bank’s shareholders are Latin Americans, which helps banking relationships in their countries. David Schwartz, President & CEO of the Miami-based Financial &

International Business Association (FIBA), says that, “IFB is a long-time member of FIBA and Roberto has been a well-respected banker in Miami for many years. His experience in the Latin American market goes a long way to explaining IFB’s success.”

For these and other reasons – such as capital flight from Latin America that pumped $80 million into IFB from Peru alone in 2021 – the bank has grown from $350 million in deposits in 2015 to just under one billion dollars today. It has also become a more balanced institution, moving from a community bank model where most loans were in residential real estate, to one with equal weight between commercial real estate, residential real estate, corporate, and commercial/industrial loans. “We look at our portfolio every day, and are very, very careful to maintain this balance,” says Gatica.

As for clientele, the preponderance of IFB’s deposits come from Venezuela, followed by Ecuador and Argentina. U.S. deposits come in at slightly more than 50 percent, but that figure is misleading, says Gatica, because the bank does business with numerous domestic LLCs that are, in fact, holding companies for foreign nationals.

While Gatica is not bullish for banking in general in 2023, he says the advent of left-leaning governments in Latin America

bodes well for banks that can accommodate foreign citizens looking to protect their assets. Other trends also favor IFB, such as the growing shift of Mexican investments from Texas and Arizona to Florida. “You have the Brazilians coming, the Europeans coming, the Canadians coming – you name it,” Gatica says. “Right now, Argentina is the most active in terms of deposits, followed by Chile and then Peru. So for us it’s a big opportunity, because being international is part of our DNA.” l

The advantage is that we have done this for 30 years. Any bank can offer banking solutions, but not with the same closeness. We are a niche bank with a human touch.

ROBERTO GATICA, SENIOR VP FOR INTERNATIONAL BANKING AT IFB

HOW CAN WE HELP YOU

Our personal injury law firm has obtained in excess of a billion dollars in verdicts and recoveries for clients and is recognized as a leader in plaintiffs’ personal injury and wrongful death, class actions, mass torts, and other areas of litigation

Colson Hicks Eidson, one of Miami’s oldest and most accomplished law firms, is considered among the top trial firms in the United States, having won hundreds of multi-million dollar verdicts and settlements for its clients.

–Chambers USA, 2022

WHAT WE PROVIDE

Our personal injury lawyers have a long history of serving individuals, groups of individuals and businesses in a wide range of lawsuits. Our trial attorneys are highly regarded for their depth of legal experience, responsiveness to client concerns and ethical tactics, both inside and outside of the courtroom. Our law firm receives respect throughout the legal community, which recognizes Colson Hicks Eidson for its various distinguished achievements.

WHO WE HAVE HELPED

We are or have been actively engaged in the following and many other cases:

• Takata Airbags MDL

• Champlain Plaza

• Allergan Biocell MDL

• Monat Marketing MDL

• Parkland Shootings

• Elmiron Eye Injury MDL

• 3M Combat Earplugs MDL

• BP Deepwater Horizon Oil Spill

• Ford Firestone MDL

• Toyota Sudden Acceleration MDL

• Zantac MDL

• Camp LeJeune Contamination Claims

Settling Global Disputes

WHY MIAMI IS NOW A TOP HUB FOR ARBITRATION IN THE AMERICAS

BY DOREEN HEMLOCKIt was a glorious autumn Sunday in Miami – sunny and breezy, a perfect day to be outdoors – when nearly 200 people gathered indoors for a conference on international arbitration. Some came from South America, some from Europe, all keen to discuss ways to resolve disputes where no party has “home-court” advantage.

Fifteen years ago, such a specialized gathering would have been unimaginable. But Miami has blossomed into a hub for international arbitration, especially for commercial disputes in Latin America. A recent survey of lawyers from 39 countries ranked Miami No. 2 in the Americas for the practice, trailing only after New York. Indeed, the University of Miami Law School now shines as one of the few places worldwide to offer a master’s in international arbitration, attracting top practitioners to teach.

Conference attendee Alicia Menendez personifies the city’s rise. A longtime international lawyer in Miami, she began handling arbitration cases three years ago. Now, she represents investors from Canada, Portugal, and beyond in a dispute with a Latin American country that “expropriated” their businesses, the Cuban-American attorney with Shook, Hardy & Bacon in Downtown Miami says. “[I came] to meet up with colleagues from multiple countries. More events like this in Miami can help grow international arbitration here.”

WHAT ARBITRATION IS AND WHY MIAMI IS A HUB

International arbitration is a practice where parties in conflict choose private individuals to resolve their dispute. It differs from mediation in that the individuals act more

like judges that issue decisions, rather than facilitators for the parties to reach a settlement themselves. Most arbitration decisions are binding and final. The practice is gaining ground as a more neutral, cost-effective, and streamlined solution than litigation.

Miami, long a gateway for business with Latin America, has been targeting arbitration as a growth area for decades, recognizing that foreign investment – and accompanying disputes – have been on the rise in the Latin region.

Leading the advocacy effort is the Miami International Arbitration Society, a group made up largely of lawyers. The Society helped get Florida law changed to allow overseas attorneys not in the Florida Bar to work on international arbitration cases in the state. It also helped train court judges in Miami-Dade County to handle questions that might arise from arbitration cases – moves that make Miami more “arbitration-friendly,” says the Society’s chair Don Hayden of law firm Mark Migdal & Hayden.

Much of the international arbitration in Miami now centers on commercial contract disputes in Latin America. Both sides in those conflicts see the city as convenient because of its ample airlinks, abundant hotels, state-of-the-art digital links, and easy access to stenographers, translators, and arbitrators who speak Spanish, Portuguese, and other languages besides English.

“Foreign investors in Latin America often turn to arbitration so they won’t be home-towned,” says Hayden, meaning they won’t face judges abroad who may favor the parties of their homeland, or won’t have to deal with unusual aspects of a legal system different than their own. “And what better location for international arbitration than Miami,” he says, “because for Latin Americans, many have second homes here, and for Americans and other foreign investors, you still have the protection of U.S. courts to enforce any arbitration award.”

What really put Miami on the world map, however, was hosting a key global conference. In 2014, the city welcomed the International Council for Commercial

What better location for international arbitration than Miami, because for Latin Americans, many have second homes here...

DONHAYDEN (LEFT) OF LAW FIRM MARK MIGDAL & HAYDEN, WITH LOUIS O’NAGHTEN AND ALEXIS MOUREE AT THE INTERNATIONAL ARBITRATION CONFERENCE

Arbitration (ICCA) for its biennial meeting. That influential group had met just once before in the United States, back in 1986. The conference not only brought some 1,000 top practitioners to Miami, but also provided funding to the host city to develop arbitration programs for things like training and promotion.

That sparked more conferences and encouraged more players to enter Miami’s arbitration market, from law firms to venues that host the hearings, says Hayden. Los Angeles-based law firm Quinn Emanuel, for example, which has 900-plus lawyers in 31 offices worldwide, opened a Miami office in 2021 to focus on litigation and arbitration. Atlanta-based King & Spalding, which has 1,200-plus lawyers in 23 offices worldwide, touted arbitration among several practice areas to explain why it opened a Miami office in 2022. And Veritext Reporting, a U.S. chain known for court reporting and translation, recently opened a multi-party arbitration center in Downtown Miami.

WHAT MAKES A GOOD ARBITRATION HUB

To be sure, Miami is not alone in chasing the arbitration business. Panama, Atlanta, Houston, and Rio de Janeiro are also active. Some of those rivals have specialties. Oil-rich Houston is big in energy cases, for example, while Rio is strong for domestic Brazilian disputes, given delays in Brazil’s courts.

To keep arbitration growing long-term, Miami needs to stay strong in several key areas. Venues for hearings, for example, must keep up with technology. California-based JAMS, the largest private provider of arbitration and mediation services worldwide, just improved capabilities at its 10-yearold Miami office, offering high-resolution monitors with top-quality sound to better handle witnesses from afar. It also added virtual moderators for online sessions, says lawyer Gary Birnberg, who, like all JAMS members, serves only in neutral roles such as mediator or arbitrator.

The city also needs a pipeline of attorneys skilled in arbitration. That’s where UM’s International Arbitration Institute comes in. Many of the Institute’s graduates practice first in Miami, and, given their experience, often write Miami into contracts as the seat for arbitration if needed, Birnberg says.

Arbitration panels also must include specialists in different industries and not only professionals skilled in law. Consider aviation. When a company misses payments on a leased jet, courts sometimes order the

jet seized. But that means the plane stops generating cash. An aviation specialist on an arbitration panel might help devise a payment plan or other options to help the jet owner get paid. Birnberg himself is part of a group that helped start a new global court specializing in aviation. The Hague Court of Arbitration for Aviation launched in July in the Dutch city known for its court of international justice.

“If we in Miami are going to be on par with New York for international arbitration in the Americas, it’s because we have all these elements in place, but also because we’re a more pleasant and economical locale than New York,” says Birnberg. “With our sunny weather, come October or November, there’s a huge argument to hold hearings in Miami, even when cases may be seated elsewhere.”

That helps explain why some 200 people turned out on Sunday, Oct. 30 for the Miami International Arbitration Society’s 1st Annual LatAm Investor-State Arbitration Conference, focusing on disputes between investors and governments in Latin America. But not everyone came from chillier climes.

Valeria Romero, a Colombian attorney with a master’s in corporate law from Spain, was excited to attend an event conveniently

hosted at UM, where she’s completing another master’s – this time in international arbitration. She’s keen on arbitration to widen her opportunities in Miami and beyond.

“Lawyers sometimes have a limited scope of work. But with international arbitration, you can learn about other legal systems,” says 29-year-old Romero. “And frankly, it’s a practice that’s really growing.” l

With our sunny weather, come October or November, there’s a huge argument to hold hearings in Miami, even when cases may be seated elsewhere.

MIAMI LAWYER GARY BIRNBERG (BELO,W, RIGHT) SPEAKING AT THE ARBITRATION CONFERENCE

We Speak GLOBAL

Customized Commercial Real Estate Loan Solutions for Domestic and Non-Resident Clients

It‘s important that your business facilities address your needs—the same goes with your financing. At Sunstate Bank, our lending specialists are just as well versed in the local real estate market as they are in the unique circumstances of each of our business customers.

We support the real estate needs of domestic and foreign buyers, including purchases, rental income properties, business acquisition loans, and expansion loans. With flexible term options, we offer both fixed and adjustable interest rates*.

Please speak with a banker to discuss eligibility requirements.

*Terms for credit products are subject to final credit approval. Terms and conditions apply.

Canadian Candor

Last November, the Canadian Consul General in Miami, Susan Harper, departed for her next posting in Dallas, Texas after more than six years of service in Miami. About a month into her new role, we sat down with the new Consul General, Sylvia Cesaratto, to discuss her position and priorities. Cesaratto, who has worked for the Canadian Foreign Service all over the world (including postings in the UK, Brussels, Belgium, and Panama), is taking over at a time when Canada is now one of Florida’s biggest international economic partners.

What are your primary responsibilities?

The Consulate General of Canada in Miami is like a mini embassy. We provide consular support to Canadian citizens who travel here and to Canadian companies who want to do business in Florida, but also to those Floridian companies who want to establish relationships with Canada. We also have a foreign policy dimension, where we work on nurturing relationships with key influencers in the political stream and provide advice and analysis back to our headquarters. We do a lot of work together with our U.S. partners here in Florida to address security concerns, such as the presence of organized crime, irregular migration, and the illegal trafficking of guns and narcotics. We want to strengthen what’s happening in the Caribbean but also limit what moves into the States and eventually north into Canada.

What kind of trade relationship do Miami and Canada have?

Canada and the U.S. share partnerships like no two other countries. At the U.S.-Canada border, there are billions of dollars worth of trade that happens every day. The thing is, we don’t sell things to each other as much [as we] make things together. A perfect example of this is the automotive industry. A car can pass through the border many times before it’s completed. This speaks to our integrated nature. We have been working on strengthening our supply chains, [and] on working together to address the ongoing impact of COVID on our economies. We’ve pledged to work together on irregular migration coming up from Central America. We’re working very closely when it comes to Haiti, which is an emerging crisis and pertinent here in Florida given the large diaspora.

How important is foreign direct investment to your role?

We figure there are about 3.5 million Canadians that come to Florida every year. That’s 10 percent of our population and 15 percent of Florida’s. But they don’t only come here to spend a couple of weeks

or grab a cruise. Many come to live here for at least six months. That is important in terms of what they bring to the local economy. [Canada is] the biggest foreign investor when it comes to private real estate. In Florida, we estimate there’s a stock of about $60 billion in private property owned by Canadians. And, of course, they pay property taxes, which are about $600 million. Then, we figure they spend about $6.5 billion when they’re here. There are also about 500 Canadian-owned companies in Florida [that] employ about 60,000 Floridians. The bilateral trading relationship is almost $8 billion between Canada and Florida.

How can the business relationship between Canada and Miami be improved?

We’re looking to position Canadians to not only come to Miami because there are a lot of opportunities here, but also to look at it as a gateway to Latin America. We also need to get more Floridians up to Canada. Government and non-government organizations are looking to develop trade missions, which is fantastic. But they’re not looking at Canada, though Canada is Florida’s top trading partner. There is a solid foundation from which to build. Canadians come here for the beaches and the sun, but they don’t necessarily think of Florida as a business destination. So that’s also our challenge, to change that perspective and build those partnerships.

What have been some of the other challenges while working in Miami?

We have gone up to Tallahassee to ensure that any kind of actions that pertain to protectionism do not become commonplace here in the state. We have seen it in a couple of jurisdictions, so we make sure we are not excluded. It is a partnership; we create things together. There are some domestic actions that don’t consider the impact on their partners, like Canada. And we are so integrated that if it affects Canada, it will ultimately affect Miami. l

Check It Before You Wreck It

USING AI AND 3D TECHNOLOGY, CHECKTOBUILD AIMS TO IMPROVE CONSTRUCTION EFFICIENCYFor general contractors, the process of getting an inspection done can be long and arduous, involving time, money, and a fair dose of faith. Miami-based CheckToBuild is out to change that. The brainchild of entrepreneur Alejandro Ruiz Lara, the tech startup has created an innovative construction management solution, using artificial intelligence (AI) and 3D models to fast-track the process; while it cannot grant an inspector’s approval, it can ensure quality and avoid any slowdowns from requested changes. It can also catch costly mistakes.

CheckToBuild’s CB2 platform, a construction analysis engine, compares the original design of a construction project with video taken by the contractor at the site, and, within minutes, can provide an overview of any potential geometric deviations from the original blueprints. The technology does this by building a 3D model from the

BY YOUSRA BENKIRANEdesigns, instantly overlapping the model with the construction design to compare every element in reality versus its architectural intent. After this “inspection,” the platform provides results of what is working, what is not, and potential costs for the builder.

CheckToBuild’s technology mitigates two of the biggest issues in the construction management industry, those of delays and cost overruns. A formal inspection process can take days or longer to complete, but the process is reduced to minutes with CheckToBuild’s technology.

For example, its software was used to inspect the progress in a 232,737-squarefoot, $16.5 million office building project in Madrid. During construction, the client noticed an area where water did not drain properly. Knowing this would represent a safety concern, the client wanted to know if there were any deformations in the floor’s

The technology does this by building a 3D model from the designs, instantly overlapping the 3D model with the construction design to compare every element in the reality versus the architectural intent.

ABOVE: USING THE SOFTWARE TO BUILD A 3D MODEL FROM THE ARCHITECTS PLANS IN ORDER FOR THE “INSPECTION” TO BEGIN

To engage our community on global issues

The World Affairs Council of Miami is an all-volunteer team working to elevate a non-partisan, non-profit startup to a world-class center for public education on global affairs by and for Miami.

Since our founding in August 2021, we have:

• Launched a free-for-the-public world affairs Distinguished Speaker Series in partnership with Miami Dade College.

• Held an annual world affairs trivia contest for local high schools and sponsored the winners’ travel to compete in D.C.

• Connected local innovators & entrepreneurs with Miami-based diplomats in partnership with Venture Café Miami.

Contact us to help build Miami’s premier nonprofit for global affairs. Your support means the world.

The World Affairs Council of Miami is a 501(c)(3) taxexempt non-profit organization. Contributions are tax-deductible to the full extent of the law.

structure, so videos were taken by CheckToBuild and compared with 3D models. It was soon clear that a 30-square-foot area was uneven, causing an accumulation of water. An inspection by traditional methods would have taken several days.

“CheckToBuild provides a key tool in the digital transformation of construction,” says Óscar Liébana, project coordinator of Spain’s FCC Construcción. “Its automation technology improves, speeds up, and brings accuracy to some tasks that have historically been slow and expensive.”

Originally based in Madrid, CheckToBuild began working on pilot projects in 2020, with its team continuing to design and patent the technology. Using comparative models, Ruiz Lara concluded his software could save builders up to 37 percent in wasted materials and become 87 percent more efficient in the inspection process. He then dedicated four months to testing the international waters by offering CheckToBuild’s services in Chile, Peru, Colombia, the U.S., and the UK. By February 2022, it was clear the U.S. would prove most fruitful.

Ruiz Lara partnered with the University of Miami in a start-up program designed

to generate business, securing an account with Moss & Associates Construction, one of the southeast’s largest privately held general contractors. “Real estate in Florida is rapidly growing, so it only made sense for us to establish [in Miami],” he explained. By May 2022, CheckToBuild became a U.S.based company with international outreach.

Since relocating to Miami, the company has raised $1.5 million in an initial investment round, and is continuing to develop both its technology and business model. “Since we moved to Miami, we have increased our number of customers and created revenue of $120,000, but we are still selling in a controlled way to strategic customers so that when we are finished with our product by June 2023, we will be able to scale our sales process and system,” Ruiz Lara said.