THE ACCOUNTANT

THE ACCOUNTANT magazine is issued quarterly.

Published by EDITOR Maria Cauchi DeliaDESIGNER

Daniela CutajarADVERTISING INQUIRIES theaccountant@miamalta.org

All correspondence, articles for publication and enquiries are to be addressed to:

The Editor MIA Professional Limited Level 1, Tower Business Centre Tower Street, Swatar BKR 4013, Malta.

The Institute does not necessarily concur with the views expressed by the authors in the articles published in this journal. The publishers and authors do not assume any responsibility for loss or damages incurred by any person acting or refraining from action as a result of any view expressed in this journal.

If you would like to be featured in this publication, please visit www.bit.ly/GetRecognised for more information.

Welcome to the first edition of 2024 of The Accountant.

Once again, this publication brings you a series of thought-provoking articles, interviews and information snippets to help you keep abreast with the key developments surrounding the accountancy profession and the wider financial industry. In parallel, we seek to give you a snapshot of the Institute’s activity as we continue with our efforts to serve as a bridge between institutions, regulatory authorities and standard setters, and the members of the profession.

The role of the Institute has never been so relevant as it is now, at a moment where the profession finds itself at the crossroads, contending with an array of challenges that necessitate a careful reassessment of conventional practices.

Compounding the complexity is the perpetual stream of new regulations and standards coming to us from all directions. As the regulatory landscape undergoes continuous transformation, practitioners are tasked with the intricate job of staying abreast of these changes, ensuring compliance whilst adapting their methodologies to meet the evolving standards. This not only places a considerable burden on accountants but also highlights the profession’s need for flexibility and agility in response to regulatory shifts.

The urgent call to address climate change and integrate sustainability considerations into financial decision-making processes adds another dimension to the accountant’s role.

As an Institute, we remain committed to keep the industry at the forefront of these developments and provide the necessary training, including through CPE events, as necessary.

One of the main challenges is the increasing sophistication of financial crime, particularly money laundering and the financing of terrorism, where accountants bear a major responsibility in strengthening financial systems against illicit activities on a global scale. The evolving nature of these threats demands a constant evolution of countermeasures and heightened vigilance within the profession.

In this context, I must express a sense of relief and appreciation to note the conclusions of Malta’s National Risk Assessment for 2023, which has been formulated under the coordination of the National Coordinating Committee on Combating Money Laundering and Funding of Terrorism following extensive collaboration with government authorities actively involved in the fight against financial crime, as well as representative bodies from the private sector, including the Malta Institute of Accountants.

The report observes a reduction in Malta’s overall money laundering risk since 2018, reflecting the effectiveness of measures implemented by authorities and the private sector. Significant enhancements in mitigating measures across various industries have contributed to notable improvements in the overall risk landscape.

This is indeed a very positive development, and I do thank all stakeholders involved, no less all accountancy and auditing professionals who played an important role, for reaching this important milestone. At the same time, I do invite subject persons to integrate the risks outlined in this updated NRA into their risk assessment procedures, conducting thorough reviews and updates to controls, policies and procedures as necessary to address and mitigate the identified risks.

These are just a few of the subjects matter which are being followed very closely by the Institute, with our feedback submitted as required, to proactively seek solutions which respect the interests of the members but at the same time safeguarding the country’s competitiveness and reputation.

For this to be possible, extensive background work and consultation is required and we are therefore extremely grateful to the over 160 volunteers who have accepted our call to form part of our 13 committees and focus groups as well as 20 working groups falling under their remit, to contribute towards the growth of the Institute, the profession and the wider industry.

The Committees, which started a new two-year term in January, are integral to the Institute’s operations. They facilitate a two-way communication channel between the Institute and its members, providing support in the creation of guidance documents, responding to consultation documents, and staying informed about evolving European and national legislation along with new standards. Additionally, these Committees play a vital role in supporting Continuous Professional Education events,

cultivating an environment conducive to continuous learning and professional growth.

I am informed that during the previous term, these collective groupings dedicated over 500 hours in meetings and contact time, and that excludes hours of additional work, including research, carried out by these members on their own as they prepare their contributions to these committees. On behalf of the Institute, I would like to thank the outgoing formations and warmly welcome the new ones and augur them success for the work ahead.

Looking ahead to the next months, the Institute is actively planning a series of engaging events that promise to capture the interest and participation of all our valued members. These events are designed to offer insightful perspectives, foster networking opportunities, and contribute to the professional development of our diverse membership.

I eagerly await the opportunity to meet and connect with as many of you as possible in the coming months. Your active involvement and feedback are essential in shaping an enriching experience for our collective professional community.

Dear readers,

It is my pleasure to share with you again some thoughts in this quarterly appointment, as we seek to brief you with the key developments concerning the Institute and the wider accountancy profession.

“Where to start?” is always my first thought as I seek to put together the most pressing issues affecting the Institute and profession. Indeed, global events continue to shape our profession, including a more determined push towards corporate tax reform and transparency, a pervasive effort to combat financial crime, and the emergence of sustainable finance as a key priority for authorities, regulators and citizens alike. These profound changes have prompted international institutions, especially at the European Union (EU) level, to develop a stream of new legislation, regulation and standards which are poised to significantly influence our professional landscape, necessitating adaptability and proactive engagement.

In response to this evolving context, the Malta Institute of Accountants (MIA) has been tirelessly engaged in bridging the communication gap between authorities and professionals. Our efforts extend beyond merely providing feedback on proposals emanating from Brussels or Maltese regulators; we have assumed the proactive role of collaborating with authorities in shaping the new regulatory landscape. Concurrently, we have been committed to guiding our members through these developments, ensuring they are wellinformed and equipped to succeed in this new environment.

Malta’s fight against money-laundering is a perfect example of this. Over the past years, we have been a staunch advocate for enhanced efforts in combating money laundering, playing a pivotal role in fostering a substantial shift in mindset and cultural approaches towards addressing financial crime.

Our work with the Financial Intelligence Analysis Unit (FIAU) has been ongoing, involving contributions to Implementing Guidelines, procedural frameworks, and governance matters. We also participate in FIAU discussions, to better understand each other and seek common ground on the way ahead.

In similar ways we are involved on developments relating to various other regulatory matters. I am proud to share that we have also been invited to form part of the recently established Malta Financial Services Authority Stakeholders Panel, an initiative which aims to consolidate opinions, addressing concerns and ensuring timely actions towards better jurisdictional practices.

We are collaboratively addressing key issues with the Malta Tax and Customs Administration, with particular focus on the changes to the audit requirements announced in Budget 2024. Our goal is to strike a balance between streamlining processes and reducing burdens without significantly escalating associated risks.

Additionally, our active participation in the Companies Act Reform Group, being led by the Malta Business Registry (MBR), underscores our commitment to shaping regulatory frameworks. We are also in ongoing discussions with the

MBR, contributing to changes in the Civil Code. Concurrently, we are engaged with the Office of the Commissioner for Voluntary Organisations, supporting their efforts to reform this sector in Malta.

Furthermore, our collaborative efforts extend to working with the Ministry for Finance and regulatory bodies on the transposition of the Corporate Sustainability Reporting Directive. At the same time, we are vigilantly monitoring EU and international developments in the realm of sustainability. Our participation at international events hosted by Accountancy Europe, the International Federation of Accountants and similar organisations are also more relevant than ever in such a context.

In parallel to this, we remain very conscious of the challenge presented by the struggle experienced by firms to recruit accountancy and auditing professionals. While we have continued with our efforts to push for immediate solutions which mitigate the issue on the short-to-medium term, we continue to look beyond. Indeed, our education campaign remains very much at the top of our priorities. As an Institute we seek to address the root challenges, as younger generations show a growing inclination toward more alluring and technologically advanced career paths, contributing to a diminishing interest.

Despite this trend, there continues to be an increasing demand for accounting professionals across diverse industries, and we are therefore committed to foster a deeper understanding of the accountancy profession, the opportunities it creates, and the role it plays in the world around.

The MIA team, in collaboration with guest speakers from the profession, actively engaged with numerous students at different educational levels through a variety of events. While our approach with Year 8 students involved direct in-class interaction, as we have done for the past three years, we also explored innovative methods for students in the latter phases of secondary and post-secondary education.

These approaches included taster sessions, hosting talks, participating in fairs, and more, allowing us to connect with over a thousand students during the present scholastic year. This publication showcases these efforts, but I would like to offer a special mention for a oneday seminar for career advisors and guidance teachers. Organised with the support of the Ministry for Education, this event provided a platform to connect with career guidance teachers, who are influential figures and crucial in guiding the decisions of young students. The interactive seminar was a resounding success, offering a delightful opportunity to meet dedicated professionals eager to enhance their understanding of the careers they present to their students. I do look forward to build on this positive development in the months ahead.

Going forward, as we approach the longer, brighter days of Spring, we have many exciting events coming up, including conferences, seminars and CPE events. I invite you to keep following updates from the Institute, including through our website, our social media platforms and our daily news updates to keep in the loop. As always, I encourage you to reach out to us as necessary as we work together in pursuit of our common goals.

Amendments to the GAPSME were published by Legal Notice 41 of 2024. These amendment regulations shall be read and construed as one with the Accountancy Profession (General Accounting Principles for Small and Medium-Sized Entities) Regulations.

The Malta Institute of Accountants contributed to these amendments through its Financial Reporting Committee and GAPSME Working Group.

The National Coordinating Committee on Combating Money Laundering and Funding of Terrorism (NCC) published the National Risk Assessment (NRA) for Malta - Money Laundering, Terrorist and Proliferation Financing and Targeted Financial Sanctions. More information about this NRA is available on page 32 of this publication of The Accountant

New General Accounting Principles in respect of certain Eligible Entities related to the business of Insurance and related MFSA Circular

Legal Notice 299 of 2023 - Accountancy Profession (General Accounting Principles in respect of certain Eligible Entities related to the business of Insurance) Regulations, 2023, published in December 2023, provides an option for eligible insurance entities to apply an alternative framework to International Financial Reporting Standards as adopted by the European Union. This Legal Notice (L.N.) is effective from 1 January 2023.

Further to the publication of this L.N., MFSA issued a Circular and amended paragraph 8.2.1 of Chapter 8 of the Insurance Rules issued under the Insurance Business Act, as well as the titles to Annexes II and III to Chapter 8 of the Insurance Rules.

Confirmation of the Final Compromise text of the EU AML/CFT Package and political agreement on the location of the seat of AMLA

The compromised legal texts of the EU AML/CFT Package are now public.

Read more here.

The Anti-Money Laundering and Countering the Financing of Terrorism Authority (AMLA) will be located in Frankfurt. Read more here

In order to provide background information about the process that led to this L.N. and the rationale behind, the Malta Institute of Accountants published an Information Note. The Institute had contributed to the issue of this L.N. through its Financial Reporting Committee, Financial Services Committee and Insurance Working Group.

Access the L.N. from here, the MFSA Circular from here and the Information Note from here

In December 2023, the European Financial Reporting Advisory Group (EFRAG) released for consultation the first three draft European Single Reporting System (ESRS) Implementation Guidance documents. The first draft, EFRAG Implementation Guidance (IG) 1, focuses on materiality assessment requirements within the European Sustainability Reporting Standard (ESRS), whilst the second draft, EFRAG IG 2, addresses value chain aspects. The third draft, EFRAG IG 3, comprises detailed ESRS datapoints presented in a Microsoft Excel workbook, accompanied by an explanatory note. Following an analysis by the members of the MIA Sustainable Finance Reporting Working Group, the Malta Institute of Accountants has submitted its feedback to this consultation by EFRAG. Further details on the proposed implementation guidelines are available here

The Global Reporting Initiative (GRI) and the International Financial Reporting Standards (IFRS) Foundation unveiled a comprehensive summary on interoperability considerations for GHG emissions. This joint publication provides a comprehensive analysis and mapping guide, shedding light on the crucial factors companies need to consider when quantifying and disclosing Scope 1, Scope 2 and Scope 3 greenhouse gas (GHG) emissions. Specifically tailored to align with both GRI 305: Emissions and IFRS S2 Climate-related Disclosures, this resource serves as a valuable tool for companies navigating the intricate landscape of environmental reporting, ensuring a seamless integration of standards in the pursuit of comprehensive and transparent emissions disclosure.

Member States agreed on the compromised text for the European Union’s Corporate Sustainability Due Diligence Directive (CSDDD). The next step is for the European Parliament to approve the amended version agreed to by the Member States.

The International Organization of Securities Commissions (IOSCO) has launched its strategic priorities for the months ahead, reflecting the views of its 130 global members. Launched during the 28th session of the Conference of the Parties (COP28), these priorities encompass initiatives such as capacity building with regards to the IFRS Sustainability Disclosure Standards. Additionally, IOSCO aims to advance the development of a global assurance framework for corporate reporting on sustainability, transition plans and financial integrity within voluntary carbon markets. Further information is available here

The International Organization of Securities Commissions (IOSCO) Board has released a report focusing on Supervisory Practices to Counteract Greenwashing. Greenwashing is seen as a key obstacle towards building a more reliable ecosystem that ensures trust in sustainable finance markets. This report offers insights into various initiatives proposed in multiple jurisdictions to combat greenwashing. Among the highlighted challenges, IOSCO raises concern and provides recommendations on data gaps, transparency concerns, the quality and reliability of ESG ratings, consistency in labelling and classifying sustainability-related products, changing regulatory approaches, and the lack of necessary skills. The full report is available here

The MIA held its annual Tax Conference on 14 December 2023. This event served to shed light on the different tax reforms which are leaving their mark on the accountancy profession. These include changes in direct and indirect tax, sustainability reporting disclosures, as well as reforms in VAT and Customs formalities.

The discussion on direct taxation addressed the changes brought about by the Unshell Directive and the Subject to Tax Rule (STTR), as well the expectations in terms of required documentation and timelines with regards to Transfer Pricing. On the subject of indirect taxation, experts engaged in a lively debate on issues such as the Intrastat Declarations, Recapitulative Statements, the Budget Implementation Bill, Central Electronic System of Payment information (CESOP), and the applicability of the 12% VAT Rate.

Other topics addressed during the MIA annual Tax Conference included issues such as the Carbon Border Adjustment Mechanism (CBAM) and the Emissions Trading System (ETS).

The Malta Institute of Accountants, in collaboration with the Ministry for Education, hosted a training seminar directed at guidance teachers and career advisors, with the objective of shedding further light on the accountancy profession and the opportunities awaiting those who study accountancy.

The objective of this seminar, held on 23rd February 2024, was to equip guidance teachers with the necessary knowledge and resources to better guide students who seek assistance with regards to their preferred career path.

Members of the MIA team, led by CEO Maria Cauchi Delia and accountancy professionals coming from different backgrounds, provided a high-level overview of the profession and shared details on the roles that accountants can assume, as well as the different study paths available, and related MIA support.

Participants were also guided on the skillsets required by the industry and provided tips on how to identify the characteristics sought during recruitment processes in this field.

MIA hosts Networking Events to launch the new Committees and Groups for 2024 - 2025

The beginning of the year brought about the reconstitution of the Malta Institute of Accountants’ thirteen committees and focus groups, and twenty working groups falling under their remit, bringing together over 160 members to contribute towards the growth of the Institute, the profession and the wider industry.

Committees and groups are a core part of the Institute’s activity, and serve as a bridge between the MIA and the membership base, establishing a two-way communication channel between the two. In recent years, they

have adopted a very active role, supporting the activity of the Institute by backing it up in producing guidance documents on relevant subjects, responding to consultation documents, and staying abreast of a continuous flow of European and national legislation and new standards. Moreover, they play a crucial role in supporting Continuous Professional Education events, fostering an atmosphere of ongoing learning and growth.

The committees and groups for the current two-year term consist of individuals with prior experience within the MIA structures and newcomers who bring valuable

fresh perspectives, an aspect actively sought by the Institute.

The Institute celebrated the reconstitution of these Committees at a networking event held at Villa Arrigo, attended by over 150 members of these committees and groups, together with MIA management and staff, creating a platform for collaboration and exchange of ideas and setting the way ahead for the next two years.

The Committees span diverse sectors within the broader financial industry, encompassing areas such as taxation, sustainable finance, ethics, auditing and financial reporting among others.

In contrast, the groups cater for the specific needs of distinct communities within the accountancy profession – the professional accountants in business, small and mediumsized practitioners and younger members. While these communities face specific realities, some challenges overlap, and their different perspectives enrich the Institute with diverse and innovative approaches in devising collective solutions.

During the previous two-year term, which extended until the close of 2023, the committees and groups collectively amassed a substantial commitment of over 500 hours in meetings and

contact time. This dedicated effort resulted in the creation of several expertly-researched technical documents, active participation in over 25 events, and provided comprehensive responses to a constant flow of consultation documents, coming from every direction, including the European Union, the Maltese Public Sector, as well as European and international standardsetters.

Addressing the networking event, Ms Maria Cauchi Delia, the Chief Executive Officer of the Institute, acknowledged the significant contributions of the outgoing committee members to the growth and success of the

Institute. In extending a warm welcome to the new committee members, she recognised their dedication to the cause and underscored the collective responsibility to drive positive change within the industry. “Your willingness to contribute your time and expertise speaks volumes about your passion for our shared mission. Together, let us move forward, shaping the future of the accountancy profession in Malta”, she concluded.

Further information on these committees and groups, including the members constituting them as well as their terms of reference, is available on the website of the MIA.

The Institute continued to secure presence in several educational institutions across the island as part of its ongoing #AccountsForYou campaign, aiming to connect with students eager to explore the opportunities in accountancy. Through various events, members of the MIA team and guest speakers from the profession engaged with hundreds of students at different stages of their educational pathway highlighting the career paths that studies in accountancy would open to them.

The Institute’s main efforts focused on Year 8 students, prior to the latter making key study selections in this scholastic year. Indeed, the MIA was present in fourteen schools, meeting 1,004 students in this particular year. Over and above, the MIA also organised taster sessions at San Anton School and took part in a fair at St Dorothy’s meeting more than 300 students in the process. In order to target students in post-secondary education, the MIA took part at Junior College’s Career Expo, conducted a panel discussion at Giovanni Curmi Higher Secondary School, Naxxar and hosted a special talk for ACCA students at The Malta College of Arts, Science and Technology.

Mazars in Malta has announced the appointment of Ruth Farrugia and Ramon Cutajar as Partners with effect from 1st January 2024.

PwC Malta has announced the appointment of Michael Formosa, Andrew Schembri and Chris Mifsud Bonnici as Assurance, Advisory, and Tax partners respectively, with effect from 1st January 2024.

BDO Malta has appointed Milena Palikarova as its new Associate Director of Tax with effect from January 2024.

Zampa Debattista has announced the appointment of Brandon Gatt as Partner with effect from 1st January 2024.

RSM Malta has announced the appointment of Albertine Farrugia Sacco as Director with effect from 12th January 2024.

A company may distribute its profits or assets, in cash or otherwise, to its members. In Malta, such distributions are regulated by Cap. 386 of the Laws of Malta, the Companies Act, which specifies that a company shall not make a distribution except out of profits available for that purpose. In addition, distributions shall be determined by reference to the assets, liabilities and equity of the company as stated in its accounts. This implies that an entity’s financial reporting framework plays an important role in determining amounts available for distribution.

Dividends may be declared by the company in a general meeting. However, the amounts declared should not exceed the amounts recommended by the directors.

The directors of a company are also responsible for the administration and management of its business, as well as for the general supervision of its affairs. Accordingly, they should be mindful of the requirements laid out in the Companies Act with respect to the determination of distributions.

What are the consequences of an unlawful distribution?

Repayment by members

If it turns out that a distribution has been made to the company’s members in contravention of the requirements of the Companies Act, and these members are aware of the unlawfulness of the distribution, then they become liable to repay it. If the distribution was made in-kind, then a sum equal to the value of the distribution should be repaid.

Dividends are declared based on the directors’ recommendations and it is the directors’ responsibility to oversee the financial position of the company. Accordingly, although members would suffer the consequences of an unlawful distribution, any oversight from the directors would be in contravention of the duties they are bound to

by their position and put them in bad light with the shareholders of the company.

In cases where dividends are distributed to another company and this company would be entitled to a tax refund and such refund would have been applied for, one would also have to keep in mind any adverse implications arising from a change in the distributed amount and refund. This is because tax refunds would have been issued in proportion to a related distribution, which would mean that an overdistribution of dividend would result in an overstated refund application. All documentation would need to be revised and any form of overpayment would need to be paid back to the Commissioner for Tax and Customs together with interest. Should it transpire that a company claims refunds based on an overdistributed amount, then this might also trigger the need for a tax investigation on the company.

Chapter XI of the Companies Act is limited to stating that profits available for distribution shall be a company’s accumulated realised profits, so far as not previously utilised by distribution or capitalisation less its accumulated realised losses, so far as not previously written off in a reduction or reorganisation of issued share capital duly made. By referring to income and expenses as included in the accounts of a company, one could be looking at amounts which would typically include both realised and unrealised elements. Therefore, additional guidance should be sought, and an analysis of the financial position, facts and circumstances of the company should be prepared to determine the extent to which an entity’s profits are distributable, if any.

Although the Companies Act requires that distributable profits must be realised, one must also take into consideration the financial position of the company before effecting a distribution. Therefore,

an assessment of the assets, liabilities and equity position of the company should be made. What if the company is in a negative working capital position, or would result in such after a distribution? What if the company is illiquid, or would become illiquid post distribution? These are examples of questions to be asked during this process.

Should an entity distribute all of its distributable profits?

The spirit of the Companies Act is to always adopt a cautious approach with a view of safeguarding an entity’s creditors. Therefore, although the company might have substantial distributable profits, it may be prudent to take into account any unrealised losses which might eventually become realised, such as changes in expected credit losses in terms of IFRS 9 – Financial Instruments.

Can a deemed distribution impact an entity’s distributable reserves?

At times a company could enter into transactions with related parties which would be accounted for as a deemed distribution from an accounting point of view. An example of this could be when a subsidiary provides a loan at below market rates to its shareholder. Although one might argue that this transaction might not directly impact the distributable reserves of the company, a detailed analysis of the facts and circumstances is typically required before affecting a distribution as the Companies Act requires that a distribution is made by reference to the company’s accounts and such a transaction could potentially create negative reserves.

Is a merger reserve distributable and to what extent?

When looking at a merger reserve, further analysis needs to be made as it would all depend on the assets and liabilities taken over by the company as part of the merger. One needs to determine what the merger reserve is made up of and whether the components included in such reserve are realised or not.

Can an entity distribute an asset if it does not have sufficient distributable reserves?

This will depend on what the entity is planning to distribute and the financial position of the entity. Will the entity distribute cash, or will it be a distribution in kind? If it is planning to distribute a non-cash asset, are there any unrealised profits related to this asset?

An analysis of the specific distribution should be made.

Do contributed assets impact an entity’s distributable reserves?

Careful consideration should be given as to the nature of the contributed asset and the legal implications of such transaction. At what terms was the asset contributed? What type of asset was contributed? Here there is no clearcut answer as further assessment would need to be made to analyse the situation at hand and determine if the related reserve can be considered to include realised profits or otherwise.

Conclusion

A dividend distribution can be a complex transaction and it can have negative consequences on the company, its directors and its members.

Hence, management and directors need to be mindful of the above considerations when a company is planning to distribute a dividend.

Authors

Rosalene Caruana is a CPA specialising in the provision of technical accounting advisory services. She also assists clients with their book-keeping and financial statements preparation requirements. She started her career with KPMG over ten years ago as an accountant and now holds the position of Associate Director within the Corporate Accounting Advisory Services department. Within the firm she also forms part of the Knowledge Management Committee and is frequently involved in the delivery of training sessions.

A Partner within the Advisory function, Dr Jonathan Dingli PhD leads both the Corporate Accounting Advisory Services team, which he had setup earlier in his career, and the Learning Academy at KPMG in Malta. He is responsible for the strategic direction of the Academy and is also involved in the delivery of several financial reporting courses under the IFRS learning suites umbrella. He lectures on advanced financial reporting at the University of Malta and is an elected member of the Council of the MIA.

End-to-end sustainability solutions that unlock a clear, actionable path to net-zero emissions including calculating your GHG footprint, developing a double materiality assessment, support with grants and incentives, as well as human capital training. Step by step, we can help you transform strategy into action, and start working to reduce your carbon footprint.

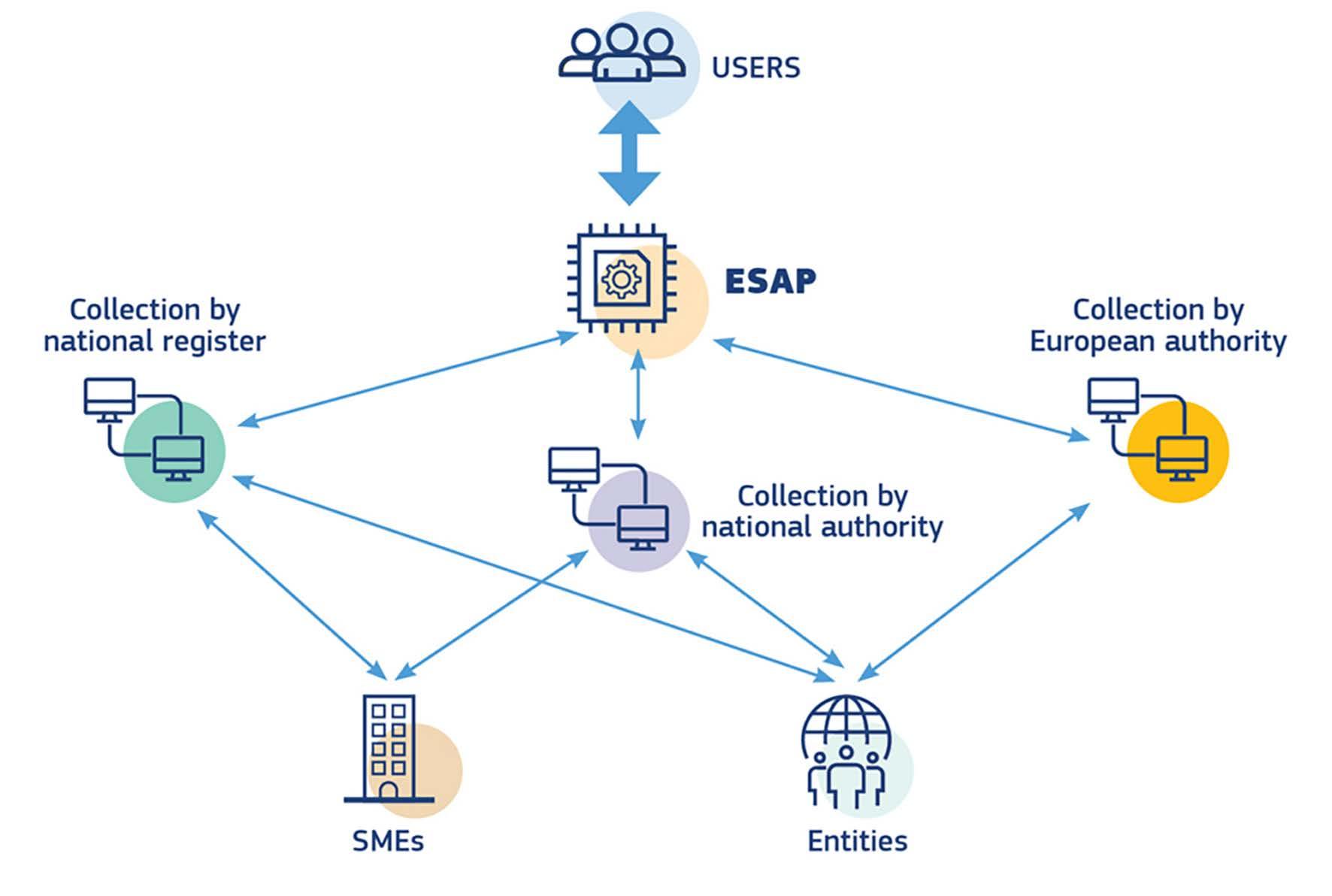

In an era characterised by digital evolution and ever-changing market dynamics, the establishment of a unified platform for accessing financial and non-financial data holds profound implications for investors, regulators and market participants alike. The European Single Access Point (ESAP) is a regulation by the European Commission which aims to serve this purpose by streamlining the access to publicly available financial and sustainability-related information of European Union (EU) companies and investment products, in an effort to promote greater transparency via technology enablement means.

Among its peers, the ESAP regulation forms an integral part of the Capital Markets Union (CMU) Action Plan, the European Commission’s Digital Finance Strategy and a meaningful instrument in the context of the European Green Deal. According to the European Commission, the successful roll-out and long-term management of ESAP will have a positive impact to the affected industries, stakeholders and general public, specifically in the following core dimensions:

1. Enhancing transparency and accessibility of data by providing interested parties, such as regulators and financial analysts, with a robust and single source of access means to review information disclosures of stakeholders operating within the EU;

2. Enabling investor protection by creating a new governance instrument over impacted stakeholder information; and

3. Streamlining regulatory and reporting compliance by simplifying data submission processes and reducing administrative burdens associated with them.

ESAP is anticipated to be an invaluable tool in the arsenal of the European Securities and Markets Authority (ESMA) towards facilitating a consolidated

and high-quality data set of reporting information, specifically regulatory-driven disclosures in financial services, sustainable finance and capital markets industries.

From a technical perspective, the core of the ESAP’s functionality is anticipated to reflect that of an online platform, intended as a repository of published data by entities and Small and MediumSized Enterprises (SMEs). Meanwhile the discussion is well underway via ongoing consultation papers by key relevant actors, such as the Joint Committee of the European Supervisory Authorities, on other complementary discussions regarding the technical implementation of ESAP - including the adoption of its standards.

Similarly, another notable effort in the transition to digitised EU capital markets involves the adoption of the European Single Electronic Format (ESEF) for financial reporting throughout Europe. This initiative shall establish cohesion and comparability of reported data and appears to have a significant conducive impact in this direction.

Moving forward, ESEF is expected to be a crucial component of ESAP. ESEF mandates the use of Extensible Markup Language (XML) tagging for financial statements, which has proven to improve the accessibility and comparability of financial data. By aligning with ESEF standards, ESAP will be able to promote seamless integration and interoperability, ensuring that financial information is presented in a consonant and machine-readable format.

ESAP in Operation

ESMA is set to be responsible for the establishment and operation of the ESAP. In this role, ESMA is expected to leverage ESAP as a technology instrument to contribute to the overall integrity, transparency of information disclosures, improvement of investor protection, and governance

of reporting within financial markets. Nevertheless, ESMA will need to rely on the support of, among others, Member State collaboration and the appointment of collection bodies to act on their behalf in the management and overall governance of ESAP and the impacted stakeholders.

As per the regulation, the role of the collection bodies on behalf of the ESMA shall, among others, include the following duties: (i) serving as the first-step reporting, that is collection and storage of information submitted by entities; and (ii) performing validation checks on submitted data to preserve a high-quality data set for the use by interested parties. For the purposes of the ESAP regulation, the collection body may be a union, or national authority/register that is of current designation as the reporting entity in scope of the listed Regulations/ Directives. Naturally, a range of relevant collection bodies (which may extend to European authorities) will be interacting with one another to consolidate the spectrum of financial and non-financial reporting to be published onto the ESAP. Once the first-stage reporting is complete, the responsibility will be on the respective collection body to perform the second and final stage reporting to the ESAP.

In terms of key functionalities, ESAP is expected to operate the following key components:

• A web portal with a user-friendly interface in all the official languages of the Union;

• An application programming interface (API) enabling easy access to the information available;

• A search function in all the official languages of the Union;

• An information viewer;

• A machine translation service for the information retrieved;

• A download service, which offers the download of large quantities of data; and

• A notification service informing users of any new information available in the ESAP.

Additionally, to support a frictionless data transfer among parties, the collection body is expected to be responsible for the implementation of application programmable interfaces (APIs) to the ESAP digital environment, as needed. An equal, if not larger effort, is envisaged in the area of cybersecurity protecting the ESAP platform that shall extend to the protection of personal data, where observed. The tasks of the collection bodies as well as further detailing of activities are currently taking the form

of an open consultation paper being driven by the ESMA and European Banking Authority (EBA).

ESMA is expected to formalise the set-up of the ESAP by the end of 2024, with an envisaged three-phase implementation timeline to follow. The Commission had noted that ESAP will need to be developed in a progressive and proportionate manner throughout the upcoming years, hence transitionally scaling-up the collection and submission of information onto the platform.

Initially, the first phase is understood to focus on the Transparency Directive, Prospectus Regulation and Short Selling Regulation. Following the onboarding of information disclosures onto ESAP, subsequent

References:

regulations and directives are anticipated to be included throughout the implementation of the second and third phases.

The trajectory for a single source of contact that will support interested parties, affected market stakeholders and regulators is well and truly on its way. Looking ahead towards the ongoing technical developments necessary to be ready for ESAP, along with the continuous support from local authorities guiding entities on ESAP, and the internal considerations that those impacted will need to be mindful of, it is an exciting prospect that the ESAP regulation is driving towards: an EU single market that is brought together through technology, under one reporting standard.

1. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0723

2. https://www.esma.europa.eu/sites/default/files/2024-01/JC_2023_78_CP_on_ITS_on_ESAP_tasks_of_ collection_bodies_and_ESAP_functionalities.pdf

3. https://www.amf-france.org/en/news-publications/news/european-single-access-point-financial-andnon-financial-information-european-entities-esap-enters

4. EU Factsheet: 2021 CMU package - European Single Access Point (ESAP)

Authors

Julian Sciberras is currently a senior consultant specialising in digital strategy & transformation within the PwC’s Digital Services practice. Julian has played a leadership role in several large scale, multi-complex digital transformation projects with demonstrated experience in the public and private sectors.

Julian also forms part of the PwC Emerging Tech team focusing on harnessing contemporary technology such as GenerativeAI in day-to-day value offerings.

Ahmad Bannout is a senior consultant within PwC’s Digital Consulting practice, forming part of the digital strategy & transformation team. Ahmad is passionate about solving complex business problems with digital solutions, having several years of experience working on projects that involve developing sustainable digital strategies and managing business transformation projects.

On the 30th of January, the Malta Tax & Customs Administration (MTCA) successfully held a seminar on the Central Electronic System of Payment information (CESOP) which was attended by various stakeholders including payment service providers and local tax practitioners.

In his presentation, the Commissioner, Mr Joseph Caruana, highlighted the importance for the MTCA to capitalise on digitalisation opportunities, such as CESOP, which plays a fundamental role in the coordinated effort in the fight against VAT fraud. During the same seminar Mr Nico Sciberras, Chief Tax Officer within MTCA, discussed the salient features of local provisions related to CESOP. This was followed by a presentation by Mr Kevin Mifsud, Director Inspectorate and Aspect Audit, who focused on the use of CESOP information. Attendees of the seminar were able to participate in a workshop focusing on the practical aspects of CESOP registration and CESOP filing which was run by Mr Andrew Buhagiar, Director Tax Operations, and Mr Gerald Vassallo from MITA.

Finally, an insightful panel discussion was held featuring panellists from the MTCA as well as from the Malta Institute of Accountants, the Malta Institute of Taxation, and the Institute for Financial Services Practitioners wherein the challenges and opportunities of CESOP were discussed.

The MTCA has adopted a modern and adaptive strategy to achieve its strategic objective of meeting the ever-increasing needs of Malta’s growing and diverse economy.

As part of this vision, the Office is embarking on a number of innovative initiatives including a new Facebook and LinkedIn page which are regularly updated with legislative highlights, updates and events. Individuals can now easily subscribe to the Office’s pages and keep abreast of the Office’s work. Investment in new technology which focuses on streamlining the work of the MTCA and taking a new technologically advanced approach to undertaking tax audits and investigations also forms an integral role in the MTCA strategy, ‘Delivering Transformation Strategic Plan 2023 – 2025 A new Strategy for Malta’s Tax and Customs Administration’.

This tangible change in the way the Office works, using the latest in data analytics, will improve efficiency and effectiveness of present resources, improving taxpayer services and meeting the demands arising from transforming the relationship of the Office with taxpayers.

Taxpayer education is foremost in meeting taxpayers’ needs and supporting their obligations and responsibilities. The MTCA has undertaken a renewed focus on providing legislative summaries, manuals and guidelines, in addition to tax clarification on issues which are pertinent to taxpayers on a regular and consistent basis.

As part of the transformation process of the MTCA, a new service will be launched in the coming months for taxpayers who – because of their relative importance in the national tax collection – are considered as large taxpayers.

The main scope of the Large Taxpayer Office (LTO) is twofold. From the taxpayer side, they will receive an improved and dedicated customer care service which will focus on their particular needs. This will be achieved by assigning a case manager who will serve as a single contact point for all types of taxation within the MTCA. From the MTCA side, the establishment of the LTO will optimise the tax compliance and payments of the large taxpayer segment including High Net Worth Individuals (HNWI) as well as the accurate and timely filing of financial statements and other documents. The case manager will handle, among other things, compliance and payments, technical queries, tax clearance certificates, processing of refunds and documents. The eligibility criteria for the LTO is based on turnover, number of employees and VAT contributions, while the basis of selection of the HNWI is declared income, shareholding in companies with a certain amount of total asset value and the total value of acquisition and sales in property during a calendar year.

MTCA is planning to hold a series of meetings with the main stakeholders to explain the concept of the LTO.

At Grant Thornton, it's simple: you do what you do best, we'll handle the rest. Let's invest in your success together.

April

• VAT Return Quarter Period Ending February 2024 –Electronic Submission 22nd April

• Recapitulative Statement Period Ending March 2024 – 15th April*

• CESOP Report for Quarter period ending March 2024 –28th April

• TA22 Part-Time Self Employment – 30th April

• TA24 15% Tax on Rental Income – 30th April

• TA25 Payment of 7.5% Tax on Royalties on Qualifying Literary Works – 30th April

• TA26 Payment of 7.5% Tax Rate for Creative Practitioners – 30th April

• RA6 – Determination of Net Profit from Student Housing –30th April

• FS5 Payer’s Monthly Payment Advice for March 2024 – 30th April

• SSC Self Employed (Class 2) payments – 30th April

• Provisional tax payments Y/A 2025 – January to April 2024 –30th April

• Company Tax Return – Financial Year ending 31st July 2023 –Manual Return Deadline – 30th April

• DAC 2 Reporting - Deadline for Financial Institutions (FIs) – FIs using XML – 30th April

• DAC 4 / CbC Reporting by Ultimate Parent Entity/ Surrogate Parent Entity –Group’s fiscal year ending 30th April 2023 – 30th April 2024

• DAC 4 Annual Notification by Local Constituent Entities –Financial year ending 31st July 2023 – 30th April 2024

• VAT Return Quarter Period Ending March 2024 – Electronic Submission 22nd May

• Eco-Tax Quarter Period January to March –15th May

• Recapitulative Statement Period Ending April 2024 – 15th May*

• CESOP Report for Quarter period ending April 2024 – 28th May

• FS5 Payer’s Monthly Payment Advice for April 2024 – 31st May

• Company Tax Return – Financial Year ending 31st August 2023 –Manual Return Deadline – 31st May

• DAC 4 / CbC Reporting by Ultimate Parent Entity/ Surrogate Parent Entity –Group’s fiscal year ending 31st May 2023 – 31st May 2024

• DAC 4 Annual Notification by Local Constituent Entities –Financial year ending 31st August 2023 – 31st May 2024

• VAT Return Quarter Period Ending April 2024 – Electronic Submission 22nd June

• Recapitulative Statement Period Ending May 2024 – 15th June*

• CESOP Report for Quarter period ending May 2024 – 28th June

• FS5 Payer’s Monthly Payment Advice for May 2024 – 30th June

• Company Tax Return – Financial Year ending 30th September 2023 – Manual Return Deadline – 30th June

• Individual Tax Return – Manual Submission and Payment – 30th June

• DAC 4 / CbC Reporting by Ultimate Parent Entity/ Surrogate Parent Entity –Group’s fiscal year ending 30th June 2023 – 30th June 2024

• DAC 4 Annual Notification by Local Constituent Entities – Financial year ending 30th September 2023 – 30th June 2024

Since 2022, the MTCA has been providing regular legislative updates summarising newly published legal notices and subsidiary legislation related to taxation. The first update for 2024 includes reference to Legal Notice (L.N.) 277 of 2023, Nomad Residence Permits (Income Tax) Rules, 2023 which clarifies the tax status of non-residents seeking to legally take up residence in Malta whilst still maintaining their foreign employment. The first update also includes reference to L.N. 296 of 2023 Tax Credit (Costs of Therapy Provided to Children with Disability) (Amendment) Rules, 2023 which increases the maximum disability allowance that can be claimed from €200 to a maximum of €500. These rules shall apply with effect from the year of assessment 2025. Further information about these and other legal notices can be found here.

* Recapitulative Statements are due on the 15th day of the following calendar month. Where the total quarterly amount (ex. VAT) is less than €50,000, the recapitulative statement is due by no later than the 15th day of the following calendar month.

The MTCA has recently published tax manuals on diverse issues affecting individual and corporate taxpayers. The manuals can be found online under the legal and technical section of the MTCA website - https://cfr.gov.mt.

Manual on the Taxation of Rental Income – Article 31D & other rental provisions of the Income Tax Act (ITA) – in line with the MTCA’s aim to encourage greater compliance, the manual outlines not only the tax obligations arising from receipt of rental income but also tax credits from properties rented to the Housing Authority and those arising from rental agreements in excess of 12 months.

Manual on the application of Tax on Income from Part-Time Work Article 90A of the Income Tax Act – summarises the salient features of part time employment both on a self-employment and employed basis. The manual includes reference to tax rates, thresholds, and deadlines for submissions.

Manual on how spouses may apply for a Separate Tax Return Article 49A of the Income Tax Act – provides a step by step guidance on how to apply and most importantly how common costs are to be divided between spouses as well as terminations of agreements.

Manual on Return Attachment Forms – summarises the use and application of Return Attachment (RA) forms presently in force. Most importantly, the manual highlights the legislative sources applicable to each RA form, thus providing taxpayers with the opportunity to further understand how specific deductions, credits and exemptions may apply to their case.

This article is written and complied by Dr Carmel Said Formosa, Senior Lecturer at the University of Malta and MTCA Technical Advisor, Legal, Policy, Technical and International Relations, with contributory articles written by Mr Nico Sciberras, Chief Tax Officer heading the VAT Legal, Policy, Technical & International Relations Section and Mr Sergio Ebejer, Director Large Taxpayer Office.

ISA 315 (Revised) ‘Identifying and Assessing the Risks of Material Misstatement’ requires auditors to obtain an understanding on the entity’s Information Technology (IT) environment and the relevant IT controls in place. Although auditors must obtain and thoroughly document this understanding in the audit file, auditors are not obliged to test the operating effectiveness of IT controls. Nonetheless, in today’s technology driven world, conducting an IT audit to ensure the integrity and security of digital systems is becoming essential for auditors when auditing larger entities to obtain sufficient appropriate audit evidence that the financial statements are fairly stated in all material respects.

IT audits bring unique challenges that demand careful consideration and strategic solutions. This article will explore some common hurdles faced in IT audits, the respective impact on financial audits and practical approaches for overcoming these hurdles.

An initial challenge in IT auditing is gaining a comprehensive understanding of the specific requirements and objectives of the audit by both the financial auditors and the IT auditors. If the financial auditors are not clear on what the scope of the IT audit is, or the IT auditors do not thoroughly understand the scope of their work, the financial auditors might be in a position whereby they are relying on the work of the IT auditors to address particular assertions with respect to particular financial statements’ line items, when, in actual fact, the work of the IT auditors would have not addressed or was not sufficient to fully address those particular assertions.

Solution: Effective Communication between the Different Members of the Audit Engagement Team

Effective communication is essential for a successful audit. It is crucial that during the planning stage of the audit, the audit engagement team discusses the audit plan (i.e. the nature, timing and extent of audit procedures) and the audit strategy (i.e. the scope, timing and direction of the audit) . The financial auditors need to be clear on what the scope of the IT audit is – the scope comprises the objectives that shall be achieved through the IT audit.

2. Challenge: Resistance from Auditees

A key challenge faced by IT auditors is resistance from entities being audited, stemming from a lack of understanding of the audit process, fear of the consequences of non-compliance or reluctance to share information.

Solution: Effective communication with Entities IT auditors should communicate the scope of the IT audit together with its implications on the financial audit with the auditees in a clear and concise manner. IT auditors should also establish a good relationship with the auditees and explain the benefits of the audit process for them.

3. Challenge: Navigating the Pace of Change

The rapid pace of technological advancements can be overwhelming, making it challenging for IT auditors to keep up with the latest developments. Moreover, the IT systems of larger entities are becoming increasingly complex. New technologies and evolving IT landscapes can quickly outdate audit methodologies and tools.

Solution: Embrace Continuous Learning

IT auditors should prioritise continuous professional development, stay informed about

emerging technologies, attend relevant workshops and conferences, and engage with IT experts. This will help them acquire the necessary competencies and keep their knowledge up to date with the latest IT standards and audit techniques. By fostering a learning culture, IT auditors can adapt the audit approach to match the ever-changing technological landscape.

Selecting the right team for the job is crucial. IT auditors should ideally have experience within that same industry, entity size and type of software used.

Financial auditors need to ensure that the IT auditors have the necessary skills and competencies to carry out the IT audit.

4. Challenge: Maintaining Independence

IT auditors may face the challenge of being perceived as integral members of the team, rather than independent evaluators. This perception can compromise the objectivity required for a comprehensive audit.

Solution: Establish Clear Roles and Emphasise Independence

Prior to accepting an audit engagement, auditors should assess whether there are any threats to independence and if appropriate safeguards can be applied to eliminate or reduce the threats to an acceptable level. If significant threats have been identified that cannot be eliminated or reduced to an acceptable level, it is prohibited to accept that audit engagement.

Furthermore, auditors should establish clear roles and boundaries from the outset of the audit. Emphasising the importance of independence in the audit process and regular rotation of audit team members is key.

5. Challenge:

In an era of escalating cyber threats, IT auditors face the challenge of ensuring robust data security and privacy measures. Protecting sensitive information and maintaining compliance with data protection regulations is crucial for entities.

Solution: Collaborate for Cybersecurity

IT auditors should assess the entities’ cybersecurity measures to ensure they are robust. Detailed

risk assessments should be conducted to identify vulnerabilities and recommend security enhancements. Moreover, staying updated with the latest data protection regulations and integrating compliance frameworks into audit processes will ensure audits align with legal requirements.

Financial auditors should discuss this area in detail with the IT auditors to assess whether there are any implications on the financial statements, both in terms of adjustments to balances and / or disclosure requirements. For example, cybersecurity threats might lead to material fines and penalties, subsequent events and might also have an impact on the going concern assumption. In fact, the going concern assumption might not remain appropriate or there might even be a material uncertainty related to going concern.

6. Challenge: Navigating Regulatory

Auditors need to consider the entity’s compliance with laws and regulations throughout the audit and assess whether there are any implications on the financial statements, both in terms of adjustments to balances and / or disclosure requirements. Similarly to cybersecurity threats, non-compliance with laws and regulations might lead to material fines and penalties, subsequent events and might also have an impact on the going concern assumption. In fact, the going concern assumption might not remain appropriate or there might even be a material uncertainty related to going concern.

Solution: Stay Informed and Collaborate

It is essential for auditors to dedicate time to stay informed about the industry-specific regulations that apply to the entity being audited. Involving legal and regulatory experts is necessary to ensure a comprehensive understanding of the regulatory landscape and compliance requirements.

7. Challenge: Optimising Limited Resources

Resource constraints, both in terms of time and budget, can hinder the effectiveness of IT audits. Balancing the need for thorough assessments and professional skepticism with practical resource constraints is an ongoing challenge.

Solution: Prioritise, Automate, and Communicate

Auditors must adopt a risk-based approach when determining the extent of audit procedures required. This means that one needs to consider the level of risk associated with that particular financial statements’ line item. A reasonable budget is to be prepared accordingly. Additionally, auditors should consider using automation tools to streamline audit processes. This reduces manual effort and enhances efficiency.

Entities often rely on third-party vendors for various IT services and solutions. However, this reliance introduces a significant challenge for IT auditors - the challenge of managing the risks associated with third-party relationships. Outsourced services and vendor dependencies can expose entities to security vulnerabilities, compliance issues and operational disruptions.

IT auditors should establish robust vendor management processes. In fact, a sample of vendors need to be selected for testing. IT auditors should assess the vendors’ security protocols, vendors’ compliance practices, and overall risk posture of the entity’s systems being audited.

IT auditors can suggest to entities to implement agreements that clearly outline security expectations, data protection requirements and incident response procedures. IT auditors can also encourage entities to proactively manage their third-party relationships by regularly monitoring and evaluating vendor performance to ensure ongoing compliance and mitigate emerging risks.

Authors

Financial auditors should obtain all the agreements that the entity would have entered into as at period end to check if there are any disclosure requirements with respect to commitments. They should also assess whether any clauses in the agreements could give rise to contingent liabilities and / or provisions. These matters should also be corroborated when assessing the going concern assumption. Financial auditors should also ensure that entities have relationships with reputable service providers with respect to anti-money laundering related considerations, and that these indeed provide the services stipulated in the agreement.

The scope of conducting an audit is to express an opinion in the independent auditors’ report on whether the financial statements are fairly stated in all material respects. If the above challenges are not tackled well, auditors risk expressing the wrong opinion, which could have both legal and reputational repercussions for auditors and might also mislead the users of the financial statements.

Navigating the challenges of IT audits requires a strategic, proactive, and comprehensive approach. By understanding the requirements of the IT audit, maintaining effective communication between involved parties, prioritising continuous learning, emphasising independence, addressing data security and privacy concerns, staying informed about regulatory complexities, optimising resources and establishing robust vendor management processes, auditors can overcome the hurdles posed by the ever-evolving IT landscape.

Malta National Risk Assessment sheds light on prevailing money-laundering risks

The Malta National Risk Assessment (NRA) for 2023 has been published, offering a comprehensive analysis of the country’s exposure to risks associated with money laundering (ML), terrorist financing (TF), proliferation financing (PF) and targeted financial sanctions (TFS). It also provides subject persons with vital insights into prevailing risks, enabling them to adapt their compliance strategies and risk mitigation approaches effectively.

This report has been formulated under the coordination of the National Coordinating Committee on Combating Money Laundering and Funding of Terrorism (NCC) following extensive collaboration with government authorities actively involved in the fight against financial crime, as well as representative bodies from the private sector, including the Malta Institute of Accountants.

A key tool in enhancing Malta’s resilience and fight against financial crime, the NRA aims to guarantee that continuous, risk-based mitigation measures align with the 2023 NRA.

In this context, it is therefore crucial for subject persons to integrate the risks outlined in this updated NRA into their risk assessment procedures, conducting thorough reviews and updates to controls, policies and procedures as necessary to address and mitigate the identified risks.

In general, the NRA reports a decline in Malta’s overall money laundering risk since 2018, indicating the efficacy of measures implemented by both authorities and the private sector. Notable improvements are evident in various industries, as a result of enhancements in mitigating measures.

The report attributes decreased risk to sectors such as accountancy and auditing, the legal persons’ sector, trust and company service providers, banking, investment services, insurance, remote gaming as well as virtual financial asset service providers. The only exception is the land-based gaming sub-sector, where the residual risk increased from medium-low to medium. Financial institutions, real estate, and high-value goods dealers also exhibit reduced risk, although these are susceptible to a higher risk of ML.

The report also underlines specific ML typologies, such as cash abuse, cash-based businesses, Maltese registered companies lacking sufficient links to Malta, complex corporate structures, and high-value movables and immovables acquisition, posing a substantially higher residual risk. Some of the higher risks identified in the 2023 NRA include risks of laundering of proceeds derived from drug trafficking, foreign organised crime, and fraud (including cybercrime). The residual risks pertaining to TF, PF, and TFS were identified to be at a moderate level.

Although the report has positively lowered down the money-laundering risk associated with the accountancy profession, the NRA highlights specific areas of vulnerability and specific areas of improvement with regards to the effectiveness of mitigating measures. For instance, one specific area where improvements are needed is in relation to ML risk understanding and risk assessment that will in turn enhance another area that was identified as being lacking in effectiveness. This refers to the quality and the quantity of the reporting of suspicious transaction and activity reporting.

These findings have to be seen specifically with respect to audit and assurance, and assisting in planning and carrying out transactions, where the vulnerability of conducting due diligence and having all relevant documents in the absence or a limited local footprint are more pronounced. This corresponds to the fact that the overall ML residual risk of the legal persons that are registered in Malta is driven by the higher weighting attributed to the lack of sufficient links to Malta.

As a result of these findings the NRA calls on accountants and auditors to take note of its conclusions, in line with their obligation at law to review and, where necessary, update, their business risk assessment and their AML/CFT framework to take it into account. Looking ahead, the NRA encourages accountants and auditors to continue investing and reviewing their AML/CFT frameworks to improve their effectiveness, including in detecting suspicions of proceeds of criminal activity to be reported to the FIAU.

The NRA adds that accountants and auditors should assess and monitor the effectiveness of their transaction monitoring measures and align to the FIAU Implementing Procedures to ascertain that these allow proper detection of transactions that may be related to national or emerging risks. Finally, accountants and auditors are also expected to ensure that assessment of the effectiveness of their transaction monitoring system also takes into consideration the submission of good quality and material STRs. While when compared to the previous review the number of STRs submitted has increased, the NRA notes that submissions from the profession remain relatively low, with only 9% of accountants and auditors submitting at least one STR and a number of the STRs submitted had an

insufficient element of ML/TF, thus ended with no disseminations/further action.

The report also sheds interesting light on the relationship between the structure of accountancy firms and the possible exposure to ML. A significant proportion of accountants and auditors who are engaged in one relevant activity covered by the PMLFTR have fewer than 50 customers. Among the registered natural persons in this category, only 2% have 250 or more customers, while 15% of the registered legal persons in this field serve 250 or more customers. A more detailed examination of the granular data reveals that natural persons, in comparison to accountants and auditors registered as legal entities, tend to have a higher number of customers per employee.

For the first time, the report also classifies tax advisors with a medium-high moneylaundering risk. The NRA indicates that given that Maltese law does not provide a definition of the activity or activities that would fall to be considered as tax advice, tax advice includes the legitimate minimisation of tax burdens, corporate reorganisation, transfer or sale of ongoing concerns, estate planning, re-domiciliation of entities and other advice on specific tax related questions, tax audit, tax planning or tax optimisation.

The NRA indicates that accountants and auditors are the largest group offering these services (49%), followed by CSPs (29%).

The NRA specifies that this sector has key vulnerabilities that drive the higher overall residual risk. The lack of ad hoc market requirements and the lack of sufficient guidance, including on international illegitimate tax planning, are key vulnerabilities. In fact, within the context of the provision of tax advice, the lack of market entry controls is considered to present a higher weight in the inherent risk analysis. There is no effective mitigating measure for this other than the fact that very few unregulated or unwarranted natural persons and/or legal persons actually provide tax advice.

Furthermore, when assessing the effectiveness of the mitigating measures, it was found that the number of reports submitted by the tax advisors to the FIAU amounts to a very small number.

In its assessment, the NRA concludes that the predominant factor contributing to this risk is primarily associated with the potential for money laundering arising from advice related to legitimate tax burden minimization, specific tax-related inquiries, tax audits, tax planning or optimization, and cross-border tax advisory services.

In this context, tax advisors are therefore urged to revise their business risk assessment and customer risk assessment methodologies to incorporate the outcomes of the NRA. Tax advisors are also encouraged to enhance their understanding and awareness of identifying red flags signalling suspicious activities related to money laundering or terrorist financing.

The NRA and company service providers

Similar to the accountants and the auditors, in this iteration of the NRA, the ML risk associated with company service providers has decreased from ‘high’ to ‘medium-high’.

It is to be noted that key vulnerabilities highlighted here include the fact that the directorship service is being offered by the same individual company service provider to a significant number of clients. This may impinge on proper oversight of the companies being serviced. The fact that you may have the same company service provider offering multiple services to the same customer may, for example, lead to cases of inadequate identification of the beneficial ownership.

Furthermore, there is also another vulnerability stemming from when a company’s share capital is paid through pooled accounts. Using pooled accounts to pay a company’s share capital can make it difficult to trace the original source of funds.

All the above vulnerabilities are more pronounced when one takes into consideration the fact that company service providers have limited visibility on their customers’ activity due to such companies operating overseas and having a limited local footprint.

It is to be noted that the ‘medium-high’ residual risk in this sector is driven mainly by the threat of abuse of Maltese registered legal persons with no sufficient links to Malta for ML/TF purposes or concealment of beneficial ownership when providing only services of a registered office, when providing the services of formation of legal persons, and when acting as, or arranging for another person to act as, a director of a legal person. The latter has a ‘medium-high’ inherent risk. The former two have a ‘high’ and ‘mediumhigh’ residual risk and have to be seen in line with the ‘medium-high’ residual risk rating in the legal persons’ sector where it is explained that the main gatekeepers to mitigate the risk of misuse of legal persons for foreign tax crime purposes are the company service providers. The NRA explains that major improvements are needed in the company service providers’ risk assessment that will further lead to a higher quality of STRs.

Subject persons are to revisit their risk assessments to take into consideration the results of this NRA. During this process, they are encouraged to give due consideration not only to their section, but also to the sections pertaining to ML, TF, PF and TFS, and also the section on legal persons.

The full version of the NRA 2023 is available through this link

Author Dr Pauline Saliba is the Executive Secretary of NCC. After spending fifteen years in the Economic Policy Department of the Ministry for Finance, in 2019, Dr Saliba took a position as a senior manager within the NCC Secretariat. In 2020, Dr Saliba was promoted to Chief Economics Officer and held this position until she took her role as Executive Secretary and Head of the Secretariat in February 2023. Dr Saliba graduated with a Bachelor of Commerce with Honours in Economics. Subsequently, she read her Master of Science degree in Development Finance. In 2018, Dr Saliba defended her doctoral thesis entitled “The Role of the EU’s Official Development Assistance (ODA) in Fostering Economic Growth in Sub-Saharan African Countries.

RSM Malta is a member of RSM International; a world wide network of independent professional services f irms, providing audit, tax, and specialist advisory servi ces to ambitious growing organisations around the g lobe. It strives to be the middle market leader in sustainable busin ess practices that drive positive future for its fi rm, clients, colleagues and communities.

The company takes a multi-faceted approach when it comes to advising clients. This includes having conversations with co mpany boards and business leaders to support them in the planning as well as execution of their business journey, always with the objective of being more ES G-ready.

RSM MALTA PRIDES ITSELF ON LEADING BY EXAMPLE, INTEGRATING ESG PRINCIPLES INTO ITS OWN OPERATIONS AND CORPORATE CULTURE. WHEN IT COMES TO THE ENVIRONMENTAL ASPECT, THE FIRM IS HEAVILY INVESTED IN ALLEVIATING THE IMPACT OF ITS OPERATIONS ON MALTA’S ENVIRONMENT.

We delve into the business, identifying the “material” elements.

We assess the current practices, examining how the business manages its ESG impact.

Compliance with Legal Standards

We compare such operations with ESRSs mandated by the law and we map the

“We start off by understanding our client and then preparing a plan that would help them address any potential lacunas in their operations. We propose the introduction or incorporation of the right ESG practices for them, helping them assess costs and opportunities. Then we guide them through digitalisation, the evolution of their business model, reassessment of their operational models and future plans, as well as their overall dynamics with the stakeholders.”

We pinpoint the gaps - the initial stride towards sustainable transformation.

The initial stride towards sustainable transformati

George Gregory Managing Partner of RSM

George Gregory Managing Partner of RSM

Malta

Our unique differentiator that truly sets us apart mpany specialising in testing, inspection, and certification services. We advise several clients on ESG matters through a variety of services, helping them measure their status quo using the European Regulatory Landscape as a framework. Then, we help them embark on their journey to become ESG-ready by the time the regulatory requirements become active”.

We are starting to see the impact of our poor management of the planet and its resources everywhere and this is just the beginning. Scientists have been ringing alarm bells for decades, but governments’ and business’ responses remained grossly below par. The latest report of the EU’s Scientific Advisory Board on Climate Change outlines that “based on an assessment of more than 80 indicators, it found that more efforts are needed across all sectors to achieve the EU climate objectives from 2030 to 2050”.

From a more subjective perspective, the latest Global Risks Report 2024 of the World Economic Forum notes that environmental risks dominate the risks landscape. This shows that awareness is growing, but not necessarily that the problem is being managed as it should. Professional accountants have a key and historical role to play in providing measurement, transparency and assurance that is indispensable to change.

The Corporate Sustainability Reporting Directive Markets need meaningful, comprehensive and reliable information on sustainability impacts to make sustainable decisions. This is why the European Union Corporate Sustainability Reporting Directive (CSRD) is a critical piece of legislation for the profession. It aims to bring sustainability reporting on the same footing as financial reporting. The CSRD requires companies to report the information necessary to understand the company’s impacts on sustainability matters and how they affect the company’s development, performance and position. The information must be provided in accordance with the European Sustainability Reporting Standards (ESRS), which use a double materiality lens and include information on own business operations as well as the value chain.

The ESRS cover environmental, social and governance issues, including climate change, biodiversity and human rights. They are a muchneeded step forward in the harmonisation of reporting practices and as a catalyst to providing relevant, comparable and ultimately verifiable sustainability-related information. Despite resulting from EU regulation and being novel, ESRS reporting must not be seen as a compliance exercise. Reporting is a key enabler of a sustainable transition, and transitioning to sustainable and just business practices and ways of life is a strategic imperative for humankind and the planet. Governments and companies that slow down or impede this change will bear an unprecedented responsibility and will shortly lose their relevance and legitimacy.