creating supportive cultures and telling accounting’s story

What employers should understand about today’s accounting students

Are you ready for your next peer review?

MAY | JUNE 2023

VOLUME 15 |

EDITOR

Jessica Salerno-Shumaker –jsalerno@ohiocpa.com

GRAPHIC DESIGN

Kyle Anderson – kanderson@ohiocpa.com

EDITORIAL OFFICES

CPA Voice 4249 Easton Way, Suite 150 Columbus, OH 43219

Tel: 614.764.2727

Email: CPAVoice@ohiocpa.com

Website: www.ohiocpa.com

ADVERTISING

For our display advertising rates or a copy of our media kit, contact us at sales@ohiocpa.com or by call 614.764.2727

ARTICLE SUBMISSIONS

We welcome submissions of analytical articles on issues relevant to Ohio CPAs. Desired length is 800-1200 words. Send an electronic copy with a cover letter to the editor at the email address above. Please note that CPA Voice is not a peer-reviewed journal.

SUBSCRIPTIONS/CIRCULATION

Members of The Ohio Society of CPAs receive CPA Voice as a member benefit. Nonmembers may subscribe for $39.95 annually. To update your mailing address or to subscribe to CPA Voice, contact your Member Service Center at 614.764.2727, option 2.

REPRINTS

To order reprints of CPA Voice articles, or for reprint permission, contact the editor at the address above.

CPA Voice is the official magazine of The Ohio Society of Certified Public Accountants. CPA Voice’s purpose is to serve as the primary news and information vehicle for the nearly 21,000 Ohio CPA members and professional affiliates. Articles are reviewed for technical accuracy. However, the materials and information contained within CPA Voice are offered as information only and not as practice, financial, accounting, legal or other professional advice. While we strive to present accurate and reliable information, The Ohio Society of CPAs makes no warranties regarding the accuracy of the information provided herein. Readers are strongly encouraged to conduct appropriate research to determine the accuracy of the information provided and to consult with an appropriate, competent professional adviser before acting on the information contained in this publication. The statements of fact, thoughts, advice and opinions expressed in CPA Voice are those of the authors alone and do not represent or imply the positions, opinions, nor endorsement of The Ohio Society of CPAs or of its publisher, editors, Board of Directors, or members. It is our policy not to knowingly accept advertising that discriminates on the basis of race, religion, gender, age or origin. The Ohio Society of CPAs reserves the right to reject paid advertising in its sole discretion. We do not necessarily endorse the resources, services or products unrelated to The Ohio Society of CPAs that may appear or be referenced within CPA Voice and make no representation or warranties about those products or services or the accuracy and claims regarding those products and services. Advertisers and their agencies assume liability for all advertisement content and responsibility for all claims resulting from such advertisements made against The Ohio Society of CPAs. The Ohio Society of CPAs does not guarantee delivery dates for CPA Voice and disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delivery delays.

CPA Voice (ISSN 0749-8284) is published six times per year by The Ohio Society of CPAs, 4249 Easton Way, Suite 150, Columbus OH 43219, 614.764.2727. Subscription price for non-members: $39.95.

Copyright © 2023 by The Ohio Society of CPAs; all rights reserved. No part of the contents of CPA Voice may be reproduced by any means or in any form, or incorporated into any information retrieval system without the written consent of CPA Voice Permission requests may be sent to the editor at the address above. While care will be given to all materials submitted for publication, we do not accept responsibility for unsolicited manuscripts, and they will not be returned unless accompanied by a self-addressed postage prepaid envelope.

Periodicals postage paid at Columbus, OH and at additional mailing offices. POSTMASTER: Send address changes to: CPA Voice The Ohio Society of CPAs, 4249 Easton Way, Suite 150, Columbus OH 43219.

MAY | JUNE 2023 | 1 CONTENTS in depth feature 2 CEO letter 3 Self-assessment exam Free for members! 4 Ohio House votes out $88B state budget bill, OSCPA sees movement on key issues impacting accounting OSCPA made its presence known at the Ohio Statehouse this spring. 6 Reaching your career goals when you’ve lost motivation Facing obstacles in your life doesn't have to stop you from achieving your dreams. 8 Supplier Diversity: What it is and why it matters for your business Introducing diversity into your supply chain in a smart business decision. 10 Are you ready for your next peer review? Peer review is facing new challenges. 16 What employers should understand about today’s accounting students Employers need to understand the unique attributes of the young professionals entering the workforce. 26 How to be strategic about your next big technology investment Thinking ahead to how your technology will adapt in the future is critical. 31 Learning events at a glance 20 Talent retention: Creating supportive cultures and telling accounting’s story The impact of the accounting profession's talent shortage has elevated the need to create stickier cultures that both attract and retain people.

ISSUE

3

A profession of change

There’s no doubt about it- we are at an exciting time in our profession. The rapid pace of technology combined with thoughtful discussions of growing the pipeline and strengthening the workforce make this moment a critical one for the future of accounting.

This is a profession of change. This is the profession that businesses turn to when they need to evolve, that people seek out when they want a career of opportunity and that history has shown can offer expert guidance in tough times. But the truth that sometimes gets overlooked is that in order to be all of those things, accounting has had to reinvent itself over and over again. Accounting is not immune to the growing pressures of the business world; however, it is rising up and meeting the demands of the future. Reinvention is at the core of who CPAs and accountants are, along with trust and integrity.

Part of those demands means sharpening skills and learning to keep up, which is why OSCPA is so heavily invested in workforce development for the profession. We are committed to acting as a convener for groups coming together to solve the talent crisis and held a Town Hall at Columbus State Community College in March dedicated to the issue. Find out more about workforce development and how OSCPA is making a difference by listening to our dedicated series, The State of Business, available now wherever you get your

2 | CPA Voice

A WORD from our CEO

podcasts. In September we will expand our efforts with another event in Columbus. If you’re interested in participating, please contact Tiffany Crosby, at tcrosby@ohiocpa.com .

And while you’re learning more about workforce development, don’t forget we have quality learning available for you whenever you need it. Coming this summer are Town Halls, the Women, Wealth and Wellness Conference, and in September you can attend our in-person CORECon – Core Skills Conference in Cleveland.

What are you most excited about for the future of the profession? I’d love to hear from you.

Self-Assessment Exam

SCOTT D. WILEY President and CEO

Log in to my.ohiocpa.com, look up the exam using the product ID number above and answer the 12 required questions based on content in CPA Voice.

Cost Members Free

Nonmembers

$40

Exams remain available online – and may be completed for CPE – through the same month of the following calendar year.

MAY | JUNE 2023

Product ID: #58499

Online Instructions

1. Log in to my.ohiocpa.com

2. Search "CPA Voice" and then find the appropriate exam.

3. If you're a member, click "Enroll." If you're a nonmember, click "Add to cart" and purchase the exam.

4. On the Confirmation Page click “Go to your learning center.”

5. The exam will be available under the "Current" section. Turn off pop-up blockers, then click "Launch."

Self-Assessment Exam Results

Respondents taking the exam online receive their results immediately. Respondents who pass with a grade of 70% or better receive one hour of CPE credit in specialized knowledge, as approved by the Accountancy Board of Ohio.

MAY | JUNE 2023 | 3

swiley@ohiocpa.com | 614.321.2218 (o ce) | 614.546.9430 (cell) Twitter: @ScottDWiley | LinkedIn: www.linkedin.com/in/scottwileycae

Ohio House votes out $88B state budget bill, OSCPA sees movement on key issues impacting accounting

The Ohio House in late April passed House Bill 33, Ohio’s massive biennial budget legislation for fiscal years 2024-2025, by a wide margin, officially sending the bill to the Senate.

Included in the bill are several OSCPA priorities such as conforming state to federal law on bonus depreciation, as well as provisions targeting improving Ohio’s workforce priorities.

A top priority of the House was to keep chipping away at Ohio’s personal income tax rates and brackets in the budget bill. While their goal of a flat tax rate was not achieved, House leaders did eliminate another tax bracket, cutting costs for low- and middle-class Ohioans. In the bill’s current form, the revised budget bill would keep the level at which Ohioans would not pay any income tax up to their first $26,050 of income. It also would eliminate a middle-class tax bracket, with the result that lower- and

middle-income Ohioans making up to $92,150 per year would pay the same reduced income tax rate – 2.75%. The House didn’t change the top two rates.

Numerous Senate hearings will take place on this 4,600page bill chock full of funding and public policy issues. Per the Ohio Constitution, the final budget bill must be signed into law by Gov. DeWine before July 1.

While the budget bill continues to progress through the Ohio legislature, OSCPA made its presence known at the Ohio Statehouse this spring.

Deduction of Bonus Depreciation and Expensing Allowances. House Bill 116 seeks to amend R.C. 5747.01

4 | CPA Voice

ADVOCACY in focus

OSCPA staff report

to allow taxpayers to deduct in a single year the full bonus depreciation and enhanced expensing allowances the taxpayer deducts for federal income tax purposes. The bill creates an election allowing taxpayers to eliminate the addback and phase out subtraction. The sponsors are State Rep. Bob Peterson (R-Washington Court House) and State Rep. Thad Claggett (R-Newark). OSCPA provided proponent testimony in favor of H.B. 116 on April 18. H.B. 116 was amended into H.B. 33 (the budget bill) prior to passing the Ohio House.

Municipal Notices and Late Filing Fees. House Bill 105 places limits on late filing notices and penalties. H.B. 105 is sponsored by State Rep. Jim Thomas (R-Jackson Twp.), and OSCPA provided proponent testimony in favor of H.B. 105 on March 28. H.B. 105 was amended into H.B. 33 (the budget bill) prior to passing the Ohio House, along with another OSCPA priority that would extend the due date for filing municipal net profits tax returns from Oct. 15 to Nov. 15.

Municipal Net Profits Tax Safe Harbor. House Bill 121 allows businesses with remote and hybrid employees or owners to use a modified apportionment formula if they

choose to make the election. The bill is sponsored by State Rep. Monica Robb Blasdel (R-Columbiana) and State Rep. Adam Mathews (R-Lebanon). In proponent testimony on April 25, Greg Saul, CAE, Esq., OSCPA director of tax policy said this “relieves the administrative burden for many taxpayers” by situsing the net profits to the remote worker’s regular reporting location at the employer’s place of business.

BID and Guaranteed Payments. House Bill 138 classifies certain pass-through entity payments as business income. Its sponsors are State Rep. Angie King (R-Celina) and State Rep. Tom Young (R-Washington Twp.). OSCPA offered proponent testimony on May 2. It would classify guaranteed payments paid to pass-through entity (PTE) investors, regardless of their ownership interest, as “business income” and therefore eligible for the business income deduction and flat income tax rate. Currently, ODT only treats guaranteed payments received by 20% or more owners as business income.

Please be sure to keep following the OSCPA Advocacy webpage for more updates.

MAY | JUNE 2023 | 5

Reaching your career goals when you’ve lost motivation

By Jessica Salerno-Shumaker, OSCPA senior content manager

While facing obstacles in your professional and personal life is inevitable, these challenges don’t have to stop you from achieving your dreams.

“Everyone has been through deeply challenging experiences in their life,” said Bevin Farrand, executive coach, professional speaker and founder of the Take the DAMN Chance Movement. “And those can make it hard to move forward on our big goals.”

Farrand is the keynote speaker at the July Women, Wealth and Wellness Conference, presenting her session, “Take the DAMN Chance.” She’ll share how she persevered through some of the most challenging obstacles in her life to bring her dreams to reality.

“I understand that feeling of when something happens, whether it's in your personal or your professional life, asking yourself if you should just stop and accept status quo,” she said.

To get through challenging times and still meet your goals, Farrand recommends applying something she calls the “DAMN Framework.” It stands for:

• Decide and declare

• Attend your own party

• Moments not minutes

• Now is the time

The two big elements of “DAMN Thinking” are movement over mindset and decide and declare. Movement is more important than mindset, she said, because instead of waiting around to get in the right mindset to achieve something, you can begin making progress, however small it might be.

Farrand calls this type of progress “micro-actions,” which are the smallest possible actions you can take. It might mean sending an email, or even typing the first sentence of the email. Because eventually those micro-actions will build momentum.

And if you still find yourself stuck, Farrand says to think about priorities. You might not have the clarity that’s

needed, but once you know your top priorities you can begin to work toward achieving those goals.

“We hear all the time you have to fix your mindset first, and that thinking positive thoughts will make good things happen,” Farrand said. “We can never get to a point where we only think positive thoughts. But we can get into action no matter what our mindset is.”

This allows inspiration and creativity to flow from action, she said, as opposed to waiting around for the right mindset to strike. She compared it to pushing a merry-go-round on the playground.

“Once we get our feet moving, then the momentum starts to pick up,” Farrand said. “Those first few steps are the hardest and take the most energy and focus. But once you get into motion and jump on, you’re spinning, and the momentum keeps you going.”

Go to ohiocpa.com/www to register for the July 20 Women, Wealth & Wellness Conference.

Jessica Salerno-Shumaker, OSCPA senior content manager

6 | CPA Voice CAREER center

Land the perfect professional connection

Whether you’re still basking in the glow of passing your CPA exam, a mid-level manager who needs a change, or a seasoned CFO who wants top talent, the OSCPA Career Center is your one-stop-shop to uncover rewarding careers and discover untapped talent.

Employers:

• Post jobs

• Review resumes

• Screen candidates

• Expand your reach with enhanced posting options

• Explore our recruitment and retention resources

Job Seekers:

• Search for jobs

• Customize your job alerts

• Post resumes anonymously

• Save resumes and cover letters on your dashboard

• Access videos and articles on interviewing, resume writing and more

• Get free interview coaching via email or more personalized coaching for a fee

For more info, visit ohiocpa.com/career-center

MAY | JUNE 2023 | 7

DIVERSITY, equity & inclusion

Supplier Diversity: What it is and why it matters for your business

By Jamie Ousterout

By Jamie Ousterout

Diverse suppliers are procurement partners that are majority owned and operated (51%+) by individuals belonging to underrepresented or historically marginalized groups, including women, people of color, veterans, people with disabilities, and members of the LGBTQ+ community. These businesses offer organizations convenient and profitable paths towards building more robust, agile, and competitive supply chains. Diverse suppliers can also have an outsized impact on your organization’s bottom line and the strength, unity, and success of your local community.

Supplier Diversity and Your Bottom Line

Sure, smaller businesses benefit from partnerships with larger organizations, including increased revenue and higher visibility. However, supplier diversity also helps larger, more established businesses improve their innovation, revenue, and brand reputation. Let’s dive deeper into the business case for supplier diversity by examining exactly how these partnerships can boost your business’ success.

1) Diversity drives valuable competition in the supply chain

It’s no secret that competition breeds advancements, improvements, and innovation. Your supply chain is no different.

When given the opportunity, diverse and small businesses are often able to compete with their larger competitors with advantageous pricing, new and innovative solutions to common inefficiencies, and boutique-style customer service, attentiveness, and care. These advantages also force more prominent players in your supply chain to improve their product quality, reduce costs, and increase the value of their offers to maintain their market share.

2) Diverse suppliers introduce flexibility, resilience, and adaptability to your supply chain

The COVID-19 pandemic and ensuing supply chain disruptions have made a clear and compelling case for

8 | CPA Voice

Strategically introducing diversity into your supply chain isn’t just a social good – it’s great for your business, too.

organizations around the globe to invest in building supply chains that are resilient, agile, and diversified.

In fact, 93% of surveyed senior supply chain executives named improving the resiliency and agility of their supply chains as their number one tactic for returning to and maintaining normalcy in a post-pandemic business landscape.

Why? Because supply chain resiliency is essential for minimizing unexpected disruptions and avoiding painful supply-and-demand shock cycles.

Local businesses, small businesses, and other diverse suppliers often represent ideal fits for enhancing the resiliency and adaptability of an organization’s supply chain. Their nimbleness and agility make diverse suppliers ideal partners for organizations looking to avoid the unexpected disruptions, ballooning expenses, and unreliable quality that have become increasingly common among large, multinational suppliers in recent years.

3) Partnering with diverse suppliers can significantly boost your organizational reputation

Shining a spotlight on your diverse supply partners can be a boon for your organization’s reputation.

According to a recent report from McKinsey & Company, more than 65% of American consumers report using their social values to guide their shopping decisions and habits. Highlighting your organization’s commitment to creating a fair, equitable, and inclusive business landscape can help drive positive brand recognition, grow consumer loyalty, increase market share and support overall growth.

Supplier Diversity Certification

Verifying potential supply partners’ diversity status should be a non-negotiable step during your organization’s vetting process.

Diversity certifications are granted by third-party certification firms that verify businesses’ diversity status using a combination of document reviews, employee and owner interviews, and even on-site visits. These certifications are invaluable for companies that want to ensure the advancement of their DEI goals and avoid unscrupulous organizations looking to drive business with inaccurate diversity claims.

The most common diverse business certification agencies include:

• United State Hispanic Chamber of Commerce (USHCC)

• Women’s Business Enterprise National Council (WBENC)

• National Gay & Lesbian Chamber of Commerce (NGLCC)

• National Minority Supplier Development Council (NMSDC)

• U.S. Business Leadership Network (USBLN)

• Native American Chamber of Commerce (NACC)

• Vets First Certification Program (VFCP)

• Asian Pacific American Chamber of Commerce (APAAC)

Supplier Diversity and Your Community

If improving your bottom line isn’t enough to convince you to improve the diversity of your organization’s procurement partners, you’re in luck. The benefits, advantages, and perks of supporting supplier diversity extend well beyond your bottom line.

According to U.S. Census data, roughly 18% or 1 million businesses are owned and operated by minorities in the United States; women own an additional 20% (1.1 million). Creating strong markets that empower these diverse business owners to compete, grow, and thrive is crucial for stimulating further business ownership growth within these historically disadvantaged communities.

Diverse suppliers also provide jobs, advancement opportunities, and professional development to underserved communities, creating valuable economic activity and providing sustainable paths toward financial security and freedom for millions of American workers.

By partnering with diverse suppliers, organizations support veterans, women, minorities, individuals with disabilities, and members of the LGBTQ+ community in their missions to uplift and serve historically underserved communities and economically disadvantaged areas. Investing in business practices that minimize barriers to entry for minority and small business owners moves us all toward a more equitable, profitable, and inclusive future.

The Diversity Movement Library is your trusted source for thousands of up-to-date resources, including how-to guides, FAQs, webinars, articles, podcasts and more. Find out more at thediversitymovement.com/library

MAY | JUNE 2023 | 9

Jamie Ousterout is a Certified Diversity Executive and as the vice president of client success at The Diversity Movement.

Are you ready for your next peer review?

By Laura Hay, CPA, CAE, OSCPA executive vice president

By Laura Hay, CPA, CAE, OSCPA executive vice president

10 | CPA Voice AUDIT & assurance

Peer review update

The profession’s peer review program, which leads the charge in audit quality, has faced new challenges in a pandemic environment, changing work methods, how technology is applied, standard-setting areas of focus and engagement risk profiles.

As part of the AICPA’s Enhancing Audit Quality Initiative (EAQ), AICPA technical committee leads identify annual areas of emphasis for the AICPA Peer Review Program. When monitoring your firm’s quality control system and preparing for your next peer review, 2023 areas of focus include the following.

Risk assessment

Continued from prior years, noncompliance with SAS No. 145 and its changes to AU-C 315, Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement, remains a priority, particularly due to increasing fraud risks in the current environment.

SAS No. 145 introduced inherent risk factors and new requirements to consider those factors that affect an assertion's susceptibility to material misstatement. A common misconception is that sufficient procedures can be performed to support the audit opinion, particularly for a smaller entity, without a consideration of risks or how audit procedures are linked to those risks.

Frequent peer review issues seen in this area include:

• Risk assessment is limited or non-existent

• No linkage between assessed risks and responsive audit procedures

• Improper use of third-party practice aids

• Setting control risk at less than high without testing the effectiveness of controls

• Performing risk assessment at the audit level rather than at the relevant assertion level

• Not properly identifying or documenting risks and controls associated with the role of IT

• Not documenting fraud risk assessment procedures regarding inquiries with those in charge of governance and responses to management override of controls

For peer reviews starting on or after Sept. 30, 2021, pervasive risk assessment non-conformity will not

necessarily be limited to a peer review finding, as it was during the standard’s initial implementation phase. The reviewer would need to assess if any pervasive nonconformity related to risk assessment should be a deficiency or a significant deficiency.

For more information, see AICPA’s Risk Assessment Toolkit at: https://www.aicpa-cima.com/topic/auditassurance/riskassessment.

Quality management

Statement on Quality Control Standards (SQCS) No. 8, A Firm’s System of Quality Control (Redrafted) (AICPA, Professional Standards, QC sec. 10), requires every CPA firm with an accounting and auditing practice, regardless of its size, to have a system of quality control. The objectives of the firm’s system of quality control are to ensure that (1) the firm and its personnel comply with professional standards, legal and regulatory requirements, and (2) reports issued by the firm are appropriate in the circumstances. Firms accomplish these objectives by establishing and maintaining policies and procedures related to several elements of quality control.

On May 12, 2022, the AICPA Auditing Standards Board voted to issue Statement on Quality Management Standard (SQMS) No. 1, A Firm’s System of Quality Management, SQMS No. 2, Engagement Quality Reviews, and Statement on Auditing Standards (SAS) No. 146, Quality Management for Engagements Conducted in Accordance with Generally Accepted Auditing Standards (conforming changes are also being adopted to SSARS.)

The new quality management standards (QM) adopt a riskbased approach requiring firms to customize the design, implementation and operation of their system of quality management, tailored to the firm and its engagements. The QM standards include a new risk assessment process for the firm, enhanced monitoring and remediation requirements, and an explicit responsibility of firm leadership to proactively manage quality.

SQMS No. 1 is required to be implemented by Dec. 15, 2025. The firm is required to evaluate its system by Dec. 15, 2026, and annually thereafter. SQMS No. 2, SAS No. 146 and SSARS No. 26 will be effective for audits and engagements for periods beginning on or after Dec. 15, 2025.

The transition process should be started now as implementing the new QM standards will take time. Initial steps include developing a comprehensive understanding of the standards and conducting the firm’s initial risk assessment. Peer reviewers can be a great resource in helping firms develop an understanding of how the standards should be applied.

MAY | JUNE 2023 | 11

2023

Resources, including an executive summary of the QM standards and a crosswalk from the quality control standards, are available at: https://www.aicpa-cima.com/ topic/audit-assurance/quality-management.

Single Audit

Single Audits remain a focus area for 2023 as significant federal relief funding in response to the pandemic will continue to be expended by recipients. Many first-time auditees are expected to require Single Audits, and the profession is focused on both supporting auditors with the resources they need to perform high-quality work, as well as raising awareness with auditees about the importance of selecting a qualified auditor in this area.

Single Audits are complex, highly specialized audits focused on compliance with federal laws or regulations (and internal controls to ensure compliance) that apply to specific federal funds and require the financial statement audit to be performed under Government Auditing Standards (GAS) and additional requirements issued by the U.S. Government Accountability Office (GAO). If the firm performs a Single Audit engagement, it will be required to have a System Review, which includes a review of at least one Single Audit engagement.

More information is available at: https://us.aicpa.org/ interestareas/governmentalauditquality.

ESG attestation

In response to user demands and emerging regulatory requirements, entities are increasingly reporting on their environmental, social and governance performance indicators in addition to financial reporting measures. In the interest of quality, comparability and consistency in reporting such information, there is a need for assurance

services over this information and the systems and processes used to generate it. As a newer area for attestation in the U.S., these attestations present new risks and opportunities for the profession.

For more information, see: https://www.aicpa-cima.com/ topic/sustainability-esg/sustainability-esg-greater-thansustainability-assurance.

Technology-enabled auditing

Auditing techniques enabled by technology, including data analytics, remote auditing and the use of computerassisted auditing, introduce new approaches and risks. New applications of audit evidence, including gathering evidence remotely, put additional focus on gathering sufficient appropriate information to support the auditor’s report.

Several continuing education courses are currently available addressing remote auditing and audit evidence.

Additional areas of focus

In addition to the EAQ areas of emphasis for 2023, the following deserve attention in your preparation.

• Digital assets – knowing the appropriate accounting and audit risks in evolving and complex circumstances. The AICPA’s Digital Assets Working Group continues to develop nonauthoritative accounting and auditing guidance including a Practice Aid.

• Documentation – still the most common peer review issue. Per AU-C 230, Audit Documentation, documentation should be sufficiently detailed to give experienced auditors who were not previously involved in the audit a clear understanding of the work performed, the evidence obtained, and the conclusions reached.

12 | CPA Voice

The Future is in Their Hands. And Yours.

Support

Your generous support:

Welcomes the next generation to our profession with programs and college scholarships.

Introduces students to the bene ts and values of becoming a CPA. Contributes to leadership development programs that enable students to enter the workforce prepared for success.

MAY | JUNE 2023 | 13

Thank you, your gift makes all the difference! the future of the accounting profession by making a gift to The Ohio CPA Foundation or by contributing online at www.ohiocpafoundation.org.

Encourages people of all backgrounds to pursue accounting careers so the profession better re ects the communities it serves. www.ohiocpafoundation.org

• Revenue recognition – the evaluation of risks, controls and procedures related to estimates must be documented even if adopting the new standard did not materially affect accounting recognition.

• Code of professional conduct – certain understandings need to be documented, including a written understanding regarding nonattest services and management’s responsibilities for the services provided.

• Accounting and reporting – additional frequent issues include:

- Disclosing the date through which subsequent events were evaluated

- Correctly classifying long-term debt and cash flows, presenting gross amounts instead of net, and identifying non-cash transactions on the cash flow statement

- Performing sufficient procedures and sufficiently documenting procedures to obtain assurance on fair value measurements

- Following the financial reporting model for not-for-profit financial statements in accordance with recent professional standards

- Following the reporting requirements of recent auditor reporting standards.

Laura Hay, CPA, CAE, is the executive vice president of The Ohio Society of CPAs and the staff liaison to the Accounting, Auditing, Professional Ethics Committee and Peer Review Committee. She can be reached at Lhay@ohiocpa.com or 614.321.2231

Interested in becoming a peer reviewer?

If you have been thinking about adding peer review to your practice, or if you are interested in becoming a peer review Team Captain or committee member, please reach out to your reviewer or the OSCPA staff team for further information. Benefits include positioning your firm as a leader in technical expertise, adding another type of service for your firm, gaining leadership experience and learning and sharing best practice information with clients.

THREE THINGS

1. SAS No. 145 introduced inherent risk factors and new requirements to consider those factors that affect an assertion's susceptibility to material misstatement.

2. Single Audits remain a focus area for 2023 as significant federal relief funding in response to the pandemic will continue to be expended by recipients.

3. New applications of audit evidence, including gathering evidence remotely, put additional focus on gathering sufficient appropriate information to support the auditor’s report.

14 | CPA Voice

To register, go to OSCPA has strategic partnerships with other organizations to bring you relevant, high-quality learning content in these specialized industry areas: Specialized Learning Designed With You in Mind ohiocpa.com/featured June 14, 2023 8:30 a.m. – 12:30 p.m. Real Estate Tax Conference 4 credits TX June 22-23, 2023 8:00 a.m. – 5:10 p.m. Health Care Industry Conference 16 credits MULTIPLE August 2, 2023 8:00 a.m. – 12:50 p.m. Cannabis Conference 5 credits MULTIPLE December 7, 2023 8:00 a.m. – 4:00 p.m. Not-for-Profi t Conference 8 credits MULTIPLE or call 614.764.2727 (option 2 for Member Services) Register by Aug. 1, 2023 and save $50 New branding/new time/same great content! Fraud is constantly evolving, are you prepared for what the future holds? ohiocpa.com/Fraud Aug. 29, 2023 Virtual 8:30 a.m. – 2:30 p.m. 6 credits MULTIPLE

MAY | JUNE 2023 | 15

Hackers attack every 39 seconds, causing organizations to lose 5% of revenue annually.

What employers should understand about today’s accounting students

By Colleen Sump, Portland State University School of Business

By Colleen Sump, Portland State University School of Business

16 | CPA Voice BUSINESS management & strategy

These young professionals, who were born after 1996, will make up 30% of the workforce in just a few short years. To successfully attract, recruit, and retain this talent pool, employers need to understand the unique attributes and preferences of these young professionals who have come of age in a rapidly changing and technological world. While juggling high school and college, Gen Z students experienced a global pandemic, political and civil unrest, a growing climate emergency, school shootings, and various economic crises. These challenges shaped and influenced what this generation not only wants from their careers, but what they want from their lives, including career growth opportunities, competitive compensation, a healthy worklife balance, and a strong company culture that reflects their values.

Career growth and professional learning opportunities

This generation is interested in upskilling and has a strong desire to stay relevant so they can advance as quickly as possible. The pandemic has strengthened their ability to learn on their own, but they also expect to be coached and trained at work. More specifically, accounting Gen Zers see a future world of work that is connected and transformed by technology, so they want access to training in new technologies and to be seen as the early adopters within their organizations. They are also looking for career development to be personalized since they have grown up with customized experiences, from playlists to newsfeeds. For employers - Create mentorship programs, offer online certifications and courses, and encourage attendance at conferences and seminars. Train your managers to be coaches. Consider having “stay” interviews instead of “exit” interviews. Provide real-time feedback rather than orchestrated performance reviews.

Competitive compensation

Salary has always been a major determining factor as emerging professionals weigh job opportunities, but today’s students are much more financially savvy due to the abundance of information at their fingertips. Right now, a top concern for early professionals is how rising inflation is outpacing salary growth. Financial stability is an important factor for many students who choose the accounting field,

so they are concerned about the current inflation situation and salaries keeping up with their ability to lead the lives they were expecting.

Gen Zers also understand that compensation means a lot more than a paycheck. In addition to the traditional benefits like retirement, vacation, and health insurance, this generation is interested in additional perks like financial guidance, student loan assistance, tuition reimbursement, parental leave, backup caregiving options, and most importantly, benefits that directly affect mental health and well-being. Gen Z has grown up in tumultuous times and they understand that their physical, mental, and social well-being directly affects their ability to thrive at work and at home.

For employers – Think outside the box regarding compensation. When a candidate is weighing their options, this may be what convinces them to choose your offer.

Healthy work-life balance

This sentiment is shared by many Gen Zers who point to flexibility as a major factor contributing to a good work-life balance. Gen Z understands that in today’s connected world, work doesn’t necessarily start and stop at pre-determined times. They want flexibility in taking time off, working remotely, and determining for themselves how to balance their personal and work lives, as long as they meet their employer’s expectations.

For students going into public accounting, the rigorous schedule during the busy season is expected and the trade-offs are understood, but firms should take note of this generation’s desire for a healthy work-life balance if they want to retain them past the first few years of employment.

For employers - Provide as much flexibility as possible, with options for remote or hybrid work.

Strong company culture

Gen Zers are drawn to employers with strong values and a sense of purpose. They care about environmental sustainability, wealth inequality, social justice, and corporate ethics. As the most diverse generation to enter the workforce, Gen Zers want employers to be able to articulate what DEI looks like in the day-to-day of their firm or business and not just have DEI as a part of their mission

MAY | JUNE 2023 | 17

The accounting profession is seeing a lot more of Gen Z, the first digital native generation to enter the workforce.

statement. They value action over promises, so employers need to show evidence they are actively working on their DEI initiatives while also recognizing the work will be ongoing and ever-changing.

Because Gen Z is mission-driven, they are interested in doing meaningful work for organizations that reflect their personal ethics. They are taking action on matters that are important to them and not waiting for change to happen. Employers that also make efforts to create positive impacts on society will benefit from having these young professionals want to work for their organizations.

For e mployers – Clearly communicate your mission and purpose to potential recruits. Develop pathway opportunities for students from diverse backgrounds. Display positivity, authenticity, and transparency during the recruiting process. Develop a culture of belonging for all employees. Be charitable.

What else should employers know about Gen Z?

• They enjoy being independent and getting their work done without relying on others.

• They want to feel valued for their ideas and recognized for their contributions.

• They are intentional about their career choices and are ready to move from one employer to another with relative ease.

• They want to make a difference in their workplace and in society in general.

• They are visual content connoisseurs, so using short videos on social media, in emails, and on websites is critical to reaching and engaging this audience.

• They are concerned about entry-level accounting work being taken over by technology. That said, employers

can convey that although technology is transforming many entry-level tasks, they are looking to emerging accounting professionals to step into higher-value work that requires personal judgment and problem-solving skills.

The next generation of accounting professionals will not all be Gen Z; non-traditional students are returning to school to study accounting because of its reputation as a stable field with excellent growth and earning potential. But these non-traditional students (mostly Millennials) have also been affected and shaped by the same world events and technological advances that Gen Z has and are wanting similar things from their employers. Millennials have been affected by the Great Resignation as they’ve watched many of their friends and family change jobs in the last few years looking for something more – more purpose, more flexibility, and more empathy. This has influenced their view of the work they want to do, who they want to do it with, and who they want to do it for.

The workplace is facing a lot of disruption, but it is also a time of great opportunity for employers who are willing to reimagine their approach to talent acquisition and retention. Gen Z students and early professionals are bringing an entrepreneurial spirit, a “can do” attitude, and an appetite to make the world a better place that has the potential to benefit us all.

THREE THINGS

1. Gen Z is interested in upskilling and has a strong desire to stay relevant so they can advance as quickly as possible.

2. As the most diverse generation to enter the workforce, Gen Zers want employers to be able to articulate what DEI looks like in the day-today of their firm or business and not just have DEI as a part of their mission statement.

With more than thirty years of experience with educational institutions throughout the Northwest, Colleen Sump is a career coach in the School of Business at Portland State University working primarily with accounting and finance students.

3. Non-traditional students have also been affected and shaped by the same world events and technological advances that Gen Z has and are wanting similar things from their employers.

18 | CPA Voice

Printed with permission from the Oregon Society of CPAs.

DO YOU HAVE INCOME TAX DEDUCTIONS HIDING IN YOUR BUILDING? Building Purchases • New Construction • Leasehold Improvements DUFFY I )-!JI.Ii DUFFY �ENERGY TAX SAVINGS DUFFY ill DUFFY COST SEGREGATION SERVJCES,lNC. Engineering-based Cost Segregation Studies Call OSCPA Member Craig Miller Cleveland 440.892.3339 I Columbus 614.362.3773 / Detroit 248.289.4880 or visit our website www.costsegexperts.com COST SEGREGATION IS THE MOST POWERFUL TAX TOOL FOR REAL ESTATE or call 614.764.2727 (option 2 for Member Services) Learn more at Build your core, strengthen your skills We’re back in person and better than ever! Join peers and thought leaders to get the latest updates on: May 23, 2023 | Columbus | The Grand Event Center Sept. 22, 2023 | Cleveland | 700 Beta Banquet & Conference Center Dec. 7, 2023 | Virtual KEYNOTE SPEAKER: Eileen Smith TOPIC: Public Speaking & Executive Presence ohiocpa.com/CoreCon up to 8 credits MULTIPLE Financial Accounting, Reporting & Analysis Tax Audit & Assurance Ethics & Professional Standards Sponsored by: MAY | JUNE 2023 | 19

TALENT management & human resources

Talent retention: Creating supportive cultures and telling accounting’s story

By Tiffany Crosby, CPA, CGMA, MBA, chief learning officer

By Tiffany Crosby, CPA, CGMA, MBA, chief learning officer

20 | CPA Voice

The far-reaching impact of the accounting profession’s talent shortage has elevated talent attraction and retention to the key priority list.

Public accounting firms are declining new work or firing clients to manage workloads, reporting timeliness is slackening, and work-life balance issues are worsening as employees in corporate and public accounting work to manage the increasing demands of the job.

accounting profession’s need to create sticky cultures that retain talent has never been greater. So, recognizing the need begs the question, what does an employer-of-choice model for the accounting profession look like?

According to an AICPA 2021 Trends report, the number of students graduating with bachelor’s or master’s degrees in accounting decreased during the 2019-2020 academic year by 2.8% and 8.4%, respectively. Additionally, the number of new candidates seeking to take the exams to become a CPA decreased by 12.2% between 2019 and 2021, while the number of candidates anywhere within the CPA examination process declined by 12.9%. Concurrently, overall turnover rates in large accounting firms with revenues greater than $75 million increased to 19.3% in 2022 from 16.8% in 2019 per Inside Public Accounting’s 2022 Human Resources Report. During the same period, turnover in small public accounting firms with revenue less than $5 million increased to 15.2% from 12.2%. Excessive turnover has been an ongoing issue in the accounting profession, exacerbated by the post-COVID-19 talent crisis, declining enrollment in undergraduate and graduate accounting programs, and fewer candidates pursuing licensing as a CPA. As the pipeline continues to shrink and turnover increases, the

Self-determination and empowerment theories provide a great glimpse into sticky cultures. In essence, employees want a sense of competence, autonomy, relationship, meaning and impact. Employees need work that has a clear purpose, is challenging but achievable, and aids personal growth. Fortunately, leaders do not have to work hard to meet these criteria. The accounting profession operates in a trusted business advisor position, helping leaders across all industries navigate the complexities of the business environment, making sense out of mountains of financial and non-financial data, and producing reports that serve as a bedrock of trust in a capital market system. Meaning and impact are there, provided we tell the story well. The other aspects of stickiness are also easily accessible with intentionality. Take competence for example. Competence is all about having the skills and resources necessary to perform responsibilities with excellence. Seldom do people aspire to be poor performers. However, individuals may struggle with understanding what’s required of them or may lack the requisite skills and need targeted learning and development to bridge the gap. Crafting performance development plans as a standard operating practice

MAY | JUNE 2023 | 21

Turnover rates in large accounting firms with revenues greater than $75 million increased to 19.3% in 2022 from 16.8% in 2019 per Inside Public Accounting’s 2022 Human Resources Report.

versus a punitive measure for underperformers establishes an expectation of continual learning and ongoing growth and acts as a value signal. Not only does the company value organizational growth, but they also value the individual’s growth and are willing to allocate organizational resources accordingly.

As painful and demanding as the COVID-19 pandemic has been, the increase in employee autonomy has been an unanticipated upside. Autonomy responds to the human need to have choice. Although many components of an accountant’s work are predefined by the role, flexibility in where and how the work is accomplished still meets the need for autonomy. The processes and technologies implemented during the pandemic’s fully or primarily remote work phase greatly increased autonomy. Workplace autonomy does have its limits though, with one key limiter being the aspect of culture. Employees need to feel connected and have a sense of belonging. As returning to the office occurs, leaders must determine how much workplace flexibility is possible and desirable for balancing individuals’ need for autonomy and relatedness. Though not the focus of this article, the organizational need for collaboration and agility also influences that decision. Leaders need to be able to tell the story of hybrid work as a series of ANDs: supporting flexibility and relationship, autonomy and collaboration, individual and team development, and individual and organizational productivity. Accounting and finance teams and firms that live out this story and can tell the story well have an advantage in the talent war.

22 | CPA Voice

Leaders need to be able to tell the story of hybrid work as a series of ANDs: supporting flexibility and relationship, autonomy and collaboration, individual and team development, and individual and organizational productivity.

Join

Je

Presented by:

us under our virtual big top, where you’ll gain jumbo-sized knowledge from our jackpot of excellent speakers!

miss the opportunity to join thousands of your peers!

learn more or

go to: or call 614.764.2727 , option 2. ohiocpa.com/Showtime Register 4 weeks in advance to save $50! 8:30 a.m. – 4:30 p.m.

25–26 |

credits MULTIPLE

Don’t

To

register,

October

November 15-16 16

Randy Dean, MBA Outlook E ciency and Productivity

Sean Stein Smith, CPA, CMA, CGMA, CFE Crypto Currency: FTX, Binance and What’s Next

Toby Groves, MS, PhD Finding Fraud

rey Bell, CPA Federal Tax Update

Amy Vetter, CPA, CGMA, CITP Mindful Technology: Embracing Technology, Innovation, and Mindfulness

1. As the pipeline continues to shrink and turnover increases, the accounting profession’s need to create sticky cultures that retain talent has never been greater.

Leadership style and team dynamics significantly influence whether employees are intrinsically motivated and engaged in the workplace. Non-supportive, impersonal, or overly stressful work environments negatively affect employees’ engagement in work-related tasks, motivation, and productivity. Employees are more likely to feel impactful and more motivated to engage when operating in supportive environments where individualized consideration is given, and employees can directly affect outcomes through their discretionary efforts. Establishing stable relationships with a hybrid team can be particularly hard and requires additional effort by team leaders to maintain frequent communications and create meaningful connections with team members at an individual and group level. Leaders can nurture a sense of relatedness by establishing social groups and scheduling open chats for the team to gather and share experiences. Additionally, leaders can connect team members to the bigger picture to provide a sense of purpose or context for the work and the value delivered to the internal or external client and to the public. Team members should be encouraged to develop themselves, take on new and interesting tasks, and be recognized and rewarded accordingly. As you can see, there is no silver bullet to addressing the retention issue. Instead, the issue comes down to an ongoing, intentional focus on creating a supportive culture and telling accounting’s story of meaning, growth, and impact repeatedly.

Tiffany Crosby, CPA, CGMA, MBA is the chief learning officer for The Ohio Society of CPAs. She can be reached at tcrosby@ohiocpa.com

614.321.2255

THREE THINGS

2. Employees are more likely to feel impactful and more motivated to engage when operating in supportive environments where individualized consideration is given, and employees can directly affect outcomes by their discretionary efforts.

3. Leaders can connect team members to the bigger picture to provide a sense of purpose or context for the work and the value delivered to the internal or external client and to the public.

24 | CPA Voice

July 20, 2023

8:00 a.m. – 4:00 p.m. Virtual | 8 credits PD

Join hundreds of peers and hear from inspirational leaders as they share insights for accelerating your career, owning your industry, and living life on your terms.

NYU Certi ed Executive Coach and Human Development Expert Author of Heart Boss

Topic: Your Life, Your Terms

Sponsored by

Executive Coach & Professional Speaker Founder, Take the Damn Chance Movement

Topic: Take the DAMN Chance

For more information, visit ohiocpa.com/www23

REGAN WALSH

BEVIN FARRAND

MAY | JUNE 2023 | 25

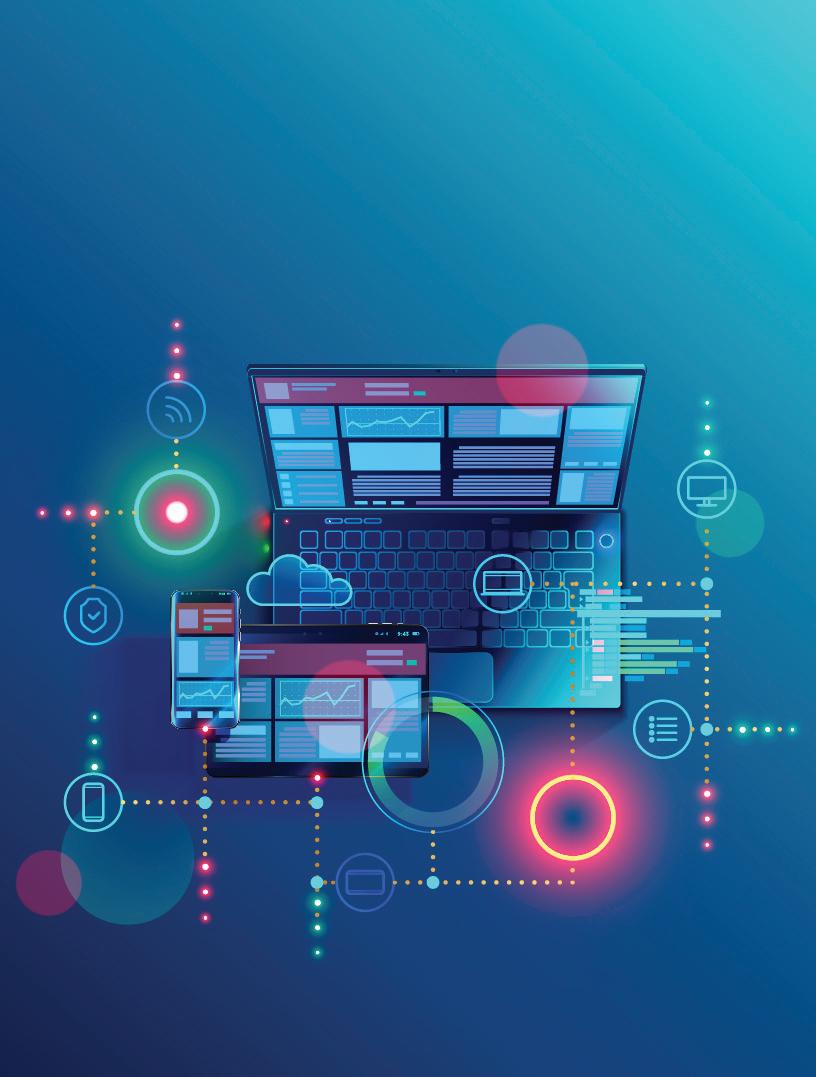

How to be strategic about your next big technology investment

By Jessica Salerno-Shumaker, OSCPA senior content manager

By Jessica Salerno-Shumaker, OSCPA senior content manager

26 | CPA Voice TECHNOLOGY

In a fast-paced environment that increasingly emphasizes technology, your business might be considering making sizable improvements to cybersecurity, the online customer experience or a myriad of other projects to make it more competitive.

But when undergoing a large tech project, it’s crucial to plan the project strategically before any real changes are made to ensure the process runs as smoothly as possible and is set up for success.

OSCPA is undergoing a technology transformation of its own to improve member experience at MyOSCPA. The changes mean an upgraded visual layout and will allow members to find education that interests them more quickly. Keyword category type, search and filter, previous purchase history and other essential functions will be easier to navigate in the new system. The upgraded system means the purchase experience will have the ability to auto renew membership and allow for credit card saving. Mobile access will also be a top consideration as the site is redesigned. Members will enjoy an upgraded and more seamless experience when the site goes live this summer. For this project and any large technology upgrade, Jason Blevins, OSCPA director of information technology, said one of the first steps is picking the right vendors.

“With the vendors that we're using to put all this together, we wanted to make sure we had the best at what they do,” he said. “We picked vendors to do certain parts of this project because they were good at ‘X’, and this other company is really good at ‘Y’. And we put those people together to integrate all the systems that we have to make them work seamlessly.”

Blevins said it helped that many of the vendors chosen he had worked with before and already had confidence in their abilities. He suggested considering past vendors you already have a relationship with, and when meeting with new vendors, take checking references seriously. Consider what aspects of the project are most crucial and how those vendors will help you achieve your goals.

“We felt very confident that the vendors we chose could pull this off, because we've worked with them for many years,” Blevins said.

And while a new project in itself is exciting, another part of being strategic means considering what the project will look like years from now, not just in the initial months after the launch period. Technological advances and organizational needs might change, and while no one can predict everything that will happen in the future, instead contemplate how the organization might evolve.

Blevins said to consider the level of customization that will be required for the project in the immediate future and years from now. Will it require an extra amount of work to make simple changes because everything is so customized? That might prove difficult later on as your company evolves to keep up with the changing marketplace. If the owner of the project leaves a year after its launch will other staff know how to keep it running? These are all areas to consider before starting the real work.

“From the beginning we discussed using these systems at their core,” Blevins said. “And even potentially how to change our business practices to be more in line with how the software product works, rather than trying to customize it to the way we want things to work.”

MAY | JUNE 2023 | 27

Making a serious investment in technology to improve your business’s long-term sustainability requires time, focus and being strategic about future goals.

“With the vendors that we're using to put all this together, we wanted to make sure we had the best at what they do.”

Jason Blevins, OSCPA Director of Information Technology

For those considering a large tech project in the future, Blevins said avoid underestimating the cost of the “discovery” portion of the project. Instead of jumping in and immediately selecting a vendor, take the time to come up with a plan of what you want to achieve and what it will take to get there. If you do have multiple vendors, bring them together to discuss the project from multiple angles to ensure what you’re trying to accomplish makes sense.

“Don’t go off a gut feeling of ‘Well, of course this will work,’” Blevins said.

The discovery process is also used to build requirements and expectations of the project. Blevins said while it might seem expensive in the beginning to take so much time talking through everything before the work actually begins, it’s well worth the effort and money. This way as the project progresses there will already be an understanding of small details or potential issues that might pop up because it has already been discussed beforehand.

And finally, don’t lose sight of the ultimate goal while considering all the bells and whistles along the way. While project add-ons can seem exciting, be wary of flashy additions that might detract from the real work. Blevins said OSCPA understands that members are busy and looking for quality education without complications, and that an improved MyOSCPA member experience would answer that need.

“The goal is to make it very simple to find education that interests you,” Blevins said. “And have the least amount of barrier to do that.”

THREE THINGS

1. When picking the vendors to use for a large-scale technology upgrade, be sure to consider who you already have relationships with and check the references of those you don’t.

2. Think about the level of customization the project will require and how it will be able to evolve and grow with the business needs of the future.

3. Don’t underestimate the time and energy spent in “discovery,” and use that to consider all angles of the project.

28 | CPA Voice

Jessica Salerno-Shumaker is OSCPA's senior content manager.

Ohio CPA KnowledgeHub Publication Ad.indd 1 9/3/20 1:28 PM Read CPA Voice on Issuu.com, and never miss the latest news, best practices, trends in the profession and information on what OSCPA is doing to serve you as a member. issuu.com/cpavoice Follow us at: issuu.com/CPAVoice Read on Issuu MAY | JUNE 2023 | 29

MEMBERS in motion

AKRON

Bober Markey Fedorovich recently received ClearlyRated’s 2023 Best of Accounting Award for Service Excellence.

CINCINNATI

Kari Maue, CPA, has joined GBQ Partners LLC (GBQ) as a director within the assurance practice.

CLEVELAND

Brandon Miller, CPA, CGMA, CEO of HW&Co. was named a Notable Leader in Accounting, by Crain’s Cleveland Business.

For the second year in a row, HW&Co. has been included on the list of Top Firms in the Great Lakes Region by Accounting Today magazine.

DEFIANCE

Alyssa Pluta has been promoted to in-charge accountant at Shultz Huber & Associates, Inc.

ST. MARYS

Kara Dahlke was recently promoted to in-charge accountant at Shultz Huber & Associates, Inc.

WORTHINGTON

Whalen CPAs recently promoted Tammy Snider, CPA to Vice President of Accounting Services.

ADVERTISER INDEX CLASSIFIED

Selling or Buying a Firm in 2023? Selling an accounting firm is complex. We can make it simple!

p19

p30

Accounting Biz Brokers, LLC has been selling accounting firms and tax practices for over 18 years! Let’s face it, you know how to run your business, but it takes a very different skill set to sell a business successfully. Our team of Certified Business Intermediaries is committed to providing personalized business brokerage services to our clients and customers. Selling professional practices like yours is all we do. Through the use of targeted marketing strategies, we have developed a large database of active buyers ready to purchase.

Call or email us today to receive a FREE Market Analysis of your firm or to start the confidential sales process. We’re ready to help you achieve a successful sale!

Kathy Brents, CPA, CBI Office 866.260.2793; Cell 501.514.4928

Kathy@AccountingBizBrokers.com www.AccountingBizBrokers.com

YSU Ethics & Economic CPE Day May 10 8:00 a.m. – 12:00 p.m. | 4 credits 30 | CPA Voice

Kari Maue, CPA

Kara Dahlke

Brandon Miller, CPA, CGMA, CEO

Alyssa Pluta

Duffy+Duffy Cost Segregation Services

Accounting Biz Brokers, LLC

LEARNING events at a glance

CORECon – Core Skills Conference

Accounting Shows

Register today + fi nd more events at Explore OSCPA competency framework at ohiocpa.com/CBL ohiocpa.com/Events23 6/15 12:00 p.m. – 1:00 p.m. Town Hall 1 credit MS 6/22-23 8:00 a.m. – 5:10 p.m. Health Care Industry Conference 16 credits MULTIPLE 7/20 8:00 a.m. – 4:00 p.m. Women, Wealth and Wellness 8 credits PD 8/2 8:00 a.m. – 1:00 p.m. Cannabis Conference 5 credits MULTIPLE 8/24 12:00 p.m. – 1:00 p.m. Town Hall 1 credit MS 10/30-31 & 11/28-29 8:30 a.m. – 4:30 p.m. Form 1040 Individual Tax Tune-Up 16 credits TX 12/7 8:00 a.m. – 4:30 p.m. CORECon – Core Skills Conference 8 credits MULTIPLE 12/7 8:00 a.m. – 4:00 p.m. Not-for-Profi t Conference 8 credits MULTIPLE 12/12-13 8:30 a.m. – 4:45 p.m. MEGA Tax Conference 16 credits TX COMPETENCIES Financial Accounting Audit & Assurance Business Management Technology Ethics & Professional Standards Tax Essential Skills & Prof. Development Risk Management & Fraud Talent MGMT & Human Resources Multiple CREDIT TYPE AC Accounting RE Regulatory Ethics BL Business Law AG Accounting (Government) BE Behavioral Ethics IT Information Technology AU Auditing TX Taxes AV Auditing (Government) CA Computer Software & Applications EC Economics PR Production MS Management Services FI Finance BM Business Management & Organization CM Communications & Marketing ST Statistics HR Personnel/ Human Resources SK Specialized Knowledge PD Personal Development MULTIPLE

Sept. 22 | In-person 700 Beta, May eld, OH 8:00 a.m. – 4:30 p.m. | 8 credits Oct. 25-26 | Virtual Nov. 15-16 | Virtual 8:30 a.m. – 4:30 p.m. | 16 credits

Fraud & Forensic Conference 8:30 a.m. – 2:00 p.m. 6 credits Aug. 29 | Virtual Fraud & Conference Real Estate Tax Conference 8:30 a.m. – 12:30 p.m. 4 credits Jun. 14 | Virtual Quarterly Ethics: Ohio Professional Standards & Responsibilities 8:30 a.m. – 11:30 a.m. 3 credits | Virtual Jun. 15 | Sept. 28 | Dec. 9 MULTIPLE MULTIPLE MULTIPLE TX RE MAY | JUNE 2023 | 31

my.ohiocpa.com PROFILE ACCOUNT SETTINGS 100% CONTACT INFO FIRST NAME CONTACT INFO LAST NAME 1. Go to Get what you want — where you want — not the stu you don’t. 2. Complete your Membership profi le Contact Info License/Certifi cation Information Practice Areas Industry Sector Communications Preferences A liations Social Media Education my.ohiocpa.com Accelerate your career and enhance your skills with quality learning from OSCPA. by CPAs for CPAs Choose from 9 core competencies to help you transform your skill set and compete in today’s crowded marketplace Audit & Assurance Ethics & Professional Standards Business Mangement & Strategy Financial Accounting, Reporting & Analysis Essential Skills & Professional Development Talent Management & Human Resources Tax Risk Management & Fraud Technology ohiocpa.com/CBL 32 | CPA Voice

THE OHIO SOCIETY OF CPAs 2022–2023 BOARD OF DIRECTORS

CHAIR OF THE BOARD

Craig Marshall, CPA

Ernst & Young Plain City

CHAIR-ELECT

Libby Cullins, CPA, MBA

JPMorgan Chase Columbus

Keenan Cooper, CPA, CISA Grant Thornton LLP Cincinnati

Rick Fedorovich, CPA

Bober Markey Fedorovich Akron

Chris Igodan Jr., CPA Nationwide Financial Columbus

Gregory J. Jonovich, CPA, MBA The Lubrizol Corporation Wickliffe

PAST CHAIR

Lori Kaiser, CPA, MBA, CGMA Kaiser Consulting Columbus

VICE CHAIR, FINANCE

Jessie C. Wright, CPA, CGMA, CVA Schroedel, Scullin & Bestic, CPAs and Strategic Advisors, Canfield

DIRECTORS

Angela Lewis, CPA Crowe Columbus

A’Shira Nelson, CPA Wellspring Financial Advisors Cleveland

Carolyn Smith, CPA, MBA, CRMA Columbus City Schools Columbus

Aaron Swiggum, CPA/PFS William Vaughan Company Maumee

LATELY on the podcast

PRESIDENT AND CEO

Scott D. Wiley, CAE

The Ohio Society of CPAs Columbus

Amy Vetter, CPA, CGMA, CITP

The B3 Method Institute & Drishtiq Yoga Mason

Mark Welp, CPA, CFE Holbrook & Manter Columbus

Ellen Wisbar, CPA Mayer Hoffman McCann, P.C. Cleveland

The workforce development series is available now!

Episode title: The impact of workforce development on the accounting profession

From the episode:

“As we think about workforce development through the lens of the profession, we're really thinking about how we help prepare professionals or workers with the skills necessary for the types of jobs that they're encountering today, but more importantly, for the type of work that we know is going to be a huge part of the future.”

Scott Wiley, CAE, OSCPA president & CEO

Listen to the entire series wherever you get your podcasts!

ohiocpa.com/Podcast

No matter where you are in your career or role in your organization, OSCPA has what you, your team (and maybe even your boss) need to excel.

and growing; together we transform careers, business, legislation, and lives.

to taxpayers through OSCPA-backed income tax bracket reductions and rate cuts.

attended and connected through Town Halls and Advance to stay current on hot topics in the profession.

were awarded to tomorrow’s CPAs.

were delivered twice a week through Takeaways and LegUp to keep you in the loop on the ever-changing business and tax environment.

of complimentary learning/CPE. Your Member Curriculum is included with your membership to keep you current on the topics that matter most.

ohiocpa.com/Renew23 MEMBERSHIP ADVOCACY LEARNING PIPELINE NEWS MEMBERSHIP

Renew today by calling 614.764.2727 or going to

By Jamie Ousterout

By Jamie Ousterout

By Laura Hay, CPA, CAE, OSCPA executive vice president

By Laura Hay, CPA, CAE, OSCPA executive vice president

By Colleen Sump, Portland State University School of Business

By Colleen Sump, Portland State University School of Business

By Tiffany Crosby, CPA, CGMA, MBA, chief learning officer

By Tiffany Crosby, CPA, CGMA, MBA, chief learning officer

By Jessica Salerno-Shumaker, OSCPA senior content manager

By Jessica Salerno-Shumaker, OSCPA senior content manager