AS MANHATTAN’S OFFICE MARKET LAGS, RETAIL IS PERKING UP

Elevated vacancy rates are coming down as shoppers slowly return

Betting that more than a few passersby would buy a scoop of Peanut Butter Brownie Honeycomb or Vegan Oat Milk Brown Sugar Chunk, Van Leeuwen Ice Cream inked a rich deal to open a new shop in Times Square.

“It’s more rent than we’ve ever paid anywhere,” said CEO Ben Van Leeuwen, who is paying $35,000 a month for 600 square feet near West 47th Street for the store, which opened Aug. 24. “But it’s a way to engage with a potential grocery store shopper or a potential franchisee.”

After a frigid three years, the market for retail space in Manhattan is warming up. Business

Burst water main was 50 years past due for an upgrade

By Caroline Spivack

A 127-year-old water main ruptured above Times Square early Aug. 29, gushing nearly 2 million gallons of water into the city’s busiest subway station. e break brought service on multiple lines to a crawl and upended the morning commute as the city’s Department of Environmental Protection needed 90 minutes to shut o the water. e burst occurred at 40th Street and 7th Avenue and spilled into the Times Square-42nd Street subway station.

Debra Laefer, an associate professor at NYU’s Tandon School of Engineering, said the morethan-century-old infrastructure is emblematic of larger city infrastructure challenges.

NEARLY 40% of New York City’s water mains were installed before 1941.

By Aaron Elstein

may lag 2019 levels, but it’s good enough—and rents are down enough—to start luring merchants back into storefronts that were empty for a long time. ere were more than 40 fewer “direct ground- oor availabilities” on the best shopping streets last quarter, according to brokerage rm CBRE, a 17% decline from last year, and the Real Estate Board of New York declared in a July report that retail is “in a healthy place”—a statement no one would make about the o ce market.

“Rents are at a healthy level for both tenants and landlords,” said Matt Chmielecki, a senior vice

president at CBRE. “And that’s all you need.”

To be sure, full recovery remains a ways o . In prepandemic times Manhattan’s retail vacancy rate was a bit more than 5%, a 2019 report by the city Comptroller’s O ce found. Today, the Times Square Alliance says 12% of storefronts are vacant, down from 18% a year ago. e 34th Street Partnership reports the retail vacancy rate on that corridor is 14%, down from 19% a year ago.

Signs of progress are visible on store signs. Century 21 emerged from bankruptcy and reopened in the Financial District, although with a smaller footprint. PC Richard & Son recently leased 31,000

Former Bath & Body Works manager brings data to the fragrance industry with startup Scent Lab. PAGE 3

e chaotic episode gave New Yorkers a tangible taste of what can happen when the city doesn’t keep pace with upgrading its roughly 6,800 miles of decaying water mains—enough to stretch from New York City to Tokyo if laid end-to-end. City o cials said the pipe in question had been in use since 1896, which is eight years before New York’s subway system launched and when horsedrawn carriages were still a common sight on city streets.

“Typically the life expectancy for one of these pipes would be 50 years, and at the rate that we and other communities are replacing them, there’s a mismatch so that they will never catch up unless they start putting in new pipes more quickly,” Laefer told Crain’s. “While, yes, some pipes can last 127 years, we shouldn’t be counting on that; we really need to invest in them more.”

Nearly 40% of New York City’s water mains were installed prior to 1941, despite the average design life of these pipes being estimated between 50 and 70 years, according to a 2022 infrastructure report card from the American Society of Civil Engineers. e report card gave New York a Con its investments in drinking

See

WATER MAIN on Page

GOTHAM GIGS

At 89, D’yan Forest, the ‘oldest working female comedian,’ aims to entertain a younger crowd. PAGE 23

VOL. 39, NO. 31 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAINSNEWYORK.COM I SEPTEMBER 11, 2023

Water main repairs at 40th Street and 7th Avenue | BUCK ENNIS

The 127-year-old pipe above Times Square shines a light on the logistical headache that is overhauling the city’s water infrastructure

Century 21 reopened in the Financial District, although with a smaller footprint, after emerging from bankruptcy. | BUCK ENNIS

|

See RETAIL on Page 22 22

CHASING GIANTS

City to open large-scale migrant shelter in Long Island City of ce building

The former Queens warehouse on Austell Place will serve as the city’s 16th major relief center

By Nick Garber

A vacant o ce building in Long Island City will become the city’s newest large-scale shelter for newly arrived migrants, City Hall ocials announced Sept. 7.

e o ce building on Austell Place, near the sprawling train yard that juts through the Queens neighborhood, will ultimately hold about 1,000 asylum seekers, Mayor Eric

town’s Roosevelt Hotel or the Wingate by Wyndham, also in Long Island City—or other sprawling facilities like the Creedmoor Psychiatric Center in Queens and the Randall’s Island soccer elds where the city opened a tent shelter last month.

Property records show the veoor Austell Place building is owned by an LLC based in New Jersey. e building was at one point managed by Columbia Property Trust, a company spokesperson said. e city has contracted with private companies to oversee the large-scale relief centers, under the supervision of New York City Health + Hospitals.

Adams’ o ce said. It has already been serving as a smaller-scale “respite site,” one of several shelter categories that the city has created to tackle the growing crisis, but will be expanded to become the city’s 16th large-scale “humanitarian response and relief center.”

A former warehouse converted to o ces in 2020, the Long Island City building di ers from many of the other relief centers the city has opened thus far, which have tended to be either hotels—like Mid-

As of last week, more than 110,100 migrants had entered the city since last spring, with 59,700 remaining in the city’s care, Deputy Mayor Anne Williams-Isom said Sept. 7. In addition to the 16 relief centers, the city has opened 206 emergency shelters for migrants.

News of the new relief center came hours after City Comptroller Brad Lander announced that he was rejecting a $432 million migrant-services contract that the city signed with onetime urgent-care company DocGo. e contract’s size, the company’s relative inexperience with migrant issues and re-

ports of mismanagement at its shelters led to criticism of the Adams administration—but City Hall o cials have defended their handling of the di cult crisis.

“ e speed at which the city is rapidly scaling capacity to meet the needs of this crisis is nothing short of Herculean,” Adolfo Carrión Jr., commissioner of the city’s Department of Housing Preservation & Development, said at a news conference where the new relief center

was announced.

Illustrating the tall task of converting a slew of buildings into shelters, omas Foley, the commissioner of the Department of Design and Construction, said his agency had to partially demolish and reconstruct the building’s boiler room to provide a proper emergency egress, install new stormwater drains, and build a new exterior landing before letting asylum-seekers move in.

Lower East Side to get 47,000-square-foot, 46-unit mixed-use residential project

The Horizon Group is planning an 11-story development on a site at 125 Chrystie St.

EVENTS CALLOUT

SEPT. 20

POWER BREAKFAST

Join us for a live interview with Andrew Kimball, president and CEO, NYC Economic Development Corp. He’ll share his priorities and outlook on the New York City economy, where the economy is heading, and how the EDC envisions the future for public-private partnerships.

DETAILS

Location: 180 Central Park South, NYC CrainsNewYork.com/pb_kimball

By Eddie Small

A new residential project is coming to the Lower East Side.

Brian Hamburger of Britt Realty, the construction arm of Brooklyn-based developer the Horizon Group, recently filed plans with the Department of Buildings for a development with 46 residential units at 125 Chrystie St., close to the intersection of East Houston Street and Bowery. The project will stand 11 stories and 137 feet tall and span about 47,000 square feet.

The project will feature retail space on the ground and second floors and space for a community facility as well. Fischer Makooi is the architect.

The property has been owned by the Lintien Corp. since 1971 and is currently home to a 2-story industrial building that was built in 1950 and spans about 7,000 square feet, according to city records and CoStar Group. The Horizon Group filed demolition plans for the site in July.

The Horizon Group, led by David Marom, was founded in 1985 and has developed more than 30 projects in and around the city since then, according to the company’s website. Its other projects in New York include The Library, a condo project at 61 Rivington St. on the Lower East Side, and 378 Weirfield St., a luxury residential building in Bushwick.

Representatives for the Horizon Group did not respond to a request for comment by press time, and a representative for the Lintien Corp. declined to comment.

Manhattan’s residential pipeline has been very slow lately, although there have been some

signs

2 | CRAIN’S NEW YORK BUSINESS | SEPTEMBER 11, 2023

of life. Developer Guy Peleg recently filed plans for a 12-unit residential project in Kips Bay, while the Naftali Group secured

a 99-year ground lease at 301 Third Ave. in the neighborhood where it plans to build a multifamily project.

“The speed at which the city is rapidly scaling capacity to meet the needs of this crisis is nothing short of Herculean.”

Adolfo Carrión Jr., commissioner of the city’s Department of Housing Preservation & Development

A warehouse-turned-of ce building in Long Island City will serve as the city’s latest large-scale migrant shelter, of cials said. | GOOGLE

The

property at 125 Chrystie St. was built in 1950 and spans 7,000 square feet. | COSTAR GROUP

E55THST. SOUNDVIEW NORTHERN 28TH STREET 45TH STREET 43RD STREET 41ST STREET 38TH STREET VERNON11TH. REVIEW 48TH STREET SKILLMAN 49TH. 48TH. 43RD. 47TH. QUEENS BLVD. FDRDRIVE LONG ISLAND EXPY. Shelter location New York

Scent Lab brings data to the fragrance industry

The upstart: Scent Lab

When Queens native Ariana Silvestro worked as a store manager at Bath & Body Works and then as a corporate manager focused on customer insights, it was her job to ensure shoppers found candles and personal care products in scents they loved. Not so easy!

The chain relied heavily on training and education so that sales associates could guide shoppers through the options, but Silvestro didn’t think it was a reliable strategy because customers sometimes wound up frustrated by the vast selection.

“Shopping for fragrance should be enjoyable and fun and lighthearted,” Silvestro says. “And it gets overwhelming, really easily.”

Her solution? Scent Lab, her scented-candle startup based in the Meatpacking District, employs a data-driven recommendation engine to help shoppers find the right fragrance for their home.

The company has raised approximately $1 million in its first institutional round and is actively seeking new investment this year.

Customers undertake a 60-second, video-based “scent discovery process” to determine which fragrances will appeal. A recommendation engine then calculates individualized scores for each of Scent Lab’s fragrance blends. A shopper might score a 93% match on Blend No. 2223, “Lavender Smoke,” for example, and a 15% match on Blend No. 1226, “Dewy Days.”

Shoppers can choose a $30 candle sample pack that includes their three top-scoring fragrances or buy a full-size 14-oz candle—in the jar color of their choice—for $45.

Upon receiving their order, customers can complete a detailed feedback survey. Over time, Scent Lab uses machine learning and artificial intelligence to refine the scores and create new fragrance blends.

Launched online in November 2022, Scent Lab has delivered candles to more than 5,000 unique customers, the majority of whom make a repeat purchase, Silvestro says.

Among them is Ali Kriesgman, a Fort Greene-based writer and entrepreneur. She first spotted Scent Lab on Instagram and enjoyed the online scent discovery test. Her familiarity with BuzzFeed quizzes on Facebook drew

her to the company’s personalized approach.

She’s since bought the full-size version of her top-scoring Scent Lab blend, “Breezy Bay,” four times. “I was really well matched with my initial scent—they did a good job,” she says.

The reigning Goliath: Bath & Body Works

The Columbus, Ohio-based personal and home fragrance retailer operates more than 1,800 company-owned locations in the U.S. and Canada along with more than 425 international franchised locations. Sales of products including body lotion, candles, home fragrance diffusers and liquid hand soap topped $7.5 billion in 2022.

How to slay the giant

Silvestro, who worked at several New York City startups after leaving Bath & Body Works, launched a beta test for what would become Scent Lab in 2021 while still employed full-time as head of strategy and marketing at a dentistry startup.

Working weekends and evenings, she created a bare-bones website featuring the first iteration of the fragrance discovery quiz and sent notice to friends and family, hoping to generate perhaps 50 to 100 responses. Word got out and she was soon deluged with more than 700 orders. She spent many late nights making candles by hand and shipping them from her Hell’s Kitchen apartment. Silvestro initially gave customers two options: They could create their own custom candle, choosing from a list of scent options, or take the quiz and buy a customized blend Silvestro created based on their responses.

To her surprise, the “create your own scent” option was a flop. Shoppers found the long list of fragrance options overwhelming. “Or they would do it and it wouldn’t smell very good, and then they would never come back,” she says.

But the overall results were promising. Shoppers loved the quiz and left positive reviews of the scented candles Silvestro created based on their preferences.

In 2022, she left her job and devoted herself to Scent Lab, relying on small checks from friends and family—totaling

less than $200,000—to get started. She brought on a head of product and teamed up with a fragrance house to design a line of 10 original scents based on her customer research. She also partnered with a small U.S.-based candle manufacturer. It wasn’t easy to find a company willing to accept her small orders, she says.

She soon faced the opposite problem. Sales began to grow and the manufacturer struggled to keep up with demand, resulting in long delays.

Silvestro scrambled to keep customers happy—posting on social media to keep followers updated on the supply chain snafu and sending gift cards to make up for the long waits. The response was overwhelmingly supportive, she says. Scent Lab has since paired with a larger manufacturer, which will allow it to scale up.

Silvestro also created a team of data scientists, engineers and fragrance experts to devise a more sophisticated, algorithm-based version of the scent discovery quiz that takes into account the customer’s scent preferences, moods and memories. The system gets smarter over time as the company collects more data. “We went through 100-plus iterations of the quiz before landing where we are today, and it’s fluid,” she says. “We’re always learning, adapting and tweaking.”

Another challenge for any consumer product startup— cutting through the noise and getting attention. Claire Cherry, an investment partner in Joyance Partners, the venture capital firm that led Scent Lab’s institutional round, says the startup’s unique recommendation technology made it stand out in a crowded field.

Cherry was further impressed when she learned that Silvestro had generated additional interest in the brand by launching several pop-up stores in Manhattan and offering its candles in-store at Neighborhood Goods in Chelsea Market. “I was amazed at how much they’ve been able to achieve with such a small amount of money,” says Cherry.

The next challenge

The online candle shop is just the first step, Silvestro says. Next year, Scent Lab will expand into new product categories, starting with a perfume mist. It also plans to expand its in-store presence by teaming with a retail partner.

Anne Kadet is the creator of Café Anne, a weekly newsletter with a New York City focus.

September 11, 2023 | CrAIN’S NeW YOrK bUSINeSS | 3

CHASING GIANTS

Anne Kadet

Scent Lab CEO Ariana Silvestro’s experience at Bath & Body Works inspired her to create a data-driven way for customers to find the perfect scent. bUCK eNNIS

Landlords split over law fining them for illegal pot shops

By Eddie Small

The smoke shop leasing a small amount of space in one of New York landlord Jim Wacht’s buildings had been there for years. Though he had never been thrilled about renting to a store selling tobacco, describing it as “not a great look,” he only recently became suspicious that the business was breaking the law.

“They didn’t advertise that they were selling cannabis products, but I was concerned,” said Wacht, president of brokerage and management firm Lee & Associates’ New York City office. “So we had somebody go in there covertly and ask if they could buy any cannabis. The answer was yes.”

Wacht, who said the property is in Midtown but declined to provide its specific address, warned the business that it could not keep selling marijuana without a license from the state, but it continued to do so anyway. His firm is now pursuing legal action against its tenant.

“It’s a violation of every lease that’s written because it’s illegal,” he said. “If they’re operating illegally, it’s a lease default, so a landlord could take action to shut them down.”

Wacht’s firm is acting how the city would presumably like all landlords of smoke shops found to be operating illegally to act, especially given how rapidly they have spread throughout the city since the state legalized recreational marijuana sales in 2021. But officials are no longer just hoping that property owners will choose to

“If the illegal activity is prostitution or selling hard drugs, a landlord will very quickly try to evict. We’ve helped many landlord clients do that,” he said. “But it’s a little different here because cannabis has been decriminalized, and the stores are on the thin gray line between legal and illegal.”

Illegal opportunities

State officials have faced plenty of criticism over how long it has taken to launch New York’s recreational weed retail program. The law legalizing cannabis sales passed in March 2021, but the first dispensary did not open until December 2022, and even now there are just 23 licensed stores throughout the state. This has created an opportunity for unlicensed stores to open, and estimates for their total number in the city have ranged from about 1,500 to 8,000.

Government agencies have taken steps to crack down. In July, for instance, the Manhattan district attorney’s office fined the owner of 11 unlicensed shops $400,000 and ordered him to stop selling weed.

But such efforts have yet to make much of a dent in the number of illegal shops, many of which can simply change locations even if they get shut down.

“The city knows that going after these tenants is like playing a game of Whack-a-Mole,” Davidson said. “They can shut down one, and Exotic Vape Clouds Three will show up the next day somewhere else as Exotic Vape Clouds Four.”

This is the main reason the City Council’s law was necessary, says Councilwoman Lynn Schulman, who sponsored the bill and represents Queens neighborhoods including Rego Park and Forest Hills.

upon himself to find out whether the smoke shop in his building was selling weed, the law does not require landlords to spy on tenants, Schulman stressed. It is up to law enforcement agencies to both determine if the tenant is breaking the law and inform the landlord if that is the case.

“This is a game-changing bill,” she said, “and it’s another tool in the toolbox to hopefully shut these businesses down.”

Industry opposition

take action. Under a law that the City Council passed 48-0 in late June, landlords who continue to lease space to unlicensed pot shops after being warned by law enforcement that the stores are operating illegally could now face fines of up to $10,000.

Wacht views the explosive growth of unlicensed pot shops as a blight on the city and is a supporter of the new law, but support is not universal. Some landlords see it as the city pawning off on them a problem it has been unable to solve through its own law enforcement agencies. And given that the overall retail market is still struggling to recover from the pandemic and evicting and replacing a tenant can be difficult, many could still be inclined to quietly look the other way.

This is the fork in the road that landlords are now facing. That the sale of marijuana is legal only in very specific circumstances makes this decision more complicated, says Harris Davidson, an attorney at the law firm Rosenberg & Estis.

“All the other efforts that were being conducted by the city and state focused solely on those businesses,” she said, “and those businesses haven’t been going away.”

Under the new law, which took effect Aug. 14, if a raid on a store uncovers illegal activity, city officials will first tell the landlord it is renting to an illegal business. If later inspections show that the business is still operating, the landlord could be fined $5,000, followed by a $10,000 fine for each subsequent failed inspection.

Evicting a tenant in New York is a long and difficult process, and many landlords have expressed concerns that a second or third raid could reveal the unlicensed store is still selling weed even though the landlord is actively trying to get rid of the tenant. However, the legislation specifies that the landlord will not face fines if this is the case.

“They have to show in good faith that they’ve at least initiated the proceedings,” Schulman said. “That’s an affirmative defense, and they won’t be subject to fines.”

And although Wacht took it

Although the law has the support of the Real Estate Board of New York and some individual landlords, it faces plenty of opposition in the real estate community. The Rent Stabilization Association and the Community Housing Improvement Program, two lobbying groups representing smaller landlords, are both against it, as are several others in the industry.

“It won’t end this business, and it only hurts property owners,” said CHIP Executive Director Jay Martin. “Those who want to sell black market weed products will still do so, and the real solution is robust enforcement and rapid licensing.”

One Lower East Side landlord said he is currently dealing with illegal cannabis stores at three of his properties. The landlord, who asked not to be named because the stores are still operating, argued that the new law traps him in a no-win situation. He doesn’t like these shops and knows that their being open puts him at risk of incurring steep fines, but he will also lose sorely needed income streams if he kicks them out.

“You’re between a rock and a

hard place. It bothers you. You want to do the right thing. But at the same time, if you want to get rid of this tenant, who’s going to compensate you for the money that you spend?” he asked. “You get cheated, and then you have to be the police yourself? I can’t be the victim and the police.”

Retailers generally do not tell property owners they want to open an unlicensed weed store in their building. Many come in saying they want to run a deli, then slowly add tobacco products and then cannabis products to their inventory, according to the landlord.

This ends up being bad not only for the landlords but also for prospective tenants that actually do just want to run a deli but now face added suspicion, he said.

“I have a new building right now where a deli guy has been calling me every day to lease my store,” the landlord said. “I have a vacant store, and I’m not comfortable leasing a store to him. He wants the space. I have to lease the space, but I cannot trust that he’s not going to end up doing a business that is not allowed.”

Bill Abramson, director of sales and leasing at Buchbinder & Warren Realty Group, said his company has also been getting a lot of interest from businesses it suspects want to sell unlicensed cannabis products. Many of the firm’s commercial spaces are on the smaller side, which is what these stores tend to like, but it has turned down every offer.

“We get a ton of calls, but we wouldn’t accept them as a tenant even though, frankly, they offer above-market rent,” said Abramson, who supports the new law. “I understand why a landlord would

be attracted to that, but it’s illegal.”

Rough retail

The proliferation of unlicensed pot shops is happening against the backdrop of a retail sector that was struggling even before the pandemic hit and has yet to fully bounce back from Covid. Although the latest Manhattan retail report from CBRE found that the average asking rent had risen for the fourth quarter in a row, rents and leasing activity both remain far below their prepandemic peaks.

This makes it all the more painful for landlords to evict an unlicensed store, especially one that has no financial issues, notes Rosenberg & Estis attorney Adam Lindenbaum.

“These tenants typically pay their rent. They’re doing well, and that’s something not to cast aside,” he said. “Landlords are not going to jump to throw a tenant into default when they’re paying rent over something that’s non-monetary.”

But Wacht said he had no sympathy for landlords who opt to look the other way when they discover they are renting to an unlicensed cannabis store, no matter the financial hit they might take. He stressed that if a property owner finds out they are renting to an illegal business, it is their responsibility to shut it down.

“If your tenants are acting illegally and you’re aware of it, you have an obligation to do something about it. I feel very strongly about that,” he said. “It’s one of the risks of being a landlord, the cost of doing business. You have an illegal tenant? Get rid of them.”

4 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 11, 2023

“If they’re operating illegally, it’s a lease default, so a landlord could take action to shut them down.”

Jim Wacht,

president of brokerage and management firm Lee & Associates’ New York City

office

Bill Abramson of Buchbinder & Warren Realty Group supports the city’s new law fining landlords who knowingly rent to illegal cannabis shops. | BUCK ENNIS

Bank of America demonstrates its commitment to being a Great Place To Work with initiatives like Sharing Success, which awarded 96% of our employees around the globe additional compensation — nearly all in stock. This is the sixth time teammates received this award, totaling more than $4 billion. And it’s just one of the reasons we’ve been named America’s Most JUST Company. Everyday dedication meets everyday appreciation 2023 For the annual Rankings, JUST Capital collects and analyzes corporate data to evaluate the 1,000 largest public U.S. companies across 20 Issues identified through comprehensive, ongoing public opinion research on Americans’ attitudes toward responsible corporate behavior. https://justcapital.com Bank of America, N.A. Member FDIC. Equal Credit Opportunity Lender © 2023 Bank of America Corporation. All rights reserved. Learn more at bofa.com/about What would you like the power to do?®

Let Staten Island pay the price for secession talk

The borough’s leaders are renewing a threat they’ve made for years, but leaving the city might bring unwelcome surprises

Talk of Staten Island secession is back in the news. Nicole Malliotakis, the Republican congresswoman representing the borough and parts of southern Brooklyn, said the migrant crisis should prompt Staten Islanders to break away from New York City entirely.

“If you’re not gonna do your job, mayor, then let Staten Island secede,” she said at a recent rally opposing a small shelter for asylum-seekers that city ofcials opened on the island. “We didn’t vote for your policies. We should not be subjected to your policies, and we’re gonna keep on turning out. Let Staten Island secede.”

Other Staten Island Republicans have long supported these calls. ey argue Staten Island is too distinct politically and culturally to belong to the rest of the city and that City Hall forces policies on them that they don’t support. ey point to Nassau and Westchester, counties bordering the ve boroughs that have their own local governments and county executives.

ere is logic to secession. With a population of nearly 500,000, the independent city of Staten Island would be larger than Tulsa,

Oakland or Minneapolis. at’s enough taxpayers to form a county government and elect an independent mayor or county executive. Given the conservative politics there, the Staten Island government would be Republican-run for the foreseeable future.

It’s worth pointing out that secession calls have inevitably been bound up in racism or xenophobia. irty years ago, more than 60% of Staten Islanders voted in a referendum to leave the city when David Dinkins, the rst Black mayor, was running for re-election. Today, it’s the migrant crisis driving these calls, and a single shelter at a former school site that housed, at its peak, only 50 migrants. (Far fewer are there now, according to the city.)

Hispanic migrants are too much for some of these locals to stomach. e vitriol of certain Staten Islanders has been outright heinous—and it’s been encouraged, every step of the way, by elected o cials.

Perhaps Malliotakis is right. Maybe Staten Island should leave New York City. It might be what they deserve.

Among the Staten Island political class, there’s been a long

“maker or taker” view toward the rest of the city. In this formulation, Staten Island is the home of honest, hardworking middle-class taxpayers—cops, teachers, reghters, sanitation workers—who give back to the city and get little in return. It doesn’t matter that the municipal government subsidizes a free ferry to Manhattan, paves the local streets and heavily funds all of the local public schools. Staten Island is home to the makers—and the city takes. If Staten Island left tomorrow, New York City would lose a tax base. But Staten Island is still, by far, the smallest borough. A citywide population trending toward 9 million would dip back closer to eight. Certainly, the municipal budget would have to be recalibrated for the loss of Staten Island taxpayers. Secession, though, cuts both ways. Staten Island’s prized public schools—Staten Island Tech, Susan Wagner, Tottenville High— would lose all of their city funding. It would be up to the new City of Staten Island to keep the doors open and pay the teachers.

All of the NYPD precincts would close. New York City Transit would withdraw bus service, and it would be up to the new county to negotiate, with the Metropolitan Transportation Authority, what bus routes should look like

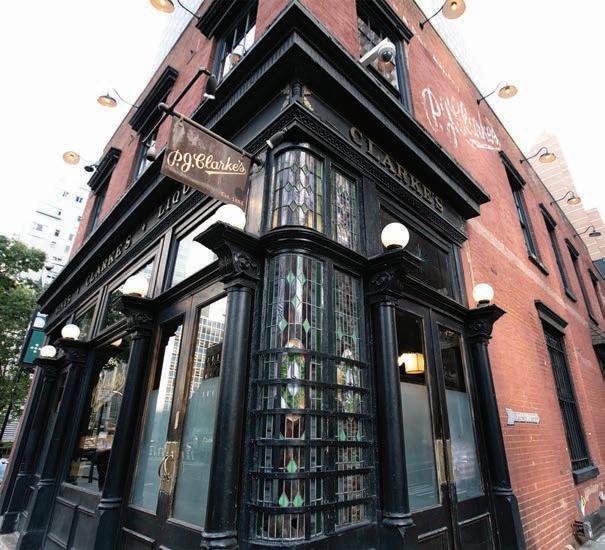

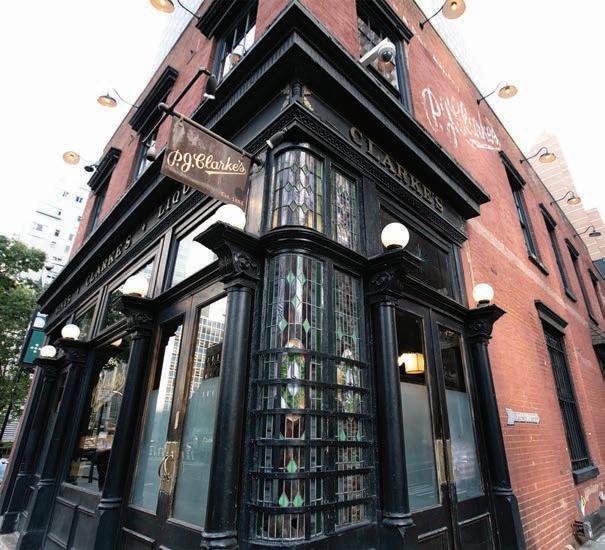

Historic saloon P.J. Clarke’s to reopen upstairs party room

By C. J. Hughes

By C. J. Hughes

Slowly, and with an occasionally di erent vibe, Midtown Manhattan is beginning to resemble its pre-Covid self.

A party room popular with the business crowd atop historic bar P.J. Clarke’s is reopening this week, more than three years after it closed for the pandemic.

But the restaurant’s owners, which had included late real estate developer Arnold Penner, will be serving up some changes in the Sidecar, the name of the low-ceilinged, second- oor space.

No longer will the 90-seat room

der a bacon cheeseburger and gin martini at Sidecar, provided they make a reservation rst. e original downstairs space, which has anchored the corner of ird Avenue and East 55th Street since 1884, allows walk-ins.

And don’t expect to party into the wee hours at Sidecar, as was often the case at P.J. Clarke’s in the middle of the last century, when Marilyn Monroe, Buddy Holly and Frank Sinatra often turned up (the latter preferring table No. 20). Sidecar will shutter at 8 p.m. and be open just Tuesday through Friday nights. Downstairs, known for its dim, wood-accented room and checkered tablecloths, stays open till midnight most nights.

existential threats over its 139 years. In the late 1960s, developer Tishman Realty sought to raze its home, at 915 ird Ave., which was then a four-story tenement building owned by Daniel Lavezzo, in order to construct a soaring o ce tower. But Lavezzo refused to sell. In the end, his holding out allowed him to score a long-term lease for the site. He also won more than $1 million in payments for lopping o two stories of its brick building to secure Tishman additional rights for the tower, the 47-story, 1.5 million-square-foot spire at 919 ird today.

Owned by SL Green

and what the county government could feasibly pay for.

City sanitation workers would stop garbage pickup. e city’s Department of Transportation can readily cut all funding for paving and road repair. It would be the new government’s problem.

Staten Islanders who complained about the property taxes they pay to New York City may encounter a new reality: the tax bill of a Westchester or Nassau County resident. e suburbs of the city pay the highest taxes in America. Perhaps this is the price of independence locals are willing to pay. Either way, it may be time to let Staten Island nd out.

Quick takes

◗ e City Council will give Madison Square Garden a new, ve-year operating permit. James Dolan, MSG’s mercurial owner, wanted the permit to last forever, and some politicians and local activists demanded an even shorter window— two or three years. Five years is a tough pill for Dolan to swallow.

◗ Will Mayor Eric Adams really shut down Rikers Island by 2027? He is wa ing on what he is required to do by law—and in the meantime, federal receivership for the jail complex seems likely. Ross Barkan is a journalist and author in New York City.

be the domain only of dues-paying members, a vestige perhaps of the business district’s old power-lunch era.

Now, in a more democratic approach, anyone will be able to or-

“Sidecar’s hours are tailored to accommodate the rhythms and preferences of our predominantly corporate clienteleirst seeking a lunchtime oasis and a lively post-work destination for socializing,” P.J. Clarke’s owner, Phil Scotti, said in a statement.

ough the pandemic undoubtedly rocked P.J. Clarke’s business, the restaurant has faced greater

Its owner is SL Green Realty Corp., the city’s largest owner of o ces, which presumably is heartened by P.J. Clarke’s now giving employees another reason to come back to work. SL Green acquired 919 ird as part of its 2007 acquisition of Reckson Realty for $6 billion. In April SL Green renanced 919 ird in a $500 million deal.

Penner, who died in July, bought P.J. Clarke’s with Scotti and other partners in 2002 after Lavezzo’s

son, also named Daniel, led for bankruptcy amid a dispute with Reckson over unpaid rent. e new owners renovated 915 ird, including converting the second oor, which was an apartment before it became a gambling den, into the Sidecar space. A few years later, the owners expanded the brand into a small national chain. An outpost opened on the Upper West Side, across from Lincoln Center, in 2007. Battery Park City also has a P.J. Clarke’s.

Penner was director at landlord Philips International, which was an owner of 250 Church St. in Tribeca and holds other Manhattan properties. He also served as a director at investment rm United Capital, which he sold to Goldman Sachs in 2019 for $750 million in cash. Goldman announced last month that it would sell the division formed around that business, which controls about $29 billion in assets.

Sidecar reopens Sept. 12.

6 | CRAIN’S NEW YORK BUSINESS | SEPTEMBER 11, 2023

ON POLITICS

Ross Barkan

An independent city of Staten Island (foreground) would be bigger than Tulsa, Oakland and Minneapolis. | GETTY IMAGES

Now anyone will be able to order a bacon cheeseburger and gin martini at Sidecar, provided they make a reservation rst.

P.J. Clarke’s in Midtown | BUCK ENNIS

New York will soon play host to a new pro sports team

By Jack Grieve

A new professional women’s hockey league will break ice for its inaugural season in January, and the New York area is among its six founding markets.

The Professional Women’s Hockey League (PWHL) has emerged as the sport’s new governing body in North America. The league promises to reimagine women’s hockey and ignite a much-needed spark to a sport that has long struggled to find its footing.

The PWHL has not named a stadium or practice facility for the New York squad, nor has it confirmed whether the team will play within the city limits. That information is expected to come next month, a league spokesperson told Crain’s.

1031 EXCHANGES

Can a partnership pursue a 1031 exchange if some partners want to cash out?

Regardless of where exactly the team practices and plays, it hopes to establish an identity within the city. “We are going to be New York’s team,” said PWHL board member Stan Kasten. “The challenges that we will have, finding facilities and putting games on, are worth it when you realize the exposure and the level of hockey interest in that city.”

Kasten said it was a no-brain -

er to position one of the franchises here. “Of course we have to be in New York. It’s the center of the world for economics and for sports.”

Pascal Daoust, who hails from Montreal and has long coached hockey at the junior level, will lead the New York team as general manager.

The five other founding markets are Boston, Minneapolis-St. Paul, Montreal, Ottawa and Toronto. The PWHL has not yet announced the names for any of its teams.

An initial free agency period is already underway, and the official draft will take place on Sept. 18. Although the schedule has not yet been released, the inaugural season will consist of 24 games and run from January through May. Future seasons will start in November and span 32 games.

The establishment of the PWHL comes after years of turmoil surrounding professional women’s hockey in the United States and Canada. The league that previously dominated the region lost support from many of its own athletes and struggled to ink a long-term agreement with the players’ union.

The PWHL, however, offers a much more promising future thanks in part to its big-dollar backing from Los Angeles Dodgers co-owner Mark Walter.

“We took a very cold hard look at what it would take economically, and we are prepared to invest what it will take to survive and to thrive not just for the short term or the long term but permanently,” Kasten said.

The league is also set up to operate under a more centralized structure, which Kasten sees as a strategic advantage. “We are a single entity where we can ensure the proper level of competition,” he said. “We do not have owners with different egos and different agendas and different levels of resources. We won’t have any of those kinds of problems.”

Perhaps most importantly, the league has been able to gain back the support of some of the sport’s best players. “We have all of the best women’s players in the world competing together and against each other for the very first time, and that’s an exciting prospect,” Kasten said. “We’re generating a lot of excitement, both by the players and by people who are looking to follow the action as soon as we start in January.”

EVAN FOX, JD, LLM, CA

Partner, Real Estate Tax Leader

212.223.5073

efox@grassicpas.com

While the 1031 exchange is one of the most popular mechanisms to defer tax on the sale of real estate, circumstances often arise where some partners in a venture would rather take their cash and move along. In these situations, I’m asked what mechanisms or structures can be utilized to facilitate a cash out of those partners, and what the corresponding tax results will be.

Three of the most common strategies for cashing out members include:

Cash redemption. This option often involves first selling the asset and then sending to the qualified intermediary (“QI”) only the amount of funds that the remaining partners intend to use in a 1031 exchange. Importantly, when this strategy is undertaken, the amount of cash that circumvents the QI is treated as boot, and each dollar is taxable gain. While the partnership may want to allocate 100% of this gain to only the redeemed members, and possibly even alter its partnership operating agreement accordingly, such allocations may lack substantial economic effect. As such, the departing partners are typically permitted to receive gain allocations so their ending capital account equals the cash received on redemption. Any remaining gain is allocated to the continuing partners - a negative result for those who were seeking tax/gain deferral via a 1031. Furthermore, while there is less cash in the QI from the sale, any amount of debt on the relinquished property must be fully replaced (not only the ratio of debt to continuing partners), or there could be mortgage boot gain.

Drop & Swap. This strategy involves changing the ownership structure of the asset so the redeemed members receive tenants in common (“TIC”) interests prior to any sale and cease to be members of the partnership. With this technique, the earlier this structure change occurs pre-sale, the better. Furthermore, it is recommended for the TIC owners to negotiate with the buyers directly. This strategy allows members to cash out in a transaction that circumvents the partnership entirely, so the tax results of any proceeds not involved in a 1031 remain only with those members.

Redemption for an installment note. This technique involves cooperation of the purchaser. In this strategy, the buyer provides some of the consideration via a Purchaser Installment Note (“PIN”), where proceeds are to be received in a subsequent tax year. This PIN exits (or never goes into) the QI and is distributed to the cashing out members in full redemption of their interest. Although the PIN would be treated as taxable boot, the gain is only recognized when the funds are received from the purchaser. Once again, the partnership is responsible to replace the full amount of any mortgage on the relinquished property, or risk gain from mortgage boot (which should be allocated to the departing members as well, thus accelerating some of their recognition). There are other complexities and nuances in this strategy that should be further discussed with your tax advisor.

Regardless of the strategy that is ultimately chosen, it’s best to take a proactive approach and begin the analysis when partners first indicate they may want to cash out rather than stay in the partnership following a 1031 exchange.

Evan Fox is a Partner at Grassi and leads the firm’s real estate tax practice. He provides tax planning and structuring advice to the residential, commercial, mixed use, and infrastructure sectors. grassicpas.com

September 11, 2023 | CrAIN’S NeW YOrK bUSINeSS | 7

SPONSORED CONTENT talking

The establishment of the PWHL comes after years of turmoil surrounding professional women’s hockey in the United States and Canada.

“It’s best to take a proactive approach and begin the analysis when partners first indicate they may want to cash out rather than stay in the partnership following a 1031 exchange.”

Team USA forward Hilary Knight (center) celebrates after defeating Canada in the gold medal game at the women’s world hockey championships on April 16. Knight is a member of Boston’s PWHL team. ASSOCIAteD preSS

the professional Women’s Hockey League’s inaugural season will launch in 2024 and consist of 24 games played from Januar y through may

The PWHL offers a promising future thanks in part to its big-dollar backing from Los Angeles Dodgers co-owner Mark Walter.

Make the terms of the deal clear with migrant crisis contractor DocGo

Comptroller Brad Lander took the unusual step last week of declining to endorse the city’s $432 million no-bid contract with medical services provider DocGo, which is helping the city respond to its worsening migrant crisis.

As Lander noted in a letter explaining the move, it was the rst time his o ce has withheld an approval for an “emergency contract” as designated by city leaders; out of 30,000 contracts overall, the comptroller has agged only 75 in this way.

City leaders have been squishy about the potential costs of the migrant crisis response from day one and should show their math.

Lander said there’s “little evidence to show that this company has the experience to provide the services it has been contracted for,” including case management, housing and social work.

e move was largely symbolic as Mayor Eric Adams has the authority to approve the deal anyway, and he quickly made clear he intends to do so. But that doesn’t

settlement

By Luke

One person dies of an overdose every 90 minutes in New York State [“City’s use of opioid settlement threatened by lax oversight, limited funds,” Sept. 4].

Funding provided in the opioid settlement lawsuits is desperately needed to support the stressed infrastructure of community-based providers. We face increasing demand for services from families, a depleted workforce and challenges related to justice-system reform.

As longstanding neighborhood providers of substance-use disorder treatment, we advise a multipronged approach to embracing the overdose pandemic.

We suggest a re-examination of the current emphasis on harm-reduction approaches. is is not the only method to slow the escalation of overdose deaths and turn the tide of drug misuse in New York. Community-based nonpro t organizations know how present and future spending can be most e cacious.

mean there aren’t some course corrections the city ought to consider as it continues working with the Midtown-based rm.

e DocGo agreement includes minimal details on how the parties arrived at

e fastest and most cost-e ective way to get resources to the community is to reinforce the existing provider network. An established contracted program is best situated to attract and maintain a harm-reduction counseling workforce. is is obviously more e cient than the startup time and money necessary for newly contracted service providers.

New York State funds a variety of services, most of them su ering from a lack of annual adjustments to keep pace with in ation and update infrastructure. It doesn’t make sense that New York State

the total dollar amount, as Lander notes. City leaders have been squishy about the potential costs of the migrant crisis response from day one and owe it to taxpayers to show their math: No city contractor

should get a blank-check deal.

e agreement also includes negligible oversight, including little to no accountability for subcontractors DocGo brings in to help with the work. ose side deals should be disclosed and thoroughly vetted.

Another of Lander’s points, however, veers from constructive watchdog territory toward that of mayoral critic. It’s not unreasonable to question DocGo’s quali cations for the deal, but it would be di cult to argue that the mayor doesn’t get to make that call in a moment of crisis. Time was not a luxury the city enjoyed in this case.

Lander’s letter appeared to knock down DocGo’s shares as investors sorted out what it meant—before bidding them back up by the end of the day when it became clear the mayor stands behind the vendor.

“We can’t change the rules in the middle of the game,” Adams told reporters. “I think the comptroller saw an opportunity to just get in the conversation. But we have a ruling from him and his o ce on doing emergency contracts, and we’ll just continue to do that as we deal with this humanitarian crisis.”

DocGo will have to sink or swim on its results if the city holds it accountable, as it should.

Aviation career awareness critical

By Sharon DeVivo

is placing an emphasis on new programming and new organizations instead of reinforcing existing services with enhanced sta ng and programming.

Also, it is our understanding that if the settlement dollars are not spent on a timely basis, they will be subject to renegotiations through the court. e agree-

ments could be lost to delays and bankruptcy proceedings. It would be catastrophic for New York State to lose any previously committed dollars in the face of an ever-increasing surge in overdose deaths. If these deaths are largely attributable to individuals not in care of any sort, then the counties and the O ce of Addiction Services and Support should use the funding now available to focus on access to treatment. Consequently, OASAS should nd ways to fund services that show the smallest percentages of overdose deaths.

Services should be provided across the spectrum of treatment, prevention, harm reduction and recovery in every type of community setting. at would be a true harm-reduction approach.

Iread with great interest your recent article “Hochul decries air-tra c controller shortage’s impact on New York airports.” e aviation industry is facing unprecedented challenges as air travel volumes surge past pre-Covid levels, especially in New York, which is home to the busiest airspace in the country. While the reduction of ights without penalties is a short-term x, it doesn’t solve the larger, long-term problem of not having enough aviation professionals, not just air tra c controllers, but also pilots, mechanics, airport managers and more, to keep people and our planes moving.

In fact, experts predict a need for 1.3 million aviation professionals worldwide in the next decade. at’s why education and awareness about careers in our industry are so critical, especially at a young age, to ensure we provide gateways for future generations to pursue the life-changing opportunities for all skill levels in an industry hungry for talent.

Sharon DeVivo is president of Vaughn College of Aeronautics and Technology in East Elmhurst, Queens.

8 | CRAIN’S NEW YORK BUSINESS | SEPTEMBER 11, 2023

PERSONAL VIEW

EDITORIAL Write us: Crain’s welcomes submissions to its opinion pages. Send letters and op-eds of 500 words or fewer to opinion@CrainsNewYork.com. Please include the writer’s name, company, title, address and telephone number. Crain’s reserves the right to edit submissions for clarity.

New York City Comptroller Brad Lander | BLOOMBERG

Nasta and Seep Varma

Seep Varma is chairperson of the Coalition of Community Services.

Luke Nasta is the organization’s public policy o cer.

Opioid

funds should go to existing providers

The fastest and most cost-effective way to get resources to the community is to reinforce the existing provider network.

LETTER

TO THE EDITOR

State regulators must retain flexibility in health plans

By Sagine Pierre

By Sagine Pierre

All New Yorkers deserve health and financial security, regardless of where they live and work.

I know that addressing health care cost concerns and how to ensure access to quality, affordable prescription drugs are a priority for the Legislature and the Hochul administration. As an employer who provides benefits to my employees, I appreciate our state leaders’ attention to an issue that’s crucial to us.

Currently, the Department of Financial Services is working to implement a law passed by the Legislature in 2021, which focuses on reporting and transparency requirements for pharmacy benefit managers. Pharmacy benefit managers work with employers and unions to help them provide prescription drug benefits to their employees.

Transparency is essential to good decision-making when it comes to health care for both employers and patients, but it’s also important that DFS does not accidentally do more harm than good as they implement this law. As hospital and pre-

PERSONAL VIEW

scription drug prices continue to rise, employers rely on flexible health benefit options that allow us to address the unique needs of our employees, ensuring that they receive quality, affordable coverage. A small business with 10 employees has much different needs and resources than a major company—a one-size-fits-all system just won’t work.

I encourage DFS to commit to staying within the scope of the law passed by the Legislature and not take action that will have consequences. Any regulation that dictates how and which benefits employers and unions can offer must be off the table. Otherwise, these new mandates will increase costs and make it harder for employers and unions to provide coverage to their New York employees, undermining the robust health care options currently available to employees, regardless of their location or work environment.

Another way that DFS can help employers and unions is by protecting the Employee Retirement Income Security Act, or ERISA. For decades, this law has played a critical role in safeguarding the interests of employees and beneficiaries in pri-

Climate investment should prioritize areas most in need

By Daphany Rose Sanchez

We are currently living through our planet’s hottest recorded year. Climate disasters have become a frequent reality for millions of people globally. In Hawaii, we saw powerful wildfires in Maui destroy entire communities and change lives forever. Nobody can hide from the impact of climate change, but we repeatedly watch communities of color and low-income families experience the worst effects of extreme heat, severe storms and constant flooding.

I was raised in a proud, hard-working Puerto Rican family in Williamsburg, Brooklyn. We lived in NYCHA housing for a good part of my upbringing. Eventually, my family had an opportunity to buy a home on Staten Island. Homeownership was a pinnacle moment for us—our dream had become our reality. But less than one year later, Hurricane Sandy hit, and like thousands of others our home was decimated. We lost everything.

the only ones on my block met with extra hoops to jump through to receive help from the authorities. To them, our brown skin was a sign that we didn’t actually live in the neighborhood.

vate-sector health and retirement plans. It requires employers and unions to provide consistent and reliable benefits to their workforce by standardizing regulations across states. This approach enables businesses to continue to grow without compromising the quality of benefits they offer.

Preserving ERISA is crucial

Most importantly, ERISA ensures that every patient and family member, no matter where they live or work, receives equal care under the benefit plan. Preserving ERISA is crucial to upholding the continuity of benefits across state lines, while also avoiding the complexities that may arise from navigating a patchwork of state-level regulations, which would increase bureaucratic costs for employers and unions. Any attempt to undermine ERISA, and the protections it provides to employers and

workers in New York, demands urgent attention and decisive action.

New York policymakers should be doing everything they can to control rising health care costs, not raise them. It is crucial that DFS regulators consider the implications of new regulations on how health plans, unions and employers offer benefits, as well as any action that will erode the patient protections under ERISA—both of which will weaken unions’ and employers’ ability to deliver affordable benefits to workers and their families.

New York State needs to take a proactive stance in safeguarding workers’ benefits, and to ensure the financial security and well-being of residents and businesses. Unions and employers are proud to offer health care benefits, and ERISA helps protect equal access to those benefits. New York policymakers should strengthen our system rather than work to undermine it.

At Kinetic Communities, we actively cultivate talent from the communities we serve. We work to build trust, provide long-term education and connect families with the resources they need to retrofit their homes, lower their energy costs and reduce their carbon footprint.

Daphany Rose Sanchez is executive director of Kinetic Communities Consulting in Maspeth.

For decades, environmental redlining has exposed neighborhoods of color to pollution, while a systemic lack of public infrastructure investments wore down our roads and backed up our sewers. Now, these populations have a higher risk of respiratory diseases, underscoring the need for clean air. With the rise of extreme rain weather events, these neighborhoods face extreme flood damage.

The climate crisis affects everyone, and New York must prioritize investment in protecting those they have not protected in the past.

through what I went through and to fight for communities like mine to be recognized as equally deserving of protection from the effects of climate change.

Community engagement

We weren’t the only ones who had to put our lives back together, but we were

Kinetic Communities is an organization dedicated to connecting people in low-income communities—including residents of public housing, immigrants and communities of color—to make the green energy transition. When I started this company it wasn’t just a business for me. It was a deeply personal mission: I wanted to make sure that no one else ever has to go

For years—as a City Council aide, an organizer and then a clean-energy advocate—I noticed that none of the city planning initiatives, clean-energy companies or large environmental nonprofits I worked with were meeting community members where they were—both in their communities and at their level of understanding. Currently, less than 40% of U.S. clean-energy economy workers are people of color. This is unacceptable.

As long as we continue treating events like Ida, wildfires, extreme rain and extreme heat as strange, oneoff events that won’t happen again, we do so at the expense of the Black and brown communities already bearing the brunt of natural disasters. Climate change isn’t coming. It’s already here.

New York’s concurrent crises deserve a robust investment strategy, which we’re seeing the beginnings of through the allocation of $5 billion toward energy efficiency and building electrification proposals by the New York State Public Service Commission. But it means more than making green energy more accessible to New Yorkers; it means long-term community engagement, demonstrated investments in the neighborhoods that need it most, and prioritizing those neighborhoods in preparedness and recovery efforts. That’s the work I’ve been proud to do in the climate justice space—and it’s the work I know the entire city must take up. The best time for lasting action on climate change was yesterday; the second best time is now.

September 11, 2023 | CrAIN’S NeW YOrK bUSINeSS | 9

PERSONAL VIEW

Sagine Pierre is president and executive director of the West Hempstead Chamber of Commerce.

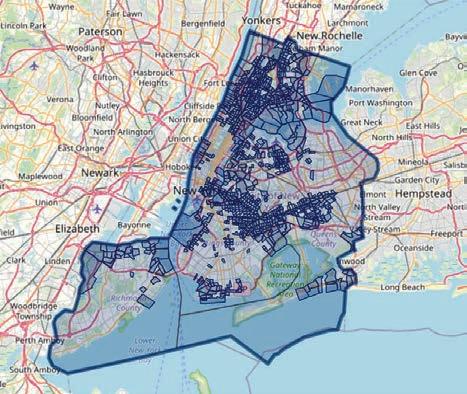

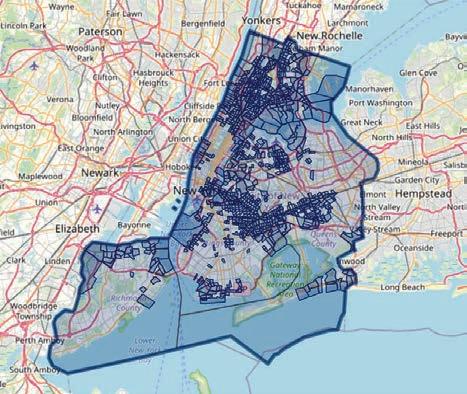

The areas identified as at-risk include large swaths of the city’s coastline, much of the Bronx, upper Manhattan, central Brooklyn and parts of Queens. NYS CLImAte JUStICe WOrKING GrOUp

Medly Pharmacy | COUrteSY

Hard times await city, warns commercial real estate broker

Myers Mermel has been a leading commercial real estate dealmaker for more than 30 years. His rm, Mermel & McLain Management, has bought and sold 1 million square feet of of ce space, including 660 Madison Ave. and 104 W. 40th St. He’s the city’s leading air-rights broker and advised Gov. George Pataki on Lower Manhattan’s post-9/11 recovery. When at Morgan Stanley in the 1990s, Mermel acquired a Times Square building out of bankruptcy that serves as Morgan Stanley’s headquarters. He says New York of cials are in denial over how working from home has changed the city’s economy for the worse.

How does the city feel nowadays?

A number of things have happened in Manhattan over the last few years that have been hostile to growth, including Local Law 97, congestion pricing, the lack of 421-a, crime without consequences and uncontrolled migration. Work from home has caused a systemic change in the commercial real estate market that we haven’t seen the full e ect of. Building sales are down 60%. Land and air-rights sales are down 50% to 60%. ere’s very little construction nancing, so almost nothing is moving forward. e economics of the city have changed, and we know we’ll have less tax revenue. On top of that, hundreds of thousands of predominantly wealthy people have left the city.

If people are leaving, shouldn’t housing prices be going down instead of up? at’s a function of work from home. It used to be you worked in an o ce, then people moved into

| Interview by Aaron Elstein

Dossier

Who he is: Managing partner, Mermel & McLain Management

Born: McLean, Virginia

Resides: Manchester, Vermont, with an apartment on the Upper East Side

Education : Bachelor’s in political science, University of Vermont; master’s in divinity, Yale University; master’s in American history, Columbia University

Political chops: Mermel ran for the Republican nomination for governor of New York in 2010. He ran for U.S. Senate in Vermont last year and won 18% of the vote in the GOP primary.

Deep roots: He is a direct descendant of Ethan Allen’s Green Mountain Boys. Another ancestor, Jacques Cortelyou, produced the first map of New Amsterdam in 1660.

WeWorks, and now apartments have become personal WeWork o ce spaces. e hot residential market doesn’t o set the nancial hit the city will take from the change caused by work from home.

Will of ce buildings get taken down?

I don’t think it’s economic to take buildings down. It’d be best to seek tenants who can cover a property’s operating costs. A lot of these buildings are highly leveraged and won’t be able to pay debt service, so there will be an accounting at some point.

The state wants to develop of ce towers around Penn Station. Is that a good idea? e project doesn’t make sense because tenants who wanted new o ce space have moved into Hudson Yards and, because of work from home, there isn’t enough demand to ll the size of buildings being discussed. ere’s no way the architecture and engineering rms that historically

have been the neighborhood’s tenant base could a ord to rent in new buildings without massive subsidies. If heavily subsidized space is built, it could make the rest of Midtown South worse o because buildings there couldn’t compete against the subsidized rents. What can city leaders do to avoid the dire scenario you spell out?

ey need to get rid of persistent anti-growth policies that are hollowing out the city. One thing they can do is create free market zones in Midtown with zoning and tax incentives for companies to rent space.

Perhaps you’re underestimating New York’s strengths? New York has emerged from crises in the past, but the underlying forces against the city are great and aren’t appreciated. Silicon Valley investors have bought 55,000 acres in northern California, and if they develop that land into an economic freemarket zone, that means they are intending to replace New York City as the nation’s nancial capital. Global power is moving to the Paci c rim, so there’s certainly a need for a global nancial center on the West Coast.

What makes you optimistic about the city?

New York has attracted and continues to attract some of the brightest people. At some point there will be an assessment that things have to change. But for now there’s a general denial that New York has to change in order to be successful.

Lawsuit hits landlord for alleged demolition by neglect

By C. J. Hughes

An Upper Manhattan landlord infamous for collecting cans when not acquiring multimillion-dollar townhouses is in the hot seat again.

Lisa Silversmith, who owns 451 Convent Ave. in Hamilton Heights, has been sued by the owner of the next-door property, MTA architect Projjal Dutta, for allegedly letting her property become so run-down that it has caused leaks and cracks to Dutta’s home as well as infesta-

smith’s husband, Mark Silversmith, works for the city, Dutta says in the suit, No. 451’s demolition approval came about as part of a governmental conspiracy, which is why the suit also names the city itself as a defendant.

Dutta is seeking at least $20 million in compensatory and punitive damages.

“Defendant’s conduct has been and continues to be wanton, reckless and malicious,” the suit says, adding the “city of New York is purposefully causing or are [sic] grossly indi erent to causing injury to plainti and others to bene t defendant Lisa.”

ployee of the city. He worked as a special counsel with the city’s Economic Development Corp. through 2021, and he’s currently secretary of the New York City Land Development Corp., a decade-old group that dispenses with city-owned land, according to public payroll records.

But if 451 Convent stays in private hands and is redeveloped as housing, the EDC or Land Development agency would seem to have little jurisdiction over it.

E orts to reach Silversmith through both the EDC and the Land Development agency were unsuccessful. e EDC, also named in the suit, had no comment.

tions of raccoons around it.

e wide-ranging suit, led Aug. 29 in Manhattan Supreme Court, has more explosive elements. It says Silversmith is letting the place go on purpose in order to make its site, in a protected landmark district, more attractive to developers in order to enrich herself.

Likewise, the suit rails against the decision by o cials last year to green-light a demolition of No. 451 to deal with the problem of its decrepit state. And because Silver-

e Silversmiths have not yet led a legal response. E orts to reach the couple at their co-op in Prospect Heights, Brooklyn, were unsuccessful.

But since the Department of Buildings issued an emergency order to raze the structure in summer 2022 because its roof was on the verge of collapsing, the Silversmiths have secured permits to x some of the hazards at the address, records show. No. 451 is currently cocooned in sca olding. e Department of Buildings had no comment.

For his part, Mark Silversmith does indeed appear to be an em-

In 2000 Lisa Silversmith, who has used her maiden name, Lisa Fiekowsky, on property records, bought 451 Convent, a four-story, townhouse-style edi ce zoned for 10 apartments, for $231,000, according to the city register.

Owns nearby properties

Meanwhile Dutta, who handles sustainability issues for the MTA, bought next-door 453 Convent, also a townhouse-style property, in 2014 for $1.3 million, records show, and then undertook a renovation. Around that time, 451 Convent started becoming the subject of regular complaints about collapsed

oors, missing windows and piles of garbage, as well as the occasional intruder, according to DOB records. When reached by phone, Dutta’s lawyer in the case, Reena Rani, declined to comment or make her client available.

Records show that No. 451 still has not addressed more than a dozen of the most severe kinds of violations, those that potentially make the site a danger to the public.

Silversmith, who once worked as a stockbroker and whose parents are Washington, D.C.-based economists, began spending her days collecting cans a few years ago, a “hobby” that earned her about $30 a day, according to a 2018 pro le in the New York Post.

But she’s fond of collecting real

estate as well. Silversmith also owns two properties around the corner from 451 Convent: 47 Hamilton Terrace, a stoop-fronted property worth $3.2 million, according to city estimates, and 60 Hamilton Terrace, a $3.5 million townhouse site.

But she’s also cashed out some properties along the way, including 46 W. 130th St., part of Harlem’s celebrated Astor Row complex. Silversmith bought it for $60,000 in 1994 and sold it for $210,000 six years later, records show.

And despite 451 Convent’s extremely dilapidated condition, Silversmith might still come out ahead. e city puts its market value today at $463,000, about double what she paid.

SEPTEMBER 11, 2023 | CRAIN’S NEW YORK BUSINESS | 11

ASKED & ANSWERED

“Defendant’s conduct has been and continues to be wanton, reckless and malicious.”

Lawsuit against Lisa

Silversmith

451 Convent Ave. | BUCK ENNIS

LARGEST ACCOUNTING FIRMS

Ranked by number of New York-area professionals

Area’s biggest accounting firms see modest growth after watershed year

The New York area’s biggest accounting firms grew their headcounts by an average of about 12% this year. The modest growth comes after a year marked by rampant consolidation that increased firms’ fleets of accountants by 34% last year, according to Crain’s annual list of the top firms.

The average firm size across the list, which is ranked by the number of New York-area accountants, is 2,270, an uptick from last year’s figure of 2,191. In all, the largest accounting firms across the area employ a total of about 57,000 tax professionals. Globally, that number is nearly 664,000, with most firms housing an average of 39% of their workforce in the New York area.

The average firmwide revenue for 2022 was $6.9 billion among companies that disclosed figures to Crain’s, a 27% increase from 2021.

—

Amanda Glodowski

12 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 11, 2023 RANK FIRM/ ADDRESS PHONE NUMBER/ WEBSITE MANAGING PARTNER(S) IN NEW YORK–AREA OFFICE 2023 NEW YORK–AREA TOTAL ACCOUNTING PROFESSIONALS/ % CHANGE 2023 NEW YORK–AREA AUDITING AND ACCOUNTING PROFESSIONALS 2023 NEW YORK–AREA TAX PROFESSIONALS 2023 NEW YORK–AREA MANAGEMENT ADVISORY SERVICES PROFESSIONALS 2023 FIRMWIDE ACCOUNTING PROFESSIONALS/ % CHANGE 2022 FIRMWIDE REVENUE (IN MILLIONS)/ % CHANGE 1 EY One Manhattan West New York,NY10001 212-773-3000 ey.com AlysiaSteinmann 13,888 +2.7% 13,888 n/d n/d 400,000 +9.6% $50,000.0 +11.1% 2 PwC 300 Madison Ave. New York,NY10017 646-471-3000 pwc.com TimothyRyan 13,567 1 +2.6% n/d n/d n/d n/d n/d n/d n/d 3 KPMGUS 345 Park Ave. New York,NY10154 212-758-9700 kpmg.com/us YeseniaScheker Izquierdo 7,682 -3.5% 1,785 1,635 2,292 36,902 +1.5% $35,000.0 +8.9% 4 Deloitte LLP and subsidiaries 30 Rockefeller Plaza New York,NY10112 212-492-4000 deloitte.com RogerArrieux 7,319 +8.6% 7,319 n/d n/d 86,311 +6.3% $27,936.0 +21.8% 5 Marcum 2 730 Third Ave. New York,NY10017 212-485-5500 marcumllp.com JeffreyWeiner 2,421 +21.1% n/d n/d n/d 4,560 +52.0% $1,100.0 +37.7% 6 EisnerAmper 3 733 Third Ave. New York,NY10017 212-949-8700 eisneramper.com CharlesWeinstein 1,612 +7.0% 768 565 279 3,623 +36.9% $642.0 +40.8% 7 RSMUS 4 151 W. 42nd St. New York,NY10036 212-372-1000 rsmus.com StuartTaub 1,333 +10.3% 415 n/d n/d n/d n/d $7,200.0 +14.3% 8 Citrin Cooperman AdvisorsLLC 5 50 Rockefeller Center New York,NY10020 212-697-1000 citrincooperman.com MarkBosswick 1,212 6 +71.2% n/d n/d n/d n/d n/d $488.0 6 +39.4% 9 BDOUSA 100 Park Ave. New York,NY10017 212-885-8000 bdo.com MathewDeMong Demetrios Frangiskatos 1,156 +17.0% 579 360 204 97,329 +18.6% $11,800.0 +14.6% 10 PKF O'Connor Davies 245 Park Ave. New York,NY10167 212-286-2600 pkfod.com KevinKeane 1,025 +10.8% 500 225 165 1,275 +9.9% $365.0 +49.0% 11 Grant Thornton 757 Third Ave. New York,NY10017 212-599-0100 grantthornton.com MatthewDiDonato 854 -11.9% 332 n/d n/d 6,096 +7.3% $2,420.0 +22.8% t HE LIS t

amanda.glodowski@crainsnewyork.com

#1 EY

#3 KPMG

#4 DELOITTE

GE tt Y m AGES

#2 PWC

NewNewYorkYork areaarea includes NewYorkCity andNassau, Suffolk and Westchester countiesinNewYork and Bergen, Essex,Hudson and Union countiesinNewJersey. Crain'sNew YorkBusiness uses staffresearch, extensive surveys and themostcurrent references available toproduceitslists, but there is no guaranteethat thelistings are complete. To qualify for this list,firmsmust havean office in the NewYork area. n/d-Not disclosed. 1 Crain's estimate, based onotherBig4 average percent change. 2 Mergedwith Friedman inSept.2022. 3 Mergedwith Raich Ende Malter &Co.inJune2022. 4 Mergedwith ParthenonCapital in Jan. 2022. 5 Acquired Untrachtrarly inAug.2022 and BerdoninFeb.2023. 6 Figure from AccountingToday. 7 CBIZ and Mayer HoffmanMcCannareassociated through an alternative-practice structure. CBIZ acquiredMarksPaneth on Jan. 12022. 8 Acquired Bader Martin in May 2022. 9 UHY is an independent CPA firm organized under an alternative practice structure with UHY Advisors Inc. 10 Previously listed as PBKD CPAs and Advisors.

September 11, 2023 | CrAIN’S NeW YOrK bUSINeSS | 13 7 RSMUS 4 151 W. 42nd St. New York,NY10036 212-372-1000 rsmus.com StuartTaub 1,333 +10.3% 415 n/d n/d n/d n/d $7,200.0 +14.3% 8 Citrin Cooperman AdvisorsLLC 5 50 Rockefeller Center New York,NY10020 212-697-1000 citrincooperman.com MarkBosswick 1,212 6 +71.2% n/d n/d n/d n/d n/d $488.0 6 +39.4% 9 BDOUSA 100 Park Ave. New York,NY10017 212-885-8000 bdo.com MathewDeMong Demetrios Frangiskatos 1,156 +17.0% 579 360 204 97,329 +18.6% $11,800.0 +14.6% 10 PKF O'Connor Davies 245 Park Ave. New York,NY10167 212-286-2600 pkfod.com KevinKeane 1,025 +10.8% 500 225 165 1,275 +9.9% $365.0 +49.0% 11 Grant Thornton 757 Third Ave. New York,NY10017 212-599-0100 grantthornton.com MatthewDiDonato 854 -11.9% 332 n/d n/d 6,096 +7.3% $2,420.0 +22.8% 12 Mazars USALLP 135 W. 50th St. New York,NY10020 212-812-7000 mazars.us RobertDeMeola 768 6 +31.3% n/d n/d n/d n/d n/d n/d n/d 13 CohnReznickLLP 1301 Sixth Ave. New York,NY10019 212-297-0400 cohnreznick.com JayLevy MichaelMonahan StephenHarrison AlanWolfson 636 +14.2% 295 237 104 3,305 +17.0% $892.0 +10.9% 14 CBIZ and Mayer Hoffman McCann CPAs 7 5 Bryant Park and 685 Third Ave. New York,NY10018/10017 212-790-5700 cbiz.com mhmcpa.com JeffGluck AbeSchlisselfeld 630 +8.2% 248 336 6 4,146 +9.9% $1,380.0 +24.9% 15 Crowe 485 Lexington Ave New York,NY10017 212-572-5500 crowe.com KellyFrank 432 +13.4% 139 104 182 5,285 +9.1% $1,062.4 +14.7% 16 Baker Tilly 8 66 Hudson Blvd. E New York,NY10001 212-697-6900 bakertilly.com CraigSavell 418 +13.9% 157 182 79 5,233 +11.5% $1,313.5 +30.6% 17 Grassi 750 Third Ave. New York,NY10017 212-661-6166 grassicpas.com LouisGrassi 335 -0.3% 186 116 19 411 +15.4% $116.2 +16.7% 18 Prager Metis CPAs 14 Penn Plaza New York,NY10122 212-643-0099 pragermetis.com StuartMayer 320 -1.5% 78 163 38 510 -1.7% $139.0 +12.2% 19 SaxLLP 1040 Sixth Ave. New York,NY10018 212-661-8640 saxllp.com JosephDamiano 221 +28.6% 125 89 5 244 +41.8% $82.2 +48.1% 20 UHYLLP 9 1185 Sixth Ave. New York,NY10036 212-381-4700 uhy-us.com MichaelMahoney 220 +17.0% 125 64 17 1,304 +4.4% $285.0 +29.0% 21 Withum 1411 Broadway New York,NY10018 212-751-9100 withum.com PatrickWalsh 193 +23.7% 98 76 n/d 1,708 +45.7% $429.1 +34.9% 22 FORVIS 10 1155 Sixth Ave. New York,NY10036 212-867-4000 forvis.com RyanReiff 169 +8.3% 71 18 80 5,300 +6.0% $1,400.0 +84.7% 23 Goldstein Lieberman & Co.LLC 1 International Blvd. Mahwah,NJ07495 201-512-5700 glcpas.com PhillipGoldstein 127 +18.7% 41 63 11 127 +18.7% n/d n/d 24 Frankel Loughran Starr & ValloneLLP 1475 Franklin Ave. Garden City,NY11530 516-874-8800 flsv.com AlanFrankel SethStarr CharlesVallone 102 +8.5% 9 93 n/d 109 +6.9% n/d n/d

Janover 100 Quentin Roosevelt Blvd. Garden City,NY11530 516-542-6300 janoverllc.com MarkGoodman 102 -19.7% 18 82 2 114 -17.4% $36.1 +2.0%

24