Wall Street astrologer warns that the skies portend nothing good for the earthly economy.

Wall Street astrologer warns that the skies portend nothing good for the earthly economy.

Heading into the new year, my email box groaned under the weight of reports from cheerleader market strategists, all of them predicting that 2025 will be almost as wonderful as 2024, when the S&P 500 gained 23% and concluded its best two-year run since 1999.

“Bull market is alive and well in 2025,” declared the folks at Bank of Montreal, who reckon the stock market will gain 14% this year. at’s nothing compared to the soothsayers at Deutsche Bank, who forecast it will go up by 21%. Even one of the more bearish rms,

Morgan Stanley, says an 11% gain is coming.

In search of someone brave enough to steer clear of the thundering herd of optimists, I sought out Wall Street’s No. 1 astrologer, Henry Weingarten. Weingarten describes himself as a “cosmic value investor,” which means that in addition to examining economic data, he susses out market trends by charting the planets and stars.

Weingarten was feeling optimistic when I caught up with him around this time last year. Last April’s total solar eclipse was a sig-

nal of exciting times ahead, including the possibility of the Federal Reserve cutting interest rates. Months later the Fed did cut, markets raced higher, and those who heeded Weingarten’s predictions made money. Heaven knows his predictions last year were more accurate than mine.

Alas, this time Weingarten warns that the skies portend nothing good for the earthly economy. In fact, he predicts a global recession is coming this year, perhaps as soon as July.

He worries rising levels of commercial,

By Aaron Elstein

When Donald Trump and the Republicans swept control of Washington, the markets took it as a clear signal that 2017’s steep tax cuts will be extended before they sunset at the end of 2025. at would be an unbridled boon for wealthy New Yorkers who likely would have faced higher tax bills in a Harris administration. e corporate tax rate, cut to 21% in 2017, would have risen to something closer to its former 35% level. Earnings from partnerships, such as law rms or private equity shops, would have been taxed at higher rates, too. e expected extension would put more money into the pockets of wealthy New Yorkers. Fully 10% of New York house-

TAXES on Page 19 See FORECAST on Page 18

By Nick Garber

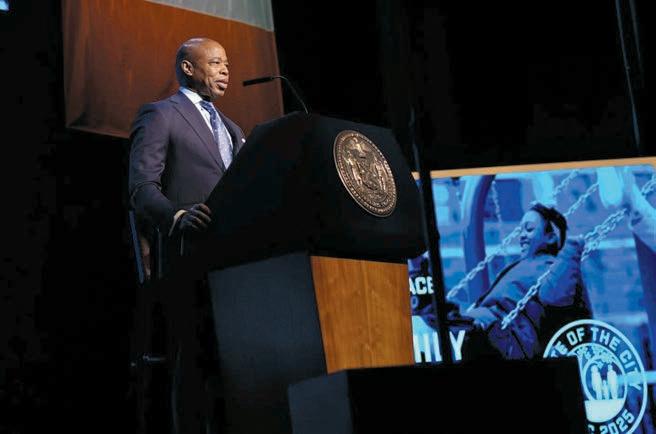

As he kicks off a year that could see him jailed or booted from City Hall, and quite possibly both, Mayor Eric Adams on Jan. 9 laid out an agenda for 2025 that doubled as a platform for his uphill re-election campaign.

In his fourth State of the City address, Adams laid out plans that respond to the issues that have defined his first term: public safety and New York’s affordability crisis, which has taken a particular toll on families. The mayor announced a new proposal, City of Yes for Families, that will use zoning and rule changes to construct more family-sized homes and build more housing near schools, playgrounds, libraries and grocery stores — all in hopes of preventing families from being forced to decamp to the suburbs.

As part of the same initiative, Adams set a sparsely defined goal of building 100,000 new homes in Manhattan over 10 years — a dramatic jump from the borough’s current total of about 900,000, which will rely in part on the pending rezoning of Midtown South that promises nearly 10,000 units.

And, acknowledging the recent spate of subway violence that has unsettled the city, the mayor pledged to spend $650 million to

FEB. 12

POWER BREAKFAST

What’s better than looking out at Central Park from our Crain’s New York Power Breakfast series? A great conversation about the treasured park itself, featuring Elizabeth “Betsy” Smith, who has served as the president and CEO of the Central Park Conservancy since 2018. Smith will talk about the park’s history and future, projects in the works that will continue to add new amenities, and ways the park can play a critical role in boosting quality of life in the city, in a conversation with Crain’s New York Business Editor-in-Chief Cory Schouten.

address homelessness and mental health — including opening a new facility to treat unhoused people with serious mental illnesses and creating 900 new beds in Safe Haven shelters that have low thresholds for admission.

“Our city must go further to get you the health care and housing you need, the parks and playgrounds you deserve, the education that sets your child up for success, and the chance to make the best possible life for yourself and your family,” Adams said from the stage at the Apollo Theater in Harlem.

Housing remained at the center of Adams’ remarks on Jan. 9.

Building on an initiative last year that began planning for 26 housing developments on 24 cityowned sites, Adams said he would add to that list in 2025: starting with a plan to build 800 units of mixed-income housing atop the existing Bloomingdale branch of the New York Public Library on the Upper West Side.

The city will also propose a 2,000-unit project at 100 Gold St. in the Financial District — presently the site of a city-owned office building — and additional developments at 395 Flatbush Ave. in Downtown Brooklyn, the Coney Island Waterfront, and the St. George neighborhood of Staten Island. The projects on publicly-owned land will amount to some 8,700 units, City Hall said.

Mayoral spokeswoman Amaris Cockfield said City Hall was unable to share any additional sites or neighborhoods being considered for zoning changes or new development as part of the Manhattan housing plan or the City of Yes for Families proposal. She said the administration remains in early planning stages.

Adams used the speech to reiterate other proposals he has made in recent weeks, including a populist plan to end city income taxes for some low-earning households that would require state approval. Another Adams priority in Albany will be the Supportive Interventions Act, which will increase the number of practitioners able to

issue orders of involuntary treatment.

Adams’ tone-setting speech came three months before he is set to go on trial in his federal corruption case, and five months before the June 2025 mayoral primary election in which he faces stiff competition. Several of those more left-leaning rivals were in the audience Jan. 9 as Adams sought to cast himself as the candidate most focused on working-class issues.

and violent crime in particular has fallen significantly in recent months. The mayor reminded his audience that he entered office in 2022 at a precarious moment in the wake of the pandemic, and suggested that he deserved another term to build on the progress.

“Despite all we have accomplished, I won’t stand here and try to tell you our work is complete,” he said.

“Now is the time for renewed dedication and continued [action], because no matter what challenges we face, I promise you this: No one will fight harder for your family than I will.”

Adams’ obstacles remain daunting: His approval ratings have been dismal, and prosecutors continue to scrutinize him and some of the high-level aides that he pushed out at the urging of Gov. Kathy Hochul. Adams was also denied public matching funds last month, which will force him to mount a time-consuming fundraising campaign he had hoped to avoid.

Despite prominent efforts to tackle subway crime and a statistical decline in offenses, high-profile attacks have continued — including the December immolation killing of a woman at Coney Island. Adams on Jan. 9 reiterated a commitment to deploy hundreds of additional officers into the transit system.

“Stop telling us the city is safer than ever when New Yorkers are nervous to get on the subway. Stop claiming our city is more livable when no one can find an apartment.”

Zellnor Myrie, Brooklyn State senator

“When others wanted to defund the police, we defended them,” he said.

His administration packed the historic venue with many of the key groups that helped put him in office in 2021 and could make or break his re-election bid, including business leaders and labor unions like the Hotel and Gaming Trades Council and SEIU 32BJ. The self-described blue-collar mayor has delivered all four of his annual addresses in locations outside of New York’s traditional Manhattan power centers, instead choosing neighborhoods where his political base lies: the Kings Theatre in Flatbush, the Queens Theatre in Flushing, Hostos Community College in the South Bronx and now the Apollo.

Adams enters 2025 with some wins under his belt, including the passage of his City of Yes housing plan that promises 82,000 new homes over 15 years. Crime, while slightly elevated over the course of his mayoralty, declined last year,

By Eddie Small

The median rent price in Manhattan rose annually for the third month in a row to close out 2024, a trend that seems likely to continue moving into the new year, according to the latest report from Douglas Elliman and Miller Samuel. The borough’s median rent for December was $4,334, up both month over month and year over year, the report says. Renters signed about 4,300 new leases, down from November but up almost 20% from December 2023, while listing inventory rose sharply to 9,741 apartments. The typical discount from an apartment’s original listing price was a minuscule 0.4%, and the borough’s vacancy rate was about 2.9%, according to the report.

“We all know safety is about more than just crime stats — it is about being comfortable riding the subway, knowing you can send your kid to play in the park, and feeling safe walking home at night,” Adams said Jan. 9. “People need to be safe, and they need to feel safe.”

And some of the commitments Adams announced Jan. 9 are no sure bets. The unspecified new zoning changes proposed as part of City of Yes for Families will require signoff from the City Council, which may be in no rush to help after grueling negotiations on the first City of Yes housing plan. (The council, in a post on X, cheekily noted that Council Speaker Adrienne Adams had made a similar proposal to build housing atop public libraries in her own State of the City speech last year.)

Zellnor Myrie, a Brooklyn state senator who is among the people challenging Adams for re-election, wrote on social media Jan. 9 that Adams’ latest proposals were too little, too late.

“Stop telling us the city is safer than ever when New Yorkers are nervous to get on the subway. Stop claiming our city is more livable when no one can find an apartment,” Myrie said. “Eric Adams can keep calling mediocrity success — but no one is buying it.”

In Brooklyn, the median rent was effectively flat month over month and year over year at $3,495, the report says. The number of new leases was similarly lower than November but roughly 20% higher than in December 2023 at about 2,700, while the listing inventory of 5,092 apartments was virtually unchanged from November but up almost 50% year over year. The listing discount was -2.8%, meaning apartments typically leased for more than their initial asking price.

And the median rent in northwest Queens dropped year over year for the first time in three months, to $3,395, a slight decrease from November as well. Tenants signed 559 new leases, down month over month but up year over year, while the listing inventory was 972 apartments, lower than in November but almost double what it was in December 2023, the report says. Apartments generally went for more than their initial asking price here as well, with a listing discount of -3.3%, according to the report.

Jonathan Miller, CEO of Miller Samuel and author of the report, said the stretch of declining rents the city saw last year probably won’t happen again soon, especially with mortgage rates in the housing market remaining fairly high.

By Eddie Small

As the City Council prepared for its final vote on the contentious City of Yes housing reform package in December, one member put out a blistering statement that decried the legislation as “a blank check” to the real estate industry and slammed the city for doing “the bidding of developers” by passing it.

The language echoed what some progressives have been saying about the city’s relationship with real estate for years on specific issues like the affordable housing tax break 421-a and broad issues like gentrification.

But this particular statement came from Councilman Robert Holden, one of the body’s most conservative members.

“You would expect that the progressives or the left would say, ‘We don’t like developers. We don’t want to give them more profit margins than we have to,’” Holden said. “But I think this is where affordable housing clashes with overdevelopment.”

Holden’s statement highlighted how much the dynamic between developers and progressives in the city has changed in a relatively short period. Though seemingly every major new real estate project during the 2010s was met with a wave of protests from the left about how it would make the neighborhood more expensive and displace longtime residents, progressives are now much more likely to see new housing as part of the solution to the city’s affordability crisis than part of its cause.

This shift remains tenuous at best and has certainly not made unconditional allies of progressives and the real estate industry. The sides remain at loggerheads over issues including “good cause” eviction and broker fees, and the left still places a strong emphasis on building more affordable housing rather than just building more in general, as evidenced by the $5 billion commitment for affordable housing programs and infrastructure improvements the council insisted on from Mayor Eric Adams’ administration during City of Yes negotiations.

But the final vote on City of Yes still marked a major change in their relationship. The package ultimately passed the City Council 31-20, a relatively narrow margin of victory, and much of the support key to its success was concentrated among the more liberal members. None other than the city’s chapter of the Democratic Socialists of America released a statement soon after the housing package passed lauding the affordable housing components even as it stressed that the package would not solve New York’s affordability crisis on its own.

Brooklyn Councilman Lincoln Restler, an outspoken progressive and City of Yes supporter, described this shift toward becoming more pro-development as a gradual one. He noted that many rezonings under Mayor Michael Bloomberg often had negligible affordability requirements and resulted in luxury buildings, contributing to the sense that new construction meant pricier neighborhoods. But as the city toughened up its affordability rules and the realities of

the housing shortage became starker in the ensuing years, progressives began to embrace that development could help get New York out of its affordability crisis.

“It’s been an evolution over the past decade,” Restler said. “I think it has accelerated significantly over the last couple years as the housing crisis has gotten worse, and progressive elected officials have recognized that we do have a supply issue.”

It is infamously difficult for people to actually relate to government statistics, but the harsh realities of finding an affordable place to live in the city have helped bridge this gap, according to multiple housing policy experts.

The city’s rate of available apartments, for instance, has hit a historic low of 1.4%, according to the latest survey from the U.S. Census Bureau and the Department of Housing Preservation and Development, conducted in 2023. And though rents have fallen slightly after hitting record highs in 2023, they remain significantly more expensive than before Covid with little relief in sight, according to data from Douglas Elliman and Miller Samuel.

“Normally, these sorts of data points are not things you can see and feel,” said Rachel Fee, executive director of the New York Housing Conference. “In the housing market right now, you can see and feel it. Anybody that needs to move is having such difficulty finding any housing options at all.”

Annemarie Gray, executive director of the pro-housing group Open New York, similarly stressed how real the housing crisis has started to be. An October poll of 900 New Yorkers that Slingshot Strategies conducted for the organization found that 78% know someone personally who had to leave the city over housing costs.

These numbers have made it harder for progressives concerned about rising housing costs to argue that a lack of supply isn’t at least part of the reason behind them —

especially when the city still has a brief but fairly recent example of oversupply to point to, as New York Law School program director Ben Max pointed out.

It can be easy to forget following months and months of increases, but before the city’s rents started this yearslong upward trend, they plummeted significantly in 2020 during the height of the pandemic. Multiple factors were at play, but the overarching one was a sharp drop in demand as the future of the city itself came into question, leading to a huge surplus of available apartments that

“It’s not a panacea. It’s not a magic bullet. There’s a lot more work to do, but this is a consequential step in the right direction.”

Lincoln Restler, Brooklyn councilman

quickly became much cheaper.

“You saw the equation shift and the leverage shift,” said Max, who runs New York Law School’s Center for New York City and State Law. “All of a sudden, there was a market where landlords didn’t have the same upper hand.”

In the past, the main issues progressives generally have cited when opposing new developments were the twin threats of gentrification and displacement. Rents at a new luxury high-rise would be expensive, the thinking went, and this would in turn raise rents throughout the neighborhood and make it unaffordable for the people already living there, with the prime example of Williamsburg looming constantly in the background.

Recent research, however, has cast serious doubt on this theory. A well-regarded 2023 study from New York University’s Fur-

man Center, for instance, found that building more housing can slow down rent increases, as the added competition that new units provide puts downward pressure on costs. Construction can also make units more available for neighborhood residents across income levels, as the “chains of moves” that begin when wealthier households head to newer buildings then free up other homes, it said. Progressives tend to be especially susceptible to academic research, and these types of studies have helped move them away from knee-jerk opposition to new projects, Max noted.

The idea that new buildings cause gentrification has long been a misconception, one that is only now starting to clear up, according to Howard Slatkin, executive director at the Citizens Housing and Planning Council. If developers start constructing new projects in a neighborhood, it is because rising rents have already started to take root, he said.

“Umbrellas don’t cause rain. Just because you see them everywhere it’s raining doesn’t mean that they’re the cause,” said Slatkin. “Development is the umbrella that comes out when the rents are rising to the point where somebody can make some money building something.”

Skepticism among progressives about developers is not dead by any means. Even during City of Yes negotiations, some of Restler’s liberal colleagues questioned why the city should be making it easier for developers to build and maximize their bottom lines, he said. But, especially once the council secured its $5 billion affordable housing and infrastructure commitment, most members came around to the idea that adding more homes was at least one important component of addressing the city’s affordability woes.

“Most of my progressive colleagues ultimately felt that this proposal will help alleviate the affordable housing crisis in our city,” Restler said. “It’s not a panacea. It’s not a magic bullet. There’s a lot more work to do, but this is a consequential step in the right direction.”

By Aaron Elstein

Two apartment towers on the Upper East Side have been sent to special servicing after their owners, two major players in New York real estate, defaulted on the properties’ mortgage.

The $540 million loan for 305 E. 86th St. and 160 E. 88th St. was sent last month to special servicing, where troubled mortgages get worked out, after a “payment default,” credit-rating agency KBRA said in a report Jan. 2. That indicates a monthly payment was missed by owners Meyer Chetrit and Stellar Management.

Chetrit is a principal at Chetrit Group, a developer with a portfolio of 14 million square feet nationally that once owned Chicago’s Willis Tower, the country’s second-tallest skyscraper after 1 World Trade Center. Stellar was co-founded in 1985 by Larry Gluck and Steve Witkoff, who went his separate way in 1997 and recently was tapped to serve as Middle East envoy in the Trump administration. Gluck passed away last year at age 71; his firm, which the Real Deal said is run by a partnership including his widow and oldest daughter, owns over 12,000 apartments in New York plus 2 million square feet of commercial space.

In 2014, Chetrit and Gluck teamed up to buy the Upper East Side buildings, called Yorkshire Towers and Lexington Towers, for

$485 million. The 21-story Yorkshire, at the corner of Second Avenue and East 86th Street, has nearly 700 units and amenities including an indoor pool, saunas, and private balconies. It also shares 204 parking spaces with nearby Lexington Towers, which has about 125 market-rate apartments.

In recent years cracks have appeared in the buildings’ finances. Their combined occupancy rate of 90% early last year was six percentage-points less than in 2022, KBRA said. Net cash flow has slipped by nearly 25% in that period, to $27

million. A broker familiar with the properties said that rents for the more than 300 stabilized units haven’t kept pace with escalating costs, even as market-rate units command record rents.

The Yorkshire and Lexington also carry hefty debt loads, giving them little margin for error if rental revenue falls short. In addition to the $540 million mortgage, they have $175 million in mezzanine debt, KBRA said, which presumably comes with a higher interest

rate. The mortgage comes due in 2027, the result of a 2022 refinancing in which Chetrit and Stellar extracted $55 million in cash from the properties.

Both the Yorkshire and Lexington were developed in the early 1960s. In 2016, Con Edison shut off the gas at Yorkshire after unauthorized electrical work was discovered on the premises. The building paid an $800 fine but city records show the code violation remains open.

Chetrit didn’t return a call to his office, and a spokesman for Stellar had no immediate comment.

By Julianne Cuba

A trio of prominent real estate firms in the city is forging ahead with plans to convert a Times Square office building into a residential property, records show, and brokers are optimistic that tenants will flock to the new digs.

Midtown-based Apollo Global Management, together with RXR and SL Green, filed plans with the Department of Buildings recently to build 942 apartments at 5 Times Square — an existing 38-story office tower that was formerly the headquarters of Ernst & Young.

While some developers may still be wary of office-to-residential conversions, two brokers who spoke with Crain’s Jan. 2 said they see this project as a lodestar for these kinds of developments, especially given the general resurgence of people returning to Midtown.

“So many lifestyle amenities, like private clubs, dining and wellness clubs, have moved into the Midtown area. Midtown has really become a lot more attractive for not just New Yorkers but international residents looking for pieds-

à-terre,” said McKenzie Ryan of Douglas Elliman. “This will be a great litmus test for other residential buildings to either be converted or built.”

Apollo did not return a request for comment by press time to provide more details on its plans, but city records indicate that the project, located between West 41st and West 42nd streets, will include 659,968 square feet of resi-

dential space — likely rental units — and 247,592 square feet of commercial space. It is also unclear at this time what amenities the newly converted residential building will include, but Gary Malin, chief operating officer at The Corcoran Group, said the entire project will likely be “well thought-out, well-designed and well-marketed” to successfully attract tenants.

“I think the city is starved for new housing. The people involved know real estate extremely well,” Malin said.

The Commercial Observer previously reported on the developers’ likely plans for an office-to-residential conversion in August.

Neither RXR nor SL Green responded to requests for comment by press time.

By Eddie Small

A mixed-use affordable housing project in Mott Haven has traded hands for almost $46 million, adding to the flurry of activity in the trendy South Bronx neighborhood. Real estate firm RJ Block has purchased the development known as Morris Court from a limited liability company for about $45.8 million, according to sources familiar with the deal. The complex consists of two buildings addressed at 253 E. 142nd St. and 250 E. 144th St., close to Lincoln Hospital and Hostos Community College. They were constructed in 2014 and each stand 7 stories tall with 201 apartments, three commercial units and 120 parking spots total across about 268,000 square feet. The commercial tenants include a Dollar Tree, according to commercial real estate database CoStar.

RJ Block assumed a roughly $41.5 million loan from the city as part of the transaction. The project’s affordable housing deal is set to expire in about five years, and RJ Block said it plans to keep all of the units affordable at least through then and possibly longer.

Rosewood Realty Group’s Aaron Jungreis, Ben Khakshoor and Alex Fuchs represented RJ Block in the deal, and Rosewood’s Mike Kerwin represented the seller. The team declined to comment on the sale, and a representative for RJ Block did not respond to a request for comment by press time.

RJ Block is based in Rockland County, and its portfolio includes multiple apartment buildings in the Bronx and Newark, according to CoStar.

Mott Haven has been undergoing a real estate boom in recent years highlighted by major projects from major developers such as Brookfield and RXR. Peter Fine’s Atlantic Development Group recently sold a development site in the neighborhood at 350 Grand Concourse to Shorewood Real Estate Group for $28.5 million. Shorewood seems to be planning a mixed-use project.

By Amanda D’Ambrosio

Local oncologists and cancer experts say that a federal warning linking even moderate alcohol consumption to increased risk of cancer could prompt more public health measures to reduce the disease.

U.S. Surgeon General Vivek Murthy issued an advisory Jan. 3 linking alcohol to seven types of cancers, including breast, colorectum, esophagus, liver, mouth, throat and voice box, and suggested updating warning labels on alcoholic beverages to advise peo-

city oncology experts say that the surgeon general’s call for greater awareness about the risks of alcohol consumption could be the rst step to more public health e orts to prevent cancer.

Many oncologists already have conversations with patients who are diagnosed and treated for cancer about the risks of drinking alcohol, said Dr. Stephanie Bernik, chief of breast service at Mount Sinai West. e surgeon general’s advisory could prompt those conversations earlier and encourage general practitioners to talk to patients about their drinking habits long before a diagnosis.

Advisory could improve awareness and public health measures to reduce cancer cases in New York, experts say.

ple about their cancer risk.

Federal policy mandating warning labels on alcoholic beverages can only be introduced by Congress, and it is not clear if the incoming Trump administration would back such a change. But

“ is brings that awareness to a di erent level,” Bernik said. “It really has to come from the primary care physicians who are taking care of these patients for their yearly checkups.”

e advisory comes as cancers continue to rise in the U.S. Last year was the rst time that there were more than 2 million new cancer cases in a single year, largely because of rising diagnoses of common diseases such as breast, prostate and pancreatic cancer, according to the American

Cancer Society. New York has also seen an increase in breast, thyroid, colorectal and other common cancers in the past two decades. ere are many factors that contribute to rising cancer rates, but lifestyle habits such as diet and exercise play a role. Alcohol consumption contributes to roughly 100,000 cancer cases and 20,000 deaths in the U.S. each year, the surgeon general said. ese cancers are preventable, with alcohol being the third leading cause of preventable cancers behind tobacco use and obesity.

e advisory counters longstanding advice that small amounts of consumption may carry zero to low levels of risk. e general public perception is that moderate drinking could be good for cardiovascular health, such as a glass of red wine at dinner, but the warning informs individuals that even moderate drinking can carry risks, said Dr. Jiyoung Ahn, a cancer epidemiologist at NYU Langone’s Perlmutter Cancer Center.

Bernik said that recommended drinking advice depends on each individual’s family history and

cancer risk, but that the advisory should encourage patients to reduce their overall drinking habits.

Public awareness is the rst step to implementing preventive health e orts that can reduce rates of cancer, said Dr. Jennifer Hay, a clinical health psychologist who leads the laboratory of genomics, risk and health decision-making at Memorial Sloan Kettering. Similar warnings for smoking have reduced cancer rates in the U.S., Hay said. e surgeon general in 1964 issued a landmark report linking tobacco use to cancer.

Although smoking-related cancers did not plummet immediately, subsequent public health measures such as mass media campaigns and warning labels on cigarettes have led tobacco use in the U.S. to decline and lowered cancer rates, she added.

“We’re not telling people not to drink,” Hay said. “We’re just promoting informed choice based on the most accurate, updated information about alcohol and cancer risk.” Warning labels are just one way to increase awareness, she added.

With the nation’s highest cardiac success rates and most experienced team in the tri-state, there’s nothing we can’t handle.

It’s why others trust us to help treat their patients with the most challenging conditions. And with 300+ cardiac specialists working together across Northwell, we’re delivering deeper insights and bigger breakthroughs in cardiovascular care no matter where you live.

Northwell.edu/LimitlessHeart

Facing a tough path to re-election in 2026, the governor has to make New Yorkers excited about New York again

This will be the year that makes or breaks Kathy Hochul’s political career.

e Democratic governor, who won a full term in 2022 and intends to run again in 2026, is at a crossroads. Her approval ratings are middling and she has never enjoyed widespread popularity. And unlike her scandal-scarred predecessor, Andrew Cuomo, she has not been able to intimidate well-heeled, viable challengers who could make life di cult during a campaign.

First, there’s the Democratic primary, where she seems increasingly likely to face Ritchie Torres, the young congressman from the Bronx who has given every indication he wants to run for governor. Torres, ideologically, pro les like Tom Suozzi, the Long Island congressman who ran to Hochul’s right in 2022 and was beaten easily. Torres, of late, has attacked Hochul for instances of crime on the subways.

a year earlier in a sexual harassment scandal. at fall, the crime issue would rst start to damage Hochul, with Republican Lee Zeldin coming within seven points of defeating her. She hasn’t been overly popular since.

Hochul does have tangible accomplishments to tout. She has boosted funding for public schools compared to Cuomo, signed into law new environmental and tenant protections, and managed an administration that has been mostly free of scandal, no small feat in Albany. Under her watch, the statewide Democratic organization has also started to function again after many decades of neglect and even sabotage. For lawand-order types who wanted the state’s criminal justice and bail laws weakened, she certainly accomplished that.

But there are reasons to believe Torres, if he does run, could do far better than Suozzi. In 2022, Hochul was a new governor, and more voters were giving her the bene t of the doubt after she replaced Cuomo, who had resigned

e trouble for Hochul is that many residents aren’t feeling overly optimistic about New York. Cost of living remains an enormous challenge. It is harder than ever to buy a house, and rents post-pandemic have been stubbornly high. Lingering anger over the migrant crisis has damaged her standing. Crime concerns haven’t helped, either.

And her wa ing over congestion pricing — the tolling plan for Manhattan nally launched on Jan. 5 — has pleased few constituencies. Progressives and transit advocates were furious in June when she temporarily mothballed the program. Outer-borough and suburban motorists who were infuriated about having to pay a new toll were not placated and haven’t given her much credit for lowering the peak charge to $9 from $15.

Torres is a strong fundraiser and could spend much more on the primary than Suozzi. As an Afro-Latino, he could hold appeal in nonwhite working class neighborhoods, and he’s forged a strong relationship with the Jewish community over his full-throated defense of Israel and criticism of pro-Palestinian protesters. He is, for now, an underdog, but he has a chance to pull o the upset against Hochul if he decides to run.

Her other problem is Mike Lawler, the Republican congressman from the Hudson Valley. Lawler, like Torres, is weighing a 2026 run. If Hochul survives Torres, she will have to fend o a Republican who is arguably more talented and formidable than Zeldin. Lawler has cut a more moderate path in

Washington and is a proven vote-getter in a district that Joe Biden once carried. If the 2026 electoral conditions should be more favorable to Hochul — it will be President Donald Trump’s midterm, and a backlash to Republican policymaking is probable — Lawler will still be a feisty opponent and would likely make his staunch opposition to congestion pricing a centerpiece of his campaign. All is not lost for Hochul. She’ll need to take a page out of the playbooks of more popular Democrat-

ic governors like Jared Polis of Colorado, Josh Shapiro of Pennsylvania, and Gretchen Whitmer of Michigan by delivering tangible goods for her state and reminding voters of what she has done. She will need to become, at the minimum, a better communicator. And she’ll have to o er a compelling argument and vision for what New York should be. Can she make New Yorkers excited about New York again? at’s her real challenge. Ross Barkan is a journalist and author in New York City.

By Nick Garber

Mayor Eric Adams is replacing the head of a city o ce that works with nonpro t organizations, a shakeup that comes as nonpro ts complain that the city is threatening their livelihoods by failing to improve a pattern of late contract payments.

Michael Sedillo, currently an adviser to First Deputy Mayor Maria Torres-Springer, is taking over as executive director of the Mayor’s O ce of Nonpro t Services, Adams said Jan. 3. Adams previously appointed Johnny Celestin to the same role in June 2024, after the mayor’s inaugural pick, Karen Ford, quietly departed months earlier.

City Hall did not mention Celestin in the Jan. 3 announcement. Mayoral spokeswoman Liz Garcia said Celestin, a longtime nonpro t executive, was not removed from the post, but had decided to take a new role at the Economic Development Corp. working with minorityand women-owned businesses.

But the sta ng change coincides with vocal complaints from the nonpro t sector that the city is sti ng organizations by taking months to pay them money they are owed. e city relies on nonpro ts for a huge range of critical social services, and Adams has

pledged to improve the late-payment issue.

But the problem has apparently worsened lately, due partly to a painful transition to the online payment platform PASSPort that has added delays. e leader of homeless services provider Breaking Ground told the City Council in June that her organization was owed $23 million by the Department of Homeless Services.

A nonpro t sector leader who was granted anonymity to speak freely told Crain’s on Jan. 3 that Celestin had been well-liked and that Sedillo, a former adviser for the mayor’s O ce of Contract Services, is also held in high regard. But providers are concerned that the o ce is now on its third leader in three years.

e Adams administration has said it is focused on improving the payment lag problem. A 2023 reform designed to speed up contracts awarded through the City Council’s discretionary budget has succeeded in dropping those contracts’ processing time from an average of 366 days in Fiscal Year 2024 to just 46 days in the current Fiscal Year 2025, City Hall said. And since October 2024, the O ce of Contract Services has cleared a

backlog of more than $1 billion and processed over 3,700 invoices.

Adams on Jan. 3 also announced he was forming a new working group led by Deputy Mayor for Strategic Initiatives Ana Almanzar, in which City Hall o cials will meet weekly to “examine contract performance data” and focus on speeding up payments.

Jocelynne Rainey, executive director of the philanthropic group Brooklyn Org, said at least three nonpro ts that her group supports nancially are considering shutting down due to late payments. Rainey told Crain’s she had been excited when Adams established the O ce of Nonpro t Services in 2022, “but I have been really disappointed in the fact that that hasn’t done anything to move the needle in regards to these nonpro ts getting the resources they need in order to survive.”

“ is is the third leader that they've had for this agency,” she said, “and nonpro ts are not getting any bene t from it as far as the movement of funding.”

e nonpro t Legal Aid Society said Jan. 3 that while it welcomed Sedillo's appointment, the city needed to do more to resolve the most pressing issues — like the inability of some nonpro ts to even submit invoices for payment. Legal Aid and other defender groups

have said the delays threaten their ability to give legal representation to vulnerable New Yorkers.

“ ese payment delays jeopardize the basic operations of nonpro ts, especially smaller ones, a ecting their ability to meet payroll and ultimately reducing access to critical legal services for New Yorkers who rely on them,” Legal Aid said. “If City Hall genuinely values the vital safety net nonpro ts provide for our most vulnerable residents, Mayor Adams and his administration must take decisive, long-term action to

address the systemic issues pushing these organizations to the brink of collapse.”

Of the 14 nonpro t legal groups that are pushing Adams to reform the system, none has received any payments for the 2025 Fiscal Year that began in July, since the city's Human Resources Administration has not yet approved their budgets, according to Legal Aid. ose groups are now on their fth month of not receiving the city funding they are owed, even though their contracts were registered on time.

By C. J. Hughes

Another food hall — a once-hot amenity that some hoped could entice employees back to the office — has bitten the dust.

Citizens Market Hall, a two-level offering at the Brookfield Properties-owned Manhattan West project, will shut its doors in April and let go of all 68 employees, according to a state layoff filing made public Jan. 8.

The hall, which features about a dozen eateries offering burgers,

Katsuya New York, was Creating Culinary Communities, or C3, a company founded in 2020 by Los Angeles hotel and nightlife entrepreneur Sam Nazarian. His C3 partners include national mall landlord Simon Property Group as well as Brookfield, according to a press release announcing the Citizens opening.

But Legends Hospitality, which operates concessions at Yankee Stadium and other sports venues around the country, joined the team in 2023, according to news reports.

The three-year-old offering, whose operators include Legends, will close in April.

sushi and Spanish dishes in a 40,000-square-foot space at 5 Manhattan West, an office building also known as 450 W. 33rd St., had a short shelf life, opening only in 2021.

Initially the owner of Citizens and all its restaurants, which include Plant Nation, Casa Dani and

Legends appears to be handling the layoffs, which will take place April 2, according to the filing, known as a worker adjustment and retraining notification. WARN notices are intended to give employees time to find new jobs before employers let them go.

Legends deferred comment to Brookfield spokeswoman Laura Montross, who said the developer was not giving up on food halls as a perk. In fact, she said Citizens is

being closed to make way for a new concept akin to Hudson Eats, the food hall at Brookfield’s Financial District complex Brookfield Place.

Hudson Eats features stalls operated by different owners unlike Citizens, a single-owner model.

“While Citizens was performing reasonably well,” she said in an email, “we are excited to be launching a comprehensive redesign of the Manhattan West market hall space to introduce a new, modern experience.”

An upscale take on the classic mall food court, Citizens, which is tucked into a corridor near a Peloton studio and a Whole Foods

Market off 10th Avenue, is not the only hall to have met its demise in recent months. In fact, the number of food halls citywide is now about 25, operators say, down from a peak of more than 30 preCovid.

Other casualties include Gotham West Market, a Gotham Org.-owned anchor of the Gotham West megadevelopment located about 10 blocks north, which closed last month after 11 years. Gotham declined to cite a reason for the closing of the 10,000-square-foot space, which

was down from about 10 restaurants to five when it called it quits.

Meanwhile Williamsburg Food Hall, an 18-vendor offering, shut down in March 2023, and Market Line, a subterranean version at the Lower East Side’s Essex Crossing development, closed in April after five years.

Brookfield, backed by the Qatar Investment Authority, developed Manhattan West, a 7 millionsquare-foot mixed-use project with offices, apartments, shops and a hotel between West 31st and West 33rd streets, cost nearly $5 billion to build. Its last building, the office spire 2 Manhattan West, was completed about a year ago.

Congestion pricing is here at long last. Now, lawmakers must stop debating a settled matter and turn their attention to investing the proceeds into transit improvements in a cost-e cient way.

e policy, rst proposed in 2007, is o to a promising start, reporter Caroline Spivack found. While transit experts contend that it’s far too early to have a full understanding of the program’s impact, preliminary data shows that cars are moving faster on bridges and tunnels and around key corridors in the city. Bumper-to-bumper gridlock on Manhattan streets has noticeably evaporated. Subway ridership jumped by 400,000 travelers on the rst Tuesday for which data was available, and the Long Island Rail Road and Metro North Railroad both experienced an uptick of more than 30,000 passengers, respectively.

Gov. Kathy Hochul wasted no time oating rail improvements on Metro-North’s Hudson line, which she said would speed up commutes to the city by up to 30 minutes on a round trip. e upgrades include a second track at the Spuyten Duyvil sta-

tion in the Bronx, signal and track enhancements at the Croton-Harmon station in Westchester County and increasing capacity at the Poughkeepsie Yard.

The announcement, made on the same day that the $9 congestion pricing toll took effect, was a smart move by Hochul, who has fences to mend with sub-

will only bankroll transit upgrades for wealthy Manhattanites.

Other lawmakers, who continue to kick and scream about a done deal,

Congestion pricing, rst proposed in 2007, is off to a promising start.

should follow suit. Instead of wasting taxpayer dollars dragging out a decades-long debate about the merits of the toll, it’s time to turn the page and focus on how to spend the money efficiently. The city’s business community relies on workers being able to get to their jobs quickly.

Ensuring that the MTA makes good use of the money won’t be an easy task; the agency has a $33 billion dollar hole in the latest capital budget it pitched to Albany and a recent audit alleges that it failed to implement any of the cost-cutting measures it pledged back in 2019. But cameras are firing and tolls are being collected. Electeds must now turn their attention to making sure those dollars go toward funding innovative projects and improving New Yorker’s lives.

New York City’s 220,000 small businesses are the heartbeat of our city, from vibrant bodegas in Brooklyn to entrepreneurs in Queens to family-run shops in the Bronx. ese aren’t just places to grab a co ee or pick up groceries — they’re the catalyst for our community ties and relationships, and the cornerstone of our neighborhood economies, o ering jobs, stability, and character to every part of our city.

But these businesses face an alltoo-common New York obstacle: bureaucratic nes that come with layers of confusion and ambiguity that make it harder to succeed.

ink about a new hardware store trying to get up and running that gets hit with thousands of dollars in nes due to not adhering to signage regulations. Or an important community laundromat that gets ned for not realizing they were improperly recycling. Even minor nes can accumulate and become a real threat to the stability of these essential neighborhood hubs. e large number of regulations is not only di cult to navigate but also disproportionately impacts small, community-rooted businesses.

Recognizing this obstacle, the City Council last year passed Local Law 151 as part of the Mayor’s Small Business Forward Initia-

tive. By reducing penalties and extending the time to address violations, this legislation was a great step forward and we’re seeing the impact in our communities already — but there’s still work ahead. Business owners and advocates need more transparency to navigate the ne process — a system that all too often acts as a roadblock to thriving communities.

is is why passing the Fine Transparency for Small Businesses bill — introduced by Council Member Oswald Feliz — is vital.

e legislation would require an annual study from the NYC Department of Small Business Services to gather data on common nes to better understand trends, affected industries, and geographic patterns of nes. is data will aid the Mayor and City Council in ensuring that businesses of

di erent types and in different neighborhoods are being treated fairly, and to make informed policy decisions that support small businesses. Insights from this analysis will also guide targeted e orts from local business advocates, such as workshops and outreach programs, helping businesses to avoid nes from the start. With better data will come smarter policymaking and more targeted community engagement, making compliance easier and making it easier for businesses to thrive.

e Fine Transparency for Small Businesses bill has gained strong support from organizations citywide, including the Five Borough Jobs Campaign — a coalition of 30 local economic development corporations and business improvement districts from all ve boroughs. From Brooklyn, to Queens, to the Bronx, we know the impact that more transparency will have in helping small businesses grow and create more jobs to keep New York vibrant and strong. is is the type of legislation that every New Yorker can get behind, no matter who you are. When it comes to unnecessary bureaucracy and red tape that makes it

harder for working people to do their jobs and live their lives, we should all be aligned in any measures we can take to simplify. is legislation is crucial — and our small businesses need it now more than ever.

So, the next time you pass by your favorite shop or stop by the corner café, remember: these businesses are the lifeblood of our neighborhoods. Let’s support them, including by championing this bill and working together to make it just a little easier for them — and ultimately our city — to succeed.

PERSONAL VIEW

In 2019, New York City took a bold step toward climate action with Local Law 97, one of the most ambitious building decarbonization laws in the country. The law’s first year of implementation in 2024 has placed significant pressure on building owners to take meaningful steps in addressing emissions and improving reporting practices. With over 50,000 buildings subject to LL97, energy usage is under close scrutiny, and penalties for non-compliance are set to take effect in 2025.

Beyond the sheer numbers, LL97 has sparked crucial conversations among property owners, government agencies, and sustainability advocates about what it will take to collectively tackle decarbonization. However, this observation year has revealed significant challenges that could undermine the law’s success—burdensome compliance costs, vague rulemaking, and inconsistent emissions data are all hurdles that require urgent attention and refinement.

savings that can eliminate upfront costs and create an economically viable path to compliance, paid for through energy savings. These solutions show that compliance doesn’t have to be prohibitively expensive, but there is still a major need for additional financing solutions.

When LL97 came into being it was understood the costs to modernize New York City’s buildings would be astronomical. Yet, over the past five years, companies like BlocPower, Kelvin, Parity, and Runwise have pioneered financing mechanisms tied to future energy

PERSONAL VIEW

Progress has been further stalled by unclear, inconsistent, and delayed rulemaking from the Department of Buildings. Frequent and sometimes contradictory updates have left building owners and decarbonization service providers like Kelvin grappling with uncertainty, eroding trust in the process and delaying projects. For building owners, the misconception that LL97 compliance is synonymous with unaffordable upgrades persists.

More robust communication from the city, as well as expanded rebate programs and clearer guidelines, could help dispel these myths and enable property owners to take meaningful action.

Another significant challenge is the city’s reliance on self-reported emissions data, which can often be inaccurate. Without standardized measurement tools and stricter parameters for data submission, compliance tracking risks being undermined by poor-quality information. Addressing this gap is critical for

creating an enforcement system that is both fair and effective.

The city itself has struggled to manage the volume of data and track compliance effectively, highlighting the need for enhanced resource allocation and a streamlined approach to enforcement as 2025 approaches.

While LL97 is groundbreaking, New York City is not alone in its climate ambitions. Cities like Boston, Washington, D.C., and Denver have introduced similar building decarbonization mandates, with more municipalities likely to follow. This positions New York to lead by example, setting a national standard that other cities can adopt to accelerate the transition toward sustainable urban infrastructure. However, for LL97 to serve as a true blueprint, the city must address its early missteps.

By enhancing rulemaking transparency, investing in accurate emissions measurement tools, and expanding financial incentives, New York can ensure compliance is both achievable and scalable. LL97 holds the potential to transform the city’s building stock into a global model of sustainability, but only if policymakers, industry leaders, and property owners collaborate to overcome its challenges. Together, they can create a framework that balances ambition with practicality—solidifying New York’s role as a leader in both vision and execution, while inspiring cities nationwide to join the fight against climate change.

Minority and women-owned business enterprises, or MWBEs, are more than just letters in an acronym. They represent the beating heart of our city’s economy. Dreamers and do-ers, strivers and go-getters, these are the businesses that make our city move.

But they haven’t always been treated that way. For too long, poor policies, bad management, and a general oversight of this vital demographic eventually led to MWBEs being left behind.

Now, we are turning the corner, and the results speak for themselves. Recently, Mayor Adams announced $6.4 billion in total MWBE contracts and a record-breaking 31.2 percent MWBE utilization rate, milestone achievements that mark progress towards awarding an ambitious goal of $25 billion in contracts to MWBEs by Fiscal Year 2026.

Former New York City Comptroller William Thompson and New York Building Congress Chairperson Emeritus Elizabeth Velez are the chairs of the newly formed MWBE Advisory Council.

the top of the city’s agenda. Mayor Adams created the position of the city’s first ever chief business diversity officer with Michael Garner at the helm. The sole function of this role was simple: make it easier, not harder for city government to do business with MWBEs. Make no mistake, city government has both a substantive and symbolic role in supporting MWBEs. Not only is it good for the entire economy, but it is vital for the municipal government to serve as a role model to all sectors, showing you can deliver quality services to New Yorkers while prioritizing diversity.

chase contracts: agencies awarded $250 million in contracts to MWBEs via this contracting method—up from just $77 million in Fiscal Year 2021. This has led to more than 60 percent of the total contract value awarded to Asian women-owned or Blackand Hispanic-owned businesses, which have historically been the most underutilized categories of M/WBEs. Smart changes led to real impact.

However, behind all the numbers, figures, and legislation are real stories. Small businesses with big dreams, who too often were confronted were racial and gender barriers that halted their success. The MWBE programs sought to turn those dreams into realities. The work is far from over and more work needs to be done, but progress is being made.

Adding bus lanes isn’t right for every community

I READ WITH INTEREST Caroline Spivack’s story on Dec. 6 about the Adams administration’s poor record on constructing bus lanes: “New bus lanes have slowed to crawl under Adams admin.” Yes, some plans have been slowed or stopped, but to blame them vaguely on “community squabbles” demeans those who feel their livelihoods are threatened by ill-conceived transit plans.

BID.

Here in the Belmont section of the Bronx, Little Italy, we fought hard against a bus lane on nearby Fordham Road, which would have had a terrible impact on our customers. Two major Business Improvement Districts and six major institutions unified against this poorly thought-out and destructive one-sizefits-all proposal.

While we celebrate our victories today, tomorrow we remain steadfast in our goal of breaking another record next fiscal year for these vital businesses. First, let’s understand how we got here.

The Adams administration took serious steps to move MWBEs from the backseat to

Secondly, our lawmakers stepped up to the plate. Thanks to leaders like Gov. Kathy Hochul, New York State Senator James Sanders and New York State Assemblymember Rodneyse Bichotte Hermelyn, commonsense reforms were signed into law that cut red tape and created opportunities. New laws authorized agencies to award up to $1.5 million through the city’s MWBE Small Purchase method, tripling the initial threshold of $500,000 from the de Blasio Administration. This enhancement has paved the way for MWBEs to better compete for small pur-

That’s where we are hoping to step in. Together, as co-chairs of the newly formed MWBE Advisory Council, we are bringing every stakeholder to the table — from civic and corporate to policy experts and political leaders — who are laser-focused on executing one goal: supporting MWBEs.

Our North Star is far and wide, but that’s what our MWBEs deserve. We should aim for the stars because MWBEs are the economic engines of our communities. They are the mom-and-pop shops, vendors who help city government function, and lend a hand to those most in need. In short, when we invest in our MWBEs, our entire economy thrives.

Turns out, we were right — the plan was unnecessary. Once the existing bus lane was repainted and enforcement was stepped up, bus speeds went from what the Department of Transportation and the Rider’s Alliance claimed were 4 m.p.h. to what the Rider’s Alliance said were over 9 m.p.h. — well above the borough-wide average.

The bus lane that the city Department of Transportation tried to impose on this transit desert was a solution in search of a problem. It was based on ideology not on a genuine need. Yes, there are places in New York City where bus lanes not only work but are badly needed. But not everywhere. No two New York City neighborhoods are the same. Any community having a lane foisted on it by DOT should take a page from our playbook and fight it.

SBI Consultants

SBI Consultants, a trusted advisor to project leaders and stakeholders of complex construction projects, has promoted Michelle Grossman and Alexandre Lachaud to partners in the firm. Both bring exceptional engineering expertise, leadership acumen, and a clientfirst mindset to their new roles.

As Partner & Director of Leadership Solutions, Grossman will oversee the arm of the business that guides clients through the feasibility, design, bid, construction, and closeout phases of a project.

As Partner & Director of Technical Solutions, Lachaud will focus on leveraging firm expertise and data-driven insights to help clients plan for the most efficient project execution, control project cost and scope and stay ahead of any potential pitfalls.

Chris Dowd will serve as Head of Specialty Finance for IDB Bank. In this role, he will lead a portfolio in excess of $1 billion across key national business segments, including Sponsor & Leverage Finance, Syndications, Asset-Based Lending, and Factoring. Under Chris’ leadership, IDB will continue to strengthen its position across commercial markets. A seasoned industry leader, Chris’ appointment follows his recent tenure as Head of Syndications, Sponsor & Leverage Finance.

Hodgson Russ LLP

Matthew K. Parker has been elevated to Partner at Hodgson Russ LLP. A member of the Litigation Practice, Parker concentrates on business and employment litigation matters in New York City and throughout the country. He handles a variety of business and contract litigation matters on behalf of financial institutions and commercial clients, including claims involving breach of contract, breach of fiduciary duty, shareholder disputes, tortious interference with contract, and other business torts.

Farrell Fritz, P.C.

Farrell Fritz is pleased to announce the promotion of Becky (Hyun Jeong) Baek and Jason A. Little to partner effective January 1, 2025.

Becky (Hyun Jeong) Baek is a commercial litigator and business divorce attorney. She earned her J.D. from Brooklyn Law School, her M.A. from Alliance Theological Seminary, and her B.A. from Trinity College. Becky practices out of the New York City office.

Hodgson Russ LLP

EisnerAmper

Navin Sethi has joined EisnerAmper as a Tax Partner in the firm’s Financial Services Group. With 25 years of experience, Navin services hedge, venture, and private equity funds. He has deep expertise within the financial services, cryptocurrency, and digital asset areas.

PJ Manchanda has joined EisnerAmper as a Tax Partner in the firm’s Private Client Services Group. With approximately 15 years of experience, PJ specializes in servicing high-net-worth families and privately owned businesses. He works across the financial services, law, real estate, and entertainment sectors. PJ provides tax compliance, strategic consulting, succession planning, family office consulting, and trust and estate planning.

Farrell Fritz, P.C.

Jason A. Little is a commercial litigator, bankruptcy, cannabis and corporate attorney. He earned his J.D. from University of Buffalo Law School and his B.A. from Clarion University of Pennsylvania. Jason practices out of the Albany office.

Farrell Fritz is pleased to announce the promotion of Damian J. Racanelli and Michael L. Webb to partner in the firm’s real estate group effective January 1, 2025.

Damian J. Racanelli is a transactional real estate, construction and commercial finance attorney. He earned his J.D. from Maurice A. Deane School of Law at Hofstra University and his B.S. from Boston University.

Michael L. Webb is a real estate, economic development, and commercial finance and banking attorney. He earned his J.D. from St. John’s University School of Law and his B.A. from Queens College.

Kel Christensen joins KeyBank as SVP, Commercial Banking Relationship Manager, developing and managing relationships with middle market firms with $50M to $2B in sales in the NY tri-state area. Prior to Key, he spent 10 years at Santander Bank. He began his career with Brown Brothers Harriman before serving 12 years with Citibank. Kel is involved with Big Brothers Big Sisters and Queens Center for Progress. He has a bachelor’s degree from Johns Hopkins University and lives in Manhattan.

Nick Nadgauda will join MetLife as Executive Vice President and Global Chief Information Officer. In this role, he’ll have accountability for MetLife’s application development, infrastructure, enterprise platforms and architecture teams.

Nick will be responsible for the strategic vision and execution across the technology portfolio, leading efforts to further enable market differentiation at every stage of the customer journey.

Nick will report to Bill Pappas, Head of Global Technology and Operations.

Hodgson Russ is pleased to announce Andrew W. Wright has assumed responsibility as Practice Leader for the firm’s renowned State & Local Tax (SALT) Practice. Wright has in-depth experience in state tax residency and assists clients on residency matters ranging from strategic planning through audits and litigation. He also counsels clients on structuring transactions and ongoing business relationships to minimize their state and local tax burden.

Nixon Peabody LLP

Nixon Peabody LLP is pleased to announce that Josie Morris has joined the firm as counsel in our Affordable Housing & Real Estate practice. Josie brings more than a decade of experience representing developers, owners, and institutional investors in all aspects of commercial real estate transactions, including acquisitions, dispositions, joint ventures, leasing, and financing. She earned her JD from New York University School of Law and her BA from the University of Michigan.

Farrell Fritz is a full-service law firm of more than 80 attorneys serving clients across the New York region.

Farrell Fritz is a full-service law firm of more than 80 attorneys that has earned a strong reputation in the New York business community serving clients across the region.

To place your listing, visit crainsnewyork.com/ company-on-the-move

Grassi

Grassi, a leading accounting, tax and advisory firm, announced the relocation of its New York City headquarters to 360 Madison Avenue. The move to the building’s entire seventh floor reflects the firm’s continued growth and commitment to the New York market.

The expanded office space features modern amenities and a prime Midtown location, positioning Grassi to serve its growing client base while providing an enhanced work environment for its professionals.

Grassi’s New York City office provides advisory, tax and accounting services to individuals and business clients in the construction, real estate, nonprofit, healthcare, manufacturing and distribution industries, among others.

By Ethan Geringer-Sameth

Gov. Kathy Hochul is reiterating her efforts to make it easier to involuntarily commit and treat people with severe mental illness in the wake of a spate of violence in the subway.

In a statement Jan. 3 ahead of the new legislative session, Hochul decried a recent parade of “horrific incidents” in the transit system and repeated a playbook she has pushed for years to boost psychiatric hospitalization and court-ordered treatment. Her executive budget will include changes along those lines when it is released in the coming weeks, she said, without providing specifics.

But some experts say the focus on adding more legal fixes hides a lack of accountability and coordination among existing programs meant to reach people living on the streets. And some of the efforts Hochul lauded, like a push to create more psychiatric beds, have yet to come to fruition.

Crime in the subway was up in December compared to the previous year, punctuated by several heinous and apparently unprovoked attacks: a woman was burned to death on a train car in Coney Island, a man was shoved in front of a moving subway on New Year’s Eve and multiple people were stabbed or slashed in separate events recently. The NYPD recorded 49 felony assaults in the transit system during four weeks in December, a 40% increase over the same period in 2023.

Hochul claimed recent attacks involved people with untreated mental illness and blamed them on a failure to reach homeless residents. The claim echoes several violent episodes in the past, in which perpetrators were previously

known to law enforcement and mental health workers. But neither the governor’s office nor spokespeople for Mayor Eric Adams, who issued his own statement of support for Hochul’s latest call to action, have provided evidence that the most recent high-profile incidents involved people with a history of mental illness.

In her statement Jan. 3, Hochul touted the steps she has taken to improve mental health services and flood the transit system with police and National Guardsmen. That included a $1 billion commitment to outreach and community-based services, supportive housing and psychiatric beds. But despite directives to remove more people by force from the subways, she said changes to state law were needed to make it easier for hospitals to commit people at risk of harming themselves. She also said state lawmakers should expand Kendra’s Law, a 1999 measure that allows court-mandated mental health treatment in the community.

“Moving the goalposts”

That assertion is being challenged by a growing chorus of politicians and advocates both for and against more involuntary hospitalization. City Councilman Robert Holden, a conservative Democrat from Maspeth, Queens, accused Hochul of “moving the goalposts” in response to her statement Jan. 3.

“Governor Hochul is gaslighting the public by punting the mental health crisis to the State Legislature under the guise of needing changes to Kendra’s Law,” he said in a statement. “The truth is that Kendra’s Law works when properly enforced, but city and state

agencies have failed to follow through, and the Governor has failed to allocate the necessary resources to make it effective.”

Harvey Rosenthal, CEO of the Alliance for Rights and Recovery, a mental health advocacy group that opposes efforts to increase involuntary treatment, said a lack of accountability by providers and policymakers has allowed people like Jordan Neely, who was strangled to death on the subway after cycling through outreach programs, to fall through the cracks.

“Despite accessing a variety of services, our systems failed to provide him with the level of persistent engagement and well-coordinated and accountable follow up he deserved,” Rosenthal said.

Many of the legislative changes Hochul has championed are already in practice through regulation, including a 2022 directive from state Mental Health Commissioner Ann Marie Sullivan that clarified the criteria for involuntary commitment to include people who fail to meet their own basic needs. The Adams administration has backed a piece of state legislation known as the Supportive Interventions Act, that would increase the number of practitioners able to issue orders of involuntary treatment, a tool the mayor has said would relieve logjams in hospitals but which some advocates for the homeless say could be prone to abuse.

Hochul also hailed her administration’s efforts to restore psychiatric beds that were taken offline during the height of the pandemic “so individuals who need care have a place to go.”

But some of the efforts Hochul lauded, like a push to restore closed psychiatric beds in hospi-

By John Schroyer, Green Market Report

With less than 12 hours to spare before the clock switched over to 2025, Gov. Kathy Hochul announced that the state’s legal cannabis industry surpassed the $1 billion sales mark since its launch just over two years ago, driven by 275 operational adult-use dispensaries. Not only that, but the number of legal marijuana shops is poised to more than double this year, a key cannabis regulator told the New York Post, forecasting that the number of dispensaries will hit 625, still short of the 2,000 cannabis stores the state is expected to eventually host.

“Governor Hochul is gaslighting the public by punting the mental health crisis to the State Legislature under the guise of needing changes to Kendra’s Law.”

Robert

Holden, city councilman

tals, have yet to come to fruition. Of the more than 1,000 inpatient psychiatric beds that were shuttered during the pandemic, just 517 hospital beds had been restored as of November, according to Office of Mental Health. Hochul’s marquee promise to bring the beds back online as a means to address the state’s mental health crisis has proved difficult, as psychiatric beds are less lucrative for hospitals than medical beds. Despite state-imposed fines for not reinstating the beds and attempts to sweeten the pot with increased reimbursement for hospitals, the number of beds in private hospitals, where patients are often seen first for psychiatric evaluation, has not moved in a year.

Separately, the Hochul administration has set its sights on expanding the number of beds in a different type of facility, long-term state-run institutions, creating 200 new beds with plans to open another 200, said spokesman Avi Small. The restoration of only 190 general hospital beds is currently in planning out of a remaining 500, according to figures provided by Small.

Hochul hailed the sales figures as “a testament to the hard work of those who helped build the strongest cannabis industry in the nation,” and said that a statewide crackdown on over a thousand unlicensed cannabis shops last year was also a big help in pushing sales to their current levels.

According to an annual report released by the state Office of Cannabis Management, New York regulators have thus far approved more than 5,250 total adult-use cannabis business permits, of which 54% are for social equity licensees harmed by the war on drugs.

Sales for the coming year could surpass $1.5 billion, OCM Policy Director John Kagia told the New York Post, in part because the market continues to launch on a rolling basis. Kagia predicted that “over 350 dispensaries” will open in 2025, bringing the total to at least 625, the Post calculated.

The OCM is also expecting to add “hundreds” more of other business license types as well, Kagia indicated, which is in keeping with how the OCM has approached permitting for months.

This article originally appeared in Green Market Report.

The annual gathering of The Real Estate Board of New York serves as a convergence point for prominent developers, owners, brokers, and key public gures to foster connections, share perspectives, and acknowledge the signi cant impact they collectively bring to the fabric of New York City. At this event, REBNY unveils its distinguished award recipients. In 2025, REBNY takes pride in introducing a remarkable cohort of individuals leading the charge in the city’s real estate sector and civic engagement. These exceptional men and women showcase an unwavering dedication to enhancing the city, supporting its residents, communities, and overall economic vitality.

Meet this year’s astounding honorees who will be honored on January 16 at The Glasshouse, in New York City.

Presented to REBNY members who have displayed exceptional service to the real estate industry and professional accomplishments over the course of distinguished careers.

Jonathan Mechanic is chairman of Fried Frank’s Real Estate Department and a member of the rm’s Governance Committee, where he counsels developers, owners, investors, REITs and lenders in all aspects of commercial real estate. Prior to joining Fried Frank as a partner, he was general counsel and a managing director of HRO International, a real estate development organization responsible for developing more than 2.5 million square feet of of ce space in Manhattan.

Recognizes REBNY members’ outstanding service to the community.

Michelle Adams is a distinguished leader in urban development and a driving force in New York City’s real estate community and civic landscape. Michelle currently oversees global external relations for Tishman Speyer, including government and community affairs as well as communications and philanthropy. Prior to Tishman Speyer, Michelle served as the executive director of the Association for a Better New York from 2002 until 2010.

Presented to REBNY members who have displayed exceptional service to the real estate industry and professional accomplishments over the course of distinguished careers.

Scott Rechler is the CEO and Chairman of RXR, a fully integrated real estate company and investment manager that owns and manages over 30.5 million SF of commercial properties and over 9,800 multi-family units. RXR specializes in public-private partnerships and master developments, including the new Terminal 6 at JFK International Airport and a 1,100-acre, $3 billion mixed-use development in Raleigh, North Carolina. RXR also has a multi-billion credit platform.

This award is presented to a New Yorker who has displayed exceptional accomplishments and service in the public’s interest.

Representative Ritchie Torres is a ghter from the Bronx who has spent his entire life working for the community he calls home. Ritchie represents NY-15 and is a member of the Financial Services Committee and the Select Committee on China. In 2013, at the age of twenty- ve, Ritchie became New York City’s youngest elected of cial and the rst openly L.G.B.T.Q person elected to of ce in the Bronx.

Tishman Speyer congratulates Michelle Adams on receiving REBNY’s

As a prominent leader of urban development in New York City’s real estate community and civic landscape, this award formally recognizes Michelle’s outstanding dedication to fostering positive social impact.

Recognizes individuals within the management area. Winners display outstanding professionalism in property management, civic achievement and contribution to the real estate industry.

Thomas Lloyd is Senior Managing Director of Investor Services in the New York City market for CBRE. Tom represents CBRE lines of businesses for an over $30 billion client portfolio of local and global investor owners of office, retail and industrial assets. With more than 25 years of management experience, Tom has deep expertise in working with real estate investors to maximize investors asset value.

Honors a REBNY broker with personal and professional integrity, leadership and prominence in the brokerage community and participation in REBNY’s committees.

Nicola Heryet is a Principal at Avison Young’s New York City office, bringing over 37 years of expertise in commercial real estate. She specializes in the leasing and strategic planning of office spaces, representing both owners and occupiers across New York City. Throughout her career, Nicola has facilitated over 35 million square feet of transactions, earning long-term relationships with prestigious clients.

Presented by the Young Men’s/Women’s Real Estate Association to a member whose skills, integrity and ethics have contributed to his or her profession and the community.

Craig Waggner is a Managing Director in the Private Capital Investment Sales Group for Cushman & Wakefield. Craig joined Cushman & Wakefield following the acquisition of Massey Knakal Realty Services in 2014 where he had served for 16 years as a Senior Director. Craig’s accolades include receiving the Steve Spinola Award for demonstrating superior performance and dedication company wide and several CoStar Power Broker Awards.

Jonathan L. Mechanic

Partner, Real Estate

Fried Frank extends heartfelt congratulations to Jonathan L. Mechanic on being named the recipient of the 2025 Bernard H. Mendik Lifetime Leadership Award from REBNY.

With this historic recognition, Jon joins the ranks of those who have shaped New York City’s real estate landscape becoming the first lawyer to receive this accolade.

His leadership has not only elevated the field but inspired countless others to follow his path—proving that true greatness is built on vision, dedication, and an unwavering commitment to excellence.

FRIED, FRANK, HARRIS, SHRIVER & JACOBSON LLP

By Eddie Small