Warehouse wars break out in the suburbs

From Naperville to Deer eld, plans to repurpose dormant o ce campuses spark backlash

BY DANNY ECKER

Coming soon to a suburb near you: the battle over converting empty o ce parks to warehouses.

Amid record high o ce vacancy and demand for workspace that may have weakened for good, proposals are popping up across the Chicago area to replace underused o ce buildings with distribution hubs for the booming online retail sector.

In some cases, it’s getting heated. Hundreds of north suburban residents packed the Deer eld High School gym in May to wave signs and boo as Chicago-based Bridge Industrial pitched its plan to raze the Baxter International headquarters and build a pair of large industrial buildings on the 101-acre site.

“It’s not consistent with what the future of Deer eld should be for the young families we have

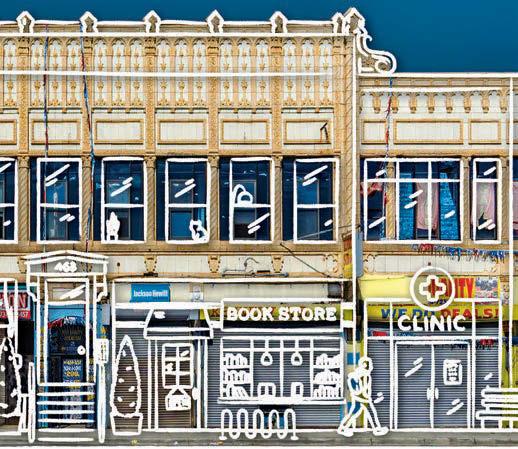

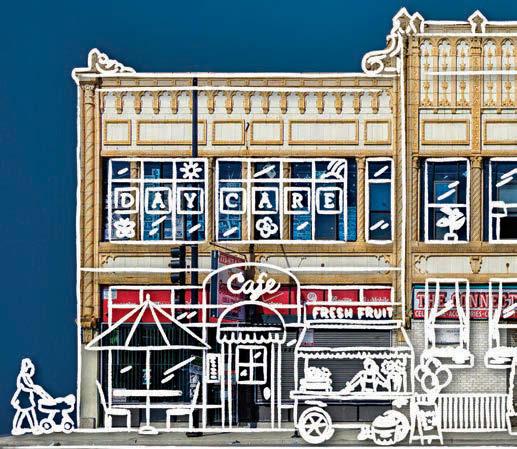

The boom in unused desks and cube walls

BY JUDITH CROWN

The nation is awash in used Herman Miller desk chairs, Steelcase desks, conference room tables and cubicle walls.

As companies continue to downsize their o ce space in the post-pandemic era, furniture is pouring out of downtown high-rises and suburban o ce parks. Facilitating the transition are used furniture dealers who earn money breaking down or decommissioning o ces. e companies giving up space can earn a credit for valuable

pieces they have on hand. In other instances, they pay the dealers to cart away obsolete furniture.

“For every action, there’s an opposite reaction,” says Mason Awtry, CEO of Chicago o ce services rm Wurkwel, which owns used dealer O ce Furniture Center at Roosevelt Road and Cicero Avenue.

Decommissioning jobs have more than doubled since the start of the COVID pandemic at Wurkwel,

See FURNITURE on Page 18

here and the young families we want to continue to attract,” says Harry Steindler, a 37-year Deereld resident who lives across Interstate 294 from the Baxter property. “ at’s the lifeblood of our whole community.”

e ght puts pressure on ofcials in suburban municipalities to weigh the impact that such massive redevelopments would have on their towns and make decisions that could not only spark ghts among their neighbors but dramatically change their environs for decades. ose in favor see them as e ective ways to reinvigorate white-elephant o ce properties, bringing new jobs and local tax revenue to large commercial

See CONVERSIONS on Page 19

Wondering where your property tax bill is?

BY ALBY GALLUN

If you live in Cook County, your next property tax bill will be arriving late — again.

For the second year in a row, the county has delayed sending out notices to property owners informing them what they owe for the second installment of their property taxes. e county treasurer normally sends out the

MADELEINE DOUBEK

From the high court on down, government ethics must take center stage now. PAGE 2

bills in early July, with taxes due in early August. is year, the bills should come out in early November with a due date of Dec. 1, according to a news release from the o ce of Cook County Board President Toni Preckwinkle.

“ e COVID-19 pandemic, coupled with a critical overhaul of the technological backbone of the system, has had a dramatic impact on the county’s property tax processes and timelines,” the release said.

Late tax bills became a source

See TAX BILLS on Page 18

CRAIN’S LIST

Size up the assets of the Chicago area’s largest banks and thrifts. PAGE 9

VOL. 46, NO. 29 COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. ALL RIGHTS RESERVED CHICAGOBUSINESS.COM | JULY 24, 2023 | $3.50

JOHN R. BOEHM

A ood of furniture and xtures is pouring in from high-rises and o ce parks. ‘For every action, there’s an opposite reaction,’ says one o ce services CEO. I

Mason Awtry is CEO of Chicago o ce services rm Wurkwel.

MORE: Suburban o ce vacancy hits new high. PAGE 6

If you live in Cook County, your next statement will be arriving late — again

Pat Hughes deserves every praise — and then some

“Baseball is the only game you can see on the radio.”

e line is from former Chicago Tribune colleague Philip Hersh, and it greets visitors to the broadcasters’ wing at the Baseball Hall of Fame in Cooperstown, N.Y.

It’s an apt summation of a broadcaster’s challenge: Craft the word pictures enabling a listener to see, in their mind, the beauty of baseball as it’s being described on the radio. No one handles it more skillfully or vividly than Pat Hughes, for 28 years the radio voice of the Chicago Cubs. us, it’s entirely tting that this unwaveringly cheerful voice of summer was recognized as a Hall of Famer when he accepted the Ford C. Frick Award for distinguished service as a baseball broadcaster at induction ceremonies in Cooperstown over the weekend.

“Overwhelmingly sublime,” Hughes said of his initial reaction to the news of his selection. “ is isn’t something you can aspire to or set out to achieve. From my

earliest days in broadcasting I was determined to work hard and do the best I could at whatever job I was doing. To be recognized by the Hall of Fame . . . it’s hard to put it into words. You just work hard, and sometimes good things happen.”

It speaks to the city’s rich baseball history that he’s the fth Chicago voice to be enshrined, following Bob Elson (1979), Jack Brickhouse (1983), Harry Caray (1989) and Hawk Harrelson (2020).

Elson — sober, taciturn, just the facts — could have been delivering an economics lecture. Brickhouse — always enthusiastic and fun, but an unabashed homer. Caray and Harrelson — bombastic self-promoters who purposely or not made themselves part of the story.

Hughes is refreshingly di erent — the word “bombast” doesn’t exist in his expansive vocabulary, and he’s more self-deprecating than self-promoting, entertaining boothmates Ron Coomer and Zach Zaidman with a quick-witted willingness to

poke fun at himself. e crowd at Wrigley Field gave him a rousing ovation during last Tuesday night’s Washington game, the last one he’d call before heading to Cooperstown. Grossly competent comes to mind in assessing his game calls— clear, smooth and accurate, his excitement level in sync with the ow of the game, but never forced. Hughes is adept at engaging his analysts, especially the late Ron Santo, who didn’t always seem to be watching the game.

He can call upon a vast storehouse of baseball knowledge and general knowledge to keep the broadcast moving when a game slows down or to keep the audience engaged in the event of a blowout.

Noted Bay Area broadcasters and Frick Award recipients Russ Hodges, Lon Simmons and Bill King were the voices of Hughes’ youth as he grew up in San Jose, Calif., the middle child of ve in a sports-loving household. He played some basketball at San Jose State, “but by

DAN McGRATH ON THE BUSINESS OF SPORTS

the time I was about 17,” he said, “I realized my path to a career in sports was not as an athlete.”

Older brother John’s suggestion that he take broadcasting classes changed the course of history.

“I was calling a San Jose Missions game at Visalia in the California League probably in 1978,” Hughes recalled. “I was the only ‘media member’ in the ballpark. My ‘booth’ was a card table behind home plate, with a rickety wooden chair. I can’t imagine there were any ratings at all. But I thought, ‘ is is it for me. is is what I want to do.’”

Forty- ve years years later, after stops in Columbus, Minneapolis and Milwaukee, after some 6,000 games, he’s still doing it, fresh, enthusiastic and cheerful as ever, an

ideal summertime companion. Pat Hughes clearly loves what he does.

“What is there in life,” he asked, “that brings you as much enjoyment as a senior citizen as it did when you were a 12-year-old? Besides baseball?

“I’m just grateful. My parents were educators, and they instilled in me a love of learning that I retain to this day. My family (wife, Trish, daughters Janell and Teddy) have supported me in everything I’ve ever done. I’ve worked for great people, with great partners. It’s been an amazing run.”

Crain’s contributing columnist Dan McGrath is president of Leo High School in Chicago and a former Chicago Tribune sports editor.

Government ethics must take center stage now

Let’s start with the perspective that there are hundreds of elected o cials in Illinois and even more in the federal government who do the work, put in long hours and do so honorably, never coming near crossing a line or having a whi of an ethical question raised about their behavior.

at fact often is noted by state legislative leaders when calls come to beef up e orts to curtail corruption. It’s true: Most do the job and do it well and for the right reasons.

Yet it also remains true that we continue to see questionable if not illegal behavior by many elected ocials at every level of government.

For some reason, even some politicians who run on platforms of embracing ethics and changing corrupt business as usual take o ce, get caught up in the trappings, embrace the sense of entitlement and start crossing the line.

e latest examples of ethical lapses? e very people who are supposed to set the platinum standard for the rest of us: U.S. Supreme Court justices. ProPublica has reported on luxury ights, vacations and other goodies never disclosed for more than two decades by Justice Clarence omas. A similar luxury trip was accepted and not disclosed by Justice Samuel Alito. e pricey gifts were given by people who have had business before the court.

In Illinois, we’ve just seen the convictions of Michael McClain, a crony of former House Speaker Michael Madigan; former ComEd CEO Anne Pramaggiore, and former ComEd lobbyists John Hooker and Jay Doherty. Madigan’s chief of sta , Tim Mapes, is scheduled to face trial next month on corruption charges; Madigan is slated to follow next year.

In Cook County, a judge recently

removed the need for an outside monitor for Cook County Clerk Karen Yarbrough’s o ce, despite the fact that in the past year, the court-appointed monitor over her o ce said she “repeatedly and materially violated its hiring policies.” Yarbrough has been accused of hiring her friends, relatives and Madigan allies for years.

In Chicago, Inspector General Deborah Witzburg found probable cause, and the city’s ethics board members agreed, that a council member, identi ed in news reports as James Gardiner, wrongly punished a critic constituent by seeing to it that hundreds of dollars in bogus nes were levied against him for weeds and rodents in his yard. And former Mayor Lori Lightfoot was soliciting campaign contributions and help from Chicago Public Schools and City Colleges employees. A Lightfoot spokesperson said the nding is “demonstrably false,” but reports indicate that her campaign sent thousands of emails over several weeks, and Witzburg is not backing down.

She told the Chicago Sun-Times that the increased focus on enforcing ethics rules is an intentional effort to “pay down Chicago’s de cit of legitimacy.” Witzburg added, “We’re gonna hold people accountable when they break the rules, regardless of the positions they sit in.”

Clearly, at all levels of government, there still is a need for strict, clear ethics rules and laws and a need for sti , meaningful punishment when there are violations.

Chicago has had a strong inspector general and independent ethics board for years, including prior to Witzburg’s appointment.

ere remains a need to boost the power and independence of the IG

who oversees the state’s legislative branch and its con icted ethics board comprised of current and former lawmakers.

More changes can and should be enacted to make clear what is acceptable behavior and to rmly punish those who act corruptly.

Hiring decisions should be based on what you know, not who you know. Campaign solicitations should be sent only to people who do not work for you. You should not pay o an o cial to get a desired policy or law changed. Don’t accept expensive gifts or perks if you are serving the public. Treat everyone with dignity and respect. ese are

not tough concepts, but we continue to see them dishonored.

Let’s give the last word here to “ComEd Four” juror Amanda Schnitker Sayers, who o ered a clarion call after she and her colleagues rendered their May verdict:

“ is should be a landmark where we start to do better for ourselves, for our children, and have

pride in our city and our state and not make any shady dealings to get stu done. Because we don’t need to,” she said. “We’re amazing people. We can all do amazing things.”

Madeleine Doubek is executive director of Change Illinois, a nonpartisan nonpro t that advocates for ethical and e cient government.

2 JULY 24, 2023 • CRAIN’S CHICAGO BUSINESS #1 SBA LENDER IN ILLINOIS E XPECT MORE FR OM Y OUR B ANK Based on total amount of dollars lent through SBA loans in fiscal year ending 9/30/2022. SEE WHY WE’RE #1 AT WINTRUS T. CO M/SBALending Banking products provided by Wintrust Financial Corp. banks. IS ON VACATION GREG HINZ MADELEINE DOUBEK ON GOVERNMENT

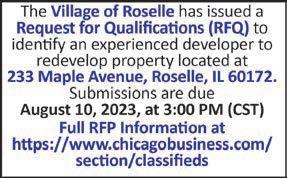

Auction scheduled for site housing Obama records

BY ALBY GALLUN

As construction crews work on the Obama Presidential Center on Chicago’s South Side, the suburban building where the federal government stores the 44th U.S. president’s records is heading to auction.

Area’s home prices reach a record high

But the city median dipped for the eighth straight month, according to a new report I

BY DENNIS RODKIN

The median price of homes sold in Chicago dipped again in June, for the eighth consecutive month, according to a report from a statewide real estate group.

But in the nine-county metro area, median prices grew, reaching a new record high.

e disparity between Chicago and metro-area price movement continues this year’s marked trend of the housing market showing far more vig-

or in the suburbs than in the city. In Chicago, the median price of homes sold in June was $332,900, down 3.3% from the same time in 2022, according to data released July 20 by Illinois Realtors, a statewide professional group. It’s a smaller decrease than in the two months prior — in April, city home prices dropped by 8.1% — but continues the string of declines.

Rivian showroom set for Gold Coast

BY ALBY GALLUN

As Rivian ramps up production at its downstate factory, the edgling electric vehicle maker is preparing to open a showroom in the Gold Coast less than a block from a storefront occupied by its rival Tesla.

Rivian con rmed it plans to open the 5,160-square-foot showroom at 871 N. Rush St. in September. e Irvine, Calif.-based company had planned to open a retail space in the Fulton Market District in 2021 but changed its mind, opting instead for the Gold Coast.

A retail presence in the neighborhood would allow Rivian to increase its visibility among wealthy residents and tourists alike as it tries to spur sales in an electric vehicle market led by Tesla. Rivian, which makes electric trucks and SUVs and delivery vans for Amazon, has struggled over the past year with recalls and supplier issues but has boosted production this year, pleasing investors and fueling a major rally in its stock.

Rivian is moving into the Gold Coast as Tesla mulls closing its showroom the next block north that opened in 2017. Tesla recently

hired a broker to market its space at 901 N. Rush St. for sublease. If it nds another retailer to take the space, Tesla would have one showroom left in Chicago, in River West, and six in the suburbs.

Rivian, which makes vehicles in a factory in downstate Normal, already operates a service center for Rivian owners at 2033 W. Walnut St. e company currently has just two showrooms — called

e owner of a former Homan Estates furniture store reincarnated as a processing and storage facility for Barack Obama’s presidential records has decided to auction o the property Aug. 7 after trying for months to sell it the conventional way. e rm overseeing the online auction has set the starting bid at $4 million.

e National Archives & Records Administration has occupied the 74,200-square-foot building at 2500 W. Golf Road since Obama left o ce in 2017. e federal government spent $5 million retro tting the property, bringing it up to “Level 4” security standards requiring “lobby blast protection,” a “ballistic protective barrier” and X-ray machines at its entrances.

A local physician who owns the building, Dr. Yan Katsnelson, put it up for sale last fall, but bids came in “below what he was willing to accept,” said Bob Huber, the broker hired to sell the property. So Katsnelson decided to try auctioning it o instead.

“We’ll get it out there and nd out what it’s worth,” said Huber, vice president at Chicago-based

Imperial Realty.

e property had its 15 minutes of fame last August, after government agents raided Mara-Lago, Donald Trump’s Florida estate, looking for records from his presidency. Defending himself against charges that he broke the law by storing classi ed documents there, Trump accused Obama of bringing presidential records with him to Chicago.

But that turned out to be false: Obama’s records were actually in Ho man Estates, in the custody of the National Archives.

THE PROPERTY SAT UNLEASED AND EMPTY UNTIL THE FEDERAL GOVERNMENT DECIDED TO LEASE IT IN 2016, OBAMA’S FINAL YEAR IN THE WHITE HOUSE.

The starting bid has been set at $4 million for the sale of the former furniture store in Ho man Estates The Rush Street space would help the EV maker increase its visibility

Katsnelson paid $2.45 million for the building in 2011, a couple of years after its original owner, Plunkett Home Furnishings, went out of business. A cardiac surgeon, Katsnelson is a founder and CEO of USA Vein Clinics, a Northbrook-based chain of vein clinics around the country. He invests in real estate on the side. e property sat unleased and

ing, where anyone who is curious is welcome to come in to learn more about us and our products,” Denise Cherry, Rivian’s senior director of facilities design and retail development, said in a statement. “We’ve peeled away the formality that can be associated with automotive retail and focused on creating a relaxed, family-friendly environment that invites guests to stay awhile and discover at their own pace.”

e Gold Coast is a logical location for a Chicago showroom, said Charlotte Catania, a Rivian spokeswoman.

“Rivian Spaces” — total, in New York and Venice, Calif. It plans to open additional ones in Vancouver, B.C.; Laguna Beach, Calif., and Austin, Texas.

Visitors to the stores can sit in, explore and drive Rivian’s vehicles, as they would at a normal car dealership, and buy Rivian merchandise.

“Rivian Spaces are purposefully designed to be casual and invit-

“It’s a great hub for both residents and visitors so we can introduce people to the brand for the rst time” and reconnect with consumers already familiar with it, she said.

CoStar Group rst reported news of Rivian’s Gold Coast plans. Rivian’s R1T pickup truck starts at $73,000, while its R1S sport utility vehicle starts at $78,000, according to the company’s website.

CRAIN’S CHICAGO BUSINESS • JULY 24, 2023 3

RE/MAX

IN THE VILLAGE

among wealthy residents and tourists alike

This house on Lombard Avenue in Oak Park sold in June for a little over $755,000, or nearly 9% over the asking price.

See HOME PRICES on Page 16

An architect’s rendering of the Rivian retail space.

See OBAMA RECORDS on Page 16

MORE: McKinsey forecasts ‘muted’ demand through 2030 for homes in the city of Chicago PAGE 14

These Chicago execs want their fraud convictions overturned. Here’s the argument they’re making.

Outcome Health co-founders Rishi Shah and Shradha Agarwal are taking a novel tack

BY JOHN PLETZ

Rishi Shah and Shradha Agarwal are using a novel argument in asking a federal judge to throw out their April convictions on federal fraud charges or at least grant them a new trial.

Shah and Agarwal, co-founders of Outcome Health, say prosecutors seized more of their assets than they should have before trial, which left the two without enough money to hire the attorneys who were their rst choices.

e improper forfeiture “amounts to misconduct by the government that violated Mr. Shah’s right to due process under the Fifth Amendment. Because it is not possible to restore Mr. Shah to the position he would have been in prior to the violation of his constitutional rights, the appropriate remedy is for this Court to dismiss the charges against Mr. Shah,” Shah’s attorneys said in a lling July 14.

“In the alternative, Mr. Shah requests that the Court set aside his conviction and order a new trial at which he may support his defense using the funds and assets that the government has unlawfully restrained for the past three years.”

Agarwal’s attorneys made a similar argument in a ling on July 14, which was the deadline for post-trial motions before sentencing.

Shah, Agarwal and Brad Purdy were the top executives at Out-

come Health, which sold advertising on television and computer screens that were installed in doctors’ o ces to provide educational content.

TOOK OFF IN 2012

e company took o in 2012 and soon reached $100 million in revenue, becoming one of Chicago’s most well-known startups. It raised more than $300 million from lenders and $488 million from investors such as Goldman Sachs, Google’s parent company and a venture fund founded by Illinois Gov. J.B. Pritzker.

But the company was accused of overbilling pharmaceutical clients for millions of dollars in ads they didn’t receive, which in ated the company’s nancials that were used to raise money from lenders and investors. After Shah and Agarwal were indicted in 2019, prosecutors froze roughly $30 million that the co-founders received in a settlement with investors after fraud allegations were made against Outcome Health.

Among those funds was $10.3 million Shah and Agarwal had put up to retain lawyers to represent them. ey tried to get the money released, but prosecutors argued that it came from investors and lenders who were defrauded in the scheme for which Shah and Agarwal were indicted. U.S. District Judge omas Durkin sided with prosecutors.

Shah had put up more than $7 million to hire Quinn Emanuel

Urquhart & Sullivan in Washington, D.C., led by William Burck, a white-collar defense lawyer who was among the prosecutors who convicted Martha Stewart, and Jonathan Bunge. Agarwal had put up $3.8 million to hire law rm McGuireWoods.

Burck estimated their defenses combined would cost $14 million to $15 million.

“I withdrew from the criminal case because I knew that, in light of the (court’s) order, Mr. Shah did not have adequate funds available for Quinn Emanuel to defend him through the conclusion of a trial in the criminal case,” Burck wrote in a statement led this month. “Had the court granted Mr. Shah access to the funds, it was my understanding that he would have preferred to continue with myself and Mr. Bunge as his defense counsel in the criminal case and would have retained us for that purpose. Under those circumstances, my colleagues and I would have accepted the representation, but in light of Mr. Shah’s inability to raise the required funds after the issuance of the order, we declined the representation.”

Shah ultimately hired Hueston Hennigan, a Los Angeles law rm led by former Enron prosecutor John Hueston. Agarwal hired Los Angeles law rms Larson and Willkie Farr & Gallagher.

Shah has been ghting the forfeiture of his assets, which is normally a straightforward procedure following a conviction.

Pat Ryan Jr. rides the ChatGPT wave with $23M for car-shopping startup

BY JOHN PLETZ

BY JOHN PLETZ

Pat Ryan Jr. raised $23 million for his car-shopping app, CoPilot, thanks to a little help from articial-intelligence darling ChatGPT.

CoPilot, launched in 2019, offers a mobile app and website that help buyers shop for the kind of vehicle they want and see the inventory available at new and used-car dealers.

e company already was seeing a steady rise in tra c early this year when it built a chat-enabled plug-in for the ChatGPT platform, which piqued investors’ interest. ChatGPT, which was made available to the public last fall, marked a turning point in arti cial intelligence, sparking a massive wave of interest from users, tech companies and investors.

e technology, called generative AI, is a powerful chatbot that has shown to be surprisingly e ective at distilling information and creating sophisticated, de-

tailed and customized responses to human questions and prompts.

e responses are less rigid and robotic than previous chatbots, and the technology is surprisingly exible in adapting to users’ requests, allowing them to drill down on information.

Generative AI is seen as a potential boon for all kinds of companies by automating the labor-intensive interaction with customers, from marketing to support, as well as internal functions, such as gathering and summarizing data for reports. One of the most commonly talked about early uses is the idea of a virtual “copilot,” using AI to guide workers in everything from writing code to algorithms, gathering information to write reports or analyze customer performance.

ChatGPT’s parent company, OpenAI, recently began allowing companies to create customized “plug-ins” that pair its user-friendly technology with their

own data, similar to what Amazon did with its Alexa platform or what Apple created with its App Store. e plug-ins are only available to ChatGPT users who pay for a premium version of the service. OpenAI declined to disclose how many plug-ins have been launched.

CHATGPT

PLUG-IN

Nonetheless, Ryan jumped at the chance, quickly creating a ChatGPT plug-in. In a tough market for startups to raise money, ChatGPT has captured the interest of investors who are otherwise reluctant to write checks, especially to companies that already have raised money. A post-pandemic correction in tech stocks caused valuations of venture-backed startups to decline sharply.

“If you believed in the future of generative AI, it gave us a leg up,” he says.

CoPilot had always been a play

However, he was an active startup investor before he received nearly hundreds of millions in payouts when Outcome Health raised money from lenders and investors between 2016 and 2017, and his attorneys argue that millions of dollars in assets frozen by the government were invested before then and aren’t connected to crimes.

‘A NEW TRIAL IS NOT ENOUGH’

One of Shah’s attorneys, Richard Finneran of Bryan Cave Leighton Paisner, who has represented him in the forfeiture proceedings, argues that at least $4.8 million in assets, such as startup investments, were improperly frozen and that they had quickly appreciated to more than $20 million. e improper seizure was discovered during the middle of the 10-week trial, according to the ling.

“At the very least, the violation

of Mr. Shah’s rights under the Constitution and the federal forfeiture laws requires a new trial. But under the peculiar circumstances of this case, a new trial is not enough,” Finneran argues. “Given the fact that the trial has already occurred, and Mr. Shah has already expended considerable resources defending his case with substitute counsel over the course of more than three years, a new trial is insufcient to “restore (Mr. Shah) to the status quo ante,” which is the proper remedy for such a constitutional violation. As a result, “(i)f there was a . . . violation, dismissal of the indictment is required.”

Shah, Agarwal and Purdy made other arguments in seeking to have their convictions thrown out by Durkin, mostly arguing that the jury shouldn’t have reasonably convicted them based on the evidence.

on AI and big data, amassing a massive cache of information on vehicles, such as the individual options on particular cars as well as pricing. Its concept of a virtual assistant to help people shop for vehicles was a perfect t for generative AI.

Ryan says he was expecting to raise money later this year, but he took advantage of the timing.

“It made it a lot easier,” he says, noting the company also had seen a 52% increase in monthly visitors to 2.7 million. “(Funding) conversations were happening already, but we made the ask when we had

the plug-in.”

CoPilot doesn’t allow users to buy vehicles directly through its site, nor does it take money from car dealers. Instead, it gets most of its revenue from referring its customers to auto and home insurers. Ryan declined to disclose its revenue.

e company has 25 employees and has raised more than $40 million, with the most recent round coming from existing investors, including Chicago Ventures, Next Coast Ventures and PayPal co-founder Max Levchin’s SciFi Ventures.

4 JULY 24, 2023 • CRAIN’S CHICAGO BUSINESS

Outcome Health co-founders Shradha Agarwal, left, and Rishi Shah

Pat Ryan Jr.

CRAIN’S FILE PHOTO

Suburban office vacancy hits new high

The Chicago suburbs have now collectively lost more than 3 million square feet of tenants since the start of the COVID-19 pandemic, pushing the vacancy rate to a record level for the 10th straight quarter I

Three full years after the COVID-19 pandemic sent demand for suburban Chicago office space into free fall and vacancy climbing, both trends are still happening.

The share of available office space in the suburbs rose during the second quarter to a record-high 28.9% from 28.5% at the end of March, according to data from real estate services firm Jones Lang LaSalle. The new vacancy rate is up from 27.1% a year ago and 22.1% at the beginning of 2020.

e ugly statistics for suburban landlords continue to get worse as a steady ow of companies shrink their o ce footprints amid the remote work movement. While reports suggest more employees have returned to o ces on a more regular basis since the formal end of the public health crisis in May, it hasn’t stemmed the tide of space-shedding that has now collectively cost the suburbs more than 3 million square feet of tenants since 2020, JLL data show. ose losses are close to the same amount of tenancy lost in the suburbs in 2008 and 2009 combined, the worst of the Great Recession, according to JLL.

Combined with high interest rates, the historic gap between supply and demand has spurred a wave of distressed properties in 2023. Many office building owners that have seen their property values crushed have been unable to pay off their mortgages when they come due, forcing a growing number into foreclosure or simply handing their keys to their lenders to avoid a lengthy legal process. The Central Park of Lisle office complex is one of the latest in the distressed mix, as its owner was hit with a foreclosure lawsuit in March involving its $80 million mortgage on the property.

DISTRESS DOMINATES TALKS

Banks that provide big office mortgages are experiencing — and still bracing for — a world of hurt still to come. JPMorgan Chase and Wells Fargo recently both boosted allowances for losses tied to commercial property loans, primarily as a result of office mortgages.

The growing distress is dominating conversations between landlords and prospective tenants, said JLL Executive Vice

President Jeff Shay, who oversees leasing at several suburban office properties. Companies emboldened by the weak market are pushing for lower rents and more lease concessions, but they’re also wary of landlords’ ability to deliver on their end of deals.

“When a tenant comes to tour a property, they’re leading with questions about (the owner’s) loan, what’s the maturity . . . what is their exposure in the next couple of years.

They’re trying to put themselves into a situation that won’t be negative,” Shay said.

Whether or not they can fulfill their promises, landlords are still committing to unprecedented levels of perks to lure tenants, according to Shay.

High construction costs continue to push up the amount of cash owners are doling out to tenants to build out their offices, and companies are still commanding longer periods of free rent to start their leases than they did before the public health crisis.

Rents, meanwhile, are still holding relatively steady. Lowering those rates are a last resort for landlords, since reducing future rental income decreases what a building is worth. But pressure from lenders to pay off loans or negotiate an extension might start to change that, Shay said. As lenders or court-appointed receivers take control of more buildings, they’ll be motivated to offer cheaper deals that could undercut the market and put pressure on

BY DANNY ECKER

building it bought last year to prevent it from being redeveloped into something it doesn’t want next to its main headquarters next door.

Meanwhile, Allstate’s former headquarters campus continues its transition into a logistics park, and Baxter International is under contract to sell its 101-acre Deerfield campus to Chicago-based Bridge Industrial, which aims to redevelop the site into an industrial campus.

SPACE CONVERSIONS

A JLL report earlier this year found that investors have purchased 3.9 million square feet of offices in the Chicago suburbs since the start of the pandemic with the intent to redevelop it into industrial space. “Taking that kind of chunk out of the market would be helpful,” Shay said.

DEMAND KEEPS FALLING

other landlords.

“You’ll see some aggressive moves by certain lenders,” Shay said. He added that as vacancy increases and deals are harder to get done, lower rent “is the next thing for people to compete with.”

One thing that would help reduce the vacancy rate is less supply, something likely to happen over time as distressed properties are redeveloped

into something else. A prime example emerged in April when Rosemont-based Brennan Investment Group bought a distressed office building at 3800 Golf Road in Rolling Meadows, a 40-acre property that it plans to transform into a 600,000-square-foot industrial park. Just down the street at 2550 Golf Road, insurance brokerage Arthur J. Gallagher plans to tear down a 10-story office

Non-industrial conversions could make a dent, too. Chicagobased LG Group is under contract to buy a vacant 38-acre ofce campus previously occupied by Walgreens Boots Alliance, teeing up a plan to convert it into a mixed-use entertainment and retail project. And in Skokie, the owner of the Old Orchard Towers o ce complex recently put the property up for sale, shopping it as an opportunity to convert the 10-acre site into an apartment development.

Shay sees other benefits of such redevelopments, including companies like Baxter potentially filling other available office space in the market. Some companies with offices within industrial buildings they own are also looking to realize the higher value of those properties and move their workspace into a traditional office setting. Windows, siding, doors and roofing company Feldco recently announced it would move its headquarters from a longtime industrial building in Des Plaines to a revamped office building in Rosemont.

But there are still plenty of downsizes offsetting those gains. Among the recent moves, engineering, architectural and management firm Middough relocated its office into 23,000 square feet in an office building in Downers Grove, 48% less space than it previously had in Oak Brook. Hearing aid maker Beltone recently vacated a large portion of its 49,000-squarefoot headquarters in Glenview, moving its main office into just more than 7,000 square feet in the West Loop downtown.

Net absorption, a key demand gauge that measures the amount of space leased and occupied compared with the prior period, fell by almost 110,000 square feet during the second quarter, according to JLL.

6 JULY 24, 2023 • CRAIN’S CHICAGO BUSINESS

Office buildings in the Chicago suburbs have collectively lost more than 3 million square feet of tenants since the beginning of 2020.

2008 2010 2012 2014 2016 2018 2020 2022 2008 2010 2012 2014 2016 2018 2020 2022 30% 25 20 15 10 5 0 28.9% 27.3% Direct vacancy

Note:

Total vacancy

Total vacancy includes space available for sublease.

NET ABSORPTION 500K -500K -1M COSTAR GROUP

Source: Jones Lang LaSalle

ONE THING THAT WOULD HELP REDUCE THE VACANCY RATE IS LESS SUPPLY, SOMETHING LIKELY TO HAPPEN OVER TIME AS DISTRESSED PROPERTIES ARE REDEVELOPED INTO SOMETHING ELSE.

The owner of the Central Park of Lisle o ce property faces a foreclosure lawsuit over its $80 million mortgage tied to the complex.

U.S. Soccer Federation’s two Prairie Avenue mansions may become residential again

BY DENNIS RODKIN

e two 19th-century Prairie Avenue mansions where the U.S. Soccer Federation was headquartered for the past three decades may go into residential use for the rst time in almost a century.

e two connected houses, at 1801 and 1811 S. Prairie Ave., went under contract to a buyer this month, with a contingency.

e soccer federation, which announced its move to Wacker Drive o ces in October, put the two old mansions on the market in January, priced at $4.2 million.

ey are separate houses, one made of limestone and the other red stone, but connected at the back of their lots by a coach house. at gives the combined 29,000 square feet a U-shaped footprint, which at present surrounds a parking lot.

e buyer who put the property under contract has said the plan is to use the entire thing as a single-family home, said Melanie Giglio, a Compass agent who is representing the sellers along with Marc Bahnsen, also of Compass.

“ at’s what they have stated, that it would be a single-family home,” Giglio said. e property went under contract with a contingency July 13. A contingency is a detail that has

to be resolved before the deal can be nalized. Giglio did not say what is contingent in this deal.

rough their agent, the buyers declined to comment. No published information is available about the agent or the prospective buyer.

Giglio said private residential use “would t with what the neighbors want, something that will keep the neighborhood nice and quiet.” She said the pair of buildings went under contract earlier this year to buyers “who wanted to do something non-residential” and it didn’t sit well with the neighbors. e contract was canceled, she said.

Tina Feldstein, president of the Prairie District Neighborhood Alliance, said there were never any formal presentations about what that past potential buyer planned. Feldstein said the rumor in the neighborhood was that it was a restaurant, and “the neighbors were not looking for something like that on that high-end residential block.”

Putting the properties back into residential use, Feldstein said, would likely get neighborhood support.

“I think the neighbors would say that was great,” Feldstein said. “I don’t know why they wouldn’t. And it’s within the zoning” for the two buildings, so it wouldn’t re-

Chan Zuckerberg biohub will move to new space

BY JOHN PLETZ

e new Chan Zuckerberg Biohub just moved into a new home in Fulton Market, but it’s already planning for new digs.

e bioresearch hub, which was announced in March, quickly leased 25,698 square feet in a lab building at 1375 W. Fulton St. But now it’s looking to occupy 28,200 square feet of space at 400 N. Aberdeen St.

Both buildings are owned by Dallas-based developer Trammell Crow, which made an early life sciences bet on Fulton Market by building wet-lab space in what had primarily been a haven for traditional technology companies — rst with 1375 W. Fulton, followed by 400 N. Aberdeen.

“We’re going to build out a facility from scratch,” says Shana Kelley, president of the Chicago biohub. “We’ll have a clean room specialized for our purposes. We also want to have space to grow and to host visitors.”

e goal of the Chan Zuckerberg Biohub Chicago — funded with $250 million from a foundation set up by Facebook founder Mark Zuckerberg and his wife, Dr. Priscil-

la Chan — is to attract top-tier scientists to tackle the biggest health problems, such as in ammation, by doing fundamental research into cells and tissues with the goal of better understanding and treating disease. It’s a high-pro le win for Trammell Crow.

Kelley, a Northwestern University researcher, says she has hired a half-dozen sta ers and expects to “be up to 10 to 15 pretty quickly.” It will have 50 to 60 people by 2025. She plans to move into the new space in January.

Portal Innovations will join the Chan Zuckerberg biohub at 400 N. Aberdeen, providing lab space and other support for about three dozen Chicago life-sciences startups. Portal is a fellow tenant at 1375 W. Fulton and a CZ Biohub collaborator.

Portal is taking 6,000 square feet on the same oor as Chan Zuckerberg, which will be connected to Portal’s existing space on the oor above by an internal staircase.

“We’re both trying to open up the life-sciences ecosystem in Chicago,” says John Flavin, CEO of Portal Innovations. “ ere’s no better way to be adjacent to what they’re doing than to be on the same oor.”

quire community meetings over changes to the site.

e north member of the pair is the ornate Kimball House, built of Bedford limestone for William Kimball, who in 1857 opened a piano dealership with his wife, Evalyne, that later became the world’s largest piano and organ manufacturer. Designed by Solon Spencer Beman, architect of the town of Pullman and the Fine Arts Building, and completed in 1892, its turreted, carved chateau-esque look was inspired by the Chateau de Josselin, built in 1370 in Brittany, France.

e interior, according to the listing, still has much of its original

lavish woodwork and leaded glass, although no pictures of those details were included.

William Kimball died in 1904 and Evalyne died in 1921. eir home became a boarding house then, and according to a history published online by the Glessner House across the street, has not been a private home since 1924.

e Coleman House, south of the Kimball and connected to it, has original leaded glass windows, plaster details and carved wood trim, according to its listing, but no photos of those were included.

e Coleman House became the o ces of a publishing rm in 1921

and has not been residential since then.

e architects of both houses, Henry Ives Cobb and Charles S. Frost, designed the fabled Potter Palmer mansion on Lake Shore Drive, demolished long ago, and the Ransom Cable House on Erie Street, now the home of Driehaus Capital Management.

On their own, Cobb designed the Newberry Library and buildings at the University of Chicago and Lake Forest College, and Frost designed dozens of railroad stations in the Midwest and Canada.

e soccer federation moved into the pair of buildings in 1991.

CRAIN’S CHICAGO BUSINESS • JULY 24, 2023 7 #5 Business Incentives Program in U.S. #7 Overall Cost of Doing Business #4 Speed of Permitting mississippi.org All business. No red tape. GET MIGHTY.

The prospective buyer plans to use the houses as one single-family home, says one of the seller’s agents

POSITIVE IMAGE

The two connected houses, at 1801 and 1811 S. Prairie Ave., went under contract this month, with a contingency.

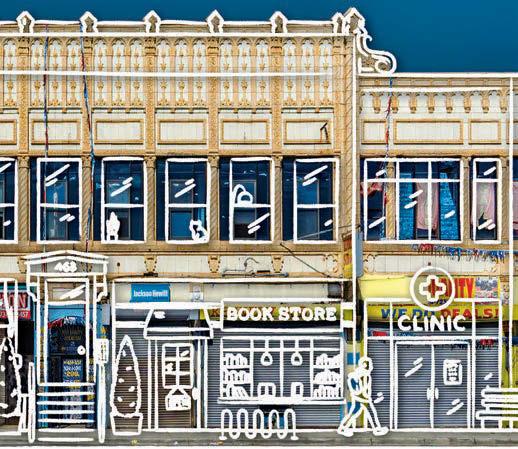

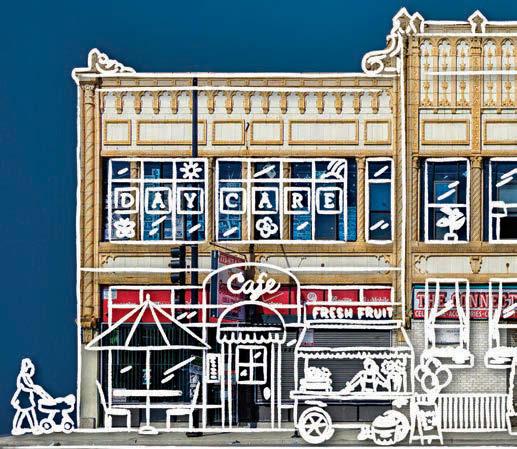

A look at Jackson’s legacy as he exits the limelight

The activist, who stepped down as Rainbow P U SH’s president, is called ‘incredibly important in bringing all kinds of . . . civil-rights measures to Chicago’

BY STEVEN R. STRAHLER

In the annals of Chicago politics, the Rev. Jesse Jackson proved to be the ultimate “we don’t want nobody nobody sent.”

An outsider by birthplace, race and social outlook to the Democratic Party machine, Jackson as a young activist and then as founder of the Rainbow PUSH Coalition catalyzed the African American community’s move toward political independence, which gathered momentum in the 1970s and triumphed in 1983 with Harold Washington’s election as mayor.

“He is incredibly important in bringing all kinds of — for lack of a better term — civil-rights measures to Chicago and helping elect more Black o cials,” said Don Rose, a political consultant who has known Jackson since the mid-1960s. “He paved the way for Harold Washington’s victory. You could go on and on, but that sums it up.”

Diagnosed with Parkinson’s disease in 2017 and COVID in 2021, Jackson, 81, o cially stepped down July 16 as president of the coalition. e Rev. Frederick Douglass Haynes III, a Dallas pastor, was named the new president.

In the 1980s, Jackson was twice an unsuccessful candidate for the Democratic Party presidential nomination, considered the rst viable presidential candidacy by an African American, and then saw two sons elected to Congress.

At Barack Obama’s presidential victory rally in Grant Park on election night in 2008, Jackson wept openly, a scene captured for a global audience that encapsulated the transformation of American politics since Jackson arrived here nearly 60 years ago, when the lone Black members on the City Council were known as the “Silent Six.”

Jackson’s political impact was an outgrowth of the economic boycotts he launched with Operation Breadbasket and then Operation PUSH — People United to Save (later Serve) Humanity — to press rms to hire and promote more African Americans and improve minority contracting, and for banks to do more lending in struggling communities. In the mid-1980s, Jackson put the heat on Channel 2 (WBBM-TV), now known as CBS2, which led the station to hire a Black general manager, a city rst.

“Today’s young people may not know how famous and in uential Jesse was at that point in history, but he had real power,” Georgetown University basketball coach John ompson wrote in an autobiography published posthumously in 2021. Operation PUSH led a boycott of sports apparel and equipment maker Nike in 1990 when ompson was on the board.

OPERATION BREADBASKET

A native of South Carolina, Jackson came to Chicago to attend the Chicago eological Seminary but in 1966 found himself leading the Chicago branch of Operation Breadbasket, the economic-development arm of Martin Luther King Jr.’s Southern Christian Leadership Conference. Early on, Jackson and King attended a meeting with Chicago’s Black business leadership in the o ce of George Johnson, who with his wife, Joan, had started Johnson Products, makers of Afro Sheen and other ethnic hair care o erings.

“From that day forward, my colleagues and I wrapped our arms around him and gave him the support he needed,” George Johnson told Crain’s in 1988.

Operation Breadbasket targeted Jewel food stores and other retail chains with atrophying

locations and shoddy produce in majority-minority neighborhoods, organizing don’t-shop campaigns and extracting promises through economic “covenants” to hire more African Americans and stock products of minority businesses, such as those of Baldwin Ice Cream, Parker House Sausage and Johnson Products.

Jackson could be grandiose. Newspaper columnist Mike Royko dubbed him “Jetstream Jesse.” He sometimes rubbed King and his followers the wrong way and split with Operation Breadbasket in 1972 to found Operation PUSH. at year, he and Ald. Bill Singer, 43rd, headed a coalition that pulled o the once-unthinkable: unseating Mayor Richard J. Daley’s slate of delegates to the Democratic National Convention, presaging a tumultuous new era in Chicago and national politics.

“You didn’t run for national o ce in the United States in the

’70s, ’80s and ’90s without going to PUSH,” Singer said. “Everybody made the pilgrimage. Jesse just commanded that amount of respect and power.”

In 1982, Jackson criticized ChicagoFest, a city-sponsored festival, for its lack of minority participation and persuaded entertainers Stevie Wonder and Kool & e Gang to cancel their appearances. While the protest petered out, it is credited with energizing the Black community against Mayor Jane Byrne, paving the way for Washington’s election.

1999 MERGER

During the 1980s, Operation PUSH targeted multinational rms like Coca-Cola, Kentucky Fried Chicken owner Heublein, Burger King and Revlon. Critics pointed to subsequent business awarded to Jackson’s half-brother, Noah Robinson, by Coke and Heublein and what Johnson

Products had to gain from a boycott of cosmetics maker Revlon. e Nike boycott zzled, and Operation PUSH struggled to remain solvent and relevant. In 1999, it merged with the National Rainbow Coalition, a Washington, D.C.-based social justice organization Jackson founded in 1986, forming Rainbow PUSH.

By then, he had turned his attention to Wall Street, putting pressure on nancial rms to foster minority entrepreneurs by connecting them to mainstream nancial partners and potential customers. It was called the Wall Street Project, with President Bill Clinton giving the keynote address in 1998.

Six months later, Jackson mounted a LaSalle Street version. In one of the ironies of history, the keynoter for that event was William Daley, then Clinton’s secretary of commerce — and the son of the mayor who was Jackson’s early nemesis.

Blue Cross & Blue Shield of Illinois looks to fill 300 jobs in Pilsen

BY KATHERINE

Illinois’ largest health insurer, Blue Cross & Blue Shield of Illinois, is nally ready to start lling 300 jobs at a Pilsen customer service center it leased more than three years ago.

BCBSIL, one of ve insurance plans owned by Chicago-based Health Care Service Corp., seeks to initially hire up to 70 people for customer service positions, with a focus on applicants who can speak both English and Spanish, according to a statement. e insurance giant will

continue hiring over the coming months, and about 30 of the roles will be information technology jobs.

About 40 people have been hired so far, according to BCBSIL spokesman John Simley. Twenty started last week and another 20 begin this week.

e Pilsen customer service center and hiring plans were rst introduced in May 2020 but were signi cantly delayed by the COVID-19 pandemic, Simley said. Hiring resumed this summer as BCBSIL enrolls more members and demand for cus-

tomer service grows.

e o ce occupies about 103,000 square feet at Pilsen’s Mural Park development, where BCBSIL has a 10-year lease.

e Pilsen outpost adds to HCSC’s headquarters at 300 E. Randolph St. and several other BCBSIL facilities in Chicago.

Over the past four years, BCBSIL has opened other outposts, including wellness centers, in Pullman, Morgan Park and South Lawndale. Across Illinois, the insurance company employs about 13,000 people.

“Our new location and the

jobs it will bring to Pilsen show how we’re creating opportunities and investing in local neighborhoods,” BCBSIL President Stephen Harris, who was appointed to the role last year, said in the statement. “We’re excited to open a new o ce in Pilsen, bolstering our multilingual capabilities and bringing additional economic opportunity to this vibrant community.”

MORE HCSC MEMBERS

Ramping up the Pilsen center comes as BCBSIL parent company HCSC has seen its member base grow in recent years. As Crain’s has previously reported, HCSC has added 2 million members since 2018, totaling

17.7 million enrollees across its ve plans in 2022, with BCBSIL serving about 9 million of them. Aside from Illinois, HCSC owns and operates Blues plans in Montana, New Mexico, Oklahoma and Texas.

e customer growth boosted pro ts, which jumped 20% last year to $1.5 billion as revenues reached $49.3 billion. Top HCSC executives also saw signi cant pay hikes in 2022.

BCBSIL is hosting a job fair Aug. 10 as it seeks workers for the new Pilsen o ce. BCBSIL says job seekers can register online to apply for open roles. Wages start at $18 per hour, and employment comes with retirement plans and health insurance.

8 JULY 24, 2023 • CRAIN’S CHICAGO BUSINESS

BLOOMBERG

Jesse Jackson

After COVID-19 delayed hiring plans, the health insurer says it’s now looking for bilingual customer service representatives and technology employees

DAVIS

LARGEST BANKS CRAIN'S LIST

Ranked by assets. All gures are as of Dec. 31, 2022. Dollar gures are in millions.

DataprovidedbyS&PGlobalMarketIntelligence,withadditionalresearchbySophieRodgers(sophie.rodgers@crain.com). |IncludesbankswithheadquartersinCook,DuPage,Kane,Lake(Ill.),Lake(Ind.),McHenryand Willcounties,andreportingassetstotheFederalDepositInsuranceCorp.“Commercialloans”includessecuredandunsecuredloansforcommercialandindustrialpurposes;domesticonly.“Realestateloans”includesonlydomesticnonfarmand nonresidential loans. “Consumer loans” includes unsecured domestic loans to individuals. Sum of loan types may not equal 100% because of rounding. “Total loans” includes domestic and foreign loans.

CRAIN’S LIST LARGEST THRIFTS

Ranked by total assets as of Dec. 31, 2022. L

CRAIN’S CHICAGO BUSINESS • JULY 24, 2023 9 2022 RANKBANK ASSETS; % CHANGE FROM 2021 RETURN ON AVERAGE ASSETS RETURN ON AVERAGE EQUITY LOANS-TO-DEPOSITS RATIO COMMERCIAL LOANSREAL ESTATE LOANSCONSUMER LOANSOTHER LOANS TOTAL LOANS; % CHANGE FROM 2021 NONPERFORMING LOANS; % OF ASSETS 1 2 BMO BANKNA Montreal $176,988.4 6.2% 0.6% 5.8% 71.0 38.1%8.8% 8.3% 44.8%$100,830.0 14.8% $574.9 0.3% 2 1 NORTHERN TRUSTCORP. Chicago $154,522.9 -15.9% 0.9% 12.6%34.4 11.7%9.0% 0.9% 78.3%$42,893.3 6.0% $85.5 0.1% 3 3 CIBC Chicago $50,933.9 5.0% 1.4% 8.7% 79.8 32.8%25.7%1.3% 40.3%$32,691.3 13.1% $269.9 0.5% 4 4 WINTRUST ILLINOIS Rosemont $49,808.9 6.7% 1.4% 14.5%89.5 46.3%15.9%17.3%20.6%$36,874.5 12.7% $138.6 0.3% 5 5 BYLINE BANCORPINC. Chicago $8,582.7 7.7% 1.3% 10.1%93.9 31.0%35.6%0.0% 33.4%$6,309.9 39.1% $52.0 0.6% 6 7 CENTIER BANK Merrillville $6,722.8 8.5% 1.7% 18.6%97.0 7.7% 36.9%7.8% 47.7%$5,288.2 10.0% $8.8 0.1% 7 8 FIRST AMERICAN BANK Elk Grove Village $6,105.3 -0.1% 0.6% 9.4% 57.0 23.1%24.2%17.9%34.8%$2,587.8 23.6% $21.3 0.3% 8 6 OLD SECOND BANCORPINC. Aurora $5,883.8 -5.3% 1.2% 13.1%75.2 26.6%47.2%0.2% 26% $3,869.6 13.1% $31.7 0.5% 9 9 PARKWAY BANK AND TRUSTCO. Harwood Heights $3,251.5 12.9% 1.4% 13.1%96.5 26.5%37.5%0.0% 36% $2,538.4 15.7% $55.2 1.7% 10 10 REPUBLIC BANK OF CHICAGO Oak Brook $2,703.2 7.0% 1.7% 16.4%68.1 34.1%30.0%0.1% 35.8%$1,595.5 7.7% $15.5 0.6% 11 11 LAKESIDE BANK Chicago $2,268.0 -3.1% 2.1% 22.4%99.7 6.9% 51.2%0.0% 41.9%$1,808.3 9.1% $1.8 0.1% 12 17 PEOPLES BANK Munster $2,066.7 27.7% 0.7% 10.2%85.3 6.1% 32.1%2.8% 59% $1,513.6 56.6% $12.6 0.6% 13 13 FIRST BANK CHICAGO Highland Park $2,054.3 6.9% 0.2% 2.0% 88.0 45.7%14.5%0.3% 39.5%$1,418.3 12.6% $6.3 0.3% 14 12 MARQUETTE BANK Orland Park $2,041.3 1.0% 0.6% 7.9% 84.5 1.1% 20.5%0.0% 78.4%$1,427.2 11.7% $11.0 0.5% 15 15 SIGNATURE BANK Rosemont $1,584.6 -5.4% 1.6% 25.7%76.4 45.9%37.7%1.6% 14.9%$1,070.2 17.5% $5.9 0.4% 16 14 BANKFINANCIALNA Olympia Fields $1,574.4 -7.4% 0.8% 7.5% 88.7 44.8%9.7% 0.1% 45.4%$1,234.9 17.5% $1.4 0.1% 17 18 PROVIDENCE BANK & TRUST South Holland $1,544.1 13.5% 1.0% 10.3%79.9 15.3%49.2%0.2% 35.3%$1,050.2 34.2% $6.7 0.4% 18 20 EVERGREEN BANK GROUP Oak Brook $1,421.9 18.9% 1.4% 12.1%96.0 1.9% 12.6%68.0%17.5%$1,180.5 21.7% $11.9 0.8% 19 21 FIRST SECURE BANK GROUP Sugar Grove $1,129.2 -1.0% 0.9% 10.0%74.4 22.8%44.7%2.2% 30.3%$704.8 6.8% $13.1 1.2% 20 16 AMALGAMATED BANK OF CHICAGO Chicago $1,103.9 -32.8% 0.7% 7.9% 61.0 1.5% 43.5%0.0% 55% $592.6 12.7% $0.2 0.0% 21 22 CORNERSTONE NATIONAL BANK & TRUSTCO. Palatine $988.6 4.1% 1.1% 13.7%69.0 28.9%48.4%0.5% 22.3%$609.1 3.0% $1.3 0.1% 22 24 INTERNATIONAL BANK OF CHICAGO Chicago $963.8 8.3% 1.6% 15.8%84.7 5.4% 48.3%0.0% 46.3%$724.1 14.8% $19.6 2.0% 23 23 AMERICAN COMMUNITY BANK & TRUST Woodstock $916.1 1.8% 1.1% 11.4%69.6 20.7%54.0%0.1% 25.3%$573.8 10.7% $0.6 0.1% 24 25 BELMONT BANK & TRUSTCO. Chicago $857.9 -2.4% 1.6% 16.9%80.8 25.2%56.2%0.3% 18.3%$619.6 21.3% $2.1 0.2% 25 NR HOME STATE BANKNA Crystal Lake $763.9 -2.4% 1.3% 15.1%58.2 8.6% 45.1%0.5% 45.8%$399.9$1.0 0.1%

iberty

Federal Savings

Lisle Savings

Hoyne Savings Bank,

Community Savings Bank, Chicago McHenry Savings Bank,

North Shore Trust and Savings,Waukegan Central Federal Savings and Loan Association, Cicero United Trust Bank, Palos Heights Midland Federal Savings and Loan Association, Bridgeview Mutual Federal Bank, Chicago Central Savings FSB, Chicago GN Bank, Chicago Pulaski Savings Bank, Chicago Source: S&P Global Market Intelligence Percentage change from 2021 -3.2% 1.6% -2.0% -5.1% -11.0% -4.9% 17.2% -22.1% -7.8% 72.2% -4.5% 26.0% -7.2% -16.3% 6.5% $881.5 million $812.4 million $781 million $580.2 million $468.3 million $430.5 million $328.1 million $264.5 million $184.7 million $131.8 million $122.5 million $116.9 million $106.4 million $70.9 million $52.6 million

Bank for Savings, Chicago First Savings Bank of Hegewisch, Chicago The

Bank, Chicago

Bank, Lisle

Chicago

McHenry

The taxman cometh — but he’s very, very late

Death and taxes are two of life’s certainties. When it comes to death, however, the timing is an enduring mystery. Taxes, for better or worse, once occurred at a grimly predictable cadence. At least, that is, until recently.

For the second year in a row, Cook County has delayed sending out notices to property owners informing them what they owe for the second installment of their property taxes. e county treasurer normally sends out the bills in early July, with taxes due in early August.

As Crain’s Alby Gallun reports in this week’s issue, this year’s second-half bills should come out in early November with a due date of Dec. 1.

“ e COVID-19 pandemic, coupled with a critical overhaul of the technological backbone of the system, has had a dramatic impact on the county’s property tax processes and timelines,” said a news release from Cook County Board President Toni Preckwinkle’s o ce.

Late tax bills became a source of political nger-pointing in 2022 as Cook County Assessor Fritz Kaegi and Larry Rogers, a commissioner on the Cook County Board of Review, took shots at each other. Rogers blamed Kaegi’s o ce for delays in assessing properties, while Kaegi attributed missed deadlines to a new computer system in the assessor’s o ce. He criticized the Board of Review for not upgrading its technology to speed up the assessment process.

e statement from Preckwinkle’s ofce suggests that computer systems are a

bottleneck again.

e county didn’t send out the second installment of tax bills until late November last year, with a due date of Dec. 31.

e delays compress two payments into a short period of time, which could spark a cash- ow crunch for some taxpayers. An-

other pain point: Local governments rely on property taxes to fund their operations. Without a steady stream of revenue, many may be forced to make tough choices that wouldn’t be necessary if the county had its act together.

So now Cook County property owners

can expect to see their second-half bill land in their mailboxes by early November. ey’ll be required to cover that tab by Dec. 1 and then will need to prepare to pay their next installment sometime in March. For most property owners — but

COOK COUNTY PROPERTY OWNERS CAN EXPECT TO SEE THEIR SECOND-HALF BILL LAND IN THEIR MAILBOXES BY EARLY NOVEMBER.

particularly for owners of large commercial properties — that’s a lot of money ying out the door within a very tight time frame.

It shouldn’t be necessary to point out what an inconvenience this situation is for homeowners and businesses alike. And there’s frankly no excuse for it. e computer system overhaul that was cited as the root of last year’s problems should have been resolved by now, full stop. is kind of lousy customer service — and that’s really how county o cials should think of it — would never be tolerated in the private sector.

If Kaegi, the Board of Review and the treasurer’s o ce can’t cooperate to ensure a stable, predictable ow of tax bills and deadlines, then it’s incumbent upon Preckwinkle to knock their heads together until the supposed technical glitches are xed. Enough is enough.

Threads will reshape the social media landscape

Like many Twitter users frustrated with Elon Musk’s mismanagement of Twitter since his acquisition of the company last year, I recently joined Meta’s new social network, reads. reads is meant to be a direct competitor to Twitter and mimics many of its features intentionally to give disa ected Twitter users like me a place to land. And land we did: reads became one of the fastest-growing apps in history, earning 100 million new users in less than a week.

reads was able to achieve such growth because it isn’t technically a new social network: It is built o of Instagram, which has 2 billion users worldwide. is kind of product-adjacent play wouldn’t have been available to Meta just a few years ago. Given its privacy mis-

steps, capture-or-kill strategy for competitors and inability to deal with the spread of misinformation, Meta was de cient in goodwill. But that’s how toxic Twitter has become under Musk: Mark Zuckerberg now seems like the kinder malevolent billionaire.

at is, unless you like Musk’s brand of owning-thelibs dominance. Viewed from another perspective, Musk has brought a brash leadership style and much-needed free speech absolutism to a platform that previously censored conservative viewpoints. (Even if that absolutism has clear culture war boundaries.)

Zuckerberg has himself defended free speech principles, most notably in a 2019 speech at Georgetown University that faced immediate backlash over its juvenile understanding of the

First Amendment. So it is not without some internal dissonance that many like me, who have criticized Meta, are finding a new home on a Meta platform. But that’s what Musk’s extreme takeover of Twitter has wrought. The social media ecosystem is bifurcating politically.

Time will tell if Threads can make product updates fast enough to keep those who seek to rebuild their Twitter network on the platform. The Meta team seems interested in re-creating the pre-Donald Trump Twitter experience, at various times claiming they want to scale to a 1 billion-strong “public square” that is “less angry.” The problem with this thesis is that it again betrays a juvenile understanding of what a true public square should be: regulated for the public interest, not dominated by one private company. reads will inevitably run into the same kinds of scale issues that Twitter did because it is starting from the same awed thesis that ran Twitter o course in the early 2010s: that an algorithm-driven

timeline, funded by advertising and surfacing the loudest voices, will create the best user experience. After Twitter went public in 2013, it caved to shareholders looking for growth at all costs, shutting down a vibrant third-party app ecosystem that many of its earliest users loved in favor of a centralized experience that it could control. Its new strategy achieved scale, but at a cost: a long-running monthly active users problem. Twitter became a platform full of lurkers uninterested in contributing.

Meta isn’t aiming for what originally made Twitter special; it’s jumping ahead to the product that gave us President Trump. Upon sign-up, the reads timeline is dominated by celebrities and brands, served up by an algorithm for no clear reason. To create value as a user, one has to go around the noise, muting aggressively and digging through the blue checks to nd the real people. Value is currently being created by users on reads in spite of the product, not because of it.

e network e ects from Instagram are

10 JULY 24, 2023 • CRAIN’S CHICAGO BUSINESS Sound o : Send a column for the Opinion page to editor@chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer. Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited. Send letters to Crain’s Chicago Business, 130 E. Randolph St., Suite 3200, Chicago, IL 60601, or email us at letters@chicagobusiness.com. Please include your full name, the city from which you’re writing and a phone number for fact-checking purposes. EDITORIAL YOUR VIEW

JOHN R. BOEHM

Caleb Gardner is a founding partner of Chicago management consulting rm 18 Co ees. He ran former President Barack Obama’s Twitter account and social media strategy for Organizing for Action during the president’s second administration.

real, and so far, Meta has capitalized on them. Between that and anti-Musk sentiment, I expect reads to have staying power long enough for Meta to integrate it successfully into its pro table advertising suite. My clients will likely nd value in reads, and as an individual user, I’m already seeing more value from it than I have from Twitter in years. But I’m sober about its place in our public conversation, and still mourn for how we’re building our social ecosystem. Meta has not proven itself capable of the moral imagination to create a global conversation that doesn’t become destructive.

President/CEO KC Crain

Group publisher/executive editor Jim Kirk

Editor Ann Dwyer

Creative director Thomas J. Linden

Director of audience and engagement

Elizabeth Couch

Assistant managing editor/audience

engagement Aly Brumback

Assistant managing editor/columnist Joe Cahill

Assistant managing editor/digital

content creation Marcus Gilmer

Assistant managing editor/digital Ann R. Weiler

Assistant managing editor/news features

Cassandra West

Deputy digital editor Todd J. Behme

Deputy digital editor/audience

and social media Robert Garcia

Digital design editor Jason McGregor

Associate creative director Karen Freese Zane

Art director Joanna Metzger

Digital designer Christine Balch

Copy chief Scott Williams

Copy editor Tanya Meyer

Contributing editor Jan Parr

Political columnist Greg Hinz

Senior reporters

Steve Daniels, Alby Gallun, Ally Marotti, John Pletz, Dennis Rodkin

Reporters

Katherine Davis, Brandon Dupré, Danny Ecker, Leigh Giangreco, Jack Grieve, Corli Jay, Justin Laurence, Steven R. Strahler

Contributing photographer John R. Boehm

Researcher Sophie H. Rodgers

Senior vice president of sales Susan Jacobs

Vice president, product Kevin Skaggs

Sales director Sarah Chow

Events manager/account executive

Christine Rozmanich

Production manager David Adair

Events specialist Kaari Kafer

Custom content coordinators

Ashley Maahs, Allison Russotto

Account executives

Linda Gamber, Claudia Hippel, Menia Pappas, Bridget Sevcik, Laura Warren

Sales administration manager Brittany Brown

People on the Move manager Debora Stein

Even if Threads, as expected, puts significant competitive pressure on Twitter in a way that hurts its revenue prospects, Musk’s ego won’t let Twitter die. Tesla is doing well enough that Musk can likely self-fund Twitter as it settles into a smaller niche of the social internet.

Ahead of another presidential election, we’re on the path to having two imperfect global news and conversation platforms, run by two ego-driven billionaires, with different political constituencies making up their user bases. Lurkers are the least of their problems.

Keith E. Crain Chairman

Mary Kay Crain Vice chairman

KC Crain President/CEO

Chris Crain Senior executive vice president

Robert Recchia Chief nancial o cer

Veebha Mehta Chief marketing o cer

G.D. Crain Jr. Founder (1885-1973)

Mrs. G.D. Crain Jr. Chairman (1911-1996)

For subscription information and delivery concerns please email customerservice@ chicagobusiness.com or call 877-812-1590 (in the U.S. and Canada) or 313-446-0450 (all other locations).

CRAIN’S CHICAGO BUSINESS • JULY 24, 2023 11

YOUR VIEW Continued Leadership In Uncertain Times Learn Strategies To Manage Today’s Workforce More information crainsacademy@crain.com | crainsacademy.com Designed and taught by renowned faculty from Chicago Booth School of Business. This executive education program is a 5-week series in leadership development. Crain’s Leadership Academy is custom-designed to hone the leadership skills of executives across the Chicagoland area CRAIN’S LEADERSHIP ACADEMY APPLY NOW In Person | Fridays 9 AM–1:30 PM October 13–November 10

BLOOMBERG

ACCOUNTING

Sassetti, Oak Brook

With great enthusiasm, the Sassetti partners want to announce the admission of Renee Morawa and Shawn Carter to partnership effective July 1, 2023. With 15 years of experience, Renee’s strategic vision and innovative approach have played a pivotal role in driving the rm’s success and solidifying her position as a trusted advisor in the industry. Shawn also has more than 15 years of experience in public accounting, with a primary focus on assurance services and nancial statement preparation for privatelyheld businesses, not-for-pro ts, and employee bene t plans. Please join us in congratulating Renee and Shawn on this well-deserved achievement.

CONSTRUCTION

Skender, Chicago

Skender, one of the nation’s top building contractors, congratulates Ryan Cotter on his promotion to Preconstruction Executive. Since joining the rm in 2016, Ryan has proven himself to be a true collaborator with developers, architects, engineers, consultants and trade partners, and has helped to create a comprehensive vision for the rm’s preconstruction services. In his new role, Ryan will further expand the preconstruction team and enhance estimating and preconstruction services.

CONSTRUCTION

Skender, Chicago

DESIGN

Of ce Revolution, Chicago

Jill Stewart, who served as vice president of business strategy for Of ce Revolution, a leading contract furniture provider for commercial environments, is now the company’s new president. Jill has more than 25 years in the contract furniture industry with extensive dealer and manufacturer experience. “Our high-performance culture will be a tremendous asset as we continue to manage growth driven by today’s need to make the of ce a destination of choice,” said Jill.

DESIGN

Of ce Revolution, Chicago

LAW FIRM

Riley Safer Holmes & Cancila LLP, Chicago

Riley Safer Holmes & Cancila welcomes Robye Scott to the rm as its new Chief People Of cer. Scott is a seasoned human resources executive and civic leader who has served the City of Chicago in three executive leadership roles, most recently as the Assistant City Treasurer. At RSHC, she will oversee programs and initiatives focused on recruiting, professional development, employee engagement, and rm culture.

NON-PROFIT

Environmental Law and Policy Center, Chicago

The Environmental Law & Policy Center is pleased to announce Manny Flores as the new Chair of its Board of Directors. Manny is the President and CEO of SomerCor, a Small Business Administration nonpro t lender that has made more than $1.7 billion in SBA 504 loans. He previously served as Vice-Chair, succeeding Harry Drucker following his many years of exemplary service as Chair. ELPC is the Midwest’s premier environmental legal advocacy organization currently celebrating its 30th year.

NON-PROFIT

ARCHITECTURE / DESIGN

Lamar Johnson Collaborative (LJC), Chicago

LJC has promoted Sarah Hitchcock, AIA, NCARB, to Principal. With a diverse portfolio of work in mixed-use, corporate, multi-family residential, community, and entertainment markets, Sarah brings a wealth of design experience to complex projects. Sarah is an advocate for industry mentorship and has been involved with ACE and the AIA Wing Mentorship program. Sarah holds a Master of Architecture and a Bachelor of Science in Design both from the University of Nebraska.

CONSULTING

Resultant, Chicago / Indianapolis

Resultant, a leading consulting rm, is proud to announce it has hired former West Monroe Managing Partner Greg Layok as CEO. As CEO, Layok will lead the rm through its next stage of growth as Resultant continues its focus on delivering industry-leading client outcomes. Since 2019, Resultant has grown its workforce from less than 100 to more than 500 by successfully helping government agencies and private sector companies unlock opportunities with data and technology.

Skender, one of the nation’s top building contractors, congratulates Clint Siebert on his promotion to Director of Technology. He has taken the company almost entirely into the cloud while at the same time growing and mentoring a team of IT professionals. His deep understanding of the needs of the business and how tech can position Skender as a solutions-driven rm has enabled the company to stay in front of security matters, create a scalable infrastructure and provide innovative connectivity.

CONSTRUCTION

The Walsh Group, Chicago

Jim Gresik has been promoted to Vice President of Midwest Multi-Family at The Walsh Group. Jim’s knowledge of the market, trusted relationships with customers and collaborative management style have helped propel the company’s multi-family practice. Jim’s collection of work includes notable multi-family projects in Chicago, including Wolf Point East, Salesforce Tower, AMLI 808 and 160 N. Morgan. Jim has also delivered projects for Misericordia, Chicago Jesuit Academy and Mt. Carmel High School.

Other Of ce Revolution leadership team changes have been made to ensure the company evolves and is uni ed to create growth, improve operational excellence and gain market share. Bruce Tharp has been appointed as president of architectural interiors. Bruce will provide strategy for expansion, market growth and scalable ef ciencies nationally. Kelly O’Donnell has been appointed as vice president of professional services. Kelly will lead all operational team members including designers, corporate account managers and project managers maintaining an ef cient team structure and performance.

FINANCIAL SERVICES

Distributed Ventures, Chicago Venture Capital rm; Distributed Ventures, announced the addition of Mandy Yoh to their leadership team as Chief of Staff. Mandy will focus on brand growth and expanding investment opportunities. Mandy began her tech career as the rst hire at SpotHero where she led the community management of their ecosystem. Most recently, Mandy managed the global startup community at the worlds #1 private tech incubator, 1871 as well building the community function at a mid-market PE rm.

LEGAL

Benesch, Chicago

Amanda Ray has joined Benesch as an Associate in the rm’s Benesch Healthcare+ Practice Group. She is highly skilled in all areas of healthcare law. Amanda has experience in drafting and negotiating transactional and corporate documents in healthcare private equity platform and addon deals such as asset and stock purchase agreements, employment agreements, disclosure schedules, and ancillary documents.

Opportunity International, Chicago

Leading anti-poverty NGO Opportunity International has welcomed Greg Nelson as their new Chief Technology Of cer, leading the organization’s Digital Innovation Group which seeks to build high-tech solutions that enable those experiencing extreme poverty to improve their livelihoods through training, nancial services, and social support. Greg has an MBA from Harvard Business and spent 26 years at Microsoft, most recently as Vice President of Partner Ecosystem for Business Applications.

NON-PROFIT

Union League Club of Chicago, Chicago

MANAGEMENT CONSULTING

Centric Consulting, Chicago

Centric Consulting is excited to announce that Mark Federman is moving from leading talent acquisition for our Chicago team to becoming a member of Chicago’s Business Development & Client Relationship Management team. Mark has over 25 years of experience in recruiting and employee/client relations across many industries. He has a proven ability to work effectively with executives, HR staff, IT resources, outside vendors & consultants, cultivating an environment of cooperation and communication.

Cynthia Doloughty was elected the 134th President of the Union League Club of Chicago (ULCC) on Tuesday, June 6. Doloughty received her degree from DePaul University and attended John Marshall Law School. She has spent most of her career as a small business owner and running a certi ed woman-owned business specializing in public affairs. Rated the #1 City Club in the Midwest by Club Leaders Forum, the ULCC is a distinguished and inclusive club where members can embrace a more inspired life.

CONSTRUCTION

The Walsh Group, Chicago

Erik Logan has been promoted to Vice President of National Aviation at The Walsh Group, leading the company’s airport projects across the United States. Erik has 31 years of experience at Walsh, highlighted by successful and engaging relationships with numerous airport customers, including DFW Airport, LaGuardia Airport, Houston Airport System and Chicago’s O’Hare Airport. Erik also has experience in hospitality, government of ce buildings, manufacturing and industrial market sectors.

LAW FIRM

Croke Fairchild Duarte & Beres LLC, Chicago

Croke Fairchild Duarte & Beres welcomes Kyla Vick to the rm as an associate in the Private Funds & Investment Management practice group. Kyla advises clients on a range of matters related to the nancing of private funds, including real estate funds and Delaware statutory trusts, as well as other SEC compliance matters in connection with private investment activities. Prior to joining the rm, Kyla was a fund nance attorney at Mayer Brown LLP.

MANUFACTURING

Leeco Steel, Lisle

Leeco Steel, a steel plate distributor and processor based in Lisle, IL, announces the promotion of Andy Polka to Director of Sales, North. In his new position, Mr. Polka will manage strategies for Leeco’s East, Central, North and Canada regions and play an instrumental role in growing the company’s business. Mr. Polka has over a decade of steel industry experience and most recently served as Regional Manager of Leeco’s South region.

TECH / TELECOM

Comcast, Chicago