Local of cials, the state of Illinois and even the Cook County Sheriff’s Of ce are working to provide relief for cost-burdened households I PAGE 10

The Chicago-based carrier has boosted ying from its hub

By John Pletz

United Airlines is ying more capacity from O’Hare International Airport than at any time in the past 20 years.

CEO Scott Kirby pushed the throttle coming out of the COVID-19 pandemic in an e ort to regain market share lost over decades to rivals. He’s wooing well-heeled travelers while also taking aim at leisure markets such as Florida, as well as businessheavy routes such as New York, Atlanta and Dallas. United also is adding frequency to small markets, such as Peoria.

As a result, the Chicago-based carrier will be ying 5% more seats to and from O’Hare this month than it did in 2019, before the pandemic hit the U.S., and 17% more than it did a decade ago.

United’s capacity at O’Hare, where it’s the largest carrier, will be up 12% in the fourth quarter from a year ago. San Francisco is the only hub where United will add more seats, according to an

analysis by Raymond James analyst Savanthi Syth.

It’s part of the United Next playbook Kirby and then-CEO Oscar Munoz drew up before the pandemic. It’s been tweaked along the way to deal with shifting travel patterns, including less-frequent business trips, a tight hiring market for pilots and mechanics, higher-than-normal pay increases for the rank-andle, and serious delays in getting new planes.

United’s boost in the number of seats it's ying in and out of Chicago to the highest level since 2004 is a vote of con dence in O’Hare, which is about to spend billions of dollars and several years constructing new terminals that will increase the gate space available for parking aircraft by about 25%.

“It answers skeptics who worried that O’Hare is a mature hub without much growth potential,” says Joe Schwieterman, a DePaul University professor and transportation expert. “ is sets the stage for more international ying at O’Hare. I expect American to grow to protect its market as United kicks into high gear.” American Airlines jump-started

An election meant to democratize the city’s school board has become an insider’s game. PAGE 2

DAN MCGRATH

The White Sox of cially hit rock bottom, and Jerry Reinsdorf nally owns the team he deserves. PAGE 2

What would happen if they held a big election and everyone pretty much yawned — except for special interests with their own agendas, not to mention their own war chests?

That’s one of the bigger questions this fall as Chicagoans prepare to vote for the first time ever on members of the Board of Education.

The shift from a mayoral-appointed body is a big deal, one that some groups have been advocating for for decades. It comes at a time when Chicago

Public Schools issues have been making all kinds of news, be it contentious talks between the board and Chicago Teachers Union, financial strains that threaten insolvency, and a nasty dispute between Mayor Brandon Johnson and schools CEO Pedro Martinez. Yet as early voting begins, the board elections have a near-invisible public profile.

Part of the reason is that voters this year will select only 10 of the 21 board members. Johnson will pick the other 11, who will serve until another election in 2026. That can make for some confusion at the ballot box.

Another reason is that a host of other issues — from the presidential race and City Hall turmoil to the

DAN MCGRATH ON THE BUSINESS OF SPORTS

travails of the Chicago White Sox and Bears — have sucked up the local media oxygen lately, leaving voters who might care about representation on the school board more or less on their own.

A few outlets have tried. Both Chalkbeat Chicago and the Chicago Sun-Times/WBEZ have primers up on their websites that detail solid, if basic, information about the 10 races. But voters will have to do their own homework and seek out such data. And even if they want to vote, they’re going to have to work hard to actually do so.

The school board races are near the bottom of a lengthy November general election ballot, stuck between races for county judge (groan) and judicial retention

questions (double groan).

How come? The Chicago Board of Elections says it followed guidelines set by the Illinois State Board of Elections. The state board says state- or area-wide contests always come first, and that it has received no directive to the contrary from the General Assembly.

So there’s a political vacuum of sorts. You can rest assured the Chicago Teachers Union on one hand and foes of the union (many of them charter school advocates) on the other are doing their best to fill it.

CTU, which bankrolled Johnson’s election campaign and appears to be pulling his strings on CPS and other issues, is running a full slate of candidates, one per

district. Together with an allied group that is financed by CTU, Our Schools Action, the powerful union so far has spent nearly $200,000 promoting its slate, with more and potentially much more on the way, some from an upcoming fundraiser starring American Federation of Teachers President Randi Weingarten.

CTU also has kicked its crack army of precinct election workers into high gear. Interestingly, the Chicago Federation of Labor is with CTU in six of those 10 races, but is backing other candidates in the 4th and 9th districts and is neutral in two others, the 2nd and 10th. Lining up on the other side are

See HINZ on Page 6

Most, if not all, of the neighborhood men who sat on their front porch with transistor radios and quarts of Hamm’s beer for those Whitey Ford-Billy Pierce/ Yankees-White Sox showdowns from long ago are gone now. It was a South Side thing.

And probably a good thing that they’re gone, spared the indignity of seeing their beloved ball team sink to depths of bad they never could have imagined.

Dan McGrath

How bad? With a 4-1 loss to the Detroit Tigers on Sept. 27, the Sox set the modernday MLB record for losses in a season with 121. They eclipsed the dubious achievement of the 1962 New York Mets, who lost 120 in their first year of existence as an expansion team, with no farm system and a roster made up entirely of other teams’ castoffs.

The White Sox, in business since 1901, have no such excuse. And it had been inevitable throughout this hideous season.

My folks are buried in Holy Sepulchre Cemetery in Alsip, where I paid them a visit over Thanksgiving in 2005. Four weeks earlier, the White Sox had secured their first World Series title in 88 years with a four-game sweep of Houston’s Astros, completing a dizzying 11-1 run through the postseason.

Half or more of the headstones in the sprawling, sacred burial ground were decorated with some type of White Sox memorabilia — a pennant, a button, a photo, a cap, a banner newspaper headline, proudly placed there by nostalgic fans longing to share the occasion with loved ones who

hadn’t lived to see it.

This, I thought, was big. I called the Chicago Tribune, where I worked at the time, and asked for a photographer to come out and take pictures, which made for a nice Thanksgiving Day spread.

I spent 40-plus years in newspapers, involved with more stories than I could hope to recall. And though I’ve been out of the game for a while, I’m occasionally asked which of those stories was most memorable.

It doesn’t require much deliberation: the 2005 White Sox. Because of what they meant to so many people I care about.

It’s a South Side thing.

The White Sox are as South Side as potholes and political favors, yet curiously revered. Jerry Reinsdorf doesn’t get that and never has. If he did, he would never have allowed this proud, feisty, underdog franchise to wallow in such pitiful misery as we have witnessed this year.

Reinsdorf doesn’t get the South Side and never has. If he did, he wouldn’t have brandished the threat of a move to St. Petersburg as leverage for a new ballpark, no matter how decrepit the old Comiskey Park had become.

You don’t want us? Why should we want you?

It’s a South Side thing.

And, when he did get a new park, he wouldn’t have complained about being coerced into keeping it in Bridgeport when his preferred site in Addison would have drawn millions more customers.

Not many would have come from the South Side, Mr. Chairman. Those folks don’t like to be told where to go.

Nor do they like to be told what to do, which is why the clueless TV announcer’s blatantly contrived order to “Stand up, South

Side!” was met with such roll-ofthe-eyes derision.

The Sox let the clever, observant and smoothly polished Jason Benetti go and replaced him with this sadly overmatched John Schriffen? As sage TV critic Phil Rosenthal has suggested, there might be no better example of franchise mismanagement. The games are as unwatchable on TV as they are in person.

Of course, Reinsdorf would tell us it’s the fans’ own fault for not turning out in greater numbers.

The Athletic recently produced a deep, thoroughly reported dive into

how the White Sox came to be this bad. With all the missteps in one place, what emerges is a jarringly unflattering portrait of Reinsdorf and his small-market mentality. He still loves the game, but passion doesn’t confer wisdom. He was loath to embrace analytics and other technological advances, so much of the knowledge on which he prides himself is outdated — the game has passed him by. But he’s still an inveterate meddler, and let’s say hello again to Tony La Russa.

Finally, as this mudhole of a season comes to a close, a season

that has been embarrassing and insulting to those grimly loyal South Siders who live and die with the White Sox, the chairman is agitating for another new ballpark. For this mess? Reinsdorf leads the league in chutzpah. You’ve got to give him that.

A three-game sweep of the comparably inept, mailing-it-in Angels changed nothing. It’s time for him to sell.

Crain’s contributor Dan McGrath is president of Leo High School in Chicago and a former Chicago Tribune sports editor.

“It’s the partnership that matters.”

BART VITTORI – CHIEF FINANCIAL OFFICER | MEATS BY LINZ

renters in hot-spot neighborhoods on chicago’s North and West sides will gain a measure of control over who buys the buildings they live in when the ordinance soon takes effect I

Renters in some North and West Side neighborhoods will soon have the rare power to control who buys the buildings they live in, under the city's latest tool for cooling off gentrification hot spots.

In parts of Humboldt Park, West Town, Logan Square, Pilsen and Avondale, renters in many buildings will have the right of first refusal over any sale contract their building owner signs with a potential buyer.

By Dennis Rodkin

Under the ordinance, passed by the Chicago City Council Sept. 17 and taking effect when it’s published by the city clerk Oct. 9, renters have the right to match a buyer’s offer and buy the building, pass their right to buy on to another party, or approve the sale going through as

the seller has lined it up. Covering 6 square miles, the measure quadruples the portion of the 234-square-mile city where renters have a right of first refusal. In a 2020 plan to protect existing Woodlawn residents from being pushed out by gentrification sparked by the Obama Center, tenants in that 2-square-mile neighborhood also secured a right of first refusal.

A survey of industry professionals showed where they’d like to see resources dedicated if they were not earmarked for stadiums

By Danny Ecker

A public discussion about whether taxpayers should chip in close to $1 billion to help the Chicago Bears or Chicago White Sox build new stadiums in the city has prompted a question among the local commercial real estate community: Where would you want that money invested instead?

That was the exercise put before about 300 Chicago-area real estate pros over the summer by the Urban Land Institute and the Real Estate Center at DePaul University as part of its annual Chicago real estate midyear sentiment report.

A field of developers, investors, brokers, financial partners, real estate attorneys and other industry stakeholders were asked to choose from a list of where they'd want to see such resources dedicated if they were not earmarked to subsidize either recent proposal from the pro sports teams for new venues.

violent crime in the city have become a big hurdle keeping some investors from putting money into local real estate since the onset of the public health crisis.

Mayor Brandon Johnson — who has publicly championed the Bears' pitch for $900 million in upfront public money for a new lakefront stadium — has also pledged to transform the city's approach to policing, hoping a more progressive philosophy will help fight crime and yield safer streets.

The top answer, selected by 42% of respondents: more funding for police.

The top answer, selected by 42% of respondents: more funding for police.

Here are the other results from the survey:

The responses send a message to political leaders about public safety improvements that real estate leaders want to see as Chicago continues its recovery from the COVID-19 pandemic. Real and perceived issues with

The City Council approved a nearly $2 billion budget for the Chicago Police Department last year. Johnson recently said the city's police and fire departments will be exempt from a citywide hiring freeze as the mayor tries to close a $982 million budget shortfall for 2025.

“The Chicago real estate community isn’t ready to be in the vanguard of a defund the police strategy,” DePaul Real Estate Center Director Reagan Pratt said in a statement on the report, which is set to be discussed at an event tomorrow at 110 N. Wacker Drive. “Given the short- and long-term Chicago area challenges identified in the survey, it is little surprise that a primary focus among CRE professionals is to attack real problems or

UChicago’s $100 million donation is among its largest ever

the school said the gift will support ‘leadership on the principles and practice of free expression’

By Brandon Dupré

The University of Chicago landed a $100 million donation to support free speech, making the gift one of the largest in the elite college’s history.

The gift, whose benefactor remains anonymous, is the school’s eighth nine-figure donation, according to the university.

The largest donation ever was $300 million from David Booth,

founder and chairman of investment firm Dimensional Fund Advisors, to the school’s business program, which was renamed in his honor. Ken Griffin owns the title of second-largest donation to the university, giving $125 million to the economics school, which was renamed after him.

Here’s the complete list of nine-figure donations:

2007: $100 million from an anonymous donor for under-

graduate financial aid

2008: $300 million from David G. Booth for the Booth School of Business

2015: $100 million from the Pearson family for study and resolution of global conflicts

2017: $100 million from the Duchossois family for science and medicine

2017: $125 million from Ken Griffin for the Kenneth C. Griffin Department of Economics

2019: $100 million from the Pritzker Foundation for molecular

It marks one of the largest new suburban leases completed since the start of the COVID-19 pandemic

By Danny Ecker

As Medline Industries adds to its office footprint downtown, it's bulking up on workspace in the suburbs, too.

The Northfield-based medical supply giant has signed a new lease for 210,000 square feet at 2375 Waterview Drive in Northbrook, the company announced. Marking one of the largest new suburban office leases completed since the start of the COVID-19 pandemic, Medline will occupy almost all of one building in the two-building complex owned by the U.S. arm of Japanese drugmaker Astellas Pharmaceutical.

The dramatic expansion 4 miles west of Medline's Northfield headquarters comes as the company more than triples its office space downtown at the Merchandise Mart. New York-based Vornado Realty Trust, which owns the Mart, announced on Sept. 18 that Medline had signed on for a 110,000-square-foot expansion in the building.

In a separate statement, Medline also announced it was planting its flag in Northbrook and that more than 1,000 of its local employees will relocate their workspace to that office or the Mart "with room for incremental growth."

“As Medline continues to grow, the company is committed to ensuring it has the space needed for employees to thrive, collaborate and feel connected to the culture that has sustained us through the years," Medline Vice President of Real Estate and Construction Kate Slattery said in the statement.

With the 370,000 square feet of

new downtown and suburban office space, Medline said its real estate footprint in the Chicago area is now 3.8 million square feet. That includes industrial facilities, such as the 1.4 millionsquare-foot distribution center it opened in far north suburban Grayslake in 2022.

It's unclear whether Medline will be vacating any local office space elsewhere in the Chicago area as part of the Northbrook office deal. The company also has offices in north suburban Mundelein and Libertyville.

Medline said in the statement

that it has grown its headcount in the Chicago area by 33% over the past five years to nearly 6,100 employees. The company today has over 39,000 employees worldwide and does business in more than 100 countries and territories.

Medline, whose products include medical gloves, gowns and exam tables used by hospitals and doctors, generated more than $21 billion in sales last year. It was sold to private-equity firms Blackstone, Carlyle Group and Hellman & Friedman in 2021 and has reportedly been ex-

ploring an initial public offering that could value the company at as much as $50 billion, according to Bloomberg.

The Northbrook lease is a win for Astellas, which built its headquarters complex in Northbrook in 2012 but occupies only part of one of the buildings today. Astellas in recent years has been hunting for tenants to move into empty space at the property and inked a deal last year with chemical company CF Industries to move its headquarters there.

An Astellas spokeswoman said in a statement to Crain's that the

company has reduced its office space in Northbrook "based on average office attendance figures" but that it "remains committed to maintaining operations" in the suburb.

"While Astellas will continue to occupy part of the facility, we have decided to lease the remaining space to a new tenant in order to support the local economy," the statement said. Medline's lease is among the largest leases completed in the Chicago suburbs over the past few years, an outlier at a time when many companies are embracing the remote work movement and shrinking their workspace footprints.

The deal is similar in size to a recent 214,000-square-foot sublease signed by fleet management company Wheels at the Zurich North America headquarters in Schaumburg. That marked the biggest office deal in the Chicago suburbs since Ace Hardware's 2022 lease for the main office building on the former McDonald's headquarters campus in Oak Brook.

The office vacancy rate in the Chicago suburbs topped 31% midway through the year and has hit new record highs for 14 consecutive quarters, according to data from brokerage Jones Lang LaSalle. Companies have collectively cut back on nearly 4 million square feet of office space in the Chicago suburbs since the beginning of 2020, roughly 8% more than the suburban office space reduction from the beginning of 2008 to the end of 2010 when the great financial crisis hammered the market.

By Rachel Herzog

A high-end diamond retailer appears to be planning its first Chicago location on the city’s ritziest shopping strip.

Lugano Diamonds has a deal to take up 100-104 E. Oak St., according to sources familiar with the property. The space has been occupied by two recently shuttered shops and a soon-to-be-closed restaurant.

Adjacent to North Michigan Avenue and home to luxury brands and upscale boutiques, Oak Street hasn’t struggled with retail vacancy the way Chicago’s other shopping districts have. Local retail brokerage Stone Real Estate estimates the strip’s vacancy at less than 10%, with just three storefronts that have available ground-level space.

“It’s fundamentally luxury

and contemporary brands having their moment, and those brands either require wealthy customers or customers who are willing to spend,” Stone Principal John Vance said of the strength of the Gold Coast shopping corridor. Vance is not involved in the Lugano deal.

Lugano didn’t respond to requests for comment. It’s possible the Chicago location will be a similar concept to the brand’s “salons” in other cities that offer a luxurious shopping experience. Based in Newport Beach, Calif., the retailer also has U.S. locations in Aspen, Colo.; Greenwich, Conn.; Houston; Ocala, Fla.; Palm Beach, Fla.; and Washington, D.C.; and opened its first international location in London in April, according to its website.

French fashion brands Maje and Sandro have shuttered their

stores at 100 and 102 E. Oak St., respectively, according to messages posted at those locations. Mediterranean restaurant Fig &

Olive is closing its location at 104 E. Oak St. after Oct. 6, a spokesperson for the restaurant confirms. The restaurant occu-

pies about 12,400 square feet of second- and third-level space, while the shops took up about 4,700 total.

Neither Fig & Olive nor the boutiques’ parent company, SMCP Group, responded to requests for comment from Crain’s.

Both boutiques and the restaurant opened their doors in 2014 and were among the first tenants when the 54,000square-foot building, formerly the Esquire Theater, was redeveloped and opened as retail space.

A venture of Miami-based Ponte Gadea USA, the real estate investment business of Spanish billionaire Amancio Ortega, owns the building, which spans 58-104 E. Oak St., according to property records. The firm didn’t respond to a request for comment.

Jones Lang LaSalle brokers Peter Caruso and Jose Gonzalez represented the landlord in the deal.

the space — once the home of Maxim’s restaurant and a magnet for celebrities — is selling old-school elegance to its members in the form of an a ward-winning chef on staff I

By Ally Marotti

The subterranean Astor Club in the Gold Coast is dripping with old-school elegance. There are 24-karat gold flecks in the floors, plush red chairs in the lounge, a pink marble sink in the bathroom. Dozens of vintage wine bottles are on display in the entry, and a 1936 ivory-keyed Steinway sits in the lounge. Member lockers have names on the placards that are recognizable enough that Crain's had to agree not to print them.

As a members-only spot, the Astor Club’s ethos is centered on exclusivity. Now the owners, who opened the spot just over a year ago, are piloting a new theory: Can their members taste exclusivity, too?

The test began with the hiring of Michelin-starred Chef Trevor Teich, who took over the kitchen in late June. Teich rolled out a new menu and is preparing special events for members, such as a tasting menu, wine tastings and more. So far, his changes — and his gravitas — are appealing to members. Membership has increased since he started. And, perhaps more notably, members are spending about 40% more each time they visit.

“Many clubs in the city haven’t, I would say, really focused on the food,” said Adam Bilter, who bought the space with his wife, Victoria, in 2022. “But because we’re literally an old restaurant space — a pretty old, famous restaurant space — we always knew that that was going to be a focus.”

Astor Club exists in the space at 24 E. Goethe St. that for two decades was Maxim’s. The spot opened in December 1963 in the basement of what was then a hotel. It was, by many accounts, the place to be. There were parties, near-nightly performances, and eventually, discos. There were celebrities, from Audrey Hepburn to The Beatles. Framed photos on the wall show glimpses of those days.

Maxim’s was a sister of the Parisian mainstay, Maxim’s de Paris, which has been open since 1893 in the French capital and has drawn customers such as Ernest Hemingway. The Chicago iteration’s Art Nouveau decor mir-

From Page 2

two groups: Affiliates of the Illinois Network of Charter Schools, which reportedly has up to $3 million to spend if it so chooses; and a new organization, The Urban Center, founded by former Latino charter school operator Juan Rangel with lots of help from former CPS chief and ex-mayoral hopeful Paul Vallas.

The Urban Center's political action and independent expendi-

rored that of its French sibling, with deep red seating, over-thetop trim, nature-inspired accents and gold fixtures. The Bilters bought the space for $680,000 from the city, which had used it as an event venue after Maxim’s closed. It sat vacant for about a decade before the Bilters came along and sank more than $1 million into fixing it up.

Walking in now, one is transported back to the Belle Epoque.

The Bilters worked to keep as many features as possible. A piano in the entry says “Maxim’s” just above Middle C. Those vintage wine bottles on display were drained half a century ago. The white tablecloths in the dining room stand stark against the original deep red carpet, booths and wallpaper. The light fixtures are the same, and on the wall hang flourished gold “M’s,” for Maxim’s.

‘Out of a James Bond film’

“It’s out of a James Bond film that didn’t get made,” said Teich on a recent afternoon, looking into the dining room. “It’s incredible to do the food that would be here, with a modern lens.”

When Teich was hired, he went to Myopic Books in Wicker Park and bought French cookbooks

tures committees so far have raised roughly $700,000 for board races with more potentially on the way. Included are $100,000 each from Morningstar’s Joe Mansueto and Madison Dearborn co-founder James Perry, and $50,000 each from mergers and acquisitions lawyer Charles Mulroy and Residco exec Vince Kolber.

The Urban Center has its own candidates in nine of the 10 districts. The charter network says it’s still deciding. So is a third waiting in the wings that’s headed by former Richard M. Daley and

from the 1960s for inspiration. The resulting menu is old-school French with a modern touch that matches the decadence of the place. Appetizers include a seafood tower ($71 per person), salmon rillettes ($18) and deviled eggs ($5 each.) There’s Vichyssoise soup ($12), or diners can pay $27 and get scallops and caviar added. There’s a fork and knife Caesar salad ($18) and avocado Louie ($20).

Three items were on Maxim’s original menu: onion soup ($12), Sole Meuniere ($42) and Tournedos Rossini ($65). The lobster pot pie ($26) is a holdover from Teich’s previous restaurant, Claudia. Other entrees include steak frites ($60) and two burger options, plus a carbonara ($26) that harkens to the Bilters' days living in Italy.

The poulet roti pour deux ($85) is prepared tableside. Teich pipes chicken mousse under the chicken skin, adds herbs, then takes it back to the kitchen to be carved up. The result is served with farro and corn risotto.

“It’s over-the-top presentation,” he said. “It’s fun to do the showy stuff in a place like this, where they’re expecting fire.”

Teich said the menu is off to a good start, though he’s still gathering data on what’s working. The

Rahm Emanuel aide Mike Ruemmler. Among founders of that group is Civic Committee chief Derek Douglas.

Amid all of this money-raising is a little Chicago-style political intrigue. For instance, among those running are one Democratic ward committeeman and the wife of another. And no one who knows wants to talk about how the CTU candidate in one district suddenly enjoyed a clear path to victory, after his only opponent abruptly withdrew.

“What’s at stake is the future of

and inflation set in. Some Chicago restaurant customers are cutting back. It’s been a blow to the already low-margin industry, and the economics of running a restaurant have changed in recent years. Claudia cost $20,000 a month just to turn on, Teich said, not including labor and the food, which are typically the two biggest line items.

prime beef short rib Wellington for two ($125) is the star item, and the deviled eggs are quickly becoming a favorite, too.

“We sell tons and tons of deviled eggs with caviar on top,” he said. “While you figure out what you want to eat, a glass of bubbles and a couple of those will get you in the mood.”

Members-only spots like Astor Club offer luxury, and people join for the exclusivity, said Alexander Chernev, a marketing professor at Northwestern University’s Kellogg School of Management. Having a Michelin-starred chef checks that box.

“You need something which will make you exclusive,” he said. “When it comes to food, being able to say, ‘I have a Michelin-starred chef,’ that’s exclusivity.”

Just over a year before Teich started at Astor Club, he was closing his Michelin-starred restaurant in Bucktown. The 70seat restaurant served a seven- to nine-course tasting menu that stretched over 2.5 hours. It closed for financial reasons.

The cost of dining out has gone up about 30% since 2019, when the pandemic drove up labor costs

our public schools,” summarizes CTU Political Coordinator Hilario Dominguez, suggesting that “millionaires and billionaires” are trying to “buy control” of the school system.

“We’re trying to restore some sense of normalcy in our policies,” says The Urban Center’s Rangel, asserting that CTU is too far out of the mainstream to be given control of the school system.

We’ll see if any if this is enough to motivate Chicagoans to turn out in high numbers and actually vote.

My take: Given that the CTU is

“We’re still in a time where restaurants haven’t fully bounced back (from the pandemic,) and … it really seems like the dice is just being rolled on who gets to stick,” he said. “Filling 70 seats for a tasting menu that’s over $220, it’s a hard thing right now while people are feeling an economic burn.”

Working at Astor Club offered a reprieve from the daily struggle to fill seats. Astor Club, a nonprofit, charges its 350 members a one-time initiation fee of $4,800 and monthly dues of $300. (It’s slightly cheaper if a member is under 40 or lives in the building.) Those dues support the club, giving the restaurant a little more wiggle room in what normally would be razor-thin margins.

For Teich, that means less stressing over filling seats. For club members, that wiggle room means bigger portions and larger pours, Adam Bilter said.

“We have those dues that come in every single month and support the club,” he said. “(They allow) it to function and not have to scrimp and scrounge and try to reduce portion size and scrape by.”

Teich has big plans going forward. He’s dreaming of monthly or quarterly themed dinners, and thinking of how else he can weave history into the menu.

“My goal for the club is to do things that I couldn’t do in a normal restaurant,” he said. “There are cool opportunities to do some wild dinners. We have a captive audience.”

effectively seeking to elect a captive board that will roll over and do what it’s told, regardless of the cost to taxpayers, my sympathies lie with the charter/business guys. Chicago has a better chance of getting board members who will think for themselves if it elects people not slated by the CTU. That said, how this all turns out is anyone’s guess. Chicago waited a long, long time for an elected school board. Given how the first round is going down, whether the city gets what it wanted is very much an open question.

the barack Obama Foundation confirmed that it quietly acquired the bungalow on euclid Avenue, but said it’s focused for no w on getting the presidential center built a few miles away in Jackson Park I By

Dennis Rodkin

While the monumental Obama Center is rising in Jackson Park, the former president’s foundation is holding off on activating a far more modest property in its portfolio, the childhood home of Michelle Obama 2 miles away in South Shore.

The Barack Obama Foundation quietly acquired the bungalow on Euclid Avenue, where the former first lady grew up in the secondfloor apartment and later lived for a short time with her husband, four years ago, Cook County property records show. The transfer came to light in recent months because of the death in May of Marian Robinson, Michelle Obama’s mother, the bungalow’s longtime owner.

An Obama Foundation spokesperson confirmed it owns the bungalow.

The foundation “is committed to preserving Mrs. Obama’s childhood home on the South Side of Chicago for the benefit of future generations,” the spokesperson said in an email. “This decision aligns with the practices of other cultural institutions such as the King Center (in Atlanta), which has preserved the family home of

Dr. Martin Luther King, Jr.”

The home has been little-used since Robinson moved with the Obamas into the White House in January 2009 at the start of Barack Obama's presidency, the spokesperson confirmed.

Beyond that, “we do not have any further announcements to make about the home. We are currently focused on the completion of the Obama Presidential Center,” scheduled to open in spring 2026.

In September 1965, Michelle Robinson was a toddler, about 1 year and 8 months old, when her great-aunt and great-uncle, known as Robbie and Victor Terry, bought the bungalow. Cook County land records show the date but are not clear on the purchase price. Michelle Robinson moved with her parents, Marian and Fraser Robinson, and older brother, Craig Robinson, from a Parkway Gardens low-income co-op into the bungalow’s second floor, a finished attic beneath the sloping roof. It had one bathroom.

Fifty-four years later, on a tour of Chicago with ABC News, Michelle Obama stood in front of the bungalow, gestured at the upstairs

windows and said, “I walk in there and I think, ‘My God, how four people lived a full life in that little bitty space.’”

A 2015 book about the former first lady, "Michelle Obama: A Life," by Peter Slevin, said she recalled playing with her Malibu Barbie and Easy Bake Oven as a child in the small apartment and watching "The Brady Bunch" on television.

In her 2018 autobiography, “Be-

coming,” Obama wrote that “I spent much of my childhood listening to the sound of striving. It came in the form of bad music, or at least amateur music, coming up through the floorboards of my bedroom — the plink plink plink of students sitting downstairs at my great-aunt Robbie’s piano, slowly and imperfectly learning their scales.”

In 1980, Robbie Terry transferred the deed on the bungalow to Fraser

Robinson, according to the deeds filed in the basement of the Cook County Building. He died in 1991 and the title transferred to his widow, Marian Robinson. The home remained in her name until June 2020, when it was transferred to the Barack Obama Foundation. No amount was recorded.

Before the foundation took over, the bungalow had been in the Terry and Robinson family for a few months shy of 55 years, a notably long tenure, even if the house hadn’t been the place where a future first lady grew up and the then-future president also lived. The Cook County assessor estimates the value of the bungalow at $164,000.

When Marian Robinson first moved to Washington in 2009, she told People magazine it was only temporary, to help the Obamas and their two young daughters settle in. “I love those people,” she told the magazine, “but I love my own house. The White House reminds me of a museum and it’s like, how do you sleep in a museum?”

At some point in the future, the bungalow where Robinson slept for more than four decades may also be a museum.

Though Chicago is generally less pricey than comparable housing markets, we're still experiencing an affordability gap here, with estimates of the shortage lately hovering around 120,000 units. Rising rents — up roughly 6% by some measures in 2023 — are tipping more Chicagoans toward housing instability, contributing to homelessness and fueling other ills ranging from rising crime to disrupting kids' school attendance as their families seek shelter they can afford.

Everyone seems to agree this is a problem — from academics to real estate investors to community activists and beyond.

So why is the city of Chicago about to enact a new ordinance that's going to intensify the problem?

That's the big question as the City Council and the Johnson administration barrel ahead with the soon-to-be-enacted Northwest Side Housing Preservation Ordinance. It's touted as a measure to slow gentrification and protect affordable housing. Sadly, it will only stymie the kind of investment the city desperately needs to build new housing stock and upgrade older buildings.

At the heart of this ordinance is a $60,000 demolition fee, supposedly designed to discourage developers from tearing down properties in favor of new

PERSONAL VIEW

construction. Proponents argue this fee will slow the pace of gentrification and prevent displacement in communities like Logan Square, Avondale and Pilsen. But the financial burden will also fall on everyday homeowners who seek to sell their properties, not just large develop -

ers. Longtime property owners in these areas, many of whom are elderly and on fixed incomes, may find their homes are now less attractive to buyers or developers, limiting their options when they seek to sell their only significant financial asset.

Then there's this little time bomb built into the ordinance: a tenant's first right of refusal, which allows tenants to purchase the property they are renting before it can be sold to another buyer. This policy, ostensibly designed to empower tenants, can significantly delay the sale process, giving tenants four months to close without any requirement to demonstrate ahead of time that they can actually afford to buy.

One real estate industry exec, Mike Zucker, put it to Crain's Dennis Rodkin in terms we can't really improve on: "This nonsense is going to make (investors) have to sit around and wait for months before they can find out they have the right to sell a building they own — a right they've always had. If the goal was to stop investment from going into those neighborhoods, they have succeeded."

It's hard to understand how the supporters of this legislation think. They seem to believe restricting housing supply will somehow make housing more affordable. They bemoan disinvestment in their communities while making it increasingly difficult for investment to happen. They seem to regard those who have the means to help them solve the city's problems as the enemy, rather than as partners. And with that kind of thinking, we all lose.

Look at any map of Chicago measuring crime or poverty, and you’ll see a disheartening picture: The communities with less economic opportunity have more crime. This is not a new revelation. Economists, community advocates and policymakers understand that fewer opportunities in disinvested communities translates into more crime.

Aren’t we all tired of looking at this map and the way crime impacts our city? Aren’t we ready for new solutions and innovative approaches to improving public safety and fostering economic development in struggling communities?

Diverse stakeholders who have watched the same cycle of violence devastate Chicago neighborhoods came together to support legislation that incentivizes businesses that hire formerly incarcerated individuals.

Through sustained grassroots efforts, a law was enacted which triples the tax credit available for businesses that hire a formerly incarcerated employee and quintuples the ceiling for these incentives (from

Good jobs keep people off the streets and out of prisons, making communities safer and saving taxpayers huge amounts of money every year. Small businesses also benefit from a more expansive workforce, and economic activity increases in neighborhoods when formerly incarcerated individuals are hired in their communities.

If you're skeptical, small business owners aren’t. Business owners and entrepreneurs overwhelmingly support reducing barriers to employment for returning citizens.

capitalize on their new skills.

Finally, these enhanced incentives connect two groups of people that can help each other. Small businesses are being significantly affected by workforce shortages, while formerly incarcerated individuals struggle to find work, despite the fact that turnover rates are lower for employees with a record than others. Motivated business, meet motivated employee.

$1,500 to $7,500).

Sound bold? Good. Persistent problems like crime and recidivism require bold, visionary solutions.

But how can a business tax credit reduce crime? By preventing it in the first place.

One of the greatest factors in reducing recidivism is stable employment. When a returning citizen lands a steady job, it reduces their risk of re-offending in a significant way.

These enhanced tax credits also support returning citizens when they need it most. When someone is released from incarceration, they are most likely to re-offend shortly after their release. These increased incentives will be available to businesses that hire formerly incarcerated individuals upon their release, creating a powerful way for businesses to recruit formerly incarcerated individuals when they most need stable employment.

These tax credits can also help people that receive valuable training in prison

We want to make sure local businesses know about these enhanced tax credits and can take advantage of them. Indeed, if entrepreneurs need employees, and are interested in exploring these incentives, they should explore this opportunity now because funds will be limited.

We applaud policymakers for taking proactive measures to support small businesses, create opportunities for formerly incarcerated individuals, improve public safety and reduce the cost of recidivism. We also encourage politicians to enact additional innovative measures that support entrepreneurs while addressing root causes of crime and poverty.

Americans of every race and every state, Black, white, Asian American, even Jamaicans in Jamaica and anti-Trump Republicans, were energized when Kamala Harris stepped before the cameras to declare her candidacy for the presidency of the United States in advance of the Democratic National Convention.

Loida Lewis is chair of the Reginald F. Lewis Foundation, chair of the U.S. Filipinos for Good Governance and an author.

Within days, some $300 million was raised from donations, many from firsttime givers, from Americans overjoyed that they now have a young, vibrant, brilliant former prosecutor and U.S. senator running against a 78-year-old convicted felon and sexual predator.

As an Asian American woman who in 1994 succeeded my late husband, Reginald F. Lewis, as chair and CEO of TLC Beatrice International, I was met with skepticism and doubt about my abilities. However, bolstered by the team I selected to run the multinational company, we cut costs, reduced debt and increased revenues from $1.5 billion to $2.2 billion. We then sold and liquidated the company with a 30% internal rate of return for shareholders in 2002.

Today, it is taken for granted that women can be effective CEOs and run huge organizations. As my personal experience demonstrates, that was not always the case.

In the same way, Americans should not underestimate Kamala Harris’ ability to run this country as president simply because she is a woman who also happens to be Black and Asian. Other nations have elected powerful women leaders like Great Britain’s Margaret Thatcher, Germany’s Angela Merkel, Israel’s Golda Meir, India’s Indira Gandhi, and Pakistan’s Benazir Bhutto. Even the Philippines has twice elected woman presidents — Corazon Aquino and Gloria Macapagal Arroyo.

And with the addition of Minnesota Gov. Tim Walz, we have an even more potent team. Both are proven and experienced executives who will be good for the economy and our collective mental health. We’ll be able to sleep soundly at night knowing that capable people are running the country, which was not the case from 2016-2020 — witnessing Trump’s threats to pull out of NATO, his offer to buy Greenland, his prescription of horse medicine to protect against COVID-19 and then his advice to people to inject disinfectant to cure it. And the list goes on. Do we really want to go back to

that? The Harris-Walz ticket will lead us forward into the future where Americans can be proud of who they are and what their country stands for and not get dragged back into the everyday chaos that made this nation — a beacon of hope for the rest of the world — seem like a banana republic.

It is high time for the United States to elect a strong and competent woman who has served as vice president for three and a half years to the position of president.

Local officials, the state of Illinois and even the Cook County Sheriff’s Office are working to provide relief for cost-burdened households I

Chicago renters keep feeling the sting of rising rents. Though rents may have stabilized in recent months, the stock of affordable rental housing is dwindling and leaving fewer options for renters with the lowest income.

“There’s not enough housing for low-income tenants,” says LaTanya Jackson Wilson, vice president of advocacy with the Shriver Center on Poverty Law. “The supply is low and the demand is high. That causes rental rates to rise.”

And rising rates put renters further behind. Consider that in 2022, the median wealth gap between homeowners and renters in the U.S. reached almost $390,000, according to the Urban Institute.

Homeowners saw significant wealth gains as home prices increased over the last decade. But as rental prices have increased faster than incomes, renters’ residual incomes after paying for housing have decreased. In 2022, the share of renters spending more

By Eric Gwinn

than 30% of their income on rent reached a record high, with about half of renters being cost burdened.

A cost-burdened household is defined as one that spends more than 30% of its income on housing. For the lowest-income renter households in Chicago, well over 80% are cost burdened. In Englewood, for example, where the median monthly income two years ago was about $2,315, that would

See RENT on Page 11

SPONSORS

“Black renters face a disproportionate share of evictions, and the eviction filing rate for adults with children was more than double the risk seen by adults living without children.”

County sheriff’s office 2023 evictions report

mean $2,050 of that would be spent on rent and related expenses.

RentCafe, an online rental listing service, reports the average rent for a 750-square-foot apartment in Chicago is $2,349. That’s out of reach for many renters in neighborhoods such as North Lawndale, where the median annual income is $33,334 and 30% of that budgeted for rent would be about $833 a month. Half of Chicagoans cannot afford the average rent of $2,350 a month, which has increased almost 50% from a decade ago.

Affordable housing in Chicago has become a major policy discussion among a diverse group of parties, from those needing a roof over their heads to public officials, developers and landlords in Chicago. Affordable rentals are a huge piece of the housing pie, and when that piece shrinks, families, neighborhoods, businesses and schools feel the effects.

Unaffordable rents can lead to tenants choosing between even lower-cost and substandard housing or becoming unhoused. But tight housing markets can affect the choices landlords make, too.

Take Lisa Cotton, who has been a landlord on Chicago's Northwest Side for 31 years. She rents seven small, tidy, unsubsidized apartments for $700 to $1,050 a month to people on fixed incomes.

“My rents are low because when you keep the rent high, you have a lot of turnover,” Cotton says. “It takes time to screen new tenants and to upgrade an empty apartment. I’m an owneroccupied landlord, so the money I would lose with revolving high rent, I might as well give tenants a discount. They really appreciate it, and it’s less headaches for me.”

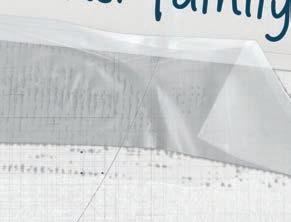

But when the rental costs become too much and tenants fail to pay their landlords, the agreement between the two parties frays, which can lead the building owner to file an eviction order. In Cook County and across the nation, those who most often face eviction are Black and Latino women and families with children, the Cook County Sheriff’s Office noted in its 2023 evictions report.

Evictions add more costs for those unable to pay rent — moving expenses, child care costs, lost income — making it harder to find a new apartment. Even when a new home is found, landlords will see an eviction order on the rental applicant's personal record and refuse to rent to them. The next step might be to “sofa surf” with temporary living situations at the homes of family or friends until those options run out.

In some cases, evictions lead to homelessness.

“If we prevent people from being evicted, those people wouldn’t be homeless,” says Michelle Gilbert, legal and policy

director of the Law Center for Better Housing, a Chicago nonprofit that assists low- and moderate-income renters.

Turning point

Matthew Desmond, a Princeton University sociology professor and director of The Eviction Lab at the school, pushed the topic of evictions to the forefront in his 2016 book “Evicted: Poverty and Profit in the American City.” But even as the book was winning a Pulitzer Prize and other acclaims, tenant advocates in Chicago were already working on legal mechanisms to stop a system that usually sides with landlords.

“Matthew’s influential book really helped people think about eviction, but there was already a movement in Chicago,” Gilbert says. “There was already a dawning recognition this was an unfair system.”

Gilbert also manages the city of Chicago's Right to Counsel pilot program and helped create the Cook County Circuit Court’s Early Resolution Program, which helps residents obtain free legal aid in resolving eviction, foreclosure, debt and tax deed issues. Before the ERP’s establishment in 2021, renters and homeowners often showed up in court without legal representation and unprepared for the case against them. Services are provided through Cook County Legal Aid for Housing & Debt.

Nationally, Black and Latino tenants make up the largest share of those who are evicted, according to a 2020 study by researchers with The Eviction Lab. Cook County figures echo those findings.

“Black renters face a disproportionate share of evictions, and the eviction filing rate for adults with children was more than double the risk seen by adults living without children,” according to the 2023 evictions report by the Cook County Sheriff’s Office. Roughly half of all evictions in the county occur in majority-Black ZIP codes, while less than a quarter of the county’s population is Black.

In 2019, Cook County landlords filed an average of 1,147 eviction orders a month. When the COVID-19 pandemic shut down the city and much of the world, people lost jobs and were told to shelter at home with no income to pay rent. Lawmakers in Illinois and across the U.S. enacted eviction moratoriums and offered rental assistance to tenants while granting mortgage forbearance to landlords. When Illinois phased out its moratorium in 2021, eviction orders in Cook County had plummeted to an average of 226 per month but climbed back to nearly 1,000 in 2023.

Rising prices, inflation-eroded income and a lack of affordable residences have low-income renters feeling trapped, advocates say. And the problem is exacerbated by bad property managers who often have the upper hand by skipping repairs, main -

tenance and pest eradication.

“If a car salesman treated you like many managers treated tenants, they would have zero business,” says John Bartlett, executive director of the Metropolitan Tenants Organization. “It’s almost like they’re treating the tenant like the enemy.

“People say, ‘If you don’t want to live here, then move.’ But moving costs thousands that people don’t have. There are a lot of barriers that keep people from moving places. And things could always get worse. You don’t want to move out of the frying pan into the fire.”

In many cases, tenants have organized, finding strength in numbers to stand up for their rights. They have withheld rent, documented unhealthy and unsafe conditions, and sought out legal representation.

Housing advocates have also helped win protections for people emerging from incarceration and needing a place to live. In 2019, the Cook County Board of Commissioners passed the Just Housing Amendment to the Cook County Human Rights Ordinance, prohibiting housing discrimination based solely on an individual’s criminal record. Landlords are required to assess each rental application on a case-by-case basis.

Preserving affordable units

Chicago once was home to many single-room occupancy, or SRO, hotels and rooming houses, which catered to people who could afford only a small studio or tiny apartment. Despite a 2014 city ordinance to preserve SROs, the number has continued to decline at a faster rate than projected — particularly in Uptown, where many SROs were located, according to research by Ryan Fulgham of the Institute for Policy & Civic Engagement at the University of Illinois Chicago.

On a different front, local leaders also have moved to preserve two- to four-flat buildings that often contain an owner-occupied unit as well as rental space. In Chicago’s majority-Hispanic or -Latino and predominantly Black communities, two- to four-flat buildings make up much of the housing units in neighborhoods like Little Village, Brighton Park, New City and West Garfield Park, according to the Institute for Housing Studies at DePaul University.

In mid-September, the Chicago City Council approved a socalled anti-gentrification ordinance to discourage developers from buying such buildings, razing them and replacing them with high-priced residences that would displace longtime residents. The measure increased demolition fees to $20,000 per unit and $60,000 a building. Previously, fees were $5,000 and $15,000, respectively.

In 2021, Gov. JB Pritzker signed into law House Bill 2621, which reduces Cook County tax bills for building owners that have seven or more units if they

In 2023, the cook county Sheriff’s Office was ordered to enforce 11,988 evictions. During the cOVID pandemic, average monthly eviction orders reached a low of 226 but climbed back to nearly 1,000 in 2023. both March and August 2023 surpassed 2019’s average monthly orders.

“The rent is too damn high!” This is what many Chicago residents have been saying these days. Even though the city’s minimum wage is twice that of the federal minimum wage ($15 an hour compared to $7.24 an hour), it is still not enough. If a person works a fulltime job at $15 an hour, they will make $2,400 for the month before taxes. The median rent in Chicago for a two-bedroom unit is $1,900. What does it say when a person can work a fulltime job but not be able to afford to live in the city?

the community because rent was too high.

Over 90% of Bronzeville residents are renters, and of that group, over 50% are rent burdened, which means they are paying more than 30% of their monthly income toward rent. This is not affordable, and if they experience any monetary emergencies, then they are a step closer to eviction.

Having affordable rents does two things: 1) reduces homelessness and 2) stabilizes communities. People get to stay in their community instead of moving every five years because rents have gone up.

As a Bronzeville resident living in a community that is 85% Black, these cries of rent being too high from community members have to be heard. Many residents have seen their friends and family members move out of

Rents in Chicago increased 35% from 2018 to 2022, but we do know wages haven’t increased 20%. The eviction rate in Bronzeville is 50% higher than the city average (4.5% compared to 2.9%), which then contributes to more Black people

possibly leaving the city of Chicago.

The Black population in Chicago has dropped from 52% of the overall population 30 years ago to 28% of the population now. This has been a result of the destruction of public housing that was the catalyst for gentrification in many historic Black communities. If we truly want an equitable society, we need rent rent stabilization legislation that makes rent increases equitable for all. Right now, corporate landlords can price-gouge our community to death with no regulation from our local governments. This is what the government should be, the regulatory agency that protects its citizens from corporate greed. In order for Chicago to truly be a world-class city, we have to change the paradigm. It is not how well it treats its affluent residents but how well it treats the most vulnerable citizens. This is what will make Chicago world-class.

When someone says “fair housing,” we think of people trying to obtain housing. But preventing eviction is as much about fair housing as is seeking admission.

In 2019, my organization, the Law Center for Better Housing, released the Chicago Eviction Data Portal, which examined a decade of Chicago eviction records to highlight patterns in evictions. The data showed that eviction overwhelmingly affects communities of color on the South and West sides of Chicago, with South Shore having an eviction rate nearly three times the city average. Repeated studies find that eviction disproportionally impacts Black people, especially Black women with children.

Michelle Gilbert is the legal and policy director for the Law Center for Better Housing.

moratoria because they needed to be paid rent, we did not disagree. Instead, we said they needed a new tool in their toolbox — not just eviction, which leaves housing providers with a paper judgment and an empty apartment, but rather rental assistance. Rental assistance not only preserves tenancies — it actually puts money back in the landlord’s pocket, which they can turn around and spend in their communities.

Because eviction happens largely to traditionally disempowered communities, eviction defense has not often been at the top of policy agendas. The pandemic, which brought eviction to the doorstep of many communities, changed that thinking and brought unprecedented attention to eviction prevention, including a moratorium on evictions so that people could shelter at home.

When landlords opposed the

We were not the only people who felt this way: Gov. JB Pritzker and the General Assembly agreed that pandemic-era rental assistance had been so successful in promoting housing stability that in this year’s budget, they appropriated $75 million for courtbased rental assistance, recognizing that investing in housing stability is more costeffective than rehousing people who have become homeless.

The second critical set of pandemic-era changes arose under the leadership of the Cook County courts, the Cook County Board, the Chicago Department of Housing, and the Chicago Bar Foundation. Cook County Legal Aid for Housing & Debt, a new legal aid consortium, was formed to provide advice and negotiation assistance for both unrepresented

tenants and landlords. This effort implemented changes in the practices of eviction court so that tenants have time to consult an attorney and prepare defenses before going to trial. We appreciate that Cook County Board President Toni Preckwinkle and the county board are working to continue CCLAHD.

After tenants have completed CCLAHD’s services, for more complicated cases or particularly vulnerable tenants, Chicago created the Right to Counsel Pilot Project, which my organization leads. Preliminary data by independent evaluators shows that around 92% of RTC clients seeking to avoid a formal eviction order were able to achieve that goal. RTC staff, from partners Law Center for Better Housing, Legal Aid Chicago and CARPLS, are not magicians. We win cases because tenants have defenses that they are not able to present on their own. We appreciate that Mayor Brandon Johnson has introduced an ordinance to make right to counsel permanent in Chicago — joining 17 cities, two counties, and five states that have enacted permanent right to counsel legislation.

In my 34 years as a legal aid attorney, I have talked to too many people on the verge of eviction and homelessness — people who helped with a family member’s funeral expenses, who did not

Because eviction happens largely to traditionally disempowered communities, eviction defense has not often been at the top of policy agendas.

have paid maternity leave, or who withheld rent after living with troubling housing conditions. Preventing their evictions has been my life’s work and my small way to try to achieve a more

racially just society. Maybe, with systemic changes like rental assistance and right to counsel, we can make eviction more rare and move toward a society that embraces justice for all.

Numerous considerations, both financial and other, have to be taken into account when deciding whether to rent or buy your next house or residence.

Renting versus buying can also be a determining factor if the housing prospects in your price range are scant or it is difficult to find anything in the exact neighborhood or section of town you desire.

Generational Trends" report, the median down payment among homebuyers of all ages was 13%, and some loan programs allow buyers to make down payments that are much lower, such as 3%, 1% or zero.

For many would-be homeowners, the down payment is all that's holding them back. Renting could be an equal if not better avenue, depending on financial conditions (interest rates, housing market status, etc.) and non-financial conditions (area of town, family and friends proximity, etc.).

Renting considerations

Jamie

Hermann is the mortgage sales manager and senior vice president for Old National Bank.

If finances are tight and interest rates are high, renting may be the best option to continue to save to buy a house down the road. Buying “too much house” can put you in a precarious position if you’re meeting your mortgage payment with little to spare and monthly surprise bills (medical, insurance, home fixes, etc.) put you over the top in terms of your planned bills and expenses.

Purchasing considerations

The down payment amount is typically the biggest consideration for a potential homebuyer. A survey from NerdWallet shows that 37% of nonhomeowners said that their lack of a down payment was preventing them from buying a home. But there are opportunities to get into a house without spending years saving up for a down payment:

1. Reconsider your down payment needs.

It’s a common assumption that you have to bring a down payment of 20% of the purchase price in order to buy a home, but that is not necessarily true. According to the 2023 National Association of Realtors' "Home Buyers and Sellers

2. Talk to a lender who offers, and is knowledgeable about, down payment assistance programs.

In a lot of cases, potential homebuyers come in and sit down with me and we talk through the process of qualifying for a mortgage. Many banks offer an in-house down payment assistance program for lowto moderate-income homebuyers in certain communities.

3. Get prequalified for a mortgage.

This provides prospective buyers a good idea of how much home they can afford and how much a lender may loan them.

4. Learn as much as you can about the process.

Many down payment assistance programs require participants to take a homebuyer education course in order to qualify. Take the course as early as possible in the

process so you can benefit from all the knowledge it will provide.

5. Consider various options for assistance.

Some down payment assistance

programs will provide 3% of the purchase price, up to $10,000, for qualifying homebuyers. Those who qualify and purchase in select areas can receive up to $15,000 toward the purchase price.

HOUSEHOLD MEDIAN NET WORTH

$210,000 WHITE

$40,500 MEXICAN (U.S.-BORN)

$24,000 PUERTO RICAN

$6,000 MEXICAN (FOREIGN-BORN)

$0 BLACK

By Eric Gwinn

For more than a century, Chicago’s iconic two- to four-flat homes have been an important part of affordable housing in the city. About 40,000 of the structures sprung up in every neighborhood from the late 1890s to about 1920.

They were built with renters and upward mobility in mind. New immigrants saved enough money to buy a two- or three-flat (four-flats came later) and lived on one floor while renting out the rest of the home. The rent took care of the mortgage, allowing the homeowner to save up enough money to buy a detached single-family home, living the American dream. For generations, the cycle of success continued. Today these homes remain a crucial source of unsubsidized rental housing for residents with low income.

Lisa Cotton owns and lives in a

two-flat on the Northwest Side, in an area that has a high share of lower-income renters living in high-cost units. Since 1993 she has offered low rents for the seven units in her building and nearby coach house. Nearly all of her tenants are on fixed incomes.

She likes being a landlord in the building where she lives, and tenants feel like family. But “repair costs on two buildings that are over 100 years old is constant,” she says. “I always have a huge list of things to do. I once had to do rat eradication on my birthday. I have to buy seven stoves and seven refrigerators and once had to make $20,000 in repairs to my porches.”

Cotton wrestles with raising rents because of the expenses. “I have retirees, independently employed people and a family with a kid," she says. "I don’t want anyone to suffer.” So she has taken on a job outside the home to keep things running.

Meanwhile, other landlords have countered inflation and rising property taxes by raising rents. In turn, tenants and community groups statewide are pushing the state to reintroduce rent controls at the municipal level. Cotton understands the desire for rent control and is determined to hold the line against raising her rents. But she is convinced that if rent control were approved, other landlords would jack up their rents significantly before it went into effect in a bid to lock in a cushion against future expenses. That, she predicts, would eliminate even more affordable housing.

Two- to four-unit buildings are Chicago’s most common type of rental housing, according to a study by the Institute for Housing Studies at DePaul University. They account for more than 32% of the city’s housing supply.

But in the last decade, Chicago has lost many of these types of

creased, the study found. Areas with lower income and a history of disinvestment saw the structures deteriorate and demolished without replacement. Those neighborhoods also lost population, as people left when the supply of affordable housing shrunk.

Citywide, over 73% of rental units in two- to four-flats are occupied by a person of color, a separate study from the institute shows, and the majority of two- to four-flats are owned by a Black or Latino head of household.

Aldermen have sought to protect two- to four-flats and other homes in some rapidly gentrifying areas home to Hispanic and Latino residents. The Northwest Preservation Ordinance, approved in September by the City Council, makes it more costly for developers to buy and destroy older two- to four-flats in parts of Hermosa, Logan Square, Avondale, West Town and Humboldt Park. The intent is to preserve affordable housing so that longtime residents aren’t forced out as higher-income people move in.

The so-called anti-gentrification ordinance increased demolition fees to $60,000 for two-flats and $20,000 per unit for multi-unit residences. That is up from $15,000 per building and $5,000 per unit. Advocates for affordable housing hope the measure can be extended to other community areas.

Cotton approves of the move and wants to see more city efforts to protect and expand affordable housing.

“Please,” she says, “don’t make it harder for people who are trying to keep folks off the streets.”

provide affordable apartments and make substantial renovations.

But the number of existing and proposed affordable units is under threat, the Institute for Housing Studies warns.

Rising expenses and increasing property taxes are pushing landlords to raise rents, making more units unaffordable for renters with low incomes. Rising costs affect small-scale landlords, who own a large percentage of unsubsidized affordable housing in Chicago. Owners of two- to four-flats often have fewer renters to shoulder a rent increase. Or, they might be tempted to sell, which could lead to investors raising rents beyond the reach of people in the neighborhood.

Meanwhile, growing the number of new affordable properties locally and nationwide has been tough.

“Builders of affordable housing are facing a lot of headwinds,” said Christine Serlin, editor of Affordable Home Financing magazine, published by housing market researcher Zonda. Soaring development and operating costs in 2023 pushed down construction of affordable developments across the U.S. by 8% among developers the magazine surveyed.

Serlin says raising money to get projects started has become more complex for developers, who are now using more financing resources than usual to try to bring down construction costs. They’re combining block grants with philanthropy dollars, low-income tax credits, environmental funding and other reductions to move the projects forward.

In Bronzeville, a 10-story apartment building on the corner of 43rd Street and Prairie Avenue is nearing completion. It's part of a two-building, $81 million project next to the 43rd Street Chicago Transit Authority Green Line station that will have 99 studio, one-, two- and three-bedroom apartments, with 51 of them affordable. Funding came from multiple sources: $10 million in tax-increment financing, $6 million in multifamily loan funds and $3.9 million in low-income housing tax credits.

“It takes a lot of hard work and perseverance,” Serlin says. In November, Zonda will host its annual AHF Live convention in Chicago, bringing together affordable housing stakeholders, service providers, attorneys, accountants and government agencies to share lessons and case studies.

“It is really rewarding to see that affordable housing is becoming more mainstream on the national level,” Serlin says.

Despite legislative efforts and policy initiatives, though, af-

fordable rents still remain out of reach for low-income renters.

“People think that those who are living in poverty are not working, but generally they have multiple jobs,” says Wilson of the Shriver Center.

A state-funded, court-based rental assistance program recently opened for tenants who are struggling to pay rent and their landlords. It's one piece of Illinois' Early Resolution Program to deter evictions.

Rental assistance programs became common during the COVID pandemic, aiding millions of renters who struggled to pay their rent due to job loss or sickness.

The office of Cook County Sheriff Tom Dart created a social services unit and protocols to guide tenants and landlords through the eviction process.

Dart says a team from the sheriff’s office visits a tenant weeks before their eviction date to offer

services that range from finding new housing and schools for children to transportation and assistance for seniors.

“We tried to make it a more thoughtful system,” Dart says.

“We want to both help take some of the trauma out of the eviction process for tenants and get the property back quicker to landlords, who were oftentimes a mom-and-pop with just this one building and hadn’t received rent in a year.”

To place your listing, contact Suzanne Janik at (313) 446-0455 or email sjanik@crain.com .www.chicagobusiness.com/classi eds

CAREER OPPORTUNITIES

MltplopeningsavailforfollowingposinWarrenville,IL&unanticipatedclientlocationsthroughout the Analyzeuserreqs&cnvrttheenduser'sbizProcessesreqsinto deliverablesmeetingtheprojobjctvs.DsgnanalyticssysusingSAPBWonHANA,SAPIntegrated Planning,SAPABAP&SAPBPCw/Consolidation.Relocation&15%ofdomestictrvlarepossibleto anunanticipatedclientsitethroughouttheU.S.Offeredsalary:$148,949.Toapply:Plse-mailresume& posappliedforto:HR,TalentAcquisitionTeamathrusa@teklink.comormailto Suite215,4320WinfieldRoad,Warrenville,IL

CAREER OPPORTUNITIES

seeks inChicago,ILtodevelopweb applicationsaspartofthepatientfacingdevelopmentteam.Telecommutingpermitted.Applyat www.jobpostingtoday.comRef#57083.

CAREER OPPORTUNITIES

CounterpartyCreditRiskAnalytics(DataControls&Integrity)isafunctionwithinGBAMRisk.The group'sprimaryfunctionistoensureadequatecontrolsandprocessesexisttovalidatethefirm'sTraded ProductsactivityforthepurposesofCreditandCapital(Basel)calculations.

CCRAARCTICDataManagementisresponsiblefordatavalidationoftheTradedProductsrepository (ARCTIC)utilizedinBaselRWAcapitalcalculations.TheBaselcontrolframeworkrequiresaccurate representationofthebank'sBooksandRecordsinallRWAcapitalcalculationsperformed.Inaddition, giventhatARCTICisalsothedatasourceforanumberofCreditandCollateralManagementprocesses, theteamisalsoinvolvedinmanagingtheserelatedwork-streams.

FullJobDescriptionandrequirementsat jobs.chicagobusiness.com

CAREER

TheMarketingDepartmentofArnold&PorterisseekingadynamicandorganizedBusiness Development(BD)Specialist.ThisrolemaybelocatedintheBoston,Chicago,NewYork,or Washington,DCoffice.TheBDSpecialistwillsupportthetransactionalpracticegroupinitiatives.The BDSpecialistprovidessupportforawiderangeofbusinessdevelopmentactivities.Successinthisrole willdependuponyourabilitytocollaborateeffectivelywithteammembers(includingseekinghelpand askingquestionswhenneeded),developfamiliaritywiththefirm’svariousresourcesandsystems,hone yourinstinctstoanticipatequestionsandpotentialissues,independentlymanageyourtimeand consistently“gotheextramile”withoutbeingasked.FullJobDescriptionandrequirementsat jobs.chicagobusiness.com

OneofthelargestandmostaccomplishedlawfirmsintheMidwest,isseekingabusinesslitigation attorneytojoinourChicago,ILoffice.Thepreferredcandidatewillbeanexperiencedandversatile attorney,withaclient-centricphilosophy,andwhohasdemonstratedanabilitytocompeteandprosper incomplexenvironments.Weareseekingawell-rounded,dynamic,highlymotivatedlawyer,whohas demonstratedanabilitytocompeteandprosperinhighlycompetitive andcomplexenvironmentswith significantclientcontact.Strongwriting,communicationandinterpersonalskillsarerequired.Flexible workarrangements,includingremoteworkoptions,areavailable. FullJobDescriptionandrequirementsat jobs.chicagobusiness.com

Several investors led by Jason Weingarten, co-founder of recruiting startup Yello, will acquire his part of the restaurant company

By Brandon Dupré

Nick Kokonas, co-owner of The Alinea Group, the team behind Michelin-starred restaurant Alinea, announced the sale of his ownership stake in the restaurant group in a Sept. 30 post on X, formerly known as Twitter.

Kokonas, who co-owns The Alinea Group with chef Grant Achatz, said he sold to an investor group led by Chicagoan Jason Weingarten, co-founder of recruiting startup Yello. Kokonas will “remain a minority, passive investor,” according to the post.

“I look forward to seeing Grant and Jason build on the amazing organization and experiences TAG has in place,” he wrote on X. “Personally, I'm excited to work on new ventures and stay as uncom-

fortable as I dare. That usually leads to the best results.”

Kokonas declined to comment further on the transaction, and terms of the deal were not disclosed.

Alinea, the flagship of the Chicago restaurant group, is one of only two restaurants in the city to have three Michelin stars. The other is Smyth in the West Loop.

“(Twenty) years of innovation in hospitality, book publishing, and reservation software — along with making 1M+ diners happy and full of wonder — has me feeling very thankful for the many team members who helped make all of that happen,” Kokonas wrote in the post.

He is also the architect behind Tock, a reservations company launched in 2014 with former Google engineer Brian Fitzpatrick.

Website-hosting service Squarespace bought Tock in 2021 for more than $400 million.

Achatz and Kokonas founded Alinea in 2005, which put the restaurant group on the map. The Alinea Group has since opened five other establishments, according to its website, including Roister and Next.

The purchase is investor Weingarten’s latest move into the restaurant and food industry, following the launch of meal-kit company Entreé and recently opened Oliver’s in the South Loop, which is led by chef Alex Carnovale — an alum of fine-dining restaurant The French Laundry — and is inspired by the vibes of old Hollywood, “where supper clubs were the epitome of elegance and timeless charm,” according to the eatery’s website.

Derivesvaluesforcompaniesusingdiscountedcash flowandrelativevaluationmethods.Analyzesthe company'sproducts/services,financialstatements,industry,endmarkets,andoutlooktodetermine appropriatevaluationassumptions.Documentsandreportsresultsandassumptionswithsupporting rationaletocreditofficers,auditors,regulators,andotherstakeholders.

FullJobDescriptionandrequirementsat jobs.chicagobusiness.com

From to p ta lent to to p em pl oyers, Crain’s Career Center is the next step in

By Rachel Herzog

A New York investor best known in Chicago as an office landlord has picked up an apartment highrise near Millennium Park.