A taxing situation

Majority-Black towns that are already struggling face a relentless cycle that perpetuates the inequities of taxation and limits economic growth | PAGE 31

Bears may be early target for private equity

The first firms through the breach may start with underperformers, like a popular team that keeps dwelling in the standings cellar

By Palash Ghosh and Arleen Jacobius, Pensions & Investments

The National Football League, the premier sports league in the U.S., will allow institutional investors, including private equity firms, to take up to 10% stakes in their teams, after lagging well behind Major League Baseball and the National Basketball Association.

The NFL plans to move slowly on this front — among other things, prospective institutional owners will be limited to at most a 10% stake and at least a 3% stake, and will have to keep their ownership interests for at least six years. The first firms through this breach may see the Chicago Bears as a prime target to plant their flag.

Shana Orczyk Sissel, founder, president and chief executive officer of Banríon Capital Management, an alternative asset technology platform, said private equity firms may initially target underperforming clubs — like her hometown Bears — rather than the more highly-valued teams like the Cowboys or New England Patriots.

The Bears have had only one winning season in the past 10 years. Similar to an undervalued and underperforming company targeted by a private equity firm, she said, the Bears might be a very appealing candidate for an alternatives firm looking to enter the NFL, given the team’s long history, huge popularity, as well as the large population of its home base.

A quick injection of capital would likely assist in the team’s effort to get a new stadium built, be it on the city’s lakefront or in the suburbs. After a heavy lobbying

The Bears have had only one winning season in the past 10 years — similar to an undervalued and underperforming company targeted by a private equity firm.

effort and winning over Chicago Mayor Brandon Johnson on a $3.2 billion domed stadium next to where Soldier Field currently stands, the team has yet to move the ball forward an inch in Springfield to secure public subsidies.

The Bears’ current owner, 101-year-old Virginia McCaskey, could have another incentive to sell that dates back to how she took control of the club.

Before his death, her father George Halas, the team’s founder

See BEARS on page 39

CRAIN’S LIST

Check out our annual roundup of the largest law firms in the Chicago area. PAGE 28

PHOTOS BY CASSANDRA WEST

After a heady summer, fiscal reality hits City Hall

For a few weeks this summer, Chicago caught a glimpse of what it could be: an international powerhouse, a city that works for all of its residents.

First Gov. J.B. Pritzker landed a U.S. Defense Department research lab and a major corporate tenant for the budding quantum computing campus on the Far South Side, one that potentially could create the kind of jobs and investment here for the 21st century that the site’s former owner, U.S. Steel, did in the early part of the last century.

Greg Hinz

Then, the owners of the United Center announced plans for apartments, shopping, entertainment and more, replacing a wasteland of windswept parking lots with a new neighborhood.

Meanwhile, a third megaproject in the billions, the expansion and modernization of O’Hare’s inadequate terminals, finally got going, with fast-rising patronage numbers at the airfield indicating it is not a fantasy but a critical step for the city’s economic future that will pay for its own way.

The Democratic National Convention came off without a major hitch, giving the city’s huge hospitality sector income and zillions of free publicity. I happened to be in London during the confab, and you couldn’t buy the kind of friendly exposure the event created. The gravy came from Da Bears, who still don’t have a stadium deal but finally may have the kind of team that can bring Chicago together.

“The last couple of months have been terrific for Chicago,” said Michael Fassnacht, who served as the city’s chief salesman as head of World Business Chicago. “Just wonderful. A couple of the biggest development deals in decades.”

Ah, sweet home Chicago. The old town still is kicking.

But you know there was another shoe to drop. And it did with the news that Mayor Brandon Johnson faces a nearly $1 billion hole — a projected $982.4 million, to be precise — in the proposed 2025 city budget he’ll unveil in October, surely the time for a Halloween fright.

Now, the city has faced big budget holes before, and you can bet your wallet that Team Johnson included every possible bit of bad news this week, if only to make them look like financial wizards when a less draconian budget actually comes out.

That said, $982.4 million is a big number, among the biggest in city history. And it comes at a time

when two other units of municipal government, Chicago Public Schools and the Chicago Transit Authority, face barrels of red ink themselves, collectively putting lots of stress on an already too stressed local tax base.

Of the three, the CTA looks like the easiest to save. Johnson is going to have to loosen his control over the transit agency, but in exchange, state lawmakers seem inclined to come up with more revenue from higher tollway tolls, an expanded service tax and perhaps other pots because, while the CTA mostly serves Chicagoans, Metra mostly serves the suburbs and is in a post-COVID financial pickle, too.

I don’t expect lawmakers to be as forthcoming with CPS, however much the Chicago Teachers Union wants to caterwaul about how it — and the students — are “owed” another $1 billion or so. That ain’t happening, because if you give a lot more to CPS, you have to give a lot more to public schools in the suburbs and downstate, collectively requiring billions of dollars from a major new tax hike that I don’t see Pritzker, who still harbors national political ambitions, getting behind. Especially if Johnson is successful in forcing out schools CEO Pedro Martinez for having the gall to reject a plan for CPS to borrow its way out of trouble year at a cost of kneecapping its operations in the out years.

At least as bad off is the city itself.

One of the reasons for the big hold is CPS balking at paying the city hundreds of millions for worker pensions that now is paid by the city’s treasury. Another is the downtown office market remains in a deep, deep funk, costing the city all kinds of tax revenue. Then there’s nice 5% annual raises being handed out to municipal unions, and this mayor’s continued temptation to spend money the city doesn’t have on racial equity programs. However hard, sometimes you just have to say no.

Based on all of that, Johnson almost certainly will look at a big property tax hike, the kind of thing he vowed during his election campaign to never, ever implement. Doing so could scuttle any re-election hopes Johnson has because, as I suggested in a column earlier this year, a Chicago property tax revolt is brewing out there, driven by a decline in downtown office building value and insatiable demand by CPS for every property tax penny it can get. I don’t know what Johnson will do. If I were him, I’d get out the big ax. I do know that if Johnson wants to revisit the heady days of earlier this summer, he can’t tax Chicago to death.

Agricultural hub for small biz, energy and produce opens on the South Side

By Pawan Naidu

An agricultural campus recently launched on Chicago’s South Side aims to improve the quality of life for Auburn Gresham residents by providing an eco-focused economic engine and community space.

The Green Era Campus, a 9acre facility at 650 W. 83rd St., transformed a site once used as an auto impound lot for the Chicago Police Department into a hub for green energy, jobs, fresh produce, small-business incubation and educational programming, according to a statement from the joint venture.

One of the partners is Urban Growers Collective — a local nonprofit that uses urban agriculture to address inequities and structural racism. The group earlier announced plans to purchase a separate 30 acres of unincorporated Cook County land for sustainable farming initiatives.

Urban Growers looks to these sorts of projects to provide economic opportunities for residents

in underserved communities.

"This is true change: a facility that can grow food, create energy and provide education and inspiration to young people and folks returning from incarceration — all happening within a community that represents the challenges we've been up against for the last 130 years,” said Erika Allen, Urban Growers Collective's CEO.

Auburn Gresham, a predominantly Black neighborhood, faces more economic insecurity than most in the city, with an unemployment rate of 19.2% and median household income of $41,000, according to city census data. For comparison, citywide unemployment was measured at 8.2%, with the median household income at $71,000.

One of the main components of the campus is an anaerobic digester — a machine that produces renewable energy by converting organic biodegradable materials into natural gases. The tool can hold 1.7 million gallons of material, usually a combination of ma-

nure, water waste and food waste.

The site will also feature a retail nursery that is expected to increase food accessibility for more than 2,000 people per year in the neighborhood. More than 125 varieties of produce will be grown.

Despite these lofty goals, some residents have been skeptical since the campus was pitched over a decade ago. Locals voiced concern over previous projects in South and West Side communities not delivering on their promises.

“There was some political kind of rhetoric where people were being told that we're going to be a sewage plant and we're going to be creating all these toxic chemicals and shouldn't be in our community,” Allen previously told Crain’s. "And we were like, no, this is the absolute opposite of what we're doing. We're cleaning up a brownfield.”

The project is backed by $2 million in state funding and was among the Auburn Gresham projects that received $10 million from the inaugural Chicago Prize in 2020.

“It’s the partnership that matters.”

BART VITTORI – CHIEF FINANCIAL OFFICER | MEATS BY LINZ

Banks push to end Illinois law cutting credit card fees

the industry is already racking up costs before the change takes effect next year

By Mark Weinraub

Lawyers representing bank and credit union trade groups argued on Sept. 3 for a quick ruling in a lawsuit seeking to strike down enforcement of a new Illinois law that reduces the fees retailers pay credit card processors.

The industry is already racking up costs to prepare for implementation of the law, which is to take effect next summer.

“July of 2025 is not a starting gun, it is a finishing line,” attorney Boris Bershteyn of Skadden, Arps, Slate, Meagher & Flom said during the 16-minute hearing in front of Judge Virginia Kendall of the U.S. District Court for the Northern District of Illinois.

The Illinois Attorney General’s Office downplayed the urgency, arguing there was currently no enforcement of the law so there was no need to expedite a hearing on the banking industry’s request for a preliminary injunction.

Oral arguments on the proposed injunction were set for Oct. 30, with the government’s written reply to the request due Oct. 4.

“We understand that this is complicated,” Ben Jackson, executive vice president of government relations for the Illinois Bankers Association, said after the hearing. “At the same time though, our members, the credit union’s members, they have a desire that this injunction occurs as quickly as possible because they are incurring costs, direct costs, already today, to prepare for implementation.”

Jackson added the industry was having a lot of conversations with legislators about the law ahead of the so-called Illinois veto session starting Nov. 12, but he said it was

too early to say if any action would be taken in Springfield.

Bankers were surprised by the law, which emerged at the 11th hour of this year’s budget session. Lawmakers decided to reduce interchange fees, largely paid by merchants, on credit and debit card transactions as a way to soften the blow of a new law that would generate $100 million in state revenue by reducing the amount of money paid to merchants for collecting state and local sales taxes. The Interchange Fee Prohibition Act, the first of its kind, reduces the interchange fees merchants pay credit card processors by exempting state and local taxes and tips from the calculation.

Bankers, credit card companies and airlines such as United — who rely heavily on the profits they make from credit card partnerships — opposed the law from the outset, claiming compliance costs could run into the tens of millions for some credit card issuers.

Among the plaintiffs in the suit filed in August are the American Bankers Association, Illinois Bankers Association, America’s Credit Unions and Illinois Credit Union League. They are bringing the case on behalf of some of the largest credit card processors and issuers, such as JPMorgan Chase, Citibank, Wells Fargo, Mastercard and Visa, as well as smaller community banks and credit unions.

They claim the law runs afoul of various federal banking regulations by unfairly usurping the powers of those regulators, which set standards for banks, home lenders and credit unions. They also say the Illinois law would put financial institutions here at a disadvantage to those in other states.

Was the DNC a boon for restaurants? Yes and no.

eateries that booked big private events did well. Others left with no regulars around the Loop recorded a slump in business. |

For Chicago restaurants during the Democratic National Convention last month, business was feast or famine.

Some restaurants that were able to book big, DNC-related private events did well. Carnivale, a Latin American restaurant on Fulton Street near Interstate 90, logged revenue that was 2.5 times higher than the same week the previous year. But other restaurants recorded a slump in business.

Downtown offices told employees they could work from home during the event, which took place mostly at the United Center from Aug. 19-22. Locals avoided the area, thick with foot traffic and motorcades. As such, restaurants lost out on their regular dinner and happy hour business. And though the DNC drew more than 50,000 people to Chicago, few of them left the convention for dinner — lest they miss keynote speakers such as President Joe Biden, Barack and Michelle Obama, and Democratic presidential

By Ally Marotti

“The city really shut down for the DNC. From our perspective, it definitely did not bring in business. If anything, it kind of took away.”

Anna Posey, co-owner and pastry chef of Elske

Chicago faces a milestone as the Greyhound station closure looms

city could soon become the largest in the Northern Hemisphere without a bus terminal

By Pawan Naidu

The search for a new Greyhound bus station downtown is heating up as Chicago looks to avoid becoming the largest city in the Northern Hemisphere without an intercity bus terminal.

The city is in danger of losing its transportation hub in less than a month as the property owner eyes the site for redevelopment. Greyhound’s parent company sold the bus line to German company Flix in 2021

for $172 million. Three years after the sale, the bus line’s lease on 630 W. Harrison St. is expiring Sept. 20, and there is not a “viable path” for an extension, said Gilda Brewton, head of public affairs at Flix.

The current owner of the station, Twenty Lake Holdings, is looking to offload the terminal. Twenty Lake, owned by New York hedge fund manager Alden Global Capital, could seek a deal with a developer aimed at turning the station into a high-rise apartment tower.

The city attempted to acquire the site to keep it a transportation hub, but the funds were not available, Ald. Carlos Ramirez-Rosa, 35th, said at a virtual meeting Aug. 27. It would cost around $25 million to buy the station.

If it loses the station, Chicago will join Kinshasa, in the Democratic Republic of the Congo, and Nairobi, Kenya, as the only three of the 130 largest global cities to have no intercity bus terminal, according to a recent study by DePaul University.

“It’s Mid-America’s connecting hub to a lot of places trains do not go,” said Joe Schwieterman,

The Greyhound bus station at 630 W. Harrison St. | GOOGLe

LaSalle Street office landlord surrenders building to lender to fight post-COVID rut

Chicago-based real estate investor Steve Hearn says he’s hoping to recapitalize, take back the reins and regain value after grappling with weak demand in the sector and high interest rates | By

The city of Chicago’s LaSalle Street office landlord has surrendered the building to its lender, but it’s hoping to retake the reins to steer the property out of a postCOVID rut.

A joint venture of Chicagobased real estate firm Hearn and New York-based Fortress Investment Group last month transferred the building at 2 N. LaSalle St. to New York-based Torchlight Loan Services via a deed in lieu of foreclosure, Hearn CEO Steve Hearn confirmed. Torchlight is a so-called special servicer overseeing the Hearn-Fortress venture’s $137 million mortgage on the building, which was packaged with other loans and sold off to commercial mortgage-backed securities investors.

Hearn and Fortress handed over the keys to the building more than a year after the loan matured, according to a Bloomberg loan report.

It’s one of many cases of downtown office landlords giving up their buildings to lenders as they grapple with weak office demand and high interest rates, which have made it difficult to pay off maturing debt. A wave of foreclosure lawsuits has swept through the central business district over the past few years, with some owners seeking to walk away from their buildings rather than endure a lengthy foreclosure process.

But Hearn said he’s not done with the 26-story LaSalle Street building, framing the recent property transfer as a formal step in an ongoing conversation with Torchlight about how to recapitalize the building.

“Nothing really changed, except the due process (of transfer-

ring title to the property) had to happen,” Hearn said, adding that Fortress is not pursuing future control of the property with his firm. Hearn said his firm reached an agreement with Torchlight to continue managing the property for now. “We’re working with the lender. They wanted to keep us on, we have a nice relationship with them. . . .We’re in conversation about how we want to proceed.”

It’s unclear whether Torchlight will pursue a new arrangement with Hearn as it looks to recover as much of the property’s value as it can for bondholders. The special servicer could put the property up for sale to gauge its value and determine whether it

wants to wager on its recovery. A spokesman for Torchlight did not respond to a request for comment.

The building today is likely worth less than the roughly $127 million balance of the loan, based on recent sale prices of other comparable downtown office buildings. The property was appraised at just $60 million in August 2023, according to Bloomberg loan data.

But Hearn has reason to believe it can still generate steady cash flow and potentially regain value. The city of Chicago, which inked a 15-year lease at the building in 2019, has signed on to expand its massive office in the building a few times. The

most recent addition boosted the city’s footprint to nearly half of the roughly 709,000square-foot building, according to Bloomberg loan data.

The city is also moving into space that will be vacated next year by law firm Neal Gerber & Eisenberg, according to Hearn, who also touts the upside of leasing the building’s empty top four floors.

“We have the best space (in the building) available,” he said.

The property last year generated $7.7 million in net cash flow, which was easily enough to cover the Hearn-Fortress venture’s $4.6 million in annual debt service, loan data shows.

Hearn is also hoping to keep

Danny Ecker

a stake in the property while its environs start to see big new investments. The building is just more than a block south of the James R. Thompson Center, which Google is redeveloping into its new Midwest headquarters. That project could push more companies to hunt for office space in the Loop.

Mayor Brandon Johnson’s administration is also poised to use more than $151 million in taxpayer subsidies to help developers turn four outmoded office buildings on and near LaSalle Street into more than 1,000 apartments — the city’s most direct effort thus far to restore regular foot traffic lost to new post-COVID work patterns.

Hearn and Fortress originally took control of 2 N. LaSalle through a 2016 recapitalization. The duo put up $42 million for a majority interest in the building to help its previous owner, Norfolk, Va.-based owner Harbor Group International, stave off default on the loan. Harbor had purchased the property for $153 million in 2007.

A spokesman for Fortress declined to comment. CoStar News first reported the 2 N. LaSalle deed in lieu of foreclosure.

Hearn has several large interests in the downtown office market, and the LaSalle Street building isn’t his only immediate loan challenge. Elsewhere in the Loop, Hearn and two joint venture partners were hit earlier this year with a $276 million foreclosure lawsuit involving the 57-story office tower at 70 W. Madison St.

Hearn also owns the office portion of 875 N. Michigan Ave., the skyscraper previously known as the John Hancock Center.

Chicago Yacht Works expands on the Calumet River

It acquired the Sunset Bay marina as the industry expects to continue growing in the coming years

By Pawan Naidu

Chicago Yacht Works is expanding its boating services with the acquisition of Sunset Bay Marina on the Calumet River. Chicago Yacht provides sales, service and storage along lower Lake Michigan. Headquartered in Pilsen, it operates out of an 8-acre facility on the southern end of the Chicago River at 2550 S. Ashland Ave. The latest acquisition adds a 12.5-acre location in Hegewisch and will provide indoor and outdoor storage, wet

slips and a fuel dock.

“Chicago Yacht Works has a dynamic new vision for Sunset Bay Marina, and we plan to start construction and improvements in the summer of 2025,” said Rob Hannah, CEO of Chicago Yacht Works.

The purchase price was not immediately clear, and the sale has not yet appeared in Cook County property records online.

The marina industry is on the rise, according to a recent study conducted by The Business Research Co. Its market size will

grow from $18.89 billion in 2023 to $19.87 billion in 2024 and is expected to jump to $24.22 billion by 2028. Industry growth can be attributed to increased demand for recreational boating and growing waterfront property developments. While older boaters are still driving activity at marinas, Yahoo Finance reports young adults now purchase the most boats. This trend began during the pandemic when younger people turned to water sports as a social distance-friendly activity.

2 N. LaSalle St. | COStAR GROUp

NAR says it will take fight with DOJ to Supreme Court

the dispute between the Chicago-based trade group and the Department of Justice prolongs the period of uncertainty over ho w real estate agents will get compensated for their work in a deal

By Dennis Rodkin

The National Association of Realtors plans to ask the Supreme Court to prevent the U.S. Department of Justice from restarting an investigation into the Chicago-based trade group’s practices around commissions.

The move adds more uncertainty to the question of when the process of homebuying will start evolving toward a new standard practice for getting buyers’ agents paid for the work they do in a deal. NAR intends to petition the Supreme Court by Oct. 10, it said in an Aug. 29 court filing.

The NAR said in a statement issued last month that it’s making the move “as part of our commitment to championing the interests of our members and the home buying and selling public.”

The old standard, where both buyers’ and sellers’ agents were

paid by the sellers out of their proceeds from the sale of a home, ended Aug. 17 as the result of NAR’s settlement in a separate legal battle known as Sitzer-Burnett. That settlement, which followed a massive jury verdict against the NAR, is up for final court approval in November.

Now, the contretemps between the NAR and the DOJ prolongs the period of confusion, as agents and consumers wait to find out if there will be further strictures placed on whatever new models emerge. The DOJ has signaled in past court briefs that it won’t be satisfied until buyers are paying their agents independent of the purchase of the house.

That has implications for how buyers will finance their purchase, raising the question of whether a mortgage would be written to cover two separate transactions — the purchase of

the home, which would include compensation to the seller’s agent, and the compensation paid to the buyer’s agent.

The NAR said in the Aug. 29 court filing that it will go to the Supreme Court to request DOJ not be allowed to reopen an investigation into commission practices. In the same filing to the U.S. District Court for the District of Columbia, the DOJ said it will narrow the number of documents it’s requesting from the NAR.

The DOJ’s investigation of the NAR’s commission practices dates to 2019. In 2020, the NAR and the DOJ reached a settlement under which the NAR agreed to make changes the DOJ said would “enhance competition in the real estate market, resulting in more choices and better service for consumers.”

A key piece of the agreement was that the NAR and real estate agents would not tell consumers that the services of a buyer’s agent cost the buyer nothing. For decades, the standard practice of the seller compensating the agents for both the buyer and the seller had led some buyers’ agents to market their services as free to the buyer.

In early 2021, following a change of leadership in a new presidential administration, the DOJ withdrew from the agreement, saying it needed the latitude to continue investigating NAR standards that might be causing financial harm to buyers and sellers. A real estate economist at Florida Atlantic University described the DOJ’s withdrawal as “a declaration of war with the NAR,” according to a 2021 article in Housing Wire.

The NAR asked the District of Columbia court to stop the DOJ from continuing its investigation. The court sided with the NAR, writing that letting the DOJ reopen the investigation would make the 2020 agreement “a letter worth nothing but the paper on which it was written.”

The DOJ appealed and won. The U.S. Court of Appeals for the D.C. Circuit ruled in April that the 2020 agreement doesn’t stop the DOJ from reopening the investigation it closed. In May, the NAR requested a rehearing, which the court denied in July.

By Oct. 10, the NAR said in the latest filing, it will request that the Supreme Court look into the lower court’s decision.

In its statement last month, the NAR said it was petitioning the Supreme Court to "hold the Department of Justice to the terms of our 2020 agreement.”

A CHICAGOAN TO KNOW

Jay Goltz of the Goltz Group

Goltz, 68, is founder and CEO of Chicago-based Goltz Group, a suite of design-centric businesses, including Artists Frame Service, Gallery 1871, Jayson Home, Bella Moulding and Prisma Frames. This summer, New York's Bergdorf Goodman invited Goltz to open a 1,000-square-foot Jayson Home pop-up in its Fifth Avenue store through Aug. 19. Goltz and his wife live in Riverwoods.

I

By Laura

Bianchi

If your office were on fire, what would you save?

The vintage cash register and popcorn vending machine from my grandfather’s dime store in Chicago.

Why?

From the age of 6 through college, I worked there weekends and summers with my grandparents, aunt and uncle, mother and father. My grandfather immigrated to Chicago from Russia in the 1920s. He started with a pushcart on Maxwell Street that evolved into a dime store on Armitage (Avenue).

Was that good training for entrepreneurship?

I learned the customer service side very well. Once, a regular with a tendency to drink too much came into the store. I asked my father how he ended up such a “mess.” He said, “If you had his life, you might be a mess, too.” My father never complained about customers, like some retailers. But I never learned anything about management.

How did that pan out?

I was naive and trusting, so Artists Frame Service started as a revolving door of employees who were not a good fit, to say the least. One was canceling orders from Friday and rewriting them the next week so he could earn a gift certificate for top salesperson.

How did you fix that?

I brought in a hiring guru and it was life-changing. She had an innate ability to interview and find the right people. Many of the people she hired 25 years ago are still here, some in key management roles.

How did you get into framing?

While I was studying accounting at Northern Illinois University, I started doing custom picture framing for a friend’s father. We would go to art fairs, take orders, make the frames and deliver them. I put myself through college with that, and I loved it.

How did your parents react? When I told my mom I was going to open a frame shop, she said, “What? You’re going to waste your degree?”

A favorite movie scene?

I like the one from “Rocky III,” when Rocky realizes that Mickey, his trainer, has been protecting him from fighting Clubber (Lang). Mickey says, “Three years ago, you were supernatural. But then, the worst thing happened to you that could happen to a fighter. You got civilized.” It reminds me to remember where I came from and not become too “civilized.” If the curb’s messy in front of one of our stores, I still get a broom or shovel and clean it up, like I used to do at my father’s store.

Deerfield firm pays $53M for DuPage County apartments

A 296-unit complex in Glendale Heights traded at a 30% markup from its 2018 sale price

By Rachel Herzog

An apartment complex west of Chicago sold at a more than 30% markup from its previous sale price, showing the continued appeal of strong suburban rent growth to investors.

A venture tied to Deerfieldbased Oak Residential Partners paid almost $53.3 million for the 296-unit Mark Apartments at 1245 Fordham Drive in Glendale Heights, according to DuPage County property records.

That’s up from the $40.5 million that seller FPA Multifamily paid for the complex in 2018, property records show.

Though a tight lending environment has made it a difficult time to sell large commercial properties, rents have been on the rise around Chicago, drawing investors’ attention.

The median net rent in the DuPage County submarket was $2.09 per square foot as of the first quarter of 2024, up 4.9% year over year from the same period in 2023, according to data from appraisal and consulting firm Integra Realty Resources.

Built in the 1980s, The Mark

is 93% occupied and has an average asking rent of $1,734 per month, or $2.12 per square foot, according to data from real estate information company CoStar Group.

Oak Residential Partners financed the acquisition with a $38.3 million Fannie Mae loan arranged by brokerage Walker & Dunlop, according to property records.

Allan Edelson, senior managing director of multifamily finance at Walker & Dunlop, said in a statement that the firm was proud to have secured the loan “especially in the current

challenging economic environment and competitive lending landscape.”

San Francisco-based FPA bought The Mark in a twoproperty portfolio along with the adjacent, separately managed 336-unit Monroe Apartments at 1400 N. Oakmont Drive in Glendale Heights, paying $42 million for the latter property, according to CoStar. FPA sold Monroe to Oak Residential Partners for $62.6 million in 2022. Neither firm returned a request for comment on the latest deal.

FPA has been one of the most active investors in the Chicago-area apartment market in recent months, dropping hundreds of millions of dollars on large properties in Oak Park, Hoffman Estates and Chicago’s South Loop neighborhood.

Oak Residential Partners’ portfolio also includes a 226unit apartment complex in Geneva, along with properties in Minnesota, Kansas, Nevada, Georgia and Florida, according to the firm’s website.

The Real Deal Chicago was the first to report on Oak Residential Partners’ acquisition of The Mark.

The Mark Apartments in Glendale Heights | COStAr GrOUp

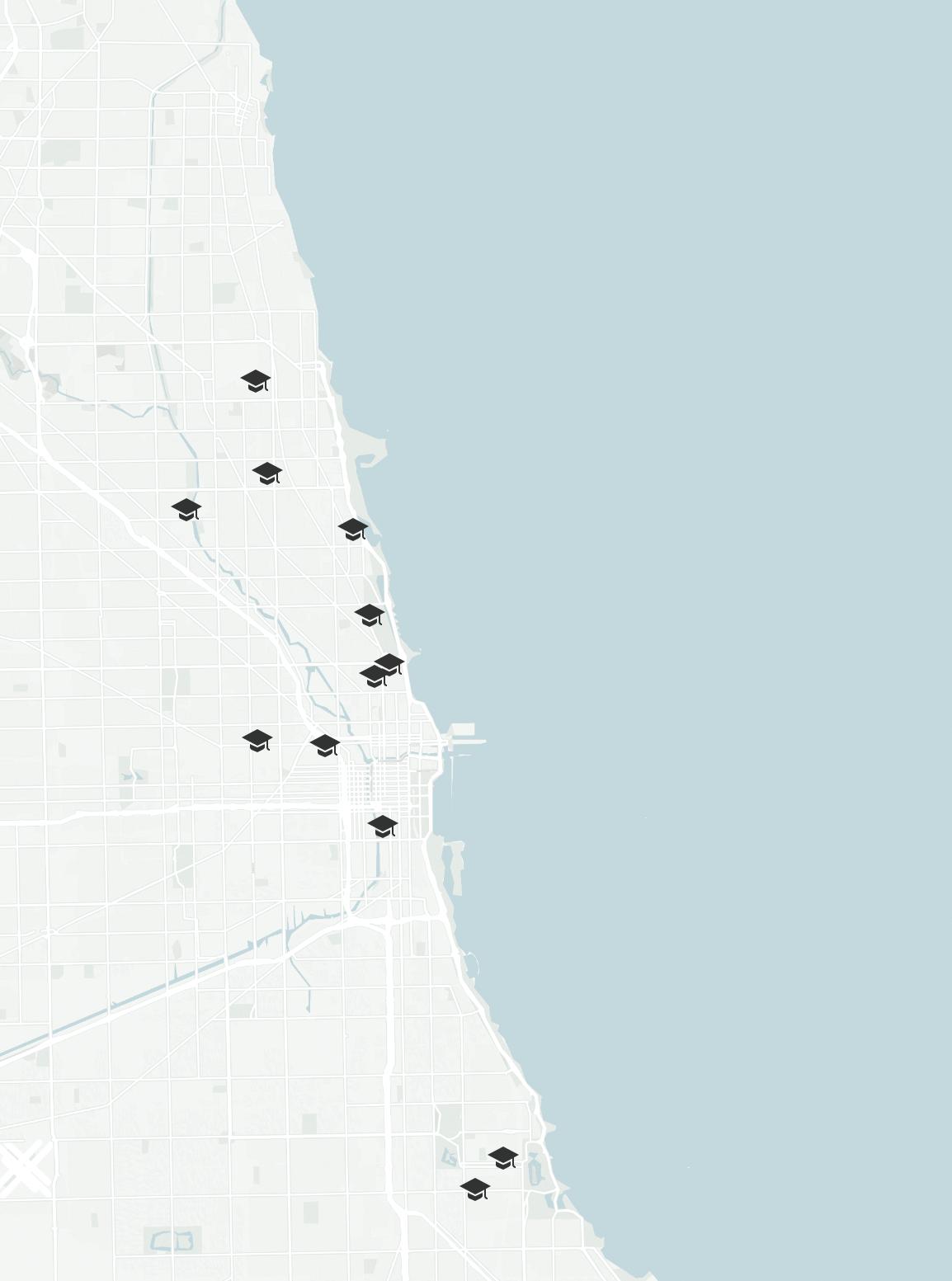

Don’t overlook this one factor in your first-ever school board vote, Chicago

With Election Day just around the corner, the battle lines are drawn, the candidates are sharpening their pitches, and money is flowing in on all sides.

Of course, that’s true of the presidential election — but it’s also an accurate depiction of what’s playing out closer to home as Chicago prepares to hold its first school board elections on Nov. 5.

What Chicagoans will be voting for are new entrants to what will be a hybrid board, a mix of elected representatives as well as mayoral appointees. That’s a stopgap along the path to a fully elected board, which will be put in place in 2027, according to state law signed in March by Gov. J.B. Pritzker.

The challenges ahead for the eventual winners of this contest are formidable — so much so that one has to wonder whether the victors may someday come to envy the losers.

Here’s just a taste of what’s in store: Amid efforts to rein in a roughly $500 million deficit and larger ones looming down the road, Chicago Public Schools earlier this year approved a budget for the current fiscal year that did not build in any funding for teacher pay hikes or other asks that the Chicago Teachers Union has brought to the bargaining table in its current contract

negotiations with the Board of Education. That budget also did not include a $175 million payment to the pension fund for CPS staff that Chicago Mayor Brandon Johnson and the CTU have insisted the district should cover — even though, as the respected education news site Chalkbeat Chicago points out, the union harshly criticized Johnson’s predecessor, Lori Lightfoot, for passing that cost on to CPS.

ing of replacing school district CEO Pedro Martinez in favor of a candidate more to the liking of his friends at the CTU, his former employer. That revelation prompted more than 400 CPS principals and assistant principals to issue a letter backing Martinez. And as of this writing, Martinez remains in place.

Still, he’s being urged by the CTU’s chief, Stacy Davis Gates, to aggressively lobby for more school funding — additional dollars Springfield has made fairly clear will not be coming, and which aren’t likely to be found anywhere around City Hall, where the mayor is staring down a $1 billion funding gap of his own.

High-quality schools that are on par with any found in the suburbs or beyond is one of Chicago’s best selling points for families of all income levels, and a key consideration when companies decide to put down stakes in Chicago.

And CPS estimated in early August that a chunk of the CTU’s contract proposals, including raises for educators, would create a $4 billion deficit for the district by the 2029-30 school year.

Meanwhile, by most accounts the current CTU contract talks haven’t made much progress. Early bargaining sessions were so contentious, in fact, that word began to trickle out that the mayor was think-

So that’s the landscape the elected school board members will be parachuting into after Election Day. They’ll be joining a set of mayoral appointees who will no doubt be sympathetic to the CTU’s point of view — which means it’s that much more important for voters to select candidates who will represent broader viewpoints.

The most crucial of these is the need to assure Chicago parents they will continue to have viable choices when it comes to educating their kids within Chicago’s city lim-

its. We’re talking about the kind of choice that Davis Gates, a vocal critic of public funding for private and charter schools, exercised when she opted to send her child to a Catholic high school that charges tuition of more than $16,000 a year. Or the mayor’s choice to send his child to a magnet school across town rather than to the one serving his family’s West Side neighborhood.

Indeed, Chicago’s selective enrollment schools have been a key driver of innovation and improvement within the CPS system, spawning some of the best schools not only in the state but in the nation. And yet, the CTU and the current Board of Education have announced their desire to move away from selective enrollment schools as part of a five-year strategic plan.

Those calling for dismantling the district’s system of school choice rather than fine-tuning its flaws ignore a compelling fact: High-quality schools that are on par with any found in the suburbs or beyond is one of Chicago’s best selling points for families of all income levels, and a key consideration when companies decide to put down stakes in Chicago.

Chicagoans who care about the economic life of this city would be wise to weigh that competitive advantage as they cast their first-ever votes for their representatives on the Board of Education.

Clean energy is driving a once-in-a-generation boom in manufacturing across the country

In 2022, Congress enacted the Inflation Reduction Act (IRA). It included the biggest investment in clean energy by any nation in the history of the world, largely in the form of tax credits to clean energy producers and manufacturers.

Two years later, a sea change in American technology and manufacturing is under way.

The private sector has announced over $300 billion in investments in clean energy manufacturing and deployment, creating hundreds of thousands of new, good-paying jobs.

William Daley is the former U.S. secretary of commerce and vice chairman of Wells Fargo, and currently serves as senior adviser to Crux.

And the pace of growth is getting even faster. In the first quarter of this year, the United States saw a record $71 billion invested in clean energy and transportation. That’s a 40% increase over the first quarter of 2023.

As a former secretary of commerce and White House chief of staff, I have seen firsthand the transformative power of strategic

economic policy. Now, in my new role as a senior adviser to Crux, which operates the central technology platform to help companies sell clean energy tax credits they get through the IRA, I’m seeing just how quickly the pace of clean energy investment is creating new factories and jobs all across the country.

Transferability — or the power to buy and sell these tax credits — levels the playing field for smaller developers and those building brand-new technologies.

One example: One company generated a $3.5 million investment tax credit from the first microgrid project using their patented digital energy management platform. They sold that credit to a thirdparty buyer, resulting in an immediate cash infusion of new capital to fuel their business’s growth.

These stories are not rare. They are happening in states, cities, and small

towns all across the country.

In fact, for every dollar the government is spending on new clean energy development, the private sector is spending five.

What’s even more exciting is that these investments are overwhelmingly finding their way to rural and underserved communities.

An analysis from the Treasury Department at the end of 2023 found that over 80% of clean investment dollars since the IRA passed land in counties with belowaverage weekly wages and below-average college graduation rates.

These historic investments in clean energy manufacturing on American soil are essential to meeting the demands of a growing economy.

A Wells Fargo analysis from April of this year projected electricity demand could grow by as much as 20% by the end of the decade as the electrification of sectors like transportation accelerates and artificial intelligence data centers draw more power.

The work to accelerate the growth of

abundant clean energy is well underway throughout the U.S., and it looks a lot like the economic engine that turned the United States into the global superpower it is today.

Public and private investments in advanced technology are driving an American manufacturing comeback. The clean energy boom is sparking innovation and creating jobs all across the country, positioning the United States to meet the challenges of the next decade and beyond with technology built right here at home.

Supporting domestic manufacturing isn’t a Democratic or Republican issue, it’s an American issue. Just last month, 18 House Republicans wrote a letter to Speaker Mike Johnson urging him not to repeal the IRA, as these “energy tax credits have spurred innovation, incentivized investment, and created good jobs in many parts of the country — including many districts represented by members of our conference.”

It’s clear investments in domestic manufacturing are a key contributor to the next decade of growth here in America.

Mayor Johnson, please keep Pedro Martinez as head of CPS

The Illinois Chamber of Commerce and the Illinois Hispanic Chamber of Commerce are writing to express our unwavering support for Pedro Martinez, the CEO of Chicago Public Schools (“Is Brandon Johnson trying to replace CPS CEO Pedro Martinez?” Aug. 14). His leadership since taking office in 2021 has been nothing short of transformative, not only in the academic achievements of CPS students but also in the broader ecosystem that supports Chicago’s youth and business community.

Under Martinez’s leadership, CPS has reached a historic graduation rate of 84%, a remarkable accomplishment that directly benefits thousands of students and their future prospects. His forward-thinking initiatives, such as expanding dual enrollment programs and creating career-themed academies, have paved clear pathways for students into highdemand industries. This kind of leadership is critical to ensuring that the next generation of Chicago’s workforce is equipped with the skills and knowledge needed to thrive in the modern economy.

Moreover, Martinez has played a pivotal role in forging strong partnerships between CPS and the business community. By aligning education with workforce needs, he has ensured local and state businesses access a well-prepared and capable future workforce. These collaborations are crucial to strengthening Chicago’s economic foundation and ensuring that both students and businesses benefit from a more connected and innovative ecosystem.

Equally important is Martinez’s commitment to equity and inclusion. He has worked tirelessly to allocate resources where they are most needed, ensuring that students from disadvantaged communities receive the support necessary to succeed. His focus on leveling the playing field is not only essential for the students directly impacted, but also for the long-term health and success of our entire city.

We need more leaders like Pedro Martinez. His removal from office would be a big mistake. The business community relies on strong, visionary leaders like him who are committed to the success of every student and neighborhood in Chicago. The impact of leaders such as Martinez enriches both Chicago and our state. His removal would be a tremendous

loss, not only for the schools, but for the broader community that depends on CPS to develop the next generation of thinkers, workers and leaders.

Mayor Johnson, we strongly urge you to reconsider any decision regarding his dismissal and to recognize the immense value that Pedro Martinez brings to

CPS, our city and the state. Chicago cannot afford to lose a leader of his caliber at such a critical time.

Lou Sandoval is president and CEO of the Illinois Chamber of Commerce. Jamie Di Paulo is president and CEO of the Illinois Hispanic Chamber of Commerce.

2024 NOTABLE LEADERS IN ACCOUNTING, CONSULTING & LAW

Congratulations!

Benesch is proud to congratulate the outstanding leaders selected among the 2024 Notable Leaders in Accounting, Consulting & Law, particularly our three recognized attorneys.

Hanna Conger

Chris GrohmanJuan Morado Jr.

Chicago Public Schools CEO Pedro Martinez (left) and Mayor Brandon Johnson | CHALKbeAt CHICAGO

NOTABLE ACCOUNTING, CONSULTING & LAW LEADERS

The 88 members of this group are leaders in their firms and industries. They’re managing offices large and small, representing companies public and private. Some handle multibillion-dollar matters; others make their mark among nonprofits. With specialties including health care, technology, manufacturing, finance and real estate, these Notable leaders are touching practically every aspect of business in Chicago.

METHODOLOGY: The individuals featured did not pay to be included. Their profiles were written from submitted nomination materials. This list is not comprehensive and includes only individuals for whom nominations were submitted and accepted after an editorial review. To qualify for the list, nominees must be serving in a leadership role at an accounting, consulting or law firm; show work on significant projects or cases; and have practiced in their profession for a minimum of 10 years. They must live and work in the Chicago area and demonstrate leadership through involvement in professional organizations and civic and community initiatives.

Bobby Achettu Principal Sikich

Scope of work: Bobby Achettu supports Sikich’s global expansion, helping drive growth across 37 tech-enabled services and leading strategy and operations for the company’s first international offices in India. He oversees 200-plus staff members across two countries.

Biggest professional win: Achettu built Sikich India operations into a team of more than 170 across three cities — Ahmedabad, Bangalore and Coimbatore — and played a pivotal role in establishing the firm’s international presence to provide clients with technology services and solutions.

Other contributions: He’s an adjunct faculty member at both Loyola and Northwestern universities, teaching undergraduate courses on global entrepreneurship, social entrepreneurship and modern workplace culture. He holds fiduciary or advisory roles in industries including financial services, technology, marketing and nonprofit management.

Andrew Avsec

Chicago office managing partner

Crowell & Moring

Scope of work: Andrew Avsec serves as managing partner of Crowell & Moring’s Chicago office (roughly 150 employees, including 60 attorneys), which opened when Crowell combined with 100-yearold Chicago intellectual property firm Brinks Gilson & Lione in 2021. He advises clients ranging from Fortune 100 companies to startups on brand protection, copyright, advertising, trade secret and social media issues.

Biggest professional win: He represented Harvard University in shutting down a scheme to fraudulently franchise the Harvard trademark to more than two dozen schools in Turkey.

Other contributions: Avsec volunteers for Legal Prep Charter Academy on the West Side, Chicago’s first legal-themed college prep school. He’s also vice chair of the Right of Publicity Committee for the International Trademark Association.

Sergio Acosta

Co-chair, white-collar crime and government investigations practice

Akerman

Scope of work: Sergio Acosta represents clients in regulatory, civil and criminal proceedings, including bribery and financial fraud, and conducts internal investigations for state and local governments.

Biggest professional win: Acosta defended a former trucking company CFO in a securities and accounting fraud prosecution in the U.S. District Court for the Southern District of Indiana, winning a rare dismissal of the indictment in August 2022.

Other contributions: Acosta has mentored numerous attorneys through his leadership positions at the U.S. attorney’s office, the Hispanic Lawyers Association of Illinois and in private practice. He’s a member of Elmhurst University’s board of trustees and serves on the board of the Chicago chapter of the Federal Bar Association.

Rebecca Weinstein Bacon

Partner

Bartlit Beck

Scope of work: Rebecca Weinstein Bacon is a litigator leading teams in pharmaceutical product liability, commercial disputes, antitrust and employment lawsuits. She’s trial counsel for multinational pharmaceutical and biotechnology company GSK in matters involving Zantac.

Biggest professional win: Bacon represents a major motor carrier company in matters related to fatal roadside incidents in various states, securing a settlement in a wrongful death and negligence case. She led teams on two confidential American Arbitration Association arbitrations for Align Technology against Smile Direct Club concerning breach of contract claims, successfully defending the first one and obtaining a $63 million verdict in the second.

Other contributions: Bacon co-chairs the Depression & Bipolar Support Alliance and is a member of The Chicago Network.

David Agay

Chair, strategic advisory and restructuring

McDonald Hopkins

Scope of work: David Agay, who’s also on the board of directors and executive committee, represents public and private companies, financial investors, lenders and more in a variety of distress and non-distress engagements across industries. Formerly Chicago office managing member, both the office and the restructuring group have nearly doubled in attorney headcount under his leadership.

Biggest professional win: His engagements include megacases like that of Intelsat, representing the board in connection with its $14.7 billion in funded debt, and smaller-scale cases representing companies like Independent Pet Partners and AmeriMark.

Other contributions: Agay supports professional development of younger attorneys and tutors K-8 students in reading and writing. He’s part of the American Bankruptcy Institute and the Turnaround Management Association.

Devon Beane Partner

K&L Gates

Scope of work: Devon Beane focuses on competitor litigation, both enforcing patent rights and defending against competitor cases. She was appointed K&L Gates’ firmwide co-chair for the IP litigation practice group and was elected to the firm’s equity partnership.

Biggest professional win: Beane co-led a team representing LifeStraw in a patent infringement case in which Brita sought to prevent LifeStraw from importing its home gravity-fed water filter product line into the U.S. The International Trade Commission found for LifeStraw, reversing an administrative law judge’s initial determination.

Other contributions: Beane manages pro bono asylum and immigration matters at the firm, often collaborating with the National Immigrant Justice Center. She’s on the executive committee of the Richard Linn American Inn of Court.

Chicago office managing partner

Latham & Watkins

Scope of work: Named Chicago office managing partner in 2022, Mary Rose Alexander has been global chair of the environmental litigation practice and the Women Enriching Business Committee. She’s won 15 putative class actions for Netflix and since 2021 has secured more than 20 federal, state and appellate court wins.

Biggest professional win: As first-chair trial lawyer, in November she secured a full defense jury verdict for Dow in San Francisco Superior Court after the city of Modesto, Calif., alleged Dow and other manufacturers of a common dry cleaning product were responsible for groundwater and soil contamination.

Other contributions: Alexander is an adviser to Equal Justice Works. She won the 2022 Award for Excellence in Pro Bono & Public Interest Service from the U.S. District Court for the Northern District of Illinois and the Federal Bar Association’s Chicago chapter.

Partner BatesCarey

Scope of work: Patrick Bedell oversees dozens of multijurisdictional mass torts cases, including lawsuits over prescription opioids and PFAS chemicals in drinking water, on behalf of insurance carriers worldwide. He’s a member of BatesCarey’s opioid coverage task force and works with King’s Counsel to shape London arbitration strategy on claims presenting billions of dollars of exposure.

Biggest professional win: He successfully litigated one of the nation’s first insurance coverage cases involving thousands of lawsuits alleging billions in damages resulting from drinking water contaminated by PFAS — widely referred to as “forever chemicals.”

Other contributions: Bedell is a frequent speaker and panelist at conferences, including those sponsored by the AIDA Reinsurance & Insurance Arbitration Society and the American Bar Association. He supports the Big Shoulders Fund.

Mary Rose Alexander

Patrick Bedell

Sean Berkowitz Partner

Latham & Watkins

Scope of work: A former federal prosecutor, Sean Berkowitz handles litigation and investigations, including more than 30 cases he has successfully tried to verdict. He recently joined the firm’s executive committee.

Biggest professional win: Berkowitz successfully represented Gary Winemaster, former Power Solutions International CEO, in a bench trial against the Department of Justice. In 2022, he won full acquittal of former Hilary Clinton campaign lawyer Michael Sussman in a jury trial in D.C. federal court. This year he successfully defended Walmart in a federal securities class action over disclosures related to the DOJ’s opioid investigation.

Other contributions: Berkowitz is the former Illinois chair of the American College of Trial Lawyers and is a past president of the Chicago Inn of Court.

Monique “Nikki” Bhargava Partner

Reed Smith

Scope of work: Monique “Nikki” Bhargava co-leads the artificial intelligence section in Reed Smith’s emerging technologies practice, focusing on the convergence of advertising and use of AI tech.

Biggest professional win: She led the implementation of a retail media network for one of the largest food and drug retailers in the U.S., assisting their new business initiative by supporting partner relationships, developing internal and external policies, strategizing on innovative legal solutions and navigating compliance regulations.

Other contributions: Bhargava is a leader of the firm’s Pacific and Asian American legal business inclusion group. A former board member of Chicago Volunteer Legal Services, she’s involved in the South Asian Bar Association of North America and the Asian American Bar Association of Greater Chicago.

Jessie Blank

Managing

director

Slalom Consulting

Scope of work: In her 12-plus years at Slalom Consulting, Jessie Blank began as a consultant and rose to managing director. She heads the retail, consumer packaged goods and travel industry portfolio, generating $35 million in revenue; founded the innovation and insights group; and helped establish Slalom’s business advisory services practice.

Biggest professional win: As part of the team that established business advisory services, she’s overseen 300-plus consultants, driving more than $75 million in revenue. During COVID-19, despite hits to the retail, consumer goods and travel sectors, she helped Slalom invest in client support, helping them innovate and become more responsive and agile.

Other contributions: Blank is a guest lecturer in the Learning & Organizational Change program at Northwestern University.

Kelly H. Buchheit

Director of audit and assurance quality control

ORBA

Scope of work: At ORBA since 2011, Kelly H. Buchheit has expertise in an array of sectors, notably nonprofits. She became audit and assurance quality control manager in 2021 and director in 2023.

Biggest professional win: She collaborates with ORBA’s innovation team to leverage new technologies to create efficiencies in the audit process. The firm’s first subject-matter expert in ASC 842 leases, she developed and led courses on ASC 842 internally and for clients.

Other contributions: Buchheit is a member of the American Institute of Certified Public Accountants and the Illinois CPA Society, where she was nominated to be the 2024-25 vice chair of the Accounting Principles Committee and chair for the 2025-26 service year.

David P. Buckley Jr. Co-founder and managing partner

Buckley Fine Law

Scope of work: David P. Buckley Jr. concentrates in estate planning and corporate representation. For over 25 years, he has helped high-networth individuals and families administer estates and represented closely held family companies.

Biggest professional win: With Buckley Fine’s corporate team, he facilitated the sale of a multimanufacturer car dealership known for its premium brands, achieving significant benefits for the owners and their families.

Other contributions: Before co-founding Buckley Fine, he co-founded Kelleher & Buckley and helped grow the firm to 50 attorneys and support staff with three Illinois locations. He has served on the boards of the District 220 Educational Foundation, the Barrington Area Council on Aging and the Samaritan Counseling Center.

Barbra Bukovac

Vice chair, consumer markets

PwC

Scope of work: Barbra Bukovac leads PwC’s U.S. consumer markets practice of nearly 9,000, serving as the senior relationship partner for retail, consumer packaged goods, travel, hospitality and transportation clients. The practice, which serves 87% of the Fortune 500 companies, exceeds 60% of the firm’s overall business.

Biggest professional win: Her advocacy, mentoring and leadership has been instrumental in a 15% increase in female partner candidates and the success of the firm’s Women’s Consulting Experience, which empowers emerging female leaders.

Other contributions: Bukovac is on the National Retail Foundation and is a board member of The Chicago Network. She’s a member of the Dean’s Business Council at the University of Illinois Urbana-Champaign’s Gies College of Business.

Marc Carmel

Chicago managing member

McDonald Hopkins

Scope of work: Marc Carmel, a member of McDonald Hopkins’ board and its Strategic Advisory & Restructuring Department, founded and co-leads the private-equity and litigation finance groups. Under his two years of leadership, the Chicago office grew from 26 to 40 attorneys.

Biggest professional win: Over the past five years, he expanded his personal business across three practice areas: restructuring and distress, litigation finance and private equity, coinciding with his elevation to managing member. He created a training program to equip Chicago office attorneys with essential business development skills.

Other contributions: Carmel co-chairs the American Bar Association Business Bankruptcy Committee’s claims and priorities subcommittee and belongs to the American Bankruptcy Institute and the Turnaround Management Association.

Daniel Chavez Partner PwC

Scope of work: For three years, Daniel Chavez has led PwC’s U.S. utilities and sustainable energy audit practice in the Midwest. He leads four audit teams serving public and private utilities and sustainable-energy companies.

Biggest professional win: Since 2020, he’s been PwC’s Latino Inclusion Network partner champion, growing the group by 60% to more than 3,700 members, increasing national programming events by 10 times annually, and creating more than a dozen forums for members, from new joiners through partners.

Other contributions: Chavez serves on the boards of three Chicago nonprofits: the Latino Policy Forum, Nourishing Hope and Chicago Commons. He’s on the advisory board for Career Spring and leads PwC US’ activities with the Association of Latino Professionals for America.

Erin Clifford

Partner and director of marketing and business development

Clifford Law Offices

Scope of work: Erin Clifford manages strategic business development for Clifford Law Offices and serves as a firm wellness coach.

Biggest professional win: After clerking at the Illinois Appellate Court and serving as legal counsel at the Cook County Treasurer’s Office, she now helps professionals create and maintain healthy lifestyles. Since the Illinois Supreme Court Commission on Professionalism required wellness as a Continuing Legal Education course, Clifford has offered a program across four states for more than 3,000 lawyers.

Other contributions: Clifford is on the boards of Friends of Prentice, the Chicago High School for the Arts, WTTW and WFMT, and is on the American Bar Association’s Mental Health & Wellness Task Force.

Robert Clifford

Founder and senior partner Clifford Law Offices

Scope of work: Robert Clifford founded Clifford Law Offices in 1985. Practice areas include aviation, medical malpractice, transportation, premises liability, class actions and construction accidents.

Biggest professional win: The settlement of cases against Boeing; a fourth trial is set for November, with six cases set for trial in Chicago federal court. In the last five years, Clifford obtained hundreds of millions in reported verdicts and settlements — including a $56.8 million settlement in 2021 for passengers injured or killed in a Tacoma, Wash., Amtrak derailment — and billions in confidential, unreported settlements.

Other contributions: He’s on the board of WTTW and the Rand Institute for Civil Justice board of overseers and has been president of the Chicago Bar Association and Illinois Trial Lawyers Association.

Kevin Cole

Chicago office managing partner

EY

Scope of work: Kevin Cole, the head of EY’s second-largest U.S. office, leads a network of 14 office managing partners across the Great Lakes area. He is also the global coordinating partner for several major corporations.

Biggest professional win: Under his leadership, the EY Chicago team has experienced significant growth and numerous promotions, and he has championed EY’s presence and commitment to more than 60 Chicago nonprofits and six major civic and nonprofit enterprisewide pro bono engagements.

Other contributions: Cole is on the boards of World Business of Chicago, United Way of Metro Chicago and the Boys & Girls Clubs of America-Midwest. He is also a member of the Civic Committee of the Commercial Club of Chicago.

Hanna Conger Partner

Benesch Friedlander Coplan & Aronoff

Scope of work: Hanna Conger is longtime counsel to some of Illinois’ largest utilities, including ComEd. She guides energy-sector clients, from major investor-owned utilities to new ventures, through regulatory compliance; advises on building grid infrastructure, setting rates and transactions; and represents clients before regulatory commissions and as first-chair litigator.

Biggest professional win: She prevailed in a series of three first-of-their-kind cases before the utility regulator in Illinois regarding implementation of a new piece of omnibus energy legislation, helping shape the law and determine the interpretation and application of new legislation.

Other contributions: Conger is on the board of the Energy Bar Association’s Midwest chapter and a member of the Chicago Bar Association’s Energy, Telecommunications & Water Committee.

Cassie Crist Principal Sikich

Scope of work: As an employee benefit plan audit practice leader at Sikich for eight years, Cassie Crist oversees a practice serving over 600 benefit plan audits annually ranging from $100,000 to over $800 billion in assets. She’s also the firm’s employer workforce solutions initiative leader, collaborating with companywide resources to support clients’ needs.

Biggest professional win: Since 2023, Crist has generated over $500,000 in service revenue comprising over 20 new clients. She also sponsors Sikich’s Women’s Empowerment Circle and helped launch the firm’s Veterans & Allies Employee Resource Group.

Other contributions: Crist is a founding member and co-chair of the Alzheimer Association’s Accounting Industry Leadership Council and co-founded USO Accountants Salute the Troops to support veterans, military members and their families.

Caragh DeLuca Partner PwC

Scope of work: Caragh DeLuca is PwC’s State and Local Tax Financial Services leader for the U.S. She leads a team of almost 1,000 staffers serving clients in the financial services industry and oversees a budget of more than $280 million.

Biggest professional win: When DeLuca arrived in Chicago to build the local State and Local Tax Financial Services business, the team consisted of a handful of people with a small portfolio of clients. It now has more than 40 members and nearly $27 million in revenue. That career success led to DeLuca rising to lead the national practice.

Other contributions: DeLuca chairs the board of Family Focus and is a member of the National Association of Black Accountants.

Matthew Devine Partner

White & Case

Scope of work: Matthew Devine, a first-chair litigator with a nationwide practice representing clients in commercial disputes, was named Chicago office executive partner in 2023, leading Midwest growth strategy and expanding the office to 60 lawyers.

Biggest professional win: He was lead counsel for Bayport Financial Services, which sued companies that engineered a raid of top Bayport executives. After defeating several defendant motions to dismiss, the matter settled on confidential terms after a mediation.

Other contributions: Among his pro bono work, Devine persuaded a Chicago judge to overturn the murder conviction of Tyrone Holmes after nearly 40 years because it was based on unconstitutional bite-mark evidence. Devine has served on the Loyola University Chicago School of Law board of governors and founded the Loyola Academy Bar Association.

Not only is Sheri recognized as distinguished in her field based upon her experience, it is her attention to detail and personal approach that makes her unique. She is amazingly responsive and educates clearly as to what can be very complicated strategies.

SHERI WARSH | Trusts & Estates Partner

William Dorsey Partner

Blank Rome

Scope of work: A founding partner of Blank Rome’s Chicago office, William Dorsey is co-chair of the corporate litigation practice group, leading nearly 100 litigators across 16 offices.

Biggest professional win:

Among his trial victories in recent years: the return of a $100 million real estate portfolio that had been misappropriated by a family member; a total defense verdict for a bank on a $48 million lender liability claim, myriad commercial real estate foreclosures and collection actions; and a $6 million judgment for a former real estate executive.

Other contributions: Dorsey authored chapters for the Illinois Institute of Continuing Legal Education and has taught Practicing Law Institute seminars. He leads community initiatives at Christ Church Winnetka.

James Drury III

Chairman and CEO

James Drury Partners

Scope of work: James Drury III founded James Drury Partners in 2001 after serving as vice chairman of the Americas at Spencer Stuart. James Drury Partners has been retained by hundreds of corporations, including 32% of the Fortune 100.

Biggest professional win: Since 2020, Drury and his team have facilitated approximately 150 board placements, including Fortune 500 CEOs, CFOs, chief operating officers and other senior executives. As of 2023, James Drury Partners clients served on the boards of public companies with combined annual revenue approaching $10 trillion.

Other contributions: Drury is on the boards of the Museum of Science & Industry and Music of the Baroque Chorus & Orchestra and is a member of the Commercial Club of Chicago.

As office managing partner for KPMG LLP’s Chicago office, Travis C. Hunter, Jr. leads approximately 3,000 professionals at one of the firm’s largest U.S. offices. Since launching his career at KPMG as in 1999, Hunter advanced through the firm, becoming partner in 2012 and, most recently, serving as the Dallas Business Unit Partner in Charge in the audit practice, where he served clients with a specialized focus on healthcare.

After relocating to Chicago for his new role in 2022, Hunter immediately embedded himself in community causes — demonstrating his commitment to supporting the next generation, both within the accounting industry and throughout the local community.

Daniel Farris

Co-partner-in-charge, Chicago

Norton Rose Fulbright U.S.

Scope of work: Daniel Farris co-leads Norton Rose Fulbright’s Chicago office and leads the firm’s U.S. technology transactions group. He’s on the board of Norton Rose’s independent innovation-focused subsidiary, LX Studio, which he co-founded in 2022 to advance the firm’s digitally driven service strategies. He also founded legal-tech firm NMBL Technologies.

Biggest professional win: Farris was an original founding partner and first partner-in-charge of the firm’s Chicago office. Under his leadership, the office has grown into a technology hub, going from 11 lawyers in 2022 to over 35.

Other contributions: Farris is on the board of the South East Side Experience Incubator, associated with the Big Shoulders Fund, which he’s been involved with for over 20 years.

Adam Fayne

Transactional department vice chair and cannabis law co-chair

Saul Ewing

Scope of work: Adam Fayne focuses his practice on the cannabis sector and tax controversy forum, advising businesses on M&A, corporate governance, compliance and tax planning. He was elected to the firm’s nine-member executive committee in January.

Biggest professional win: In the last few years, Fayne participated in numerous cannabis go-public deals, including Ascend Wellness Holdings’ IPO and Verano Holdings’ go-public transaction, helping a growing sector become a multibillion-dollar industry.

Other contributions: Fayne is active in Students for Sensible Drug Policy and the Mary Jane Project. He’s a former member of the Jewish Federations of North America National Young Leadership Cabinet and a volunteer fundraiser for Bernard Zell Day School in Chicago.

Sponsored Content

NOTABLE SPOTLIGHT

Corey Fox Partner

Kirkland & Ellis

Scope of work: Corey Fox counsels private-equity sponsors and portfolio companies in matters involving several million dollars to over $10 billion, in industries including financial services, technology, health care and manufacturing.

Biggest professional win: He’s the lead relationship partner for Thoma Bravo, the world’s fourth-largest private-equity firm in capital raised over the last five years. His recent work for Thoma Bravo-backed companies includes Adenza in its $10.5 billion sale to Nasdaq; Luke Bidco on the acquisition of Darktrace at an enterprise value of $5 billion; and Imperva in its $3.6 billion sale to Thales.

Other contributions: Fox cochairs Kirkland’s Firmwide Finance Committee and is a member of the firm’s Diversity, Equity & Inclusion Committee and Senior Income Partner Review Committee.

with Travis C. Hunter, Jr., CPA, MBA

Demonstrating a deep commitment to serving clients and communities

Interviewed by Brooke Bilyj for Crain’s Content Studio

What has kept you at KPMG for 25 years?

It comes down to the people and the culture. There’s something special about the culture here that fosters collaboration and brings out the best in people. I’ve formed friendships that have lasted decades, and that’s truly priceless.

What also gets me excited to come to work every day is the opportunity to tackle complex business challenges and work with our clients to find innovative solutions. It’s incredibly rewarding to see the impact we can have on a company’s success when we all work together.

What are your top goals in your new role as Chicago Office Managing Partner?

The Chicago office was already in great hands under my predecessor, Linda Imonti, so my immediate priority was to maintain and enhance our brand as a trusted business advisor to the C-suite of Chicagoland businesses.

At KPMG, our values are at the core of what we do, which is why I’ve also

continued to focus on corporate responsibility and philanthropy.

Lastly, I strongly believe in ensuring that our office has a culture that will attract, retain and grow talented professionals.

Since relocating from Dallas to Chicago, how have you gotten involved in the local community?

We are all a product of our communities, so it’s incredibly important for me to contribute. On my first day here, I volunteered to co-chair the American Cancer Society’s Discovery Ball, which helped raise more than $1.6 million to end cancer. I’m also on the boards of numerous non-profit organizations — including the United Way of Greater Chicago, Kids First Chicago, Navy Pier, mHub, Executives’ Club of Chicago, Civic Committee of Commercial Club of Chicago and World Business Chicago — focused on making a positive impact.

What role has mentorship played throughout your career?

Mentorship has been very important throughout my career. Early on, I was fortunate to have strong mentors who coached me, advocated for me and helped me make important career decisions. Today, I’m passionate about paying that forward and providing the

next generation of leaders with the same support.

Beyond formal mentoring programs, I always make time to share my insights, perspectives and experiences to help young professionals develop and advance in their careers.

What do you enjoy most about working with your clients?

Prior to my current role, as an auditor and advisor to clients in the health care space, I enjoyed helping companies be positioned to best serve patients. The health care system is complex, which underscores the importance of an auditor who deeply understands the regulatory environment, statutory reporting requirements and overall system. I found purpose working in that industry, knowing what was at stake for the patients relying on the system to work.

Currently, my role enables me to serve clients at the most strategic level across many industries as leaders navigate constant business disruption as well as the resultant opportunities it presents to their businesses, customers, employees and communities.

Jessica Freiburg

Managing partner

Sassetti

Scope of work: Along with her role as managing partner of Sassetti, Jessica Freiburg is also an active audit partner. She leads the Oak Brook-based firm’s client accounting and advisory team, manages Sassetti’s human resources and administrative department, and is actively involved with the firm’s marketing program and DEI initiatives.

Biggest professional win: Freiburg’s biggest career win over the last five years was being named Sassetti’s first female managing partner.

Other contributions: She is a member of the Illinois CPA Society, the American Institute of Certified Public Accountants and the National Association of Women Business Owners.

Mary Fuller

Chicago office managing partner

Citrin Cooperman

Scope of work: Mary Fuller was an integral part of joining Shepard Schwartz & Harris, a midsize, $16 million accounting firm in Chicago, with Citrin Cooperman, a $700 million-plus national professional services and advisory firm, in 2022.

Biggest professional win: Fuller and a partner negotiated the deal on behalf of the partnership. She was the lead in Chicago during the integration process and in transforming Shepard Schwartz into a national firm at a rapid pace.

Other contributions: Fuller is a past president of Commercial Real Estate Women Chicago and was recognized with the 2023 CREW Chicago Industry Leadership Award. She is a past chair of the Illinois CPA Society and currently serves on the Illinois CPA Society Endowment Fund Board.

Sean Gallagher Partner

Bartlit Beck

Scope of work: Sean Gallagher leads trial teams representing U.S. and international companies in intellectual property, product liability, accountant liability, toxic tort and breach of contract cases.

Biggest professional win: As lead trial counsel for Pratt & Whitney he won environmental tort cases involving more than $1 billion in claims arising from an alleged “cancer cluster” near the manufacturer’s Florida facility. He was also lead counsel for several institutional investors who lost billions when the Structured Alpha hedge funds managed by Allianz Global Investors U.S. collapsed in 2020. He and his team secured a favorable settlement.

Other contributions: Gallagher has volunteered for over 10 years with CARPLS, serving on the board and as president. He is now on the organization’s senior advisory board.

Robert Gerber

Managing

partner

Neal Gerber Eisenberg

Scope of work: Robert Gerber leads Neal Gerber Eisenberg’s strategic direction in association with the executive committee. A member of the corporate and securities practice group, he counsels private companies on M&A, private-equity investments and joint-venture transactions.

Biggest professional win: In June 2021 he became the firm’s third managing partner — and the first former summer associate to ascend to the role. As outside general counsel for a second-generation family-owned business, he helped in succession planning and growth, including acquisitions leading to over $2 billion in revenue, resulting in a family liquidity event in 2023.

Other contributions: Gerber is on the Chicago All Stars Project board and Indiana University’s College of Arts & Sciences Executive Dean’s Advisory Board.

Sameer Ghaznavi