Peoples Gas’ pipe-palooza costs keep rising

Chicago’s natural gas utility still insists the multidecade, customer-funded project will cost $8 billion

BY STEVE DANIELS

Peoples Gas appears all but certain to exceed its latest cost estimate and timeline for a massive overhaul of Chicago’s underground natural gas pipes, a project that’s already billions over budget and years behind schedule.

Underway for more than a decade, the project has seen its ultimate projected cost mushroom to $8 billion from $2 billion initially and then $4.5 billion. Based on progress and costs to date, Peoples will shell out nearly $11 billion to

complete the job, not $8 bil lion. Peoples will pass that cost along to customers in their bills, plus a profit.

Additionally, the utility won’t finish the work until about 2048 at its present pace, well beyond the 2040 goal Peoples still as sures regulators it will meet. That’s 10 years past the original 2030 completion target.

Peoples has yet to hit its an nual pipe replacement target for any year since its 2015 ac quisition by Milwaukee-based WEC Energy Group.

A year in, Dave Kimbell puts his stamp on Ulta

As

BY ALLY MAROTTI

BY ALLY MAROTTI

When Dave Kimbell succeeded Mary Dillon as CEO of Ulta Beauty a year ago, he faced the poten tially daunting prospects of following a Wall Street favorite and crafting a growth strategy for uncer tain times.

Still, the timing was good. COVID-19 restrictions that smoth ered retailing during 2020 were largely gone, and the Boling brook-based cosmetics chain

snapped back from its worst slump ever. A run of six straight 20%-plus quarterly sales increas es since early 2021 have lifted revenues past pre-pandemic levels.

“ is has been the best year of my career by far,” Kimbell says. “So many factors came together for us to have a strong year.”

But as the increases slow, Kim bell’s longer-term challenges are

COMING NEXT WEEK

We introduce our roster of 40 incredible individuals who are already wildly accomplished and poised to do even bigger things.

CHICAGOBUSINESS.COM | OCTO BE R 31, 2022 | $3.50 NOTABLES: For these veterans, service continues in life after the military. PAGE 21

JOE CAHILL: Trott ’s offer for Weber boxes

out other bids PAGE 3

NEWSPAPER VOL. 45, NO. 43 COPYRIGHT 2022 CRAIN COMMUNICATIONS INC. ALL RIGHTS RESERVED

the company’s snapback from pandemic restrictions

slows,

its new CEO rolls out multiple growth tactics

See PEOPLES on Page 36

Dave Kimbell

See ULTA on Page 38 BEST NEW As people are planning holiday get-togethers, we checked in with the hottest new restaurants that offer private rooms. PAGE 12

e Workers’ Rights Amendment is a step too far

Forthose of us who believe labor unions have brought bene ts to workers they could not have won individual ly—but who also believe the an swer to extremism is not more extremism—a big question on the Nov. 8 general election bal lot poses a real dilemma.

e question, known as the proposed Workers’ Rights Amendment, is whether to change the Illinois Constitu tion by adding a new section banning passage of any law that infringes on “the fundamental right to organize and bargain collectively through representa tives of (workers’) own choosing for the purpose of negotiating wages, hours, and working conditions, and to protect their economic welfare at work.”

Proponents say the intent is clear: to guarantee the right to bargain as a group with employ ers. Opponents agree the intent is clear: in their view, to create special protections for one group that risk the state’s econo my and budget. Both sides are spending millions. Who’s right?

I am beyond sympathetic with labor’s desire to protect itself while it can against the emergence of an Illinois version of Scott Walker.

You remember Walker, the take-no-prisoners former Wisconsin governor who, thanks to one election win and a gerrymandered legislative map, pretty much put labor out of business in representing state and other public-sector workers north of the Illinois border. As GOP hardliners cheered, Walker pushed through bills limiting contract negotiations over wages, banning the deduction of union dues from paychecks and requiring unions to be recerti ed by members as their bargaining agent every 12 months.

e result years later: Membership in Wisconsin public unions has plummeted 70%. With that big Democratic weapon hobbled—but corpora tions and business o cials like shipping mogul Dick Uihlein still free to contribute as they want to friendly pols—a state that is pretty much evenly split politically has a House and Senate that approach two-thirds Republican.

Unions don’t want that here. Nor do they want the right-towork laws banning union shops that have passed in Wiscon sin and other states lately. So they’re pushing the proposed

amendment arguing, with some facts behind them, that union ized workers are paid better and treated better than those without such representation.

But the situation here in Illinois is more complicated than that.

Part of the problem is that the “economic welfare” language is, according to some legal observers, vague and open to loose interpretation. For in stance, would that language set the stage for a legal challenge to Illinois’ property tax cap laws, on the grounds that they restrict the ability of, say, local school boards to o er workers the pay hikes they deserve?

Advocates say no, that other parts of the Illinois Constitution clearly leave all tax questions to lawmakers. But few thought the state’s voluntary move to pay for retirees’ health was a binding commitment—until the Illinois Supreme Court abruptly ruled a few years ago that it is.

Another argument is that the “welfare” language would allow groups such as the Chica go Teachers Union to demand more city spending on things such as a ordable housing in order to prevent a strike. Amendment proponents say the “welfare” language is clearly tied to “at work.” But CTU and its attorneys have made it clear they will use every lever at their command to create a welfare state on steroids in pursuit of racial equity.

en there’s the argument that the state’s reputation as a bad place to locate a business and create jobs doesn’t need this precedent-setting amend ment.

However, my biggest con cern is that advocates aren’t trying to pass a law, which can be changed next time power in Spring eld changes par ty hands, but rather amend the Constitution, which can be altered only via a timeconsuming, laborious process.

On that score, it’s worth noting that Illinois already had its version of Scott Walker. His name was Bruce Rauner. He now lives somewhere in Florida. So if labor and its friends suc ceeded in repelling extremism through the normal electoral process, why do they have to try to prevent a repeat by the extreme step of amending the Constitution?

at’s my thinking, folks. Sometimes, you can just go too far.

ComEd gets $50 million rate hike approved, and that’s just the start

Regulators will also consider a separate $199M rate hike request

BY STEVE DANIELS

Commonwealth Edison will hike rates by $50 million next year to pay for its energy-e ciency programs.

e Illinois Commerce Com mission approved the new rates unanimously Oct. 27 without dis cussion.

As is the case in the e ciencyrelated increase the ICC green lighted last year, most of the cost hike will be shouldered by com mercial and industrial customers.

ey will cover more than $35 mil lion of the increase, while house holds will absorb the remainder.

e average residential custom er will see their electric bill rise by 25 cents a month, ComEd repre sentatives said. It’s more di cult to assess how much of an increase each business will see because of the di erence in size and usage among companies.

is increase is the rst and smallest of two rate requests reg ulators are expected to approve this year. ComEd led earlier this year for a $199 million general rate hike, which it said would cost the average household another $2.20 per month.

Commissioners will have little choice but to say yes to that, since it’s the nal submission ComEd will make under the controver sial annual formula rate-setting system, enacted in 2011 and ex piring after this year. Former House Speaker Michael Madigan’s shepherding of that law—a gen

erous rate regime, giving the ICC little say each year on ComEd’s spending and no say on its au thorized returns—played a star ring role in the elaborate bribery and in uence-peddling scheme ComEd admitted to in 2020.

e energy e ciency increas es are essentially automatic each year as well. Another statute, the 2016 Future Energy Jobs Act, al lowed ComEd for the rst time to pro t on its energy-savings programs. Previously, the costs of ComEd’s e ciency programs were passed through to ratepayers at cost.

at law, too, was enacted during the period ComEd was nancing no-work jobs and con tracts for associates of Madigan.

e ComEd scandal played a major role in the indictment of Madigan, who has pleaded not guilty. Also under indictment is former ComEd CEO Anne Pramaggiore, who is scheduled to face trial next spring and also has pleaded not guilty.

e state’s most recent major energy law, Gov. J.B. Pritzker’s Cli mate & Equitable Jobs Act, doubled

down on the energy e ciency ap proach in the Future Energy Jobs Act. Enacted a little over a year ago, Pritzker’s law authorizes ComEd to hike its budget for e ciency pro grams by $75 million a year.

Future e ciency-related rate hikes are likely to be steeper than the $50 million slated for next year, since ComEd will seek in the fu ture to recover the higher expen ditures and add a pro t to them.

ComEd executives emphasize that under state law energy e ciency programs must provide nancial bene ts to ratepayers that are greater than their costs. But the programs bene t only those who take the time to research them and apply for aid in, say, weather izing their homes or businesses or installing new eco-friendly equip ment.

ComEd divides the costs among residential and business custom ers based on the types of pro grams it’s running. More of them are geared to commercial users rather than households these days, which is why the e ciencyrelated increases fall more heavily on businesses.

2 OCTOBER 31, 2022 • CRAIN’S CHICAGO BUSINESS CORRECTION

ON POLITICS GREG HINZ w An Oct. 24 story on the proposed Kroger-Albertsons merger failed to reflect the presence of 10 Kroger-owned Food 4 Less locations in Illinois and one in Indiana.

GETTY IMAGES

Mortgage payments soar at trophy properties

Floating-rate

BY ALBY GALLUN

What do the deep-pocketed

common

Tower

Oak

a

e monthly mortgage payment for the Willis Tower, the city’s tallest skyscraper, has jumped 172% since January. At Oakbrook Center, one of the biggest local malls, monthly payments have nearly doubled this year.

Blackstone Group, owner of the Willis Tower, and Brook eld Prop erties, which owns Oakbrook Center, are experiencing the downside of nancing properties with variable-interest rate mortgages. After en joying more than two years of rock-bottom interest rates, they’re now watching their

the month, as the Federal

ation

Avant sees future in credit cards

BY STEVE DANIELS

Avant is best known for mak ing high-rate loans to strapped consumers over the internet. But credit cards now are the Chicago-based company’s future more than the online personal lending machine that made it a unicorn seven years ago.

Avant is quieter these days than when it stampeded onto the Chicago startup scene near ly a decade ago. But the company’s credit card business, launched in 2017 and trans formed into its flagship product beginning in mid-2020, is grow ing fast.

It’s also raising questions about the high interest rates

cardholders are paying and the relatively large number who are defaulting on their card loans and further tarnishing credit ratings that already are bruised.

Avant had 1.2 million card holders as of June 30, up 50% from 800,000 at the start of the year. e rm issued 550,000 cards last year.

Of roughly $1.5 billion in loans on Avant’s books, half

are credit card loans, CEO Matt Bochenek says in an interview. Avant packaged $150 million of its credit card loans into se curities sold to investors a little over a year ago. at securitiza tion, rated last month by Kroll Bond Rating Agency, o ers in sights into Avant’s credit card business model.

Trott’s insider squeeze at Weber

Webergrills are known for durability, providing years of reliable perfor mance for backyard burger flip pers.

Weber’s tenure as a publicly traded company, by contrast, may not last much longer than a single grilling season.

Byron Trott, the billionaire investor who controls a majority of Weber stock, has o ered to buy out minority shareholders at $6.25 per share. at’s a 24% premium to Weber’s closing price before the o er was disclosed, but a 68% drop from $19.55 at the close of trading on the day the Palatinebased company went public last August.

Weber’s IPO looked like another success story for Trott, a former Goldman Sachs poohbah once known as Warren Bu ett’s favorite investment banker. His rm, Chicago’s BDT Capital Partners, specializes in helping wealthy families cash out of privately owned companies. It acquired a controlling stake in Weber from the founding Stephen family in 2011.

“ is investment is a perfect example of our business model— to partner and invest alongside best-in-class and enduring family businesses with strong manage ment teams and loyal customers,” Trott said at the time.

Weber’s performance has been less than perfect since the IPO. After soaring in 2020 when COVID-19 lockdowns boosted outdoor eating, demand for grills slumped. In ation and supply chain bottlenecks increased pres sure on pro t margins. Weber’s sales fell to $1.4 billion in the nine months ended June 30, down 15.5% from the year-earlier period. e company swung to a loss of $178 million from a pro t of $92 million.

To stem the bleeding, Weber suspended its dividend, an nounced a cost-cutting campaign that will include job cuts and named a new CEO. Still, Weber is burning through cash and piling up debt. As of June 30, the com pany had $40 million in cash and its debt had climbed 28% to $1.28 billion since September 2021.

Wells Fargo estimates Weber’s net leverage ratio at 9 times earnings, a worrisome level that could breach loan covenants.

With interest rates rising and lenders backing away from deals, it’s a bad time to seek forbearance from banks. at’s where Trott might come in. Bloomberg report ed Oct. 11 that BDT was discuss ing a possible debt nancing with Weber.

Now it appears Trott sees op portunity in Weber’s beaten-down stock. Despite the company’s woes, BDT is o ering to buy the

Weber shares it doesn’t already control. If Trott wants to buy more Weber shares, you can bet he thinks the company eventually will be worth a lot more than he’s o ering.

But the $6.25 o er represents a signi cant loss for public share holders who bought into Weber any time between August 2021 and early May. As they try to evaluate the fairness of his price, they’d surely like to know if anoth er buyer would pay more.

ey’ll likely never know. Trott has e ectively precluded a competing o er. BDT’s o er letter warns that it would vote its majority shareholdings against “any alternative sale, merger or similar transaction involving the Company.”

Would another bidder be interested? Maybe. StreetInsider reported Oct. 11 that a privateequity rm approached Weber about a takeover.

In another apparent prod to public shareholders mulling the buyout o er, BDT’s letter high lights the risk that “the company’s current leverage position is un sustainable and that the company may be unable to e ect a recapi talization.”

To Trott’s credit, the letter says BDT’s willingness to lend Weber money isn’t contingent on accep tance of the buyout o er. It adds that BDT won’t proceed with the buyout unless it’s approved by a committee of independent Weber directors.

Still, BDT is using its majority voting power to the disadvantage of public shareholders by boxing out other potential bids. BDT’s majority is bolstered by mech anisms that canny insiders use to retain control after taking a company public. Most notable is a dual-class stock structure that gives BDT far more votes than outside investors.

Critics say such structures separate corporate control from economic interest in a company, while insulating insiders from accountability and allowing them to take advantage of outside investors.

Yet supposedly sophisticated investors like mutual funds and pension plans keep lining up for second-class stock, likely drawn in many cases by the reputations of promoters like Trott. ey pay little heed to warnings like the passage in Weber’s IPO prospec tus cautioning potential investors that insiders could engage in “actions that are not in your best interests.”

Weber’s stumbles as a public company may make some inves tors more skeptical of Trott’s next deal. His buyout proposal should make them more skeptical of any IPO o ering second-class shares.

CRAIN’S CHICAGO BUSINESS • OCT OBER 31, 2022 3

JOE CAHILL ON BUSINESS

“IT WILL BE PAINFUL. OWNERS WILL BE LESS PROFITABLE. IT DOESN’T MEAN THEY WON’T BE PROFITABLE.”

David Hendrickson, mortgage broker and senior managing director in the Chicago o ce of Walker & Dunlop

loans hammer Willis Tower, Oakbrook Center and others as interest rates surge |

GETTY IMAGES

A peek into the Chicago company’s playbook echoes its beginnings

owners of Willis

and

brook Center have in

with

lot of homeowners? ey’re hurting as rising interest rates drive up their mort gage payments.

pro t margins shrink by

Re serve jacks up short-term interest rates to bring in

under control. See MORTGAGE on Page 32 See AVANT on Page 32

The Willis Tower

Where the COVID pandemic hit Illinois jobs the hardest

BY GREG HINZ

e COVID-19 pandemic had sharply di erent e ects on Illinois workers, depending on their age, educational background, type of job they held and whether they live in the Chicago area or downstate.

at’s the bottom line of a new study by the University of Illinois that for the rst time breaks down who really got hurt and who just su ered an incidental blow when the state lost half a million jobs in short order as the pandemic hit—and that gives some hints as to growing sectors the state ought to nurture now.

According to research by the Illinois Economic Policy Insti tute and the Project for Middle Class Renewal at the Universi ty of Illinois at Urbana-Cham paign, total employment in the state dropped 498,759 between 2019 and 2021, a decline of 8.1%.

The state recovered half of that by 2021 and another 170,000 so far this year, leaving it about 80,000 (1%) short of its pre-pan demic peak.

e report focuses on what hap pened between 2019 and 2021. It chooses that period because it is the last for which data is available from the U.S. Census Bureau’s

American Community Survey.

Numerically, the biggest drop in jobs was in the o ce and ad ministrative support category, down 160,000, or 22%. But on a percentage basis, food service and preparation and personal care and services were hit much higher, down 33% and 42%, re spectively. Leisure and hos pitality su ered a milder 19% drop, with wholesale/retail trade and transportation each gain ing 81,000 jobs as consumers switched to internet purchases from shopping in person.

ose with a high school edu cation or less su ered the biggest loss of jobs in that two-year peri od, 18%, the study reports. But the state actually added 125,000 jobs, or 7%, among those with a bache lor’s degree or higher.

Employment among whites dropped just 4%, markedly less than the gures for Blacks or Lati nos, down 6% and 7%, respective ly. Employment among workers of Asian descent actually rose 9% over the two-year period, a gain of 39,000 jobs. Some of that may be due to population shifts, but Frank Manzo, executive director of the Illinois Economic Policy Institute and the report’s co-author, said the main reason is that Asians are

more prone to work remotely than other groups.

One particularly striking nd ing: e two-year employment drop downstate was almost triple that of the Chicago metropolitan area, 11% versus 4%.

Another point of interest from Manzo: While Illinois’ job recovery still lags that of the nation, which now has passed its pre-pandemic total, the state’s 64.5% labor-force

Apartment, hotel project OK’d for near casino site

BY JUSTIN LAURENCE AND DANNY ECKER

A proli c developer’s plans to build a slew of housing units and a hotel near the planned Chicago casino have been approved by the City Council.

e vote represents the nal zoning hurdle for Shapack Part ners, which cleared the Chicago Plan Commission and Zoning Committee earlier this month.

e approvals Oct. 26 would allow founder and CEO Je Shapack to build over 2,200 apart ments, but he has said he plans only about 1,400. He has branded the collection of projects NoMa (North of Market).

Shapack’s original zoning ap plications aimed to transform a property along Grand Avenue between Desplaines Street and Union Avenue with a 1,110-unit

apartment building rising 600 feet and a 141-room hotel. A Shapack venture paid $25 million for the site, home to a shuttered Salvation Army family store and donation center.

Separately, Shapack propos es to redevelop a trio of sites southwest of the Salvation Army property near the intersection of Milwaukee and Union avenues and Hubbard Street. e origi nal applications included three buildings on three parcels total ing 1,159 residential units, as well as ground- oor retail space and a small amount of o ce space. However, Shapack now plans only 1,400 apartments.

e collection of projects amounts to one of the most ambi tious bets on a downtown apart ment market that has roared back from early COVID-19 pandemic devastation.

It also piles onto a mix of huge apartment projects near the Chi cago Tribune’s Freedom Center, which is poised to be redeveloped into a $1.7 billion Bally’s casino, hotel and entertainment venue if the gambling giant can win nal approval from the Illinois Gaming Board and Chicago Plan Com mission for the project.

If the Shapack projects come together as planned, it would fur ther establish the area between Fulton Market and the North Branch of the Chicago River as a burgeoning new downtown neighborhood.

A source familiar with the new Shapack plan said the hotel would be developed before the apartment buildings, similar to the way Shapack began his Fulton Market work with Soho House to help generate foot tra c in the neighborhood.

participation rate is back to where it was while the nation’s still is lower than it was prepandemic: 62.3% vs. 63.4%.

What’s the takeaway from this for the future?

“Ultimately, the data reveals that occupations o ering high er levels of job quality, access to modern technology and infra structure, and those that allow re mote or hybrid work options have

been the quickest to recover,” said co-author Robert Bruno, a U of I professor and head of the Project for Middle Class Renewal.

Illinois also would be wise to push investments in broadband, promote the state as a hub for e-commerce and warehousing, in vest in higher education, and work hard to rebuild Chicago’s position as a travel and tourism hub, the study says.

Raoul, peers reviewing Kroger-Albertsons deal

Attorneys general hope to ensure merger won’t hurt shoppers and workers

BY ALLY MAROTTI

Illinois Attorney General Kwame Raoul and counterparts from other states are reviewing the proposed Kroger-Albertsons deal.

Raoul was among a half-doz en attorneys general from several states and the District of Columbia who signed a letter sent to the CEOs of Mariano’s parent Kroger and Jew el-Osco owner Albertsons on Oct. 26. e letter said they are “dedicat ed to ensuring” the proposed merg er “does not result in higher prices for consumers, suppressed wages for workers, or other anticompeti tive e ects.”

“If the proposed merger has anticompetitive e ects, nearly ev ery corner of this country will feel them,” the letter said.

e letter also asked Albertsons to delay payment of the up to $4 bil lion dividend it promised to share holders until the attorneys general have completed their review and the deal is done. If the payout occurs pre-emptively and the deal does not go through, Albertsons would be at a competitive disadvantage.

Albertsons said in a statement that its planned combination with Kroger would provide “signi cant bene ts” to customers and em ployees, and “o ers a compelling alternative to larger and non-union competitors.”

e move by the attorneys gener al came one day after U.S. Sens. Eliz abeth Warren and Bernie Sanders joined Rep. Jan Schakowsky, D-Chi cago, in sending a letter to the Fed eral Trade Commission urging it to oppose the $24.6 billion deal.

Experts had predicted the deal would face backlash from politi cians and strict scrutiny from federal regulators, given antitrust concerns and the in ationary price hikes that have hit grocery aisles hard.

Kroger and Albertsons an nounced their plan this month. A combined company would operate almost 5,000 stores .

e grocery companies have said they plan to spin out up to 375 stores to fend o antitrust concerns. Experts also predict they will sell o or close additional locations in mar kets where they compete closely, such as Chicago.

Kroger owns the 44 Mariano’s in the Chicago area, plus about 10 Food 4 Less locations in Illinois.

Albertsons has 188 Jewel-Osco lo cations, most of which are in the Chicago area.

4 OCTOBER 31, 2022 • CRAIN’S CHICAGO BUSINESS

U of I study examines the pandemic’s impact on Illinois employment, with some surprising winners and losers

GETTY

Developer Shapack says he plans to build about 1,400 units of housing near the proposed casino

A view of the Salvation

Army site from the north.

COSTAR GROUP

Fueling the

Broker

Tech-Enabled

BrokerTechVentures.com

BDT offers to take Weber private just a year after its IPO

BY STEVE DANIELS

Chicago nancier Byron Trott’s private-equity rm is o ering to take Weber private barely a year after leading a public o ering of shares in the Palatine-based grill maker’s stock.

BDT, which owns the majority of shares in Weber even after the initial public o ering in August 2021, proposed paying $6.25 a share for the remaining shares it doesn’t own. at would cost BDT $172 million, according to a letter dated Oct. 24 to Weber shareholders.

e o er represents a 24% premium to Weber’s Oct 24 closing price. But it’s a 55% haircut from the $14-per-share price investors paid when the stock went public last year.

Weber was a hot commodity during the pandemic when sales of outdoor grills rose as consumers were stuck at home and unable or unwilling to eat out. But the growth proved transitory, and the company has struggled in the past year.

Weber CEO Chris Scherzinger left the company in July. Chief Information O cer Alan Matula was tapped as interim CEO. Shares dropped on the news back then.

At the time, board Chair Kelly Rainko said, “We are taking decisive action to better position Weber to navigate historic macroeconomic challenges, including in ationary and supply chain pressures that are impacting consumer con dence, spending patterns, and margins.”

ose were expected to include job cuts.

For BDT, if the Weber board agrees to the o er, it will cement a substantial money-loser for investors in the IPO and be a black eye for a rm that otherwise has performed well for its investors. Trott has strong relationships with many of the country’s wealthiest families, including the Pritzkers.

A BDT spokeswoman declined to comment beyond BDT’s public lings.

BDT isn’t alone, however. Other private-equity rms that led public o erings of portfolio companies over the past 18 months also are making similar go-private o ers as banks sour on re nancing debt these companies have on their balance sheets.

“Our proposal o ers immediate liquidity to the company’s public stockholders, while eliminating the risks to the public stockholders in the current market and operating environment that the company’s current leverage position is unsustainable and that the company may be unable to e ect

a recapitalization,” BDT said in its letter.

Weber shares closed Oct. 25 at $6.56, above Trott’s o er, signaling that investors believe another acquirer might bid or that BDT will be pressured to raise the price.

at appears unlikely, according to one analyst.

“Per the o er, BDT noted that it is ‘only interested in acquiring the shares of the company that we do not currently own, and accordingly we have no interest in a disposition or sale of our holdings’ and ‘have no interest in participating

in an alternative change of control transaction involving the company,’ and ‘would not vote in favor of any alternative sale, merger, or similar transaction involving the company,’ ” Wells Fargo analyst Chris Carey wrote last week. “In our view, this is a ‘take it or leave it’ type o er and counterbids (from other entities) among other alternatives seem a low probability.”

Earlier this month, Trott announced a planned merger of his own rm with the New Yorkbased investment rm founded by technology industry mogul Michael Dell.

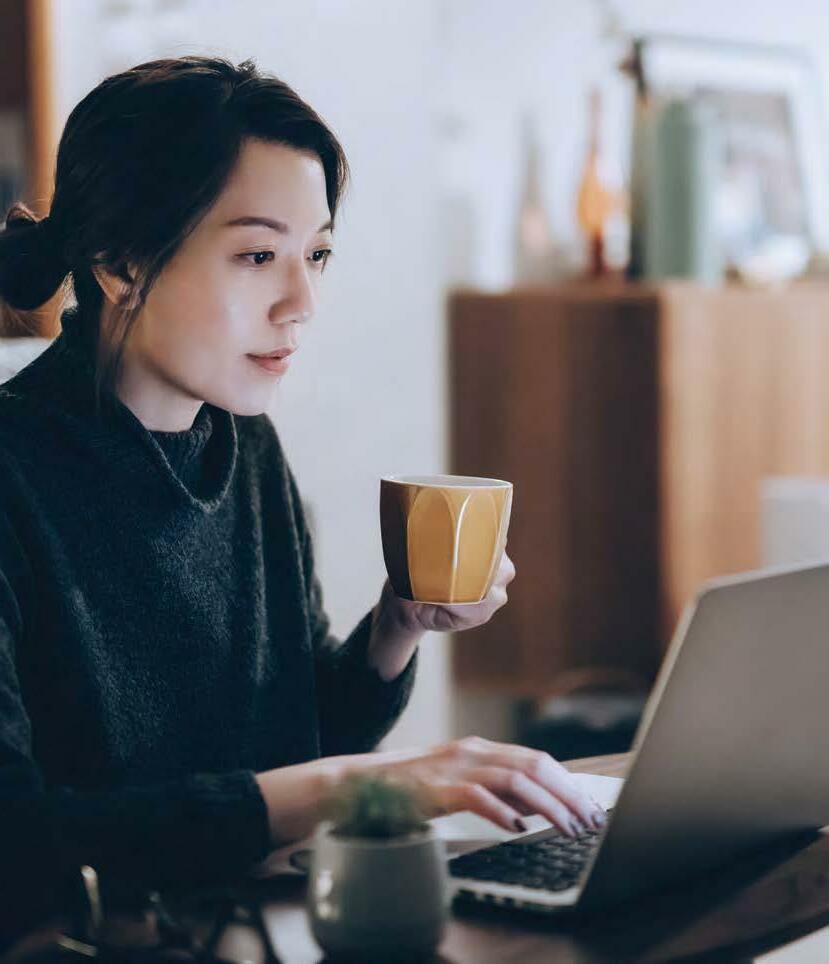

Most Chicago employers mandate in-office work at least weekly

humility in saying, ‘You know what? I trust my team to make the right decisions.’ ”

BY SOPHIE RODGERS

Most Chicago employers are requiring employees to return to the o ce on a weekly basis—but most companies without a mandate plan to keep it that way.

More than 6 in 10 employers surveyed by Crain’s reported that they are mandating employees come in at least once a week, citing collaboration and training as the top two reasons for this decision.

Here are some quick stats:

Among employers that mandate weekly in-o ce attendance, 22.3% require employees to come in three days a week, 17.5% require twice a week and 16.9% require ve days a week, according to Crain’s survey.

As of Oct. 19, the Chicago metro area had a 45% return-to-ofce rate based on keycard swipes compared to pre-pandemic levels, according to building security tech rm Kastle Systems. By comparison, New York had a 46.5% return rate and Los Angeles had a 46% return rate.

CTA’s bus and rail ridership has plateaued at about half of pre-pandemic norms.

As for employers that do not

currently require weekly in-o ce attendance, a whopping 88% reported they have no plans to create such a mandate, according to Crain’s survey of 176 employers in the Chicago area.

Wireless service carrier U.S. Cellular, with about 1,300 local employees, has adopted a exible model that will stay in place for the foreseeable future, according to CEO Laurent erivel.

“I did not feel comfortable trying to establish a broad policy for the company that says you need to be in on Mondays, Wednesdays and Fridays,” erivel said, adding that employee attrition could rise if managers mandate workers, who maintained or even increased

productivity during the pandemic, come in two to three days a week. Instead, U.S. Cellular allows individual managers to determine when their teams come in but emphasizes that it should solely be for a purpose. “A reason isn’t because it’s a Tuesday or Friday. A reason is a speci c meeting,” erivel said. erivel practices what he preaches: e CEO requires his executive team only come into the o ce six days a month, aligning with particular team meetings.

“ e pandemic has required so much exibility, not just from leaders and companies, but the people,” erivel said. “I think CEOs need to have a little bit more

Other employers are keener on getting their workers back to the o ce. More than a quarter reported they would prefer for their employees to work from the o ce three times a week, 21% would prefer a full ve times a week, 20% would prefer twice a week and 15% have no preference.

Accounting rm Plante Moran has implemented a model called “workplace for your day.” On any given day, employees may decide for themselves where to work, whether that’s on-site with a client, in the o ce or at home, according to Chicago managing partner Tom Kinder.

“ e alternative ‘hybrid work’ approach being adopted by many companies is to mandate o ce work for two or three days a week. In our experience, people tend to dislike this—not because they don’t want to be in the o ce, but because they don’t like being ordered when to be there. Instead of rules, we rely on guidelines and trust,” Kinder said.

“As long as people are communicating with their managers, supervisors and team partners, then it’s working.”

As for employers that do mandate weekly in-o ce attendance, the most common days to come in are Tuesdays, Wednesdays and ursdays.

Crain’s survey also reveals that the most common incentives employers have added to encourage talent to come into the o ce are social events—such as happy hours—free meals and renovations to the o ce.

“INSTEAD OF RULES, WE RELY ON GUIDELINES AND TRUST.”

Tom Kinder, Plante Moran

erivel said that U.S. Cellular renovated the Chicago headquarters to feature more collaborative spaces for employees. “We had to create more collaboration space because now, employees will spend a higher percentage of time doing team-related activities in the o ce,” he said.

Kinder noted that Plante Moran’s current model is more of an art than a science. “You’re a professional. If you need to be in the o ce, be in the o ce. If you don’t, you can work from home,” he said.

As for now, erivel said that “once our teams are no longer having a purposeful interaction, they can work from wherever they want to. . . . ey can do it from home, from a co ee shop or even Aruba.”

6 OCTOBER 31, 2022 • CRAIN’S CHICAGO BUSINESS

Crain’s survey reveals latest return-to-o ce insights

Byron Trott’s rm, which is o ering $172M, still retains a majority of Weber shares after leading its IPO in 2021

Weber was a hot commodity during the pandemic when sales of outdoor grills rose as consumers were stuck at home. But the growth proved transitory.

STILL NOT RIDING Monthly CTA bus and rail ridership is still nowhere near pre-pandemic levels. TOTAL MONTHLY CTA RIDER Source: Chicago Transit Authority Note: Data as of July 2022; reflects boardings for both CTA bus and rail services 2018 2019 2020 20212022 0 10 20 30 40 50 million 20.9 million July

A new 58-mile bike trail will connect Chicago to Michigan

The Marquette Greenway Trail Project will stretch from Calumet Park on the city’s Southeast Side to New Bu alo

BY JACK GRIEVE

From Illinois to Indiana to Michigan, bikers and pedestrians will soon be able to travel across state lines on a scenic, nonmo torized greenway along the south shore of Lake Michigan.

e Marquette Greenway Trail Project will stretch 58 miles and connect Calumet Park on the city’s Southeast Side to downtown New Bu alo, Mich. e project is funded in large part by a $17.8 million grant from the U.S. De partment of Transportation to the Northwest Indiana Regional Plan ning Commission, in addition to millions of dollars in other feder al, state, local and private grants.

Construction on the Illinois strip is already complete.

e Indiana section, which makes up the bulk of the trail, is almost fully funded with the ex ception of one mile-long strip between Burns Harbor and Ches terton, which project managers hope to secure state funding for later this year. Work is under way on the Indiana stretch and expected to be completed at the

end of 2026 or beginning of 2027.

In Michigan, the project has secured $5.35 million of the addi tional $5.6 million needed for the 4-mile leg between the MichiganIndiana border and downtown New Bu alo. Volunteers are kicking o their nal fundraising stretch and asking for community donations to help acquire the last $250,000, starting with a fund raising event at Bentwood Tavern in New Bu alo on Nov. 3.

“So many years of hard work are nally coming to fruition, and we are looking forward to the community rallying around this last, important nancial e ort to complete the trail to New Bu alo,” said fundraising chair Gary Wood. “Our dream is to one day have a nonmotorized trail that goes all the way to the Mackinac Bridge.”

Construction in Michigan is set to take place in two phases. Phase 1, running from downtown New Bu alo to Grand Beach, is set to begin in spring 2023 and conclude by the end of the year. Phase 2 stretches from Grand Beach to the Indiana state border and is expect ed to wrap up by early 2025.

You’re paying more for weed in Illinois

BY JOHN PLETZ

Weed prices are beginning to fall in Illinois, but they’re holding up better than in most states.

Oversupply is pounding canna bis markets from Massachusetts to Michigan to California, and there are signs that some con sumers have been trading down because of in ation.

Retail marijuana prices in Illinois have been among the highest in the nation because of a relatively limited number of stores since rec reational weed became legal nearly three years ago. But retail weed prices are down 15% so far this year, Cantor Fitzgerald analyst Pablo Zuanic writes in a note to clients.

Although that’s steeper than the 13% decline in Pennsylvania and 12% drop in Florida, Illinois prices are still much higher: It costs $15.69 per gram on average in Illinois for smokable cannabis “ ower,” which is 16% more than Pennsylvania and 43% higher than Florida, Zuanic says. Prices here are 62% higher than in Massachusetts.

Pro ts in Illinois also remain higher than elsewhere, with retail ers here selling marijuana for 48% more than they pay to buy it from growers in the state. at works out to a gross pro t of about $7.62 per gram in Illinois, compared with $4.62 in Massachusetts and $1.84 in

Michigan, Cantor Fitzgerald says.

However, the spread between wholesale and retail prices in Illi nois was 20% higher at the begin ning the year, which is bad news for the holders of 185 new retail licens es who have yet to open their doors. Capital is drying up, the money available is now more expensive— and the margins are dropping.

at said, Illinois remains one of the best markets for selling legal weed because licenses are limited. e nation’s sixth-most populous state has just 110 retail licenses. Zuanic estimates that even if all 185 new stores open, Illinois will have fewer stores per capita than many states.

For growers—such as Chicagobased Cresco, Green umb In dustries, Verano and Pharma Cann—prices are holding up even better. Wholesale prices are down about 7% from a year ago in Illinois, compared with a 35% drop in Mas sachusetts and 55% in Michigan, Cantor Fitzgerald estimates.

e data illustrate the disparity in approaches that Illinois and Michigan took to legalizing mar ijuana. Michigan has allowed far more licenses to growers and retail ers. A year ago, the two states had roughly equal recreational sales. Now Michigan’s total sales are 49% higher: $195 million in September vs. Illinois’ $130.7 million.

CRAIN’S CHICAGO BUSINESS • OCT OBE R 31, 2022 7 LUXURY HOME OF THE WEEK Advertising Section Tour Model Home: 1650 W Wolfram St., Chicago 5-Bedroom Homes from $2.18M // Lots with Permit from $780K wo lf ra m1 8. co m Carrie McCormick · Melinda Lawrence // 312.624.6222 La keview’s N ewest Luxury Single-Family Development

Here’s why retail cannabis prices—and pro ts—in Illinois have been among the highest in the nation

Medical offices, skybridge planned in Streeterville

BY DANNY ECKER

Northwestern Memorial Health care plans to turn two oors of the Hyatt Centric Chicago Magni cent Mile hotel in Streeterville into medical o ce space and connect the property to its hospital campus with a skybridge.

In a proposal that highlights the strong demand for outpa tient medical clinic space in the neighborhood, the hospital sys tem aims to convert the fth and sixth oors of the hotel at 633 N. St. Clair St. into roughly 41,000 square feet of medical o ces, ac cording to a zoning application

connecting the hotel’s second oor to Northwestern’s Galter Pavilion outpatient care center. e plan stands to add to a roughly 13 million-square-foot supply of health care real estate in Streeterville that has proven to be insu cient to handle demand in the neighborhood. NMHC and neighboring Lurie Children’s Hospital have been snapping up real estate for several years to ex pand their administrative o ces and as more medical services are pushed out of hospital settings and into outpatient facilities.

NMHC signaled the Hyatt would be its next expansion target when it bought the hotel.

set to be introduced to the City Council this week. NMHC, which paid $67.5 million for the 17-story hotel earlier this year, aims to re move 74 rooms from the hotel under the plan and build the pe destrian bridge over Erie Street

e property today o ers patients and their fami lies a place to stay on the campus while receiving care and houses confer ences and events, but medical o ce demand in the area is soaring while hotel performance downtown has been slow to recover from the COVID-19 pandemic.

e Hyatt Centric would be reduced to 345 rooms if NMHC completes the project, accord ing to the application. Elevators

in the hotel would have to be recon gured as part of the proj ect, which would require the re moval of a couple rooms on the building’s seventh oor. e top 11 oors in the 28-story building are separately owned and house o ce space, including the head quarters of the American College of Surgeons.

e 15-foot-wide pedestrian bridge would cross Erie on a diag onal, and NMHC will seek a zon ing change to permit its construc tion, according to the application.

e hospital system needs the City Council to sign o on the pro posed conversion because the ho tel’s zoning status does not allow medical services, the application said.

A spokesman for NMHC did not respond to a request for comment.

Other commercial property owners in Streeterville are hop ing to capitalize on surging de mand for health care real es tate in the neighborhood. In the highest-pro le case, the Chicago real estate investor that owns the 900,000-square-foot o ce por tion of the tower at 875 N. Mich igan Ave.—formerly known as the John Hancock Center—is now marketing several oors in the building as the Mag Mile Medical Pavilion with clinical o ce space that it foresees accounting for half or more of the building’s o ce block in the next several years.

e 11-hospital NMHC system bought the leasehold interest in

the 23-year-old Hyatt Centric ear lier this year—its rst-ever pur chase of a traditional hotel—from a venture of Irvine, Calif.-based real estate investment trust Sun stone Hotel Investors. e deal was part of a broader strategy by Sunstone to exit the Chicago ho tel market entirely, one reason NMHC paid a relatively low sum for the property.

Sunstone bought the leasehold interest in the hotel—the Wynd ham Chicago at the time—in 2012 for more than $88 million, ac cording to Cook County property records. Sunstone rebranded it as Hyatt Centric under a franchise agreement that expires in 2039, according to Sunstone regulatory lings.

Companies knowingly sold harmful hair relaxers, suit says

Chicago law rm DiCello Levitt accuses L’Oréal USA and Namaste Laboratories, a Chicago-based beauty company, of selling cancer-causing products

BY BRANDON DUPRÉ

Chicago law firm DiCello Levitt filed a lawsuit in federal court in Chicago on Oct. 21 al leging be auty-care companies— including L’Oréal USA and Namaste Laboratories, a Chica go-based company—knowingly sold hair relaxers to women de spite knowing they were harmful and could cause uterine cancer.

e mass tort suit alleges that plainti Jennifer Mitchell’s di agnosis of uterine cancer was the result of prolonged expo sure to phthalates and other endocrine-disrupting chemi cals found in these hair prod ucts. Phthalates are chemical compounds used in a variety of cosmetics and personal care products, which, the lawsuit says, could have “negative long-term impacts on the success of preg nancy, child growth and devel opment, and reproductive sys tems in both young children and

adolescents.”

e suit, which names as de fendants a total of ve compa nies, says Black women have been disproportionately targeted and harmed by hair relaxers and the practices of these compa nies. Also named in the lawsuit is Soft Sheen, a company founded in Chicago in 1964 that was sold to French cosmetics giant L’Oreal in 1998.

“ is is a cultural thing born out of slavery,” Diandra “Fu” Debrosse Zimmermann, a DiCello Levitt partner repre senting the plainti along with co-founding partner Adam Levitt, said in an interview. “Law prohibited the showing of hair of African descent amongst en slaved people, leading to a mas sive cosmetic industry focused on helping women relax their hair with chemicals that compa nies knew to be extraordinarily toxic and dangerous, and ulti mately has led to cancer in what

A lawsuit cites L’Oréal products among those that market hair relaxers to African American customers.

we imagined to be in the tens or hundreds of thousands of wom en of African descent.” e companies named in the suit did not respond to requests

for comment.

e lawsuit alleges the de fendants violated state statutes and failed to protect consum ers against “deceptive, fraudu

lent and unconscionable trade and business practices and false adver tising by knowingly and falsely” selling harmful products.

“Today as we sit here, there are women and children con tinuing to use hair relaxers,” said Zimmermann. “And we want to hold them accountable and say, ‘Look, you’ve put pro ts over people and sold a product that is extraordinarily toxic, dangerous and a carcinogen.’ ”

e suit follows a recent study showing women who use chem ical hair straighteners could have a higher risk of developing uter ine cancer than women who have never used the products. e ndings followed nearly 34,000 U.S. women for more than a de cade.

Uterine cancer is one of the most common gynecologic can cers with incidence and mortality rates increasing in the United States in the past two decades, with more than 65,950 new cas es and 12,550 deaths expected in 2022, the study says. e nd ings showed frequent use of hair straighteners more than doubled the risk of developing uterine cancer for women in the study.

8 OCTOBER 31, 2022 • CRAIN’S CHICAGO BUSINESS

Northwestern Memorial Healthcare aims to convert two oors of the Hyatt Centric hotel it recently purchased

The Hyatt Centric Chicago Magni cent Mile occupies the rst 17 oors of the building at 633 N. St. Clair St. in Streeterville.

THE PROPOSAL HIGHLIGHTS THE STRONG DEMAND FOR OUTPATIENT MEDICAL CLINIC SPACE IN THE NEIGHBORHOOD.

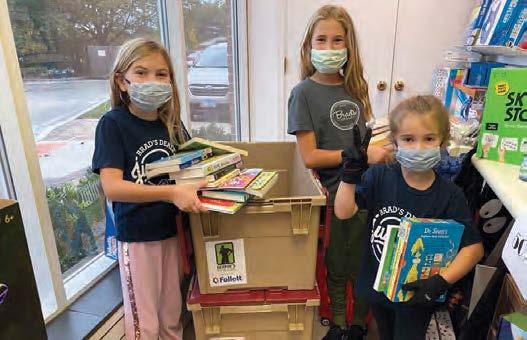

Using technology to help feed the hungry

BY CORLI JAY

e Greater Chicago Food De pository partnered with the ierer Family Foundation, a Chicagobased technology organization, to develop Vivery, which is now available for food banks and pan tries across the U.S. e foundation aims to help nonpro ts increase their impact through technology.

e development of the plat form is meant to address the ab sence of an e ective online pres ence for food pantries and food banks, as many of their websites are outdated and limited. Since it started using Vivery in summer 2021, the Greater Chicago Food Depository has reported an in crease in how many people have accessed the bank. It also has im proved its food nder map, added search lters and a Spanishlanguage search option, and im proved analytics, a ierer Foun dation press release said.

Vivery was launched in Chicago in summer 2021. According to the press release from the foundation, Vivery helps “communities easily nd and access the right food, so cial programs and services nearby in the ongoing battle against food insecurity.” e Greater Chicago Food Depository uses the platform to increase access to the more than 300 food pantries it supports. e

ierer Family Foundation is cov ering the cost for the early adopters in its home state of Illinois; the ser vice now is available to food banks nationwide at various prices.

Vivery was developed in 2020, with the foundation working with the Greater Chicago Food De pository to address the growing number of those seeking food as sistance. According to data from Feeding America, 35 million peo ple across the U.S. sought food as sistance from food pantries before the COVID-19 pandemic, with the number jumping to 60 million at the height of COVID in 2020. “Be tween the lasting e ects of the pan demic, in ation, and rising food prices, the latest gure is 53 mil lion, which is still a shocking 51% higher than pre-pandemic levels,” a press release from Viviery said.

“By centering on the end user experience and having an inten tional focus on analytics, we can

be more responsive to the needs of our community,” said Andy Seikel, head of technology and transfor mation for the Greater Chicago Food Depository in an emailed statement. “After seeing the im provements rst-hand, Vivery is that rare combination of using tech for good that is well-positioned to help food banks and pantries really move the needle to end hunger nationwide.”

According to a 2022 status re port released by the Greater Chi cago Food Depository, 16% of households in the Chicago area faced food insecurity in early 2022. at number was higher for house holds with children—22% faced hunger. Black Chicagoans with children saw the highest percent age of food insecurity, with a total of 32%, compared to 16% for white households with children. Over the past six months, the Greater Chica go Food Depository’s network of food pantry and grocery-style pro grams served an average of 347,584 people a month.

“Vivery was built on the vision to help people thrive and live their best lives,” Nasrin ierer, co-founder of the ierer Family Foundation, said in the press re lease. “People seeking food as sistance have unique needs and should be supported as such. With our digital tools for food banks and pantries, people can now narrow or expand their search with several lters beyond just location, and food resources can interact more e ectively with their communities through text messaging and a bet ter online presence.”

e new platform centers the user experience to simplify the process for those looking for assis tance. Filters on the website can be used to help people with speci c needs, such as families looking for centers that give food as well as diapers, those seeking a hot meal instead of groceries, or people who can speak only Spanish.

e platform also aims to con nect people with resource provid ers by providing hours of opera tion, establishing text message alerts for the public and provid ing data feedback to organiza tions to help them better under stand gaps and ways to improve services.

MORE

Access the ci ty’s leading business news in print, online or on any mobile device with our new app, now available for download for free with

the

CRAIN’S CHICAGO BUSINESS • OCT OBER 31, 2022 9

Volunteers pack boxes of food at the Greater Chicago Food Depository.

GET

your subscription! Visit www. .com today or ind us in

app store.

The Greater

Chicago Food Depository and Thierer Family Foundation have developed a tool to assist food banks

KENNETH

JOHNSON FOR THE FOOD DEPOSITORY

Vote no on the Workers’ Rights Amendment

When Gov. J.B. Pritzker visited Crain’s newsroom earlier this month to make his case for re-election, he cited what he viewed as the two biggest challenges that have hurt Illinois’ economy and un dercut its competitiveness in the stateby-state derby for corporate investment: First, the perception that Illinois has for years been a fiscal wreck, thus creating an unstable and unpredictable tax en vironment for companies that choose to operate here. Second, the perception that Chicago is a cesspool of crime.

Though Pritzker didn’t list it, there’s a third impediment—one the governor was eager to back away from in our Oct. 12 conversation. It’s the perception that labor runs the show in Illinois, making it costlier to do business here and nearly impossible to solve the biggest budget ary burden we face as a state—namely, the unfunded obligation of about $130 billion that every man, woman and child in this state owes to our public employee pension systems.

And that’s why passing the Workers’ Rights Amendment on the Nov. 8 general election ballot would be a major mistake for Illinois.

The ballot question asks whether Illi nois should amend its Constitution by adding a new section that would ban the passage of any law that infringes on “the fundamental right to organize and bar gain collectively through representatives of (workers’) own choosing for the pur pose of negotiating wages, hours, and working conditions, and to protect their economic welfare at work.” It will be added to the state Constitution if it wins three-fifths of votes cast on the measure, or a majority of all votes in the November

election.

As Crain’s business columnist Joe Ca hill pointed out on Oct. 3, if the WRA passes, Illinois will stand out for giving broader constitutional protections to or ganized labor than any other state. The amendment bars any legislation that in

terferes with unions’ bargaining rights, and—going further than any of the handful of states that constitutionally protect collective bargaining—explicitly prohibits “right-to-work laws” like those recently adopted by neighboring states.

As Cahill argues, provisions like the

YOUR VIEW

WRA, designed to protect clout-heavy special interests, can harm the state as a whole. The Illinois Constitution’s pen sion-protection clause, for instance, bars any diminution of public employee pen sions, language that has hobbled more than one effort to get our pension crisis under control. Similarly, a clause that bans the state from taxing higher-in come households at higher rates, Cahill notes, means Illinois can’t adopt the progressive rate structures that allow the federal government to raise needed rev enue without overburdening those who can least afford it.

Constitutions are supposed to delin eate the powers of government and es tablish fundamental rights that belong to everyone—like freedom of speech and religion. A pension-protection clause, a ban on progressive tax rates, a right to unionize—these are policy questions that should be decided by elected leg islators responding to the will of the people and the state’s changing circum stances. They have no place in a state’s constitution.

But beyond that foundational legal argument, there’s a practical matter at issue. Passing the WRA would showcase expanding union power in a state al ready considered a bastion of organized labor. As corporate headquarters exit Il linois and important players in up-andcoming industries like electric vehicle manufacturing bypass Illinois for other states, an anti-business message is hard ly a selling point for the Land of Lincoln. In fact, it’s the very last thing this state needs. Bestowing special constitutional status on unions would give companies one more reason to avoid Illinois.

Social support system key to SAFE-T Act’s success

In all the dialogue about cash bail ending on Jan. 1, we feel the fear about crime in a city that’s had enough. But we’re not talking enough about the underlying issues that have fueled violence and poverty in our city for decades. Address ing these root causes is a guid ing light for public safety.

The key to breaking the cycle of arrest-jail-repeat is linking people with services that pro vide affordable housing and employment, while also treat ing addiction, mental health issues, medical problems and other social needs.

That creates structure. And structure creates safety.

Because we’re serious about safety for all, we will provide these services to indi

Write us: Crain’s

Crain’s

include

viduals who want them after they are arrested and pre sumed innocent while they await trial.

I understand if you’re skeptical. Maybe you al ready disagree. I grew up in Lake Zurich and didn’t un derstand the power of so cial supports until I moved to the West Side in 2010 to raise a family and open a legal center. These services can heal the emotional and physical trauma of living with violence.

Now there is more vio lence in neighborhoods that historically haven’t experi enced shootings, robberies and carjackings. And many more people unfortunately know this trauma and need

healing from harm.

What do we do?

We use holistic social support as a mod el. Several Chicago violence-intervention groups learned from us to build their own models for adults and juveniles who need positive intervention. We’re a law office, but we spend three-fourths of our budget on supportive services.

Last year, we received a $2.9 million boost from The Bail Project, a nation al nonprofit, to merge its Community Release with Support model with our strategies. As a result, we’re inside Cook County Jail every weekday to interview detainees to identify the services they need should the judge grant their release. We know many people need this structure to be successful, and the pretrial popula tion responds best when those services are provided by and in the communities where they live.

We’ve also partnered with the system, working with the Cook County Circuit Court on the first Restorative Justice Community Court and the Chicago Police Department on limited legal representa tion for juveniles in custody at Area One.

We take a lot of pride in being commu nity-based, and our vision of Chicago is one that supports people so they can sup port themselves. That’s a safer city. That’s a stronger city. And we’re already playing our part to help ensure the successful rollout of the SAFE-T Act.

It sounds strange that a criminal de fense law office says its work is violence prevention. But we guide our clients away from guns and drug sales every day.

And our doors are open to anybody who wants to meet with our successful clients, some who now run their own businesses. Supportive services not only change indi vidual lives, they make us all safer.

130 E.

edited.Send letters

letters@chicagobusiness.com.

fact-checking purposes.

Sound o : Send a column for the Opinion page to editor@ chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer.

10 OCTOBER 31, 2022 • CRAIN’S CHICAGO BUSINESS EDITORIAL

welcomes responses from readers. Letters should be as brief as possible and may be

to

Chicago Business,

Randolph St., Suite 3200, Chicago, IL 60601, or email us at

Please

your full name, the city from which you’re writing and a phone number for

GETTY IMAGES

Cli Nellis is executive di rector of the Lawndale Christian Legal Center, a nonpro t that pro vides social and legal support for individuals awaiting trial.

Demonstrators march in front of McDonald’s headquarters in April 2019 demanding a minimum wage of $15 per hour and union representation.

Urban universities are the future of higher education

and their families worry about how they’ll cover the rising costs of college, and ask, “Is it even worth it?” If re cent enrollment trends are any indication, many would-be stu dents are answering such ques tions with a resounding “no.”

Moreover, according to a na tional poll, public con dence in the contribution of higher education to American society is sharply declining. e entire sector is experiencing a crisis of legitimacy.

Despite these challenges, there is a his toric opportunity. In cities like Chicago, pri

vate, nonpro t universities with strong ties to communities are uniquely positioned to o er ed ucational experiences that are career-focused, adaptable to the changing needs of learners and aimed at addressing intrac table social issues.

As one example, the insti tution I lead, National Louis University, spearheaded an un dergraduate model in 2015 that makes a ordability a top priori ty. Our undergraduate college re-engineered undergraduate education, making it more accessible and sustainable, with a cost that is

about $10,000 per year, less than any in-state university.

A ordability is not the only piece of the puzzle. A sizable number of those already in college, especially students of color and rst-generation degree-seekers, are margin alized and face equity gaps.

is is not a small segment of the student population. In fact, 33% of U.S. students are the rst in their family to attend college, almost 3 out of 4 are employed while taking classes and half are nancially independent from their parents.

We must provide clear, well-rounded pathways to degree completion, personal ized classroom experiences, business intel

ligence and predictive analytics to support success, motivational coaching, and embed ded career preparation and placement.

When Illinois recognized a need for early childhood educators, NLU quickly devel oped a scalable online program that made it easier for aspiring educators to pursue teaching degrees and certi cations.

Small private colleges have played an es sential role in advancing students from mi nority and low-income communities into the middle class. We hope other institutions can look at the work happening locally and see the importance of integrating accessible, equitable and impactful programming for all students, regardless of background.

Cities at a Crossroads

CRAIN’S CHICAGO BUSINESS • OCT OBER 31, 2022 11 President/CEO KC Crain Group publisher/executive editor Jim Kirk Editor Ann Dwyer Creative director Thomas J. Linden Director of audience and engagement Elizabeth Couch Assistant managing editor/audience engagement Aly Brumback Assistant managing editor/columnist Joe Cahill Assistant managing editor/digital content creation Marcus Gilmer Assistant managing editor/digital Ann R. Weiler Assistant managing editor/news features Cassandra West Deputy digital editor Todd J. Behme Deputy digital editor/audience and social media Robert Garcia Digital design editor Jason McGregor Associate creative director Karen Freese Zane Art director Joanna Metzger Copy chief Scott Williams Copy editor Tanya Meyer Contributing editor Jan Parr Political columnist Greg Hinz Senior reporters Steve Daniels, Alby Gallun, John Pletz Reporters Katherine Davis, Brandon Dupré, Danny Ecker, Jack Grieve, Corli Jay, Justin Laurence, Ally Marotti, Dennis Rodkin, Steven R. Strahler Contributing photographer John R. Boehm Researcher Sophie H. Rodgers Senior vice president of sales Susan Jacobs Vice president, product Kevin Skaggs Sales director Sarah Chow Events manager/account executive Christine Rozmanich Marketing manager Cody Smith Production manager David Adair Events specialist Kaari Kafer Custom content coordinators Ashley Maahs, Allison Russotto Account executives Claudia Hippel, Bridget Sevcik, Laura Warren Sales administration manager Brittany Brown People on the Move manager Debora Stein Digital designer Christine Balch Keith E. Crain Chairman Mary Kay Crain Vice chairman KC Crain President/CEO Chris Crain Senior executive vice president Robert Recchia Chief nancial o cer Veebha Mehta Chief marketing o cer G.D. Crain Jr. Founder (1885-1973) Mrs. G.D. Crain Jr. Chairman (1911-1996) For subscription information and delivery concerns please email customerservice@ chicagobusiness.com or call 877-812-1590 (in the U.S. and Canada) or 313-446-0450 (all other locations). CRAIN’S CHICAGO BUSINESS

Chicago and other major cities are dealing with several signi cant challenges ranging from higher crime to lower school test scores, and uncertainty about the future of business centers with hybrid work. THUR S DAY, NOVEMBER 17, 2022 Marriott Marquis Chicago 7:30 a.m. – 10.30 a.m. chicagobusiness.com/ForumLIVE CRAIN’S FORUM SPONSORS Featuring a keynote conversation with Mayor Lori E. Lightfoot , followed by three panels taking a close look at several issues. Students

YOUR VIEW

Nivine Megahed is presi dent of National Louis University.

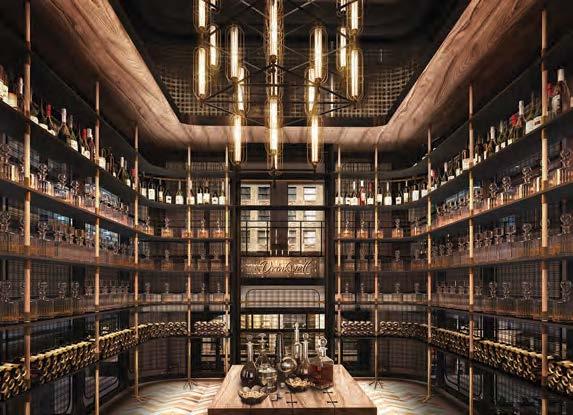

BEST NEW PRIVATE DINING ROOMS

As life slowly returns back to normal and people are planning holiday dinners and get-togethers, we checked in with the hottest new restaurants (mostly downtown) that offer private rooms.

BY ARI BENDERSKY

BY ARI BENDERSKY

ANDROS TAVERNA

2542 N. Milwaukee Ave. 773-365-1900 AndrosTaverna.com

Private room seats up to 35 or up to 60 for a cocktail reception.

Decor: Andros’ newly enclosed Kipos Greenhouse extends the warmth of the main dining room. Bathed in western light from a wraparound wall of windows, the room has lush greenery. A single-file line of pendant lights hangs across the middle of the ceiling; exposed brick and glass separate Kipos from the main din ing room.

Cuisine: Greek. This modern Greek restaurant from the husband-andwife team of chef Doug Psaltis and pastry chef Hsing Chen offers tastes of the menu ranging from spicy whipped feta and tarama salata spreads with warm, fluffy pita; roasted calamari; woodgrilled lamb shank; whole grilled sea bass; prawn saganaki; and gyros. Brunch is available as well. Well-curated all-Greek wine list.

Cost: Minimum spend is $5,000.

BAMBOLA

1400 W. Randolph St. 312-526-3983 BambolaChicago.com

Private room seats up to 36 at a long table or up to 66 with smaller tables added.

Decor: Set apart from the main dining room by massive doors, the private dining room features a 32-foot wood table. Its tall windows look out toward Union Park and the room has access to the restaurant’s terrace. With inspiration from the Silk Road, Bambola features textiles, tiles and furniture from across Europe and Asia.

Cuisine: Middle East meets Asia. Chefs Alisha Elenz and Michelin-starred Marcos Campos have created a menu cel ebrating the cuisines stretching between southern Europe and Asia, notably Italy, Turkey and Persia, with influences from Thailand, China and more. Expect caper leaf-wrapped crispy shrimp; wagyu and caviar tarts; turmeric carrots with smoked eggplant labneh; spiced Israeli couscous with medjool dates and wild mushrooms; mushroom pad Thai; braised oxtail fried rice; and Xi’an fried chicken bao.

Cost: Minimum spend is $5,000.

12 OCTOBER 31, 2022 • CRAIN’S CHICAGO BUSINESS

CAFE BIONDA

Brass Tack

11 E Walton, Chicago, IL 60611 312-646-1318

Website: Brasstackchicago.com

Email: BrassTack.events@waldorfastoria.com

With its striking design elements and vintage charm, the Brass Tack’s new private dining rooms surround guests with elegance, sophistication, and privacy.

Approachable and recognizable in the heart of the Gold Coast, the private dining spaces overlook the lively street scapes from the third oor of the Waldorf Astoria. Our Wal ton Room and Gallery Salon o er opportunities for intimate dinners, sophisticated receptions, and unforgettable cele brations.

e menu specializes in dishes and sides that evoke the tra ditions of the American Brasserie but with a distinctly Chi cago touch. A robust beverage program celebrating wine and modern cocktails round out the provisions. Altogether, this new American brasserie in the heart of Chicago’s most luxurious neighborhood is a true dining experience.

1924 S. State St. 312-846-1901 CafeBiondaSouthLoop.com

Private room seats up to 64 (Dining Room) or 15 (Blueprint Lounge).

Decor: The Dining Room, separated by sliding glass doors (sourced from the original Mercantile Exchange) covered by tied-off burgundy drapes, has an open floor plan. Tiled floors hold white tablecloth-covered tables and walls have art featuring Italian culture. The room also has a private bar. The Blueprint Lounge, named for blueprint drawings of iconic Chicago buildings that hang on the walls, is hidden behind a Murphy door. The cozy space with navy accents features tables with candelabras, club chairs and leather couches for smaller gatherings.

Cuisine: Italian. A classic red-sauce Italian restaurant, which closed due to the COVID-19 pandemic, is back under new chef Cosimo Riccardi from Naples, Italy. Event menus comprise antipasti, salad, pasta, entree and dessert, along with a range of classic Italian comfort dishes like sausage and peppers; fried or grilled calamari; Caesar salad; linguine and clams; lasagna; pork chop Vesuvio; chicken Parmesan; and tiramisu.

Cost: Dining Room minimum spend is $5,000; Blueprint Lounge is $1,000.

CANAL STREET EATERY

314 S. Canal St. 312-967-6060

CanalStreetChicago.com/eatery

Private room seats up to 12.

Decor: Situated high above the restaurant, The Overpass (a nod to Union Station next door) has clear views of the main dining room as well as The Green, the building’s adjacent park to the west. The intimate space offers comforting living room ener gy through natural tones, dark wood tables, fabric-backed cushioned seats and overall art deco influences. The room also features a large flat-screen TV for use during presentations.

Cuisine: Italian. Chef Forster So rensen’s a la carte Italian menu comprises antipasti (little gem Caesar, seasonal burrata, mel on and prosciutto); wood-fired pizzas; pasta (mafaldine cacio e pepe, casarecce bolognese, lin guine carbonara); and entrees (burger topped with fontina and pancetta; salmon piccata; N.Y. strip steak with marrow butter). Full bar and wine service are also available.

Cost: Minimum spend is $1,000.

KIM YEOH CRAIN’S CHICAGO BUSINESS • OCT OBER 31, 2022 13 SPONSORED CONTENT

2734 W. Roscoe St. 312-366-2294

EdenInChicago.com

Two private rooms seat up to 18 and 22, respectively.

Decor: Two different rooms offer differ ent vibes. Selenite (seats 18) is a clean, bright, airy room with checkerboardstyle tiles, a faux fireplace and brass ka leidoscope light fixture over the table. Slate (seats 22) offers a dark, sexy per sona with a shadowy, foggy, forested theme on the walls.

Cuisine: New American. Expect seasonally driven dishes from chefpartner Devon Quinn, with ingredients sourced from the on-site greenhouse and garden, for events from break fast to dinner. Menu items include poached wild eggs Benedict with avocado and honey yogurt parfaits; ancient grain bowls with red quinoa, chickpeas and various vegetables or house-smoked turkey sandwich with grilled broccolini and Calabrian chili aioli; and wood-grilled little gem salad with white anchovies and caramelized onions or pan-roasted Loch Duart salmon with sunchokes at dinner.

Cost: Minimums range between $1,500 and $3,000.

FORA AT THE EMILY HOTEL

311 N. Morgan St. 312-764-1919 ForaChicago.com

Private dining room seats up to 14.

Decor: The intimate room features natural woods, dark chairs with black leather cushions and cozy banquettes, similar to the main dining room.

Cuisine: Mexican. With ingredients inspired from Mexico, the seafood-forward menu features fresh heirloom corn tortillas made in-house. Choose from seasonal ingredients like hamachi with grapefruit and avocado; striped bass with cauliflower puree, cucumber and tamarind; and short rib with guajillo ponzu aguachile.

Cost: Minimum spend is $1,000.

EDEN

SPONSORED CONTENT Esquire by Cooper’s Hawk 58 E Oak St, Chicago, IL 60611 (312) 736-9999 Website: EsquireByCH.com/Corporate-Dining Email: events@esquirebych.com Esquire by Cooper’s Hawk o ers some of the most unique private dining spaces in the iconic Gold Coast of downtown Chicago. Set in the historic Esquire eatre, the stunning space features eight private dining rooms for events rang ing from intimate groups of eight to receptions of over 200 overlooking the venue’s dazzling three-story wine tower. In addition to Cooper’s Hawk award-winning wines, the un rivaled wine list boasts 1,600+ bottle selections, one of the city’s largest, and has held “Best of Award of Excellence” title by Wine Spectator since 2020. Enhanced by exceptional cus tom menus and curated wine pairings, guests of any private event are in for a truly extraordinary experience. BEST NEW PRIVATE DINING ROOMS 14 OCTOBER 31, 2022 • CRAIN’S CHICAGO BUSINESS

ERIC KLEINBERG

GRILL ON 21

208 S. LaSalle St., 21st floor 872-273-0021

Private room seats up to 16.

Decor: On the 21st floor of the new LaSalle Chicago hotel, this luxurious, sophisticated space has a black marble table with plush deep-red seating creating a strik ing centerpiece; gold and brass accents add vintage flair.

Cuisine: Steakhouse/New Amer ican. Start with chilled and hot passed appetizers like caprese skewers, stuffed medjool dates, tuna poke cones, crispy vegeta ble egg rolls, or lobster mac and cheese bites. Lunch or dinner with salads, soups and entrees include lobster bisque, wedge salad, filet mignon and Faroe Island salmon.

Cost: Minimum spend is $1,000 for groups of 10 to 15; groups up to eight can order a la carte.

With its striking design elements and vintage charm, the Brass Tack’s new private dining rooms surround guests with elegance, sophistication, and privacy.

The private dining spaces overlook the lively Gold Coast streetscapes from the third floor of the Waldorf Astoria. Our Walton Room and Gallery Salon o er opportunities for intimate dinners, sophisticated receptions, and unforgettable celebrations.

Waldorf Astoria Chicago 11 East Walton Street, Chicago, IL 60611

BrassTack.events@waldorfastoria.com 312.646.1318

CRAIN’S CHICAGO BUSINESS • OCT OBER 31, 2022 15

BEST NEW PRIVATE DINING ROOMS

& SEEK

838 W. Randolph St. 312-680-8217 HideAndSeekChicago.com

Private room seats 8 people.

Decor: American. This newcomer to Randolph Street has com pletely reimagined the former Vivo, the original Restaurant Row spot. The eight-seat space, designed by Siren Betty, is separated from the main dining room by thick velvet drapes just off the main floor. It takes in spiration from Parisian mem bers-only night clubs of the 1960s, with lay ered brass disc pendant lights, black-and-white striped mosa ic marble floor and giraffe-print wallcovering. It also includes a TV disguised as a mirror in the wall for audiovi sual capabilities.

Cuisine: Expect a menu of Amer ican shared plates with ingredients and techniques inspired by Italian, Spanish and French cuisine. Dishes include burrata with grilled apricots; spinach and ricotta gnudi with ‘nduja butter; garlic herb buttered escargot en croute; croquetas filled with short rib, jamon, guanciale, fontina cheese, Sungold tomato sauce and pepper jam; roasted halibut with seasonal vegeta bles; and Colorado lamb chops.

Cost: Minimum spend Sunday through Thursday is $800; $1,200 Friday and Saturday.

LIVA AT CHICAGO WINERY

217 W. Huron St. 312-291-9427 or info@indiennechicago.com IndienneChicago.com

Private dining room seats 14.

Decor: Set toward the back of the restaurant, the intimate private room—swathed in creams, pinks and a hunter-green ceiling—centers around a rectangular Calcutta marble table with plush beige seating. Two chandeliers illuminate the table; a vintage mirror makes up the length of the back wall.

Cuisine: Modern Indian. Choose from a vegetarian or non vegetarian five-course tasting menu or work with celebrated chef-owner Sujan Sarkar to create your own. Guests can also opt to dine a la carte with items like golden Osetra caviar with a lentil doughnut and coconut chutney mascarpone; Goan curry with octopus and miso; pork belly with pickled peach, apricot and puffed black rice; and ember-roasted green garbanzo bhel with avocado mousse and buckwheat khakda.

Cost: Minimum spend is $2,500.

739 N. Clark St. 312-763-3674 or sales@chiwinery.com

Private dining room seats up to 50.

Decor: Nestled within the dining room and separated by glass walls offering views into the dining room, winery and barrel room. The private room, which opens this fall with the larger Chicago Winery, will feature rich, jewel-toned and textured fabrics and brass accents. It can accommodate a variety of tables or one long table to create an even more festive atmosphere.

Cuisine: American. Chef Andrew Graves (formerly of the Alinea Group) has created a menu focused on Mid western ingredients. Groups can order from the menu with items that may include chicory green salad with shaved root vegetables; salmon with cauliflower; and lamb and squash sugo tagliatelle. Or go with the “chef’s whim,” a unique board featuring cheeses, meats, fruits and vegetables that will pair with wines—chardonnay, sauvignon blanc, temperanillo, malbec—made on-site.

Cost: Pricing begins at $85 per person.

INDIENNE

HIDE

16 OCTO BE R 31, 2022 • CRAIN’S CHICAGO BUSINESS

ChiWinery.com/Chicago-Restaurant

NEIL JOHN BURGER

LYRA

905 W. Fulton Market 312-660-7722 LyraRestaurant.com

Two private rooms seat up to 36 and 52, respectively.

Decor: The Kava room evokes a wine-cellar feel with nearly floorto-ceiling cabinets lining the walls filled with wine bottles. Greenery fills the space with modern glass lighting hanging from the wood ceiling. The Villa room is accessed by sliding slatted wood doors lead ing into a sandstone-colored room with hanging basket pendants.

Cuisine: Modern Greek. Whether you opt for stations, stands or family style dining, award-winning Greek chef Athinagoras Kostakos prepares dish es often cooked over open flames that lean toward healthy. Look for charred heirloom carrots, spanako pita, grilled octopus, slow-roasted lamb gyro, chicken souvlaki, crab ceviche and cast-iron moussaka.

Cost: Contact venue.

MONROE RESERVE

100 S. Monroe St. 312-546-6177

SouthBranchChicago.com/events/Monroe-Reserve