SBA loan activity is up since pandemic

Despite a slight dip in 2023, volume is still above 2019 levels

By Jeremy Nobile

While overall activity in the U.S. Small Business Administration’s core lending program dipped slightly in the agency’s Northern Ohio District this past scal year, borrowers are nonetheless turning to these products more than they did prior to the COVID-19 pandemic both locally and nationwide.

And current economic conditions may be one driver.

Lending activity

e SBA’s primary 7(a) Loan Program is designed for borrowers who are unable to obtain their desired credit on reasonable terms from non-federal, nonstate and non-local government sources—or, in other words, traditional lending sources.

In theory, SBA products may be increasingly sought during more challenging economic cycles.

But the increased popularity of the SBA program today compared with, say, 2019, could also be a lingering e ect of pandemic-era stimulus e orts, said Maggie Ference, longtime director of Huntington Bank’s SBA.

e Columbus-based bank is repeatedly the nation’s largest SBA lender by volume. e company provided 7,325 SBA 7(a) loans across the U.S. in FY 2023 totaling nearly $1.4 billion.

With so many business owners turning to the SBA for support amid an economic downturn brought by the global health crisis—which came in the form of the Paycheck Protection Program and Economic Injury Disaster

See SBA on Page 17

centers nd success by staying in their lane —

and, sometimes, not

Cleveland apartment leasing declines

Newly completed projects, public safety challenges contribute

By Stan Bullard

Even though this winter has been a soft one as Northeast Ohio winters go, anticipation is strong for spring. at is especially true for apartment owners and managers who look forward to the resurgence of leasing action this spring and summer after a tepid 2023.

“We had more downtown Cleveland move-outs than move-ins last year,” said Doug Price, CEO of large apartment ownership concern K&D Group of Willoughby. “Coming out of the pandemic, urban areas have lost excitement here and across the country. I’m hoping it comes back.”

Data from Downtown Cleveland Inc., the nonpro t marketing and maintaining downtown, reports occupancy fell to 91% at year-end from 93% at the end of 2022.

By Joe Scalzo

Let’s start with two versions of the same story.

Version one: A few years ago, a 70-year-old man walked into a Cleveland bowling alley late one weekend night, paid for an open lane and played a few games unbothered.

Version two: A few years ago, Aerosmith lead singer Steven Tyler walked into e Corner Alley on East 4th Street and played a few games while everyone else in the place (including the wait sta ) tried not to freak out.

What would be the headline?

“Elderly man spends weekend at Cleveland bowling alley”

Or ...

RESTAURANTS

“Rock star spends Saturday night playing America’s most popular participation sport at city’s coolest downtown spot”?

Both are true, of course, and they illustrate why it can be tough to write about bowling. On the one hand, the sport peaked in popularity around the same time as leisure suits and the number of bowling centers in the United States keeps dropping, going from 3,470 in 2012 to 2,849 in 2022. Plus, many of the bowling alleys that are still open have diversi ed their o erings, eliminating lanes (or pool tables) while adding things like laser tag, axe throwing and escape rooms.

See BOWLING on Page 16

Melt Bar and Grilled shutters its Independence location, continuing to consolidate operations after Avon closure.

Some of the increased vacancy comes from additional apartment buildings coming online with a total of 840 units bound for completion this year in projects including e City Club Apartments, 313 Euclid Ave., and others. Vacancy also is higher in downtown and Cleveland neighborhoods, from Detroit Shoreway and Ohio City to University Circle, because of the concentration of new properties compared with widely separated suburban markets.

In K&D’s case, Price points out its apartment complexes in the suburbs are much stronger across the board, often as high as 100%.

Yardi Matrix, the Santa Barbara, California, realty data provider, estimates the Akron and Cleveland metropolitan area multifamily occupancy rate fell to 94.9% so far in the rst quarter of 2024 from 95.7% in the like period of 2023.

See LEASING on Page 15

SPORTS BUSINESS

Cleveland wants to host the best Women’s Final Four in the sport’s history — and get the NCAA to come back.

VOL. 45, NO. 9 l COPYRIGHT 2024 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAINSCLEVELAND.COM I MARCH 4, 2024

PAGE 2

PAGE 3

GETTY IMAGES/CRAIN’S CLEVELAND BUSINESS ILLUSTRATION

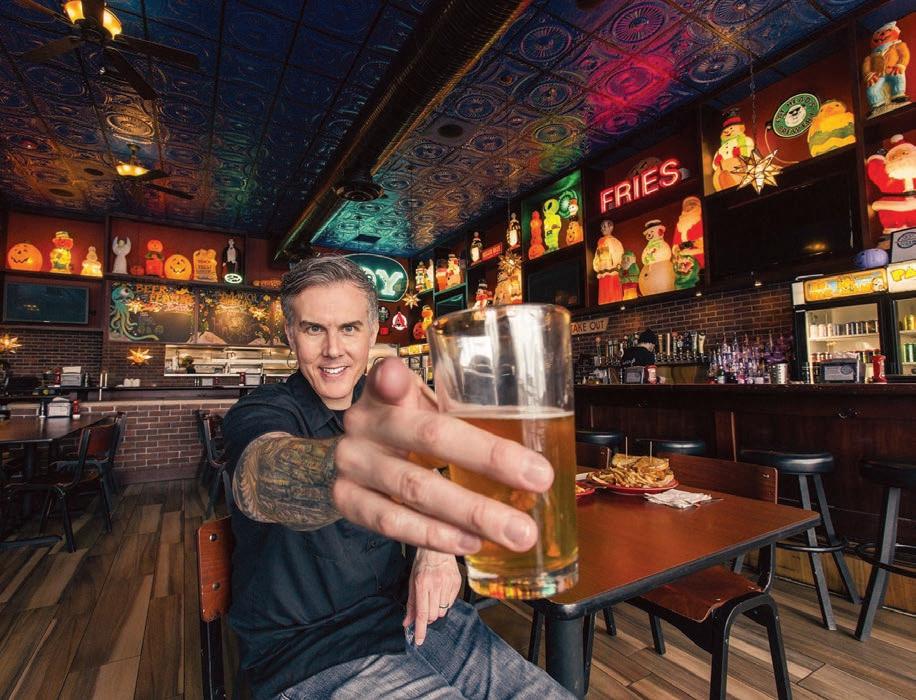

Melt Bar and Grilled in Independence shuttered

It’s restaurant group’s second closure of 2024

By Jeremy Nobile

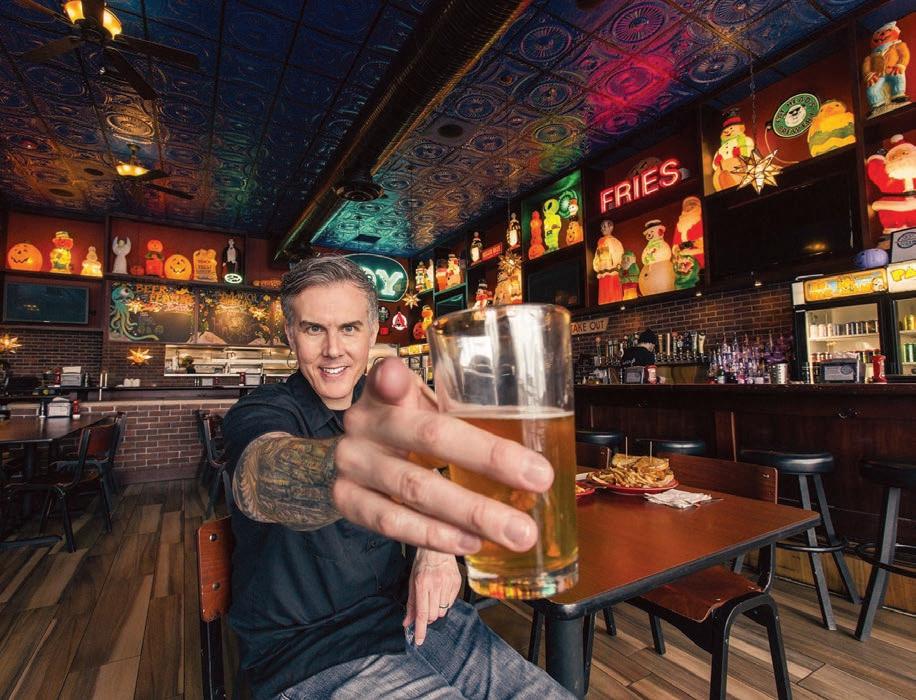

After closing its Avon restaurant in January, Melt Bar and Grilled has shuttered its Independence location as well.

Calls to that store trigger a message stating the location has permanently closed.

Melt owner Matt Fish conrmed the closure to Crain's and said the last day of business at that store — which was the largest in the company’s footprint at more than 6,000 square feet of space — was Sunday, Feb. 25.

Fish notes that while the company has been consolidating operations to reduce costs in a more challenging and expensive operating environment, the closure of the Independence restaurant was not in the plans as the Avon closure was announced at the beginning of the year.

Nonetheless, he said Melt was about two months behind on rent at that space, and e orts to work out some kind of rent assistance or payment plan did not pan out.

“We’ve been getting some assistance from other landlords, which has been great,” Fish said. “A lot of our current landlords understand our situation, a situation that many restaurateurs and people are in.”

He declined to name his Independence landlords or how much his monthly rent was at that space.

“I asked for some assistance, and it just seemed like they got more and more aggressive with their approach to us and starting to threaten locking us out of the space, which I could not let happen,” Fish said. “So, I felt like our hands were tied.”

“ at said, we fell behind, and landlords have to do what they have to do,” he added. “And, like I said, we’re getting assistance from our other landlords, and I’m looking forward to working with them in the future.”

Melt’s footprint still includes

four core stores today via restaurants in Lakewood, Akron, Mentor and Columbus.

ere are also satellite Melt locations in place at Cedar Point, Progressive Field and Case Western Reserve University.

As Crain’s explained in this deep dive into the company’s history and the struggles it’s now facing in a post-pandemic world, after opening its agship location in Lakewood in 2006, Melt generated a ton of buzz in foodie circles that would later propel its expansion.

Following a Cleveland Heights location that opened in 2010, Melt’s Independence restaurant was its third store when it came online in 2011. Amid high demand, that space expanded to an additional storefront in 2015.

By 2019, the Melt enterprise comprised some 350 employees across 10 company-owned restaurants, easily placing it among the fastest-growing restaurant groups in the state.

Based on the rst two months of business in 2020, Fish was pacing toward what could’ve been the company’s most pro table year yet.

But then came the gut punch of a global pandemic and mandatory lockdowns.

“March 16, 2020, was the day they shut us down,” Fish recalls. “ at was literally the day that my life and everybody’s lives changed. Everything just fell apart.”

Since then, nothing has really been the same.

Companywide sales have never rebounded to pre-pandemic levels. Coupled with debt taken on to fund its past expansions, higher costs and changing customer habits, the business had become unsustainable at its large size. is is what prompted more planned closings of Melt’s Canton and Dayton restaurants in 2023 and the Avon location in January.

“We don’t really have an end goal other than survival,” Fish told Crain’s in January. “I have to get us back to being a pro table company because we haven’t been since the pandemic.”

Crain Communications celebrates opening of Grand Rapids Business

Crain’s Staff

Crain Communications celebrated the opening of its newest City Brand, Crain’s Grand Rapids Business, at an open house for business and civic leaders held Monday, Feb. 26.

KC Crain, president and CEO of Crain Communications, hosted the leaders at an open house in the new o ce of Crain’s Grand Rapids Business in the Waters Center in downtown Grand Rapids.

Crain Communications entered the West Michigan market in late summer 2022 when it acquired the

Grand Rapids Business Journal. Four months later, Crain purchased another Grand Rapids-based business publication, MiBiz.

After merging the two operations, Crain’s Grand Rapids Business was launched in April 2023. e newly combined newsroom and sales sta moved into their new downtown o ce in November.

Grand Rapids joins Crain’s Chicago, Cleveland, Detroit and New York in the stable of Crain City Brands.

“A great business market deserves an equally strong news or-

“A great business market deserves an equally strong news organization to keep it informed.”

KC Crain, president and CEO of Crain Communications

ganization to keep it informed,” Crain said. “ e o cial opening of our doors in Grand Rapids marks a signi cant milestone in the Crain’s Business expansion.”

2 | CRAIN’S CLEVELAND BUSINESS | MARCH 4, 2024

After closing its Avon restaurant in January, Melt Bar and Grilled has shuttered its Independence location (above) as well. JEREMY NOBILE

KC Crain, president and CEO of Crain Communications (bottom left) and Jim Kirk (bottom right), group publisher and executive editor, speak to business and civic leaders during an open house at Crain’s Grand Rapids Business’ of ces. | PHOTOS BY SETH THOMPSON

Cleveland wants to host best Women’s Final Four in history

By Joe Scalzo

e NCAA Women’s Final Four is about a month away, but the chair of the NCAA Division I women’s basketball committee is already campaigning to get the love interest of a Kelce brother to come to Cleveland — and bring a few people with her.

Not Taylor Swift.

Jason Kelce’s wife, Kylie.

“We really hope Kylie Kelce and her three daughters want to come to the Final Four here in Cleveland,” said Lisa Peterson, who is also the senior associate commissioner of the Pac-12. “She’s a former NCAA student-athlete and this is the biggest (women’s) event.

“Kylie, we’ve got a seat for you.” ere aren’t many seats left for April’s games — semi nal tickets (Friday, April 5) on the NCAA’s Ticket Exchange range from $375 to $1,300, while championship game tickets (Sunday, April 7) range from $300 to $1,500. But there are lots of opportunities for fans of all ages to be part of the event, not just the ones married to famous NFL players from Cleveland.

e Women’s Final Four has become like the NBA All-Star Game or the Super Bowl, a multi-day celebration of the sport that includes a number of activities surrounding the game(s). Last year’s tournament was the biggest in the sport’s history, with the nal drawing an average of 9.9 million viewers on ESPN, which was more than the average for last year’s World Series on FOX (9.1 million) and nearly doubled the previous record (5.7 million) for a women’s nal.

“It’s not even a goal, it’s an expectation that will outpace and outdo what we did last year,” said Lynn Holzman, a Rocky River native who is now the NCAA’s vice president of women’s basketball. “ e eyes of the world are on Cleveland.”

While last year’s event got a huge boost from LSU’s Angel Reese and Iowa’s Caitlin Clark facing

o — and it’s a safe bet tournament organizers are hoping they’ll play a rematch in April — the women’s game is as healthy as it’s ever been.

Cleveland is in a great position to capitalize on that momentum, especially if the weather cooperates.

“We have a supernova of a sporting event coming to Northeast Ohio,” said Nic Barlage, the CEO of the Cleveland Cavaliers and Rock Entertainment Group.

“(Visitors) are going to see a city with world-class assets without a world-class ego. Cleveland’s got everything a major city needs and desires, with all the attributes from a culinary scene and a hospitality scene, to the fabric that’s woven throughout the community by the people that live, work and play here.

“(We’re) going to be praying to the high heavens that the weather cooperates for all of us, but you’re going to see a city that’s on the rise. You’re going to see a city that has a vibrancy to it and a heartbeat to it that we’re very proud of, but you’re going to (also) see a city that’s going to probably beat your expectations, but that’s what we aim to do every single day.”

(It’s worth noting that the day after the championship game — Monday, April 8 — is also Eclipse Day and the Guardians’ home opener.) is is the second time Cleveland has hosted the Women’s Final Four, and this year’s event will be much bigger than the one in 2007, in large part because of the number of ancillary events surrounding the three games. When Cleveland was awarded this year’s Women’s Final Four six years ago, Greater Cleveland Sports Commission (GCSC) CEO David Gilbert projected it would have an economic impact of $22 million, “and we actually think it’ll be quite a bit higher,” he said.

“ e women’s sport has grown,” Gilbert said. “ is is the epicenter of women’s sports in America. is is an event almost every major city in America wants to host.”

Cleveland landed it for two reasons. First, Rocket Mortgage FieldHouse’s $185 million renovation project made it a destination-level arena — one that got another $12 million boost from Dan Gilbert’s wallet last summer, allowing the team to renovate four locker rooms and six dressing rooms.

Second, the GCSC has helped

Berkshire Hathaway paid $2.6 billion for nal 20% of Pilot Travel Centers

Scott Suttell

e Warren Bu ett-led conglomerate Berkshire Hathaway (NYSE: BRK.B) disclosed in a regulatory ling that it paid $2.6 billion for the nal 20% stake in the Haslam family’s Pilot Travel Centers that it didn’t already own.

In deals in 2017 and 2023, Berkshire Hathaway acquired an 80% stake in Pilot from billionaire Cleveland Browns owner Jimmy Haslam. It broke down this way: Berkshire paid $2.76 billion in 2017 for 38.6% of Pilot, and $8.2 billion for an additional 41.4% in 2023.

e latest deal, which was announced Jan. 16 without a purchase price, brings to about $13.6 billion the total that Berkshire Hathaway paid for Pilot.

Berkshire Hathaway disclosed

the purchase price of the January transaction in its annual report, led with the U.S. Securities and Exchange Commission on Feb. 24. News service Reuters was rst to report the deal price.

Getting to the nal portion of the Pilot takeover was tricky.

As Berkshire Hathaway noted in its ling, Pilot Corp., the holder of the remaining noncontrolling interests in Pilot Travel Centers, “had an annual option to require us to redeem for cash all or a portion of its interests beginning in 2024. e redemption price was to be based on a multiple of PTC’s earnings for the preceding year, with speci ed other adjustments, including the amount of PTC’s net debt.”

Pilot Corp. led a lawsuit against Berkshire Hathaway during the fourth quarter of 2023 “concerning

the application of certain terms underlying the formula for calculating the purchase price to be paid upon exercise of the option,” Berkshire Hathaway said in its ling. Subsequently, Berkshire Hathaway led a counterclaim against Pilot Corp. On the eve of a trial, though, the two sides settled all litigation, clearing the way for Berkshire Hathaway to acquire the nal 20% stake for $2.6 billion.

e ling stated that Pilot, which is based in Knoxville, Tennessee, contributed $603 million to Berkshire Hathaway’s pro t in 2023.

Berkshire Hathaway said Pilot’s revenues and earnings “are highly dependent on diesel fuel and gasoline volumes, prices and margins,” and it noted that revenues for the 12 months ended Dec. 31, 2023, were about $56.8 billion, a decline of $16 billion, or 22.%, from 2022.

Women’s Final Four fan and community activities. It will have entertainment, food, licensed merchandise, exhibits, games and interactive displays.

◗ Beyond the Baseline: e convention center will hold talks, panels and guest speakers designed “to empower and equip women in sport and business with tools for personal and professional success.”

◗ Party on the Plaza: A three-day event at Gateway Plaza featuring partner activations, photo opportunities, food and beverage for purchase and red-carpet arrivals.

Cleveland gain a reputation as a great host city, a key element in landing the MLB All-Star Game in 2019, the NBA Draft in 2021 and the NBA All-Star Game in 2022.

“Buildings at the end of the day are steel and brick and mortar — and this is really nice steel and bricks and mortar — but what makes this place sing are the people who operate it,” said Mid-American Conference commissioner Jon Steinbrecher, whose conference is headquartered in Cleveland’s Public Square district.

“ e sta here is phenomenal. e training they do is phenomenal.

e customer service here — starting with Rocket Mortgage FieldHouse to the sports commission to our sta — we think will be second to none. Our goal is, when this concludes, the (NCAA) sta comes back and thinks, ‘We’ve got to get back to Cleveland.’”

e city’s leadership hopes visitors will feel the same way, whether they see a game or not. ere are seven free ancillary events planned between ursday, April 4, and Sunday, April 7:

◗ Tourney Town: e Huntington Convention Center will serve as the “host city” and epicenter for all

◗ Super Saturday practice: Fans can watch an open practice with the two championship nalists at Rocket Mortgage FieldHouse. Red-carpet arrival: Fans can cheer on the nal two teams as they enter the arena before the championship game.

◗ Super Saturday concert: Atlanta rapper Latto will headline a concert at Public Hall.

◗ Women’s Final Four Bounce: Fans 18 and younger are invited to dribble basketballs along the streets of Cleveland on the morning of the championship game.

at’s too young for the youngest daughter of Jason and Kylie, 1-year-old Bennett, but their other two children — Elliotte, who turns 3 next month, and 4-year-old Wyatt — could join in.

(Hint, hint.)

“We like to say our women’s basketball championship and our Women’s Final Four is the mega, premier, elite women’s sporting event of the world,” Holzman said. “ ere are multiple, multiple opportunities for the community and individuals of all ages to be immersed in the experience of the Women’s Final Four.”

MARCH 4, 2024 | CRAIN’S CLEVELAND BUSINESS | 3

BILLY DELFS

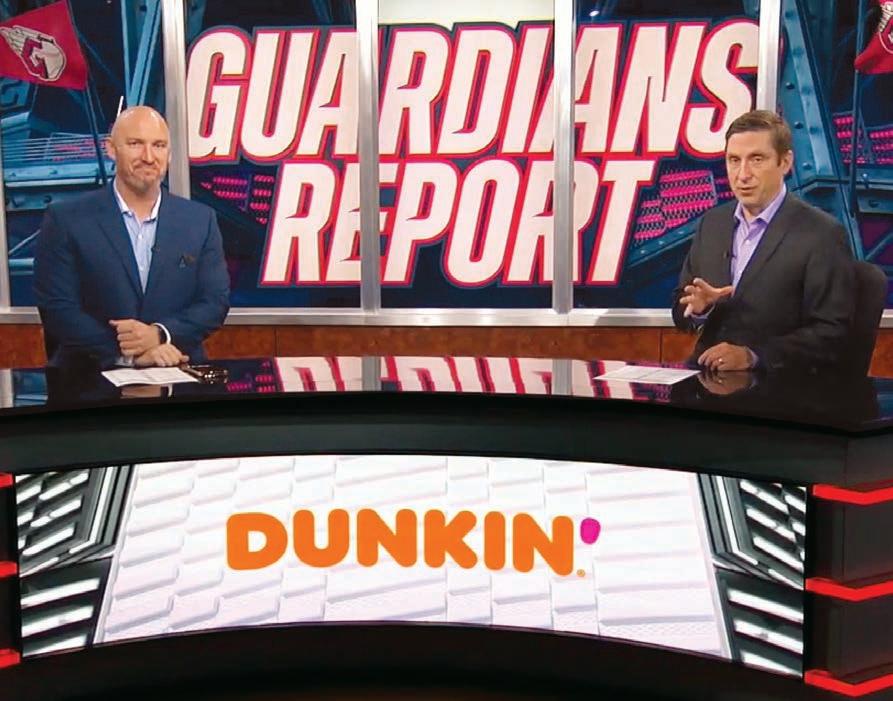

Guardians analyst Jensen Lewis: Bally Sports saga caused team to struggle to make roster moves

By Joe Scalzo

e Cleveland Guardians’ oseason saga with Diamond Sports Group didn’t just a ect airways.

It a ected paydays, too.

Guardians Live studio analyst Jensen Lewis said the Guardians, Minnesota Twins and Texas Rangers all struggled to make oseason moves because of the negotiations with Diamond Sports Group, which owns the Bally Sports regional sports networks (RSN).

ose three teams nally reached one-year agreements with Diamond for this season’s linear broadcasting rights on Feb. 5.

e Guardians had a quiet oseason — even by their standards — and their payroll currently ranks 28th out of 30 MLB teams at $84 million, just ahead of the Pittsburgh Pirates ($77.5 million) and Oakland Athletics ($45.5 million). e Twins are 19th ($112 million) and the World Series champion Rangers are eighth ($216 million). e Guardians had a $92 million payroll last year.

“All I know is we’re back on Bally Sports Great Lakes at least for one year. Same time, same station. You know where to nd us.”

Guardians Live studio analyst Jensen Lewis

as a Cleveland baseball broadcaster; he is best known for pairing with longtime studio host Al Pawlowski.

Last season, Lewis split time in the studio with two ex-Indians, catcher Chris Gimenez and out elder Ellis Burks. When asked if that will again be the case this summer, Lewis said, “I would assume so. We haven’t been told yet, but I would assume that’s probably the (situation). Until we’re told, I don’t know, but I hope we get some clarity soon.”

“When you look at Minnesota and the other teams in the same boat as us, like Texas, that had Bally Sports RSNs issues, they were not able to expand payroll if they wanted to,” said Lewis, who spoke to the Hall of Fame Luncheon Club in Canton on Monday, Feb. 26. “ ey were looking for cost certainty beyond this year and that’s hard to do when you don’t know what your revenue stream is like. I rmly believe that was an impactful thing, not just for us but from people I talk to across the league, it was certainly in their thoughts about decisions on free agents, trades — any acquisitions whatsoever.”

e Guardians made $55 million from Diamond last year but likely had to lower its rights fees for 2024 by around 15% as part of this year’s agreement. Proceeds from MLB teams’ telecast deals represent roughly 20% to 30% of a team’s revenue, according to Texas Rangers lawyer omas Lauria.

e Guardians’ original contract with Diamond ran through 2027, but no one knows where the team’s games will appear after this season — including Lewis. “All I know is we’re back on Bally Sports Great Lakes at least for one year,” said Lewis, who was a relief pitcher for the Indians from 2007-10. “Same time, same station. You know where to nd us. After this year, I’ll say the same thing I said last year: Who knows? We know as much as you guys know.”

is season will be Lewis’ 12th

Like everyone associated with the team, Lewis is hoping to get some clarity on the Guardians’ long-term broadcast home, but he knows that will take time. e Guardians are free to sign new media rights deals beginning with the 2025 season and could end up back on Bally Sports Great Lakes. One other option is MLB Network, which holds the broadcast rights for the Arizona Diamondbacks, Colorado Rockies and San Diego Padres.

“I know (my girlfriend) Michelle and I don’t want to go through another o season of, like, ‘Where are we going to be?’” Lewis said. “It kind of depends on what MLB wants to be and what (MLB commissioner Rob) Manfred and those people want to do. I honestly don’t know if there’s an immediate solution or if there’s a long-term solution.

“All I know is the show is going to go on somewhere and I hope we’re part of it. But I have no clue what that’s going to look like with everything evolving the way it is. We’re watching like everyone else.”

4 | CRAIN’S CLEVELAND BUSINESS | MARCH 4, 2024 Ideal Multi-Tenant/Office Building LAND FOR SALE: Beacon West, Westlake CONTACT US Charles Marshall 330-659-2040 3457 Granger Road, Akron, OH 44333 beaconmarshall.com Property Features *Price for 7.22 lot is $650,000 *Price for 6.59 lot is $630,000 *“Army Core Wetland Approval on Both Sites” FOR LEASE 8,700 & 5,916 SF can be combined for 14,616 SF 1+ AC secured outdoor storageVehicles/Construction Equipment/ Materials Automatic Drive-In Doors/Pallet Racking/(2) Air Compressors 4,000 SF Warehouse - $6.00 SF MG 20’ Clear Height 16’ Automatic Drive-In Door Perfect for Boat/Car Collection/ Motor Home/Vehicle Storage 330.958.7291 johnlubinski@hannacre.com John Lubinski 801-807 EVANS AVE809 EVANS AVE FLEX INDUSTRIAL AKRON Agent Owned CONTACT JONATHAN A. MOKRI 440.526.8700 • jmokri@cbscuso.com www.cbscuso.com Straight Talk. Smart Deals.® Providing Commercial Real Estate Loans Throughout Northeast Ohio and 15 Other States NO HEADACHES WITH CBS! Personalized Service • Loans up to $30 Million • No Prepayment Penalties • Investment & Owner-Occupied Commercial Real Estate

| BALLY SPORTS GREAT LAKES

Jensen Lewis (left) and Al Pawlowski host “Guardians Live” on Bally Sports Great Lakes.

Akron General nurses union to hold informational picket

By Paige Bennett

e nurses union at Cleveland Clinic Akron General intends to hold an informational picket this month amid contract negotiations with the hospital.

e Professional Sta Nurses Association, Ohio Nurses Association of Akron General Cleveland Clinic noti ed hospital executives and the Federal Mediation and Conciliation Service of its intent to picket March 6 through March 8, according to a news release issued by Ohio Nurses Association (ONA).

consider the option.

Union nurses have been in negotiations with the hospital since Jan. 9, according to the news release. Negotiations have stalled as Akron General o cials have rejected the union’s proposals for safe patient limits, ONA says.

“Our nurses are the direct line of care for patients,” Lentz said.

“We don’t feel that we’re able to do our jobs safely under current conditions to provide the quality care our patients deserve. Hospital executives continue to disregard our plea for safe patient limits to better serve our patients and community. We are hopeful that picketing will send a strong message to the hospital that we are not backing down.”

“It’s a shame that Akron General executives don’t value their nurses enough to come to the table and bargain for what patients and nurses need.”

Rick Lucas, president and executive director of the Ohio Nurses Association

Linzi Lentz, co-chair of the Professional Sta Nurses Association, Ohio Nurses Association of Akron General, said in a news release that the union does not want to strike, but is prepared to

The Ohio Nurses Association represents more than 700 registered nurses at the hospital. The contract between the hospital and the union was set to expire Feb. 29.

“It’s a shame that Akron General executives don’t value their nurses enough to come to the table and bargain for what patients and nurses need,” said Rick Lucas, president and executive director of the

Ohio Nurses Association, in a statement. “Before the pandemic, nurses were already working hard and long hours every day to ensure the best care possible for our patients. e pandemic made it more di cult with many nurses leaving the bedside.”

Nurses need a contract that ensures they are fairly compensated and work in an environment with safe sta ng, Lucas said.

“We are continuing good faith negotiations with the nurses’ bargaining unit at Cleveland Clinic Akron General,” the hospital said in a statement. “Our goal is to achieve a mutually agreeable contract renewal, as we have in past years. Akron General greatly appreciates the care provided by all caregivers, including those in the bargaining unit, at the hospital.”

Last spring, ONA launched its Code Red campaign to call attention to understa ng in Ohio hospitals. In September, the association showed support for a bipartisan bill called the Nurse Workforce and Safe Patient Care Act, which would establish legally enforceable minimum sta ng standards in Ohio hospitals and create an incentive program that encourages people to pursue nursing careers in Ohio.

Lake Erie College receives $1.5 million grant to add turf eld

Lake Erie College (LEC) is adding something good for the Storm — and the storms.

The Division II school has received a $1.5 million grant from the Lake County Board of Commissioners to add turf and lighting to an on-campus field that will become the home for the lacrosse and soccer teams.

The grant will cover the cost to turf and light the field and is scheduled to be completed in time for competition in the fall. LEC is looking for donors to expand the project to include an updated scoreboard, press box and grandstands.

The current grass field is surrounded on three sides by the Lincoln Library and Learning Commons, a quadrant of residence halls, and the Jerome T. Osborne Athletic Facility and Wellness Center.

Since 80% of the Storm’s students are student-athletes, the field will serve as an important recruiting and retention tool, LEC president Jennifer Schuller said in a news release announcing the grant.

“When I met with the commissioners late last spring and shared our needs in order to remain a strong, viable institution,

turfing this field was at the top of the list,” Schuller said. “I’m ecstatic and appreciative that, especially in such a short period of time, the commissioners are making this transformational grant.”

LEC athletic director Molly Hoffman said the field also will be used by local K-12 students and club teams and will allow the school to host state and national tournaments.

“This increased activity will not only bring greater visibility to Lake Erie College but also bring tourism to the county and region,” Hoffman said.

“We understand the importance of having a safe and well-maintained field for athletic activities, and we are committed to making sure that this project is a success,” commission president John T. Plecnik said. “Lake Erie College is an anchor institution in Lake County, and we are proud to ensure they can thrive and support our growing community.”

The Storm’s football, soccer and lacrosse teams currently play home games at Jack Britt Memorial Stadium, which is also the home stadium for Harvey High School. The football team will continue to play off-campus once the turf field is completed.

Cleveland has one of largest income inequality gaps in nation

By Jack Grieve

Cleveland is home to extreme income inequality, and a new report shows just how wide the city’s wage gap is relative to the rest of the country.

The report, conducted by financial technology company SmartAsset, analyzed the incomes of the top and bottom 20% of earners in 98 cities. Smar-

tAsset calculated an income inequality ratio for each city by contrasting the floor dollar figure a household must earn to enter the top quintile of earners against the ceiling salary a household can earn while remaining in the bottom 20%.

e bottom line: Cleveland’s income inequality gap is the ninth-largest among the U.S. cities surveyed, according to the

report. A household in Cleveland must bring home an annual salary of at least $115,915 to be among the city’s top 20% of earners. On the other hand, any household earning less than $21,102 is in the bottom quintile bracket. That means the city’s top one-fifth of earners make at least 5.49 times as much as the bottom one-fifth of earners.

Nationwide, New Orleans has the largest income inequality gap. ere, $110,820 puts a household in the top 20% while anything less than $14,078 is in the bottom bracket.

New Orleans is followed by Boston, Newark, Jersey City, Atlanta, New York, Memphis, Detroit, Cleveland and Chicago.

Chesapeake, Virginia, is home to the lowest income inequality gap.

e report also noted that more than 20% of households in the cities surveyed earn more than $200,000 each year.

e SmartAsset report is based on an analysis of 2023 data from the University of Wisconsin Population Health Institute’s County Health Rankings & Roadmaps. e 98 cities surveyed were the largest cities in the U.S. for which data was available.

MARCH 4, 2024 | CRAIN’S CLEVELAND BUSINESS | 5

Cleveland Clinic Akron General | CLEVELAND CLINIC

Joe Scalzo

A rendering shows the new turf eld planned at Lake Erie College. | CONTRIBUTED

Marijuana regulators propose fee changes

Annual charges would end for medical patients, caregivers and renewals would be cut for processors

Jeremy Nobile

Ohio regulators have proposed changes to marijuana program rules that would eliminate annual fees for medical marijuana patients and caregivers, reduce annual registration fees for processors and also allow licensed cannabis companies to hire employees on a provisional basis.

e state’s Division of Cannabis Control said that it is accepting public commentary on these recommended changes through Tuesday, March 12.

Medical marijuana patients and their caregivers currently pay annual fees of $50 and $25, respectively, to be registered with the state.

DCC proposes cutting those fees entirely, noting that it encourages eligible patients to remain part of the Medical Marijuana Control Program regardless of the legalization of adult-use.

In scal year 2023, registration fees for patients and caregivers totaled $6.6 million.

At the end of the 2023 calendar year, 410,565 people have registered as medical marijuana patients at some point during the life of the program, according to state gures. At that time, there were 169,339 patients with active recommendations and 38,101 caregivers.

“Eliminating the patient and caregiver registration fees is a strong move from the new Division of Cannabis Control and illustrates a clear dedication to improving the medical marijuana program for Ohio's patients,” Matt Close, executive director of the Ohio Cannabis Coalition (OHCANN), which represents the medical and recreational cannabis operators in Ohio, previously told Crain’s.

“Removing barriers to patient access is the best way to create an environment where both the medical and adult use marijuana programs can thrive and to combat the illicit market," Close

added. "We applaud the Division for proactively proposing this patient-focused change less than a month into their new role regulating patients, caregivers and dispensaries. We encourage medical patients to renew their medical marijuana cards because it is likely adult use marijuana won't be available until later this year."

As far as processor renewal fees, which apply to cannabis companies that make manufactured products ranging from oils and concentrates to foodstu s, the agency proposes cutting those in half from $100,000 to $50,000.

In a corresponding business impact analysis, it noted that while fees like these are necessary to over administrative costs of the program, the DCC suggests it will continue to have funds to cover program costs while “providing a more equitable fee schedule” and bringing those more in line with other facility fees.

With respect to provisional employee badges, DCC proposes permitting these to help operators more readily hire needed sta .

Currently, marijuana industry workers must pass background checks before they can be ocially employed, a process that can take up to 60 days. Industry stakeholders have reported that the amount of time required to hire has led to the “loss of good, quali ed candidates—resulting in increased recruiting and hiring costs for licensees.”

Under the proposed changes, someone would be permitted to begin working for a marijuana business provided that: they complete an employee badge application; the parties attest that an employee does not have any o enses on their record that would disqualify them from obtaining a badge; provided evidence that the applicant has submitted ngerprints for both Bureau of Criminal Investigation and FBI background checks.

Topgolf to open location in Avon

Topgolf plans to add a second Northeast Ohio location, this time a two-story, family-style concept with 60 bays in Avon.

e golf center will be visible on the north side of I-90 on a 13-acre site. It will be built between Ashley Furniture and Planet Fitness on Chester Road, according to plans approved Feb. 21, by the Avon Planning Commission.

Pam Fechter, Avon’s economic development director and plan-

ning coordinator, said the Lorain County location will be familyfocused rather than the corporate focus of its Independence location.

“We’re excited to have something new in the city,” she said, “especially something that will bene t our residents.”

Plans call for a bar, restaurant and Topgolf’s tech-assisted play tracking.

e proposed site is on land that Jacobs Group of Cleveland has been developing for years on the north side of I-90, west of the

Nagel Road interchange.

e area’s rst Topgolf opened in December 2019, at the intersection of I-480 and I-77 in Independence. at larger location, with 100 suites, is on 15 acres.

Dallas-based Topgolf, part of Topgolf Callaway Brands Corp. (NYSE: MODG), has 90 locations around the world, the company said when it announced beginning construction on a two-story community and family-focused location last December in Greensboro, North Carolina.

Hopkins passenger traf c rises in January

By Scott Suttell

Cleveland Hopkins International Airport is o to a good start in meeting its projection of serving more than 10 million passengers in 2024.

e airport on Monday, Feb. 26, reported that it served 670,633 passengers in January, up 5.7% from 634,484 passengers in January 2023.

January’s passenger gure also is slightly higher than January 2019, when Hopkins served 669,606 passengers. In the airline/ airport business, 2019 data is important, because that was the last full year before the COVID-19 pandemic upended the industry.

( e January 2024 Hopkins number is slightly behind the passen-

ger gure of 705,611 in January 2020, just before the pandemic hit hard in the U.S.)

Bryant L. Francis, who oversees Hopkins from his position as director of port control for the city of Cleveland, said in a statement, “We are greatly encouraged by the ongoing strength of the Northeast Ohio air travel market. ere have been numerous air service announcements in recent months, some of which is currently operating with more to debut this spring, allowing for continued upward momentum."

Hopkins' current forecast is for 10.25 million passengers at the airport in 2024. If that forecast holds, Hopkins would top the 10 million mark for the rst time since 2019, when the airport served 10.04

million passengers.

Passenger tra c at the airport plunged to 4.12 million in 2020 as the pandemic struck, then recovered somewhat to 7.28 million in 2021, 8.69 million in 2022 and 9.87 million in 2023.

Service at the airport is getting a boost most prominently from Frontier Airlines, which earlier this month announced it was adding 10 additional nonstop destinations from Cleveland beginning in May.

Frontier’s 10 route additions bring the airline's total to 30 destinations at Hopkins. e airline's new Hopkins-located crew base, announced late last year and scheduled to open this month, is expected to bring more than 400 airport-related jobs and increased service to the city.

6 | CRAIN’S CLEVELAND BUSINESS | MARCH 4, 2024

Stan Bullard

Five years after its Independence location opened, Topgolf plans to add another venue in the area. | TOPGOLF

H

INTERNATIONAL AIRPORT

CLEVELAND

OPKINS

BUCKEYE RELIEF

Knowing Slavic Village’s history helps director plan for bright future

By Kim Palmer

Slavic Village, also known as “the old neighborhood behind Republic Steel where the fallout from the steel mills turns the laundry orange on the clothesline,” has been in the process of slow, intentional renewal for more than a decade.

Shauna Sanders took over as executive director of Slavic Village Development (SVD) — one of Cleveland’s most active and crucial Community Development Corporation — two months ago, and she is well aware a lot is riding on her shoulders.

Sanders took over from longtime SVD leader Chris Alvarado, who oversaw the community’s ambitious transition from a national foreclosure crisis data point to a model of sustainable legacy-community redevelopment.

It’s been a slow burn for Slavic Village, but over the last decade home values have nearly doubled. e pollution that discolored laundry on the line has been mitigated and Slavic Village is now certi ed as only one of nine communities in the world to receive EcoDistricts certi cation.

Besides the massive public/private remediation, renovation and demolition e orts, Slavic Village is now an epicenter of regional development with multimodal trails and public transit projects in the works.

“I think that Slavic Village is primed to be an area of priority in this city, a place where we can build on the rich history that is already here,” Sanders told Crain’s during an interview about where Slavic Village is going and how she plans to help it get there.

is interview has been edited.

that we had to do it. We are here right on the precipice of the steel industry and it is part of our history and our lineage and that means we have no choice but to do things, do development a little more wisely, more clean.

We have to remediate these things that have to happen here. We already have to work on cleaning up hazardous toxins at these industrial sites that have residential housing. Someone has to be the gatekeeper to a process and a standard and figure out a way for us to do it cleaner.

Slavic Village has a lot of 80- to 100-year old housing stock and a number of empty storefronts. Where do you put your focus?

in the right businesses? Does that involve ever saying no to some things?

We really are focusing on the viability of our major corridors, Broadway Avenue and Fleet Avenue. We already have great anchor organizations like the Third Federal Bank and MetroHealth Hospital and we want to capitalize on those relationships to help support small business development.

But we are looking at businesses not just to fill spots, but that are able to come in and help the community thrive. We are looking at business

sustainability, getting businesses in that are sustainable. Businesses that can meet where the economics are right now and support community partners who can promote thriving business development.

Under the last executive director, Slavic Village spearheaded a program using residents for community engagement. How has that worked out?

They have become an integral part of our community engagement and the front door to Slavic Village in the process. Accessing all of those neighborhoods and getting feedback, vetting feedback, and then working on programming was invaluable.

Now we are trying to figure out funding to keep that program going because it has been an invaluable way to engage residents. Our stewards were residents who have become our outreach arm and it is very effective. We even have stewards who have continued to do committee work with us.

Any last thoughts about the new job?

This staff, this team who have been working at Slavic Village Development, is beyond talented, beyond capable and very passionate about what they do. I’m pretty lucky to have them and I purposely keep my blinds all the way up and look out at the corner of Broadway Avenue because I want to remember what it once was, and that it will be much more in the future.

Running a CDC is considered one of the harder jobs in the city and you now lead one of the most active and necessary ones. How did you end up here and why take the job?

It’s been over 20 years that I’ve been in direct service. When I was at the Malachi Center in Ohio City, I developed a good relationship with CDC director Tom McNair, and that evolved into me sitting on a board. When this position became available, I sat down with the board in an interview, and I really liked the vibe. I already had a high opinion of SVD, already had a high opinion of (previous SVD executive director) Chris Alvarado and the work that he was doing. I really liked the board’s housing services, housing outreach and response.

annual budget, about half comes from sources other than the city, City Council or other neighborhood funding groups.

My board is very intentional about (that), and I’m blessed that I come behind a very good director. Chris Alvarado took care to build a balanced funding structure, a good funding mix. Not every CDC is that fortunate. I do think that CDCs need a responsive support mechanism. And I’m working to help do the buildout on whatever that looks like. I come from a background in social service and grant writing and I know you have to be intentional, not just about income, but even how cash flow comes in.

It is a chicken-or-the-egg dilemma. Do you work on housing to bring in residents that will drive the need for business? Do you work on businesses that may attract more residents? I found that it’s a balancing act, and it depends on what the assets are in each particular area.

There is so much vacant land here that it makes it appealing for new construction. One of the assets of Slavic Village is its accessibility to downtown, to hospitals, so we are working on getting more affordable housing—not just low-income, but affordable housing.

From Cleveland to Akron Our Guests are all VIPs

Book a group of 10 or more for discounted pricing, concierge service and exclusive experiences.

Residents expect a lot from their CDCs but for the nearly $2.4 million SVD

What motivated Slavic Village to pursue the lengthy EcoDistrict certi cation and tell me why it was important with everything else you have to do?

The very honest answer is

We want to build up mixedincome communities and housing stock that is appealing to employees of downtown businesses, hospitals and students. We also are using our projects as benchmarks for contractors. In Slavic Village, we try to stay true to the genre of the house, we try to do it with a green footprint, use energy-efficient appliances and do things like replace lead pipes.

Slavic Village has all these opportunities but is it important that you are intentional about bringing

MARCH 4, 2024 | CRAIN’S CLEVELAND BUSINESS | 7

Sanders

CONTRIBUTED

PERSONAL VIEW

Brown, Vance should ght IPO led by retailer Shein

Far be it from me to argue against the pursuit of a bargain, let alone the American Dream. But separating good buys from garbage (not to mention nightmares from dreams) requires a discerning eye, particularly when it comes to fashion.

One of my granddaughters, a senior fashion student at Kent State, possesses has an eye for both fashion and social issues. She can put together an ensemble of environmentally friendly recycled clothes from Goodwill that would be Red Carpet-worthy at the Oscars.

that Sens. Sherrod Brown, a Democrat, and JD Vance, a Republican, and their congressional colleagues should be urged to ght.

Brown, at least, has taken an important rst step. While not exclusively targeting Shein — his o ce declined to comment to an inquiry on the subject — Brown last year sponsored legislation to close a loophole allowing companies (like Shein) that depend on small-dollar transactions to evade taxes that others are forced to pay, giving them an unfair advantage over businesses in Ohio and across the country.

It is the appeal of such discount fashion triumphs that helps explain the popularity of Shein (pronounced SHE-in), a rapidly growing Chinese fast-fashion company gaining hold among American consumers who may have an eye for bargains but who are considerably less discerning about human rights.

Besides manufacturing “disposable” clothing destined soon to be thrown in the trash, the laundry list of allegations against Shein includes employing forced labor and using unsafe materials. Ohioans need to be especially on the lookout for products from this highly dubious company, as the mostly online retailer showed up live and in person with a pop-up store in Cincinnati last August.

Undaunted by issues and protests well documented by investigative news reporter Madeline Fening in Cincinnati’s independent arts and issues publication CityBeat, Shein last fall led for a U.S. IPO with the Securities & Exchange Commission. e move would give the retailer greater in uence in the American economy. It is a move

PERSONAL VIEW

While the political di erences of Ohio residents are unsurprisingly magni ed in this election year, there are still plenty of areas where we should nd common ground. Stopping overseas businesses from undercutting small manufacturers here at home is one of them. Another is preventing human rights abuses around the world. Happily, Brown’s legislation, the Import Security and Fairness Act, has bipartisan support. Joining him in introducing the legislation was Sen. Marco Rubio, a Florida Republican.

e legislation focuses on the de minimis rule, which allows packages valued at less than $800 to be exempted from U.S. import duties. Equally problematic, the packages are not as closely investigated as those worth more. As a result, bad actors overseas can use the loophole to smuggle illicit goods like fentanyl into the U.S., which threatens to exacerbate the deadly opioid epidemic that has gripped Ohio and other parts of the country. Regardless of one’s politics, such cross-border trade must be universally unwelcome.

Generation X needs some love

Generation X, born between 1965 and 1980, is often regarded as the “least-parented generation.”

Growing up, our parents guided us with phrases like “walk it o ,” “do it yourself,” or “ nd your own ride.” We cut the grass in our bare feet, rode our bikes to unfamiliar places and gured things out along the way. As a result of this hyper-independence, Generation X later became “helicopter parents” to their own children and began dismissing their own needs.

ees. Employees aged 18-34 found more growth opportunities at work (51%) compared with workers over 55 (30%). Additionally, younger workers felt they were paid more fairly and that their company cared about them, in contrast to Gen X employees, who scored much lower in both categories.

As Fening reported in Cincinnati’s CityBeat, although Shein currently is headquartered in Singapore, under its label more than a million di erent clothing and accessory products are made in third-party factories across China. Moreover, critics of Shein’s labor practices have alleged that the company has used Chinese forced labor in its supply chain, prompting a bipartisan group of 22 House members to sign a letter last May asking the SEC to investigate.

Shein also has been accused of using cotton from China’s Xinjiang region — where the Uyghur people have su ered “horri c abuses,” according to the U.S. Department of State. Imports of products from the Xinjiang region are banned under U.S. law, thanks in large part to Sen. Brown’s calls to

crack down on Chinese products made with forced labor.

Brown often has noted that he has spent his career ghting for “the dignity of work,” a take on the American Dream that demands hard work be properly rewarded — a concept that all Ohioans can support. Shein represents the antithesis of this dream: Its business practices undermine hardworking Americans and exploit oppressed minority groups.

Shein’s path to global prominence is littered with a history of alleged unethical business practices and human rights abuses that should concern all Ohioans, particularly as the company works to secure an IPO that would give it a foothold in the U.S. investor community.

As multigenerational workforces become the standard, understanding the behavior of di erent generations in the workplace has never been more important, and according to NFP’s U.S. 2024 Bene t Trend Report, Generation X needs some love.

Over the past 12 to 18 months, a revealing pattern emerged regarding compensation among Generation X and younger employ-

Despite the immense pressure that human resources professionals face every day trying to gure out how to do more with less, the Trend Report also illustrated that 58% of all employees are asking for increased access to mental tness programs and training in the workplace to handle the challenges of modern work. is malaise from older employees can impact productivity and presenteeism. If addressed early, it could be addressed with innovative programming speci cally tailored for Gen X employees that does not increase costs for the company.

Voluntary bene ts are certainly becoming

Interim Editor: Ann Dwyer (adwyer@crain.com)

Managing Editor: Marcus Gilmer (marcus.gilmer@crain.com)

Contact Crain’s: 216-522-1383

Read Crain’s online: crainscleveland.com

more innovative, yet less than half of employers o er them. ese solutions go beyond critical illness and accident and now include caregiving resources, grandparent leave programs and long-term care insurance. Currently, only 4% of Americans 50 or older pay for long-term care insurance, which is a staggering statistic when you consider that 70% of Americans will need critical services before they die. Long-term care insurance is usually purchased between 55 and 65, but it can be challenging to nd individual policies since many high-pro le carriers like UNUM, MetLife and Guardian have decided to leave the long-term care market because the payouts are just too high and climbing.

According to the American Association for Long-Term Care Insurance, insurers paid $13.25 billion to cover 345,000 long-term claims in 2022. Moreover, the median annual cost for nursing home care in a private room is approximately $100,000, and full-time home care can exceed $170,000 per year. Providing a long-term care insurance o ering at work is a home run and could potentially make Gen X employees feel more cared for at the o ce.

Deferred compensation programs o er

another way to build stewardship for Gen X employees at little or no cost to the company. If older employees are maxing out their 401(k) contributions and worrying about their looming retirement, employers can create a non-quali ed deferred compensation plan (NQDC).

An NQDC is in addition to a 401(k) plan and allows employees to defer a portion of their compensation and taxes until a mutually agreed upon later date. e downside is that the employee is required to stay at the company and probably does not have a choice in selecting the investment vehicle and could be limited to company stock. e upside is that Gen X employees will be able to save more, and the program can be used as a retention and recruiting tool.

Ultimately, a high-functioning employer should recognize how each generation excels at work and keep providing new and creative bene ts solutions. In turn, grumpy employees might cheer up and productivity will improve. So, if you work closely with a Gen Xer, give them a smile today—they deserve it since they probably raised themselves and lived to tell about it.

8 | CRAIN’S CLEVELAND BUSINESS | MARCH 4, 2024

Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited. Send letters to Crain’s Cleveland Business, 700 West St. Clair Ave., Suite 310, Cleveland, OH 44113, or by emailing ClevEdit@crain.com. Please include your complete name and city from which you are writing, and a telephone number for fact-checking purposes. Sound off: Send a Personal View for the opinion page to ClevEdit@crain.com. Please include a telephone number for veri cation purposes.

Richard Osborne is a retired journalist living in Avon.

Kate Hubben is an insurance adviser with NFP.

A Forever 21 store hosting a Shein pop-up in Times Square in New York on Nov. 10, 2023. Shein is touting its hopes for a valuation of as much as $90 billion as it lays the groundwork for an eventual U.S. initial public offering, a level that far exceeds how the fast-fashion giant is valued in private trades. YUKI IWAMURA/BLOOMBERG

Region’s industrial real estate market stabilizes after boom

Mike Petrigan, a rst vice president and industrial expert at CBRE’s Cleveland o ce, wishes more new, speculative industrial property were available in the region.

“We really don’t have much inventory out there,” Petrigan said.

“ e market is still very strong.

e tenants are out there.”

e observation is striking as developers completed four large, speculative buildings last year in Northeast Ohio, and they have some big spaces to ll. But looking beyond them, the outlook for new starts is diminishing because of headwinds from higher interest rates and other factors.

Such is the situation as the vacancy rate in industrial real estate remains low.

with lots of parking,” Kijewski said. “But you can’t think of one prospective location for that tenant.”

A 50,000-square-foot tenant is not considered a prospect for big, recent buildings because realty developers with 1 million or half-million-square-foot buildings prefer not to divide the structures up that much, casting for larger tenants, often from outside the market.

In contrast to a few years ago, when more deals were for e-commerce concerns, more manufacturers are taking space.

e most striking example of that is the $200 million building for Viega LLC, the U.S. arm of a German manufacturer. Construction started last month on a 180,000-square-foot building on 80 acres at Turnpike Commerce Center in Shalersville, near to the just- nished millionsquare-foot building, for Viega to

“Projects nished last year were started in 2021 and 2022. But since then, overall economics, such as higher interest rates and other factors, (have) slowed new development.”

David Stecker, a JLL managing director

CBRE reports Northeast Ohio industrial vacancy ticked up to 3.1% as of the end of 2023 from 2.8% at the end of 2022. e slight increase is due to buildings such as a 1 million-square-foot industrial building in Shalersville, and one half that size in West eld Township, being nished but not yet leased or occupied.

In other words, using JLL Inc.’s Cleveland report, 4.57 million square feet of new industrial space was completed in 2023, and 2.98 million square feet of space was absorbed in the market.

“ e market is going to continue to tighten,” said David Stecker, a JLL managing director. “Projects nished last year were started in 2021 and 2022. But since then, overall economics, such as higher interest rates and other factors, (have) slowed new development. We’re a bit of a unicorn. We just don’t have the pipeline of larger markets.”

Prospects for huge empty spaces tend to be from out of town, he said.

Eliot Kijewski, a principal of Cushman & Wake eld Cresco of Independence, said for Northeast Ohio companies looking for space, “It’s just case of status quo. If an existing building becomes available, it gets absorbed. ere’s simply not enough inventory. And when good buildings are available, there are multiple bidders for them.”

e consternation is widespread.

“You see email blasts going out to the brokerage community about a user wanting 50,000 square feet of industrial space

make plumbing parts. When the new plant opens in 2025, it will hire 70 workers to provide more of the rm’s press-on plumbing ttings to customers in the region and the East Coast.

Likewise, PipingRock Health Products, a Bohemia, New Yorkbased vitamin maker, in late 2023 bought an empty building on Mondial Parkway in Streetsboro for $10 million that will provide more manufacturing and warehouse space. e added building will supplement its existing Aurora operations.

Additionally, the latest building by Ray Fogg Corporate Properties at Seasons Business Park in Stow was leased by Haydon Corp., a Fort Wayne, New Jersey, building products maker. Haydon plans initially to use the 254,000-squarefoot building for distribution and add manufacturing later.

“We’re nding more advanced manufacturers beginning to look at high-ceiling space originally built for warehousing,” Stecker said. e buildings can provide substantial power for such concerns, he said, but companies often are demanding even more.

In the meantime, lease rents are climbing as landlords bene t from strong demand and have to cope with increasing construction and operating costs due to in ation.

CBRE reports the average industrial leasing rate inched up to $5.91 a square foot at the end of 2023 from $5.52 a square foot at the end of 2022.

e good news, Petrigan said, is that Northeast Ohio rents are not climbing as much as they are in other markets.

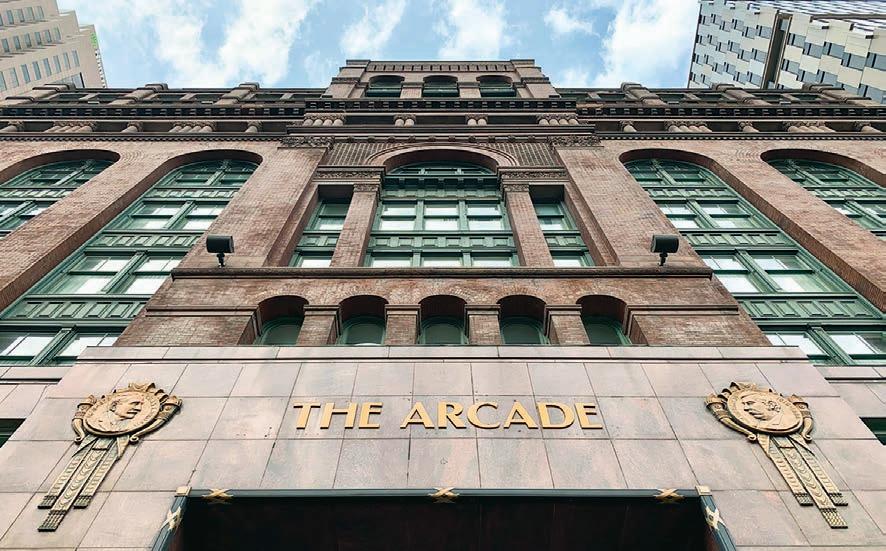

Canadian owner struggling to sell Renaissance, Hyatt hotels

Stan Bullard

Skyline Investments Inc.

(SKLN: TSX), the Toronto-based owner of the Renaissance Cleveland and Hyatt Regency Cleveland hotels, reported it did not consummate a sale of the properties by late 2023 as it expected.

Negotiations with the potential buyer “have not matured into a binding agreement as contemplated,” the company said in a Feb. 16 ling with the Toronto Stock Exchange.

However, talks with the prospective buyer are still ongoing, the Canadian hotel and resort owner said.

More is involved than the sale of the Cleveland properties, however.

Skyline also is negotiating with the same prospective buyer to buy its nine Courtyard hotels in

the U.S. e company said it may now try to sell the inns individually as well as in portfolios.

A previously announced deal for the Cleveland hotels came a cropper in early 2022 when VM Acquisitions of Toronto dropped plans for an IPO to buy them on the Toronto exchange because of “capital markets volatility.”

Skyline has been trying to sell the properties since 2018. at was a much sweeter hotel market and interest-rate environment than the current one. e sale effort has continued even though the company has gone through a change of management, bought a portfolio of Courtyard Hotels in the U.S., and now hopes to sell them.

e report on the tough-toclose deal comes as Skyline, which owns half the Renaissance with an unknown silent investor,

completes a multimillion-dollar updating of the 491-room hotel on Public Square. e property dates from 1918.

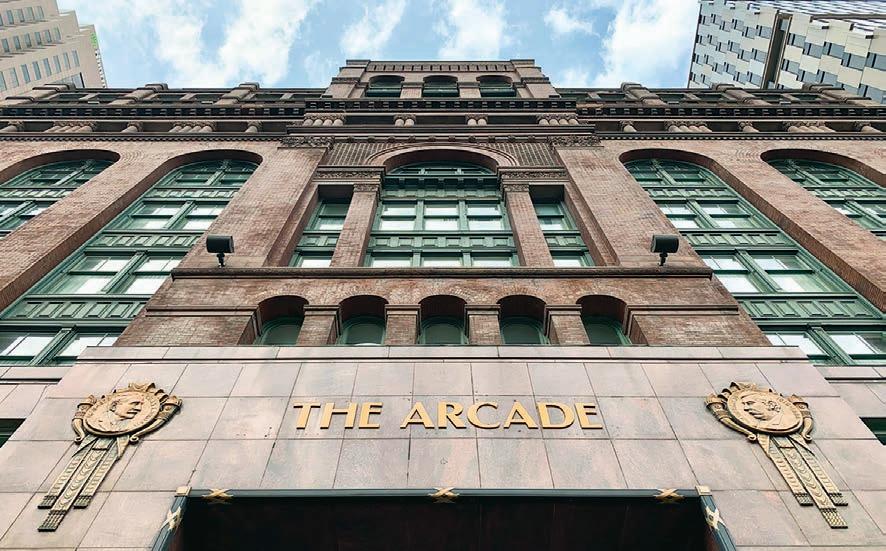

e landmark Arcade was converted to a 293-room Hyatt in 2001. Skyline bought it in 2012 at a sheri ’s sale.

Improved lodging conditions, with multiple big events downtown this year, may also help the Cleveland properties get more looks from potential investors.

Neha Kapelus, Skyline’s vice president of nance, said in a phone interview that she was unable to comment on the deal.

Blake Lyon, Skyline CEO, did not reply to an email by Crain’s Cleveland Business or return a phone message by presstime.

CoStar, the online realty data service, broke the story on the setbacks on Wednesday, Feb. 21.

10 | CRAIN’S CLEVELAND BUSINESS | MARCH 4, 2024

Stan Bullard

FILE

Skyline Investments Inc., the Toronto-based owner of the Renaissance Cleveland (top) and Hyatt Regency Cleveland (above) hotels, reported it did not consummate a sale of the properties by late 2023 as it expected. | CRAIN’S CLEVELAND BUSINESS

PHOTOS

Ark Transportation, Oswald land tax credits to spur growth

By Stan Bullard

Cuyahoga County stands to gain 191 new jobs and retain 356 existing ones under state aid approved Monday, Feb. 26, by the Ohio Tax Credit Authority.

Ark Transportation, a logistics and transportation company, and two other rms will add 103 new jobs as they relocate 36 workers to the former Darice Corp. headquarters in Strongsville from other locations.

Oswald Cos. plans to add 88 new jobs after it moves its 320 sta ers to the former E&Y Tower downtown, to be called Oswald Tower. e insurance brokerage and risk management rm is exiting the lender-owned building at 1100 Superior Ave. with the move.

Andrew Hurst, CEO of family-owned Ark, said in a news release issued by JobsOhio and Team NEO, “From the beginning, Ark Transportation has been in Northeast Ohio, and we value the business opportunities and prime location for regional, national and international shipping and logistics. As our business continues to grow, we are grateful to Team NEO, JobsOhio and the City of Strongsville for their support as we make Strongsville our new global headquarters.”

Ark has already started moving to 13000 Darice Parkway, which has

been dark since 2017. at was when the o ce and warehouse were closed by Michaels, the craft store chain that bought Darice, a wholesale craft company, and the well-known local Pat Catan’s concerns, which became Michaels locations.

Two other companies also are moving with Ark to occupy the 383,000-square-foot o ce and warehouse building in Strongsville. e state identi ed them as Veroot LLC, a Middleburg Heights company that manages software, and Delivered Inc., which performs warehousing and packaging for end-to-end delivery. e number of jobs for each rm was not

disclosed by the state.

Strongsville Mayor omas Perciak said in the release that the relocation of the company to Strongsville will provide more job opportunities for area residents.

Brent Painter, Strongsville economic development director, said when Ark and the other companies, which share related ownerships, move in, they will ll the largest vacancy in the suburb’s industrial district.

“We have less than 2% vacancy,” Painter said.

A release from Gov. Mike DeWine’s o ce said the Darice Parkway consolidated o ces and warehouse will produce a payroll of

$8.8 million annually. e trio of companies received an eight-year, 1.767% Job Creation Tax Credit for the project.

Oswald staying downtown

Oswald will occupy about 100,000 square feet in the o ce tower at 950 Main Ave. that prior anchor and namesake E&Y vacated last year to move to North Point Tower and better align its space with its post-pandemic workstyle.

Robert Klonk, chairman and CEO of Oswald, said in the release that the company appreciated the help that JobsOhio, Team NEO and state and local government

provided to the rm as it sought to remain in downtown Cleveland, its home for 131 years.

Klonk said the company plans to use the move to create a “cutting edge, progressive environment,” for the company and its sta to continue growing.

Bill Koehler, Team NEO CEO, said he’s glad the state incentives will keep Oswald here and helped it rule out expanding elsewhere.

Cleveland Mayor Justin Bibb said in the release, “We are delighted they are not only staying right here in downtown Cleveland but also adding more than 80 new job opportunities to our economy. I appreciate the hard work and partnership of everyone involved in this project.”

Oswald is part of Unison Risk Advisors Inc., a leading independent risk management, insurance and employee bene ts rm established in 2020 through the strategic merger of Oswald Companies and RCM&D of Baltimore. e combined rm has a workforce of more than 900 employee-owners in 19 o ce locations throughout the Mid-Atlantic, Midwest and Southeast.

Oswald staying downtown preserves a $10.9 million annual payroll for the city of Cleveland. e state approved a nine-year, 2.21% Job Creation Tax Credit for its project.

MARCH 4, 2024 | CRAIN’S CLEVELAND BUSINESS | 11 Cr ain s Cl evel and.co m/ CareerCenter Connecting Talent with Opportunity. From top talent to top employers, Crain’s Career Center is the next step in your h iri ng proc es s or job search. Ge t started today

Ark Transportation Ltd., a logistics and transportation company, is moving to 13000 Darice Parkway in Strongsville. COSTAR

Master Products’ new owner is close to company’s heart

CFO buys longtime stamping company in Slavic Village

By Dan Shingler Scott Suttell

Master Products, a longtime stamping company in Cleveland’s Slavic Village neighborhood, has been purchased by its CFO, said both its former and new owners.

e new owner is Tim Rankin, who has been the company’s fractional CFO for the past six years and friends with former owner and current president and CEO Je Walters for about 10 years longer.

Walters said he and Rankin spent about a year negotiating a potential sale with another company, but ultimately never came to terms. After considering selling to a private equity buyer, Walters wasn’t convinced that would be the best thing for the company or its 37 employees, some of whom have been with him for decades, going forward.

Walters said he’d seen too many of his friends in manufacturing sell to private equity and regret it later, when buyers cut sta or did other things to dress the company up for its next sale, but that would not ensure long-term success.

“ ey went through a lot of trauma because of private equity owners,” Walters said of peers he has talked to over the years.

Rankin said he stepped up because he knew the company as no outsider could, realized its value and shared Walters’ desire to not

only make money but take care of their employees as well.

“Je told me he wasn’t looking to get the last dollar out of the business, but intended to take care of his people,” Rankin said.

& Co., Je Firestone, to execute a leveraged buyout of Walters’ stock.

e company is sound and profitable, Rankin said, with sales of approximately $10 million last year that he hopes to exceed this year.

“Jeff told me he wasn’t looking to get the last dollar out of the business, but intended to take care of his people.”

Tim Rankin

Rankin is a partner with the Westlake accounting rm McManamon & Co. He said he put together an investor group that included his partner at McManamon

Board of Ohio Bureau of Workers’ Compensation approves 7% rate cut

The reduction for private employers follows a similar move for public entities

Ohio’s private employers will get some more relief this summer on their workers’ compensation premiums.

e Ohio Bureau of Workers’ Compensation board on Friday, Feb. 23, approved a 7% rate reduction for private employers that will take e ect July 1, which is the start of the state’s 2025 scal year.

BWC estimates that private employers in the state will pay nearly $67 million less in premiums next scal year as a result of the rate cut.

e coming rate cut for private employers follows a 3.9% reduction for public employers — counties, cities, schools and other public entities — that went into e ect Jan. 1.

Gov. Mike DeWine said in a

statement that the upcoming rate reduction “is a result of employers’ dedication to workplace safety and Ohio’s strong economic position.”

In February 2023, the BWC board reduced premium rates for private employers by an average of 8%.

Since then, there has been only one year in which rates rose for private employers: 2017, when the average increase was 1.9%.

Since 2011, average rates for private employers have fallen by 68%, according to BWC data.

BWC noted, as it always does when there’s a rate reduction, that the 7% cut represents a statewide average. Actual premium change for an individual employer “will di er based on multiple factors, including employer type or classi cation, payroll levels, recent claims history, and their participation in various BWC programs,” the bureau said.

Steve Stivers, president and CEO of the Ohio Chamber of

Rankin and Walters declined to say what price the private company sold for.

Walters said his two big end markets, transportation and durable goods, are both holding up well, with durable goods showing good growth recently. e transportation market entails selling to a lot of OEM customers that make cars, trucks

and heavy equipment, while durable goods sales go through distributors to all sorts of manufacturing and infrastructure applications.

Walters said a new product Masters is making, a washer that indicates when a bolt has been torqued correctly, also shows it was installed properly with visible orange markings that only appear when things are properly tightened.

e washers allow inspectors to quickly examine structures, such as bridges, to ensure that all fasteners are secured and are in demand with the increase in infrastructure spending in the U.S. and abroad, Walters said.

Rankin becomes the compa -

ny’s controlling owner in the sale. Walters’ son, Ben Walters, will remain with the company as plant manager. His son loves working in manufacturing and in the plant, but didn’t want to become a majority owner or CEO, Walters said. Ben also owns a stake in the business, though, Rankin said.

The company recently expanded its capabilities, adding equipment to thread special bolts made for Honda vehicles, for example. It used to outsource that work, but when its supplier went out of business Master Products purchased the equipment to do the work itself.

“It’s dramatically improved pro tability,” Rankin said, “and we can tap other things now too.” ere’s room to grow further as well. e company has most of its operations in its original, 60,000-square-foot plant, but also owns an adjacent building with another roughly 50,000 square feet that is now used for packaging and other non-stamping operations, Walters said.

Rankin said he plans to invest further in the company and is already shopping for another 200ton press to add to the plant. He also said neither the company nor its employees, are going anywhere as a result of the sale.

As for Walters, he’s not going anywhere either, at least for now.

“I’m the largest shareholder. Je is still serving as president and has a contract to do that, at his option,” Rankin said. “We o ered him ve years, minimum, to stay on as president and CEO.”

“By prioritizing safety in the workplace, business owners are shrinking their own operating costs and helping employees return home safely each day.”

Steve Stivers, president and CEO of the Ohio Chamber of Commerce, in a statement

Commerce, issued a statement praising BWC and state government for its management of the workers’ compensation system, and employers for their e orts to maintain safe workplaces.

“By prioritizing safety in the workplace, business owners are shrinking their own operating costs and helping employees return home safely each day,” Stivers said. “We applaud Gov.

DeWine, (BWC) Administrator John Logue and the BWC board of directors for their prudent management of employer premiums and for helping improve Ohio’s business climate.”

12 | CRAIN’S CLEVELAND BUSINESS | MARCH 4, 2024

Master Products’ new owner, Tim Rankin (left), with former owner and longtime friend Jeff Walters at the company’s plant. | DAN SHINGLER

BLOOMBERG

Recognize a woman demonstrating exceptional commitment and making a difference in Northeast Ohio.

rough a merger, two Cleveland-based nonpro ts hope to become one wide-ranging resource that provides access to critical medical services and resources for underserved patients.

Medworks and MedWish International, a pair of nonprofits that work in the health care space, plan to combine their operations. The organizations’ boards approved an intent to merge letter last month. They hope to finalize the deal by June.

“We feel that we, through this merger, will be able to provide patients with the opportunity to have a one-stop shop where they will be able to have free health services through our clinics, navigation services for insurance and social safety net opportunities and also supplies,” said Britta Latz, executive director of MedWish International, who will serve as the combined organization’s CEO.

e merged nonpro t will have about 23 employees, Latz said, and there are no plans to reduce headcount. Its name has not been nalized.

e organizations have had close ties for years. MedWish International was founded in 1993 by Dr. Lee Ponsky. It partners with health care facilities, hospitals and manufacturers to divert viable medical supplies from land lls and distribute them as humanitarian aid across the globe.

Medworks, meanwhile, was founded Ponsky’s brother, Zac Ponsky, after a group of volunteers went with MedWish on an international trip to facilitate a free health clinic for individuals in need. e trip sparked conversations about the tremendous need in Cleveland for access to medical care, Latz said. e group o ers free health clinics

to merge

and insurance navigation and connects patients with social safety-net services in underserved communities in Northeast Ohio.

“At that time, MedWish did not have a local component,” Latz said. “We were only shipping internationally. . . .In 2018, MedWish started to distribute supplies locally and, in the last couple of years, that has really taken o .”

Today, MedWish works with more than 250 domestic partners to distribute supplies. As the organization’s work grew locally, it opened up more opportunities to partner with Medworks, Latz said.

“We’ve spent time over the last year being really intentional with some di erent ways that we could look at partnerships, how we can better support each other, and it really became clear that together we can make such a bigger impact and more e ciently support those that we’re working to be able to serve,” she said.

Since 2009, Medworks has treated more than 28,000 patients and delivered 43,400 health services. MedWish has shipped aid to 115 countries and diverted nine million pounds of medical surplus from local landlls since it was founded. e organization estimates its work touched 62,000 lives domestically last year.

e move will allow the volunteer-driven organizations to engage volunteers on both sides of the work, from sorting medical supplies and preparing them for distribution to working in health clinics, Latz said.

“For our partners, we’re really excited to be able to bring everybody under one house,” she said. “We are organizations that have really incredible networks of partners that support and engage with our mission and combined we’re really going to be able to bring those together.”

Warrensville Heights group leads effort for life-saving treatment

Network works to increase cord blood transplantation to help treat cancer

Paige Bennett

Umbilical cord blood, often discarded as medical waste, could provide life-saving treatment to certain patient populations. And a Warrensville Heights-based cord blood center is leading an e ort to advance cord blood transplantation and inform best practices across the country.

Cleveland Cord Blood Center is serving as the scal sponsor of the newly formed National Cord Blood Network, a group designed to increase cord blood transplantation for patients with hematologic malignancies (leukemia, lymphoma and myeloma) at transplant centers in the U.S.