Some cities see pushback on stadium funding

As pro sports teams seek larger subsidies, voters and politicians say there’s no bene t for taxpayers

By Joe Scalzo

Soon after the Chicago Bears unveiled plans for a new $3.2 million domed stadium on the lakefront last month — one that included $900 million in bonds from the Illinois Sports Facilities Authority — Illinois Gov. J.B. Pritzker grabbed a large cup, dipped it into Lake Michigan and threw it all over the Bears’ proposal.

“As the governor has said, the current proposal is a non-starter for the state,” Pritzker’s press secretary, Alex Gough, said in a written statement following a May 1 meeting between the team and Pritzker’s top sta ers. “In order to subsidize a brand new stadium for a privately owned sports team, the governor would need to see a demonstrable and tangible bene t for the taxpayers of Illinois.”

Pritzker isn’t alone. With many professional sports teams seeking public funding for new or renovated stadiums, voters and politicians in cities such as Kansas City, Washington, D.C., Phoenix and, yes, Chicago are pushing back.

Here are three recent examples:

◗ In March, plans for a $2 billion development project in Alexandria, Virginia, fell apart thanks to opposition from state senators, with Democrat L. Louise Lucas saying it would be a giveaway to a billionaire and could jeopardize the state’s nances, per Forbes. at project, which included a new arena for the NBA’s Washington Wizards and NHL’s Washington Capitals, would have cost taxpayers in Virginia $1.5 billion.

See STADIUM on Page 15

Tech entrepreneur turns to energy-ef cient homes

Hyland founder building houses aimed at balancing conservation, livability

By Stan Bullard

Homebuilders get into the business from many routes, from framing to banking to growing up as the child of a builder. Add to that mix Packy Hyland, the serial entrepreneur best known as the founder and rst CEO of Hyland Software of Westlake, which he exited a decade ago. However, don't expect Hyland and son Dan, his business partner in PadSmart of Westlake, to immediately build you an energy-positive house powered by solar energy.

ey dissuade at least a person a week who nds them on the PadSmart website from moving ahead. In a year or two at the earliest, maybe. And don't look for it to be the type of custom home that draws applause from HGTV devotees. Instead, it is a standard design built to balance energy conservation and livability.

e Hylands are taking this venture one measured step at a time. In 2021, they constructed a two-bedroom, two-bath home on Columbia Road in Olmsted Falls as a test case. It's occupied by Packy Hyland’s daughter and her family.

See HOMES on Page 18

ON THE BRINK

Any unexpected expense — a medical bill, a car repair, a driver’s license suspension — can lead to long-lasting devastation for the working poor. PAGE 10

VOL. 45, NO. 19 l COPYRIGHT 2024 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAINSCLEVELAND.COM I MAY 13, 2024 KEN BLAZE

With hundreds of new and pre- owned vehicles, it’s like an auto show everyday at Classic. Great selection and our best deals everyday. Guaranteed. Lexus. BMW. Genesis. Cadillac. The choice is all yours at drive .com.

2551 Som Center Rd • Willoughby Hills, OH 44094 (866) 651-0427 8494 TYLER BLVD., MENTOR, OH 44060 (866)-664-2501 2571 Som Center Rd, Willoughby Hills, OH 44094 (440) 585-9990 8470 TYLER BLVD, MENTOR, OH 44060 (866) 631-7774

GENESIS

Cleveland Charge are catching the attention of fans — and the NBA

By Joe Scalzo

e Cleveland Charge keep putting more butts in the seats at the Wolstein Center — and it’s causing the NBA to sit up and take notice.

e Cavaliers’ G-League team averaged 3,383 fans per game this season, which was not only about 500 more fans per game than last season but also more than the team averaged at any point during its decade in Canton (2011-21).

Among G-League teams, they nished in the top 10 in attendance, sellouts and ticket revenue, and in the top 15 in sponsorship revenue.

More importantly, they nished ahead of every other in-market G-League team (i.e. teams that are located in the same city as their NBA parent club) in multiple business metrics, according to Charge senior vice president and chief operating o cer Rocco Maragas.

“In our third year, we were able to activate some things that I didn’t think we’d get to until Year 4 — and some people didn’t think we’d ever get to,” Maragas said. “We’ve been able to get to a point where this is a viable business that we might be able to see sustained for a very long time.” at success has impressed the NBA, which approached the Charge in February of 2023 about serving as a model for other in-market G-League teams. Including the Charge, there are nine G-League teams that either play at an NBA arena or within 15 minutes of the parent team.

“ e NBA came to us and said, ‘We’re noticing what’s going on,’” Maragas said. “ ere’s a collection of (in-market) teams that haven’t really been able to pack the house regularly.

“So the NBA came to us and said they want to use us as a model in Cleveland because of how

well we’ve been able to do, business-wise, in the same market as our parent team.”

Although the Wolstein Center has a listed capacity of 8,500, the Charge condense it to about 4,500 seats to create a more intimate atmosphere for their fans. ( ey occasionally expand the capacity for bigger games, which is why they were able to draw more than 5,500 fans for three dates this season.) Like all minor league teams, the Charge lean heavily on the fan experience, using proximity to the players, along with promotions and giveaways, to draw fans who would otherwise spend their evenings elsewhere.

“We want to give them something better than if they went out to eat or went to a movie,” he said.

It helps that the Charge are part of the Rock Entertainment Group, the umbrella entity of Dan Gilbert’s sports and entertainment properties. REG also oversees the Cavaliers and the Cleveland Monsters — and having all three under the same roof gives the Charge some resources that other G-League teams don’t have, Maragas said.

“ ey’re trying to pack the (Rocket Mortgage) FieldHouse regardless of performance and we take that same mindset,” he said. “We’re not dependent on what’s on the oor. We’re trying to nd the best promotions, the best ways to get people involved. We wanna have fun and we want people to say, ‘ at was a really cool experience and, oh by the way, there was also basketball.’ Because there are a lot of times in the G-League where we barely have enough guys to eld a team because we’re helping the Cavs, which is the point of the league. We want people to have a good time whether the team wins or not.”

Cleveland State University (CSU) wants to eventually de-

molish the Wolstein Center and replace it with a new arena on Payne Avenue at the northeastern edge of campus but that project has stalled a bit as CSU deals with more pressing nancial issues.

In December, REG teamed with the Oak View Group, Geis Companies and the Landes Group on a joint proposal. ose organizations were invited to with the Euclid Avenue Development Corp. (EADC) and CSU in December. As of January, EADC and CSU were evaluating the proposal to present it to the CSU board of trustees.

CSU has not given an update on the project since then — and Maragas doesn’t have one, either.

“I know it’s been talked about and that the Charge have been mentioned and REG’s been mentioned and it’s always nice that we’re a part of things,” he said. “But I have to say that, having been with the Charge for 10 years, we’ve been part of a couple di erent projects in the past and I try not to get too emotionally attached to them. We’ve got a great situation, we’ve got great support and if something happens there, great. We’d love to be a part of it.”

Maragas admitted he gets asked about the Wolstein Center “at least three times a week,” but as a Canton native, he often gets another question: Would the Charge ever return to his home city?

“Never say never, but it is working for now,” Maragas said of staying in Cleveland. “I don’t think the basketball side will ever let us move. It does make a lot of sense on the business side for us to be elsewhere, but it’s been so wonderful to be closer on the basketball side. We’ve picked up pieces and we’re able to nd a way to make that puzzle work and really glue it together the right way.”

MAY 13, 2024 | CRAIN’S CLEVELAND BUSINESS | 3 CRAIN’S PARTNER PROMOTE AND PUBLICIZE YOUR INDUSTRY EVENT NEWS INCREASE ATTENDANCE AT YOUR WORK EVENTS Networking / Educational Events / Seminars / Conferences Fundraisers / Galas / Events of Interest to the Business Community Submit an event to Debora Stein at dstein@crain.com We align with your goals Contact Us Today Bethany Bryant Regional Director, Cleveland 216-378-2900 Bethany.Bryant@glenmede.com

Sophisticated, personalized solutions for your lifestyle, legacy and philanthropic goals.

www.glenmede.com

Fans line up outside the Wolstein Center before a Cleveland Charge game. | CONTRIBUTED

CIFF names nonpro t veteran as its next executive director

By Scott Suttell

A new era for the Cleveland International Film Festival will start in June when new Executive Director Hermione Malone takes over for the organization’s longtime leader, Marcie Goodman.

CIFF on May 6, announced the appointment of Malone as executive director, e ective June 10. e festival called Malone “a seasoned and accomplished leader” who “brings a wealth of experience in nonpro t management, entrepreneur support and organizational transformation” to the role.

She succeeds Goodman, who in August 2023 announced she would step down after the 2024 festival, which took place in April.

e just-ended festival was Goodman’s 23rd as executive director.

Chris Blake, president of CIFF’s board of trustees, said the organization used a search consultant to “cast a national net” for a process that led to Malone’s hiring. She will be CIFF’s fourth executive director since its founding in 1977.

“Ultimately, our search committee’s work became easy as we realized that Hermione was the clear choice to lead CIFF as we head into our fth decade of bringing the best lms from around the world to Cleveland,” Blake said.

CIFF said Malone “brings more than 15 years of experience in strategic development, program design and implementation, innovation, and collaboration to the role.”

Malone is originally from Detroit but is no stranger to Cleveland, where she lived for 13 years before moving to New Orleans in 2016. In Cleveland, CIFF said, Malone held leadership positions at Cleveland Clinic and University Hospitals, and she served on boards and committees including the Cleveland (OH) Chapter of e Links Inc.; ICA Art Conservation; Susan G. Komen For the Cure Northeast Ohio A liate; Women in Sports and Events; and the Junior League of Cleveland, where she served two years as president and 11 years as a member.

In a statement, Malone said she has long considered CIFF “one of the best things about living in Cleveland. So I am thrilled to return to the city to lead CIFF at this transformative time as the festival reimagines ways to attract new audiences and deepen its community partnerships.”

At the end of June, shortly after Malone starts as executive director, CIFF will have a new board chair, Joe Marinucci.

Goodman as well as Patrick Shepherd, its longtime associate director, who is taking on a new job as director of membership services and engagement for the Greater Sandusky Partnership. Goodman said in a statement that the transition for Malone is eased by “a dedicated board of directors, an extraordinary sta , generations of devoted volunteers, a group of corporate and philanthropic funders who go above and beyond time after time, a passionate assembly of members and attendees, and the most supportive community any leader could ever hope for.”

He said Malone “has been an innovative leader in the nonpro t space both in and outside of Cleveland.”

It’s a time of transition for CIFF, which sees the departure of

Most recently, she was head of emerging markets at the American Journalism Project, where she “built and led philanthropic partnerships to close local news gaps across the U.S.,” CIFF said.

CIFF recently landed (as it has multiple times) on MovieMaker Magazine’s 2024 list of 50 Film Festivals Worth the Entry Fee. e publication said CIFF “is known for programming lms that both challenge and delight audiences, who pack the glittering, historic Playhouse Square.” It said CIFF organizers “are known for professionalism and generous hospitality, o ering airfare and lodging to guest feature lmmakers, as well as the opportunity to share in one of the largest festival prize packages — it totals more than $130,000, across 34 awards.”

Next year’s festival will take place March 26-April 5, 2025, at Playhouse Square. Submissions for CIFF49 will open in mid-summer 2024.

Cleveland Clinic announces new president of Northeast Ohio Market

By Paige Bennett

A new president will take the reins of Cleveland Clinic’s Northeast Ohio Market this summer.

Dr. Jorge Guzman, the current CEO of Cleveland Clinic Abu Dhabi, will return to the U.S. and begin his new role as president of the Northeast Ohio Market on July 1.

Dr. Guzman is succeeding Dr. Donald Malone Jr., who will become a senior adviser for capital, space and strategy and continue clinical practice, according to a news release issued Tuesday, May 7, by the Clinic.

Meanwhile, Dr. Georges-Pascal Haber has been appointed the new CEO of Cleveland Clinic Abu Dhabi e ective June 1. Guzman, who joined the Clinic in 2007, has been CEO of Cleveland Clinic Abu Dhabi since 2021. He previously served as vice president of regional hospital medical operations at the Clinic’s main campus. He was also director of the medical intensive care unit and chair of ICU operations, coordinating the standards of critical care services and leading the development of the ICU telemedicine program, the Clinic says.

In his new post, Guzman will oversee leadership for the main campus and all Ohio regional hospitals, family health centers, ambulatory sites and pharmacy. He and Haber will report to President and CEO Dr. Tom Mihaljevic. Malone has been with the health system for 35 years, holding various leadership positions, such as chair of the Department of Psychiatry and Psychology and president of Lutheran Hospital. At Cleveland Clinic Abu Dhabi, Haber will lead more than 5,300 caregivers. He has worked for the health system for almost 20 years and served as chair of the Glickman Urological Institute, enterprise chair of urology and professor of surgery.

4 | CRAIN’S CLEVELAND BUSINESS | MAY 13, 2024 FlySkyQuest.com 216-362-9904 Charter@flyskyquest.com On-Demand Charter Jet Club Memberships Aircraft Ownership Opportunities How to Fly with Sky Quest: Private Travel Made Easy! 7 CLEVELAND INDUSTRIAL BUILDINGS AVAILABLE FOR LEASE 216.861.5686 ChrisHondlik@HannaCRE.com 216.839.2032 MikeBerland@HannaCRE.com Chris HondlikMike Berland Address SFCeiling Ht 4001 Hamilton Ave57,00028’-30’ 4519 Hamilton Ave87,94814’-30’ 6515 Juniata Ave47,00016’-36’ *900 East 69th St140,00023’-32’ 17009 Roseland Ave93,00016’-24’ 17100 Olympia Rd21,40020’-28’ 12911 Taft Ave 57,60013’-20’ 21,400-140,000 SF *Income producing tenant in half the facility CALL FOR PRICING BLOOM WITH A LOAN FROM CBS! CONTACT JONATHAN A. MOKRI 440.526.8700 • jmokri@cbscuso.com www.cbscuso.com Personalized Service Loans up to $30 Million • No Prepayment Penalties Investment & Owner-Occupied Commercial Real Estate Straight Talk. Smart Deals.® In compliance with applicable State and Federal Regulations, this is an advertisement for commercial loans, and does not offer any specific terms or conditions, and does not constitute a commitment to lend. Cooperative Business Services, LLC (“CBS”) is a credit union servicing organization, and is not a lender. Commercial loans discussed in this advertisement, if any, are subject to underwriting by CBS, satisfactory legal documentation, regulatory compliance, approval from the lead lender, and approval from all participant lenders, as applicable. *Term and condition apply. CALL TODAY Providing Commercial Real Estate Loans Throughout Northeast Ohio and 15 Other States

Guzman Malone

A crowd turns out for the opening night lm of the 43rd Cleveland International Film Festival at the festival’s home of Playhouse Square. TIMOTHY SMITH

Hyland names successor to longtime CEO Bill Priemer

By Jeremy Nobile and stakeholders

Hyland announced that its board of directors has hired Jitesh Ghai, currently executive vice president and chief product ocer for California-based Informatica Inc., as the company’s new CEO e ective May 20.

In the CEO post, Ghai will succeed Bill Priemer, who has served as the rm’s top executive since 2013. Priemer, who joined Hyland nearly 27 years ago as a vice president of marketing, is retiring, though he will retain his seat on the board of directors following the leadership transition, according to the company.

“It’s been an honor and privilege to be a part of Hyland’s growth into a global leader in our industry,” Priemer said in a statement. “I’m proud of the accomplish ments of all Hylanders and thank ful for our time together. I’m su premely con dent in Jitesh and Hyland’s global team and know they will carry on the company’s rich tradition of success.”

Here are some more details about Ghai as laid out by his new employ er: “Ghai joins Hyland with more than two decades of progressive technical and business accomplish ments. During his 14 years at Infor matica, Ghai was part of the key leadership team that de ned the strategy and led the successful exe cution of its transformation to a cloud leader. Ghai was integral in leading the product innovation that resulted in the company being rec ognized as the enterprise leader in cloud data management and the de velopment of its market-leading AI.”

Hyland notes that Ghai has led more than 2,000 team members in Informatica’s global product orga nization, encompassing product management, engineering, user experience, cloud operations and technology alliances.

e company notes that Ghai’s background in cloud, data and AI capabilities will be of great value to Hyland, which has been trans forming over the years from pri marily a software developer to a provider of cloud services and re lated products and solutions. is is underscored by the re cent launch of its cloud-based and AI-driven Hyland Experience Au tomate (Hx Automate).

“Hx Automate, along with soonto-be-released Hyland Experience Insight (Hx Insight), will drive Hyland customers to deeper intel ligent content automation, trans forming the way they leverage ar ti cial intelligence for content and process management,” according to the company.

“I’m incredibly excited and hon ored for this unique opportunity to lead the next chapter for Hyland employees, customers and partners globally,” said Ghai in a statement. “I congratulate Bill on his successes at Hyland, and my goal is to build upon the foundation he’s estab lished, drive our innovative cul ture forward and to further ce ment our position as the industry leader in intelligent content solu tions. We are just getting started, and our Hyland team members

can be excited about what our future holds.”

Hyland notes that the company has grown from about $7 million in annual revenue when Priemer joined in 1997 to roughly $1 billion in revenue today and completed 11 acquisitions since Priemer became CEO in 2013. is hasn’t come without some growing pains for the Westlake-based rm, which has been owned by Chicago private equity oma Bravo since 2007.

“Congratulations to Bill on his ca-

reer at Hyland and the growth he’s led,” said Seth Boro, managing partner at oma Bravo, in a statement. “After an extensive search, the Hyland board believes Jitesh brings the innovative vision and leadership necessary to accelerate the company to achieve even greater heights.”

Hyland had a history of funding growth, acquisitions and dividend payments to its private equity owners through debt, according to a 2022 credit report from Moody’s, which contributed to some nancial duress for the company in the

wake of surging interest rates. at debt load and some uncertainty about customer demand appeared to be some factors behind Hyland trimming its sta by 1,000 employees—or roughly 20% of its workforce at the time—last spring.

While highlighting Hyland’s transformation into a cloud company amid those layo s, Priemer explained that the company’s evolution “required substantial investment in both people and systems.”

“While we had planned for this investment, we did not anticipate the degree to which in ation, rising interest rates and wage increases would impact our expenses,”

Every day, I answer the question,

“How do we

Priemer explained in a publicly shared letter at the time. “Furthermore, the challenging economic climate we currently face is prompting many organizations to pull back on their technology expenditures.”

As of June 2023, Hyland reported a local workforce of approximately 1,300 people, which was still more than enough to rank it as Northeast Ohio’s largest software developer and among the region’s 100 largest employers overall, according to Crain’s research. According to a company spokesperson, Hyland has 3,641 employees today globally. In 2022, the business posted $1.1 billion in annual revenue.

It might be moving goods around the world by land, sea, rail, or air, Unraveling miles of red tape along the way. It might mean negotiating a critical contract, answering a regulatory investigation, closing an M&A deal, resolving a dispute, or deciphering old-world laws for the new world of modern supply chains. Always, it’s about solving your problems efficiently and pragmatically.

Knowing the business need, articulating risk, and executing on a clear path forward. As an attorney, MBA, licensed customs broker, and transportation industry veteran, I work with companies at every link in the supply chain, from raw materials to e-commerce. Providing practical tactics and strategic vision to support your operations today and help you grow for tomorrow. Breaking down roadblocks, so you can get it done.

I’m JONATHAN TODD I’m on your team.

> Partner and Vice Chair, Transportation & Logistics Practice Group

> 216.363.4658 | jtodd@beneschlaw.com

MAY 13, 2024 | CRAIN’S CLEVELAND BUSINESS | 5

MY BENESCH MY TEAM www.beneschlaw.com

done?” get it

Ghai

amongmanyothersmallertransactions.

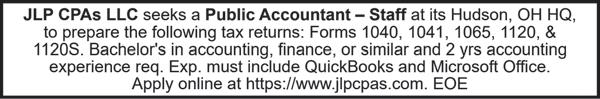

Paul Davis owners go all in on Progressive Field sponsorship

By Joe Scalzo

Paul Davis touts itself as the nation’s leading insurance restoration company, a network of franchises that provide cleanup and repair services for residential and commercial properties due to water, re, mold, storms or other disasters.

But it has a problem.

Unlike like, say, Kentucky Fried Chicken or Anytime Fitness — or even competitors in the restoration space like ServPro or ServiceMaster — “Paul Davis” doesn’t tell you a whole heck of a lot about what the business does.

“If you would have asked me what Paul Davis was the rst time I heard of it, I would have said, ‘I have no idea,’” said Ted Baugh, the Cleveland Guardians’ VP of corporate and premium partnerships. “I think the marketplace is like, ‘What’s Paul Davis?’ Some people absolutely know who they are and some people don’t.”

To x that, the owners of a Paul Davis franchise in Auburn, Ohio, reached out to the Guardians in 2020, guring the team could help with brand awareness. ey started small — a static sign behind rst base — but the sign included the words “ re, storm, mold and water,” which at least gave viewers a description of what they do.

“People might be like, ‘What does that do?’ but it clicks when you see how many times they cut over to rst base for a TV shot,” Baugh said.

Paul Davis stuck with the Guardians through the 2020 season (which had no fans due to COVID-19) and 2021 (which initially allowed limited capacity in the stadium) and both sides were happy — but both sides were also starting to think bigger.

In January 2023, Paul Davis employees Nick Piccirillo (who ran the emergency mitigation di-

vision of the business) and John Lawrence (reconstruction) bought the franchise from retiring owner Je Suszynski. Piccirillo and Lawrence are more aggressive by nature — “We have goals and that some people would call us crazy (for having),” Lawrence said — and, with their business doing well, they told the Guardians, “We want to do something bigger, something out of the box.”

So, the Guardians o ered something out of left eld … er, right.

Baugh’s team gave them a sneak preview of the new spaces being built at Progressive Field and Piccirillo and Lawrence kept gravitating toward the new openair group space in right eld, the one designed for corporate/commercial clients that make up much of Paul Davis’ business.

After talking for about six months — a short time for these kinds of deals — Piccirillo and Lawrence inked a ve-year contract to serve as the space’s naming rights sponsor.

e Paul Davis Pennant District was born. In addition to putting Paul Davis across two buildings in the section, the partnership includes additional signage in the ballpark, radio spots across several di erent stations and the ability to use the Guardians’ branding in marketing materials.

“My father said to me one day, ‘ ere’s a reason why you’re successful and it’s because you take risks,’” said Lawrence, who looks more like Kid Rock than a buttoned-up executive. “He said, ‘I was able to coast and I did well, but I never take risks. You take risks and that’s what elevates you to where you are today.’

“ is opportunity with the Guardians is a huge risk for us. It’s a lot of money. It’s a lot of years. It’s something that, being a new owner, we probably shouldn’t have taken on this quick. But, on

the other hand, what are the upsides to this? What could this do for us? at’s what we looked at.”

It’s the Guardians’ job to mitigate that risk, Baugh said. e team will look to help Paul Davis forge connections with corporate clients throughout the summer and look for organic marketing opportunities throughout the season. (Like Paul Davis-sponsored sunglasses on a sunny day, for instance.) To the Guardians, these kinds of investments go both ways.

“ ey’ve been an awesome partner,” said Lawrence, whose company also partners with the Akron RubberDucks minor league baseball team. “We actually involved some people from our corporate to help us out with this thing, to go from Step A to Step Z. In that process, we kept telling them, ‘Listen, the Guardians will take care of us.’ And, of course, our corporate said they want everything in writing, and we said, “We don’t need everything in writing. We know they’re going to give us this and do this additional thing for us.’ at’s how the Guardians are.”

Progressive Insurance felt the same way, which is why they recently extended their stadium naming rights deal through 2036, with the option to go longer.

“Progressive renewed for many reasons, but at the end of the day they wanted to renew, we wanted them to renew and it just works,” Baugh said. “Paul Davis is taking some risks. ey’re investing ve years of signi cant funds to partner with us, but I feel good about myself and my team and the actual Guardians team and they believe it’s a great investment. We’re going to show them that it is and hopefully continue for a long time.”

Baugh laughed, then added, “Now I’ve just got to nd the next Paul Davis for some of these other spaces.”

6 | CRAIN’S CLEVELAND BUSINESS | MAY 13, 2024 CrainsCleveland.com/CareerCenter Connecting Talent with Opportunity. From top talent to top employers, Crain’s Career Center is the next step in your hiring process or job search. Get started today Ideal Multi-Tenant/Office Building LAND FOR SALE: Beacon West, Westlake CONTACT US Charles Marshall 330-659-2040 3457 Granger Road, Akron, OH 44333 beaconmarshall.com Property Features *Price for 7.22 lot is $650,000 *Price for 6.59 lot is $630,000 *“Army Core Wetland Approval on Both Sites” Growthcapitalfor yourbusinesswithout banksorinvestors. Secure a line of credit, term loan, or one of our many other growth capital solutions. Access growthcapital to: Hiremoresalespeople Acquireanotherbusiness Investmoreinadvertising FinancenewCostofGoodsSold TakeonnewPurchaseOrders HannaKassis,JD,CPA,MA transactions@babylonassets.com *FOR BUSINESSES WITH $2M-$50M IN ANNUAL SALES* Recenttransactions total$2Massetbasedlineof credit;$5Maccountsreceivablefacility;$500K termloan;$300Ktermloan;$150Kbridgeloan;

The Paul Davis Pennant District made its Progressive Field debut on April 8. | CONTRIBUTED

Board of Elections plan is part of decadelong strategy

By Kim Palmer

For the Cuyahoga County government, one primary logistical issue has been the push and pull between minimizing the organization’s footprint and ensuring there’s enough space to meet its needs.

is ongoing balancing act now has the county focused on the former Plain Dealer headquarters at 1801 Superior Avenue as a potential new home for its Board of Elections, a solution to those two seemingly at-odds issues.

e county has been slowly chipping away at its real estate square footage for more than a decade. e work to reduce the county footprint began when the rst County Executive, Ed FitzGerald, took o ce and realized that population losses resulted in un- and underused space — space ripe to unite county government o ces in fewer places.

“He had the vision for the consolidated administration building and we see this as really continuing this momentum,” explains county Public Works Director Mike Dever.

e plan led to the County relocating its headquarters to East Ninth Street, the sale of various vacant properties and assessment studies every four years — the last one focused on the county Board of Elections (BOE) in 2022.

e county’s needs, it turns out, were not being met by the current 64,000-square-foot Hughes Building. at building is ill-suited to accommodate the crush of early voters forced to line up at the corner of Euclid Avenue and East 30th Avenue.

“ ere’s been a real shift over the last few years with people less interested in voting by mail and now wanting to use the early in-person vote option,” Dever said.

Despite its popularity, the statehouse has limited early voting to one location per county and prohibits drop-o ballot boxes from being located o -site, rendering the measly 48 spots behind the building insu cient.

“During the last Presidential election the line stretched all the way down to Chester Avenue, over the I-90 bridge,” Dever said. “ ere are also a lot of people trying to pull into drop o their ballot, then all these pedestrians crossing the busy road and people running around with signs and campaigning materials. It’s really a kind of a mess.”

e building, which was last rehabbed in the 90s, also needs a signi cant and expensive upgrade. “We gured with the new Ronayne administration coming in, the BOE would be high on the list of priorities,” Dever said. “We had started evaluating a strategy to have as the new county executive walk-through the door.” Dever was right. About three months after County Executive Chris Ronayne took o ce, Public Works had seven requests for

proposal (RFP) options for a new BOE location.

e former Plain Dealer building was the clear leader of the pack, Dever said. e 235,000-squarefoot, four-story building in the central business district can accommodate the early vote crowds as well as the BOE administrative o ces — and it’s near a transit line.

Additionally, the 800 parking spaces at the building well exceed the 500 parking spots required by the RFP.

“We went and visited all of them,” Dever said. “We knew there was probably no one place that was going to check every single box but we wanted to get as many of those boxes checked as we could.”

The other six RFP responses included some false starts and other well-known — even iconic — buildings. The owners of the former St. Vincent Charity Hospital on East 22nd Street submitted a proposal but then pulled that offer while another proposal offered space in Garfield Heights.

Jack Entertainment, the owners of 100 Public Square — the former Higbee Building and the Reserve Square Apartments at 1701 East 12th Street — also submitted a proposal.

e county, too, received RFPs from the historic Tyler Village warehouse space at 3615 Superior Avenue and Lighthouse Artspace Cleveland at 850 East 72nd Street, a build many might remember housing the Immersive Van Gogh Exhibit.

“Reserve Square was interesting but everything would be on multiple oors and the East 72nd space was decent and would work fairly well but felt a little o the beaten path,” Dever said.

A proposal for a $91 million, 17-year lease at 1801 Superior is currently in front of County Council and, if the measure passes, the BOE will increase from 48 voting stations to close to 125 sta-

tions, allowing voters to queue inside and easily nd free parking outside.

e BOE would take up the rst oor and part of the second oor of the building. e extra space would allow Dever to look at tackling another one of Ronayne’s priorities: consolidating the sprawling campus and multiple footprints of the county’s Health and Human Services (HHS) department.

Population losses mean fewer residents and fewer residents means less need for some HHS services. A county study estimated that HHS needs about 400,000 square feet of o ce and facility space, or about two-thirds of its current total square footage, Dever explains.

HHS services are spread across six buildings across the county, including the Jane Edna Hunter and Virgil E. Brown buildings.

“HHS isn’t really functioning in those old buildings that have had overhauls since the 90s,” Dever said. “Back in the day, there were lots of paper les and le cabinets and they’ve gone away from that and we are losing parking in that area to new development.”

e department is also using a new model, that does not require a lot of o ce space because workers are meeting people where they are, Dever said.

“ ey are going to where the people who need services go to like libraries in the community, setting up shop,” he added. Moving to 1801 means those workers in the o ce will work in one location rather than in satellite o ces across the county allowing the county to get out of those leases.

Superior at E. 17th St. (projected to cost in the $40 million to $50 million range).

“After the BOE move in 2025, the county will either sell or lease (the current BOE building),” Dever explains. “In 2026, part of HHS will move to the 1801 Superior space when some of those leases are ending. If all goes well, the capital improvement will be completed at Virgil Brown in 2027 and that will become the main HHS building.”

e HHS consolidation will save

an average of $1 million in annual costs, which, while modest, will go back to providing services, Dever points out.

e BOE move will mean voters will be more likely to stay in line to vote because they won’t be stuck in cold weather in an outdoor line. And it’ll shore up HHS’s footprint, leaving more valuable downtown space for private development.

“If it all works out we will shed a little over 200,000 square feet in Cleveland proper,” Dever said.

e move to the second and third oor of 1801 will also free up 200,000 square feet of excess space and allow some HHS sta to move into the Jane Edna Hunter Building for a short term during a complete overhaul of the 75,000 square feet, seven- oor Virgil Brown building at

MAY 13, 2024 | CRAIN’S CLEVELAND BUSINESS | 7 Prior registration required Call for help with the process Eric M. Silver, Broker Ag Real Estate Group, Inc. 216.350.2394 / info@agrealestategroup.com This property is set for Sheriff Sale ONLY and is NOT listed by Broker STUNNING MEDICAL / OFFICE PROPERTY 555 GRAHAM ROAD CUYAHOGA FALLS, OH 44221 Summit County SHERIFF SALE JUNE 7TH GRAHAMROAD FOR SHERIFF SALE INFORMATION VISIT: Parcel lines are for illustration only.

Cuyahoga County is proposing to lease the former Plain Dealer building at 1801 Superior Ave. | INDUSTRIAL COMMERCIAL PROPERTIES LLC

Time to help build a stronger housing market

There’s a dramatic data set — well, as dramatic as data sets get — on page 13 of a new, 94-page report from the Ohio Senate, “Housing Reimagined: Building a Solid Foundation for Ohio’s Future.”

e data shows Ohio’s housing stock by year built, and it might not surprise you to learn that the state has a lot of old housing units — a little more than 1 million that were built in 1939 or before. As recently as the decade from 1970 to 1979, Ohio built nearly 750,000 homes. But that number is falling, dramatically.

e ’90s saw the construction of about 572,000 homes, but that dropped to 515,000 in the period from 2000 to 2009, to 300,000 in the 2010s, and, in the pandemic-scarred 2020s, just under 24,000 so far. Talk about going in the wrong direction.

Ohio’s population doesn’t grow as fast as many other parts of the nation, but housing production isn’t keeping pace with need and demand, leading to a lack of inventory for homebuyers and renters — particularly in the a ordable housing segment of the market. at paucity of available housing drives up costs for everyone and puts people who are on the lower end of the income scale at particular risk.

e Senate Select Committee on Housing that compiled the report deserves credit for the depth of its e ort and the seriousness of its purpose. Members spent more than six months meeting with stakeholders, homeowners and community groups across the state to gather information about the issue and come up with recommendations — 23 of them, to be exact — to address Ohio’s complex housing challenges.

It’s a problem across the state, exacerbated by factors including complex local permitting regulations, in ation and supply chain disruptions. As state Sen. Michelle

Reynolds, a Republican from the Columbus area, writes in the report, “ e housing market illustrates that Ohio is not meeting the housing demand in either the fast-growth markets or the slower-growth rural markets.”

e report summarizes housing-related challenges by region. In Northeast Ohio, it notes, there are “signi cant gaps in housing a ordability, particularly in urban areas, where rising rents outpace wage growth. Witnesses highlighted the interconnected nature of housing insecurity and social determinants of health, such as access to health care and education.”

In short, when people aren’t secure in their housing, it creates a cascade of other challenges.

e committee’s 23 recommendations are varied in target and scope, re ecting the reality that there’s no easy solution to the problem. ey focus on issues ranging from implementing more protections for renters and homebuyers, encouraging alternative forms of housing, tweaking tax policy, encouraging density and making capacitybuilding grants for local governments.

ey’re all worthwhile. We especially like the rst two, which encourage the Ohio De-

partment of Development to create a statewide housing dashboard that monitors and analyzes key metrics related to housing and to launch the Ohio Housing Toolkit as a resource for local governments. e state needs to take a more active role, and these are reasonable, helpful steps.

But housing has to be tackled by a number of parties.

is issue, thankfully, has caught the attention of the Ohio Chamber of Commerce, which in a 2023 report called “ e Blueprint for Ohio’s Economic Future” identi ed six key areas for improvement. Among them: a “sense of place,” which includes housing and, more generally, “the components and resources that make a community a desirable place in which to live, work and visit.”

Providing places to live has been a challenge, the chamber noted, as housing production has been hampered by “land availability, zoning, density restrictions, regulations, construction costs and a lack of skilled workers — the last of which has only worsened since the pandemic.”

As far as the a ordability piece goes, the National Association of Home Builders found that in 2019, the median price to

build a single-family home in the U.S. topped $296,000. It’s not quite that high in Ohio, but as the state chamber noted, “With the growing lack of resources and funding for residential development, the working Ohioan’s ability to own a ordable housing remains nearly unattainable.” e chamber has pushed for public policy solutions that include “incentives to encourage zoning reform, expand the use of historical tax credits and other nancing tools to increase housing supply, and tax policy solutions to assist older Ohioans who want to age in place.”

Local governments need to redouble their e orts to streamline permitting and other regulations. Too many housing projects die in a tangle of government rules.

One notable piece of research on this point comes from the American Enterprise Institute, a center-right think tank based in Washington, D.C.

In a case study about Denver, it found zoning changes implemented since June 2010 have “encouraged housing construction” in the Colorado city. AEI said Denver “experienced a massive building boom after 2010,” after previously having been “a bit of a laggard in construction activity.” In particular, AEI found, Denver “expanded its housing supply by tweaking its policies on multifamily (MF) buildings.” It allowed “greater density in areas already zoned for MF,” which was “achieved primarily by allowing another story, but not by expanding lot sizes,” and by allowing MF buildings “to be built in more areas.”

Ohio’s not alone in this challenge. Housing is an issue almost everywhere. e state has made a good rst step in adopting a more expansive mentality and framework to aid the production of more housing, and local governments should follow suit. e bene ts will be numerous.

Is your business losing money by not caring for midlife women?

It is well known that midlife women encounter signi cant health changes, particularly those associated with the menopause transition. But did you know that not having policies to support those health changes may be hurting your company’s pro ts and costing American businesses billions?

In a 2023 study by the Mayo Clinic, 13.4% of women reported one or more adverse workplace outcomes — such as absenteeism or reduced productivity — due to symptoms associated with menopause and other midlife conditions. Additionally, almost 11% reported missing work within the prior year due to these symptoms, with a median loss of three work days. e risk of adverse work outcomes increased by up to 15.6 times for women with the highest symptom burden, leading to an estimated loss of $1.8 billion per year in the U.S. in lost work days alone.

Dr. Alexa Fif ck is the founder and CEO of Concierge Medicine of Westlake.

If you didn’t think you needed to change your policies before, that $1.8 billion might make you reconsider. ere are many other costs as well.

For example, a retrospective cohort study of more than 500,000 women (published in 2015) found that women with untreated menopauserelated symptoms had 82% higher health care resource utilization. ese women also had a 57% increase in indirect work productivity loss.

e Mayo Clinic study estimated that $24.8 billion per year is lost due to medical expenditures for these midlife female employees. at means that upwards of $26 billion is lost in the U.S. every year when you combine the lost work days with the money spent on health care.

Losing $26 billion per year simply because of the failure to address the e ects of the health issues in this subpopulation? Talk

about a costly oversight.

As shocking as these numbers are, the team that performed the Mayo Clinic study suspects their estimate is quite conservative, as it left out multiple other factors. is is suspected because several previous studies (including one in 2020) note that with increasing severity of symptoms, there is an increase in female workers reducing work hours, changing jobs, declining promotions and exiting employment completely, either due to job loss or early retirement.

Moreover, a U.K. study on 3,000 women found that women reporting one disruptive menopausal symptom by age 50 had a 43% increased likelihood of leaving their jobs by age 55. ese numbers are staggering, considering women in midlife currently constitute roughly 30% of the total U.S. workforce, and that this cohort is the largest growing cohort in the workforce.

So what can companies do to stop thenancial bleeding? While there is currently a dearth of government intervention in chang-

ing laws and policies, corporations large and small can lead the charge.

One suggestion is to consider implementing formal workplace policies akin to those for sick and parental leave. Some companies have also added employee bene ts, such as coverage to access certi ed midlife women’s health specialists and hormonal/nonhormonal therapies, regardless of their inclusion in the company’s health insurance plan.

Other recommendations include training HR and supervisors to understand these health changes and how they a ect their workers, allowing for exibility in remote/ hybrid work schedules, and allowing female workers to have control over their work environment (i.e., temperature).

ese changes are likely not only crucial for employee satisfaction, but for employee retention, and the success of the companies they work for. Next time you are looking at pro t margins, it might be time to consider how much ignoring the issues facing midlife women is costing, and make a change.

8 | CRAIN’S CLEVELAND BUSINESS | MAY 13, 2024 EDITORIAL Interim Editor: Ann Dwyer (adwyer@crain.com) Managing Editor: Marcus Gilmer (marcus.gilmer@crain.com) Contact Crain’s: 216-522-1383 Read Crain’s online: crainscleveland.com Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited. Send letters to Crain’s Cleveland Business, 700 West St. Clair Ave., Suite 310, Cleveland, OH 44113, or by emailing ClevEdit@crain.com. Please include your complete name and city from which you are writing, and a telephone number for fact-checking purposes. Sound off: Send a Personal View for the opinion page to ClevEdit@crain.com. Please include a telephone number for veri cation purposes.

PERSONAL VIEW

BLOOMBERG

T:14" Looking to talk with a financial expert about anything from buying a home to planning for the future? Stop by one of our greater Cleveland area financial centers or get started 24/7 in the Bank of America Mobile Banking app. Where your financial goals meet our local experts. Find a location near you at bankofamerica.com/TalkToUs Mobile Banking requires downloading the app and is only available for select devices. Message and data rates apply. Deposit products and services are provided by Bank of America, N.A. and affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Equal Housing Lender. © 2024 Bank of America Corporation.

ECONOMIC HARDSHIP

ON THE BRINK

Unexpected expenses can put an extraordinary burden on the lowest wage earners

By Ally Marotti

One in four of Ohio’s 4.8 million households teeter on the edge of poverty. For them, nancial stability does not exist.

Any unexpected expense — a medical bill, a car repair, a ne or fee that would be a mere inconvenience to a middle- or upperclass household — can lead to long-lasting devastation for the working poor. For one 28-yearold woman, her topple into nan-

cial catastrophe began last summer at a Cleveland Heights gas station.

e woman, who wished to remain anonymous to protect her job security, had a minor crash near a gas pump that ultimately resulted in her license being suspended. A police report indicates it was not her fault but, initially, that did not matter. She did not have insurance — her Kia had been stolen and recovered, and she was having trouble securing a policy for the highliability vehicle. It resulted in a

double whammy: A noncompliance suspension for driving without insurance, and a security suspension, which occurs when an uninsured driver causes a crash with more than $400 of damage. Without an insurance company to ght for her, the woman’s e orts to prove the crash was not her fault were fruitless. She took out a high-cost insurance policy and paid the ne to remove the noncompliance suspension, but the security suspension was trickier. She owed $4,800. Paying that

o would mean cutting back on food for the next three years. She started skipping utility payments, too. Meanwhile, to keep making money, she had to keep driving to work without a license. e anxiety consumed her.

“I’m trying to get to work every day and I’m terri ed,” she said. “I stopped going to visit my family and see my friends. I was worried if I drove somewhere and a cop stopped me, everything would be over.”

See BURDEN on Page 12

“I

have a four-year bachelor’s degree, I do a lot of work in the community and I’m genuinely a good person. I just couldn’t afford insurance, and that almost ended everything for me.”

10 | CRAIN’S CLEVELAND BUSINESS | MAY 13, 2024 FORUM UNDERWRITERS

A 28-year-old woman fell into nancial distress after a minor car crash resulted in her license being suspended. She’s not alone: One in four Ohio households are without nancial stability and teeter on the edge of poverty. | KEN BLAZE

Families cannot budget their way out of poverty

The path from poverty to economic independence is often described as a ladder.

Emily Campbell is president and CEO of the Center for Community Solutions

Emily Campbell is president and CEO of the Center for Community Solutions

Once on the right track, someone just needs to put one foot in front of the other and their nancial circumstances will improve. Make good choices, and they will climb out of poverty. at is not reality. ere are fundamental aws baked into the economic and social supports meant to address families’ immediate needs. People might do all the right things and still nd themselves stuck in poverty.

More than 10,000 Cuyahoga County residents worked full time for the full year in 2022 and still did not earn enough to be above poverty, according to the latest Census data. About 44,000 more poor people worked at least part time for at least part of the year. In a recent survey of Cuyahoga County residents conducted by e Center for Community Solutions, 61% said it is more di cult to rise out of poverty today than before the COVID-19 pandemic. Over one-quarter of workers believe their current job will not help them “get ahead,” a substantial increase since 2019.

Many public bene t programs have built-

in disincentives to work, or bene ts cli s. Getting a raise or working extra hours can put a family over the income eligibility threshold for programs that help meet basic needs. In addition to the nancial burden of having to cover these expenses, losing a public bene t means signi cant disruption if they must suddenly nd di erent child care arrangements without a voucher, enroll in a new health plan after losing Medicaid coverage, or move out of subsidized housing. Even while earning more, they are not getting ahead.

Welfare reform in the 1990s introduced strict time limits and work requirements for many people receiving cash assistance. e problem? e way work requirements are structured does not facilitate career development. For example, participation in “vocational education,” including higher education, has a 12-month lifetime limit. After that, adult students must nd another acceptable work activity for 20 to 35 hours per week to keep cash assistance. Some drop out because they cannot a ord to lose the bene t and no longer have time to attend courses.

On paper, these policy choices are designed to target resources to families most in need and encourage people to get o benets. In reality, they do exactly the opposite, creating disincentives to paid employment and preventing people who are willing and able to move forward in their jobs and ca-

From where you are

reers from doing so. ey aren’t a hand up or a handout; they hold workers back.

Recent data shows that when low-income families have extra money, they use it for exactly what we would hope. In 2021, temporary federal Child Tax Credit (CTC) enhancements sent families a direct deposit up to $300 per month per child as pre-payment of the credit they were expected to claim when they led their taxes. Most Ohioans who spent CTC pre-payments used them for food, utilities and other basic needs. Unlike other government assistance, CTC came with no complex eligibility or redetermination criteria and no work requirements. A study by Brookings found that

families who received CTC enhancements did not reduce employment. at means the extra resources were enough to cover some expenses, pay down debt or save for education, but not enough to disincentivize work.

Too often, the “smart choice” or the economically rational decision for a family in poverty is to NOT earn more. is may be short sighted but because 62% of low-income residents in Cuyahoga County reported having to make at least one tradeo between necessities in the last year, many cannot think about the future as they barely get by today. e rungs on the ladder out of poverty are too sticky.

MAY 13, 2024 | CRAIN’S CLEVELAND BUSINESS | 11 COMMENTARY | ECONOMIC HARDSHIP

Loans subject to credit approval. The CIBC logo is a registered trademark of CIBC, used under license. ©2023 CIBC Bank USA. Products and services o ered by CIBC Bank USA. Ambition drives your business. Let our expert advice and tailored banking solutions get you from where you are, to where you want to be. COMMERCIAL BANKING | CAPITAL MARKETS | PRIVATE WEALTH cibc.com/US To where you want to be

GETTY IMAGES

As circumstances change, households may nd themselves below or above the ALICE (asset limited, income constrained, employed) Threshold at different times. While the COVID-19 pandemic brought employment shifts, health struggles and school/business closures in 2021, it also spurred unprecedented public assistance through pandemic relief measures. There

BURDEN

From Page 10

Millions affected

at woman is not alone. Ohio has about 3 million driver’s license suspensions on its books during the average year, according to a report from the Legal Aid Society of Cleveland that analyzed BMV data from 2016 to 2020. In a state with 8 million licensed drivers, it’s a staggering number. More than two-thirds of the suspensions are not related to unsafe driving; instead, they are debt related.

e costs surrounding driver’s license suspensions are just one example of the nes and fees that push people into poverty and keep them there. Others include fees associated with turning utilities back on once they’ve been shut o for nonpayment, hidden hospital fees or the cost of child care.

For those caught in the cycle of unpayable nes and fees, it feels like a setup.

For example, how does one make money to pay o fees without a driver’s license in a state where 82% of people drive themselves to work? People often remain trapped under debt-related driver’s license suspensions for decades, and can break free only through a bankruptcy. at, in turn, makes them less employable, hurting the state’s economy. But such problems are not unsolvable. Experts say that policy changes could eliminate certain nes and fees, and break the cycle of poverty they create.

e Cleveland Heights woman, who is Black, said her situation “felt very systemic.”

“ is is what they do to keep us where we’re at, to make it impossible for us to get above that poverty line,” she said. “I have a four-year bachelor’s degree, I do a lot of work in the community and I’m genuinely a good person. I just couldn’t a ord insurance, and that almost ended everything for me.”

e woman sought help from the Legal Aid Society of Cleveland. An attorney there used the police report to prove the incident at the gas station was not the woman’s fault. Ultimately, the attorney convinced the insurance company to lift the suspension. But that was an unusual case. e police report saved the day.

A chance for relief

e hundreds of thousands of Ohioans with similar suspensions could see sweeping relief from Senate Bill 37, which is working its way through the state legislature. e bill would eliminate certain driver’s license suspensions and reduce nes for others. If passed, the law could be “a pretty radical game-changer,” said Anne Sweeney, chief of civil legal services with the nonpro t National Legal Aid and Defender Association.

“ ere is a much greater chance of keeping their job, keeping out of

poverty, supporting their family, being able to maintain insurance and drive lawfully.

“ e spiral that we see will be entirely avoided. … is, to me, is a super easy way to reinvest millions of dollars into communities that desperately need it — by simply not taking it in the rst place.”

e bill would eliminate the security suspension, which resulted in the Cleveland Heights woman’s $4,800 penalty. It would also eliminate judgment suspensions, which occur when someone is in a crash, gets sued for damage and cannot pay. A court would no longer be able to suspend a license for failure to pay court nes or fees. e bill also looks to tweak how nes pile up for noncompliance suspensions, issued for driving without insurance.

As it stands now, driver’s license suspensions are being used to collect debt, Sweeney said. But it’s not as though people don’t want to pay that debt. ey simply cannot.

Take Cleveland ZIP code 44104 as an example. Residents there paid more than $831,000 in reinstatement fees and other costs from debt-related suspensions between 2016 and 2020, according to the Legal Aid report. But they still collectively owed almost $4.3 million. In that ZIP code, the median household income is just $17,000 per year.

at example is not an anomaly. irteen percent of Ohio households were in poverty in 2021, according to a recent report from the nonpro t Ohio United Way. Federal guidelines said that a fourperson household was in poverty if it brought in less than $26,500 that year. But many experts consider the U.S. Federal Poverty Guidelines

to be outdated. e income thresholds do not re ect what families need to get by in the communities where they live.

Teetering on the edge

Another measure looks at households that earn above the federal poverty level but cannot a ord the basic cost of living in their county. e measure is called ALICE — asset limited, income constrained, employed — and includes housing, child care, food, a smartphone plan, health care, transportation and taxes. e annual income threshold to be considered in that measure in 2021 was $63,684 for a family with two adults, one infant and one preschooler, according to the United Way report. e report found that 38% of Ohio households fell below that measure in 2021. at means that almost two out of every ve households in Ohio were either in poverty or teetering on the edge of it. e pandemic made matters worse, pushing that gure up from 37% in 2019. e situation is more acute in Cuyahoga County, where 42% of the almost 560,000 households are either in poverty or near it. And United Way’s report captured data only through 2021, before the worst of in ation had hit consumers. Nonpro ts around Cleveland say calls for aid have increased with ination. With several pandemic aid measures ending this spring, nonpro t operators expect the situation to worsen.

Ohio’s economic strength is tied to the nancial stability of its residents. When people become trapped in poverty by

and

12 | CRAIN’S CLEVELAND BUSINESS | MAY 13, 2024 ECONOMIC HARDSHIP

nes

below

of households below the ALICE Threshold Financial hardship in Northeast Ohio Source: ALICE Threshold, 2010-2021; American Community Survey, 2010-2021 1,000,000 ALICE Poverty 500,000 201020122014201620182020 2010 12%24% 62% PovertyALICEAbove 15%24% 60% 2012 15%24% 61% 2014 14%24% 62% 2016 14%25% 62% 2018 13%23% 63% 2019 13%25% 62% 2021 21% 56% Cuyahoga 41% Scioto 56% Summit 39% Delaware 21%

is signi cant variation in the number of households who live below the ALICE Threshold within each county in Ohio. The percentages combine those at poverty-level and ALICE households. Number of households

the ALICE Threshold Percentage

Ronald Crosby was hit with unexpected nes and a suspended license after being released from prison. KEN BLAZE

fees, they often miss work trying to sort them out. In some cases, like with debt-related driver’s license suspensions, the nes and fees could keep them out of work entirely.

If half of Ohioans with a debtrelated suspension complied and stopped driving, the state’s labor force could lose more than 830,000 working or work-seeking people, according to a February study from the Federal Reserve Bank of Cleveland. e study also found that 14% of job ads in Ohio requested a driver’s license in 2022, higher than the national average of 10.6%.

ose job ads were concentrated among lower- and middle-wage occupations. In other words, having a valid driver’s license is key for economic mobility among the lower half of wage earners.

When Ronald Crosby got out of prison in September 2020, one of his rst orders of business was heading to the Ohio Bureau of Motor Vehicles. He had served 25 years, secured a job for when he got out and needed his driver’s license to get to work.

When he arrived, the o cial would not let him take the driving test. Crosby had a suspension on his license, leftover from before he went to prison. Crosby remembers the crash that triggered that suspension. He was 19 years old when it happened. He just turned 53. Crosby thought he paid o his ne years ago while in prison and had the suspension lifted, but he was wrong.

Crosby had taken plenty of re-entry courses before he was released from prison, but no one had warned him about this. He walked into the BMV that day with enough money to take the driver’s test, not

situation and it’s very hard to dig out of it.”

e Center for Community Solutions conducts a survey that asks people how they would pay a $400 expense. e share of respondents who said they’d use a credit card or borrow from friends and family increased 17% between 2019 and 2023.

ose ndings indicate that people are not able to save money for unforeseen expenses, like a fee, illness or even child care. e average cost of an emergency room visit in the U.S. was $2,700 in 2022, according to insurance company United Healthcare. Child care is another huge cost. e estimated median cost to send a toddler to a child care center in Cuyahoga County last year was almost $13,200, according to data from the U.S. Labor Department. Experts say that when faced with unexpected expenses, the rst thing people do is cut back on food.

“If you give up food, you’re hungry for a few days, but you don’t have to pay that money back later,” Campbell said. “If you don’t pay your utility bill, that expense does not disappear. It piles up.”’

How a pay raise could hurt lowerincome workers

By Ally Marotti

Lifting people out of poverty is not always as simple as paying them more.

For some Ohio households, taking a wage increase could mean losing a public bene t that puts them in a worse positionnancially. Such situations are called bene ts cli s, and experts say they can force adults to choose between advancing their careers and feeding their families.

County family with two adults in their early 30s, an infant and a 2-year-old increased its annual income to $40,000 from $39,000, it could mean the loss of almost $11,700 in Supplemental Nutrition Assistance Program benets.

e more assistance programs a household uses, the more likely it is to experience bene ts cli s, Ruder said. And the more programs that are lost, the harder it is to bounce back.

enough to pay a reinstatement fee and take out the mandated insurance policy for high-risk drivers. Getting his license — which he needed to get from his home in the Cleveland neighborhood of Lee-Harvard to his job in suburban Twinsburg — meant several more trips to the BMV in suburban Parma. He had to rely on friends and family to drive him to the BMV and loan him money.

“ at’s an added weight to an individual fresh out of prison,” he said.

In the meantime, Crosby took Ubers to work or paid friends for rides. He missed work traveling back and forth from the BMV before he was able to get his license. It was lost income, but he said he felt lucky that his employer gave him exibility.

“Some jobs don’t have that understanding,” he said.

Poverty does not hit all demographics equally. Black, singleparent and young households have the highest rates below the ALICE reshold, according to the United Way report. e occupations with the highest percentages of workers below the threshold were cooks, cashiers, servers, nursing assistants and personal care aides.

Crisis aversion

Working a minimum wage job in Ohio for 40 hours a week for 52 weeks a year is not enough to get people out of poverty, said Emily Campbell, president and CEO of nonpro t think tank the Center for Community Solutions.

“It almost doesn’t matter what the fee or the ne is, or what the expense is,” Campbell said. “Anything can push people into a challenging

When it comes to utility bills, nonpro t operators say Cleveland-area residents have increasingly sought help with payment in recent months. Utility shuto s were paused during the pandemic, but that grace period ended. In 2022, almost 274,000 households had their electricity shut o , and almost 157,000 had their gas shut o , according to data compiled by Ohio Sen. Kent Smith’s o ce. Cleveland nonpro t Step Forward, which helps people pay their electric, gas and water bills, said it saw a 30% year-over-year increase last year in people seeking assistance during the summer and winter, which are considered utility crisis periods.

If customers get their utilities shut o , it’s not always just a matter of catching up on payments. In many cases, they must also pay a reconnection fee.

ough Ohio has some laws protecting residents from utility shuto s during the coldest months of the year, Smith introduced a bill in September that would further limit shuto s. Senate Bill 150 would prohibit utility companies from disconnecting electricity or gas for nonpayment if a household has a person who is 65 or older living there, a child 5 years old or younger, or a person with a disability, illness or pregnancy. Utilities also could not disconnect customers who are at or below 200% of the poverty line for nonpayment.

ose households would instead be enrolled in a payment program.

Some experts say that such a measure could help keep some households from nancial crisis— or at least from having to choose between eating and staying warm.

“When people have to choose between paying their utility bill or feeding their family, they’re not saving,” said Campbell from Center for Community Solutions. “Every day it’s raining, so they can’t save for a rainy day.”

“A lot of people don’t understand this. It’s like, ‘Why aren’t people taking that $2-an-hour wage increase?’” said Ken Surratt, chief development and investment o cer of United Way of Greater Cleveland. “Well, they could be losing $20,000 in food. Is that $2 an hour worth $20,000 a year in food? For some families, it’s not.”

It is more common for families with children to face bene ts cli s because they are often more reliant on assistance such as child care subsidies, experts say. e income level most at risk are those households that hover just above the poverty line.

One in four of Ohio’s 4.8 million households were teetering on the edge of poverty in 2021, according to a recent report from the nonpro t Ohio United Way.

e report looked at households that earn above the Federal Poverty Level but cannot afford the basic cost of living in their county. e measure is called ALICE — asset limited, income constrained, employed — and includes housing, child care, food, a smartphone plan, health care, transportation and taxes.

e annual income threshold to be considered in that measure in 2021 was $63,684 for a family with two adults, one infant and one preschooler, according to the United Way report. ese are the households most at risk of falling o a bene ts cli .

“You’re right in that range where any income gains mean you’re going to lose one or all of those programs, or at least have a reduction in them,” said Alex Ruder, Community and Economic Development director and principal adviser at the Federal Reserve Bank of Atlanta.

It creates an environment of uncertainty and risk for workers, who might not realize the repercussions of accepting an hourly wage increase, he said.

e Federal Reserve Bank of Atlanta has a tool that calculates the potential nancial loss for families as their income increases. For example, if a Cuyahoga

“If you’re losing your food and your housing at the same time, that’s much harder to recover from,” he said. “Evidence says workers will take advancement opportunities but they’re doing it in an environment of confusion and uncertainty, and risking nancial instability because they’re unable to plan for that move and the loss of assistance that comes with it.”

It’s a conundrum that forces families into short-term thinking, said Emily Campbell, president and CEO of the nonpro t think tank Center for Community Solutions.

“ ey literally cannot a ord to think longer term and to take some risk,” she said. “People are forced to make (decisions) that they know will hurt them in the long run, but they don’t have any other choice. ey’re stuck.”

Many public assistance programs are designed so that families lose the bene ts before they can pay for the expense themselves, Campbell said. If bene ts tapered out, experts say it could turn the cli s into ramps. As families earn more money, they receive less funding. Allowing families to maintain bene ts as they earn more could help. Some programs are already designed this way. Ohio’s child care program, for example, has an initial eligibility threshold, but allows children to continue receiving a subsidy as their parents’ incomes increase.

Employers can also help, experts say. First, they must understand why an employee might not want to accept a raise. ey can o er bene ts or perks that would not a ect an employee’s income and, therefore, would not impact their eligibility for bene ts. An example would be to o er them space in on-site child care.

“We have so many people with this fear of falling back, (who) feel stuck in systems they didn’t create,” said United Way’s Surratt. “Even if they do the right things — go back to school, get a higher paying job — they can end up in a worse place.”

MAY 13, 2024 | CRAIN’S CLEVELAND BUSINESS | 13 ECONOMIC HARDSHIP

HARDSHIP

Debt-related suspensions perpetuate cycle of poverty

TWe need to join together to eliminate barriers to work

Katherine Hollingsworth is the managing attorney of the economic justice practice at e Legal Aid Society of Cleveland.

his year, as Ohio Senate Bill 37 makes its way through the Statehouse, testimony was provided by Ohioans regarding the signi cant impact of debt-related driver’s license suspensions. More than 60% of Ohio’s driver’s license suspensions do not stem from bad driving. Instead, they arise because the driver owes a debt. ese types of suspensions prevent people from getting to work where they could make the money needed to repay the debt. Legal Aid has helped many clients le bankruptcy to resolve driver’s license suspensions when they cannot a ord judgments, fees and other debts. Individuals resort to bankruptcy because they feel trapped by needing to work to pay the money owed, but not being able to get to work without a license.

For instance, we recently helped Walter Garrity (named changed to protect client privacy), a 35-year-old resident of Northeast Ohio who went to school to get a commercial driver’s license to support himself and his family.

In 2022, Garrity’s car was hit by another driver who was using a cellphone. After the accident, he learned that his insurance had lapsed due to a late payment. He reinstated the insurance, but unbeknownst to him, the other driver sued him, got a default judgment for $33,000, and had the Bureau of Motor Vehicles (BMV) place a judgment suspension on his license. He had to quit his truck driving job because of the suspension. He did not want to drive unlawfully and risk getting in more trouble.

Mr. Garrity had no way to pay the judgment without working, so he came to Legal Aid for help.

In 2022, Legal Aid published a report that highlighted how Ohioans face more than three million debt-related suspensions to-

taling over $900 million yearly in outstanding debt. Residents in areas with high poverty rates and high percentages of people of color are disproportionately a ected by suspensions and the associated fees and costs, revealing that those struggling to pay for debt-related suspensions pay the most.

Debt-related driver’s license suspensions in Ohio are a racial justice issue holding back our economy from thriving. License forfeitures, warrant blocks and registration blocks are collectively the largest type of debt-related suspension. In 2020, over 785,000 Ohioans faced almost 1.7 million of these suspensions. Courts throughout Ohio use these suspensions to compel defendants to appear in court and to pay money owed to the court. A person who cannot get to work because of a license suspension — or who cannot get a job because so many employers now require a valid driver’s license — will have a much harder time paying the money they owe than someone who can continue to work.

Noncompliance suspensions are the second largest category of debt-related suspensions in Ohio and are uniquely problematic.

In 2020, over 675,000 Ohioans had over 1.3 million noncompliance suspensions. Noncompliance suspensions are imposed when people are stopped by police and cannot prove that they have insurance, and it is one of the suspensions imposed on uninsured drivers involved in accidents. Under current law, drivers must pay higher insurance rates and maintain a certi cate of insurance (an SR-22) with the BMV. Subsequent violations within ve years trigger mandatory suspension periods, meaning people cannot get their licenses back, even if they have the money to pay the insurance costs and BMV fees. But for many Ohioans, the costs are so prohibitive, they just give up and risk driving.

Driving is a privilege, not a right — and it is currently a privilege that is quickly revoked for many Ohioans with low incomes. Barriers to transportation threaten an individual’s ability to maintain employment, which perpetuates the cycle of poverty.

The Social Determinants of Health (SDOH) has garnered signi cant national attention for its role in shaping individual well-being. However, there is another important lens that groups those determinants differently — as barriers to work that highlight our local economic challenges.

e impact of driver’s license suspensions extends far beyond individual circumstances, allowing systemic inequities to continue and hindering socioeconomic mobility. Communities of color and low-income individuals, already marginalized by structural barriers, bear the brunt of these punitive measures, which deepen existing disparities. Moreover, businesses and local economies su er as employees struggle to access transportation and employment opportunities, stiing growth and perpetuating cycles of poverty.

Social Determinants of Work (SDoW), rst introduced by Dr. Angela Jackson, founder of Future Forward Strategies, illuminates the myriad factors in uencing employment opportunities and economic stability. e recent ndings of the Federal Reserve Bank of Cleveland on the profound impact of driver’s license suspensions on the region echoes and underscores the urgent need for systemic reform to this speci c barrier to work.

At its core, SDoW recognizes that employment outcomes are in uenced not only by individual quali cations and market conditions, but also by broader social and economic factors. ese determinants encompass everything from access to education and transportation to the availability of a ordable housing and health care. Among them, the issue of driver’s license suspension emerges as a poignant example, encapsulating the intersectionality of socioeconomic barriers and punitive policies.

e Federal Reserve Bank of Cleveland’s research o ers a stark portrayal of the prevalence and repercussions of driver’s license suspensions in Ohio, with Greater Cleveland bearing a disproportionate burden. Over 1 million Ohioans experienced driver’s license suspensions, triggering a cascade of consequences that reverberate throughout the community. For many residents, a driver’s license isn’t merely a convenience; it’s a prerequisite for employment, education and essential services.

To address this pressing issue, a shift is needed in how we approach driver’s license suspensions and their implications for workforce participation. Instead of applying measures that further exacerbate socioeconomic challenges, policymakers must prioritize the solutions that promote equity, opportunity and economic stability. is entails reevaluating the punitive nature of driver’s license suspensions and exploring alternative sentencing measures that address underlying issues that can keep people in poverty.

Furthermore, investments in barriers to work regarding transportation infrastructure and access to a ordable transportation alternatives are crucial to ensuring equitable opportunities for employment and economic participation. By enhancing connectivity and reliability, Greater Cleveland can mitigate the adverse e ects of driver’s license suspensions on workforce mobility and access to essential services.