Lakewood Country Club looks to ‘MAKE A BIG MARK’

Massive

$6M restoration to begin July 15 and the course will reopen Memorial

By Joe Scalzois is the story of how Lakewood Country Club found the courage — and the cash — to embark on a massive, generational, image-changing $6 million restoration and it begins in late 2019, with head PGA golf

professional Tim Perin ri ing through a stack of applications for the club’s greens superintendent opening.

It was a good stack — “A lot of good, quali ed guys,” Perin said — but one application stood out. It came from Aaron Archambault, the assistant su-

perintendent of e National Golf Links of America in Southampton, New York, a course that’s a xture in Golf Digest’s top 20 rankings and that Sports Illustrated once called “America’s snootiest golf course.”

“When his resume came across my desk, it was like,

Day 2025

‘Why in the hell would an assistant from e National, a top-three club in the country, want to come to Cleveland, Ohio?’” Perin said. “I was like, ‘I don’t know, but let’s call him and nd out.’”

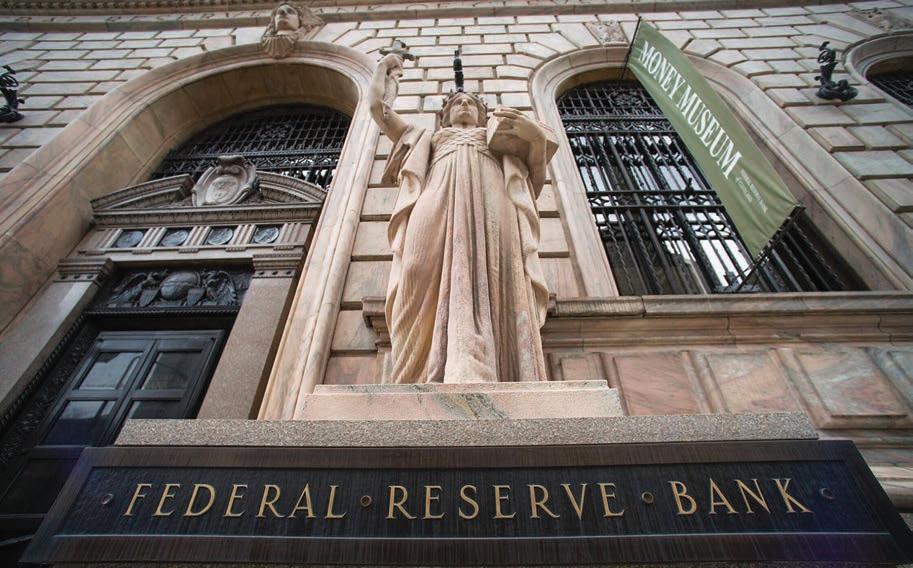

Cleveland Fed names next CEO, president

Beth M. Hammack is a Goldman Sachs veteran

By Scott Suttell

e Federal Reserve Bank of Cleveland has named Beth M. Hammack, a longtime Goldman Sachs Group Inc. executive, as its next president and CEO. Hammack, 52, will take o ce on Aug. 21 as the Cleveland Fed’s 12th president. She succeeds Loretta J. Mester, whose tenure with the bank ends on June 30, consistent with Federal Reserve mandatory age and length-ofservice policies. Until Hammack’s start date, Cleveland Fed First Vice President Mark S. Meder will serve as interim president and CEO. Hammack is the fourth woman to lead the Cleveland Fed, which in 1982 became the rst regional Fed bank to appoint a female president. She will oversee about 1,100 Cleveland Fed employees in o ces in Cleveland, Cincinnati and Pittsburgh.

Summer safety in Cleveland will get an all-hands approach

By Kim PalmerBuilding on a nearly 50% reduction in homicides this spring, Cleveland Mayor Justin Bibb announced a new, multi-pronged approach to keeping the city safe this summer.

Dubbed Operation Heat Wave, the all-of-government approach to preventing crime began May 1 and will run through to Aug. 30, the city’s law enforcement leaders told reporters

Tuesday, May 21, at a press conference.

“I’ve always said, public safety is my number one priority as mayor, and it will always be my number one priority as mayor,” Bibb told reporters gathered at Cleveland’s Trent Park. “As we approach the summer season, it was important for our administration to really show a true all-of-government approach to addressing violent crime in the city of Cleveland.”

e mayor, interim public safety director and deputy police chief spoke about how investments in the Cleveland Police Department (CPD) sta ng, partnerships with local, state and federal law enforcement, and employing new, data-driven technologies constitute a holistic approach to crime prevention this summer. Here are five takeaways from the announcement of

Big banks ordering more staffers back to company of ces full time

By Todd Gillespie, Gillian Tan and Ambereen Choudhury, BloombergCitigroup Inc., HSBC Holdings Plc and Barclays Plc are ordering more sta ers to report to company o ces ve days a week as regulatory changes make it trickier for Wall Street to allow working from home.

Citigroup is requiring about 600 U.S. employees previously eligible to work remotely to commute to company o ces fulltime, the New York-based rm said in a statement May 24. Even then, the majority of sta can continue their hybrid schedules, working up to two days a week outside the o ce, it said.

At HSBC, shifting regulations a ect about 530 sta in New York — roughly half of its workforce in the city — and the bank is speaking to them about their options, Mabel Rius, head of human resources for the U.S. and Americas, said in an interview. e rm is trying to let as many people as possible retain the option of logging in from home if they would like to, Rius said. HSBC’s regional chief has said it can avoid a blanket ve-day mandate for all sta .

Barclays will require thousands of investment banking sta globally to spend ve days a week in the o ce or traveling to see clients, beginning from June 1, it said May 24 in a memo. e decision — after Bloomberg reported the bank was weighing a ve-day o ce mandate for more U.S. sta — coincides with the “new regulatory policies,” it said.

“Being together in the o ce drives innovation, collaboration and a stronger culture,” wrote Cathal Deasy and Taylor Wright, the rm’s global co-heads of investment banking. “We remain

committed to exible working and we recognize that there will be times when you will need to work from home,” they said, adding that group heads have discretion to allow occasional exible working where needed.

e banks are known to be among Wall Street’s more exible in allowing employees to continue working remotely after the pandemic. e changes come as the Financial Industry Regulatory Authority — the U.S. brokerage industry’s main watchdog — is set to re-instate pre-pandemic rules for monitoring workplaces in coming weeks.

at may spell the end of remote work for many bank traders and some other dealmakers, as bosses conclude that allowing the practice under Finra’s framework is not worth the trouble or cost. Firms such as Deutsche Bank AG have been sizing up the burden as they weigh changes to their own policies.

e number of sta a ected by the Finra shift is relatively small compared to the banks’ total headcount, but comprises an outsized proportion of their revenuegenerating sta — making it important that banks manage the transition e ectively to retain talent. Citigroup has about 240,000 sta worldwide, while HSBC has about 220,000 and Barclays has about 93,000. A large proportion of the banks’ total headcount sits in consumer-facing divisions like local branches or back-o ce parts of the bank.

With some bosses blaming Finra’s rules for a new slew of veday o ce mandates, regulators have shot back, saying that, if anything, they’re trying to allow greater exibility — not less.

e tension stems from U.S. requirements that banks monitor

sta and facilitate periodic workplace inspections. When Covid-19 broke out, regulators initially eased some of their rules to ensure people could work at home. Some of those accommodations are now poised to sunset.

While Finra says the changes don’t require rms to summon sta to o ces ve days a week, it has acknowledged that compliance requires work.

Some home o ces will have to be listed with regulators as socalled “residential supervisory locations.” A pilot program for those sites lays out a system for remotely inspecting them at least every three years, starting in July. Privately, some executives have said that keeping up with the requirements may amount to a hefty price tag to preserve an employee’s ability to log on from the comfort of home.

Firms may ultimately reach different conclusions. Other banks have been weighing a ve-day ofce mandate for some sta , people with knowledge of the matter said earlier last month.

At Deutsche Bank, executives expect the rm can remain compliant with limited impact on its protocols, according to a person with knowledge of its thinking. In April, Truist Financial Corp. told investment-banking sta that they must work from the o ce every weekday from June 1.

Some of Wall Street’s largest banks — such as Bank of America Corp., JPMorgan Chase & Co. and Goldman Sachs Group Inc. — already have embraced veday o ce commutes across many of their desks, at least in practice if not as rules. But some smaller franchises have touted exibility, which can give them an edge in recruiting and retaining talent.

Epidemiologist explains bird u outbreak among dairy cattle

Your milk is ne, just don’t drink the raw stuffBy Jon Asplund, Crain’s Chicago Business

e United States is in the midst of an outbreak of bird u among its dairy cattle. While the virus can infect humans, it has not caused widespread infections or spread from person to person.

are not inviting public health workers on farms to test.

So it starts with testing farm workers?

With a bird u, we think about di erent health security scenarios. First, we look for the virus jumping from animals to agricultural workers in close contact with the animals, then to non-workers around farm populations. at moves on to health care workers and then to the general public. So, right now we are seeing agricultural workers in low to medium risk. e risk to everybody else is low or very low.

and an eye out for it developing the ability to move much more e ciently to humans, which seems to be several mutations away. It hasn’t evolved enough to easily infect people.

One of the concerns is if the virus moves into pigs.

We have not seen it spread to the pig population yet, but this would raise more concern to epidemiologists because pigs have receptors for both avian and mammalian u strains. is could cause a recombination event like the swine u pandemic of 2009.

e U.S. Centers for Disease Control & Prevention announced on May 22 a second case of a human having caught the avian in uenza A (H5N1) virus. In the latest case, a dairy worker in Michigan was found to have been infected with H5N1, showing minor symptoms. Previously, a Texas dairy farm worker was infected.

Crain’s spoke with Katrine Wallace, an epidemiologist and adjunct assistant professor in the division of epidemiology and biostatistics and division of community health sciences at the University of Illinois Chicago’s School of Public Health, about what the general public needs to think about when it comes to bird u.

e following has been edited for length and clarity.

So far, human cases seem limited in the U.S. Is that a good sign or just what’s being reported?

ere have been two reported cases; both are agricultural workers in close proximity with infected animals. Both the cases have been mild and have been resolved and have not spread from these cases to any other people.

ere are likely more human cases among farm workers that have not been detected since the symptoms are mild.

But it is important to note it is not spreading from person to person.

Still, access to farms and livestock operations is limited. While the CDC has called for better surveillance, much of the work falls to the U.S. Food & Drug Administration and the U.S. Department of Agriculture, and they don’t always collaborate well.

And surveillance can be di cult when states and individual farms

For the larger population, a big question seems to be whether our milk is safe to drink. Is it?

Yes, I have gotten hundreds of DMs asking me to talk about this on my Instagram.

ere have been traces of avian u H5N1 in the commercial milk supply. What’s being found in the milk supply are viral fragments, not active, infectious H5N1 virus. And there’s really no evidence that these fragments could infect humans. e FDA has said pasteurizing can still leave traces of inactive virus or fragments.

But we know that pasteurization would make the virus inactive?

ere haven’t been studies using this bird u strain and pasteurized cow milk, but we know it is inactivated in eggs when pasteurized. is strain doesn’t stand up to increased temperatures, so we’re good.

at’s why the people talking about the bene ts of raw milk are wrong.

ey were wrong even before this bird u strain, but they’re even more wrong now. H5N1 increases the risk pro le of drinking raw milk even further.

I’m always worried about that, but it’s even more risky now. Don’t drink raw milk.

What other risks are epidemiologists concerned about?

ere is genotyping of the virus

Is there something people should be doing, beyond not drinking raw milk?

I am glad that the public is pushing to stay on top of this, but there doesn’t need to be fear. Just education.

Infection control measures are still what they’ve always been. Pasteurized products, cooking meat to the proper temperature and washing hands. Proper, consistent hand washing remains a top recommendation.

e CDC recommends avoiding close, long or unprotected exposures to sick or dead animals or animal poop, bedding, materials that have been touched by or are close to birds or other animals with suspected or con rmed H5N1, and, of course, unpasteurized milk.

Wallace pointed out that the CDC is very active, recommending states implement monitoring and testing strategies in exposed persons.

The CDC states it is also holding weekly engagements with state and local health departments and updating interim recommendations for worker protection to include those who work with dairy cows. It also issued a Health Alert Notice on identification of human infection and recommendations for investigations/response.

It is asking states to increase submissions of positive in uenza virus samples to public health labs and to furnish personal protective equipment for farm workers. And the CDC is providing incentives for workers who participate in public health research e orts into the outbreak.

A new strategy is paying off for KeyBank

Company takes invigorated approach to its wealth management division

By Jeremy NobileKeyBank has transformed its wealth management division over the past few years into a pro table and fast-growing segment amid an otherwise challenging cycle for bank pro tability.

Growing this business further under Key Wealth president Joe Skarda is a core strategy for the company moving forward.

e idea is to lean into fee income in an otherwise challenging banking environment that has lenders grappling with high interest rates and soft loan demand.

e bank is seeing success here. Fee income, driven in large part by wealth management, was a bright spot in Key’s Q1 earnings, as highlighted at the time by KeyCorp president and CEO Chris Gorman.

While the bank posted quarterly decreases of 5% in net-interest income, 3% in loans and 2% in deposits for the period, it reported $647 million in noninterest income — a bucket that includes fee income. at marks a 6% increase from the prior quarter and accounts for 42% of all bank revenue for the rst three months of the year versus 35% of revenue at the same point in 2023.

While many market analysts were underwhelmed with that performance and leery of the bank’s outlook following Q1 earnings, Key’s strong fee income was a positive.

At Key, the wealth management division comprises four segments.

Some of the success here can be traced back to Skarda, who joined Key in April 2021 after 20 years with JPMorgan Chase & Co., where he last held the title of managing director of banking and wealth management.

ere’s the mass a uent piece, which is part of Key Private Client and features customers with investable assets between $250,000 to $2 million; the private bank, which ranges in client assets from $2 million to $10 million; the family wealth business, which encompasses families with $10 million and up (the average family in that group has about $75 million with the bank); and the institutional advisory group, which works with entities like pooled trusts, foundations and charitable organizations.

To create a better client experience, “We came up with the quick conclusion that we needed to hire people and in strategic places across the country,” Skarda said.

While Key trimmed costs by reducing net headcount across the company in the years following the COVID outbreak, it was strategically adding to its bench of nancial advisers.

“We’ve taken a world-class investment platform and made it more appropriate for a retail client.”

Skarda said he was intrigued by the opportunity to lead a business he was so intimately familiar with at a smaller company with ambitious goals.

“Key was committed to growing this business, and they had the resources to do it,” Skarda said. “ ey had a really good asset management business, and leadership was committed to its strategic position across Key. at was the lure for me.”

Skarda’s rst move was an audit of the manpower in each of its wealth management groups, which resulted in a boost in adviser headcount across the board.

So what does that look like?

In the years since joining Key, Skarda estimates that advisers in the mass a uent and private client segment have increased from about 260 to at least 315, a 21% increase. Relationship managers in the private bank also grew by 25%.

“It is by far the most growth that we’ve had in those client-facing roles in any kind of recent data we might have,” Skarda said.

Secondly, Skarda explored crossselling opportunities where meat was being left on the bone. In this case, that means nding instances where customers served in other areas, namely the commercial or retail bank divisions, could be courted with wealth management services via those four key channels.

It was something the bank had always done, but not as well as it

could have with groups often siloed from one another.

An important metric there is collaborative revenue, or revenue shared across Key. In 2019, that shared revenue number was approximately $9 million, Skarda said. By 2023, that increased by two-and-a-half times to $33 million.

Skarda said that Key’s wealth management business had run net ows that were either neutral or negative for years. In 2021, net ows turned positive for the rst time—or at least as far back as the data goes—and have remained positive ever since. is illustrates how Key was providing wealth management

services, but the business hadn’t been as much of a revenue contributor until more recent years under a refreshed approach.

In terms of other opportunities ahead, Skarda said a focus now is not just on bringing on net new clients but on building an enterprise that attracts more of those clients’ money.

For example, Skarda notes how Key’s retail bank has some 2.3 million customers and how a good 30% of those “screen mass a uent,” something that can be gleaned from characteristics such as spending habits.

But Skarda estimates that the wallet share of that group is just 5%, meaning those customers

have just 5% of their assets with Key. e other 95% that isn’t with Key could be as much as $5 billion. at is “a signi cant growth opportunity,” Skarda said.

Key charges about the industry average for portfolio management, which can range from about 1% to 2% of assets, with fees being less the more assets there are to manage. Of course, the more assets there are to manage, the more revenue there is to make from servicing those clients.

By adding sta and improving aspects of the business such as customer service and outreach, the hope is existing clients will trust more of their wallet with the bank.

And while there’s more money to be made with high-net-worth clients, the strategy is not exclusively about them.

Skarda said the bank has re ned operations at the retail level as well to serve customers with as little as $50 to invest in a 529 college savings plan.

Meanwhile, investment service capabilities once targeted more speci cally to the richest clients are being extended to others down the line of asset levels.

“All the things that had once been reserved for the multi-millionaires we have made available in a branch for clients at $250,000 and up,” Skarda said. “We’ve taken a world-class investment platform and made it more appropriate for a retail client.”

Before Key Private Client was established a few years ago, Skarda said Key was generating about $100 million a year in revenue from that mass a uent segment (those in the range of $250,000 to $2 million in investable assets). is year, with $275 million generated from the same channel in Q1, that group is on pace to surpass $1 billion in net ows.

In terms of cumulative assets under management, Key’s wealth management group surpassed $57 billion in Q1.

With this growth strategy in place, Skarda is quite optimistic that growth can continue, especially this year with a presidential election and general geopolitical and economic uncertainty. Such uncertainties make clients uneasy, which creates more opportunities for outreach to discuss customers’ investment goals

“In years like this where you have a lot of volatility in the capital markets just broadly, you have a lot of uncertainty around the rate environment. And anytime you have an election year, there is going to be more headline risk and short-term volatility,” Skarda said. “We use that as a means to reinforce the notion with our advisers that we have to be more proactive with our clients because the likelihood that they are going to have questions given the macro and geopolitical environment is going to be a lot higher. And then we can double down on the emphasis around the need for nancial planning.”

Waging a political ght over minimum wage

There’s another push — a signi cant one, with a strong chance of making it to the ballot this fall — to raise Ohio’s minimum wage, and it comes with all the complications and tradeo s that arise when legislation is used to try to boost workers’ pay.

A group called Raise the Wage Ohio is collecting signatures to put a constitutional amendment on the statewide ballot in November. It’s part of a national campaign, One Fair Wage, that seeks to boost the minimum wage in 15 states, including potential ballot issues this year in Arizona, Massachusetts and Michigan, in addition to Ohio.

e Ohio e ort needs 413,000 valid signatures by a July deadline. Backers say they already have more than 400,000 signatures and are con dent they’ll make it, setting up a minimum wage showdown in a presidential election year — and in an environment with an ostensibly more populist Republican Party that’s less hostile than it traditionally has been to raising the minimum wage. (Still TBD.)

e proposed Ohio constitutional amendment would raise the state’s minimum wage, currently at $10.45 per hour, to $12.75 per hour on Jan. 1, 2025, and then to $15 at the start of 2026. For 2027 and beyond, the minimum wage would be tied to in ation.

As far as these proposals go, that’s pretty standard. And, it should be said, $15 per hour isn’t what it used to be when the push for that wage started a few years ago, before the current period of high in ation kicked in. A 40-hour-per-week job at that wage pays $31,200 a year.

One variation from many past e orts, though, is that the proposed Ohio amendment would eliminate the current system in

PERSONAL VIEW

which tipped workers are paid a lower hourly wage — $5.25 per hour — but are allowed to keep their tips.

Under the proposed amendment, tipped workers wouldn’t earn the full minimum wage until Jan. 1, 2029, after which they would make the minimum plus whatever they receive in tips. (For 2025-2028, employers would have to gradually increase the minimum wage paid to tipped workers.)

e politics of the minimum wage, always tricky, are becoming even trickier.

e Ohio Restaurant & Hospitality Alliance, representing an industry that has been and remains opposed to minimum wage hikes, in May released results of an online survey of nearly 1,000 tipped workers that showed workers like things as they are today.

Take the results of an online survey from an interested party as you will, but the alliance found 93% of respondents wanted to keep the current tipped system. About 83% say they

currently make more than $20 an hour with their tips, and 64% say they are earning $25 to more than $40 per hour. More than 90% of respondents believe they will earn less money if tipped wages are eliminated, and 85% believe that customers are unlikely to continue tipping on top of any mandatory service charge. at may just re ect a natural resistance to change. It also might be a case of short-term thinking, since if the measure passes, tipped workers eventually would be paid the full minimum wage with tips on top. Even then, though, changes in consumer behavior around tipping, in an environment in which servers are paid a higher minimum wage, could scramble the overall pay picture.

An April report by Policy Matters Ohio, a liberal think tank, estimated that raising Ohio’s minimum wage to $15 per hour by 2026 would bene t nearly 1 million Ohioans, or about 19% of the state’s workforce. It said that gure includes 470,000 people who are

currently paid less than $15 per hour, and 500,000 currently paid up to $17.25 per hour who would get a raise as employers adjust pay scales. e average a ected worker would take home an additional $2,128 each year, Policy Matters Ohio estimated.

If the issue makes it to the ballot, there will be signi cant business opposition, particularly from the restaurant industry. e Ohio Restaurant & Hospitality Alliance, which says it represents 23,000 bars and restaurants that employ 520,000 workers, already has promised a strong campaign to ght the issue. (It has, though, indicated support for a bill introduced by State Sen. Bill Blessing, R-Colerain Township, as an alternative to the proposed constitutional amendment. at legislation, Senate Bill 256, would raise the minimum wage for non-tipped workers to $15 and tipped to $7.50 by 2028.)

For the restaurant industry, in particular, the ght will come as the business remains in a post-pandemic environment in which restaurants “have raised prices to o set ination, but consumers are cutting back on dining out,” Bloomberg noted. Sit-down chains are among the hardest hit, the news service said, “and the industry argues ending the tip credit could harm small businesses and chains.”

Voters tend to like minimum wage hikes when they get to the ballot. Florida, a big, Republican-leaning state not dissimilar to Ohio, passed a minimum wage hike to $15 per hour in 2020 — also a presidential year. Ohio businesses will need to decide how hard they want to lean in to ght it. In this era of high in ation, there’s a strong likelihood voters will be sympathetic to a renewed ght for $15.

Entrepreneurial lessons from the rise and fall of Bloom Bakery

Picture this: A bustling Cleveland street corner, the air lled with the enticing aroma of freshly baked pastries, each piece an edible masterpiece rivaling the nest bakeries of Paris. is was the dream, the vision behind Bloom Bakery—a dream that, despite its eeting success, taught me invaluable lessons about the harsh realities of entrepreneurship and the bitter taste of failure. Not only did this venture fail, but it also cost me hundreds of thousands of dollars and nearly led to bankruptcy.

Logan Fahey Franz is president and CEO of Graze Robotics.

Logan Fahey Franz is president and CEO of Graze Robotics.

I returned recently from speaking at the Airport Leadership Forum in Germany, an experience that reminded me how rarely we discuss our professional setbacks openly. Today, I am choosing to share my journey— not to dwell on defeat, but to celebrate the resilience and essential lessons that come from embracing our failures.

Bloom Bakery was born from a desire to make a di erence. I aimed to create a business that would hire primarily ex-o enders, integrating them back into society. Our vi-

sion was to open a high-end bakery and café that would not only serve the community but also become a beacon of hope and rehabilitation. After months of diligent research and planning, and with over $1 million in funding, what happened when we launched Bloom Bakery? e initial response was nothing short of exhilarating. Our opening week saw record sales, with food that could rival any artisan shop in Paris. e community’s support was overwhelming, and it seemed we were on the path to success.

en what happened? Although initial sales were strong, they were insu cient to support the ambitious scale and social mission of our enterprise. So, what did we do? We expanded into wholesale and catering to improve our nancial standing, yet the pro ts from these initiatives couldn’t keep pace with the high overhead and tight margins required by our specialized workforce. As these pressures mounted, the once vibrant dream of Bloom Bakery began to fade, constrained by a market that wasn’t as robust as we needed.

e board’s reluctance to invest further was a heavy blow. Decisions were made, and eventually, I found myself outside looking in, as the non-pro t owner transitioned the business into a non-pro t model. But my connection to Bloom Bakery was far from over.

So, what’s next? In a last-ditch e ort to save what we had built; I acquired the bakery’s assets in late 2019. is decision, driven more by heart than by hard data, would soon confront an unexpected adversary: a global pandemic. COVID-19 was merciless, and as it swept through Cleveland, it took with it the remnants of my beloved Bloom Bakery. Despite our e orts to keep the location open, Cleveland did not rebound as we had hoped, including the area around Cleveland State University where the bakery was located.

Moreover, we had counted on our landlord being sympathetic to our social mission—an expectation that proved to be a serious miscalculation. is taught me an essential lesson: never, under any scenario, personally guarantee a lease. Still, we were able to uphold our commitments, even as the business failed.

As I re ect on this journey, I recognize where I went wrong: an overestimation of the market, a misjudgment of the economic landscape, and allowing my emotional ties to cloud my business decisions. Yet, it is these very missteps that have enriched my understanding of business.

Despite these setbacks, I cherish the journey and everything I learned along the way. Sharing these failures is crucial; it’s how we grow, learn, and better prepare ourselves for the future. My experiences at Bloom Bakery have not only taught me about the importance of data-driven decision-making but also about resilience and the relentless pursuit of social good.

As I share my experiences with audiences around the world, it becomes increasingly clear how crucial it is to discuss not only the successes but also the failures and the profound lessons they bear. By sharing this story, I aim to help other entrepreneurs navigate their paths with both caution and courage. Why is failure an integral part of the entrepreneurial journey? Because it is from these experiences that we often draw our most valuable lessons.

Cleveland still ranks in top 100 on ParkScore index

The city slips to 31st, down from 26th in 2023

By Kim PalmerCleveland once again ranked in the top 100 largest cities nationally for park access and amenities, according to the 2024 Trust for Public Land’s ParkScore index.

But it wasn’t all sunshine, as the city’s ParkScore ranking slipped from last year, ranking 31st out of 100 — down from 26th in 2023 and 23rd in 2022. e dips have hit as other large cities have made signi cant increases in park investment, according to the ndings published Wednesday, May 22.

“ is was a year where we knew that Cleveland wouldn’t make a big jump,” said Sean Terry, associate vice president and Ohio state director for Trust for Public Land. “We’ve stayed the course this year in terms of park access and nothing substantial has changed, so comparatively there was a mild dip.”

e ParkScore rankings are based equally on park access, park equity, park acreage, park investment and park amenities using Geographic Information Systems and spatial analysis.

One of the strongest metrics for Cleveland is park access, which shows that 81% of Cleveland residents live within a 10-minute walk of a park, compared to the national average of 76%.

Cleveland also ranked second nationally for the abundance of “splashpads” and other waterbased options available across the city.

Terry points out that the city’s ParkScore ranking dip comes as other cities have devoted a large share of federal American Rescue Plan Act dollars to upgrading or expanding local park systems.

According to ParkScore index research, of the cities evaluated, the average park spending per resident increased to $124 in the 2021-2023 city budgets compared to $108 in the previous budget cycle.

“COVID was really an in ection point for the industry in general. We really saw an uptick in people gravitating to the parks and nature

as an outlet,” Terry said. e move to invest more in public green spaces, Terry said, shows heightened awareness among pol-

Nestlé courts people taking weight-loss drugs like Ozempic

By Deena Shanker, BloombergNestlé SA is launching a new line of frozen foods speci cally targeting users of GLP-1 drugs like Ozempic and Mounjaro, pouncing on a weight-loss drug craze that is changing eating habits and impacting industries spanning retailers to airlines.

e portion-controlled food line, dubbed Vital Pursuit, will include high protein, ber and other nutrients like calcium, iron and vitamin A, the company said on May 21.

e weight-loss drugs help people shed pounds by reducing ca-

loric intake, which leads to losing muscle alongside fat. So some doctors suggest their patients eat high-protein foods to help stem muscle loss.

One

in

60

adults

pizza, all with a suggested retail price of $4.99 or less. Gluten-free options will also be available. It will be available at select retailers by the fall, beginning with 12 products.

were prescribed GLP-1s in 2023, a number that is expected to increase this year.

Pharmacists Association

Nestlé says its new food line will include pasta, sandwich melts and

“Vital Pursuit provides accessible, great-tasting food options that support the needs of consumers in this emerging category,” said Steve Presley, chief executive o cer of Nestlé North America. “We’re leveraging our deep understanding of consumers and nutritional science to stay ahead of the trends that are shaping consumer behaviors.”

icymakers that parks are part of a city’s vital infrastructure. “ is year Public Trust did a study to look at parks as a place for social cohesion. It looked at how parks provide connective tissue for people of di erent backgrounds and di erent demographics to coming together,” Terry said.

e report, e Power of Parks to Strengthen Community, found that residents of cities ranking in the top quarter of the ParkScore index are 60% more likely in the last year to have volunteered compared to lower-ranking cities. It also found that people in higher-ranking cities were 26% more likely to form friendships with people in di erent socioeconomic groups. is year, Cleveland’s ranking was also a ected by the city’s below-national-average park size.

Nationally, the cities ranked highest on the ParkScore have a median acreage of 5.4 acres while

Cleveland’s median is 3.9 acres — but with some major changes on the horizon. e completion of the Irish Town Bend 23-acre park, proposed Lakefront and River developments and the Metroparks’ ambitious CHEERS project will boost that number in the near future.

“We anticipate more spending to address deferred maintenance, but also to renovate old rec centers and we are looking at the city to make big investment into large new parks,” Terry added. “ ere is a lot on the horizon with the city’s park master plan and the department being reorganized,” Terry said. “We anticipate seeing more park investment with other departments including capital projects. e city is on the precipice of change, and we’re seeing a stated interest in committing to parks and wanting places to convene as a priority for city land use.”

e company cited statistics showing the growing market for such products, including that one in 60 adults were prescribed GLP-1s in 2023, a number that is expected to

increase this year, according to the American Pharmacists Association. JP Morgan Research has predicted that by 2030, as many as 30 million Americans could be GLP-1 users.

Thursday, June 20 | 11 AM-1 PM

Maria Bennett, President, CEO & Founder, SPR Therapeutics

Emily Campbell, President & CEO, The Center for Community Solutions

Carrie Carpenter, SVP, Regional Manager, Corporate Affairs, Huntington National Bank

Shelly Cayette-Weston, EVP and Chief Commercial Officer, Cleveland Cavaliers

Elaine Eisner, Principal, Eisner Gohn Group

Deb Janik, SVP of Business Development, Bedrock

Charmaine Rice, SVP, Learning, Development & Diversity, AmTrust Financial

Jasmin Santana, Cleveland City Councilwoman, City of Cleveland

Celina Cunanan, Chief Diversity, Equity & Belonging Officer, University Hospitals

Dr. Airica Steed, President & CEO, The MetroHealth System

Elizabeth Voudouris, President & CEO, Business Volunteers Unlimited

Sonia Winner, President & CEO, Cleveland Museum of Natural History

Dr. Michele Scott Taylor, President & Chief Programs Officer, College Now Greater Cleveland

Northeast Ohio aims to build sustainable plastics hub

By Steve Toloken, Plastics NewsOrlando, Fla. — A coalition of Northeast Ohio plastics companies, governments and universities is hoping to secure at least $40 million in federal funding to become a national technology hub for sustainable polymers.

e group, the Polymer Industry Cluster in Akron, Ohio, secured $400,000 in seed money from Washington last year as part of a program to identify and support potential technology hubs around the country.

At a May 7 event at NPE2024 in Orlando, they said they’re competing for at least $40 million in additional federal funding to take their plans to the next step.

Cluster members, including materials supplier Avient Corp., said the group hopes to strengthen ties among the 500 plastics and rubber rms within an hour’s drive of Akron and help the industry transition to more sustainable plastics manufacturing.

One strength, they said, is the size of the industry now in the region. Northeast Ohio is the densest grouping of plastic, polymer and rubber manufacturing in North and South America, said Brian Anderson, vice president of the polymer industry cluster at the Greater Akron Chamber of Commerce.

tage as a rubber city and evolving into a polymer city,” she said.

In November 2023, the cluster was one of 31 programs around the country to secure initial seed funding in a U.S. Department of Commerce program to identify potential technology hubs. e Commerce Department is expected to further narrow that list later this year.

Amit Kulkarni, global technology director for Avient, said a beefed-up polymer cluster could help the region accelerate innovation and meet needs for skilled labor.

e e ort relies closely on the University of Akron and its wellknown plastics programs, which are part of the cluster, he said.

“Being at the table to leverage some of the emerging innovations coming out of academia is extremely attractive for an industry partner like us,” Kulkarni said.

As well, he said a strengthened cluster can help the region better deal with challenges in attracting and retaining talent.

ey see a similar chance to build up the sustainable polymers

Panelists drew parallels to the 1940s, when they said federal support and direction during World War II built up the synthetic rubber industry in Akron, after the war exposed dependence on natural rubber supplies from Asia.

industry, with federal direction.

“What we’re excited about now is that there’s a new opportunity, and instead of having the pressure of a World War on our shoulders, our pressure is to think about how the sustainability of polymers helps us become a leader in not

JumpStart, North Coast Ventures receive massive capital jolt

Jeremy NobileA jolt of federal funds funneled to the state is expected to help support early-stage tech companies either based in Ohio or that could relocate here, with some money geared speci cally toward startups owned by women or minorities.

e Ohio Department of Development recently divvied up $86 million in awards to 11 new or existing Ohio venture funds, including a few controlled by Northeast Ohio fund managers JumpStart Ventures and North Coast Ventures, which happen to be the two largest benefactors of these investments.

e money comes from the federally funded State Small Business Credit Initiative, a $10 billion program designed to support small businesses and entrepreneurship. It’s disseminated via the state’s Ohio Venture Fund and Early Stage Focus Fund. ( e latter is centered on minority- and women-owned companies.)

“ ese awards will help spur innovation by fostering a diverse entrepreneurial ecosystem and accelerating the growth of high-potential companies,” said Lydia Mihalik, director of the Ohio Department of Development, in a statement. “By directing these funds to historically under-repre-

sented founders and tech-focused companies, we’re leveling the playing eld and ensuring everyone has a chance to succeed in the heart of innovation.”

With a total of $35 million sent its way, JumpStart gets almost 41% of that $86 million, which is allocated to four distinct funds.

“ e opportunity this federal funding provided is unique, and I am so grateful to the state of Ohio that they have recognized JumpStart’s value by awarding these funds to our management,” said Julie Jacono, CEO of JumpStart Inc. and JumpStart Ventures. “ is infusion of capital will allow us to expand our collective pool of venture capital to strengthen Ohio’s position as an innovation hub.”

Here’s how that breaks down for JumpStart Ventures, according to state details:

$5 million for the Focus Fund II to “help accelerate access to capital for innovative Ohio-based preseed and seed-stage technology startups founded by underserved leaders.”

$10 million for the NEXT Fund III, which will primarily invest in “capital-e cient businesses operating in the areas of software applications for business, healthcare and medical technology and, on occasion, will consider secondary technology areas,” like sensors, electronics and advanced materials.

$10 million for the Evergreen Fund IV, which will primarily invest in the areas of “software application for business and healthcare and medical technology, with advanced manufacturing as a secondary focus area.”

◗ $10 million for the Ohio Life Sciences Fund, which will “focus its investments in Ohio’s most promising life sciences companies that have the greatest potential to attract follow-on capital from outside Ohio.”

just the nation but the world’s economy so that we can think differently about the nature of plastics and how they can be recycled,” said Suzie Graham Moore, economic development director with the city of Akron.

“We’re moving from our heri-

“We are grateful to our partners at the state of Ohio for bringing federal SSBCI funding to early-stage technology startups in Ohio,” said JumpStart board chair Jeanne Coughlin. “ is announcement arrives at a pivotal time for JumpStart as we welcome our new CEO, bolster our venture capital e orts and dive into a new, strategic chapter.”

“ e investment will advance our work to drive transformational economic growth through returns generated by JumpStart Ventures,” she added, “and, through the Focus Fund II, drive more investments in high-growth companies led by women and founders of color.”

“This infusion of capital will allow us to expand our collective pool of venture capital to strengthen Ohio’s position as an innovation hub.”

Julie Jacono, CEO of JumpStart Inc. and JumpStart Ventures

is infusion of capital comes to JumpStart at an interesting time. e organization, fueled by a mix of public and private dollars, just installed Jacono as its second-ever CEO last fall.

And in a big change this spring, JumpStart Ventures restructured itself as a for-pro t operation—a move designed to help the former nonpro t entity compete in the venture ecosystem and operate more like a traditional VC rm.

For some context on at least one of its funds, JumpStart’s NEXT Fund II began fundraising with a $50 million target in June 2021, according to Securities and Exchange Commission lings. e original NEXT fund was stood up in 2016 with $20 million. ere are about 80 limited partners who have participated in those two funds.

North Coast Ventures, meanwhile, gets $15 million that is being split between two funds.

Here’s how that breaks down for them, according to state details: $5 million for the North Coast Angel Fund V, which will primarily invest in B2B SaaS ventures “through Series A that are working to solve problems that intersect with NCV’s member and regional industry expertise.” e fund focus

“Coming out of COVID, I would say our industry as a whole is facing some new ground realities about trying to attract new talent to polymers, plastics and composite materials,” he said.

Steve Toloken is the Assistant Managing Editor for Crain’s sister publication, Plastics News.

will be on early-stage companies in Northeast Ohio and also identify non-Ohio companies that have the potential to relocate their headquarters to Ohio.

$10 million for the North Coast Venture Fund III, which will primarily invest in B2B SaaS startups with a focus on companies in “late incubation” or “demonstrating stages” of development. e capital will be used to “enable companies to build on existing commercial traction, achieve meaningful milestones and market validation, and fuel the company to the next nancing round.”

e $15 million awarded to North Coast comes with a $15 million match raised by the rm from 100 Cleveland-based investors. “ e vote of con dence from both the state and over 100 private investors accelerates our mission to fuel the success of promising B2B SaaS startups,” said Todd Federman, managing director of North Coast Ventures. “We are eager to leverage our platform to help these innovative companies thrive, creating great outcomes for the entrepreneurs, private investors and the state.”

Other recipients of the state’s SSBCI funds are: Cintrifuse Capital of Cincinnati ($10 million); H Venture Partners of Cincinnati ($10 million); Cincinnati Cornerstone Capital ($10 million); Rev1 Ventures of Columbus ($3 million); and BOLD Opportunities Fund I of Westerville ($3 million).

More details on how those groups can use their allotted funds can be found via the Department of Development website.

Guardians ride hot start, trendy merch to big business

e Cleveland Guardians’ new jerseys aren’t the only thing connecting with the city.

Boosted by the team’s best start since 1995, the Guardians are winning everywhere — at the ballpark, at the turnstiles, on TV and on social media.

“ is is a dream scenario for starting a season,” said Curtis Danburg, the Guardians’ vice president of communications and community impact. “Obviously (there’s bene t) with a new leader in (manager) Steven Vogt and that meshing with the City Connect (jersey) opportunity that we had this year. You’re seeing a con uence of great oneld performance meshing with great business performance.”

e team’s most noticeable jump has been at Progressive Field, where the Guardians are averaging 21,107 fans through their rst 24 home games.

the American League and the fth fastest in Major League Baseball.

Single-game tickets this season are up 18% year over year.

“This is a dream scenario for starting a season.”

at ranks rst among American League Central teams and is a 17% increase year over year, giving Cleveland the secondfastest growing attendance in

More impressive? e Guardians already boosted attendance by 41% last season, the second-highest jump in MLB in 2023. Last year’s growth was tied to the Ballpark Pass — the monthly standing-room-only (SRO) pass that debuted in April 2023 — while this year’s growth is a combination of increased SRO space at Progressive Field in the upper deck, the overall play of the team and the launch of the City Connect jerseys.

“ ere are many factors that have led to success this year,” Danburg said.

e City Connect jerseys debuted in front of a sellout crowd on May 18, Cleveland’s rst May sellout since 2011. at was also a José Ramirez bobblehead night and the star third baseman homered to lead the Guards to an 11-4 victory, the rst of nine straight wins.

“The fact that we took advantage of a great opportunity off-the-field with on-field performance was awesome,” Danburg said. “That weekend, the weather was great, the team was performing, José Ramirez hitting a homer on his bobblehead night. ... They followed

the storybook plan to a T.”

Between May 13 (the retail launch of City Connect) and May 22 (the rst ensuing homestand), City Connect merchandise represented just over 70% of total merchandise sales. e Guardians’ sales on May 18 were the highest in regular season history. Overall, that day ranks just behind Cleveland’s three home World Series games in 2016.

“It starts with our players,” Danburg said. “Our players, from the moment they saw it, were overwhelmed by the design and they keep mentioning, ‘Can we wear this every day?’ ey wanted to take them on the road, and we had to remind them this is City Connect and they’re only for home games.”

e Guardians also are on pace to set a record for most group sales in the history of Progressive Field, with 25% of those sales coming from the new Paul Davis Pennant District in right eld. Cleveland also is poised to set franchise records for the highest premium revenue and has already set a franchise record for the highest corporate partnership revenue.

“Our group sales used to be a circus tent outside the ballpark and now we have a beautiful space that is appealing for groups to use for entertainment,” Danburg said. “And that’s

another area for fans to go to for standing-room-only with the Ballpark Pass, along with the Terrace Garden (in left eld).” Television ratings on Bally Sports Great Lakes are only up 2% year over year, but some of that is because the Guardians’ local TV ratings are already high and the fact that many households don’t have access to the broadcasts. Unlike the Cavaliers, who o er a $20-per-month streaming option, Guardians fans must subscribe to cable, satellite or FuboTV, a situation unlikely to change until Diamond Sports Group exits bankruptcy.

( e Guardians said there’s nothing new to report on the broadcast front, although they should know more by midsummer. A bankruptcy judge will decide on July 29 whether to approve Diamond Sports Group’s Chapter 11 plan.)

As for social media, total engagements are way up on X, formerly known as Twitter (240%), Instagram (225%) and Facebook (320%). e team also launched its TikTok account two months ago and is currently up to 24,000 followers.

“We have a lot of positive momentum, with the renovations and the team and the City connect,” Danburg said. “It’s all lined up and contributed to the success.”

Equestrian estate is a private oasis

Moreland Hills property for sale at nearly $4.2M

By Alexandra GoldenNestled adjacent to the Metroparks in Moreland Hills sits an equestrian estate featuring two houses and a horse stable on 20.33 acres.

e estate shares a small piece of Cleveland lore, designed and built by Dominick Benes, of the Cleveland architectural rm Hubbell and Benes, in 1924. Benes and Benjamin Hubbell also designed two of Cleveland’s most iconic buildings: the West Side Market and the Cleveland Museum of Art. After living at 36205 Miles Road since 2010, Derek and Rebecca Yuhasz Smith put the property on the market May 3 with a listed price of $4,195,000. e couple is ready to start a new adventure after giving the “extremely rough” property a “tremendous transformation” over a decade.

Rebecca Yuhasz Smith is the CEO and designer of Rebecca Ray Designs, a 20-year-old luxury handbags, accessories and home goods brand inspired by the equestrian lifestyle. e property acts as a backdrop for the business and supports it as an authentic equestrian-inspired brand, she said.

“We’re hoping that there will be another family who cherishes it as much as we do. It’s the most wonderful place in the world to raise children,” Rebecca Yuhasz Smith said. “We tease it’s our Little House on the Prairie.”

e listing agent is Craig Cantrall of Chestnut Hill Realty Inc. Between the two houses, there are seven bedrooms, ve full baths and two half baths. e main house has three stories plus a walkout basement while the second house has two stories and also features a walkout basement.

e original (and main) house kept its original footprint, Smith said, but the owners opened up the space. ere are four beds, 3 ½ bathrooms and four replaces in the roughly 4,500-square-foot home. Most of the ceilings are nine feet high or higher.

e Smiths replaced all the windows and installed all new plumbing and heating, along with adding air conditioning.

Although it is a “completely different home,” the Smiths kept details such as the pocket doors and salvaged the hardwood. Additionally, they kept the original stainless steel counters in the laundry room and the butler’s pantry.

e kitchen is the “hub of the house,” Smith said. e property itself is a “fabulous entertaining” space given that there are three patios on the main home, she said.

e walkout basement has a warm chestnut family room and bar with a replace that they use as their own private pub. e couple mainly lives on the rst and

second oors, but the third oor could be turned into a teen suite or another bedroom.

Not only did the Smiths do renovations to the main home, they transformed a former barn into a second home and built a new stable. e barn was too small for the Smiths’ horses so they turned it into a second home. It’s around 3,200 square feet; the Smiths’ parents live in it for half the year.

“It really is generational living here,” Smith said.

“ ere’s so much property here, and it is so magnicently planted and treed on this property and matured that … we don’t even really know they’re there unless we want to know they’re there.”

When renovating, the Smiths kept as much of the original barn, including the copper roo ng and the pine oors. When people enter, they can see the hay drop.

e garage doors are original to the barn and the island and counter in the kitchen are made of wood from the original barn structure.

ere are two replaces in the second home, along with a rst- oor master suite with a steam shower and oversized soaking tub.

e second oor has two additional bedrooms and a bathroom.

e Smiths then built a ninestall horse stable to accommodate their horses, featuring a brick aisleway and European stalls. e washrooms, tack rooms and feed rooms are on radiant oor heat. ere is also a kennel, which was used for raising show dogs.

Another perk of the property? Fruit. e land includes both an apple orchard and about 850 to 1,000 feet of concord grapes in a vineyard, which can be used for jams, jellies and pies. It also has four buildable lots.

e property allowed the Smiths to “maintain all of the urban amenities that we want, but once you get on this property, it’s like a private oasis,” she said.

e location is also a big plus, close to the Metroparks, ve minutes from Chagrin Falls, a Whole Foods and two Heinen’s — and it sits just 25 minutes from Cleveland Hopkins International Airport. But the property still has complete privacy, where Smith said they can go days without seeing anyone.

“You can have as little or as much of that outdoor experience that you want here,” Smith said. “ ere’s no limitation to how much fun you could have here. Whether it’s with no animals here or lots of animals here, and it’s the most wonderful place to raise children. ey can explore and be outside and do things forever here.”

SITE Centers readies sale of six plazas for $497M

By Stan BullardAs part of a push to purge huge shopping centers from its portfolio, Beachwood-based SITE Centers (NYSE: STC) disclosed in a U.S. Securities and Exchange Commission ling that it has a purchase agreement for six plazas for $497 million.

e prospective buyer is Pine Tree, a Chicago private real estate company with a retail portfolio valued at $3 billion. All of the properties in the deal are outside Northeast Ohio. ree of them, though, are in Ohio.

e properties that SITE Centers has an agreement to sell for cash are Arrowhead Crossing, Phoenix; Easton Market, Columbus; e Fountains, Miami; Kenwood

Square, Cincinnati; Polaris Towne Center, Columbus; and Tanasbourne Town Center, Portland.

e REIT said the planned sales are subject to typical closing conditions.

SITE Centers also said it intends to retain three small, convenience-oriented segments of some of the properties as part of its plan to spin out a new company called Curbline this fall that would exclusively own tiny plazas in a uent neighborhoods.

e largest of the properties it will retain from the latest pending deal is the 70,971-square-foot Shops on Polaris. e other retained properties will be Shops at the Fountains, 14,159 square feet, and Shops at Tanasbourne, 8,497 square feet.

Based on the last SITE Centers conference call with investors May 1, the just-announced transactions represent nearly half of the $1 billion in deals that the company expects to consummate this year.

David Lukes, SITE Centers CEO, observed on that conference call that he has been surprised by the volume of private groups with cash on hand in search of regional shopping centers in its portfolio. e observation was included in a Yahoo! Finance transcript of its rst-quarter call.

Lukes has said that if SITE Centers sheds enough properties it may be able to launch Curbline on a debt-free basis. e company has not said which executives and directors will remain with SITE Centers or go over to the new concern. Ken

Stan BullardTwo companies led by Ken Ganley, CEO of the Ken Ganley Automotive Group of Broadview Heights, have purchased, respectively, the sites of Hooley House restaurant in Westlake and the Ducati motorcycle dealership in Brook Park.

rough 26940 Sperry Road LLC, which takes its name from the street address, Ganley paid $1.36 million on May 17, according to Cuyahoga County land records, for the Hooley house site.

e restaurant, which remains in operation, is in a building that dates from 1999, separated from Ken Ganley’s BMW dealership by an Outback Steakhouse location.

Using KG Airport Real Estate LLC, Ganley on May 20 paid $3.5 million, according to land records, for the site of the Ducati dealership, 14070 Brookpark Road in Brook Park. Ducati occupies a former Mini Cooper dealership that sits on 1.5 acres.

Keith Gingerich, Ducati general manager, said the dealership plans to continue operating and he was unfamiliar with the sale of the property.

e Ducati Cleveland dealership was established by Indianapolis-based race car driver Graham Rahal, who owns three Ducati dealerships along with multiple other auto-related ven-

tures.

In the past, Ganley has snagged sites and later installed a dealership from another location, such as putting the BMW dealership at the site of a former Enterprise rental car operation. Both locations might serve as investment properties with rent-paying tenants in place. Or they might be land-banked for future use with tenants remaining in place until conditions change.

Michelle Boczek, Westlake economic development manager, said in a phone interview that the Hooley House site is zoned for interchange services, which would allow the operation of a car dealership, among other uses, if it secures a conditional use from the city.

However, she said, the suburb’s zoning code would preclude Ganley from adding a second location for the nearby BMW dealership, as the two parcels do not adjoin each other.

e Westlake property has visibility on I-90, while the Brook Park property is visible on I-480 Ganley did not return either an email request for comment or multiple calls to its headquarters. Rahal did not return two calls by press time.

Ken Ganley Automotive Group has 54 locations in three states: Ohio, Pennsylvania and Florida.

Biotech company gets green light for ulcer treatment trial

Paige BennettAmputation is a common solution for patients who develop advanced diabetic foot ulcers, but a clinical-stage Cleveland biotech company is working to commercialize a treatment to reduce incidences.

Discovery erapeutics Caribe received approval from the U.S. Food and Drug Administration (FDA) to initiate a phase three trial of Heberprot-P, a Cuban treatment injected into a foot ulcer to facilitate healing.

Lee Weingart, president and co-founder of Discovery erapeutics Caribe, told Crain’s the company expects to start the 18-to-20-month trial early next

year. It will involve 180 patients across approximately 20 to 25 sites. Weingart said the company is raising money to fund the trial, which is estimated to cost between $12 million and $15 million.

Discovery erapeutics Caribe is targeting mid-2028 to start marketing the product, provided the trial is successful and the company receives the necessary approvals to move forward.

Weingart said the company has not disclosed any nancials.

Standard treatment for Heberprot-P is between six and eight weeks, with patients receiving three injections per week, he said.

It is an intralesional recombinant human epidermal growth factor, which is derived from yeast and

helps cells grow and di erentiate.

Weingart said foreign trials and post-market studies have shown ulcers heal after 10 weeks. What’s di erent about Heberprot-P compared to other ulcer treatments, he said, is that it’s an injectable, not a topical.

“ e problem with topicals is there’s a bacterial layer that forms over the foot ulcer, and it’s di cult for the topical to permeate that layer and get to the foot ulcer itself and start the healing process,” he said. “So, by injecting this biologic right into the foot ulcer, you get through that bacterial layer, and you can facilitate healing much quicker.”

e company was founded in 2020 and consists of a small team, Weingart said. e company con-

sulted with a network of experts in preparing to submit its Investigational New Drug application to the FDA. Weingart also runs LNE Group, a Cleveland-based lobbying rm. He is a former Cuyahoga County commissioner who ran unsuccessfully for county executive in 2022.

Discovery erapeutics Caribe estimates the market for the treatment to be about $6 billion. Diabetic foot ulcers a ect approximately 18.6 million worldwide and 1.6 million in the U.S. every year, according to a 2023 entry in the medical journal JAMA. Roughly half of these ulcers become infected and 20% of these infections result in the amputation of part of or the whole foot.

Diabetic foot ulcers a ect approximately 25% of veterans who receive care from the Veterans Administration. Racial and ethnic minorities have diabetes at greater rates and are more likely to develop diabetic foot ulcers and receive amputations than white individuals. Weingart said the company expects its primary payers to be Medicare, Medicaid and the Veterans Administration. e VA spends approximately $3.5 billion on diabetic care each year. e cost to treat each foot ulcer is $47,000, according to VA data. Weingart said that doesn’t include the ongoing costs to a patient who undergoes an amputation, such as the inability to work or drive and disruptions to their lifestyle.

HIGHEST-PAID CEOS CRAIN’S LIST

Netincomeisincomeattributabletoordinaryshareholders.Pensionvaluechange guresincludenonquali eddeferredcompensation.ToappearonthislistanexecutivemusthaveservedasCEOofalocal publiccompanyduring2023.CEOpayratiosmaybebasedondifferentcompensationcalculationsunderSECrules.SmallerreportingcompaniesarenotrequiredtodiscloseCEOpayratios. 1. Morikis resignedaschiefexecutiveasofDec.31,2023. 2. Mapesservedaschairman,presidentandchiefexecutivethroughDec.31,2023. 3. Pattersonresignedaschairman,presidentandchiefexecutiveasof Dec. 1, 2023. 4. Carestio previously served as senior vice president and chief operating of cer. 5. MasterBrand Inc. relocated to Beachwood in December 2023. Get all 50 CEOs and historical compensation data in Excel. Become a Data Member: CrainsCleveland.com/data

Fast-growing Becco Bags sets storefront debut at Pinecrest

Stan BullardBecco Bags, a Chagrin Falls business launched by Caitlin Osborne, plans to open its rst brick-and-mortar store in June at Pinecrest in Orange Village.

e bags can be personalized and frequently transformed with changeable patches that Osborne designed. e business sprung from an idea Osborne tried at a birthday party for her then 6-yearold daughter. And, now, Becco Bags has made its way to Orange Village in an unusual way: by gaining exposure in Europe and placements in major department store chains.

“We are a very young company, launched in 2023, but we’ve had success with big retailers so we’ve targeted them and held pop-ups rather than go the B2B route with small boutiques,” Osborne told Crain’s. “ is will be our rst inline store.”

“We feel once a consumer sees and feels our bags, it’s a sale,” Osborne said. “We had instant suc-

cess with that at Harrod’s in London, which was open to our products.”

Becco Bags also are sold at Saks Fifth Avenue and Bloomingdale’s. The backpack-resembling bags have also been seen by viewers of The Today Show and Good Morning America as well as readers of Condé Nast Traveler, Glamour, Good Housekeeping and Better Homes and Gardens.

e heart of the concept is in patches that can be attached and changed using what Osborne calls a “dot and loop system” she’s seeking to patent. e bags are produced in Shanghai.

Becco Bags made its way to the storefront at the tony local retail center through friend-of-a-friend connections.

e storefront is more than a pop-up as it’s set for a six-month run at Pinecrest that Osborne can choose to extend.

However, she’s got pop-ups aplenty in the planning stages, in part because she’s found Europe a

more hospitable environment for a start-up than the U.S. She’s setting up pop-up shops in Abu Dhabi, Paris, Dubai and locations in Germany and Sweden.

At Pinecrest, she said, Becco Bags will o er birthday parties and other in-store events, a claw machine and a sel e stage.

Adam Fishman, Pinecrest developer and a principal of Fair-

mount Properties, said in a news release he considers Becco Bags a “best-in-class” o ering to add to its product mix.

e shop will go in between Vineyard Vines and J. Crew, formerly a Homage location, but certainly a rare ed location for a retail newbie.

Moreover —and also online, of course — Becco Bags o ers chil-

dren’s bags, backpacks, beltbags, tote bags and lunchboxes. Osborne has a background in digital marketing from when she lived in Chicago and New York, but Becco Bags is her rst small business venture.

“We see it as a razor blade venture,” Osborne said, referring to its repeat sales opportunity as customers.

Spokbee founders Mac and Karina Cameron leverage Youngstown Business Incubator to grow AI-based software

his wife Karina founded the company about a year ago while they were still living in Boston (Karina, a so ware engineer, met Mac at an entrepreneurial meetup).

Cameron’s background was in additive manufacturing and 3D printing, and Spokbee — the name is an anagram of the word bespoke; “It’s all about customized things,” Cameron says — was started to help people learn how to design and ultimately manufacture custom parts.

intelligence, automating the sales process and doing it much faster than it’s been done before, Cameron says.

“We built a platform that can price products in seconds, not weeks,” he says. “ ere’s an industry called con gure-price-quote, and that’s where we were initially, but that doesn’t do it justice. We con gure-price-deliver.”

Because it’s so ware as a service, it’s all cloud-based and can be done by sales representatives in the o ce or on the road.

“ e EVOLVE tech program specializes in helping early-stage tech companies ourish. Spokbee is the perfect example of our ability to deliver as a team and help make a di erence for founders like Mac and Karina,” Fi ck says.

By Vince Guerrieri, Crain’s Content StudioMac Cameron wanted to eliminate a learning curve for complicated computer-assisted drawing so ware.

Instead, he stumbled on a whole new way to do business.

Cameron is the CEO of Spokbee, a portfolio company in the EVOLVE Technology Entrepreneurship Program, which is part of the Youngstown Business Incubator (YBI), a nonpro t focused on developing successful digital businesses, advancing women and minority entrepreneurship and small businesses, and furthering advanced manufacturing technologies. Cameron and

“When I started this business, we thought additive manufacturing was the market,” he says. We quickly realized that we had accidentally built one of the fastest, most complex part-quoting tools ever created.”

While 3D printing can take moments, it can be preceded by a lengthy period of time — up to seven weeks, Cameron says — to give a price estimate. In fact, Cameron says some companies will lose out on business because they have to stop taking orders due to a backlog for price quotes. A catalog can help, but it’s also limiting.

“If you can’t show all the products you can build, you most likely won’t sell the ones they can’t see — especially if you have a button that says call for a quote,” Cameron says.

“Customers will see that and leave your site.” Spokbee uses a narrow form of arti cial

e couple moved to the Cleveland area shortly a er starting the company (Karina is from Northeast Ohio, Cameron says, and they wanted to be closer to family). At the time, they thought Spokbee had a place in the additive manufacturing space, and that drew them to the Youngstown Business Incubator. But even with the company’s pivot, Cameron says YBI and its EVOLVE program is exactly what he was looking for.

Chandler Fi ck, director of the EVOLVE Technology Entrepreneurship Program, says Spokbee is one of about 50 portfolio companies in the program. Spokbee worked with one of EVOLVE’s entrepreneurs in residence, who was so impressed with the company that he eventually became an investor (a er divesting himself of his advisor role, Fi ck, and Cameron stated).

Spokbee became part of EVOLVE just by applying, Fi ck says. It’s free, and the only rule for applicants is that they must be domiciled in Ohio, either incorporated here or as the state where it has its primary business address. And YBI doesn’t ask for any equity in the company — a common tactic for many incubators.

“ is is exactly what you want out of these programs,” Cameron says. “Funding? Check. Introduction to big customers? Check. No equity or fee? Check. Grants that help us? Check. Publicity and press? Check. It’s truly a unique and amazing program.”

HAMMACK

Hammack will become a voting member this year of the Federal Open Market Committee, following the established rotation of Reserve Banks, the Cleveland Fed said in an announcement on Wednesday, May 29.

“Beth Hammack is the ideal leader to build on the great work already underway at the Cleveland Fed to promote a healthy economy and nancial stability within the region and on the national stage,” said Heidi Gartland, chief government and community relations o cer with University Hospitals and chair of the presidential search committee and the Cleveland Fed’s board of directors, in a statement.

e Cleveland Fed said Hammack “has more than 30 years of experience in nance, capital markets, and risk management, as well as service on several advisory groups to the U.S. Department of the Treasury and the nancial industry.”

Most recently, she was co-head of global nancing at Goldman Sachs, where she was a member of the management committee, before leaving earlier this year. Her previous roles at the rm include global treasurer, global head of short-term macro trading and global head of repo trading.

e bank noted that Hammack “has worked closely with U.S. policymakers as chair of the Treasury Borrowing Advisory Committee, o ering presentations on macroeconomic and geopolitical topics

SAFETY

From Page 1

Operation Heat Wave:

All-of-government approach

Bibb stressed that the reason this plan will work when others may have failed is because this time, Cleveland police will not have to make the heavy lift of dealing with the traditional uptick in summer crime alone.

“ e teammates and community leaders, that is what makes this plan di erent. We recognize that we can’t do it alone at City Hall. Police can’t do it alone,” Bibb told reporters.

“ at’s why we have clergy partnering with us to walk the beat with the men and women of our police department, and violence interrupters to connect young people so they don’t get caught up in violent crime.”

As part of the all-of-government approach, CPD o cers will be able to work with the city’s other departments to fast-track the building and housing department to enforce code violations, contact the Department of Aging to help seniors in need, and reach out to public works to address illegal dumping sites.

e approach is about crime prevention and nding out what is driving crime — something that takes all of the city services to address, Bibb said.

including on the outlook for U.S. growth and in ation.” She also served several years as a member of the Financial Research Advisory Committee and the Treasury Market Practices Group, which advances nancial industry best practices and is sponsored by the Federal Reserve Bank of New York.

Bloomberg reported that at Goldman Sachs, Hammack “was once seen internally as a top choice to become the next chief financial officer — a rare elevation for a woman to one of the bank’s most senior positions.”

The news service added, “Her rise was driven in part by her ability to deal with regulators and government bodies after she

made partner in 2010.”

e Cleveland Fed announced a nationwide search for a new president in November 2023.

e process that ended in Hammack’s appointment was led by a search committee comprising eligible members of the Cleveland Fed’s board of directors. In addition to Gartland, members of the search committee were Jacqueline Gamblin, CEO, JYG Innovations; Ramona Hood, president and CEO, FedEx Custom Critical; Richard J. Kramer, former chairman, president and CEO, Goodyear Tire & Rubber Co.; Darrell McNair, president and CEO, MVP Plastics Inc.; and Holly Wiedemann, founder, AU Associates Inc. (Doris

Crime hotspots

Law enforcement will concentrate on several areas of high crime — or hotspots — around the city.

ose hotspots, which CPD will not publicly announce, were selected as a result of analyzing crime trends over the last three summers to determine where there were high rates of homicides, robberies and assaults.

“We identi ed several hotspots, and we’re going to concentrate our e orts ... in those particular hotspots,” said interim Safety Director Wayne Drummond.

Included in, but not limited to, the hotspots will be warrant

sweeps, usually focused and directed enforcement patrols identifying individuals known for committing crimes.

CPD will also bring back the fast-response car, a zone car that in each 12-hour shift focuses only on violent felony crime.

Data-driven solutions

To make up for police o cer shortages and the proliferation of illegal guns on the streets, the administration is looking for technological solutions.

“We’re using data and intelligence to really make sure we have precise law enforcement and ag-

its search for a new president, involve key community groups and consider diverse candidates.

e Cleveland Fed said Hammack joined Goldman Sachs in 1993 as an analyst in capital markets “before moving to the interest rate products trading desk and then into other roles of increasing responsibility.” She was named managing director in 2003 and partner in 2010. During her tenure, Hammack served on several rmwide committees, including the enterprise risk, nance, and global inclusion and diversity committees.

Hammack holds a bachelor of arts in quantitative economics and history from Stanford University.

Carson Williams, president and CEO of the African American Chamber of Commerce of Western Pennsylvania, also served on the search committee prior to the conclusion of her board service on Dec. 31, 2023.)

e committee hosted two public town halls “and conducted outreach within the community to seek nominations from the public and feedback on what the committee should look for in the Cleveland Fed’s next president,” the bank said. Two key Democratic U.S. senators from the Cleveland Fed’s region — Sherrod Brown of Ohio and John Fetterman of Pennsylvania — had urged the bank to be more transparent in

gressive law enforcement to get the most violent criminal o enders o our streets,” Bibb said. “ at’s why our homicide solve rate is roughly 74% — way above the national average. We’re using technology, we’re using data, and we’re partnering with federal law enforcement in a way we’ve never done before.”

Like last year, Cleveland will continue to use the National Integrated Ballistic Information Network (NIBIN), a database that uses ballistics to tie guns to previous crimes. is summer, the city will work with federal partners to identify illegal straw purchases of guns, tracking where the weapons came from through the Crime Gun Intelligence Center (CGIC).

is city will also use ShotSpotter data and continue to roll out CPD dash cams in every district, Bibb said.

“We have two districts up and running, and once we get all the o cers trained, then they’ll be implemented across all ve districts,” he added.

Community involvement

Operation Heat Wave is an evolving project from law enforcement, and the city wants resident feedback, Deputy Chief Ali Pillow said.

“We will adapt to whatever crime trends we see occurring over those few months,” Pillow said. “After these enforcement ac-