7 minute read

Western Australia/Northern Territory

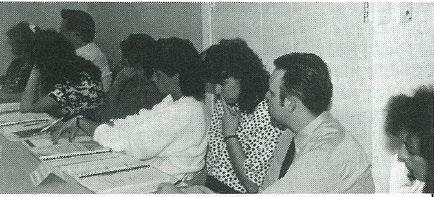

1987 – Ron Ryder (President), Bunty Paramor, Jim Crockett, Maggie Duff, Bill Walter (Councillor), Stephan Borton and Bob Blakiston (Councillor).

Advertisement

1991 – Course participants: (seated L-R) Diane Cowl, Patricia Wilson, Tracey Williams and Ruth Stubberfield. (Standing L-R) Tony Christensen, Jane West, Donna Olney, David Almeida, Keith Upton, Carlo Borrelli, Lisa Wood, Michelle Taylor and Steve Thomas (State President).

1990 – Steve Mitchison (Division President). 1991 – Lesley King (Top student in Credit Management).

Presidents Report It all seems rather surreal that I am penning yet again another President’s Report (literally felt like I did this just yesterday) in a time when the world seems to be in a holding pattern and there still exists a very real uncertainty as to what the world is going to look like in another few months.

Just when we thought there was light at the end of the tunnel, and restrictions started lifting, we’ve been plunged back into the grips of COVID again with outbreaks and further lockdowns in Melbourne and now Sydney – we really feel for our east coast brethren during this time, having been able to taste the relative freedoms that we all take for granted, before having them taken away again.

For the west, we can gloat (guiltily) that we are all almost back to normal, and can now enjoy an afternoon at the football or a quiet beverage on a Sunday afternoon, but we must not rest on our laurels as the recent Victorian experience is a stark reminder that this is very real and very dangerous if not treated with the respect that it deserves.

Whilst our AICM activity on the West has been restricted, it has been fantastic to see the great work

1991 – Steve Thomas (Life Member) at the Credit Toolbox on 6 May. 1991 – Glenda Jeffrey at the Credit Toolbox on 6 May.

that the National Office has continued to do in face of these challenges, and a testament to the engagement of our members with record numbers attending the virtual webinars, seminars and training activities held on line. Certainly, the Insights from Credit Industry Leaders webinar in which I had the privilege of sitting on the panel for, was very well attended and well received and certainly insightful in terms of how the credit impacts of Covid-19 are being addressed and more importantly, how we are continuing to support our people on this time of uncertainty.

Locally, we are planning on holding our WinC event in August at Crown Perth (dependant on ongoing COVID developments and safety considerations) – this has always been a very popular event and well attended so hopefully we can proceed as planned. We also look forward to hosting our AGM in August and will make attendance available to all members via physical (if appropriate) or virtual means, and I really encourage all members to attend to have their say. We are always looking for members with an interest to join our Council and the AGM is the perfect opportunity to put yourself forward.

In closing, a warm welcome to all our new members

1991 – Margaret McIlwraith at the Basics of Credit Control on 26 April.

1991 – Bill Walter. 1991 – Lesley Dabelstein.

1992 – Education Evening, Certificate Presentation: Roy Haagman.

1992 – Education Evening, Certificate Presentation: Kevin Allen (Life Member) and Stewart Risbey.

1992 – Eight finalists with State President: Con Crista, Carmen Woodhouse, Vicki Horlock, Jan Barrett, Narelle Lewis, Diane Cowl and Steve Thomas.

and returning group members and it would be great to see as many of our Western Australia members at our WinC event on (TBC) and the upcoming AGM. In the meantime stay safe and be good to yourself, and each other. – Troy Mulder MICM CCE AICM WA Divisional President

Sponsor in the spotlight It’s been a while since we caught up with WA Division Partner and resident legal expert – Raff Di Renzo. For those who don’t know Raff let’s learn about him and his response to the pandemic.

YourName, Position, Time in the legal profession? Raffaele Di Renzo;

Legal Practice Director, Nova Legal

Completed Bachelor of Laws in 1997, commenced articles in 1998 with Paul Tottle who is now the Honourable Justice Tottle of the Supreme Court of WA, I was admitted as a practitioner of the Supreme Court of WA in 1999 and Raffaele Di Renzo the High Court of Australia in 1999, I worked for a national firm for approximately 7 years, I was a founding director of Nova Legal and started that

1992 – Basic Credit Course: Glenda Birch, David Almeida, Bobbie Bonham, Verna Brookes, Natalie Davies, Eleana Dimartino, John Dabelstein and Maria Evangelista.

practice in 2012, I was awarded AICM’s Legal Practitioner of the Year award in 2018 as part of the WA Pinnacle awards.

How are you finding work differentthese days with lock-down and social distancing? Work is different primarily because meetings are held with clients via Zoom video conferences and court hearings are attended by teleconference.

Have you found that the legal/regulatory sector is getting more online/electronic now that physical paper is less in demand? Yes agreed. However, some documents are still required

1992 –Twilight Seminar: Nick Bentuelzen, Carol Longman and Warren Myers.

to be signed in person as opposed to electronically signed. Physical storage of those types of documents is still required.

Have you noticed any increases in credit related friction? Definitely. From our perspective – many of our clients require longer payment terms of out accounts. We have also entered into a few arrangements with clients who are unable to pay outstanding fees. From our clients’ perspective – more chasing up of unpaid debts.

How is your office preparing for the insolvency phase of this crisis? It’s more wait and see how things pan out post COVID-19.

Given that the government seems to want to protect debtors from failure, which precedent cases are likely be most pivotal in protecting creditors’ rights? Can you provide a quick rundown of the gist of those findings? There are no case authorities that I am aware of. The government’s protection to creditors are contained in schedule 12 of the Corona Virus Economic Response Package Omnibus Act 2020 (Cth). Three main points: 1. The minimum threshold sum at which creditors cab issue a statutory demand has been increased from $2,000 to $20,000; 2. Debtor companies will have 6 months to respond to statutory demands, rather than 21 days; and 3. Directors will have temporary relief from the risk of personal liability for insolvent trading where the debts of the company are incurred in the ordinary course of business.

Can you describe any common traps or pitfalls that our members may encounter in their dealings with customers? What general recommendations do you have to avoid or prepare for these disagreements? A common trap is not to have solid credit agreements and guarantees with charging clauses in place.

1992 –Twilight Seminar: Chris Tollis, Rochelle Hambleton, Felicity Hutson and Yvette Hawley.

Recommendation is to make sure updated agreements are in place with all customers.

Finally, for a bit of levity, have you had any opportunities to attend online hearings with only your top half dressed suitably – like those reported lawyers in Florida? Obviously tricky these days with winter just around the corner. Yes, our hearings are held via teleconferences. I have attended those hearings with either jeans or track pants. But, never with no pants as seems to be the case with Florida lawyers.

The Australian Institute of Credit Management welcomes our Partners for 2020.

National Partners

Trusted Insights. Responsible Decisions.

Divisional Partners

Official Division Supporting Sponsors

Our National and Divisional Partners support and work with the AICM to promote the Institute’s activities, represent the Credit Industry and develop the careers of all Credit Professionals. As these organisations support your Institute and your Industry please consider them when you require assistance.