5 minute read

Resilience - using ratings to restore credit confidence

by AICM

COMMENTARY Analysis &

Resilience – using ratings to restore credit confidence

Advertisement

By Brad Walters Head of Product and Rating Services, Equifax Australia

Brad Walters knows well the risk insolvency poses to a set of otherwise adequately weighted credit terms.

As head of Equifax Australia’s Credit Ratings business he oversees a continuous process of financial diagnosis, assessment and rating of all manner of credit risk exposures. And insolvency poses particular dangers.

“The economic cost of insolvency is significant, with 96% of unsecured creditors estimated to receive less than 11c in the dollar,” Mr Walters said.

And he cautioned that those numbers will need adjustment once the full impact of the COVID-19 pandemic can be assessed.

“Credit managers are experiencing unprecedented times and possibly being presented with challenges they’ve never seen before,” Mr Walters said.

“While I would envisage there is strong universal support for tax relief, I also acknowledge there will be some with strong views around other measures, including temporary director relief (from insolvent trading) and higher thresholds and more time to respond to creditor demands – changes that will impact court and creditor wind-ups.”

In addition to insolvency laws being relaxed, Mr Walters identified other initiatives that will provide temporary relief including: z easing of capital requirements z mortgage deferral z small business debt relief (for those with <$3m in total debt) z $90b funding facility for ADIs to support

SME lending z SME guarantee scheme (50% of loan, up to $250k) z Employer cash support payments (up to $100k) z business investment support (including asset write off to $150k) z other State Govt stimulus (including payroll tax waivers, business grants/loans)

“Given the unprecedented disruption to both domestic and global economies currently being experienced, credit professionals should consider augmenting their current credit assessment processes (especially for their larger credit exposures) by having a similar, open dialogue with their customers around these impacts and their respective business plans & activities to manage through this season,” Mr Walters said.

“Now would also be timely for credit professionals to review the range of services available to assist them in this process.”

To this end Mr Walters recommended credit professionals employ the following tools:

z Portfolio risk monitoring z Financial viability assessments z Registering security interests z Digital customer verification z Fraud check services

In terms of assessing the risk posed by larger credit exposures Mr Walters stresses the value in reviewing three areas – a company’s financials; its business and its people.

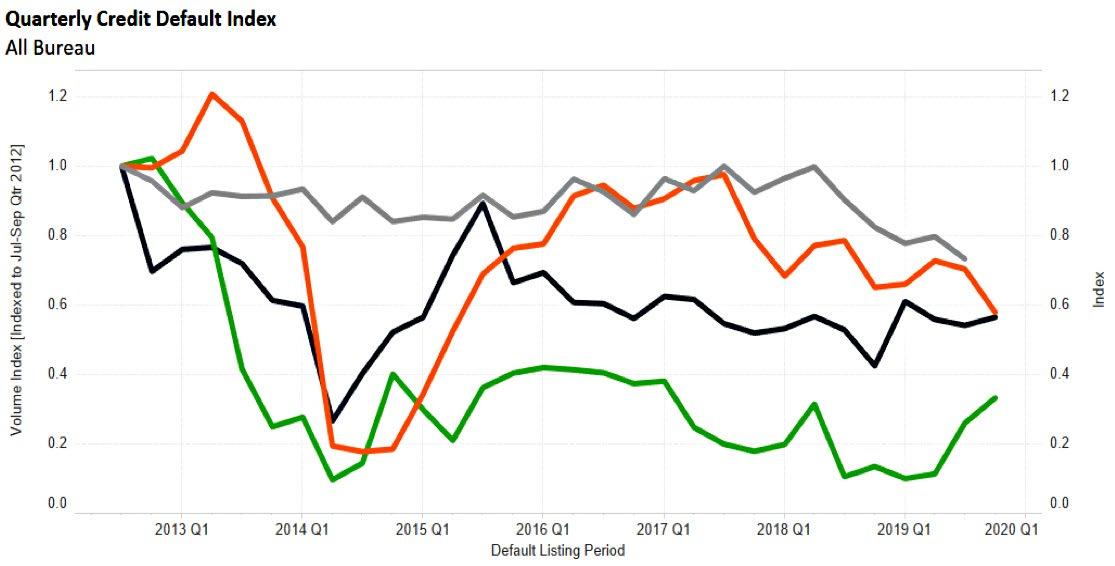

Consumer Defaults

Equifax continues to actively engage all customers on their default provision for all portfolios. z Credit card decreased by 17.7% and Personal Loan default provision increased by 4.3% QoQ during 2019 Q4 period. z Mortgage defaults continued to experience a steep QoQ rise during the 2019 Q4 period. z Total Personal Insolvencies (as reported by AFSA), decreased 8.1% QoQ, for Q3 2019.

Credit Defaults Reported per Quarter

Indexed to Sep QTR 2012

Bankruptcy & Personal Insolvency

Credit Cards

Personal Loans

Mortgage

“A business’ financials are critical to understanding insolvency risk, especially when reviewing businesses that generate sales revenue in excess of $5 million,” Mr Walters said.

“We’ve observed that financial statement analysis provides more than a 40% uplift in predicting insolvency for these businesses.”

It’s also important to understand a business’ trade payment performance. Equifax notes those with an average of 15+ days past due are nearly 4x more likely to have an adverse event recorded in the next 12 months. Understanding a business’s legal and ownership structure, including identifying where possible its proprietors, directors, related parties, and ultimate beneficial owners is also critical.

“Some credit exposures can be quite complex,” Mr Walters said. “Understanding the various business linkages and potential contagion risk is important prior to extending credit.”

It’s therefore important to understand who is behind the business.

“Some individuals can be seen propping up their business through personal finance and may also propose personal indemnities to support business credit applications,” Mr Walters said.

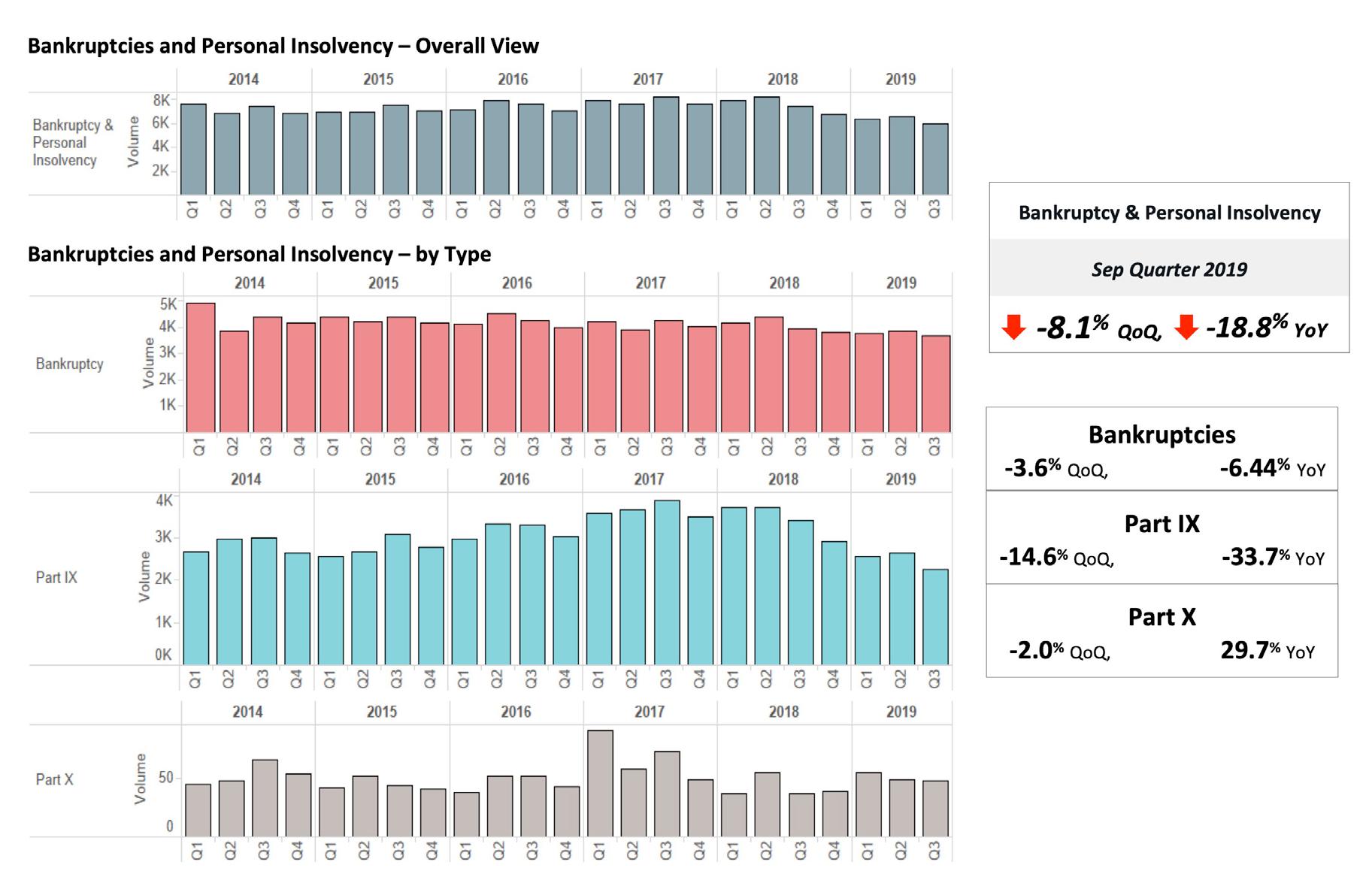

Insolvency Trends

“They may be financially vulnerable or exposed to other distressed businesses, so credit professionals should utilise both commercial and consumer reports and services to identify and make the necessary assessments,” he said.

Especially as businesses with adverse information on file are significantly more likely to fail, being up to 20x more likely than average.

“At 30 June 2019 there were 2.4 million actively trading businesses in the Australian economy,” Mr Walters said.

“While there were 356k new businesses, there were 293k exits representing a 12.7% exit rate (up from a 12.5% exit rate in 2018). While there have been some positive signs, industry remains exposed to several risk factors with increased uncertainty and subdued sentiment following significant market volatility on the back of oil

“Insolvency appointments, which have decreased each calendar year since 2016, have most recently shown an annual increase of 5% to December 2019”.

price shocks and COVID-19 impacting global trade and supply.

Mr Walters is however encouraged by a growing focus on director traceability, phoenix operators, subcontractor payments and tax delinquency disclosures. He said credit professionals can take comfort in the knowledge that a business does not fail overnight and advised there are early warning signs enabling people to protect themselves from financial harm.

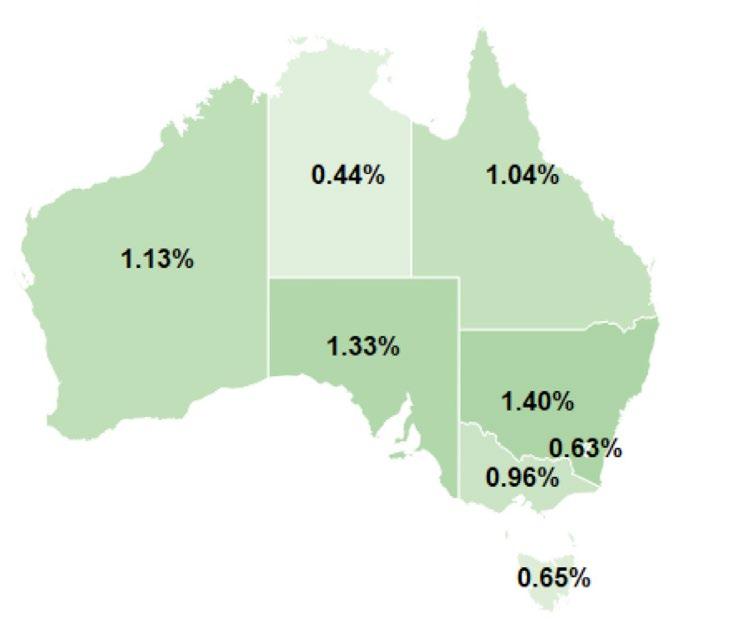

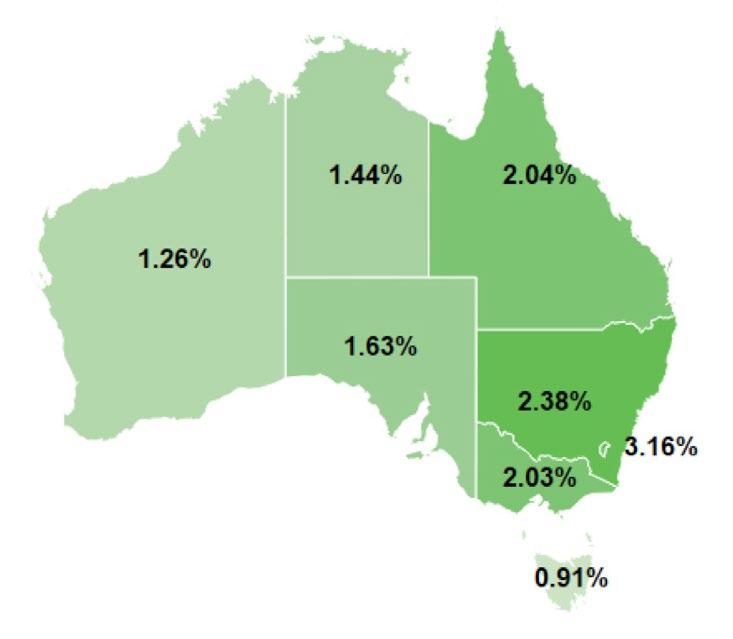

Commercial Defaults and Judgements by State

Proportion to the Number of Active Entities, 2019 Q4

Commercial Defaults – State

Previous 2 Years

Eastern States (NSW, QLD, VIC and ACT) have the highest proportion of commercial defaults in Australia NSW has the highest proportion of commercial default judgements.

Commercial Default Judgements – State

Previous 2 Years