Spring 2025 Commodity Report

Price rises and fewer staff: How hospitality is preparing for the National Insurance rise

‘Perfect storm’ of increased operating costs and National Insurance rises could mean ‘many services are lost forever’

The deforestation regulation clock is ticking for food and drink

Food prices look to be more inflationary in 2025 than 2024. Reasons for this have been well-documented, including the increased National Living Wage and increase in Employers National Insurance costs. These will certainly have an effect of food production prices in the UK.

From an import perspective, Pound Sterling has fallen in value versus the Dollar and the Euro (at the time of writing) and if this continues for a sustained period of time, we will see imported goods prices rise because of it.

Further afield, possible US sanctions on imports would impact the Global markets amongst other things. A surge in demand for stock ‘pre-tariff’ could impact the freight markets

further. The volatility in freight costs post-Covid remain a real challenge for importers.

The previously delayed EUDR (EU Deforestation Regulation) which has been postponed until the end of 2025 will also bring about change as suppliers scramble to be able to meet this regulation and provide in depth traceability of their raw materials including coffee, cocoa, soy and palm oil. The first two of which are already at really high levels. Maybe this will force consumer habit changes should they continue.

It is, however, worth putting into context that many experts are predicting around 4% inflation levels in 2025, this is still a far cry from the 15% or above inflation seen in 2022.

£1.00 TO $1.231

Pound to dollar

The British Pound has declined against the U.S. dollar, falling from $1.3044 in October 2024 to $1.2311 in January 2025. Key drivers include weaker UK retail sales (-0.3% in December 2024), concerns of economic stagnation, and expectations of further Bank of England rate cuts to 3.25% by mid-2026.

Geopolitical and Market Sentiment: EURO EXCHANGE RATE

£1.00 TO €1.194

Pound to euro

The British pound has weakened against the euro, declining from €1.2064 in December 2024 to €1.1943 in January 2025. Key drivers include weaker UK retail sales (-0.3% in December) and expectations of Bank of England rate cuts, with markets pricing in 62 basis points of reduction.

Political uncertainty, such as potential U.S. tariffs under President Trump, and mixed investor sentiment have created volatility.

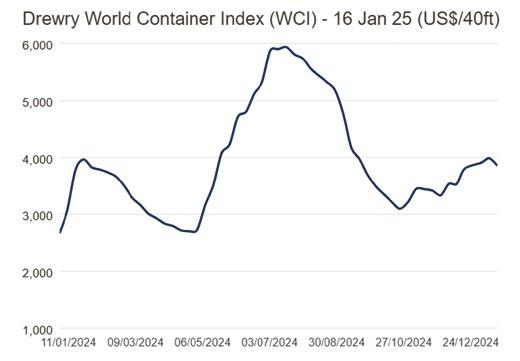

Following a turbulent year for global freight costs in 2024, early 2025 is showing signs of relative stabilisation in container shipping rates. Despite this recent stability, there are still notable variations across trade lanes.

Since October 2024, rates have risen by nearly 20%, largely influenced by seasonal demand during the holiday season, increased fuel prices, and capacity adjustments by shipping lines. However, as the peak season has subsided, January 2025 has already seen a modest correction, with rates declining by 3%, bringing the global average to approximately $3,855 per 40-foot container.

Red Sea attacks are testing combat information centers aboard U.S. Navy warships like never before

In November 2023, Yemen’s Houthi rebels said they would attack Israelilinked ships passing through the Red Sea, in response to Israel’s invasion of the Gaza Strip. Numerous attacks have been carried out on vessels since then, leading to retaliatory airstrikes from both the UK and the US.

Two of the world’s largest container shipping companies, Mediterranean Shipping Company (MSC) and Maersk, have announced new surcharges in January. MSC’s measures, effective January 13, 2025, are aimed at easing disruptions caused by port congestion in Mombasa. Maersk will introduce surcharge increases from January 15, 2025, as the situation in the Red Sea worsens due to attacks on ships by Yemeni Houthi militants.

Most recently, there has been U.S. Navy attacks targeting Houthi positions in Yemen, in retaliation to the attacks on Israel and their threats to maritime security in the region.

The escalating conflict has raised alarms within the global shipping industry. Shipowners have placed record orders for container vessels, anticipating disruptions and seeking to mitigate risks associated with the Red Sea’s instability. There has been a shift to smaller vessels to enhance flexibility and reduce risks when navigating through high-conflict zones.

In summary, whilst the news may be quiet, the impact is still loud.

Despite fuel prices being significantly lower compared to this time last year, there has been a sharp increase over the past quarter, with petrol prices surpassing the 137p mark for the first time in four months.

In the first two weeks of January, prices of oil rose over 8.5%, reaching a 4-month high of $80.85 per barrel (compared to $73.98 at the end of December 2024), as the U.S. introduced intensified sanctions against Russian oil.

Seasonal demand also has an impact on fuel costs, as freezing temperatures have led to higher fuel consumption as vehicles require more energy to operate efficiently in colder conditions.

Current trends suggest that motorists should be prepared for continued fluctuations in fuel costs throughout 2025.

On 1 January, the Energy Price Cap rose by 1.2%, meaning a household with typical usage paying by Direct Debit will pay £1,738 a year. Despite this increase, the current cap is approximately 10% (£190) lower than the cap set from January to March 2024, which stood at £1,928. This reduction indicates a gradual easing of energy costs compared to the previous year. Experts anticipate further increases in energy costs during early 2025, with the potential for stabilisation as the year progresses.

Jan 2026 to 31 Mar 2026

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.5% in the 12 months to December 2024, unchanged from November.

The largest downward contribution to the monthly change in both CPIH and CPI annual rates came from restaurants and hotels; the largest upward contribution to both came from transport.

Core CPIH (excluding energy, food, alcohol, and tobacco) rose by 4.2% in the 12 months to December 2024, down from 4.4% in November; the CPIH goods annual rate rose from 0.4% to 0.7%, while the CPIH services annual rate fell from 5.7% to 5.4%.

Food and non-alcoholic beverage prices rose by 2.0% in the year to December, unchanged from November 2024. The annual rate of 2.0% is down from a recent high of 19.2% in March 2023, which was the highest annual rate for over 45 years.

There were downward contributions to the change in the annual rate of inflation between November and December 2024 in 2 of the 11 food and non-alcoholic beverages classes (1. bread and cereals, 2. mineral waters, soft drinks and juices).

This is because prices were either unchanged or rose at a lower rate between November and December than the rate of growth between the same two months last year.

There were upward contributions to the change in the annual rate of inflation between November and December 2024 in 2 of the 11 food and non-alcoholic beverages classes (1. fruit 2. sugar, jam, honey, syrups, chocolate and confectionary). This is because prices rose this year but were either unchanged or fell between the same two months last year.

Inflation is set to average 2.6% in 2025 but as always, it’s very unpredictable. It was expected that there would be a 0.1% rise to 2.7% in December, but in fact went the other way and dropped 0.1% to 2.5%. It’s worth noting that the annual inflation rate for restaurants and hotels is at its lowest since July 2021.

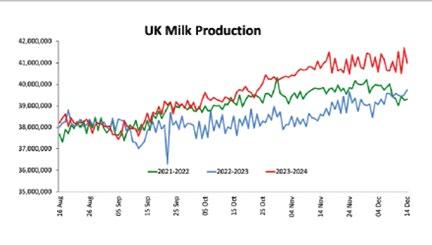

Signs of an oversupply of milk in the market.

December in particular saw a huge uplift year on year in terms of UK milk volume production. This is also combined with a general drop in wholesale dairy market pricing in recent weeks which will have major processors considering a reduction in the price that they pay to farmers.

There is one caveat however, the UK Government has imposed a ban on German meat and dairy following a Foot and Mouth outbreak in the Brandenburg region of Germany w/c 13th January.

Germany accounts for 12% of dairy exports to the UK, and this could cause some real disruption in what is an ongoing situation with UK and German authorities.

The markets are quiet, with buyers generally waiting to see what happens following the increased milk volumes.

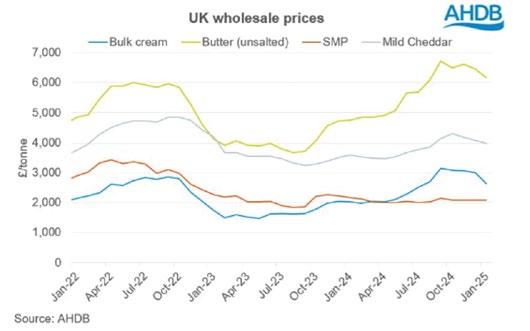

It is fair to say that the market is slightly down on its November 2024 highs, currently sitting around £6,250 per tonne.

Despite this, European butter futures are showing price increases, and those increases are higher in the last couple of weeks which does paint a mixed picture about the coming weeks and months on butter.

Prices fell Christmas week (as most trading was already concluded) and did start the year with some further falls, however, they have since rebounded. Prices for bulk cream are notably high for this time of year with prices generally reported around the £2.70/kg level but with some quotes not far off £3.00/kg.

Cheddar markets saw a relaxation late November into December. Bulk raw material prices sit around £3,900 per tonne, even though sellers would want that number to be at least £4,000.

There is some talk of stocks tightening but this is more theory than anything else now. For example, European curd currently equates to around £4,000, this suggests that cheddar should sit around £4,150 per tonne and the fact it doesn’t at this moment leads people to believe the price is slightly lower than it should be. Demand and cover of major buyers will also play a role.

Currently stands at around £3,500£3,600 per tonne after some small increases, however, still stands slightly lower than late November / early December.

The price of Grana has continued to rise, and we are hearing that manufacturers are paying £11/kg for the wheel. Export and consumption within Italy have only been on the rise too, until the demand eases / reduces, the prices will continue this increase path.

Halloumi & Feta prices have spiked and dropped over the last 6 months but ultimately remaining quite flat across the board.

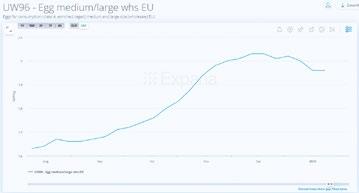

Egg pricing rose by around 3%-7% in Q4 2024, due to the first case of bird flu confirmed since February 2024. This meant that the average price of a dozen medium eggs was around £1.60, with a dozen large eggs being around £1.95. There was a very slight softening in price at the start of 2025, and whilst the input pricing such as feed has been relatively stable, there is expected to be a further increase in 2025, especially whilst consumers move to more economic options.

The UK pork market in Spring 2025 is facing a mixed outlook, with steady domestic demand, but growing pressures from rising production costs.

Retail prices for pork are elevated due to a number of inflationary factors:

• Higher feed costs

• Energy expenses

Producers are focusing on efficiency improvements to manage costs, while consumers are increasingly drawn to value-added products such as marinated cuts and ready-tocook options. Export opportunities, particularly to Asian markets, are providing some support to the industry, although global competition continues to influence trade dynamics.

Domestic production is projected to remain stable, with the UK pork industry continuing to adapt to stricter sustainability and welfare standards.

However, producers are navigating challenges:

• Labour shortages

• Increasing regulatory demands

• Additional operational costs

The recent outbreak of foot-and-mouth disease in Germany has raised concerns for the UK pork market. As Germany is a significant exporter of pork within the EU, restrictions on German exports could disrupt European supply chains, tightening regional supply and putting upward pressure on prices in the UK. Additionally, heightened biosecurity measures and import checks are likely to increase logistical costs for UK importers. This outbreak could also influence consumer confidence in pork products, potentially dampening demand if fears around food safety escalate.

While premium beef products maintain strong demand, value-driven consumers are increasingly opting for alternative protein sources, leading to slight shifts in purchasing patterns.

The UK beef market in Spring 2025 is navigating a period of stability, with steady consumer demand and cautious production levels.

Retail prices for beef remain elevated due to:

• Effects of inflation

• Rising production costs - including feed and energy

Domestic beef production is projected to remain stable, supported by ongoing investments in efficiency and sustainability measures within the farming sector.

However, producers face challenges:

• Labour shortages

• Compliance with stricter environmental regulations

Export opportunities to the EU and emerging markets remain significant, though competition from countries like Brazil and Ireland continues to influence trade dynamics.

As with pork, Germany is a key player in the European beef trade, so the restrictions on German exports could tighten overall supply in the region, add in supply chain disruptions and potentially lower consumer confidence, there is likely to be upward pressure on prices.

Spring 2025, the UK lamb market is experiencing a tightening of supply. The lamb crop for the 2024–2025 season is projected at 15.9 million head, a 1.2% decrease from the previous season, due to a smaller breeding flock and challenging scanning rates. This reduction is expected to lead to a 2.9% decline in total sheep meat production for 2024, amounting to 278,000 tonnes.

Internationally, several factors are influencing the cost of raw materials and lamb production:

New Zealand’s sheep flock decreased by 3% in 2024, impacting production and exports into 2025

Exports to the UK and US have significantly increased

Australia’s lamb market has seen record slaughter and production levels in 2024, reaffirming its position as a key player in global lamb supply

As with other meat categories, the recent foot-and-mouth disease outbreak in Germany has further implications for the UK lamb market. Germany’s loss of FMD-free status has led to import bans from several countries, including the UK, disrupting trade flows and potentially affecting meat availability. While the European Commission has allowed continued trade within the EU under strict containment measures, the situation adds uncertainty to the market and may influence lamb prices in the UK.

As of Spring 2025, the UK turkey meat market has seen a modest recovery, despite a long-term decline in consumption. Production has slightly increased, with better yields per turkey, although the number of turkeys slaughtered has remained steady.

The fresh chicken market in the UK remains strong, driven by consumer demand for affordable and versatile protein options. Retailers are expanding their range to include organic and free-range products, reflecting a growing interest in health-conscious and sustainable choices.

Upward pressure on prices due to:

• Rising production costs - particularly feed and energy

• Global feed cost volatility - driven by climate change and disease outbreaks

Despite these challenges, fresh chicken remains a staple for UK households, with steady demand in both retail and foodservice sectors.

Consumption of turkey meat in the UK has significantly decreased over the years. On a per capita basis, this decline equates to a drop from over 4kg in 2003 to around 1.5 kg in 2023. Efforts are ongoing to renew consumer interest, particularly during festive periods, to help turkey regain its prominence.

The UK remains a net importer of turkey meat, sourcing primarily from Poland, Germany, and Ireland. Exports have declined sharply in volume and value over the past decade.

While the market faces challenges like shifting consumer preferences and competition from other meats, cautious optimism remains for gradual recovery.

The frozen chicken market is experiencing growth due to increasing demand for convenient and cost-effective meal solutions. Foodservice suppliers and retailers are meeting this demand with diverse frozen chicken offerings.

Upward pressure on prices due to:

• Rising storage costs

• Increasing Transportation costs

• Record-high exports – particularly from Brazil & Thailand are reshaping supply dynamics

While frozen chicken remains a key category for value-driven consumers, it must navigate global economic pressures and logistical challenges to sustain its appeal.

Russian caught Cod and Haddock processed in China has seen a consistent rise in price since April 2024. There was a small and short drop in August 2024, however, pricing is steady, but at record highs, due to Russia’s weakened catch numbers.

Norwegian, Russian H&G cod, haddock prices stable at record levels

Experts say that the supply into China dropped by around 12% (353,000 tonnes), which is related to the US sanctions on Russian caught seafood and the EU tariffs.

As predicted, the scarcity of the previously cheaper Russian caught fish is continually driving the price up of the already expensive Norwegian varieties. Add this to the recently agreed 20% reduction for the 2025 quota to manage the species sustainably, the lowest quota since 1991, the outlook for these whitefish does not look good.

Salmon of the UK’s favourite fish as sales rise by more than 9%

Enormous’ jump in Norwegian, Scottish salmon prices for New Year, Chilean up too

As expected, Salmon pricing saw a rise in the last quarter of 2024, due to the increase in demand for the Festive season. Whilst there is expected to be a softening in price, as usually happens at the beginning of a new year, it is not expected to be back at the levels seen in Q3.

Salmon remains the UK’s favourite fish and Norway’s seafood industry reporting a record year for exports. Salmon makes up around 70% of the £13.12 billion export value.

Tuna prices have risen towards the back end of 2024. Less availability has contributed to this. In the early part of this year, the monthly price has dropped a little bit, but this is after 3 or 4 months of consecutive gains. From a UK perspective, the raw material price would need to fall a lot further to start seeing any meaningful price reductions.

Most tuna trading / purchasing of raw material is conducted in Dollars.

The shortage of raw material in the market has contributed heavily to the steep price increase, with reduced quotas in Greenland pushing up the price of Norwegian raw material.

Norway had a record year for exports in 2024, with prawns seeing a 30% increase, meaning that Norway took an extra 10% of the worlds Cold Water Shrimp trade. In addition there are rumours of a quota cut in Canada, which is keeping pricing at high levels.

Europe’s coldwater shrimp prices continue to firm with all material in high demand

Warm Water Prawn (or King Prawn as they are more commonly known) pricing has remained at high levels since the beginning of the year. Experts put this down to a lack of raw material available from Ecuador and India.

That said, since the UK-Vietnam free trade agreement came into effect in 2021, shrimp has been the leading force in the boost in volume. Whilst pricing remains high still, shrimp have a 0% tariff, which has meant that the UK has been able to import lower cost King Prawns than the rest of the EU.

Ecuador is one of the largest producers of farmed shrimp, but their export volumes are down 12% YoY, meaning less available product.

Frozen fruit outlook

Frozen Fruits will skyrocket off the back of consumer health kicks at the start of a new year. We expect to see out of stocks and price rises, as the consumer demand increases.

Canned fruit outlook

It is expected that canned fruit prices, apart from pineapple, are to remain stable. The cost-of-living crisis has seen demand surge in this category and hopefully this won’t drive pricing up.

In the last 12 months several factors have drastically affected pricing:

• Increase raw material costs

• Rising freight costs

• Uncharacteristic rainfall in Thailand

The Winter growing season ends at the end of February and the hope is that there is more yield available, but there are no guarantees. This has had a well-documented knock-on effect across juice and all pineapple varieties.

Coconut Milk is facing similar issues to Pineapple, meaning there may be a problem not only with price on coconut, but supply.

• Peak season for mature coconuts is April to July - typically prices start to ease

• Low season is August to March – usually prices increase

• Increased freight costs

• Poor yield due to drought and heavy rainfall

Thailand’s coconut yield drops below average due to drought & pests

“The Department of Internal Trade and provincial commerce offices will continue to monitor the coconut situation and key consumer goods prices. If any business is found inflating prices excessively or disrupting the market, legal action will be taken, with penalties of up to seven years in prison and/or fines of up to 140,000 baht (approx. £3,350).”

Witthayakorn Maneenet, Commerce Ministry Spokesperson

Global prices for sultanas and raisins have increased due to a drop in Turkish production and robust demand from Europe and Asia. Export volumes have declined, pushing prices higher, especially for premiumquality products. In 2024, despite a 29% reduction in export quantities, the total export value rose by 16% compared to the previous year.

After substantial price drops throughout 2024, prices have been gradually rising over the past three months. During the winter months, Malatya, Turkey’s main apricot producing region, experienced cooler temperatures, prompting farmers to bring fewer goods to local markets. This reduction in supply has driven prices higher.

To date, prices have risen by just over 6%, but this upward trend may stabilise as weather conditions in the region improve. Despite this recent increase, prices remained over 20% lower compared to the same period last year.

Since the start of the year, we have already seen a 3% increase In European Potato Prices as this trend continued from October.

Market value and growth are expected to increase almost 4% , YoY over the next five years.

Harvest delays affect supply and these factors in turn have caused prices to rise.

These increases affect all varieties, with Innovator and Agria rising more in particular.

UK Potato pricing has seen notable price increases in recent years due to:

• Weather conditions

• Rising production costs.

In retail, potato prices have surged to levels not seen in a decade, with projections indicating they may exceed £1 per kilogram, marking a 30-year high. This increase is attributed to anticipated shortages across various potato types, a phenomenon referred to as ‘spudflation’. With uncertainty around the current Government, plus future growth, there is no certainty that pricing will stop increasing.

As of Spring 2025, the UK wheat market is experiencing a modest recovery. The planted area for wheat is projected to increase by 5.4% to approximately 1.613 million hectares, following a challenging previous season marked by adverse weather conditions. Despite this increase, the total area remains below the five-year average of 1.705 million hectares, suggesting that production levels may still be constrained.

Global factors are exerting significant influence on wheat prices:

• Adverse weather conditions in key wheat-producing regions i.e. Russia

• Farmers have had to reduce wheat cultivation, in favour of more profitable crops

• Geopolitical tensions and trade policies

These global dynamics are expected to affect UK wheat prices, posing challenges for both producers and consumers in the domestic market.

The UK rice market in Spring 2025 is experiencing steady growth, driven by evolving consumer preferences and demand for healthy, convenient food options. Per capita consumption is expected to remain stable at 2.0 kg per person, while total market volume is forecast to grow by 2.3% in 2025.

Globally, rice prices are facing upward pressure due to several factors.

• Adverse weather events in major riceproducing regions i.e. Southeast Asia

• Reduced supply due to disrupted harvests

• India’s continued restrictions on rice exports are exacerbating supply constraints on the international market.

• Rising input costs such as fertilisers and energy

As the UK depends heavily on imports for its rice supply, these global trends are likely to impact consumer prices and market stability. Retailers and suppliers in the UK face the challenge of managing higher import costs while meeting consistent demand, particularly as rice remains a staple food for many households. Adaptation to these market pressures will be crucial for industry stakeholders in the coming months.

For Spring 2025, the UK cocoa market is experiencing significant volatility due to global supply constraints and rising prices. The International Cocoa Association (ICCO) has raised its 2023/24 global cocoa deficit estimate to 478,000 metric tonnes, the largest in over 60 years, citing a 13.1% year-on-year decline in production. This shortfall has led to unprecedented cocoa prices, reaching record highs of $12,605 per metric tonne, nearly double the price from two months prior.

The surge in cocoa prices is exerting pressure on UK chocolatiers and manufacturers, particularly smaller artisanal producers. Many are grappling with increased costs, some experiencing spikes up to 33%, which are challenging to absorb or pass on to consumers. This financial strain is prompting difficult decisions regarding product offerings during key seasons like Easter and Christmas.

Upcoming EU antideforestation regulations aimed at promoting sustainable practices are anticipated to further strain the market.

Sugar prices have seen a decline year on year. Good prospects of production in major producing countries have meant that Global sugar prices were around 10% lower in December 2024 vs December 2023.

Different markets will see different levels of deflation and recently, India has announced that it will in fact export volume whereas it previously banned exports out of the country. Thailand has also indicated a +18% year on year increase in production which adds further downward pressure on prices.

There will be focus on freight costs and the rising crude oil prices in the coming months to see what impacts they have on raw material prices.

Olive oil prices in Spain finally plummet after 2-year drought

SOYA could be a big driver globally as there may be some positive prospects moving forward. All eyes are on Brazil which is expecting a record harvest and would then see declining soya prices, potentially also impacting other oils.

EUROPEAN RAPESEED prices rose towards the back end of 2024 but are showing some small signs of decline, yet this is too early to tell whether it will continue.

PALM OIL has seen some small declines also in recent weeks.

“Indications are that if everything develops normally, especially if rains continue to favour production, we could see a downward trend in prices this year”

Miguel Ángel Guzmán, Chief Operating Officer, Deoleo

Palm and Soya are going to be subject to European deforestation requirements at the end of 2025, likely bringing volatility to the markets, with ‘compliant’ stock likely to command a premium.

“Production numbers are key. For Spain, we are looking at 1.3 million metric tons [projected] compared to last year’s 670,000”.

Kyle Holland, Senior Oilseed Market Reporter, Expana

Deoleo is the world’s largest olive oil producer. They contribute to Spain being the world’s key resource in olive oil, accounting for over 40% of the world’s supply. Extreme weather conditions, notably droughts across the globe, meant that olive oil production fell drastically causing nationwide chaos.

As of Spring 2025, the UK tea market is experiencing modest growth amid evolving consumer preferences and industry challenges. The market is projected to expand at a compound annual growth rate of 6.5% from 2025 to 2030, reaching an estimated revenue of $2,057.3 million by 2030. Despite this positive outlook, volume sales are expected to decline by 8% between 2023 and 2028, indicating a shift in consumption patterns.

The industry is also facing challenges, exemplified by the recent financial struggles of Typhoo Tea, one of Britain’s oldest tea companies. Typhoo experienced a significant decline in sales and was on the brink of administration before being acquired by Supreme for £10.2 million. This acquisition reflects broader market pressures, including competition from alternative beverages and changing consumer preferences.

Consumer preferences are increasingly favouring specialty teas, such as green and herbal varieties, over traditional black tea. This trend is contributing to the anticipated decline in volume sales, as consumers opt for higherpriced specialty options.

In Spring 2025, the UK coffee market is experiencing significant developments influenced by global supply constraints and evolving consumer preferences.

Despite these challenges, the UK coffee market continues to expand, driven by a growing consumer base and the proliferation of specialty coffee shops. However, the industry must navigate the complexities of rising costs and supply chain disruptions to maintain growth and meet consumer demand.

Pricing has been variable over the last 12 months, causing the future to be unpredictable. However, it is projected that prices will stabilise after this month’s increase, with supply outweighing demand.

Raw material is dropping by the month, but this is combatted by supply dropping and ultimately government ruling. The raw material decrease might mean good things for prices but with plastic tax, plus bans in sectors and initiatives to move away from plastic, it’s not saving consumers money.

The last six months have been a struggle for the London Metal Exchange; the spikes and drops are usual but a 15% increase in six months overall is a lot for the market. It is predicted that foil, amongst other things, will take a hit in the early parts of 2025, unless the market turns in our favour.

Staverton Technology Park, Cheltenham Road, Staverton, Gloucester, GL51 6TQ

Manners Industrial Estate, Manners Avenue, Ilkeston, Derbyshire, DE7 8EF

Wooburn Industrial Park, Thomas Road, High Wycombe, Buckinghamshire, HP10 0PE FOR MORE INFORMATION ON OUR COMMODITY REPORT, PLEASE CONTACT YOUR CREED ACCOUNT MANAGER OR VISIT OUR WEBSITE WWW.CREEDFOODSERVICE.CO.UK

CreedFS @creedfs