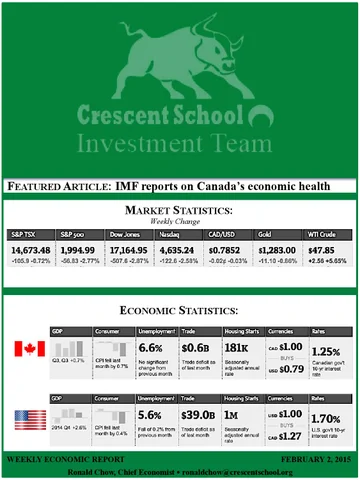

FEATURED ARTICLE: IMF reports on Canada’s economic health MARKET STATISTICS: Weekly Change

ECONOMIC STATISTICS:

WEEKLY ECONOMIC REPORT

FEBRUARY 2, 2015

Ronald Chow, Chief Economist ! ronaldchow@crescentschool.org

U.S. ECONOMY SLOWS U.S. Real GDP – Q4 Final Real GDP grew 2.6% annualized in Q4,which was a little softer than the market expected. Two factors that helped the previous quarter’s 5.0% gain reversed in the fourth quarter: imports rebounded strongly and federal defense spending plunged, combining to carve 2.0 ppts from growth. As expected, business nonresidential investment slowed sharply after a couple of stellar quarters, with spending on equipment declining moderately, likely in response to cutbacks in the energy sector and to supply disruptions stemming from congestion at the West Coast ports. Exports also slowed due to the strong dollar and sluggish global demand. However, consumers ramped up spending at the fastest rate since early 2006 (+4.3) and the gains were widespread across goods and services. The one concern in the report is that inventories surged the most in four years, adding a chunky 0.8 ppts to Q4 growth. Inventory investment will surely unwind in Q1, though import growth should slow as well, suggesting the net adverse impact on GDP won’t be large. The U.S. economy took a modest step back late last year amid slower investments and exports, but it’s still in pretty good shape. While the Fed will take comfort from the “solid” pace of economic expansion, it will remain “patient” until wages and core inflation turn higher. This could occur by late summer as the unemployment rate slips toward 5%, setting the stage for a possible rate hike in September.

A STEP BACKWARDS AFTER TWO STEPS FORWARD Canadian Real GDP at Basic Prices – November Real GDP fell 0.2% in November, below consensus call of flat and following a 0.3% advance in the prior month. There was no major special factors in the month, just pronounced weakness in manufacturing (-1.9%) and mining and oil & gas (-1.5%) with little offset elsewhere. The main drop last month was in essentially the two export sectors of the economy, manufacturing and mining (including energy). While we were looking for declines in both, the drops were more intense than anticipated: mining was hit especially hard by a 3.7% fall in “special activities” as rigging services fell heavily; oil & gas production dipped 0.7%. The largest disappointment in the month was the hefty 1.9% drop in manufacturing; while some of the setback was flagged by earlier data, and the drop follows gains the two prior months, the sector still has managed meagre growth of just 1.3% y/y (versus a 1.9% rise for the overall economy) Even with the weakness, the economy is still on track for growth in all of Q4 of about 2% annualized thanks to a nice lead-in to the quarter from solid gains in September and October. However, we look for the capital spending cutbacks in the oil & gas to clamp down further on overall growth in the first half of 2015. WEEKLY ECONOMIC REPORT

FEBRUARY 2, 2015

Ronald Chow, Chief Economist ! ronaldchow@crescentschool.org

STRONG GREENBACK STRIKES CAPITAL SPENDING U.S. Durable Goods Orders – December Durable goods orders unexpectedly fell in December, with the 3.4% headline drop the second in a row and the largest since August. One cannot simply point to the drop in Boeing orders in the month; orders excluding transportation also took a hit for the third straight month and was down 0.8% at year-end. Other components were also negative: orders for transportation equipment (-9.2%), machinery (-3.7%), computers & electronic products (-1.3%), primary metals (-1.5%). There were some positives however: fabricated metal products (+1.0%) and electrical equipment & appliances (+1.3%) This is a notoriously volatile report but the weakening trend in core durable goods orders point to softer growth in Q1. It looks like the strong U.S. dollar and pullback in the oil & gas sector is hitting home.

FEATURED: IMF REPORTS ON CANADA’S ECONOMIC HEALTH The International Monetary Fund released a new country assessment, and believes that federal government remains “essentially on track to achieving its balanced-budget target in fiscal 2015/2016, despite lower prices. However, it has cautioned Ottawa to go easy on its deficit-fighting zeal, recommending that “Federal authorities consider adopting a neutral stance, given past consolidation gains and downside risks to growth”. In the annual report, which reviews Canada’s economic outlook and financial stability, the IMF estimates that Canada’s housing market is now overvalued by “7 to20 percent” on a national basis, “although with important regional differences”. This suggests that home prices have become more overvalued from a year ago, when the IMF estimated the prices were “about 10 per cent” above justifiable values. The IMF noted that “low and declining interest rates” have continued to fuel the Canadian housing market. However, with that said, the IMF also remains confident that Canada’s housing sector will achieve a “soft landing”. In early January, in its World Economic Outlook update, the IMF trimmed its growth forecasts for Canada to 2.3 percent in 2015 and 2.1 per cent in 2016, down from its previous projections of 2.4 per cent for both years. Given the slowing growth outlook and the impact of the oil shock, the IMF gave its thumbs-up to the Bank of Canada’s decision last week to trim its key interest rate.

THE WEEK AHEAD U.S. Personal Income & Consumption – December - Monday, February 2, 2015 at 8:30am

U.S. Factory Orders – December - Tuesday, February 3, 2015 at 10:00am

Canadian Employment Report – January - Friday, February 6, 2015 at 8:30am

U.S. Employment Report – January - Friday, February 6, 2015 at 8:30am

UPCOMING CSIT MEETINGS Monday, February 2, 2015 at 1:30pm - Sector Meetings WEEKLY ECONOMIC REPORT

Thursday, February 5, 2015 at 3:30pm - Team-Wide Meetings FEBRUARY 2, 2015

Ronald Chow, Chief Economist ! ronaldchow@crescentschool.org