Cross Tech THE MAGAZINE OF THE CROSS-BORDER PAYMENTS INDUSTRY COLUMN OF OPINION Innovation in the financial market TO KEEP IN MIND 10 reasons you are being discontinued or declined by your bank Global Head, Visa Direct, Visa Ruben Salazar 4Q 2022

Priscilla D'Oliveira Friedman

Priscilla D'Oliveira Friedman

Priscilla comes with an extensive background in operations management, strategy, process improvement, consulting and training. She started her career in American Express where she led a variety of teams in the call center industry (executive customer care, dispute resolution network and social media response team).

EDITOR’S LETTER

EDITOR

Hugo Cuevas-Mohr

CO-EDITOR

Priscilla D’Oliveira Friedman

WEB EDITOR

Virginia Martínez

DIGITAL PRODUCT MANAGER Ana González

CREATIVE MANAGER

Carolina Busnelli

GRAPHIC CO-EDITOR

Marcela Molina

CONTACT US AT María Auxiliadora García help@crosstechpayments.com

The views and opinions expressed in this magazine are those of the authors and contributors and do not necessarily reflect the position of CrossTech, The Platinum Network or IMTC. The content here is for informational purposes only and should not be taken as investment, business, compliance, or legal advice. Content contained within this publication is not to be reproduced in whole or part without the prior written consent of the company. We welcome quotes of our articles by mentioning “CrossTech Magazine” or #crosstech and share the quote with us using our social media channels.

When talking about the main trends in the industry in 2022, what comes to mind is digitalization. Nevertheless, partnerships are the key to a successful business, from digitalization to worldwide payments networks.

Partners are the equation component that allows the creation of a professional company at a post-pandemic speed faster than ever known.

One benefit of this industry is the close ties between companies and people that open the door to a wide range of opportunities, giving birth to many solutions and, above all, connecting families and helping improve life quality in all sense.

As our CrossTech World 2022 Conference is getting closer, it is important to remember the intimacy of our events and the platform that it becomes to leverage your company, your goals, and your future projects for 2023.

Join us at this wonderful conference and get the best of experiences for Networking.

See you in Miami!

COO, CrossTech

© 2022 | ALL RIGHTS RESERVED EDITOR’S LETTER

XT 3

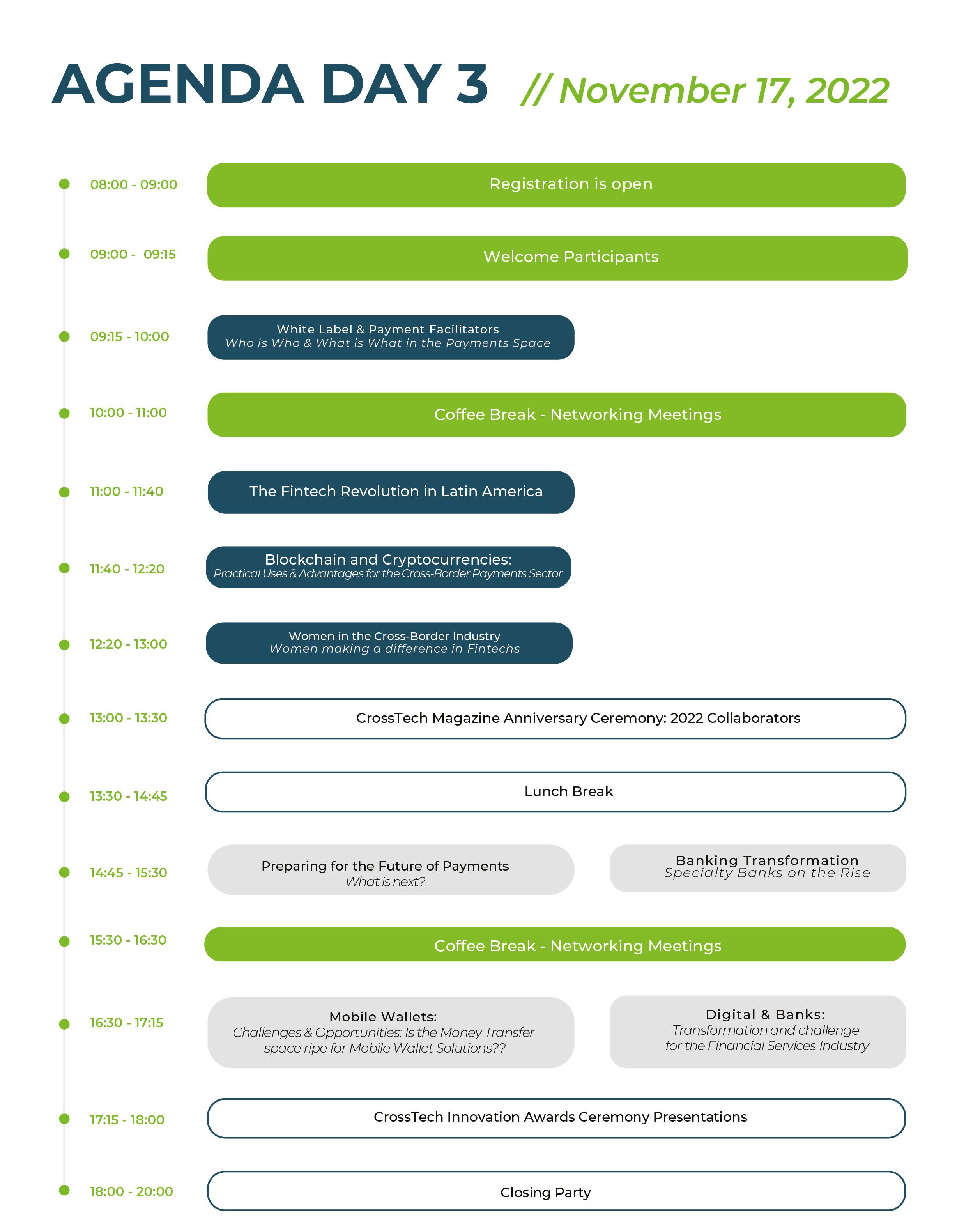

NEXT ISSUE DECEMBER 2022 COLUMN OF OPINION Innovation in the financial market Page 11 Accelerating growth for remittances businesses Page 12 GADGET CORNER Find out the trends on gadgets for hardworking people like you! Page 16 TO KEEP IN MIND 10 reasons you are being discontinued or declined by your bank Page 14 CONTENTS SPONSOR OUR NEXT EDITION ADVERTISING | COLLABORATIONS | OPINION LEADERS | BE IN OUR COVER ANNUAL PACKAGE INCLUDES PRINTED EDITIONS 2023 Ruben Salazar Global Head Visa Direct, Visa Page 20 Page 22 INDUSTRY EXPERT SPEAKERS 38 TEAM 40 SPONSORS 25 HOTEL MAPS 26 AGENDA 28 AGENDA 28 COURSE/WORKSHOPS 34 XT 5

YOU ARE READING

Ruben Salazar - Industry Expertv

Ruben Salazar Genovez is the Global Head of Visa Direct where he is responsible for expanding Visa’s global money movement capabilities beyond the card for Visa Direct. He also leads Yellowpepper, part of the Visa Direct portfolio of solutions that helps facilitate global money movement.

Kyle Oden - To Keep in Mind

Kyle Oden, CAMS has more than 13 years of experience within the alternative financial services space. Because of his adept ability to understand the complexity of the industry, he has excelled at working one-on-one with primary points of contact, overseeing consulting projects and identifying ideal solutions necessary to satisfy the needs of high-risk businesses, banks, IRS or state regulators.

Fredo Pen - To Keep in Mind

Fredo is Vice President, Financial Services for the Americas at Nuvei. He leads market and business development with focus on fintech, remittance, investment, insurtech and crypto industries. Nuvei’s future-proof technology allows businesses to accept cuttingedge payment options, optimize new revenue streams, and get the most out of their stack—all on one platform.

Ana Tena - Column of Opinion

C Level Executive , Board Member and Advisor with +25 years experience Graduated in Business and Law with executive specialization in Stanford, Wharton, Columbia and INSEAD, Ana is Travelex Brazil CEO (Bank and Broker). She has exten sive experience, in Corporate Finance, Treasury, M&A, Plan ning, Joint ventures, Sales Development, Insurance, Retail products distribution, organizational restructuring projects, operations outsourcing, and Business Intelligence.

XT 6 CONTRIBUTORS

AI MINIMIZES FINANCIAL CRIME RISKS

An AI-driven, risk-based transaction monitoring approach helps minimize your financial crime exposure.

Managing risks in the current climate can be a challenge as new predicate offenses emerge, and criminals turn to new channels for financial crime. As a result, risk assessments are quickly becoming outdated. Payments and financial services organizations also face challenges with operations and complying with evolving regulations.

The complexity and range of data that must be analyzed during the transaction monitoring process means that manual monitoring can be inefficient and sometimes inaccurate. Advancements in technology can help firms and regulators address the growing diversity and complexity of financial crime. More and more

organizations are using technologies to tackle financial crime, including artificial intelligence (AI) and machine learning (ML), biometrics and predictive analytics. AI-based solutions can flag high-risk behaviors and patterns more accurately.

These technologies also enable automation. Data can be processed with speed and accuracy in a manner that manual compliance processes could never achieve. AI and ML can make the onboarding process smoother by accurately flagging, prioritizing and rectifying false positive alerts as well as adapting to regulatory changes and jurisdictional disparities. With AI, anti-money laundering (AML) processes become less timeconsuming for internal compliance professionals. Experienced analysts can then focus their time on the higher-risk cases.

When selecting a transaction monitoring system, you should consider the practical benefits of the system you plan to integrate, including its speed and efficiency, its adaptability to factors such as regulatory change, its compatibility with existing technical knowledge and infrastructure, and the level of industry accreditation and confidence that it offers. ComplyAdvantage helps compliance teams create complex risk assessment frameworks, map rules against a host of potential risks, and identify connected persons and entities. Payments companies and financial services organizations can manage their exposure to sanctions risks by screening customers against relevant lists at onboarding, and on an ongoing basis, in alignment with the firm’s risk-based approach with ComplyAdvantage’s financial crime risk management solutions.

To learn how you can enhance your transaction monitoring system with AI, download your copy of “A Practical Guide to AI for Financial Crime Risk Detection.”

8 | CROSS TECH Ad Repo R t

DOWNLOAD NOW

Complete Series avialable on YouTube Watch Our "Road to World" VRT Series WATCH NOW XT 9

Innovation in the financial market

The financial market has undergone many transformations in the last decade, and we are still experiencing a vital revolution, in which digital transformation in the financial sector remains on evidence. The arrival of Fintechs changed the banking system, which had to reinvent itself and find new directions to meet the needs of customers who have increasingly expanded their business and need global solutions with security, trust, and agility.

Travelex Confidence Group invests in technology, offers Exchange As A Service solutions through our APIs, and implements Mass Payments to support companies who need to send abroad a large number of payments, simultaneously and online. Our expertise has also enabled us to offer solutions such as NDF (Non Deliverable Forward) and hedge solutions. We offer several possibilities to customers, from the purchasing

By: Ana Tena CEO, Travelex Confidence Group

and selling currencies, international transfers and payments, to international SIM cards and insurance for international travel, among others.

Travelex Bank, the first exclusive foreign exchange bank approved and regulated by the Central Bank of Brazil, in the first half of 2022, recorded a growth of 98% in net income, when compared to the same period in 2021. Also, Travelex Bank carried out 130 thousand operations, USD 7,3 billion in volume traded and more than 2 thousand new customers.

With that, we placed the Bank in the group of the 20 main Financial Institutions in the foreign exchange market, reaching the 16th position in the Bacen's ranking of primary exchange. By the way, we received an invitation from B3 (Brazilian version of Nasdaq) to be one of the banks that compose PTAX (exchange rate) in 2022.

OPINION

XT 12

XT 13

Kyle Oden, CAMS

10 REASONS

YOU ARE BEING DISCONTINUED OR DECLINED BY YOUR BANK

While there are many reasons for being declined by your bank, these are some of the most common:

10. PROCRASTINATION

Many of our clients come to us at the 11th hour after receiving a letter from their bank. If you receive a letter, inform your preferred compliance consultant early so there is time to prepare you for the bank review. Most banks will offer at least a 30-day window to respond. In some cases, the bank may allow for an extension if you can show you are in the process of gathering all items being requested.

DO NOT PROCRASTINATE! Immediately engage. Gather documents early.

9. NON-RENEWAL

It is important to make sure that all your licenses, permits, registrations and other business-related documents are up-to-date and not expired. If a document is expired, it may extend the turn-around time to meet a deadline.

Ex. FinCEN registration, money transmitter permit, and deferred deposit license are items that need to be renewed regularly.

8. TEMPLATES

Believe it or not, we still see compliance programs that are NOT tailored to the operation's needs. We have seen business owners try to duplicate another business or family member’s BSA/AML compliance program, or even attempt to use a copy of one of their vendor’s AML programs. Please ensure your BSA/AML compliance program and/or CMS are customized to your operations.

7. INADEQUATE MONITORING

Electronic monitoring technology is much more effective than manual monitoring. Although manual monitoring is acceptable, the bank tends to be more comfortable whenever technology is involved in monitoring due to accuracy, efficiency, and better safeguards.

Technology is especially important when monitoring transactions over a given amount of time and specific thresholds are set.

XT 14

6. UNQUALIFIED THIRD-PARTY

When a bank asks for an independent review to be conducted by a qualified third party, three types of professionals are acceptable; an attorney, CPA, and a CAMS-certified specialist. From a bank’s perspective, the CAMS-certified specialist is preferred, as they are most familiar with the industry and the internal workings of an alternative financial services provider.

Through experience, we have seen many businesses come to us after having an attorney or CPA review their business and, unfortunately, fail. There are a few that do specialize in working with alternative financial services providers, but most do not. It is more efficient to directly seek a compliance professional working within your industry.

5. FAILURE TO ADHERE

What’s the point of having a compliance program in place when it is not being followed? Banks want to know that you have policies and procedures in place and that the owners, managers, and employees are abiding by those policies and procedures.

Side note: Your compliance program and risk assessment should be updated/reviewed at least annually as well as any time a change in services and/or staff is made.

4. NOT KNOWING YOUR BUSINESS

“Compliance is Everybody's Business”

As a business owner the more you know about your business, policies, and procedures the better. It is not enough to have a business. You need to know and understand that your business is adhering to the rules.

3. RED FLAGS

This is tough to hear sometimes: You need the bank more than the bank needs you. From experience, we know that banks will reject an application or renewal based on what they call a “character decline.” So, be nice to your relationship manager. Respect the risk department, respect your bank’s requests, and comply.

2. TRANSPARENCY

As stated previously, it is important to know your business. Full transparency with your bank is very important. It can be the difference between being approved and being declined. Or even worse, being approved and then declined later because the bank finds out you did not disclose everything on the application.

1. UNCOOPERATIVE

It’s important to create a symbiotic relationship with the bank. Government imposes rules and enforces them by auditing the banks. Banks need to abide by their own set of policies and procedures. Try to view that you and the bank are working together to appease the federal government. If we all work together, then everyone wins.

If you would like help with any of the above, contact us. Our CAMS consultants would love to take a look at your business and see how we can help.

TO KEEP

MIND

IN

XT 15

GADGET CORNER H

eading to the year-end, we want to bring a recollection of the best gadgets for hard-working people like you. Now you will have the best options to pumper yourself and have a fresh start in 2023.

Enjoy!

INNOVATION

CUBE FUTURE MOBILITY PLATFORM

The projections for the autonomous car market are anticipating this industry to become the largest market in the world, even when theres is a limitation of labor force. However, different technologies such as Lidar, Radar, high-precision GPS, stereo and top cameras, and high-precision mapping open up the possibilities for the future.

Cube has developed autonomous vehicles with its own technology in these markets, and is developing various other autonomous vehicle technologies.

Mobility Data Business

The Mobility Data Business is solving some of the biggest problems associated with

mobility such as overcrowding, traffic congestion, emissions and mode shift. By using data-driven methods and digital rewards schemes Cube intents to enact behaviour change among urban citizens, paving the way for more liveable cities across the world.

DIGITAL

GC GADGET CORNER a guide to... 16

CrossTech

KNOW MORE

XT 16

Blockchain-Backed Autonomous Car Security Platform

TP-LINK ROUTER

AXE16000 Quad-Band Wi-Fi 6E

The TP-Link Archer AXE300 router is the solution for the home-office era. Professionals working from home will maximize conectivity and security in one single click. It is powered by 2.0 GHz quad-core processor and offers 6 GHz band, bringing more bandwidth, faster speeds, and near-zero latency. Plus, the 8x antennas provide maximized Wi-Fi connectivity coverage, supporting more than 350 devices to be connected. The router offers protection with HomeShield to prevent unauthorized access to the networks.

VAYDEER MOUSE JIGGLER

Driver-Free Mouse Movement Simulation for Computer Awakening

No need to install any driver on your computer since the computer is just a power supply for this mouse jiggler. Even it doesn’t need to be connected to your computer, you just need to supply power to it. It is is compatible with win7/8/10/Linux/Mac. Any optical mouse can be used with this mouse jiggler.

WORK

a guide to... 17 GC GADGET CORNER

FROM HOME

TO BE REALEASED

KNOW

33.99

BUY

XT 17

MORE

USD

NOW

Sharing Sharing One One Industry Voice Industry Voice

Track legislation at federal and state levels.

Be briefed on latest industry trends.

Build relationships with other industry stakeholders

Improve industry awareness and perception.

Network with and gain access to global clients.

Become a part of an Become a part of an important & influential voice important & influential voice in the in the Money Services Business industry. Money Services Business industry.

info@msbassociation org www msbassociation org

For questions or quotes please contact us We serve: Money Transmitters, Fintech Companies - Crypto Companies

HEALTH CARE

Two wearable and rechargeable Soovu heat pods.

Soovu carrying case, charger, and disposable adhesives.

The Soovu System includes: 1 2 3

Soovu App with behavioral coaching, relaxation and movement training, and tracking.

SOOVU SYSTEM

Wireless Pain Relief Wearable

Smilewave TM status indicator

Advanced microchip Thermistor sensor & heater Magnetic adhesive ring

Battery Bottom housing & magnets

Soovu™ is a wearable pain relief device with patented HeatWave™ technology that pulses waves of heat at optimal temperatures to the area that hurts for effective, targeted pain relief. Combined with digital coaching and behavioral support, Soovu helps relief pain offering 3.5-hours of use per charge and boasts a hypoallergenic adhesive to make it suitable for those with skin sensitivities.

MAKE-TO-ORDER

ORDER NOW

a guide to... 19 GC GADGET CORNER XT 19

|CEO ALBERTO GUERRA

Technology will be an essential part of UniTeller’s success. It’s what drives innovation. And we make conscious efforts to review and improvise our systems, products, processes, and infrastructure and it is technological advancements that enable them.

was what really jumpstarted my career. I was the Head of the International Banking Division at Banorte at the young age of 33 years after which I became a key instrument of Banorte's expansion into the U.S., and I continue to be truly grateful for the opportunity and trust they placed in me to be able to lead UniTeller to where it stands today.

INDUSTRY LEADER

XT. What is your greatest professional accomplishment to date?

AG. I don't know if I can rank my accomplishments and define a single one as my greatest. Most of my accomplishments have been the result of collaborative teamwork through which some of the most innovative ideas have originated. It is in these environments that I have been able to strengthen self-growth and reinforce my values as a leader. Keeping that in mind, pointing out just one, may not be fair.

So, here are a few of my achievements that I value the most:

From graduating from college to building a family, and raising my children into self-reliant, young adults with the education and qualities they need to make a positive impact in the real-world.

On a professional note, joining the Banorte Group

XT. What effective strategies, initiatives, or actions have you implemented to achieve success at UniTeller?

AG. “Our strategies have evolved over the course of time, but if I were to point out the ones that have facilitated our growth and relevance in the market, it would be the following.

Identifying the needs of different players in the industry and addressing those needs by developing solutions and a product portfolio that revolves around a customer/partner-focused strategy.

Expansion and diversification are the foundation for sustainable business growth. By growing our ubiquitous network of partners across the globe, we are able to offer a more comprehensive service.

Invest in Technology. The standards for international payments used to be defined by a few key providers. In today’s day and age, customers are the ones that are defining the standards. They expect a seamless and transparent experience from beginning to end. They value real-time payment experiences, reliable payments delivery, and access to preferred payment methods to name a few. Making sure that you provide the most reliable processing platform and ensuring that your product offers a seamless experience for your business partners and end customers is key.

XT 20

A Solid Compliance. Companies now operate within a technology-reliant environment, which leads them to be more susceptible to cyber security threats, money laundering, data privacy loopholes, and more. For this reason, making sure your compliance is solid plays a crucial role in guiding new business models and financial technologies. It’s critical to ensure that your business and growth always adhere to the regulatory and compliance requirements.

Being responsible with your resources, expenses, budget, and business line profitability and operational KPIs plays an important role in achieving short and long-term goals.

Team and Human Capital matters. Every company is what it is because of its employees. Individuals who make up a company’s workforce are responsible for its success or failure. Build a team of qualified individuals that bring skills and value to the table and do your best to collaborate and work together as a team.”

elements that drive my decision-making.

From deciding my line of study, the college I went to, building a family, to deciding my place of work, these have all been life-altering decisions that originated from the power of positive thinking and that I cherish to date.

From a professional perspective, joining the Banorte Group at the start of my career followed by leaving the corporate world of Banorte in Mexico, and accepting the position of a CEO at UniTeller have all been an integral part of my professional journey and have allowed me to grow in ways more than one.”

XT. Tell us about your future plans.

AG. “My future plans are my best-kept secrets,” says Alberto as he lets out a lighthearted laugh.

AG. “It is very hard to define success as a static goal. Your goal should be to aspire to succeed while continuously moving your target and defining what success means for you at any given moment in your journey. Success in life can be whatever you define it to be. I once read that success is not the key to happiness, but it is the other way around, that happiness is essential if you want to achieve success.”

XT. What is the best decision you've ever made?

AG. “I never regret my decisions. It's not healthy for your mind to second guess or regret your decisions, so I always have a positive outlook on the decisions that I make and I truly believe that my decisions are for the best. Negative decisions are based on fear. Positive decisions are based on hope. Whether personal or professional, hope, optimism, and the power of positive thinking are the fundamental

“Talking seriously, I believe that what you do in the present is what guides your future. So, I strive to do my best today to ensure I can aspire to have a promising future. Nevertheless, it’s important to be aware of the fact that achieving success goes much beyond just having dreams and expectations. We need to be persistent with our actions as we make every effort to continuously achieve our objectives. Many of the seeds that we sow today will only provide a return on investment for years to come in the future.

As for UniTeller, for now, let's just say that the future holds some noteworthy projects through which we aim to support our journey of continuous growth. These range from expanding our global footprint and dedicating substantial investments to our platform, technology, and digital capabilities. Technology will be an essential part of UniTeller’s success. It’s what drives innovation. And we make conscious efforts to review and improvise our systems, products, processes, and infrastructure and it is technological advancements that enable them. We believe that with investments in technology we are sure to maintain our stance and competitive edge in the marketplace to remain relevant to our business partners and customers alike.

XT. How do you define success? What is your take on the ways to achieve long-term success?

XT 21

How Visa Direct is helping pave the way for the future of global money movement

By: Ruben Salazar | Global Head, Visa Direct, Visa

For over sixty years, Visa has successfully built a payment network that has been digitizing payments for individuals, businesses and governments around the world.

In FY 2021, we processed more than 10.4 trillion dollars in payment volume1. We continue to partner with FinTechs and solution partners to bring innovative global money movement solutions to market.

We connected 3.7 billion cards, more than 100 million merchants5, and 15,100 financial institutions . As a world leader in digital payments working with key players in the industry along with other payment networks, Visa continues to displace cash and accelerate commerce around the world.

Dee Hock and all the Visa pioneers to follow in his footsteps, declared that the company’s mission is to create a ubiquitous network to digitize currency and reduce the reliance on cash within the global payments ecosystem; that’s as true now as it was 60 years ago.

As commerce evolves, Visa continues to innovate to help accelerate the speed, resilience, and security of digital payments. Visa Direct is one important element of how we are helping shape the future of money.

Visa has been diligently building our real-time money movement solution to participate in transactions across multiple use cases, such as personto-person and account-to-account transfer of funds, business payouts to individuals and small businesses, merchant settlements, and refunds4.

In FY 2021, Visa Direct processed more than 5 billion transactions across 500 programs with nearly 550 enablement partners, reaching consumers and businesses in more than 180 countries

Global money movement requires a network that is nonstop

We are excited about the possibilities we can unlock with Visa Direct as we help connect businesses and consumers around the world with vast

XT 22

Today, Visa Direct serves as a vast money movement network with more than 5 billion end points combining cards and accounts.

With the launch of Visa Direct Payouts , Visa now has access to 66 ACHs, 7 RTPs and 5 payment gateways around the world.

scale, security, efficiency, and speed with innovation that’s nonstop – all through a single point of connection.

Scalability matters

Today, Visa Direct serves as a vast money movement network with more than 5 billion end points combining cards and accounts. With the launch of Visa Direct Payouts , Visa now has access to 66 ACHs, 7 RTPs and 5 payment gateways around the world.

Visa also operates a Push Payment Gateway, expanding the network to eligible non-Visa cards for disbursement purposes, while providing added convenience and simplicity from a single integration.

The next generation of money movement starts now

To accelerate widespread adoption and usage, Visa is simplifying the global connection to the Visa Direct network with the introduction of a single API, which reaches eligible cards and accounts, enabling quick

and convenient funds transfers for individuals and small businesses. We also continuously look to add new endpoints, such as wallets and crypto partners, to expand the reach of Visa Direct in the future.

For example, actively developing the ability to land transactions directly in mobile wallet is relevant for countries with large unbanked populations. Visa Direct’s ability to send to card, send to account, or eventually send to wallet – under a single connection – can help accelerate time to market for our clients and partners around the world.

The winners are consumers and SMBs

A robust money movement network helps empower people and businesses to pay and get paid, and to send and receive money around the world. The potential to reduce payment friction and reach bank accounts or cards in more than 180 countries via an expansive global network, is helping unlock a future of nonstop potential.

Want to learn more about how Visa is powering cross-border P2P remittances?

Check out Visa Direct. Visa Direct | Partners | Visa

XT 23

MEET OUR SPONSORS XT 25 EXHIBITORS, SPONSORS & PARTNERS

THANK YOU FOR YOUR SUPPORT

DIAMOND

D1 - UNITELLER

D2 - BANTRAB

PLATINUM SPONSORS

P1 - VISA

P2 - DAYCOVAL

P3 - TRAVELEX

P4 - INTER

GOLD SPONSORS

G1 - NUVEI

G2 - TERRAPAY

G3 - FLUTTERWAVE

G4 - CROSSTECH CONSULTING

SILVER SPONSORS

S1 - CAPITAL COMPLIANCE EXPERTS

S2 - FRENTE CORRETORA DE CAMBIO

S3 - INTERNATIONAL SURETIES

S4 - NAIRAGRAM

S5 - MAYA TECH

S6 - THUNES

S7 - SECURECASH S8 - COMPLY ADVANTAGE

BRONZE SPONSORS

B1 - TREVISO

B2 - BALUWO

B3 - ALACER GROUP VELOCITY

B4 - EASTERN POINT

B5 - GT LAW

B6 - CASHBOX

B7 - BOZ

B8 - CROSSTECH MAGAZINE

Plenary

FAIR

XT 26 WORLD MAPS

ups

TRADE

VIP Lounge

Start

WORLD MAPS VIP LOUNGE HOTEL Registration Networking Lounge XT 27 VIP Offices VIP Pass Must be an attendee of the event Up to 8 people in each office with VIP pass No entrance restrictions Coffee Break available all day

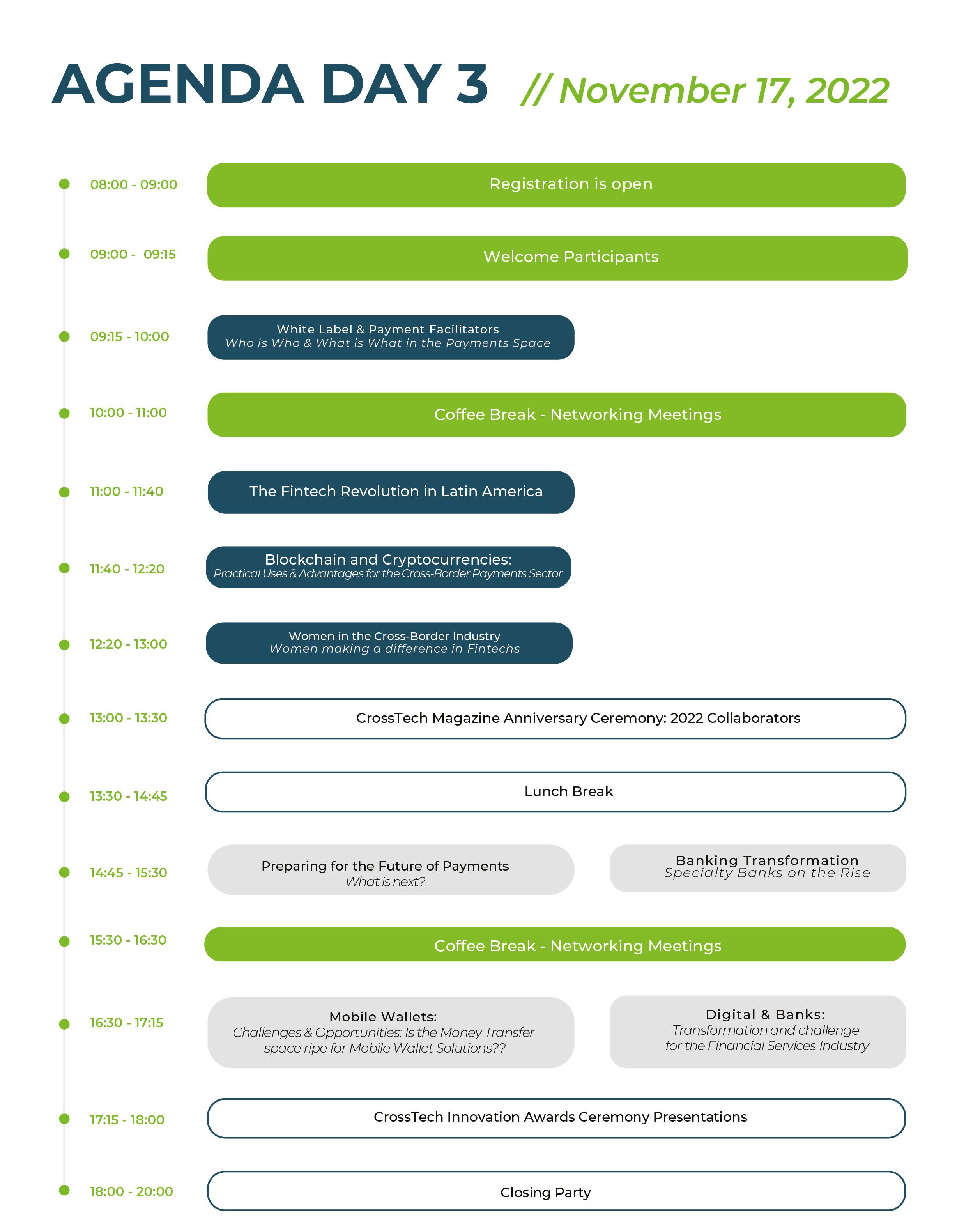

XT 28

XT 29

XT 30

XT 31

XT 32

XT 34

XT 35

Rick St. Onge State of Washington

Munir Khan SecureRemit Group

Andrew Ittleman Fuerst Ittleman David & Joseph

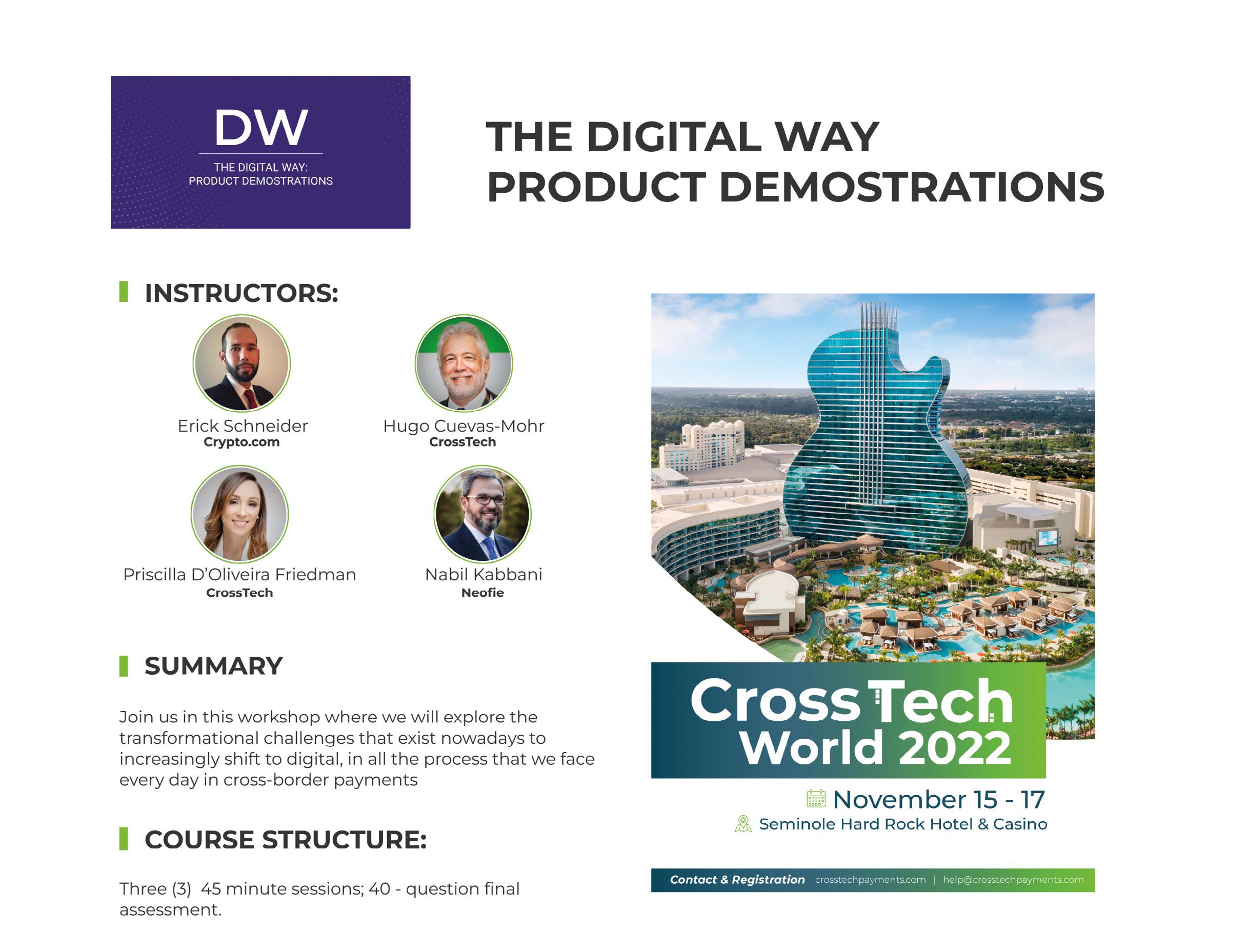

This course will focus on the here and now requirements as well as the current regulatory environment. We will have case studies and lessons learned from those found to be less than compliant by regulators. We cover the current and ever-evolving policy making decisions and regulator expectations, both state and federal, directly impacting those offering cryptocurrency financial products and services. We'll share lessons learned and valuable insights from the perspective of regulators, examiners, and other industry stakeholders, while providing attendees with actionable takeaways and realistic expectations for the months and years ahead.

XT 36

Carly Howard K&L Gates

XT 37

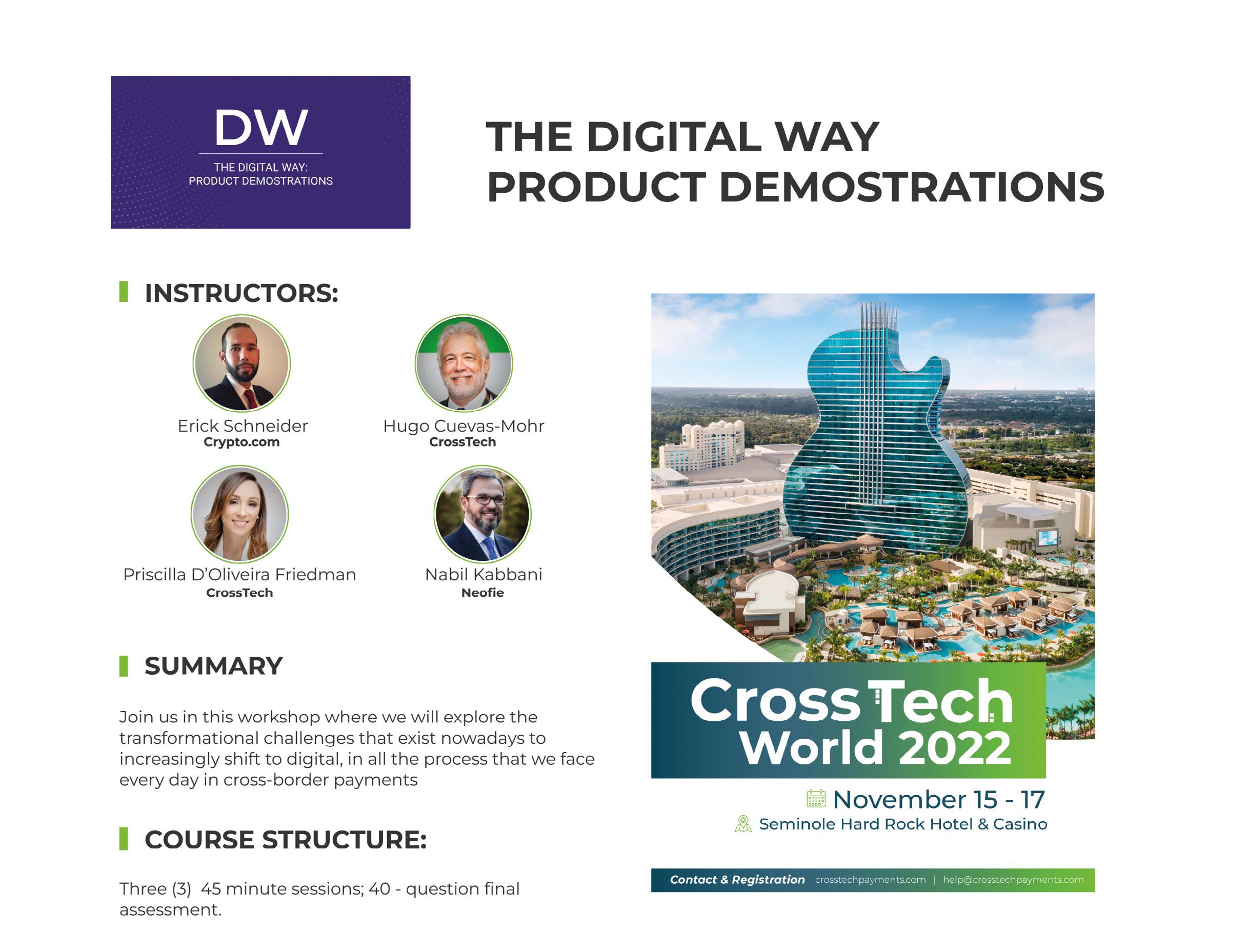

Priscilla D'Oliveira

Friedman CrossTech

Fredo Pen Nuvei

Hugo Cuevas-Mohr CrossTech

Alberto Guerra UniTeller

Nabil Kabbani Neofie

Alex Pereira PMI Americas

Erick Schneider CrossTech

XT 38

CAROLYN DICHARRY

DANIEL WEBBER

JORGE MONDAL

SPEAKERS

HUGO CUEVAS-MOHR

ANDREW ITTLEMAN

MARINA OLMAN-PAL

DARIO GAMBOA

RONALD MAZURSKY

ALEX PEREIRA

ERICK SCHNEIDER

BRANDI REYNOLDS

NABIL KABBANI

ROBIN GARRISON

KATHY TOMASOFSKY

JOÃO CAMPANELLI

ALBERTO GUERRA

PRISCILLA D'OLIVEIRA FRIEDMAN

CARLY HOWARD

LICELY SANCHEZ

DANIEL WOOD AMY GREENWOOD-FIELD

ZORY MUÑOZ

JOE CICCOLO

ROBIN ORTNER

RICHARD MESZAROS

39 SPEAKERS LINEUP JAIME MARQUEZ ALOISIO MATOS SPEAKERS GABRIEL CARVAJALINO JAIRO RIVEROS DANIEL AYALA SANTIAGO BERNAL LIZ BOTINAS AJ HANNA ARINA ANAPOLSKAYA MOISES JAMES ALEX COOPER LAURINEY SANTOS KOFI KYEREMEH KELLY MASSARO HENRIQUE CARDOSO RODRIGO NUNEZ PETER KELLY IDRIS IBRAHIM LUIS CAMBRONERO MICAEL MARTINS JOSEP ARROYO RUDY ROCOURT RICK ST. ONGE MUNIR KHAN JORGE GUERRERO

OUR TEAM

Hugo Cuevas Mohr President & CEO CrossTech

Claudia Ávila Director of Conferences and Sales

Ma. Fernanda Valera María A. García

Jennifer Holguín Lead Consultant

Isabel Cortes UK Consultant

Virginia Martínez IT Consultant

Marcela Molina Sr. Designer

Ana González

Digital Events Coordinator Customer Service Digital Product Manager & Content

Carolina Busnelli

Juan Posada Business Analyst

Diana Jofre

Creative Manager & Content Executive Assistant

We are thankful to all our staff and the supporting team of collaborators who help us develop our conferences in each of the cities and regions we select to host them. Without their help, it would be impossible for us to give all the participants in our in-person and virtual events the unique experience we strive to give everyone attending.

Check our next destinations and join us!!

CrossTech

Priscilla D'Oliveira COO CrossTech

Lourdes Soto Spain Consultant XT 40

MAGAZINE RIDE THE PAYMENTS REVOLUTION ON TIME! HYBRID MAGAZINE WITH DIGITAL AND PRINTED ISSUES Published monthly and distributed at our annual events, forums, and other relevant events in the industry. READERS DISTRIBUTION CONTENT • 11 Sections • 6 Contributors per issue • +8,500 Total distribution • +21,000 Impacts • 42 Countries • 23 % Female • 77 % Male TAKE YOUR COMPANY TO THE NEXT LEVEL! CONTACT US NOW

Priscilla D'Oliveira Friedman

Priscilla D'Oliveira Friedman