Trends in Commodity Risk Management Technologies

Commodity trading is fraught with various types of risk. In recent years, the number of types of risks that businesses that trade, procure, consume, or use commodities are exposed to have increased in both intensity and breadth. In the current environment of commodity shortages, geopolitical conflict, increasing environmental regulation and continuing covid impacts, risks of all types must now be constantly measured, valued, and ameliorated where possible. Where once price or market risk was the almost sole focus for commodity firms, a plethora of emerging risk now must also be front and center for these companies, including credit, regulatory, legal, political, operational, liquidity and multiple other forms of risk.

Examples of these increasing risks include both technology trends and global market developments:

/ The increasing migration of software and/or services in the cloud has introduced and/or increased a whole series of other risks around IT, application, and infrastructure security.

/ Fraudulent trading activities have also been in the news in recent months and years, requiring additional surveillance and new programmatic checks and balances throughout supply chains to help minimize such risks.

/ Environmental, Social and Governance (ESG) has also emerged as an area that will impact risk management practices for years to come.

/ And, perhaps most impactful in the near term, immediately after kicking off this project, Russia invaded Ukraine sending prices spiraling, increasing volatilities, and disrupting supply and demand patterns.

Though the Commodity Trading and Risk Management (CTRM) software used to track, value, and manage commodity transactions has continued to evolve, these solutions are often ill-equipped to address the plethora of risks that exist outside of a portfolio of commodity transactions, and even then, are often light on commodity-specific risk analytics or use overnight batch jobs to calculate positions.

Against this backdrop, ComTech had recently noted several technology trends that included:

/ The development of more advanced risk analytical solutions in various areas of risk management to supplement CTRM-type risk functionality,

/ The development of broad cross-commodity risk platforms that allow further enterprise-level assessment of risks utilizing data from disparate systems across the company,

/ Increased risk functionality and analytics added to CTRM and CM solutions,

/ A move to real-time and event-driven calculation of risk metrics and away from overnight calculations of prior day.

Given the seemingly ever increasing litany of risks faced by market participants and apparent gap in technology solutions required to address those risks, ComTech has conducted a research effort to look specifically at current industry risk concerns and emerging practices in addition to reviewing the availability of commodity risk tools and solutions, with a generic view of different application classes. Additionally, an attempt was made to classify vendors and products in the market according to their relative risk capabilities and footprints at a directory-type level. This ‘directory’ can provide a tool for buyers and investors seeking to build short lists of solutions for consideration.

The research was conducted in several ways.

1/ A short industry-wide web-based questionnaire,

2/ Follow up interviews with risk managers across the industry,

3/ Interviews with other industry participants, including vendor personnel who also provided software demonstrations where appropriate.

Unfortunately, the survey component, which is always a highly useful indicator of trend and sentiment, proved unexpectedly

difficult to complete. Responses were slow in coming in and were often incomplete. It seems that risk management in commodities is a sensitive topic, and that people are somewhat reluctant to provide input, particularly in a survey that required those risk professionals to identify themselves to validate the legitimacy of the respondent (though assurances were provided their identifying information would be permanently deleted after that validation). None the less, we continued to push the survey and, in the end, gained 40 valid and usable responses. Further, scheduling interviews with risk professionals was even more difficult and those who did ultimately agree declined to be identified and would only engage with ComTech personnel under the assurance of complete anonymity. While this reluc-

Those answering the survey were industry professionals working in commodity risk management around the globe. Most of these professionals had responsibility for market risk (Figure 1), though many had broader responsibilities across a group of exposures such as credit, regulatory, operational, and other risks. A small number did not have direct responsibility for specific risks but were involved in managing risks in some way.

tance was perhaps disappointing in terms of information gathering for this research effort, it is also understandable and is in of itself, a data point.

The study was sponsored and supported by Amphora, Commodities People and Nasdaq Risk Platform – see the end of this report for more details.

In summary, the results of this study drew upon the 40 valid survey responses, a half dozen anonymized interviews and a great deal of research. It also draws upon the knowledge gained as an analyst covering the industry over a 25-year period.

When asked which types of risk they thought required greater focus, credit risk emerged as the top choice with market risk and ESG/Carbon risks also being cited by more than half the respondents. Those who stated ‘Other’ were unanimous in mentioning liquidity risk, which has apparently come sharply into focus due to the Russia-Ukraine war.

When asked which areas of risk they felt were lacking tools to help manage exposures, the overwhelming response was ESG/Carbon with more than a third of respondents mentioning this gap. Somewhat surprisingly, although perhaps related, regulatory risk was also identified by more than a quarter as an area lacking tools. Another 25% felt that they didn’t lack tools to manage risks in any specific area. However, it is apparent that some respondents felt as if they were lacking adequate tools across almost all areas of risk identified in the survey, with 20% citing market risk and 23% saying contract and legal, for example.

In reviewing the various types of software used to help manage the previously noted risks, about two-thirds of the respondents (who were able to select multiple tools/products in the survey) said they used either a single or multiple CTRM solutions as part of their suite of risk tools. Almost half utilized some form of stand-alone regulatory risk software solution, and about a third noted they used a credit risk solution. A third also said that they used other software tools for risk analysis and management, which likely includes Excel. Only one quarter indicated that they used an enterprise aggregation tools for risk data.

When it came to the effectiveness of the risk management software tools at their disposal, more than half of the respondents felt those technology products were only partially effective, with an additional 15% saying they were not at all effective. However, a larger number of respondents (30%) did feel their risk tools were fully effective for their area of responsibility versus those that said they were not.

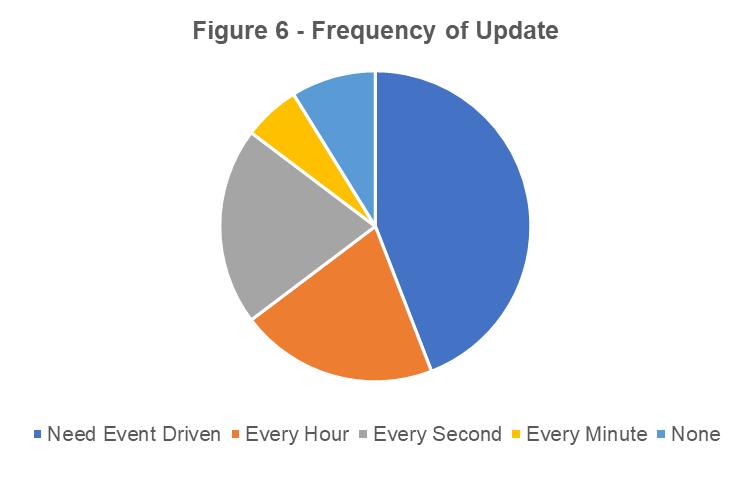

The inability of risk management tools to provide near real-time calculations has been an often-cited issue in the commodity trading space. The information latency introduced by older risk tools that could only calculate and provide “after the fact” daily updates have proven insufficient for many market participants, particularly in markets where the speed and breadth of available data has increased. Most respondents would like to have event driven updates, but almost all would like increased update frequency; with hourly and near real-time (every second) updates noted by more than a third. Only a small minority appeared satisfied with currently available update frequencies.

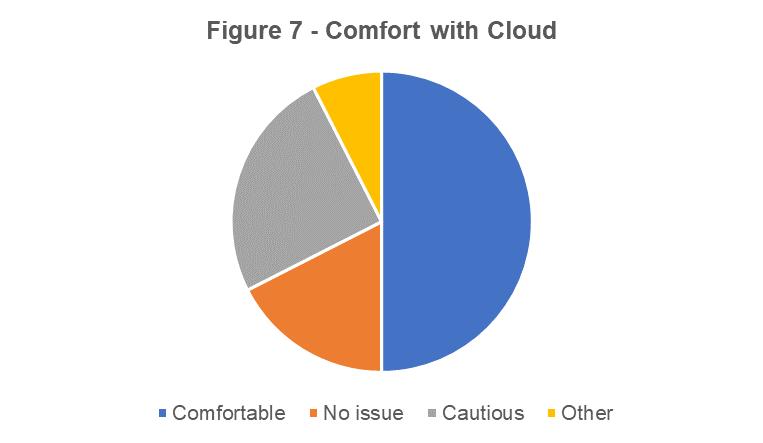

In recent years, cloud SaaS and subscription-based applications have become increasingly popular. This evolution is reflected in the results with half of the respondents saying they are entirely comfortable with cloud-deployed risk solutions and a further 18% noting they had no specific issue with cloud solutions. Only a quarter stated that they remain cautious regarding cloud and a small number indicated that despite any personal feelings, their businesses had already committed to the cloud.

In reviewing the survey results, it’s important to keep in mind that the responsibilities and tools that fall within the umbrella of risk management will vary greatly depending on the commodities and markets being managed, and the assets, processes and strategies deployed by the market participants. Further, as analysts we’ve seen that the attitudes of executive management will vary significantly from company to company within the same market segments - some will take a very proactive role in trying to manage most or all risks, while others will be more reactive to market developments. These views are particularly diverse in terms of price or market risk, as it’s not

What about managing risks holistically meaning taking a view of all risks as a cohesive whole rather than individual types of risk? Some 60% said they thought that their organizations did that poorly or there was room for improvement, while a third thought it was done well or even very well.

uncommon to find that some executives believe that trying to anticipate future price movements is essentially speculation. Similarly, within our response group, there are those who take a risk-centric approach and there are still quite a number who appear less than diligent about most or even all aspects of risk. That said, regardless of the intensity of attempting to manage risk, many still use CTRM solutions as their tool of choice for risk, despite the shortcomings of these software applications in performing risk analytics and managing holistic risks being well known.

The spectrum of focus and functional coverage found in risk responsibilities and solutions reflects a similar range of approaches to risk management - from rudimentary (at best) to highly sophisticated - as was expressed by those that we interviewed in this research effort. It was also made clear by those that we spoke with that some aspects of risk can be well managed and are well covered by existing tools, while other forms of risk are not and addressing them may never be completely achievable. Overall, the consensus from our conversations was that the industry in general still has some ways to go to address risk management holistically and properly.

There also emerged a view in some quarters that risk management was evolving to being less active and more systemized than it should be. The structuring of approaches to risk management with methodologies often promoted by large consulting firms was roundly criticized by a couple of our interviewees. Their view was that in systemizing the approach to managing risks, risk was increasing as those methodologies removed the active identification and management risks specific to their firms in favor of a standard by-the-book approach.

The activities of different firms in commodities are likely to be different even in entities in the same segment meaning that specific risks existed and needed to be identified and managed that might not necessarily be recognized in a highly methodized approach.

This view resonates with us as analysts looking at applications serving the industry. We too have made the same argument with respect to CTRM software in that experience has demon-

strated that no commercial CTRM software solution can ever actually fulfill the requirements of all users. Even the implementation of a “highly configurable” solution often results in suboptimal results because a homogenous approach is being used to solve a heterogeneous problem. In essence, it is not a true packaged software market but more of a custom solution market seeking to keep costs down through a packaged software approach. Given this, there are inherent risks that the costly acquisition and implementation of a packaged software product will never address all the specific needs of any business. An even bigger risk is that, once put into production, users believe that their specific requirements are well covered by the software when in fact they are not.

In essence, this also can apply to risk management. By systemizing and methodizing risk management, one runs the risk that while management believe they have it covered, there is some specific aspect to their business (i.e., a unique asset, business process or even trading strategy) that represents an unrecognized and therefore unmanaged risk. These “unknown unknowns” are likely only identifiable when the risk manager is taking an ‘active’ approach in seeking out, identifying and documenting areas of risk that would otherwise be missed in a standardized and systemized approach.

This also applies to the use of analytical tools in the industry. As evidenced by our conversations with risk professionals, firms using systemized or packaged analytics inappropriate for the task at hand, yet feeling themselves managing exposure effectively, may be another issue. It again highlights the complexities of the industry. Different commodities, and assets employed in the industry require that the analytics need to be both appropriate and specific to the problem at hand in the first place. They must also be used appropriately, with a correct mathematical understanding of input parameters, calculations, and interpretation. Among those we talked to, there was some suspicion that there are complacency around certain risks because the models or analytics in use are inappropriate, or their shortcomings are not understood. Areas like valuation and market risk can be utilizing poor models and analytics, especially if a CTRM solution is being used as a ‘black box’ calculation tool. This may well be a serious and

underappreciated issue across the industry.

Indeed, the use of CTRM solutions for risk management was a concern for some. Many of the solutions in use are aging and perform overnight ‘batch’ calculations for mark-to-market, position, and risk metrics such as VaR, for example. Perhaps reflecting the fact that most CTRM solutions continue to provide overnight, batch calculated valuations, most of the respondents do want increased frequency of calculation of exposures. As can be seen from the survey results above, the industry increasingly wants to understand position on a near real-time basis and a majority would like to have access to event-driven risk numbers. Given that need, the legacy CTRM is increasingly a chokepoint in risk management – limiting timely review of positions and risks, and ultimately requiring the use of supplemental support (most often spreadsheets even with their inherent problems) during the day to stay current with changing market conditions. And again, the analytics and models used in these CTRM solutions can be inadequate or inappropriate for the job as previously described. We see this as driving a need for more sophisticated commodity risk analytics software that supplements the CTRM solution, offering configurable or tunable models and analytics that are more appropriate for specific commodities and/or assets, as well as offering the possibility of some aggregation and drilldown into the results. It is not just knowing position, but understanding what drove any movements, that is key.

The survey suggests that a large portion of the industry still uses a CTRM or CTRMs to manage some aspect of risk –most likely price/market, basic credit risk and some aspects of other risks like legal, operational, and so on. Outside of regulatory risk, the survey suggests that less than 1/3rd of the respondents use specific risk tools designed for the type and nature of the risks being managed. Again, we believe this highlights an issue common in commodities as discussed above – lack of appropriate tools to effectively manage the unique risks inherent in different segments of the commodities space. When combined with a sometimes-false sense of security that the deployed risk management tools and approaches are effective and/or with a lack of understanding of the model or math’s shortcomings, constraints, and excep-

tions, this can be dangerous.

In addition to the survey results, those we spoke to saw carbon and ESG as an area for emerging and significant concern. Everyone is aware that these are emerging risks, yet there is insufficient detail around the requirements and a lack of understanding as to who the ultimate regulator is. Within the commodities space, there appears to be a real fear of confusion developing in the absence of clarification and increased detail, particularly around proposed regulations and laws across all geographies and markets. In fact, a recent KPMG publication1 looking at mining identified this concern as the number one cited risk for 2022 yet it didn’t even make the top 10 in 2021. The KMPG authors also state that “The impact of this is not being underestimated by mining executives: nearly three-quarters of them (72 percent) agree or strongly agree that ESG will be a cause of major disruption in the industry over the coming three years.” Uncertainty will only

serve to increase that disruption. Some 55% of executives in the KPMG study “do not believe ESG expectations are clearly understood and consistent across the market.”

There are at least two aspects to this issue. First, who is the regulator and what regulations are they enforcing? We discussed confusion around this issue with risk managers, all of whom preferred that this were all a bit more sharply defined. Secondly, what are the details that need to be managed? Calculating and reporting carbon footprints for transactions seems to be one emerging requirement and ESG auditing seems to be another, but these are proposed by different groups at different levels in industry and by various jurisdictions within governments, including local, state, and national; and there is little or no harmonization among the current proposals. Furthermore, there seems to be concern as to potential impacts on other aspects of the business, like credit scoring and KYC (both ways), supply chain optimization,

financing, prices, and much more. Clearly, ESG is, for commodity market participants, an area in which more definition, and more coordination with market participants, is urgently needed.

An area of risk not covered by our survey was staffing. We heard however that staffing posed a risk to many commodity businesses from our interviewees. The industry has reached a point of maturity at which many experienced veterans are retiring, and their expertise is being lost. At the same time, the entire industry is changing with new technologies and new constraints emerging – like ESG for example. Meanwhile, salary expectations have surged following inflationary pressures making it difficult to identify, recruit and retain good talent and representing a significant risk to businesses that now also needs to be managed. This is particularly a critical concern for hydrocarbon-focused firms, including producers and traders. The demonization of the oil, gas, and coal industries appear to have had a significant negative impact on the perceptions of potential recruits that are now emerging from colleges and universities. This demonization has also spilled over into other parts of the energy complex as well. The expertise leaving the industry includes the specific knowledge of how various models and analytics really apply to commodity risks thus potentially increasing the risk of using inappropriate risk metrics.

Another area not explicitly covered by the survey but brought into sharp focus by the impact of the Russian invasion of Ukraine, is liquidity. Several respondents mentioned this under ‘other risk’. Having access to sufficient cash in the right currency at the right time and place requires a quite sophisticated approach to cash management, especially if the business has operations in multiple countries with local currencies. While often the bailiwick of treasury professionals, the rapid rise in most commodity prices and resulting margin calls has stressed the entire system. Adequate liquidity is critical for commodity businesses and the current market volatility poses a large risk that needs to be effectively managed.

With the migration to cloud and the penchant for digitaliza-

tion, a further area for potential concern that emerged during our research was around IT architectures and security. Previous research into CTRM in the Cloud by ComTech highlighted issues such as where data was located (jurisdiction, privacy and so on), security of that data and an unease generally due to a perception of giving up control over vital business assets (data and processes). Such fears appear to have eased considerably in the last couple of years and the cloud is the choice of most firms these days. Perhaps the work from home regime during covid lockdowns helped to ease these concerns? Anyway, the survey reflects the growing ease with which cloud and newer technologies are viewed. After all they come with considerable business and cost benefits cited, none the less, IT-related risks still do need to be considered and certainly security is a key issue to be addressed given the rise in hacking and ransom ware.

Overall, the view of those we spoke to was that the visibility and management of risk was much improved in recent years yet much remained to be done. CTRM was viewed to be largely inadequate to manage anything but basic risks, especially if an older legacy solution was in use. These systems are thought to not offer timely enough information given market conditions as they often rely on overnight batch jobs to calculate position, mark to market and profit numbers. In other areas, specific solutions like credit, regulatory and treasury solutions have helped to manage risk, though a minority of those polled and questioned had all these systems in place, indicating many firms have not adequately leveraged available risk technologies.

In summary, risk management sophistication remains highly variable across the industry; however, based on the survey and our conversations, firms that are seeking to improve their risk management capabilities do have more tools available to them. Unfortunately, new risks (such as ESG) are emerging and require constant vigilance and an understanding of their impacts on the specific profile of their firm by both their risk managers and executives.

Given that the current environment in which this study was undertaken is extremely dynamic, (escalating and volatile prices, new regulatory mandates and proposals seemingly coming daily, ongoing impacts of the global pandemic, and the continuation of the Russian invasion of Ukraine), and probably more so than most market participants have previously experienced, it’s difficult to draw definitive conclusions about risk developments and practices that might sustain themselves into the future. As such, in this summary of market developments by risk type, we will limit commentary to what we learned in conducting the study. As the questions were quite high-level, this does limit the analysis that we can confidently perform yet the information garnered by the survey is interesting and informative none the less at a summary level.

Market or position/price risk is quite often left to the CTRM solution, and in fact, given that those systems are the intended repository of all trades, they should be best positioned to address the measurement and analysis of these risks. Unfortunately, if that solution is older technology, it is likely only calculated daily, well after the daily trading cycle has concluded. Further, if the firm trades multiple commodities it may also rely on multiple CTRM solutions, requiring a complex automated process or tedious manual effort to aggregate all the position data elsewhere. With an automated approach, that aggregation process may require frequent technical updates to address code updates that might occur in the end-point solutions; and even when fine-tuned, can provide results only quickly as the slowest system. Since these processes rely on the availability of many external data like prices and so on, there is also the risk that the overnight job doesn’t run at all due to missing data or, it uses older and existing data as a fallback position and produces inexact results.

Another common issue is that often-understanding changes in this exposure information is difficult to ascertain using many CTRM solutions. Though features such as PnL attribution with drill down capabilities are becoming more common in vendor supplied solutions, many legacy solutions still lack this necessary capability.

Portfolio management and trading and analytics platforms may also be used to help manage market risk along with various other solutions including spreadsheets, BI solutions, and ad hoc reporting tools, but only about 20% or so of those sur-

veyed suggested that they used specific tools to manage market risk. Increasingly, valuing complex commodity positions requires more sophisticated models and this is another area where a typical CTRM often comes up short or where the analytics used are inappropriately applied. The survey also suggested than more than half of those responding felt this area of risk required more focus than currently given.

Interestingly, data management didn’t come up in any conversation, yet experience shows that managing price and other data is an area that requires focus and care. Ensuring that price data from whatever source is accurate, timely and valid is essential in building the curves needed to calculate position. Additionally, for many market participants, the ability to construct and maintain derived curves is also key for valuing more opaque or less liquid or thinly traded positions. Though some CTRM solutions can provide these curve management capabilities, we find that data management platforms are often used as well.

In summary, this study identified the following key issues related to managing market risk:

/ Timeliness and relevance of the information with many looking for event driven or closer to real-time recalculation of valuations, positions, and analytic metrics. The typical scenario of end of day (overnight) calculation and then estimation of changes over the course of the business day is simply too slow for market conditions especially in commodities like power,

/ Ability to understand changes in position data is often difficult with CTRM and other tools,

/ Aggregated position data is problematic for firms trading multiple markets and commodities especially if multiple

Though credit risk is often referred to a singular capability, it in fact comprises multiple aspects: credit scoring, exposure calculation and limit monitoring, credit instrument management and credit analytics. There is specific vendor supplied credit applications on the market and many CTRM solutions incorporate sometimes rudimentary credit functionality as well. Around a third of the respondents said that they used a credit application to manage this exposure yet less than 20% felt this to be an area where tools were lacking and almost 60% felt that this was an area requiring greater focus. Around a third used specific credit risk tools and applications to help manage exposures.

In our experience, despite there being several credit solutions on the market, many firms still appear to use home grown tools to manage credit exposures along with the use of some limited CTRM functionality. Mostly, these tools appear to be spreadsheets-based. Despite this, we do anticipate continu-

There are various forms of applications available on the market to aid with regulatory risks, ranging from trade reporting through surveillance tools that look at trading patterns for illegal or questionable trading activities. Despite the current availability of these types of solutions, the respondents in our survey saw this area as one requiring greater focus. The results of the survey are interesting as although almost half of the respondents indicated they have tools in place for regulatory risk (the most for any class of risk applications), almost 30% claimed that suitable tools were lacking. We consulted with Aviv Handler of ETR Advisory and a specialist regulatory risk expert to try to understand what was behind these results.

The first phase of regulatory risk was about trade reporting and software solutions were designed and built to support

CTRM or similar solutions are in use,

/ Sometimes questionable appropriateness of analytics used.

ing adoption of dedicated, vendor-provided credit solutions driven by several current needs, including the ability to better forecast margin and improved monitoring of counterparty exposures. Managing and predicting cash needs is a key aspect of risk management and knowing what margin calls may be anticipated, what cash is tied up in collateral and counterparty exposures is key. Additionally, though perhaps longer term, the increased focus on ESG which will require increased focus on KYC (Know Your Customer) capabilities and counterparty selection.

Key issues in this risk area identified in this study are:

/ Credit is identified as an underserved area requiring greater focus,

/ It is an area that can also be impacted by ESG regulations going forward.

these activities, and in the main, this problem has been addressed through those software solutions. However, changes to trade reporting from various regulators are coming and must be catered for within these solutions. The second round of regulatory risk was addressed via trade surveillance and although there are software solutions to aid with this activity, they are often not adequate originating in different asset classes, for example. According to Aviv, there is a long way to go in this area still. Finally, Aviv points to market interventions being discussed by politicians in European markets in particular because of rising energy prices and volatilities. This represents a huge concern to the industry as there is little or no clarity around what interventions may occur and when. Market intervention could take the form of arbitrary price capping up to and including renationalization, he says.

On that basis, the results of the survey might make a little more sense as regulatory risk is a broad term. Most have regulatory reporting solutions deployed to meet the reporting side of the regulations. Some have trade surveillance tools but find these not totally appropriate for commodities and re-

The survey also suggests that risk of fraud – which would certainly include fraudulent trading practices – is an area seen as requiring greater focus. Again, risk of fraud is a term covering a wide variety of risks – not just fraudulent trading activities. Some respondents claim to use tools to help manage the risk of fraud and this probably does include trade surveillance tools.

Risk of fraud can occur anywhere within a firm’s operations and requires monitoring and diligence to both prevent and detect. Technologies are available and are being deployed along much of the commodities value chain to aid in reducing risk of fraud. These range from GPS location monitoring to track containers, various types of physical surveillance systems and alarms to help eliminate tampering, blockchain applications

Another area of focus for many respondents is contract/legal risk. Though often viewed as an area for the firm’s legal staff, about a quarter of those responding noted they had responsibility for this area of risk. Of those, most felt that they had adequate tools to manage this risk area. Tools like contract management and document management applications (or modules within other solutions like CTRM systems), along with more specialist tools used by lawyers to manage agreement drafting and review processes appear to offer largely adequate tools, particularly given commonly available document management capabilities that capture and store electronic scans of physical documents. Additionally, workflow tools with

The respondents felt that this was the area generally well covered by the currently available tools. Still, a sizeable minority also felt more focus was needed. With increased currency

quire manual intervention and greater oversight. Finally, there is a lack of clarity around the future as politicians and regulatory bodies continue to be intent on intervening in and having greater oversight and control of the markets.

(including smart contracts) to help increase confidence in contract performance and documentary evidence of ownership, as well as the previously discussed trade surveillance tools that look for illegal trading patterns. CTRM and related systems can provide embedded functionality to help establish and monitor workflow and authorizations, and record/provide auditable records of system activity (who changed what data, when and why), helping reduce the risk of fraudulent activities. Other applications and/or services are available to assist in proper KYC and other due diligence activities related to counterparties.

However, what our survey tells us is simply that risk of fraud is an ongoing concern on the part of the respondents, many of whom believe it requires greater focus.

embedded and configurable approval processes, audit trailing and other system features can also help with managing legal risks. The ability to access digital versions of the key documents from within a CTRM or risk application is functionality that many feel important, and some vendors have or will implement.

Nonetheless, legal risks largely remain the jurisdiction of company legal staff who simply need to understand the commodities business and the capabilities to monitor legal exposures embedded in the systems deployed by the commercial side of the business.

volatilities impacting exchange rates, this can be a key area of risk for businesses operating transnationally and by implication, require adequate working capital and cashflows in

multiple currencies. Though these monitoring activities have been traditionally covered by treasury-centric solutions, in re-

The elephant in the room in terms of risk management and needs is ESG and carbon. Here, respondents felt that more focus was needed and that tools were lacking. Given the current state of emerging and proposed regulation in all trading jurisdictions, this is not surprising given that it is not yet clear who the ultimate regulators are, and what the regulations may require in detail once enacted. It is something everyone knows will need to be addressed yet the details are still to emerge.

There are currently available tools and newly emerging ones as well in this area. Existing solutions include those that can capture trades of various carbon-related instruments, manage and value the portfolio, manage the life cycle of the instruments, and so on.

In the area of new requirements, carbon footprint calculators

cent years ComTech has noted a greater interest in tighter CTRM-Treasury integration to help manage this risk.

are likely to be a requirement for all players in commodity supply chains. Capturing the carbon emissions associated with commodity trades and movements may be necessary across all aspects of a commodity market participant, from corporate reporting to invoicing what will require the carbon footprint of the transaction to be reported for proper hedging/offsetting/ counterparty reporting. Other tools will need to look at ESG monitoring and auditing, including the assessment of counterparties from an ESG perspective as well as a financial perspective. Another area may well be the need to audit suppliers and producers for various ESG criteria and demonstrate provenance and traceability.

Not surprisingly, the study confirms that ESG is a real and significant area of concern for risk managers right now.

While this research effort utilized a high-level set of questions and a smaller number of more detailed interviews, it has succeeded in its objective of identifying that most risk managers see the need for greater focus and commitment to “real” risk management – that is the active identification and assessment of all risks Reading between the lines, there is some dissatisfaction with the level of focus and tools available to identify, measure and monitor all forms of risk within commodity trading and related activities. Certainly, the methodized approach to risk management promoted in recent years is roundly criticized, yet without it, one wonders if there would be less focus on risk than there is.

Perhaps what is surprising is that all areas of potential risk are seen as requiring more focus and more tools to better manage them – including market risk. Current conditions of volatility, geopolitical disruption, supply chain issues, labor shortages and so on are only accentuating the need for a more rigorous and more modern approach to risk management, requiring:

/ More specific algorithms and models appropriate to the

task at hand and that are better able to be understood by users and managers alike,

/ More timely calculation of risk metrics – most favor an event driven approach whereby an event like a new assay or price triggers a recalculation and assessment,

/ A more holistic view of risk metrics and exposures across the enterprise,

The above conclusions support several trends that we have observed in recent months and years in the software side of commodity trading. CTRM or ETRM has increasingly seemed like a misnomer especially as it relates to the “RM” or Risk Management aspect of those solutions. This is true with both new and older legacy systemsthe older solutions, while offering a somewhat rudimentary level of risk analysis, such as black-boxed VAR, MtM, position management, and counterparty risk limits, often lack many much of sophistication required by risk managers. On the other hand, many of the newer CTRM solutions, those launched within the last decade, have often pursued market segments that do not practice active risk management or who may use third party solutions or spreadsheets for their risk management needs. These vendors often lack the internal expertise to address risk tracking and analysis.

Based on our observations, most CTRM solutions offer at best the following incomplete list of tools:

/ Various forms of position management both physical and financial updated daily overnight in batch mode. This includes being able to view the reports by various criteria like geography, book, trader, strategy and so on in the form of a reporting hierarchy. However, drilling into the data to explain changes or investigate an aspect of risk can be extremely difficult within many systems,

/ Within day position is most usually maintained in spreadsheets or on whiteboards and is hardly real time nor accurate,

/ While most support limits on trader activity or counterparty exposures and will report or actively notify broken or close to the limit situations, the CTRM usually offers no form of associated action save manual intervention outside of system processes,

/ The approaches to valuation and various measures of risk are often black box simplistic models that ensure that structured and exotic deals must also be duplicated separately in spreadsheets. Incomplete or inaccurate valuation of these transactions in the CTRM system will result in inaccuracies that impact results those impacts may not appreciated and understood to be an issue at all by management,

/ Rudimentary credit limit management that may often lack support for many types of collateral,

/ Workflow and audit trailing is usually available and at least affords some degree of after-the-fact protection against fraud and other forms of risk.

A few of the more modern CTRM solutions are addressing some of these issues along with improved performance and capabilities. We see that in a limited number of newer cloudbased solutions, the RM aspect is being focused on more so that they may offer:

/ Improved drill-down capabilities to explore reasons for changes,

/ Better tools to visualize and explore exposures graphically,

/ Improved selection of models for risk calculations like VaR and for valuation purposes,

/ Improved model applicability, and

/ Improved workflow, alerting and auditing sometimes with the potential to automate actions.

Though still limited in number, these few newer systems are gradually improving the robustness of risk management content of CTRM to satisfy the average shop.

However, we are also seeing the possible emergence of a new software category – that of Trading & Advanced Analytics Platforms or Advanced Commodity Analytic Tools. It is true that certain vendors of analytics have been around for some time (including Lacima, Kyos, Ascend, Ion FEA, eOpt, and others) offering add-on analytics and even overlay risk packages of some sophistication, often tailored to specific assets or commodity classes. However, we have seen an increase in new software and vendors targeting trading and advanced analytics in the recent past including specialists like Beacon, Topaz, and others as well as others more generalized

risk application providers like Cubelogic in conjunction with Numerix. Additionally, FIS has focused in on risk as a service via its Enterprise Risk Suite and cQuant has found good success offering risk analytics via the cloud.

Recently, however, several vendors in the CTRM space have increased their focus on risk and have been bolstering their capabilities in the area. These include vendors such as Previse Systems, CTRMCubed, Gen10, Eka, and others. In addition, there have been several new entrants with trading and risk solutions coming in from other asset classes like Quantifi, Compatibl, Nasdaq Risk Platform, and others.

Most of these solutions focus in on market risks primarily bringing improved analytics for things like valuation, VaR and other risk metrics as well as improvements in the ability to drill into and explain changes in exposures, position and so on. Several have improved that pricing/deal structuring capabilities, permitting improved capture, tracking and valuation of more exotic, complex structured deals that would otherwise require spreadsheets to manage.

Another possible emerging software category is that of Enterprise Risk Aggregation. Here, the concept is to pull together risk information from a variety of sources including CTRM’s, treasury solutions and spreadsheets or specialist tools and aggregate them at the enterprise level. These applications also provide improved presentation and allow drill down into the underlying data as well as analytical tools to work with the data.

In essence, this software category reflects the need for better holistic risk management (across locations, commodities, and certain types of risk) seen in the survey. Vendors like Tradesparent, Beacon, FIS and others can play here and provide tools to perform aggregation.

Outside of market risk, other areas remain served primarily by different classes of applications, such as regulatory reporting, trade surveillance, credit, FX, and traceability/provenance tracking. In short, despite some progress, managing the multiplicity of risks in commodities is still a mix of suboptimal applications, manual procedures, and spreadsheets at the holistic level.

Based on current market and technology trends, we can offer some predictions regarding the future of risk tools:

/ Continuing and increasingly adoption of cloud-based and SaaS technologies offering better integration capabilities,

/ Growing availability of more sophisticated, or more appropriate/applicable analytics that offer greater choice for the user in determining which analytics algorithms or models to apply,

/ Increasing near real-time results driven most likely on an event basis with those results more easily consumed and investigated by users,

/ Greater emphasis on tools and capabilities such as workflow, approvals, audit trails, traceability/provenance tracking and automation,

/ Greater choice of vendor and capabilities for the end users.

Risk management is generally defined as the process of identifying, assessing, and controlling the myriad of risks that can negatively impact a company or organization’s capital value and earnings. The tools of risk manage will vary greatly depending on the nature of the business - its assets, operational processes, commercial activities, geographic locations, and any number of traits that can and will create risks from both internal and external forces.

Even within commodity-centric industries, from production to consumption, risk exposures and the approaches and intensity in managing those risks will vary greatly. For example, though power utilities and merchant generators share very similar assets, their focus and approach to risk management can be vastly different. Utilities are regulated entities whose financial returns are generally baked into their regulator approved service rates. As such, even the most basic of risk management strategies, such as fuels hedging, offers little upside - if they successfully control fuel costs via hedging in a rising market, their market regulators will likely view that success as an opportunity to lower costs for consumers. Whereas if their hedges are not successful and spot fuel prices fall below their hedged value, the regulator could easily force that utility to eat the cost of the hedges without any compensation for those losses (in the past, some utilities have even been accused of “gambling” with rate payer money when hedging). On the other hand, merchant generators, those that sell power into non-regulated markets, will commonly hedge at least a portion of their fuel costs to maximize financial returns.

Commodity trading companies will also have a broad range of risk management practices and focuses from company to company, largely dictated by business strategies and assets held or deployed. Those that hold and aggregate/disaggregate inventories may also own and operate the means of transporting those commodities, potentially including terminals. trucks, barges, ships, and even rail lines and rolling stock. For these companies, the collection, aggregation, and analysis of a broad range of data, from market prices to inventory levels and location/condition of assets are critical components of their risk requirements. However, for traders that do not hold inventory, or may only trade financial commodities, market prices (both

current and futures) are their primary focus. That said, these “pure” trading houses may also employ highly sophisticated algo models that consume numerous sources of other macro and micro data to project future market movements.

Clearly, and as the results of this research effort show, just as there is no singular approach to managing risks in the commodities space, there is no singular solution that address all, or even most, of the needs of this broad industry. Unfortunately, with increasing instability in underlying markets conditions –regulations, market transformations, geopolitical conflicts, pandemics, natural disasters, etc. – impacting both sides of the supply and demand balance, the needs of companies to identify, assess and control their risks is potentially greater than it’s ever been. Risk managers of all stripes, even those in organizations with a less active risk approach will require specific and sometimes specialized tools and systems that enable a granular view of those potential risks (at an asset or market level) and the ability to view those risks holistically at the enterprise level. These tools could include something as fundamental as a consolidated position screen within their CTRM solution to something as complex as a multivariable, multi-asset optimization algorithm.

For many emerging external risks, including those such as regulatory, ESG or political, constant monitoring of potential developments that could impact business strategies should be part of the risk strategies of the company. With little ability to influence the direction of these risks, as these challenges do arise, effected companies can only ensure that they can adapt to new market requirements or are positioned to pivot their business strategies as may be required.

Risk management is generally defined as the process of identifying, assessing, and controlling the myriad of risks that can negatively impact a company or organization’s capital value and earnings. The tools of risk manage will vary greatly depending on the nature of the business - its assets, operational processes, commercial activities, geographic locations, and any number of traits that can and will create risks from both internal and external forces.

Advanced Freight Trading Capital

Aegis Hedging

AFT Technologies Ltd owns and invests in patented freight trading technologies that are designed to maximize financial returns and give greater confidence in forecasting future returns. AFT Advisory Ltd is a consultancy that “works to protect client interests in a number of different areas of your business”.

AEGIS uses technology and expertise to deliver market insights, tailored hedge strategies, efficient trade execution, and full-cycle management of hedge positions – all designed for regulatory compliance.

Amphora is well known as a vendor of liquid hydrocarbon, LPG, LNG, Coal and Iron Ore CTRM solutions, but it is also developing a risk platform called Clarity to accompany its VaR module that is already available. Amphora is as also entering the Concentrates market with it’s game changer Alchemy CTRM.

Analytics www.advanced-freight-trading.com/

Analytics Service www.aegis-hedging.com

Analytics CTRM www.amphora.net

Ascend Analytics

The Ascend Analytics Product Suite integrates weather variability as a key predictor in modeling renewables, load, and price to provide risk-based portfolio management and optimized resource plans. It also offers an analytics and data platform for portfolio management, risk management, hedge analysis, and asset valuation.

The Beacon Platform provides a next generation quant technology, elastic cloud infrastructure, and front office applications give financial services and commodity trading firms a flexibility, secure, and scalable solution.

Analytics www.ascendanalytics.com

Analytics

Risk Aggregation www.beacon.io

Brady Technologies

CommodityPro

Brady Technologies (‘Brady’) provides trading, risk management and logistics software solutions to energy markets. Brady solutions address the needs of utilities, independent power producers, asset developers, asset optimizers, energy traders, oil & gas companies, commercial aggregators, and hedge funds, helping to optimize trading performance, drive greater visibility and cost control across the trade life cycle.

CommodityPro is an enterprise risk management platform developed by TechnoGen – an India based IT & software service provider. Emerging vendor in commodity trading and risk management software, covering various areas of trading including finance & accounting, FX trading, inventory & distribution, trade documentation, and farming operations

www.commoditypro.com

CommodityRA

CompatibL

CommodityRA is a price Risk Management and data provider firm. Services commodity exchanges, producers, brokers, and financial institutions in the area of price risk management.

CompatibL’s risk management technology is developed for market and credit risk, regulatory capital, financial limits, and initial margin. The CompatibL team capabilities address front-office, mid-office and back-office software for strategy, asset, and risk management, utilizing the best market practices, quantitative algorithms, and technical architecture.

Analytics www.commodityra.com

www.compatibl.com cQuant

cQuant.io provides analytical software and related solutions for the energy industry’s most challenging data-driven problems. Its models integrate with up- and down-stream business processes and with each other to create actionable business insights.

CubeLogic

Provides out of the box risk and reporting solutions using the latest Business Intelligence platforms and concepts.

Analytics www.cquant.io

Regulatory Aggregation www.cublogic.com

Built from the ground up for raw material and commodity businesses, Eka Analytics is a comprehensive solution that integrates data management, business intelligence, statistical analytics, and AI capabilities all embedded in one platform.

e·Opt is a specialized products and services company, working exclusively in the energy domain. They deliver their solutions via their modular application PriceHub. Based in Mannheim, Germany, e·Opt is focused on the Central & Western European markets.

FIS markets the Enterprise Risk Suite (formerly Adaptiv) a risk simulation and calculation engine that provides fast, accurate XVA, SIMM and risk calculations. It also offers this solution as “risk as a service”.

FEA’s advanced energy and commodities analytic solution offers decision support, portfolio valuation, complex option pricing, hedging strategy recommendations, and asset optimization across multiple commodity classes. Supports standard and structured commodities trading and risk management, including exchange-traded, over-the-counter derivatives and options, and complex structured transactions.

www.iongroup.com

Ion’s Credit Risk consolidates data from multiple upstream commodity trading and risk management (CTRM) systems to measure, manage, and mitigate counterparty default risks. A web-based credit application that offers comprehensive counterparty, contract, collateral and exposure management, and credit scoring. Credit www.iongroup.com

Mobius Risk Group

KYOS offers specialized advice on trading and risk management in energy markets. Its solutions are developed to support decision making, investment proposals and risk calculations. KYOS offers software to optimize, value and manage energy portfolios and advisory services to support decisions in energy markets

Lacima, now part of EEX, offers stand-alone trading, risk, and valuation tools for the front office as well as a complete optimization, valuation, and risk management suite for the middle office.

Analytics www.kyos.com

Analytics www.lacimagroup.com

Molecule

Nasdaq Risk Platform

Mobius Risk Group is an independent commodity and physical energy risk advisory firm. Provides strategic advisory services including financial, physical, and commodity risk management and valuation, carbon strategy development, and regulated energy oversight for producers, consumers, distributors, and capital providers backed by its proprietary C/ETRM, RiskNet.

Molecule calculates P&L, position, and risk for commodity portfolios. It comes with support for financial and physical trades: fixed-price and formula-priced swaps, forwards, options, futures, complex assets, exotics, and more.

Murex MX.3 solution provides users capabilities across trading, hedging, funding, risk management and processing operations.

The Nasdaq Risk Platform provides comprehensive risk management infrastructure tools to help minimize risks in increasingly regulated, latency-sensitive, high-volume, and global trading environments. Users can monitor and manage your aggregate risk exposure across markets, asset classes, regions, and accounts in real-time.

Analytics www.mobiusriskgroup.com

Analytics CTRM www.molecule.io

Analytics Credit Treasury www.murex.com

Analytics

www.nasdaq.com/solutions/ nasdaq-risk-platform

Numerix

Orchestrade

Numerix maintains over 19 offices, 700 clients and 90 partners across more than 26 countries and is focused on quantitative research to price and risk manage any derivative instrument – vanillas to the sophisticated exotic products.

Orchestrade ETRM has been designed for modern energy markets. We offer comprehensive risk management functionality across energy trading, renewable assets, B2B/B2C supply contracts and environmental trading in a single open and highly performant front to back platform. Our modern scalable architecture is designed to meet the increasing need to support high volume, short-term trading, large forecast volumes and complex products such as PPA’s. The platform is designed to deliver real-time position and valuation of large complex energy portfolios across trading, assets and supply. We also real time stress-testing, intraday VaR and credit risk across the portfolio.

Pexapark

Quantifi

Risk Edge Solutions

Pexapark provide analytics and support for deal transactions. Works with renewables participants to optimize portfolio, revenue, and risk management.

www.numerix.com

www.orchestrade.com

Analytics www.pexapark.com

Quantifi works with over 180 clients across 40 countries including 5 of the 6 largest global banks, 2 of the 3 largest asset managers, leading hedge funds, pension funds, insurers, brokers, clearing members, corporates, and other financial institutions. Analytics

Risk Edge offers solutions for Machine Learning and analytics needs of medium and large enterprises. Solutions enable predictive analytics capabilities for its clients.

www.quantifisolutions.com

www.riskedge.com SAS

SAS is a global scale advanced data analytics provider addressing risk management and data aggregation and analytics across multiple industries.

TRADESPARENT is a data & analytics solutions provider specializing in the commodity industry.

Topaz provides advanced commodity trading and risk analytics for traders and risk teams. Provides real-time valuations, exposure, and risk across the full spectrum of complex trading activity.

www.sas.com

www.tradesparent.com

Analytics www.topaz.technology

In addition to the previously noted vendor-supplied solutions for Risk Management, most CTRM/ETRM solutions also offer some form of risk management and reporting, though some may be rudimentary. The following is a list of CTRM/ETRM suppliers that may be an option for a range of risk functionalities.

ABB Agiboo Amphora

Aplus Energi APT Energy Solutions Arantys

Atos Worldgrid Beacon Brady Commodities

Brady Technologies CMS ComFin

Commodities Engineering

Commodity Pro CoreTRM

CTRMCubed Cultura Technologies Datamine

DSFlow Dycotrade EGAR Technology

Egistix e-Kommoditi Eka

EMK3 Energy one Group EnHelix

Enuit Eximware Exxeta

Fendahl FIS Gen10

Graintrack Hitachi Hivedome

Ignite Inatech Instream

Invensoft Ion Commodities iRely

Kiodynos Kisters Likron

Marango

Microstep Systems Mineman systems

Momentum3 Molecule MTX Commodities

Murex Navitasoft nGenue

OATI Orchestrade PCI

PCR Phinergy Previse Systems

Procom Progressive Software SAP

SAS Satoshi Systems Scalable

Sinergetica Sisu Group Softsmiths

Soptim Square Four Tegos

Topaz Technology Tigernix Transition Technologies

Trilogy Effective Solutions Unicorn Systems Volue W Energy P2

Amphora is the proven software solution provider for commodity trading, logistics and risk management in the global oil, refined products, LPG, bunkering, biofuels, coal, ore, LNG, metals, concentrates and freight marketplace.

Founded in 1997 with headquarters in London, Amphora provides enterprise software solutions designed and developed for commodity trading organisations. Our team includes some of the most experienced software designers, developers, and business analysts in the commodities industry today.

Since our inception, our goal has been to provide the trading community with the most robust, user-friendly, easy to implement and enterprise-wide software package available.

Amphora continues to launch new products that

address customers’ needs and adjust to dynamic market demands.

• 100+ employees with direct hands-on experience with commodity trading systems

• Development Centres in London, Dubai, Hyderabad, Zug

• Service Centres in London, Dubai, Houston, Zug, Hyderabad, Mexico City and Singapore

Trade Commodities? Need a fresh look at your risk management? We got you!

Commodities People is a specialist, independent provider of energy and commodity sector knowledge, and have been running events for the trading communities in these markets for many years. As the organisers of Commodity Trading Week and Energy Trading Week in Europe, the Americas and APACevents that have long been the place to be for industry players, the team have extensive knowledge of current market topics, opportunities, and pain-points.

Commodities People’s experience and understanding of the market attracts pioneering companies and

decision-makers to its community, be it online or offline, bringing the entire industry together for shared market expertise, latest insight and innovation.

Today’s capital markets are highly complex. Increasing trading volumes coupled with price volatility can present significant challenges for firms looking to minimize risk without sacrificing P&L in latency-sensitive, global trading environments.

The Nasdaq Risk Platform offers real-time risk and exposure, improving client relationship management and respective capital allocation. A cloud-based SaaS solution, the platform is hosted and maintained by Nasdaq, so firms can focus on what matters most – driving revenue. The Nasdaq Risk Platform is a fully integrated real-time risk system supporting nearly 100 markets globally with an extensive drop copy network, offering a harmonized source of risk to better control market and counterparty risk, while optimizing capital efficiency.

With Nasdaq Risk Platform, firms can benefit from:

• Real-time Visibility – view exposures and exchange margin replication as trades are being executed across multiple systems in real-time with integrated initial margin calculations and limit monitoring combined across asset classes.

• Singular View – one harmonized view of risk, which provides market, counterparty, and liquidity risk in one platform to improve and enhance the risk remediation process while providing business insight to senior management and reducing costs.

• Ease of Adoption – cloud native architecture allows for rapid implementation, reduced time-to-market, and high performance.

• Connectivity – system functionality is exposed via REST APIs, allowing customers and customers’ services to connect and utilize Nasdaq Risk Platform services and functionality to enhance external ecosystems and improve operating models.

• Assurance – firms can better anticipate and mitigate risk in real-time with initial margin what-if calculator, which enables firms to stress test different scenarios and further optimize capital efficiency and maintain regulatory compliance.

• Stability and reliability : Backed by Nasdaq’s continuous commitment to research and development and best-inclass info-security protocols.

• Scalability – microservice architecture for horizontal scaling of compute enables consistently high performance as volumes and market conditions change, allowing firms to adapt based on market volume and requirements.

With over 50-years in financial markets, Nasdaq’s integrated multi-asset trading and clearing platforms set the benchmark for performance, reliability, and scalability, enabling the trading of any asset anywhere in the world.

Nasdaq’s market-leading surveillance and risk management offerings promote market integrity by providing real-time, cross-market risk monitoring and surveillance across the globe. Nasdaq’s commercial technology business provides technology and advisory services to over 70 marketplaces, clearing organizations and central securities depositories in over 50 countries. More than 180 trading firms in 35 countries leverage our risk management and surveillance solutions. Our capabilities are unique, unmatched by any exchange technology provider in today’s markets.

Find out more about the Nasdaq Risk Platform here >

Commodity Technology Advisory is the leading analyst organization covering the Energy and Commodity Trading and Risk Management (E/CTRM) technology markets. We provide invaluable insights, backed by primary research and years of experience, into the issues and trends affecting both the users and providers of the applications and services that are crucial for success in markets constantly roiled by globalization, regulation and innovation.

Patrick Reames and Gary Vasey head our team, whose combined 60-plus years in the energy and commodities markets, provides depth of understanding of the market and its issues that is unmatched and unrivaled by any analyst group.

For more information, please visit: www.comtechadvisory.com

ComTech Advisory also hosts the CTRMCenter, your online portal with news and views about commodity markets and technology as well as a comprehensive online directory of software and services providers. Please visit the CTRMCenter at: www.ctrmcenter.com

19901 Southwest Freeway

Sugar Land TX 77479

+1 281 207 5412

Prague, Czech Republic

+420 775 718 112

ComTechAdvisory.com

Email: info@comtechadvisory.com