Standard the Setting

Standard Meat Co., a fourth-generation family business, is breathing new life into the industry that gave Cowtown its nickname.

Siblings

Standard Meat Co., a fourth-generation family business, is breathing new life into the industry that gave Cowtown its nickname.

Siblings

The key to success starts with a clear vision and strong relationships. Your Whitley Penn advisors recognize this goal and partner with you to deliver unique solutions and connect your vision to your reality.

Discuss your business opportunities by scanning the QR code to connect with an advisor or visit whitleypenn.com today.

Standard Meat Co., a fourthgeneration family business, is breathing new life into the industry that gave Cowtown its nickname.

Monica Paul has helped bring more than 570 sporting events to DFW. Her latest feat, scoring the most 2026 FIFA World Cup matches for North Texas, will have the greatest economic impact the region has ever seen.

story by BEN SWANGER illustration by MARK FREDRICKSON

when i was in my 20s, my mom and i took a ski trip to Winter Park in Colorado. While there, I talked her into doing a NASTAR ski race just for fun. I went down the course first, then it was her turn while I watched from the bottom of the hill. Still a beginner, she took her time, traversing much of the mountain and snowplowing the entire way.

It was a sunny day, and people were enjoying après ski outdoors at a mid-mountain lodge. Soon, they began to take notice. At first, a few people made fun of my mom. “At least she’s trying!” I thought. But as my mom continued to make her way down the hill, the mood of the crowd shifted. Everyone began cheering her on and shouting, “Go, go, go!” They lost their minds when she crossed the finish line—it was glorious. I will never forget her beaming smile as she held her ski poles high in the air in the shape of a “V” for victory.

The experience taught me a lot about perspective and attitude. I thought about this when the news broke that Dallas would not be getting the FIFA World Cup final as widely expected. Assistant Editor Layten Praytor was there for the official announcement. There was complete disbelief in the room, he said. And after the press conference, he felt as though he had just left a funeral.

Managing Editor Ben Swanger had been working for months on a profile of pivotal figure Monica Paul, executive director of the Dallas Sports Commission. (It’s on page 28. Don’t miss it.) “We still won a lot of matches, right?” I asked Ben as he was updating his story. “Yes, it’s still a big win for the region to host the most games of any stadium,” he said. “We host nine games, which is huge.”

I thought about the people of North Texas, and I knew it wouldn’t be long before they shook off the negative and focused on the positive. That indomitable spirit is one of our region’s greatest strengths. I knew everyone would quickly see the real victory in the outcome—just like my mom.

Christine Perez Editor

Christine Perez Editor

analogies, similes, and references to common experiences give an audience a tangible commonality they’ve experienced that brings home the message. “What you’re saying is just like when a used car salesman says…” “Their response sounds like what a child says when caught with their hand in the cookie jar.”

The danger of using analogies is that many in your audience may be totally unfamiliar with the analogy. As a sixth-generation Texan, when discussing bad luck, I’m fond of saying that person “drew the black bean.” Many native Texans know that refers to the aftermath of the battle of Cuidad Mier, where Mexico roundly defeated Texicans and Tejanos.

The 243 Texicans and Tejanos captured were prisoners of war marching to Mexico City. 181 escaped and 176 were recaptured. Santa Anna wanted to send a shock and awe message to those still fighting Mexico. He ordered the execution of one-tenth of the escapees. Each man drew a bean from a jar containing 17 black beans. Whoever drew a black bean was shot. I asked my class of 55 executive MBA students at SMU what the phrase “you drew the black bean” meant. Not one person in this sophisticated and educated crowd knew this reference, which reminded me that references are often ineffective communication tools.

Years ago, when only three main TV networks and a few independent stations existed, TV show references were persuasive. Now, with the plethora of cable, satellite, and web-based shows, references to shows are risky because chances are many people in the audience have never seen or heard of that show. Even if you reference long running, popular shows like “Yellowstone,” “Seinfeld,” “Friends,” “Game of Thrones,” “The Walking Dead,” “Breaking Bad,” and “The Sopranos,” many in the audience may have never seen an episode.

Using analogies with demographically diverse audiences is especially risky. The more diverse the crowd is in age, socioeconomic, and educational status, the more likely references will be understood by only a sliver of the listeners.

Appearances can fool you. Recently, I saw a young Home Depot employee wearing a Nirvana t-shirt in the parking lot. I stopped, lowered the passenger window and repeated the beginning lines of my favorite Nirvana song: “Where do bad folks go when they die? They don’t go to Heaven where the angels fly. They go to the lake of fire and fry. See ‘em again on the Fourth of July!”

It was readily apparent that he had no idea what I was saying. He looked at me like, “Who is this crazy old man? Is he about to spray the parking lot with an AK-47?” Just because he was wearing a Nirvana t-shirt, I assumed he knew the words from the famous Nirvana “Lake of Fire” song—not so.

Use well known analogies or logic; as Mark Twain said, “Quitting smoking is easy; I’ve done it 1,000 times.” Or use well known clichés like “be careful what you wish for” or “the grass is always greener on the other side.”

The Takeaway: Be careful using shows, movies, and historical events as analogies; many audience members will be too young, not well read, or otherwise will not understand the analogy.

ROGGE DUNN represents companies, executives, financial advisors, and entrepreneurs in business and employment matters.

Clients include the CEOs of American Airlines, Baker Hughes, Beck Group, Blucora, Crow Holdings, Dave & Busters, Gold’s Gym, FedEx, HKS, Texas Motor Speedway, Texas Capital Bancshares, and Texas Tech University, and sports figures like New York Mets manager Buck Showalter, NBA executive Donnie Nelson, and NBA Hall of Fame coach Larry Brown.

Dunn’s corporate clients include Adecco, Beal Bank, Benihana, Cawley Partners, Match.com, Rent-A-Center, and Outback Steakhouse.

In 2021, 2022, 2023 and 2024 Dunn was included in D CEO Magazine’s Dallas 500 list, which recognizes the most influential business leaders in North Texas.

He has been named a Texas Super Lawyer every year that award has been given and recognized as one of the top 100 attorneys in Texas by Texas Monthly (a Thomson Reuters service) and a D Magazine Best Lawyer 15 times.

Aas midnight approaches on sept. 21 , 2023 , the Communities Foundation of Texas office is still buzzing with activity. New CEO Wayne White and his team of about 50 are busy closing out the 15th edition of North Texas Giving Day, raising $63.9 million for local nonprofits in a 24-hour period.

White has spent the day in a whirlwind of media appearances and meetings. The organization’s efforts surpassed the previous year’s total through a combination of more than 97,000 individual donors, 261,481 individual gifts to 3,249 organizations, and matching funds from select nonprofits. The event is the largest regional online giving event in the nation.

“In my 36 years of work experience, it’s the single most inspirational employee event that I’ve seen,” White says.

Since arriving in Dallas last July, White has been busy getting acclimated to his new role and his new hometown. He’s a fast learner; his Cowboys blue suit on the day of the interview makes him look like a seasoned native. White grew up in Philadelphia, but his fellow University of Pittsburgh alumnus Tony Dorsett sparked his longtime Cowboys fandom.

He and his family moved to Philadelphia from Jamaica when he was a young child. “I didn’t wear shoes until I was six,” White says. The family lived near the home where his mother was employed as a domestic worker, allowing him to attend one of the best schools in the state.

After college, White entered a management development program at General Electric, but his desire to serve his community has always been knit into his fabric. While at GE in Cleveland, he spent time volunteering at inner-city schools and got an up-close look at the limited opportunities available to the average Black male teenager and the educational discrepancies that plague vulnerable communities.

“It was an eye-opening experience for me,” he says. In his current role, he can now address similar issues in North Texas.

White’s climb up the corporate ladder included stops at AT&T, Verizon, and Alcatel. His family has had extensive battles with cancer, so when a recruiter approached him about an executive role at the American Cancer Society after a close cousin passed away from breast cancer at age 39, he took his corporate skills to the nonprofit world. In his role at ACS, he led the North Central region and national partnerships.

White says parts of the nonprofit world align well with Corporate America. Attracting, retaining, and developing talent are essential in both spheres, as is the bottom line. “One thing we must do is raise money, which looks very similar to selling,” he says. “What I found through trial and error is that the sales process is very similar to fundraising management. The only difference is that you aren’t selling a product or service—it’s a mission.”

These days, White stays busy learning about all things CFT, from how the organization works with donors to educating the community about needs and working to address them. One difference from working in the corporate world is how his colleagues embody the mission.

“The inspiration and focus and mission centricity of the staff inspires me in a way that was different from when I was in my corporate role,” he says. “As a leader, you have to recognize that and make the mission central in how you lead.”

Alhough he has one North Texas Giving Day under his belt, White knows there is still a lot to learn. As the interview ends, he asks his assistant to send him a reminder at the oh-so-precise time of 11:53 a.m.. He has not a single minute to waste at the helm of CFT.

GIVING BACK

The organization is a critical factor in the success of nonprofits throughout the region.

MULTIPLY IMPACT

Since its founding in 1953, CFT has managed 1,300 charitable funds, awarding more than $2.5 billion in grants. The organization vets nonprofits to help donors achieve their giving goals.

NORTH TEXAS GIVING DAY

CFT helps donors find and donate to thousands of local nonprofits via an online portal on North Texas Giving Day through the 18-hour event that has raised over $566 million for North Texas since its founding in 2009.

EDUCATE TEXAS

An initiative of the CFT, Educate Texas develops policy and implements programming to improve public education. It focuses on college and career readiness, effective teaching, and higher education.

the co-founder of crm data optimization compa ny Cien.ai, Margot Carter also serves as president of Living Mountain Capital, a firm that invests in tech-focused businesses. Its portfolio includes Austin-based Capital Factory and Dallas-based fintech CollateralEdge. Carter follows a philosophy of generative leadership. “It’s a holistic and purposeful approach in which leaders strive to make the world and their organizations better than they found it using their head, heart, and hands,” she explains. “It focuses on enriching experiences for people, incorporating diverse perspective, and emphasizing a culture of learning to help them realize greater potential. We seize opportunities to innovate through embracing change and leveraging tech.”

EDUCATION:

Fordham University (JD), Binghamton University (BA)

BIRTHPLACE: New York, New York

PROUD MOMENT:

“Cien.ai has benefited tremendously from the world’s awareness of the benefits of and need for generative AI. We started our company seven years ago and quickly identified multiple millions in additional earnings before EBITDA for our clients.”

CHILDHOOD DREAM:

“Growing up in the suburbs of Manhattan, I had dreams of becoming the mayor of New York City, living in the Big Apple, and making it an even better place.”

FIRST RIDE:

“A very old white Buick. My father handed me the car keys and told me driving it would build character. At first, I parked far away to avoid people

Park and working out at CycleBar Uptown.”

DESTINATIONS OF CHIOCE:

“I love Spain for its architecture, cuisine, and its people—especially my Cien team in Barcelona. I also love Israel, not just for its history and beauty, but also for its entrepreneurial spirit and innovation in technology. New York is also special to me because I can visit with family and friends and enjoy some downtime in the Hamptons.”

seeing me. Over time, my friends and I grew to love that old, safe car, which we affectionately named Herman.”

FOOD I HATE:

“I love food and enjoy trying new types of cuisine. I haven’t found anything yet that I truly dislike.”

GO-TO ADVISER:

“I am inspired by Steve Winn, the founder and chairman of RealPage, who convinced me to move back to Dallas. He is a visionary and smart business leader. He saw a business gap and changed his career path to start a new business later in life to achieve enormous success. He understands the power of collaboration, the value of hard work, and the need to continuously transform to keep up with a dynamic marketplace.”

HOBBY/PASSION: “I enjoy yoga at Klyde Warren

MUST-READ: “I recommend AI Superpowers and AI 2041, by Kai-Fu Lee, which are great primers for those looking to learn more about AI. I also enjoy Kim Zoller, CEO of ID360, and listening to her content and reading her blogs on leadership and self-care.”

FUTURE FORECAST: “I’m excited about the opportunity to continue to grow the innovative culture and entrepreneurial ecosystem in Dallas, especially relating to venture capital and funding. Texas can be the ‘start-up state,’ with Dallas as the world class business destination for innovative businesses.”

Snaps Clothing Co. aims to reinvent the pearl snap shirt with innovative materials and a contemporary fit.

a few years back, patrick lynn and Edgar Baronne were talking about making career changes, and Lynn happened to be wearing a pearl snap shirt. That inspired the two to talk about how to redesign a century-old product that Hollywood Westerns popularized in the mid 1900s. “Most of the pearl snaps I’ve worn aren’t a shirt I could wear to an office or date night,” Lynn says. “We wanted to make it modern and realistic in every facet of life, taking it from its traditional fit and thin cotton fabric and upgrading the materials and fit.” In four years, Snaps has raised more than $1 million and expects to reach $2 million in funding by the time the first quarter of 2024 closes. And although Snaps has done much of its business through e-commerce, it plans to have its first brick-andmortar location by 2025 while also moving into local Dallas stores— and, eventually, a large national chain. —

Layten PraytorTHE RIGHT FIT

Dallas-based Snaps Clothing Co. expects revenue to grow by 1,000 percent in 2024.

As a financial planning and wealth management firm based in Dallas for nearly 50 years, we understand the pride that can only be earned by forging your own way, leading others down innovative paths, and taking calculated risks that allow you to achieve your dreams. Our firm is, and always has been, independent, never answering to a parent company or stockholders with agendas that contradict what is right for clients. Our 16 Certified Financial Planner practitioners remain proudly, fiercely independent, ensuring your needs come first. We sleep well at night, knowing we’ve worked hard to do the right thing for every client, every time. In today’s financial environment of aggregation and consolidation, how independent is your financial advisor?

maria dixon hall is on the roller coaster ride that is Corporate America’s understanding of and approach to diversity, equity, and inclusion. After serving as a communication professor at Southern Methodist University for years, she was named the school’s chief diversity officer in August 2020 and serves as senior advisor to the president.

The disconnect with the organization’s mission, value, vision, and emphasis on race, she says, led to frustration at multiple levels. The newly hired DEI leaders felt like they were banging their heads against a wall without support, and employees felt like they were being forced into mandatory DEI training they didn’t want to do.

story by WILL MADDOX illustration by JAKE MEYERSFollowing the social upheaval and increased awareness of systemic racism in 2020, corporations and organizations nationwide added diversity positions to their C-Suites. But four years later, many of those organizations are reversing course.

Meanwhile, the Supreme Court struck down affirmative action, and the State of Texas passed a law banning DEI offices in public education institutions. The law also prohibited diversity statements for job applicants and mandatory DEI training for state employees.

This news might cause despair for a DEI professional in higher education like Dixon Hall, but she says the backlash will force organizations to rethink and expand their definition of DEI. At SMU, she sees the role of a DEI leader as an internal consultant who seeks to get the best out of the school’s leaders “in spite of and because of our differences,” she says.

Many organizations added DEI positions without considering their cultures, Dixon Hall says. “The office was not ingrained in who they were and were more tied to the political realities of where we were than understanding the true organizational value of having a DEI office,” she says.

SMU has expanded the view of DEI to include gender, sexual orientation, religion, neurodivergence, and more. Good DEI leadership, especially in the current climate, means considering all iterations of diversity and seeing those differences as strengths, Dixon Hall says. “In an orchestra, you do not try to get a violin to sound like the tuba,” she says. “You want the richness of the violin and the brass of the tuba. They are different instruments, but that doesn’t mean they’re not both valuable. They both have a seat on the stage, but they have different roles.”

DEI leaders who want to be successful in this new environment must see themselves as talent management professionals who go beyond celebrating and recognizing differences and put those differences to work for the organization’s benefit, she adds. Meanwhile, CEOs must ask themselves if the DEI initiatives result from public pressure or true belief. It won’t be easy, but it will be worth it in the end, Dixon Hall says. “It’s going to get worse before it gets better,” she says. “Sometimes there is a backlash, and then we emerge and evolve. The refining is not going to be done in a year.”

new york native and shug’s bagels ceo justin shugrue hates conversations debating whether or not a bagel is an authentic “New York bagel.” He is more concerned with the experience than labels. “Is Shug’s delicious? Was the customer service nice? Was it a good time? That’s all that matters,” he says.

That sort of practical, customer-focused mindset helped Shugrue launch a bagel empire before he turned 30. In November, he added a second location on Lemmon Avenue, following the explosive success of the Mockingbird original. The company made $3 million in revenue in 2021 and is on track to exceed $6 million in 2023.

Raised in Westchester, New York, Shugrue’s passion for hospitality grew by working summers at a fine dining restaurant near his home. He followed his brother to SMU, where he majored in finance. For a time, he considered going into investment banking, but after miserable internships in the field, he knew the world of finance was not for him. After some reflection, his path became clear. “What do I have an innate ability for? What am I willing to hustle to get?” he asked himself. “It didn’t feel like work when I was in hospitality.”

After graduating from SMU in 2017, he waited tables to pay off college loans. He then returned to New York to work as an apprentice in various bagel shops, and in June 2020 he initiated a friends and family fundraise of $300,000 to launch his own bagel shop in Dallas. For a grab-and-go business like Shug’s, the pandemic was a boon. “It was a blessing in disguise,” he says. “The food writers had nothing to write about, and we were a positive story in a sea of dead restaurants.”

Shug’s was an instant success. “It was light years better than I was projecting and far beyond my wildest dreams,” Shugrue says. “I had champagne problems.”

Growth has forced the young entrepreneur to delegate more, as he focuses on the big picture. Shugrue, who says the two locations are doing similar revenue numbers, is resisting another fundraise, but he is eyeing several DFW neighborhoods for future expansion. “We want slow, purposeful growth,” Shughrue says. “Every step of the way, we want to make sure that we don’t deviate from having an excellent product and that customers are happy.”

Standard Meat Co., a fourth-generation family business, is breathing new life into the industry that gave Cowtown its nickname.

story by WILL MADDOX

portrait by JUSTIN CLEMONS

story by WILL MADDOX

portrait by JUSTIN CLEMONS

ASHLI AND BEN ROSENTHAL GREW UP LITERALLY surrounded by the family business. Their home was stockpiled with goods from their dad’s Standard Meat Co.—a teenager’s dream. Weekends were spent raiding the pantry for soups, queso, and spinach and artichoke dips. Steaks were easy to come by, and pool time was interrupted by snacks of giant slices of pepperoni.

If the Rosenthal kitchen shelves resembled the stockroom of a restaurant distribution center, that’s because it wasn’t too far removed from one. Ashli and Ben’s father, William (known by most as Billy), was the third-generation leader at Standard Meat. It was founded in 1935 by Billy’s grandfather, Ben H. Rosenthal, a Russian-Jewish immigrant who launched the company to serve hotels and restaurants in Fort Worth. Today, it has nearly 1,000 employees and works with the biggest brands in the business.

But the story of Standard Meat is far from a traditional succession tale. At one point in its 89-year history, it was absorbed by a conglomerate. The family later regained control of the brand, only to face their most formidable challange yet—the pandemic. Today, Ashli and Ben are the fourth-generation leaders, guiding the company as it breathes new life into the industry that gave Fort Worth its Cowtown nickname.

Let’s begin with what Standard Meat doesn’t do. It doesn’t raise or harvest animals, so it isn’t a ranch or slaughterhouse. You won’t find Standard Meat brand steaks or other cuts in grocery stores or its logo on the sides of distribution trucks. The company focuses on value-added processes like the portioning of a cut.

If hotels or restaurant chains want perfectly proportioned 8 oz steaks with consistent thickness and packaging, they turn to Standard Meat. Although you would never know it, you have likely eaten a meal processed and portioned in a Standard Meat factory.

Over the years, the company has expanded its offerings to include cooked items and other food

products. These days, customers are restaurant chains, retailers, and meal kit companies.

After its founding in 1935, Standard Meat grew to have its products shipped within a 100mile radius by 1937 and overnight by train in 1940. It eventually became one of the leading suppliers to hotels, restaurants, and military outlets nationwide. Ben’s son, E.M. “Manny” Rosenthal, took over the business and added in-flight airline meals to the business. During Manny’s tenure, the company suffered some financial hardships, but it was a DFW partnershp that cemented the company’s model.

Collaborating with Norman Brinker of Steak and Ale and Chili’s fame, Standard Meat developed a revolutionary way to package and extend the life of fresh meat in 1969. Manny’s son Billy (Ashli’s and Ben’s father) took over as president in 1981.

But after Manny had a heart attack, the family sold Standard Meat to Consolidated Foods in 1983. (The company rebranded as Sara Lee two years later.) Billy continued to work for the company until he retired in 1989.

For the first time, the Rosenthals weren’t in control of Standard Meat, which essentially did not exist, as it was operating as part of Sara Lee. But Billy couldn’t stay away for long. In 1995, he bought the rights to resurrect the Standard Meat brand from Sara Lee and be -

gan serving Outback Steakhouses in North Texas. Over the next decade, the company opened three new facilities, including a Dallas processing plant that’s still active today.

In 2005, global food company Cargill, Standard Meat’s major protein supplier, purchased the business and made the Dallas facility the dedicated supplier of steaks for all Outback locations in the U.S. Under Cargill, Standard Meat began processing chicken in 2014. Although the partnership allowed for significant growth, Standard Meat was destined to return to family ownership, with Ben and Ashli to take the helm.

Most family businesses go like this: The first generation establishes the enterprise and passes it on to the next generation or two. At some point, family members decide to cash out to do something else—or nothing at all. But it wasn’t so simple for Ashli and Ben Rosenthal, whose grandfather has a meat science and technology center named after him at Texas A&M.

Despite growing up in the business, the siblings say they never planned to have careers at Standard Meat. At first, neither did. After graduating from Tulane, Ashli spent five years in New York as a communications professional in the fast-moving, cutthroat fashion industry. After working as a hostess in a restaurant and answering phones at a pepperoni plant in her youth, she was adamant that she wouldn’t join the family business. But when she and her husband decided to leave the Big Apple, Fort Worth made as much sense as any for a new home base.

Ben graduated from the University of Virginia and had a successful career as an investment banker with Goldman Sachs in New York. He eventually returned home to work in the family’s investment office, Penrose, but wasn’t sure he would be a part of Standard Meat Co. “Ashli

and I never felt any pressure to go into the food business or our family business,” Ben says. “I give my dad a ton of credit for that because I think if it had been the opposite, we would have run away from the business.”

As time passed, the kids returned home and Ashli started a job as a sales associate with CTI Foods, another Rosenthal family business, while Ben worked as a forklift operator for a vending company owned by the family. In 2019, the Rosenthals brought Standard Meat back into the family. In what is described as an amicable move and partnership, the family bought out Cargill. Ashli (who by then had added her married last name of Blumenfeld) and Ben became co-presidents, with Ben also serving as CEO. Around the same time, the company moved from downtown Fort Worth into the stockyards. Standard Meat now operates out of a

bright and remodeled Swift and Co. office building, built in 1902 when Swift had a meatpacking plant in the area. (It was later home to a Spaghetti Warehouse restaurant.)

Billy may not have pushed his kids into business, but it would be difficult to imagine better skillsets to bring to the leadership of a company than the finance and public relations backgrounds his children gained during their time away. Billy says his kids have helped professionalize the business, beefing up the sales, management, and finance teams.

“They are a great team,” he says. “They are strong, thoughtful, and have respect for each other.”

That corporate experience, teamwork, and ingenuity would prove essential as the company faced its biggest challenge yet.

Many industries have pandemic war stories, but restaurants and hotels suffered more than most. And Standard Meat Co.’s

fortunes rested on supplying those businesses.

In April 2020, the company received exactly zero pounds in meat orders for the month. The ongoing loss of restaurant business meant Ashli and Ben would have to furlough employees—unless they got creative.

As luck would have it, Standard Meat began working with Hello Fresh in 2017 and as fear of the virus spread, the meal kit business boomed. The siblings responded by turning a processing plant into an assembly operation for the meal kit company. “We love problem-solving moments, and that’s what gives us our energy, which often leads to the next form of our business,” Ashli says.

Standard Meat’s clients eventually returned, and the company is now larger than it was before the pandemic. When its new facility opens, it will have grown from two processing plants

1981

Like

1983

2001

his father before him, Manny moves into Standard Meat’s chairman role and his son Billy assumes the role of president. 1969 Standard Meat partners with Norman Brinker and pioneers a packing technology to extend the shelf life of fresh meat. Consolidated Foods (renamed Sara Lee in 1985) acquires Standard Meat, ending the Rosenthal family’s ownership. 1995 Billy acquires the Standard Meat Co. brand and relaunches operations to supply 10 DFW Outback Steakhouses.to five since 2018. Six years ago, Standard Meat employed about 550 people and processed about 64 million pounds of meat a year; today, it has just under 1,000 workers and processes more than 111 million pounds annually.

It also has become an involved corporate citizen. The company has donated $3 million worth of food and funds to the community in the last five years while upping its standards to limit the environmental impact of its packaging and processing facilities and developing animal welfare requirements for its meat suppliers.

After focusing on portioning raw meat for decades, the company began to expand with cooked meats, launching sous vide and cast-iron cooking platforms and smoked sausage and meatballs.

Standard Meat also partnered with Austin-based Australian chef, TV personality, and author Jess Pryles, founder and CEO of Hardcore Carnivore, which makes meat seasoning and grilling tools. Grocery giant HEB had approached Pryles about launching her smoked sausage brand, and she contacted Ashli.

Despite working mostly with large national accounts, Ashli and Ben saw this as an opportunity to explore a new type of partnership. They helped Pryles source the protein and did multiple rounds of testing to get the flavors right, adjusting their smokehouses to use hardwood smoke. Since launching in July, sales of the Hardcore Carnivore sausage brand have exceeded expectations.

“They have the bigger accounts in place that are imperative to the growth of their business, but it’s rare to find a company that will look back to help move the next person forward,” Pryles says. “That’s exactly what they did.”

Innovations like these could keep Standard Meat going strong for generations to come, but Ashli and Ben say they don’t want to pressure their children to keep things going. Still, they

say the cousins are interested in the business and take pride in knowing their family has a role in delivering a Chipotle burrito, for example.

“They will get as involved as much or as little as they want,” Ashli says. “We would love it because it would be fun, but if we had been pressured to have worked in the business, we may have never ended up here.”

Ben knows the perception of children who are handed a successful family business, which is part of the reason he had his own career before joining Standard Meat. “Part of the reason that we wanted to go off and do our own thing was that we never wanted to look like we were those kids that took the easy way,” he says. “We believe that we are good at what we do, and not that it was just handed to us. It motivates us.”

Anyone who has watched Succession knows how difficult it can be to get a multi-generation family business to innovate and shift trajectories. But Ashli and Ben have leaned into change and incorporated outside experience without losing the family feel of the business, all while remaining true to the core of the enterprise. “What got us here won’t get us there,” Ashli says. “We have to be on top of whatever the next evolution of Standard Meat will be to stay relevant. If we weren’t good at that, we wouldn’t

here four generations later.”

Standard Meat Co. is adding a plant in the heart of the Fort Worth Stockyards.

Since 1866, the Fort Worth Stockyards has been integral to the meat industry and continued to be a place where livestock was bought, sold, and slaughtered until the 1950s. In 1976, the stockyards were named to the National Register of Historic Places, and today is a tourist destination. Standard Meat will soon be bringing the beef back to the neighborhood with its fifth meat processing facility, a 166,000-square-foot plant in a restored 1955 plant. “At Standard Meat, we’re all in on Fort Worth and bringing new investment and jobs to the place we’ve always called home,” says Ben Rosenthal, Standard Meat Co.’s co-president and CEO.

story by BEN SWANGER

story by BEN SWANGER

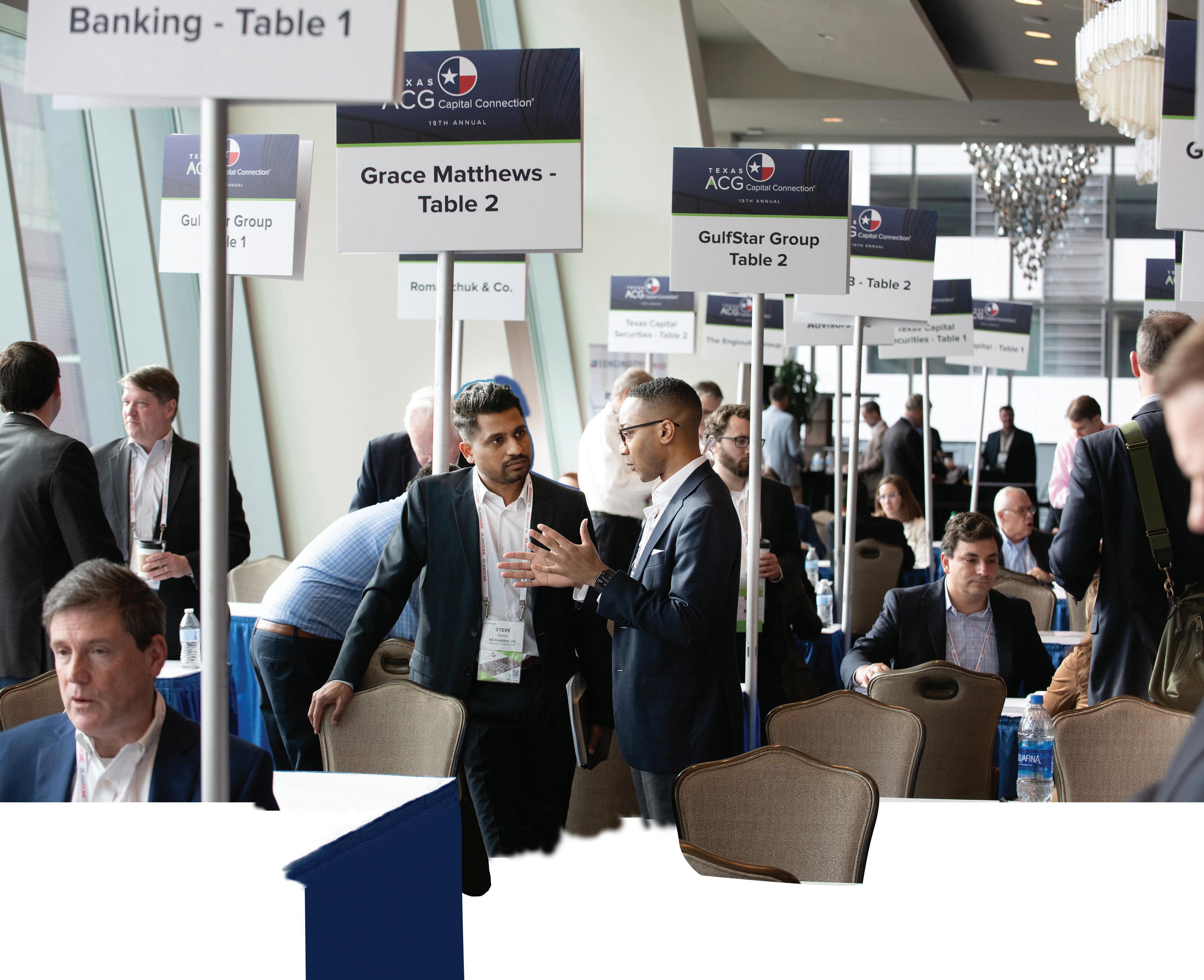

In her time as executive director of the Dallas Sports Commission, MONICA PAUL has helped bring more than 570 sporting events to North Texas with 8.1 million attendees—creating $4.3 billion in economic impact. But you’d never know it. Her behind-the-scenes maneuvering has cultivated an under-the-radar persona. After scoring the most 2026 FIFA World Cup matches for North Texas, though, there’s no hiding the shine of this star.

MONICA PAUL IS ACCUSTOMED TO WINNING. EVEN DATING BACK TO her teenage years, she was the valedictorian at her high school in the Texas town of Caldwell, just outside of College Station. These days, Paul is executive director of the Dallas Sports Commission and the chief figure in scoring sporting events— large and small—for North Texas. The 570 events she has brought to North Texas since 2008 have yielded $4.3 billion of economic impact for the region.

Her most recent win will have the biggest impact Dallas-Fort Worth has ever seen—scoring an impressive nine 2026 FIFA World Cup matches for AT&T Stadium in Arlington, the most of any of the 16 North American hosts. But when FIFA announced that honor on Sunday, Feb. 4, Paul knew the grand prize, the final match, was no longer in play for North Texas. Despite rumors swirling for weeks from British media outlets that AT&T Stadium would be selected for that honor, FIFA chose MetLife Stadium in East Rutherford, New Jersey.

“The rumors might have been the worst part of the process,” Paul says. “When you’re two weeks out from the announcement and you start seeing headlines that its coming to Arlington ... that put us in a unique situation—and, frankly, released a little bit of doubt in my head. So, going into announcement day, we had an inkling that the most matches a city could host and host the final was eight. So, after

they said we’d get nine, we knew we were not going to be announced as the final city. Was it heartbreaking? I’m not going to lie, yes it was.”

The feeling is not unlike what followed a similar heart wrenching verdict. “After we hosted the Men’s Final Four in 2014 ... [pause] I thought I was over this,” she says with a strain in her voice. “We put in a bid to host it again sometime between 2023 and 2026. When I got the phone call telling me we didn’t get it, but Houston and San Antonio did—that one hurt.”

The wound didn’t linger for too long as Paul led a successful bid to bring the 2023 Women’s Final Four to the American Airlines Center. As it turned out, the year belonged to women’s basketball. The three games in Dallas attracted 18.9 million viewers, with the national championship game peaking at 9.9 million. It was the mostviewed Women’s Final Four weekend on record, with the three-game slate garnering an 87 percent increase over 2022’s event. For Dallas, it resulted in $40.3 million in economic impact. “God might’ve known what he was doing when he didn’t give us the 2023 Men’s Final Four,” Paul says. Thanks to her efforts, though, the Men’s Final Four is returning to North Texas in 2030.

Similarly, the wound from not scoring the World Cup final for the region was not one that lasted. Paul has her full sights on the men’s World Cup, but in 2027 or 2031 Paul is chasing after the women’s World Cup for DFW. “I think our results from the 2026 tournament will show FIFA we need to be in consideration for hosting a women’s final,” she says.

Initial forecasts for the 2026 World Cup showed that the DFW region will see about $400 million in economic impact from the matches. But due to various financial factors, Paul has thrown that figure out the window. “All the calculations we’re running, which factor in various other events like fan fests and corporate activations, is showing a much higher number than $400 million,” she says. And Dan Hunt, prior to the announcement, suggested the figure could finish with an extra zero. “Should AT&T Stadium host six or seven games, we’re going to

be talking about billions in economic impact,” he says. Turns out, Hunt’s expectations were exceeded—and the impact could reach beyond his forecast, as well.

PAUL TIRELESSLY WORKS TO HAVE all the answers. It’s the feature that Dave Brown, chief operating officer and general manager of the American Airlines Center and past chair of Visit Dallas, saw in Paul when he interviewed her in 2008 for a director of sports marketing position at the organization.

“When we hired Monica, the region went from smallgame hunters to big-game hunters,” Brown says. But the one answer Paul doesn’t have is exactly how her career morphed from planning area volleyball tournaments one day to Final Fours and the FIFA World Cup the next. “I think about it often—like, when did things explode?” she asks rhetorically. “When I look back on my career and the events we’ve hosted, I really have no idea when the skies opened up.”

Back when Paul joined Visit Dallas (known as the Dallas Convention & Visitors Bureau at the time), the city’s sports commission had not yet been established. There had been efforts to create such an entity over the years, most notably in the 1980s, when the Dallas International Sports Commission emerged under the direction of former Dallas Mayor Annette Strauss and former Cowboys coach Tom Landry. More recently, the Dallas-Fort Worth Regional Sports Commission was created in 1999 as part of a movement to secure the bid for the 2012 Summer Olympics. Both organizations quickly shuttered.

“I think they failed because they tried to start as standalone entities,” Brown says. “They didn’t have the backing of an already established organization, and when they couldn’t land big events, they fizzled.”

The Dallas Sports Commission was officially spun out of Visit Dallas in 2014, and Paul was appointed to helm the organization, which had a staff budget of $725,000. Today, that budget has grown to more than $2 million, and the commission has become precisely what Brown thought it would under Paul. “When you’re trying to bring these high-profile events to town, it’s cutthroat,” he says. “But Monica thrives in the heat of competition, which has made her so good for Dallas.”

Despite working with global partners on the highest of high-profile events, Paul prefers to operate under the

radar. But her peers would like more people to know about everything she has accomplished. “Monica is so humble, and her humility allows her to bring people together, but her recognition is long overdue,” says Charlotte Jones, chief brand officer for the Dallas Cowboys. “Monica isn’t just the leader of the Dallas Sports Commission; she’s the leader of North Texas. Without her, AT&T Stadium would never host the sporting events we have—especially the World Cup.”

ASTRONOMERS ESTIMATE THAT A SUPERNOVA EVENT OCCURS JUST THREE TIMES EACH CENTURY.

PAUL CAME OF AGE ON HER FAMILY’S FARM IN CALDWELL. She and her younger brother spent their Saturdays tending to the fields, with Paul sprinkling feed pellets for the grazing cows from the tailgate of her mother’s truck. When she wasn’t on the farm, she was out golfing, playing volleyball, basketball, or throwing the shotput or discus. Ultimately, volleyball became her lead sport and carried her to the University of Mary Hardin-Baylor. But after a year of having to abide by a curfew as a college student, Paul left the team and transferred to The University of Texas at Austin. “A curfew wasn’t necessarily my speed,” she says with a laugh.

At UT, she got a job as the volleyball program’s team manager, and in Paul’s senior year in 1997, the head coach at the time, Mick Haley, was named head coach for the U.S. Women’s National Team. Haley offered Paul a job to join his staff, and she left her studies to move to the Olympic Training Center in Colorado—14 hours short of a college degree.

A BIG

Paul scored the first-ever College Football Playoff national championship for Arlington.

Paul worked 11-hour days, making $50 a week, taking care of statistical video analysis, coordinating with numerous sponsors, and handling the team’s travel agendas. She traveled to 27 countries, including the 2000 Olympic Games in Sydney, Australia, and, as a technical delegate, the 2004 games in Athens, Greece. She eventually earned her undergrad degree by piecing together classes at other universities and transferring the credits back to UT. “I might’ve taken a Spanish class from Oklahoma and transferred it back to Texas,” the Longhorn grad says with a laugh. “Man, that’s horrible.” She later earned a master’s degree in sports administration from Northern Colorado.

In 2001, Paul returned to Austin to work for Austin Junior Volleyball as the director of events and sponsorships, running the Lone Star Classic—the largest girl’s junior national qualifier—and various other tournaments. She worked out of an office in a church about the size of a closet. Still, it was where she cut her teeth in event hosting, guest experiences, negotiating contracts with convention centers and vendors, and setting up deals with hotels for officials.

In 2004, the Colorado Springs-based U.S. Olympic Committee was on the brink of decertifying USA Taekwondo as the national governing body for the sport. So, its CEO made sweeping moves to the staff at the time, including hiring Paul as director of international and domestic events. After 18 months, Paul says the organization moved from the red into the black. In 2006, she moved to Louisville to become competition director of the Local Organizing Committee for the National Senior

Games. A year later, she rejoined USA Volleyball as its associate director of events. In 2008, Brown poached her to join what eventually would become Visit Dallas. “When I first started, the expectation was just to find space for events and the hotel rooms for attendees,” Paul says. “Fifteen years later, I think there’s a little more weight on my shoulders.”

Paul claims she does, in fact, sleep—although those around her are not so convinced. But when it comes to her work, there’s no shuteye on the job. “I’m still this way today: If I can’t give 120 percent to the task, I need to take a break and come back later or just move on to something else,” she says. At any given moment, Paul and her DSC team of 10 could be working on 25 different events at once. “There’s a reason why North Texas hosts more great events than any other community in the U.S.—Monica is the biggest part of that,” Hunt says.

The load is nothing Paul can’t carry. After all, Charlotte Jones and other industry icons say she’s a star they can’t do without—a fact Paul still can’t believe. “In the darkness, in the celebration, Monica is the exact same,” she says. “In the stress, without the stress, she’s unflappable. The weight of the world was on her shoulders to bring the global game’s biggest event to Arlington.”

After she left the women’s volleyball national team in 2001, Monica Paul acquired the rights to sell and distribute the statistical and video analysis tech the team used in the U.S. She proceeded to sell the software as a service to colleges and universities across the country. Paul can’t count the number of volleyball clients she had, but it was significant, she says. She eventually sold the technology for “a few dollars” and it morphed into a company that was eventually sold to Genius, an American digital media concern. That same year, Toshi Yoshida, the U.S. volleyball women’s national team head coach from 2001 to 2004, hired Paul to edit and publish a book of his. And from 2019 to 2023, she taught contemporary issues in sport management for SMU. Today, outside of her demanding day job, Paul co-hosts the Mic Drop Podcast and, with her recently acquired real estate license, helps friends and family buy and sell properties.

Paul began working on the 2026 FIFA World Cup bid in 2017. The big event will arrive in about two years.

WORK ON THE 2026 FIFA WORld Cup is intensifying. The region is just two years away from hosting the largest sporting event it has ever held, and because the decision came in later than anticipated, the Dallas Sports Commission is working on a condensed timeline—the expectation was to receive the schedule in early 2023. Bringing the event to town won’t be cheap, Paul says, but she assures that returns will be there—despite a study by Switzerland’s University of Lausanne that found more than four out of five Olympics and World Cups ran at a deficit. Of the 14 World Cups analyzed, only Russia’s in 2018 generated a profit, the study found. The university says it is rare for local organizing committees to turn a profit for their regions, but Hunt isn’t worried. “Monica does not make promises she can’t execute on,” he says. Paul doubles down: “The city and region are going to be profitable, even with the expenses we incur,” she says.

According to the study, the 1994 World Cup, hosted by the U.S., cost the country more than $800 million. Accounting for inflation that equates to $1.6 billion in today’s dollars. Per multiple outlets, Qatar spent a staggering $220 billion on hosting the 2022 Cup. A more realistically comparable event for North America—as Qatar built a transit system, dozens of hotels, and a new stadium for the event—would be Russia, which spent $11.7 billion.

Paul says the World Cup won’t be a burden for local entities. “It’s our goal not to have to go to the city governments and ask for money to assist in putting this on,” she says. “We have the ability to sell 10 host city supporter agreements to corporations, individuals, or other nonprofits. We will work with FIFA on the list and iron out our sellable assets, such as tickets, fan fest activations, legacy programs, and ancillary events. In late 2024, we will set up our donor program, and we’re looking at raising more than $100 million.” That money will go toward event security, ancillary events, event production, transportation elements, and marketing. Additionally, AT&T Stadium will undergo at least $295 million in renovations, but Jerry Jones says that figure is still in flux. An estimated total cost is still to be determined, as well—the local organizing committees and economists working on projections did not run forecasts on a nine-game slate.

One of the most significant question marks for the event during the bid process was—and still is—transpor-

tation. North Texas does not have a transit system comparable to other major metropolitan areas in the country. So, an all-encompassing plan is still being ironed out. “We’ve been able to work with the North Central Texas Council of Governments to put a plan together to get the funding necessary to utilize the system that we currently have and then obviously have a significant bus presence—that seemed to be a suitable plan for FIFA,” Paul says.

Paul is in communication with FIFA on local issues ranging from homelessness and the state’s stance on LGBTQ+ and transgender rights to trafficking, sustainability, and how the airports operate. She is not just the leader of the local sports commission; she has become the voice for North Texas’ sporting activities.

Along with the high-profile global games, the DSC sees to it that recurring events like the Cotton Bowl and the Red River Rivalry stay in DFW. It also works on local events like recurring youth sports tournaments, chess events, spelling bees, cheerleading competitions, and eSports tournaments. “In January, February, and March, more than 65,000 cheerleaders and their moms and dads are out spending their money at restaurants and attractions downtown,” Paul says. “The youth and grassroots events are our bread and butter.”

As she looks beyond the 2026 World Cup, she foresees a future in which Dallas is viewed in the same vein as New York City—as a premier international destination. She also sees big things for the sport of soccer. Just as the 1994 World Cup birthed Major League Soccer, she believes a new wave of enthusiasm for the

"WHEN I FIRST STARTED, THE EXPECTATION WAS JUST TO FIND SPACE FOR EVENTS AND THE HOTEL ROOMS FOR ATTENDEES. FIFTEEN YEARS LATER, I THINK THERE’S A LITTLE MORE WEIGHT ON MY SHOULDERS.”

sport will engulf the states. Locally, Paul is hopeful the outcome will result in more sporting events for the region, just as Super Bowl XLV and the 2010 NBA All-Star Game acted as sporting event incubators for the DFW region.

This year, she expects to work on more than 60 local sporting events; as the years progress, that number will only grow. After all, the cost of doing business in North Texas is projected to stay lower than competing markets, the region is only expanding, and more wealth is being infused into the economy with corporate and individual relocations. Who knows, maybe someday, DFW will score the Olympics. “North Texas has all the venues to host an Olympics right now,” Paul says. “But I think the soonest we could do it is 2056 (due to LA hosting in 2028). I’ll be 81 years old—I don’t want to be working that event. But I’ll be the first volunteer and, hell, for the cause, I might even donate.”

Other more immediate targets on her list include the 2027 or 2031 FIFA Women’s World Cup, the WNBA All-Star Game, and various NCAA postseason tournaments and volleyball championships. Additionally, she is aiming to strike a partnership with the Dallas Stars to find a host institution for the NCAA Frozen Four tournament. “We are bidding on the 26–27 season and 27–28 season,” she says. Paul also wants to bring the Super Bowl and the College Football Playoff National Championship back to town. “I’m not saying that other cities don’t have what Dallas has,” she says. “But the full package? That only exists in Dallas.”

Established in 2007, Vestals Catering is a trusted partner for Fortune 500 companies across Texas, delivering on our promises for seamless event execution and dedication to detail. We don't merely provide a service; we become an extension of your brand, working to enhance your company's image and reputation, backed by our proven track record of culinary excellence and generous hospitality.

Discover the difference of partnering with Vestals Catering and ensure all your future events are a complete success.

At Parkland Health, artificial intelligence is helping trauma surgery teams make data-based decisions about when to operate.

story by WILL MADDOXWwhen an individual experiences a traumatic injury that requires emergency surgery, sometimes choosing not to operate can be what saves the patient’s life. In Dallas, those decisions are now being guided by artificial intelligence that’s leading to a technological shift in the industry.

Here is how it often plays out: A patient arrives with severe injuries from something like a car accident or a significant fall. Trauma surgeons are trained to move quickly and fix problems but aren’t the only providers who make decisions; the intensive care unit team is another stakeholder. The surgeons and ICU physicians can, at times, disagree about whether a patient is stable enough to undergo surgery, and each gives weight to opposing variables to make their cases.

“The physicians were literally verbally arguing on the floor to say when to take patients to

surgery,” says Albert Karam, vice president of data strategy and analytics at Parkland Center for Clinical Innovation, or PCCI. “There wasn’t a standard in the industry for quantifying what the decision should be.”

Until now. As AI becomes more mainstream, the conservative medical community is allowing AI to impact decision-making in ways that would have been unthinkable a few years ago. As is often the case in the modern economy, AI and cloud technology collect reams of data that can improve outcomes and reduce costs, but it isn’t always used. Physical trauma is the leading cause of death for those under 45 and costs the economy $670 billion each year. With extensive electronic health records holding dozens of data points on any patient that passes through the system, the information care teams need is already there. However, these data banks need AI to make information accessible and display it in a way that can quickly guide decision-making.

At Parkland Health, an AI collaboration between Dallas County’s safety net hospital and PCCI is now providing ICU and trauma surgery teams with a data-based method to guide choices for treating traumatically injured patients. It is changing the paradigm for trauma surgery, where for years best practice has been to do surgery as early as possible to improve outcomes. But AI is providing a more precise outlook.

Parkland is the ideal candidate for a timesaving and outcome-improving technology. It is consistently the busiest emergency department in the country and was the only ED in the U.S. to see more than 200,000 patients in 2022 when it cared for 226,178 patients.

The Parkland Trauma Index of Mortality is a groundbreaking program that provides care teams with objective data about whether the patient is strong enough to undergo surgery, replacing what had been subjective decisions made in stressful moments.

The index analyzes dozens of variables and compares them to historical outcomes to give the patient a score determining whether they are ready for surgery. The score tells the provid-

ers if a patient is likely to die in the next 48 hours and, thus, requires stabilization and provides updates based on the patient’s evolving condition. Using a scale from 0 (great condition) to 100 (won’t survive surgery), physicians are able to make a data-driven decision about whether a patient is ready for surgery. After the first 12 hours, the score is updated hourly to determine whether a patient is likely to survive for the next 48 hours. Not only does it provide objective data to guide decisions, it also saves time. Each of the dozens of variables can take up to seven clicks by a physician to find. In the end, the call is still in the hands of the physicians, but now they have thousands of patient encounters and dozens of variables to inform them. The program, which went live in 2019, has revolutionized the trauma surgery process at the hospital.

“You have to look at multiple variables. A really smart human being can consider two or maybe three things at the same time in their head, but you can’t look at 50,” says Dr. Adam Starr, who championed the program at Parkland. “But the computer can.”

A professor in orthopaedic trauma at UT Southwestern Medical Center and the medical director for orthopaedic surgery at Parkland Hospital, Starr remembers the first patient whose score told the physicians he wasn’t ready for surgery. It was a young man in his 30s who had been in a motorcycle accident and had a femur fracture. He was awake and talking but had multiple broken ribs. When they received his PTIM score, it was much higher than expected, meaning he might have died on the operating table. If it were up to Starr’s previous training and prevailing dogma, they would have gone ahead with surgery, and according to PTIM, he likely wouldn’t have made it. They waited until his score went down to operate, and everything turned out well.

“I cannot imagine going back to what we had before because, in the past, we made our decisions based on our gut,” Starr says. “But that’s certainly not scientific, and it’s often wrong. This is a much better way to do it.”

The strategy used to help trauma teams at Parkland is expanding to other surgical teams and service lines.

The tech behind PTIM, which analyzes and weighs dozens of variables to impact medical decisions, applies throughout the healthcare industry. Vikas Chowdhry founded TraumaCare.AI and has connected with University of Cincinnati, USC/LA County, and University of South Alabama Hospital to address challenges in critical care domain with the use of real-time AI. Chowdhry sees potential for AI to improve outcomes in lower-level trauma centers and rural hospitals, where care teams have to make quick and difficult decisions about whether to treat patients onsite or transfer them to a higher-level care center.

“Those decisions are made by ER physicians who are not trained for tackling these situations,” he says. “We can help them make triage decisions.”

“At its core, innovation is stepping back from the way things have always been done, identifying strategic improvements, and developing realistic solutions. Having the courage to change and experiment with new concepts is paramount as we strive to envision new paths forward and create efficiencies. But although we strive to be creative, we also understand that forward-thinking solutions must be able to be implemented efficiently, in terms of time and monetary resources.”

illustrations by JAKE MEYERS

“Innovation is working in uncharted territory to deliver outsized returns to investors, while still mitigating risk. We do this by first understanding the rules of the game and knowing what the conventional path for a project would be, then determining how we can stretch beyond the conventional path to do something that further improves the community and investment returns. It’s also about deploying scientific methods to solve problems and never, ever giving up.”

“Innovation is the synonym of survival. Those who have neglected innovation or innovative ideas have not survived. There are many examples in history. This is even more true in the competitive landscape in which we and our companies operate today. Innovation for me is also an inclusive term in the sense that innovation is not something that only some people in some fields can do. Anyone, anywhere, engaged in any field can innovate and must be encouraged to do so.”

D CEO proudly launched its inaugural 2023-2024 Emerging Women Leadership Network this year, and we are now looking ahead to the future. Applications for the 2024-2025 program will launch in May, and sponsorship opportunities are available for companies that want to demonstrate their investment in women leadership and align with one of the region’s top development programs. Please contact Rachel Gill, sales manager, at Rachel@dmagazine.com for more information on how you can get involved..

LEARN

MORE

87% of organizations believe in leadership development… but only 5% actually invest in it. When organizations invest in leadership development, they get outsized results (7x-41x). *

*Source:

Some lawyers make a living suing trucking companies. Locke Lord attorney and financing guru Drew Slone opts to pull the trucks instead.

story by BEN SWANGER photography by SEAN BERRY

Llocke lord attorney drew slone wants to apologize to her neighbors. The public development finance lawyer is up at 4 a.m. every day slinging weights and later in the day drags sleds and throws sandbags in a gym she built in her garage. It’s all training for feats of strength like pulling 18,000-pound trucks across parking lots. During working hours, she has been the behind-the-scenes force on the bond funding for numerous DFW projects such as the Statler Hotel, Collin Creek Mall, and the $4.5 billion Legacy Hills project.

In her spare time, she focuses on weighty matters of a different kind, including pulling 18-wheeler trucks 40 feet—which is just one of many intense strength tests that contenders in strongman and strongwoman competitions must complete. Last year, Slone qualified for her first Official Strongman Games, a three-day event with nearly 400 participants. She was disappointed in her performance, so this year, she’s training to redeem herself. At her most recent event, the Battle Axe Showdown V at Battle Axe Barbell gym in Garland, she walked away with her second consecutive win.

Slone, who ran marathons during college and did CrossFit for 13 years, got her start in strongwoman during her stint at Winstead. So, in 2021, Slone— who has secured $3 billion in capital financing for clients throughout her career—began working out at Battle Axe

Barbell and training for her first strongwoman competition. Things got off to a rocky start.

“For 28 straight days, I worked 15 hours a day trying to tie together $110 million in bond funding,” she says. “And by the time the competition rolled around, I couldn’t use my hands—my husband had to help me type. So, it didn’t go well.”

At her second competition, she finished on the podium. In her third, she took home the gold in two weight classes. “This hobby was the space I gave myself to fail and not be so critical of myself,” Slone says. “In my training, I taught myself the proper strongman movements through YouTube videos. And in my career, I had to teach myself about development. That same curiosity has been the chief driver in helping me become a better lawyer.”

Slone’s thirst for adrenaline does not just materialize in pulling vehicles. She recently qualified to earn her sports car racing license, and you can spot her driving her Porsche Macan around Dallas with the license plate “BondXX.”

As the years go by, Slone says she has seen more women get involved in strongwoman competitions, but “not enough professionals make time for this stuff,” she says. “It’s incredibly empowering to strength train and compete, and I wish more women would get involved. I want to inspire the woman who thinks she’d never even be able to pick up a stone to go and drag a truck—plus, it looks really cool.”

Mark Parmerlee began his Boy Scouts journey as a Webelo and for nearly three decades, the Golden Chick president and chairman has organized and led the Sporting Clays Invitational. Co-founded with Oak Stream Investments Director Jack Furst, the event attracts 30 to 40 teams who shoot clay pigeons and raise money for ScoutReach, which funds Boy Scout camp scholarships, uniforms, and transportation to scouting events for underresourced urban and rural communities. Former Cowboy great Jay Novacek and other big names have participated over the years, and the event has raised about $7 million. “Every year, as we get to the end of our day, I commit for next year,” Parmerlee says. “Scouts is the gang we want our kids to be in.”—Will Maddox

CHRISTINE PEREZ Editor, D CEO

CHRISTINE PEREZ Editor, D CEO

MODERN TAKE

Goldener Hirsch got a major expansion in 2020 when 40 condominiums were added to the inn’s 18 rooms and suites.

FIRESIDE CHAT

Guests can play board games or unwind at Goldener Hirsch’s Antler Lounge, which serves three meals a day.

This luxury ski resort in the Wasatch Range of the Rocky Mountains is a favorite getaway for Dallas attorney Rogge Dunn

story by CHRISTINE PEREZ

SKI AND SWIM

The slope-side, heated outdoor pools and hot tubs are among the most popular spots at St. Regis Deer Valley.

GOING UP

The Jordanelle Express gondola takes skiers to the top of Little Baldy Peak at Deer Valley.

GOOEY GOOD Complimentary s’mores are served nightly at St. Regis Deer Valley’s Astor Terrace.

TWISTED FUN

Goldener Hirsch guests can learn to make Bavarian pretzels in classes taught by the resort’s pastry team.

WAY TO RIDE

St. Regis Deer Valley’s unique funicular connects the hotel to lowerlevel residences and restaurants.

Iit’s always risky to book an early-season ski trip; you never know what conditions you’ll encounter. But the stars were aligned during a December getaway to Deer Valley in Park City, Utah, with plenty of fresh snow falling in the days leading up to our arrival.

Just a quick 40 minutes from Salt Lake City International, Deer Valley makes skiers a priority; it limits the number of lift tickets sold each day and is one of just three venues in North America that doesn’t allow snowboarders.

We spent the first couple of nights at Goldener Hirsch in the resort’s Silver Lake Village. Frequently lauded as one of the country’s best boutique ski hotels, a 2020 expansion added 40 condominiums to the inn’s 18 rooms and suites. A year later, Auberge Resorts Collection was selected to manage the property. (Visit dmagazine.com for an in-depth recap, including details about Goldener Hirsch’s modern Bavarian restaurant.)

For the next few days, we moved to the nearby St. Regis Deer Valley, an ultra-luxe hotel that opened in 2009 with 181 rooms. The resort is known for its inventive special touches, including a one-of-a-kind funicular, whose Swiss cable cars travel 500 vertical feet in 90 seconds, connecting residences, La Stellina restaurant, and a Topgolf swing suite with the hotel proper.

Our visit coincided with the holidays, and the resort was festive and glowing. A highlight was a life-size gingerbread house crafted by the St. Regis pastry team. Along with a 3-foot-tall toy soldier made of fondant, it also featured seasonal drinks—including gourmet hot chocolate, complete with an expansive toppings bar.

Perks at St. Regis include its famed butler service, full-service spa (the “boost and brightening facial” is divine), slope-side pool and hot tubs, in-house Saks Fifth Avenue store, and a ski valet team that will even help you put on your boots. The experiences stand out, too. My boyfriend and I learned how to saber a bottle of Veuve Cliquot and to make the resort’s 7452 Mary. (Every St. Regis resort has a signature Bloody Mary that’s inspired by its locale.)

We spent an evening in Park City’s quaint downtown and had a terrific meal at Riverhorse on Main, where the offerings include a Trio of Wild Game featuring buffalo, venison, and elk, served with truffle twice-baked potatoes, asparagus, and huckleberry). But you won’t need to stray from the St. Regis campus for a delicious meal. Along with the fresh and flavorful Italian fare at the funicular-served La Stellina, options include above-standard treats at St. Regis Bar (where you can view the locally inspired “Into the Mine” mural by Phillip Buller), French food at Brasserie 7452 (try the Croque Madame or the French onion soup), and traditional American cuisine at RIME (seafood and steaks are standouts).

It was at RIME where I indulged in a decadent breakfast of Utah Toast—brioche with toasted nuts, honey-peach-apricot compote, and alpine whiskey mascarpone. It was the perfect foundation before heading out the door for another glorious day on the slopes.

EASY ACCESS

St. Regis Deer Valley is a ski-in, ski-out resort with a top-notch ski valet team that keeps your boots warm and equipment ready to go.

Dallas attorney Rogge Dunn went to the 2002 Olympics in Park City and fell in love with the region. He had recently taken up skiing and decided to buy a second home at Deer Valley to pursue his new passion. “It’s great to go there for the holidays and have a white Christmas,” Dunn says. “It’s also a magnet for the kids to come hang out with mom and dad.” When it comes to local fare, he recommends Boneyard Saloon and Wine Bar (“by far the best pizza in town”) and The Mariposa (“best lobster bisque I’ve ever had”). Dunn’s vacation home has ski-in, ski-out access. He prefers the slopes at Deer Valley or the nearby Alta Ski Resort for one simple reason: “No boarders,” he explains.

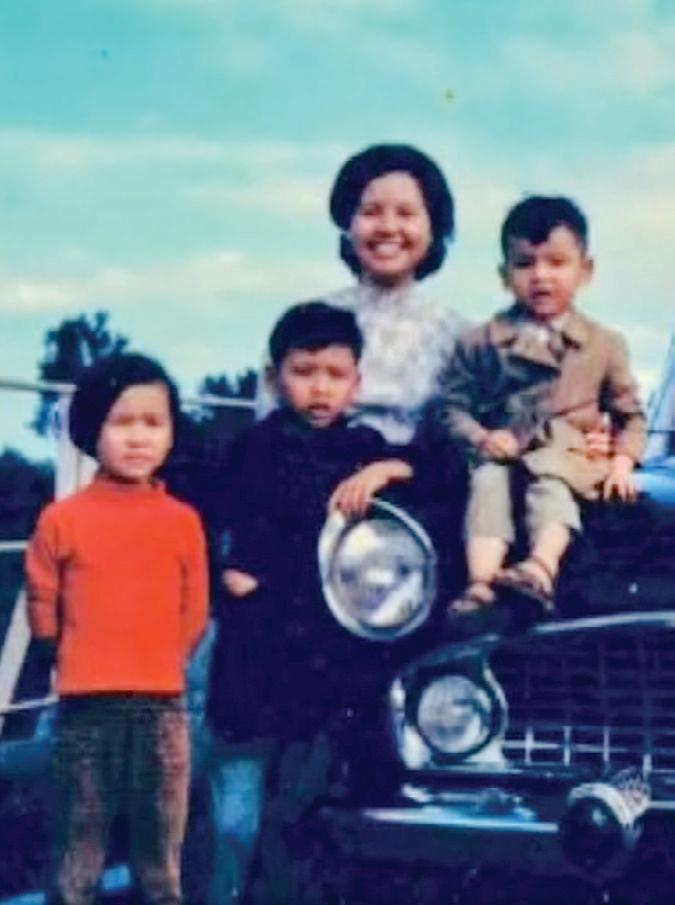

zalat pizza founder and ceo Khanh Nguyen can recall every detail of the day he and his family fled Vietnam in 1975 near the end of the Vietnam War. Nguyen’s father, a general in the Vietnamese army, defied orders, risked arrest and execution, and made plans for the family to safely leave the country. After plans fell through, a bowl of pho ended up saving their lives. Here, Nguyen shares details of his life-changing journey.

“We didn’t have airline tickets that could take our whole family out of Vietnam, so we traveled from Saigon to one of the coastal cities because we heard that people could get on a boat to leave. We stayed at this convent for two days, but no boats were coming in. So, we decided to stay one more night. My dad said, ‘In the morning, let’s pack up and drive back to Saigon,’ and said he’d try to work his connections with the American Embassy. And that was the day the country

fell. But before we left, we had to eat. I remember one of my uncles animatedly talking, and somehow, he knocked a bowl of pho in his lap. He said, ‘You guys stay here, I have to go take a shower.’ In that time, they set up barricades on the road back to Saigon and said ‘The country is lost. You don’t want to go back there.’ So, we turned around. That bowl of pho saved our lives because had we gone back then and there, my dad would have been killed. The next day, the troop carriers came in, my dad walked up, introduced himself, they let us on, and we headed out to sea. And it took us probably two days to run into an American battleship.”

The Women Leaders in Law featured on the following pages are well-respected and highly sought after throughout Dallas-Fort Worth. Every day, they expertly guide their clients toward a resolution and use their experience and expertise for the best possible outcomes. These Women Leaders in Law practice a wide range of specialties and are held in high regard as valuable counsel by their firms, legal peers, and—most of all—by the clients they zealously represent.

AT THE HELM of Witherite Law Group is the dynamic Amy Witherite, a visionary leader who has cultivated a culture of putting “people first, unmatched expertise, and integrity always” at the forefront of the firm’s mission. Under her guidance, Witherite Law Group has emerged as one of the nation’s preeminent female-owned law firms, with a reputation for excellence in managing commercial truck wreck cases.

The firm’s legal prowess emanates from a dedicated team of top-tier attorneys and a supportive staff, united in their pursuit to uplift the lives of their clients. This commitment to client well-being is the cornerstone of Witherite’s philosophy, and it is this dedication that has propelled the firm to two decades of remarkable legal victories and personal triumphs.

Says Witherite, “As a firm, we are deeply committed to fighting for justice for our clients. We understand the significant impact

we can make on people and their futures, so we take what we do very seriously. As a result, we have seen this reflected in our success for 22 years.”

Beyond the courtroom, Witherite and her team’s devotion extends to nurturing the communities they call home—Dallas, Fort Worth, Atlanta, and Chicago. They have become local pillars through annual events that not only stitch communities closer but also offer tangible support to those in need.

Whether it’s the heart-warming Thanksgiving turkey giveaways, the ebullient Peace in the Streets block parties in Chicago, or even the life-changing opportunities presented through generous scholarship programs, their service transcends legal work.

For Witherite Law Group, excellence is more than legal expertise: it’s a sustained commitment to making a difference inside and outside the courtroom. It’s the art of law, practiced with a human touch.

witheritelaw.com

10440 North Central Expressway, #400 Dallas, Texas 75231 800.227.9732

BRINGING AN entrepreneurial spirit to the practice of law, the attorneys at Barnes & Thornburg, a national full-service firm, work with clients to protect their companies and innovations. The highly talented attorneys at Barnes & Thornburg are experienced in appeals, commercial real estate, complex litigation, compliance, e-discovery, fund formation, government and regulatory law, intellectual property, labor and employment, M&A, private equity, tax, and white collar criminal defense. The partners in the Dallas office of Barnes & Thornburg understand what keeps you up at night and work collaboratively to find practical and creative solutions. Find out more at btlaw.com.

WOMEN IN general are a powerful force; women in the practice of law are unstoppable. Bogdanowicz Family Law is a woman-owned, women-run boutique law firm that handles exclusively family law cases throughout Dallas-Fort Worth. After practicing at some of the most prestigious law firms in the area, Erin Bogdanowicz founded Bogdanowicz Family Law with the single goal of crafting a legal team that could provide dedicated services in the field of domestic litigation and answer the call of clients struggling with extremely complex custody and property issues.

Bogdanowicz, Board Certified in Family Law by the Texas Board of Legal Specialization, is trained in collaborative law and a certified family law mediator, but the courtroom is where she and her team shine. “Our firm is known for our tenacity in the representation of our clients,” Bogdanowicz says. “Getting to really know my clients, what makes them tick, and their desired outcomes is part of the process I enjoy because it allows me to craft something distinctively for them.”

THE COURTROOM is where LPHS partners Mary Goodrich Nix, Britta Stanton, Sara Hollan Chelette, and Becky Adams shine. They are known and respected not only for their tenacious advocacy styles but for their unique ability to successfully guide business leaders through complex litigation matters.

The women leaders at LPHS skillfully try cases to judges, juries, and arbitrators and have been recognized locally and nationally, earning honors and accolades for their exceptional trial and leadership skills. “We are consistently hired to handle the most crucial litigation matters our clients face,” says Mary Goodrich Nix, a panelist at the Women Leaders in Law Event on March 27, 2024. “Our firm values and embraces diverse perspectives and experiences, and it’s empowering to be part of a firm that unapologetically prioritizes, amplifies, and values diversity.”

SCHULTZ TRADE LAW is a Dallas-based, woman-owned firm dedicated to the seamless flow of international trade with the highest quality legal support. Michelle Schulz, Lindsay Forbes, and Marina Mekheil work tirelessly in representing clients in matters of regulatory compliance and enforcement for imports and exports. “Our mission is to help companies navigate complex areas of international trade with a focus on compliance,” Schulz says. Schulz has specialized in international trade law for more than two decades and founded her firm two years ago. Her goal was to empower women attorneys and staff who are multilingual with ties to other parts of the world, like herself. At Schulz Trade Law, you’ll hear attorneys and staff speaking German, Arabic, Spanish, Kinyarwanda, and Bengali, among other languages. “We are approachable lawyers with extensive experience and a deep bench in this area,” Schulz says. “We all know how to work with the government and deal with Customs, the Commerce Department, and other trade agencies. We can always resolve things before they get too far, potentially saving clients millions of dollars.”

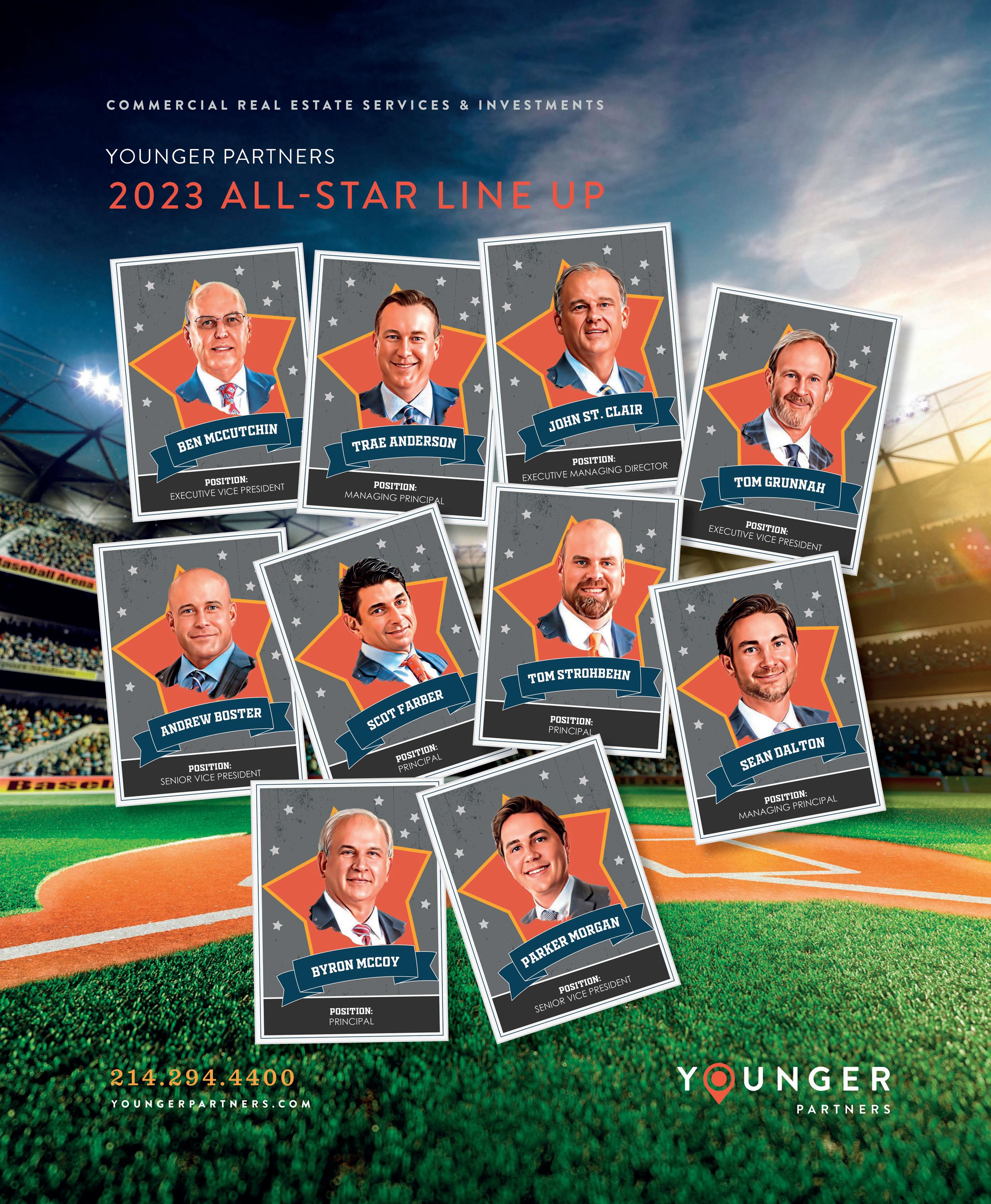

Dallas-Fort Worth is a bright light in commercial real estate, leading the nation in investment property sales, hotel projects, office development, and more.

FEATURING

SEE WHO MADE THE 2024 POWER BROKERS LIST

PLUS A LOOK BACK AT THE YEAR’S TOP REAL ESTATE STORIES

AND NOTABLE PROJECTS AND TRENDS TO WATCH IN 2024

The new Knox Street Development will transform the neighborhood.

Mike Dement Altschuler and Company

Greg Langston

Avison Young

Jared Laake

Bradford CRE

Harlan Davis

CBRE

Jeff Ellerman CBRE

Renee Castillo CBRE

Ryan Buchanan CBRE

Tommy Nelson CBRE

Walker Lafitte CBRE

Jade Parrish CBRE

Steve Berger CBRE

Phil Puckett

CBRE

Joe Cherry

Cherry Speir

Blaine Shawaker

Colliers

John Pelletier

Cresa

Kris Lowry

Cresa

Mitchell Wolff

Cresa

Roy Reis

Cresa

Tor Erickson Cresa

Alexandra Boury

Cushman & Wakefield

Campbell Puckett

Cushman & Wakefield

Chima Ogueri

Cushman & Wakefield

Matt Heidelbaugh

Cushman & Wakefield

Robbie Baty

Cushman & Wakefield

Travis Boothe

Cushman & Wakefield

L.J. Erickson

Duggan Realty

Tyler Howarth

Holt Lunsford Commercial

Berkley Baker

Hughes Marino

Blake Waltrip JLL

Brad Selner JLL

Bret Hefton JLL

Calvin Hull JLL

Fiona Forkner JLL

Granite Park 6 Plano, Texas

Kelley Kackley JLL

Pat Madsen JLL

Jet Leonard

Morrow Hill

Casey Hilbun Newmark

Catherine Gibbons

Newmark

Chris Mason

Newmark

Frank Puskarich

Newmark

Jack Brewer

Newmark

John Beach

Newmark

Trace Elrod

Newmark

Joe Bright Partners Real Estate

Charlie Otte Rubicon Representation

Clay Vaughn

Savills

Curtis Krusie

Savills

Dina Zavislak

Savills

Preston Lynn

Savills

Jack Dawson

SRS Real Estate Partners

Nate Hruby

Stream Realty

David Dunn