ACQUISITIONS AWARDS

ACQUISITIONS AWARDS

In the fickle world of fashion, knitwear giant Ming Wang is planted in tradition. This commitment carries through as the next generation takes control of the luxury brand.

Deal makers often face merger and acquisition frustrations such as complex accounting challenges, integration difficulties, regulatory hurdles, and uncertainty about cost synergies. Whitley Penn’s Deal Advisory team will work with you every step of the way to identify and create a streamlined yet customized approach that mitigates risk and allows you the confidence of knowing you have the right team for your deal advisory needs.

Connect with a deal advisor by scanning the QR code or visit whitleypenn.com today.

We’re in the business of helping Texas business thrive.

Chad Burke President & CEO Economic Alliance Houston Port Region

Chad Burke President & CEO Economic Alliance Houston Port Region

Deborah Davenport Territory Management Specialist Texas Mutual Insurance Company

Deborah Davenport Territory Management Specialist Texas Mutual Insurance Company

Building a better Texas starts with supporting Texas business.

That’s why we’ve put over $4 billion back into the state’s economy through dividends and community giving. We’re proud to partner with organizations like the Economic Alliance Houston Port Region. Together, we’re supporting working Texans — today and tomorrow, developing the workforce of the future and helping to strengthen the Texas economy.

Business is better. Texas is better.

Visit texasmutual.com/better to learn more about Texas Mutual’s commitment to the state.

AI is revolutionizing industries, but Dallas businesses struggle to implement it. At Resolve Tech Solutions we understand that IT innovation is both a priority and a constant challenge and we help local businesses by offering AI solutions and guidance, making complex AI accessible.

Why is it crucial for businesses to embrace AI in today’s landscape?

Businesses that become early adopters gain a significant edge by:

• Automating tasks

• Extracting valuable insights from data

• Identifying inefficiencies

• Increasing productivity

• Predicting future trends

What are the risks of not having an AI strategy for my business?

Businesses without an AI strategy risk falling behind. They miss chances to streamline operations, save money, and improve customer experiences. An AI strategy keeps your business innovative, adaptable, and relevant in today’s AI-powered world.

How can partnering with a company like Resolve Tech Solutions benefit my business’s AI strategy?

By working with a partner that has proven and tested strategies, you can not only accelerate your time to market with your AI projects but ensure a successful outcome. RTS provides a comprehensive suite of AI solutions and expertise, guiding businesses through every stage of the AI journey, from ideation and prototyping to full-scale implementation and ongoing management.

www.resolvetech.com

marketing@resolvetech.com +1

Vinod Muthuswamy, CEO Resolve Tech Solutions

Why Resolve Tech Solutions?

25+ years of delivering trusted IT services and solutions

AI Breakthrough Award 2024 for Hybrid Intelligent Systems

Named Top 25 Artificial Intelligence Companies of 2024

Top 25 Executives for Artificial Intelligence in 2024

SAP Service Excellence Partner

1000+ High Trained IT Professionals Your Trusted Partner

ERP Modernization

Cloud Migration & Managed Services

Digital Transformation

AI/ML

Congratulations to both Jennifer Mitzner and Angela Monschke Hutson of Baylor Scott & White Health, finalists for the 2024 D CEO Financial Executive Award.

Some people are great with numbers, and some are inspiring leaders. Jennifer Mitzner and Angela Monschke Hutson are both, and they are making healthcare better with an unwavering focus on the people and communities we serve.

Baker Tilly proudly supports the

Congratulations to this year’s top transactions in North Texas and the deal makers who made them happen.

advisory | tax | assurance

Let’s connect bakertilly.com

© 2024 Baker Tilly US, LLP

Profit from our experience from due diligence and valuations to operational improvements and divestitures, our specialized advisory, tax and assurance professionals are here to help you achieve your financial and transaction objectives.

The Texas Tech University Health Sciences Center community shapes the future of health through education, training and steadfast service. As one of the largest universities for depth and breadth of health care programs, we are fueling and advancing the health care workforce in Dallas and beyond.

Our determination drives change. We are The Future of Health

reconciliation involves understanding what’s going on inside of the offended person’s mind. Charging forward with an apology without understanding their point of view is folly. The offender needs to initiate discussions, listen, and understand the issues and how to best respond. An important part of the apology process is letting the offended person vent, express their perspective, and believe you are truly listening. Resist the temptation to interrupt and inject your point of view and rebuttal facts—no matter how accurate. Conversations and reflection over time enable you to realize what upset the offended person so you can meet their needs and expectations and avoid future disagreements. Disputes that can lead to the end of a relationship and create a lifetime of anger and resentment are seldom a one-off incident. Prior slights or transgressions build up over time. This is especially true when people are not communicating their dissatisfactions with another person’s actions or attitude. When the tensions reach a crescendo, they boil over into an explosive argument or confrontation, where tempers flare and override logic or the innermost desires in someone’s heart. Therefore, when fashioning an apology, try to do so in the context of the history of your interactions with the other person.

Apologizing too soon can be problematic, and apologizing too late can be ineffective. Every situation is different so apologies must be customized to the sensibilities of the person with whom you’re interacting. What makes the timing of apologies so tricky is that many approaches are not perceived as the apologizer intended. Cynthia Frantz’s studies on the timing of apologies indicate that early apologies can be less successful because they are viewed as in-

sincere. However, if you wait too long, it’s perceived as if you hoped to avoid apologizing, but eventually succumbed to the pressure to finally admit you were wrong. Cynthia Frantz, “Better Late than Early: The Influence of Timing on Apology Effectiveness,” Journal of Experimental Social Psychology, 2005.

So, given that the apologizer is walking this timing tightrope, when is the right time to apologize? If you choose not to apologize right away and decide to apologize later, give a legitimate reason why it took you so long to apologize. Say something like, “I know it’s been a while since our disagreement. I want you to know that I took time to sincerely reflect on what I did, your feelings, how I offended you, understand your viewpoint, and how I hurt you.” Accompanied by a persuasive explanation, the delay can be a plus.

I find an immediate apology is the most effective, if you are quick on your feet and have a choreographed apology game plan ready. If not, tell the offended person, “Please give me a few minutes/24 hours and some quiet time to reflect on your point of view and what I have done/said.” Then use that time to reflect and fashion a persuasive, prompt apology. That approach portrays you justifiably needed some time for introspection to thoughtfully reflect on what you did.

ROGGE DUNN represents companies, executives, financial advisors, and entrepreneurs in business and employment matters.

Clients include the CEOs of American Airlines, Baker Hughes, Beck Group, Blucora, Crow Holdings, Dave & Busters, Gold’s Gym, FedEx, HKS, Texas Motor Speedway, Texas Capital Bancshares, and Texas Tech University, and sports figures like New York Mets manager Buck Showalter, NBA executive Donnie Nelson, and NBA Hall of Fame coach Larry Brown. Dunn’s corporate clients include Adecco, Beal Bank, Benihana, Cawley Partners, Match.com, Rent-A-Center, and Outback Steakhouse.

In 2021, 2022, 2023, and 2024 Dunn was included in D CEO Magazine’s Dallas 500 list, which recognizes the most influential business leaders in North Texas. He has been named a Texas Super Lawyer every year that award has been given and recognized as one of the top 100 attorneys in Texas by Texas Monthly (a Thomson Reuters service) and a D Magazine Best Lawyer 15 times.

grazerobotics.com

CLXV • GRANITE • HILLWOOD • JLL • KE AND REWS

MUNSCH HARDT KOPF & HARR • PLAINSCAPITAL BANK • PROLOGIS

TRAMMELL CROW

ALLIANCE ARCHITECTS • ALSTON CONSTRUCTION • BIEL PARTNERS

BILLINGSLEY • BRADFORD • CAWLEY PARTNERS • CBRE

CENTERPOINT • CHAMPION PARTNERS • COLLIERS

CONSTELLATION REAL ESTATE PARTNERS • CTI

CUSHMAN & WAKEFIELD • ECS LIMITED

HOLT LUNSFORD COMMERCIAL • IDI LOGISTICS • JACKSON SHAW

KDC • KFM • LINK LOGISTICS • LOGISTICS PROPERTY CO.

MAJESTIC REALTY • MCADAMS • METHOD ARCHITECTURE

ML REALTY PARTNERS • MW BUILDERS • PAPE-DAWSON

PARTNER ENGINEERING • PEINADO CONSTRUCTION

PIEDMONT OFFICE REALTY TRUST • PRIMERA • RINER ENGINEERING

RYAN COMPANIES • RYAN LLC • SEALY & COMPANY • STREAM REALTY

TRANSWESTERN • VANTRUST

ARCH-CON CORPORATION • AUSTIN COMMERCIAL • CORE5

FCL BUILDERS • JE DUNN • LAS COLINAS ASSOCIATION

MOSS ADAMS • MYCON

RIDGEMONT CONSTRUCTION

David began his time with the Dallas YMCA as a member of the Board of Directors in 1998, and after 9 years of volunteer service, he became a member of the sta as Chief Financial O cer in 2007. During his time at the Y, David has helped the organization grow in service area and revenue and negotiated financing of several new YMCA facilities, and the renovations of many others.

Most recently, he managed the New Market Tax Credit process to help fund the building of a new Park South Family YMCA in South Dallas. And, in 2023, David’s expertise led the YMCA of Metropolitan Dallas to become one of the few, if not the only, large YMCA in the nation with no debt, a crowning achievement of his illustrious career.

David began his career as a sta auditor with Touche Ross in Downtown Dallas, after graduating from Austin College. During his career he has worked in a variety of industries, including serving as CFO of one of AT&T Wireless’ divisions for many years.

David’s work has long been recognized, as he was previously named Dallas Business Journal’s CFO of the Year in 2018, and a finalist for that same award in 2010.

We are grateful for your exemplary work, and we celebrate your accomplished career!

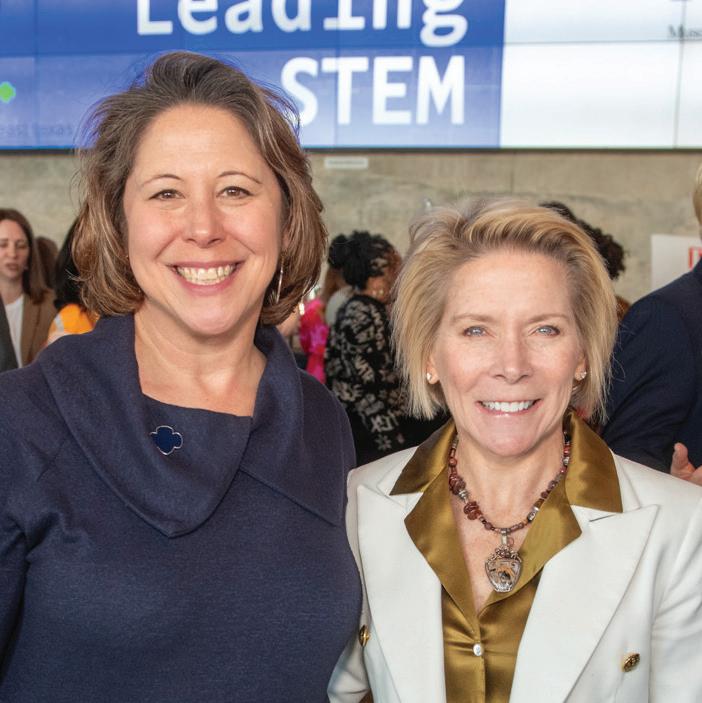

d ceo welcomed about 250 guests in February to its third annual Women Leading STEM luncheon and forum. The event, held at the Perot Museum of Nature and Science, brought together the region’s leading thinkers, pioneers, and executives who are paving the path for more women in the fields of science, technology, engineering, and math. Noelle LeVeaux, publisher of D Magazine Partners, welcomed the guests. Expert panelists included Linda Silver, CEO of the Perot Museum of Nature and Science, Marissa Horne, a VP at Capital One, and Jenn Makins, the executive director of STEM for the Girl Scouts of Northeast Texas. The panels were moderated by LeVeaux and Christine Perez, editor of D CEO. A huge thanks to title sponsors Amazon, Capital One, Thomson Reuters, and Slalom for supporting this inspirational event.

You’ve worked hard to build your organization. We’re driven to boost your efforts with a forward vision that helps unlock your potential. Our driven professionals listen to understand, respond with care, and consult with purpose to deliver an Unmatched Client Experience ®. Discover how our uncommon commitment to excellence can help prepare you for what’s next.

d ceo annually recognizes the region’s top real estate pros who generate the most revenue for their companies with its Power Broker Awards. This is the 16th year for the one-of-a-kind program. The 2024 class was celebrated on Feb. 22 with an exclusive event at the iconic Bank of America Plaza. This year, 108 firms employing more than 4,000 brokers participated; only the top 20 percent of those individuals make the Power Brokers list. The program’s special Legacy Award was presented to Jack Gosnell of CBRE, a retail force in the development of Uptown as a district who helped brand and market the area. Thank you to our founding host sponsor Bank of America Plaza, title sponsor Downtown Dallas Inc. and signature sponsors Allen EDC, Farmers Branch, and Mansfield for their support.

Congratulations to Munsch Hardt Shareholder Luke Lechler for being selected as an “Emerging Leader of the Year” finalist for the and Association for Corporate Growth 2024 Mergers & Acquisitions Awards!

Luke Lechler Corporate & Securities Entrepreneurial Client Group Leader

In the fickle world of fashion, knitwear giant Ming Wang is rooted in tradition. That heritage is carrying the $45 million luxury brand into the next generation.

Financial executives share how they empower employees to think like entrepreneurs to navigate the headwinds of a challenging market.

As with everything else, generative AI is primed to revolutionize how M&A is approached. The market is already seeing early adopters

pave the way. about 70 clubs across the largest golf course operator in the States. But the arc has only just begun.

Arcis Golf owns and operates country, making it the secondGoing

photography by

it happened in an instant, but everything played out in slow motion. I was making my way down a steep run in early March when a skier in front of me unexpectedly turned and entered my path. It was my boyfriend, looking up the mountain to check on me. “I can’t stop,” I told him, in the moment before impact.

It was surreally slow; that’s what I remember. I don’t remember the collision, my skis flying o , or careening down the slope. The next memory I have is lying on the ground, trying to shade my eyes from the bright sun. Answers I gave to questions compelled our ski guide to radio for help. (I was confused and had temporary amnesia.) Ski patrols put me on a toboggan and took me to an onsite ER at Breckenridge, where I was diagnosed with a concussion.

I called my twin sister the next day to get her advice; she had experienced a similar injury about a year prior after slipping on some ice. “You won’t realize this now,” she said, “but it’s a gift.”

I was banged up physically and felt overwhelmed with work that needed to be done and the pressure of others depending on me. But a few weeks into my recovery, I’m beginning to understand what she meant. Forced to break up my work into smaller, manageable pieces, I’m bringing a better focus and awareness to each task. Faced with limitations, I’ve had to reevaluate the expectations I place on myself. And having to rely on others is teaching me to let myself be cared for and has made me even more grateful for those around me.

It hasn’t been easy. I’ve had to be reminded to slow down as symptoms randomly recur. I’ve gotten frustrated when words don’t come as easily as they once did. “Give it time,” my sister warned. “It’s like you’re trying to walk on a broken foot.”

Through it all, I’ve found that by eliminating a lot of the noise, I can more easily hear myself. And not being able to do all I want has helped me see what I miss most— and what is truly important.

Sometimes, losing your balance can help you fi nd it.

Christine Perez Editor

Christine Perez Editor

PlainsCapital Bank is here to help you turn a possibility into a reality. We have business loans and nancing solutions that t your business needs. Our dedicated team will guide you through the process and continue to provide support for the lifetime of your business.

Whatever your next step is, we have the loan to help your business grow.

• Make capital improvements

• Expand your inventory

• Open a new location

• Get more working capital with a line of credit

Qualifying applications for loans from $10,000 to $100,000 will receive an o er within 24 hours. Talk to a loan o cer to get started today!

PlainsCapital.com

The entire Thryv team congratulates Cameron for his great accomplishment and dedication to helping small businesses thrive.

CAMERON LESSARD

AVP Investor Relations thryv.com

• Sale of GTI Group, a portfolio company of Novacap, to Canada Cartage, a portfolio company of Mubadala Capital (December 2023)

• Sale of Fortbrand Services, a portfolio company of Wincove Private Holdings, to Basalt Infrastructure Partners {September 2023)

• Structured equity investment in lntermodal Tank Transport by Apollo Infrastructure Funds (August 2023)

• Majority recapitalization of W&B Service Company by Stellex Capital Management (December 2022)

• Sale of Total Transportation Corp. to First Student, a portfolio company of EQT Partners (June 2022)

• Sale of XPO Logistics' lntermodal Division to STG Logistics, a portfolio company of Wind Point Partners and Oaktree Capital Management (March 2022)

After moving the company’s headquarters to Dallas last year, CEO Nick Je ery has built the formerly bankrupt enterprise into the country’s largest pure-play fiber provider.

Nnick jeffery says he fell into telecom by accident. Growing up in the U.K., his father was an artist by trade and a Royal Air Force navigator in the Second World War. His mother was a primary school teacher. He jokes he was useless at both art and education. He was a less-than-stellar accountant, which was his first job after earning an economics degree in England at the University of Warwick.

He shifted gears and opted to try his hand as a graduate trainee at Mercury Communications, a startup built to rival the U.K.’s largest cable providers. It was there that he found a “canvas to paint on,” the CEO says. “Because the company was so new, nobody had ever done anything like it before,” he continues. It was the perfect place to learn—and it did not take long for him to make an impact. Jeffery built out a B2B phone service wholesale revenue stream for Mercury, and by the time he was 25, the P&L grew to £400 million—eventually the P&L ballooned to more than £2 billion.

He went on to form Vodafone’s Internet of Things connectivity unit from scratch, a software solution that connects more than 150 million global devices to a range of network technologies. It produces about £1.2 billion for the conglomerate. Jeffery also created Vodafone’s B2B operation—a unit that now accounts for about £12 billion in revenue.

Both opened the door for him to resurrect the company’s home market. At the time, revenue

and EBITDA were shrinking. “The business was written off,” he admits. “But after five years, our EBITDA growth was in the double digits.”

Come 2020, Jeffery moved to the U.S. to take on a new role as the CEO of Frontier Communications. He was to turn around and completely remake the bankrupt internet provider, which was founded in 1935 as a public utility corporation. Like Vodafone’s home market, Frontier’s revenue was shrinking, EBITDA was sinking, and customer satisfaction was low. After filling out his C-suite and hiring an entirely new board over video calls, Jeffery questioned if Connecticut was the right home base for the company.

Despite never visiting DFW, he says, “I knew it was a city of opportunity.” So, in 2023, he planted Frontier’s global HQ in Uptown.

Over the next decade, Jeffery expects Frontier to create and retain 3,000 local jobs and generate $3.8 billion for state and local economies. Early returns suggest the move has paid dividends. In 2023, for the first time in over 10 years, Frontier delivered positive adjusted EBITDA growth. Its total revenue was $5.75 billion and adjusted EBITDA $2.13 billion.

Of course, the relocation isn’t the only factor. Jeffery guided Frontier to shift its entire system from copper-based networks to focus solely on fiber broadband connections. Fiber moves at the speed of light and is less susceptible to interference from electromagnetic signals, weather conditions, or electrical resistance—making the connections more reliable than traditional copper connections.

Since taking over, Jeffery has led Frontier to double its fiber footprint. In a few years, the company will have more than 10 million fiber locations built out. It currently has about 6 million locations established and has been building at a pace of 1.3 million homes a year.

Jeffery has also helped raise about $3 billion in debt through traditional markets for Frontier and another $2.1 billion through a securitization—becoming the first publicly traded company in the U.S. to secure funds backed by fiber-to-the-home assets. “We’re already a successful American turnaround story,” he says. “We’ve already grown to become the largest pure-play fiber provider in the U.S., and I don’t see that changing.”

Nick Jeffery is gaining market share at the speed of light.

Fiber penetration in the United States is low by international standards—the technology can only be accessed by about 56 percent of U.S. markets. In other developed economies across the globe, fiber is present in up to 95 percent of households. In the U.S., legacy cable companies like Charter and Comcast are the competitors that own the market share that Frontier is attempting to take. According to Jeffery, the two brands have had a free run of it for decades. By many standards, though, fiber is the best technology for internet connection within homes that have numerous internetdependent devices.

But Frontier is slowly converting its copper wire across the country into fiber passing 3,500 connections daily. “Fiber moves at the speed of light, and it’s pretty hard to go faster than that,” Jeffery says.

As a financial planning and wealth management firm based in Dallas for nearly 50 years, we understand the pride that can only be earned by forging your own way, leading others down innovative paths, and taking calculated risks that allow you to achieve your dreams. Our firm is, and always has been, independent, never answering to a parent company or stockholders with agendas that contradict what is right for clients. Our 16 Certified Financial Planner practitioners remain proudly, fiercely independent, ensuring your needs come first. We sleep well at night, knowing we’ve worked hard to do the right thing for every client, every time. In today’s financial environment of aggregation and consolidation, how independent is your financial advisor?

as ceo of the world’s largest diamond jewelry retailer, a position she was appointed to in 2017, Gina Drosos leads an organization of nearly 30,000 whose brands include KAY Jewelers, Zales, Jared, and more. Under her leadership, Signet’s market capitalization quadrupled from less than $1 billion at the start of the pandemic to $3.9 billion today. The former president and CEO of Assurex Health and group president of consumer goods giant Procter & Gamble, her influence extends beyond business; earlier this year, Drosos was appointed to the executive committee of the U.S. Golf Association. She says she loves seeing the fresh thinking happening in retail and the jewelry industry. “I’m very excited about Gen Z’s values and relentless focus on diversity, equity, inclusion, sustainability, and authenticity—all things to make the world a better place,” she says.

EDUCATION:

University of Pennsylvania (MBA), University of Georgia (BBA)

BIRTHPLACE: Macon, Georgia

FIRST JOB:

“My first ‘job’ was helping my grandmother at the golf driving range she owned and operated. Every morning, we picked up golf balls from the night before, washed them, and filled the buckets before opening time.”

BEST ADVICE:

“Play to your strengths and build a diverse team around you. We all have skills and talents that we bring to every situationlean into those. The more you grow and develop them, the stronger a leader you can become.”

LOCAL FARE:

“I love the Tango Room

in the Design District. It has a speakeasy vibe. The deviled egg caviar, filet, and lobster mac are to die for. And the wine list is truly special.”

KEY STRATEGIES:

“The most rewarding challenges I’ve faced—and the biggest business successes—were the ones that demanded transformational change.”

FIRST CAR:

“A white AMC Rambler named Rosy. She was almost 20 years old and on her last leg.”

HOBBY/PASSION: “I love being outdoors, surfing on the lake, hiking, walking on the Katy trail with my dogs, or playing golf. Being immersed in an activity like that helps me relax and rejuvenate.”

I COLLECT:

“Friends and experiences,

not things. I learn so much from every interaction. I’m part of all that I have met.”

GO-TO ADVISER:

“I have several mentors I can call on in tough situations when the way forward is ambiguous. They are each very helpful but in di erent ways. The common thread is that they don’t give me advice; they ask me questions that make me think and see things di erently and often more clearly.”

FUN FACT:

“This summer, my family and I hiked Jostedalsbreen in Norway, the largest glacier in mainland Europe. It was quite the adventure and the trip provided a unique view of the world’s breathtaking natural beauty.”

DESTINATIONS OF CHOICE

“For business, I visit our stores as often as I can. I love the pulse of the retail environment and being close to our team and customers. Personally, there’s nothing better to me than a fall Saturday afternoon at Sanford Stadium, home of the University of Georgia Bulldogs.”

GUILTY PLEASURE:

“Homemade chocolate chip cookies straight out of the oven—when they are still gooey.”

MEMBERS ONLY

99 Proof Partners’ Tucker McCormack also owns The Algiers, a private spirits club in the Design District.

the seeds of tucker m c corMack’s future were planted when he was in school in Washington, D.C., blocks from the Jack Rose Dining Saloon, which at the time had one of the largest whiskey libraries in the world. He later combined his skills and passion through consulting for early-stage spirits brands. McCormack is a member of the Dallas Bourbon Club and owns and operates the members-only Design District spirits space The Algiers. He co-founded 99 Proof Partners in the fall of 2020. It organizes the funds of individuals and family o ces to connect investors with brands they enjoy without annual management costs and just a one-time 2 percent closing fee. The firm manages $5 million in assets and requires a $25,000 minimum investment. “If there is a top deal that we’re excited about, we help businesses raise capital because the creators are making product and don’t know how to raise money,” McCormack says. —Will Maddox

The bigger the business, the faster the pace. More payments. More transactions. More to manage. More to think about. At Cadence, we’ve got the scale and sophistication to keep up with you, with a dynamic, secure technology platform built for business backed by a commercial banking team focused on you.

Our approach to relationships is what makes us your bank. Visit or call us today to find out how we can help you achieve your potential.

Kevin Lavelle brings his innovative touch to the world of baby monitors with Harbor’s remote night-nanny device.story by WILL MADDOX

for new parents, the first months of a child’s life are always a mixture of inexplicable joy and constant exhaustion. A night nanny can help them get their rest in the early weeks, but the service is not affordable or accessible for most. Dallas-based Harbor came out of stealth mode this year with a tech-enabled baby monitor device that provides access to a remote night nanny to ensure the baby is safe and that every noise doesn’t awaken parents. Harbor co-founder and CEO Kevin Lavelle—the mind behind performance dress shirt company Mizzen + Main—raised $3.7 million in seed funding for the startup. Early investors include former NFL quarterback Tim Tebow, former tennis star John Isner, current NFL punter Thomas Morstead, and Dallas investor Rogers Healy.

Harbor’s video monitor is like most high-end devices but isn’t dependent on Wi-Fi. It provides remote access via an app and can record and rewind. What separates it from others is the option to upgrade to a dedicated remote human who monitors the situation and can turn down the device’s volume in the parents’ room and watch the child sleep through the night. If the baby makes a noise that doesn’t warrant immediate attention, the remote worker won’t notify the parents, allowing them to sleep knowing their baby is being closely watched. If the disturbance doesn’t resolve itself quickly, then he or she will raise the volume on the parents’ end to let them know that it is time to feed or comfort their child.

Lavelle, a father of two, knows how much interrupted sleep can impact the rest of the family and one’s mental health. “It changed our sanity and our marriage; there’s this sense that there’s hope tonight,” he says of his innovation. “When you go days without sleep, it’s a dark time.”

SLEEP WELL

Harbor launched its waiting list in February, is hosting a pre-sale by June, and plans on shipping its first devices this summer. It has hired a director of nursing and is building up its corps of night nannies, with US-based and Philippines-based nannies. As the name suggests, Lavelle hopes the device can provide relief and keep families humming. “Ships are meant to be out at sea but have to recharge in the harbor,” he says. “Then they can conquer and explore and do all the things they are meant to do in the world.”

D CEO proudly launched its inaugural 2023-2024 Emerging Women Leadership Network last year, and we are now looking ahead to the future. Sponsorship opportunities are available for companies seeking to showcase their commitment to women’s leadership and join a premier regional development program. Please contact Rachel Gill, sales manager, at Rachel@dmagazine.com for more information on how your company can get involved.

Since selling his tenant rep powerhouse Mohr Partners, the longtime industry pro has focused on the investments side of the game.

like many of his midwestern peers, bob Mohr left Indiana in the mid-1980s to pursue a commercial real estate career in Dallas. The market was hot, and there was money to be made. But within two years, conditions had drastically changed. Banks were failing, the S&L crisis was taking hold, office buildings that had sprouted up were sitting empty, and no deals were in sight.

The developer for whom Mohr worked wanted to take away his salary and shift him to a commission-only role. Instead, the industry upstart decided to go into business for himself and focus on the emerging specialty of tenant representation. “I worked out of an executive suite someone let me use, and my wife helped me,” Mohr says. “I didn’t have much money to invest in buildings at the time, and I thought that, frankly, tenant reps and corporate folks—nobody wants to hear this— make an obscene amount of money for what they do. You know, you renew a lease and get paid 4 percent of the gross. So, I thought that might be a good area to focus on.”

His first deal was a 3,000-square-foot lease for Christian Broadcasting Network. Initially, business centered around renegotiating agreements for tenants. As the real estate market rebounded, Mohr Partners grew. Clients asked him to do what he did in Dallas in Atlanta and other markets, and the firm evolved to specialize in multisite, multi-year agreements for national tenants. By 2017, after 31 years of growing and running his company, Mohr was ready for a fresh challenge and sold the firm to then-president Robert Shibuya in a management buyout. (Shibuya now serves as chairman and CEO and is major-

ity shareholder.) Mohr Partners had 18 offices at the time; today it has 24 and is among the world’s largest tenant-only advisory firms.

“I had done the same thing for so many years, and intellectually, as much as anything, I was ready for something new,” Mohr says. Retirement, however, was not in the cards. He had quietly begun a capital markets side hustle in 2000 and decided to double down on investments via his family office. Things have gone well.

Through Mohr Capital, he has bought and developed projects across the country—retail, industrial, hospitality, and office, and he may expand into student housing, too. In Dallas, he put about $2 million into a 12-story office tower at 4851 LBJ Freeway he bought in 2020 and has nearly filled it up. Among other improvements, he upgraded the building’s cafe and brought in noted Dallas chef James Rowland to run it. “I also used the old Trammell Crow model of hiring a good security guy who knows everyone,” Mohr says.

He’s currently making $7 million in capital improvements to a hotel in Austin and developing a 705,000-square-foot logistics park in Surprise, Arizona. That project, in partnership with Rosewood Property Co., is the first in which he has taken outside equity. Looking ahead, Mohr intends to pursue more hospitality deals. “There are many moving parts, but the yields are so much better if you can hit it right,” he says. He’s also working on a flurry of industrial acquisitions, but intends to proceed with caution on office buys. “Values are down 35 percent,” he says. “There are going to be some great opportunities; you just have to wait for the timing to be right.”

In the fickle world of fashion, knitwear giant Ming Wang is firmly planted in tradition. That commitment carries through as the next generation takes control of the multimillion-dollar brand.

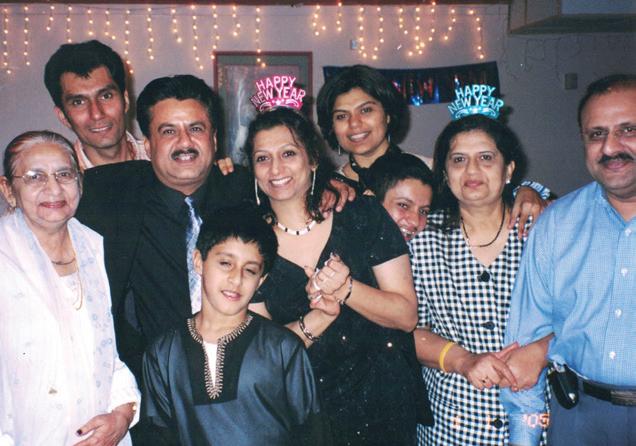

Steven Wang’s parents have trusted him to carry the baton for the family business into the future; his focus every day is not to drop it. Since he joined Ming Wang, a women’s knitwear company that’s now a foundational part of a $45 million group of brands, he has had his work cut out for him—just based on his last name.

Steven joined his parents’ then-fledgling company in 2002 as a sales rep after earning degrees in economics and Asian studies from the University of Michigan and doing M&A work in Chicago. Sitting in his first sales meeting, Steven braced for how the others would react to him. “I remember getting hazed in the beginning because I was the owners’ son; they called me ‘college boy,’” he recalls. “Any ideas I had were immediately shot down.”

The ribbing didn’t last long.

Steven, now 47, took over as CEO of the organization in 2012. Today, he also sits at the helm of Meison, which encompasses the knitwear giant and four a liated brands. (See sidebar on page 41.) In the pressure-filled world of fashion, no one puts more heat on Steven than himself.

“I come to work every single day not wanting to be the guy who runs his parents’ business into the ground,” he says. “I know the business has evolved into a completely di erent organization from the day I started. But I also realize that I get to be a part of something here. It’s the legacy I want to protect for my parents.”

Steven’s mother, brand namesake Ming Wang, started the fashion line with her husband Eddie out of a two-bedroom apartment they shared with another family in Queens, New York, more than four decades ago. Even though he was very young at the time, Steven remembers his parents worrying about how they would make money after emigrating from Taiwan.

They decided to pin their hopes on fashion. Eddie, now 72, and Ming, 74, began attending classes at the Fashion Institute of Technology—one during the day and one at night. At the suggestion of a friend, Ming took up knitting to earn a living and found that she had a talent for designing knitwear. Eddie sold the custom products she made door-to-door, and the small hustle turned into Ming’s eponymous clothing brand.

These days, Ming continues to work at the company about four hours a day, but Eddie has since retired. They’re content to let Steven run the enterprise, wherever he may take it. In 2006, that trust in his leadership brought them to Dallas. Twenty years earlier, the company, which was mostly manufacturing for other fashion brands, established its own Ming Wang label and moved from New York to Miami. The Wangs were comfortable in South Florida, but the cost of doing business in the Sunshine State caught up with them.

Following Hurricane Katrina, flood insurance premiums worsened real estate prices in North America’s hurricane alley. What’s more, the location at the base of a peninsula

was less than ideal for Ming Wang’s distribution chain. However, Ming wasn’t keen on relocating the company or the family out of Florida, and the debate resulted in a clash between Steven and Eddie. “Dad was like, ‘Alright hotshot, alright big guy, where do you suggest we move the company?’” Steven says. “But my mom felt comfortable enough that if my dad and I could hash it out, that was enough for her.”

Steven focused his search on Southern California, the Pacific Northwest, Atlanta, Memphis, and Dallas. Almost immediately after landing in North Texas, he knew it would be the right fit for Ming Wang’s new home. “I got here, and it just felt different,” he says.

Meison now employs about 80 people in North Texas, New York, and Atlanta. About half, including Steven’s brother Eric, who serves as president

and director of administration, operate out of the headquarters and distribution center in Grapevine. The rest are spread out among New York and other locations. Manufacturing is done in China, India, Vietnam, Portugal, Indonesia, and Turkey, but some final inspections are done in Grapevine before the garments are shipped to retailers.

The Wang family has watched countless trends come and go. And although the temptation has been high—and opportunities plentiful—to enter di erent segments, including loungewear, men’s apparel, and even shoes, Ming Wang hasn’t veered outside the lines of high-end women’s fashion.

Even with uber-casual clothing and loungewear leading the charge during and after the pandemic, Steven says the brand was not swayed to add what

From the start, knitwear designer Ming Wang has focused on intricate attention to detail, the use of highquality materials, and intentional cutting. This customer-centric approach helped the company grow by 28 percent in 2023.

were then wildly popular items, such as yoga pants and hoodies, to its line. Others have approached Ming Wang over the years with opportunities to enter new niches and expand overseas. Steven says some of the propositions excited him at the time, but the answer was always no.

The first yes, however, came in the form of its first-ever licensing agreement in 2012 with New York-based Authentic Brands Group for the knitwear brand Misook. Steven says the decision required much deliberation. But licensing ended up dovetailing so smoothly with Ming Wang’s business that the company later entered into similar agreements

with Masai Copenhagen, Jones New York, and Kasper. In 2021, the corporate entity Ming Wang was rebranded as Meison. “The change was made to prevent any confusion with our strategic partners, ensuring clarity in how we communicate as a brand and a corporate entity,” Steven says. “Drawing a parallel, in 2017, Coach rebranded to Tapestry Inc. when it acquired Stuart Weitzman and Kate Spade. Our move was similar to theirs.”

Initially, Ming Wang handled wholesale licensing for Misook. But after just two years, Authentic turned over the online side of the Misook business to Ming Wang, too. Jarrod Weber, group president of lifestyle and chief brand officer at Authentic—which has more than 1,500 partnerships—says Ming Wang’s management of the Misook line has been “nothing short of remarkable.”

“Steven looks at the business from 10,000 feet above,” Weber says. “It doesn’t matter what the item or widget is; he looks at it with a methodical approach.”

That careful approach has held Ming Wang within specific parameters over the years; the company is quick to stay on top of trends but with its own refined twist. In response to the loungewear craze during the pandemic, for example, Ming Wang added more casual touches to its existing lines. The Misook line rolled out a “cozy cashmere” collection that included cashmere sweaters and cashmere wraps paired with more casual pants—a far cry from stretchy pants and athletic-fabric T-shirts that were gaining in popularity.

“After Covid, there were a lot more relaxed and loungewear products across most of our brands, and we did have to change and really get after it to provide that solution because that’s what our customers were looking for,” Steven says. “All of the brands that were exclusively focused on that are not nearly as viable today as they were three to four years ago. We see it as our job to maintain what’s true to the brand.”

The pandemic put other pressures on the company. Many of the stores that carry Ming Wang and Meison’s licensee brands were shut down for months, forcing the business to rely on e-commerce sales. Although Ming Wang has never taken on out-

side funding, the financial strain required the company to trim its workforce and take on PPP loans from the government to retain as many employees as possible and stay the course. Steven says the experience was a stark reminder that no matter how good success feels, companies must stay humble.

Even with subtle adaptations, Ming Wang has always stayed true to its key customer base of women between the ages of 35 and 55. The brand’s high-end pieces—a jacket or blazer can run upwards of $360—range in size from XXS to XXXL.

Jay Rodgers, a Dallas founder of nonprofit Biz Owners Ed and more than 20 companies, has served as a longtime mentor to Steven. He believes that part of what has made him successful is his willingness to seek out advice from others, even though Rodgers believes Steven is frequently the most intelligent person in the room. “He is so smart, yet he is so open to learning,” Rodgers says. “Instead of accepting problems, he jumps at them. He is wide open to accept the thinking of others.”

It was counsel from others that led Steven to hire Meison’s first-ever brand and integrated marketing manager to spearhead its social media presence and spark and maintain relationships with fashion influencers. The goal is to heighten its respected brand awareness across more consumer segments.

With Ashley Bevans in the newly created role, Ming Wang is working on an agreement with a Dallas-based social influencer to help elevate the brand. Bevans, who has served as social media manager for Sally Beauty and Beauty Bio, says she has been surprised by the 45-year-old company’s willingness to understand and embrace the importance of social media’s role in fashion. “I can honestly say that the ideas have been so well-received, and, more importantly, the company has been quick to take action,” she says. “That is not something you come across very often. With a lot of leadership, there can be dragging of heels because influencer marketing can be pricey.”

In the early days, the Wangs ran their company on a shoestring budget—it was launched with less than $20,000 borrowed from Eddie’s father. But the popularity and staying power of the Ming Wang brand—and the lucrative licensing agreements—have transitioned Meison into a fashion powerhouse that generates $45 million in annual revenue. Steven says the company has seen year-over-year double-digit growth through retailers such as Neiman Marcus and Nordstrom, even as consumers remain nervous about inflation and the economy. He credits that growth to the ability to boost engagement via online platforms as well as maintaining sales with brick-and-mortar retailers, all while identifying and filling in brand-aligned gaps based on customer demand.

MING

Steven never wants the company to lose its edge. “I still view us as a startup,” he says. “Who we are today is not who we were five years ago and five years before that … We can’t lose focus.”

KASPER

RETAILERS:

Financial executives share how they empower employees to think like entrepreneurs to navigate the headwinds of a challenging market.

LUSITANIA WAS THE FASTEST SHIP IN THE WORLD in 1915, having crossed the Atlantic more than 200 times at record speed. For a while, it was also the largest passenger ship on the seas, transporting nearly 2,200 passengers and 850 crew between the U.K. and the U.S. Believed to be unsinkable, a German U-boat took down the vessel with one torpedo during World War I, catalyzing America’s entrance into the conflict. When the ship went down, nearly 1,200 passengers and crew died.

The outsized loss of life was due in part to a lack of training and independence. Passengers and crew members assumed those in charge would protect them. However, the captain and other leaders did not prepare those on board for an emergency, and the results were tragic.

Although a CFO’s decisions are rarely as consequential as those made at sea on a WWI ocean liner, the same skills and leadership qualities are needed to achieve success. After speaking with several financial executives about the choppy economic waters of 2023 and how they steered their organizations through them, problem-solving and readying others for leadership emerged as essential strategies. Investing in the development of teammates is a long-term move that may be time-consuming on the front end but pays dividends down the line—just as life jacket training could have saved the lives of hundreds of Lusitania passengers.

Here’s a look at how some winners in D CEO’s 2024 Financial Executives Awards ensure their teams are prepared.

Inflation and ensuing high interest rates in 2023 pushed typical capital providers into conservation mode; inves-

tors moved to protect their portfolios, and corporations focused on profitability versus the risks of growth. For service providers, these conditions created challenges in landing new clients or renewing existing contracts, but resilient financial executives navigated the troubled waters.

“I have always believed in the importance of managing for the uncertain,” says Pascal Desroches, CFO at AT&T. “It is important to have several contingency plans and ensure you are in a position to deal with inflation and the unknowns that come with that.” For an essential business such as AT&T, Desroches isn’t too fazed by the immediate conditions and is focused on the long term, continuing to invest in employees and infrastructure even in hard times. The networks AT&T builds and invests in today will be needed several years in the future, so maintaining a company’s north star is essential to continued profitability.

But not every business can head straight into the economy’s rogue waves and be unscathed. Smaller firms without hefty capital reserves may have to avoid the proverbial U-boats, change course, and find other opportunities.

Such was the case for Dallas-based Davis Davis & Harmon CEO Chanel Christoff Davis, who pivoted during the pandemic to take on less traditional roles in tech. What was a sales tax consultancy took on an I.T. project to save the company. More recently, it ventured into oil and gas. Even though her company didn’t have much experience in the field, Davis built a team fit for the job. “It was unexpected, but we had to be scrappy,” she says. “Oil and gas keeps us on our toes, but we’re excited about our business.”

Leaders at o9 Solutions found that 2023 forced them to look inward. The maker of software that helps other firms predict demand for its products, o9 used its platform to measure its own prospects and plan parts of its business. What the Dallas company found was that the trends that had helped the company grow 1,000 percent in the last five years would continue in 2023.

Armed with data, o9 doubled down on client satisfaction strategies. “Eating our own dog food paid off,” says CFO Anand Govind. “Extreme financial literacy was important. At our scale, there was no way we could execute without it.

An essential component of preparing for success during tough times is empowering leaders at all levels of the com-

pany to be problem-solvers and think like stakeholders. At o9, Govind says he strives to achieve this by making sure future leaders are invested in the company’s success and developing a culture where people can bring their entire selves to work and where their passions will be supported.

The firm uses an initiative-based management style that dissolves hierarchy and allows employees at different levels to lead various projects. “We have a highly entrepreneurial culture,” Govind says. I could lead one initiative, support another as a contributor, and report to that person. That ethos prevails in our culture.”

Financial executives who encourage their employees to think like leaders reap the benefits, especially in tough financial times when creativity becomes even more important.

Davis’ firm is small enough that she often identifies how employees can help by assuming leadership over different projects. She works with new employees to foster unique development strategies. When she identified a quieter employee to take the lead on new software implementation for the company based on her specific experience, the impact was immediate and sizable. “We took a person who may have been overlooked elsewhere and gave her a voice,” Davis says. “She is doing a phenomenal job.”

At a company that is as essential to the American economy as AT&T, Desroches knows he needs to be a coach or captain of the financial ship. He can’t play every position and isn’t on the front lines to solve every problem. He endeavors to eliminate control for control’s sake in the finance department and allow his team to fight the battles before them.

“My goal is to hire good people, allow them to do their thing, give them resources, and eliminate obstacles,” he says. “I want them to think, ‘If this were my company, what would I do? How would I organize it?’ It is important as leaders to employ that mindset.”

JUDGES: Joining D CEO editors to select honorees in the 2024 Financial Executive Awards, presented in partnership with the Association of Corporate Growth Dallas-Fort Worth, Financial Executives International DFW, and TXCPA-Dallas, were Sharon Adams of Thomas Edwards Group, Jennifer Cuello of EisnerAmper, Ray Estep of Estep Growth Partners, Jay Smith of Jefferson Wells, and Austin Waugh of First Liberty Institute.

CONSTANTINE “CONNIE” KONSTANS AWARD

Mahesh Shetty, ILE Homes

CFO: LARGE PUBLIC

Anand Govind, o9 Solutions

Dylan Bramhall, Energy Transfer; Jackson Hildebrand, MB2 Dental; Austin Robertson, Rogers-O’Brien Construction

CFO: LARGE PRIVATE

Henry Moomaw, U.S. Oral Surgery Management

Jared Day, Compass Datacenters; Rudy Gonzalez, Ansira; Erik Laney, Santander Consumer USA; Elizabeth Reich, Dallas Area Rapid Transit

CFO: MIDSIZE PRIVATE

Andrea Hulcy, Tolleson Wealth Management

Jimmy Dockal, SRS Real Estate Partners; Jeff Jones, Twisted X Global Brands; Keegan Smith, Bright Realty; Brandon Standifird, U.S. Energy Development Corp.

CFO: SMALL PRIVATE

Dinesh Parbhoo, ILE Homes

Marla Beckham, Cyber Defense Labs; Irma Gonzalez, Lerma/Agency; Sohail Hamirani, Mohr Partners; David Stark, OpTic Gaming

CFO: NONPROFIT

Jennifer Mitzner, Baylor Scott & White Health

Lindsay Clark, State Fair of Texas; Beth Edwards, Texas Trees Foundation; Amber E. Kinney, Mothers Against Drunk Driving; Larry W. McCoy, Klyde Warren Park; Anne Woods, Perot Museum of Nature and Science

INNOVATIVE FINANCE

TEAM: PUBLIC AT&T

INNOVATIVE FINANCE

TEAM: PRIVATE State Fair of Texas

CAO, CONTROLLER, OR

TREASURER: PUBLIC

Sandra Schneider, ZimVie

Travis Stricker, Primoris Services Corp.

CAO, CONTROLLER, OR

TREASURER: PRIVATE

Angela Monschke Hutson, Baylor Scott & White Health

Christy Philen, MCR Hotels

INNOVATOR IN FINANCE

Daniel S. Hoverman, Texas Capital Bank

David Bornowski, YMCA; Rory McCrady, JPS Health Network

INTERNAL AUDITOR

Vic Summers, Parkland Health

Danielle Okland, Texas Capital Bank; Saumil Patel, Globe Life; John Wauson, Weaver

PUBLIC ACCOUNTANT

Jennifer Norris, Saville CPAs & Advisors

John Baines, John E. Baines; Alyssa G. Martin, Weaver; Michael Nesta, KPMG

PUBLIC CONSULTANT

Chanel Christoff Davis, Davis Davis & Harmon

Mark Brown, VIP Management Consulting; Matthew Edwards, VIP Management Consulting

PUBLIC SERVICE

Mehran Assadi, National Life Group

Meg Campbell, formerly TXCPA-Dallas; Eric Holleman, FEI-Dallas; Kathryn Loo, Private Directors Association

Dallas-Fort Worth

EMERGING LEADER

IN FINANCE

Cameron Lessard, Thryv

Kimberly Casarez-Haro, Goodwill

North Central Texas; Lane Duncan, Cyber Defense Labs; Landon Timms, AllerVie Health

As with everything else, generative AI is primed to revolutionize how companies, attorneys, investors, and due diligence professionals approach mergers and acquisitions. The market is already seeing early adopters pave the way.

story by BEN SWANGERWITHIN THE NEXT THREE years, generative artificial intelligence is expected to be used in more than 80 percent of mergers or acquisitions, according to a study conducted by Bain & Co. For the most part, this won’t involve the ChatGPTs or the Copilots of the world but proprietary models built by computer scientists.

Currently, only 16 percent of mergers or acquisitions involve the use of generative AI. But early adopters are beginning to use models that are built in-house or by contracted programmers to source deals and sift through thousands of legal documents in minutes. Developers can build most models in just a couple of days.

And generative AI is accelerating at a pace we’ve never seen before in the tech space. “Knowledge work is being replaced by generative AI,” says Skip Howard, CEO of computer vision and AI company Spacee. “It’s not there today, but it’s moving so fast it will literally be there tomorrow.”

The marketplace will begin to see these tools emerge within the year, but how they’re regulated remains to be determined. After inputting datasets into proprietary models, generative

AI can produce a list of potential public and private merger or acquisition targets for the sourcing company. These models can also run simulations to measure financial performance after integration. During the deal process, these models can read through hundreds of thousands of legal and financial documents during due diligence, deal structuring, and integration.

“Forget how it has been done,” says Hank Olken, a local computer scientist and chief operating officer of consulting firm Highwire Ventures. “If everyone in M&A starts to use generative AI, things will work a lot more efficiently and smoothly.”

From a lawyer’s perspective, private equity specialist Scott Parel, co-managing partner for Sidley Austin’s Dallas office, believes AI creates more problems than it solves. “There’s certainly potential for erosion in the legal field as a result of generative AI—fewer attorneys and fewer hours,” he says. “But for every issue AI might solve, I think it creates three to four more issues. We’re already seeing an uptick in the need for legal work on AI litigation.”

Last year was on the slow side for M&A activity due to inflation, but with better rates, 2024 is set to be better. Tech experts foresee generative AI, which has already proven to work faster than humans on countless tasks, as a remedy that can turn around a stalled or negative market. “One of the best combatants to inflation is technological innovation—it is inherently deflationary,” Olken says. “Generative AI can absolutely spur M&A activity in a slow cycle.”

JUDGES: Joining D CEO editors to select honorees in the 2024 M&A Awards, presented in partnership with the Association for Corporate Growth DallasFort Worth, were Brooke Ansel of Prudential Private Capital, Daniel Boarder of Whitley Penn, Jay Desai of Kainos Capital Partners, Gary Golden of Media Culture, Rob Kibby of Munsch Hardt Kopf & Harr, Courtney Lewis of Cadence Bank, and Lindsey Wendler of 414 Capital.

DEALMAKERS

LEGACY

Tony Banks, RSM US

ATTORNEY

Abby Branigan, Vinson & Elkins; Jon Finger, McGuire Woods; Richard Frye, Weil, Gotshal & Manges; William Howell, Sidley Austin; Robert Little, Gibson, Dunn & Crutcher

DEBT PROVIDER

Courtney Lewis, Cadence Bank; Rob Swift, Woodforest National Bank; Chase Wildes, Sunflower Bank

DUE DILIGENCE

Duke Deen, Whitley Penn; Dane Harris, Bennett Thrasher; Brad Porter, Moss Adams; Mary Cathryn Rau, IMA Financial Group; Eric Young, Grant Thronton

INVESTMENT BANKER

Jared Behnke, Transitus Capital; Simon Martin, Hext Capital Partners; Jon Mueller, Exit Partners; Robert Rough, Telos Capital Advisors; Daniel Vermeire, Corporate Finance Associates

EMERGING LEADER

Emily Ackerman, Bennett Thrasher; Gage Dutkin, TKV-6 Strategies; Logan Fahey, Graze Robotics; Luke Lechler, Munsch Hardt Kopf & Harr; Wes Romanowski, Pinecrest Capital Partners

PRIVATE EQUITY (FAMILY OFFICE + INDEPENDENT SPONSOR)

Tanvir Arfi, Banyan Technologies Group; Tom Beauchamp, Surge Private Equity; Shaun Gordon, Astria Group; Patrick Hamner, Clavis Capital Partners; Joseph D. O’Brien III, AG Hill Partners; Teddy Saltzstein, Six Pillars Partners

Michael Bertrand, Crossplane Capital; Robert Covington, Braemont Capital; Kelly Ann Winget, Alternative Wealth Partners DEALS

$1 BILLION + Aligned Data Centers acquires ODATA; Avantax’s take-private sale to Cetera; Bain Capital acquires Fogo de Chão; Gigapower joint venture between AT&T and BlackRock

$250–$999 MILLION

Giampaolo Group and Rio Tinto’s joint venture between Matalco and affiliates; Kainos Capital acquires Evriholder Products; Park Cities Asset Management acquires Elevate Credit

$50–$249 MILLION

Braemont Capital invests in Incline P&C Group; GXO Logistics acquires PFSweb; IKS Health acquires AQuity Solutions; Medical City Healthcare acquires Wise Health System; Transition Capital Partners acquires Texwin Metal Buildings

UNDER $50 MILLION

Azalea Capital acquires Brittle-Brittle; Banyan acquires Competition Specialties; Fieldware acquires Uptrust and Orion Communications; Marco 4M Auto Parts acquires Texas assets from IEH Auto Parts Holding; MB2

Dental’s national network expansion; Pattison Sign Group acquires Chandler Signs; Surge Amuze Holdings acquires Pipeline Games

Arcis Golf in 2013. The new CEO quickly achieved a feat rarely seen in business: He earned a private equity investment prior to the company even earning cash. Now, Walker’s enterprise owns and operates approximately 70 clubs across the country, making it the second-largest golf course operator in the States—second only to Walker’s former company. But the arc has only just begun.

Blake Walker left ClubCorp to launch

story by BEN SWANGER portrait by JUSTIN CLEMONS

Blake Walker left ClubCorp to launch

story by BEN SWANGER portrait by JUSTIN CLEMONS

BBACK IN 2013, BLAKE WALKER WAS WORKING to take ClubCorp public. The Dallas-based private golf club leader had just reported more than $754 million in annual revenue. But while working through due diligence and pricing, Walker, then the company’s chief acquisitions and development officer, noticed how low the default rate was dropping in the industry. Walker identified an unprecedented opportunity to capitalize on approximately $3.5 billion worth of near-term debt maturities. So, the SMU grad’s gears started turning.

“I think I want to walk away,” he told his wife Karen, while strolling around their neighborhood with the family dog. “And, yes, eviscerate all my equity … I want to create a startup.”

the U.S., we could build an ecosystem of a much larger consumer segment.”

It turned out to be a good bet. Today, Arcis Golf—anchored by four pillars: health and wellness, experiential dining, lifetime sports, and arts and entertainment—owns and operates about 70 courses across the U.S. and employs 7,000 people. The brand is backed by private equity firms Fortress Investment Group and Atairos—combined, the two platforms hold more than $50 billion in assets. Arcis clubs range from those that charge a $30 daily fee for 18 holes up to private clubs that demand $90,000 in initiation costs and $1,000 in monthly fees.

In North Texas, it owns and operates Lantana Golf Club, Cowboys Golf Club, Gentle Creek Country Club, Bear Creek Golf Club, and more. It also recently acquired Champions Retreat, a 27-hole golf facility in Augusta, Georgia (and host of the Augusta National Women’s Amateur) as well as the prestigious Grayhawk Golf Club in Scottsdale (host of the men’s and women’s NCAA D1 National Championships from 2021 to 2023). “And we have a lot of interest in hosting a tour event at Grayhawk,” Walker says.

The only U.S. brand bigger than Arcis Golf is Walker’s alum, Invited. According to national golf broker Steve Ekovich, whose Leisure In-

It would not be Walker’s first stint as an entrepreneur—nor his first time leaving ClubCorp to do so. Ten years earlier, he left after several years as its SVP of acquisitions to found Pegasus Golf Partners. The golf investment company backed by private equity firm Carlyle Group grew to have a portfolio of 14 middle-market golf courses. But in 2009, Walker slowed his work with Pegasus and boomeranged to ClubCorp. After all, he says, the company leaders had set out a clear succession plan for him to move to the C-Suite. And it didn’t hurt that he foresaw a liquidity event in the brand’s near future.

Leaving again, even amidst an IPO, would be different. This time, instead of launching a company with an investment thesis, he’d start his new venture with an operational one. And rather than honing in on one asset class—for Pegasus it was middle-market clubs, for ClubCorp (which has since rebranded to Invited) it is high-end private clubs—Walker set out to create an ecosystem of golf assets scattered across entry-level, middle-market, and high-end daily fee and private clubs.

“I began to see how fragmented golf was,” says Walker, who Golf Inc. listed as the sixth-most influential person in the sport in 2021. “Golf was either high-equity private clubs or municipal courses and not much in between. So, if I could create a platform that owned everything from entry-level daily fee courses to high-end daily fee courses, and everything from entry-level private clubs to high-end private clubs in every major metropolitan area in

vestment Properties Group is the largest golf and marina brokerage in the U.S., Arcis Golf’s institutional value is around $1.5 billion—and is on track to grow higher. “Arcis certainly has an opportunity to reach $2 billion to $2.5 billion in institutional value in the near future,” he says. “I don’t know when or if they’ll eclipse Invited’s golf course business, but could they? Certainly.”

Craig Stamm, a veteran in private equity turned CEO of IT solutions fi rm Zyston, is even more confident. “I think that Arcis will not only pass Invited, it will become the largest player in the golf space,” he says.

W“WHAT’S THE WORST THING THAT COULD HAPPEN?”

Karen asked him on that walk. “If you fail, you’ll go get a job. If it becomes too much, just communicate that with me, and we can go in a di erent direction.”

After getting her vote of assurance, Walker flew around the country to meet with some of the industry’s most well-respected private equity fi rms and investors to pitch his concept. He went from L.A. to Aspen to New York City, hoping to receive feedback and guidance—that’s all he was seeking. Most private equity fi rms target heavy cash-flowing businesses.

“A part of me wanted them to say, ‘Are you crazy?’ Walker recounts. “’You’re working for a great company and are about to take it public; why would you do this?’” That wasn’t the response he got from Fortress Investment Group. Despite Arcis Golf not having any revenue or funding beyond Walker’s own pockets and quite literally just being an idea and not even a company at this point, the private equity firm agreed to back it.

“That’s so rare; it has never been done before except for Blake,” Ekovich says. Stamm doubles down: “There’s a lot of people who can come up with a billion-dollar idea,” he

says. “But there’s not many people who can fi nd the investors willing to cut a massive check for their business. Blake is both.”

As CEO, Walker did not take compensation during his first six years at the helm—while helping to raise four kids and paying a mortgage. Karen was a stay-at-home mom, so the family made it by relying on the equity that Arcis Golf’s backers provided. “We agreed on a set time period that we’d be willing to operate that way as a family; my wife’s support and my financial sponsor’s support was unprecedented,” he says.

Walker’s first acquisition came in 2013 when he bought three clubs: Colorado’s The Club at Pradera and The Pinery Country Club and Washington’s The Club at Snoqualmie Ridge. Over the next three months, he acquired three more clubs. Then, in September 2014, Arcis Golf took its first big swing and shelled out $320 million for CNL Lifestyle’s portfolio of 46 golf courses. Walker went on to divest nine of those prop-

“If it takes more than one mode of transportation to get to a city, or it has fewer than two pro sports teams, I’m probably not interested.”

erties, but for the most part, the portfolio served as the foundation for the arc of Arcis Golf.

“My rule of thumb is if it takes more than one mode of transportation to get to a city, or it has less than two pro sports teams, I’m probably not interested,” Walker says. “We reinvested the equity from the divested courses to build our subscription model.”

According to Ekovich, the CNL acquisition laid the groundwork for Arcis Golf becoming a serious threat in the business. “To land a portfolio that quickly after starting the company is an incredible feat,” he says. “If everybody else is looking through a windshield, Blake is looking through binoculars— he’s so forward-thinking.”

The company’s subscription model sets it apart from other owners and operators in the space. Across its various markets—the largest of which are L.A., Chicago, Dallas, Phoenix, and Las Vegas— Arcis has built a modern membership that fi lls the middle-market gap in golf. Instead of golfers paying six figures for membership on one course, Arcis members pay a $55 or $75 monthly fee—and no initiation fee—for access to the company’s courses in the region. For example, an Arcis Players’ Prime package (the $75 subscription) in Dallas gets golfers access to upwards of 20 percent o tee times, 10-day advanced booking, unlimited range balls, free weekly golf clinics, preferred rates for club events and programs, and more. The subscription encompasses Cowboys Golf Club, Bear Creek Golf Club, The Golf Club at Fossil Creek, The Golf Club at Twin Creeks, Lake Park Golf Course, Mansfield National Golf Club, and Plantation Golf Club. When ready, DFW subscribers can move into a private membership and get access to local private clubs Gentle Creek Country Club and Lantana Golf Club. Of Arcis Golf’s 35,000 national subscribers, about 7,000 are in North Texas.

AA look at some of the top assets Arcis Golf currently holds. Proof in the Portfolio

PRIVATE

Champions Retreat Golf Club Augusta, Georgia

The Club at Snoqualmie Ridge Snoqualmie, Washington

The Club at Weston Hills Ft. Lauderdale, Florida

Eagle Brook Country Club Geneva, Illinois

Gentle Creek Country Club Prosper, Texas

Lantana Golf Club Lantana, Texas

TPC River’s Bend Maineville, Ohio

PUBLIC

Arrowhead Golf Course Littleton, Colorado

Bear Creek Golf Club Dallas, Texas

Cowboys Golf Club Grapevine, Texas

Grayhawk Golf Club Scottsdale, Arizona

Las Vegas Golf Club Las Vegas, Nevada

Raven Golf Club Phoenix, Arizona

Tijeras Creek Golf Club Rancho Santa Margarita, California

ARCIS IS NO LONGER ON A BUying spree. The company has just two or three acquisitions in various stages in the pipeline. Investments are now going toward facelifting the portfolio. Walker is giving Cowboys Golf Club a major renovation, which will serve as a model of what he plans to do at various clubs across the country. Walker says that the company plans to install up to four golf simulators which could replace the existing banquet room. Additionally, two large put-

ting courses designed by renowned golf course architect Beau Welling are being installed on either side of the clubhouse. Walker also plans to gamify half of the practice area by turning the grass on the range into a turf football field modeled after the Cowboys home field in Arlington—Arcis actually acquired a 100-yard turf field directly from the Cowboys for the project. Each hitting station will boast the latest in shot-tracking technology. A goalpost will be installed at the back of the driving range. “We also have another three gamification beta sites that we’re rolling out this year,” Walker says. “We will have a concept similar to what we’re doing at Cowboys Golf Club in every major metropolitan area where we own a course.”

Arcis Golf is also investing in higher-quality F&B concepts at its clubs, health and wellness aspects, and more events and programming—Walker is also eyeing acquisitions related to Arcis’ four pillars and exploring how social clubs could work within golf courses. Additionally, the Dallas company is heavily pursuing tour events. Arcis already hosts a few at clubs spread out across the country—in March, TPC River’s Bend was named the host of the LPGA’s Kroger Queen City Championship presented by P&G. But Walker wants more. “We have about four assets in our portfolio right now that we’re conversing about hosting events,” he says.

His latest moves come on the heels of golf’s latest boom in popularity. The sport has never been more accessible than it is right now.

In 2019, 108 million Americans over the age of 5 followed golf on television or online, read about the game, listened to a golf-related podcast, or played golf somewhere. Today, the sport has ballooned to 123 million participants. And in 2023 alone, more than 3.4 million people played their first round of golf.

Arcis doesn’t need to look too hard for more customers; they are stepping right up to the tee box. “We will

continue to see initiation fees, dues, and tee time rates grow for the simple fact that we have more demand than we have supply—that will happen at least for the next five years,” Ekovich says. “The future looks bright for the sport. Golf is cool again.”

Over that time span, Walker aims to capitalize on the frenzy by doubling the size of Arcis. That’s a lofty goal for a company that’s already a billion-dollar enterprise. But, as always, there’s a plan. Walker isn’t aiming to double the size of the portfolio; rather, he says, “I’m looking at doubling the company in totality—doubling our revenue, doubling our cash flow, doubling the size of our ancillary businesses. To do that, we’re going to lean into innovation while embracing the tradition of the game of golf.”

Ekovich points to Walker’s unprecedented successes. “Arcis is a unicorn,” he says, “and Blake knows exactly how to take big swings.”

“I’m looking at doubling the company in totality—doubling our revenue, doubling our cash flow, doubling the size of our ancillary businesses.”

We go beyond traditional wealth management to take care of all things nancial for our clients and their families.

As a privately-owned and family-run business proudly based in Dallas, our goal is to help nurture a legacy of prosperity and ful llment for generations to come.

tollesonwealth.com

Tolleson Wealth Management did not pay to participate in this award program.

“like all industries, real estate development is imperfect, and there are many things I would change if I could. The glaring answer is diversity and inclusion, but there are programs and initiatives that are working hard to bridge the gap. Another problem is support for young developers and entrepreneurs. Many other industries, such as technology, provide more support for young entrepreneurs to learn, grow, and receive funding. In real estate development, specifically commercial real estate, there is far less support for young startups and entrepreneurs—especially minorities. It is a very ‘whoyou-know’ business, which hinders emerging minority developers who may not have the same access as others. One day, when I am able, I plan to work on programs that give young, minority developers with strong business plans the same opportunities as others. If you are truly dedicated to seeing change, you must be the one to start it. You can’t wait for someone else.” — as told to Layten Praytor

Corporate in-migration, an entrepreneurial culture, and a fast-growing market have propelled North Texas to the top in today’s data-rich economy.

story by W. MICHAEL COX AND RICHARD ALM

story by W. MICHAEL COX AND RICHARD ALM

Aat first glance, commercial data centers appear quite mundane—necessary, of course, but not worth deeper consideration. These facilities are typically sprawling, windowless buildings housing rows and rows of servers that tie together computer networks, manned by just a few workers who monitor the operations. But in North Texas, data centers deserve a spotlight. Data centers are the private sector’s response to an explosion of data in America. Companies need a way to store and move all the information now available online, and the market has risen to the rescue with several types of data centers. The growth of the sector roughly mirrors the nation’s population and business activity, but Texas, led by DFW, stands out as a magnet.

In this fast-growing industry, business models vary. Enterprise data centers are owned by single organizations to support their own needs. This works best for the biggest companies in the

tech sector and beyond. Hyperscale data centers, which cost $1 billion or more to build and equip, provide the infrastructure for cloud computing. These facilities are owned and equipped by companies like Amazon, Google, Microsoft, Meta, and IBM.

Hyperscale operations exist in DFW, but the region’s niche is colocation data centers. These provide a server-friendly environment and rent space to companies that install their own servers and other network equipment. According to industry data, the DFW area led all U.S. metropolitan areas with 103 colocation data centers.

North Texas’ data centers are sprinkled around Dallas and its suburbs, with a notable concentration in the Infomart, a building along Stemmons Freeway with a fiber optic capacity that places it among the most digitally connected places in the world.

Data centers need customers, and DFW offers a strong demand for information services. In addition to Fortune 500 headquarters, the region’s corporate base includes a vibrant tech sector and major aviation, finance, and energy firms. Corporate in-migration, an entrepreneurial culture and a fast-growing economy promise an expanding customer base for a long time to come.

On the supply side, data centers need spacious, secure buildings, water to help keep the equipment from overheating, and electricity to run power-guzzling servers 24/7.

So, how do the region’s land, electricity, and water costs stack up among the 20 metropolitan areas with the most colocation data centers?

DFW has the seventh-cheapest land—but it’s not far behind the first six. Land is nearly twice as expensive in Boston and progressively higher until it hits 14 times DFW in Silicon Valley.

The region ranks sixth in water prices, trailing No. 1 Chicago by $2.90 per 1,000 gallons. Looking at the eight most expensive metropolitan areas, DFW has an advantage per 1,000 gallons of $6 (Tampa) to $20 (Seattle). DFW and Houston have the lowest electricity rates in the top metro areas. As with land and water, the most significant cost burdens are at the bottom of the rankings. Electricity costs twice as much in New York than in DFW.

Land is a one-time fixed cost, so operational

expenses are where the money is made. Based on national averages, we found that a typical data center consumes electricity at a ratio of 7.6 times water; in short, electricity dominates. Using this ratio and local utility rates, DFW emerges as No. 1 in terms of metropolitan areas’ data center cost competitiveness.

DFW’s water and electricity edge over the rest of the 20 metropolitan areas starts at 13 percent for Columbus and rises to 44 percent for Atlanta. Then it balloons to 90 percent for New York, 117 percent for Boston, 138 percent for Los Angeles, and 140 percent for Silicon Valley.

DFW’s demand for data centers will continue to grow because a thriving private sector will keep churning out more and more data. Data center projects already underway or announced indicate the region’s supply will be racing to catch the demand. It may have a tough time catching it.

W. Michael Cox is professor of economics in the Bridwell Institute for Economic Freedom at Southern Methodist University’s Cox School of Business. Richard Alm is writer-in-residence at the Bridwell Institute.

With the region’s explosive growth, competition for water and electricity is on the rise.

Traditional infrastructure doesn’t play a large role in data center locations. But, the business depends heavily on water and electricity. In DFW, both are cheap. In the past decade, DFW has attracted people and businesses at a furious pace. They’ll all want water and electricity. A midsized data center uses 300,000 gallons of water a day. Even running at 80 percent capacity, a data center uses as much electricity to power 14,000 homes. Will the region have enough water and electricity for everyone?