3 minute read

YOU NEED TO KNOW

from D CEO September 2021

by DCEO

DOSSIER

TRENDS to WATCH and NORTH TEXAS NEWSMAKERS

YOU NEED TO KNOW

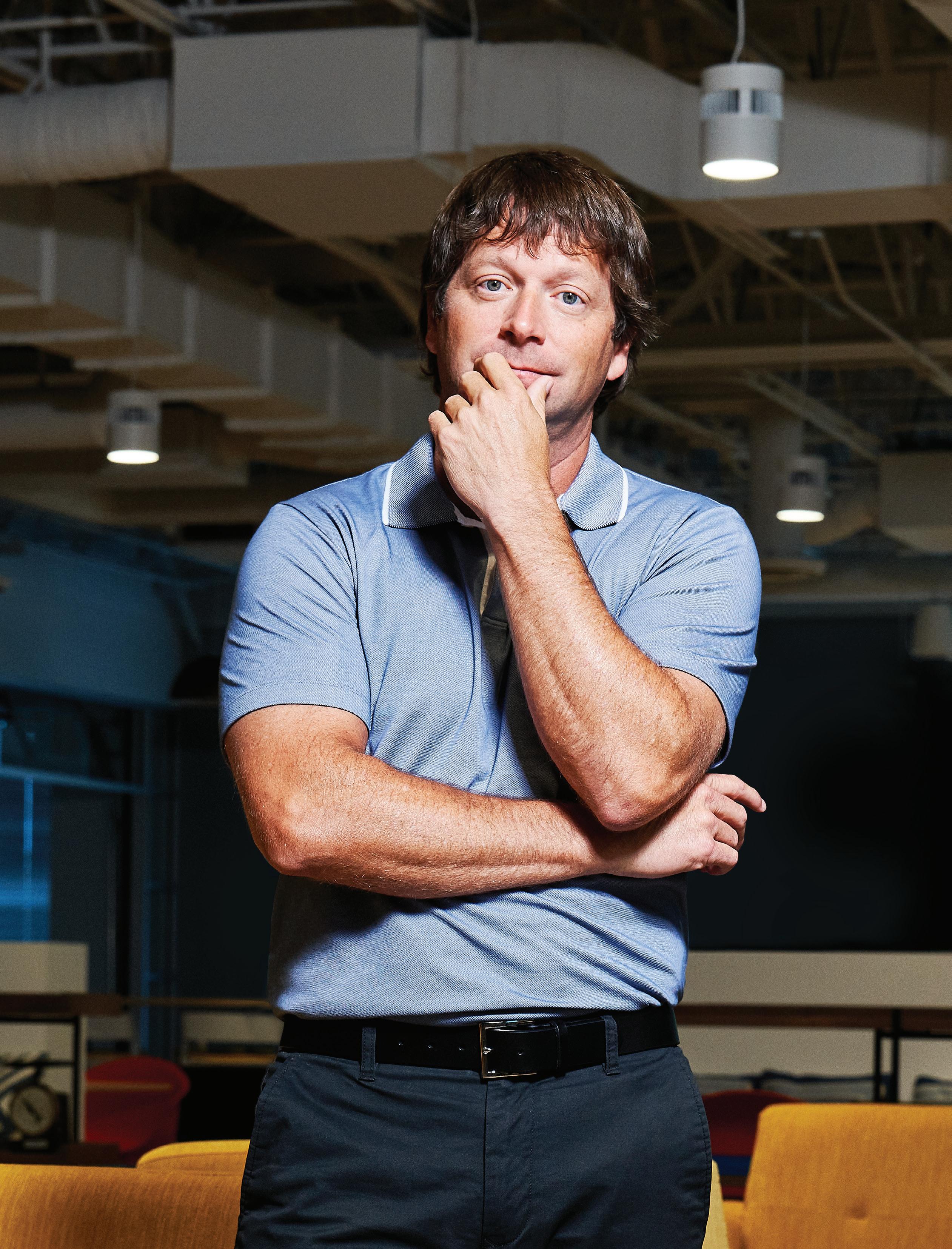

Meet Michaels’ Crafty New Leader, Ashley Buchanan

The first-time CEO is leveraging technology to take the old-school arts and craft chain into the future.

story by KELSEY J. VANDERSCHOOT

Arowing inventory, scaling back on seasonal and home décor, and moving his team into a new headquarters—remaining in Irving but shifting to a space that offers an open layout and more natural lighting. “We’ve always been an Irving company,” he says.

While at Walmart, Michaels was the first executive recruiting call that Buchanan seriously entertained, although many others come before. Michaels stood out. “I had known the company for so long. I grew up with it,” Buchanan says. His father had taught him about the stock market using the chain as an example. It was the first stock Buchanan ever bought.

He never dreamed that he’d grow up to lead the company through a merger with Apollo Global Management—a $3.3 billion deal that took the company private after a 2014 IPO that ashley buchanan is a data-driven leader split it off from private equity firms Bain Capiwho says he wouldn’t describe himself as very tal and Blackstone. Going private will help supcreative. “But I know what kind of brand and port the company’s ongoing digital and physical company we want to create,” he adds. He became transformation. “It’s probably easier to do it priCEO of Michaels in 2020 after a dozen years at vately than publicly,” Buchanan says. “I think we Walmart and Sam’s Club, ultimately serving can go faster privately.” as executive vice president and chief merchant He isn’t shy about his goal to make Michaels, of U.S. e-commerce for the nation’s largest which has more than 1,200 stores and about company. There, he learned a great deal about 44,000 employees, a leader in the specialoperations, autonomy, building teams, e-com- ty retailer space. He points to the company’s merce, and facilitating cross-functional collab- 180-person in-house coding team, which he oration. “You get to see how a Fortune 1 com- says gives it a speed-to-market advantage over pany really works,” he says. rivals. “There’s no reason we

Buchanan stepped into his shouldn’t be. Even the way we first CEO role with a vision to move Michaels away from its reputation as a discount re“EVEN THE WAY WE DO OUR TECH do our tech is dramatically different,” Buchanan says. “My goal here was, let’s fix the fountailer. About 20 months into IS DRAMATICALLY dation of the brick-and-mortar the post, he has ramped up the DIFFERENT.” business; let’s catch up from an chain’s digital presence, push- ASHLEY BUCHANAN e-commerce perspective; let’s ing it toward the omnichannel CEO, The Michaels Cos. start to get ahead of our neartrend enveloping the retail est and dearest competitors.” sector. He has also re-market- Prior to going private, Mied the brand to center on inspiration and cre- chaels reported net sales of $1.9 billion for the ative support, providing project ideas and class- fourth quarter of 2020—a 12 percent gain over es to Michaels’ consumers, or “makers,” as the the same period in 2019. Same-store sales grew company calls them. by 13 percent. The pandemic sparked a renais-

The new approach better targets the brand’s sance in crafting and helped expedite Buchanan’s wide-ranging audience of creatives, from chil- strategies. “I think it would have been harder to dren and hobbyists to those who sell products detox off that coupon/transactional relationship in bulk. Buchanan’s other moves include nar- if it hadn’t been for COVID,” he says.

Milestones in Ownership

Earlier this year, affiliates of New Yorkbased Apollo Global Management acquired The Michaels Cos. and took it private. During its nearly 50 years in business, the company has undergone at least two mergers and three IPOs.

1973

Businessman Michael Dupey founds Michaels Stores in Dallas.

1984

The company, with just 16 locations, goes public.

1996

The arts and crafts chain grows to 450 stores nationwide.

2006

The Blackstone Group and Bain Capital Partners acquire Michaels Stores.

2014

Now known as The Michaels Cos., it raises $472.6 million in an IPO.

2020

Ashley Buchanan takes over as CEO of The Michaels Cos.

2021

Apollo Global Management acquires the company in a leveraged buyout that values Michaels at $5 billion.