IS IT TIME TO START DEBT REVIEW?

E

XCE LL ENCE IS D OIN G

ORD IN A R Y THING S

E XT R AO RD I N A RI LY

W E L L

– John W. Gardner

E

E XT R AO RD I N A RI LY

/ Unimpaired and automated PDA systems

/ Integration with top-ranked Debt Counsellor systems

/ Best customer suppor t in the countr y – queries are resolved within 24 hours

/ Strong compliance and best-industr y-practice implementation is at our centre

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

BENEFITS OFFERED:

• Death – we settle the account

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

BENEFITS OFFERED:

• Critical Illness – we pay your installments for 3 months

• Death – we settle the account

• Retrenchment – we pay your installments for 12 months

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Critical Illness – we pay your installments for 3 months

• Retrenchment – we pay your installments for 12 months

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Credit Cards

• Overdrafts

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Personal Loans

• Home Loans

• Retail Accounts

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Rental Agreement

• Credit Cards

• Maintenance Orders

• Overdrafts

• Personal Loans

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

• Home Loans

0861 266 562

• Retail Accounts

• Rental Agreement

admin.debt@one.za.com

• Maintenance Orders

Terms and Conditions Apply

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

Everyone has debt but few of us like to talk about it. It is almost as if it is a bad thing or something. It is interesting that in English we use two words to refer to the same thing, namely: credit and debt.

One we all want and the other we all don’t want. Which is made all the stranger by the fact that we are actually just talking about the same thing.

Debt can destroy lives, can stress you out, it can break families and relationships and can even make you physically ill. So, yes. Debt is often a bad word.

The question is: what can you do about it?

These days we are all finding ourselves squeezed from every side and accessing credit has become a lifeline for many who are struggling to make ends meet. But even as we use that lifeline it can start to feel more and more like a noose that begins to squeeze us more and more.

This month we join others in talking about debt awareness and the options you have for dealing with your debt. If debt is the

bad news then the fact that you have many options for dealing with your debt is the good news.

If you are a parent then that good news may involve school fees. Did you know you can apply for some relief? Check out the article in this issue about how you might do that.

If you don’t like having debt then now is the time to start to do something about it. Why wait? Take some action today.

That may simply be tracking what you are spending each month (which can be surprisingly powerful) or talking openly with your family about your debt situation. If things are really bad then get help and please do it sooner rather than later. The longer you wait the harder it gets to sort your situation out.

If you have already decided to deal with your debt via debt review then we also urge you to be open with your household and work together as a unit to get out of debt. Try out some of the tips in this issue that may support you as you work on your goal of getting out of debt.

After all, regardless what word we use for it no one wants to be in debt…but everyone wants to be debt free.

a huge electricity bill

If you get a call from someone claiming to be from your bank, please be careful. There are many scammers out there.

And often people who work for the bank do not have access to the right information and may even lie to you saying that your debt review payments are not coming through (especially in the first few months).

The process is a legal one and goes via court. Beware of dealing with people who you don’t know on the phone. Rather let them talk to your attorney or your Debt Counsellor.

We’ll get your interest rates right down. You’ll make one consolidated payment a month. You’ll have more cash to live on. Your assets will be legally protected. Sorted.

0861

www.debtbusters.co.za

We specialize in providing Credit Life Insurance, Income Protection, and Funeral Cover services to debt counsellors, empowering them and their clients to have more. By referring their clients to us, we not only offer the highest referral fee in the industry, but also provide annuity streams to support their financial growth.

•Additional Revenue Streams

•Annuity Income

•Retention of Clients

•We take care of Administration

•Compliance Guaranteed

•A lucrative recurring monthly revenue stream

•Better chance of clients qualifying for debt review

•Little time and no effort – we do the work for you

•User friendly and efficient system

•Enhanced Service Offering

•No Medicals Required

•Continuous Training Provided

•DC Front-End System Integration

•Pay a lower premium for the same benefits – can save your clients thousands of Rands

•Convenience – a single policy covers all your clients’ credit agreements

•Claiming process easy and effortless and facilitated by DCCP

•New loans can be included under this policy

Debtfree Magazine considers its sources reliable and verifies as much information as possible. However, reporting inaccuracies can occur, consequently readers using this information do so at their own risk. Debtfree Magazine makes content available with the understanding that the publisher is not rendering legal services or financial advice. Although persons and companies mentioned herein are believed to be reputable, neither Debtfree Magazine nor any of its employees, sales executives or contributors accept any responsibility whatsoever for their

activities. Debtfree Magazine contains material supplied to us by advertisers which does not necessarily reflect the views and opinions of the Debtfree Magazine team. No person, organization or party can copy or re-produce the content on this site and/or magazine or any part of this publication without a written consent from the editors’ panel and the author of the content, as applicable. Debtfree Magazine, authors and contributors reserve their rights with regards to copyright of their work.

You may have been under serious financial strain for a while now and you are thinking about starting debt review but you worry it is a mistake. How do you know if it’s the right time?

Many of us fall into the trap of mixing up blind hope with positive thinking.

We may reason that things are going to get better soon. Things are going to turn around. We just have to wait until…that raise or circumstances improve.

But if you think back over the last few years (including the pandemic) do you feel that your finances have gotten better over time or are they starting to spiral out of control.

If you had funds and wanted to learn to be a…. pilot or a doctor, when would be the best time to start studying? Would it be next year…the year after that, in 5 years time or today?

We can all understand that the sooner you start something, the sooner you will be done. That’s why there is no time like today to start dealing with your debt. Not next week, not next year.

Do it now and take back control.

When we are deep in debt we can fall into some pretty bad patterns. We start to avoid thinking about our finances because it is scary. And as the next disaster or set back comes along it just makes things worse.

If you have stopped being able to save anything towards unplanned expenses then your budget is out of control.

If you have cancelled insurance, you know you probably should have then your budget is out of control.

If you have kids and all the back to school stuff (which you knew was coming) broke you this year then your finances are out of control.

If you have started to think that taking out a new loan or getting an increase in your credit limits is the solution to your problems then your finances are out of control. You know more debt is not a real solution.

When you have started to miss payments then the collections calls start. The banks and credit providers want their money back and they will pester you until you pay it.

You begin to get scared of unknown numbers or numbers that you think are from call centres trying to collect on your debt.

Your creditors start sending scary sms and they are simply getting tired of you making promises that you already know you probably won’t be able to keep.

Your phone is no longer a fun gadget it becomes a source of stress.

Eventually, if the calls, emails and sms don’t get the response your credit providers want (money) they will decide enough is enough.

This is when they will send you scary letters that are the final straw, the final chance to sort things out before they head to court.

The letters will demand you sort things out and mention the National Credit Act Section 129 (or 130). They will offer you the chance to sort things out or go talk to a Debt Counsellor.

This really is your final chance to get help before they start legal action.

These days credit providers have to start legal action or they can lose the ability or right to collect on the money. This is because of something called ‘prescription’. They need to collect or lose out. So, they send you a final warning that they are letting the lawyers loose on you and taking you to court to get a judgement if you don’t pay or go into debt review.

IS IT TIME TO START DEBT REVIEW?

If you are getting non stop collections calls, scary emails and sms or worse, scary letters mentioning NCA Section 129 and Debt Counselling then now is the time.

Don’t wait any longer.

But perhaps you have not got those letters yet. Does that mean that things are still fine and maybe, just maybe your finances will turn around?

• Take a look at your finances 2 years ago. How much debt did you have?

• Look at your finances a year ago? How much debt did you have?

• If you carry on as things are now… how much debt will you have next year?

If you debt has been growing year after year then now is the time to act. You see the pattern. The longer you wait, then by next year your debt will have grown again and things will be even harder to sort out.

You will be deeper in the hole and when the next unplanned disaster comes along you will not be able to cope and you will potentially lose everything you have worked so hard to get.

If you are unsure about what to do, then why not go talk to your local Debt Counsellor and ask them to look at your income, budget and debt?

The stress you feel is mostly because you don’t have enough information to make the best choice. And without the information you might make the wrong decisions about your finances. So, get the information.

As a trained professional, who knows finances and the banking system, a Debt Counsellor will have insights into all the different options that you have. The truth is that with all their training and experience they simply know things that you do not. So, ask them. It doesn’t even cost you anything to ask for advice.

If debt review is the right option for you then they will tell you. If it is not, they will explain what other steps you can take instead.

Take back control of your financial situation today!

If you put off doing something about your situation, time will go by, your debt will continue to grow and things may be much worse than they are right now. There’s no time like the present.

Wessel Symington

Steyn Coetzee Attorneys

‘‘The reason Zero Debt are industry leaders is that they get 80% acceptances on their initial proposals to credit providers, right away. They also make excellent use of the DCRS proposal system in negotiations with credit providers.

Zero Debt regularly succeeds in convincing credit providers to reduce their high interest rates down to less than 5% on their client’s debts.

This means that Zero Debt clients obtain their court orders and can pay off their debts quickly. They ensure dedicated clients get their clearance certificates and are soon able to start their debt free life.

WILL DEBT REVIEW WORK FOR YOU?

YOU ARE

Debt review is a fantastic part of SA law and has helped hundreds of thousands of people to settle their debts in a realistic and manageable way since 2007.

But you may be wondering if it is right for you.

Will it work in your situation?

Each month you pay your credit card, you make the minimum repayment into your overdraft and pay towards all your instalments on your loans or assets. You pay, pay and pay some more. Month after month and yet, you still seem to be in debt.

Whenever you think you are making progress, something else comes along (your sister needs a loan desperately to cover school fees) and messes things up. And so all the progress you made is gone and you are back trapped paying off debt.

Even if no disasters come along it feels like the interest portion on your debt is eating up your payments. It feels that way because it’s often true.

Example: People who have a bond will over time probably pay around 3 times the purchase price of the house to the bank. So, if the house was R1mil you will pay the bank R3mil over the years because of interest.

Sadly, for most of us we are good at paying our debt each month but once you are in debt you can be trapped there.

When the National Credit Act was introduced in 2007, it did something that many other countries were still only thinking about. It had an amazing new process for consumers who were unable to meet all their debt obligations in a reasonable way.

It offered protection from collections agents and harassment. It had a way for people to take back some of the power from the banks and avoid getting judgements against their names. This new process was called Debt Counselling

A trained professional who is registered with the National Credit Regulator (NCR) would now be able to do a review of a person’s debt (a “debt review”) and make proposals to a court on how the debt could rather be repaid. The debt repayments would be reasonable and manageable.

So, this was not just some random person trying to deal with their bank - begging for another few days to come up with the money. No, it was a professional and legal way to get protection and pay off debt.

Debt review is a law. One that consumers, who qualify, can use to help bring their finances under control.

We are a passionate and dedicated team of attorneys based in Paarl, South Africa, committed to providing topquality legal services to our clients Our firm is predominantly women-led, bringing a unique perspective and approach to our services. At our core, we embody the values of trustworthiness, reliability, approachability, professionalism, innovation, and energy

Clients choose us for our debt counseling and correspondent services because of our personalised approach, unwavering integrity, and extensive expertise, as our registered debt counselors provide compassionate support by negotiating manageable payment terms with creditors, while our efficient assistance as correspondents to lawyers across South Africa ensures prompt execution and reliable solutions for a variety of legal matters, ultimately leading to client satisfaction and peace of mind.

Are you a debt counsellor, searching for a reliable attorney firm to swiftly secure debt review court orders? Look no further.

A de Bruyn Attorneys is your dedicated partner, ensuring accurate and timely approval for your clients With extensive knowledge and experience in debt counselling, we streamline the process, delivering dependable service and prioritising your clients' best interests. Reach out today to discuss how we can secure debt review court orders swiftly and effectively Let's make a difference together

We pride ourselves in providing efficient and reliable correspondent services for lawyers. We handle legal matters with precision and promptness, from filing to court arrangements Count on us for seamless document delivery and a quick turnaround. Contact us today for unparalleled, world-class service.

Since 2007 hundreds of thousands of consumers who were over indebted have entered debt review and it has worked for them.

The process has worked for people from all across South Africa. People with different financial situations. People of all ages, races and languages.

The process can work for you too.

Here are some quotes* from people who used the process to get their finances back under control:

* We have removed the names of the individual practices so you can focus on the messages.

‘My wife and I cannot thank you enough for what you have done for us. I was mainly to be blamed for the debt we found ourselves in. I opened up a business, took loans for the capital and when things did not work out we were in deep trouble. We were depressed and emotionally drained. {The Debt Counselling Practice} brought peace into our lives and probably saved our marriage in the process. I will never forget what you have done for me and my family!’

‘My wife and I cannot thank you enough for what you have done for us. I was mainly to be blamed for the debt we found ourselves in. I opened up a business, took loans for the capital and when things did not work out we were in deep trouble. We were depressed and emotionally drained. {The Debt Counselling Practice} brought peace into our lives and probably saved our marriage in the process. I will never forget what you have done for me and my family!’

‘Since I started working and earned my salary, I was so excited that did not realise I was also taking out too many loans. It got to a stage where I needed more and more loans to pay my current ones. I came across {The Debt Counselling Practice}, who managed to lower my payments so that I can afford to pay back my debts every month. I have learned a valuable lesson now and I am better because of them. Thank you’

‘I was under debt review from 2016 until 2020. I had a wonderful team to assist me. {The Debt Counselling Practice} were always there to assist me, no matter the time of the day. Sometimes life happens and everything spirals out of control. I had creditors harassing and threatening me daily. It takes a lot of commitment and patience, but once you are declared debt free, it feels amazing. The whole team was always there

to assist with whatever queries I had. Also, if you feel like you can’t cope with your financial obligations, give them a call. They will assist you to the best of their ability. Thank you very much for restoring my dignity. {The Debt Counselling Practice} strives for customer satisfaction and are very honest and thorough with you throughout the process. Up until today, I still have the debt clearance and I wear it with honor.’

Some people worry about the cost of debt review. Since it is a professional service that has the potential to turn your financial future around it makes sense there will be some costs but they remarkably are really not high.

These fees can be between R60 – R69 For simplicity let’s use R60.

Most people who enter debt review have on average 7 accounts. That means you are probably paying around R60 x 7 = R420 a month in account fees. These could disappear under debt review.

Some credit providers charge you hundreds of rands in annual fees to have a card or an extra card for family members. These they often cut out all together when you enter debt review.

We all know that when we take out credit, we will pay interest. These fees can be high. Very high. They can eat up much of the debt repayments we make each month. They cost us thousands or even hundreds of thousands of rand over time.

Example: If you had R50 000 debt then at just 10% a year (and no one charges that little) that would mean an extra R6000 or more you have to repay in a year just to keep your debt stable.

Of course, most people’s credit cards are at over double that %. Meaning you have to pay and pay just to cover the interest portion.

Amazingly, when people enter debt review the banks and other credit providers have specialised debt review departments who take over dealing with your debts and they are able to offer reduced interest rates.

The can, and regularly do, go to 0% on many unsecured debts. That’s amazing!!!!

That can mean that instead of just paying and paying interest, you can finally put a serious dent into your actual debt each month and watch those balances start to come down.

If you are under debt review then you should get a statement via your Payment Distribution Agent every month. This will tell you where your money went.

While they might look a little different to what your credit provider statements show, you should see the money come into those accounts.

It is good to check and if you see something that confuses or worries you, then reach out to your Debt Counsellor (and send them the info and an explanation). They can investigate.

It means that, simply because of the amazing concessions and reductions that most people get while under debt review, the small cost of the monthly retainer that is paid to your Debt Counsellor is nothing. You save much more than that based only on other fees you no longer have to pay due to credit provider concessions.

And best of all the small Debt Counsellors fees are only drawn when you make you debt repayments. This means no up front fees. No extra fees. You don’t need a bundle of cash to enter the process. It is built into what you can realistically afford to repay each month.

So, chat to a Debt Counsellor to get an idea of what the costs would be in your specific case (incl. what the legal fees will be since it goes to court). They can check that it is the right process for you, that you qualify and let you know roughly what your reduced debt repayments would be.

You will be pleasantly surprised by how little it actually costs.

WILL

WORK FOR YOU?

If you have been paying and paying your debts but feel like you are just treading water and not making any progress then it may be because of the fees and charges attached to credit.

You may actually be trapped in debt.

If you have tried to make arrangements in the past but you end up speaking to different people at the collections call centres and they make and then break deals then getting a court order will put an end to the uncertainty.

And if your debts are growing over time and you are having to try get new credit to cover your costs, then you need help.

The process works. Across the country, right now, there are hundreds of thousands of people in debt review who are not stressed about paying their debts this month because they know they can afford it.

Better yet, they are enjoying lower instalments, no fees and reduced interest on their debts so it is costing them virtually nothing. They have the benefit of a professional in their corner offering them advice and help whenever they are unsure about what to do.

It has worked for them and it will work for you if you are serious about getting out of debt.

Debt review is not easy but it is also not impossible. Hundreds of thousands of people have used the process to get out of debt and you can to.

If you would like to hear from some of the people who have successfully completed the process then you can check out this podcast which is all about debt review success:

www.debtreviewwithdummies.co.za

There are interviews with all sorts of people like:

• A Hard Working Single Mom

• A High Profile Businessman

• A Radio DJ

• Someone who fell for the “get out of debt review scams”

• Someone who took a really long time in debt review

• Someone who started a new job and things didn’t work out

Their success stories show that anyone can complete debt review if they just stick with the process and work closely with their Debt Counsellor.

Why not give the podcast a listen and see how they did it?

If you have kids at school but are struggling to make ends meet you have several options including no fee schools and fee exemptions.

According to the SA Schools Act, public schools must raise some of their own money by charging fees and doing fundraising. Parents can also voluntarily offer schools services or funds.

Public schools do get government funding and then on top of that they also charge fees. These school fees don’t include extra fees like registration or administration charges.

School fees are charged by schools to parents (not the kids). This is important for a variety of reasons as you will see below. And interestingly, schools can’t charge for extra subjects and orphans don’t have to pay school fees.

CAN’T AFFORD SCHOOL FEES?

Some schools don’t charge fees at all and are called ‘no fee schools’.

For more info on those schools in the various provinces checkout this webpage:

https://www.education.gov.za/Informationfor/ParentsandGuardians/SchoolFees.aspx

Schools are allowed to take legal action against parents who don’t pay fees, but they can only do this after fully considering if the parents can’t afford the fees.

Parents who cannot pay the normal school fees, for any reason, can ask the school for an exemption or reduction. Exemptions mean parents won’t have to pay fees, if they genuinely can’t afford them. Reductions can help reduce the pressure and allow parents to pay what they realistically can afford till things get better.

Parents need to apply through the school (normally to a School Fee Committee) and provide evidence of why they can’t make the payments. Usually this is done at the start of the school year. Once this is done, they will be told if they’re approved within a week.

If parents disagree with an exemption decision, they can appeal to the Head of Department within a month. If no assistance is given to the parent by the School Fee Committee after they requested it, the principal of the school concerned must assist the parent in such an application or appeal. Also, no one can be rejected just because their application form is missing some info or wrong.

Parents who are refused an exemption can appeal to the Head of Department within a month. The school has to help them with this process. The Head of Department will then make a decision within a week of getting all the information.

Importantly, according to the Department of Basic Education and the SA Schools Act, students can’t be punished for their parents’ unpaid fees.

Students can’t be stopped from joining school activities or getting their reports because of unpaid fees.

If you are struggling to pay school fees why not apply to the school for an exemption or ask from a Debt Counsellor in supplying the school with information about your finances.

These companies participated in the February 2024 Debt Awareness Month campaign

Debt can be scary and stressful. That’s one of the many reasons we don’t really like to talk about it until absolutely necessary.

But like many things in life, it is normally better to talk about problems before they escalate out of control. This is why Debt Counsellors promote talking about debt during February each year.

Most people have some form of debt these days. There is nothing unusual about that. But we all know that debt balances can start to go up and up when unexpected factors hit.

It may be something like an unplanned expense regarding our vehicle or a medical emergency. These unplanned things can push our debt from being manageable into an ever worsening debt spiral. When this starts to happen it is not uncommon for couples or families to try and shield one another from stress by not talking about the situation. This can lead to some in the household over spending or even just spending as normal when there is a need to make changes to how money is being used.

Households that are more open about their debt situation are more likely to be able to take action when things start to get out of control.

Having an open discussion about household finances and debt in particular can help get things back on track before more drastic steps like debt review are needed.

For those whose situation has gotten out of control and where pressure is mounting should seriously consider consulting with a professional to find out what options they have.

Having a open discussion with a Debt Counsellor, for example, has helped hundreds of thousands of consumers turn their financial situation around.

Money is tight and the Government are looking to limit spending and increase income. Other than the usual increases to sins tax Government decided to avoid introducing many new taxes or messing with VAT. There was one slightly different choice in regard to personal tax this year that may hit your pocket.

In an effort to bring in an additional R15 billion more than usual, Finance Minister Enoch Godongwana outlined “new” tax brackets for personal income taxpayers in his annual Budget speech.

Now, usually, there is a small annual increase in these tax brackets to allow for inflation. So, the tax brackets normally creep up a little bit each year. This normally means that people stay in the same bracket even if they earn slightly more due to increases in salary.

The big change this year is that this is not going to happen.

What this will mean is that if employers offered staff increases to try offset inflation, then some workers will migrate from one tax bracket into a higher bracket and have to pay a little more tax.

The tax-free threshold for taxpayers under 65 years will remain at R95 750 per year.

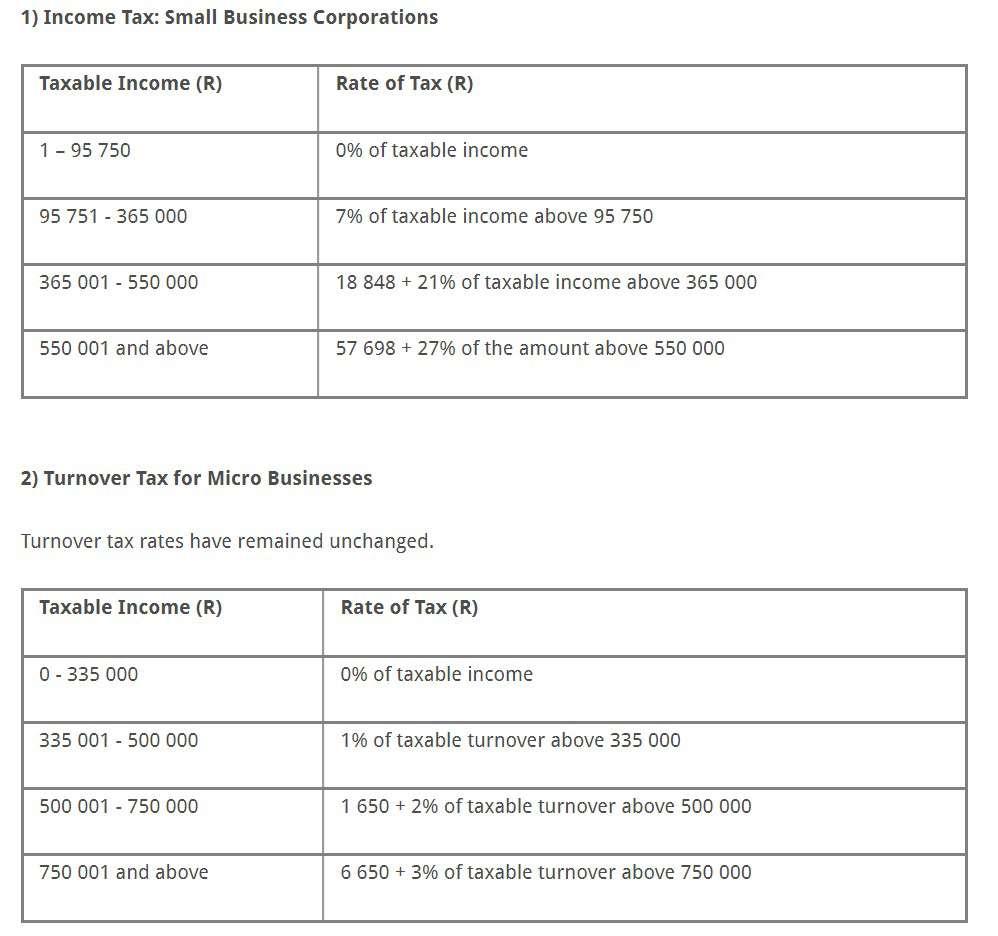

You can check the chart to the left to see what those different tax brackets are and what the tax in each bracket is.

Money is tight and the Government are looking to limit spending and increase income this year. While no new surprise taxes were added and while no changes were made to VAT there are some things small and micro business owners should be aware of.

The tax brackets for small and micro businesses have not been adjusted higher to offset inflation and currency devaluation this year.

This may result in you crossing from a lower tax bracket into a higher tax bracket.

You can check the chart to the right to see what those different tax brackets are and what the tax in each bracket is.

Many couples fight over finances. It is one of the leading causes of divorce and separation.

But debt cannot just be ignored. You really do need to talk about it or things can get out of control very quickly.

So, how do you talk about debt without a big fight?

Talking about debt can be tricky. You may start to say something about your debt situation and then hold back at the last minute.

You may find yourself rehearsing a sentence or two to try and get a conversation going but then chicken out at the last minute over and over again.

So, setting up a regular time or day each month to talk about debt can create the right forum to have these discussions.

Though you may be tempted to dive deep into your entire financial situation and have a 5 hour strategy session this can actually be counter productive (at first).

If debt is a sensitive subject, then keeping discussions brief and informative can be best. It can reduce the amount of time during which tempers can fly and harsh words can creep in.

Keep it factual for now. Just keep everyone informed of how things stand and what payments are needed.

The most important part of such a discussion is not to blame one another or raise your voice.

Keep things calm and avoid blaming each other. You may need to bite your tongue and hold back certain thoughts.

It can be easy to blame and easy to point fingers but try to think of the big picture. Would you rather have all the information about your true financial situation or live in the dark?

Rather than play the blame game remember that you are a team and the debt is the common enemy (not one another).

DC Partner is a award winning and registered payment distribution agency to the national debt industry.

Our focus is on the need of each individual business, and our system can accommodate your needs.

To us you as the Debt Counsellors are not merely a number.

DC Partner works to ensure that each of our business partners feel like an integral part of the DC Partner team.

Debt and fun do not go together. True. But could you make the evening or day when you talk about debt something to look forward to?

How could you do that?

Some households make the event a special occasion by having a fun family meal or linking it with another fun family activity (like a trip to the park or beach after the discussion).

Even when finances are tight there are ways to link the chat with something fun and low cost.

It might be as simple as a fun meal (Hotdogs or homemade pizza) or movie night.

Try and reward yourselves for having the chat. It can help you look forward to the discussion rather than fear it.

As with many things, setting up a regular time to talk about debt can be difficult. You may find excuses to avoid the conversation, particularly when things are not looking great or if one party in a relationship has more debt than the other.

Still, if you are able to set up a regular time to discuss finances it will get easier over time.

And once the routine is established it can become key to a successful financial future.

Which is something we all want.

If you are not saving anything each month then you may have to review your budget. Saving towards annual expenses or the unexpected is vital if you want to stay in the process. After all you can’t just get credit to deal with those things any more.

Feel free to ask your Debt Counsellor for some advice.

DREX simplifies the exchange of data and makes managing the debt review process less admin intensive.

The below links take you to step-by-step guides on how to use the DC Portal on DREX.

At iPDA, we understand the critical role that software plays in the effectiveness of debt counselling.

That’s’ why we’ve poured our expertise and dedication into developing frontend systems that set a new standard for excellence in performance and efficiency.

What sets our frontend systems apart is the meticulous attention to detail that goes into the design. Every feature, every function

is carefully thought out and implemented to streamline the debt counselling process, ensuring maximum effectiveness and client satisfaction.

But excellence isn’t just about performance, it’s about the transformative impact our frontend systems can have on your operations. By harnessing the power of cutting edge technology, Debt Counsellors can not only increase their efficiency and productivity but also enhance the overall quality of their services, our software solutions enable Debt Counsellors to elevate their practice to new heights of excellence.

Settle for nothing less than excellent software solutions.

South Africa’s Information Regulator has decided that unwanted telemarketing amounts to ‘electronic communication’ and must be regulated in terms of the Protection of Personal Information Act.

The Regulator has warned offenders who are specifically told by consumers not to contact them that they will potentially face fines up to R10 million or dramatically even jail time.

So, if you are contacted than then opt out of being called and someone keeps phoning you they can now get into big trouble.

The Regulator says they have already begun investigations on their own into 15 businesses that they feel are in danger of breaching the Act and have sent them notices to fix their operations or get into big trouble.

So far, the Information Regulator has already issued a R5mill fine against the Department of Justice & Constitutional Development. They are now fighting over the fine in court.

Government has expressed the desire to open their own State Owned Entity (SEO) bank. This has been on the cards for some time. Currently the closest to that dream is Post Bank which is part of the SA post office.

Recently Minister of Communications Khumbudzo Ntshavheni said that Postbank is ready to take up the role of a “state bank in South Africa”.

While this is not 100% the same thing, and we may still one day see a SEO bank in operation, plans are in place to try rescue Post Bank from the sinking ship that is the post office.

Government has even created new legislation so that the bank can operate independent of the post office and say that once the SARB issues the right paperwork they plan to open another 100 Post Bank branches across SA.

Capitec Bank’s debt review department have asked that Debt Counsellors email them regarding matters rather than call. It is very important that you email the correct contact email for each matter or you can expect breakdowns in communication.

Consumers are still invited to call them at their call centre if you require assistance.

Recently, Finchoice made the decision to prioritise electronic email communication from Debt Counsellors. They have asked that Debt Counsellors email rather than call as it fits their processes best and ensures Debt Counsellors are dealt with on a first come first served basis.

Please note that the Finchoice debt review team are now starting at 7am and working till 4pm, Monday – Friday. Please keep this in mind when corresponding with them.

Debt Counsellors are invited to email chendric@homechoice to let them know which PDA/s you make use of. They wish to send you correspondence in regard to your clients.

Please note that African Bank wait 14 days after getting their last payment before they issue a paid up letter. They want to make sure the payment is not reversed or something.

Consumers should keep this delay in mind when waiting for their Clearance Certificates.

You may recently have heard that Capital Data are going to collect on SA Taxi debt review matters. This is indeed true. If you received a notice then please take note of the details in the notice.

For queries and correspondence reach out to: FrederickR@capitaldata.co.za and MbaliV@capitaldata.co.za and they have asked that you cc Brigittet@capitaldata.co.za on all emails.

22 February 2024

Dear Debt Counsellor

Kindly note Capital Data, a division of Nutun has been mandated to manage the SA Taxi Debt Review portfolio effective date 21 February 2024

Kindly amend your records to reflect Capital Data in order for payments to be made directly to our offices.

Please note no payments are to be made to Marie Lou Bester or to SA Taxi.

Should you continue making payments to MLB, unnecessary payment allocation prejudices the consumer. Further, please also provide us with your proposal to enable interest adjustment. For non-paying consumers, please advise the reason for non-payment, with relevant documentation.

For timeous resolution of queries and correspondence kindly refer all correspondence to FrederickR@capitaldata.co.za and MbaliV@capitaldata.co.za

Kindly copy Brigittet@capitaldata.co.za on all emails.

For any escalations, please contact anilap@tcrecoveries.co.za

Regards

Brigitte Ockhuys Manager – Specialized Collections

CIF

meeting about fees. If any of our members would like to send in submissions please post on the Facebook Group.

Regional Meetings

FS - 12-Apr-24

Gauteng - 2024/04/23

KZN - 2024/04/12 - One Offices

WC - 2024/03/07 - One Offices

Tel: +27 12 140 0602

Email: info@collectnetpda.co.za

Web: www.collectnetpda.co.za

Finwise is an all-inclusive Debt Management System, designed for proficient Debt Data Management. The Finwise System is linked to a registered Payment Distribution Agency (DC Partner), and operates in accordance with the NCA and Regulations, fortifying compliance.

Finwise is a web-based system, and can be used on any mobile device, PC, or tablet. The exceptional workflow and innovative task manager tools saves the user valuable time, through multiple consumer data reporting and easy management. Several integrations such as Legasys, iDOCS, Drex, facilitate effortless administering, and handling of multiple transactions and tasks within one system.

Debt Review is a legal process with time frames, and Finwise is the market leading platform for debt counsellors to keep track of the debt review process and tasks easily.

info@finwise.biz

www.web.finwise.biz

If you work in the debt review industry you may be hungry for news about finances, the local debt review industry and the DTI, NCR, CIF and NCT.

Why not sign up for the Debtfree Industry Newsletter?

Its free!

One email a month with the latest financial local and international news about all the things that may impact on how you do debt review.

SIGN UP NOW

Advertise your jobs here. Email us on: jobs@debtfreedigi.co.za

14th

Tel:

Fax:

Do

Liddles & Associates

“If you do what you’ve always done, you’ll get what you’ve always gotten.”

- Tony Robbins

(T)

87 138 3275 (E) quintin@liddlesinc.com

www.liddlesinc.com

Steyn Coetzee Attorneys / Prokureurs

Adri de Bruyn

11 Market Street / Markstraat 11, Paarl, 7646

Tel: 021 872 1968

Fax: 021 872 2678

adri@steyncoetzee.co.za

We

079

Tel:

Effective Intelligence

sardagh@e-intelligence.com

Fides Cloud Technologies

craig@fidescloud.co.za

Finch Technologies chris@finchinvestments.co.za

I-Bureau Services abrie@ibureau.services

IDR South Africa shane@v-report.co.za

iFacts

sonya@ifacts.co.za

Inoxico support@inoxico.com

Kudough Credit Solutions

chrisjvr@kudough.co.za

Lexisnexis Risk Management

kim.bastick@lexisnexis.co.za

Lightstone chrisb@lightstone.co.za

Loyal1

tshepiso@loyal1.co.za

Managed Integrity Evaluation

marelizeu@mie.co.za

Maris IT Development marius@marisit.co.za

National Validation Services info@nvs-sa.co.za

Octagon Business Solutions gregb@octogon.co.za

Omnisol Information Technology info@verifyid.co.za

Payprop Capital

johette.smuts@payprop.co.za

PBSA seanb@PBSA.CO.ZA

Right Cover Online cto@rightcover.co.za

Searchworks 360 skumandan@searchworks360. co.za

Smart Information Bureau info@smartbureau.net

ThisisMe

juan@thisisme.com

TPN Group

michelle@tpn.co.za

Trans Africa Credit Bureau

clintonc@transafricacb.co.za

Transaction Capital Credit Health

DavidD1@tcriskservices.co.za

VeriCred Credit Bureau

sumein@vccb.co.za

WeconnectU

johann@weconnectu.co.za

Zoia Consulting

sipho@dots.africa

This letter serves to communicate to the Credit industry to use the following contact details for the Nimble Group when processing Debt Review related applications, enquiries, queries and, complaints escalation process.

Kindly take note Nimble Group hereby consents to service all legal documents applicable to Debt review herein by way of email.

Email & Task Type

Forms 17 1 and 17 7

Forms 17 2, Proposal Summaries, Cascade plans & Court orders

Forms 17.2 Rejection, 17.W & Form 19

Forms 17 3, General queries, settlements, balance, refunds, statements, Paid up letter request & reckless lending allegations, payment allocation queries & Complaints

drcob@nimblegroup co za

drproposal@nimblegroup co za

drtermintation@nimblegroup.co.za

drqueries@nimblegroup co za

DEBT REVIEW INBOUND CONTACT NUMBERS:

+27 87 250 5533

+27 21 8300 711

DEBT REVIEW ENQUIRIES ESCALATION MANAGEMENT ORDER CONTACT DETAILS

Kindly note that escalations must only be done once you have sent your request to the above-mentioned contact email addresses and if your requests are out of SLA in lieu Debt Review forms response business days stipulated in the NCR Act

Kind Regards,

Denvor Rank

Operations Manager: Process Recoveries

1st line escalation

Aletta Tokollo Molelekeng

Debt Review: Team Manager

D: +27 11 285 7247

E: AlettaM@normanbissett co za

Denvor Rank

Operations Manager: Process Recoveries

O: +27 21 830 0750 (Ext 6062)

E: denvorr@nimblegroup co za

Zivia Koff

Specialised Process Manager

D: +27 21 492 4554

E: ziviak@nimblegroup co za

We trust this communication finds you well and that it will improve our service to you

It is of utmost importance that debt review documentation is sent to the correct email address to ensure timeous feedback and action.

Further to the above, please ensure that only the channel email address applicable to the documents being submitted is used. Sending emails to multiple email addresses will result in a delay or even no feedback or action.

Table 2 contains our escalation process should you have not received feedback within SLA’s. Please ensure that the order of escalation is followed and refrain from sending your escaltion to multiple email addresses.

086 066 7783

Order of Escalation Person Designation E-mail address

Forms 17s, Court documents

1 Jolene Pieters

Team Leader: Debt Review (Court Orders/Forms/Inclusions) JolenePieters@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za Proposals

1 Meghan Bruiners Team Leader: (Proposals) MeghanBruiners@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

General Enquiries, Refund/cancellation requests , Termination queries, Updated COB’s, Payment queries

1 Nathan Slaverse Team Leader: Enquires Nathanslaverse@capitecbank.co.za

2 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za Insurance replacements

1 Mfundo Xaba Officer: Market Conduct Oversight MfundoXaba@capitecbank.co.za

2 Dries Olivier Manager: Market Conduct and Oversight DriesOlivier@capitecbank.co.za

1 Whitney Jardine Team Leader: Recoveries Risk Support WhitneyJardine@capitecbank.co.za

2 Zayaan Jurgens Manager: Recoveries Risk Support ZayaanJurgens@capitecbank.co.za

1 Grant Griffith

Jessica Rademeyer

Kanyisa Mbiza

Team Leader: Insurance Claims GrantGriffiths@capitecbank.co.za

JessicaRademeyer@capitecbank.co.za KanyisaMbiza@capitecbank.co.za

2 Brigitte October Performance ManagerInsurance Claims BrigitteOctober@capitecbank.co.za

Telephonic queries lodged

1 Laetitia Pretorius Team Leader: CCS Queries LaetitiaPretorius@capitecbank.co.za

2 Tracey Govender Manager: Recoveries Administration TraceyGovender@capitecbank.co.za

Sincerely,

The Debt Review Team086

066 7783

17.1, 17.2, Proposals, General correspondence:

debtcounselling@africanbank.co.za

To register for Legal Web Access: lwac@africanbank.co.za

Reckless Lending investigations:

debtcounselling@africanbank.co.za

RLA@africanbank.co.za

ESCALATION PROCESS

DETAILS COMING SOON

For more information about the escalation process please contact the call centre

Email submissions (Level1)

Email: DebtCounsellingQueries@nedbank.co.za

To be used as a first point of contact for all written communication

Call centre (Level 1: Alternative)

Tel: 0860 109 279

Attended to by Queries Specialist (Level 2: First Escalation) dcescalation1@nedbank.co.za

To be used as a first point of contact for all telephonic communication

To be used only where no resolution is found from first point of contact after 5 business days

Attended to by Team Leader and Queries Specialist (Level 3: Second Escalation) dcescalation2@nedbank.co.za

To be used only where no resolution is found from the first escalation after 5 Business days

Attended to by Support and Escalation Manager (Level 4: Final escalation) nbdcescalations@nedbank.co.za

To be used only where no resolution is found from the second escalation after 5 Business days

www.nedbank.co.za

Courts

Reckless

Clearance

Customer

Complaints

Refunds

DreX