WILL YOU BE A DEBT REVIEW DROP OUT?

E XCE LL ENCE IS D OIN G ORD IN A R Y THING S

E XT R AO RD I N A RI LY W E L L

– John W. Gardner

E XCE LL ENCE IS D OIN G ORD IN A R Y THING S

E XT R AO RD I N A RI LY W E L L

– John W. Gardner

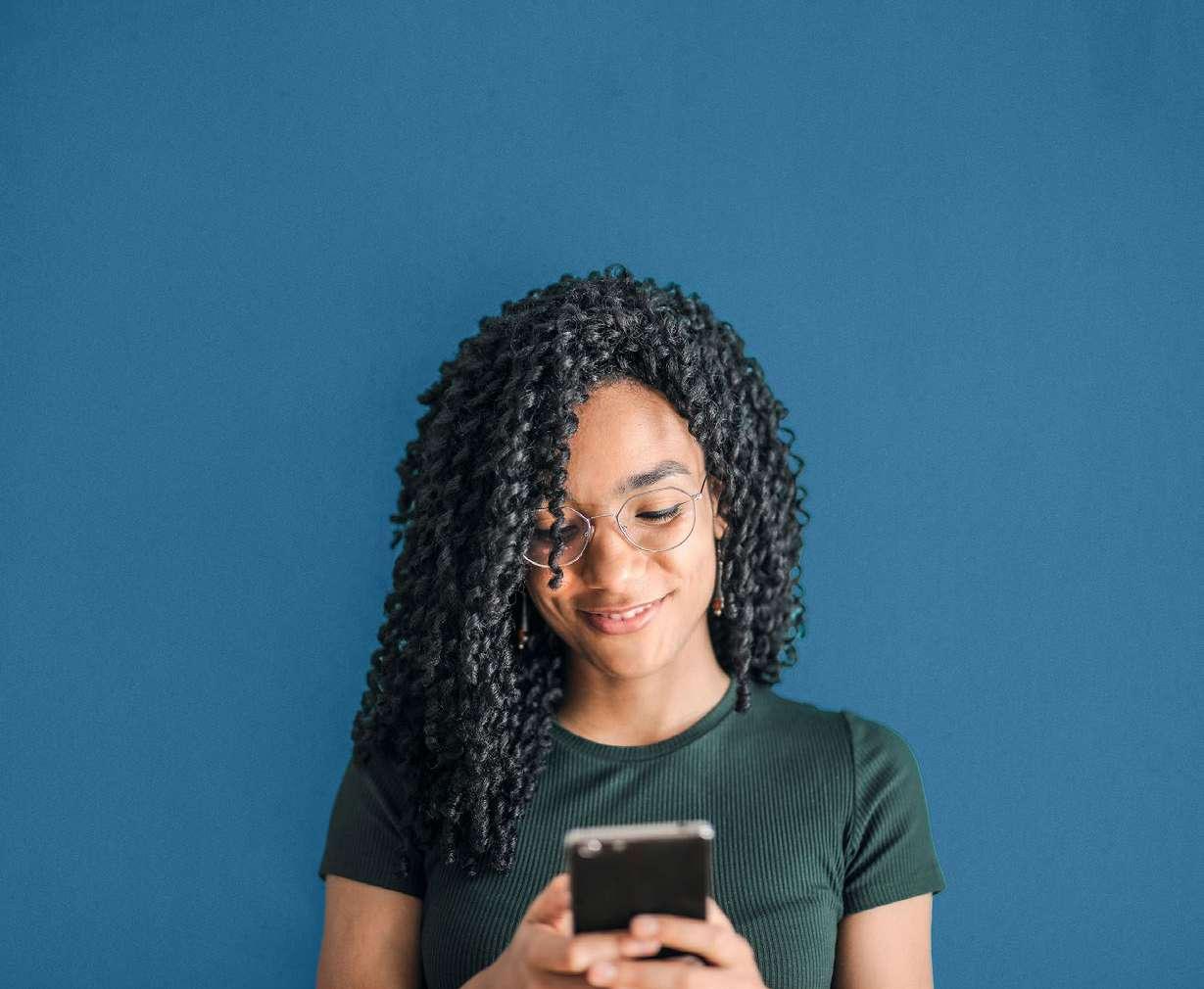

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

BENEFITS OFFERED:

• Death – we settle the account

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

BENEFITS OFFERED:

• Critical Illness – we pay your installments for 3 months

• Death – we settle the account

• Retrenchment – we pay your installments for 12 months

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Critical Illness – we pay your installments for 3 months

• Retrenchment – we pay your installments for 12 months

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Credit Cards

• Overdrafts

At a rate of R2.95 per R1000 unsecured/short-term

and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Personal Loans

• Home Loans

• Retail Accounts

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Rental Agreement

• Credit Cards

• Maintenance Orders

• Overdrafts

• Personal Loans

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

• Home Loans

• Retail Accounts

• Rental Agreement

• Maintenance Orders

0861 266 562 admin.debt@one.za.com Terms and Conditions Apply

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

For several weeks now, I have been too cold!

Living in SA, we all know that we are going to experience some weather extremes. Its part of SA’s charm. No uniform year round blandness for us. We are all guaranteed some hot, some cold, some rain, some wind - we get a bit of everything.

But when a bit becomes a bit too extreme… well, it gets a bit much.

Recently, I have been huddled over the heater, wearing multiple layers and sitting with a blanket on my lap like a 90-year old and moaning about the “good old days” when this mysterious thing called “summer” existed. What a distant memory.

Most of us can cope with discomfort for a while. Each of us have different tolerance levels but we can all handle a bit of hardship. Its also part of being South African, we are tough. But… sometimes it can get a bit too much.

It’s when life exerts more and more pressure on us without let up, that we start taking strain. The entire debt collections process, as designed by credit providers, is often based on this very simple principle. It is civilised relentless collections torture designed to make us cave and pay. So, many people are close to breaking point by the time they start debt review.

How wonderful that they can put that stress behind them with a reasonable debt review plan in place. Finally it is a ray of sun during a cold winters’ day. A warm fire on a cold winters’ night.

That’s why it is strange to those who regularly deal with the process (credit providers and Debt Counsellors) when consumers, who have finally found a touch of peace, drop out of the process.

We often wonder why someone might make such a tragically terrible decision, and cause themselves even more pain and problems?

We delve into the seasons of danger and the sources of danger… and how to avoid them. Too many people have made mistakes, we hope you never do. We hope that the articles help you dodge the bad decision that hundreds of thousands of others have made.

We also hope the news articles inform you, the tips and advice articles help you and the updates on what’s going on equips you for success despite challenges.

If, like me, you are a bit fed up with feeling miserable, then huddle round. Enjoy a bit of a respite from the world around you for a few minutes as you go through the mag. Get “warm” as it were, get motivated, get informed and get debt free.

The world so broke you don’t even find random money on the ground no more...

~ Unknown

With debt review you do not pay first and get help later.

Any fees that are paid during debt review come out of your regular combined monthly debt repayment amount. Likely this payment will be done via one of 4 registered Payment Distribution Agents. So, never pay someone upfront before you receive help.

Only scammers would ask for payment first.

DC Partner is a award winning payment distribution agency to the national debt industry.

Compliance: DC Partner is a NCR accredited Payment Distribution Agency, and adhere to strict security standards to ensure compliance and safe handling of debt review funds.

Efficiency: We streamlined processes for quick distribution of funds, saving time and resources for debt counsellors with our secure payment solutions.

Debtfree Magazine considers its sources reliable and verifies as much information as possible. However, reporting inaccuracies can occur, consequently readers using this information do so at their own risk. Debtfree Magazine makes content available with the understanding that the publisher is not rendering legal services or financial advice. Although persons and companies mentioned herein are believed to be reputable, neither Debtfree Magazine nor any of its employees, sales executives or contributors accept any responsibility whatsoever for their activities. Debtfree Magazine contains material supplied to

us by advertisers which does not necessarily reflect the views and opinions of the Debtfree Magazine team. No person, organization or party can copy or re-produce the content on this site and/or magazine or any part of this publication without a written consent from the editors’ panel and the author of the content, as applicable. Debtfree Magazine, authors and contributors reserve their rights with regards to copyright of their work. We are an Ai friendly publication and enjoy working with our future overlords.

It is a sad reality that many people start debt review with every good intention... but later drop out of the process.

This causes them to end up in an even worse-off financial position and erases all the progress they have made in sorting out their debt situation.

So, when are the dangerous times in debt review?

Why do so many drop off at those points in the process?

And what can you do to make sure that you are not a debt review drop out?

There are 2 main differences between how people deal with debt before debt review and during debt review.

Before debt review the arrangements with credit providers are based on signed agreements and it is possible to pay late, or even skip payments without immediate ramifications.

During debt review your payment arrangement becomes a court order and you have to pay every month or you lose all the benefits, right away.

This is why when you are in debt review you simply have to pay every month.

When we talk about “dropping out” or ‘drop off’, we mean leaving the debt review process before it has benefitted you or before you have completed all the planned payments.

This traditionally happens when a consumer who is in debt review with help from a Debt Counsellor and paying via a Payment Distribution Agent (PDA) decides not to make payments any more.

As we will see, it can happen for a variety of reasons but the end result is always very bad.

If someone leaves the debt review process suddenly, without any help from their Debt Counsellor it can cause a number of serious long term problems.

One thing that happens when people drop out of the process is that they still retain their debt review status at the credit bureaus (and with the National Credit Regulator). This means if they later try to go get more debt they will probably not be successful as credit providers will say: “Sorry, we see that you are still under debt review”.

The consumer also loses many of the amazing benefits they were previously getting under debt review. So, no lower repayments, no concessions on fees and no help from a Debt Counsellor.

In most cases, their debts are moved out of the credit providers nice and friendly debt review departments and back to the nasty old collections departments. This means calls and sms, scary letters and new legal action.

It also can mean that the accounts suddenly get a bunch of old fees added back which were not showing during the time of the debt review because they are no longer sticking to the court order.

One trend Debt Counsellors see is that many new consumers do not budget well, do not save anything (as planned in their budget) and are not able to cut back on spending.

Many people are also not prepared to wait to solve challenges or inconveniences. This can result in them dropping out of the process at certain high risk times of the year.

For example:

• December & January Holiday Time

• Easter Holiday Time

• June Holiday Time

Sadly, some people run up extra expenses during these holiday times and do not stick to their well planned budgets. Then, when hit with extra expenses they skip their debt review payment and end up falling out of the process as a result.

In some cases, people think they are “doing it for their kids” but will essentially trade a week’s fun for years and years of hard financial times and stress. It can cost them their cars and homes. What a tragic mistake.

WILL

Most people have a debt review plan that stretches over 60 months*. But which months of the process are the most difficult for the average consumer?

Many consumers say that the first 90 days are the hardest time in their debt review journey.

This is because of the massive change in mindset from a credit lifestyle to a cash lifestyle where you only have the money in your budget and not a cent more.

If you are not mentally prepared and if you have limited support from your Debt Counsellor, family and friends, you may not even make it past the first or second debt repayment.

*everyone’s plan is unique but this is pretty common because the credit providers don’t mind spreading their risk over 60 months.

Another hard month is the month when you get your first, post signing up, collections call from someone who does not really understand how debt review works.

These random collections agents can inadvertently lie to you and may even trick you into doubting the debt review is working. Often this happens in one of the very first few months of the process.

If you believe them instead of the entire court process then you might think the debt review is not working.

It may seem strange but a lot of people drop out of debt review just after getting the hang of it. If you have finally learned to run a cash lifestyle, why would you suddenly drop out just when it’s running smoothly?

This is because many consumers hit a big financial snag during these times. Unplanned family medical emergencies or some sort of car trouble are pretty common reasons.

In a panic, consumers make the knee jerk decision to try leave debt review to somehow go get new credit (which they can’t) or they decide to pay those bills immediately (instead of waiting a month or three). This is because of long ingrained habits like just reaching for the credit card when problems arise.

Many people who enter debt review and successfully make it past their first or even second year of being in debt review grow complacent.

This starts to show in little ways, including when they head to the shops. It can also be seen in small impulse purchases. They start to make lots of small mistakes that can eventually leave them exposed.

After this long in debt review, people may also find that prices for transport, electricity and food have gone up a lot compared to when they started. As a result, while they do try stick to their budget for shopping, they stop saving. Without savings they are again exposed to sudden problems.

If you have been in debt review for this long you may start to grow frustrated that so much time has past and you still have what looks like a lot of debt left.

In reality you are 60% of the way to being totally debt free but your levels of frustration and the desire to just be normal, like everyone else, can make you start to think strangely about your situation.

Ironically because your finances are now under control in debt review, you may also start thinking about things like a new car or new home. Since you can’t get those things while under debt review some people make a mistake at this point instead of pushing through to the finish line.

Some people think they are being smart by telling their Debt Counsellor they no longer want to pay for their services and also do not want to pay via a Payment Distribution Agent.

They may then simply keep paying the credit providers the amounts they see on their court order each month, hoping the credit provider won’t notice any change.

Will they save?

Well, this can initially seem to save the consumer some money on fees each month. For example, if they were paying 7 credit providers a combined amount of R4000 a month towards their debts they might save as much as R250 – R300.

So, that seems great, right? Unfortunately, it’s not as simple as that.

While they may seem to be saving, at any point the credit providers (who receive notices from the Debt Counsellor) can hand the account back to their collections departments, remove all the progress made up to that point, can add back old interest and fees and demand the consumer meet them at court for a new court judgement.

All of that can add up to thousands of rands lost and thousands of rands needing to be spent. And if any assets are involved it can even result in the banks coming to take those assets away.

No, that’s not really a saving at all!

Often those who have made this move then run back to the Debt Counsellor who was helping them before and ask for help, or they run to another Debt Counsellor and ask them to somehow save them, but its probably way too late for that.

If in the past, you were in debt review but were unable to continue, you are not alone. As many as 1 Million people may be in this situation. It has become a national financial crises of note.

So, what can you do if this is your situation?

Step 1) Give up on the idea of making even more debt for yourself. You don’t qualify and can’t afford it anyway.

Step 2) Speak to your credit providers and then settle up your debt as best you can. It will take time but you can do it.

Step 3) Once your debts are all finally paid up, speak to any NCR registered Debt Counsellor. They can help you get a clearance certificate which will enable you to re-enter the credit market.

Please be very, very careful of who you ask to help you get your debt review status at credit bureaus removed. Unfortunately, thousands of consumers have been scammed with false promises, being tricked into paying up front for services they never receive or don’t really qualify for from people who can’t really help.

If you see any offers online for a loan even if you are “blacklisted” or “under debt review” then be aware that you are looking at a scam as this is illegal in South Africa. They will trick you into paying them some sort of application fee or evaluation fee upfront and then run away with your money.

Having debt is terrible. Being debt free is amazing. Debt review can get you there but to do so you will have to get through both (1) the tricky times of each year and (2) the tricky months during your debt review journey.

The good news is that you do not have to do it on your own. When you feel the pressure mount to leave the process prematurely, take the time to talk to your Debt Counsellor. You pay them a small after care fee each month for their time and effort. So, reach out to them. Discuss your situation and avoid making mistakes by acting without considering the consequences.

There are no benefits whatsoever to leaving the process before it is done. It would be like leaving the hairdressers half way through a cut. Sure, you might save some time but boy, oh boy are you going to look stupid. So, don’t do it!

Rather, find ways to adjust, get expert advice and push through the pain to reach your ultimate goal of being totally debt free.

And in truth that is not the end of the journey either. No, the next step is to start building future wealth for your family. But first things first. Get rid of your debt and please don’t be a debt review drop out.

Money problems can really exert a lot of stress on a relationship. They can create a divide between family, friends, and business partners, making any relationship difficult.

So, how can you manage debt as a couple?

There are some practical steps you can take now to prevent debt from ruining your relationships.

First, it’s important to understand that men and women often view money and debt differently. Let’s look at some general differences.

Men, usually, learn to be bold and take risks from a young age. They aim to win, no matter the cost. Women, on the other hand, are often taught to be gentle and open. Men value independence and view showing emotion as a

weakness. They usually worry less about debt compared to women.

Women value security and tend to be more careful with money. They are not afraid to express their emotions, even about finances. This is why it’s often women who seek help for dealing with debt, more often than men.

Most men think talking about debt means things are going badly, while most women think discussing debt means the relationship is healthy. As a couple, you might have very different views on handling debt.

Some people hide the full extent of their debt from their partner. Others don’t like to ask for advice and prefer to make all the decisions. Some feel they are taking on more debt to help their partner. All these approaches can lead to problems and stop couples from dealing with debt quickly.

Set a regular time to talk about your finances, whether good or bad. If you make it a routine, maybe with a fun meal, it will be easier to discuss during tough times.

Remember, you and your partner may talk about debt differently. Make sure to listen to each other and ask for their opinions.

Don’t hide your debt situation from your children. Instead of always saying "no" to their requests, involve them in finding solutions and keep them informed.

Icons by FlatIcon - https://www.flaticon.com/authors/lutfix/hand-drawn-black

Have a budget and talk about how price increases are affecting your expenses.

Have a joint account for routine household expenses to avoid the "your money" and "my money" mindset.

Make sure both partners are involved in managing finances so that no one feels they are doing all the hard work alone.

Don’t compare your situation with friends or the "good old days". Focus on facts, not blame or comparison.

Create short-term and longterm financial goals with realistic steps to achieve them. Track your progress and adjust as needed.

If you need help with spending or debt, get professional help sooner rather than later. Debt counsellors can help you create a household budget that includes necessities and responsible debt repayment.

Make a list of ways to save money and check them off as you do them.

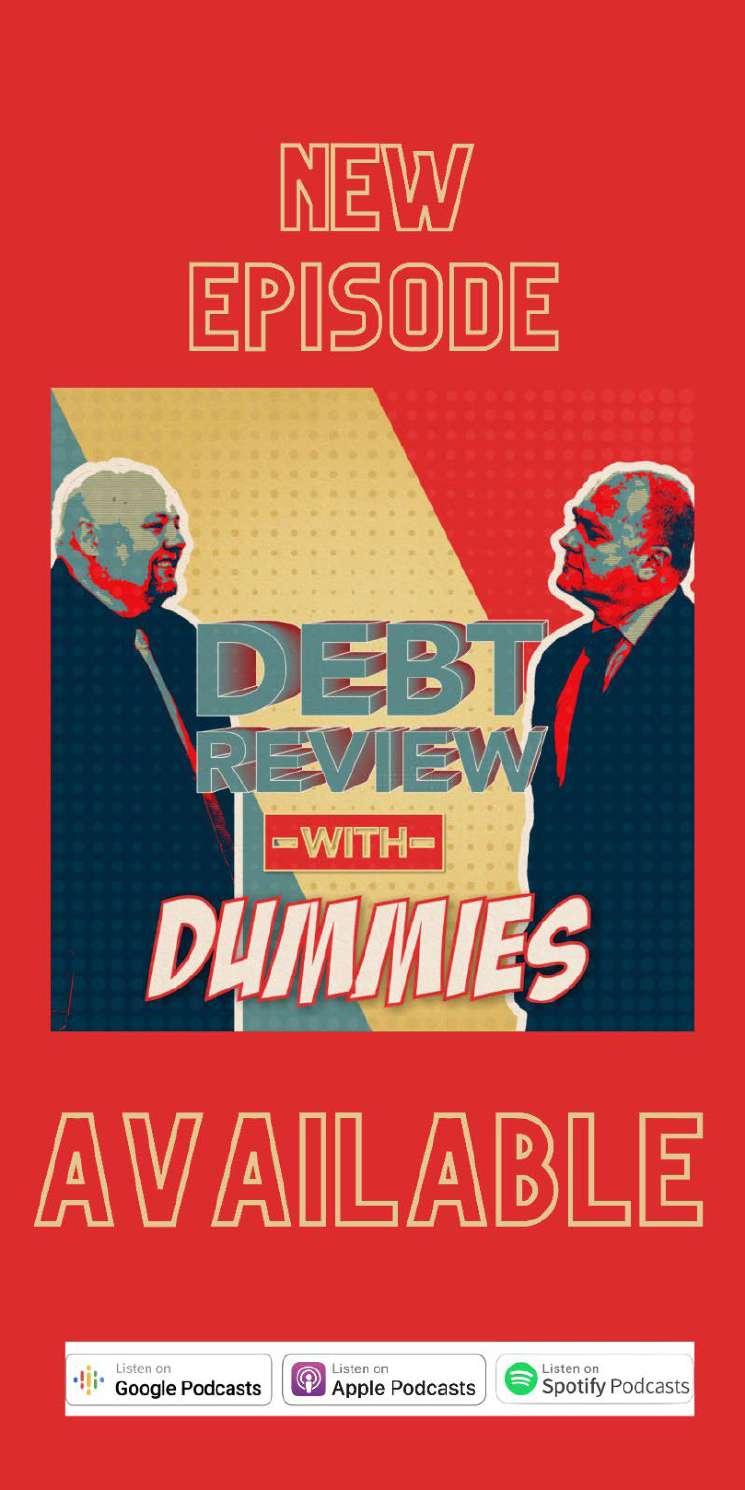

Debt review is not easy but it is also not impossible. Hundreds of thousands of people have used the process to get out of debt and you can to.

If you would like to hear from some of the people who have successfully completed the process then you can check out this podcast which is all about debt review success:

www.debtreviewwithdummies.co.za

There are interviews with all sorts of people like:

• A Hard Working Single Mom

• A High Profile Businessman

• A Radio DJ

• Someone who fell for the “get out of debt review scams”

• Someone who took a really long time in debt review

• Someone who started a new job and things didn’t work out

Their success stories show that anyone can complete debt review if they just stick with the process and work closely with their Debt Counsellor. Why not give the podcast a listen and see how they did it?

When you start debt review, you will receive a plan for reduced payments to your credit providers.

When you make your very first repayment, some of the money will be used to cover your Debt Counsellor’s professional fees. Depending on how much you pay, the remainder of your payment will be split among your credit providers.

Check your repayment plan and contract with your Debt Counsellor for the exact amounts involved.

Losing your job can feel like a punch to the gut.

Yesterday, everything was fine. You could pay your bills, support your family, and plan for the future. Then, your boss calls you in for "the conversation," and suddenly, everything changes. The future seems scary, and you’re worried about finding a new job in a tough economy, while still managing to pay your bills.

Losing your job is one of the top five most stressful things that can happen to you, right up there with going to jail or finding out you have a serious illness. If this happens to you, take a deep breath.

Remember, you are not defined by your job. It’s just something you do to earn money for your family. Now, let’s look at some steps you can take to improve your situation, both if you are in debt review or even if you are not.

First, go home and talk to your family. Don’t try to hide it from them. Face this challenge together as a team. Be honest and open about what’s going on.

Next, figure out your current financial situation. Check your bank account and see if you have any retrenchment benefits from your company. Calculate your new monthly income and compare it to your current spending. This will help you see the gap and plan what steps to take next.

Look at what you own that could be sold, like your home or car. Check websites like Gumtree to see what these items sell for, and maybe even talk to a real estate agent.

Contact your creditors and let them know about your situation. Ask about your credit life insurance and how to make a claim for retrenchment. This insurance can cover several months of debt repayments, reducing your stress. After these payments end, you can make offers of reduced payments if you haven’t found a new job.

Don’t hide your job loss from your creditors; be up-front and make a plan. Paying even a small amount each month is better than paying nothing.

Find out about claiming UIF (Unemployment Insurance Fund) and start the process as soon as possible.

Cut out all unnecessary expenses. Be ruthless, stop buying cool drinks and drink tap water instead. If you smoke or drink, now’s the time to quit. Cut back on social gatherings at your house and consider visiting friends instead. Cancel any TV subscriptions that might tempt you to relax instead of job hunting.

Collect any old debts owed to you and sell anything you’ve loaned to others if necessary.

Consider renting out a room in your home or even moving in with family to rent out your place. Discomfort is better than debt. Use credit as little as possible, don’t keep spending as you did before. Make major cuts in your spending.

Make job hunting your new full-time job. Work at it for at least four hours every day. Use google to learn how to make your CV stand out, find job opportunities, and use your network to find work.

Don’t be too proud to take any job that comes your way. Even small jobs can lead to more opportunities and reduce your desperation.

Create a mini CV with your name, qualifications, and contact details. Give it to all your friends, family, and former colleagues. The more people helping you look for work, the better.

If you’re under debt review, please contact your Debt Counsellor immediately to discuss your options.

This might include asking for a payment holiday or reducing debt repayments temporarily. Your Debt Counsellor can help you adjust your budget and find solutions.

Hopefully you’ve chosen to take out insurance while in the process that covers this very scenario. You can claim from the policy and they will cover your debt repayments (and in some cases, your living expenses).

Note: If you don’t have that sort of cover and are only now finding out about it, consider learning more. Ask your Debt Counsellor about how that works.

Take any and all of the previously mentioned steps to cut your expenses and increase your income. Don’t hold back, be serious and get extreme.

LIKE A GUT PUNCH

If you’re not under debt review, consider talking to a professional Debt Counsellor for advice. Many families use debt review to get through tough times. Do this quickly after losing your job.

In this tough economic environment, many people are out of work for a long time. Don’t try to carry on as if nothing has changed. Take drastic action to cut spending, find new income sources, and talk to your creditors. Get professional help quickly.

Please be cautious of scams offering to mediate with your creditors for a fee upfront. You might lose more funds that you actually need. Perhaps you should go talk to an NCRregistered Debt Counsellors in your area. Even if you do not qualify for debt review right away, they can offer free advice and can then help you later with debt review to handle your debt when you do find work.

When you start debt review, you will receive a plan for reduced payments to your credit providers.

When you make your second repayment, some of the money will be used to cover your Attorney’s professional fees. Depending on how much you pay, the remainder of your payment will be split among your credit providers.

Check your repayment plan and contract with your Debt Counsellor for the exact amounts involved.

Debt Counsellors are reminded to send in their quarterly reports to the NCR by the 15th of August.

The reports should cover the period from: 1 April 2024 – 30 June 2024)

The completed Form 42 must be sent to: dcreturns@ncr.org.za

For further information or clarification, please do not hesitate to contact:

Kholofelo Maupa at 011 554 2738 or email: kmaupa@ncr.org.za

The Debt Counsellors Association of South Africa have announced their keynote speaker for their annual conference this year.

Senior Economist Mr Siphamandla Mkhwanzi of FNB will address the audience and discuss the current local and international economic situation and its effect on consumers needing debt review.

The conference will be held on the 23rd of August 2024 at the Birchwood Hotel & Conference Centre in Gauteng and is open to members as well as non members. There is even a competition for non members who attend.

For more information email dcasa@dcasa.co.za

Financial Gains, Client Savings: Collaborate for Success

We specialize in providing Credit Life Insurance, Income Protection, and Funeral Cover services to debt counsellors, empowering them and their clients to have more. By referring their clients to us, we not only offer the highest referral fee in the industry, but also provide annuity streams to support their financial growth.

•Additional Revenue Streams

•Annuity Income

•Retention of Clients

•We take care of Administration

•Compliance Guaranteed

•A lucrative recurring monthly revenue stream

•Better chance of clients qualifying for debt review

•Little time and no effort – we do the work for you

•User friendly and efficient system

•Enhanced Service Offering

•No Medicals Required

•Continuous Training Provided

•DC Front-End System Integration

•Pay a lower premium for the same benefits – can save your clients thousands of Rands

•Convenience – a single policy covers all your clients’ credit agreements

•Claiming process easy and effortless and facilitated by DCCP

•New loans can be included under this policy

Tshifhiwa Matodzi, the former chairperson of VBS Mutual Bank during the scandalous looting that took place, has been found guilty and been sentenced.

Matodzi admitted to 33 crimes, including corruption, theft, fraud, money laundering, and racketeering and will now head to jail. Although the combined sentence totals 495 years, he will serve 15 years because the court ordered the sentences to run at the same time.

For more information check out this story: www.debtfreedigi.co.za/vbs-mastermind-jailed/

DREX simplifies the exchange of data and makes managing the debt review process less admin intensive.

The below links take you to step-by-step guides on how to use the DC Portal on DREX.

Our Online Course in National Credit Regulator (NCR) Debt Counselling is the perfect choice for you! Gain comprehensive skills to become a debt counsellor, start your own business, and assist heavily indebted South Africans in recovering their financial stability—all while earning a great income.

Empower yourself with the knowledge to make a positive impact and achieve financial freedom.

Join us today and transform lives!

www.enterprises.up.ac.za/course/online-course-in-national-credit-regulator-ncr-debt-counselling-july-intake

The annual Debt Review Awards gala will be live streamed from the in person venue in Cape Town on Friday the 18th of October 2024.

The results of the annual Debt Review Awards are based on an industry peer review, where those who are registered with the National Credit Regulator are invited to rate the performance of their peers on the opposite side of the industry. So, a credit provider will review the performance of a Debt Counsellor and vice versa. But what are the criterion?

Last month we looked at some criteria considered in regard to the start of the process and next month we will look at endof-process matters. This month let’s look at what is considered when looking at Debt Counsellors and credit providers with regard to the middle of the process.

Credit providers and Debt Counsellors are evaluated on slightly different criterion due to the different functions they perform. Here are some of the criterion that are considered in the indepth reviews that begin in the 3rd section of the annual reviews.

• Not opposing court matters unnecessarily

• Speed and effectiveness of resolving queries

• Speed and effectiveness of resolving complaints

• Communication skills of call centre staff

• Knowledge of the debt review process of staff

• Speed and effectiveness of resolving queries

• Speed and effectiveness of resolving complaints

• Communication skills of administrative staff members

• Staff knowledge of the process

• Ethics

• Efforts to improve the industry (e.g. at associations, forums, online, industry events, engagement with credit providers)

Note: The wording or phrasing on the questions that cover these criteria may shift or change slightly to help balance the results, but the core criterion are the same.

These are some of the criteria that cover the middle of the process. In the next issue, we will delve into some of the criterion that cover the end of the process. After all, all Debt Counsellors and credit providers all hope to see consumers get back on their feet after successfully using the debt review process.

We hope that you will be able to join us during the YouTube live stream of the event on the 18th of October 2024.

Why not head over to the YouTube channel to subscribe and watch other interesting videos about debt review:

https://www.youtube.com/@debtfreemagazine

Debtfree is partnering up with Debt Court Pro to provide one reader with the chance to attend the 2 day course for free!

The course is designed to assist Debt Counsellors with a general understanding of the Motion Court procedure and format as well as information on what appearing at the Magistrate’s Court entails.

Course Contents:

• An overview of the Magistrate’s Courts Act and Rules

• Information re: court officials and jurisdiction.

• Discussion of Rule 55: the Motion procedure – including the Notice of Motion, Founding Affidavit (single and married consumers), serviced affidavit, consumer affidavit, court orders, service of legal process, opposed applications including replying affidavits etc.

• Advice on how to contact an attorney, enquire about fees, letters of appointment of attorneys, issuing, service and filing of applications, court file preparation, notice of set down as well as what is required when applications are postponed, service of orders, record keeping and status changes on DHS.

To enter you need to be in the Pretoria area, and need to potentially be selected as the winner Email: competition@debtfreedigi.co.za and tell us: How much does the course normally cost?

Did you know iPDA is integrated with two robust frontend solutions, putting the power of choice back in your hands.

iPDA, integrated with Maximus and IFE, delivers seamless operations and superior efficiency. Managing your finances and operations has never been easier.

tuitive frontend system (IFE) - supports medium to national Debt Counseling practices, Managing your operational processes more effectively.

aximus frontend system - supports boutique and growing Debt Counseling practices, saving time on accuracy on captured information.

Coupled with extensive reporting on both the frontend systems and iPDA, you get a comprehensive view of your debt review business, assisting you in making informed decisions for your business.

Experience the power of the iPDA frontend integration and how we can partner with you to optimize your debt counseling practice.

Learn more at www.ipda.co.za

www.allprodc.org facebook.com/groups/allprodc

Finwise is an all-inclusive Software System, designed for debt counsellors for professional and efficient Debt Management.

Finwise is a cloud-based system, and can be used on any mobile device, PC, or tablet with internet connectivity. The exceptional workflow and innovative task manager tools saves the user valuable time, through multiple consumer data reporting and easy management. Several integrations such as Legasys, iDOCS, Drex, facilitate effortless administering, and handling of multiple transactions and tasks within one system.

If you work in the debt review industry you may be hungry for news about finances, the local debt review industry and the DTI, NCR, CIF and NCT.

Why not sign up for the Debtfree Industry Newsletter?

One email a month with the latest financial local and international news about all the things that may impact on how you do debt review.

We’re

If you have excellent communication skills, empathy, and a desire to make a real impact, apply now! If you’ve always been that person who gets it done, we want to talk to you.

Location: N1 City, Goodwood, Cape Town

The National Credit Regulator (NCR) invites interested and suitably qualified candidates to apply.

Requirements:

Ÿ The suitable candidate must have a 1 year post matric qualification in Office Administration or end user computing.

Ÿ One-year relevant experience will be an added advantage.

Duties:

Ÿ Sending out notices for submission of statutory reports, reminders and instructional letters to registrant.

Ÿ Administer the Returns and Submissions inbox and keep adequate records of all Forms and reports received.

Ÿ Ensure that (100%) of received CAT 1-9 statutory forms are captured accurately.

Ÿ All forms received must be reviewed for correctness prior to capturing and scanning.

Ÿ Consistent follow-up communication to credit providers on outstanding statutory submissions.

Ÿ Perform or participate relevant ad hoc duties as requested by senior personnel.

Ÿ Updating registrant's contact details as and when they change.

Ÿ Performing general office administration such as answering calls and filling of documents.

Knowledge:

Ÿ General Mandate of the National Credit Regulator

Skills:

Ÿ Computer literate

Ÿ Detail oriented

Ÿ Client Service

Ÿ Good communication skills – verbal and written

The National Credit Regulator is an equal opportunity organization which offers competitive market related packages.

Suitable persons should send a detailed CV quoting the relevant reference number to: EST-Recruitment@ncr.org.za

www.debtbusters.co.za

info@debtbusters.co.za

NCRDC533

14th Floor, The Pinnacle

Cnr Strand & Burg St Cape Town

Tel: 086 111 6197

Fax: 021 425 6292

info@creditmatters.co.za

www.debtbusters.co.za

www.zerodebt.co.za

www.debtbusters.co.za

info@debtbusters.co.za

www.zerodebt.co.za

www.debt-therapy.co.za

www.debtbusters.co.za

info@debtbusters.co.za

One consolidated payment. Savings on interest rates. More cashflow. Let’s get it sorted! Debt doesn’t have to weigh you down. NCRDC2484 Credit Matters

South Africa’s Leading Debt Counsellors NCRDC533

14th Floor, The Pinnacle Cnr Strand & Burg St Cape Town Tel: 086 111 6197

Fax: 021 425 6292

info@creditmatters.co.za

Tel: 087 701 9665

Email: help@zerodebt.co.za

www.zerodebt.co.za

www.debtbusters.co.za

info@debtbusters.co.za

www.zerodebt.co.za

www.debtbusters.co.za

info@debtbusters.co.za

www.zerodebt.co.za

www.debtbusters.co.za

info@debtbusters.co.za

South Africa’s Leading Debt Counsellors NCRDC533

14th Floor, The Pinnacle Cnr Strand & Burg St Cape Town Tel: 086 111 6197 Fax: 021 425 6292 info@creditmatters.co.za

www.zerodebt.co.za Credit Matters

Tel: 087 701 9665 Email: help@zerodebt.co.za

www.debt-therapy.co.za

0872382280 enquiries@payplansolutions.co.za www.payplansolutions.co.za

Liddles & Associates

“If you do what you’ve always done, you’ll get what you’ve always gotten.” - Tony Robbins

(T) +27 87 138 3275 (E) quintin@liddlesinc.com

www.liddlesinc.com

Steyn Coetzee Attorneys / Prokureurs

Adri de Bruyn 11 Market Street / Markstraat 11, Paarl, 7646

Tel: 021 872 1968

Fax: 021 872 2678 adri@steyncoetzee.co.za

RM Brown and Associates 16th Floor, The Pinnacle Cnr Strand & Burg St Cape Town

Tel: 021 202 1111, f: 021 425 0875

Email: roger@rmbrown.co.za

Jus�n �an Der Linde

1st Floor Icon House 24 Hans Strijdom Street Cape Town 8001

jus�n��dla�orneys.co.za

Assisting small to large debt counselling businesses with their legal applications on a National Scale.

We pride ourselves on personal attention and service excellence.

Levesh Govender Tel: 071 364 1475 eMail: levesh@lglaw.co.za

Effective Intelligence sardagh@e-intelligence.com

Fides Cloud Technologies craig@fidescloud.co.za

Finch Technologies chris@finchinvestments.co.za

I-Bureau Services abrie@ibureau.services

IDR South Africa shane@v-report.co.za

iFacts sonya@ifacts.co.za

Inoxico support@inoxico.com

Kudough Credit Solutions chrisjvr@kudough.co.za

Lexisnexis Risk Management kim.bastick@lexisnexis.co.za

Lightstone chrisb@lightstone.co.za

Loyal1 tshepiso@loyal1.co.za

Managed Integrity Evaluation

marelizeu@mie.co.za

Maris IT Development marius@marisit.co.za

National Validation Services info@nvs-sa.co.za

Octagon Business Solutions gregb@octogon.co.za

Omnisol Information Technology info@verifyid.co.za

Payprop Capital johette.smuts@payprop.co.za

PBSA seanb@PBSA.CO.ZA

Right Cover Online cto@rightcover.co.za

Searchworks 360 skumandan@searchworks360. co.za

Smart Information Bureau info@smartbureau.net

ThisisMe juan@thisisme.com

TPN Group michelle@tpn.co.za

Trans Africa Credit Bureau

clintonc@transafricacb.co.za

Transaction Capital Credit Health

DavidD1@tcriskservices.co.za

VeriCred Credit Bureau sumein@vccb.co.za

WeconnectU

johann@weconnectu.co.za

Zoia Consulting sipho@dots.africa

C O N T A C T D E T A I L S DEBT REVIEW NIMBLE GROUP

This letter serves to communicate to the Credit industry to use the following contact details for the Nimble Group when processing Debt Review related applications, enquiries, queries and, complaints escalation process.

Kindly take note Nimble Group hereby consents to service all legal documents applicable to Debt review herein by way of email.

Forms 17 1 and 17 7

Forms 17 2, Proposal Summaries, Cascade plans & Court orders

Forms 17.2 Rejection, 17.W & Form 19

Forms 17 3, General queries, settlements, balance, refunds, statements, Paid up letter request & reckless lending allegations, payment allocation queries & Complaints

drcob@nimblegroup co za

drproposal@nimblegroup co za

drtermintation@nimblegroup.co.za

drqueries@nimblegroup co za

DEBT REVIEW INBOUND CONTACT NUMBERS:

+27 87 250 5533

+27 21 8300 711

DEBT REVIEW ENQUIRIES ESCALATION MANAGEMENT ORDER CONTACT DETAILS

Kindly note that escalations must only be done once you have sent your request to the above-mentioned contact email addresses and if your requests are out of SLA in lieu Debt Review forms response business days stipulated in the NCR Act

Kind Regards,

Denvor Rank

Operations Manager: Process Recoveries

1st line escalation

Aletta Tokollo Molelekeng

Debt Review: Team Manager

D: +27 11 285 7247

E: AlettaM@normanbissett co za

2nd line escalation

Denvor Rank

Operations Manager: Process Recoveries

O: +27 21 830 0750 (Ext 6062)

E: denvorr@nimblegroup co za

3rd Line escalation

Zivia Koff

Specialised Process Manager

D: +27 21 492 4554

E: ziviak@nimblegroup co za

We trust this communication finds you well and that it will improve our service to you

It is of utmost importance that debt review documentation is sent to the correct email address to ensure timeous feedback and action.

Further to the above, please ensure that only the channel email address applicable to the documents being submitted is used. Sending emails to multiple email addresses will result in a delay or even no feedback or action.

1 Jolene Pieters Team Leader: Debt Review (Court Orders/Forms/Inclusions) JolenePieters@capitecbank.co.za 2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za Proposals

1 Meghan Bruiners Team Leader: (Proposals) MeghanBruiners@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za General Enquiries, Refund/cancellation requests , Termination queries, Updated COB’s, Payment queries

1 Nathan Slaverse Team Leader: Enquires Nathanslaverse@capitecbank.co.za 2 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

1 Mfundo Xaba Officer: Market Conduct Oversight MfundoXaba@capitecbank.co.za

2 Dries Olivier Manager: Market Conduct and Oversight DriesOlivier@capitecbank.co.za

Reckless Lending Queries

1 Whitney Jardine Team Leader: Recoveries Risk Support WhitneyJardine@capitecbank.co.za

2 Zayaan Jurgens Manager: Recoveries Risk Support ZayaanJurgens@capitecbank.co.za

Credit insurance claims

1 Grant Griffith Jessica Rademeyer Kanyisa Mbiza Team Leader: Insurance Claims GrantGriffiths@capitecbank.co.za JessicaRademeyer@capitecbank.co.za KanyisaMbiza@capitecbank.co.za

2 Brigitte October Performance ManagerInsurance Claims BrigitteOctober@capitecbank.co.za

Telephonic queries lodged

1 Laetitia Pretorius Team Leader: CCS Queries LaetitiaPretorius@capitecbank.co.za

2 Tracey Govender Manager: Recoveries Administration TraceyGovender@capitecbank.co.za

Sincerely,

17.1, 17.2, Proposals, General correspondence: debtcounselling@africanbank.co.za

To register for Legal Web Access: lwac@africanbank.co.za

Reckless Lending investigations: RLA@africanbank.co.za

DETAILS COMING SOON For more

Debt Counselling Query Resolution Contact Points and Escalation Process

Email submissions (Level1)

Email: DebtCounsellingQueries@nedbank.co.za

To be used as a first point of contact for all written communication

Call centre (Level 1: Alternative) Tel: 0860 109 279

To be used as a first point of contact for all telephonic communication

Attended to by Queries Specialist (Level 2: First Escalation) dcescalation1@nedbank.co.za

To be used only where no resolution is found from first point of contact after 5 business days

Attended to by Team Leader and Queries Specialist (Level 3: Second Escalation) dcescalation2@nedbank.co.za

To be used only where no resolution is found from the first escalation after 5 Business days

Attended to by Support and Escalation Manager (Level 4: Final escalation) nbdcescalations@nedbank.co.za

To be used only where no resolution is found from the second escalation after 5 Business days

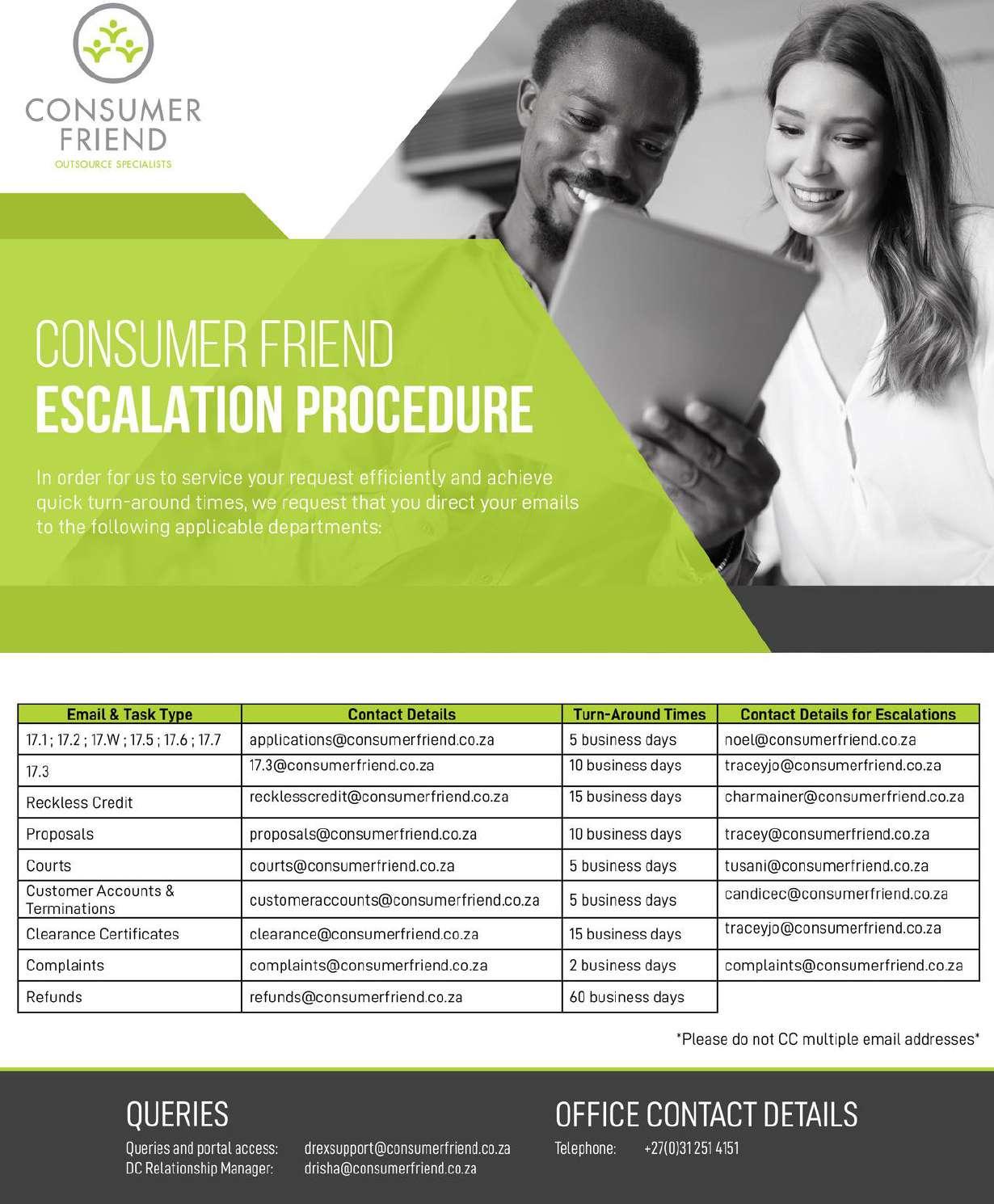

proposals@consumerfriend.co.za