5 minute read

The Interbanc Capital Corp. strategy for investing in junior mineral exploration companies

Privately owned Interbanc Capital Corp. (“Interbanc”) has substantial investments in multiple private and public companies that hold substantial land holdings in three historically prolific mineral exploration regions in Northern Ontario. This was not an accident. Interbanc deliberately seeks investment opportunities in companies that hold contiguous, underexplored properties that are near or adjacent to properties that have significant proven or historical mineral resources. These companies include Tashota Resources Inc. (“TRI”), Strike Copper Corp. (“SCC”), and Trojan Gold Inc. (“TGI”), now trading under the symbol CSX:TGII.

In the Hemlo Gold Camp, Interbanc’s investee companies hold some 34,600 acres that surround Barrick Gold Corporation to south, west and north.

It is now well-known that Barrick has recently extended the life of its Williams underground mine and that they have been conducting an extensive drilling program within 1,200 metres of TRI’s Hemlo West property. In the Beardmore-Geraldton Gold Camp (“BGGC”) located east of Lake Nipigon, 160 to 275 kilometres northeast of Thunder Bay, TRI holds nearly 9,600 acres. This property has a current NI 43-101 deposit containing 260,000 tons at .241oz./Au (68,900 ounces); surface rock grading 8,000 tons at .12 oz./Au (approximately 1,100 ounces); and a drill hole (W13-02), which contains 8.226 g/t Au over 8.70 metres, including 3.90 metres averaging 15.675 g/t Au.

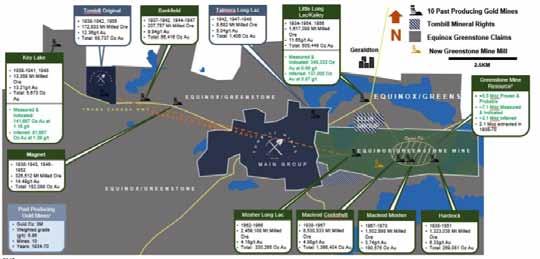

TRI’s property is about 60 kilometres from Equinox Gold Corp.’s Hardrock property, which is the site of its Greenstone Project – an open pit mine under development based on its Proven & Probable reserves of 5.5 million oz Au and total resources of 11.5 million oz Au. Tombill Mines Limited also has property interests in that area.

Given that the area has a history of gold production in the past 50 years from 18 mines and the BGGC rates among the top five gold camps in the Canadian shield with production of 4.12 million oz. Au of gold and 250,000 oz. Ag, these resources are not surprising.

historical resource as well as Kesselrun Resources Ltd.’s formerly producing Huronian project and are all not far from properties held by Paleo Resources Inc. and White Metal Resources Corp.

geRaldton gold CaMp past pRodUCeRs 1934-1970

Source: https://www.tombillmines.com/project/ tombill-main-group.html

In the Shebandowan Greenstone Belt, Interbanc’s investees hold nearly 47,400 acres which are either adjacent to or within a stone’s throw from Goldshore Resources Inc.’s Moss Lake property with its nearly four million oz AU

exploRation aCtivities

All three of Interbanc’s investee companies have been active in the Shebandowan area and have established exploration plans to be implemented utilizing currently valid and pending exploration permits. After all, proximity to properties with proven resources does not guarantee that underexplored properties will ultimately yield commercially viable deposits. specifically:

• TRi has an exploration permit valid until Q4 2022 for its

Echo Ridge property, which has a mineralization signature of over 500 metres strike length and is open on strike. At present, a 3D geologic and mineralization model is being drawn up based on the thirteen drill holes conducted last year. A down-hole geophysics program to be conducted by

Abitibi Geophysics is scheduled to commence on May 15, 2022 (preparation has been scheduled with a contractor with drilling to follow immediately after).

• An exploration permit approval is pending at TRi’s Larose property where Abitibi Geophysics has been retained to do a DasVision 3DIP survey on a grid cut last year and a drilling program is being considered in addition to a two-day exploration program for the phosphate occurrence at the

Obadinaw Syenite Stock showing.

• sCC is awaiting an exploration permit approval for work at its Sungold property (formerly held by Freewest). In the meantime, an excavator contractor has been engaged to do two more drill pads plus trenching at Hamlin (on the border of the Moss Lake property). Mapping of the

Hamlin Lake area is planned to be done after completion of trenching. The drill/crew assigned to the Echo Ridge property has been acquired for the Hamlin Lake area work, which is expected to follow immediately after completion of the Echo Ridge drill program. Freewest’s drill collar uTM positions are to be recorded and flagged at the Wye/ Redfox area with additional prospecting across from Wye Lake’s zinc and copper occurrence with down-hole geophysics being contemplated for later this year at that area.

• TGi is also awaiting an exploration permit application currently under review, for its Watershed property, which is adjacent to the west and north of the Moss Lake property). In the meantime, after evaluating Abitibi’s MAG survey of the property; an in-depth program of rock/soil sampling along with mapping is scheduled with two crews to start on May 15, 2022. This surface geological survey will assist in the selection of a trenching/channel sampling program to be followed with a drill program.

In summary, Interbanc Capital Corp. has investments in companies with substantial, but underexplored property holdings in historically prolific areas of Northern Ontario. Not satisfied with simply holding the properties for future sale, these companies are all in the process of undertaking new exploration efforts - with Interbanc’s full support!

For more information about Interbanc, please contact Charles J. elbourne, president and CeO, directly at (416) 315-6490 or by email at elbourne007@gmail.com.

nilex.com/mining | 1.800.667.4811

PRESENTS

Grab your phone, scan the QR code and conveniently subscribe for FREE.

North of 60 mining sector, delivered to your inbox twice per year.

MINING your business

E-NEWSLETTER | A NORTH OF 60 COMPANION PUBLICATION

Potash THE

PRODUCER

E-NEWSLETTER | A POTASHWORKS COMPANION