4 minute read

MiLLenniaL LiTHiuM CoRP. exeCuTiveS TRanSiTion To nexT SuCCeSS – PoTaSH

financial markets rarely offer a do-over, and it’s certainly not often that ground-floor opportunities present themselves in such a promising package. After the development of Millennial Lithium Corp. (Millennial Lithium) (OTCQX: MLNLF, TSXV: ML) into a desirable, advanced-stage lithium company, which resulted in an overwhelming success, Millennial Lithium was acquired for more than $400 million USD, generating a return of over +1,300 per cent for early investors. As a result, two key members of the company’s board of directors have transitioned from lithium to potash to create Millennial Potash.

Graham Harris and Farhad Abasov— two names very familiar to Millennial Lithium investors – will now bring their expertise to the ever-promising potash industry.

millennial p otash – leadership

Three members of Millennial Potash’s board of directors and its chief financial officer (CFO) come directly from Millennial Lithium. Graham Harris, who was the founder and chairman of the board at Millennial Lithium. Farhad Abasov, who was Millennial Lithium’s president and CEO. Dr. Peter J. MacLean, Ph.D., P.Geo. was the senior vice-president technical services at Millennial Lithium; and Max Missiouk, CPA, CMA, who served as CFO for Millennial Lithium.

If past is prologue, then Millennial Potash’s investors are in for quite a journey. It’s a trip that could resemble the path Millennial Lithium’s shareholders wandered down that recently landed them squarely in the middle of an attractive buyout deal with the NYSE’s Lithium Americas Corp. (NYSE: LAC) that was completed on January 25, 2022.

Leadership at Millennial Potash has kept the vision simple—identify and acquire a significant asset that is amenable to known/proven extraction techniques that fits in the lowest quartile of extraction costs.

Millennial Potash’s stated mission to execute that vision is a familiar one, “Build a strong team that has done it before and that can execute the strategy”. That strategy is locating a lowcost project, fast-tracking exploration, and fully developing the project to drive shareholder value.

Millennial Potash’s dream team is no stranger to developing companies and then positioning those projects for successful exit strategies. Abasov and MacLean, as well as their team, have been involved in potash projects before. The most recent, Allana Potash Corp., was taken from a very early stage (even earlier than Banio) through feasibility and sold to Israel Chemical Ltd. for $170 million. Abasov was also the cofounder of Potash One, sold to German producer K+S for $430 million. Making the transition to the potash industry even easier, the group chose a project with a history and with some key development assets already in place.

millennial p otash – company & project

Currently trading in both the U.S. and Canadian markets, Millennial Potash Corp. (Millennial Potash) (TSX-V: MLP) is an advanced startup mining company that is anything but an upstart. Its seasoned board of directors and executives, combined with a meticulously chosen property located in the potash-bearing basin of Southwest Gabon, makes Millennial Potash a real player in the potash sector. The Banio Project’s owner, Meridian Drilling (Meridian), have been sitting on the project for a couple of years. Meridian approached Millennial Potash earlier in the summer of 2022. After some research, Millennial Potash decided to move ahead with the Banio Potash Project because it has a combination of three key components: right location, strong resource, and right jurisdiction.

The Banio Project covers 1,238 square kilometres and is in the southwest corner of Gabon along the Atlantic coast of Africa. Banio is located 50 kilometres south of a port city of Mayumba. Access to the Banio site can be made via several accessible roads from Mayumba and waterways provide alternative access to the project. The Banio project sits on the border with the Republic of Congo and is located 70 kilometres north of significant potash deposits and the historical mines of the Kola and Dougou potash deposits, all of which are located within the same sedimentary horizons of the past-producing Congo Basin. The potassium-bearing salt layers of the Republic of Congo extend into Gabon, at similar depths and thicknesses. The Banio project has a proximity to Brazil, which is a large importer of potash. The project also represents reduced shipping times to the India and China market compared to other potash projects.

The Banio project was drilled in 2017 and 2018. A three-hole drill program including BA-001, BA-002, and BA-003 was completed on the Alpha Section in order to test the previously reported exploration target. Drill holes BA-002 and BA-003, drilled 2.2 kilometres apart, were successful in intersecting multiple wide potash seams. Drill hole BA-01 was stopped at 364 metres after intersecting steeply dipping evaporites.

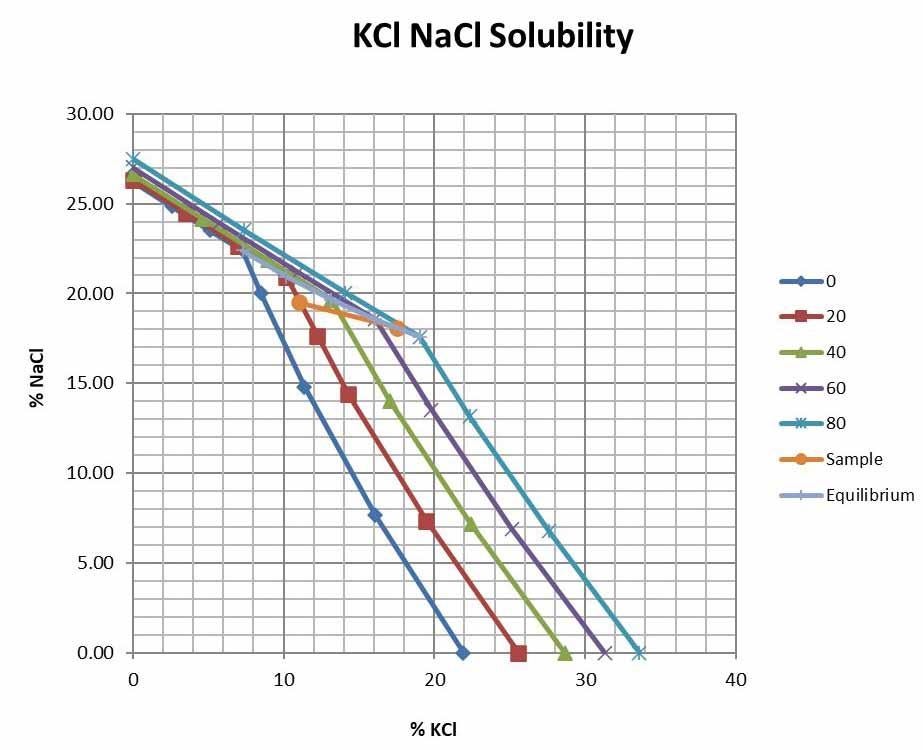

Millennial Potash doesn’t just plan on completing a 43-101 compliant resource. Millennial Potash will look to complete a feasibility study setting up the potential to become a target for acquisition. The production and processing method is critical. Millennial Potash envisions using solution mining to extract the sylvinite and carnallite. The reasoning for solution mining is because it has been done before by similar projects in the region and has been quite successful. Solution mining also has a lower CapEx compared to traditional underground mining. After the extraction of the resource there will also be a processing plant of crystallizers, drying, and compaction to produce Muriate of Potash (MOP) product. The MOP product will be delivered on 7,000-tonne barges to a Mayumba off- shore loading facility and loaded onto bulk carriers. Millennial Potash had money in the bank for the initial Phase 2 exploration program to be expedited and to start drilling in Q2 2022. Drilling was to be followed by an updated mineral resource estimate and continued permitting. Phase 3 exploration will follow and include a resource update and a preliminary economic assessment (PEA) by end of Q4 2023.

Gabon is a stable country with low sovereign risk and a recently revised mining code. It has the third-highest per capita GDP in Africa and recently joined the British Commonwealth in June 2022. Transparent mining industry laws have allowed Gabon to diversify from their mainstay oil and gas export. Major global foreign firms such as Fortescue, Eramet, Total, and Shell all have developing projects in the country.

t he p otash marK et

Currently there is a lot of expressed interest in potash. Potash prices surge on disrupted production from Russia and Belarus due to sanctions caused by the war in Ukraine. Potash prices are expected to remain strong as elimination of approximate sanctions against Russia and Belarus decreased the global annual MOP capacity to approximately 55 million tonnes, while demand is approximately 73 million tonnes. Demand is expected to increase to approximately 90 million tonnes by 2030 due to population growth where the increase in affluence in developing nations will lead to higher-quality food products.

Even if the potash price dips, this will be a very strong project with solid margins.

Millennial Potash Corporate Office: Suite 300, 1455 Bellevue Avenue West Vancouver, BC, Canada V7T 1C3

Email: info@millennialpotash.com www.millennialpotash.com

Farhad Abasov – Chairman: Farhad@millennialpotash.com

Graham Harris – SVP, Capital Markets, Director: Graham@millennialpotash.com l

• Custom machining and milling on small to large work pieces, in shop or on-site.

• Extensive industrial mechanic services, includes refurbish, maintenance, and installations.