Transforming Orthodontics: A Walk Through A Visionary Path

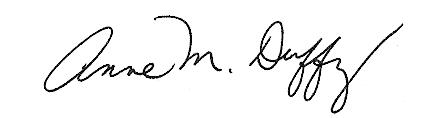

an interview with Dr. Marc Lemchen

an interview with Dr. Marc Lemchen

When you’re designing a productive practice, you need a strong mix of high-quality products that o er the value you expect. From everyday disposable supplies to durable clinical items – Patterson products consistently deliver on performance, price and patient satisfaction.

Plus, by choosing a name you can trust, you can take advantage of our certified supply chain and avoid “gray market” products.

It’s time to invest in the right products, at the right time, for the right price with Patterson products. Because practicing well and spending wisely looks great on you.

Editor & Publisher

Anne M. Duffy, CEO, RDH

Assistant Editor Clare Yeo

Project Manager

Tari Sixpence Website

Bhakti Kulmala

Sales & PR Officer

Nyasha Maripakwenda

Layout and Design

Brian Rummel

Editorial Board

Mary Fisher-Day

Dr. Dirk Fleischman

Dr. Sharon Parsons

Dr. Isabel Rambob

Dr. David Rice

Travis Rodgers

Barb Stackhouse

Dr. Lucas Shapiro

Dr. Tom Snyder Ryan Vet

Winter 2024 Contributors

Walt Gramley

Dr. Marc Lemchen

Jamie Marboe

Dr. David Rice

Travis Rodgers

Dr. Luke Shapiro

Dr. Tony Stefanou

Haden Werhan

Ryan Whitley

Dr. ArNelle Wright

Editorial Office

8334 Pineville Matthews Rd Ste. 103-201 Charlotte, NC 28226

704/953-0261

Fax 704/847-3315

anneduffyde@gmail.com

Send materials to:

Dental Entrepreneur Magazine

8334 Pineville Matthews Road Ste. 103-201 Charlotte, NC 28226

In an era where the landscape of dentistry is constantly evolving, the journey of a dental entrepreneur is both exhilarating and challenging. As we navigate through the complexities of running independent dental practices and the broader dental industry, it’s essential to remain adaptive, innovative, and steadfast in our commitment to excellence.

Defining what success means to you is the cornerstone of this journey. Success in dentistry transcends financial gain; it’s about achieving clinical excellence, ensuring patient satisfaction, and fostering a sustainable business model. It’s about balancing the intricate dance between being a healthcare provider and an entrepreneur, ensuring that both facets grow in harmony.

From our inspirational cover author, Dr. Marc Lemchen, and his never-ending pursuit of innovation, and Luke Shapiro’s spotlight on how Dr. Schwartz from Inbrace transformed and modernized lingual braces, to our practical and implementable tax tips for 2024 by both Haden Werhan and Ryan Whitley – it is crucial that every aspect of your practice needs to be meticulously planned and executed.

Embracing technology and modernization, not just as a tool for clinical procedures but as a backbone for marketing efficiency, stands out as a critical factor in this new era of dentistry.

Navigating the challenges of today requires not just a sound strategy, but also the frame of mind. Arnelle Wright helps us navigate the “Learning Years” as a new clinician, as Tony Stefanou shares reinforces the importance of knowing your company’s worth. Jamie Marboe speaks to the challenges of hiring as she gives us the tools needed to lead and maintain a happy, thriving team.

The future of dentistry is bright for those willing to embrace change, invest in their growth, and stay true to the core values of our profession. At Dental Entrepreneur, we are committed to being your partner in this journey, offering insights, resources, and support to help you navigate the path to success. Together, we can achieve more than we ever thought possible.

Cheers to possibilities!

Anne

PS: Dr. Marc Lemchen and I had a grand time recording our podcast, Dental Entrepreneur: The Future of Dentistry, which will be released next month. He is truly one of the most interesting and engaging dentists I have ever met. I hope you enjoy him as much as I do! Please let us know what you think and keep in touch. We want to share your story too.

6 Transforming Orthodontics: A Walk Through A Visionary Path

Dr. Marc Lemchen Culture

10 The Current Hiring and Compensation Dilemma

Jamie Marboe

14 Dental Success for the New Clinician: The Learning Years

ArNelle Wright, DMD Business

16 Navigating the Challenges of Running a Successful Independent Practice in 2024 Walt Gramley

20 Specialized Tax Strategies for PLLCs and S Corporations in Dentistry

Ryan Whitley

24 Tax Time 2024

Haden Werhan

26 Business Owners: Knowing the Value of Your Company is INVALUABLE!

Anthony Stefanou DMD, CBI

28 Run Your Marketing Like a Marketing Agency

Travis Rodgers

30

An interview with Dr. Marc Lemchen

ANNE DUFFYIt’s not every day that you have the honor and privilege to sit with a truly inspirational and remarkable individual. Dr. Marc Lemchen isn’t just a visionary in the field of orthodontics; he’s an inventor, entrepreneur, and thought leader in which many dental professionals look up to.

I have the privilege of speaking with Dr. Lemchen, whose career has been marked by groundbreaking innovations and a steadfast commitment to pushing the boundaries of dental care. Dr. Lemchen, let’s start from the beginning. How did your upbringing influence your journey into the world of dentistry and orthodontics?

DR. MARC LEMCHEN

Thank you, Anne. It’s a pleasure to be here. My journey into this field is deeply rooted in my family’s culture, which celebrated intellectual curiosity and the pursuit of innovation. My father, being an inventor himself, significantly influenced my path. This environment sparked my interest in exploring a career where technology could be integrated with hands-on care.

Ultimately, this exploration led me to dentistry and, specifically, orthodontics. The comprehensive education I received at Tufts and Columbia not only provided me with a solid foundation in dental science but also instilled in me a pro -

found commitment to excellence and innovation in the field.

AD What an incredible family to have grown up with. You mentioned your dad being an influence on your path. Did your mom play a role in the nurturing of your interests and your career?

ML There’s actually a humorous instance when I was 17; my mother, like many parents wishing to guide their child’s future, insisted I take a vocational test. Despite my initial reluctance, I took the test, largely out of a sense of obligation. The results amusingly suggested I pursue a career as an airline pilot, given my affinity for technology and a secret wish to fly.

This moment, though in hindsight seems like fate, was crucial in my journey. It underscored life’s unpredictability and serendipity. My eventual path led me not to the skies but to serving in the Air Force as a dentist and later into the specialized field of orthodontics. This story illustrates the blend of passion and family influence that has shaped my rewarding career.

AD Moving on to a major milestone in your career – Dolphin Imaging. What drove its creation, and what hurdles did you encounter? Tell us about your journey!

ML Dolphin Imaging was born from a desire to fundamentally change the way orthodontic practices managed patient imaging and data. In what I often call the “dark ages” of our field, we were significantly limited by the available technology. At an orthodontic convention, a friend and I encountered a system that used sonic digitizing for tracing X-rays, which sparked a thought: why not measure the patient’s head directly?

This idea faced initial skepticism but captured our imagination. The journey to realize this vision was fraught with challenges, from securing funding to overcoming industry skepticism and the technical hurdles of convincing practitioners of its viability. However, the transformative potential of Dolphin Imaging fueled our perseverance, leading to the development of a system that has since revolutionized orthodontic practice worldwide.

AD How has Dolphin Imaging changed the landscape of orthodontic practices globally?

ML It has become an indispensable tool in orthodontic practices around the world. It has enhanced diagnostic accuracy, streamlined treatment planning, and improved practice operations.

More than just a technological innovation, it has revolutionized how orthodontists approach patient care, allowing for a more integrated and efficient workflow. The impact of Dolphin Imaging goes beyond the technical; it’s about fostering a change in the profession that ultimately benefits the patients we serve.

AD Innovation is central to your practice. How do you foster an environment that encourages innovative thinking?

ML I look at it this way – innovation thrives in environments that champion creative problem-solving and open-mindedness. In my practice, we’re committed to embracing new technologies and continually seeking ways to enhance patient experiences.

For example, integrating robots for patient management and engagement not only optimized our operations but also enriched the patient experience, making it unique and memorable. It’s about pushing the boundaries of what’s possible and exploring new ways to improve care.

AD Collaboration seems to be a cornerstone of your success. How has working with others shaped your career?

ML Absolutely, Anne. Collaboration has been instrumental in my journey. Working closely with fellow practitioners, researchers, and innovators has broadened my perspective and has been critical in refining technologies and methodologies. The field of orthodontics, like many others, benefits greatly from the collective pursuit of knowledge and the exchange of ideas. It’s through these collaborations that we can drive the profession forward.

AD Reflecting on your illustrious career, what advice would you give to those aspiring to innovate within dentistry?

ML My advice is to embrace perseverance, safeguard your innovations, and keep your vision sharply in focus. The path of innovation is replete with challenges, but with determination and the right support, achieving your objectives is entirely possible. Remember, the journey of innovation is continuous, and the future holds boundless opportunities for those willing to pursue them.

AD Finally, looking forward, what excites you about the future of dentistry and orthodontics?

ML I’m incredibly excited about the limitless potential for innovation within our field. My passion for technology and a deep desire to contribute to the betterment of dental care continues to motivate my work. The advancements we’re seeing today are just the tip of the iceberg.

There’s so much more we can achieve in improving patient care, treatment outcomes, and the overall patient experience. Innovations in digital dentistry, 3D imaging, and treatment planning software, for instance, are transforming our capabilities and how we interact with patients.

I believe that by fostering a culture of innovation and embracing new technologies, we can continue to push the boundaries of what’s possible in orthodontics and dentistry at large. This journey, though far from over, inspires the next generation of dental professionals to envision and achieve a future where even the most challenging treatments can be made simpler, more effective, and accessible to all.

AD Dr. Lemchen, your journey is not only inspiring but a testament to the transformative power of innovation and persistence in the field of orthodontics. Thank you for sharing your insights and experiences with us.

ML Thank you, Anne, for the opportunity to share my story. It’s been a pleasure taking a walk down memory lane, particularly the moments that shaped my career and the field of orthodontics. I look forward to seeing the new heights to which the next generation of orthodontists will take our profession.

Dr. Lemchen is a board-certified orthodontist, receiving degrees from Tufts University School of Dental Medicine and Columbia University School of Dental Medicine. He is affiliated with several of New York’s leading hospitals, including Lenox Hill and New York Presbyterian, where he holds a teaching appointment at Cornell University Medical College. He has pioneered and developed many cutting-edge technological innovations in orthodontic imaging, mechanics and software used in his practice and others worldwide. He is also a founder of Dolphin Imaging and Management, the leading imaging and management software provider to the orthodontic community, and a founder of EasyRx, CadFlow and Zeeno Robotics. For the past ten years he has chaired the Board of Advisors at Tufts University School of Dental Medicine.

You would have to be living under a rock in the last 3 years to not recognize the current state of hiring in our profession! It is somewhat of a scratch on the head to many business owners as to how our team went from once having dedicated and happy hygienists and team members to having them jump ship for the office down the street just to make a few dollars more? How did the going rate for a hygienist suddenly increase by almost 30% to fill that position? Why has it become so hard to hire and keep quality hygienists and team members?

While providing coaching to private business owners for over 14 years now, I have come across several challenges related to the current hygiene and hiring dilemma. When I conduct exit interviews, I have been given a variety of reasons from the once dedicated team member. While increased income was an influencer due to cost-of-living stresses, the other answers may surprise some. Thus, changing the focus of my coaching topics from hygiene systems and implementation of new services to team culture and thriving leadership styles.

In Part I, I will focus on actions that business owners can take to maintain or create a happier, safer, and more cohesive environment. Part II in the Spring edition will focus on different hygiene compensation models and what might be the right fit for your practice or team.

Five “Tried and True” Needs for a Thriving and Happy Team

When you decided to become a business owner you also chose to be a leader. Let me make this clear, leadership was your CHOICE…it is now not an option! Developing consistent and smart leadership skills has never been more important. To have a team that follows, it is essential to establish and communicate the expectations and vision of the team. The team will never run faster than its leader, so what pace are you running at versus your team? Once the team member is clear on the expectation, accountability is the next step. Consistent follow through is just as critical as setting them. Without accountability, clear expectations are a moot point. Today, highly functioning and happy teams are looking for three key elements – clarity, consistency, and compassion. If you find that you are lacking in leadership skills, surround yourself with other leaders and or mentors that can help you grow in this crucial area.

In my experience as both a team motivator and hygiene department consultant, I have often observed that doctors are usually the last to know when a team member is unhappy or considering leaving the practice for various reasons, including the allure of a higher salary. There are many reasons that families are struggling financially, the Pandemic being just one of them. As a result, even content team members may be tempted to accept a job offer that pays $2-10 more per hour, regardless of their dedi-

cation. Therefore, I suggest not assuming that team members are satisfied with their job solely based on their longevity or job performance. Instead, be proactive with communications and openness as to their thoughts and feelings.

I suggest business owners take time to engage with their team regularly. You could arrange in your schedule monthly or quarterly meetings where team members can approach you privately with any concerns or issues they have. Make it clear that you have an open-door policy, allowing them to discuss their needs and concerns and collaborate with them on solutions. It is always better to have these conversations before a team member decides to resign for many reasons, but obviously hiring is now quite challenging. I would suggest you check your state laws to see if you can ask for a 30-day notice. Finally, most team members crave leadership and mentorship. Facilitating these opportunities within your team will help you build trust and improve the work environment.

I recently had a past client reach out to me for this exact reason. To help them ensure that their team was still happy and committed. Rather than assume due to the low turnover and great compensation they offer, they wanted to give the team and themselves the opportunity to re-engage with an outsider’s perspective and see where there may be areas in the environment to improve on.

Like mentioned previously, while money may not always be the reason for a dedicated team member to “jump ship”, business owners still have the responsibility to be savvy of this rising dilemma. I would hope that you have assessed where your wages compare to industry standards in your location. But if you are having a hard time hiring at your current offering in hygiene wages particularly, let me ask a few “deeper dive” questions to think about before reading Part II in the Spring edition based on Hygiene compensation solutions.

If currently paying hourly, how do you decide on an increase in hourly pay? Is it by experience and longevity? Or are your raises based on performance?

Are you aware of the hygiene team’s individual and daily production goals needed to meet the 3:1 model (producing 3 x their salary plus benefits)?

Are you open to changing your current compensation model to meet the demands of the current hygiene compensation and hiring dilemma?

I have a current client that was just faced with the hiring

dilemma and was baffled why what she had been doing the past 10 years was no longer working. She was paying the going rate, offered health insurance, life insurance, 401(k), 2-4 weeks PTO, bonuses, and pretty much more than most other practices in the area and was considered the “dream team” to work for. She had 6 hygienists in total, with two “seasoned” hygienists that had been with the practice for almost 20 years and were making about $2-3/hr more than the other two. The newer hirers, who had been there for about 5-10 years, were making less but producing more.

So, when she went to hire a new hygienist and put what she thought was a good ad with good compensation and benefits, it was crickets for any applicants. We found that the hourly rate had JUMPED to $4-6/hr more than even the seasoned hygienist was making. We knew we had a dilemma on our hands for hiring, being fair to the current hygienists and financially for the business side. We had to come up with a win-win solution for all. We then knew that the model that had been working in dentistry for decades, was no longer so. I will be going into detail in Part II in the Spring DE edition regarding different hygiene compensations and how to determine the best fit for you and your practice.

As a coach, in some of my exit interviews, hygienists are seeking reasonable expectations for a fair compensation due to the growing number of tasks and services asked of them to include

in the same 50-60 minute recare appointment than in the past 5-10 years and for nearly the same amount of pay. This has created a huge amount of stress and burnout. They would like to see their high-level thinking and producing doctors extend the same courtesy to them during that hygiene visit, that the doctors afford to their own chairs. Like more time for a single canal RCT versus a 3 canal one. I know as a coach that while this is a little tougher in some practices due to operatory restraints, something must change if you want to keep your quality and dedicated hygienist happy and less stressed. Maybe it is balancing of recare patients needing to get in versus pushing for new patient numbers? Close the back door before opening the front door. It’s important to prioritize quality over quantity in every aspect of the practice.

To boost the morale and productivity of your current team, it is essential to understand their individual languages of appreciation. While financial incentives may not be the only factor motivating your team members, other forms of recognition such as words of affirmation or quality time can be just as effective.

during a morning huddle is a nice gesture, those who respond well to words of affirmation will be touched by personalized recognition. For instance, thanking John for the calming effect he had on a nervous patient demonstrates that his efforts are appreciated and valued. Similarly, for those who appreciate quality time, maybe taking advantage of opportunities to chat one-onone over lunch can demonstrate that you genuinely care about them as a person. By taking the time to understand and cater to each team member’s language of appreciation, you can foster a positive work environment that benefits everyone involved.

While I can’t say when the current hygiene dilemma will normalize, I do know that as business owners, what worked before in many cases is not working now. The hygiene and team hiring landscape has shifted and we must adapt accordingly. If you need help with hygiene compensation or any of these 5 areas I have mentioned, please feel free to contact me at jamie@jamiemarboe. com

With help from CrownBuyers, in 2023 27% MORE kids received clinical treatment from our safety-net dental clinic partners!

Together, we can help every child have a healthy smile! Visit AmericasToothFairy.org.

Jamie Marboe BSDH, CEO and Founder of Marboe Dental Consulting, has accumulated more than 40 years of experience in Dentistry. She obtained her Dental Hygiene degree from Idaho State University and held a clinical instructor position there as well. During her early career, Jamie served as a Registered Dental Assistant in her home state of California. Throughout her time in dentistry, she also became certified as an Eaglesoft trainer and still trains offices on best uses of their software today. Her main objective is to encourage and inspire her clients to develop their team and leaders into an effective and cohesive team, and to assist them in becoming the best versions of themselves. This led Jamie to earn the title of “Team Achiever” coach. Her commitment to the growth of people has rewarded her with countless lifelong friendships with her clients and colleagues.

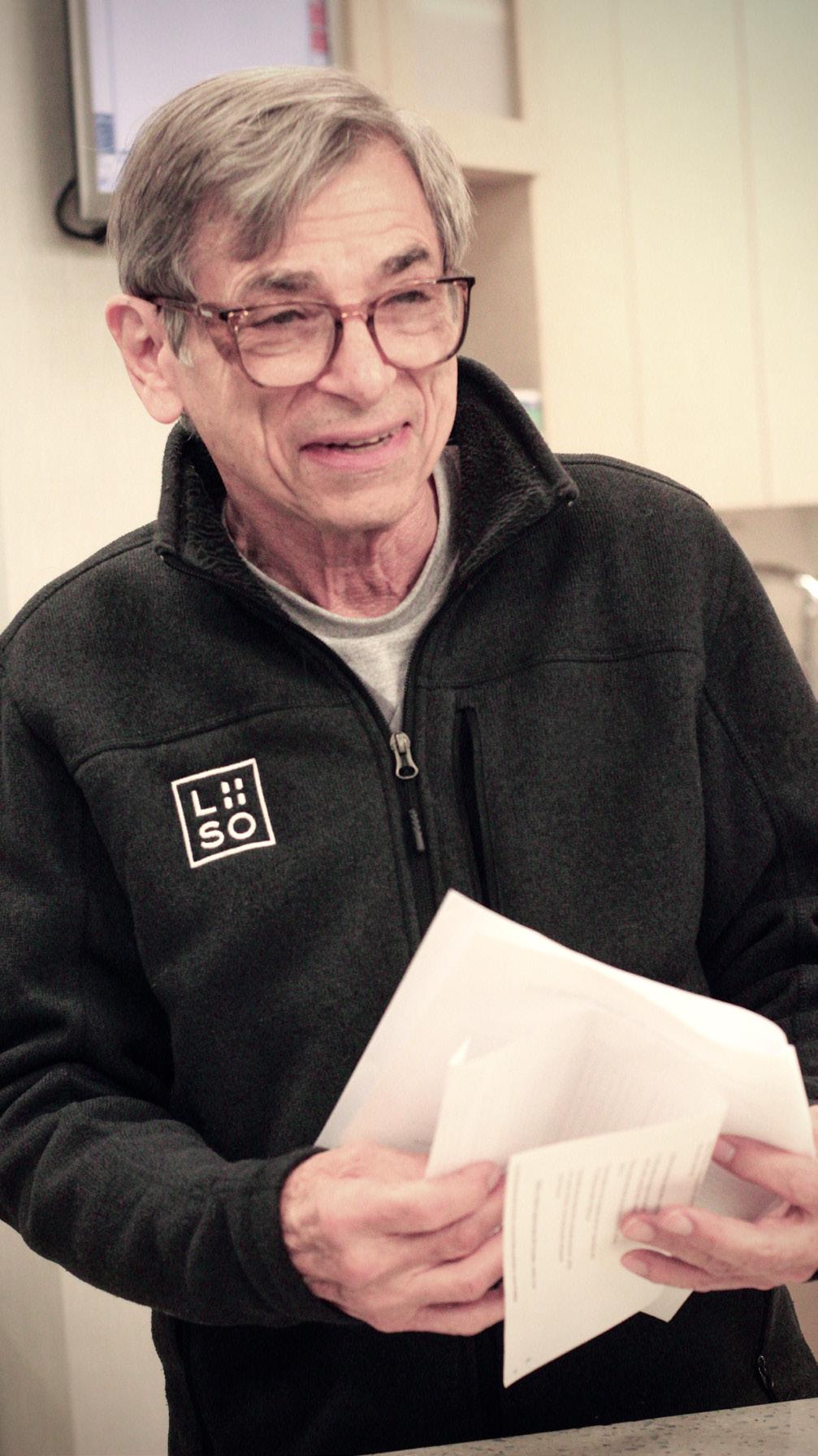

We’re the only dental staffing platform that not only fills shifts—but also maximizes the value of your business.

Hire dental staff quickly and easily. Find dental hygienists, assistants, and front-office staff today.

Connect with top talent in your area. Dentistry’s most qualified professionals are just a few clicks away.

Enhance your team with onDiem. We invest in our dental workers so that they become your top talent.

Unlock new growth for your dental practice. Discover new revenue and production levels when you hire through onDiem.

Becoming a dentist is one thing, but growing into a confident dental provider is another. Your evolution as such can also seem oversimplified, and underemphasized. Once you graduate from dental school it’s game on. Fast forward to “that day” in your mind’s eye. You’re in practice, and you’re seeing more patients than you ever have, all while navigating a new landscape, a new position, and arguably a new season of growth. Aside from implementing all of the clinical training you’ve been taught over the past 4 years, you’re now at the helm of the team, and the patients are looking to you for simple answers to sometimes complex cases.

In the first year or so you can expect to not always know what to do. The flip side of that is that you may have clinical answers to some cases, but you may not fully understand the why. Allow me to be the first to assure you: this is common, and this is okay. I learned the following statement through a podcast during my first year as a licensed dentist: “You have your learning years, and your earning years.” - Dr. Bruce Baird. Your learning years are the early days in the field where you’re connecting the dots clinically with what you’d recently learned back in dental school. It’s the years where you have multiple factors of the profession pulling at you at all times and from every angle. Clinical judgment, your clinical speed, insurance narratives, and leading a team of

people potentially older than you and in dentistry longer than you’ve been alive. These are all examples of something you may experience as you perform comprehensive dentistry.

What I want you to do early on though, is to define some things about how you’ll navigate the start of a rewarding career:

1. Keeping standards of care in mind: ask yourself what success looks like to you in your day-to-day. Include your mentors and employers in this rhetorical line of questioning. By entering the profession with your own measuring stick, not only are you setting yourself up for success early on, but you’re also stewarding your health and well-being from the beginning. Success for me starts with being comprehensive in my approach to clinical dentistry and equipping my patients with enough information to aid their informed decision making. Once my patients say “yes” to treatment, I then strive for success by doing or completing the treatment I’ve diagnosed.

2. Keep in mind that we’re all juggling the multitude of things happening in our lives throughout the day, but you get to decide the ball that doesn’t get dropped. With wellness in mind, all of us are so committed to outcomes

that we may sacrifice family time and/or personal time for the urgent needs of our patients. Our patients are important, yes; and without them we have no business(es). However, without you, dear doctor, the oral systemic connection is at greater risk, and more patients potentially go without treatment.

If you haven’t figured it out already, during the early days of your new life as a dentist, it’s critical that you take as much care of yourself as you care for the team, the practice, and your patients of record. To help with this idea, here are four areas of focus you should remember as new dentists:

Also referred to as clinical judgment, it is critical that you remain curious about dentistry, and I’ve committed to this in a number of ways. For starters, I still place a high premium on self assessment. This is before, during, and after treatment has been rendered. Not only do I constantly make mental notes about my performance, I also seek new information to guide my decision making, while challenging my implementation.

Although I’ve mentioned this in passing earlier on, there’s an additional point for you to consider about the learning years. More times than not our colleagues take pride in coming alongside us at various stages of our careers. What’s necessary though, is that you seek mentorship, and once found you should share the challenges that you have. Only then can your senior colleague help you avoid further pitfalls down the line. What will be even more beneficial is that you build your network, and learn different aspects of dentistry so that you can later apply the method that best aligns with your clinical approach.

Healing the healers has surfaced as a topic of discussion, and it’s only growing in precedence. By applying our clinical knowledge with our clinical skills, we dentists have the opportunity to change lives in some of the most meaningful ways. We are also constantly up against meeting and surpassing the expectations of our patients, which has been to our detriment at times. One of the most valuable advances I’ve made in both my professional and personal life is creating room for my well-being, even in the simplest of ways. I believe that when I’m my best, I bring that energy to the workplace, and in my home.

I’ll bet this one caught you by surprise, because very few share openly on the monetary side of healthcare. However, it’s important for you to reward yourself on at least a small scale for the work you’ve put in thus far. What you want to avoid doing though, is overindulging. Student loans are back in repayment, rates have skyrocketed in the home lending department, and with the ensuing economic recession the best thing we can all do is plan for the oscillation of the future.

The early days of your career will be dedicated to managing more than you’ve ever known about dentistry. During those days I want to remind you to give each patient the best care you have in your wheelhouse and lead your team with confidence, but when the dust settles, insert time for you to recharge intentionally. This is one reason I created the Being & Becoming Your Best Personal Growth Community. Oftentimes the needs of the healer are placed on the back burner and eventually go unaddressed. I want this to be the year that all women take time to define what selfcare looks like, and be relentless about creating the margin to make a regular practice.

Dr. ArNelle Wright is a graduate of the University of Florida, a wife and mom of two. In addition to practicing General Dentistry, she is also heavily involved in organized dentistry. Her approach to dentistry and mentorship inspires students to value their role as leaders, while providing their patients with optimal dental care. Outside of dentistry Dr. Wright can be found lecturing, and facilitating discussions on the significance of culture-driven leadership in the workplace.

Independent and small group dental practices face a number of challenges in today’s marketplace. You encounter a unique set of obstacles that require adaptability, resilience, and strategic thinking. You must balance clinical responsibilities, administrative tasks, and business operations simultaneously. Providing exceptional patient care and running a financially sustainable practice requires a disciplined and strategic approach that goes beyond clinical expertise.

As the calendar turns to 2024, it is important to take a moment to step back and critically assess where your practice is today, where you want it to be one, three, and five years from now, and what you need to do to achieve that end. In this article, we will explore some key strategies and tools for independent dentists to successfully manage your practices and thrive in today’s challenging healthcare landscape.

Every practice owner should go through the exercise of defining success on a regular basis. Success in an independent dental practice goes beyond financial prosperity; it encompasses a blend of clinical excellence, patient satisfaction, and a sustainable busi-

ness model. For independent dentists, it must also consider the personal elements that make up your work/life balance. Taking time to define what success means for you enables you to confirm that you (and your practice) are on the right path, identify areas that require attention and focus, and ensure you know when you are achieving the goals you set. Some things to consider when defining success include:

Clinical Excellence – How would you assess your current clinical skill set and are you taking steps to maintain and demonstrate exceptional skills and knowledge? Are you staying updated with the latest advancements in dentistry that are keys to providing high-quality care such as emerging technologies, treatment modalities, and best practices?

Patient-Centric Approach – Ask yourself if your practice has created a positive and personalized patient experience. The interactions between patients and staff should be what we at BEST for Dentistry describe as a “care first conversation”. The care you provide is personalized and patients are well-informed about treatment options, procedures, and expected outcomes. Patients who are well-informed and believe they are receiving great care will remain loyal to your practice and refer others.

As the calendar turns to 2024, it is important to take a moment to step back and critically assess where your practice is today, where you want it to be one, three, and five years from now, and what you need to do to achieve that end.

Engagement with Your Community – As an independent practitioner you have a unique position in your community. Maximizing that position takes work and must be cultivated over time. A strong presence in your community is vital for success. Often referred to as reputation management, it is built on positive word-of-mouth, community engagement, and a stellar online reputation.

Financial Sustainability – Alongside clinical excellence and patient satisfaction, financial sustainability is a key component of success. While this seems like an obvious statement, your evaluation of the practice’s financial position must be intentional, consistent, and based on established metrics. Maintaining a healthy bottom line allows practitioners to reinvest in the practice, upgrade technology, and continue providing exceptional care.

Operational Efficiency – an efficiently managed practice drives so many other aspects of the success equation including patient and employee satisfaction, financial performance, and leveraging technology. Are current practice operations a success driver or a drag on your performance? What does operational efficiency look like and how do you achieve it?

Too often, dentist entrepreneurs jump right into the mechanics of running their practice without first defining success. Success has many drivers, each one an important contributor to achieving your goals. Just as importantly, defining success is an exercise that should be done regularly.

Translating your definition of success into key strategic objectives is another critical exercise for independent dentists. These objectives are what you come back to when dealing in the day-today gets you off track. Your list should be clear, achievable, and

contribute directly to your success measures. It should also consider where you are in the life cycle of your practice and career since decisions regarding investments in technology, adding associates or operatories, or expanding your fee-for-service patient base are all impacted by where you are in the life of your practice. Some potential areas to consider when developing key objectives could include:

Prioritize Patient Experience – Prioritize creating a positive and welcoming environment for patients. Implement staff training on excellent customer service from the initial interaction to the patient’s departure. Establish clear communication channels and patient education about treatment plans, addressing patient concerns, and case acceptance. Make the scheduling and payment process as customerfriendly as possible. Everyone in the practice is part of the patient experience and should be trained accordingly.

Financial Management and Budgeting – Solid financial management is essential to the sustainability and growth of your practice. Begin with a comprehensive budget that covers overhead costs, staff salaries, supplies, and other operational expenses. Regularly review financial reports and evaluate results against key performance indicators (KPI’s). Consider billing and invoicing systems to tighten revenue cycles. Integrate financial considerations into the patient experience using clear communication protocols and financial transparency. Financial and payment policies should enhance case acceptance and satisfaction, not detract from it.

Strategic Pricing and Fee Structures – Carefully evaluate your pricing strategy to ensure it aligns with the quality of your services and the local market. Consider things like tiered pricing, membership or loyalty programs, service discounts, and other incentives where patients can choose from different treatment packages based on preferences and budget.

Optimize Insurance and Billing Processes – Ensure that you have the processes in place and a team well-trained in navigating insurance procedures, verifying coverage, and submitting claims promptly. Critically assess your payer mix to understand where patients are coming from and patient revenue associated with each patient. Negotiate fee schedules with insurance providers and explore strategies to drop insurers and transition patients to fee for service. Implement a transparent billing process, clearly communicating financial responsibilities to patients and offering flexible payment options.

Embrace Technology for Efficiency – Technology can be a great tool for independent practices, enabling the practice to operate more efficiently, increase capacity, and improve profitability. But it must be evaluated carefully and implemented strategically. It is also critical to establish a return on investment (ROI) framework for each technology option whether that be imaging or diagnostic equipment, patient financing and payment options, or a new website and social media engagement.

Marketing and Communication – Identify objectives for marketing that include both online and offline channels. Utilize social media, search engine optimization (SEO), and online reviews. Engage with the local community and build relationships with local businesses and healthcare providers. As importantly, implement tools that enable you to track and confirm how effective your marketing activities are and how they translate into new patients (your “marketing ROI”).

These are just a few areas to consider when establishing or refining your key objectives. It is an important exercise that enables you to set a clear path for your practice, effectively communicate with your patients, and ensure that your team is welltrained, operates efficiently, and stays motivated. You are then well-positioned to set priorities, effectively evaluate investments, and confirm the financial health of your practice.

You can’t go it alone. There are a broad range of companies with the products, tools, and resources to help independent dentists manage their practices. BEST for Dentistry is one of those companies and was founded to support independent dentists by providing the resources and solutions you need to compete successfully. If you have taken the steps to define success and developed your key objectives, you are in a great position to identify partners that support your objectives and drive your success.

Some practical considerations that could emerge as you plan for 2024 and beyond, with partners available to support you along

the way:

Managing your Supply Spend – engage a partner capable of improving your supply spend and managing it to levels appropriate for your practice.

Conduct an Insurance and Fee Schedule Re-Set – engage a partner to help you dig into your current payer mix, assess and balance your fee schedule, and implement a plan to optimize reimbursement for the practice.

Evaluate your Lab Services – engage a partner to analyze your lab spend, confirm it is market competitive, and that services are of high quality.

Consider Outsourcing Staffing – identify and engage resources to outsource patient billing and payment.

Implement a Marketing and Patient Engagement Plan –take steps to expand your practice profile and acquire new patients for your practice.

Successfully managing an independent dental practice requires a multifaceted approach that combines clinical expertise with strong business acumen. Embracing technology, prioritizing the patient experience, efficient appointment scheduling, financial management, staff training, compliance, and effective marketing are all essential components of a thriving dental practice.

By adopting these strategies and staying adaptable to changes in the healthcare landscape, independent dentists can maintain a successful practice, build a positive reputation within their communities, and stay true to their commitment to clinical excellence.

Walt Gramley is currently a Partner & COO at BEST for Dentistry. Throughout his 30-year career in healthcare, Walt has focused on solutions for providers across the healthcare spectrum that enables them to maintain clinical independence and operate effectively in today’s challenging healthcare marketplace. Walt can be reached at wgramley@ bestfordentistry.com. To learn more about BEST for Dentistry, visit www.bestfordentistry.com.

Balancing the art and business of dentistry extends beyond the creation of perfect smiles; it necessitates astute financial management. Within this realm, tax planning emerges as a cornerstone of financial success for dental practice owners, especially those operating as Professional Limited Liability Companies (PLLCs) and S Corporations. In this comprehensive article, we will delve into specialized tax strategies tailored for these structures, with a focus on optimization and maximizing deductions to enhance profitability.

Choosing the appropriate business structure is pivotal for PLLCs and S Corporations. PLLCs offer professional liability protection and flexible taxation options, while S Corporations provide liability protection and the advantage of pass-through taxation. The selection depends on factors such as income, liability concerns, and long-term objectives.

A well-informed choice between PLLCs and S Corporations sets the stage for effective tax planning. PLLCs, designed for professionals, offer a unique blend of liability protection and flexibility

in taxation. On the other hand, S Corporations, with their pass-through taxation, allow profits and losses to be passed directly to shareholders, potentially resulting in substantial tax savings.

Investing in state-of-the-art dental equipment is essential for providing top-notch care. Section 179 deductions empower PLLCs and S Corporations to deduct the full purchase price of qualifying equipment and software in the year of acquisition. This strategy not only enhances the practice’s capabilities but also provides a substantial upfront tax benefit.

Consider the scenario where a dental practice acquires cuttingedge digital imaging equipment. Instead of depreciating the cost over several years, Section 179 allows the practice to deduct the entire amount in the year of purchase. This not only improves the practice’s technological infrastructure but also offers a considerable tax advantage, positively impacting cash flow.

The QBI deduction proves to be a powerful tool for S Corporations. Allowing eligible business owners to deduct up to 20% of their qualified business income, maximizing this deduction involves careful planning and collaboration with tax professionals to optimize its application within the unique structure of S Corporations.

For S Corporations, understanding the intricacies of the QBI deduction is paramount. By working closely with tax professionals, practitioners can identify opportunities to optimize income allocations and maximize the deduction. This collaborative approach ensures that the practice benefits fully from the QBI deduction, contributing to overall financial health.

Retirement planning remains a potent strategy for reducing taxable income. PLLC and S Corporation owners can explore retirement plans such as Simplified Employee Pension (SEP) IRAs and 401(k)s. Contributing to these accounts not only secures the financial future of dental practitioners but also provides valuable tax advantages.

Incorporating retirement planning into the financial strategy is a wise move. Contributions to retirement plans not only build a safety net for practitioners but also offer tax benefits. The taxdeductible nature of contributions to SEP IRAs and 401(k)s reduces current taxable income, providing immediate financial relief while ensuring a comfortable retirement in the future.

PLLC and S Corporation owners can capitalize on HSAs and FSAs to manage healthcare costs efficiently. These accounts allow pre-tax contributions to cover qualified medical expenses, offering immediate savings and a long-term financial safety net. Maximizing contributions to these accounts enhances the overall tax-saving strategy.

Healthcare costs are a significant aspect of a dental practice’s expenses. By strategically utilizing HSAs and FSAs, practitioners can manage these costs effectively. Contributions made to these accounts are deducted from taxable income, providing immediate tax savings. Moreover, these accounts offer flexibility in covering various medical expenses, ensuring a comprehensive approach to healthcare cost management.

Meticulous record-keeping is critical for PLLC and S Corporation owners. Implementing robust accounting systems and tracking expenses diligently ensure that all eligible deductions are identified. This not only maximizes deductions but also safeguards against potential audit challenges, providing peace of mind for practitioners.

Efficient expense tracking is more than a regulatory requirement; it is a proactive approach to financial management. By leveraging modern accounting software and staying organized, dental practitioners can not only maximize eligible deductions but also streamline financial processes. This diligence not only aids in tax planning but also contributes to overall practice efficiency.

Both PLLCs and S Corporations can benefit from bonus depreciation. This provision allows for an immediate deduction of a substantial portion of the cost of qualifying property. Dental practices looking to make significant capital investments can leverage bonus depreciation to maximize deductions, thereby improving cash flow and overall financial health.

Bonus depreciation is a valuable tool, particularly for practices making significant capital investments. Whether acquiring new office space, upgrading technology, or investing in other qualifying property, the ability to accelerate depreciation through bonus depreciation provides a significant upfront tax benefit. This enhances cash flow and enables practices to reinvest in further growth and development.

Tax laws are dynamic, and staying informed is crucial for PLLC and S Corporation owners. Regular consultations with tax professionals specializing in these business structures are essential to ensure strategies align with the latest regulations and opportunities. Being proactive in adapting to changes ensures that dental practitioners continue to optimize their tax positions.

The landscape of tax laws is ever-evolving, and dental practitioners must stay ahead of these changes. Engaging in regular consultations with tax professionals ensures that the practice’s strategies align with the latest regulations and opportunities. This proactive approach not only minimizes the risk of non-

compliance but also positions the practice to capitalize on new tax-saving avenues as they emerge.

For dental practice owners operating as PLLCs and S Corporations, specialized tax planning stands as the linchpin of financial success. From strategic business structure selection to optimizing deductions through Section 179 and QBI, these strategies are tailored to the unique needs and benefits associated with PLLCs and S Corporations. By maximizing deductions, staying informed, and collaborating with tax professionals, dental practitioners can navigate the complexities of tax planning, ultimately ensuring sustained financial health and the continued success of their practices.

In the delicate dance of art and business, strategic tax planning becomes the partner that leads to a harmonious and prosperous future for dental practices. As practitioners continue to provide exceptional care, these financial strategies create a solid foundation for a thriving and resilient dental practice in the everchanging landscape of the healthcare industry.

Hinman Dental Meeting

March 21-23, 2024

World Congress Center

Atlanta, GA

Midwest Dental Conference

April 10-14

Kansas City

Star of the North

April 25-27

Minneapolis/St Paul, MN

Accelerate by Vyne Dental

May 9-10

3D Dentist Summit Nashville

May 30- June 1

Tennessee Dental Association

ADSO Summit

Ryan Whitley, CFP is CoFounder at NaviPath Advisory, where his team envisions a future that traditional tax and accounting services are transformed. We are not just your accounting and tax preparer; we are your partner, your coach, and your guide. We saw a gap in the market, where most tax relationships only look back, offering advice on past financial matters. Recognizing the flaws in this approach, we have emerged as a forward-thinking, proactive, and high-touch tax planning firm.

June 12 -15

Denver, CO

CE on the Beach

July 25-27

Aruba

ADHA Annual Conference

July 26-28

New Orleans, LA

We’d love to see you!

Ah, the good old days. Did you know: The first federal income tax form in 1913 was just three pages long? Social Security numbers didn’t yet exist, so you simply listed your name and address. Tax rates ranged from 1%–6% on income above $3,000.

Fast forward to today. With some 800 tax forms and 7,000 pages of Internal Revenue Code, your 2024 taxes are going to be a bit more involved. This includes new challenges to be faced and opportunities to be mined by digging into the most recent rounds of Federal tax law:

The Tax Cuts and Jobs Act of 2017 (TCJA): Effective January 1, 2018, the TCJA reduced the number of brackets and lowered the top tax income tax rate from 39.6% to 37%.

The SECURE Act (2019) and SECURE Act 2.0 (2022) followed, containing important retirement plan provisions that affect most dentists.

The truth is, we CPAs and tax preparers tend to be “historians” by default, meaning we help you report on income already earned. To expand on the possibilities, consider asking your tax team to work with you on past events as well as future opportunities. Here are some timely tips to guide the way.

The Augusta Rule – Also known as Section 280A of the Internal Revenue Code, allows taxpayers to rent their home for up to 14 days per year without having to include that income on their tax returns. Dentists with Corporations can rent their home for business meetings, provided the amounts are reasonable.

Employ Family Members – Dentists can employ their spouses to include them in the practice retirement plan and their children to shift income from a high tax bracket to a zero or very low tax bracket. The wages a child earns can be used to fund Roth IRA’s. Children can earn up to the Standard Deduction and pay zero federal tax. The Standard Deduction is $13,850 in 2023 and $14,150 in 2024. It is important to check one’s state income tax rates and regulations about employing minors, as well as keeping good records, the

same as you would for any employee.

Maximize Retirement Plan Contributions – Dentists with retirement plans such as 401(k) Profit Sharing Plans or Solo 401(k) Plans should strive to maximize their annual contributions. 401(k) maximum contribution limits are $22,500 for 2023 and $23,000 for 2024. For those over the age of 50, there are extra (catch-up) amounts of $7,500 for 2023 and 2024. In addition, the maximum contributions to a Profit-Sharing Plan are $38,500 for 2023 and $39,000 for 2024. Given these amounts, a dentist aged 50 or older can contribute $73,500 for 2023 and $76,500 in 2024. There are also SEP (Simplified Employee Pension) and SIMPLE IRA’s (Savings Incentive Match PLan for Employees). SEP contributions are limited to 25% of compensation with a maximum of $66,000 for 2023 and 69,000 for 2024. SIMPLE IRA’S are like 401(k) Plans in that they have employee deferrals and employer contributions (2 or 3% in most cases). The deferral amounts are $15,500 for 2023 and $16,000 for 2024 and the over-50 catch-up amount is $3,500. Of course, there are traditional and Roth IRA’s with contribution limits of $6,500 for 2023 and $7,000 for 2024 with the over-50 catch-up amount of $1,000.

Defined Benefit/Cash Balance Plans – Pension Plans, as they are also known, allow later-career dentists to defer large amounts of income into these retirement plans. They are complex and can be costly since they require the services of an Actuary in addition to a traditional Pension Plan Administrator, but the ultimate tax savings can be significant. Think about how a $300,000 - $400,000 tax deduction could offset the gain on the sale of one’s practice!

Health Savings Accounts – HSA contributions require an HSA eligible (high deductible) health plan, but the benefits from a tax savings and financial planning perspective are significant. Individual plan contribution limits are $3,850 for 2023 and $4,150 for 2024. Family plans allow $7,750 for 2023 and $8,300 for 2024. For those over 55, add $1,000 to all the above amounts. HSA contributions lower taxable income, and withdrawals for eligible medical expenses are tax-free. There is no requirement to withdraw funds from an HSA account annually so the balance can be invested and grown over the

years to be used later in life when out-of-pocket medical expenses may be more burdensome.

There are two important provisions in the tax code that are part of or related to the Tax Cuts and Jobs Act of 2017. Section 199A Qualified Business Income Deduction and the Pass-Through Entity Tax Deduction.

TCJA lowered the tax that corporations pay from 31% to 20%. Realizing that wasn’t fair for non-corporate taxpayers, Congress included Section 199A in the act for Sole Proprietors, Partnerships and S. Corporations. Simply stated, these business entities can deduct 20% of their profit with certain limitations. Unfortunately, businesses in a service industry (healthcare, accounting, financial services) are not eligible unless their taxable income is below a threshold. For 2023, the threshold is $364,300 for Joint tax return filers and $182,100 for all others. The deduction is completely phased out once income exceeds $464,200 for Joint tax returns and $232,100 for all others For 2024, the phase out begins at $383,900 for Joint tax returns and $191,950 for all others and the deduction is completely phased out at $483,900 for Joint tax returns and $241,950 for all others. There are many factors that go into determining one’s eligibility for the Section 199A deduction besides income but for most dentists, the math is pretty straightforward.

TCJA limited the Itemized Deduction for State and Local taxes (SALT deduction) to $10,000. A dentist in California with $20,000 in Real Estate tax and $50,000 in State Income tax lost $60,000 of their $70,000 Itemized Deduction. Another dentist in Texas, Florida, or another state with no income tax was barely affected by the $10,000 SALT limit depending on their Real Estate tax liability. After many months of action by several affected states including lawsuits and proposed legislation, the IRS issued Notice 2020-75 in November 2020 allowing Partnerships and S. Corporations (Pass-Through Entities or PTE) to make “Specified Income Tax Payments” (SITP’s) to their states and receive a deduction for those payments on the federal tax returns. While there is no limit on the amount of these payments for federal tax purposes, each state has its own calculation. There are currently 36 states with enacted or proposed PTE level tax. There are 9 states with no personal income tax so PTE does not apply. Washington DC, Delaware and North Dakota have yet to propose or enact PTE taxes. Along with the expiration of the Tax Cuts and Jobs Act in 2025, the Elective Pass-Through Entity Tax goes away. The math is pretty straightforward. If a dentist’s state allows a PTE payment, he or she will save federal income tax equal to their top tax bracket for the amount of the payment. The payments made by a Pass-Through Entity to a state apply to the Partner’s or S. Corporation Shareholder’s state personal income tax.

The SECURE Act and SECURE 2 made numerous changes to retirement plans:

Required Minimum Distributions – Prior to these acts, taxpayers were required to take distributions from their IRA’s and other retirement plans at age 70 ½. Under the acts, most taxpayers may now wait until they reach age 73. For folks born after 1960, the RMD age is 75.

SIMPLE & SEP Roth IRA’s – Starting in 2006, participants in a retirement plan were allowed to designate part or all of their 401(k) deferrals as Roth. SECURE 2 allows contributions to SIMPLE and SEP IRA’s to be treated at Roth. Roth contributions are after-tax but the amounts grow tax-free.

Retirement Plan Start-up Credits – Dentists may be eligible for a tax credit of up to $5,000 for 3 years after establishing a new retirement plan. The credits apply to retirement plan start-up & educational expenses and employer contributions made to the plan for participants. The deduction for the startup costs and contributions must be reduced by the amount of credit received.

Other – For people who have unused money tied up in 529 Plans, up to $35,000 can be rolled over to a Roth IRA tax-free with certain limitations. Also, Qualified Charitable Distributions from IRA’s are increased from $50,000 to $100,000.

Planning ahead is very important when it comes to taxes. It should be something dentists look at during the year to ensure that there are no surprises on April 15th. In addition, tax planning is vital when considering one’s future financial well-being. Saving for retirement is one thing, but saving in the most tax efficient manner possible can have a significant impact on a dentist’s lifestyle in retirement and the legacy they leave behind. Tools such as tax loss harvesting, asset location, and utilizing tax efficient/low-cost mutual funds in a portfolio should be part of every dentist’s Wealth Planning.

With a rich background in wealth management, accounting, and tax services specifically tailored for dental professionals, Haden Werhan has been an integral member of the Thomas Doll affiliated firms since 1998. His expertise extends from his extensive experience in managing and consulting for dental practices, covering a range from start-ups to large group practices. Haden is also a seasoned speaker, having delivered lectures and seminars at notable universities and dental societies. Holding CPA/PFS credentials and a license in real estate brokerage, he is academically grounded with degrees in economics and accounting & taxation. Residing in Lafayette, California, Haden enjoys flying, scuba diving, and swimming in his leisure time.

If you are a company owner – regardless of whether that is a dental practice or other type of dental company – here are some eye-opening statements to consider. As the saying goes, the “numbers don’t lie”!

• 80% of dental practice owners are currently UNDERVALUING what their business is worth

• 87% of dental practice owners, and 84% of dental company owners are relying on their eventual sale of their business in order to live comfortably in retirement

• 97% of dental business owners don’t have a company appraisal done until they are “ready to sell”

• Over 90% of business owners sell 3-5 years “too late” (when they have started to slow down and company value has is done significantly)

Dentistry (all aspects of it) is a “HOT” sector right now! YES!!!

For decades, we used to joke that it was the “poor stepchild” of the healthcare industry. Not anymore. Approximately ten years ago, dental was “discovered” by big money (“Wall Street”/Private Equity) and identified as being an industry that was fragmented and in need of “consolidation” – exactly the formula they look for. The result is that since then, practices and companies have been selling at higher multiples (purchase prices) than ever before. While it can be a complex conversation, the bottom line is this. We all learned in school at some point the concept of “supply and demand”. Bottom line is this…the more buyers, and types of buyers (demand) that exist in an industry, the more it

becomes a “seller’s market”. There are lots of buyers in dentistry right now – particularly for practices and especially for companies offering services, technologies and software.

Good for us, right?

Yes…except that we must take a look at those previously mentioned bullet points.

Before we do that, let’s consider the following. If you have an IRA or retirement account, as many of us do, how many of us would just keep contributing to it year after year without EVER looking at its value, and then, when you are ready to cash out, first see what that number is and hope that it is a high one? None of us do that right? You could be very surprised (in either direction)! Most of us periodically (sometimes even weekly) take a peek at our portfolio and retirement account value. WHY? In order to strategize – do you continue to contribute to a poorly performing account or consider other options?

Let’s say you own a house, and decide “we have to sell now” thinking it’s worth “X” amount of money. Then you put it on the market, get an appraisal, and it’s not even close. Now what?

You are a practice or company owner. You may be years away from retirement and/or even thinking of selling. Or not. Knowing what your business is worth NOW (and then periodically) is smart for a number of reasons, the main one being that

it allows you to develop a grounded STRATEGY – whether that be to understand what needs to be done now in order to grow the business (and work on maximizing its future value) OR thinking about exiting/selling now (while it’s at peak value within a seller’s market) and determining which type of buyer might be the best option. By the way, selling a company doesn’t mean you have to, or are, retiring. In many cases – examples being a practice owner affiliating with a DSO, or a company owner staying aboard post-sale as CEO or as a highly paid consultant – you are sticking around for years without the challenges and headaches of managing or running the company.

Let’s delve into this a little more. If you are a practice owner, chances are you were told, and possibly believe, that your practice is worth a percentage of your collection numbers. If you think that’s the formula, then you don’t need to, or wouldn’t want to, have your practice appraised until you are ready to sell. Sadly, that’s dangerous! Why?? Because that is NOT the way your practice FMV (Fair Market Value) is determined anymore – and thank goodness for that! Think about this. If you have a $1,000,000 practice and your colleague next door has a $1,000,000 practice—same zip code—that would mean BOTH of your practices are worth the same. Are they? Should they be? No! In fact, they could be worth significantly different amounts, as they are probably very different in how they operate, what their expenses are, how many or what types of patients they see, what sorts of technologies or programs they use and offer, etc.

In the “real world”, businesses are sold based on a multiple which is placed on an “adjusted cash flow” determination (EBITDA). You look at the recent collections, at each expense, and then make adjustments to those expenses based on what the “new buyer” would be needing or doing. Keeping it simple for the purpose of this article, the multiple is determined by your collections number (but placed on the EBITDA) and that multiple can (and usually does change) several times a year depending on several factors (the economy, the supply/demand ratio, what other businesses have sold at, etc.). With dental practices, the “old” way of determining FMV meant that a practice could NEVER sell at more than one time (annual) collections, no matter how strong the EBITDA/adjusted cash flow was. Crazy! We’ve seen practices (my company has now done over 1500 practice appraisals so we have a lot of experience to be able to say this) now that would have been “cheated” out of hundreds of thousands, or even millions of dollars, had they been sold by that superficial and old way of thinking. Today, with those 2 side by side practices doing $1,000,000 in collections, if one has a $200,000 EBITDA and the other a $350,000 EBITDA, the DIFFERENCE in their FMVs are $600,000! WOW!!!

But let’s say you are YEARS away from thinking of selling. Again, why should you know what your FMV is? Simple. When you have an appraisal or valuation done, because both the COL -

LECTIONS and EACH EXPENSE is analyzed, you would learn what areas of your practice/business would need to be focused or worked on in order to INCREASE EBITDA in the future, and therefore INCREASE FMV. That’s because simply increasing collections (what we might just say growing) the business doesn’t always, in itself, raise value. Since multiples are placed on EBITDA, to grow EBITDA usually means a combination of increasing collections AND reducing (certain) expenses. Increasing collections generally increases the multiple which will be placed on EBITDA, and reducing expenses (i.e. supply/lab costs) together is the ticket. Also remember, since the multiples also change periodically, you really can’t just “assume” you know what your FMV is; you should have a professional, third-party appraisal regularly done by someone who knows the multiple and knows how to calculate the adjustments necessary to determine EBITDA. These days, single location dental practices single location can have a 1.0-8.0 range in EBITDA multiple. And, that means that a high cash flow, high collections practice could have an FMV worth MUCH MORE than 1x collections! For all the reasons outlined above, it is highly recommended that you learn what your practice FMV is now, and then do so at least annually (if not quarterly, just as you look to see if your IRA is up 2% or down 3% in order to develop your next move(s)). If you are within 3-5 years of retiring from practicing, it is CRUCIAL that you find out where you stand because your next move may be to consider selling now (and staying aboard for those last few years) before the numbers (and overall market) start to decline.

When it comes to non-practice, or other dental companies, the same is true in that FMV is determined by EBITDA multiples. Incredibly, depending on your company sector, we are seeing some HUGE multiples (especially in the aforementioned software, technologies, services) sectors!

There is no other way to say this – investing the modest amount it takes to know what your company FMV is – is a smart business decision. It may mean MILLIONS to you!

Dr. Stefanou is a 1987 graduate of Tufts University School of Dental Medicine. He practiced full-time for 20 years, and is now entirely focused on the “business of dentistry”. He is a CBI (Certified Business Intermediary) and CEO of Connect the Dents, LLC, a dental specific brokerage, M&A Advisory, and Business Development consulting company. He resides in the Big Apple – New York City. He can be reached at tonydmd@gmail.com or 646-375-2067.

Every dental professional envisions an automated “money-making marketing machine.” Even my ten-year-old son Blake shares this aspiration; just last week, he approached me with the idea of starting a dog-walking business. Within minutes, I set up his business with a landing page, automated follow-up, text and email capabilities, online scheduling, payment processing, an affiliate referral program, learning management, a customer portal, a membership program, a calendar, and more.

Over the past two decades, I have worked with hundreds of dental marketing agencies, some big and some small. I have also worked on the marketing technology stack with many dental practices and DSOs. The goal is always the same, “an easy and automated marketing system that gets a strong ROI.”

Through my years of experience, I’ve found seven key players behind a successful marketing operation.

A centralized communication system that manages all patient interactions from one platform across all practices and all means of communication with patients—emails, SMS, phone calls, and social media. A system that simplifies communication workflows and ensures no patient query goes unanswered. More recently, AI is heavily being used to manage this at scale. Having your communications centralized and automated enhances the patient experience and frees staff to focus on other critical tasks.

Let’s face it: we can’t keep track of everything unless we have a system, ideally an automated system. The more automated and integrated your marketing, the better. Automating marketing

funnels facilitates lead nurturing and conversion processes for dental practices. Any tool you use should make it easy to create landing pages, email campaigns, and SMS marketing strategies with minimal effort. This ensures consistent communication with potential patients and boosts conversion rates. The key for DSOs is to oversee multiple locations effectively and repeatably to scale marketing efforts.

McDonald’s and other multisite businesses have been successful because they created repeatable processes. The same goes for marketing. Building a “snapshot” of the ideal marketing process and content for one practice and seamlessly replicating that work across multiple practices significantly reduces the time needed to set up a robust marketing system. This efficiency enables practices to establish effective marketing strategies in several hours rather than weeks.

Only some CRM and marketing automation tools are HIPAAcompliant. Make sure whatever tool you use is compliant. Integration with dental practice management systems is a must for automated marketing, but you want to ensure your vendor has a secure way of handling patient information.

Effective patient contact management is paramount for dental practices. Most practice management systems have limited or out-of-date data on patients. An integrated customer relationship management (CRM) system provides a robust solution for cleaning and updating patient information. By tracking patient

interactions, managing appointments, and collecting feedback within a platform, practices gain valuable insights into patient behavior and preferences, enabling them to effectively tailor their services and marketing strategies.

In the digital era, a practice’s online reputation significantly impacts its success. Integrated reputation management tools can automate review requests and review monitoring to help practices gather and showcase positive patient testimonials, building trust and attracting more patients.

Businesses are all moving to subscription-based products, but when you add them all up, it can get very costly and complex. Successful marketing requires a comprehensive suite of scalable tools. Ideally, you want all of that in one platform, reducing software costs and simplifying training and implementation processes.

The widespread adoption of marketing automation in the dental industry reflects a broader trend of leveraging technology to enhance patient engagement, streamline operations, and improve marketing efforts. It is important to find a tool that can grow with you so you can run your in-house marketing like an experienced marketing agency.

Travis Rodgers specializes in technology, marketing, strategy, fundraising, and go-tomarket strategies in the dental industry under his DrDDS Innovations brand. His team at GHL Dental are experts at setting up dental practices, DSOs, consultants, and vendors on Highlevel.

With a background in Silicon Valley entrepreneurship, Travis is recognized as “The Technology Guy” in the dental industry. He has pioneered electronic referral systems, online scheduling platforms, and patient file-sharing apps within dentistry. Travis is a sought-after speaker, educator, and consultant on technology implementation in dental practices. Connect with Travis on LinkedIn or subscribe to his Dental Venture Capital newsletter for insights into the intersection of technology and dentistry.

Ifirst met Dr. Scott Schwartz at an Inbrace dinner in New York. Inbrace is the latest and greatest in lingual braces, or as Dr. Schwartz refers to it, “inside braces”–because let’s be real, patients don’t know what lingual means. Some refer to it as the Tesla of braces, having raised over 170 million in capital within 4 years.

I remember being in awe as I watched Dr. Schwartz present case after case using this new lingual system. After the presentation, he sat at our table and we continued talking. At the end of the night, he gave me his phone number and said, “if you need help with any case, let me know and I’ll help you.” Most people that say that don’t genuinely mean it. Most people will begrudgingly answer a text, not really expecting you to follow up. But Dr. Schwartz is invested in my success and the success of all orthodontists who view him as an Inbrace mentor.

Dr. Schwartz went to Columbia dental school and then Columbia for his orthodontic residency. He currently practices in Long Island. Dr. Schwartz originally entered the realm of lingual orthodontics because his patients demanded it. They wanted something aesthetic but also not clear aligner therapy because they knew they wouldn’t wear it. He first started out with the lingual system Incognito, doing around 90 cases. But, it was very technique-sensitive and expensive.

One day I was on Facebook (about 8 years ago) and somebody mentioned this new company called Inbrace. And I tried to look it up, but it didn’t have a web page. There was a phone number to contact and I ended up speaking to Matt Wang. It took a few phone calls with him, and I decided to give it a try.

The company was very young at the time, so I was giving them a lot of feedback and they were really listening to everything. I believe when I first started I was one of 20 doctors using the product.

Now 750 cases into Inbrace, it’s been a tremendous success and I’m now known in the area as the guy who does the inside braces.

I’ve been working with the engineers to help them develop the indirect bonding tray that we use to place the brackets. I am also helping them develop some new Generation 2 wires called specialty wires to help level and align crowded cases where brackets cannot be bonded to the teeth initially.

When they were very young, they didn’t really have a ton of providers. And I jumped in with both feet and just started doing a lot of cases. So I kept calling and saying, “Listen, could you look at this... to help improve this?” And so they asked me, “Can you continue to you help us?”. Of course I said yes. It turned out to be a great relationship where they just welcomed me to help, especially the founders of Inbrace Dr. Robert Lee, Dr. John Pham, Dr. Hongsheng Tong and Dr. Andre Weissheimer… all great guys. They really listened and wanted to improve the Inbrace experience. I have regular meetings with the internal team and I really enjoy helping to improve the product.

I also developed a plier that all the doctors are using to take the wire out, which has been a game changer from what people are telling me.

When Gen 2 first came out, the brackets had a lot of force in order to hold in the wires. So you had to really put a lot of force on the wire to disengage it and to engage the wires. So I wanted to come up with something to aid in the removal of the wire. So, I took a curved Weingart plier and a diamond rotary instrument, and I shaped it so that it would fit in between the shoulders of the bracket. I had about 20 iterations. Then I called Allure, which is a plier company, to help develop and mass produce it. I did this all on my own. Inbrace did not ask me to do it. I just knew if we were having issues removing the wire, other offices were having the same problem. I wanted to create something to make my assistants and especially the patients’ lives easier in their Inbrace

journey, and of course wanted to share it with everybody. It took about 3 months to bring it to market (part number T-SS4).

I only charge slightly more, I don’t want to price myself out of them using Inbrace because I know I will do less work, less appointments, and 95% of the work is done by my assistants. I’m seeing the patients maybe 7-10 times to finish a case, whereas with labial braces it could be way more. The wire change visits are only 15-20 minutes. The teeth are moving more efficiently and the wire is continuously working. You can easily space out visits 3-4 months if needed. Most patients love it, the ones that have a little difficulty stick it out due to the fact their teeth improve so quickly. Of course a lot of adults want this but the adolescents are now my fastest growing patients of Inbrace.

Dr. Lucas Shapiro is a graduate of Washington University in St. Louis and Stony Brook University School of Dental Medicine, where he received his Doctor of Dental Surgery. He completed his post-doctoral orthodontic training at Tufts University School of Dental Medicine. He currently practices orthodontics at Lemchen Salzer Ortho in NYC. He started the Instagram page @futuredentists, works with the educational organization @ignitedds, and has an orthodontic tiktok page @drshap

There are 3 controls you need as a dental student and a new dentist:

The first is financial control. You know, the whole debt thing you have. We’ve had that conversation here at DE. I’m sure we’ll have it again. If however, it’s on your mind right now, click here. Dr. Tanya Sue Maestas interviews incredibly impressive dentists every week and asks how they did it and what they’d do differently.

The second is systems control. This is one most students and, in all honesty, dentists of any age know much about…including yours truly when I was a you so don’t sweat it…we all learn when we learn. Like financial control, we’ve had that chat here at DE in the past. If you have the burning desire to learn more as you read this, click here and scroll until you see “systems control”.

For today, I want us to focus on the biggest of the 3 where you are right now … clinical control. Within that, there are 3 core elements:

I know, I know. You want a high-speed in your hand. You want to prep teeth, place implants, seat crowns and more. I get it. Crazy as it sounds, when I close my eyes, I’m right back in my A16, D4 operators. I see my buddy Todd across from me. If I stand up and turn, I see the supplies counter and I see the faculty for my bay hanging out laughing… probably at one of us. Here’s

what I’ve learned since graduating…