Welcome to the November 2024 edition of INNOVATION Magazine. he year is flying by, isn’t it? As we all prepare for the holiday season, with deadlines looming and the final push of 2024 before us, why not take a break and dive into our latest magazine? We are thrilled to share three exclusive interviews, alongside the latest global technology news and features with you in our latest edition.

Innovation Magazine is a specialist technology platform with over 166,700+ readers.

In our cover interview this month, I sit down with Dr Marcel Tschanz, CEO of VP Bank (BVI) Ltd. to explore how the finance industry can embrace innovation and entrepreneurial spirit to promote financial strength and stability. Marcel also shares his perspective on the importance of clientorientated, diversified operating models in the financial sector. ( ).

Our community consists of C, V and D level executives from a wide range of industries. A unique blend of thought leadership interviews and features that cover digital transformation, cloud & cyber, enterprise IT, artificial intelligence, machine learning and sustainability.

Parag Bhise, CEO of Nucleus Software, joins me to reflect on how the company embraces emerging technologies in the fast-moving financial services industry, as one of the leading global providers of lending and transaction banking solutions. We dive into Nucleus Software’s history of innovation and highlight the cutting-edge technologies – such as AI, ML, cloud-native solutions, and advanced data analytics – the company is deploying to propel itself into the

I welcome the chance to chat with Nigel Watson, Chief Information Officer at Northumbrian Water Group (NWG), all about the creation and development of the company’s industryredefining Innovation Festival. Nigel elaborates on how NWG collaborates with stakeholders, customers and partners to create a culture of innovation, with the long-term vision of delivering unrivalled customer experiences (

Our features this month include delivering high-speed internet from space ( human and AI collaboration across workflows ( ), driving SME growth in the UK with a new p68), introducing a global initiative from Adobe for next-gen learners (p76), announcing the world’s first biodegradable plastic produced from CO emissions (p84) and spotlighting Pipe’s strategic push into the UK by partnering with GoCardless (

Last but not least, our Startup of the Month is GoWash – the company looking to redefine the UK’s private and fleet vehicle wash payments (

Please enjoy our latest edition. As always, if you would like to be considered as an interviewee or you have a story for us to include, please do get in touch.

editorial@ithink.media connect with me on LinkedIn.

We sit down with Dr Marcel Tschanz, CEO of VP Bank Ltd., to explore how the financial sector can embrace innovation

How telecommunications company Constellation delivering high-speed from space

Parag Bhise, CEO of Nucleus Software, on how the is embracing cutting-edge technologies to propel the future

42

Strengthening human AI partnership with SaaS provider Zendesk 20

telecommunications Constellation is high-speed internet

68

Discover the £1bn strategic partnership designed to drive UK SME growth

30

Nucleus the company cutting-edge propel itself into

human and SaaS

52

Nigel Watson celebrates the Northumbrian Water Group’s Innovation Festival

104

Meet GoWash, our Startup of the Month

76

Adobe introduces global initiative expanding Adobe Digital Academy

84

Fortnum Recycling & Waste develops world’s first biodegradable plastic

94

How Pipe’s partnership with GoCardless is reshaping capital access for UK businesses

Explore how the financial sector can embrace entrepreneurial spirit and innovation to promote financial strength and stability, in our exclusive Q&A with Dr Marcel Tschanz, CEO of VP Bank (British Virgin Islands) Ltd.

Today we welcome Dr Marcel Tschanz, CEO of VP Bank (BVI) Ltd. to share his expertise and perspectives on the importance of client-orientated, diversified operating models in the financial sector.

aunching our conversation, Marcel emphasises the need to embrace entrepreneurial spirit and innovation to better understand the financial sector today.

“In order to understand the financial sector today, we need to consider the client, and how banks or finance institutions can serve them,” begins Marcel. “It is the obligation of

financial professionals to remain incredibly client-oriented and develop diversified operating models to serve their needs. When I say diversified, I mean in the sense of being focused on the individual client segments or groups that are served.”

Marcel explains how the core values of financial strength and stability

are crucial dynamics underpinning client-centricity for modern-day banks.

“Stability and financial strength are tremendously important values,” summarises Marcel. “In my opinion, financial professionals serve their clients best when they are not trying to skyrocket equity prices or recklessly pursue short-term results. Instead, they should prioritise the delivery of longterm financial stability and strength for their clients, alongside high levels of customer satisfaction. I believe, and history confirms, that this is the essence of private banking. Money should be safe, and it should be safe for this and all coming generations.”

According to Marcel, while entrepreneurialism and the spirit of innovation are crucial to the financial sector, these cornerstone foundations cannot be understood without this concept of customer-centricity.

Here, Marcel explains how banks and financial institutions can overcome contemporary challenges by embracing three dynamics in their operations to serve clients: ESG, demographic adaptation and technology.

“It hasn’t been easy for the finance sector in recent years, especially when you take into account factors like evolving regulations and catalysing events behind them such as the Ukraine war,” says Marcel. “However, growth is still possible during these challenging circumstances by deploying innovations focused on and

“In theory, with the technology and expertise available today, the integration of any new solution on the market has never been easier”

Dr Marcel Tschanz, CEO

fuelled by clients’ needs and pain points. Essentially, banks can compensate for these contemporary developments by remaining close to their clients.

“One trend I’ve seen rise to prominence globally with customers is the topic of ESG. I believe a strong solution is to develop scoring systems designed to be easily comprehensible to customers –helping them understand what they are really investing in when they’re pursuing a sustainable investment strategy.”

When it comes to demographic adaptation, Marcel describes how modern banks often have clientele spread across diverse geographies and they are shifting in terms of age profiles.

“Demographic shift is a problem we must consider carefully in the financial industry,” admits Marcel. “The financial industry needs to design ways to service the next generation, establish how to help transition wealth from one

generation to the next and assist them in developing their plans for the future.

“We call this a wealth planning approach in the industry, and there is great potential in a hybrid approach combining human interaction –taking the client by the hand and explaining specific processes – and supporting the customer with digital information. That way, customers can stay calm in an often turbulent market.”

On the technology front, Marcel reiterates the importance of flexibility in the financial sector’s approach as a means of better serving its customers.

“There’s a lot of money being invested by financial institutions into rebuilding infrastructure to ensure that there’s flexibility in embracing and integrating new technological possibilities in banking,” says Marcel. “Ultimately, these initiatives strive to deploy technology so customers can easily do business – anywhere, at any time.”

Marcel elaborates that agile methodologies and digital transformation within technology strategies should be the gold standard for the financial industry, and, when deployed successfully, they can lead to growth and success for businesses.

“Agility is all about being able to adapt to and connect with new situations,” says Marcel. “Banks

are not able to master all disciplines in technological development alone. Instead, the sector needs to focus on the capability to connect with new solutions on the market and integrate them into the financial service process in a way that’s easy for customers to understand.”

To ensure that these solutions are fit to service its markets, Marcel believes it is best for financial institutions to develop them alongside its customers.

“When a bank develops new solutions, it shouldn’t invent them in an ivory tower,” says Marcel. “Instead, they

must bring customers closer, go to them directly and ask them how they do their business. By doing so, they can understand how they live and work in order to craft the right interactions and processes for their customers. Only after doing that can banks develop a system

Enable digital customer onboardings and manage existing customers without paperwork, minimising administrative tasks.

PAPERLESS CONTRACTS

Turn forms and contracts into web-based workflows with a great user experience.

BUSINESS CONTROL-CENTER

Monitor and manage all your processes from a single platform. Easily integrate third-party providers into your existing system landscape.

Time and cost savings through automated digital processes

Numerous integration options for third-party services or your existing system landscape

Legal & compliance safety combined with fast processing through integrated completeness and plausibility checks

Quick go-live and short project times

Since 2011, United Signals supports companies in their digital transformation, trusted by over 50 B2B clients. With this experience we created FLOWNIQ – an advanced Enterprise SaaS platform that simplifies digitising and optimising business processes.

OPTIMISE YOUR BUSINESS & DIGITISE PROCESSES ON YOUR OWN

FLOWNIQ empowers companies to digitise their workflows independently, without any coding skills required.

Become a partner and digitise the workflows of your clients by using FLOWNIQ! partner@flowniq.com

“United Signals had established digital onboarding solutions for the German market, but it has extended their business model to cover international customers and adapted their software to serve diverse clients worldwide”

that comprehensively supports their customers’ businesses or financial circumstances.”

According to Marcel, one key example of this is promoting advancements in digital onboarding.

“You might think that digital onboarding isn’t anything new,” says Marcel. “After all, many banks offer customers digital onboarding. However, there is a caveat to add which I believe is important. Digital onboarding needs a nuanced approach, where the needs of the customers are aligned with regulatory obligations in the areas banks operate, to facilitate a safe, secure, efficient and effective process.”

According to Marcel, digital transformation, technological deployments and innovation in the financial sector might stem from internal stakeholders or priorities, but often hinge on external collaboration and robust partnerships. Here, he loops back to the example of remote onboarding capacity.

“When creating new solutions or developing existing mechanisms, such as digital onboarding facilities for clients, tackling it in isolation extends the process of development,” says Marcel. “However by conducting thorough market research to find digital onboarding providers that can help build strong customer journeys, there are some terrific companies out there such as United Signals.

“United Signals had established digital onboarding solutions for the German market, but it has extended their business model to cover international customers and adapted their software to serve diverse clients worldwide. They offer a highly developed and efficient technological service for their customers – be it on-site or remote.”

But remote onboarding is only one early part of the entire customer journey for banking customers. Marcel reiterates how it is important to conceptualise these journeys in their entirety, while keeping in mind the multiple types of journeys different customers might embark upon.

“In my opinion, financial institutions must build IT architecture that is modular and connectable,” says Marcel. “You often read that data is the new gold in the market. I believe that data alone is not creating value – you need to make that data accessible and processible, so that it can fulfil a business purpose, for it to have value.

“At the beginning of opening a relationship with a bank, there are many regulatory obligations that have to be fulfilled, which can be a big hassle. But when financial institutions standardise this, they make a complex process significantly more efficient. Now, it’s about looking beyond that to see how else the finance sector can boost clients’ success rates.

“Obviously, all these products and services have a life cycle. Things change. But by embracing innovation, the finance sector can thrive well into the future – with their customers, together.”

Looking ahead to the future, Marcel describes how he predicts the financial industry will continue its endeavours to improve and innovate its operations and offerings to best serve its customers and investors.

“Platforms must continue to evolve so banks remain agile, with a continuous improvement mindset,” says Marcel. “Every day,

financial professionals and organisations must commit to getting better at what they do.

“Financial professionals must also commit to doing this with a long-term perspective in mind – short-term profit generation should not be the focus. Of course, businesses always want to be profitable, but I believe the finance sector needs to look beyond that and build organisations that have strong foundations, and will be around for a very long time.

“I don’t have a crystal ball, but if finance bodies can apply a robust methodology to build a stable system and governance framework, they will be in a strong position to get through global crises and changes. In theory, with the technology and expertise available today, the integration of any new solution on the market has never been easier.

“More digitisation will come but I believe, for the finance sector, that the human factor will never be replaced by digital capabilities. Rather, digital capabilities can complement and support the human being in becoming more efficient and more effective.”

Connect with Marcel.

Marcel embraces being an analytical and curious person, which he partly attributes to his background in physics, but also a deeper underlying passion for the wonders of nature and the possibilities of technology.

“From an early age, I’ve loved to build, create, experiment and innovate,” says Marcel. “What I’ve learned throughout my scientific career has been tremendously helpful for my current professional role in the finance sector. It has helped me understand clients, their purpose and various aspects of their businesses.

“For me, most technical problems usually can be resolved. The real challenges are human problems. But I believe with a curious and analytical approach we can resolve them as well."

“If we want to succeed or evolve and become better as a society, we need to be able to take a step back and reconsider which filters we apply when we look at a problem, person or situation.

“Simply put, I am a strong believer that we only can become better when we work together as teams, when we all step back, look at the problem together, and then allow all the different perspectives to be brought into that conversation. For me, this

is the is the essence of agile development: bringing all the perspectives and specialists together.

“As Albert Einstein put it: ‘The thinking that got us to where we are is not the thinking that will get us to where we want to be.’”

Channelling the team spirit of sport

Marcel enjoys playing volleyball and believes sports are an excellent way to embrace cooperation and team spirit.

“One of the most exciting recent experiences I’ve had playing volleyball was winning a tournament with my team,” says Marcel. “None of us were the best players in the tournament. But we played together, all working towards the same goal, and our team spirit helped us to victory that day – not on the merits of our own individual abilities, but through the merits of our shared ability as a team.”

Marcel is looking forward to attending the BVI Literary Arts Festival 2024 on November 7-10.

“The BVI Literary Arts Festival was created to bring local Caribbean authors and storytellers together, promoting an exchange of ideas and conversation,” says Marcel. “I am thrilled to be taking part in a panel on November 8, 2024, at the festival in Tortola.”

Other key events in Marcel’s diary include:

• Digital Leaders

• Digital Day in Vaduz

• Digital Summit

Connect with Marcel

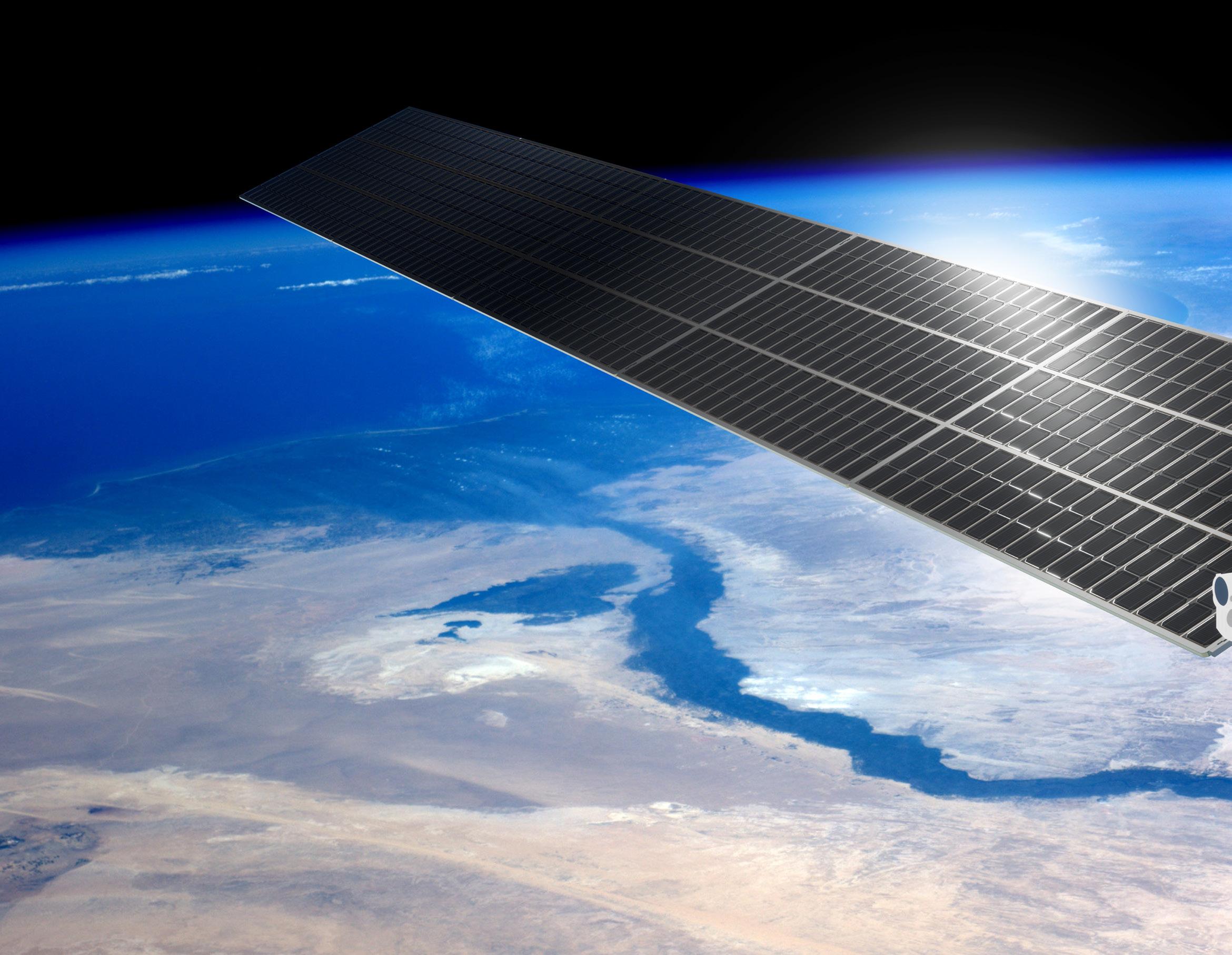

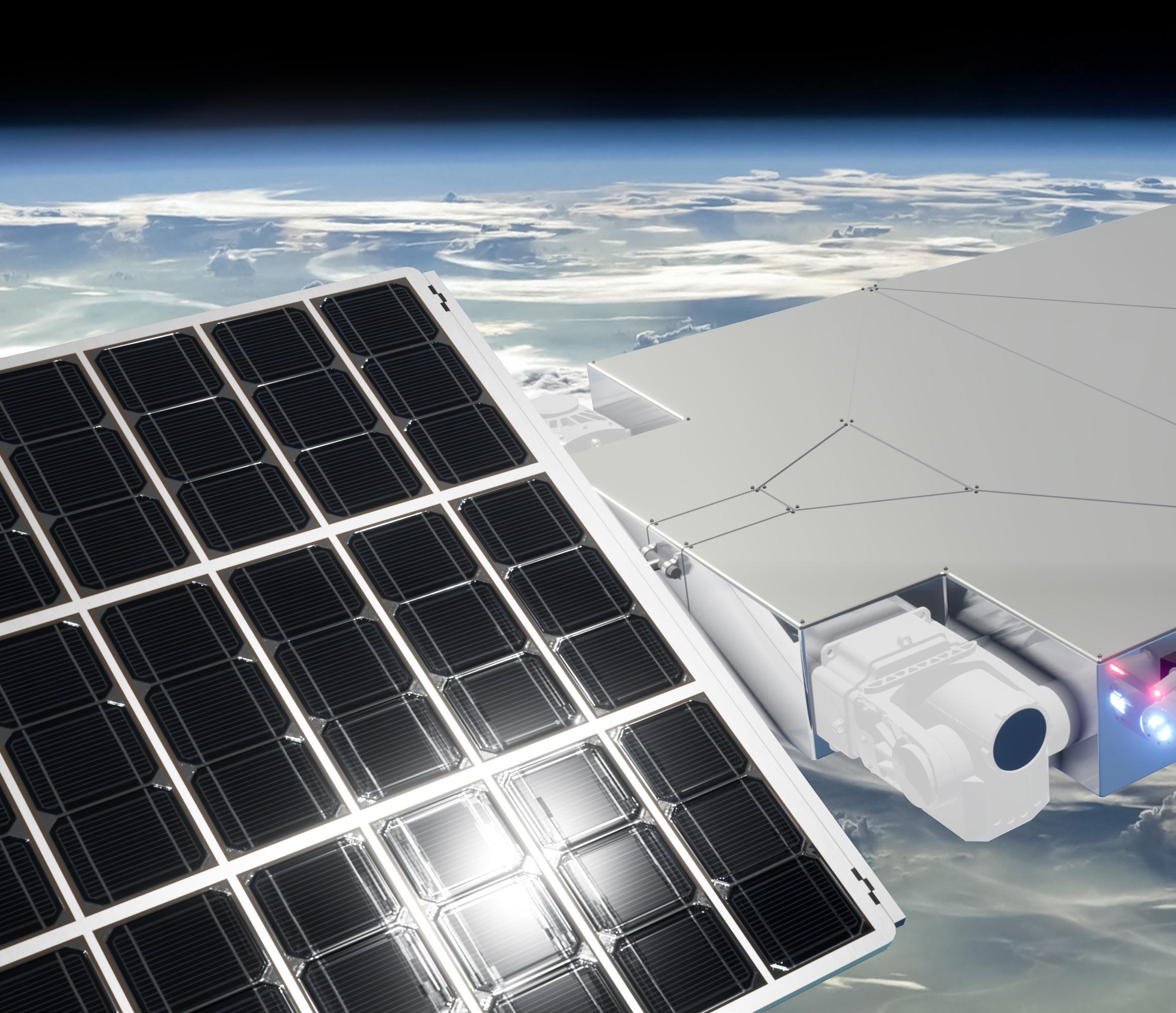

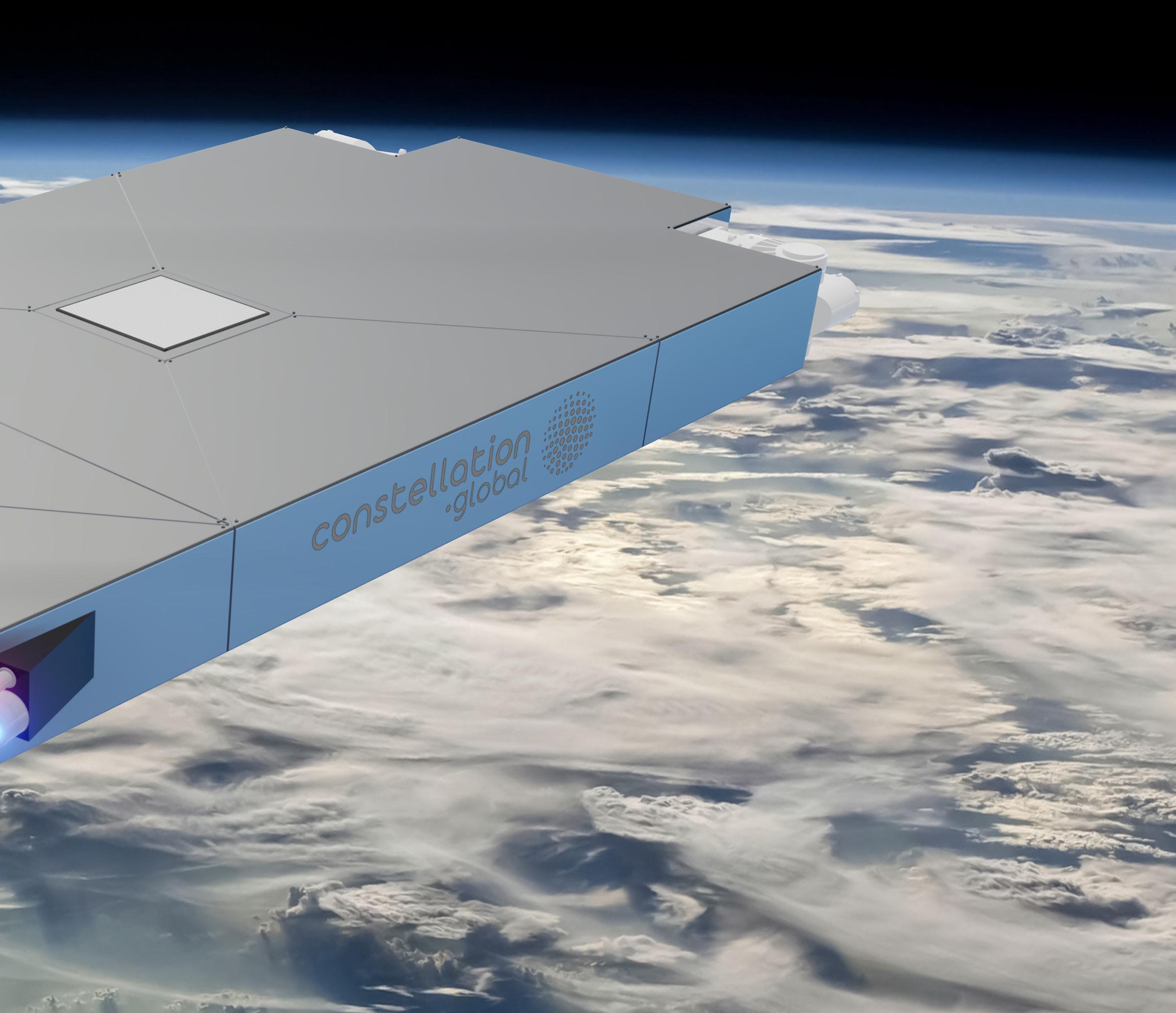

Constellation secures €9.3m to deliver high-speed internet from space for telecom operators.

CONSTELLATION TECHNOLOGIES & OPERATIONS, A STARTUP DEVELOPING A CONSTELLATION OF SATELLITES TO EMPOWER TELECOM OPERATORS TO DELIVER HIGH-SPEED, LOW-LATENCY INTERNET ACCESS FROM SPACE, HAS SECURED €9.3M IN FUNDING.

he investment comes from Expansion, which is a fund dedicated to New Space and New Air Mobility, and the French Tech Seed fund managed by Bpifrance on behalf of the French government, as part of the France 2030 plan in addition to its historical investor. This funding will enable the company to conduct its first end-toend connectivity tests on the ground and in orbit, and complete detailed engineering studies for the first two satellites of its constellation.

The global market for high-speed, low-latency internet from space is expanding rapidly, driven by the convergence in performance and pricing between terrestrial and satellite connectivity for the first time in telecommunications history. According to a 2023 GSMA Intelligence report, this market represents a potential $35bn annual revenue opportunity for telecom operators by 2035.

However, this growing market is largely being captured by new telecom

“THE COMPANY’S GOAL IS TO ENABLE UNIVERSAL INTERNET ACCESS, WHICH IS ESSENTIAL FOR SOCIAL AND ECONOMIC DEVELOPMENT”

entrants, particularly US projects like SpaceX’s Starlink and Amazon’s Kuiper, along with Chinese ambitions. These players are already developing or operating satellite B2C constellations, with several thousands of satellites – a number that could reach tens of thousands in the future.

To remain competitive, telecom operators need solutions that allow them to tap into this new spacebased connectivity market and provide internet access from space, as a complement to their terrestrial networks.

Constellation Technologies & Operations: Empowering

Telecom Operators with SpaceBased Internet Connectivity

Founded in 2022 by Charles Delfieux, Constellation Technologies & Operations aims to address this challenge by developing a B2B2C

constellation of satellites that places telecom operators at the centre of the value chain.

The company’s goal is to enable universal internet access, which is essential for social and economic development, by allowing telecom operators worldwide to offer their customers high-performance, affordable, and sustainable internet access from space, particularly in areas where terrestrial networks are unavailable.

Constellation Technologies & Operations stands out with two key technological innovations.

First, by deploying its constellation in Very Low Earth Orbit, the company ensures high-speed connectivity with minimal latency. It also supports a more sustainable use of space by

reducing the risks of space debris and light pollution.

Second, Constellation Technologies & Operations has adopted an innovative radio frequency strategy by repurposing telecom operators’ terrestrial 5G spectrum for spacebased connectivity. This approach provides operators with alternative access to unsaturated spectrum.

The €9.3m seed round, led by the Expansion fund, the French Tech Seed fund managed on behalf of the French government by Bpifrance as part of the France 2030 plan, and the company’s historical investor, will allow Constellation Technologies & Operations to achieve key milestones. These include end-to-end testing of its space-based internet services with a combination of orbiting payload and ground station prototypes. The startup employs around 30 people working across its offices in SaintQuentin-en-Yvelines and Toulouse, France.

This funding will also support the detailed engineering studies of the first two complete satellites, which are scheduled for launch by the end of 2026. Subsequently, the company plans to industrialise and massproduce the satellites, user terminals, and the overall system, with a

phased rollout of its space-based connectivity service.

Constellation Technologies & Operations expects its infrastructure to be fully deployed by the end of the decade, offering global coverage and enabling telecom operators to provide their customers with highspeed, low-latency internet access from space – just as they do today with terrestrial telecommunications networks.

Charles Delfieux, CEO and founder of Constellation Technologies & Operations, stated: “We are thrilled to have secured this funding, which will allow us to continue developing our constellation and help telecom operators unlock the enormous potential of space-based connectivity. Our mission is to bridge the digital divide and provide universal internet access, empowering telecom operators to serve customers even in the most remote areas.”

“OUR MISSION IS TO BRIDGE THE DIGITAL DIVIDE AND PROVIDE UNIVERSAL INTERNET ACCESS, EMPOWERING TELECOM OPERATORS TO SERVE CUSTOMERS EVEN IN THE MOST REMOTE AREAS”

Charles

Delfieux, CEO and founder of Constellation Technologies & Operations

Investor Charles Beigbeder, CoFounder of Expansion, added:

“Constellation Technologies & Operations represents a unique opportunity to support disruptive innovation in space connectivity infrastructure. Their approach ensures that telecom operators can fully participate in this new market while addressing the environmental challenges facing the space sector.”

Claire Waché, Senior Investment Officer at Bpifrance, said:

“We're pleased to support Constellation Technologies & Operations, as its technological innovations around ultralow orbit and the use of 5G spectrum are key to enable telecoms operators to enter and compete in the space connectivity market. This investment reflects Bpifrance's mission to support disruptive innovation in strategic sectors.”

Constellation Technologies & Operations has already received several expressions of interest from European telecom operators and is in advanced discussions with international operators.

Learn more at constellation.global.

Source: Constellation Technologies & Operations

Parag Bhise, CEO of Nucleus Software, reflects on the company’s history of innovation and highlights the cutting-edge technologies –such as AI, ML, cloud-native solutions, and advanced data analytics – it’s developing to propel itself into the future.

he company’s software powers the operations of more than 200 financial solutions in 50 countries, managing $1.2bn in global loans – supporting retail finance, corporate & SME finance, transaction banking, automotive finance, mobile banking, as well as other business areas. With over 500,000 daily users, the robustness and seamless user experience of the company’s solutions are remarkable.

But how is the company embracing emerging technologies in such a fast-moving sector? We’re joined by Parag Bhise, CEO of Nucleus Software, to explore the company’s culture of innovation.

“You have to embed innovation when operating in this space,” says Parag.

“Throughout our journey, the solutions we’ve delivered to our customers have

consistently leveraged advanced technologies, ensuring they remain at the forefront of transformation.

“For instance, around three decades ago, we collaborated with Citibank to develop email software at a time when email networks were not yet widespread. Other solutions developed for them included document management systems, ATM switch integrations, and many more, which were certainly ahead of their time, especially in the Indian technology landscape during that period. Similarly, we implemented screen scraping for another bank well before the advent of robotic process automation (RPA).

Although the technology wasn’t available then, we found innovative ways to deliver the solutions our clients required. These experiences taught us that innovation is not just a goal but a fundamental aspect of how we operate.

“When you think of innovation, it often gets equated solely with technological advancements. However, true innovation is far broader than that. At Nucleus Software, we continuously innovate not only in technology but also operationally, ensuring that our processes and strategies evolve alongside the shifting dynamics of the banking and financial services (BFS) industry. Decades of BFS domain expertise enable us to consistently meet the evolving needs of our

clients, helping them thrive in an everchanging landscape.”

Over its three decades of operations, Nucleus Software has established a reputation for providing cutting-edge, future-proof solutions.

“We call ourselves one of the oldest fintechs in India,” shares Parag. “The terminology didn’t exist when we began, but the kind of work that fintechs do – providing solutions at

a fast pace and actively innovating – is the work we’ve been doing for decades. The financial services industry changes at such a rapid pace, and we must stay ahead to remain relevant.

“Today, our focus is on implementing AI responsibly. A few years ago, we created components for various AI and machine learning methodologies, which we use in fraud detection, credit assessment and customer service. While technologies like chatbots have become commonplace, we are constantly evolving and refining these innovations to explore their full potential and deliver even greater value to our clients.”

Two particularly notable achievements are the development of intellectual property products like FinnOne Neo® and FinnAxia® that originated from Indian soil. Over the years, these solutions have been developed and redesigned to best serve the needs of the modern consumer, and stay at the forefront of innovation in the financial sector.

“FinnOne Neo® is a solution that caters to retail, corporate and SME lending,” explains Parag. “The first release of this product was created in the late 1990s, and we decided to completely re-architect it in the early 2010s.

“We recognised that the banking landscape was evolving towards increased connectivity, prompting us to undertake a complete overhaul of

“WHILE NUCLEUS SOFTWARE HAS SPENT DECADES DEVELOPING AND REFINING THESE TECHNOLOGIES, IT’S THE COMPANY’S RELATIONSHIPS WITH CLOUD INFRASTRUCTURE PROVIDERS LIKE AWS THAT ARE HELPING TO MAKE THESE SOLUTIONS AVAILABLE ON A WIDER SCALE”

FinnOne™. This led to the creation of FinnOne Neo®, which provides a comprehensive, automation-ready framework featuring 480+ APIs, designed to align seamlessly with today's dynamic environment.

“FinnAxia® is our next-generation product designed for transaction banking. We have integrated AI to enhance fraud detection and prevention using pattern analysis. This technology identifies suspicious behaviour, which is then reviewed by a human expert who evaluates the detected patterns to make informed decisions.”

But while Nucleus Software has spent decades developing and refining these technologies, it’s the company’s

relationships with cloud infrastructure providers like AWS that are helping to make these solutions available on a wider scale.

“When we started, many of our solutions were only available to big players, but now we have cloud capabilities that make these solutions much more accessible,” explains Parag. “Smaller finance companies who don’t have their own infrastructure are able to utilise these technologies through cloud Infrastructure providers. A customer can start with a small engagement with our platform using the cloud, and as the customer’s business grows, the infrastructure can be increased and enabled.”

“WE ARE A LEARNING COMPANY, WE UNDERSTAND THAT OUR GREATEST ASSET LIES IN OUR PEOPLE: THEIR SKILLS, KNOWLEDGE, AND ADAPTABILITY DEFINE OUR COLLECTIVE SUCCESS”

Parag Bhise, CEO

According to Parag, flexibility is key in such a dynamic and fast-changing industry – to navigate these changes, the company is looking outside the software industry and towards the manufacturing sector.

“We’ve been fascinated by Toyota’s lean principles in manufacturing,” says Parag. “A few decades ago, Toyota deployed total quality management (TQM) into their manufacturing systems, which is rooted in the principles of customer first, quality first and continuous improvement.

“We’ve since seen approaches like this adopted in manufacturing, but there are significantly fewer cases of lean strategies like this in software organisations. So we decided to start our own journey into lean principles around three years ago. We’ve been reading books, attending training sessions and experimenting with our operations.

“We do value stream mapping in any process to try and foresee any adverse effects that can be eliminated. Since implementing this approach we’ve seen very significant productivity improvements. One of the areas where we adopted this lean principle was to reduce the turnaround time for queries and defects. By eliminating some of our negligible processes, we were able to bring down our outstanding requests from over 200 to under 40 on any given day.

“We are one of the very few software product companies globally, who have successfully made possible 32 releases with precision and consistency – but more than this, with releases

that are future-proof and on cuttingedge robust technology platforms. By adopting lean principles, we can accelerate future releases, providing direct benefits to our end users.”

And speed is of the essence. Parag believes the future of this sector – and of Nucleus Software – is going to be centred around the technologies and niche companies that can get personalised products to end users as quickly, securely and efficiently as possible.

“We’re seeing more and more integration with fintechs in this industry,” says Parag. “There are fintechs coming out with very niche,

specialised solutions that we can now provide to our clients at a faster rate.

“AI and machine learning are also facilitating this growth, particularly generative AI. It’s helping provide stronger customer service and making product documentation easier for the end user. However, while I think these technologies are exploding right now, blockchain has high potential and is often overlooked.

“We typically refer to blockchain in the context of crypto, but I think its potential stretches far beyond that. It can be very handy with distributed ledgers, smart contracts and authenticating records

that may have been duplicated. I think we’ll be seeing blockchain being used in this way more and more, particularly in the BFS space where we operate.”

“We are a learning company,” says Parag. “We understand that our greatest asset lies in our people: their skills, knowledge, and adaptability define our collective success. Our commitment to Human Capital Development is unwavering. We believe in fostering a culture of continuous learning and skill development that empowers every individual to thrive in their roles and contribute meaningfully to our organisation’s growth journey. Through targeted L&D initiatives, we

equip our workforce with the latest tools, technologies, and industry insights necessary to stay ahead of the curve. When we talk about learning, we’re not just talking about adopting tools and techniques. It’s a complete mindset shift.

“I think this value of learning is a part of the reason why our staff retention is so high. I’ve spent over 35 years here, and you’ll find many people with comparable tenure. Nucleus is a unique company in this way, and it’s an excellent place to forge a career.”

Learn more about Nucleus Software here.

Parag is instrumental in developing many leaders, while also contributing to the overall growth of the organisation and broader industry. He puts this down to creating a culture of innovation.

“I’ve been involved in driving innovation in areas like AI, fintech, and sustainability, given my past experience foreseeing industry trends,” says Parag. “The ability to foster a culture of innovation, promote diverse perspectives and an inclusive environment that inspires others to think creatively about solutions is most important. Additionally, building team proficiency in leveraging data analytics to inform strategies and demonstrate thought leadership through evidence-based insights is vital.”

“Thought leadership is very important to me, and it’s one area that I believe all industry leaders should be contributing to,” adds Parag.

Connect with Parag

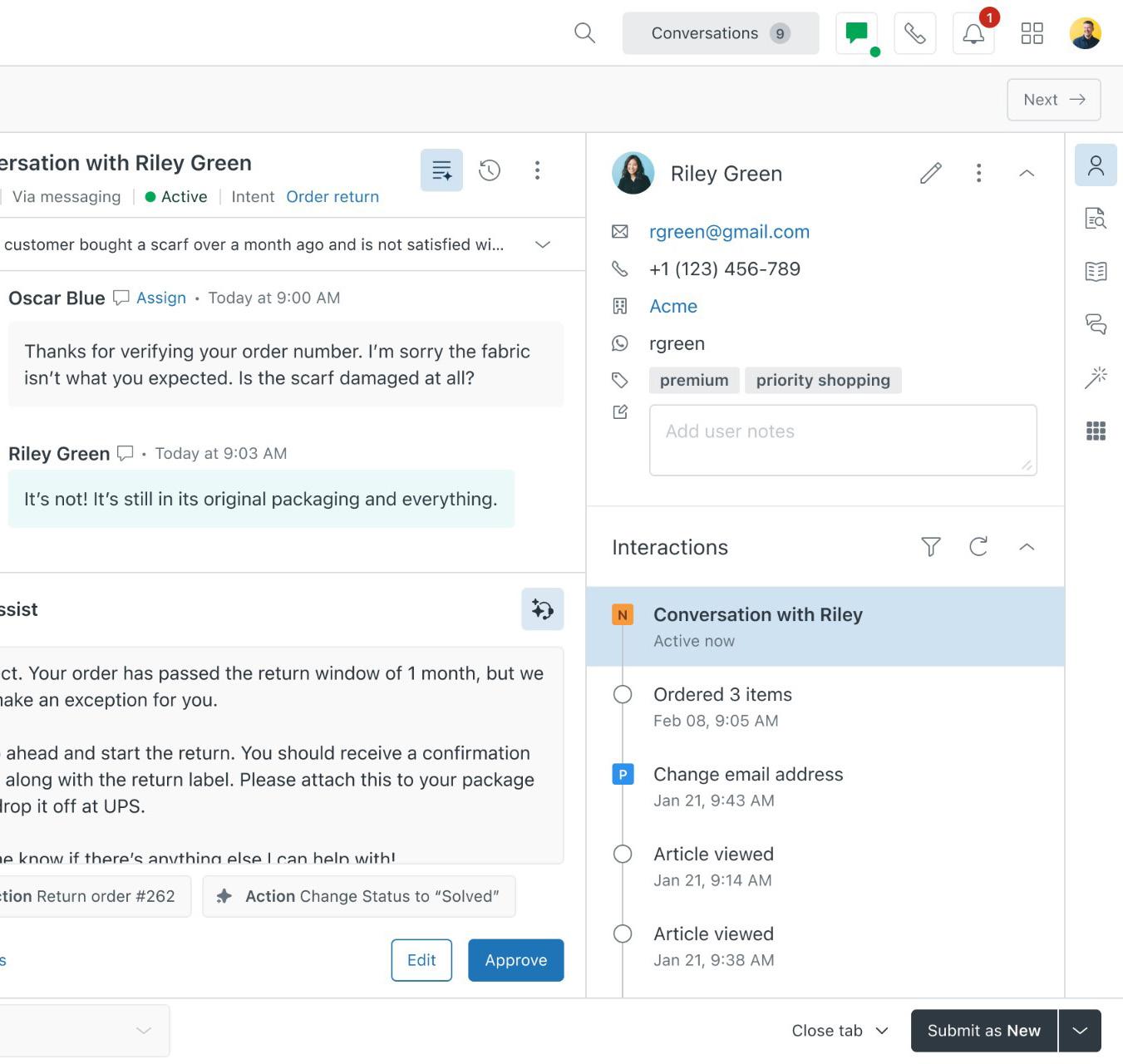

Omnichannel AI agents and next-generation agent copilot offerings boost human and AI collaboration across workflows, including powerful voice AI.

recently introduced a series of innovations, including AI-powered agents for omnichannel support, enhanced agent copilot, powerful voice support and a new AI agent builder.

eading in AI-powered customer and employee experiences through its complete service solution, Zendesk’s new capabilities help companies deliver exceptional service in a way that is easy to use, scale and drive meaningful business results.

“AI is now bridging the gap between high quality service, at a lower cost, while delivering much more personalised experiences,” says Tom Eggemeier, CEO, Zendesk, noting 73% of consumers believe AI improves the quality of customer service. “Our latest innovations, including voice AI, assist human agents in working efficiently alongside AI to deliver tailored, efficient service. This partnership leads to faster issue resolution, higher customer satisfaction and provides valuable business insights.”

“Our AI innovations clearly resonate with the increasing needs of CX leaders,” adds Matthias Goehler, EMEA CTO at Zendesk.

“In EMEA, 64% of CX leaders are rethinking their entire customer journey due to emerging tech like generative AI. The capabilities of Zendesk omnichannel AI agents who deliver instant responses and automate up to 50% voice interactions play into their hands.”

“With Zendesk, we’ve seen a major increase in agent productivity, with nearly double productivity gains in key markets like France while achieving increased customer satisfaction,” said Steve Franklin, Head of Global Operations, Siemens Financial Services. “As AI agents handle basic requests and populate tickets with data, our human

“Our latest innovations, including voice AI, assist human agents in working efficiently alongside AI to deliver tailored, efficient service”

Tom Eggemeier, CEO, Zendesk

agents are freed up to focus on value-added customer interactions. This is all critical to providing a holistic and streamlined customer journey, powered by AI.”

Combined power of AI and human agents elevate CX –across all digital channels

Zendesk is making AI agents available on all channels, including voice, ensuring that these autonomous bots can work independently or alongside human agents in resolving customer issues. Additionally, the company recently introduced a new AI agent builder that makes it easy for businesses to set up AI agents and add controls.

As the industry shifts to completely automated interactions, these new capabilities for Zendesk AI agents allow companies to tap into the full benefits of AI by:

• Delivering instant, accurate responses with generative replies and address more sophisticated issues with customisable conversation flows, now extended to email.

• Automating up to 50% of voice interactions in a new partnership with Poly.ai, ensuring seamless, consistent support across channels.

“Our AI innovations clearly resonate with the increasing needs of CX leaders”

Matthias Goehler, EMEA CTO at Zendesk

• Creating and controlling AI agents using a new AI agent builder, requiring zero training and offering full customisation – such as adjusting the brand's tone – while reducing the time to build, deploy, and maintain.

Zendesk is enhancing agent copilot with powerful capabilities which are available for all companies to deliver consistent, high-quality service. In more complex, high-value interactions between human agents and customers, agent copilot can now:

• Anticipate customer needs, offer proactive recommendations and take actions autonomously with the now widely available “auto assist” mode.

• Follow specific processes on behalf of an agent and instantly sync changes to ensure agents are always following the latest procedures with the new copilot business procedures.

• Surface relevant issues and proactive insights – such as similar resolutions – directly within the new AI-powered workspace, ensuring all tools are easily discoverable and keeping workflows uninterrupted.

As part of the enhancements, agent copilot for voice now provides instant call insights such as customer sentiment and intent, plus quickly surfaces answers from the knowledge base. This allows companies to deliver faster, personalised service to customers who call in with complex, highvalue issues that require human assistance.

Supercharged insights provide valuable and actionable business intelligence for CX teams

Zendesk is introducing more AIpowered insights to analyse customer conversations across systems, extract valuable key insights and enable real-time business intelligence. By surfacing strategic opportunities, leaders can apply these across teams and make changes needed to improve CX, which can in turn positively influence CSAT.

With improved AI-driven insights, companies can now:

• Quickly uncover why customers are reaching out with granular details through enhanced intents and entity detection, enabling faster and more personalised resolutions.

• Proactively design and refine workflows using out-of-the-box

insights from the new intelligent triage dashboard, ensuring critical issues are efficiently routed and automated.

• Use Quality Assurance across every touchpoint, now including voice and AI agents to automatically analyse and optimise customer conversations and agent performance.

“With Zendesk, we’ve seen a major increase in agent productivity, with nearly double productivity gains in key markets”

Steve Franklin, Head of Global Operations, Siemens Financial Services

“It is critical for the CX industry to continue iterating on how to best leverage AI to supercharge the customer experience”

Keith Kirkpatrick, Research Director, The Futurum Group

“It is critical for the CX industry to continue iterating on how to best leverage AI to supercharge the customer experience,” said Keith Kirkpatrick, Research

Director,

The Futurum Group. “We see how across the board – agents to admins to CX leaders – teams are using technology to better serve

customers and employees. Zendesk is providing powerful AI capabilities enabling companies to resolve issues faster, at higher volumes, with the right level of human involvement, and at a higher quality that translates to real ROI.”

Learn more at zendesk.com.

Source: Zendesk

‘Machinery,

Nigel Watson, Chief Information Officer at Northumbrian Water Group (NWG), highlights the creation and development of the company’s industry-redefining Innovation Festival.

orking with its stakeholders and customers, NWG has long-term plans in place to ensure it can deliver unrivalled customer experience today and in the years ahead.

Within these long-term plans, the company has three key change levers in its strategy – transformation, continuous improvement and innovation.

Joining us to discuss the third of these is Nigel Watson, Chief Information Officer at NWG. In particular, Nigel elaborates on the creation of the company’s Innovation Festival – an annual five-day event solving some of the water industry’s key challenges. To begin, Nigel celebrates the company’s risk-taking culture that has led to such significant innovations.

“Alongside transformation and continuous improvement, innovation

is one of three key levers that we need to pull in order to improve our business,” says Nigel. “What makes innovation different from the other two change levers is the level of risk involved.

“If we’re the first water company in the UK to do something then we categorise that endeavour as an innovation. This might mean we’re bringing something from the oil and gas industries or from somewhere globally to the UK market for the first time.

“Our expected success rate on deploying a new innovation is four out of 10, whereas we’d expect 90% of our transformation initiatives to succeed. That’s what makes innovation so critical for us – we accept the risk that some concepts might fail, because

no one will have gone down that path before. There’s always going to be bumps in the road and we might find that something isn’t going to be viable, but sometimes a new development can revolutionise the industry.”

NWG is looking for new ways to overhaul the water industry by developing a methodology for innovation, inspired by some of the world’s leading tech companies.

“Nine years ago, my boss said to me ‘I’m looking for machinery, not magic,’” says Nigel. “What she meant by that was that the brilliant ‘tada’ moments of innovation are all a part of the overall process. She told me that she wanted us to adopt a repeatable method for developing new innovations.

“I did my research, and read a book called Sprint: How to Solve Big Problems and Test New Ideas in Just Five Days

by Jake Knapp, which codified what Google and other leading companies were doing in terms of their approach to innovation.

“We looked at the concept and felt that a five-day approach could be very useful. With this methodology, on day one you look at the problem you want to solve through the eyes of the people who are experiencing the problem. Then on day two, you go into solutions mode, which you approach in a very divergent way – no idea is a bad one. We adopted the principles of improvisation where you’re saying ‘Yes, and?’ rather than dismissing anything. All of a sudden, you could reach a point where there’s something

very exciting born out of an idea you might have originally looked over.

“Day three is all about being convergent. We take that long list of ideas and bring it down to one or two winners. On day four, you’re lifting the idea off the page and bringing it to life, which could be anything from a PowerPoint to a prototype. Finally, on the fifth day, we test the product and decide if we’re going to go ahead and take it to the next stage. This is something we’ve been doing once a month for the past four years now, and we’ve found it to be a very effective process. We’re definitely realising ideas that we never would have had in the past.”

“I wanted to create an event where you feel enriched, with innovation at the centre”

Nigel Watson, Chief Information Officer at NWG

One such idea was coordinating a data hack to brainstorm solutions for some of the company’s key challenges.

“A friend of mine suggested that we try a data hack, which wasn’t something I’d heard of before,” says Nigel.

“Essentially, we put some data based around a problem we were facing into

a cloud environment and invited people to play with that data over the course of a weekend. Around 120 people took part, and it was hugely successful.

“After this, I had a conversation with my boss, and we agreed that things were going really well – but she wanted me to think bigger. She told me ‘I want you

to change the perception of the region.’ That’s when I had the idea for the Innovation Festival.”

Now in its eighth year, NWG’s Innovation Festival takes a selection of business challenges and issues currently facing the water industry and beyond. Bringing together people from a range of companies worldwide, the festival is designed to facilitate collaboration and produce solutions to these problems in five days or less.

“I wanted to create an event where you feel enriched, with innovation at the centre,” explains Nigel. “So in 2017 we held our first Innovation Festival, and I was absolutely terrified when I arrived and realised it was so much bigger than I expected it to be. There were 1,000 attendees from 140 organisations, far more than I originally anticipated.

“There was so much activity going on, and an infectious energy where people were connecting with one another – talking in the lunch queue, going between their tents, playing volleyball together. We realised that running things like this together creates something that you’d never get if you were embarking on innovation in isolation.”

Nigel credits the festival’s environment for nurturing inspiration among participants when coming up with new ideas or innovations.

“A huge part of the festival is creating a state of flow for the participants,” says Nigel. “We have uplifting live music played on site in the mornings, and we

often have a celebrity speaker. This year, we had athletes Steve Cram and Ellie Simmonds, because it was an Olympic year, as well as Dr Willard Wigan, who is the world’s greatest micro sculptor, and the RAF’s first female jet pilot, Mandy Hickson.

“Having such a range of different celebrities on our site has been great because we get such a range of different inputs and perspectives. We’ll have the interview with them, but then they’ll wander around the tents, meeting people and answering questions, which is what the festival is all about.

“We also have relaxation zones. Not everyone likes to be in a crowd, so we wanted to create places where people can sit in a giant deck chair for a little while and just breathe. We’ve found that this really helps with idea generation as well – every year, we generate 50 or 60 new ideas from the festival that go into our pipeline.”

But the NWG Innovation Festival is about more than generating new ideas – it brings together groups of people who never would have had the opportunity to work alongside one another otherwise.

“This is an event for the whole industry,” explains Nigel. “It even brings in people from outside the industry. We’ve had 900 different organisations involved from more than 30 different countries now, and we’re having the chance to work alongside people and organisations

“Once we’ve defined the problem co-create the sprint and research been done. It’s so important experts, because we want approaching this in

that we never would have encountered before.”

Having such a diverse range of people has led to new concepts that are now in the process of revolutionising the industry.

“One of our greatest innovations to arise from the festival was the National Underground Asset Register,” says Nigel. “When we did the first Innovation Festival, three out of the six sprints – all looking at different problems – said that they needed a common underground map and came to a point where they coalesced on the idea of a solution.

“When we were planning the 2018 festival, I asked what happened to that idea, but no one wanted to share their data, which led us to a third technique. We already used design sprints and hacks, and our third approach is called ‘A year’s worth of work in a week’. We’re not trying to create any new ideas – instead, we’re taking an idea that exists and crosses organisational boundaries and trying to move it along as fast as we can in a week.

“In this case, we brought in a team of lawyers – one from our company,

problem statement, we research what’s already important to do this alongside want to make sure we’re in an original way”

one from the gas industry, one from electric and one from telecoms. We gave them a blank piece of paper and told them to create a data-sharing agreement. We had another team of people setting up the platform, a team defining the data standards, a team investigating the data and lastly a team writing an app.

“By the end of the week, we could see that we had four underground areas of Newcastle mapped. It was by no means a production-ready creation, but we were excited that it could be done.

“Our next move was building a common underground map of Sunderland, with help from Sunderland City Council and the Ordnance Survey. They then made the geospatial commission aware of the product, which is when we were very lucky to receive £4m in government funding to build this map for the whole of the North East as a pilot.

“We then moved onto London before turning our attention nationwide, and now we’re in the process of deploying that across the business. The concept took time to create, but it all came from our Innovation Festival. We

couldn’t have done this without the partnership with the government, but nothing would have been created in the first place if we hadn’t taken that initial risk.

“I’ve spoken to organisations before who say that they’re all about innovation, and the first question I always ask is ‘What’s your expected success rate?’ If they tell me that it has to be a 10 out of 10 success rate – which they often do – then I tell them that they can’t innovate with that mindset. It’s all about risk. That can lead to quite a bit of scrutiny, but you need permission to fail in order to deploy meaningful change.”

While taking that initial risk can be a challenge, Nigel explains that developing these innovations is crucial for not only for the business and the water industry, but for the overall health of the planet.

“NTT Data was a ‘Brought to you By’ sponsor of this year’s Innovation Festival, they exhibited and had several members of their team actively participating in the many sprints, providing their expertise and input along the way”

“In our business, innovation is designed to do two things,” says Nigel. “On one hand, it can improve our performance in areas such as pollution, leakage and flooding. On the other, it can help us avoid capital investments and keep customer bills low.

“One example of an innovation in our pipeline right now, that also came out of the festival, is a tool called

the Tipping Point Tool. The point of this tool is to predict the degradation of concrete. Concrete has a lifespan of typically 50 years, but this can vary greatly based on operational conditions.

“What we’re doing with this tool is looking at the details of lots of concrete assets, and using AI to work out where we should make operational interventions to prevent

Water utilities are on the cusp of radical change and innovation. To meet the longterm needs of customers, communities and the environment, visibility is needed now.

With market-leading data expertise, underpinned by high-performance network connectivity, integration and AI innovation, NTT DATA enables you to deliver digitalisation across the water cycle. Water made

water more clearly.

Learn more

degradation. If you make small operational interventions in time, you can dramatically extend the lifespan of concrete – saving us and our customers costs, helping lower carbon emissions for the industry and offering broader benefits for the environment beyond.”

So, what’s in store for the 2025 Innovation Festival? Nigel reveals the company is looking at what it can do beyond straightforward sustainable initiatives.

“Every year, we set a theme for the festival,” explains Nigel. “This year, our theme was speed and scale, which was focused around sustainable initiatives, and setting up the water industry to be resilient in the face of climate change.

“Next year's theme is centred around regeneration. The principle behind this theme is how we need to go beyond sustainability. We need to figure out how to give nature a chance and help the planet replenish its resources. It’s time for us to have a discussion about what a regenerative water company would look like. So that’s what the festival will look like next year.”

As the Innovation Festival continues to grow Nigel reflects on its initial beginnings, and the work that so many people have put into it to make it successful.

“We have a massive ecosystem working on this festival, and it’s come a long way since the beginning,”

celebrates Nigel. “But you can’t underestimate the power of a halfbaked idea, because the first festival was definitely a half-baked idea.

“I grew up as a programmer, and I think this made me a perfectionist – I had to make sure every line of code I wrote worked under every single circumstance imaginable. I think I carried that thinking too far into my career as a leader.

“What I learned when we did the first Innovation Festival, because we went from concept to launch in a short time frame, there were dynamics people organised that I had no idea about. In some ways, I felt like I’d lost control – but in the best way possible. It was better because more people had contributed to the planning and execution, more people owned it. The festival wasn’t just mine – it was everyone’s, and we all had a vested interest in making it great. Within this journey, working with our partners has been a core component of the event’s success.

“How the festival works now is that once we’ve defined the theme we’ll go out to our ecosystem, and let them know the kind of problems we’re looking at solving within that theme, because we want to draw from a diversity of experience. It’ll be a long list of about 50 or 60 topics that we’ll send out to our key partners such as NTT Data for them to provide input on, based on their expertise. NTT Data was a ‘Brought to you By’ sponsor of this year’s Innovation Festival, they

exhibited and had several members of their team actively participating in the many sprints, providing their expertise and input along the way.

“There will be some dialogue that takes plays that effectively allows them to play to their strengths and helps us address our problem. Sometimes our partners will suggest new ideas, which we’re very open to.

“We’re very malleable on the content of the festival, as long as it’s addressing a problem that’s relevant to the industry, and ideally beyond. Defining a problem statement often feels more like an art than a science, because there are so many factors at play.

“Once we’ve defined the problem statement, we co-create the sprint and research what’s already been done. It’s so important to do this alongside experts, because we want to make sure we’re approaching this in an original way.”

Learn more about NWG here.

“I started life as a computer programmer when I was 17,” says Nigel. “I got halfway through my A-levels and decided I knew everything I needed to know, so I dropped out. This was in 1981, when there were three million people unemployed.

“I went to the Job Centre, and they told me to go onto a programme where I could study to be an accountant or go into computer programming. On a whim, I decided to go into computer programming.

“On that programme, there was a wonderful gentleman called David Gale, who gave me a real chance to succeed and helped me get my foot on the ladder. Ever since, I’ve been trying to pay that back.

“I’ve been lucky to have the opportunity to return the gesture

with the Innovation Festival, as we bring in young people to give them work experience. We’ve been doing this since we started the project. We’ve seen that these young people being able to put that experience down on their CV is helping them get noticed and take the next step.

“This year, we’re trying to take that a step further with our Young Citizens’ Work Experience Festival. We wanted to give 14 to 18 year olds the opportunity to come to our festival and work alongside our partners in a range of activities, and we were able to give work experience to 850 young people. I’d like to think that a few of them came out of that experience with a better understanding of what they want to do in the future.”

Connect with Nigel

"The team were professional and diligent throughout"

Leigh Feaviour, CTIO for BT’s Supply Chain

"Absolute pleasure working with the Digital Innovation team"

Mun Valiji, Chief Information Security Officer at Sainsbury’s

"A highly professional approach"

Andy Brierley, Vice President, Cloud Application Modernisation at IBM

"Digital innovation Magazine is a very flexible and professional team"

Kim Larsen CTIO, T-Mobile Netherlands

The capital comes at a crucial time for UK SMEs in the professional services, business services, technology and healthcare sectors.

GROWTH LENDING, A LEADING UK-BASED INDEPENDENT ASSET MANAGER SPECIALISING IN FUNDING FAST-GROWTH SMALL AND MEDIUM ENTERPRISES (SMES), HAS ANNOUNCED A SIGNIFICANT FUNDING

his partnership is expected to deploy £1bn worth of loans over its initial five- to six-year duration, providing a substantial boost to the UK’s SME sector.

This new source of capital comes at a crucial time for UK SMEs. After a period of uncertainty, businesses are actively seeking growth opportunities and the funding necessary to support their ambitions. The collaboration between Growth Lending and Aros aims to meet this demand with a new fund focusing on deals ranging

from £2m to £10m. The new fund will support various growth initiatives, including mergers and acquisitions, expansion, and research and development.

The partnership will primarily target Growth Lending’s core markets, which include professional services, business services, technology and healthcare. There is also a significant interest in business models such as Software as a Service (SaaS). However, the appetite for funding is broad, encompassing any business with growth ambitions and a solid business model.

“We understand that many businesses are exploring growth strategies after what has been a challenging period, and this collaboration with Aros allows us to provide the much-needed capital to fuel their ambitions”

Kimberly Martin, Managing Director at Growth Lending

Having closed the initial £200m fund in the summer, Growth Lending has already deployed £56m across 11 deals in sectors such as telecommunications, software, business services and healthcare.

This latest funding partnership reinforces Growth Lending’s strong track record in the alternative finance space, where it has already lent more than £1bn in growth and working capital to date.

“This partnership marks an exciting new chapter for Growth Lending and firmly establishes our ongoing commitment to UK SMEs,

empowering them during a pivotal time in their growth journeys,” says Kimberly Martin, Managing Director at Growth Lending. “We understand that many businesses are exploring growth strategies after what has been a challenging period, and this collaboration with Aros allows us to provide the much-needed capital to fuel their ambitions. Whether that is growth capital, acquisition finance or expansion capital, this enables us to tailor funding solutions to meet their needs.

“Our focus will be on fostering this long-term collaborative partnership

with Aros and our clients, ensuring that we not only meet their immediate funding needs but also support their strategic goals for the future.

“We’re proud to be able to play a significant role in the increasingly important alternative lending space and are dedicated to helping businesses navigate their growth challenges effectively. Together with Aros, we aim to build upon the experience we gained as BOOST&CO and create a lasting impact on the SME landscape – which is the backbone of our economy.”

“We are excited to embark on this funding partnership with Growth Lending,” adds Gustav Röcklinger, CEO at Aros. “It aligns well with our goal to consolidate our position as an important part of the funding ecosystem for SMEs in the UK, and the funders that serve them, through the provision of structured back-leverage solutions to best-in-class origination platforms, like Growth Lending.

“This collaboration not only enables us to provide essential capital to businesses at a time when they need it most, but it also reinforces our commitment to fostering innovation

“We understand that many businesses are exploring growth strategies after what has been a challenging period, and this collaboration with Aros allows us to provide the much-needed capital to fuel their ambitions”

Gustav Röcklinger, CEO at Aros

and expansion across various sectors.

“We believe that by working together, we can create significant opportunities for SMEs and contribute to the overall economic recovery and growth in the UK. We look forward to seeing the positive impact this partnership will have on the businesses Growth Lending serves.”

This latest partnership marks a pivotal moment for both Growth Lending and Aros as they join forces to empower UK SMEs.

By combining their expertise and resources, they aim to create a robust support system that not only addresses the immediate funding needs of businesses but also fosters long-term growth and innovation.

Together, they are committed to driving economic progress and ensuring that SMEs have the financial backing necessary to thrive in today’s competitive global market.

For more information, visit growthlending.com.

Source: Growth Lending

The initiative aims to help 30 million next-generation learners develop AI literacy, content creation and digital marketing skills by 2030.

Adobe has recently announced a new global initiative expanding the Adobe Digital Academy’s focus on equipping nextgeneration learners and teachers with AI literacy, content creation and digital marketing skills –helping them thrive in the modern workforce.

xpanding on the Adobe Digital Academy’s decade of success in upskilling and creating new career pathways, the programme will provide training, certifications and access to Adobe Express with the goal of helping 30 million learners globally develop these indemand skills by 2030.

Training and certificates will be available through Adobe’s collaborations with Coursera, NGOs, K-12 schools, colleges and universities and alternative education organisations. Adobe will fund scholarships and NGO

grants to help ensure that emerging professionals from all backgrounds can benefit from the training, tools and direct pathways to future careers.

The rise of the creator economy and breakthrough AI technologies have unleashed a wave of new opportunities in content creation and marketing across every industry. Emerging professionals are eager to carve out their place in this new landscape with the help of Adobe’s specialised training.

“Adobe’s mission has always been to design products that create opportunities and empower people from all backgrounds to change the world,” says Stacy Martinet, Vice President, Marketing Strategy & Chief Communications Officer at Adobe. “We want AI to bridge the digital divide, not widen it, and this programme will open doors for emerging professionals to succeed in the future workforce with AI literacy, content creation and marketing skills.”

This builds on Adobe’s commitment to empower learners of all backgrounds to succeed in today’s job market and unleash creativity for all. The company has committed more than $100m this year in donations, scholarships, product access and partnerships across this and other initiatives to enable people and organisations around the world to tell their stories.

Adobe has designed a range of curricula for this programme –covering topics including Generative

AI Content Creation, Social Media Content, Multimedia Content, Content Marketing and Multi-channel Content and Advertising. Learners will gain the ability to create high-quality content effortlessly with tools like Adobe Express and learn how to harness the power of generative AI to better express themselves creatively and visually.

The first courses are now available globally on Coursera, a best-in-class online learning platform, to enable

“Adobe

is committing $250,000 in scholarship licences that will be distributed through nonprofits in the first year of the programme to access Adobe courses and certificates on Coursera”

anyone to learn and gain creative and digital skills at their own pace. Aspiring learners can pursue Content Creator and Graphic Designer Professional certificates, with additional certificates in Digital Marketing available in early 2025.

Adobe is committing $250,000 in scholarship licences that will be distributed through nonprofits in the first year of the programme to access Adobe courses and certificates on Coursera. The coursework will be coming soon to Adobe Express and is in development for the Behance community.

The company is also providing new donations to an expanded network of alternative education and youth-serving NGO collaborators including DECA, NPower, Build.org, the Prince’s Trust, AVID, Girl Scouts of Western Washington and Pratham. These new investments will provide millions of students served by NGOs with exposure to essential workplace skills and integrate skilling opportunities into their extracurricular offerings.

“Adobe is the ideal partner for DECA as we amplify our quest to prepare students for college and careers,” says Christopher Young, Chief Programme Officer, DECA. “This initiative will empower our student members to learn and apply the creative skills they need for their future careers in marketing and business. Adobe Express is the perfect tool for DECA students to apply their creativity and experiment with AI to create content relevant to preparing for their careers.”

Source: Adobe

Tony Rehn, Program Director, Waste to Materials at Fortum highlights the company’s industryleading developments in biodegradable plastic.

Leading waste management and circular solutions company Fortum Recycling & Waste has succeeded in producing biodegradable plastic from carbon dioxide (CO2) emissions through waste incineration at its plant in Riihimäki, Finland.

his breakthrough, based on carbon capture and utilisation (CCU), is a significant step towards reducing and utilising industrial carbon dioxide emissions.

The production of CO2-based plastic is providing a new, sustainable raw material for the plastics industry.

“I am very proud that our team is the first in the world to successfully produce biodegradable plastic entirely from carbon dioxide emissions,” explains Tony Rehn, Program Director, Waste to Materials at Fortum. “This breakthrough is a significant

step towards more sustainable plastic production. This kind of development work helps to reduce dependence on fossil-based raw materials and can create new circular economy-based business.”

Similar carbon capture development projects are underway in several industrial sectors in Finland and globally, but the majority of them focus on the production of synthetic fuels and carbon capture and storage (CCS).

“Captured carbon dioxide should be utilised as a new raw material instead of storing it underground or releasing it into the atmosphere when using fuel,” says Tony.

“Biodegradable, CO2-based plastic offers a significant alternative to the market because it has the same qualitative

properties as traditional, fossil-based virgin plastics”

“Utilising captured CO2 is a much more sustainable option in terms of tackling resource scarcity in the future. Whereas carbon capture and storage is a linear solution that does not address the growing material shortage, carbon capture and utilisation promotes circular economy.”

Fortum Recycling & Waste's Carbon2x program piloted carbon capture and utilisation in 2022. The program aims to capture carbon dioxide emissions from the incineration of

non-recyclable waste and use them to produce sustainable products, such as biodegradable plastic.

Every year, Europe generates nearly 100 million tonnes of nonrecyclable waste that is incinerated and utilised in energy production. The wider implementation of the Carbon2x program's innovation means that up to 90% of the

CO2 emissions released into the atmosphere from waste incineration could be captured and bound into products.

New sustainable solutions are needed for plastic production to complement recycled and biobased plastics. Biodegradable, CO2-based plastic offers a significant alternative to the market because it has the same qualitative properties as traditional, fossil-based virgin plastics.

“We want to promote the circulation of materials comprehensively,” says Tony. “We believe that a whole new category of sustainable plastics is emerging from products such as ours, even though the mechanical recycling of plastics is still needed.”

CO2-based plastic can be recycled just like many other plastics, closing the carbon cycle. An additional advantage of biodegradable plastic is that even if it did end up in nature by accident, it decomposes and does not leave harmful microplastics in the environment.

The Carbon2x program's innovation is hoped to provide solutions not only for material production for food and cosmetics packaging, but also for other sectors such as toys and home electronics.

At this rate of development, the industrial production of biodegradable plastic made from waste incineration's CO2 emissions could start as early as the end of the decade. The new ‘Plastics born from CO2’ brand will be introduced to the European market in November 2024.

Source: Fortum

finance solution will be made available through the GoCardless boost capital access for small businesses in the UK.

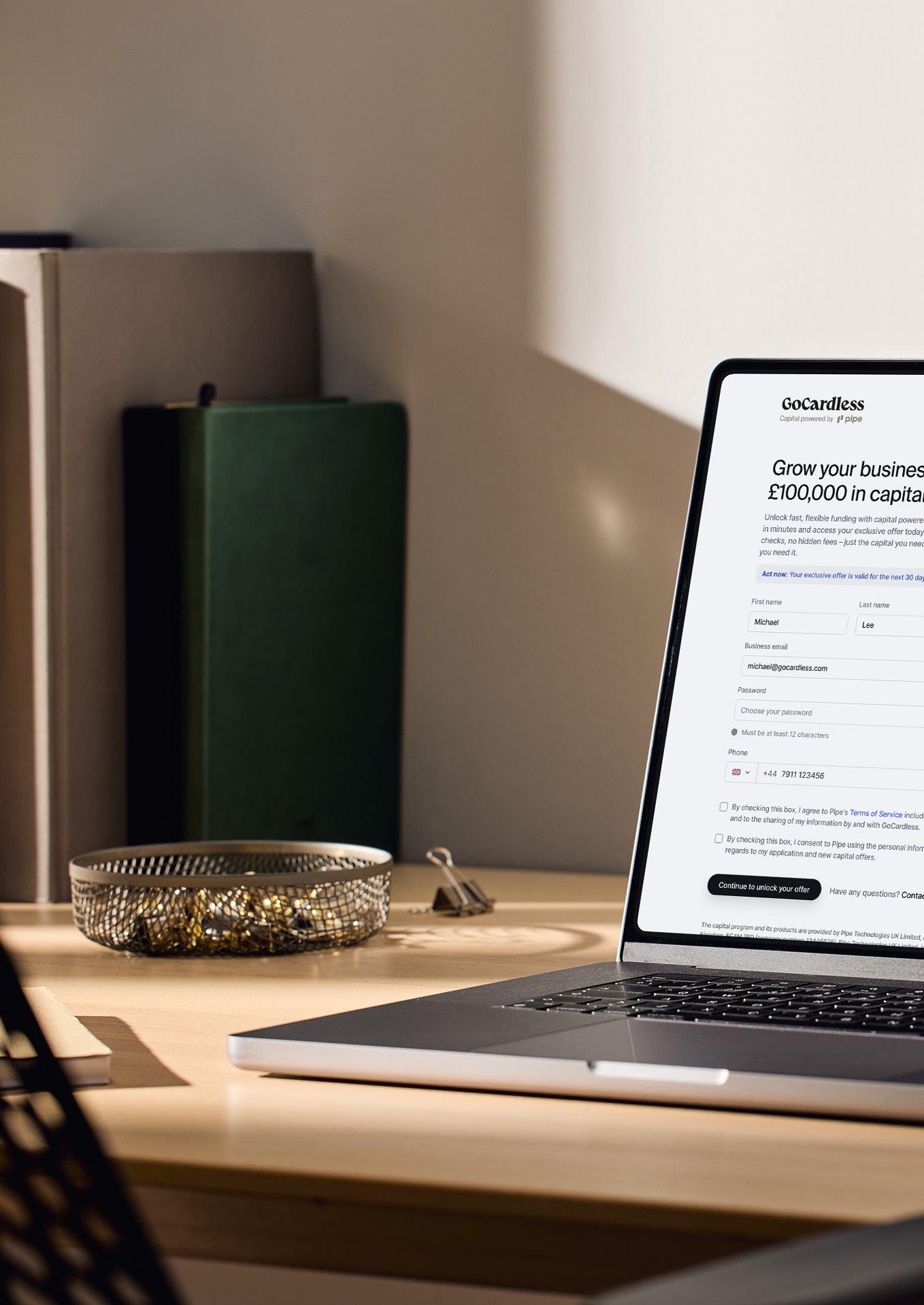

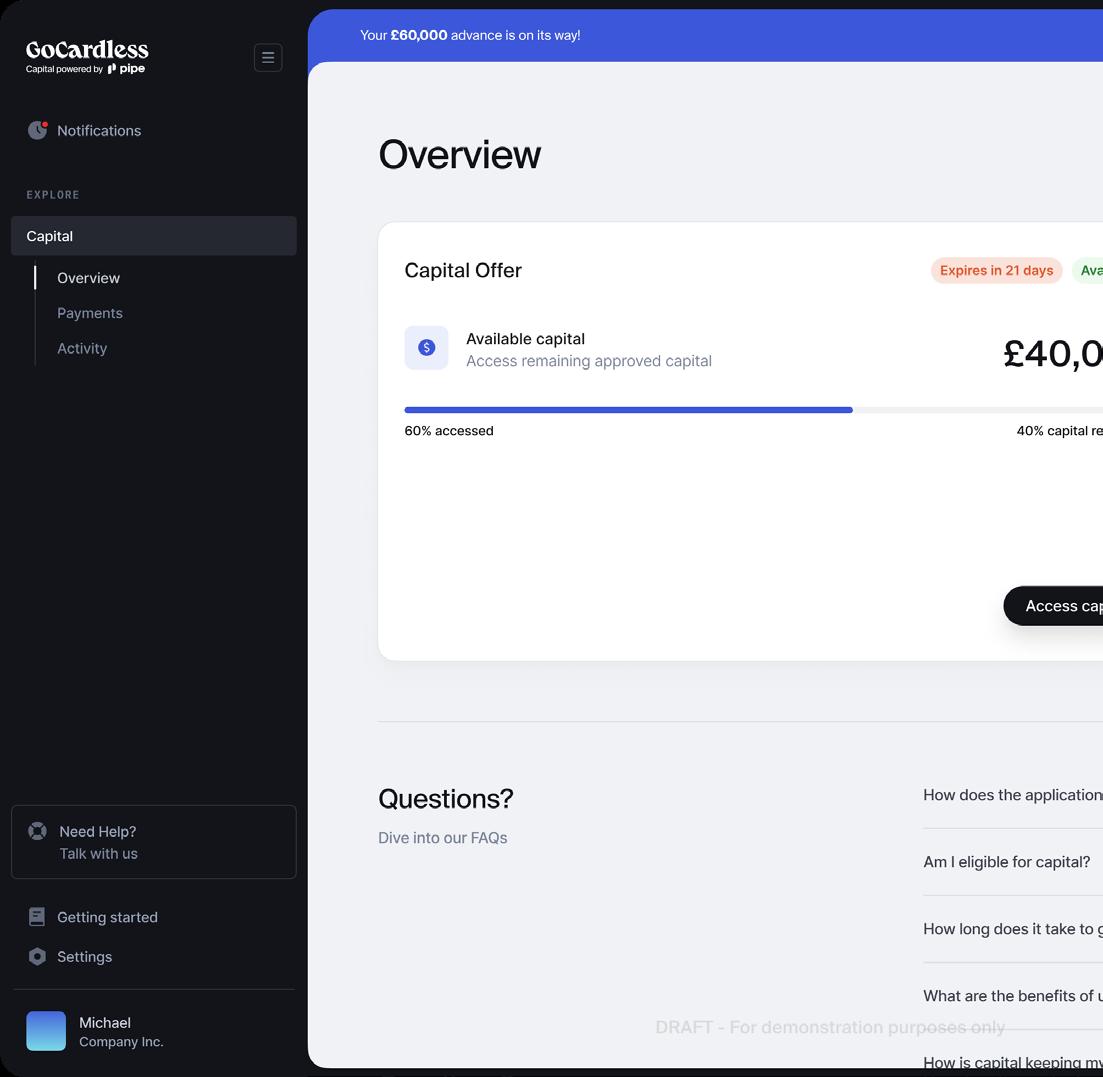

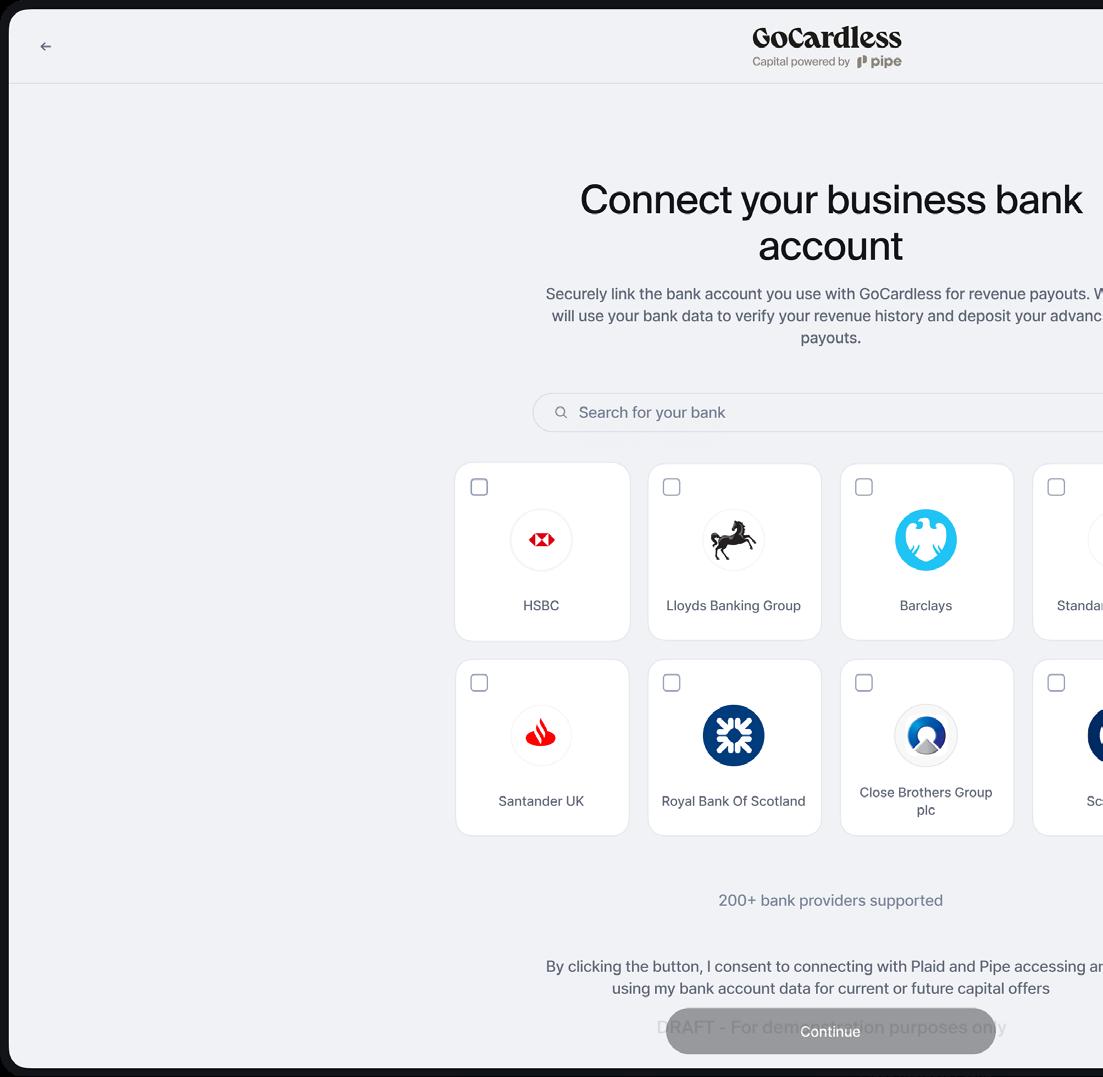

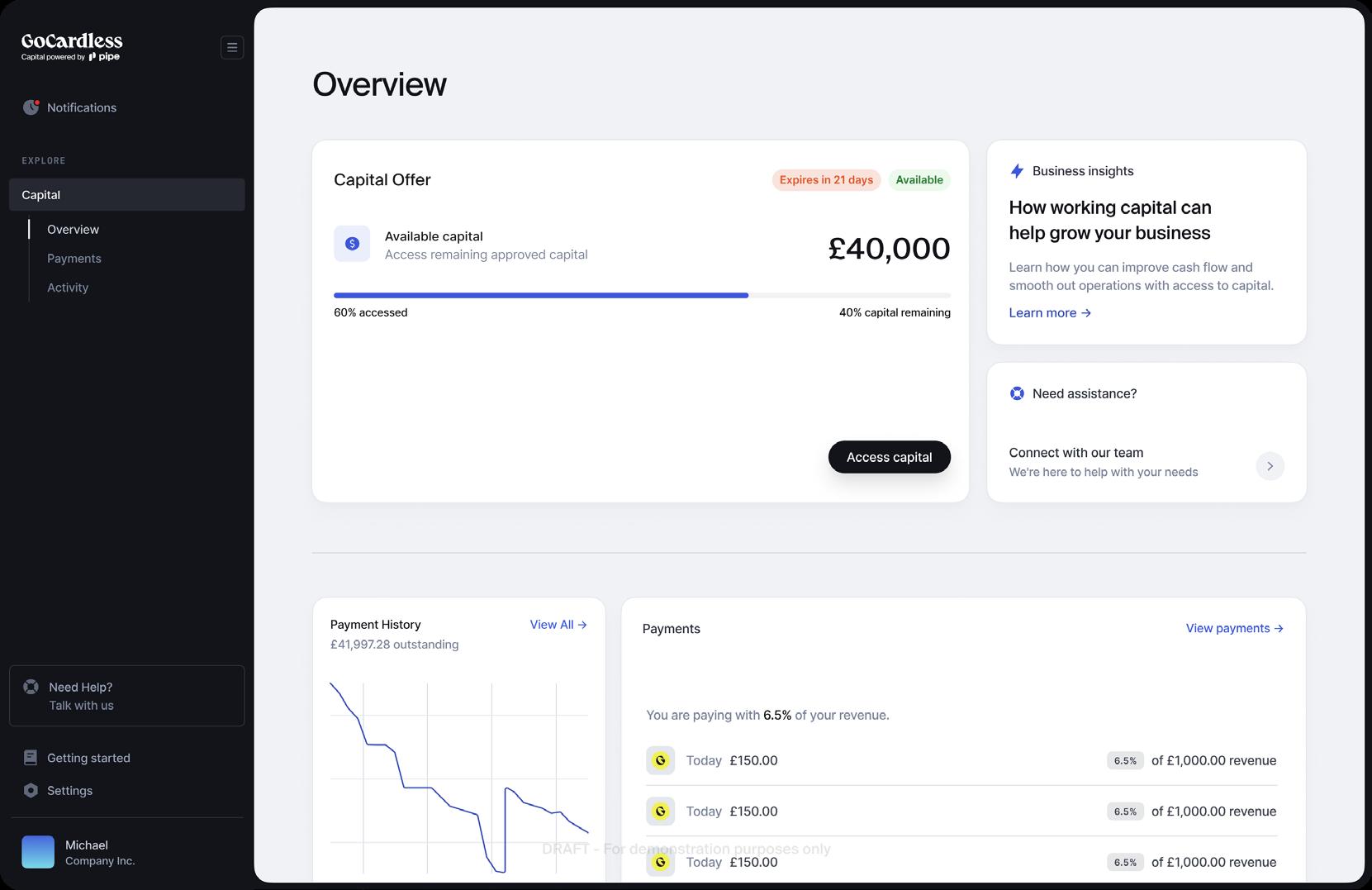

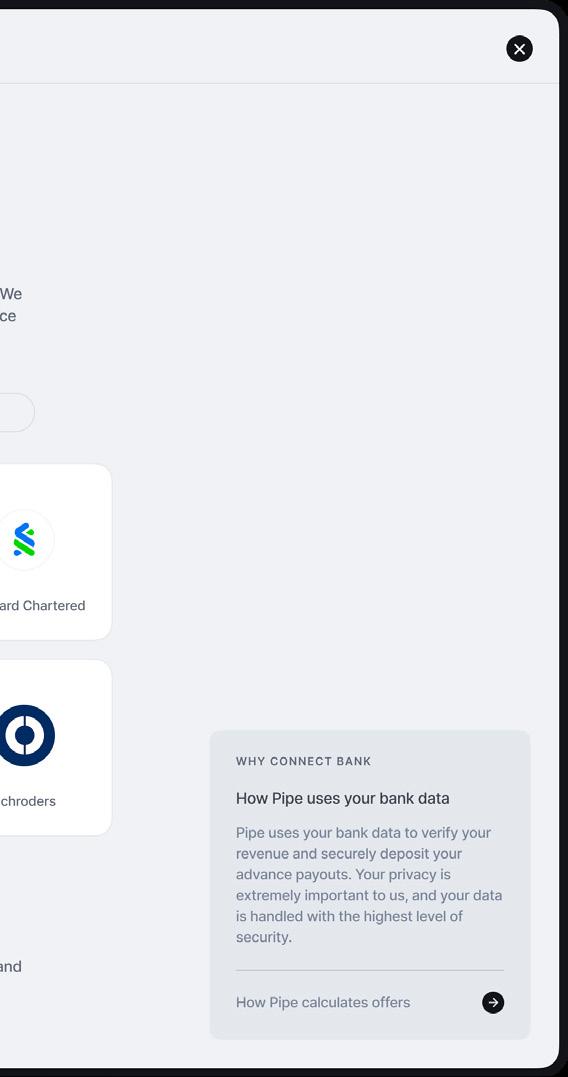

Pipe, a fintech company partnering with software platforms to deliver embedded financial solutions for SMEs, and bank payment company GoCardless recently announced a partnership to reshape capital access for UK businesses.

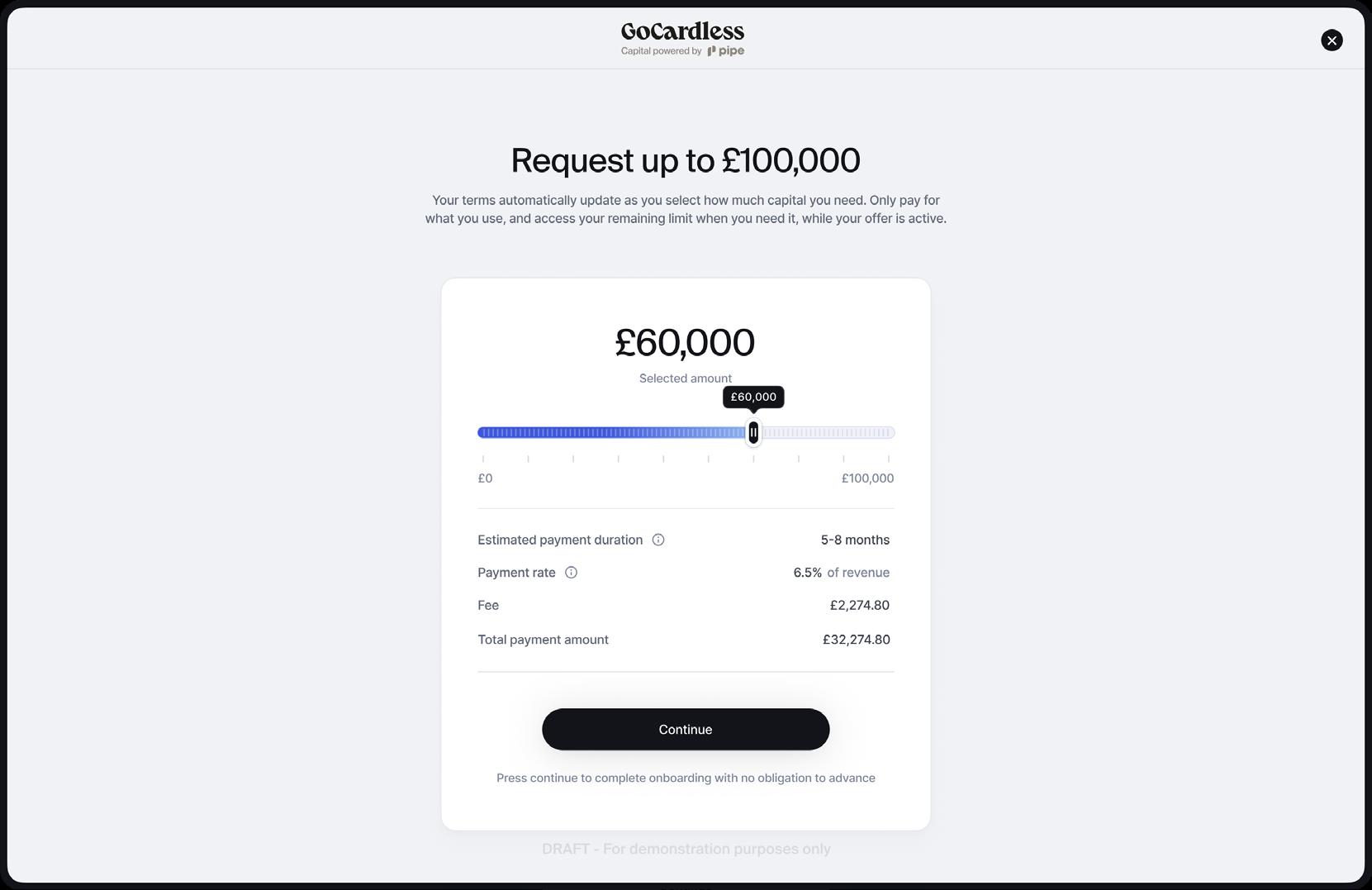

Under the partnership, Pipe's customer-friendly capital offering will be accessible via the GoCardless platform, providing simple and seamless capital access for its UK customer base.

Over the past several months, Pipe successfully conducted a pilot programme with GoCardless in the UK, and the two companies have agreed to formalise their partnership to bring Pipe’s customer-friendly capital solutions to the broader UK market.

“Our partnership with GoCardless in the UK market marks a significant step forward in our mission to empower small businesses worldwide with the financing and services they need to grow and prosper," says Luke

Voiles, CEO of Pipe. “By combining Pipe’s customer-friendly solution with GoCardless’s extensive reach in the UK market, we're revolutionising how small businesses access capital and providing them with the financial tools they need to thrive in today's dynamic economy.”

This collaboration follows the launch of Pipe’s embedded capital offering in the United States in May. GoCardless partnered with Pipe after a comprehensive market evaluation, citing Pipe’s impressive pre-approval rate for merchants and its ability to offer capital without personal guarantees.

Pipe’s solution stands out in the market for its fast, easy-to-access financing, which requires no credit checks. Its

flexible top-ups provide similar benefits to a line of credit, and the streamlined user experience results in higher sign-up conversion rates. This approach is particularly crucial for micro-businesses and minority-owned businesses, many of which lack the business history or credit scores required by traditional lenders.

UK SMEs have a range of capital financing needs from growing their business to covering cash flow gaps caused by late payments (a staggering 52% experience late payments) and it’s unsurprising that one in six are looking for financing.

By embedding capital directly into the applications that SMEs use daily to run their business, Pipe makes it fast and simple to access funding. This allows businesses to secure working capital in minutes based on their performance rather than going through the traditional lengthy and arduous underwriting process. With pre-approval rates well above 90%, Pipe eliminates a common friction point often experienced with other lenders, who may show pre-qualified offers only to disqualify applicants later.

“I was thrilled to receive an offer from Pipe through the GoCardless platform because GoCardless is a brand we trust,” says Sam Brooksworth, GoCardless customer and Founder of remote staffing

“Our partnership with market marks a significant our mission to empower worldwide with the financing need to grow and prosper”

Luke Voiles, CEO of Pipe

with GoCardless in the UK significant step forward in empower small businesses financing and services they prosper”

provider Remoteli. “Everyone needs a financial partner in their corner to take your business to another level, and that’s what Pipe feels like. Rather than feeling like you’re owing somebody, Pipe makes you feel like it’s a partnership.”

Early results from the pilot programme have exceeded expectations. Pipe saw attachment rates twice as high as benchmark figures. The full product is expected to launch in 2025.

“We’re excited to work with Pipe to roll out their capital offering to our UK customer base,” says Jolawn Victor, Chief Growth Officer

at GoCardless. “Their expertise and support helped us implement a pilot programme quickly. Early results have exceeded expectations with almost £7m in capital being advanced to GoCardless customers.

“Customer feedback has been overwhelmingly positive, with the programme achieving an impressive 88 Net Promoter Score. The strong conversion rates from the pilot show there is pent-up demand for this type of financing. We look forward to fully launching this embedded product next year, helping customers tap into new opportunities for growth and expansion while continuing to build their trust and loyalty in GoCardless.”

Source: Pipe

Innovation Magazine is a specialist technology platform with over 166,700+ readers.

Our community consists of C, V and D level executives from a wide range of industries. A unique blend of thought leadership interviews and features that cover digital transformation, cloud & cyber, enterprise IT, artificial intelligence, machine learning and sustainability.

Demand

Webinars - Hosting & Promotion

Team up with Innovation Magazine and build media programs that deliver.

Find out more

Transforming the UK’s private and fleet vehicle wash payments. vehicles, the GoWash app provides a simpler method of payment at nearly 500+ hand car washes across the UK.

oWash is a national payment app aiming to revolutionise the UK car & van washing industry for B2B and B2C customers alike.

Whether users are members of the public or businesses with company

“In

The GoWash Fleet Account has changed how companies pay for vehicle washing. Prior to GoWash, companies would have to deal with driver receipts, expense claims and petty cash for any vehicle washing.

The Fleet Account consolidates all of these transactions into one weekly invoice, saving business wasted admin time but also providing the fleet manager full visibility and control of how much a driver can

summer 2024, we launched a booking platform for a nationwide network of car washing sites. We expect to build on this and many other solutions we provide”

Jonny Billing, Managing Director of

GoWash

spend and how often the vehicles can be washed. Since every fleet operates differently, the app has been built on a dynamic system so GoWash can adjust its service tailored to customers’ needs.

Trusted by over 50,000 fleet vehicles in the UK, GoWash is growing rapidly as more companies make the switch to its platform.

The GoWash app is also changing the way the general public deals with paying for car washes. Before the app came along, a significant portion of car wash businesses in the UK was cash only – forcing customers to swing by a cash point on the way to get their car cleaned. The GoWash App removes this inconvenience by enabling secure digital payments, providing consumers flexibility and convenience when they arrive at a car wash.

“We have made some major innovations in the car wash industry over the last few years, but it has historically been an industry where innovation and technological progress have been a bit behind the times,” says Jonny Billing, Managing Director of GoWash. “But we have helped drag it into the 21st century, and we are not done yet! We have plenty more ideas and ways to streamline operations for car washes and users alike. In summer 2024, we launched a booking platform for a nationwide network of car washing sites. We expect to build on this and many other solutions we provide.”

Learn more at gowash.co.uk.

Connect with Jonny