First and foremost, I want to send my most heartfelt prayers to those in Maui, Hawaii who have lost so much. As I write this, I am watching the coverage of the devastation of lives and property that just has no measure and I want those affected to know that we see you and are sending as much support as we can to help as you navigate through this. I visited the island as a young man and have many fond memories of the area and the hospitality that my family and I received. I am lost for words for you all.

So many are suffering around our wonderful country right now, but I am encouraged by the American spirit that I see in neighbors helping neighbors, and strangers helping strangers. It is incumbent upon us all to step forward and help those who are suffering through situations that are the stuff of nightmares as we never know when it will be one of us that needs such help. Not all of us can send financial aid (as times are tough for many), so perhaps we can look for ways and times that we can help. Kindness goes a long way and can start with the simplest of acts.

Onto this issue: Betty Hovey, CCS-P, CDIP, CPC, COC, CPMA, CPCD, CPB, CPC-I, from Compliant Health Care Solutions has written about the audit process, and she outlines the various steps needed to audit accounts successfully to ensure accuracy and compliance. She hosts a LinkedIn Live broadcast every other Thursday where she discusses different healthcare topics and recently covered audits. She has expanded on this topic for you, and should you have any questions, I’m sure she’d love for you to listen in and ask her.

We’ve included a great article written by Robert Liles, Esq., discussing issues with Texas Medicaid claims for pediatric telemed-

icine; an article by Sonal Patel, BA, CPMA, CPC, CMC, ICDCM, on the proposed rule for the Medicare physician fee schedule; one from Sandy Coffta, VP of Client Services at HAP, on the Medicare proposed rule and its effect of radiology reimbursement; and another one from Scott Kraft, CPMA, CPC, on medical necessity and data under the E/M documentation guidelines.

Rachel Rose, JD, MBA, writes on two HIPAA enforcement actions that underscored the importance of the CIA of PI and the consequences. We welcome Andrew Lockhart from Fathom and his article on AI coding and how it can transform operations and enhance margins. We also have a great piece from Randi Tapio, MBA, CMRS, CPCS, CHM, CHBP, about the evolution of MIPS and the upcoming changes. Plus, much more to read!

As always, it’s another chock-filled issue with something for everyone!

Until next time.

editor Amber Joffrion, M.A. editorial@billing-coding.com

ceo - publisher Storm Kulhan storm@billing-coding.com

coo Nichole Anderson, CPC nichole@billing-coding.com

subscriptions manager Ashley Knight ashley@billing-coding.com advertising sales@billing-coding.com

Subscriptions:

To start a new subscription, please visit www.billing-coding.com/subscribe

Renewals: Keep your rate locked in for life! www.billing-coding.com/renewals

Change of address: Email - subscriptions@billing-coding.com or call 864 228 7310

26

FEATURES

10. Texas HHSC-OIG is Ramping Up Its Investigations of Medicaid Pediatric Telemedicine Claims

16. Medicare Proposed Rule for 2024 Will Not Improve Radiology Reimbursement

18. Maximize Duplex Doppler Ultrasound Documentation and Reimbursement

20. Medical Necessity and Data Under the E/M Documentation Guidelines

22. Proposed Rule for Medicare Physician Fee Schedule CY 2024 Sees Continued Decrease in Reimbursement

34. The Evolution of MIPS and Understanding the Upcoming Changes

36. Two HIPAA Enforcement Actions Underscore the Importance of the Confidentiality, Integrity, and Availability of Patient Information and the Consequences

40. Transforming Operations and Enhancing Margins with AI Coding

44. What Is at Your Fingertips?

46. Navigating Carrier Guidelines for Optimal Practice Reimbursement

48. E/M Scoring Questions

OTHERS

6. News / Updates

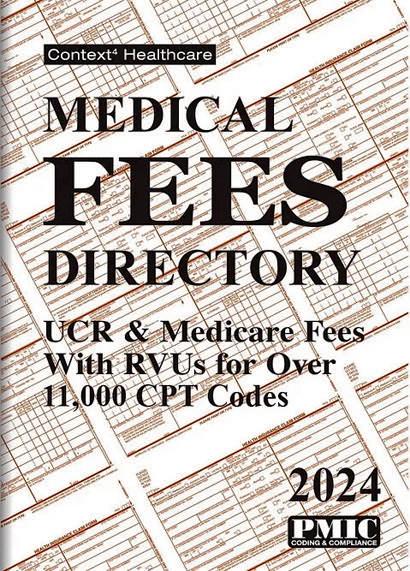

50. Reviews Medical Fees Directory 2024

The Unfiltered Guide to ERISA for Medical Providers

The Unfiltered Guide to Medical Office Management

Nancy Clements. Practice Management Institute® (PMI) trains and certifies administrative professionals working in medical offices: medical office managers and staff working in coding, billing, auditing, and compliance. www.pmimd.com

Sandy Coffta, Vice President, Client Services - Healthcare Administrative Partners, oversees the team responsible for achieving and maintaining the company’s consistently high retention and referral rates. Ms. Coffta has over 17 years of experience in client relationship management, including reimbursement analysis, workflow optimization, and compliance education. www.hapusa.com

Betty Hovey, CCS-P, CDIP, CPC, COC, CPMA, CPCD, CPB, CPC-I, is the Senior Consultant/Owner of Compliant Health Care Solutions, a medical consulting firm that provides compliant solutions to issues for all types of healthcare entities. Chcs.consulting

Scott Kraft, CPMA, CPC, Senior Compliance Consultant, is an auditor for DoctorsManagement. He also creates content for the firm’s educational division, the National Association of Medical Auditing Specialists (NAMAS). https://namas.co

Robert W. Liles, J.D., is an experienced health lawyer and a former federal prosecutor. Robert and the other attorneys at Liles Parker represent healthcare providers and suppliers around the country in Medicaid audits and investigations. If your pediatric practice or clinic is audited, give us a call for a free consultation. We can be reached at: 1 (800) 4751906. www.lilesparker.com

Andrew Lockhart is Co-founder and CEO of Fathom, the leader in autonomous medical coding. Fathom applies cutting-edge deep learning and natural language processing (NLP) to produce complete coding results for patient encounters with zero human intervention. Andrew is an avid speaker and has presented at HFMA, Academy Forum,

Stanford Medical School, and HBMA events. www.fathomhealth.com

Sonal Patel, BA, CPMA, CPC, CMC, ICDCM, is CEO and Principal Strategist at SP Collaborative, LLC. www.spcollaborative.net

Rachel V. Rose, JD, MBA, is an Attorney at Law in Houston, TX. Rachel advises clients on healthcare, cybersecurity, securities law, and qui tam matters. She also teaches bioethics at Baylor College of Medicine. She has been consecutively named by Houstonia Magazine as a Top Lawyer (Healthcare) and to the National Women Trial Lawyer’s Top 25. She can be reached at rvrose@rvrose.com. www.rvrose.com

Wyn Staheli is the Director of Content Research for innoviHealth. She has over 30 years of experience in the healthcare industry. With her degree in Management Information Systems (MIS), she has been a programmer for a large insurance carrier, as well as a California hospital system. She is also the author and editor of many medical resource books and the founder of InstaCode Institute.

Erin Stephens, CPC, CIRCC, is Sr. Client Manager, Education for Healthcare Administrative Partners. www.hapusa.com

Randi Tapio, MBA, CMRS, CPCS, CHM, CHBP, is the Owner/ CEO of MedCycle Solutions, creating revenue cycle solutions for healthcare practices that improve efficiencies, maximize reimbursements, and help their clients get paid faster. www.medcyclesolutions.com

Jill Young, CPC, CEDC, CIMC. NAMAS is a division of DoctorsManagement, LLC, a premier full-service medical consulting firm since 1956. With a team of experienced auditors and educators boasting a minimum of a CPC and CPMA certification and 10+ years of auditing-specific experience, NAMAS offers a vast range of auditing education, resources, training, and services. www.namas.co

On July 13, 2023, the Centers for Medicare & Medicaid Services (CMS) released the Calendar Year (CY) 2024 Revisions to Payment Policies Under the Physician Fee Schedule (PFS) and Other Revisions to Medicare Part B [CMS-1784-P] Proposed Rule, which includes proposals related to Medicare physician payment and the Quality Payment Program (QPP). Physicians and other clinicians are once again facing large, proposed cuts of more than 3.36% for CY 2024. While Congress has provided temporary partial fixes to physician payment in the last several years, its latest fix in the Consolidated Appropriations Act, 2023 (CAA, 2023), enacted at the end of 2022, does not offset all the proposed cuts in this rule. In all, the budget neutrality constraints of the fee schedule continue to result in a negative proposed conversion factor (CF) update. Beyond the cut to the CF, CMS proposes significant policies related to telehealth services, updates to the Medicare Shared Savings Program (MSSP), initiatives promoting health equity and other changes to further develop physician quality initiatives.

• CF Reduction: Proposes a 2024 CF of $32.7476, representing a 3.36% reduction from the 2023 physician CF of $33.8872, and a 2024 anesthesia CF of $20.4370, representing a 3.26% reduction from the 2023 anesthesia CF of $21.1249

• Add-on Code for Complexity: Would implement a new addon code for complexity, G2211, that was previously finalized but delayed by Congress until 2024

• Behavioral and Social Needs: Outlines policies to promote behavioral healthcare and services addressing health-related social needs

• Telehealth: Proposes a new process for adding, removing or otherwise changing codes on the Medicare Telehealth Service list, and would create differential payment based on the place of service

• Merit-Based Incentive Payment System (MIPS): Would raise the MIPS performance threshold to 82 points in 2024, from 75 points in both 2022 and 2023

• Appropriate Use Criteria (AUC) Program: Would permanently sunset the AUC program

• MSSP: Proposes changes to the MSSP, including to the financial benchmarking methodology, assignment methodology and more.

Source: mcdermottplus.com

CMS has changed the following codes from the severity designation of “non-complication or comorbidity” to “complication or comorbidity,” thus increasing their reimbursement rate:

Z59.00, Homelessness unspecified

Z59.01, Sheltered homelessness

Z59.02, Unsheltered homelessness

According to CMS, after a data analysis of claims data tracking the impact on resource use generated for hospitals, CMS finalized the changes based on the higher average resource costs of cases with those ICD-10-CM diagnosis codes in comparison to similar cases without these codes.

CMS stated, “This action is consistent with the Administration’s goal of advancing health equity for all, including members of historically underserved and under-resourced communities … As SDOH diagnosis codes are increasingly added to billed claims, CMS plans to continue to analyze the effects of SDOH on severity of illness, complexity of services, and consumption of resources.”

CMS also finalized changes to The Hospital IQR program, with an increase in operating payment rates of 3.1%. “As part of CMS’ health equity goals, we are rewarding hospitals that deliver high-quality care to underserved populations and, for the first time, also recognizing the higher costs that hospitals incur when treating people experiencing homelessness,” said CMS Administrator Chiquita Brooks-LaSure in the release.

“With these changes, CMS is laying the foundation for a health system that delivers higher quality, more equitable, and safer care for everyone,” Brooks-LaSure said.

Source: healthleadersmedia.com

The 2024 ICD-10-CM files contain information on the ICD-10-CM updates for FY 2024. These 2024 ICD-10-CM codes are to be used for discharges occurring from October 1, 2023 through September 30, 2024 and for patient encounters occurring from October 1, 2023 through September 30, 2024.

Note:

There is no FY 2024 GEMs file. As stated in the FY 2016 IPPS/ LTCH PPS final rule (80 FR 49388), the GEMs have been updated on an annual basis as part of the ICD-10 Coordination and Maintenance Committee meetings process and will continue to be updated for approximately 3 years after ICD-10 is implemented.

We made the GEMs files available for FY 2016, FY 2017, and FY 2018.

An announcement was also made at the September 2017 ICD-10 Coordination and Maintenance Committee meeting that FY 2018 would be the last GEMs file update.

Visit billing-coding.com to download these files.

Source: CMS.gov

From 12 people sentenced for defrauding Blue Cross Blue Shield to a federally qualified health center settling improper billing allegations, here are 12 healthcare billing fraud cases Becker’s reported since July 27:

1. Bridgeport, Conn.-based federally qualified health center Optimus Health agreed to pay more than $470,000 to settle improper billing allegations.

2. A federal jury convicted a Maryland physician on five counts of healthcare fraud for submitting more than $15 million in false claims to Medicare and a commercial insurer.

3. A North Carolina lab owner will pay $1.9 million to settle allegations his company overcharged Medicaid for unnecessary drug tests.

4. The owner of a Whittier, Calif.-based medical clinic pleaded guilty to his role in a scheme that fraudulently billed Medi-Cal for $5 million in services that were never performed.

5. Twelve people were sentenced in a $53 million scheme to defraud

6. An ambulance company owner prison and ordered to pay $388,648 Medicaid fraud scheme.

7. MedStar Ambulance agreed allegations it submitted false program, MassHealth.

8. A Texas medical equipment $5.1 million Medicare and Medicaid

9. A Virginia pain clinic owner will pay $4 million in restitution for billing Medicare and Medicaid for non-medically necessary controlled substances.

10. Four medical staffing and services companies agreed to pay $475,000 to settle allegations they submitted false claims to Medicare.

11. A physician who owns multiple urgent care centers in the St. Louis area and one of his office managers are facing federal healthcare fraud charges.

12. Lansing, Mich.-based Sparrow Health System agreed to pay $671,310 to settle allegations that it violated the False Claims Act by misuse of “incident-to” billing.

Source: beckershospitalreview.com

In the state of Texas, Medicaid plays a significant role in providing healthcare services to a large portion of the population. With more than 5.9 million Texans1 (approximately 18.9% of the current population2) enrolled in Medicaid, it is an essential program for qualifying low-income citizens. In Texas, Medicaid costs taxpayers over $40 billion. Federal and industry authorities estimate that fraud3 comprises up to 10% of the costs of the Medicaid program, making Medicaid fraud a $4 billion problem for the state.4 In an ongoing effort to identify and prevent improper billings, a number of federal and state agencies and offices currently investigate and prosecute Medicaid providers and suppliers suspected or accused of Medicaid waste, fraud, and abuse. This article focuses on the fraud enforcement efforts of the Texas Office of Inspector General, a division of the Texas Health and Human Services Commission (HHSC-OIG), with respect to Texas pediatrician offices participating in the Medicaid program.

The state of Texas employs a multi-faceted approach to investigate and prosecute instances of Medicaid fraud. These agencies work in close collaboration, sharing information and resources, to ensure the integrity of the Medicaid program in Texas and to protect taxpayer funds from fraudulent activities. Their efforts aim to detect and deter fraudulent practices, hold accountable those involved in Medicaid fraud, and safeguard the program for those who genuinely need it. At the state level, the various investigative and enforcement agencies and offices responsible for uncovering and prosecuting instances of Medicaid fraud include the following:

• Health and Human Services Commission (HHSC): The HHSC is the umbrella agency that oversees the Medicaid program in Texas. While its primary role is

to administer and manage the program, it also has investigative and enforcement divisions that work alongside the HHSC-OIG and the MFCU to identify and address instances of Medicaid fraud. There are several offices within HHSC that are actively investigating instances of Medicaid fraud. These offices include:

- Texas Health and Human Services Commission, Provider Investigations Division (HHSC-PI): The HHSC-PI is responsible for conducting investigations related to abuse, neglect, and exploitation by various providers, including facilities, community services, mental health services, home, and community-based services. When reports of abuse, neglect, or exploitation are received, the HHSC-PI notifies the involved provider and, if applicable, law enforcement. In certain cases, the HHSC-PI may collaborate with other agencies for further investigation.

- Texas Health and Human Services Commission, Office of the Inspector General (HHSC-OIG): The HHSC-OIG was first created in 2003 by the 78th Texas Legislature.5 It is responsible for detecting and preventing fraud in Medicaid and other state healthcare programs. HHSC-OIG regularly conducts investigations and audits of Medicaid claims submitted by providers and suppliers and has the authority to prosecute individuals or entities involved in Medicaid fraud. HHSCOIG’s Medicaid Provider Field Investigation (PFI) team has been tasked with reviewing allegations against enrolled providers accused of wrongdoing or identified through data analysis as a potential outlier.

• Texas Office of the Attorney General, Medicaid Fraud Control Unit (MFCU): The MFCU is a specialized unit within the Texas Office of the Attorney General. It is responsible for investigating and prosecuting cases of Medicaid fraud, as well as patient abuse and neglect in Medicaid-funded facilities. The MFCU works closely with federal and state law enforcement agencies, and it has the power to arrest, prosecute, and bring legal action against individuals or organizations engaged in Medicaid fraud. The MFCU receives 75% of its funding from the U.S. Department of Health and Human Services under a grant award totaling $20,944,200 for Fiscal Year (FY) 2023. The remaining 25%, totaling $6,981,395, is funded by the state of Texas.6

• Texas Attorney General’s Office, Civil Medicaid Fraud Division: This division, also part of the Office of the Attorney General, focuses on civil enforcement actions related to Medicaid fraud. It investigates cases of fraud, waste, and abuse involving Medicaid funds and takes legal action to recover improperly obtained funds. The Civil Medicaid Fraud Division can pursue civil remedies, such as restitution, penalties, and fines.

• Texas Department of Insurance (TDI): The TDI is responsible for regulating and overseeing health insurance in Texas. It has a Fraud Unit that investigates various types of insurance fraud, including Medicaid fraud. The TDI works collaboratively with other state agencies, such as HHSC-OIG and the MFCU, to share information and coordinate efforts in combating Medicaid fraud. Actions of the TDI Fraud Unit include, but are not limited to:

- Investigating reports of fraud

- Making referrals to criminal district attorneys and federal prosecutors

- Seeking criminal indictments

- Making arrests

- Working with and training law enforcement agen-

• Texas Medical Board: The Texas Medical Board is responsible for licensing and regulating physicians and other medical professionals under its jurisdiction. It investigates complaints and allegations of Medicaid fraud involving healthcare practitioners and takes appropriate disciplinary action when necessary.

• Texas State Board of Dental Examiners: The Texas Board of Dental Examiners is responsible for regulating licensed dentists and other dental professionals. It also investigates complaints related to Medicaid fraud involving dental services and takes disciplinary action against those found guilty of fraudulent practices.

• Texas State Board of Pharmacy: The State Board of Pharmacy plays a crucial role in investigating Medicaid fraud related to prescription drugs. It oversees the licensing and regulation of pharmacies and pharmacists in Texas. The State Board of Pharmacy investigates cases of fraudulent billing, prescription forgery, diversion of prescription drugs, and other pharmacy-related Medicaid fraud.

Separate and apart from these state agencies and offices, it is important to keep in mind that each of the Medicaid medical and dental managed care plans active in Texas are required by law to “develop a plan to prevent and reduce waste, abuse, and fraud” that must be reported to HHSCOIG each year for approval.8 Each Medicaid Managed Care Organization is responsible for investigating acts of waste, abuse, and fraud for all services. To accomplish this task, Medicaid Managed Care Organizations have established a Special Investigative Unit (SIU) within their company that is responsible for investigating allegations of provider fraud. Although the actions taken (or recommended to a payor) are administrative in nature, the SIU’s findings may be shared with federal and state enforcement agencies and may result in separate governmental enforcement. In fact, if a SIU discovers Medicaid fraud, it must:

“(a)(1) immediately submit written notice to the commission’s office of inspector general and the office of the attorney general in the form and manner prescribed by the office of inspector general and containing a detailed description of the fraud or abuse and each payment made to a provider as a result of the fraud or abuse.” 9

As a final point, the agencies, offices, licensing boards, and SIUs discussed under the first two headings above,

collaborate with each other and also work in partnership with federal agencies such as the U.S. Department of Health and Human Services Office of Inspector General (HHS-OIG) and the U.S. Department of Justice (DOJ) to combat Medicaid fraud. A review of recent cases reflects that HHSC-OIG has actively audited and/or investigated allegations of Medicaid improper billing by a number of participating pediatricians and their practices. Current HHSC-OIG audit risk areas for Texas pediatric practices are discussed below.

In 2021, both Medicaid and Children’s Health Insurance Program (CHIP) laboratory claims received a fair amount of scrutiny by Texas regulators. Two of the government’s favorite testing panels to audit included (and continue to include) outpatient respiratory and gastrointestinal tests conducted on multiplex polymerase chain reaction (PCR) testing equipment. Even though there are a wide variety of benefits associated with the use of multiplex PCR testing panels, both Texas and federal auditors have repeatedly expressed concern regarding the improper billing of tests that have not been shown to be medically necessary in the care of a particular patient. For a more detailed discussion of this issue, please see our article titled, “Audits of Respiratory (CPT Code 87633) / Gastro (CPT 87507) Panels are Ongoing.”

While earlier pediatric testing audits have focused on the use of multiplex PCR testing practices, more recent audits have targeted pediatricians and pediatric practices that have improperly billed for testing services that should have been covered by an earlier test or service performed on the same patient. For example, using data mining to identify improper laboratory testing billing practices, HHSOIG has been conducting audits of Medicaid pediatric providers alleged to have billed for tests that did not qualify for separate payment. For example:

• Texas Pediatrician – Alleged Improper Billing of Molecular Culture/Rapid Culture Strep Tests: In a case against an Irving, Texas pediatrician, HHSC-OIG alleged that the pediatrician’s office improperly billed both molecular culture and rapid culture strep tests on the same dates of service or within three dates of service for the same patient. The practice agreed to settle the improper billing allegations for approximately $1.3 million.

• Texas Pediatrician – Alleged Improper Billing of Strep A-Molecular Panel: In this case, a South Texas pediatrician was alleged to have improperly billed for a Strep A-Molecular Panel on the same date or within three days of a Strep A-Rapid Test. The practice agreed to settle HHSC-OIG’s allegations for $522,901.

While the billing of laboratory tests is expected to remain one of the primary audit areas of the HHSC-OIG, there are also several other risk areas that deserve further discussion.

During the COVID-19 pandemic, federal, state, and private payors expanded their coverage of telemedicine services. Post-COVID-19, many payors have continued to permit the billing of these expanded telemedicine services. Unfortunately, payor audits of telemedicine claims have alleged that many of the services billed by payors were improper. HHSC-OIG is actively auditing Medicaid and CHIP telemedicine claims, both directly and through private contractors hired by the government to conduct these audits.

It is worth noting that Texas is not the only jurisdiction auditing Medicaid telemedicine claims. Medicaid pediatric telemedicine audits are currently being conducted by a number of other states to ensure that the quality of care provided through telemedicine is equivalent to that provided in-person. Audits have also examined whether the documentation maintained meets applicable requirements. Medicaid telemedicine audits are typically conducted by a team of experts who review patient charts, audio and video recordings of telemedicine visits, and other documentation. The team may also interview patients and providers to get their feedback on the quality of care.

Here are two examples of current Medicaid pediatric telemedicine audits:

• California – Pediatric Telemedicine Audits: In California, the Department of Health Care Services (DHCS) has conducted a number of audits of Medicaid pediatric telemedicine providers. The audits have found that the quality of care provided through telemedicine is generally equivalent to that provided in-person. However, the audits have also identified some areas

where quality improvement is needed, such as improving the documentation of patient visits.

• New York – Pediatric Telemedicine Audits: In New York, the Medicaid program has contracted with a private company to conduct audits of Medicaid pediatric telemedicine providers. The audits are still ongoing, but they have already found that the quality of care provided through telemedicine is generally equivalent to that provided in-person.

In 2023, Texas HHSC-OIG has initiated multiple pediatric telemedicine audits of Texas Medicaid and CHIP claims. Should your pediatric practice be audited, issues of concern include, but are not limited to the following:

• Billing for Excessive Time: Physicians should exercise care when billing for pediatric telemedicine services. Prior audits have identified instances where excessive time was billed when performing Evaluation and Management (E/M) services. This has been a significant concern when the E/M services have been associated with the provision of behavioral health services. If you or the physician members of your practice are providing behavioral health telemedicine services (such as mental health assessments, individual therapy, and medication management consults), it is essential that you properly document the services being provided. Remember: Behavioral health telemedicine services should be (a) significant and separately identifiable and (b) medical services that would be billable if provided in person.

• Eligibility and Coverage: One of the risk areas audited by HHSC-OIG and their contractors is whether the patient was eligible for Medicaid and whether the specific telemedicine service being audited qualified for coverage under the beneficiary’s Medicaid program. Medicaid eligibility criteria and coverage policies may vary by state, so it’s crucial to verify these factors before providing services to avoid claim denials or reimbursement issues.

• Documentation and Coding: Accurate and thorough documentation is essential for proper coding and billing. Providers must document the telemedicine encounter appropriately, including the patient’s medical history, assessment, and plan of care. Using the correct telemedicine-specific E/M codes is crucial to ensure proper reimbursement. Failure to document and code correctly can lead to claim denials and/or audits. For example, in a recent guidance document issued by Superior, the payor noted that if a provider did an audio only visit, then they shouldn’t bill an E/M if their decision from the audio visit

resulted in the patient needing to do a video telemedicine or in-person office visit. If that was the case, then the audio visit is to be considered part of the subsequent visit. If not, then the provider could bill the audio-only visit as an E/M during the PHE.10

• State-Specific Regulations: Each state, including Texas, has its own regulations and requirements regarding Medicaid telemedicine billing. Providers must stay updated with Texas specific rules and guidelines to ensure compliance. For instance, in Texas, the Medicaid program has recently developed a “Telecommunication Services Handbook,” which sets out detailed requirements for the provision, coverage, and payment of Texas Medicaid telehealth services.11 Providers who meet these standards are eligible to receive reimbursement for telemedicine services. The quality standards include requirements for provider training, patient safety, and documentation. Failure to adhere with Texas’s Medicaid telemedicine regulations can result in claim denials or potential legal issues.

• Credentialing and Provider Enrollment: The proper credentialling of billing providers is an ongoing area of focus for federal, state, and private payors around the country.12 It is essential that you ensure that all of your billing providers are properly enrolled and credentialed by each Medicaid plan so that their services can be billed under their own number. The billing of pediatric telemedicine services performed by a non-credentialed provider under the number of a credentialed provider can be quite problematic, and can lead to administrative, civil, and even criminal sanctions. Credentialing and enrollment processes can be time-consuming, and any delays or inaccuracies in the process can impact reimbursement. It’s important to follow the necessary steps and provide all required documentation for successful enrollment in both traditional Medicaid and in Medicaid Managed Care plans.

• Compliance and Fraud: Billing for Medicaid services must comply with all applicable laws and regulations, including anti-fraud provisions. Providers should be cautious to avoid any fraudulent activities such as upcoding, unbundling, or billing for services not rendered. Non-compliance can result in financial penalties, legal consequences, and exclusion from Medicaid programs.

It’s important to note that Medicaid policies and regulations are subject to change, so staying updated with the latest

guidance from the various Medicaid payors is crucial for accurate billing and reimbursement. It is important for an experienced health lawyer to represent a provider in an audit of Medicaid telehealth claims due to the following reasons:

• Legal Expertise: Health lawyers have specialized knowledge and expertise in healthcare laws, regulations, and compliance requirements. They are familiar with the complex legal landscape surrounding telehealth and Medicaid billing. Having a health lawyer on the provider’s side ensures that they have access to expert advice and guidance throughout the audit process.

• Understanding of Audit Process: Health lawyers are well-versed in traditional Medicaid and Medicaid Managed Care organization audit processes and understand how the payors’ auditors will likely evaluate your pediatric telemedicine claims. They can guide a provider through the audit, help gather relevant documentation, and ensure compliance with audit requests. Their knowledge of the audit process helps protect the provider’s rights and interests.

• Compliance and Risk Mitigation: Medicaid telemedicine billing must comply with various regulations and requirements, many of which seem to be ever-changing and subject to update. An experi-

1 “Healthcare Statistics,” Texas Health and Human Services, May 2023, https://www.hhs. texas.gov/about/records-statistics/data-statistics/healthcare-statistics.

2 “2018 Texas Population Projections Data Tool Result,” Texas Demographic Center, 2023, https://demographics.texas.gov/Data/TPEPP/Projections/Report.aspx?id=9aaddb2cff7741ceb0b55fcc42288465.

3 “Types of Health Care Fraud,” Office of the Attorney General of Texas, Accessed June 2023, https://www.texasattorneygeneral.gov/consumer-protection/health-care/ health-care-fraud-and-abuse#:~:text=Medicare%20and%20Medicaid%20fraud%20 is,order%20to%20dishonestly%20collect%20money.

4 “Office of the Attorney General’s Medicaid Fraud Control Unit Sends Owner of Home Health Company to Prison for 57 Months for $1.4 Million Fraud Scheme,” Office of the Attorney General of Texas, June 13, 2023, https://www.texasattorneygeneral. gov/news/releases/office-attorney-generals-medicaid-fraud-control-unit-sends-owner-home-health-company-prison-57.

5 “About Us,” Office of Inspector General, Accessed June 2023, https://oig.hhs.texas.gov/ about-us.

6 “Office of the Attorney General’s Medicaid Fraud Control Unit Sends Owner of Home Health Company to Prison for 57 Months for $1.4 Million Fraud Scheme,” Office of the Attorney General of Texas, June 13, 2023, https://www.texasattorneygeneral. gov/news/releases/office-attorney-generals-medicaid-fraud-control-unit-sends-own-

enced health lawyer can review the provider’s billing practices, policies, and documentation to identify any potential compliance issues or risks. They can assist in implementing corrective measures to address any identified vulnerabilities and minimize the risk of future audits or investigations. Beyond the audit process, an experienced health lawyer can provide ongoing compliance guidance to the provider. They can help establish effective compliance programs, train staff on billing and documentation requirements, and stay updated with evolving telehealth regulations. This proactive approach can help the provider maintain compliance and reduce the risk of future Medicaid audits.

Robert W. Liles, J.D., is an experienced health lawyer and a former federal prosecutor. Robert and the other attorneys at Liles Parker represent healthcare providers and suppliers around the country in Medicaid audits and investigations.

Need help? The experienced healthcare lawyers at Liles Parker can assist you if your Medicaid pediatric telemedicine claims are audited by HHSC-OIG, or one of its contractors. Call for a free consultation: (202) 298-8750 or toll-free at: (800) 475-1906. www.lilesparker.com

er-home-health-company-prison-57.

7 “About the TDI Fraud Unit,” Texas Department of Insurance, October 20, 2020, https:// www.tdi.texas.gov/fraud/about.html.

8 Texas Administrative Code, Rule §353.502(a), Accessed June 2023, https://texreg. sos.state.tx.us/public/readtac$ext.TacPage?sl=R&app=9&p_dir=&p_rloc=&p_tloc=&p_ ploc=&pg=1&p_tac=&ti=1&pt=15&ch=353&rl=502.

9 Texas Government Code, §531.1131(a)(1), April 14, 2021, https://codes.findlaw.com/tx/ government-code/gov-t-sect-531-1131/.

10 “Superior HealthPlan Telemedicine Quick Reference Chart,” Superior Health Plan, Accessed June 2023, https://www.superiorhealthplan.com/content/dam/centene/Superior/ Provider/PDFs/Superior-Telemedicine-Quick-Reference-Chart.pdf.

11 “Texas Medicaid Provider Procedures Manual: Telecommunication Services Handbook,” Texas Medicaid and Healthcare Partnership, June 2023, https://www.tmhp.com/sites/ default/files/file-library/resources/provider-manuals/tmppm/pdf-chapters/2023/202306-june/2_19_Telecommunication_Srvs.pdf.

12 “The Dangers of Billing Payors of a Non-Credentialed Dentist/Non-Participating Dentist,” Liles Parker Attorneys and Counselors at Law, August 2019, https://www.lilesparker. com/2019/08/17/the-dangers-of-billing-payors-for-the-services-of-a-non-credentialeddentist-overpayments/.

The Centers for Medicare and Medicaid Services (CMS) announced its proposed Medicare Physician Fee Schedule (MPFS) rules for 2024, including provisions for the Quality Payment Program (QPP). While not a done deal until the final rule is issued toward the end of the year, the Proposed Rule gives an indication of where CMS is headed with regard to payment policy. In recent history, even the Final Rule isn’t final because Congress has had to intervene to stave off significant reimbursement reductions. Here are the highlights of the 2024 Proposed Rule.

In fairness, CMS is bound by statutory constraints when setting the fee schedule Conversion Factor (CF). Applying the formula as required produces a CF of $32.7476, which is 3.36% lower than the $33.8872 CF used for the 2023 fee schedule. This rate includes the 1.25% upward adjustment provided by the Consolidated Appropriations Act, 2023 (CAA 23) that was passed late in 2022 to help mitigate the effects of the formulaic calculation for 2023 and 2024. Without the CAA 23, the proposed 2024 reimbursement rate would have been even lower.

Our recent article describes a legislative effort (H.R. 2474) that would permanently improve the methodology used in the calculation of the CF for Medicare reimbursement. Radiology Business reports that specialty societies, including the American College of Radiology (ACR), are joining the American Medical Association’s effort to have Congress fix this perennial problem.

CMS estimates the following specific effects for radiology:

See table below

The CMS-estimated 4% overall decrease in IR reimbursement is the highest of any specialty listed in the CMS Proposed Rule. The CMS estimates could be understated because the 2023 rate used in their calculation did not include the 1.25% CAA increase, and so it does not match the final payment rate for the year.

The changes in reimbursement for any specialty are the result of several factors other than the CF. The Relative Value Units (RVU) are adjusted upward or downward annually to account for changes in practice expenses due to supply or technology costs. Specialties that have a higher level of Evaluation and Management (E/M) services might see a significant increase due to the availability of a new add-on code for complex cases in 2024. A more in-depth analysis of the RVU table in an upcoming article will reveal which procedures were increased and which were decreased by more or less than the overall estimates.

Another factor affecting the final payment amount is the Geographic Practice Cost Index (GPCI). CMS provides a table of Geographic Adjustment Factors showing the overall change that will be applied through the GPCIs. Of the 109 payment localities, 72 will be decreased (35 by 1% or more), including by more than 2% in areas

of Arkansas, Louisiana, Mississippi, Alabama, and Queens (NYC). 32 payment localities will have an increase to their geographic index, including areas of California that will be increased around 2%. The Consolidated Appropriations Act, 2021, established a GPCI floor of 1.0% for the Work component through December 31, 2023, and many of the decreases are due to the fact that the floor is not being applied in the 2024 proposed rule. This is something that could change either in the MPFS final rule or by last-minute congressional intervention.

The 2024 Proposed Rule would finally put to rest the AUC/ CDS program that would deny payment to radiologists when the ordering physician fails to consult a Clinical Decision Support (CDS) system to obtain Appropriate Use Criteria (AUC). This program was enacted by the Protecting Access to Medicare Act (PAMA) in 2014 and it has been delayed consistently over the intervening years. The 2024 rule “proposes to pause implementation of the AUC program for reevaluation, and rescind the current AUC program regulations.” There is no time frame for resuming implementation.

Direct physician supervision of Level 2 diagnostic exams, such as those requiring contrast administration, will continue to be allowed via real-time audio and video telecommunications through December 31, 2024. Audio-only telecommunication will not be allowed.

Revisions to the QPP will make it more difficult for radiology practices to avoid a payment penalty, let alone earn a positive payment adjustment. The performance threshold is proposed to increase from 75 points to 82 points for the 2024 performance year. This is the minimum score that must be earned to avoid a payment penalty in the 2026 payment year.

Achieving the threshold will be hindered by the proposed removal of several Quality Measures that have been useful to radiologists, including:

• Measure #147, Nuclear Medicine: Correlation with existing imaging studies for all patients undergoing Bone Scintigraphy

• Measure #324, Cardiac Stress Imaging not meeting

appropriate use criteria: Testing in asymptomatic, lowrisk patients

• Measure #436, Radiation Consideration for Adult CT: Utilization of dose lowering techniques

One new measure is proposed to be added to the diagnostic radiology set: Excessive Radiation Dose or Inadequate Image Quality for Diagnostic Computed Tomography in Adults.

The category weighting will remain the same as it is for 2023; however, the Data Completeness Threshold is proposed to be increased to 75% from 70%. The range of payment adjustment will continue to be +/- 9%.

Complete information on the proposed changes to the QPP is available for download from CMS: https://www.cms. gov/files/document/2024-qpp-proposed-rule-fact-sheetand-policy-comparison-table.pdf

Conclusion

The proposals put forth by CMS could change in the Final Rule that is typically issued in early December. The Radiology Business Management Association (RBMA)’s Radiology Patient Action Network (RPAN) urges Congress to pass H.R. 2474, which will go a long way toward alleviating the annual swing in proposed and final payment rates.

We will continue to analyze the valuation changes proposed by CMS using the published RVU tables and keep our readers apprised of the latest information.

Sandy Coffta, Vice President, Client Services, Healthcare Administrative Partners. Healthcare Administrative Partners (HAP) provides revenue cycle management, clinical analytics, and comprehensive practice management solutions for radiology practices. We also provide coding services for multispecialty practices. HAP produces results, not promises. Our key to optimizing your success is to aggressively improve all areas of your practice’s financial health – maximizing reimbursements and accelerating cash flow while reducing cost and compliance risk. www.hapusa.com

Complete documentation of any radiology procedure is the key to appropriate reimbursement. This is especially true for venous duplex Doppler ultrasound exams, where including fewer than the required number of elements for a complete procedure will result in reimbursement for a limited study.

Acomplete study includes bilateral upper or lower extremity imaging.

Lower extremity studies require documentation of all the following vessels on both legs:

• Entire femoral vein

• Entire saphenous vein

• Entire popliteal vein

The calf veins may also be included, but they are not required for a complete study.

Upper extremity studies require documentation of all the following vessels on both arms:

• Subclavian veins

• Jugular veins

• Axillary veins

• Brachial veins

• Basilic veins

• Cephalic veins

Forearm veins may also be included, but they are not required for a complete study.

A limited study is any exam that does not include all the above-listed vessels. It could also be a unilateral exam, or one done for preoperative venous mapping (e.g., vascular mapping for bypass grafts).

Whether the study is complete or limited, all three duplex techniques must be performed and documented, including:

• Gray scale imaging

• Spectral analysis

• Color Doppler flow

If any of these techniques is missing, a duplex imaging study was not performed and cannot be billed as such. It is necessary to document all techniques and provide interpretation for each one.

A handy table was produced a few years ago by the

Coding Committee of the Radiology Business Management Association (RBMA) and we have reproduced it here. This “buzz words” chart can be very helpful when coding extremity ultrasound exams.

Table 1: See below

Radiologists might also benefit by keeping this list handy, although the best solution to compliant and complete dictation is for them to use a template system. Regardless of the method, documenting all the required elements of these exams will allow the coding team to maximize reimbursement by coding to the highest level.

The coding for these exams is as follows (see Table 2):

The coding team should be providing feedback to the radiologists when they see missing elements, to be certain about the extent of the exam. If a complete exam was done but not documented thoroughly, then an addendum to the report could mean additional reimbursement. In addition to correct coding, be sure

to check with commercial payors and with your local Medicare carrier to be sure the procedure is considered to be medically necessary under the patient’s circumstances.

Optimizing reimbursement always depends on coordination of the necessary procedural steps, full documentation of those steps, and then a fully trained coding team who is up to date on the latest changes.

Erin Stephens, CPC, CIRCC, is the Sr. Client Manager, Education at Healthcare Administrative Partners. Healthcare Administrative Partners (HAP) provides revenue cycle management, clinical analytics, and comprehensive practice management solutions for radiology practices. We also provide coding services for multispecialty practices. HAP produces results, not promises. Our key to optimizing your success is to aggressively improve all areas of your practice’s financial health - maximizing reimbursements and accelerating cash flow while reducing cost and compliance risk. www.hapusa.com

Whenever I audit charts under the 2021 E/M Documentation Guidelines, which now apply in all places of service, I like to start by reviewing the first and third columns. The first column is Number and Complexity of the Presenting Problem, and the third column is Risk of Complications and/or Morbidity or Mortality of Patient Management.

If I audit both categories to the same level of service, I’m almost relieved that I don’t need Amount and/or Complexity of Data to be Reviewed and/or Analyzed to help determine the most appropriate code. I find column 2, the “data” column as we shall call it, to be the most fraught and most subject to misapplication of misinterpretation.

The first reason is medical necessity and provider intent. Many EMR systems pre-populate notes, particularly in the inpatient setting, with all manner of test results and lab findings. The rendering provider may not even consider these items in his or her treatment plan and may not consider them relevant.

In addition, many providers state a preference for the patient’s historical lab and test results to be incorporat-

ed into each note for quick reference, when necessary, even as these items have been ordered and reviewed in the past.

In these scenarios, we risk giving the provider credit in this category for something the provider may not even want to be credited with and raising the level of service beyond that which is medically necessary for the care of this particular patient.

In scenarios where I need data to help me select a code, I’ve given myself some things to consider as I navigate this category:

• Work on setting and communicating a data policy: Organizations should be thoughtful about how data is considered so that everyone in the organization

is consistent with application of data. Examples of smart policies are asking/requiring providers to incorporate review of data/results into the formulation of the treatment plan and asking providers to designate when data is incorporated for preference and not scoring into the E/M result.

• Determine frequency of review: When a provider claims credit for an independent review of imaging or review of a test result, the provider should not get credit for the review again in a subsequent visit, as the results won’t change. One exception might be a comparative analysis of findings in order to determine disease progression when specifically documented.

• Determine need for review: Set or give guidelines to providers and internal auditors that data should be credited only when necessary for the rendering provider’s work and that the burden of establishing that need is with the rendering provider. Consider carefully MACRO statements that claim all new data was reviewed and incorporated into the treatment plan.

• Consider medical necessity: When the presenting problem is of straightforward or low complexity and the provider is ordering a high volume of lab tests for rule-out purposes or to placate the patient, but the patient’s overall care is not complex, remember what didn’t change when the new guidelines were implemented. Medical necessity, not the volume of documentation, should drive the code selection.

Scott Kraft, CPMA, CPC, Senior Compliance Consultant, is an auditor for DoctorsManagement. He also creates content for the firm’s educational division, the National Association of Medical Auditing Specialists (NAMAS). Scott oversees the quality assurance process for client audits. He brings extensive experience in more than 30 specialties, including but not limited to orthopedics, cardiology, vascular, neurology, obstetrics and gynecology, physical medicine and rehabilitation, and physical and occupational therapy.

https://namas.co.

The Medicare Physician Fee Schedule (MPFS) Proposed Rule (PR) for Calendar Year (CY) 2024 was released on July 13, 2023. The PDF is available for review. Public comments are accepted for a sixty (60) day period through September 11, 2023.

The Centers for Medicare and Medicaid Services (CMS) released its own Fact Sheet on the MPFS and stressed that it is just one of several proposed rules that reflect the broader strategy “to create a more equitable healthcare system that results in better access to care, quality, affordability, and innovation.”

Some highlights from the Proposed Rule and Fact Sheet include the possibility of a decrease in the Conversion

Factor to 3.34%. The current rate for CY 2023 is set at $33.89, so this proposed reduction would yield to $32.75 for CY 2024, or a loss of $1.14.

Other details include the possibility of delay in implementing the substantive portion of split-shared visits in the hospital (or other facility-based settings) to time-only until December 31, 2024. For now, these split-shared visits will maintain the current definition of substantive portion for CY 2024 that allows for use of either one of

the three key components (history, exam, or medical decision-making) or more than half of the total time spent to determine who bills the visit.

Another highlight includes the consideration of a separate add-on payment for Healthcare Common Procedure Coding System (HCPCS) code G2211 to recognize the increased resource costs associated with evaluation and management visits for primary care and longitudinal care of complex patients in the office setting.

CMS also proposes the continuance of the definition of direct supervision to permit the presence and immediate availability of the supervising practitioner through real-time audio and video interactive telecommunications through December 31, 2024.

In addition, the PR includes the possibility for increased access to behavioral health which requires new HCPCS codes for mobile unit or home for psychotherapy crisis services. Also, under consideration for CY 2024, marriage and family therapists/mental health counselors may receive their own Benefit Category. Additionally, if addiction counselors meet all requirements to qualify as a mental health counselor, there is a proposal that these addiction counselors may enroll as mental health counselors in Medicare. The proposal also considers an increase in the valuation for timebased behavioral health services under the MPFS. Specifically, CMS is proposing to apply an adjustment to the work relative-value units for psychotherapy codes payable under the MPFS. They would want this to be implemented in a four-year transition period.

For rural health clinics (RHCs) and federally qualified health centers (FQHCs), the PR also includes the possibility of changing the required level of supervision for behavioral health services furnished incident-to a physician or non-physician provider’s services in RHCs and FQHCs to allow for general supervision, rather

than direct supervision. This proposed change would be more consistent with the policies finalized under the MPFS in CY 2023 rulemaking for other settings.

Finally, the proposal includes an extension of several telehealth waivers, including teaching settings.

Conclusion

It is recommended that all stakeholders take the time to read the Proposed Rule in its entirety of 2,033 PDF pages for awareness before making comments during the Public Comment period that is open through September 11, 2023.

For more information:

• Medicare Fact Sheet for MPFS Proposed Rule CY 2024 at: https://www.cms.gov/newsroom/factsheets/calendar-year-cy-2024-medicare-physician-fee-schedule-proposed-rule

• MPFS Proposed Rule CY 2024 PDF (full document) at: https://public-inspection.federalregister. gov/2023-14624.pdf

Sonal Patel, BA, CPMA, CPC, CMC, ICDCM, is CEO and Principal Strategist at SP Collaborative, LLC.

Sonal is a nationally recognized business of medicine professional, speaker, author, podcast creator and host.

She has served as a multi-specialty healthcare coding, auditing, and compliance professional in the indus try for over 12 years. She began her second career as a medical biller and continued to advance into a renowned cancer hospital’s patient business services’ department in Houston, Texas. Since then, she has had the honor of directly working with and supporting healthcare attorneys in defense of their clients’ myriad of reimbursement issues for almost six years.

https://spcollaborative.net/

I hold a LinkedIn Live broadcast called Health Care Happenings that also airs on Facebook and YouTube every other Thursday, in which I discuss different healthcare topics. I recently did a three-part series on auditing: Preparing for the Audit, Performing the Audit, and Providing the Audit Results. This article will expand on that series to discuss the audit process.

There are many steps when preparing for an audit. Preparatory questions include:

• What will be the extent of the audit? A full revenue cycle audit, a coding audit, or a documentation audit?

• What type of audit will be performed? Retrospective? Prospective?

• Will the audit be random or targeted?

• How many records will be included?

A full revenue cycle audit involves the complete

examination of the patient journey, from the initial scheduling or registration to the final payment collection. It helps identify problems that might be causing revenue leaks or inefficiencies in the system, whether in the front end (patient admission, registration, insurance verification) or the back end (invoice generation, payment collection, claim management).

Key aspects of review in a full revenue cycle audit include:

• Patient Registration: Accuracy of data, like demographic information and insurance details, is verified.

• Billing: Billing protocols and accuracy of invoicing are reviewed.

• Claims Management: Efficiency of claims management, including denial and underpayment handling, is evaluated.

• Payment Posting: Timeliness and accuracy of payment posting are checked.

A coding audit primarily revolves around the accuracy and appropriateness of code assignment for diagnoses, procedures, and services provided to the patients. It is vital to ensure regulatory compliance and proper Medicare/Medicaid and commercial payor payment.

Specifics to a coding audit are:

• Code Accuracy: Review of diagnosis and procedure codes for accuracy and completeness.

• Coding Conventions and Guidelines: Ensuring adherence to official coding conventions and government regulations.

• Comorbidity/Comorbidity Condition (CC)/Major CC (MCC) Capture: To maximize rightful payments if involved in Risk Adjustment Plans.

• Analysis of Denials: Examination of denied claims due to coding issues to identify patterns and trends.

A documentation audit focuses specifically on the quality and comprehensiveness of patient health records. It verifies whether the patient data, consultation notes, diagnosis, prescribed medication, and procedures are accurately documented or not.

Crucial elements of a documentation audit include:

• Medical Record Completeness: Ensuring all necessary components such as patient history, physical exam findings, and diagnostic results are included in patient records.

• Documentation Quality: Verification of precision, legibility, and timeliness of the documentation.

• Compliance with Clinical Documentation Improvement (CDI) initiatives: Checking if the documentation supports the codes used for billing.

Thus, a full revenue cycle audit, a coding audit, and a documentation audit each focus on different areas of the operation but are all mutually reinforcing. They ensure the organization’s financial health, regulatory compliance, and quality of patient care, establishing a strong foundation for comprehensive medical auditing.

Choosing the type of audit to perform is another pivotal decision.

There are two primary types to consider:

• Retrospective Audits: These audits are carried out after patient care services have been rendered and billed. A retrospective audit provides the opportunity to uncover any overcoding, undercoding, or other discrepancies with codes and records.

• Prospective Audits: This type of audit occurs before the billing is submitted. Prospective audits are preventive in nature, helping to identify potential risks or errors and take corrective actions before final billing.

Deciding between a retrospective or prospective audit largely depends on the internal audit policy of the organization, available resources, key audit objectives, and timeline of the audit process.

Based on your strategy, you can conduct either a random or targeted audit:

• Random Audits: This type employs a statistical sampling method eliminating biases and aiding in the generalization of the audit findings. Random audits may be good for baseline audits for new physicians/APPs as they can give insight into the overall coding and documentation practices.

• Targeted Audits: These are audits based on specific areas or known problem areas. It focuses on high-risk areas within the coding process. This can be helpful in a practice to check for deficiencies in areas that are “on the radar” of the payors. For example, if an OIG Work Plan project is posted that involves services performed at the practice, a targeted audit of those services can be performed to see if the documentation and coding are supportive of what is being billed. This can help a practice feel confident in their practices or show them where they need to make improvements to be compliant.

The scope of an audit, specifically the number of records to be reviewed, is reliant on several aspects—the size of the orga-

nization, risk areas, recent updates or changes in coding practices, or medical documentation, to name a few.

As a general rule, the Office of Inspector General (OIG) encourages auditing 5 to 10 medical records per physician. With most of my clients, audits consist of between 15-20 records per physician/APP. But this number may vary depending on the objectives of the audit. A well-constructed audit can yield valid results regardless of the total number of records reviewed as it’s more the quality and representation of the sample that matters.

Once the type, scope, and number of records has been determined, how should the records be chosen? Ensuring the correct sampling method for audits is crucial to maintain the standard of review. I always use RAT-STATS when choosing my records, which is a free statistical software package developed by the Department of Health and Human Services (HHS) Office of the Inspector General (OIG) to assist in claims review. The software was created by the OIG in the 1970s and is primarily used as a statistical tool for the OIG’s Office of Audit Services. RAT-STATS offers a sophisticated but user-friendly system to perform random sample or targeted selection of records. It provides a variety of statistical sampling and estimation techniques which come in handy for a typical medical record audit.

Using RAT-STATS, you can:

• Identify a Universe of Data: The first step in using RAT-STATS is defining the entire set of data that the audit would be considering.

• Choose the Sampling Method: RAT-STATS software allows selection from Simple Random Sampling, Monetary Unit Sampling, and Stratified Random Sampling.

• Determine the Sample Size: Depending on the universe of data, RAT-STATS provides an appropriate calculative approach to determining the audit sample size.

• Perform Sample Draw: Once the sample size is determined, RAT-STATS performs an unbiased sample draw from the universe of data.

After planning for the type, sample size, and scope of a medical record audit—be it random or targeted, retrospective or prospective, the next step in the auditing process is performing the actual audit. This requires understanding and employing several critical tools and guidelines, including NCCI Edits, LCDs, NCDs, payor policies, and possibly coding auditing software.

NCCI edits are automated pre-payment edits that prevent improper payments while billing Medicare Part B claims.

They involve two key types: Procedure-to-procedure (PTP) edits and Medically Unlikely Edits (MUEs):

• PTP Edits: These scrutinize CPT codes to prevent improper payment when unnecessary services are billed.

• MUEs: These limit the units of service allowable under most circumstances for a single beneficiary on a single day.

The NCCI edits significantly aid in ensuring the accuracy and appropriateness of coding. By incorporating NCCI edits into the audit process, auditors can systematically cross check individual billing records against established coding standards, identify code pairs that deviate from these rules, and flag discrepancies. Subsequently, the audit team can analyze these flagged instances to determine legitimate cases where modifiers apply or educate providers on correct coding guidelines to minimize future errors and potential revenue leakage. Incorporating NCCI edits during an audit is vital to maintain adherence to government regulations, promote ethical coding practices, and support the financial health of healthcare organizations.

LCDs and NCDs are two essential sets of guidelines that inform whether a service is covered by Medicare or not:

• LCDs: Issued by Medicare Administrative Contractors (MACs), LCDs apply to their specific jurisdiction, speci-

fying under what clinical scenarios a service is covered.

• NCDs: Issued by the CMS, NCDs offer nationwide instructions for all MACs on whether to cover a particular service.

For commercial payors, each can have its own payment policies that may be the same or differ from NCDs and LCDs. Most are published on the payor’s website and can be searched when performing an audit.

Coding books are the foundation on which NCDs, LCDs, and commercial payor policies are based. They have a wealth of information and guidance contained in them. When performing an audit, these books are the first stop on verifying proper coding. Audits may span across years in some cases, so it is important to use the books that match the year of the audited records as codes and guidelines change.

While working on a medical record audit, NCDs’, LCDs’, and payor policies’ determinations assist auditors in assessing whether medical services covered in audited records align with the federal policy. It is necessary for healthcare institutions to align their services with NCDs since they directly influence eligibility for Medicare coverage.

On the other hand, each MAC may interpret the NCDs differently and subsequently set their individual guidelines. Thus, during an audit, it becomes essential to follow LCDs that are applicable to the geographic service area of the healthcare facility. Payor policies are another critical component in medical record audits. Different insurance companies may have their unique set of coverage policies and payment limits. Becoming familiar with these specific payor policies ensures an accurate mapping of services availed to reimbursable services, which is vital in a medical record audit. Hence, auditors need to factor in the NCDs, LCDs, and specific payor policies while scrutinizing medical records to ensure a comprehensive analysis.

Specialized auditing software can significantly facilitate the auditing process through automation and advanced analytical capabilities. They can reveal patterns and discrepancies, aid in risk assessment and evaluation, and streamline the overall process. Auditing software can produce many different types of reports that can be integrated into the full audit report. Some software can track results for each physician/APP over time, so it can be noted if someone is doing better, doing worse, or staying stable with their audits.

With its roots stemming back to 1863, the False Claims Act continues to be the U.S. Department of Justice’s primary enforcement tool for returning money to the Federal Treasury. It is also considered one of five fundamental fraud, waste, and abuse laws, which potentially impact a provider every time a claim is submitted to Medicare, Medicaid, and other government programs because of the attestation language. The purpose of this webinar is to provide a synopsis of the False Claims Act and the current landscape in relation to coverage determinations and the federal Anti-Kickback Statute.

While performing the medical record audit is a significant step in ensuring compliance standards, delivery of the audit results is equally essential. Crafting a comprehensive audit report and successfully communicating the results to the stakeholders are critical for the effectiveness of the entire auditing process.

An audit report serves as the formal record of findings from the audits. It paints a complete picture of what was audited, how it was audited, findings, and recommendations for improvement.

Here are key elements that should be included in the audit report:

• Executive Summary: This provides an overview of the audit. It should summarize the objective, scope, and key findings of the audit, making it easier for top administration to understand the audit’s purpose and outcome.

• Findings and Recommendations: This section details each audit finding and pairs it with a recommendation for improving that specific issue. Be sure to use clear and concise language so even those outside of auditing can understand.

• Detailed Report for Each Physician/APP: Each Physician/ APP should have a customized section in the report detailing their individual findings. Including coding errors, documentation deficiencies, or overutilization trends specific to their work.

Discussing audit results, especially poor ones, can be a difficult task.

Here are some tips to present audit results effectively:

• Create a Positive Learning Environment: Start the meeting by appreciating their work and then introduce the audit findings. Always focus on the system or process, not on the individuals.

• Use Data and Evidence: When discussing any findings, always support them with data and evidence from the audit. Visuals like charts and graphs can be very effective

to showcase trends or patterns.

• Involve Them in the Solution: Engage physicians/APPs in forming the action plan for identified issues. It not only ensures buy-in but also makes them part of the solution.

• Provide Training and Education: Offer targeted education sessions to address the areas of weaknesses. Emphasize that audits are tools for improvement, not punitive processes. It doesn’t do any good to tell the physician/APP they have errors and not tell them ways to improve.

• Follow-Up: After implementing any remedial measures, follow up to measure progress. Also, be open to hearing feedback and making adjustments to the action plan if necessary.

Delivering audit results conducting the audit. Remember, improve the overall accuracy mentation, and other related a better understanding of ing the system rather than Communicating with empathy improvement will go a long physicians and APPs and, arching objective of the transformed from a confrontational venture, driving compliance healthcare organization.

Betty Hovey CCS-P, CDIP, is the Senior Consultant/Owner Solutions, a medical consulting solutions to issues for all

Betty for Coders, Auditors, and Facilities need assistance in navigating today’s healthcare environment, especially when it comes to coding and compliance. CHCS’ philosophy is to offer every single client extraordinary service that is customized to their situation. No cookie-cutter answers here. Each person, practice, and situation is unique; so is our response. We are honored to partner with every client we serve and will continue to show it for the long haul.

Visit Chcs.consulting

In 2021, the office/other outpatient codes and guidelines went through revisions. For 2023, the rest of the E/M sections underwent a major overhaul. We cover all sections revised with comprehension checks to ensure attendees will be able to:

• Apply the 2023 E/M definitions and guidelines in CPT to the medical record.

• Utilize the revised 2023 Medical Decision Making (MDM) Table in CPT to review E/M services.

• Demonstrate to physicians and other providers proper documentation that supports the level of services reported.

CHCS provides many types of audits for CPT and/or diagnosis.

• Physician/provider education on multiple specialties.

• CPT, ICD-10-CM, E/M, and specialty specific education solutions.

Education can be customized for your practice, department, or group. Services can be performed on-site, or virtually through our eLearning platform.

Betty A. Hovey is a seasoned healthcare professional with over three decades of experience in the field. She has extensive experience conducting audits for medical practices and payors. She specializes in educating various groups including coding professionals, auditors, doctors, APPs, payors, and others on coding, billing and related topics. Betty is a highly sought-after speaker and has co-authored manuals on ICD-10-CM, ICD-10-PCS, E/M, and various CPT specialty areas.

In the world of healthcare, the Merit-Based Incentive Payment System (MIPS) plays an instrumental role in incentivizing providers to deliver high-quality, efficient patient care. However, staying up to date with MIPS can be a challenge as the program is subject to continuous changes and updates. This article aims to provide a comprehensive understanding of MIPS, discuss its current impact, and delve into upcoming changes announced by the Centers for Medicare & Medicaid Services (CMS).

The Merit-Based Incentive Payment System is part of the Quality Payment Program (QPP) established by the Medicare Access and CHIP Reauthorization Act (MACRA) in 2015. Its primary purpose is to transition healthcare from a volume-based to a value-based system. MIPS consolidates three Medicare programs — the Physician Quality Reporting System (PQRS), the Value-Based Payment Modifier (VBPM), and the Medicare Electronic Health Record (EHR) incentive

program into a single system.

There are four key components of MIPS: Quality, Cost, Promoting Interoperability, and Improvement Activities.

1. The Quality component replaces the PQRS and requires healthcare providers to report on six quality measures that reflect their practice type or specialty.

2. The Cost component, previously part of the VBPM,

uses administrative claims data to gauge the cost of care provided to beneficiaries.

3. Promoting Interoperability, formerly known as Advancing Care Information, aims to promote patient engagement and the electronic exchange of health information using certified EHR technology.

4. Improvement Activities is a new category that includes activities related to patient safety, care coordination, beneficiary engagement, and population health management.

The current state of MIPS has a profound impact on healthcare practices, directly influencing their Medicare reimbursements. A practice’s MIPS score can result in a payment adjustment—positive, negative, or neutral—applied to each claim they submit to Medicare. This is why understanding and successfully navigating MIPS is crucial for healthcare providers.

As healthcare evolves, so does MIPS. CMS has announced several changes coming to the MIPS program.

One of the key upcoming changes is the introduction of the MIPS Value Pathways (MVPs). The MVP framework aims to reduce reporting burdens by connecting measures across the four MIPS performance categories relevant to a particular specialty or condition.

There is also a heightened focus on equity and patient outcome in the new changes. This includes considerations for social determinants of health and risk adjustments, rewarding providers who care for disadvantaged populations and promote health equity.

CMS also plans to increase the performance threshold required to avoid a negative payment adjustment,

These changes are part of CMS’s continuous efforts to optimize healthcare delivery by prioritizing value over volume. It is expected to drive improvements in patient outcomes and to further ensure healthcare providers are rewarded for the quality of care they deliver.

Understanding MIPS and staying informed about its upcoming changes is critical for healthcare providers as these directly impact the practice’s bottom line and the quality of patient care. The recent changes announced by CMS aim to further the program’s goals of rewarding high-quality, efficient healthcare services, while also increasing focus on health equity and patient outcomes.

As we move forward in this ever-evolving healthcare landscape, it’s essential for providers to be proactive and adaptive, embracing changes such as those coming to the MIPS program. As challenging as it may be, this transition brings us one step closer to the shared goal of providing the best possible care for every patient.

Randi Tapio MBA, CMRS, CPCS, CHM, CHBP, is an experienced healthcare revenue cycle professional with more than 20 years of experience in various healthcare roles, including revenue cycle, administration, and consulting. As an experienced revenue consultant, she has a long history of cultivating strong working relationships with providers, ancillary staff, and healthcare executives. Randi concentrates her efforts in working with independent and hospital-based physician groups to improve revenue by increasing productivity and office efficiency, as well as billing and coding compliance.

https://medcyclesolutions.com

In March 2023, the current Presidential Administration announced its national cybersecurity strategy. Prior to its release, the President issued two Executive Orders, which underscored the importance of privacy of individuals’ health information, tracking data without the knowledge or consent of a consumer/patient, and coordination among federal government agencies to implement initiatives or strengthen existing initiatives. Already in 2023, we have witnessed the Federal Trade Commission (FTC) utilize its Health Breach Notification Rule twice (GoodRx and PreMom), despite the effective date being February 2010 with no previous cases utilizing it.

Also in March, the U.S. Department of Health and Human Services (HHS) launched its new resources under 405(d) of the Cybersecurity Act of 2015. These resources aim to assist persons and organizations with building effective compliance programs to mitigate the risk of a breach, thwart a ransomware attack, and decrease overall liability both in terms of patient safety and legal actions. To paraphrase the approach of the National Institute of Standards and Technology (NIST) to cybersecurity: A comprehensive compliance program addresses cybersecurity in terms of prevention, detection, and correction.

Two recent enforcement actions, one criminal and one civil, underscore both the importance of maintaining the confidentiality, integrity, and availability of an individual’s health data (whether protected health information [PHI] or individually identifiable health information [IIHI]), as well as the potential consequences. This article addresses both situations and ends with best practices for avoiding landing in the “hot seat” in the first place.

Let’s begin with the criminal side of unlawfully accessing PHI and subsequently utilizing the patient information for a separate criminal act. There are two main laws that the federal government utilizes to charge people