As part of the United Nations 2030 Agenda on Sustainable Development, adopted in September 2015, the UN has recognized the importance of eradicating poverty in all forms. Poverty presents an enormous global challenge for the international community, as is a significant threat to sustainable development. In the spirit of global solidarity, the 2030 Agenda is focused on how best to meet the needs of the world’s poorest and most vulnerable citizens and acknowledges the role that the private sector must play in supporting the various organizations who have undertaken philanthropic efforts to implement the 2030 Agenda.

Poverty exists in every country around the globe, from powerful industrial nations to developing countries. It continues to affect millions of people, regardless of their social and cultural situations, and is a barrier to true prosperity and equality.

Originally a Hungarian civil society initiative to commemorate Mother Teresa’s death, International Day of Charity on September 5 took off worldwide in 2012 when the UN declared it an international holiday. Besides honoring Mother Teresa’s tireless work to help others overcome poverty and suffering, the holiday provides a platform for charitable opportunities to take place. If you can’t make a financial donation on September 5, there are still many ways to get involved, including buying gifts that give back to charities. Overall, this day reminds us that simple acts of charity can alleviate the worst effects of humanitarian crises and create more inclusive and resilient societies.

In recognition of the significant role that charities and individuals have undertaken to alleviate human suffering and humanitarian crises, the UN General Assembly, under resolution A/RES/67/105PDF, has designated the 5th of September as the International Day of Charity. This date was chosen as it is the anniversary of the death of Mother Teresa, and the resolution is, in part, a tribute to her work and dedication to charitable causes.

This 5th of September, the United Nations invites all Member States, international and regional organisations, non-governmental organizations and individuals alike to commemorate the International Day of Charity by encouraging charitable acts in their respective communities to raise public awareness of this event.

May/June 2024 | Vol. 5 | No. 25

www.foundationmag.ca

Twitter: @foundationmaga1

PRESIDENT / EDITOR-IN-CHIEF

Steve Lloyd - steve.lloyd@lloydmedia.ca

DESIGN / PRODUCTION

Jennifer O’Neill - jennifer@dmn.ca

PHOTOGRAPHER

Gary Tannyan

CONTRIBUTING WRITERS

Mary Cahalane

Duke Chang

Tracy Drenth

Serena Hak

Mark Halpern

George Irish

LLOYDMEDIA INC.

Leanne Kaufman

Nicholas Palahnuk

Kathleen A. Provost

Julie Quenneville Good Works

HEAD OFFICE / SUBSCRIPTIONS / PRODUCTION:

302-137 Main Street North

Markham ON L3P 1Y2

Phone: 905.201.6600

Fax: 905.201.6601 Toll-free: 800.668.1838

EDITORIAL CONTACT:

Foundation Magazine is published bimonthly by Lloydmedia Inc. Foundation Magazine may be obtained through paid subscription. Rates:

Canada 1 year (6 issues $48)

2 years (12 issues $70)

U.S. 1 year (6 issues $60) 2 years (12 issues $100)

Foundation Magazine is an independently-produced publication not affiliated in any way with any association or organized group nor with any publication produced either in Canada or the United States. Unsolicited manuscripts are welcome. However unused manuscripts will not be returned unless accompanied by sufficient postage. Occasionally Foundation Magazine provides its subscriber mailing list to other companies whose product or service may be of value to readers. If you do not want to receive information this way simply send your subscriber mailing label with this notice to:

Lloydmedia Inc. 302-137 Main Street North Markham ON L3P 1Y2 Canada.

POSTMASTER:

Please send all address changes and return all undeliverable copies to:

Lloydmedia Inc.

302-137 Main Street North Markham ON L3P 1Y2 Canada

No. 40050803

The iconic Terry Fox Monument, situated in the outskirts of Thunder Bay, Ontario, Canada, was created by sculptor Manfred Pervich commemorating cancer research activist Terry Fox’s Marathon of Hope, one of Canadian philanthropy’s most memorable moments. A vision of hope for our sector’s ongoing work.

Fifteen organic community gardens across the US and Canada will be awarded $7,500 each. Applications are now being accepted for Nature’s Path Organic Foods (Nature’s Path) annual Gardens for Good: Plant it Forward campaign. Gardens for Good celebrates the meaningful work of organic community gardens across the U.S. and Canada by giving away more than $100,000 a year, supporting 15 community gardens with $7,500 each. The initiative was founded on the belief that collectively, we can create a positive social impact and fight food insecurity by supporting the organic urban gardening initiatives that are on the front lines working to provide more accessibility to fresh organic food in the communities in which they are grown.

“Nature’s Path has always been committed to universal access to organic and healthy food for all, and community gardens do so much in achieving that objective,” says Jyoti Stephens, Nature’s Path VP Mission and Strategy. “Organic community gardens increase food security, provide healthy outdoor spaces for people, provide a forum for sharing knowledge, and build community connections, all while increasing access to fresh, healthy food.”

Since 2010, Gardens for Good has donated more than

$820,000, supporting 105 organic community gardens in both the U.S. and Canada, expediting Nature’s Path’s commitment of donating more than $1 million to organic community gardens by 2028. More than half of the 2023 winners of Gardens for Good are BIPOC-led organizations, and special consideration will once again be given to BIPOC-led gardens and those serving predominantly BIPOC communities.

Ten gardens in the U.S. and five gardens in Canada will be awarded grants. Winners must be a registered nonprofit organization. And for the first time in the program’s history, previous winners are encouraged to apply if they received a Nature’s Path Gardens for Good grant more than five years ago (before 2019).

“We were thrilled to be recipients of the Gardens for Good grant in 2021, helping our farm grow in size and strength,” says Reatha Hardy-Jordan, President and Co-Founder of the Black Urban Farmers Association in French Camp, CA, a nonprofit organization dedicated to honoring the heritage and legacy of African American agriculture. “The funds supported our mission of providing fresh, organic fruits, veggies, and roots with culinary ties to BIPOC food in America, and education to our

community.”

“It has been so wonderful to get to know our Gardens for Good winners over the past 14 years, and to watch their gardens grow!” says Stephens. “It’s incredibly inspirational to see so many organic gardens having a positive impact on their local communities. I can’t wait to celebrate our 2024 winners!”

Eligible organic gardens can learn more about the Gardens for Good program and submit their applications June 24th, 2024.

Nature’s Path Organic Foods is North America’s largest organic breakfast and snack food company and produces USDA and Canadian Certified Organic and Non-GMO Project Verified breakfast and snack foods sold in grocery and natural food stores in over 50 countries around the world.

Supporting the 322,000+ people in Canada with Crohn’s or colitis. On June 2, people at 50 locations from coast to coast participated in the 29th annual Gutsy Walk to show the 322,000+ people in Canada living with Crohn’s disease or ulcerative colitis that they are not alone. The list of locations

is available on the Gutsy Walk home page.

In 2024, an estimated 11,000 people are expected to be diagnosed, meaning a new diagnosis every 48 minutes in Canada. That is why it is more urgent than ever to raise funds to support programs and research that offer realistic hope for cures. Further, Canada has among the highest rates of pediatric Crohn’s and colitis in the world, driven by rising numbers among children, particularly those up to the age of six.

Gutsy Walk is the largest fundraiser for Crohn’s and Colitis Canada. The family-friendly event builds on the incredible generosity of so many people which has allowed us to raise more than $52 million since the first Gutsy Walk in 1996. Registered participants typically walk five kilometres, but any distance or activity done on the day qualifies.

Crohn’s and colitis cause the body to attack itself, inflaming the lining of the gastrointestinal tract and disrupting the body’s ability to digest food, absorb nutrition and eliminate waste in a healthy manner. They are lifelong diseases, often called invisible, as many people living with them look ‘normal’ while facing excruciating pain, exhaustion and other conditions.

“Crohn’s and colitis can be lonely diseases, with stigma and isolation added onto the physical symptoms, which are painful and disruptive to daily life. Gutsy Walk is a time to celebrate resilience as we come together to find a cure and improve the lives of those affected by Crohn’s and colitis,” says Lori Radke, President and CEO, Crohn’s and Colitis Canada. “This is also the 50th anniversary of Crohn’s and Colitis Canada, so we’re celebrating the

remarkable impact and progress we’ve achieved – all the while knowing so much more needs to be done.” (The Winnipeg Gutsy Walk took place on June 9.)

The organization considers itself on relentless journey to transform the lives of people affected by Crohn’s disease and ulcerative colitis by delivering impact at all stages of life, in every corner of the country, by finding the cures for these lifelong diseases, and improving the quality of life of everyone affected by these diseases.

The Michener Awards Foundation (MAF) is awarding Chantal Hébert and Terry Mosher its prestigious Michener-Baxter Award for exceptional service to Canadian public service journalism. The MichenerBaxter Award was established in 1983 and is presented at the discretion of the foundation’s board of directors. The award is named for Clive Baxter, who received the first Michener Award in 1971 from then-Governor General Roland Michener.

their extraordinary contributions to our profession.”

Michener-Baxter Award winners are selected by a committee of the MAF board following an open call for nominations.

Chantal Hébert, OC, is a freelance political columnist whose work is featured on radio, television and in print in both French and English. Ms. Hébert is receiving the Michener-Baxter Award for her commitment over the past several decades to explaining English and French Canada to one another – and to themselves. She is widely considered to be among the country’s best analysts of politics in terms of federal-provincial relations and national unity. To this, because of her knowledge, expertise and judgment, she brings an unparalleled voice coupled with a unique blend of moral authority and political realism.

Terry Mosher, OC, got his start drawing caricatures on the streets of Quebec City and has been cartooning since 1967 under the pen name AISLIN.

“This year the Michener Awards Foundation is proud to recognize these two great journalists who have spent their careers informing, educating and entertaining Canadians,” said Margo Goodhand, Chair of the MAF. “We are thrilled to recognize Ms. Hébert and Mr. Mosher for

Though he has spent most of his career with the Montreal Gazette, his work has been published around the world. Mr. Mosher is being recognized with a Michener-Baxter Award for his commitment to informing Canadians and lifting their spirits through humour that

is cutting, but never cruel. He is also being recognized for his leadership in reminding Canadians and many around the world of the importance of freedom of speech, through his encouragement of cartoonists in countries where freedom of expression is suppressed, and his generous philanthropy.

Ms. Hébert and Mr. Mosher join a distinguished group of Michener-Baxter recipients. More about this prestigious award, and its past honourees, can be found here: https://www. michenerawards.ca/michenerbaxter-award-nomination/

Both Michener-Baxter recipients will receive their award at an awards ceremony to be held in Ottawa on June 14 at Rideau Hall, hosted by Her Excellency the Right Honourable Mary Simon, Governor General of Canada. The evening gala will also honour the 2024 Michener fellowship recipients and the Michener Award recipient and finalists.

The Michener Awards honour, celebrate, and promote excellence in Canadian public service journalism. Established in 1970 by the late Right Honourable Roland Michener, Governor General of Canada from 1967 to 1974, the Michener Awards are Canada’s premier journalism award. The Michener Awards Foundation’s voluntary Board of Directors administers the award, in partnership with the Rideau Hall Foundation with sponsorship from BMO, Cision, Power Corporation of Canada, and TD.

The Foundation for Black Communities (FFBC) has announced the recipients of its inaugural Black Ideas Grant (B.I.G): Bridge and Build 2023/24 program. This ground-breaking

investment of over $9.1 million will empower 107 Black-led, Black-focused, and Black-serving grassroots, non-profit, and charitable organizations across Canada. The grants will support critical, community-based, solution-oriented initiatives.

The B.I.G. program addresses a significant need for sustained funding within Black community organizations. “This program is a cornerstone of our commitment to empower Black communities with the resources they need to confront historical and ongoing inequities,” said Marlene Jennings, Foundation for Black Communities Co-Chair. “B.I.G. exemplifies community collaboration and embodies FFBC’s unique Participatory Grantmaking Process, where Black community members play the lead role in determining the solutions and projects to support their communities.”

FFBC’s B.I.G. program provides flexible one-year grants, aiming for immediate impact while fostering the development of transformative programs for the future. The grants will bolster the capacity and program delivery of recipient organizations, focusing on combating anti-Black racism, improving social outcomes, and enhancing economic outcomes for Black Canadians.

“Diversity and inclusion make Canada stronger,” added Minister of Diversity, Inclusion and Persons with Disabilities, Kamal Khera .” Today’s announcement builds on transformative investments our government has made to empower Black communities across Canada since endorsing the United Nations International Decade for People of African Descent in 2018. Through the Black-led Philanthropic Endowment Fund, we have created a sustainable

source of funding for Black-led not-for-profit organizations, ensuring that they have the means to address their priorities. The recipients of this first call for proposals will help in our fight against anti-Black racism and in improving the social and economic outcomes of Black communities across the country.”

FFBC was established in response to the call for a new paradigm in philanthropy for Black communities. As the steward of the historic $200 million Black-led Philanthropic Endowment Fund, funded by the Government of Canada, FFBC is a first-of-its kind institution dedicated to ensuring that Black-led, Black-serving, and Black-focused (B3) organizations have the vital resources needed to create lasting change.

The Foundation congratulates this year’s recipients of the Black Ideas Grant and looks forward to the profound impact they will continue to make across Canada.

To learn more about the Foundation for Black Communities or to join us in our mission, visit www. forblackcommunities.org

The Foundation for Black Communities (FFBC) was established to ensure every Black person can thrive and Black communities have agency in defining their own future.

Founded in 2020, FFBC is Canada’s first-ever philanthropic foundation dedicated to ensuring Black-led, Black-serving, and Black-focused organizations have the sustained resources needed to make a meaningful impact.

New initiative speaks to the growing passion of cricket in Canada and the urgent need to Conquer Cancer.

The Princess Margaret Cancer Foundation unveiled The Princess Margaret’s Cricket to Conquer Cancer, North America’s premier street cricket fundraiser.

This groundbreaking initiative is slated to be the largest of its

kind in the country. Funds raised from this event will support The Princess Margaret, one of the top five cancer centres in the world. By combining a global passion for street cricket with a desire to live in a world free from the fear of cancer, this inaugural event promises to not only generate critical funds for cancer research but also foster a sense of community.

“Cricket is becoming one of Canada’s most popular sports,” said Steve Merker, Vice President of Corporate and Community Partnerships at The Princess Margaret Cancer Foundation.

“This inaugural event, a first of its kind in North America, aims to raise substantial funds for the Cancer Center while inspiring thousands of new supporters to take on our vision to Conquer Cancer in our Lifetime.”

The inaugural Cricket to Conquer Cancer event will be hosted on May 31st, 2025 in Mississauga. Dozens of co-ed teams made up of rookies, ringers, celebrities and players of all ages and skill levels will step up to bat in this dawn-to dusk cricket tournament.

National and International cricket stars will play alongside and against participants and are delighted to support this new initiative.

“I am thrilled to witness cricket’s growing popularity in Canada — a testament to its welcoming and multicultural community. It truly is a global sport,” said Carlos Brathwaite, world-renowned cricket player, 2023 Global T20 Canada champion, and former captain of the West Indies National team. “We all have a personal connection to cancer, me included. One thing that kept my mum going through her cancer treatment was her constant smile and positive outlook. I look forward to making this event a celebration for survivors and an inspiration for all those during their journey.”

Cancer is the leading cause of death in Canada and the second leading cause of death around the world. Funds raised from this event will accelerate cancer research, education and clinical care happening at The Princess Margaret.

“The effects from this

fundraiser will know no bounds,” said Dr. Amit Oza, Head of the Division of Medical Oncology & Hematology at Princess Margaret Cancer Centre. “Funds raised by our passionate community of participants help lead to the breakthroughs that will help patients here in Canada and around the world. As a cricket enthusiast myself, I am delighted we can celebrate this amazing sport while creating a global impact on cancer research.”

The Princess Margaret Cancer Foundation is Canada’s largest and leading cancer charity, dedicated to raising funds for Princess Margaret Cancer Centre, one of the world’s top five cancer research centres known for its game-changing scientific achievements and exceptional patient treatment and care. Through philanthropy, events, our world-leading home lottery program, and commercialization initiatives, we make possible the critical funding required to accelerate cancer research, education, and clinical care — benefitting patients at Princess Margaret Cancer Centre, throughout Canada and the world. www.thepmcf.ca

The CST Foundation (CST) released new research that aims to better understand the challenges and opportunities in rural uptake of the Federal Canada Learning Bond (CLB) program. Created in 2004, the CLB was designed to kick-start education savings for young Canadians from low-income households; to receive the CLB the eligible children must open a Registered Education Savings Plan (“RESP”). While the gap in take-up of the CLB between rural and urban Canadians has grown since 2004, the reasons for this gap have never been

explored. CST partnered with researcher S. Ashleigh Weeden, PhD, to survey rural Canadians to better understand the unique challenges they face in saving for post-secondary education.

The survey was open to adult parents and guardians that selfidentified as low-income and living rurally. Some key findings from the survey include:

Rurality matters: policies and programs such as the CLB do not meaningfully account for the lived experience and realities of rural living. The lack of local post-secondary education opportunities, limited financial services infrastructure, and less access to information on programs such as the CLB make it harder for families to financially prepare to support their children’s post-secondary education.

Administrative burdens become a barrier. The challenges of living rurally were mostly reported as being lack of services and amenities, lack of infrastructure, and lack of access to critical services. These challenges accessing services in rural regions can turn administrative burdens — such as getting a Social Insurance Number for their child — into a barrier impacting rural families access to programs like the CLB.

CLB awareness remains an issue. More than 50 per cent of survey respondents had heard of the CLB but had not applied for the program, while 37 per cent knew about the program and had applied. The most common source of information about the CLB was a friend, family member or community organization, suggesting there remains opportunities to better leverage community-level service providers and networks.

“This research underscores CST’s continued commitment

to enabling access to postsecondary education for Canadians regardless of where they live,” said Peter Lewis, President and CEO, CST Foundation. “As the pioneers of education savings in Canada, we are committed to being part of the solution to help close the gap in CLB take-up among rural families.”

“Governments across Canada, at all levels, continue to struggle to develop and implement effective rural policies and programming,” said Dr. Weeden. “This investigation into the persistent and growing gap in rural uptake of the Canada Learning Bond reinforces the critical importance of tailoring public policy and investments in a way that respects and reflects

the place-based realities of different communities across the country so that a person’s postal code does not determine their quality of life.”

Founded in 1960, the Canadian Scholarship Trust Foundation is dedicated to helping Canadian families access post-secondary education. Through philanthropy, discovery, advocacy and by sponsoring the Canadian Scholarship Trust Plans to help families save for post-secondary education, CST continues to deliver on its mission. The Foundation rewards hard working and community minded Canadian students through scholarships, bursaries and awards programs. CST has helped over 800,000 students achieve their post-secondary dreams.

It’s not uncommon in our industry to hear parents express concern about talking openly with their children about wealth — including how much of it the family has. One gentle way we often see them ease into the conversation is through charitable giving and philanthropy.

Parents will introduce children to concepts of investing, gifting, stewardship and governance by including them in family decisions tied to charitable intentions. This can be on a small scale, such as involving them in decisions about which charities may benefit from a family’s annual giving each year, or a larger scale, offering adult children the responsibility for part of an investment portfolio to be used philanthropically, or involvement in a family foundation.

Engaging in this way can highlight the similarities and differences between generations with respect to how they think, act and feel about wealth and philanthropy. The act of giving is often a statement of one’s values. But as we all know, what’s important to you or me can be vastly different from those around us, including our closest family members. In many cases, those differences are tied to generational influences.

With a huge wealth transfer on the horizon in Canada, understanding the next generation of investors and philanthropists will be key for many of us — whether we’re in the charitable sector or estate-planning and wealth-management fields. We can all expect to see a refocusing in priorities and perspectives as the shift from one generation to the next gains momentum.

The great wealth transfer to the next generation

Right now, baby boomers are the decision-makers for an enormous amount of wealth. The first baby boomers turned 65 in 2011, and by 2016, seniors outnumbered children for the first time in the country’s history. At the end of their working careers or already retired, baby boomers today are at a point in life when legacy concerns are top-of-mind.

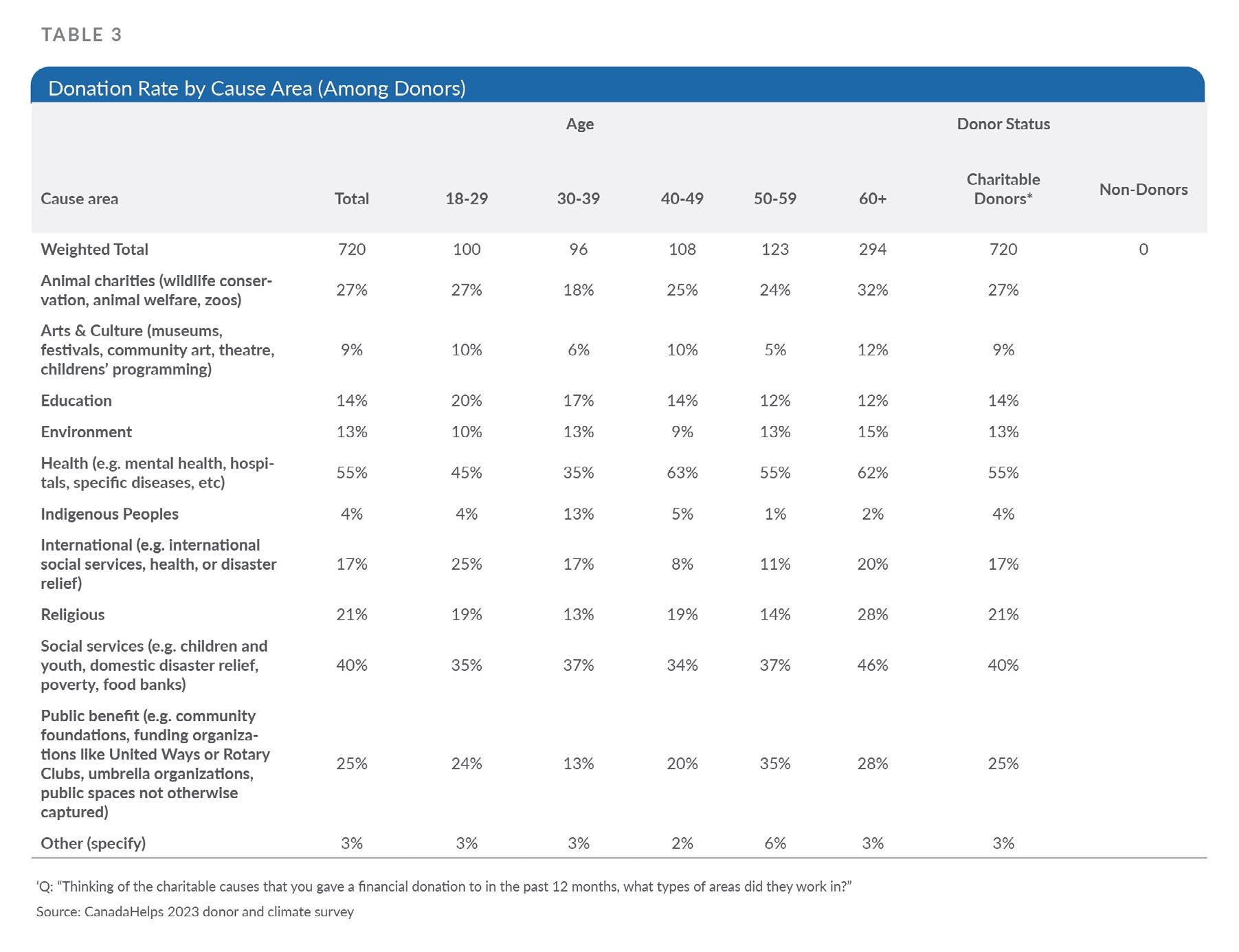

While charitable intentions are deeply personal and unique to the individuals, donors’ key causes often reflect the concerns of their lives, which can be heavily influenced by their experiences. Baby boomers form a generation that was affected by several wars and lived through the civil rights struggles of the 1960s and 1970s, so it is common to see members of this generation value social justice, world peace, and the environment. With many now in their late 70s, we also see healthcare causes as a core focus when it comes to strategic-giving planning.

People in generation X were born between 1965 and 1980, an era that saw a massive spike in globalization, increased environmental concerns and significant cuts to social services. Very likely, trends towards responsible and ESG investing and climate action will continue to be prioritized.

Millennials, who now range in age from about 28 to 43, currently tend to favour health and medical non-profits, as well as human rights and international affairs organizations. They’re also comfortable donating through online platforms and like to set recurring donations.

The preferences above are by no means comprehensive,

Establishing and maintaining open dialogue can help ensure families are aligned when it comes to values and intentions.

and of course many causes such as healthcare, education and religion span all generations.

Charitable causes are not the only wealth-related area where different generations may have differing ideas. Even within a generation, competing priorities can create family rifts when money is involved — particularly when trying to ease a transition from one generation to the next.

On the whole, younger generations value transparency and engagement, so helping families have difficult wealthtransfer conversations is extremely important. It’s these conversations that can help eliminate assumptions, provide clarity and alignment on values, and offer different perspectives and an appreciation of where and how one wants to give back.

One challenge we see often with individuals who are preparing to transfer wealth is determining what information and details to share with heirs. A report conducted by RBC Wealth Management a couple of years ago found that only 33 percent of those who had received an inheritance were made aware before

receiving any assets. And even when some discussions do take place, they often tend to be limited or high-level in nature.

While there can be disadvantages to sharing wealth-transfer information, such as the risk of creating a sense of entitlement, there are many benefits, including:

❯ Giving heirs the ability to proactively and accurately plan ahead for the wealth they are intended to receive;

❯ Eliminating any element of surprise or shock; and

❯ Providing an opportunity for the giver to help heirs prepare in advance.

Establishing and maintaining open dialogue can help ensure families are aligned when it comes to values and intentions. Open conversations can provide heirs and family members with a forum to share views, concerns or interests. And for individuals who will be passing down wealth, it’s an opportunity to share reasons and context for their decisions, but also to gain valuable insight from family members. It can also ease possible friction points between family members later by creating clarity and transparency while individuals are

still around to explain it.

Reaching next generation donors

For many in the boomer generation, money and death remain taboo topics, so it’s important to establish a safe environment to discuss wills, estate planning and philanthropic giving. The key is to encourage an open discussion backed with financial education to help families and their heirs understand how their values align. Wealth transfer done well fosters harmony during the inheritance process, while ensuring that legacy wishes and values are carried out for generations to come. Sharing a vision of how those values come to life through philanthropic planning and giving will serve to further enrich that multigenerational legacy.

LEANNE KAUFMAN is the President and CEO of the Royal Trust Corporation of Canada and The Royal Trust Company. She is responsible for the strategy and overall management of RBC Royal Trust, which provides wealth protection and transfer solutions across generations to high net wealth Canadian families. A lawyer by profession, Leanne is the author of the fourth edition of The Executor’s Handbook, a contributor to various publications on the topic of estates and trusts and the host of RBC Wealth Management’s Matters Beyond Wealth podcast. For more information, visit: https://rbc.com/royaltrust. She writes this column exclusively for each issue of Foundation Magazine

As a professional fundraiser I worry about “civility” in our work, and in our society. I use the word “civility” because fundraisers in particular build relationships, and in this context, “civility” would refer to polite remarks or courtesy in formal conversations. But that is assuming we are having “civilized conversations”. Nonetheless, I fear that: “what was, will never be again” because, this “formal politeness” has regressed, and these civil conversations are not happening anymore.

Fostering a culture of civility is not just a matter of politeness — it’s a social imperative. In our sector, philanthropy means building relationships, and I believe there is a correlation between civility and the social interaction we hold to create positive outcomes. I have found that the root of “civicism”, meaning the virtues and sentiments of a good citizen, a civic interest to a cause, originated as a devotion to the cause of the French revolution of 1789.

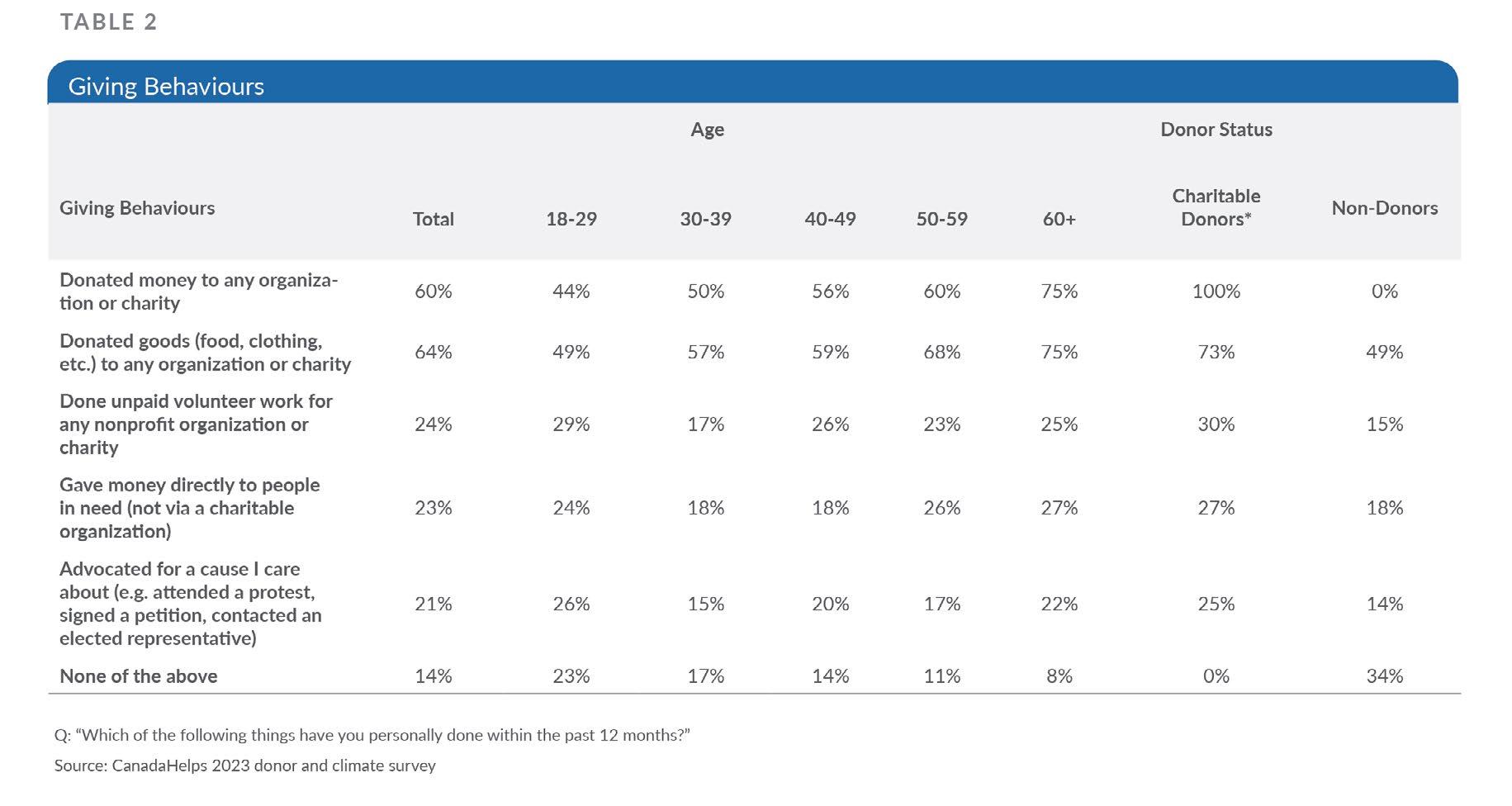

Fast forward to 2024, I am trying to grabble with what is “civicism” in today society? What are our civic interests, and how specific trends our society is experiencing deeply affects the way we socially interact. CanadaHelps just released its 7th edition of The Giving Report, examining the charitable sector and the state of giving. Though not surprisingly they illustrate downward donations and volunteerism trends; what is most troubling for me are the social behaviours we are observing.

The Giving Report, claims the number of Canadians with six or more close friends has declined from 37 percent to 22 percent between 2013 and 2023. These changing social trends of how we interact and build relationships are here to stay. The report states that giving participation has dropped as a result of Canadians becoming increasingly disconnected. Now that is what worries me more.

The decline of “generosity” needs attention, but most importantly, it is imperative to reverse the dwindling spirit of communal support. To better understand this social phenomenon, I propose we look at two key influencers of this social change namely: media and technology. Redefining how we interact with each other, ultimately, how we interact socially, has an enormous impact on how people give, and therefore how we fundraise.

We are experiencing a level of disconnect that is making it harder for individuals and communities to see how they can make a difference and have an impact in areas that matter to them. This is at the core of our interactions; this impacts the consideration we have for one another — our perceived sense of “civicism”.

Community Foundations of Canada’s 2023 Vital Report also reiterates that the number of Canadians with six or more close friends has declined. More than 80 percent of those with many close friends donate, while just over 50 percent of those with very few close friends donate. The Vital Report states that donors with many close friends were more likely to volunteer and participate in community events. There is a correlation with how socially engaged individuals are and their giving and volunteering habits.

It should be noted that in 2023 Statistic Canada claimed that close to half (46 percent) of non-profit organizations reported increased demand for services or products, whilst only 24 percent of these organizations reported an overall capacity to meet these increasing demands. According to Daniele Zanotti, United Way Greater Toronto, this social disconnect is also experienced in volunteerism which is following the downward trend of donations. In the GTA area, approximately 25 percent of individuals volunteer now, compared to 40 percent four years ago. Kim Winchell, United Way BC, says that of the 500 organizations they support, all are experiencing challenges with volunteer recruitment. And in rural areas, Andrea MacDonald, United Way PEI, states: “We’re at a tipping point here,” the same individuals volunteer in multiple places.

People are spending more time alone and this was accelerated further during the pandemic as internet and smartphones became increasingly widespread and the pandemic forced us all indoors. People have replaced time with friends with more time spent at home alone. As we experience an increasing social disconnect, it is then critical to look at how our face-to-face social networks have shrunk and see if we can reverse this trend.

Last year, The Philanthropist Journal, published Yvonne Rodney’s opinion on the state of volunteerism entitled, “Volunteerism:

In crisis or at a crossroads?” Rodney talked about the challenges of building a sense of belonging and connection in the hybrid era. Our societal infrastructure has come to depend on volunteer work and engagement to support the needs of our communities, to support essential activities that allow non-profits and charities to do what they do.

Technology has embedded itself in our everyday life and how we spend our time has been influenced by social pressures beyond our control which has created a significant mindset shift in our engagement habits. We must ask: has technology contributed to creating a “new community”? If volunteering is associated with “community belonging”, then how can we find our place in our community and feel the responsibility of taking care of each other?

We need to create a society rich with civic pride, where each act of giving strengthens the social fabric that binds us together. Whilst at the same time, remembering the role technology plays today. Whether we value or include technology, the result is that we cannot ignore the influence of technology because we are all, beneficiaries, donors, volunteers, and staff members, using technology. Hence, if technology is influencing the context of our communities and shifting our behaviours, we need to use technology as a tool that can build relationships.

Katie Gibson, responsible for digital innovation, and Marc-André Delorme, planning and development advisor for DATaide program, wrote “The case for integrating tech considerations into strategic planning”. They claim that very few Canadian non-profits incorporate technology considerations into their strategic planning processes. A missed opportunity, according to Gibson and Delorme.

Though technology is mainly seen as tactical, not strategic, by most non-profits, it has become essential to learn how to use digital strategies to support our ambitions and increase our organizational impact. Canadian non-profit organizations that have prioritized digital marketing in their

We need to create a society rich with civic pride, where each act of giving strengthens the social fabric.

strategic plans speak of many benefits to their staff and communities. Yet, a recent survey conducted on civil society organizations, by TechSoup claims only 22 percent have “defined a strategy and timeline for achieving digital readiness.”

And when CanadaHelps surveyed 1,470 organizations about their digital skills, 31 percent stated that “Digital is not incorporated into our strategic plan”, while 46 percent identified digital as not “a big enough priority compared to other activities”.

Meida influence

Very intertwine with how we use technology, is our seeming “relationship” with the media. In his April 2024 article,

Aiden Cyr, member of the Manitoba Métis Federation who has his ancestral roots in the Métis homeland along the Red River, and international advocate on Indigenous reconciliation, gender-based violence, and climate change, warns us about the hyper-individuality among young workers. He defines hyper-individuality as an outcome of our exposure to media. It is the overemphasis of self-interested competition and meritocracy that connects educational and professional achievement, status, and wealth with innate personal value. Essentially, we have created a culture of perfectionism which has created more unrealistic

expectations, and more anxiety.

The consequences of generations being raised to internalize hyper-individualist and perfectionist values have begun showing themselves through increases in mental health difficulties, leading to “hostility, tendency to blame others, and lower altruism and trust.” According to Cyr, many feel unable or reluctant to engage emotionally. Studies have found significant connections between perfectionism and increased sensitivity to criticism and failure, creating unrealistic expectations or entitlement.

Then, I must ask: Can we restore this culture of belonging by re-inventing this social need for inclusion and belonging? Charities and non-profits must communicate a strong social purpose which is essential for fundraising and program delivery. But it is imperative to authentically communicate to create a thriving environment and restore “caring for one another”. We must reverse the trend of fewer people participating in social service clubs as well as more people lessening their close ties to their families and friends.

If civility means a “polite or courteous action”, then rekindling the communal bonds that foster a thriving, charitable society is essential for these actions to take place. When we have consideration for one another, we do not “lash out” on social media, or openly criticize marginalized individuals. We must invest in, and cultivate, a society that values deep connections and active participation. While it is true that in 2023 individual donations remain the main source of funding for registered charities (41 percent Statistics Canada), we must look beyond the charitable “activity” and better understand what influences the “human” behaviour behind incentivize giving. Because the strategies and tactics that have gotten us to this point will not get us anywhere different.

Last March, Hilary Pearson reviewed, The Price of Humanity: How Philanthropy

BY MARY CAHALANE

BY MARY CAHALANE

It’s usually an inside job.

There you are, minding your own business. Getting the job done.

You know the work inside and out. Sure, there are days… and nights, when all you want is a stiff drink and a chance to relax.

But there are needs to be met. People to be fed. Or housed. Furry little animals to be adopted. You know the score.

So there you are, late into the afternoon, writing. You’ve had your notes. Fought some off. So it looks like you just might get this one done tonight. You sure hope so.

That’s when you hear the knock on the door. And you know your hopes are shot.

“You know, you haven’t captured our work quite right,” she says. “That’s not the important part of what we do. Let me explain…”

You try to hide the sigh. It escapes anyway.

She means well. Has a heart bigger than this city. But what she doesn’t know is fundraising.

And that’s the danger here. You’ve seen it before — good fundraising appeals, killed before they can work.

It’s programsplaining. And it’s brutal.

She’s left you no choice. So you slowly reach over to your desk drawer and open it. Your weapon isn’t new and shiny. But it’s trustworthy. And you know you’ll need it now.

You have to stop this crime before it goes too far. So you hand her this note, hoping to contain a fundraising catastrophe before it starts.

Dear Esteemed Colleague,

What you are suggesting is dangerous. Worse, it doesn’t work. So before you continue, please read this:

You know too much. All there is to know about what our organization does. You do it every day. I admire you. But I know what our donors need to know. I’ll keep it simple. Donors are less concerned about how you do your work.

You’re very good at what you do. You work long hours for less than private sector colleagues make. And you innovate! (Small budgets can push you to that.)

But your great new process isn’t nearly as interesting to donors as what you accomplish.

Here’s the thing: Donors don’t ask for much. What’s the problem, and how can I fix it? Sounds simple, right? It is.

Fundraising communication is for donors, not insiders. Most importantly, fundraising is for donors, not you. Sure, your work should be celebrated. I’ll come to the party.

But this fundraising appeal? The next newsletter? Not the place. Not the audience.

Here’s the bottom line: Your work? It needs money.

And that’s where I come in. You need the gifts our donors will send. So you need fundraisers to talk to our donors in the way they want to listen.

So let fundraisers do their work. We’ll all be better off.

I walked away, hoping my message got through.

Now, let’s take a look at something we all deal with.

How to write a thank you letter when you’re feeling stuck.

Stuck?

You’ve been working hard on that last campaign. And now, you have new gifts! After the celebration, you begin to wonder. How can you write a thank you that works? Where do you start?

Here’s my quick thank you letter how-to.

First, a confession: I used to write rote, boring, perfunctory thank you letters. And I didn’t much like writing them. Plus, with an appeal, you feel like you have a goal. Thanks are an afterthought, right?

Wrong. So. Wrong.

Then I read posts by my friends Pamela Grow and Lisa Sargent. My eyes were opened. Saying thank you well matters. Unless you don’t care if donors stick around. So here is my advice for your great thank you letter.

Personalize the salutation: Nothing says, “We love you for your money” like a “Dear Friend” thank you letter. Don’t do it.

First paragraph: One great line: Just like your appeal letter, the first line of your thank you does some heavy lifting. Make it sing.

“On behalf of…” is coma-inducing. Don’t do that either.

Instead, imagine your favorite person in the world.

Imagine they’ve just given you the greatest gift — the thing you’d never dare ask for. Hang on to that feeling of love and gratitude. That’s what needs to fill this line. Make it short. And make it all about the donor, not your organization.

Stuck? Try “You’re amazing!” or “You’re my hero!”

Flatter away. Gush. Trust me, no one hates being told they’re wonderful.

Second paragraph: Look at what you’ve done! Tell your donor exactly what their generosity accomplishes.

Hint: this is never “meeting our annual fund goals”. Connect their generosity to the beneficiary. Because of your generous gift, a family will have a real Thanksgiving dinner this year.

Make the connection without inserting your organization. Nothing in this letter is about how great you are.

Third paragraph: Stay connected. Use this to suggest ways they can learn more, call for a tour, or reach you or another real person via phone or email. (And do I have to say that they’d better be able to reach that person?)

Fourth paragraph: Say it again. Restate your gratitude. Tell them again why they’re important.

Have a human sign the thank you letter. Make it someone as high up in the organization as possible. Or sometimes, the person the donor has a connection to.

Sign it for real. Add a note — even if the note is only “Thank you very much!”.

Don’t make the IRS the star of the thank you letter. Stick that boring but necessary language at the bottom of the letter. No one wants to read it — they just want it there.

CONTINUED FROM page 13

Went Wrong and How to Fix It, by Amy Schiller. Referencing, Schiller, Person pointed to the unique role humanity has in helping humans live full human lives. According to Schiller, who is an American scholar with a background in fundraising, “Philanthropy must be dedicated to human flourishing by focusing more on beauty”. In her book, Schiller points to philanthropy as serving the benefactor as much as the recipient, she called it a “demonstration of civic virtue and patronage”. “Philanthropy must be the financial mechanism for supporting the creativity, imagination and plurality of collective human life.” It is not to address our growing economic social inequality, the onus for changing this is on governments and political leaders. Following this reasoning, philanthropy is to make the earth more of a home and to encourage inhabitants of the spaces and institutions it provides, to feel at home in the world. The world should serve all of us, not the few who can exploit the many for maximum profit. This may be possible if we make space for innovation and allow opportunities that can change our behaviours with an intent to enable a renewed sense of community.

My final thoughts

She writes this column exclusively for each issue of Foundation Magazine.

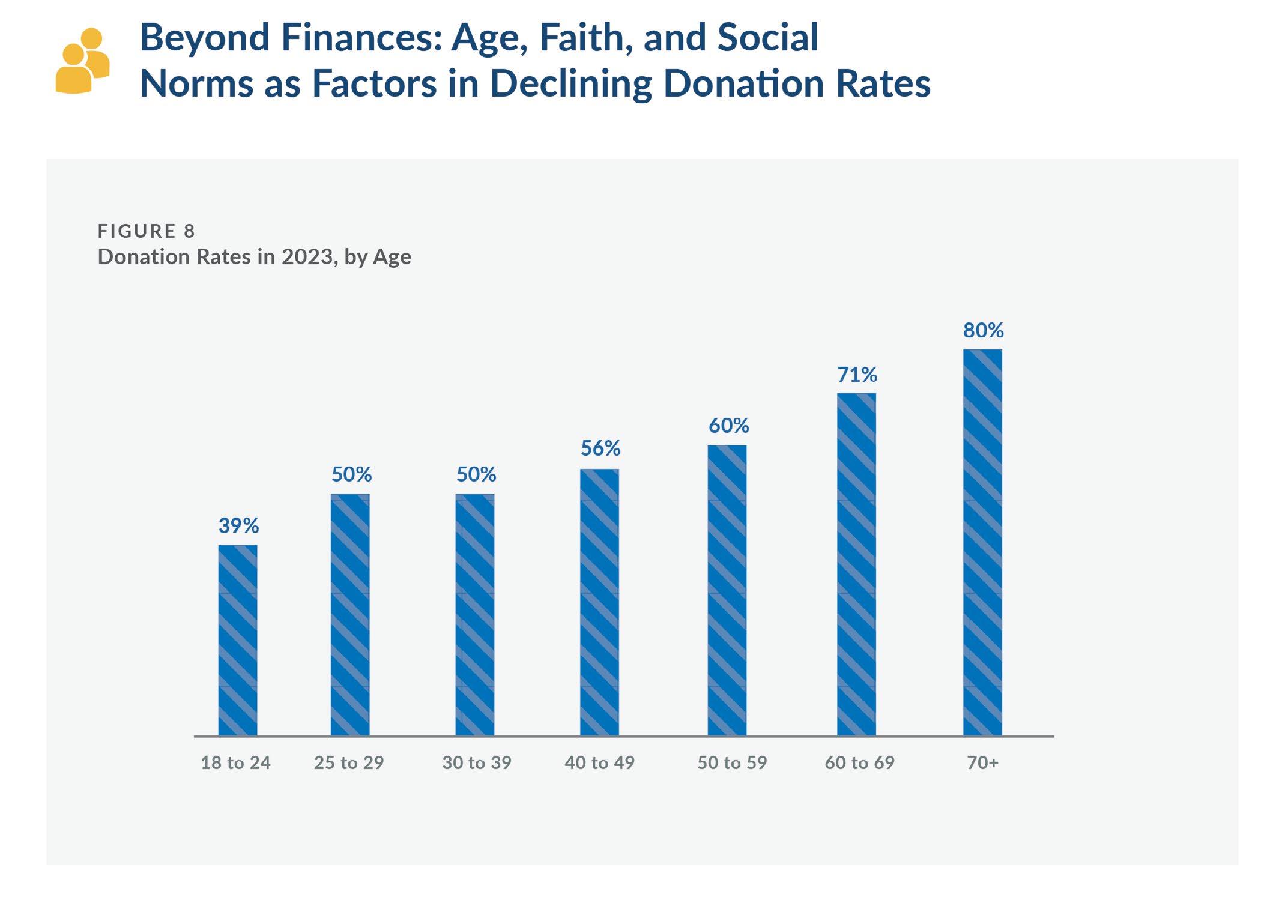

In “ 25 Years of Decline: Assessing The State Of Charitable Giving In Canada And Charting A Path Forward ”, Steven Ayer, argued, that the last time we had an increase in the donation rate was in 2010. Over the last 25 years, we have seen declining donation rates and this trend of declining charitable donations intensified during the pandemic. Time has become a luxury which forces us to chose where to invest our time. If we all agree the “clock” will not turn back and given the symbiosis we have with technology and media, we must alt this

persistent decline, now!

Not only because there are correlations between people with many close friends and people who donate. But specifically, because there are less individuals with friends (30 percent less according to CanadaHelp). As Schiller says, “Ours is a world for humans”. Any individual can make a philanthropic contribution to the common good. And any individual should feel and have the capacity to do so. But are individuals motivated to do so?

Given our beneficiaries and donors are immerse in technology and media, we must re-define our connectivity. I believe that by building new relations between individuals and members of a community we can stop this continued path to gradual disconnection from the communal ties that enrich our lives. We need to write a new definition of civility, today. It will not be easy. But recently I read something very inspiring from a very generous man, Paul Nazareth. In making bold decision and looking forward he said: “so, I’m walking onward. I’m afraid, but I know I’m not alone.” If something is going to change, we have much work to do.

It is together, that we can support people to thrive and to be engage deeply with their local communities. It is together that we will create a renewed sense of civility.

KATHLEEN A. PROVOST is currently the Vice President, Philanthropy and Communications at United for Literacy (previously Frontier College), a national organization with 125 years of community partnerships in Canada, offering free tutoring and mentoring to adult, youth, and children who need literacy and numeracy support. Kathleen has over 30 years of experience in the charitable sector. She has been a Certified Fundraising Executive (CFRE) since 2007 and a long-time member and volunteer for the Association of Fundraising Professionals (AFP). Kathleen holds a Masters degree in Adult Education from St. Francis Xavier University as well as a Baccalaureate Arts in Political Science and a certificate in Public Relations from McGill University. As a recognized leader, Kathleen has tailored presentations for French and English audiences at various events including AFP-Nova Scotia, AFP-Ottawa, AFP-National Congress, Coady Institute and the Canadian Council for the Advancement of Education. She has received numerous recognitions during her career, including the Queen Elizabeth II Diamond Jubilee Medal for her contributions to the charitable sector and was recognized as 2021 Fundraiser of the Year in Nova Scotia. She writes this column exclusively for each issue of Foundation Magazine.

No one likes bad news, whether it comes in the form of a stock market correction, a rise in inflation or a drop in interest rates that cuts cash flow for retirees living on a fixed income. But the bad news that often gets the most passionate negative reaction is an increase in taxes — so it isn’t surprising that many Canadians have been talking about the increase in the capital gains inclusion rate announced in the 2024 federal budget.

The budget proposes that starting on June 25, 2024, individuals will pay tax on 50 percent of the year’s realized capital gains up to $250,000 — and 66.67 percent of the year’s realized capital gains above $250,000. Corporations and trusts must use the 66.67 percent inclusion rate from the first dollar now of any capital gains realized during the year.

Anyone who owns an asset with a large unrealized capital gain — such as a substantial investment portfolio or real estate beyond a personal residence — will be affected. How much will the new inclusion rate cost taxpayers? Let’s say that, during the second half of 2024, someone realizes $250,000 in capital gains from investments and sells a cottage that has appreciated in value from $200,000 to $1.2 million, resulting in a $1 million capital gain. At the highest combined federal-provincial marginal tax rate in Ontario (53.53 percent), tax on that $1 million capital gain would be $267,650 with a 50 percent inclusion rate, but $356,885 with a 66.67 percent inclusion rate. That’s a difference of $89,235 — hardly small change. And of course it’s much worse for corporate holdings.

I always like to look for the silver lining. In this case, because these budget changes have captured our attention, many people are more motivated than ever to learn how to minimize taxes on capital gains. As a result, we’ve been sharing a range of strategies with our clients and professional colleagues, including ideas that transform tax into legacy-building philanthropy that benefit both foundations and the charitable causes they support.

1Averaging down each year’s capital gains tax

There’s a simple way to take advantage of the fact that the first $250,000 in capital gains earned by an individual will continue to benefit from the 50 percent inclusion rate. Between June 25 and December 31, 2024, and every year thereafter, an individual can plan to realize $250,000 in capital gains — essentially harvesting the amount that can be taxed at a lower rate. Also, consider selling depreciated stocks, bonds, mutual funds, or EFTs for capital losses to offset against any capital gains now or in the future. This strategy is known as tax-loss selling. Be aware that there’s a 30-day period during which an investor cannot repurchase the same security after selling it. Fortunately, there’s no such rule when someone realizes capital gains — which means that after locking in a new adjusted cost base, the investor can immediately repurchase the same security.

Remember that capital losses can be used to offset against capital gains in perpetuity in the future so if you are expecting a big payout in the future, stockpiling some losses now can be of help.

2

Mitigating capital gains tax with an estate freeze

An estate freeze restructures the ownership of a corporation to minimize capital gains tax when assets transfer to the next generation. The current owner holds onto preferred shares that maintain a fixed price and therefore will incur capital gains tax on a predictable amount through a deemed disposition on death. At the same time, the corporation creates common shares for beneficiaries. The common shares appreciate in value but can be held beyond the current owner’s death without a deemed disposition in the hands of his beneficiaries. The result is the deferral of capital gains tax on that growth, and it’s likely going to be sizable.

Now, with the freeze put into place, we need to determine how to create the money that will eventually fund the tax bill or convert the tax into charity.

We emphasize to all clients how important it is to make strategic decisions about how to cover the eventual capital gains tax liability on death. In most cases, the choices are to pay the tax with cash set aside for that purpose, with a nontax-deductible loan at an uncertain future interest rate, with selling assets at what may not be the optimal time or price, or with an adequate amount of life insurance.

For couples, joint-last-to-die (JLTD) life insurance is usually the most costeffective choice, because it pays out when the second spouse dies (which is when the tax liability occurs) and is easier to acquire as it’s usually based on the younger, healthier spouse’s actuarial projections. JLTD life insurance is a perfect option for estate freezes, can cost 40 percent less than insuring a single life and can work where one spouse may be uninsurable.

Life insurance premiums can be paid using cash flow, by moving taxable assets into a tax-exempt life insurance policy or implementing a financing arrangement (aka IFA - Immediate Financing Arrangement). An IFA can be particularly appealing because when set up properly, it can be cash flow neutral. First, the client uses assets to go towards the first life insurance premium. Then the borrow back the same amount from a financial institution, using the policy’s cash surrender value. The borrowed money goes back into their investments, which makes the interest tax-deductible, in addition to some other deductions available.

Canadian financial institutions love lending against life insurance policies with the cash surrender value as collateral. In fact, they tend to place a higher value on the security of an insurance policy than any other asset, including land, buildings, stocks, bonds, crypto or even precious metals such as gold. As a result, it’s easy to

get approved for a loan up to 100 percent of the cash surrender value, and the interest rate is generally very favourable.

Reducing capital gains tax with charitable donations

Charitable donations are another powerful way to mitigate capital gains taxes. One approach is to donate either publicly traded securities or (this is less well known) private company shares following an estate freeze. There’s no capital gains tax due on assets like these that are donated in- kind, and the donor receives a charitable receipt for the full market value.

It’s very worthwhile to learn how to donate private company shares but there isn’t enough space in this article to articulate fully. Please reach out to us to obtain our longer article to explain.

Additionally, charitable donations can eliminate 100 percent of estate taxes in the year of death and the prior year. Let’s assume someone anticipates a $5 million estate tax bill. They can acquire a $5 million life insurance policy to cover that tax bill alone for pennies on the dollar. But, if they’re philanthropic-minded and would prefer the tax money to go to their charitable foundation or to a charity rather than to taxes, they can double the policy amount to $10 million. When that $10 million is donated on death

to a charitable foundation or charity, it generates a $10 million tax receipt that turns the $5 million estate tax bill into $5 million of charity! We encourage all our clients to incorporate strategic philanthropy using life insurance into their estate planning.

With the right professionals in place to advise them, Canadians can implement strategies that help them chart their own best course through tax changes such as the higher capital gains inclusion rate. Your team should include a good accountant, lawyer, investment advisor and philanthropic insurance advisor who collaborate to achieve the best results. Those results may include meeting goals such as preserving wealth, maximizing charity, and creating a legacy that lasts across generations.

It’s important to get your planning in place. Reach out to us while the sun is shining for a no-obligation conversation. Introduce us to your situation and allow us to share estate planning, tax minimization and philanthropic strategies that can help you achieve your unique objectives.

Your fundraising goals will be more easily achieved if you work with experienced planned legacy giving professionals who will help you navigate the technical aspects of giving with your current supporters and prospective donors. We help charitable organizations and foundations across the country.

“We want to start using AI, but we don’t know where to begin.”

Lately, many of my conversations with nonprofit fundraisers have started this way.

I think it marks the moment where artificial intelligence (AI), including ChatGPT, has become more than a buzzword and is now a real, emerging priority.

There are plenty of good reasons why nonprofits haven’t started working with AI. The technology is still relatively new and unfamiliar to many, and the rapid pace of change can feel overwhelming. Concerns about bias in AI algorithms, copyright issues surrounding AI-generated content, and the potential for AI to produce inaccurate or misleading information (“hallucinations”) are all legitimate worries.

Nonprofits are often stretched thin, with limited resources and competing priorities. Adding AI exploration to an already overloaded plate can seem daunting. The lack of in-house AI expertise and the perceived complexity of implementing new tools can also be significant barriers.

However, industry trends show us that AI use is rapidly expanding. The recently released 2024 Microsoft/LinkedIn World Trend Index reports a 50 percent increase in knowledge workers using AI in the last six months.

In my own survey of nonprofit fundraisers, I have found that up to 20 percent already started experimenting openly with AI in their teams and are sharing learnings. Another 25 percent admit they’ve used AI but haven’t disclosed it. Only about 30 percent are not using it at all, and 25 percent say they’ve used it, but only for personal use.

Another emerging trend is ‘Bring Your Own AI’ (BYOAI), where workers use their personal AI tools for work purposes,

often without official oversight, because such tools are not provided or permitted by their workplace. This seems to be a very common practice - with up to 80 percent of AI-users admitting to some BYOAI use.

So the “when should we start” question might be too late. AI adoption is already happening.

And it’s great that we’ve reached this point. This is where the real work begins.

Using AI with purpose and confidence

Let’s revise that opening question to: “How can we get started using AI purposefully and confidently to further our organization’s mission?”

Using AI purposefully means aligning it with your core values and strategic goals. Identify specific challenges or opportunities where AI can make a tangible difference in your work, whether it’s automating time-consuming tasks, uncovering hidden insights in your data, or enhancing your communication and outreach efforts. Approach AI not as a shiny new toy, but as a powerful tool that can be strategically deployed to further your mission.

Using AI confidently requires a foundation of knowledge and understanding. It means being aware of the potential risks and limitations of AI, such as bias, accuracy, and ethical considerations. Invest in training and education for your team so they can use AI tools effectively and responsibly. Foster a culture of continuous learning and adaptation, where you’re constantly evaluating and refining your AI strategies to ensure they align with your evolving needs and priorities.

These are long-term principles to guide your organization’s AI learning journey.

But first, you need to get started. Here are three critical ‘first steps’:

A critical first step is for senior leadership to signal that AI adoption is a priority and give the go-ahead to start exploring its potential. Without clear direction, staff may be unsure if AI use is safe or even allowed. This can lead to a fragmented approach, with individuals experimenting in isolation and not sharing their learnings.

Waving the green flag means creating a unified, transparent environment where AI use is openly discussed and solutions are explored collectively.

This could take the form of a policy statement from leadership, guidelines issued to managers, or even a placeholder “AI Mandate” like this one shared recently by social sector leader Rich Leimsider:

❯ AI use and experimentation is encouraged.

❯ Never enter private client data.

❯ You are responsible for the quality of your work, even if AI helps.

❯ All of our other policies about data privacy and presenting accurate work apply here, too.

❯ If you share any AI-supported work internally, you must disclose it – but if it is good, you will be praised, not criticized.

❯ Don’t share anything AI-created externally if it would be embarrassing if you had to disclose that AI helped you.

Adapting this simple ‘placeholder’ mandate to your organization’s context may give staff the clarity they need to begin exploring AI safely and with confidence. It doesn’t replace the need for a robust AI Policy at some point down

the line, but it may be enough to get your learning journey started.

Establishing a clear and supportive stance from leadership on AI isn’t just a suggestion, it’s a necessity. Waving the green flag mitigates risks and addresses concerns about data security, privacy, and ethical use head-on, fostering trust. Openly embracing AI sends a powerful message that your organization is forward-thinking and adaptable to new technologies, attracting talent and fostering a sense of excitement about the future. Ultimately, a coordinated approach to AI adoption leads to streamlined workflows, data-driven decision-making, and a greater impact on your organization’s mission.

Identifying and empowering your AI champions is another critical step in your organization’s AI journey. These “secret cyborgs,” as Ethan Mollick aptly calls them, are the individuals who have already embraced AI in their personal or professional lives. They possess a wealth of knowledge and experience that can propel your organization forward. Here’s how to harness your champions’ potential:

❯ Find Them: Look for signs of AI enthusiasm. It could be the person who always knows about the latest tech trends, the one who’s experimenting with ChatGPT in their spare time, or the colleague who has found clever ways to automate mundane tasks.

❯ Create a Safe Space: Encourage open dialogue about AI. Host informal lunch-and-learns, create a dedicated Slack channel, or establish an “AI Explorers Club.” Make it a place where people feel comfortable sharing their discoveries, successes, and even failures.

❯ Learn while doing: Give your champions the freedom to explore AI tools and applications relevant to their roles. Encourage them to test new ideas, pilot projects, and report back on their findings.

❯ Celebrate Successes (and Failures): When AI experiments yield positive results, be sure to share those stories. Celebrate the individuals involved and showcase how AI is making a difference. Equally important, create a culture where it’s okay to fail. Learning from mistakes is a crucial part of innovation.

❯ Foster Collaboration: Encourage your champions to share their knowledge and expertise with others. Pair them with colleagues who are eager to learn, create mentorship opportunities, or host workshops to demystify AI.

The rise of AI mirrors the adoption of social media and mobile technology. It’s not a technology strategy dictated from the top down; it’s growing from the grassroots up.

Your champions are the ones who will identify the most relevant use cases, experiment with different tools, and ultimately drive the adoption of AI within your organization. By embracing their

enthusiasm and expertise, you’re not just implementing a new technology; you’re fostering a culture of innovation and continuous learning.

Get your AI journey started by providing access to the AI tools your innovators need for testing and piloting. User accounts with ChatGPT (or other chatbots like Copilot, Gemini, or Claude) aren’t just a suggestion, they’re a strategic imperative.

Encourage your early adopters to dive in and interact with these tools as active participants, not passive observers. Explore the potential of chatbots with open-ended prompts like “How can you help me do my job?” Fostering a sense of curiosity and exploration, you invite innovation and discovery.

Beyond chatbots, consider testing AI-powered apps built for nonprofit fundraisers — find an updated list at: FundraisingwithAI.com/apps. As well, encourage your explorers to try new AIpowered assistants in familiar programs like Microsoft Office 365 or Google Workspace. This approach exposes your team to a wide range of AI applications and different ways to integrate AI into their workflows.

Focus your explorations around these areas:

❯ Content Creation (appeals, thank you notes & social media): AI excels at generating text, from drafting compelling appeals and personalized thank-you notes to crafting engaging social media posts and website content.

❯ Strategy: AI can be a valuable partner in strategic planning, helping brainstorm ideas, analyze potential scenarios, and even provide a structured framework for decision-making.

“Help me write a strategy for our year-end fundraising campaign. Ask me questions to gather the information you need, then give me an overview of the whole plan. Our goals are...”

❯ Document and Data Analysis:

AI can quickly sift through large documents and datasets, identifying patterns, trends, and correlations that might be missed by human analysts. This can lead to valuable insights about donor behavior, fundraising effectiveness, and program impact.

Hands-on experience with AI tools is essential for understanding their capabilities and uncovering their practical applications.

Providing access and encouraging experimentation empowers your staff to become proficient users and advocates for AI. This fosters a culture of innovation, as individuals and teams discover creative solutions to challenges and identify new ways to enhance their work.

Congratulations on taking your first steps — now get ready for what comes next.

AI is poised to reshape the fundraising landscape, from the way we work to the tools we use. Processes and tasks that we commonly outsource may become feasible to bring in-house, and the demand for new AI-enabled skill sets will rise. And AI technology itself will continue its rapid evolution, as I saw for myself at the recent AFP ICON conference in Toronto with nearly every CRM and engagement platform announcing new AI-enhanced features.

While challenges and uncertainties lie ahead, the potential for AI to empower nonprofits and amplify their impact is undeniable. By charting a thoughtful course, rallying our champions, and embracing experimentation, we can start navigating the AI frontier with confidence and purpose.

GEORGE IRISH is a veteran of strategy, coaching and consulting for AI-powered charity fundraising. He works with Amnesty International Canada and Greenpeace among other organizations.uo He writes this column exclusively for each issue of Foundation Magazine.

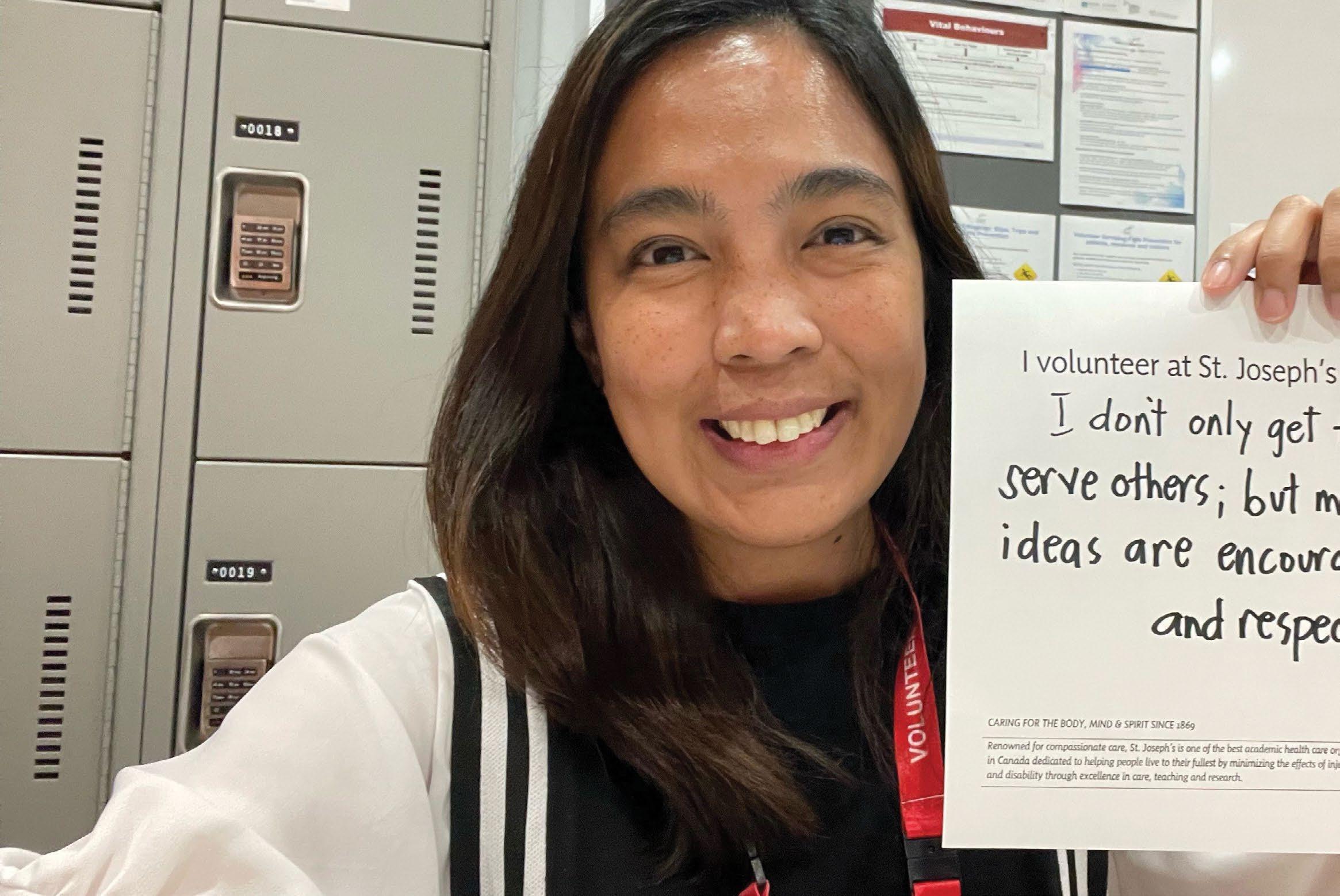

As I reflect on the transformative power of philanthropy, I can’t help but think about what an honour it is to serve in this sector. Throughout my career, I’ve had the privilege of meeting people from all walks of life who want to change our world for the better. I’ve seen firsthand the incredible impact that can happen when an entire community unites around a shared vision and purpose.

Philanthropy isn’t limited to a select number of wealthy families in our country. It’s not just about writing big cheques. Everyone, regardless of background or means, holds the power to make a difference. This concept of “approachable philanthropy” has been a guiding force throughout my career and certainly in my work as CEO of UHN Foundation, where we raise funds in support of Canada’s #1 hospital.

This belief is also at the core of our UHN Impact Collective (UIC), a volunteer group of next-generation leaders who are redefining what it means to give back. The UIC has a clear mission: to cultivate a new generation of philanthropists who are committed to helping UHN continue to reimagine health care. This impressive group is lending their time, talent, networks and fresh perspectives to not only raise funds for UHN, but to get more people aware of and engaged in our cause. And they do so in a variety of ways — from dinners and speaking engagements to yoga classes and pickleball tournaments. Their hard work embodies approachable philanthropy in action.

The creation of the UIC reflects our belief in the power of community, and has benefits for both sides that go beyond dollars and cents. By providing a platform for next-generation leaders to explore their potential as volunteers and philanthropists, we are at the same time gaining a better understanding of how to connect with an entirely new cohort of supporters — ones who may not have the traditional direct connection to our cause (in this case, UHN patients or their loved ones).

At UHN Foundation, we are committed to democratizing philanthropy and empowering individuals of all ages and stages to recognize themselves as philanthropists. While we certainly

appreciate the transformative power of major gifts and large-scale donations, we want people of all giving levels and capacities to feel that they play just as important a role in transforming health care.

Whether it’s volunteering, organizing a fundraising event, or simply helping to spread the word on social media, there are countless ways people can show their support and drive meaningful change. I recently met two young siblings who donated proceeds from a chocolate bar fundraiser in honour of their late grandmother’s care team. I hope they know that their simple act of kindness not only goes a long way to help the hospital, but also in lifting the spirits of the teams at UHN who go above and beyond for our patients every day.

We all have the power to change the status quo of health care. Donor support through UHN Foundation is helping fund groundbreaking research, acquire the latest and greatest technology, provide new life-saving treatments, and recruit the next generation of great medical minds. The work happening at UHN has an impact close to home, but also around the world. And so every donation, regardless of its size, is helping UHN change the world.

Philanthropy can and should be approachable. It is our job as fundraisers to help people feel empowered to make a difference. As I look to the future, I am excited about how the UIC will continue to evolve. I am equally as excited about the work we are doing to call on more members of the community to join us in our mission to help UHN reimagine health care. Because there is nothing more powerful than a community united.

JULIE QUENNEVILLE is the CEO of UHN Foundation. Quenneville’s acknowledged dedication to health care has earned her numerous accolades, including being named one of Canada’s Most Powerful Women; one of Concordia University’s Top 50 under 50; and receiving the Medal of the Quebec National Assembly. She serves as Chair of the Banff Forum and is a member of the Executive Committee of the 2024 President’s Cup, a global team golf competition which will be played in Montreal. Her vast knowledge of philanthropy, modern business strategy, and government relations has made her a sought-after speaker on multiple platforms. Quenneville is a change agent, a passionate advocate for innovative research, and a firm believer that advancing medicine is a global responsibility. She writes this column exclusively for each issue of Foundation Magazine.

BY NICHOLAS PALAHNUK

BY NICHOLAS PALAHNUK

Recently at a philanthropy conference in New York, I talked with dozens of people who have big visions for change. They are making bold gifts to empower and fuel the work of frontline leaders in human rights, climate change, journalism, and democracy. The stakes are high and they want to be strategic so their giving makes the greatest possible difference.

The reality is, though, that many of them are making gifts without access to real-time data to show how those commitments impact their long-term strategy.

Sophisticated software exists for people who want to accumulate wealth, plan their retirement, or compare investment strategies. Until now, there has been no software with this capacity to support planning in philanthropy.

I learned this for myself when I started my foundation three years ago. I searched unsuccessfully for software that would help me align my giving strategy with my values and resources. Even among professors who study the nonprofit sector at Harvard, where I am pursuing a degree, I couldn’t find anyone who knew of such a tool.

In need of a solution for my foundation, and wanting to

“I know I have a lot to learn, so I built a flexible giving plan that allows me to respond to new requests.”

be part of the solution for others, I spent a year interviewing people about their giving, and I researched the most pressing questions in philanthropy today.

As the founder of a wealth management practice, I’ve always been obsessed with understanding clients’ perspectives. Now, I am also obsessed with the perspectives of people who fund the social sector, and with helping them and their advisors to get charitable money moving.

After a year of deep listening, I launched PhilanthPro, a suite of tools and resources that bring the power of financial planning to philanthropy. Now, people who hold charitable accounts are equipped with software that supports bold and strategic giving.

Hundreds of billions of dollars sit in Donor Advised Funds (DAFs) and foundations that could be mobilized by frontline organizations that are driving positive change now. PhilanthPro is one actor within the movement of people and organizations that want to get these philanthropic dollars moving faster and more effectively.

While launching PhilanthPro, I met powerful advocates and innovators, and now I want to introduce you to some of these thinkers. In the following months, we will bring you a series of Q&A with established advocates in the philanthropy field.

The next issue will feature an article with Jennifer Risher, author of We Need to Talk: A Memoir about Wealth. Jen is also the co-founder of #HalfMyDAF, a matching program through which she has incentivized $50 million in giving from DAFs.

In the Q&As that follow in this series, I will speak with banking and wealth management leaders about their clients’ growing demand for philanthropy planning, with experts on the historic wealth transfer, and with frontline CEOs. Please join me as we learn together.

Philanthropy is deeply personal, and the stakes are high. Many of us struggle with whether or not to: spend down our DAFs and foundations, make large or unplanned transformational gifts, or involve younger inheritors. I’m on this journey as well, and I’m glad to be in the company of people who think hard about the good they want to do in the world.

Sharing stories helps us to clarify our values, gain strategic insights, and form a community. In this spirit, I’ll share a bit of

my story as we kick off this series.

I began working at a bank before I finished high school. Helping people manage their money always gave me a sense of well-being, especially early in my adult life when I came out as a gay man and was carving my own path forward. Behind the teller counter, I studied between customers and soon became the youngest Certified Financial Planner in Canada at the age of 21.

Only a year later, I lost my father to suicide. I was young, and without knowing any other way to grieve, I threw myself into building a practice where I was able to help people plan their futures. I built a community of clients, colleagues and peers and grew to be a top advisor. But over time, I began to ask myself if I had something more to offer. It was time to start giving back in a bigger way.

I didn’t have a lot of experience in philanthropy, but I had an anchor. I wanted to help people who suffer from mental health challenges, like my father, and I wanted to put my money to work in some of the places where mental health support is least accessible.

I decided to return to Malawi, in East Africa, where I had volunteered as a teenager. Meetings with young people, psychology students and graduates, and nonprofit leaders, convinced me that I was on the right path.