7 Financing building renovations 7.1 Overview The decarbonisation of new buildings across the EU will require not only more demanding building regulations and codes, but also public sector support to reduce investment risks, and help from financiers in the form of long-term affordable financing that is conditional on demanding GHG emission performance requirements. The costs of imposing such requirements on new buildings can be expected to fall as a result of economies of scale because advanced building components will become more widely used. Costs will also fall because of improved efficiencies in the construction process as builders gain experience with the installation and commissioning of new technologies. Such a massive challenge must be largely implemented at national and local levels, but could be greatly helped by obligations at EU level, together with funding from the EU and financial support from the European Investment Bank to leverage private investments. The total costs of the proposed Renovation Wave are difficult to estimate because of the big differences between Member States, uncertainties about the current energy performance of much of the EU building stock, and the many other variables involved. However, in most cases, investors can expect the costs of renovations to increase with depth of energy-related renovations and the corresponding impacts on GHG emission reductions. The costs of different depths of building renovation have been estimated in studies by the Buildings Performance Institute Europe (BPIE 2011) and by the European Commission (EC 2019f), which have found renovation costs lying between less than €50/m2 and more than €600/m2, depending not only on the depth of renovation but also on the type and location of the building, its use and its existing energy performance. On the basis of an average deep renovation cost of (say) €300/m2, the renovation of about 3% per year of the 25 billion square metres of EU buildings until 2050, which is proposed in the EU’s Renovation Wave strategy (EC 2020a), would cost about €225 billion per year. Most of this cost would have to be covered by private financing, but private investments could be usefully de-risked, leveraged and accelerated by publicly funded incentives; for example, the European Parliament has proposed a subsidy of €100/m2 for deep energy-efficient building renovations, which corresponds to €75 billion per year of public funding (EP 2020b).

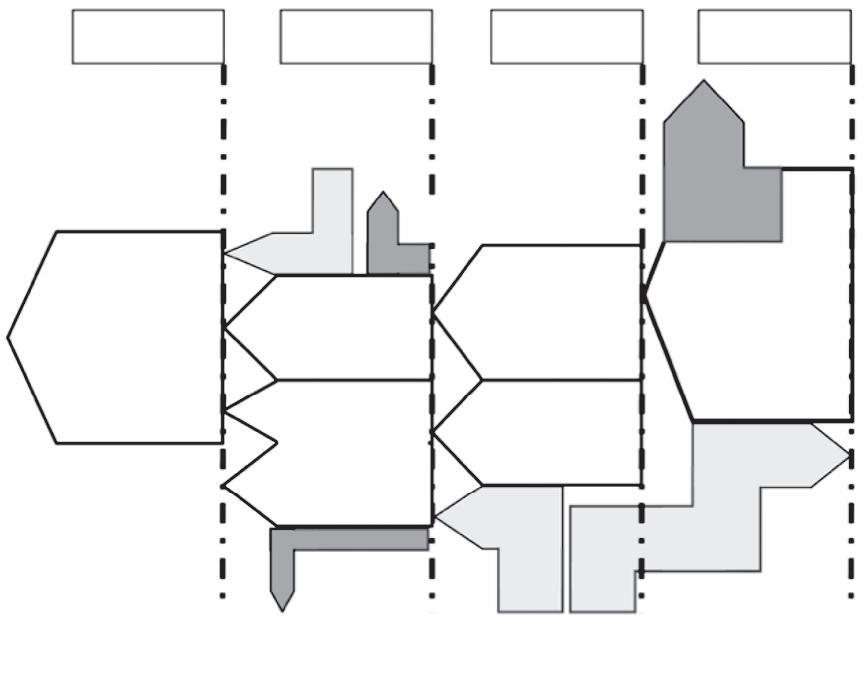

offers new employment and business opportunities as well as major contributions towards EU commitments to GHG emission reductions. A re-focused regulatory framework together with a well-targeted use of public funding to mobilise much larger amounts of private financing will be needed to guide the EU’s economic recovery and to mitigate the climate crisis at the same time. The EU’s EPBD not only requires Member States to establish national minimum energy performance requirements for new and renovated buildings, but it also encourages them to put in place financing schemes and incentives to encourage improvements to the energy performance of their existing buildings. Such renovation financing schemes should focus on deep renovations that deliver nearly zero GHG emission buildings, and they should not support shallow renovation options (with short payback times). This is important because it typically becomes more difficult than expected and less cost-effective to perform deep renovations if buildings have recently been subjected to shallow renovation. For new buildings, it may be possible to achieve nearly zero GHG emission performance with costs that are affordable for potential owners, most of whom will in any case have to take out a mortgage over many years. However, the situation is typically very different for owners of existing buildings, where deep renovations usually require major and unforeseen investments, which can typically take up to about 30 years to recover through savings in energy costs. Financing schemes for deep renovations therefore need to be like those used for house purchasing mortgages, based on long-term loans with low interest rates. Incentives, such as grants, may also be needed to trigger such long-term investments and to reduce the risks that are likely to be perceived by investors. There are three main approaches that can be used for financing energy renovations of residential buildings: equity financing, debt financing and non-repayable rewards (Bertoldi et al. 2020). The extent of their adoption reflects the diversity of contexts for building renovations across the EU and the maturity of the different approaches shown in Figure 10. The most well-established approaches are the traditional options of •

debt financing with soft loans (e.g. by extending an existing mortgage) or leasing; and

•

non-repayable rewards from governments such as grants, subsidies or tax incentives.

7.2 Financing approaches for building renovations As the EU implements its recovery from the COVID-19 pandemic, the proposed Renovation Wave (EC 2020a)

EASAC

Decarbonisation of buildings | June 2021 | 39